Author: Alan Weissberger

Highlights of GSA Private-Mobile-Networks August 2022 report

A new report by the Global mobile Suppliers Association (GSA), the Private-Mobile-Networks August 2022 report, has identified 66 MNO’s and 70 countries/territories where organisations are involved with private mobile network projects. This equates to 889 organisations deploying LTE or 5G Private Mobile Networks (PMN) in one or more locations – up from 794 reported in June 2022.

Manufacturing is the major adopter of Private Mobile Networks with 165 identified companies, growth of almost 50% from the end of 2021, with other strong interest from education, mining, and power utilities sectors.

LTE is the dominant technology, used in 672 of the private mobile networks for which GSA has data, whilst 5G is being deployed by 354 organisations. 5G Standalone currently accounts for just thirty-seven deployments.

The USA leads the way with the most organisations deploying private networks based on LTE or 5G, followed by Germany, China, the UK, and Japan.

Joe Barrett, President of the Global mobile Suppliers Association called private mobile networks a microcosm of the wider 4G and 5G ecosystem and reported “a strong positive correlation between liberalised spectrum and the adoption of private mobile networks.”

An executive summary of the report is available from the GSA website based on dataset of over 50 equipment vendors, 66 operators and 70 countries and territories.

References:

https://totaltele.com/private-mobile-network-deployments-now-in-70-countries/

C&W Networks Upgrades Pan Caribbean Submarine Cable Networks with Ciena

C&W Networks, a wholesale telecommunications service provider, announced an agreement with Ciena to upgrade its CFX-1 (Colombia-Florida Express) and EWC (East West Cable) submarine cable networks to deliver advanced broadband and IP services of up to 400Gb/s. These network upgrades will help address the soaring bandwidth needs of C&W Networks’ telco and internet service provider (ISP) customers.

C&W Networks operates the largest submarine multi-ring fiber-optic network in the greater Caribbean, Central American and Andean regions, providing reliable connectivity to approximately 40 countries. The 2400km CFX-1 express cable connects the United States, Jamaica and Colombia with less than 25ms latency, while the 1,700km EWC cable links the British Virgin Islands, Jamaica and the Dominican Republic.

“Online content, especially streaming video, continues to drive robust demand for data and high-speed connectivity in the regions we serve. The additional capacity we’re turning up on CFX-1 and EWC with Ciena allows us to meet this demand head-on, enriching our service offerings for customers while sustainably and cost-effectively extending the lifespan of these cable systems,” stated Chris Coles, Vice President and General Manager, C&W Networks.

Ciena’s GeoMesh Extreme, which utilizes the 6500 Packet-Optical Platform powered by WaveLogic 5 Extreme coherent optics, delivers C&W Networks’ new increased capacity with scalable service speeds on existing undersea systems. With Ciena’s latest technology, the CFX-1 cable connecting the U.S. with Colombia and Jamaica is transformed to provide a 10-fold capacity increase of over 32Tb/s with 100Gb/s–400Gb/s services.

Visibility and end-to-end management of the cable network is possible with Ciena’s Manage, Control and Plan (MCP) domain controller and Ciena Services provides deployment and reconfiguration services to accelerate time to revenue and ensure project success.

“C&W Networks’ submarine cables cross the ocean to bring the pan-Caribbean region new opportunities and economic growth through connectivity,” said Ian Clarke, Vice President of Global Submarine Solutions, Ciena. “With our GeoMesh Extreme, they’re able to do that while maximizing spectral efficiency and minimizing the cost-, space- and power-per-bit transported, resulting in lower total cost of ownership and greater competitive advantage.”

About C&W Networks

C&W Networks, part of Cable & Wireless Communications, Limited and wholly owned subsidiary of Liberty Latin America, Ltd, is a wholesale telecommunications service provider that offers broadband, IP capacity to global, regional and local telecom carriers, TV cable companies, Internet Service Providers and Network Integrators. C&W Networks operates the largest subsea multi-ring fiber-optic network throughout the greater Caribbean, Central American and Andean region along with the most comprehensive fully meshed MPLS network in the region. Connecting approximately 40 markets, the company’s fully protected ringed submarine fiber optic network spans more than 50,000 km. Cable routes include the Caribbean Optical-ring System (ARCOS-1), Colombia-Florida Express (CFX-1), EC-Link cable system, Fibralink, Maya 1, Eastern Caribbean Fiber System (ECFS), Taino-Carib, East-West Cable (EWC), Cayman-Jamaica Fiber System (CJFS), Caribbean-Bermuda U.S (CBUS), Americas II, Gemini Bermuda, Antillas 1, Pacific Caribbean Cable System (PCCS), and Amerigo Vespucci, Alonso De Ojeda, Saba Statia Cable System (SSCS). C&W Networks also operates terrestrial networks in the US and various Caribbean and LATAM markets. For more information, please visit www.cwnetworks.com.

About Ciena

Ciena is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive Network™ in response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness, and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

References:

AT&T wins another U.S. government contract: $119M to modernize CBP voice and data networks

AT&T said Monday it secured a contract valued at $119 million over 11 years, if all options are exercised, to modernize the U.S. Customs and Border Protection’s (CBP) voice and data networks. The contract is an expansion of AT&T’s work for the agency and the services will include virtual private networking services, cloud connectivity as well as national security and emergency preparedness services, among others.

CBP has tasked AT&T to modernize the agency’s voice and data networks supporting around 60,000 government employees including agents and other personnel. The agency awarded the order through the governmentwide Enterprise Infrastructure Solutions vehicle, AT&T said Monday.

“This new task order allows us to deliver our advanced communications capabilities to support the important work CBP’s agents do, day in and day out, to protect our nation at all points of entry: from our borders to airports and seaports,” Stacy Schwartz, a vice president for AT&T’s public sector and FirstNet business unit, said in a press release.

Examples of areas covered under the order include virtual private networking services, cloud connectivity, national security and emergency preparedness services, and unified communications. CBP can also use the order to acquire managed trusted Internet Protocol services, as well as IP-based voice capabilities.

U.S. Customs and Border Protection is one of the world’s largest law enforcement organizations with more than 60,000 employees. It is charged with keeping terrorists and their weapons out of the U.S. while facilitating lawful international travel and trade. On a typical day, CBP apprehends more than 1,000 individuals for suspected crimes; screens more than 1 million international travelers; prevents 404 dangerous pests from entering the U.S.; processes more than 74,000 truck, rail and sea containers; and seizes nearly 4 tons of illicit drugs.

CBP aims to enhance the nation’s security through innovation, intelligence, collaboration and trust. It requires reliable, highly secure voice and data communications among its agents to support its comprehensive approach to managing U.S. borders, customs operations, immigration, and agricultural protection. AT&T was selected to modernize CBP’s voice and data networks to support CBP’s mission objectives.

Image Credit: CBP

…………………………………………………………………………………………………………………………………………………..

In addition to the CBP contract, AT&T in April scored a $15 million contract to upgrade the Army National Guard’s command and control network. Prior to that, it secured $161 million to update and consolidate the U.S. Coast Guard’s data networks.

AT&T’s slew of government contracts also includes task orders from the U.S. Department of Veterans Affairs, the Department of Homeland Security, the Treasury Department and the Department of Transportation.

………………………………………………………………………………………………………………………………………………….

Regarding AT&T (T) as an attractive value investment, Petar Mirkovic wrote:

“We believe that a combination of the recently refocused strategy centered on its core competencies as a “stable and boring” telecom, a high dividend yield surpassing the U.S. average, and a substantial margin of safety thanks to a decade low investor sentiment creates great value for potential investors.”

References:

AT&T to Upgrade U.S. Customs and Border Protection Networks (att.com)

AT&T books $119M CBP network task order – Washington Technology

AT&T scoops up $119M contract to upgrade CBP network (fiercetelecom.com)

AT&T Stock: A Buy At All-Time Low Investor Sentiment (NYSE:T) | Seeking Alpha

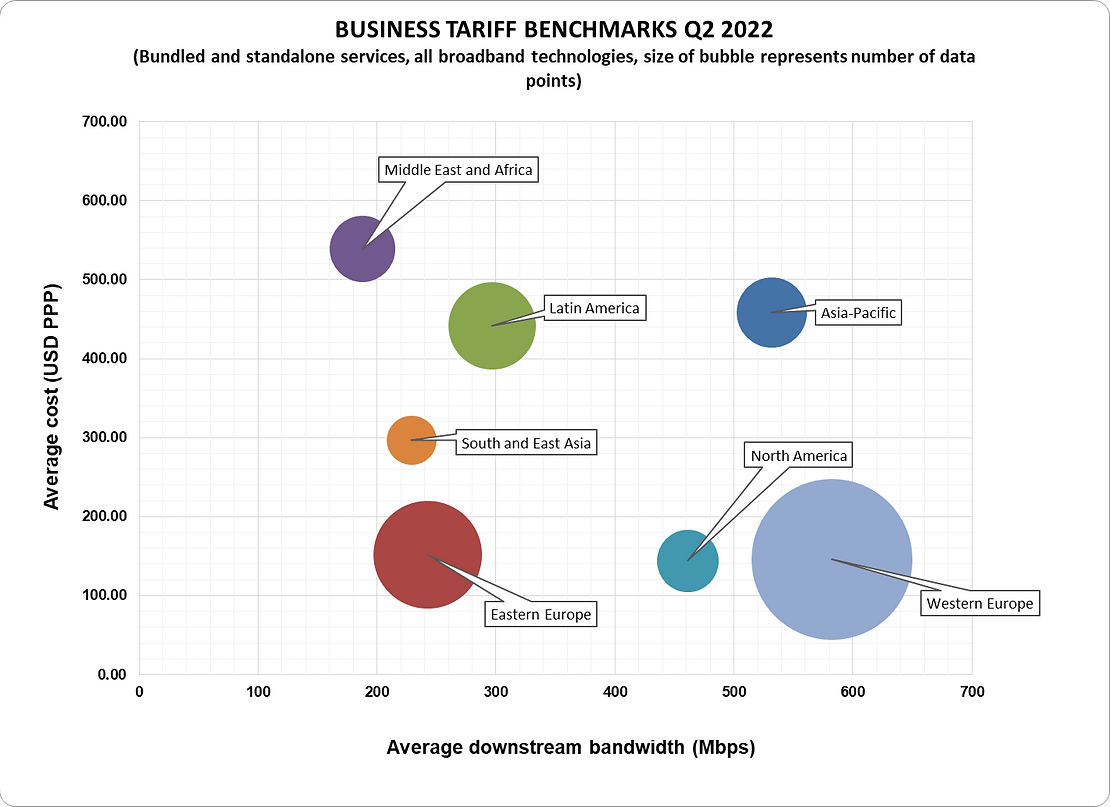

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

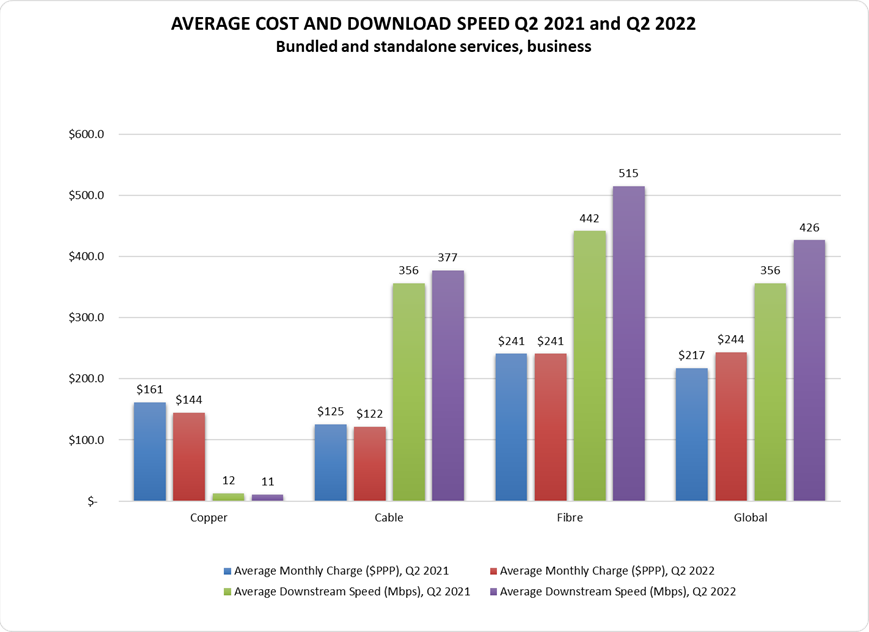

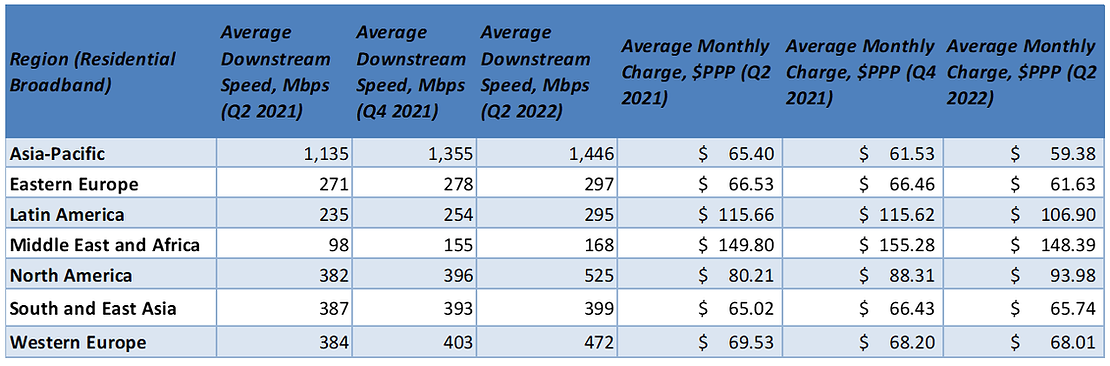

In the twelve months to the close of Q2 2022, global residential fixed line broadband subscribers saw their average monthly charges decrease by 4% on copper, cable and fiber-based tariffs. Across the three technologies the average bandwidth increased by 22% year-on-year (y-o-y), due to the increased innovation and proliferation of fiber-based networks globally. Business subscribers continued to struggle with rising monthly charges, with the average monthly charge increasing by 12% and the average downstream speed standing at 426 Mbps compared to residential tariff averages of 464 Mbps.

The Asia-Pacific region retained its dominant bandwidth position with average speeds of 1,146 Mbps, up from 1,355 Mbps in Q4 2021 and 1,135 Mbps y-o-y, followed by North America, Western Europe, and Southeast Asia with the three regions reaching a combined average of around 465 Mbps.

Qatar, Switzerland and Southeast Asian countries still remain at the top of the league by average bandwidth along Italy, France and Bulgaria; these countries all rank in the top ten cheapest for residential broadband in terms of average cost per Mbps being less than $0.10 PPP.

In Q2 2022, the combined average download bandwidth grew by 20% compared to Q2 2021 and stood at 426 Mbps. This was caused by the boost in the average speed over cable and especially fibre, 14% and 22% respectively. Copper maintained largely the same average download speed compared to the previous quarter. However, the overall global average monthly cost across the three technologies has increased by just over 12% from $217 PPP to $244 PPP at the close of Q2 2022

References:

Global Broadband Tariff Benchmark Report, Q2 2022 (point-topic.com)

Synergy & IDC: Hosted and Cloud Services are driving the Unified Communications & Collaboration Markets

In a new report, Synergy Research Group states that spending on premises and cloud collaboration grew 8% from 2021 and is now approaching $15 billion per quarter. The on-premise portion of the market continues to decline steadily and now accounts for only 20% of the total, down from 30% two years ago.

The transition from enterprise use of on-premise products to cloud and hosted services has also been a boon for the collaboration market, which has benefitted in a big way from increased demand due to the rise of hybrid working during the pandemic. It includes as-a-service (aaS) software such as UCaaS (unified communications), CCaaS (contact center) and CPaaS (communications platform). These three services together grew 17% from last year and now account for more than $7 billion in quarterly spending.

Based on worldwide Q2 revenues Microsoft is the overall leader in total collaboration and continues to hold a steady market share, thanks to a broad portfolio of collaboration products and services. Cisco is the overall number two ranked vendor but is seeing its market share under pressure from Microsoft and companies propelled by the Covid pandemic. The biggest challenger is Zoom, which is now the number three ranked vendor driven by extraordinary growth rates over the last four years. Twilio is the fourth biggest vendor and now has a growth rate far in excess of the other three, as it dominates the rapidly emerging CPaaS market. Twilio’s CPaaS revenue run rate has now reached $2.5 billion per year. Other major vendors with particularly high growth rates include RingCentral, NICE, Five9 and Sinch.

“The impacts of the pandemic opened a tremendous new market opportunity within collaboration, especially in video conferencing services and devices, rapidly driving change that would otherwise have taken a decade to achieve,” said Jeremy Duke, Synergy Research Group’s founder and Chief Analyst “The collaboration market continues to evolve rapidly, as new technologies and services emerge that increase both management capabilities and productivity of in-office, remote and hybrid workers.”

IDC released a similar analysis of the global Unified Communications & Collaboration (UC&C) market, stating that it grew 11.4% YoY for Q2, reaching $14.8 billion. The market was up about 3% compared to Q1. IDC researchers noted that UC&C growth will continue as a result of increased interest in video conferencing, collaboration and UCaaS technologies.

“We’re seeing more strategic buying decisions by organizations versus fewer short-term reactive decisions in the recent past,” said Rich Costello, senior research analyst for Unified Communications and Collaboration at IDC, in a statement. “While the overall market remains a growth story, providers are starting to see some sales cycles return to the pre-covid pace.”

Some UC&C market specifics include the following:

- Hosted Voice/UC Public Cloud (UCaaS) revenue grew 17.0% year over year and 4.3% sequentially to almost $5.2 billion in 2Q22.

- UC Collaboration (including video conferencing software and cloud services) increased 10.2% annually and 1.3% sequentially to $7.2 billion in revenue in the quarter.

- IP Phone revenue increased 7.9% year over year and 13.9% quarter over quarter to $525 million in 2Q22.

- IP Phone shipments increased 2.8% year over year and 11.6% compared to 1Q22 to 4.5 million units shipped in the quarter.

- Enterprise Videoconferencing Room Endpoints (i.e., large video room endpoints) revenue increased 15.6% annually and 27.4% sequentially to more than $525.6 million in the quarter.

- Videoconferencing Huddle Room Endpoints revenue increased 24.7% year over year and 22.4% quarter over quarter to $263 million in 2Q22.

“We’re seeing more strategic buying decisions by organizations versus fewer short-term reactive decisions in the recent past,” said Rich Costello, senior research analyst, Unified Communications and Collaboration at IDC. “While the overall market remains a growth story, providers are starting to see some sales cycles return to the pre-covid pace.”

The UC&C market saw the following overall positive results in 2Q22 from a regional perspective:

- In North America (U.S. and Canada), UC&C revenue was up 10.1% year over year and 3.6% sequentially to just over $7.0 billion in 2Q 2022.

- Asia/Pacific (including Japan) revenue was up 16.8% year over year and 4.1% compared to 1Q22 to almost $3.0 billion in the quarter.

- EMEA revenue growth was up 8.9% year over year but just 1.0% sequentially to $4.2 billion in the quarter.

- Latin America revenue increased 20.9% year over year and 3.8% sequentially to $551.5 million in 2Q22.

UC&C Vendor Highlights

- Microsoft’s total worldwide UC&C revenue was $5.7 billion in 2Q22, up 22.7% year over year and 4.9% sequentially, representing a 38.3% share of the worldwide UC&C market for the quarter.

- Cisco’s total worldwide UC&C revenue was almost $1.2 billion, up 1.0% year over year and 8.6% sequentially, representing an 8.0% share of the worldwide UC&C market in 2Q22.

- Zoom’s total worldwide UC&C revenue increased 7.2% annually and 2.1% sequentially to more than $1.0 billion in the quarter, representing a 7.0% share of the worldwide UC&C market for 2Q22.

- RingCentral’s total worldwide UC&C revenue grew 29.8% year over year and 5.1% quarter over quarter to $424 million, representing a 2.9% share of the worldwide UC&C market for 2Q 2022.

References:

CEA-Leti RF Chip Enables Ultralow-Power IoT Connectivity For Remote Devices Via Astrocast’s Nanosatellite Network

CEA, a technology-research organization, and Astrocast, a leading global satellite Internet of Things network operator, have announced their successful collaboration on a low-cost, bidirectional communication module that enables corporations to communicate with their remote assets in areas not covered by terrestrial networks.

The module’s L-band chip, based on a new architecture developed by CEA-Leti, is a key hardware component that enables Astrocast customers to cost-efficiently communicate with their assets in the field via its network. It was completed earlier this year in an expedited project between the research institute and Astrocast, and is embedded in Astrocast’s RF module, called Astronode S.

The chip’s architecture is split over the RF core and digital processing and control units. It is fully optimized to support Astrocast’s dedicated bidirectional ground-to-satellite protocol and provides an optimal trade-off between link budget and low-power and low-cost constraints. The chip also embeds all low-earth orbit (LEO), satellite-specific features such as satellite detection and robustness to Doppler shift.

The miniaturized, surface-mount module communicates with terrestrial devices via Astrocast’s constellation of LEO satellites. Using the L-band spectrum, the network primarily targets maritime, oil & gas, agriculture, land transport and environmental applications in which ubiquitous coverage is required.

“Terrestrial IoT networks cover only about 15 percent of the planet, which leaves vast remote and rural areas where our global satellite network provides coverage that is crucial for our target markets,” said Laurent Vieira de Mello, Astrocast’s COO. “Leveraging its expertise embedded in a preliminary version of the RF chip, CEA-Leti developed its chip and delivered the final prototype to meet our requirements and time-to-market goals. They managed the chip technology transfer to our industrialization, qualification and production partner.”

The project’s critical time-to-market window was managed through a flexible collaboration model covering both prototype and industrialization phases.

“An accelerated time-to-market goal drove this project from the outset,” said Michel Durr, business development manager at CEA-Leti. “We pioneered this RF technology in 2019, and our team customized it for Astrocast up to production in only three years.”

CEA-Leti’s industrial tester used for characterization was key to accelerating from prototype to production, which enabled prototype characterization in parallel on the tester and in the lab, Durr explained.

“This process provided a short-loop debug capability with all skills available at CEA-Leti, and enabled us to deliver fully validated inputs to Astrocast’s industrialization partner for an easier industrial test-program development,” he said.

The low-energy, compact, surface-mount Astronode S module for highly integrated, battery-powered IoT systems offers a total cost of ownership up to three times lower than traditional satellite IoT alternatives.

References:

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

According to Juniper Research, the revenue generated by telecom operators from 5G fixed wireless access (FWA) services is expected to increase by 480 percent between 2022 and 2023, from $515 million to $2.5 billion. Broadband and Internet of Things (IoT) networks are just two examples of the usage of FWA services, which offer high-speed Internet connectivity using cellular-enabled CP (Customer Premises Equipment).

According to the research company, 5G FWA revenue for telecom operators will total $24 billion globally by 2027. This increase is attributed to 5G’s advanced capabilities, such as ultra-low latency and increased data processing, which enables it to offer connectivity services that were previously impossible with 4G technology. The company predicted that, with 96% of total sales coming from the consumer market, operators would earn the most money.

A compelling user proposition for FWA solutions must be provided by telcos through the bundling of extra services like video streaming, gaming, and smart home security, according to Juniper Research. This will enhance user experience and give telcos a competitive edge over technologies like FTTP (fiber to the property).

The advantages of FWA are now on par with those of services provided by fiber-based networks. By offering last-mile solutions supported by their current 5G infrastructure, operators have an immediate chance to make income from internet subscriptions directly to end customers, according to research author Elisha Sudlow-Poole.

The Juniper Research survey also recognized private 5G networks as a significant monetization prospect, giving superior network capabilities to 4G. According to the research company, smart manufacturing, shipping ports, and airports are the most likely sectors where telcos would implement 5G FWA. In order to maximize return on investment, it also advises operators to collaborate with fiber optic networks in conjunction with 5G FWA to facilitate the last mile solution.

Juniper Research asserted operators should bundle services including video streaming, gaming and smart home security into their FWA offerings to better compete with FTTP. The company cited private networks as a key revenue opportunity for operators due to the superior network capabilities compared with 4G. Smart manufacturing, shipping and airports are also key use cases.

Juniper Research also indicated operators should use 5G FWA to provide last mile connectivity, by treating it as a collaborative effort with fibre networks to maximize performance and return on investment. Recent GSMA Intelligence research showed 83 operators across 29 countries have launched FWA.

Juniper Research author Elisha Sudlow-Poole concluded by saying:

“The benefits of FWA are now comparable with services using fiber-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

……………………………………………………………………………………………………………………………………………………………………………………………

References:

5G Fixed Wireless Access Forecasts Report 2022-27: Share, Size (juniperresearch.com)

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

Juniper Research backs 5G FWA for growth spurt – Mobile World Live

Advocates of 12 GHz for 5G and Broadcasters surprised by FCC notice of inquiry on 12.7-13.25 GHz

FCC Chairwoman Jessica Rosenworcel’s announcement on Monday that the FCC will launch a notice of inquiry on 12.7-13.25 GHz was a surprise to advocates of using 12.2-12.7 for 5G, but doesn’t necessarily have negative implications for a long-awaited order on the lower part of the spectrum range. Supporters of 5G in 12-2-12.7 GHz see it as a positive that Rosenworcel acknowledged that 12 GHz is mid-band spectrum, which the administration identified as critical to 5G. Some refer to the upper section as 13 GHz to avoid confusion with work on the ongoing 12 GHz band.

Rosenworcel said the country needs more mid-band spectrum in the pipeline. “We need to keep up our efforts to find more airwaves to fuel the mid-band spectrum pipeline, following our successful auctions of the 3.45 and 2.5 GHz bands … these are the airwaves that are essential for 5G services to reach everyone, everywhere.”

The most substantial objections are likely to come from broadcasters, though fixed service, satellite and other links are in the band.

NAB (National Association of Broadcasters) was surprised by Rosenworcel’s announcement and hadn’t received any indications from the agency before the speech that it was looking to the 13GHz band, said Robert Weller, Vice President-Spectrum Policy in an interview.

“We’re awaiting the NOI,” he said. TV stations use the band for fixed length transmissions from studio to transmitter, and for relays and electronic newsgathering, he said. “Records at the @FCC show 1,989 broadcast auxiliary authorizations in this band, including 400 ENG authorizations,” Weller tweeted Tuesday.

“The NOI (Notice of Inquiry), if adopted, would provide an opportunity for all stakeholders to provide information and views well in advance of any policy proposal,” said an FCC spokesperson.

“The FCC, on a bipartisan basis, recognizes we need more mid-band spectrum freed up for 5G,” said an industry expert active in the proceeding.

A top DOD official noted the difficulty of clearing the 3.1-3.45 GHz band, the top candidate band for 5G, experts said. They predicted analysis of the 13 GHz band would likely take several years.

“While certainly giving credit for recognizing the need to act on new commercial mid-band spectrum, the focus on the upper 12 GHz is a bit puzzling because an NOI could take years and lower 12 GHz is essentially ready to go,” former Commissioner Mike O’Rielly told us. “I have to hope yesterday’s announcement is part of a multipronged band identification and reallocation effort to be released soon, coupled with definitive action on lower 12 and lower 3 GHz,” he said. “The only mid-band spectrum that is available to be put to use quickly is 12.2 to 12.7,” said Jeff Blum, Dish Network executive vice president-external and legislative affairs. “We continue to urge the FCC to unleash that band for 5G to help Dish compete in the wireless market while protecting incumbent operations from harmful interference,” he told us. “It’s very encouraging for us in the 12 GHz band to see the commission recognizing the value of bringing mid-band spectrum in the 7-16 GHz range to the U.S.’s spectrum pipeline,” said RS Access CEO Noah Campbell. The lower 12 GHz band “is very unique, and it’s very important for continued U.S. 5G leadership,” he said. “The opportunity to create a 1,000 MHz block between 12.2 and 13.2 is extremely compelling,” he said.

The Rosenworcel comments show the FCC won’t act before it’s ready on 12 GHz, said Digital Progress Institute President Joel Thayer. “The chairwoman is standing with the FCC’s engineers and not bending to political pressure,” he said. “This proceeding has been unnecessarily politicized and this move sends a clear message that the engineering and FCC procedure will be the determining factor here, not corporate lobbying.” In a white paper last year, IEEE said the 13 GHz band “could be considered as a future candidate for unlicensed use due to its allocation to the same types of incumbents as the recently opened 6 GHz band.” IEEE found little interference risk. “The demand for unlicensed spectrum will continue to increase in the next years, it is necessary to study potential new bands to accommodate new technologies and services in the mid-band spectrum,” the report said.

Author’s Comment:

We’ve posted two articles on the battle for 12 GHz spectrum policy (see References below). It’s important that the FCC is proposing 12GHz for 5G despite that frequency band NOT included in revision 6 of ITU M.1036 Frequency Arrangements for IMT (and in particular for 5G).

References:

https://www.law360.com/media/articles/1531929/fcc-chair-plans-to-explore-revamp-of-12-7-ghz-band

Bloomberg: U.S. Billionaire’s Battle Over FCC’s 12 GHz Spectrum Policy

Huawei Connect 2022: It’s Cloud Native everything!

Huawei’s annual flagship event, Huawei Connect 2022 –“Unleash Digital” opened in Bangkok, Thailand today.

- Ken Hu, the Rotating Chairman of Huawei, spoke about the importance of cloud adoption for enterprises to achieve leap-forward development.

- Zhang Ping’an, CEO of Huawei Cloud, announced the launch of two new Huawei Cloud regions in Indonesia and Ireland, as well as the “Go Cloud, Go Global” program for enterprises to access expertise and experience from Huawei Cloud’s global ecosystem partners.

- By the end of this year, Zhang said that Huawei Cloud will be deployed in 29 regions and 75 availability zones, covering 170 countries and regions worldwide. At the core of its offering is Everything as a Service built on a cloud-native foundation to enable enterprises to innovate faster and accelerate digital transformation.

Zhang Ping’an, CEO of Huawei Cloud

Editor’s Note: The top four Cloud service providers in China are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu. That’s very different from the U.S. where the leaders are Amazon AWS, Microsoft Azure, and Google Cloud.

Huawei Cloud has already set up 13 localized service centers in the Asia Pacific, with more than 1,000 certified engineers to provide tailored services. In addition, ecosystem development has been fruitful, with more than 2,500 local partners generating more than 50% of the revenue of Huawei Cloud. Huawei Cloud is also forging ahead with industry-government-academia collaboration in the Asia Pacific. Investment in the Huawei ASEAN Academy and the Seeds for the Future Program will be used to cultivate more than 1 million digital experts over the next five years.

Huawei Cloud serves 80% of the 50 biggest Internet companies in China and more than 200 major Internet companies in the Asia Pacific. In Sarawak, Malaysia, Huawei Cloud, together with its partners, has built cloud native infrastructure to support the collaboration of more than 30 government departments in five fields, and provided more than 80 digital government and smart city services to ensure more efficient and better-informed decision-making. In Indonesia, Huawei Cloud has provided a unified data foundation to help CT Corp migrate its media, retail, and finance services to the cloud, enabling precise recommendations for 200 million Internet users. The cloud native technologies of Huawei Cloud have helped Siam Commercial Bank (SCB) in Thailand quickly roll out its digital loan service. Loan approval and issuance, which used to take one month of work, is now fully automated and can be completed in just five minutes.

…………………………………………………………………………………………………………………………………………… …..

To address this pain point and unleash digital productivity for thousands of industries, Zeng Xingyun, President of Huawei Cloud, APAC, shared a three-pronged approach: to act with strategic resolve, embrace cloud-native and cultivate digital talent.

Zeng Xingyun, President of Huawei Cloud, APAC

Zeng emphasized long-term planning and a top-down approach to drive collaboration between IT and business departments to modernize blueprints and architecture based on cloud-native technologies. With 90% of enterprises in developed countries already using cloud technologies and 80% of all applications to be cloud-native by 2023, Zeng noted that cloud-native delivers efficient use of resources, agile applications, intelligent services and a secured system that helps government and enterprises stay compliant and grow sustainably.

In his speech, Zeng noted that Huawei Cloud has served more than 200 top Internet enterprises in Asia Pacific and 80% of the top 50 Internet enterprises in China. Huawei Cloud has 13 service centers in Asia Pacific, but more notably, Huawei Cloud is the first public cloud vendor to build local nodes in Thailand, with three availability zone data centers serving the local market.

He spoke about how cloud-native drives digital transformation in public and private sector, elaborating on how Huawei Cloud supports Siam Commercial Bank’s (SCB) automated processes to approve large volumes of loan requests within minutes, helping SCB attract 45,000 digital users and a credit limit worth THB 204 million within a quarter.

He also highlighted the importance of a talent ecosystem to address a digital talent shortage amounting to 47 million by 2030 in Asia Pacific. Through industry-academia cooperation such as the ASEAN Academy and the Seeds for the Future Program, more than 1 million digital talents will be cultivated in the next five years. Meanwhile, the Huawei Cloud Startup Program, aimed to help regional startups adopt cloud agilely, has already attracted more than 120 Asian enterprises since its recent launch. One such enterprise is ReverseAds, a Phuket-founded startup that has successfully secured US$24 million in funding to expand beyond Thailand.

The summit also saw the joint launch of Cloud Native Elite Club (CNEC) APAC by Huawei Cloud and Cloud Native Computing Foundation (CNCF). First established in China two years ago, CNEC gathers over 200 members working collaboratively to develop industry standards and promote cloud-native technologies in China. Likewise, the APAC branch will look to further cloud-native technologies.

Cloud-Native 2.0 for Industry Enablement:

An important driving force for service innovation, cloud-native technologies such as container, microservice, and dynamic orchestration empower enterprises to build and run scalable applications in modern, dynamic environments.

As cloud-native enters a new developmental stage, Fang Guowei, Chief Product Officer of Huawei Cloud, shared that Cloud Native 2.0 is a new phase for the intelligent upgrade of enterprises, focused on delivering Everything as a Service incorporating Infrastructure as a Service, Technology as a Service and Expertise as a Service to yield breakthroughs in digital transformation for government and enterprises.

An advocate of cloud-native innovations with open source, Huawei Cloud has contributed to the CNCF with open source projects including KubeEdge, Volcano and Karmada, hence growing the CNCF community from 1 Kubernetes project in 2015 to more than 20 categories and over 1,100 projects today.

Huawei Cloud delivers cost-effective cloud services with the innovative full-stack QingTian Architecture, featuring ultra-fast I/O engine, end-to-end security and enhanced operations and maintenance.

Adding to its offerings are more than 15 cloud-native products and services introduced to the global market for the first time. Elaborating on two core cloud-native innovations, Fang introduced the Cloud Container Engine (CCE) Turbo as a new cloud-contained engine that yields increased resource utilization, reduced access latency by up to 40%, and scale out 3,000 pods per minute to cope with traffic surges.

He also featured the Ubiquitous Cloud-Native Service (UCS), a distributed cloud-native service that allows enterprises to connect thousands of Kubernetes clusters to deliver a consistent experience through multi-cloud, cross-region applications.

Introductions were made to new services based on four pipelines: ModelArts to help AI developers effectively achieve one-stop data-tagging/model training; DataArts for an efficient and intelligent data governance pipeline; DevCloud for a secure and productive software development pipeline; and MetaStudio to provide better media experience. Other upcoming offerings include MacroVerse aPaaS such as KooMessage, KooSearch and KooGallery.

Fang also took the opportunity to release the Cloud-Native 2.0 Architecture White Paper to help enterprises embark on digital transformation.

Articulating the impact of Huawei Cloud’s innovations on industries, Hu cited AI adoption in the Pangu Drug Molecule Model to yield faster drug discovery for the First Affiliated Hospital of Xi’an Jiaotong University – successfully reducing R&D costs by 70% and development to approval time from a decade to a month for the world’s first broad-spectrum antimicrobial drug.

As one global network, Huawei Cloud has launched more than 240 cloud services, aggregating more than 38,000 partners and 3 million developers to release more than 7,400 applications in the cloud market.

With cloud-native technologies becoming a key engine to unleash digital productivity, Huawei Cloud demonstrates a commitment to harness cloud-native, Everything as a Service to spur economies.

References:

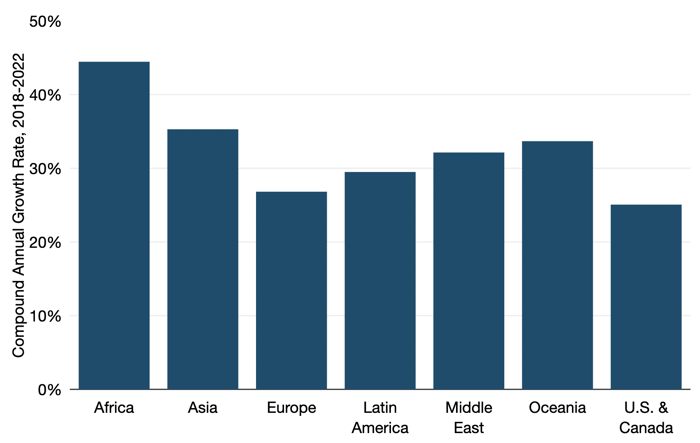

Telegeography: Global internet bandwidth rose by 28% in 2022

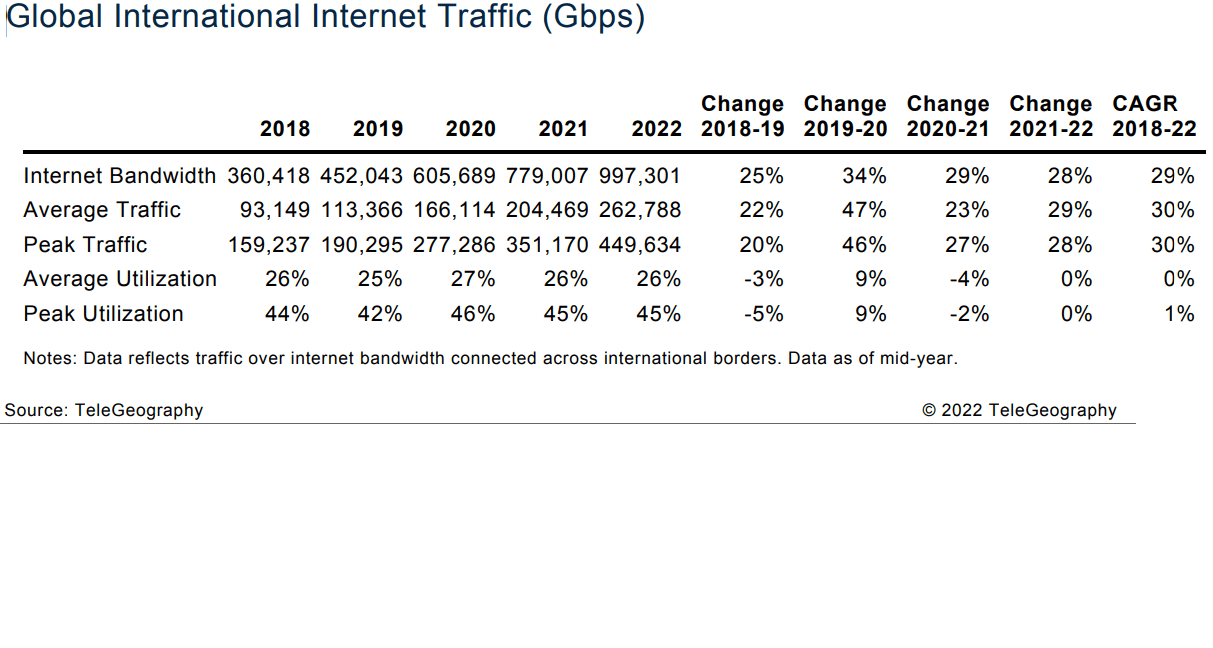

According to Telegeography, Global internet bandwidth rose by 28% in 2022, continuing the return to “normal” from the pandemic-generated bump of 2020.

Total international bandwidth now stands at 997 Tbps, representing a 4-year CAGR of 29%. COVID bump aside, the pace of growth has been slowing. Still, we do see a near tripling of bandwidth since 2018.

Strong capacity growth is visible across regions. Africa experienced the most rapid growth of international internet bandwidth, growing at a compound annual rate of 44% between 2018 and 2022. Asia is behind Africa, rising at a 35% compound annual rate during the same period.

Source: Telegeography

Both average and peak international internet traffic increased at a compound annual rate of 30% between 2018 and 2022—slightly above the 29% compounded annual growth rate in bandwidth over the same period. All the stay-at-home activity associated with COVID-19 resulted in a spike in traffic from 2019 to 2020. Average traffic growth dropped from 47% between 2019-2020 to 29% between 2021-2022, while peak traffic growth dropped from 46% to 28% over the same time period.

Prices for Internet Service:

ISPs shift to predominantly 100 Gbps internet backbones continues to reduce the average cost of carrying traffic and enables profitability at lower prices. As a result, price erosion remains the universal norm. It reflects the introduction of competition into new markets and the response of more expensive carriers to lower prices. Trends in the IP transit market generally follow regional trends of the transport market. And while some have suggested that price erosion may slow as a result of recent inflation and supply chain constraints (as it has in the wavelength market), we have not seen this trend make its way into the IP transit market.

Across the cities included in the figure below, 10 GigE prices fell 16% compounded annually from Q2 2019 to Q2 2022. Over the same period 100 GigE port prices fell 25%. In Q2 2022, the lowest 10 GigE prices on offer were at the brink of $0.09 per Mbps per month. The lowest for 100 GigE were $0.06 per Mbps per month.

The sharper decline in 100 GigE reflects the advanced maturity of 10 GigE, as well as more carriers offering it and more competition. While 10 GigE remains a relevant increment of IP transit, particularly in more emerging markets, its share of the transaction mix continues to yield to 100 GigE. In 2022, providers indicated that a majority of their sales mix in key U.S. and European hubs was now 100 GigE. On average, across the cities noted, the Monthly Recurring Charge (MRC) for a 100 GigE port was 6.7 times the MRC for a 10 GigE port. Operators are poised to adopt 400 GigE IP transit ports as the next fundamental upgrade from multiple 100 GigE ports.

Outlook:

The combined effects of new internet-enabled devices, growing broadband penetration in developing markets, higher broadband access rates, and bandwidth-intensive applications will continue to fuel strong internet traffic growth. While end-user traffic requirements will continue to rise, not all of this demand will translate directly into the need for new long-haul capacity.

A variety of factors shape how the global internet will develop in coming years:

• Post-COVID-19 growth trajectory. Initial evidence suggests that the spike in the rate of bandwidth and traffic growth in 2020 from the pandemic was a one-time event and we have largely returned to more traditional rates of growth. Operators we spoke to indicated they no longer see the pandemic leading to upward adjustments to their demand forecasts.

• IP Transit Price Erosion. International transport unit costs underlay IP transit pricing. As new international networks are deployed, operational and construction costs are distributed over more fiber pairs and more active capacity, making each packet less expensive to carry.

• We already see a major shift from 10 GigE requirements to 100 GigE requirements and expect that 400 GigE will emerge in two to three years as a significant part of the market.

• The introduction of new international infrastructure also creates opportunities for more regional localization of content and less dependence on distant hubs. As emerging markets grow in scale, they too will benefit from economies of scale, even if only through cheaper transport to internet hubs.

• International versus domestic. While there’s little doubt that enhanced end-user access bandwidth and new applications will create large traffic flows, the challenge for operators will be to understand how much of this growth will require the use of international links. In the near-term, the increased reliance on direct connections to content providers and the use of caching will continue to have a localizing effect on traffic patterns and dampen international internet traffic growth.

• Bypassing the public internet. The largest content providers have long operated massive networks, these companies continue to experience more rapid growth than internet backbones and they are expanding into new locations. Many other companies, such as cloud service providers, CDNs, and even some data center operators, are also building their own private backbones that bypass the public internet. As a result, a rising share of international traffic may be carried by these networks.

References:

https://blog.telegeography.com/internet-traffic-and-capacity-remain-brisk