5G private networks

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Private 5G ecosystem is evolving:

Private 5G is running behind schedule. Dell’Oro’s VP Stefan Pongratz adjusted the firm’s private wireless forecast downward to reflect the current state of the market. Still, the slow uptake is not dampening the enthusiasm for private wireless. If anything, the interest is growing and the ecosystem is evolving as suppliers with different backgrounds (RAN, core, Wi-Fi, hyperscaler, in-building, SI) are trying to solve the enterprise puzzle.

According to Dell’Oro’s data, the total private wireless small cell market outside of China exceeds $100 million. But Pongratz indicated that’s not very much. “Commercial private wireless revenues are still so small. We estimate private wireless small cells is still less than 1% of the overall public-plus-private RAN market in 2022.”

He did concede that the private wireless small cell market outside of China is growing at double digits. “It’s heading in the right direction,” said Pongratz. “A lot of suppliers see good things for 2023.”

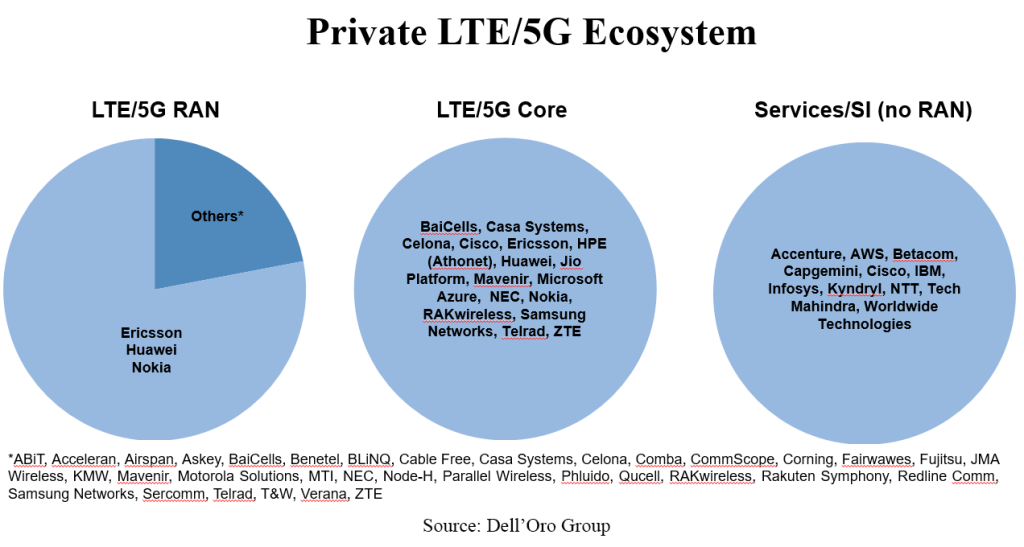

According to Stefan, the top three private wireless vendors in the world are Nokia, Huawei and Ericsson. Celona has said that its goal is to overtake Nokia in private wireless. Celona CEO Rajeev Shah said that based on Nokia’s public earnings reports, the company seems to be garnering about 30-35 private wireless customers a quarter and has about 515 of these customers in total. Shah said these numbers aren’t huge, and the industry has a long way to go.

Below is a summary of the private RAN, core, and SI/services providers that Stefan is currently monitoring.

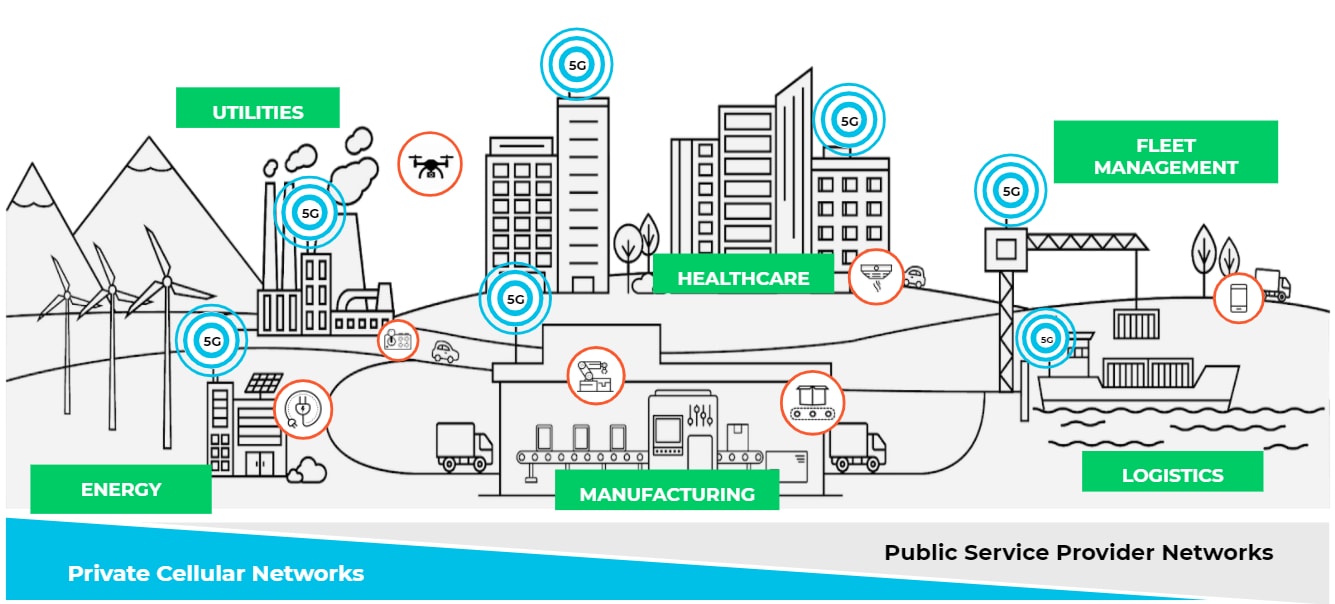

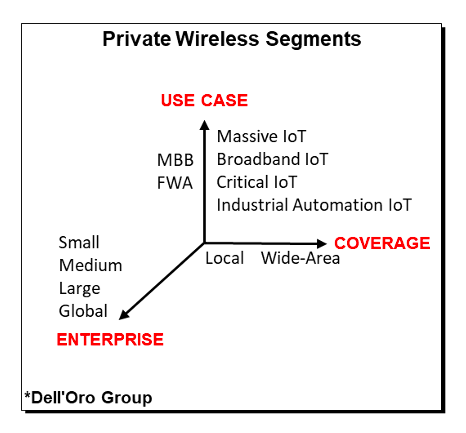

Pongratz said the private wireless market can also be segmented by macro versus small cell. He said private wireless has been around for quite some time — since 2G. But traditionally, it was used as a wide area network (WAN), using the 3GPP definition for non-public networks. Often these networks deployed macros for very large organizations such as utility companies.

“The shiny new object is really the local campus deployments; that’s really small cells,” said Pongratz. “There will be a component of the new shiny that is also WAN, like a car manufacturer that could use both macros and small cells.”

But regardless, whether the private wireless market is segmented by macro or small cell, Dell’Oro still finds the top three suppliers are Huawei, Ericsson and Nokia.

………………………………………………………………………………………………………………………………………………………………………..

Virtualized RAN is gaining momentum:

As we now know, vRAN started out slow but picked up some speed in 2022 in conjunction with the progress in the US. The challenge from a forecasting perspective is that the visibility beyond the greenfields and the early brownfield adopters is limited, primarily because purpose-built RAN still delivers the best performance and TCO. As a result, there is some skepticism across the industry about the broader vRAN growth prospects.

During MWC, Steffan learned four things: 1) Near-term vRAN visibility is improving – operators in South Korea, Japan, US, and Europe are planning to deploy vRAN in the next year or two. 2) vRAN performance is firming up. According to Qualcomm, Vodafone (and Qualcomm) believes the energy efficiency and performance gap between the traditional and new Open vRAN players is shrinking (Vodafone publicly also praised Mavenir’s OpenBeam Massive MIMO AAU). Samsung also confirmed (again) that Verizon is not giving up any performance with Samsung’s vRAN relative to its purpose-built RAN. 3) vRAN ecosystem is expanding. In addition to existing vRAN suppliers such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia announcing improvements to their existing vRAN/Cloud RAN portfolios, more RAN players are jumping on the vRAN train (both NEC and Fujitsu are expecting vRAN revs to ramp in 2023). And perhaps more interestingly, a large non-RAN telecom vendor informed us they plan to enter the vRAN market over the next year. 4) The RAN players are also moving beyond their home turf. During the show, Nokia announced it is entering the RAN accelerator card segment with its Nokia Cloud RAN SmartNIC (this is part of Nokia’s broader anyRAN strategy).

Skepticism is on the rise

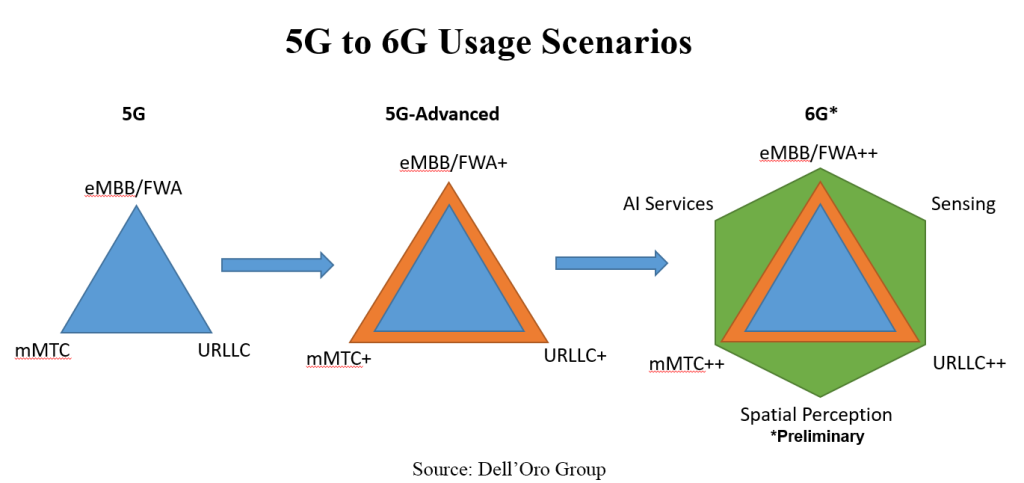

Not surprisingly, disconnects between vision and reality are common when new technologies are introduced. Even if this is expected, we are sensing more frustration across the board this time around, in part because RAN growth is slowing and 5G still has mostly only delivered on one out of the three usage scenarios outlined in the original 5G use case triangle. With 5G-Advanced/5.5G and 6G starting to absorb more oxygen, people are asking if mMTC+/mMTC++ and URLLC+/URLLC++ are really needed given the status of basic mMTC and URLLC. Taking into consideration the vastly different technology life cycles for humans and machines, there are more questions now about this logic of assuming they are the same and will move in tandem. If it is indeed preferred to under-promise and over-deliver, there might be some room to calibrate the expectations with 5G-Advanced/5.5G and 6G.

References:

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Following their first partnership one year ago, Nokia and Kyndryl have extended it for three years after acquiring more than 100 customers for automating factories using 4G/5G private wireless networks as well as multi-access edge computing (MEC) technologies. Nokia is one of the few companies that have been able to get any traction in the private 4G/5G business which is expected to grow by billions of dollars every year. The size of the global private 5G network market is expected to reach $41.02 billion by 2030 from 1.38 billion in 2021, according to a study by Grand View Research.

The companies said some customers were now coming back to put private networks into more of their factories after the initial one. “We grew the business significantly last year with the number of customers and number of networks,” Chris Johnson, head of Nokia’s enterprise business, told Reuters.

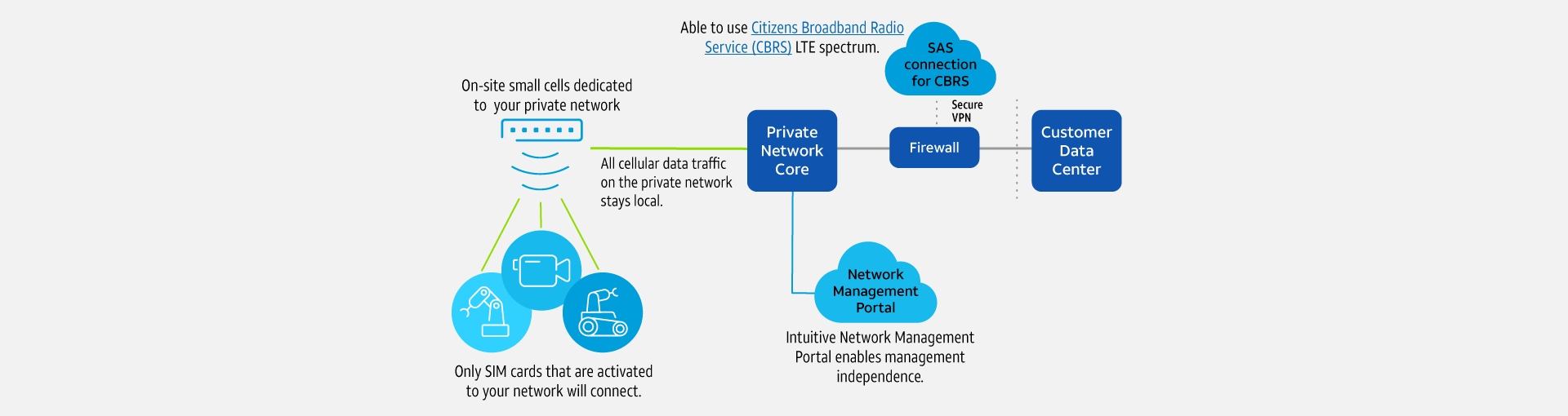

According to the companies, 90% of those engagements—which span “from advisory or testing, to piloting, to full implementation”—are with manufacturing firms. In Dow Chemical’s Freeport, Texas, manufacturing facility which is leveraging a private LTE network using CBRS frequencies to cover 40 production plants over 50-square-kilometers. The private wireless network increased worker safety, enabled remote audio and video collaboration, personnel tracking, and vehicle telematics, the companies said. Dow Chemical is now planning to expand the same coverage to dozens of its factories, said Paul Savill, Kyndryl’s [1.] global practice leader. “Our pipeline has been growing fundamentally faster than it has been in the last 12 months,” he said. “We now have over 100 customers that we’re working with in the private wireless space … in around 24 different countries.”

Note 1. After getting spun off from IBM in 2021, Kyndryl has focused on building its wireless network business and has signed several agreements with cloud providers.

The current active engagements are across more than 24 countries, including markets like the U.S. where regulators have set aside spectrum assets for direct use by enterprises; this means it’s increasingly possible for buyers to access spectrum without the involvement of mobile network operators.

“As enterprises seek to accelerate and deliver on their journeys towards Industry 4.0 and digitalization, the effective integration and deployment of advanced LTE and 5G private wireless networking technologies becomes instrumental to integrate all enterprise operations in a seamless, reliable, efficient and built in a secure manner,” said Alejandro Cadenas, Associate Vice President of Telco and Mobility Research at IDC. “This expanding, powerful, relationship between Nokia and Kyndryl is a unique combination of vertical and horizontal capabilities, and offers IT, OT and business leaders access to the innovation, tools, and expert resources they need to digitally transform their operations. The partnership offers a compelling shared vision and execution that will enable customers across all industries and geographies to access the ingredients they need to deliver against the promise of digital acceleration, powered by network and edge computing.”

The expanded effort will be enhanced with Kyndryl’s achievement of Nokia Digital Automation Cloud (DAC) Advanced accreditation status, which helps ensure that enterprise customers benefit from an expanded lineup of expert resources and skilled practitioners who have extensive training and deep understanding of Nokia products and solutions. In addition, customers will gain access to Kyndryl’s accelerated network deployment capabilities and support of Nokia cellular radio expertise in selected markets.

In response to a question about how direct enterprise access to spectrum has informed market-by-market activity, Kyndryl Global Practice Leader of Network and Edge Paul Savill told RCR Wireless News in a statement, “Spectrum availability is rapidly becoming less of a barrier, with governments allocating licensed spectrum for industrial use and the emergence of unlicensed wireless networking options (such as CBRS in the US, and MulteFire).”

The companies have also developed automated industrial drones that can monitor a site with different kinds of sensors such as identifying chemicals and video recognition as part of surveillance. While drones have not yet been deployed commercially yet, customers are showing interest in rugged, industrialized non-stop automated drone surveillance, Johnson said.

References:

Verizon deploys Private 5G at Wichita Smart Factory; 5G Radio’s an Issue?

Executive Summary:

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Verizon, as a builder-level collaborator in The Smart Factory at Wichita ecosystem of 20 leading global companies, intends to use this network of companies to help customers from various industries to innovate their approach to better connectivity and use of data to improve real-time coordination between people and assets. Verizon’s private 5G wireless network provides features that will help drive select use cases at The Smart Factory in Wichita, which include:

Select Use Cases at The Smart Factory:

- Improved shop floor visibility: Using predictive maintenance analytics on assets can improve uptime and productivity by addressing up to approximately 50% of the root causes of downtime.

- Improved quality assurance and reduced defects: Detection of potential defects in manufactured products or services before they reach customers, thereby improving the customer experience and reducing waste.

- Material handling automation: Orchestration and management of AGV and AMR fleets can improve the reliability, consistency, safety, and accuracy of moving material across the plant.

- Workplace safety: Reduces human error and manual workloads to minimize injury and productivity loss.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

The Smart Factory in Wichita:

The Smart Factory at Wichita assists firms through their most difficult manufacturing challenges by showcasing modern manufacturing techniques in a variety of applications on a shop floor. The Factory, located on the Innovation Campus at Wichita State University, includes a fully operational production line and experiential labs for creating and researching smart manufacturing technology and strategy.

Visitors to the facility can explore smart manufacturing concepts that combine the Internet of Things (IoT), cloud, artificial intelligence (AI), computer vision, and more to create interconnected systems that use data to drive real-time, intelligent decision-making.

Verizon Private 5G:

By utilizing Verizon 5G and edge computing to create applications and solutions that drive both the manufacturing and retail industries, this work with Deloitte at The Smart Factory at Wichita strengthens the commitment between the two businesses to co-innovate.

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

Could 5G Radios be a Problem for Private 5G?

CEO Hans Vestberg told a Citi investor conference this week:

“We need certain radio base stations for private networks, different price ranges. We need modems for certain things. You need more than the handset and the macro sites that is now in there,” Vestberg said at Citi’s 2023 Communications, Media, and Entertainment Conference. “We would now have offerings for cheaper private 5G networks with certain suppliers and more high level, high quality. We didn’t have this optionality, and that’s why we’re now sort of seeing that we’re actually meeting the customer demands of building private 5G networks.”

Vestberg added that the carrier now has “the ecosystem for radios so we are fully committed. We strongly believe in private 5G networks, and that’s a revenue stream we don’t have today because we’re not into Wi-Fi networks and optimization of a manufacturing site. We’re not into that today.”

Verizon Business CEO Sowmyanarayan Sampath during an investor conference in November said it had dozens of private networks already deployed, with accelerating momentum.

“On the private networks, we are very bullish on that opportunity and I think things have gotten a little faster in the last 90 days than they’ve gotten in the last year or so,” Sampath said, adding most of Verizon’s initial private network deals have resulted in incremental spending by customers.

“For example, if we are providing wireline network services – I’ll call it more broadly network services – to 10,000 stores, and if the realtor wants 100 sites or 200 sites of private network, they’re going to come to us because we are already integrated into their service stack, we are integrated into their day-two operating model, we are integrated into their operating system, so when a ticket happens they know what to do and vice versa,” Sampath said. “It’s a very logical extension to our business when you’re managing large portions of the infrastructure to manage their private network piece to it.”

References:

https://www.fiercewireless.com/private-wireless/verizons-arvin-singh-discusses-private-5g

https://www.verizon.com/about/news/verizon-private-5g-network-aircraft-hangar

Adani Group to launch private 5G network services in India this year

Adani Group, the newest entrant in India’s telecom space, is looking to launch private 5G services for enterprises in 2023. The conglomerate also announced that it would be launching consumer apps this year as part of its digital strategy.

Addressing his employees in the New Year, Chairman Gautam Adani said they will invest in expanding the network of data centers, building AI-ML and industrial cloud capabilities, along with rolling out 5G services and launching B2C apps.

“While we are fully invested in building India, it is an opportune time to contribute to nation-building outside India. All of these are big ticket, independent yet mutually connected digital opportunities that are backed by our adjacency in the energy business,” he said.

The Gujarat-based conglomerate surprised industry incumbents when it took part in 5G auctions in 2022. While Adani has not purchased spectrum across all 5G bands and thus cannot provide consumer telephony, the conglomerate parted with Rs. 212 crore to buy 400MHz spectrum in the mm-wave band. Adani is gunning to provide private network services to enterprises, including its own.

However, telecom operator Bharti Airtel beat Adani to the punch, bagging the first private 5G network deal with Mahindra Group late last year.

Reliance Jio has also indicated that private 5G will be a key avenue for monetization for the operator in the future. Chairman Mukesh Ambani has committed Rs 2 trillion investment for rolling out a 5G network across the country by December 2023, according to a recent report by the Press Trust of India.

Other entities, such as IT major Tata Consultancy Services (TCS), could also participate in the private 5G network market. They are awaiting spectrum assignment rules from the DoT and TRAI, who are still deliberating the spectrum bands, which will be given to enterprises for private network use through administrative allocation.

References:

Analysys Mason: few private networks include edge computing, despite the synergies between the two technologies

In a report on Private LTE/5G network deployments, Analysys Mason said that “Only 58 of the 363 private network announcements in our tracker explicitly mention that the private network is working with edge computing.” That’s no surprise as per our recent IEEE Techblog post that edge computing has not lived up to its promise and potential.

The number of announced private networks increased from 256 during the third quarter of last year, to 363 announced deployments during Q3 of this year. Most of that growth is coming from more advanced countries and China “where the IoT markets are mature and are driving demand for private networks.” Private networks using 4G LTE technology continue to dominate the overall market “because it is able to meet the connectivity requirements of most private network applications.” However, 5G is gaining ground with more than 70% of new networks announced this year stating the use of 5G technology.

Private networks and edge computing are complementary as each adds value to the other. When combined, the technologies can support applications that have requirements for low latency and high bandwidth or that need to be located on site for security purposes.

The adoption of edge computing with private networks has been limited thus far due to several factors, such as the relative immaturity of edge technology. The drivers of private network adoption are also different to those of edge computing adoption.

Private LTE/5G networks are often introduced to replace existing Wi-Fi or fibre access networks, and no other changes are made. Nevertheless, the share of private network announcements that mention edge is growing, and more than 20% of the private networks that have been publicly announced in 2022 so far include edge. We expect that more private networks will include edge computing in the next 18–24 months. Some vendors are promoting edge as part of a packaged private network solution (such as Nokia with its NDAC solution).

A few operators, such as Verizon, Vodafone and the Chinese MNOs, are promoting the combination, and many other service providers have trials that combine the technologies.

Verizon Business CEO Sowmyanarayan Sampath who during a recent NSR & BCG Innovation Conference explained that private 5G network momentum was outpacing demand for the carrier’s mobile edge computing (MEC) services.

“On the MEC, what we are finding is demand is taking a little longer to go,” Sampath said. “And part of that is we are having to work back and integrate deeper into their operating system. So it’s going to be much stickier when it does happen [but] it’s going to take a little longer. We’ve got loads of proof of concepts and early commercial deployments, but we shouldn’t see revenue till the back half of next year and into 2024.”

References:

https://www.sdxcentral.com/edge/definitions/what-multi-access-edge-computing-mec/

Has Edge Computing Lived Up to Its Potential? Barriers to Deployment

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Global telco revenues from 5G Fixed Wireless Access (FWA) will rise from $515 million in 2022 to $2.5 billion next year, according to a new report from Juniper Research. FWA includes services that provide high-speed Internet connectivity through cellular‑enabled CPE (Customer Premises Equipment) for uses including broadband and IoT networks.

The research predicts that operators’ 5G FWA revenue will reach $24 billion globally by 2027. It identified the consumer market as the sector generating the highest revenue for network operators, representing 96% of global 5G FWA revenue. However, it warns that operators must provide a compelling user proposition for FWA solutions through the bundling of services such as video streaming, gaming and smart home security to enrich user experience and gain competitive advantage against incumbent high‑speed connectivity technologies, such as FTTP (Fibre‑to‑the‑Premises).

| Key Market Statistics | |

| Market size in 2022: | $515m |

| Market size in 2023: | $2.5bn |

| 2022 – 2027 Market Growth: | 480% |

Juniper Research author Elisha Sudlow-Poole remarked: “The benefits of FWA are now comparable with services using fibre-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

Juniper Research notes that the increase in 5G subscribers will be driven mainly by “the accelerating migration of cellular subscriptions to 5G networks, owing to operator strategies that minimize or remove any premium over existing 4G subscription offerings,” and that 600 million additional 5G subscriptions are expected be created next year, “despite the anticipated economic downturn in 2023.”

The report predicts that the growth of 5G networks will continue, and over 80% of global operator‑billed revenue will be attributable to 5G connections by 2027. The telecommunications industry demonstrated its robustness against the impact of the COVID-19 pandemic, and the report forecasts that the growth of 5G will also be resilient against this economic downturn due to the vital importance of mobile Internet connectivity today.

Juniper Research co-author Olivia Williams noted: “Despite the growth of the Internet of Things, revenue from consumer connections will continue to be the cornerstone of 5G operator revenue increase. Over 95% of global 5G connections in 2027 will be connected personal devices such as smartphones, tablets and mobile broadband routers.”

Private 5G Networks Represent a Key Opportunity for Operators:

In addition, the report predicts that the ability of standalone 5G networks to offer ‘network slicing’ will act as the ideal platform for the growth of 5G private network revenue. 5G Standalone (SA) uses 5G core networks supporting network slicing technology, which can be used to take a ‘slice’ of public 5G infrastructure and provide it to private network users. In turn, this helps mitigate the cost of private 5G network hardware and increase its overall value proposition, all against a background of deteriorating macro-economic conditions.

The report recommends that operators use 5G FWA to facilitate the last mile-solution by treating the relationship between FWA and fibre networks as wholly collaborative to maximize network performance and return on investment.

References:

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

5G Service Revenue to Reach $315 Billion Globally in 2023 | TelecomTV

Understanding security threats for telco edge and private 5G networks

Author: Adil Baghir (edited by Alan J Weissberger)

Introduction:

Telcos and enterprises realize the need to move toward the network edge to deploy cloud-like solutions to leverage the massive advances in transmission offered by 5G. Benefits such as speed, low latency, and capacity will drive major transformation for telcos and enterprises, opening new revenue opportunities from new business models. We’ll examine several 5G deployment scenarios and security threats in this article.

Image Credit: Palo Alto Networks

……………………………………………………………………………………………………………………………………………………………………….

Discussion:

Telcos and enterprises are exploring new use cases by deploying edge clouds and bringing content and applications closer to the users and billions of IoT devices to meet the low-latency requirements. The Ericsson 2022 Mobility Report forecasts that over 30 billion Internet of Things (IoT) devices will be connected by 2027.

The 5G core network functions could be deployed as a microservice in a private data centre of the communications service provider (CSP) and enterprise network or in a public cloud (like AT&T-Microsoft Azure and Dish Network-Amazon AWS).

The shift to the edge and deploying telco cloud edge services and enterprise hybrid private 5G networks introduce new security threats associated with the 5G and edge deployment.

Even though there are security risks with 3G/4G, these risks are mainly associated with external attacks. However, with 5G/MEC/IoT architecture, these risks become more serious. 5G core and edge sites can be attacked from the internal network in an “inside-to-outside” approach. Considering that 5G provides high-speed internet broadband, connecting a massive number of consumer and IoT devices, this can be viewed as a new point of attack for the 5G cloud edge architecture.

Such massive transformation forces telcos and enterprises are deploying cloud edge and private 5G services to rethink their security and network protection. There are many challenges in how telcos and enterprises deploy security solutions today as they cannot provide integrated 5G core and security solutions to adapt with cloud-edge use cases. For example, moving to the edge will require a low footprint, automation, scaling and simplified lifecycle management (LCM). Given the increase in the number of edge sites deployed, it will be very complex to manage and scale different security solutions manually. The typical deployments of security solutions are not optimised for distributed and cloud-edge architectures.

The impact of security compromise on an operator or enterprise edge network could be massive because edge sites usually have less capacity than core sites and host mission-critical applications to accommodate low latency requirements, including IoT use cases. For example, a 10/20G volumetric DDoS attack could have a major impact on the network availability and low-latency requirements, and it would lead to a critical service interruption and result in brand damage.

The shift to cloud and edge for telcos and enterprises is an evolved approach to deploying and delivering services and solutions, and introducing a more dynamic environment. The security measures in place today are not aligned with the cloud-edge requirements for the footprint for physical security solutions, increasing number of edge sites, cloud-native strategy and other required capabilities to improve TCO.

DDoS-based IoT Botnet

Most IoT devices have limited computing resources to provide security functionality and typically are not securely coded. MOZI is an example of a DDoS-focused IoT botnet that utilises a large set of remote code executions (RCEs) to leverage common vulnerabilities and exposures (CVEs) in IoT devices for infection. These devices include network gateways, CCTVs, DVRs, etc. Once the IoT device is successfully infected, the botnet uses protocols/apps, such as TCP/UDP/HTTP, to send and receive configuration updates and attack commands. Eventually, the infected IoT nodes begin generating attack traffic, leading to a massive and sudden spike in UDP traffic going back and forth with peer-to-peer networks. Such volumetric attacks from compromised IoT devices will make it very challenging to guarantee a level of service and maintain low-latency requirements.

Even though it’s always recommended to keep the IoT devices running the latest firmware with all the necessary security patches applied. However, we can’t rely entirely on securing or updating IoT devices. Therefore the network should also be equipped with modern security solutions like DDoS baselining techniques to see anomalous behaviour versus historical norms, and AI/ML techniques, for detection and zero-day attack prevention.

Mobile Edge Cloud and Private 5G Requires New Security Approaches

Security for mobile cloud edge and enterprise hybrid private 5G must be measured carefully to align with the new and increasing security threats. This requires securing the mobile core infrastructure and modern network protection to deliver mission-critical applications while maintaining low latency requirements. Ultimately, this will help telcos and enterprises achieve their desired business outcomes.

In addition, the security implementation for telcos should consider security-as-a-service so that operators may offer secure IoT services leveraging network slicing and provide the flexibility for end customers to manage their security policies with complete network isolation. This requires security integration with the 5G ecosystems to ensure subscriber and device awareness for more agile security control.

Enterprises that deploy private 5G networks may lack the telco experience and knowledge to secure that mobile infrastructure. They might rely entirely on the MNO or their mobile network equipment providers (NEPs) to ensure the infrastructure is fully secured and protected. However, enterprises must extend their network and IT security standards and take all the necessary considerations when they move their critical systems and applications to the edge.

Although 5G comes with embedded security standards, it also introduces potential security risks associated with the deployment model and communications systems. In this post, I have focused on one of the security risks associated with 5G deployment: a DDoS-based IoT botnet. In Part II, I will cover other potential security areas:

- 5G deployment in Hyperscale Cloud Providers (HCP)

- HTTP/2 and exposure of API

- Inert-PLMN

Resources:

Threat Intelligence Report, A10 Global State of DDoS Weapons, H1 2021

Ericsson 2022 Mobility Report, June 2022

Evolving 5G Security for the Cloud, 5G Americas White Paper, Sept 2022

Lockheed Martin, AT&T Demonstrate High Speed Transfer of Black Hawk Data on AT&T 5G Private Network and 5G.MIL® Pilot Network

Lockheed Martin and AT&T securely and rapidly transferred UH-60M Black Hawk health and usage data through an AT&T 5G private cellular network and Lockheed Martin’s 5G.MIL® multi-site pilot network in a test conducted Aug. 4 at Lockheed Martin’s Sikorsky headquarters in Stratford, Connecticut.

The test demonstrated that wireless 5G technologies on the flight line can support accelerated maintenance operations and improved aircraft readiness to support our service members. It also proved highly secure interoperability between the AT&T millimeter wave 5G private cellular network and the 5G.MIL pilot network.

- Technology reduced data transfer time for military helicopters by more than 80%

- Using 5G capabilities, network engineers transfer health and usage data from a Sikorsky UH-60M Black Hawk to Waterton, Colorado, for real-time analysis

“These 5G capabilities deployed at scale are expected to enable high-speed, secure-data transfer on virtually any flight line, providing another example of how we’re advancing our 21st Century Security vision by improving customer readiness and operations,” said Dan Rice, vice president of 5G.MIL Programs at Lockheed Martin. “In collaboration with commercial 5G leaders, an interoperable 5G.MIL multi-site, multi-vendor network is another step closer to reality.”

The AT&T 5G millimeter wave private cellular network wirelessly transferred data to the 5G.MIL network through ground support equipment from the Black Hawk’s Integrated Vehicle Health Management System (IVHMS). The data was then routed to local Sikorsky networks for processing and distribution through the secure Lockheed Martin 5G.MIL pilot network to the Waterton, Colorado, 5G test range site.

Image Credit: AT&T

Currently, it takes Black Hawk crews about 30 minutes to remove the IVHMS data cartridge from the helicopter, transport it to an operations center and extract the data for analysis. Lockheed Martin used AT&T 5G private cellular technologies to reduce the time required to less than 5 minutes including cartridge removal, demonstrating the potential benefits in time and cost for military and commercial helicopter operations.

The IVHMS provides monitoring and diagnostic capabilities to ensure a more reliable aircraft. It monitors, captures and evaluates detailed aircraft-generated data as a result of flight maneuvers. It also captures aircraft limit exceedances on airframe and dynamic components and monitors temperature and vibration of key components on the aircraft. It does this through hundreds of on-board sensors that report the status of the aircraft by monitoring the airframe, engines, and other dynamic components. Operators assess these thousands of data points to ensure the aircraft is safe, reliable and ready to fly.

“Timely and secure transfer and analysis of mission and operations data are critical to military readiness and effectiveness,” said Lance Spencer, client executive vice president, Defense, AT&T Public Sector and FirstNet. “This is one of many areas of commercial 5G innovation we are exploring to support defense, commercial aviation, and related fields where our 5G-related services can modernize legacy processes and help deliver truly transformational benefits.”

Lockheed Martin and AT&T also are working with other leading companies in networking and defense to modernize and transform communications capabilities for defense purposes. Future demonstrations are expected to further enhance 5G wireless technology communications solutions for flight lines, aiming to continually shorten aircraft turnaround times to reduce costs and improve military operational readiness. These capabilities deployed at scale can support high-speed, secure-data transfer on both commercial and military flight lines.

AT&T’s 5G and private cellular Multi-access Edge Computing (MEC) capabilities are deployed together by multiple industrial customers in factories nationwide where they enable ultra-fast, highly secure wireless processing and information transfer.

References:

https://www.business.att.com/products/att-private-cellular-networks.html

For additional information about Lockheed Martin, visit www.lockheedmartin.com/5G.

For more information about AT&T’s work in Defense, click here.

Celona’s 5G LAN solution for private 5G now on Google Distributed Cloud Edge

Celona, an innovator of 5G LAN solutions, today announced it has been selected by Google Cloud to accelerate the delivery of private 5G networks in the U.S. by making its 5G LAN solution available through Google Cloud’s recently announced private cellular network solutions running on Google Distributed Cloud Edge (GDC Edge) [1.].Enterprises using Google Cloud will now enjoy unprecedented agility and economies of scale by bringing new private cellular network services closer to users, data, and applications at the mobile compute edge.

Note 1. Google Distributed Cloud Edge is a fully managed product that brings Google Cloud’s infrastructure and services closer to where data is being generated and consumed. Google Distributed Cloud Edge empowers communication service providers to run 5G Core and Radio Access Network (RAN) functions at the edge.

………………………………………………………………………………………………………………………………..

Google Cloud and Celona are working together to offer turnkey enterprise private 5G networks with the ability to run network management, control, and user plane functions on Google Distributed Cloud Edge wherever it resides. The combined solution addresses distinct performance, service-level, and economic needs of key industry verticals by combining dedicated network capabilities with full edge-computing application stacks. Celona’s solution delivers a complete end-to-end 5G LAN developed for enterprise environments.

“We are excited to partner with Celona to help IT professionals improve application connectivity through private 5G,” said Tanuj Raja, Global Director, Strategic Partnerships at Google Cloud. “Deployed on Google Distributed Cloud Edge, Celona’s end-to-end private network solution enables enterprises to simplify and operate private 5G networks at scale and with the flexibility they need.”

“The combination of 5G LANs and edge compute unlocks a new generation of enterprise IT architecture capable of keeping up with the immense rate of digital transformation and automation occurring across almost every industry,” said Rajeev Shah, Celona’s co-founder and CEO. “The intrinsic agility of our edgeless enterprise architecture gives organizations tremendous flexibility and scale by bringing closer together critical network services and mobile edge compute applications.”

Celona’s Edgeless Enterprise architecture is anchored by the Celona Edge, a cloud-native 4G/5G private core network operating system that delivers an all-in-one network service overlay with advanced policy-based routing, QoS, and security segmentation functions. Celona’s unique approach supports the convergence of radio access network (RAN), application, and network service traffic, automatically shifting the delivery route of services based on performance, policy requirements, and network paths’ real-time health. It is the only private 5G solution in the industry that has been purpose-built to help organizations easily deploy, operate, and integrate 5G cellular technology with their existing infrastructure.

Since launching the first fully integrated 5G LAN platform in November 2020, Celona has seen strong demand from a range of enterprises, managed service providers, and mobile network operators looking to satisfy strategic digital business initiatives not adequately addressed today by Wi-Fi or other networking technologies. The company’s diverse customer base includes world-class organizations such as Verizon, NTT Ltd, SBA Communications, St. Luke’s Hospital System, Purdue Research Foundation, Stanislaus State University, and many other brand-named enterprises.

Celona’s 5G LAN platform is used by manufacturers, retailers, hospitals, schools, and supply-chain leaders to drive transformational results for a wide range of mission-critical use cases that require the deterministic wireless connectivity on private & interference-free cellular spectrum and fast mobility for a new generation of highly mobile devices and robotics infrastructures.

ABOUT CELONA:

Celona, the enterprise 5G company, is focused on enabling organizations of all sizes to implement the latest generation of digital automation initiatives in enterprise wireless. Taking advantage of dynamic spectrum sharing options such as CBRS in the United States, Celona’s Edgeless Enterprise architecture is designed to automate the adoption of private cellular wireless by enterprise organizations and their technology partners. For more information, please visit celona.io and follow Celona on Twitter @celonaio.

MEDIA CONTACT:

David Callisch

Celona, Inc.

[email protected]

+1 (408)504-5487

References:

https://www.celona.io/resources/celona-partners-with-google-cloud-for-5g-lans

https://www.celona.io/resources/5g-lan-provider-celona-is-named-a-cool-vendor-by-gartner

How organizations are using Google Distributed Cloud Edge with 5G LANs to streamline operations by visiting https://www.celona.io/community-stories/google-distributed-cloud-edge-and-celona-5g-lans

Ericsson focuses on private 5G in China due to national directives

Ericsson will shift its focus towards helping Chinese businesses to build their own private 5G networks, according to an excerpt from a report by Caixin Global. The news outlet cited remarks by Fang Ying, president of Ericsson’s China operations, at a news briefing on 22 June. Fang said there are growth opportunities in the private 5G networks sector after the aggressive pace of construction in 5G infrastructure nationwide over the past three years.

Dell’Oro Group’s Stefan Pongranz explains this increased focus on private 5G in China are stimulated by several key national directives:

(1) The Made in China 2025 Initiative, which pushes for greater usage of industrial robotics and automation in 10 key strategic sectors,

(2) The Internet Plus Plan, an initiative to transform, modernize, and equip traditional industries with more advanced technologies, and

(3) Set Sail Action Plan for 5G Applications, which targets 3,000 private industrial networks and a 35% 5G penetration rate in large industrial enterprises by 2023.

Huawei, Ericsson, and Nokia are all reporting some initial success with private 5G industrial opportunities. Verizon has explored multiple solutions and found that Celona’s 5G LAN technology is easy to scale downward, could be setup in hours, and straight-forward to integrate with the existing LAN.

Perhaps more importantly, the RAN is just one piece of the private 5G puzzle. While there is limited data at this juncture to suggest that the average private RAN network as a share of total cost of ownership (TCO) will be materially different than the public RAN share (10% to 15% of total TCO), it is safe to assume that the value, the role and the importance of the RAN will differ significantly depending on the segment and the use cases.

In short, it is still early days when it comes to private 5G. But the opportunity is large and private 5G is projected to surpass $1 billion by 2025. Optimized private solutions and services will play an important role simplifying and accelerating private LTE and 5G. And if Cisco and AWS are right, it will be interesting to see how the private 5G ramp will impact the RAN vendor dynamics.

References: