Ciena

Ciena to acquire Nubis Communications for high performance optical and electrical interconnects to support AI workloads

New Ciena Acquisition:

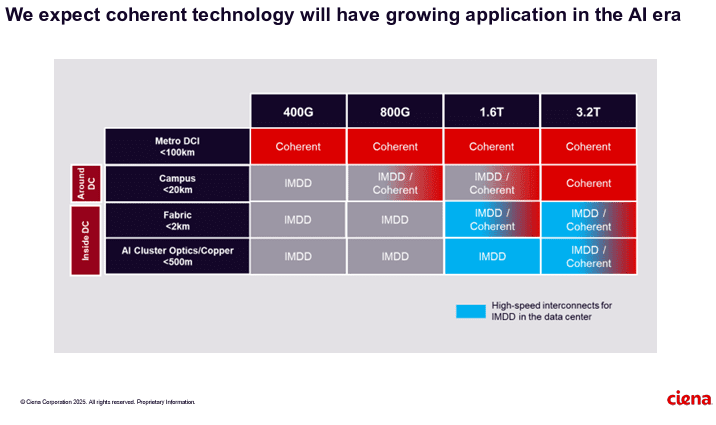

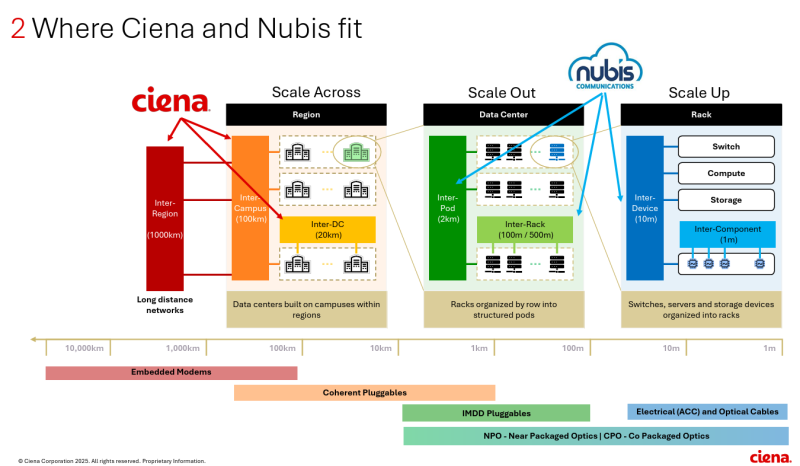

Today, Ciena announced it will acquire electronics startup Nubis Communications, a privately-held company headquartered in New Providence, New Jersey for $270 million. Nubis specializes in high-performance, ultra-compact, low-power optical and electrical interconnects tailored to support AI workloads. The Nubis acquisition will give Ciena access to technology that supports a wider range of data center use cases. It is is expected to close during Ciena’s fiscal 4th quarter.

Nubis’ solutions complement Ciena’s existing high-speed interconnects portfolio and will enable new capabilities to support growing AI workloads by significantly increasing scale up and scale out capacity and density inside the data center. The Nubis portfolio includes two key technologies:

- Co-Packaged Optics (CPO) / Near Packaged Optics (NPO): Nubis’ compact, high-density optical modules deliver ultra-fast data transfer using light instead of traditional electrical signals. Supporting up to 6.4 Tb/s full-duplex bandwidth, these modules are optimized for low-latency, low-power operation – making them ideal for scaling AI systems. Combined with Ciena’s high-speed SerDes, Nubis’ optical engines enable differentiated CPO solutions to address high-performance connectivity needs inside and between racks.

- Electrical ACC: Nubis’ advanced analog electronics enable Active Copper Cables (ACC) to support high-speed data transmission, allowing data to travel up to 4 meters at speeds of 200 Gb/s per lane. This low-power, low-latency solution helps customers connect more AI accelerators across racks without the limitations of traditional copper or DSP-based solutions

Nubis has developed two products to increase bandwidth and reduce latency within and between data center racks:

- XT Optical Engines is a series of optical modules that support up to 6.4 Tbps of full-duplex bandwidth while using light instead of traditional electrical signals.

- Nitro Linear Redriver aims to improve the performance of all the copper cables that are wired into the data center. Bloomberg has predicted copper usage in North American data centers could increase by 1.1-2.4 million tons by 2030 as “AI demands mount.”

“The acquisition of Nubis represents a significant step forward in Ciena’s strategy to address the rapidly growing demand for scalable, high-performance connectivity inside the data center, driven by the explosive growth of AI-related traffic,” said David Rothenstein, Chief Strategy Officer at Ciena. “With ownership of these key technologies for a wider range of use cases inside the data center, we are expanding our competitive advantage by advancing development of differentiated solutions, reducing development costs, and driving long-term efficiency and profitability. Nitro also supports up to 4m of reach for 200G per lane active copper cables, far beyond the limits of passive copper and legacy analog solutions. This is a game-changer for AI infrastructure, where short-reach, high-bandwidth copper is preferred for cost and latency reasons,” Rothenstein added.

“The Nubis team is thrilled to join Ciena and enhance its industry-leading portfolio with our breakthrough interconnect technologies,” said Dan Harding, CEO of Nubis. “Together, we will advance Ciena’s data center strategy by delivering reliable, high-quality, and high-performance interconnect solutions to support the next generation of AI workloads.”

Dell’Oro VP Jimmy Yu said Nubis is probably “one of [Ciena’s] most forward-looking” acquisitions, since the company is assembling the pieces it thinks are necessary to support future data center networking. “This acquisition aligns well with Ciena’s overall strategy to expand into the data center market, and it likely played a role in their decision to exit future investments in broadband PON,” Yu said.

……………………………………………………………………………………………………………………………………………………………..

Ciena Cutting Back on Residential Broadband Access investments to focus on AI and Coherent Optics:

The Nubis takeover comes shortly after Ciena announced it will reduce investment in residential broadband access (e.g. 25G PON) to focus more on AI applications and its coherent optics business. Ciena CEO Gary Smith said on the company’s Q3 2025 earnings call:

“Folks are more concentrated on 10-gig and driving that out, and there’s a good market for that. As we looked at our overall portfolio and our investments in [25-gig], we see so much opportunity in these different AI workloads that we want to continue to really make sure we’re heavily invested in that….To be clear, we will continue to sell and support our existing broadband access products. However, we will be limiting our forward investments only to strategic areas such as DCOM [1.].”

Note 1. DCOM refers to Ciena’s data center out-of-band management solution, which involves replacing bulky legacy hardware like copper cabling and console servers with passive optical network (PON) technology.

Dell’Oro Group’s Jimmy Yu thinks Ciena’s move to re-allocate R&D dollars makes sense so that the company is not spread too thin and [misses] out the biggest opportunity sitting in front of them. “My guess is that to address the future of AI workloads and AI data center interconnect, Ciena will need to not only maintain their cadence on launching new high performance coherent optics like the WaveLogic 6e for long distance 1.6 Tbps connections, but also optical devices for shorter distances like 800 ZR/ZR+ plugs and even shorter distances that take them inside the data center,” Yu explained.

Ciena considers the WaveLogic series its bread-and-butter for coherent optics. The company in Q3 gained 11 new customers for its WaveLogic 6 Extreme product, bringing its total customer tally to 60. Companies deploying WaveLogic 6 include operators such as Arelion, Lumen and Telstra, which are upgrading their networks to support demand from cloud customers.

Supplemental Materials:

In conjunction with this announcement, Ciena has posted to the Events and Presentations page of the Investor Relations section of its website a recorded transaction overview presentation and accompanying transcript.

About Ciena:

Ciena is the global leader in high-speed connectivity. We build the world’s most adaptive networks to support exponential growth in bandwidth demand. By harnessing the power of our networking systems, components, automation software, and services, Ciena revolutionizes data transmission and network management. With unparalleled expertise and innovation, we empower our customers, partners, and communities to thrive in the AI era. For updates on Ciena, follow us on LinkedIn and X, or visit the Ciena Insights webpage and Ciena website.

About Nubis Communications:

Nubis says they innovate across photonics, electronics, packaging and manufacturing to create optics significantly more dense, scalable and lower power than existing solutions, breaking the I/O wall in data centers and enabling more advanced compute, AI and machine learning. The startup has raised over $50 million in funding with the help of investors such as Ericsson and Marvell Technology co-founders Weili Dai and Sehat Sutardja.

Nubis has just over 50 employees including a seasoned executive team. Founder Peter Winzer previously led fiber optic transmission research at Nokia’s Bell Labs, while CEO Dan Harding spent over 15 years at Broadcom.

References:

https://www.nubis-inc.com/about-us/

https://www.nubis-inc.com/products/

https://www.fierce-network.com/broadband/ciena-ramps-data-center-focus-new-270m-deal

https://www.fierce-network.com/broadband/ciena-pulls-back-broadband-focus-more-ai

AI infrastructure investments drive demand for Ciena’s products including 800G coherent optics

Lumen and Ciena Transmit 1.2 Tbps Wavelength Service Across 3,050 Kilometers

Ciena CEO sees huge increase in AI generated network traffic growth while others expect a slowdown

Summit Broadband deploys 400G using Ciena’s WaveLogic 5 Extreme

DriveNets and Ciena Complete Joint Testing of 400G ZR/ZR+ optics for Network Cloud Platform

Ciena acquires 2 privately held companies: Tibit Communications and Benu Networks

AI infrastructure investments drive demand for Ciena’s products including 800G coherent optics

Artificial Intelligence (AI) infrastructure investments are starting to shift toward networks needed to support the technology, rather than focusing exclusively on computing and power, according to Ciena Chief Executive Gary Smith. The trends helped Ciena swing to a profit and post a 24% jump in sales in the recent quarter.

The company enables high-speed fiber optic connectivity for telecommunications and data centers, helping hyper-scalers such as Amazon and Microsoft support AI initiatives via data center interconnects and intra-data center networking. Currently, the company is ramping up production to meet surging demand fueled by cloud and AI investments.

“There’s no point in investing in these massive amounts of GPUs if we’re going to strand it because we didn’t invest in the network,” Smith said Thursday.

……………………………………………………………………………………………………………………………………………………..

Ciena sees a bright future in 800G coherent optics that can accommodate AI traffic. Smith said a global cloud provider has selected Ciena’s coherent 800-gig pluggable modules and Reconfigurable Line System (RLS) photonics for investing in geographically distributed, regional GPU clusters. “With our coherent optical technology ideally suited for this type of connectivity, we expect to see more of these opportunities emerge as cloud providers evolve their data center network architectures to support their AI strategies,” he added.

It’s still early innings for 800G adoption, but demand is climbing due to AI and cloud connectivity. Vertical Systems Group expects to see “a measurable increase” in 800G installations this year. Dell’Oro optical networking analyst Jimmy Yu noted on LinkedIn Ciena’s data center interconnect win is the first he’s heard of that involves connecting GPU clusters across 100+ kilometer spans. “It was a hot topic of discussion for nearly 2 years. It is now going to start,” Yu said.

……………………………………………………………………………………………………………………………………………………

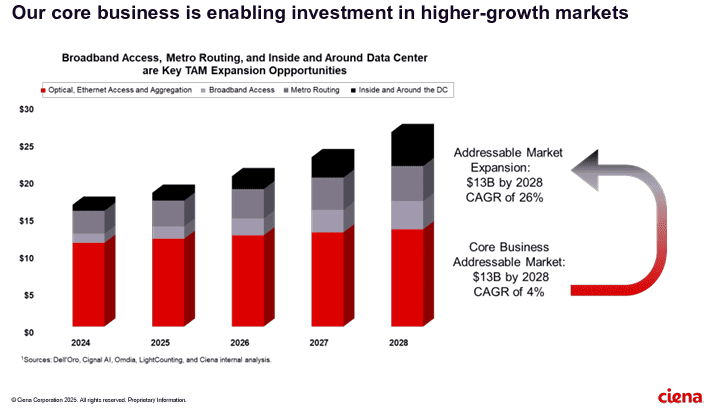

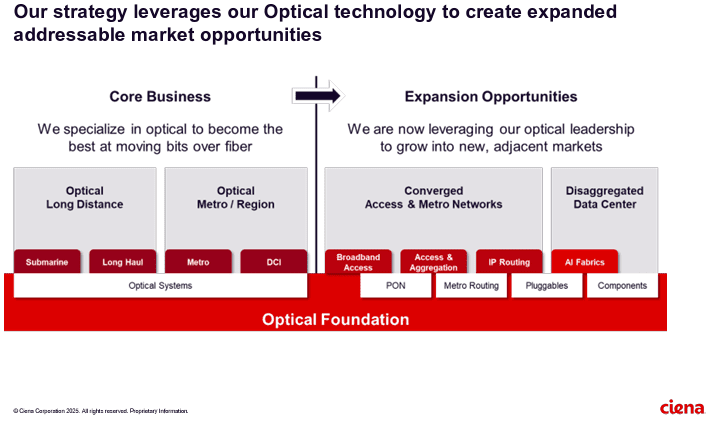

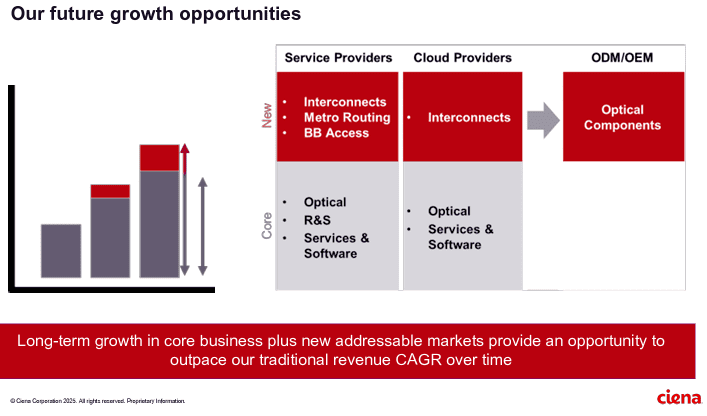

Ciena’s future growth opportunities include network service and cloud service providers as well as ODM/OEM sales of optical components.

References:

https://www.wsj.com/business/earnings/ciena-swings-to-profit-as-ai-investments-drive-demand-0195f30c

https://investor.ciena.com/static-files/d964ccac-74b3-43d9-a73e-ecf67fab6060

https://www.fierce-network.com/broadband/ciena-now-expects-tariff-costs-10m-quarter

Lumen and Ciena Transmit 1.2 Tbps Wavelength Service Across 3,050 Kilometers

Lumen and Ciena have teamed up for a significant new network trial. They have successfully demonstrated a 1.2Tbps wavelength spanning 3,050k m (more than 1,800 miles) on Lumen’s Ultra-Low-Loss (ULL) fiber network, making it the world’s longest 1.2 terabit non-regenerated signal. The trial leveraged Ciena’s WL6e technology over a 6500 photonic line system and Lumen’s fiber network between Denver and Dallas. They also used 800Gbps routing technology from Juniper’s PTX Series to establish Ethernet and IP services. Lumen’s 400G-enabled network already spans over 78,000 route miles, and the company continues to invest in next-generation fiber to enhance its Ultra-Low Loss (ULL) fiber network, the largest in North America.

Using 800G interfaces, Lumen and Ciena successfully tested and qualified the services to support wavelength, Ethernet, and IP services over the 1.2 Tbps single carrier channel. The live network trial from Denver to Dallas used Ciena’s latest WaveLogic 6 Extreme (WL6e) technology equipped in the Waveserver platform running over a 6500 photonic line system.

“1.2 terabits per second isn’t just about incredible speed and long distances, it’s about the value of enabling the next wave of digital transformation. Lumen is at the forefront of building a next-generation network designed to handle the explosive growth of AI and cloud workloads,” said Dave Ward, Lumen’s chief technology and product officer. “Our investment in increased capacity, powered by Ciena’s WaveLogic 6 technology, provides our hyperscale cloud partners and enterprises with the ultra-high-capacity connectivity needed to scale their AI and cloud applications. With 400G connectivity speeds today and a seamless upgrade path to 1.2 terabits, Lumen stands as the trusted network for AI.”

The trial also showcased the impressive performance and seamless interoperability between Ciena’s Waveserver platform and the Juniper PTX10002-36QDD Packet Transport Router at 800 Gbps over the ultra-long-haul 1.2 Tbps intercity network. By leveraging the performance, flexibility and scalability of the Juniper PTX Series Routers, Lumen successfully established Ethernet and IP services with minimal latency and zero packet loss throughout the tests.

Editor’s Note:

While the companies March 27th joint press release stated the 1.2T bps wavelength transport was a record, AT&T claimed two weeks earlier that it “achieved a long distance world record top speed of 1.6Tb/s over a single wavelength across 296 km of its long haul fiber optic network.” We reported that in this IEEE Techblog post. So yes, it’s a record considering the Lumen network wavelength distance was > 10 times that claimed by AT&T.

Faster connections up to 1.2 Tbps wavelengths means less lag, more capacity and the flexibility to handle the most data-hungry applications across multiple industries:

- AI & Machine Learning

- Hyperscale Cloud & Data Center Interconnects

- Financial Trading and Market Data Transport

- Cybersecurity & AI-powered Threat Intelligence

- Media & Streaming

“At Microsoft, the demand for ultra-high-speed, low-latency connectivity is growing exponentially as AI workloads, cloud applications, and real-time analytics scale,” Lumen said. “Lumen and Ciena’s successful wavelength trial showcases a forward-thinking approach to meeting these growing demands. By enabling more efficient data movement over vast distances, this solution helps us optimize cloud performance, enhance customer experiences, and support the rapid expansion of AI training and inferencing models across our global infrastructure.”

Ciena’s WL6e is the industry’s first high-bandwidth coherent transceiver using state-of-the-art 3nm silicon, capable of carrying capacity up to 1.6 terabits per second per wavelength.

“As the pioneer in high-speed optical innovation, we are dedicated to helping our customers set new benchmarks in network performance and efficiency,” said Brodie Gage, Ciena senior vice president, global products and supply chain. “This industry-first trial with Lumen marks a pivotal step in our efforts to prepare networks for the AI era. Lumen’s network does not stand still. Continuous investment in the latest network technology is essential for keeping up with bandwidth demands today and into the future.”

Additional Resources:

About Lumen Technologies:

Lumen is unleashing the world’s digital potential. We ignite business growth by connecting people, data, and applications – quickly, securely, and effortlessly. As the trusted network for AI, Lumen uses the scale of our network to help companies realize AI’s full potential. From metro connectivity to long-haul data transport to our edge cloud, security, managed service, and digital platform capabilities, we meet our customers’ needs today and as they build for tomorrow.

SOURCE: Lumen Technologies

References:

Analysts weigh in: AT&T in talks to buy Lumen’s consumer fiber unit – Bloomberg

AT&T sets 1.6 Tbps long distance speed record on its white box based fiber optic network

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

Ciena CEO sees huge increase in AI generated network traffic growth while others expect a slowdown

Today, Ciena reported better than expected revenue of $1.12 billion in its 4th quarter, which was above analyst expectations of around $1.103 billion. Orders were once again ahead of revenue, even though the company had expected orders to be below revenue just a few months ago. A closer look at key metrics reveals mixed results, with some segments like Software and Services showing strong growth (+20.6% year-over-year) and others like Routing and Switching experiencing significant declines (-38.4% year-over-year).

Increased demand for the company’s Reconfigurable Line Systems (RLS), primarily from large cloud providers. And he said the company was also doing well selling its WaveLogic coherent optical pluggables, which optimize performance in data centers as they support traffic from AI and machine learning.

Ciena’s Managed Optical Fiber Networks (MOFN) technology is designed for global service providers that are building dedicated private optical networks for cloud providers. MOFN came about a few years ago when cloud providers wanted to enter countries where they weren’t allowed to build their own fiber networks. “They had to go with the incumbent carrier, but they wanted to have control of their network within country. It was sort of a niche-type play. But we’ve seen more recently, over the last 6-9 months, that model being more widely adopted,” Smith said. MOFN is becoming more widely utilized, and the good news for Ciena is that cloud providers often request that Ciena equipment be used so that it matches with the rest of their network, according to Smith.

Image Credit: Midjourney for Fierce Network

…………………………………………………………………………………………………………………………..

The company also said it now expects average annual revenue growth of approximately 8% to 11% over the next three years. “Our business is linked heavily into the growth of bandwidth around the world,” CEO Gary Smith said after Ciena’s earnings call. “Traffic growth has been between 20% and 40% per year very consistently for the last two decades,” Smith told Light Reading.

Ciena believes huge investments in data centers with AI compute servers will ultimately result in more traffic traveling over U.S. and international broadband networks. “It has to come out of the data center and onto the network,” Smith said of AI data. “Now, quite where it ends up being, who can know. As an exact percentage, a lot of people are working through that, including the cloud guys,” he said about the data traffic growth rate over the next few years. “But one would expect [AI data] to layer on top of that 30% growth, is the point I’m making,” he added.

AI comes at a fortuitous time for Ciena. “You’re having to connect these GPU clusters over greater distances. We’re beginning to see general, broader traffic growth in things like inference and training. And that’s going to obviously drive our business, which is why we’re forecasting greater than normal growth,” Smith said.

Smith’s positive comments on AI traffic are noteworthy in light of some data points showing a slowdown in the rate of growth in data traffic on global networks. For example:

- OpenVault recently reported that monthly average broadband data consumption in the third quarter inched up 7.2%, the lowest rate of growth seen since the company began reporting these trends in 2012.

- In Ericsson’s newest report, Fredrik Jejdling, EVP and head of business area networks, said: “We see continued mobile network traffic growth but at a slower rate.”

- Some of the nation’s biggest Content Data Network (CDN) providers – including Akamai, Fastly and Edgio – are struggling to come to terms with a historic slowdown in Internet traffic growth. Such companies operate the content delivery networks that convey video and other digital content online.

- “In terms of traffic growth, it is growing very slowly – at rates that we haven’t seen in the 25-plus years we’ve been in this business. So it’s growing very, very slow,” Akamai CFO Ed McGowan said recently. “It’s just been a weak traffic environment.”

“The cloud providers themselves are building bigger infrastructure and networks, and laying track for even greater growth in the future as more and more of that AI traffic comes out of the data center,” Smithsaid. “So that’s why we’re predicting greater growth than normal over the next three years. It’s early days for that traffic coming out of the data center, but I think we’re seeing clear evidence around it. So you’re looking at an enormous step function in traffic flows over the next few years,” he concluded.

References:

https://www.lightreading.com/data-centers/ciena-ceo-prepare-for-the-ai-traffic-wave

https://www.fierce-network.com/broadband/cienas-ceo-says-companys-growth-linked-ai

Summit Broadband deploys 400G using Ciena’s WaveLogic 5 Extreme

DriveNets and Ciena Complete Joint Testing of 400G ZR/ZR+ optics for Network Cloud Platform

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

TechCrunch: Meta to build $10 billion Subsea Cable to manage its global data traffic

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Summit Broadband deploys 400G using Ciena’s WaveLogic 5 Extreme

Florida-based fiber optic telecommunications provider Summit Broadband has launched 400G services following a network upgrade with Ciena. Summit Broadband is leveraging Ciena’s WaveLogic 5 Extreme (WL5e) [1.] to offer 400 Gbps wavelength services to enterprise customers in Central and Southwest Florida, Ciena said last week.

Summit Broadband owns and operates over 4,300 fiber-route miles of infrastructure and serves industries and communities throughout the state with voice, video, data, internet, and Ethernet services, as well as dark fiber transport.

Note 1. Summit Broadband is deploying Ciena’s WaveLogic Ai coherent optics across a flexible 6500 ROADM network, delivering 400GbE wave services to increase capacity and reach more users. Summit Broadband is also utilizing Ciena’s 3926 and 5164 Routing and Switching platforms for cost effective service delivery, as well as Adaptive IP Apps and Manage, Control and Plan (MCP) domain controller for real-time visibility and analysis of routing behaviors to optimize network performance and identify issues with greater ease for faster resolution.

Ciena noted that Summit Broadband has rolled out 400 Gbps wavelength to support the rise in data consumption of high-bandwidth applications such as cloud computing, IoT devices, video streaming, and enterprise services. This upgrade builds on the longstanding relationship between both companies, with Ciena powering Summit’s optical network.

In his first year as CEO, Kevin Coyne has transformed Summit Broadband’s network to create data superhighways encircling the Florida peninsula, serving customers in Central, West, and Southwest Florida. This recent network expansion gives Summit Broadband even greater flexibility and adaptability to respond to the increasing needs of its customers, including school districts and municipalities.

“The past year has shown us how having access to high-quality connectivity is a necessity for everyday life,” said Coyne. “We chose to invest in deploying Ciena’s cutting edge solutions to bring an enhanced digital experience across Florida, connecting more people and businesses using higher speeds and lower latency services.”

“The demand for bandwidth shows no signs of slowing down, and our new 400 Gbps service ensures that our business customers have the high performance and scalability essential for applications like data center interconnect, which require fast speeds and low latency.”

Additionally, the upgrade will allow Summit to deliver more data per unit of energy over our existing infrastructure, maximizing network utilisation and providing capex and opex savings, Summit Broadband added.

…………………………………………………………………………………………………………………….

In January, BW Digital, the owner of the Hawaiki Submarine Cable, confirmed the availability of commercial 400 GbE services on the Hawaiki trans-Pacific cable, powered by Ciena’s GeoMesh Extreme subsea network solution.

References:

Ciena acquires 2 privately held companies: Tibit Communications and Benu Networks

Ciena® Corporation, a networking systems, services and software company, today announced that it has entered into a definitive agreement to acquire Tibit Communications, Inc., a privately-held company headquartered in Petaluma, California, and that it has acquired Benu Networks, Inc., a privately-held company headquartered in Burlington, Massachusetts. Tibit and Benu are focused on simplifying broadband access networks through next-generation PON technologies and advanced subscriber management, respectively.

Individually and together, Tibit and Benu will complement Ciena’s existing portfolio of solutions for broadband access use cases, including residential broadband, enterprise business services, and fixed-wireless access, which represent a significant addressable market for Ciena. In addition, the acquisitions will strengthen Ciena’s expertise in these areas, with the addition of a combined 60+ talented engineers with significant experience in access technologies.

“The acquisitions of Tibit Communications and Benu Networks will extend our ability to support customers’ next-generation metro and edge strategies as service providers globally accelerate investments to modernize their networks and improve connectivity at the network edge,” said Scott McFeely, Senior Vice President, Global Products and Services, Ciena. “Tibit’s high-speed PON technologies and Benu’s subscriber management products, combined with Ciena’s current access and edge portfolio, will enable us to offer broader, more complete, and fully integrated broadband access solutions that combine routing, subscriber management, and PON features and functionality.”

Tibit Communications:

Tibit combines PON-specific hardware and OS into a micro pluggable transceiver that can be easily integrated into a carrier-grade Ethernet switch. Unlike the closed and proprietary approaches of traditional Optical Line Terminal (OLT) vendors, Tibit’s open, microplug OLT technology enables rapid PON deployment in any environment.

The acquisition will enable Ciena to build on its market traction and accelerate its time to market, specifically with more vertically integrated, next-generation PON solutions that support residential, enterprise, and mobility use cases, including 10G XGS-PON with development paths to deliver 25G and higher PON in the future.

“The global PON market is growing at a rapid pace and this acquisition will provide the opportunity to take Tibit’s differentiated products to market at scale through Ciena’s extensive service provider customer base. And, as a combined team, we will continue to support and leverage Tibit’s existing network of relationships with system integrators and other equipment vendors,” said Edward Boyd, Vice President of Engineering and Chief Technology Officer of Tibit Communications.

Ciena and Tibit have a strong existing relationship. Ciena has been an investor in Tibit since its initial funding round in 2016 and is currently Tibit’s largest shareholder. Ciena is also Tibit’s largest customer, successfully leveraging Tibit’s products and technology within its portfolio of broadband access solutions.

Under the terms of the agreement, Ciena will acquire the remaining shares of Tibit that it does not already own in a cash-free, debt-free transaction currently valued at approximately $210 million, with the merger consideration to be paid in cash. In addition, Ciena will enter into certain employee retention arrangements in connection with the transaction. The Tibit transaction has been approved by the boards of directors of both companies as well as Tibit’s shareholders. The transaction is expected to close during Ciena’s fiscal first quarter 2023, subject to customary closing conditions.

Benu Networks:

Benu has developed a portfolio of field-proven, cloud-native software solutions, including a virtual Broadband Network Gateway ((v)BNG), which are highly complementary to Ciena’s existing portfolio of broadband access solutions. Benu will provide Ciena with the ability to deliver a single solution that integrates routing, OLT, subscriber management and network services, thereby reducing both capital and operating expenses and improving sustainability for our customers.

“Ciena and Benu have already successfully partnered in the market, including as part of an award-winning joint Proof of Concept (POC) with other residential broadband ecosystem vendors, as well as on active work on customer trials and POCs globally. As part of Ciena, we will be in a stronger position to further extend the market reach and continued development of our software solutions,” said Ajay Manuja, CEO of Benu Networks. The Benu transaction closed during Ciena’s fiscal first quarter 2023.

Ciena:

Ciena (NYSE: CIEN) is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive NetworkTM in response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

From Light Reading: These are positive moves for Ciena, according to Rosenblatt Securities Analyst Mike Genovese, who wrote about the deal in a note to clients on Tuesday. Ciena is looking to use its switching and routing platforms to win more business in the edge networking and fiber broadband markets, “which are in a strong and long multi-year growth cycle,” he wrote.

Genovese noted that one of Ciena’s primary customers, AT&T, intends to continue growing fiber access, even as it fights through mounting debt and economic headwinds. The carrier aims to pass 3 million to 4 million more homes with fiber between 2023 and 2025.

“We believe AT&T is the largest customer for Ciena’s PON [passive optical networking] solutions and there are good opportunities to win share at other Tier 1 telcos and cable MSOs [multiple system operators] where Ciena has switches and routers deployed,” Genovese wrote.

“Ciena has already announced a number of product enhancements and customer wins specifically using 10G PON transceivers housed within their access and aggregation switches,” wrote Kyle Hollasch, Cignal AI’s lead analyst for optical and routing hardware, in an email to Light Reading. “The Tibit acquisition brings a degree of vertical integration into an application that Ciena considers an important differentiator.”

“Traditional edge routers include tightly integrated subscriber management, but virtual and/or cloud-based BNG [broadband network gateway] functionality is gaining traction, and this is where Ciena sees its opening,” wrote Cignal AI’s Hollasch. “The Benu acquisition bolsters Ciena’s expertise in this area as they increase scale and move up the stack to become a more full-featured router vendor.”

Since 2015, Ciena has bought seven companies, and a few of those have included virtual routing and switching, network performance management, and other tools to help communications service providers of all types better control, automate and manage their networks.

Routing and switching were 12% of Ciena’s revenues in its fiscal third quarter and grew 45% year over year, according to Catharine Trebnick, a managing director at MKM Partners (and a former Light Reading editor). According to Ciena and analysts, the addressable market of the entire metro networking and edge (excluding China) has grown to $22 billion. Fiber broadband access is seen as the biggest driver in that segment.

“We view these two acquisitions as broadening its market reach into rural broadband infrastructure opportunities that are funded through the Infrastructure bill,” Trebnick wrote in a note to clients on Tuesday.

Heavy Reading Analyst Sterling Perrin, in a note to Light Reading, said that the global pandemic hit the accelerator for fiber broadband and – even with all the expected delays and bureaucracy – the massive government funding bill lessens a lot of the risk companies like Ciena would face by investing and making more bets in this space.

…………………………………………………………………………………………………………………………………………………………………………………………….

References:

Samsung and Ciena partner to deliver pre-validated implementations of 5G networks

At 2021 MWC LA, Samsung Electronics and Ciena announced that they are collaborating to deliver 5G solutions (?) by coupling Samsung’s 5G RAN and core network with Ciena’s xHaul routing and switching portfolio. The collaboration will enable the companies to offer hardware and software solutions to telecom operators to support the increasing volume of 5G data traffic at the edge and within an increasingly distributed 5G architecture.

Rafael Francis, senior director of solutions architecture at Ciena, sited the blurring between the RAN, transport and core network as motivation for the partnership with Samsung.

Image Courtesy of ACG Research

“The domains of RAN, transport and core are becoming more tied in the sense as operators roll out 5G with new architectures and approaches, like virtualized RAN (vRAN) or cloud RAN (cRAN),” Francis told RCR Wireless News. “Effectively, the network becomes an integral part of that because you not only have backhaul networks, but you have fronthaul and mid-haul networks, and these things all need to interoperate.”

5G xHaul transport needs a solution-level approach that includes both a feature-rich box and a well-integrated automation and orchestration platform. Ciena provides a complete yet open solution with its innovative Adaptive IPTM portfolio, which is well integrated with its Blue Planet Automation software. The company has simplified the 5G xHaul transport with a lean and open set of IP protocols driven by analytics focused, multidomain and multivendor closed-loop orchestration layer.

Alok Shah, Samsung’s VP of strategy, business development and marketing for the company’s networks business, agreed with Francis, adding, “Networks used to be a lot easier to understand. The RAN and the core were well defined, and the transport was backhaul for the cell sites.”

Now, though, in the world of vRAN and cRAN, the backhaul is only one means of transport. There is also fronthaul and mid-haul and, according to Shah, each one has a different level of performance requirement; when it comes to the fronthaul, in particular, the link between fronthaul and the RAN equipment has to be “really tight.”

“Because, you want to make sure that if you’re running 25 Gbps from your radio back to baseband unit, you want to make sure you’re getting the full performance out of that link,” Shah added.

Further, the combined offering will help operators accelerate critical 5G capabilities such as network slicing (requires 5G SA Core network), which Francis singled out a perfect example of why coordination across network domains has become more critical in a 5G era.

“Concepts and capabilities brought by 5G such as network slicing that can be used to drive new revenues and services for MNOs (mobile network operators) must be well coordinated across RAN, transport and core to really have the correct impact like ensuring SLAs and partitioning resources,” Shah said.

Wonil Roh, SVP and head of product strategy for Samsung Electronics’ network business said, “In order to deliver more powerful 5G services, the current network architecture needs to evolve. Samsung’s ability to couple our best-in-class 5G solutions with a leader in transport technologies like Ciena will give customers a solution to address this need, and do so with the confidence to scale and evolve their networks to support the future of 5G.”

Dell’Oro Group VP Stefan Pongratz noted that the two vendors have no material overlap. “Ciena’s telecom equipment revenues are primarily driven by its optical transport and SP switch portfolio while Samsung focuses on the RAN and mobile core markets,” he said. Stefan added that “as the backhaul becomes fronthaul, the transport requirements will change, which could impact the value of pre-integrated solutions.”

……………………………………………………………………………………………………………………………………………

References:

Samsung, Ciena partner to address ‘blurring between RAN, transport and core’

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

Lightpath to deploy 800Gb/sec links using Ciena’s WaveLogic 5 Extreme technology

Fiber-optic network services provider Lightpath has rolled out 800-Gbps capabilities via implementation of Ciena’s WaveLogic 5 Extreme technology. The company also will deploy Ciena’s Waveserver Ai platform, which will pair with a flexible-grid optical transport network based on Ciena’s 6500 RLS platforms.

The Lightpath Network consists of over 18,000 route miles of fiber providing connectivity to over 12,000 service locations. Lightpath provides a variety of connectivity and business services to customers in the metro New York area, including financial services firms (e.g. “Lightpath intros 100-Gbps optical transport service” and “Lightpath raises New York metro fiber-optic network footprint”). Using Ciena’s coherent optical solution, Lightpath’s network becomes more adaptive, allowing it to respond quickly to ever-changing bandwidth demands while maximizing operational efficiencies, providing customers with more reliable, high-speed services.

The enhanced optical transport technology will increase fiber network flexibility and efficiency as well as support Physical Layer encryption for data security. Cable MSO Altice USA owns a controlling interest in the company (see “Altice USA to sell almost 50% of Lightpath fiber enterprise business to Morgan Stanley Infrastructure Partners”).

“In order for our customers to execute on their own digital innovations, we need to provide them with fast and reliable connectivity. With Ciena’s solutions, our customers in the New York and Boston metro areas will now experience next-level digital services with high bandwidth and minimal latency,” commented Phil Olivero, CTO at Lightpath.

“As users consume more digital content, it is crucial for service providers to ensure their network can adapt to these surging and often unpredictable demands. With Ciena’s technology, Lightpath is adding scalability to meet bandwidth demands and also gaining real-time visibility into the performance of its network,” added Kevin Sheehan, CTO, Americas, for Ciena.

WaveLogic 5 Extreme is now available in three different product implementations to meet network architecture preferences: 6500 Packet-Optical Platform, Waveserver 5 compact interconnect platform, and the WaveLogic 5 Extreme 800G transceiver module

The WaveLogic 5 Extreme chip is 12mm x 16mm CMOS device. Here are some of its remarkable features:

- It is the industry’s first commercial 7nm CMOS device for optical networks.

- Based on 7nm FinFET technology, it includes 3km of wiring and contains 800 Trillion operations per second, which is about as much horsepower as 400,000 laptops!

- Some of the capabilities that are packed into the ASIC include nonlinear probabilistic constellation shaping, throughput-optimized forward error correction, frequency division multiplexing, and encryption.

…………………………………………………………………………………………………………………………………………………………………..

About Ciena

Ciena is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive Network™ n response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

About Lightpath

Lightpath is revolutionizing how customers connect to their digital destinations by combining our next-generation network with our next-generation customer service. Lightpath’s advanced fiber-optic network offers a comprehensive portfolio of custom-engineered connectivity solutions with unparalleled performance, reliability, and security. Our consultative customer service means we work with you to design, deliver, and support the solution for your unique needs, faster and more easily than ever before. For over 30 years, thousands of enterprises, governments, and educators have trusted Lightpath to power their organization’s innovation. Altice USA (NYSE: ATUS) owns a 50.01% controlling interest in Lightpath and Morgan Stanley Infrastructure Partners (MSIP) owns 49.99% of the Company.

………………………………………………………………………………………………………………………………………………………………..

References: