Cloud Computing

Synergy Research: public cloud service and infrastructure market hit $126B in 1Q-2022

According to a new report from Synergy Research Group, public cloud service and infrastructure service provider and vendor revenues for the 1st quarter of 2022 reached $126 billion, having grown by 26% (YoY) from the 1st quarter of 2021.

As expected, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud led public cloud service providers (CSPs) in revenue growth. Those three CSPs powered a robust 36% growth rate in the infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) public cloud segments, which hit $44 billion in revenues during the quarter.

In the other main service segments, managed private cloud services, enterprise SaaS and CDN (Content Delivery Networks) added another $54 billion in service revenues, having grown by an average 21% from last year. In order to support both these and other digital services, public cloud providers spent $28 billion on building, leasing and equipping their data center infrastructure, which was up 20% from Q1 of last year. Across the whole public cloud ecosystem, companies that featured the most prominently were Microsoft, Amazon, Salesforce and Google. Other major players included Adobe, Alibaba, Cisco, Dell, Digital Realty, IBM, Inspur, Oracle, SAP and VMware. In aggregate these companies accounted for 60% of all public cloud-related revenues.

Amazon, IBM, and Microsoft led in managed private cloud revenue during the quarter; Microsoft, Salesforce, and Adobe powered similar growth in enterprise software-as-a-service (SaaS) revenues; and Akamai, Amazon, and Cloudflare headed up a 14% increase in content delivery network (CDN) revenues for the quarter. Those three segments in total generated $54 billion in revenues during the first three months of the year.

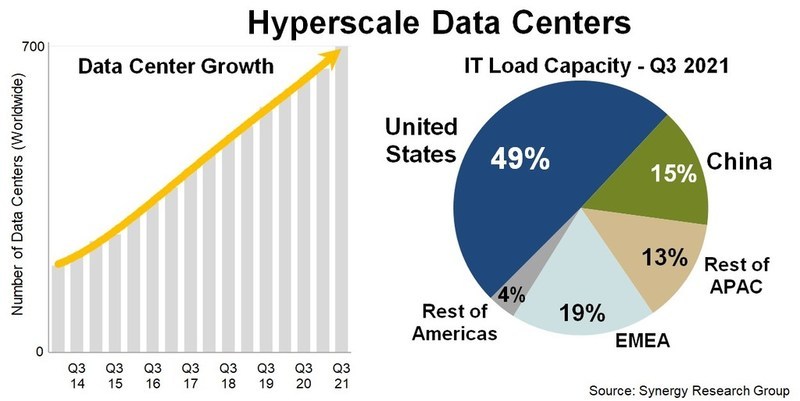

While cloud markets are growing strongly in all regions of the world, the United States remains a center of gravity. In Q1 it accounted for 44% of all cloud service revenues and 51% of hyperscale data center capacity. Across all service and infrastructure markets, the vast majority of leading players are US companies, with most of the rest being Chinese (e.g. Alibaba, Tencent and Huawei). China accounted for 8% of all Q1 cloud service revenues and 15% of hyperscale data center capacity.

Editor’s Note:

In China, Alibaba Cloud remains the leader with a 37% market share, ranking first in the cloud market in 2021, Huawei Cloud and Tencent Cloud second and third respectively, and Baidu AI cloud fourth. In 2021, the four cloud providers jointly accounted for 80% of the market share.

…………………………………………………………………………………………………………………

“Public cloud-related markets are typically growing at rates ranging from 15% to 40% per year, with PaaS and IaaS leading the charge. Looking out over the next five years the growth rates will inevitably tail off as these markets become ever-more massive, but we are still forecasting annual growth rates that are generally in the 10% to 30% range,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “To enable cloud service markets to keep up with demand by doubling in size in the next 3-4 years, the major cloud providers need an ever larger footprint of hyperscale data centers and more raw computing power, which then drives the markets for data center hardware and software. For sure the competition will be tough, but up and down the cloud ecosystem there will be a bright future for companies that bring the right products to market in a timely fashion.”

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

References:

https://www.srgresearch.com/articles/public-cloud-ecosystem-quarterly-revenues-leap-26-to-126-billion-in-q1

Telefónica Tech to integrate Red Hat’s OpenShift platform into new enterprise cloud service in Europe and Latin America

Telecom technology integrator Telefónica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat’s OpenShift platform into a new cloud service marketed at enterprises across Telefónica’s footprint in Europe and Latin America.

The integration will be marketed as the Telefónica Red Hat OpenShift Service (TROS), which will tap into the use of containers to help organizations modernize their cloud applications and drive their digital transformation. It will allow those organizations to migrate applications to hybrid cloud or multi-cloud environments using either private or public clouds from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

OpenShift is based on the Kubernetes container orchestration project that allows for the migration of applications across different cloud and on-premises environments. A recent report from TBR Senior Analyst Catie Merrill noted that Red Hat’s OpenShift platform has four-times as many customers as it did before IBM acquired the company for $34 billion in mid-2019.

Red Hat OpenShift differentiates itself by combining multiple hardened open source technologies to provide a more complete modern application platform, enabling organizations to use it as the foundation for current and future IT strategies. Additionally, the use of Red Hat OpenShift allows for use in any type of cloud, facilitating the creation of this Multi-Cloud service for Telefónica Tech.

This new, open hybrid, multi-cloud approach will allow Telefonica Tech to strengthen and differentiate its value proposition, and provide more flexibility to its customers in their digital transformation and application modernization in the markets where Telefónica Tech is present.

The complementary nature of cloud technologies integrated in TROS will enable Telefónica Tech, Red Hat and IBM to jointly define innovative use cases and provide high value-added professional services to customers to help them make the process more efficient, cost-effective and cost-optimal.

The strategic agreement also enables Telefónica Tech to develop additional services on TROS based on Red Hat technologies and IBM Cloud Paks so that customers can accelerate their transformation to cloud-native applications, enabling a more consistent user experience both in their own cloud and on the hyperscalers.

María Jesús Almazor, CEO of Cybersecurity and Cloud at Telefónica Tech, said: “This strategic agreement allows us to strengthen our differential multicloud offer by integrating world class technologies from Red Hat and IBM and consolidate our position as a leading partner for the digital transformation of businesses. We continue to evolve our ecosystem of alliances to enhance the digital capabilities of our professionals and to include in our portfolio the most innovative proposals in the market, fundamental aspects to continue offering the best service to our customers.”

Horacio Morell, IBM General Manager for Spain, Portugal, Greece and Israel: “This alliance enables us to take a quantum leap in our business collaboration with Telefonica Tech to continue co-creating enterprise multi-cloud and cybersecurity solutions that will enable companies around the world, across all industries, to implement their technology transformation strategies with greater speed, consistency and agility, while ensuring data control, privacy and reliability and increasing decision-making efficiency through the unique capabilities of IBM’s technologies.”

Julia Bernal, Country Manager for Spain and Portugal at Red Hat, said: “Red Hat is fully committed to helping our customers and partners optimize their business with open hybrid cloud and focus on innovation rather than simply managing their IT infrastructure. Our mission is to mitigate the complexities of modern cloud-scale IT environments and with managed cloud services they can do just that. Telefónica Red Hat OpenShift Service enables customers to free resources to create and manage applications more quickly across multiple clouds, streamlining time to market and accelerating growth opportunities.”

“It is going to be the way forward and what many customers who want to evolve their business models,” said Santiago Madruga, VP for ecosystem success in EMEA at Red Hat, in an interview with SDxCentral. “When going digital, it’s not just putting workloads on the cloud but really transforming businesses.” Madruga added that the use of OpenShift also allows for the micro-segmentation of application components that will open the door for edge distributed cloud work.

References:

https://www.sdxcentral.com/articles/news/ibm-red-hat-expand-telefonicas-cloud-push/2022/06/

https://newsroom.ibm.com/2021-09-23-Telefonica-Chooses-IBM-To-Implement-Its-First-Ever-Cloud-Native-5G-Core-Network-Platform

Google Cloud expands footprint with 34 global regions

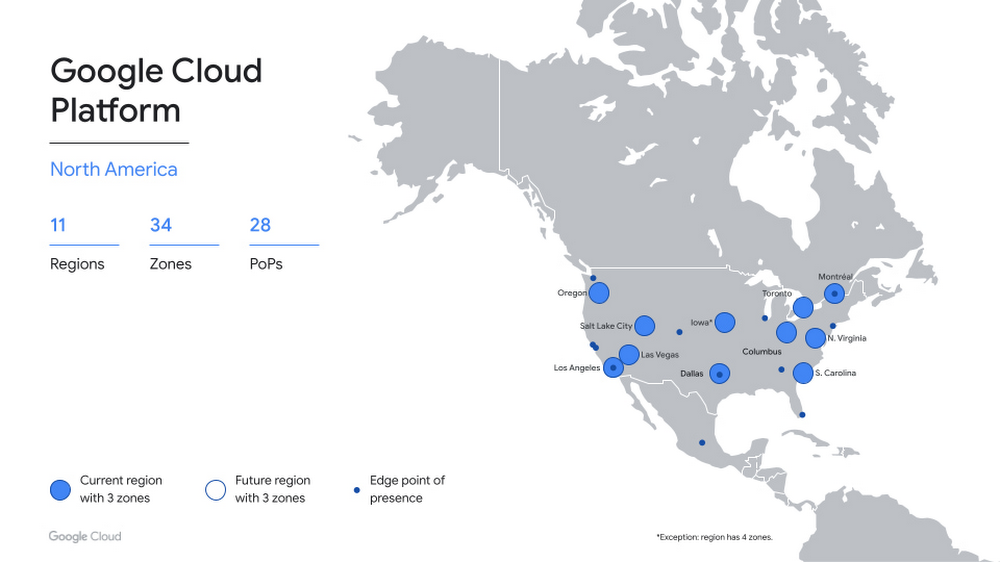

Google Cloud has added a region in Dallas, Texas, which brings Google Cloud’s total number of global regions to 34. The rollout follows the launch of its 33rd cloud region in Columbus, Ohio late last month. Other recent additions include regions in Milan, Italy; Paris, France; and Madrid, Spain.

“We’ve heard from many of you that the availability of your workloads and business continuity are increasingly top priorities. The Dallas region gives you added capacity and the flexibility to distribute your workloads across the U.S.,” Google Cloud executive Stacy Trackey Meagher wrote in a blog post.

The Texas site is the eleventh region in North America and second in the central U.S., with the other located in Iowa. It also has North American cloud regions in Oregon, Salt Lake City, Los Angeles, Las Vegas, South Carolina and Northern Virginia as well as Montreal and Toronto, Canada.

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

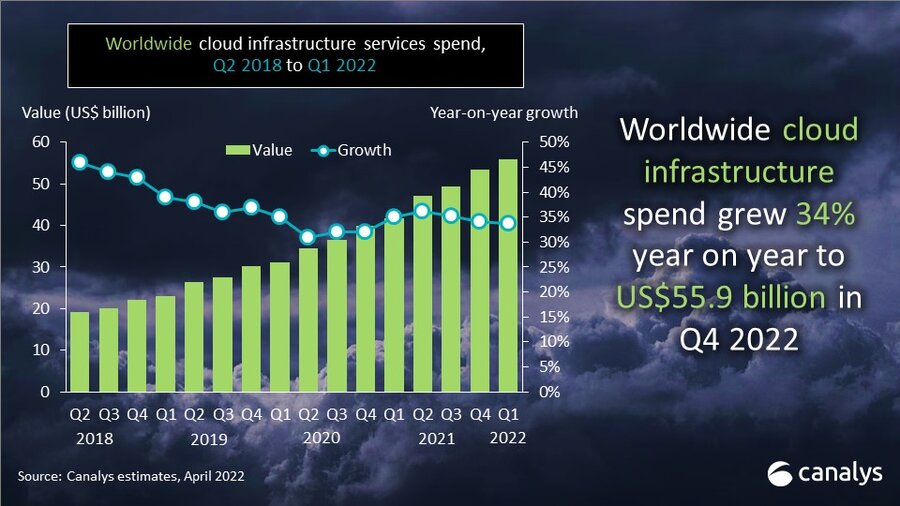

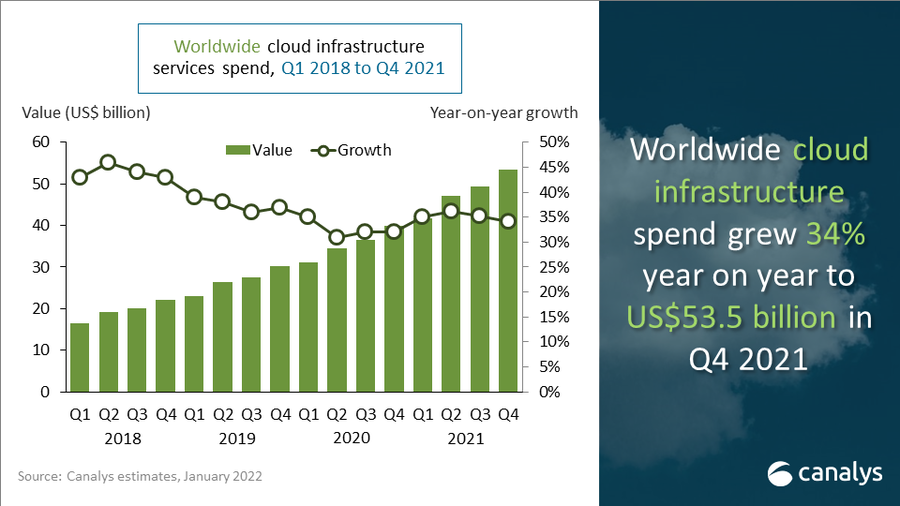

New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services was approaching $53 billion. That is up 34% from the first quarter of 2021, making it the eleventh time in twelve quarters that the year-on-year growth rate has been in the 34-40% range.

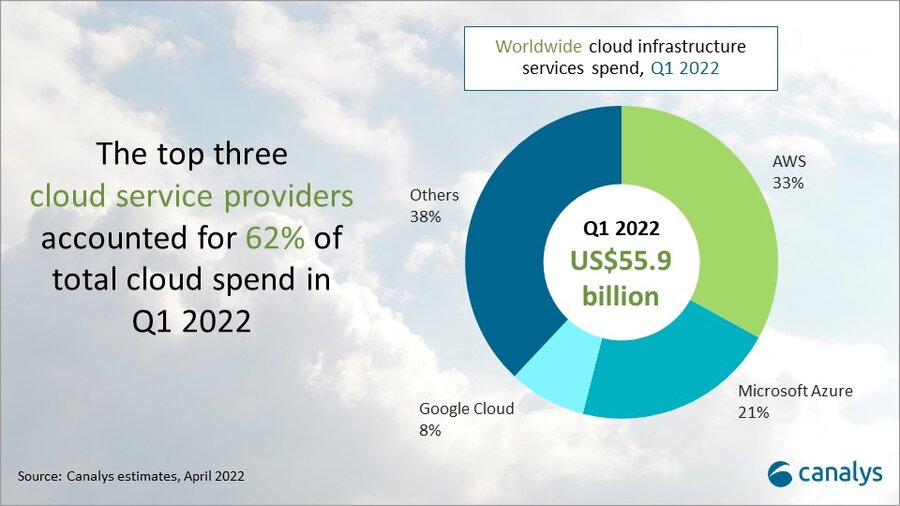

To the surprise of no one, Amazon AWS continues to lead with its worldwide market share remaining at 33%. For the third consecutive quarter its annual growth came in above the growth of the overall market.

Microsoft Azure continues to gain almost two percentage points of market share per year while Google Cloud’s annual market share gain is approaching one percentage point.

In aggregate all other cloud providers have grown their revenues by over 150% since the first quarter of 2018, though their collective market share has plunged from 48% to 36% as their growth rates remain far below the market leaders.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $52.7 billion, with trailing twelve-month revenues reaching $191 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 37% in Q1. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 71% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“While the level of competition remains high, the huge and rapidly growing cloud market continues to coalesce around Amazon, Microsoft and Google,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Aside from the Chinese market, which remains totally dominated by local Chinese companies, other cloud providers simply cannot match the scale and geographic reach of the big three market leaders. As Amazon, Microsoft and Google continue to grow at 35-50% per year, other non-Chinese cloud providers are typically growing in the 10-20% range. That can still be an attractive proposition for those smaller providers, as long as they focus on regional or service niches where they can differentiate themselves from the big three.”

…………………………………………………………………………………………………………………..

Separately, Canalys estimates global cloud infrastructure services spending increased 34% to US$55.9 billion in Q1 2022, as organizations prioritized digitalization strategies to meet market challenges. That was over US$2 billion more than in the previous quarter and US$14 billion more than in Q1 2021.

The top three cloud service providers have benefited from increased adoption and scale, collectively growing 42% year on year and accounting for 62% of global customer spend.

Cloud-enabled business transformation has become a priority as organizations face global supply chain issues, cybersecurity threats and geopolitical instability. Organizations of all sizes and vertical markets are turning to cloud to ensure flexibility and resilience in the face of these challenges.

SMBs, in particular, have driven investment in cloud infrastructure services to support workload migration, data storage services and cloud-native application development. At the same time, infrastructure hardware shortages and the threat of further price inflation has spurred many large enterprises to invest in large-scale, multi-year cloud contracts to lock in upfront discounts with the hyperscalers.

All the major cloud providers have seen a significant increase in order backlogs as a result, which now total several hundred billion dollars worldwide. This in turn is driving the importance of cloud marketplaces as a sales channel for third-party software and security, as businesses seek to burn down these cloud commitments, further fueling infrastructure consumption.

“Cloud has continued to be a hot market and transformation strategies are emphasizing digital resiliency to face the market challenges of today and tomorrow,” said Canalys Research Analyst Blake Murray. “To be effective in resiliency planning, customers are turning to channel partners with the technical and consulting skills to help them effectively embrace hyper-scaler cloud services.”

Top cloud partners are doubling down on certification efforts and skills recruitment around hyper-scaler cloud services.

Global systems integrators, including Accenture, Atos, Deloitte, HCL Technologies, TCS, Kyndryl, Tech Mahindra and Wipro, are building practices with tens of thousands of cloud engineers and consultants. This has also included acquisitions of cloud application development and migration specialists, as well as the launch of new dedicated cloud services brands.

Smaller consultants, resellers, service providers and distributors are pursuing similar strategies as mid-market and SMB customers also demand support with cloud adoption.

“As the use cases for cloud infrastructure services expand so does the potential complexity, and we see that hybrid and multi-cloud deployments are commonplace in the market,” said Canalys Research Analyst Yi Zhang. “The hyperscalers are investing in rapid channel development and partners are responding as the opportunities grow.”

…………………………………………………………………………………………………………….

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://www.canalys.com/newsroom/global-cloud-services-Q1-2022

………………………………………………………………………………………………………………………………………..

May 6, 2022 Update from Light Counting:

|

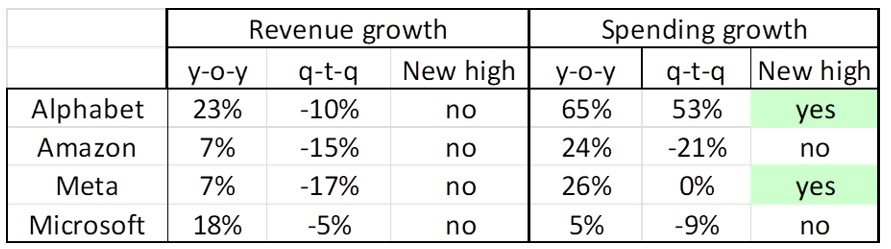

ICPs (Internet Cloud Providers) have grown spending by double digit rates (year-over-year) for many quarters and Q1 2022 looks like it will be no exception, as the combined spending of Alphabet, Amazon, Meta, and Microsoft increased 29% versus Q1 2021. What is surprising though is that Alphabet, not Meta, showed the fastest growth, with a 65% increase to more than $9.5 billion, a new record. And Alphabet’s big increase was not fueled by spending on infrastructure however, but by the closing of purchases of office facilities in New York, London, and Poland, which the company said added $4 billion to total spending in the quarter. We expect Alphabet’s Q2 capex will return from the stratosphere to the $5 billion range it has been running at. If Alphabet’s real estate spending is removed, Q1 capex for the group of four was up only 15% compared to Q1 2021, at the low end of the typical range for the Top 15 ICPs. While ICP spending appears on track to continue growing at double-digit rates this year, Q1 revenues were decidedly ‘off’ for the four majors that have reported, with no records set, and two of the four (Amazon and Meta) growing sales by only single-digit growth rates y-o-y. |

|

|

The Cloud services revenues of Alphabet, Amazon, and Microsoft continued to grow faster than overall company sales, increasing 44%, 37%, and 17% respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Network equipment makers sales growth in Q1 2022 declined by 1% y-o-y in aggregate among the reported companies, but this figure belies the fact that individual company growth rates ranged from strong double-digits (Adtran, ADVA), middling single-digits (Ericsson Networks, Infinera, ZTE), to sales declines (Nokia Networks, Ribbon Communications).

Five Chinese optical transceiver vendors have reported Q1 results, and four of them showed strong growth: HG Tech, Innolight, Accelink, and Eoptolink. CIG was negatively impacted by shutdowns in both Shanghai and Shenzhen, which affected its ability to fulfill orders.

Among U.S.-based optical component makers, Neophotonics reported Q1 2022 revenue of $89 million, up 47% year-over-year, with 400G and above products growing 70% y-o-y to $54 million. The company is now shipping production volumes of 400ZR modules to cloud and data center customers.

Two years after the start of the COVID-19 pandemic, the effects of the COVID mitigation measures continue to disrupt manufacturing, shipping, and sales in the optical industry. Several companies warned that shortages and higher component and shipping costs would persist or even worsen as 2022 progresses. And finally, costs from Russia’s invasion of Ukraine, and subsequent withdrawals from the Russian telecoms market are starting to become known, ranging from $5 million (Infinera) to 900 million Euro (Ericsson).

|

Gartner: Public Cloud End-User Spending to approach $500B in 2022; $600B in 2023

Gartner forecasts that public cloud end user spending will reach nearly $600 billion by the end of 2023. The market research firm says public cloud services will continue in 2022, and nearly capture $494.7 billion in global spending this year – up from $410.9 billion in 2021. That represents a 20.4% increase in spending from 2021.

“Cloud is the powerhouse that drives today’s digital organizations,” said Sid Nag, research vice president at Gartner. “CIOs are beyond the era of irrational exuberance of procuring cloud services and are being thoughtful in their choice of public cloud providers to drive specific, desired business and technology outcomes in their digital transformation journey.”

Infrastructure-as-a-service (IaaS) is forecast to experience the highest end-user spending growth in 2022 at 30.6%, followed by desktop-as-a-service (DaaS) at 26.6% and platform-as-a-service (PaaS) at 26.1% (see Table 1). The new reality of hybrid work is prompting organizations to move away from powering their workforce with traditional client computing solutions, such as desktops and other physical in-office tools, and toward DaaS, which is driving spending to reach $2.6 billion in 2022. Demand for cloud-native capabilities by end-users accounts for PaaS growing to $109.6 billion in spending.

Table 1. Worldwide Public Cloud Services End-User Spending Forecast (Millions of U.S. Dollars)

| 2021 | 2022 | 2023 | |

| Cloud Business Process Services (BPaaS) | 51,410 | 55,598 | 60,619 |

| Cloud Application Infrastructure Services (PaaS) | 86,943 | 109,623 | 136,404 |

| Cloud Application Services (SaaS) | 152,184 | 176,622 | 208,080 |

| Cloud Management and Security Services | 26,665 | 30,471 | 35,218 |

| Cloud System Infrastructure Services (IaaS) | 91,642 | 119,717 | 156,276 |

| Desktop as a Service (DaaS) | 2,072 | 2,623 | 3,244 |

| Total Market | 410,915 | 494,654 | 599,840 |

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service. Note: Totals may not add up due to rounding. Source: Gartner (April 2022)

“Cloud native capabilities such as containerization, database platform-as-a-service (dbPaaS) and artificial intelligence/machine learning contain richer features than commoditized compute such as IaaS or network-as-a-service,” said Nag. “As a result, they are generally more expensive which is fueling spending growth.”

SaaS remains the largest public cloud services market segment, forecasted to reach $176.6 billion in end-user spending in 2022. Gartner expects steady growth within this segment as enterprises take multiple routes to market with SaaS, for example via cloud marketplaces, and continue to break up larger, monolithic applications into composable parts for more efficient DevOps processes.

Emerging technologies in cloud computing such as hyperscale edge computing and secure access service edge (SASE) are disrupting adjacent markets and forming new product categories, creating additional revenue streams for public cloud providers.

“Driven by maturation of core cloud services, the focus of differentiation is gradually shifting to capabilities that can disrupt digital businesses and operations in enterprises directly,” said Nag. “Public cloud services have become so integral that providers are now forced to address social and political challenges, such as sustainability and data sovereignty.

“IT leaders who view the cloud as an enabler rather than an end state will be most successful in their digital transformational journeys,” said Nag. “The organizations combining cloud with other adjacent, emerging technologies will fare even better.”

Gartner clients can read more in Forecast: Public Cloud Services, Worldwide, 2020-2026, 1Q22 Update. Lean more in the complimentary Gartner webinar Cloud Computing Scenario: The Future of Cloud.

References:

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

According to the International Data Corporation (IDC) Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud infrastructure, including dedicated and shared environments, increased 13.5% year over year (YoY) in the fourth quarter of 2021 (4Q-2021) to $21.1 billion. This marked the second consecutive quarter of year-over-year growth as supply chain constraints have depleted vendor inventories over the past several quarters. As backlogs continue to grow, pent-up demand bodes well for future growth as long as the economy stays healthy, and supply catches up to demand.

For the full year 2021, cloud infrastructure spending totaled $73.9 billion, up 8.8% over 2020. IDC predicts spending on cloud infrastructure services to increase 21.7% in 2022 to $90.0 billion.

The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers. In 4Q21, service providers as a group spent $21.2 billion on compute and storage infrastructure, up 11.6% from 4Q20. This spending accounted for 55.4% of total compute and storage infrastructure spending. For 2021, spending by service providers reached $75.1 billion on 8.5% year over year growth, accounting for 56.2% of total compute and storage infrastructure spending. IDC expects compute and storage spending by service providers to reach $89.1 billion in 2022, growing at 18.7% year over year.

At the regional level, year-over-year spending on cloud infrastructure in 4Q21 increased in most regions.

- Asia/Pacific (excluding Japan and China) (APeJC) grew the most at 59.5% year over year.

- Canada, Central and Eastern Europe, Japan, Middle East and Africa, and China (PRC) all saw double-digit growth in spending.

- The United States grew 5.6%.

- Western Europe and Latin America declined for the quarter.

For 2021, APeJC grew the most at 43.7% year over year. Canada, Central and Eastern Europe, Middle East and Africa, and China all saw double-digit growth in spending. Japan grew in the high single digits, while Western Europe grew in the low single digits. The United States grew 1.5%. Latin America declined for the year. For 2022, cloud infrastructure spending for most regions is expected to grow with the highest growth expected in the United States at 27.8%. Central and Eastern Europe is the only region expected to decline in 2022 with spending forecast to be down 21.7% year over year.

Longer term, IDC expects spending on compute and storage cloud infrastructure to have a compound annual growth rate (CAGR) of 12.6% over the 2021-2026 forecast period, reaching $133.7 billion in 2026 and accounting for 68.6% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.0% of the total cloud amount, growing at a 13.4% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 10.7%. Spending on non-cloud infrastructure will flatten out at a CAGR of 0.5%, reaching $61.2 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 11.7% CAGR, reaching $130.6 billion in 2026.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

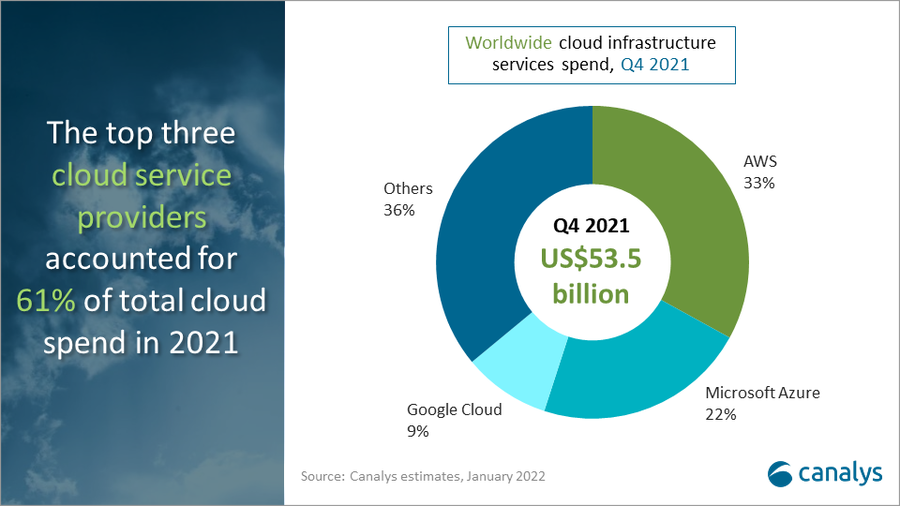

Separately, Amazon Web Services (AWS) led with 33% of spending on cloud infrastructure services in Q4 2021, according to a Feb 3, 2022 blog post from research group Canalys. Meta, previously known as Facebook, recently chose AWS as a long-term strategic cloud service provider and continues to deepen the relationship as Meta begins to move away from social media to become a broader metaverse company over the next five years. AWS also announced key customer wins across retail, healthcare and financial services and emphasized a key agreement with Nasdaq to migrate markets to AWS to become a cloud-based exchange.

Microsoft Azure was second with 22% of spending, followed by Google Cloud with 9%. The three companies accounted for 64% of total cloud investment for 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment is designed to provide clients with a better understanding of what portion of the compute and storage hardware markets are being deployed in cloud environments. The Tracker breaks out each vendors’ revenue into shared and dedicated cloud environments for historical data and provides a five-year forecast. This Tracker is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which provides a holistic total addressable market view of the four key enabling infrastructure technologies for the datacenter (servers, external enterprise storage systems, and purpose-built appliances: HCI and PBBA).

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

For more information about IDC’s Enterprise Infrastructure Tracker, please contact Lidice Fernandez at [email protected].

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48998722

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

U.S. 4 big cloud companies lead world in hyperscale data centers and capacity

The U.S. continues to lead the world in total hyperscale data centers and worldwide capacity through at least 2026, according to Synergy Research Group. “The United States currently accounts for almost 40% of operational hyperscale data centers and half of all worldwide capacity,” John Dinsdale, chief analyst at Synergy Research Group, wrote in a new report. Synergy’s new hyperscale forecasts show continued rapid growth in the number of large data centers to be used by hyperscale operators in order to support their ever-expanding business operations.

With a current known pipeline of 314 future new hyperscale data centers, the installed base of operational data centers will pass the 1,000 mark in three years’ time and continue growing rapidly thereafter.

The United States currently accounts for almost 40% of operational hyperscale data centers and half of all worldwide capacity. By a wide margin, it is also the country with the most data centers in the future pipeline, followed by China, Ireland, India, Spain, Israel, Canada, Italy, Australia and the UK.

As the installed base of operational data centers continues to grow each year at double-digit percentage rates, the capacity of those data centers will grow even more rapidly as the average size increases and older facilities are expanded.

By data center capacity the leading companies are the usual suspects: Amazon, Microsoft, Google and Facebook, though it is the Chinese hyperscalers that are growing the fastest, most notably ByteDance, Alibaba and Tencent.

The companies that feature most heavily in the future new data center pipeline are Amazon, Microsoft, Facebook and Google. Each has 60 or more data center locations with at least three in each of the four regions – North America, APAC, EMEA and Latin America. Oracle, Alibaba and Tencent also have a notably broad data center presence.

“The future looks bright for hyperscale operators, with double-digit annual growth in total revenues supported in large part by cloud revenues that will be growing in the 20-30% per year range. This in turn will drive strong growth in capex generally and in data center spending specifically,” said John Dinsdale, a Chief Analyst at Synergy Research Group.

“While we see the geographic distribution, build-versus-lease distribution, average data center size and spending mix by data center component all continuing to evolve, we predict continued rapid growth throughout the hyperscale data center ecosystem. Companies who can successfully target that ecosystem with their product offerings have plenty of reasons for optimism.”

Synergy’s Hyperscale Market Tracker research service provides key data and metrics on 19 companies that meet Synergy’s hyperscale definition criteria. The data includes information on the hyperscale data center footprint, a full data center listing, analysis of critical IT load, future data center pipeline, hyperscale operator capex, hyperscale data center spending, company revenues, and five-year forecasts for the key metrics.

Synergy Research Group tracks the data center footprints and expansion plans of 19 of the world’s largest cloud and internet service companies, including the largest providers of infrastructure, platforms, software, search, social media, e-commerce, and gaming.

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

References:

Synergy Research: Hyperscale Operator Capex at New Record in Q3-2020

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers

Synergy Research: Ethernet Switch & Router revenues drop to 7 year low in Q1-2020

Synergy Research: Cloud Service Provider Rankings (See Comments for Details)

BT selects Google Cloud for group-wide data and AI transformation

In line with the theme of telcos partnering with cloud giants, UK incumbent BT has announced a new five-year deal with Google Cloud. The objective is to leverage Google’s AI and cloud expertise to foster a new company culture BT calls ‘The Digital Way.’ The partnership will include a wide range of products and services, including cloud infrastructure, machine learning (ML) and artificial intelligence (AI), data analytics, security, and API management. In particular:

- Collaboration will involve BT using Google’s enhanced data and AI capabilities at every level of its business to deliver personalised customer experiences and continue its commitment to creating societal value through responsible, inclusive, and sustainable tech

- Google Cloud will support BT with a full spectrum of products and services, from secure cloud infrastructure to advanced machine learning tools

- Access to Google Cloud’s Site Reliability Engineering (SRE) experts will help drive the cultural change needed to enable BT to operate a data and AI platform in the cloud at scale

Image of Google Cloud. Source: Google

The work will be overseen by BT Digital, a new arm of the business created last year and headed up by BT’s Chief Digital and Innovation Officer, Harmeen Mehta.

“Our partnership with Google is one of a series of strategic moves that BT Digital is taking to help accelerate BT’s growth and digital transformation. This is a partnership that is deeper than just at the technology level. It will help Digital as a whole supercharge BT and drive its return to growth,” said Mehta. She then wrote on LinkedIn, “Delighted with this fantastic partnership with Google Cloud as we accelerate the BT digital transformation.”

As part of the deal, Google’s Site Reliability Engineering (SRE) team will also partner with BT to help the operator roll out autonomous operations and develop new cloud-based services for customers.

“We’re proud to collaborate with one of the world’s leading providers of communications services and play an integral part in its digital transformation journey,”said Thomas Kurian, CEO at Google Cloud.

“By deploying our full cloud capabilities, and support from our SRE organisation, our goal in this partnership is to set up BT with the tools it needs for future growth and innovation,” he added.

Google and BT have already started working together on adopting Google technology, and plan to complete the core migration of data by 2023.

Other telco’s have partnered with Google Cloud:

- Late last month, Finnish telco Elisa also announced its own partnership with Google Cloud into its hybrid cloud offering.

- Last November, Telenor and Google Cloud formed a partnership to digitalize the Norwegian telecom company’s global operations and are exploring ways to jointly offer services to customers

- In February 2021, Canadian telco Telus and Google Cloud signed a 10-year collaboration deal to help fuel Telus’ internal digital transformation while also jointly developing new products and services.

- In November 2019, Telecom Italia and Google Cloud formed a partnership that will enable TIM to expand its portfolio of public, private and hybrid cloud services and to offer edge computing services

References:

https://www.totaltele.com/512745/Cloud-first-AI-first-BT-selects-Google-Cloud-for-strategic-shift

Move to distributed cloud networks, edge cloud and smart city services

Last week Akamai announced that it had acquired infrastructure-as-a-service (IaaS) platform provider Linode for $900 million. As a result it can bundle its edge cloud network with Linode’s services aimed at developers and their applications. Linode is a cloud computing specialist, offering its infrastructure-as-a-service platform across 11 global markets from data centres around the world. It operates its own network, with APIs, services and educational resources to enable developers and businesses to build, deploy, and scale applications more easily and cost-effectively in the cloud. The deal appears aimed at smaller developers and the bigger rival AWS.

“If you are a large enterprise and need the ability to customize your infrastructure, AWS is a good fit. But if you’re a small business owner or independent developer, having access to all of that advanced cloud technology comes at a cost: unnecessary complexity, risk of lock-in to Amazon’s ecosystem, and frequent billing surprises.”

AWS was also active last week in the edge cloud area, focusing on applications in need of single-digit millisecond latency. It’s completed 16 Local Zones in the US to serve customers such as Netflix and Fox and plans to add another 32 zones around the world in the next two years.

In Europe, 28 companies (including Deutsche Telekom, TIM, KPN, United Groep and Vivacom) confirmed plans for the Lighthouse Structura-X Project. That project will develop cloud services compatible with the aims of the EU’s Gaia-X project.

Canadian network operator Telus is partnering with Google Cloud to develop smart city services. Telus will rely on its 5G network and NXN Digital platforms.

The French start-up InterCloud raised EUR 100 million for its interconnection service supporting all the big cloud platforms.

References:

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Enterprise IT spending on public cloud computing, within addressable market segments, will overtake spending on traditional IT in 2025, according to Gartner, Inc.

Gartner’s ‘cloud shift’ research includes only those enterprise IT categories that can transition to cloud, within the application software, infrastructure software, business process services and system infrastructure markets. By 2025, 51% of IT spending in these four categories will have shifted from traditional solutions to the public cloud, compared to 41% in 2022. Almost two-thirds (65.9%) of spending on application software will be directed toward cloud technologies in 2025, up from 57.7% in 2022.

“The shift to the cloud has only accelerated over the past two years due to COVID-19, as organizations responded to a new business and social dynamic,” said Michael Warrilow, research vice president at Gartner. “Technology and service providers that fail to adapt to the pace of cloud shift face increasing risk of becoming obsolete or, at best, being relegated to low-growth markets.”

In 2022, traditional offerings will constitute 58.7% of the addressable revenue (see Figure 1), but growth in traditional markets will be much lower than cloud. Demand for integration capabilities, agile work processes and composable architecture will drive continued shift to the cloud, as long-term digital transformation and modernization initiatives are brought forward to 2022. Technology product managers should use the cloud shift as measure of market opportunity.

In 2022, more than $1.3 trillion in enterprise IT spending is at stake from the shift to cloud, growing to almost $1.8 trillion in 2025, according to Gartner. Ongoing disruption to IT markets by cloud will be amplified by the introduction of new technologies, including distributed cloud. Many will further blur the lines between traditional and cloud offerings.

Enterprise adoption of distributed cloud has the potential to further accelerate cloud shift because it brings public cloud services into domains that have primarily been non-cloud, expanding the addressable market. Organizations are evaluating it because of its ability to meet location-specific requirements, such as data sovereignty, low-latency and network bandwidth.

To capitalize on the shift to cloud, Gartner recommends technology and services providers target segments where the shift is occurring most aggressively, in addition to seeking new high-growth cloud opportunities. For example, infrastructure-related segments have a lower level of cloud penetration and are expected to grow faster than segments such as enterprise applications that are already highly penetrated. Providers should also target specific personas, adoption profiles and use cases with go-to-market initiatives.

*Note to editors: Gartner’s research on cloud shift provides a high-level view of the market impact of cloud computing by measuring the ratio of enterprise IT spending on public cloud services compared with traditional (non-cloud) for a given set of market segments. It compares only those markets where cloud is a meaningful trend that can be exploited by technology providers. It excludes consumer spending and markets that cannot transition to cloud, for example, mobile devices.

More detailed analysis is available to Gartner clients in the report “Market Impact: Cloud Shift — 2022 Through 2025.” More information on cloud trends is available in the Gartner webinar “The Gartner Hype Cycle for Cloud Computing.”

Telcos Move to Public Cloud:

Dish Network is perhaps the poster child for this shift, with its ambitious plan to deploy its greenfield 5G network on Amazon Web Services (AWS). After a few delays, the big switch-on is expected to begin this year. Similarly, AT&T struck a deal last June to migrate its 5G network onto Microsoft Azure. Verizon is also using Azure, in this case to underpin its private mobile edge cloud service. North of that particular border, Bell Canada in July inked a deal to migrate various critical workloads – including IT, network functions and applications – to Google Cloud. It came less than two months after Bell teamed up with AWS to overhaul its business and consumer applications, as well as offer AWS-powered multi-access edge computing (MEC) services.

More recently, Telenor expanded its partnership with Amazon to jointly offer 5G and edge services to various industry verticals. In short, more and more telcos are coming to the conclusion that hyperscale public cloud offers a ready-made route for them, not just to address the enterprise IT market, but to also make their own networks cloud native.

References:

Public cloud forecast to account for majority of IT spending by 2025