Fiber deployments

California begins construction of $3.8B middle mile fiber network

California began work on an ambitious fiber project which aims to deliver statewide open access middle mile connectivity by the end of 2026. The project, which was announced in 2021, is being fueled by $3.8 billion in federal and state funds.

The sate’s network design calls for a total of 10,000 miles of fiber. The largest portion of the project will run through San Bernadino County, which will be home to 850 miles of fiber. Kern County (544 miles), Riverside County (535 miles) and Los Angeles County (525 miles) will also account for substantial portions of the system.

California’s Department of Transportation (Caltrans) is working with the state’s Department of Technology to complete the project.

During a project meeting in September, Caltrans’ Acting Assistant Deputy Director for the Middle Mile Broadband Initiative Janice Benton said preconstruction work – including environmental, permitting and design tasks – was already underway for 93% of the project’s fiber miles.

She added 114 miles of the project are expected to go into construction in 2022, with another 300 miles to come in 2023. The first leg of its work got underway this week.

The state of California has already advertised contracts covering 900 miles of the project. And by October 14, it was planning to have 60% of the middle mile network out for construction bids. It is aiming to have 100% of the system under contract by May 2023.Once the network is complete, ISPs will be able to tap into it to provide last mile connectivity. Those efforts will also get a funding boost. The same 2021 legislation that allocated $3.25 billion for the middle mile project (which was subsequently supplemented by another $550 million from the 2022 state budget) also set aside $2 billion for the rollout of last mile connections.

The 10,000-mile “middle mile” network is expected to cost $3.8 billion and help connect the roughly one in five Californians do not have access to reliable and affordable high-speed internet.

“We are thrilled to see construction begin on the middle-mile network,” said Secretary Tong. “Too many rural and urban areas lack adequate broadband infrastructure, forcing residents to attempt to connect via mobile hotspots and unreliable satellite service, which leaves out too many Californians.”

Former Los Angeles Mayor Antonio Villaraigosa, who was named by the Governor in August to serve as Infrastructure Advisor to the State of California, joined the event Thursday to highlight the substantial federal resources coming to the state for infrastructure investments like broadband networks.

“This broadband network is one of the most ambitious and impactful infrastructure projects in California – and we’re thrilled that construction is underway starting today,” Mayor Villaraigosa said. “With billions more in federal infrastructure dollars on the way, we’re getting ready to celebrate many more groundbreakings for innovative projects across California. This goes far beyond infrastructure, this is about building the future of our state and creating thousands of good-paying jobs along the way.”

CDT Director Liana Bailey-Crimmins said construction on the first segment of the Middle Mile network follows more than a year of planning.

“The rapid planning by the Middle Mile team as well as our local partners is coming to fruition. It’s wonderful to see the hard work paying off, to make a difference in the lives of Californians who live in unserved areas like this one.”

Caltrans Director Tony Tavares said each of the Department’s 12 districts is working to build segments of the Middle Mile network on an ambitious timeline in the hope of capturing the maximum amount of federal funding available.

“This project provides a wonderful opportunity for us to ‘dig smart’ and highlights the benefits of coordination among state agencies and with our local partners. Caltrans is proud to partner with the Department of Technology to create a broadband Middle Mile network, providing equitable, high-speed broadband service to all Californians.”

Once the Middle Mile network is complete, local carriers will have access to the network to provide communities with direct service to homes and businesses as well as reduced-cost or free broadband internet service for those who are eligible.

References:

https://www.fiercetelecom.com/telecom/california-kicks-construction-38b-middle-mile-fiber-network

New Hampshire Electric Cooperative and Conexon to deliver FTTH internet service to thousands of NH homes and businesses

Conexon, a rural fiber-optic network design and construction management leader, and New Hampshire Electric Cooperative (NHEC) are expanding their partnership to bring fiber-to-the-home (FTTH) service across the cooperative’s territory.

NHEC and Conexon have worked together to provide gigabit-speed internet access to two communities, Acworth and Sandwich, and will soon expand to 32 communities throughout Grafton County. NH Broadband, the co-op’s fiber subsidiary, will ultimately offer high-speed fiber internet service that spans nine counties and nearly 120 communities. Service is available today for customers in Acworth, Sandwich, Clarksville, Colebrook, Lempster and Stewartstown, and is expected to be available to initial customers in Grafton County by First Quarter 2023.

Conexon provides a comprehensive range of fiber broadband services including network design, construction project management, engineering and operations support. Additionally, through its internet service provider subsidiary, Conexon Connect, the company is also providing services including customer sign-ups, installations, billing, technical support and access to multi-gigabit speed packages.

“Over the past several years, I’ve heard people analogize rural broadband to the rural electrification movement of the 1930s and 1940s,” Conexon Partner Jonathan Chambers said. “To us, it isn’t an analogy; it’s a reality. The same companies that built electric networks across the nation are building broadband networks. Alyssa Clemsen Roberts was one of the first to recognize how electric cooperatives could solve the digital divide. In fact, Alyssa introduced me to that very idea when I was at the FCC. She also introduced me to Randy Klindt. I’m thrilled Alyssa has joined NHEC and will lead this new endeavor.”

The lightning-fast fiber-optic network offered by NH Broadband will give members access to symmetrical multi-gigabit internet capabilities – among the fastest and most robust in the nation. Additionally, it will enable enhancements and smart grid capabilities to the electrical infrastructure, including improved power outage response times, better load balancing and more efficient electricity delivery.

“Making high-speed, affordable internet available to all of our members who need it is a major undertaking, on par with the effort to bring light and power to these same locations more than 80 years ago,” NHEC President/CEO Alyssa Clemsen Roberts said. “We’re thrilled to have Conexon’s resources and experience available as we work to bring this next essential service to our members.”

Conexon brings to the project unmatched experience and expertise in deploying rural FTTH networks. The company has designed more than 200,000 miles of fiber for cooperative projects and builds more than 50,000 fiber miles of fiber annually. In addition, Conexon has created a broad ecosystem of equipment and labor resources specializing in rural fiber builds. Since forming six years ago, Conexon has assisted nearly 275 electric cooperatives, 75 of which are deploying fiber networks, with more than 500,000 connected fiber-to-the-home subscribers across the U.S.

“We’re excited to build on our current relationship with New Hampshire Electric Cooperative and make a difference in the lives of even more residents who are currently unserved or underserved with broadband,” Conexon Founding Partner Randy Klindt said. “We are pleased to have such a positive and productive partnership with Alyssa and her team, one that enables us to further our mission of closing the digital divide.”

New Hampshire Electric Cooperative is a member-owned not-for-profit electric utility, headquartered in Plymouth, N.H. NHEC connects its 85,000 members through 6,000 miles of energized lines, crossing 118 communities throughout New Hampshire.

Conexon works with Rural Electric Cooperatives to bring fiber to the home in rural communities. The company is comprised of professionals who have worked in electric cooperatives and the telecommunications industry, and offer decades of individual experience in business planning, building networks, marketing and selling telecommunications. Conexon offers its electric cooperative clients end-to-end broadband deployment and operations support, from a project’s conception all the way through to its long-term sustainability. It works with clients to analyze economic feasibility, secure financing, design the network, manage construction, provide operational support, optimize business performance and determine optimal partnerships. To date, Conexon has assisted more than 275 electric cooperatives, 75 of which are deploying fiber networks, with more than 500,000 rural Americans connected to fiber to the home. The company has secured nearly $2 billion in federal, state and local grants and subsidies for its clients.

Cindy Parks

913-526-6912

[email protected]

SOURCE Conexon

AT&T CEO at Goldman Sachs Conference: Fiber and 5G are huge growth drivers

AT&T CEO recently spoke at the Goldman Sachs Communicopia + Technology Conference. Stankey reiterated that AT&T continues to take a disciplined and return-focused approach to growth and investment and made the following points:

- The company continues to add customers in its strategic focus areas of 5G and fiber. Stankey shared he feels comfortable with AT&T’s business trajectory and the continued customer demand it is seeing. Overall industry postpaid phone volumes remain healthy, and AT&T’s consistent go-to-market approach, along with an improved customer experience, is attracting high-value customers. That’s in sharp contrast to Verizon which is losing post paid mobile customers. “We are still going to have a negative net adds on phones in the third quarter,” Verizon CEO Hans Vestberg said Wednesday at the Goldman event.

- Stankey said AT&T is developing diversified sources of growth, with wireless share gain in specific customer cohorts, such as the public sector and large and mid-sized business. He expects this momentum to continue thanks to a strong distribution ecosystem, a high-performing workforce and enhanced network quality strengthened by recent mid-band 5G spectrum deployments. He also added that recent pricing actions are performing as anticipated, supporting the company’s view that these actions will be accretive in the latter half of the year.

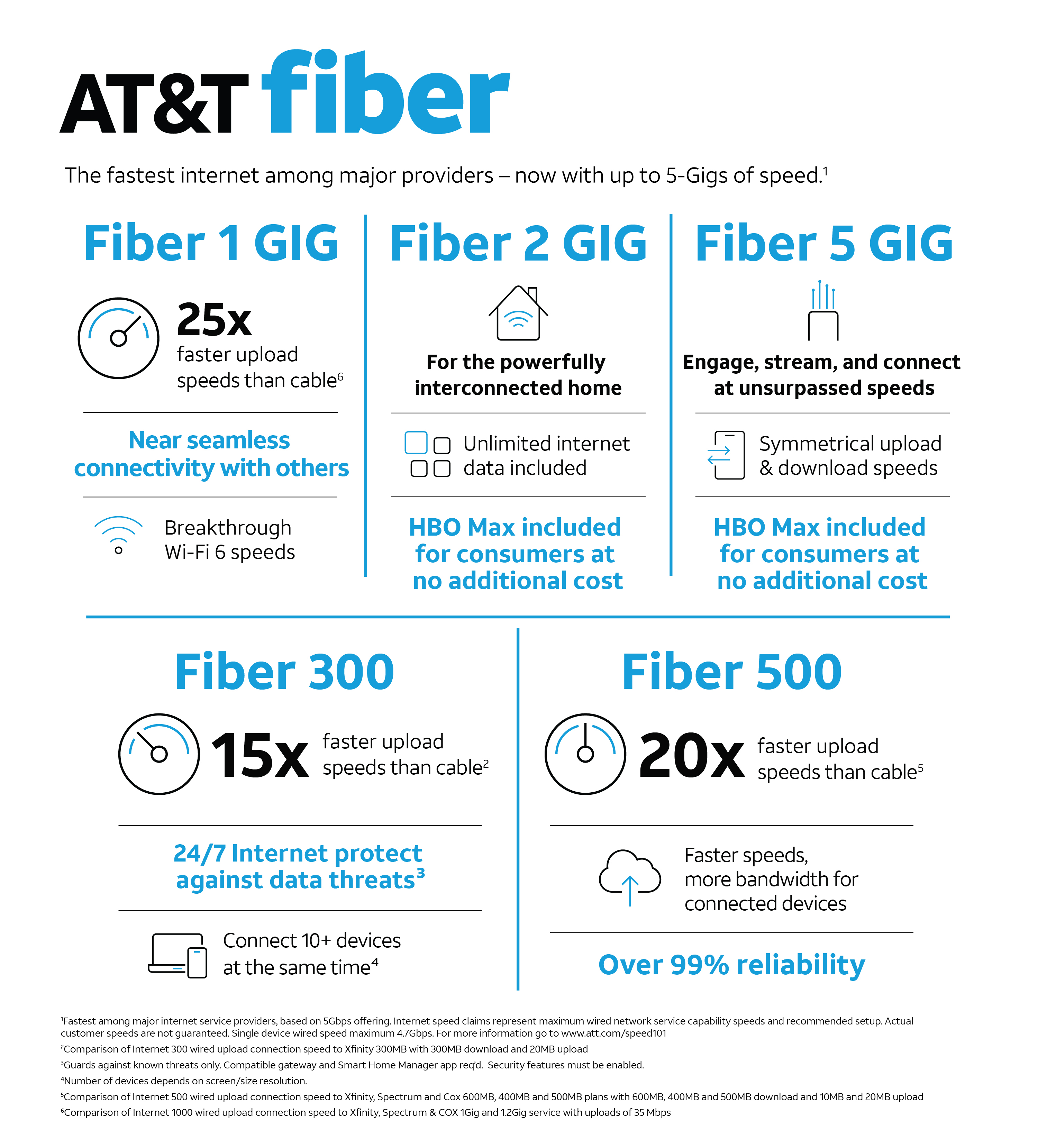

- Stankey shared that AT&T Fiber continues to deliver the best customer experience in the marketplace and that he’s pleased with the penetration rates for new fiber build. As AT&T expands to new markets, the company has seen first-year penetration rates about two times greater than historical norms. Stankey expects subscriber momentum and current penetration rates to continue based on the company’s improved ability to build fiber effectively and the strong customer demand for the product. Fiber ARPU continues to grow, and the company is seeing higher than anticipated uptake of its multi-gig fiber offerings.

- At the end of the last quarter, AT&T had over 6.5 million fiber customers. The company continues to expand its fiber footprint and has the ability to serve 18 million customer locations in more than 100 metro areas with AT&T Fiber. Stankey shared there may be an opportunity to expand the company’s fiber footprint based on the attractiveness of returns and that government subsidies supporting public-private partnership are expected to help drive broadband expansion.

-

There are three major sensitivities in a fiber business case. One is the rate of penetration, one is the ARPU and one is the cost to build. Cost to build isn’t going to move dramatically typically speaking. Nobody is going to come out with a new way to put fiber out that takes 30% out of the cost of building fiber. It uses relatively mature technologies like digging trenches that aren’t going to see that kind of rapid change. ARPUs are not only strong. They’re stronger than what we expected. We’re seeing higher uptakes when we offer 5 gig in the market than what we would have expected when we put a 5-gig product out there. And if the rate of penetration is twice as fast as we expected, that will tell you that there are homes that in previously, two years ago when we did this, we said maybe weren’t economical that now because of our execution in the market and we sustain that become economical.

Second point, government has brought in a pretty substantial amount of public subsidy, $45 billion-ish. And remember, that’s just the public portion of the subsidy. What people miss is nobody expects that when one of those locations get built, that it’s going to be done on a 100% public financing, it’s going to be done on a public private partnership.

And right now, on public monies that are coming in, for example, when we’re participating, oftentimes, $3 of private capital come in to match $1 of public capital. I don’t expect that, that ratio will probably hold as we get to some of these more difficult areas to build. But $45 billion, if it’s 1:1, could be $90 billion, right? And when you start thinking about that dynamic of how that opens up an opportunity in the market previously uneconomic areas to build. If that starts to work its way through the process next year, I would expect that AT&T is going to be an active participant in that process. And we’re going to look at it based on what I described earlier is we’re looking at places where we’re turning down existing copper infrastructure, where we have opportunity to keep scale and go in and fill in holds, that’s going to naturally cause us to lean in to doing some of that stuff going forward. And I would expect that will probably alter the number.

And then finally, I think we’re in a place in the market right now, where I believe all the fundamentals are that customers need more skilled connectivity in their home. And if I look out over five years, and I think about building a durable and sustainable franchise at AT&T, I think fiber is a key element to that.

- Fiber is also a key element for getting the kind of dense infrastructure that’s necessary for the next generation of wireless technology for backhaul. And having that owned and operated economics where you’ve got that backhaul and that transport densely out on a network is going to be a key determiner being a successful wireless business over time. And so when I step back and I think about that opportunity right now, are there other markets maybe outside of our operating footprint, given our success and what we’re seeing in rate of penetration, receptivity of the product, our ability to cross-sell both fixed and wireless, we should understand whether or not there’s something there.

- AT&T has been deploying their mid-band spectrum. We were a little bit later to that dynamic than some in the industry because of where we were in the auction and equipment availability. It is now up and starting to make its appearance. In metropolitan areas, the performance we’re getting out of it is really, really good. I think that will be a big lift on what is already a strong network.

- The CEO says AT&T has the best performing 4G LTE network in the country now paired with what we can do in 5G mid-band spectrum, I think that’s only going to be a positive for customers as we move through this.

- AT&T remains focused on its cost transformation program and its efforts to achieve more than $4 billion of its $6 billion run-rate cost savings target by the end of the year. Stankey noted that he’s comfortable with AT&T’s cost structure, and believes the company can continue to drive out costs as it exits portions of its legacy businesses. This includes efforts to transition from its legacy copper network to fiber.

- Stankey shared that AT&T is investing at a record clip to fuel growth in core connectivity, while continuing to pay an attractive dividend, and that the company is focused on building a sustainable and durable connectivity operation with improved cash generation. AT&T is pleased with the return profile of its fiber and 5G investments and continues to expect 2022 and 2023 to be the peak of this capital investment cycle with capital intensity moderating in 2024 and beyond. Overall, the company’s long-term capital allocation priorities remain unchanged, and it expects to use cash after dividends to reduce debt with a goal of reaching a net debt-to-adjusted EBITDA range of 2.5x.

References:

AT&T CEO Updates Shareholders at Goldman Sachs Communicopia + Technology Conference | Business Wire

Altice USA bets on FTTP with multi-gigabit speeds by 2025; MVNO with T-Mobile

Dexter Goei, Altice USA’s outgoing CEO, continues to strongly defend the company’s decision to upgrade large portions of its network to fiber, stating that the product and business performance of the move make dollars and sense. Altice USA’s current plan is to upgrade about 6.5 million passings to fiber-to-the-premises (FTTP) by 2025 and back that up with multi-gigabit speeds, which Altice USA has begun to soft-launch in parts of its fiber upgrade areas.

At the Goldman Sachs Communacopia + Technology conference in San Francisco, Goei said while the company has made strides in deploying its fiber network — it expects to finish 2022 with up to 2.3 million homes passed with the technology — it is still seeing customer declines in its former Cablevision and Suddenlink footprints.

In Altice’s former Cablevision systems in metropolitan New York City, gross additions are lower, there is less move activity and churn levels are low, but the company also is competing against a telco — Verizon Communications — that has been extremely aggressive on price. In its Suddenlink markets mainly in the Midwest, gross addition activity is high but churn is high, especially in markets where it is being overbuilt.

“We’re still losing subs in both markets but for different reasons,” Goei said. “We feel good about the fourth quarter turning around and looking better next year.”

Altice USA lost about 3,000 subscribers in 2021 — the only major cable operator to do so — and shed more than 50,000 broadband customers in the first half of this year.

Altice began accelerating its fiber rollout last year, with a goal of passing 6.5 million homes by 2025. At the Goldman conference, Goei said the company expects to end 2022 with 2.2 million to 2.3 million homes passed with fiber (an increase of about 1 million homes), and should add another 1.6 million to 1.8 million households by the end of 2023.

While other cable operators have seen an increase in competition from fixed wireless access providers from telcos, Goei said most of Altice USA’s telco competition is replacing slower DSL lines with fiber, hence the acceleration of its own fiber buildout plans. But he shared his peers’ disdain for fixed wireless access (FWA), agreeing with some pundit predictions that the technology will reach a performance and penetration plateau in the next two or three years.

Goei announced his intention to step down as CEO earlier this month, and will become executive chairman of Altice USA on October 3. In his place the company named Comcast executive Dennis Mathew as CEO, also effective October 3. Mathew has 17 years of experience with Comcast, most recently as senior VP of its Freedom Region (Southeast Pennsylvania, New Jersey and Northern Delaware). He earlier served as senior VP for its Western New England Region (Connecticut, Vermont, Western Massachusetts and areas of New York and New Hampshire) and has extensive experience in running cable businesses.

Goei said at the Goldman conference that his main motivation for stepping down was a desire to return to Europe, where he spent his childhood and most of his professional career, with his family. He added that he notified the Altice USA board of his decision about a year ago, starting the search process for a replacement about six months ago. He believes he’s leaving Altice USA in capable hands.

“I interviewed many, many people during the process; Dennis fits the bill across the board,” Goei said, adding that Mathew has a proven track record in operations, running one of Comcast’s most high-profile regions (the Freedom Region) and will fit in well with the Altice team. “He’s just a great guy, a team player, will focus on the prize and is someone who would do very well with the executive team at Altice USA.”

The average revenues per user (ARPU) on Altice USA’s fiber-based products are 7% to 8% higher than ARPU on cable-based services, he said. Additionally, churn rates on fiber services are also coming in about 6% to 8% lower than on HFC, and the NPS (net promoter score) for the fiber product is also coming in higher.

“Every single metric that you can imagine – that you would anticipate – are better” on the fiber product, Goei said. He acknowledged, however, that the installation process for fiber customers getting a triple-play bundle that includes pay-TV and voice could be better.

As for Altice USA’s fiber network build update, the company finished almost 270,000 new homes in the second quarter of 2022, a record the company expects to beat in Q3 and, weather permitting, in Q4.

For 2022, Altice USA expects to complete an additional 1 million fiber passings, with 1.2 million as its “stretch target.” That will put Altice USA in a position to end the year with 2.2 million to 2.3 million homes passed with fiber.

In 2023, Goei said Altice USA expects to ratchet up the build to 1.6 million to 1.8 million homes passed as the operator starts to push fiber upgrades into the Suddenlink footprint.

Altice USA is also doing edge-out builds to areas adjacent to existing facilities and pursuing grants for fiber builds in underserved and unserved areas. Altice USA has won grants or subsidies covering 40,000 to 45,000 homes, a number that Goei predicts could rise to about 200,000 in the next 12 to 24 months.

Altice USA, which has been fielding M&A inquiries about the Suddenlink properties, believes its fiber focus will set the stage for a return to broadband subscriber growth as early as Q4 2022, and certainly by sometime in 2023.

Goei said 80% of gross broadband subscriber adds in fiber areas take a fiber-based service. Though Altice USA is trying to convert HFC customers to fiber proactively, exceptions include customers who want to keep their existing setup or who are in homes and locations where a landlord won’t allow a new fiber drop.

Altice USA has been building a fiber broadband network in its Optimum territory in the New York tri-state area (New York, New Jersey, Connecticut) with 1.2 million fiber passings available for sales as of December 31, 2021. For Suddenlink, construction is expected to begin this year in areas of Texas. Additional states in the Suddenlink footprint that will benefit from this fiber expansion plan include areas of Arizona, California, Louisiana, Missouri, North Carolina, New Mexico, Oklahoma, and West Virginia.

“Altice USA is proud to announce plans to invest further in our fiber deployment strategy by accelerating the build of a 100% fiber broadband network capable of delivering multi-gig speeds across our Optimum and Suddenlink footprint,” said Dexter Goei, Altice USA Chief Executive Officer. “Fiber is the future and given the progress we have made at Optimum with our fiber expansion, we’re excited to build on that success and break ground later this year at Suddenlink to bring our advanced network to more customers and communities.”

Goei touched briefly on Altice USA’s Optimum Mobile product, which is supported by an MVNO deal with T-Mobile. He agreed that there are benefits to bundling mobile with home broadband but lamented that mobile EBIDTA is challenged by “thin margins” being driven by a mobile marketplace that’s seeing falling ARPU and rising levels of promotions.

With that backdrop, Altice USA expects to market fiber more aggressively than mobile this year and into 2023. “For the balance of this year, I don’t think you should expect real big waves in the mobile product,” Goei said.

Goei also offered some additional commentary on the recent announcement that he will be stepping down as CEO to become executive chairman of the board. Comcast exec Dennis Mathew has been tapped to take the CEO slot effective October 3.

Goei reiterated that he is shifting gears for personal reasons, as he and his family want to return to Europe. He said he informed the board of his decision about a year ago. Altice USA started its CEO search roughly six months ago.

In his new role, Goei said he will focus on “large strategic stuff” and external elements such as government affairs and conversations with the financial community, so that Mathew can focus squarely on operations.

References:

AT&T remains a fiber first network provider with FWA in rural areas

AT&T remains a fiber-first broadband broadband network provider. The carrier’s CFO Pascal Desroches told investors that the most likely instance for AT&T to use FWA (fixed wireless access) would be in rural areas where deploying fiber could prove too costly.

“We think in certain instances FWA makes sense,” Desroches said during an interview at this week’s Bank of America Media, Communications, and Entertainment Conference, according to a transcript. “If you’re in a rural area where it does make – where the economics don’t pan out for fiber, fixed wireless will be an interesting solution.”

AT&T’s transition end game is predicated on the carrier’s belief that fiber is a better long-term solution for customers and its operations. Desroches explained that FWA extracts a “very expensive” toll on the carrier’s mobile operations.

“Long term, we don’t believe it will be good enough,” Desroches said of FWA. “And that’s why we think it is really important to start to place our bets now with fiber because by the time fiber becomes the only acceptable solution, it will be too late to start to build out because of the long lead times.”

Editor’s Note: This is what investors are missing about AT&T – it’s growing fiber footprint (#1 in the U.S.) which is probably the biggest growth area in all of telecom!!!

…………………………………………………………………………………………………………………………………………………….

“With connectivity increasing at what we estimate will be a fivefold increase between 2021 and 2025, fiber will be the solution of choice. And given the long lead times, the long payback periods, if you decide you want to do fiber 4 to 5 years from now, it’s too late. And this is why we think we are building a strategy for long-term sustainable earnings with the best possible technology.”

To support that need, AT&T recently signed a long-term deal with fiber builder Corning, which is using that deal as the basis to build a new cable manufacturing facility in Gilbert, Arizona. AT&T also formed a “Fiber Optic Training Program” with Corning targeted at training 50,000 people to design, install, and maintain fiber networks.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” AT&T CEO John Stankey noted in a statement tied to the Corning deal. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity.”

“The market demand remains really healthy. We’re continuing to see good demand for subscriber — for new subscribers coming into the service. And also, look, our churn levels are at really low levels. You look at all that together, we have a mobility business now that we expect service revenues to grow 4.5% to 5%. And we expect profitability to accelerate in the back half of the year. So all indications are green and that we are performing really well.”

“We’re going to be competitive. For years, AT&T was not competitive, and we’re going to be competitive, and we’re capitalists. At the end of the day, if there are opportunities to grow subscribers in a more efficient way, we’re going to seize those. But at the same time, we’re no longer going to be the share donor to the industry.”

“We have relationships with virtually over 90% of the Fortune 1000. And it’s a core competency that we have, and it’s one that has served us well. But it is very much in transition, and we’re — what we have to do is to grow our small, mid-business connectivity solutions.”

“There will be a very attractive market for 5G-enabled IoT solutions. There is — it will come. It is nascent today. It will come and the relationships that we have among the Fortune 1000 is critical to — is critical in serving — in helping exploit that opportunity. And again, our wireless relationships. The big part of the growth in wireless is also the ability to surgically attack our enterprise base and partner with different organizations to really drive increased subscriber adoption.”

References:

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

AT&T continues to add customers in key focus areas- 5G and fiber

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

AT&T continues to add customers in key focus areas- 5G and fiber

Pascal Desroches, senior executive vice president and chief financial officer, AT&T spoke today at the Bank of America Media, Communications and Entertainment Conference where he provided an update to shareholders. Desroches reiterated that AT&T continues to take a disciplined and return-focused approach to growth and investment and made the following points:

- The company continues to add customers in its strategic focus areas of 5G and fiber. Overall industry postpaid phone volumes remain healthy, and AT&T has continued to see solid demand with continued low postpaid phone churn. In addition, AT&T’s consistent, disciplined and simple go-to-market approach continues to attract high-value customers. Desroches indicated that the impacts of recent pricing action on churn are within AT&T’s expected range and the company continues to expect that the pricing changes will be accretive in the back half of the year.

- AT&T continues to expand its fiber footprint and has the ability to serve 18 million customer locations in more than 100 metro areas with AT&T Fiber. Desroches shared he’s pleased with the increasing penetration rates for new fiber build. As AT&T expands to new markets, the company has seen first-year penetration rates about two times greater than historical norms.

- Desroches noted that AT&T is not seeing any material incremental shift in its cash collection cycles, which are within the company’s expectations and largely consistent with normal pre-pandemic levels.

- While the current macroeconomic environment has reduced visibility into economic trends going into next year, Desroches reiterated expectations for improved cash conversion in 2023 compared to 2022. Factors driving the company’s outlook for improved cash conversion include expectations for better service revenue levels exiting 2023 — from both a larger customer base and higher ARPUs — lower interest costs and the benefits from continued transformation savings.

- Expectations for improved cash conversion off this year’s free cash flow guidance of the $14 billion range provide more than sufficient financial flexibility to meet AT&T’s financial obligations – including its annual dividend commitment of $8 billion, or $1.11 per common share – even after factoring in the company’s above historical capital investment levels.

Contacts

Brittany Siwald

AT&T Corporate Communications

Phone: (214) 202-6630

Email: [email protected]

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

Corning will build a new fiber optical cable manufacturing plant near Phoenix, AZ that will primarily supply AT&T’s continuing fiber optic network buildout. The new facility, expected to open in 2024, will add about 250 jobs to Corning’s payroll.

“At Corning, our investments in capacity are always based on strong customer commitments, and that’s the case here, with a long-term commitment from AT&T,” said John McGirr, the SVP and GM of Corning’s optical fiber and cable group. “As for who it will serve: This expansion will serve AT&T as well as the broader industry by adding capacity during a time of record demand.”

AT&T, in its recent quarterly earnings update, disclosed that it now has 6.59 million fiber-connected customers and marked its tenth straight quarter with more than 200,000 fiber net adds. AT&T says it’s on pace to cover more than 30 million locations with fiber by the end of 2025.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” said AT&T Chief Executive Officer John Stankey. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity. We are also working with Corning to create training programs to equip the next generation of technicians with the skills to build the networks that will expand high-speed internet access to millions of Americans.”

Separately, AT&T announced today that it is deploying fiber internet service to the Mesa, Arizona area, with service expected to be available to Mesa residents in 2023.

Corning said the Gilbert site is part of a $500 million expansion plan for optical fiber and cable manufacturing that started in 2020, nearly doubling the company’s capacity. Optical communications has been one of Corning’s fastest-growing businesses. In the June quarter, optical sales grew 22% from the year-ago quarter to $1.3 billion, about 36% of the specialty glass company’s total sales in the period.

Corning CEO Wendell Weeks said in an interview that the decision to add the new facility largely reflects a commitment from AT&T to continue to source fiber optic cable and systems from Corning. “They are the keystone of this investment,” Weeks said.

AT&T CEO John Stankey noted in an interview that his company has “a very long relationship with Corning that goes back many years,” and now supplies all of the fiber that the company deploys to home and businesses.

AT&T now offers fiber optic service in more than 100 U.S. metro areas, reaching a potential audience of more than 18 million homes.

Stankey notes that the company has plans to reach more than 30 million homes by 2025. The company will add service in Mesa, Ariz., close to the new facility, starting in 2023.

“Ultimately everything is moving to one fiber-fed infrastructure to be able to deal with the demand equation,” said AT&T CEO John Stankey, adding the trends are “all rooted by massively increasing amount of consumption.”

Stankey said that data traffic is expected to grow five times its current level over the next five years. “There needs to be infrastructure to deal with that,” Stankey said.

Although AT&T and Corning didn’t disclose the details of their arrangement, Stankey said that the company has made long-term commitments to Corning, “as we do with other major component providers” that covers pricing, volume and other terms.

At an event in Arizona on Tuesday to announce the new facility, Weeks and Stankey will be joined by U.S. Commerce Secretary Gina Raimondo. Both Weeks and Stankey pointed to the Infrastructure and Investment Act, a measure signed into law last year which includes $65 billion for broadband deployment, as a boost to their confidence in expanding capacity.

“In order to have a foundation to invest, you need consistent and stable policy going forward,” Stankey said. The AT&T CEO said that the Biden Administration has recognized that there is a significant percentage of the U.S. population that hasn’t been effectively served by broadband–and that “the infrastructure act is intended to address that.”

Weeks notes that this is Corning’s seventh fiber optic cable manufacturing facility, and stressed that it is the Westernmost location. AT&T CEO Stankey added that the bulky nature of fiber optic cable makes proximity to manufacturing an important factor. Shipping fiber optic cables around the country is costly.

The new plant is “a great step” in that direction but the supply chain is “large and complex,” and there are many other components to look at as well, said Jeff Luong, President – Broadband Access & Adoption, AT&T.

Corning and AT&T have also expanded the Fiber Optic Training Program that kicked off four months ago in North Carolina, following a joint investment in optical cable manufacturing there. It’s not clear what the cost of the training is or how long it takes to become a fully credentialed fiber installer. The companies said the initial class is currently underway in North Carolina and the program aims to train 50,000 American workers over the next five years. The company said the industry needs another 850,000 workers by the end of the 2025 to carry out planned expansion and maintenance of fiber optic networks.

References:

https://www.barrons.com/articles/corning-fiber-optic-plant-arizona-51661818036

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Verizon is tripling the capacity of its fiber core network by upgrading older router equipment with new equipment, capable of utilizing the latest 400 Gbps per port optical technology. When the overhaul of the fiber core network (the superhighway Verizon uses to move customers’ data) is complete, Verizon will be able to manage 115 Tbps of data, the equivalent of almost 24 billion streaming songs, at any given moment. This upgrade will significantly increase the bandwidth needed to support wireless, home internet, enterprise, small business and FIOS customers.

In addition to providing the increased bandwidth needed for data growth over the next decade, the new equipment provided by Juniper Networks, Inc. offers many additional operational benefits:

- The equipment is half the size of the existing equipment, reducing space requirements in core facilities and driving down both power usage per GB and cost per GB to operate.

- The new equipment offers an advanced level of automation, allowing for automated interfaces with other network systems to make faster decisions and changes, improving reporting telemetry to advance analytics and real-time adjustments to address congestion or other performance improvements, and incorporating protocols like segment routing to make more intelligent routing decisions. These automations will make the Verizon network even more reliable, programmable and efficient.

- Additionally, because this new equipment is so dense with such large capacity, Verizon will be able to redesign its network architecture to spread the equipment out to additional facilities across geographies, building in an additional level of redundancy with the ability to reroute traffic onto a greater number of fiber routes when needed.

Verizon will replace its legacy 100 Gb/s packet network routers with Juniper’s latest PTX10000-series of modular routers. These use Juniper’s Express silicon that will eventually include the Express 5 platform Juniper introduced earlier this year. The Express 5 silicon can support up to 28.8 Tb/s of throughput, or the equivalent of 36, 800 Gb/s interfaces. This represents a 45% improvement in power efficiency over previous chipsets. The packet optical devices place data packets directly onto and receive them from an optical transport network. They are placed onto that network in what Juniper describes as an “optical transport envelope” that allows that data to bypass “much of the other external networking equipment needed to groom or otherwise process electrical or optical signals originating on the router.” This process reduces the chance of data corruption and allows for closer monitoring of that data.

“Our fiber network is the largely invisible foundation that is a key driving force behind providing the scalability and reliability our customers need and expect,” said Kyle Malady, Executive Vice President, President Global Networks & Technology at Verizon. “This new packet core will provide the reliability and capacity we need today, but more importantly will be able to scale to meet the forecasted future demands that will result from the incredible capabilities of our robust 5G network, the platform for 21st century innovation,” he added.

Kevin Smith, VP of planning at Verizon, said the PTX10000-series update will be replacing its legacy Juniper PTX3000 and PTX5000 routers that it deployed a decade ago. That legacy equipment tops out at 100 Gb/s throughput. “The kind of traffic that is on this network is all of our public and private traffic, global FiOS traffic, all of our wireless traffic, as well as our former XO [Communications] network. As we look ahead and we see both from an infrastructure as well as a customer perspective, a lot for 200-gig and 400-gig for both those places, and our current platform just can’t support that level of services,” Smith said. He added that Verizon expects a 10-times improvement in total throughput with the Express 5 silicon and new chassis footprint. Smith also said that the new equipment is upgradeable to support higher-performing optical protocols like 800 Gb/s and 1 Tb/s per-port optical technology. The current 400 Gb/s move can manage up to 115 Tb/s of data, which the carrier expects to meet network demands through 2032. Updating to 800 Gb/s or 1 Tb/s will increase support to 230 Tb/s of data.

Sally Bament, VP of cloud and service provider marketing at Juniper Networks, said those boxes will include the vendor’s four-slot, eight-slot, and 16-slot chassis housing Juniper’s line cards. Those boxes are more power-dense with a footprint half the size of the existing equipment. This results in each box requiring less power, which drives down power usage per gigabyte and the cost per gigabyte to operate.

Smith advised that the upgrades are just getting started and that it will take a couple of years to complete. This will involve overlaying the new equipment into the same locations as the current deployment as well as installing physically smaller options into more edge locations. That legacy equipment will continue to operate for some time after the new network is turned on as it will need to continue supporting the large number of network elements that will eventually be migrated to the new core.

References:

https://www.verizon.com/about/news/verizon-quadruples-capacity-fiber-network-core

Liberty Global, Telefónica and InfraVia in new UK fiber optic deal; VMO2 is the wholesale client

Liberty Global and Telefónica together will own 50% of the joint venture while InfraVia Capital Partners will own the other 50%. VMO2 will be the anchor wholesale client and provide technical services.

The new (unnamed) entity will roll out fibre-to-the-home to greenfield premises across the UK, with an initial target of 5 million homes not currently served by VMO2’s network by 2026, and an opportunity to expand to an additional 2 million premises. Liberty Global, Telefónica and InfraVia Capital Partners are putting £4.5 billion behind the project, partly through borrowing (more details below).

Liberty Global and Telefónica will jointly have a 50% stake in the JV through a holding company, with InfraVia owning the remaining 50%. VMO2 is acting as the acting as the anchor client, and has apparently pledged to enter into an agreement with the JV upon closing of the transaction. The company will target homes across the UK, both adjacent to the existing VMO2 footprint and new areas. It will seek to attract additional third-party wholesale clients later down the line.

The business plan for the initial rollout of 5 million homes envisages an investment of approximately £4.5 billion, which includes investments related to the roll-out, envisaged connection capex and other related set-up costs. The three partners will fund their pro rata share of equity funding for the build, up to £1.4 billion in aggregate, phased over 4-5 years. In addition, the JV has obtained £3.3billion of fully underwritten debt financing from a consortium of financing banks, including a £3.1bn capex facility. As part of the transaction, InfraVia will make certain payments to Liberty Global and Telefónica, a portion of which will be linked to the progression of the network build-out.

“Telefónica has a recent track record of successfully developing broadband connectivity in many markets through strategic partnerships,” said José María Alvarez-Pallete, Chairman and CEO of Telefónica. “These deals help each country firmly increase their competitiveness and digital infrastructure to help their companies and economy thrive. The UK is, indeed, a growth market for us and we are very excited to be partnering with InfraVia to accelerate access to next generation broadband connectivity to a larger number of UK households and adding to Telefónica Infra’s growing portfolio.”

Vincent Levita, CEO and Founder of InfraVia said: “We are excited to be partnering with VMO2, Liberty Global and Telefónica to build and operate up to 7 million premises FTTH in the UK. The combination of our respective expertise in fibre network deployment, financing and operations in the UK, together with VMO2’s industrial scale and network construction know-how will be key to creating the undisputed second national fibre network in the UK providing access to broadband connectivity to millions of UK households. InfraVia has been a leading investor in digital infrastructure for the past decade. Attracted by the long-term trends of ever-increasing data usage and increased need for home connectivity, this would represent our 5th investment in fibre network deployment in Europe through strategic partnerships. We look forward to working with VMO2, Liberty Global and Telefonica in this partnership in the years ahead.”

Mike Fries, CEO and Vice Chairman, Liberty Global, comments: “This landmark agreement with Liberty Global, Telefonica and InfraVia will expand our FTTH footprint to millions of new UK homes, creating the undisputed second national fibre network in the UK. VMO2 has already committed to upgrading its entire existing 16 million footprint to FTTH. This JV will take our aggregate FTTH footprint to up to 23 million homes, reaching around 80% of the UK. VMO2 will bring significant build expertise, and will benefit from a meaningful off-net growth opportunity and as the anchor client will support attractive returns for the JV – a winning combination. Finally, we are very excited to be working with InfraVia who we already partner with in Germany, and welcome the expertise they bring to the JV.”

The transaction is subject to the usual regulatory approval, and is expected to close in Q4 2022. It seems there is a very high ceiling for the amount of investment money available for fibre rollouts, this new JV represents just one of many recent announcements that involve cash outlays measured in the multiple billions. Whether the ongoing cost of living crisis has any impact on projected consumer upgrades remains to be seen.

References:

Liberty Global, Telefónica and InfraVia Form Joint Venture to Build a New Fibre Network in the UK

Liberty Global, Telefónica and InfraVia plough £4.5 billion into new UK fibre JV