Fiber deployments

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

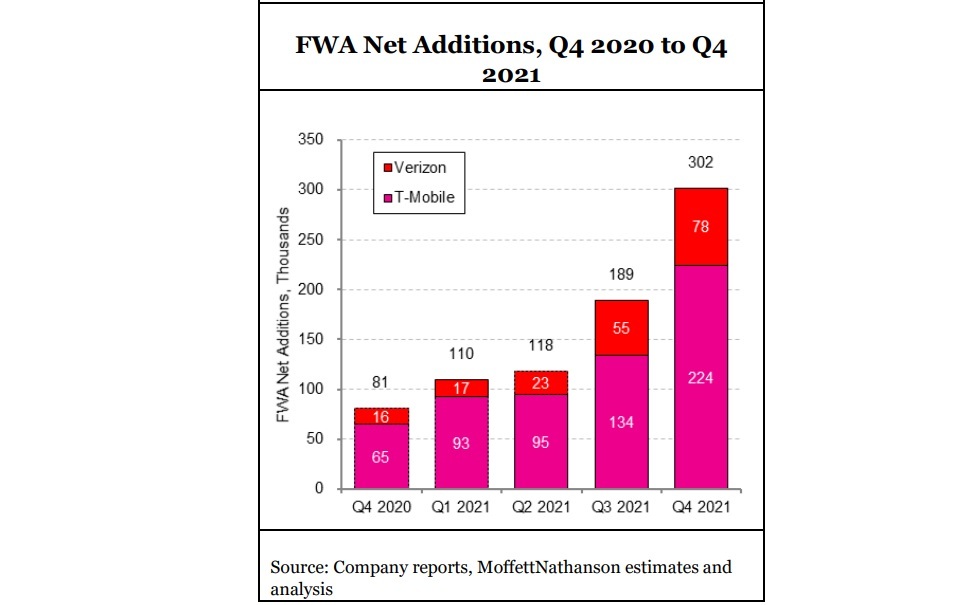

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)

Lumen Technologies tops Vertical Systems Group’s 2021 U.S. Wavelength Services Leaderboard

- Customer demand for retail wavelength circuits exceeded wholesale deployments in 2021.

- Revenue for U.S. Wavelength Services is projected to grow at a 13% CAGR between 2021 and 2026. This projection incorporates the effects of the COVID pandemic, including installation disruptions and chip shortages.

- Six providers on the U.S. Wavelength Services LEADERBOARD also hold a rank position on the latest U.S. Fiber Lit Buildings LEADERBOARD – Lumen, Zayo, Verizon, AT&T, Crown Castle and Cox. Additionally, Windstream achieved a Challenge Tier citation.

- Five U.S. Wavelength Services LEADERBOARD providers are also top ranked on the Mid-2021 U.S. Ethernet LEADERBOARD– Lumen, Verizon, AT&T, Windstream and Cox. Zayo has a Challenge Tier citation.

………………………………………………………………………………………………………………………………….

References:

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Lumen Technologies Fiber Build Out Plans Questioned by Analysts

Lumen Technologies is one of a large and growing number of telecom companies counting on a broad expansion of its fiber network. The Fiber Broadband Association (FBA) recently reported that the fiber industry is entering its “largest investment cycle ever” thanks to the efforts of companies like AT&T, Verizon and Lumen.

Lumen hopes to build its fiber network to 12 million new locations over the coming years. But it won’t be easy, according to Lumen CEO Jeff Storey.

“Supply chains are stressed, and we continue working very closely with our diverse and valued suppliers to mitigate risk as we execute on our growth objectives,” Storey said this week during his company’s quarterly conference call, according to a Seeking Alpha transcript. Others have issued similar warnings.

“I don’t want to overstate the issue, but it’s something that we are really paying attention to and working with vendors. We are starting to see some companies hold off on taking new orders. And as we see that, then we are working to put in our mitigation plans to make sure it’s factored into our build plan. But it is an issue that I will highlight as a real one that we have to mitigate.”

Lumen Technologies reported fourth-quarter results and 2022 expectations that generally fell below the forecasts of some financial analysts.

“Lumen’s 2022 guidance will fuel concerns that the company will have no choice but to eventually let leverage rise to inappropriate levels, dial back on investment, cut the dividend, or choose some combination thereof,” wrote the financial analysts at MoffettNathanson. “In particular, 2022 EBITDA [earnings before interest, taxes, depreciation, and amortization] guidance was noticeably below expectations at a time when capex will be elevated.”

“Results at this stage don’t give investors confidence in the company’s ability to earn an adequate return,” wrote the financial analysts at New Street Research.

Lumen and other fiber providers like Frontier Communications and AT&T are moving forward with their fiber buildout plans. Some, like AT&T and Frontier, are reporting big gains in the number of their new fiber customers. But others, like Lumen, are not.

“The past few quarters have been relatively weak for broadband net additions for Lumen, even for its higher-speed fiber offering,” MoffettNathanson said of Lumen’s consumer broadband business. “This quarter’s broadband net adds were at the low end of what the company has reported over the past few years and were shy of consensus estimates.”

The financial analysts at Evercore wrote that Lumen’s business segment drives three-quarters of the company’s revenue, and that too remains stressed. “The jury remains very much out on the company’s prospects in this sector,” they wrote, noting that sales in the company’s business segment declined slightly in the fourth quarter when compared with the third quarter of last year.

New Street analysts say a key metric for Lumen will be the percentage of customers in a given area who opt to purchase its new fiber optic access. If Lumen gets 40% of potential customers to sign up, the company likely will generate profits. “At 30%, the company would likely destroy value,” they warned.

Lumen CEO Storey stated that the company has already managed to get an average of around 29% of customers in its new fiber markets to sign up for its service. And that, he said, is with relatively little marketing.

He expects that number to be above 40% in the months and years to come. “If you look at the quality of the product that we have, we have a very effective competitive product and even with the limited marketing, we are doubling our penetration rates in our traditional copper areas,” Storey said.

New findings from the financial analysts at Cowen are supportive of Lumen’s fiber optic build out plans. The Cowen analysts recently conducted a nationwide survey of more than 1,000 respondents and found that fiber-to-the-home (FTTH) “take rates” reached 56% among those surveyed.

“Take rate, or more specifically, market penetration, is a key driver of the FTTH business case,” they wrote. “We have previously noted that a penetration rate of 30-35% is the typical minimum break-even threshold when underwriting FTTH projects. When there is one broadband competitor, fiber penetration can approach high-50s and even 60% penetration levels in mature markets.”

Lumen CMO Shaun Andrews said: “One of the things that really differentiates us right now is our focus on fiber as part of the core infrastructure to an edge experience versus a distraction with 5G or content. And being able to look an enterprise in the eye and say ‘Not only do we have these capabilities, but we will build the fiber to you where you are.’ That resonates with customers, and I think that’s a differentiator.”

…………………………………………………………………………………………………………………………

Last month, Lumen reported that they secured a massive $1.2 billion contract with the U.S. Department of Agriculture (USDA), setting it up to give one of the biggest government agency networks a major makeover.

Under the contract, Lumen will “completely transform” the USDA’s network covering 9,500 locations across the country. It will provide a range of services, including SD-WAN, managed trusted internet protocol, zero-trust networking, edge computing, remote access, virtual private networking, cloud connectivity, unified communications and collaboration, contact center, voice-over-internet protocol, ethernet transport, optical wavelength, and equipment and engineering.

References:

https://www.lightreading.com/opticalip/analysts-fret-over-lumens-fiber-plans/d/d-id/775229?

https://www.fiercetelecom.com/telecom/lumen-reels-12b-contract-overhaul-usdas-legacy-network

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

Lumen Technologies to empower customers to set up the wavelength subnetworks

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

Deutsche Telekom expands its fiber optic network in 78 cities and communities

Deutsche Telekom said it has expanded its fiber optic network for almost 7,000 companies in 78 cities and communities. Telekom is providing the companies with up to 1 Gbps speeds. The German based telco has connected industrial parks in the municipalities of Ahrensburg, Deggendorf, Lastrup, Lauf, Mainz and Mannheim among others.

Telekom is laying 560 km of fiber-optic networks to carry out the project and to connect the companies. It is using a trenching process to expand its fiber network.

“Telekom is Germany’s digital engine. That is why we are building our network seven days a week, 24 hours a day. In the city as well as in the countryside. We are massively accelerating our roll-out. In the coming year, we will go one better and invest around six billion euros in Germany. By 2030, every household and every company in Germany should have a fiber-optic connection. We will build a large part of this. But our competitors are also in demand,” said Srini Gopalan, Member of the Board of Management of Telekom Deutschland.

He also commented on the new German government’s plans in terms of digitization: “The new coalition is focusing on FTTH as THE technology of digitization. We explicitly welcome this. Faster processes – including for applications and approvals – will also help us to speed up fiber roll-out. We support the digital set off in our country. Digital networks should bring people together. Their roll-out should no longer be stuck in paper files.”

References:

https://www.telecompaper.com/news/deutsche-telekom-expands-network-for-7000-companies–1413189

https://www.telekom.com/en/media/media-information/archive/turbo-for-fiber-and-5g-643014

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

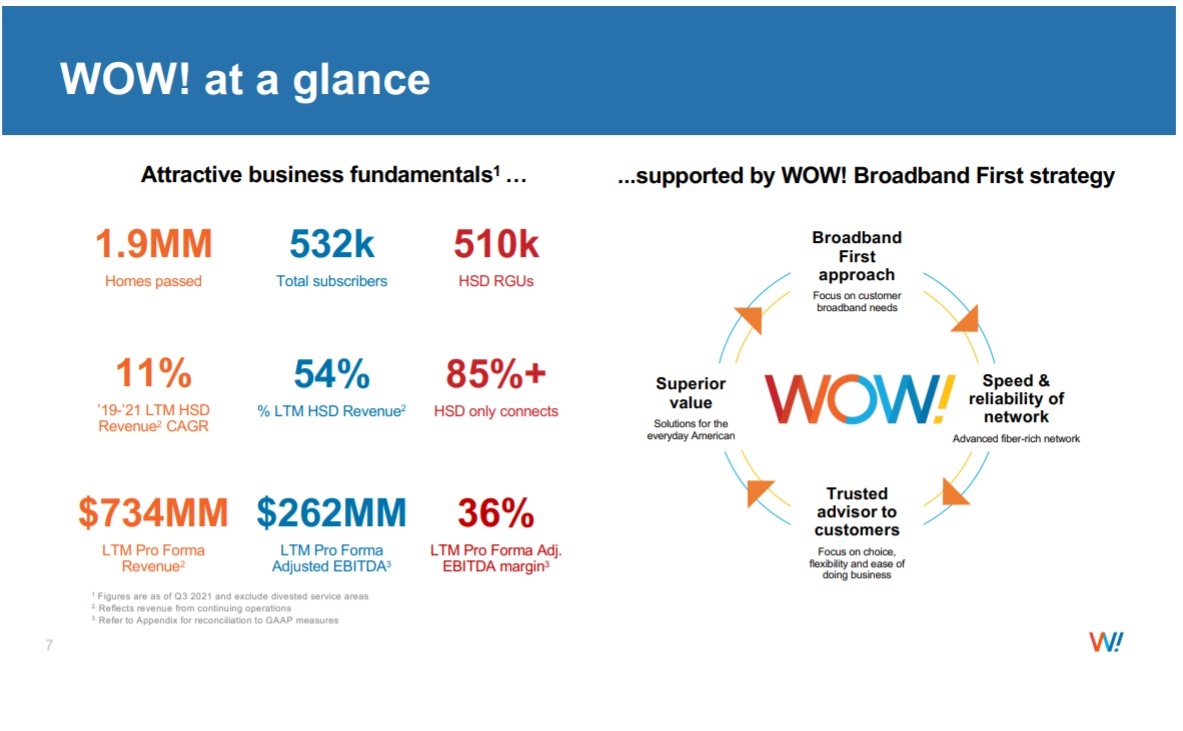

Like so many legacy and regional telcos, cablecos, WideOpenWest (WOW) [1.] is pursuing aggressive fiber-to-the-premises (FTTP) deployments. The company is targeting a part of Seminole County, Florida located near Orlando, as the first area for its ambitious plan to deploy FTTP Internet access to greenfield areas. Cableco Charter Communications currently provides broadband internet service to Seminole County.

This new expansion is part of the company’s larger Greenfield initiative to build new markets non-adjacent to its existing network and bring its advanced fiber technology and award-winning customer service to customers across its growing footprint. WOW! already serves Pinellas County and Panama City in Florida and identified Seminole County as a new community ripe for innovation and growth. The company plans to reach more than 60,000 homes passed upon completion of the project.

Note 1. WideOpenWest is the sixth largest cable operator in the United States with their network passing 3,248,600 homes and businesses. The company offers landline telephone, and broadband Internet services, and IPTV. As of December 31, 2020, WOW! has about 850,600 subscribers. They offer up to 1 Gb/sec downstream fiber internet service in some areas.

………………………………………………………………………………………………………………

WOW estimates it will invest at least $60 million in the county for its FTTP deployment. The estimated cost of $1,000 per passing is consistent with prior expectations.

“We are excited to announce Seminole County as the first service area to kick off our Greenfield initiative,” said Teresa Elder, CEO of WOW!. “We are delighted to offer communities in Seminole County a better broadband choice so they can work, learn and be entertained using WOW!’s multi-Gig fiber-to-the-home network. Area residents and businesses will be pleasantly surprised by our reliable network, super-fast speeds and choice of exceptional products to meet their broadband usage needs.”

Work on the new all-fiber infrastructure in Seminole County has already begun. Once completed, customers will benefit from WOW!’s innovative technology and product suite that provides the best in choice, reliability, speed and value. Customers will have access to multi-Gig HSD service, WOW!’s fastest broadband speed available, home and business WiFi solutions to support streaming, remote work and small business needs as well as WOW! tv+, its premier IP-based video service.

“Investing in Seminole county is investing in its community, its people, and its growth,” said Kirk Zerkle, VP of Market Expansion at WOW!. “We are thrilled to give residents and businesses in Seminole County the service they deserve. We know how important it is to be connected in every aspect of our lives and look forward to WOW! becoming an integral part of this county.”

The selection of Seminole county comes almost two months after WOW announced that building FTTP networks to greenfield markets [2.] will play a big role in fueling growth over the next five years. WOW recently sold off a handful of systems for $1.8 billion to help fund this growth initiative. The company intends to build out fiber networks to greenfield areas passing at least 200,000 homes and businesses by 2027, with the potential to expand that to 400,000 locations.

Note 2. WOW has identified greenfield areas as those that are not-adjacent to its existing markets which have low density. The company expects to announce additional greenfield markets later this year.

WOW! continues to pursue expansion opportunities across the country and expects to announce additional markets later this year.

“We’ve reached an inflection point in the industry where fiber-to-the-home build costs have reached parity with HFC [hybrid fiber/coax],” Henry Hryckiewicz, WOW’s chief technology officer, explained at an investor day held in December 2021.

About WOW! Internet, Cable & Phone:

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia.

With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years.

Source: WideOpenWest

………………………………………………………………………………………………………………….

Please visit wowway.com for more information.

………………………………………………………………………………………………………………….

WOW! Media Contact:

Jamie Mayer

[email protected]

References:

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Continuing with the massive U.S. fiber to the premises (FTTP) movement, regional fiber carrier MetroNet (headquartered in Evansville, Indiana) said it will bring fiber-optic internet access directly to homes and businesses throughout the Deltona, FL and neighboring communities, including DeBary and Orange City.

Deltona marks the third community in Florida that will have access to MetroNet services through a fully funded $35 million investment in the community. The three-year construction project is set to begin in the summer of 2022, with the first customers able to receive service as early as the fall of 2022.

Once completed, Deltona will join the country’s internet elite as a Gigabit City. Only about 40 percent of households in the U.S. have access to symmetrical upload and download gigabit (1,000 mbps) speeds that only fiber optic networks can provide.

“MetroNet is thrilled for Deltona residents and businesses to have access to our future-proof services that will allow sparkling 4k video streaming, glitch-free gaming, crystal-clear virtual meetings, and internet experiences of the future that we can only begin to imagine,” said John Cinelli, MetroNet’s CEO. “MetroNet is proud to soon be able to add Deltona to our growing list of Gigabit Cities.”

MetroNet plans to hire local market management positions, sales and customer service professionals, and service technicians to support the Deltona area. Those interested in joining the MetroNet team can visit MetroNetInc.com/careers to search available positions and to submit applications.

………………………………………………………………………………………………………………………

Last week, Metronet announced it has merged with fellow independent fiber based network provider Vexus Fiber. The combined companies will continue to operate under their existing brands and with their existing executive roster. Financial terms of the deal were not disclosed.

Vexus, based in Lubbock, TX, deploys and operates FTTP networks in Texas and Louisiana, with plans for expansion in New Mexico. Markets currently serving those states include Lubbock, Amarillo, Wichita Falls, Abilene and surrounding areas of Texas, as well as Hammond, Covington and Mandeville in Louisiana. New FTTP networks in the Rio Grande Valley are in various stages of deployment (see “Vexus Fiber to Build FTTH Network in Rio Grande Valley Region of Texas”), Tyler, Nacogdoches, and San Angelo, TX; Lake Charles, LA; and Albuquerque and Santa Fe, NM. Investors in the company included Pamlico Capital and Oak Hill Capital.

Metronet is operating or building FTTP networks in more than 120 communities in Indiana, Illinois, Iowa, Kentucky, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, and Missouri. It had received cash from KKR last April (see.) “KKR will take stake in Metronet as part of new funding round”) Oak Hill Capital is also an investor. Both companies provide gigabit or faster broadband services to their residential and business customers.

“We are very excited to welcome Vexus Fiber and their partners to Metronet,” said Metronet CEO John Cinelli. “Vexus has rapid growth and a high-customer-service mindset, similar to Metronet, and joining them allows us to expand our service area to even more Americans.”

“At Wexus, our mission is to bring our high-quality service to as many homes and businesses as possible in the Southwest,” said Jim Gleeson, president and CEO of Wexus. “With this merger, we can reach even more people faster.”

About MetroNet:

MetroNet is the nation’s largest independently owned, 100 percent fiber optic company headquartered in Evansville, Indiana. The customer-focused company provides cutting-edge fiber optic communication services, including high-speed Fiber Internet and full-featured Fiber Phone with a wide variety of programming.

MetroNet started in 2005 with one fiber optic network in Greencastle, Indiana, and has since grown to serving and constructing networks in more than 150 communities across Indiana, Illinois, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, Missouri, and New Mexico. MetroNet is committed to bringing state-of-the-art telecommunication services to communities — services that are comparable or superior to those offered in large metropolitan areas.

MetroNet has been recognized by PC Mag as one of the Top 10 Fastest ISPs in North Central United States in 2020 and Top 10 ISPs with Best Gaming Quality Index in 2021. Broadband Now has recognized MetroNet as the Top 3 Fastest Internet Providers and Fastest Fiber Providers in the Nation in 2020, and #1 Fastest Mid-Sized Internet Provider in two states in 2020. In 2020, MetroNet was awarded the Vectren Energy Safe Digging Partner Award from Vectren. For more information, visit www.MetroNetinc.com.

Media Contact: Katie Custer [email protected] 502.821.6784

References:

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

At the 2022 CitiApps Economy Virtual Conference yesterday, Lumen Technologies, Inc (formerly CenturyLink) President and CEO Jeff Storey said his company plans to increase its fiber deployments from 2.5 million locations to 12 million, which represents a five-times increase over the company’s traditional deployment rate. Storey said Lumen had been investing about 400,000 new fiber locations passed every year. “We have been very strategic and targeted and micro targeted in our approach to. We wanted to build — all digital experience of the quantum fiber platform, we’ve done that our NPS scores are really, really exceptional for quantum fiber. And so we’ve proven that we can build successfully, we proven that we can deliver successfully, and built all of the systems around the customer unnecessary to do that. So we’ll continue to invest there.”

Storey did not state how many years it would take company to reach 12M locations passed.

Separately, Lumen is expecting to close a sale of its local exchange business (formerly US West) to Apollo Funds in the second half of the year, which means it will retain mostly markets in metro areas. “We’ve rewritten the consumer playbook,” said Storey, noting that the company is now positioned as an “all-digital fiber brand.”

Like other broadband providers that have relied, in large part, on traditional copper network infrastructure, Lumen has been losing broadband customers in recent years. The company hopes that its investment in fiber will reverse that trend and has set a goal of returning to revenue growth within two to three years.

“Fiber wins. If you are competing with any other technology, fiber wins. And we’ll continue to deliver the majority of our services over fiber infrastructure and integrate those capabilities into an all digital experience. And when you do that, I think Lumen wins.” Storey said.

Lumen’s office building at 1025 Eldorado Blvd, Broomfield, CO 80021

……………………………………………………………………………………………………………………………………………………………..

Not surprisingly, considering Lumen’s emphasis on the business market for telecom services, Storey went on to note several advantages that are likely to be most appealing to business customers. In particular:

Fiber and data communications are more important than ever. But we don’t just look at it as data growth opportunity. For example, enterprises are shifting. I already said this, but more and more to hybrid environments. With hybrid employees, hybrid computing, hybrid network connect those employees, the computing, the applications that they use in the most sensible manner.

We look at combining our fiber infrastructure with capabilities like SASE, edge computing, and dynamic connections. Dynamic connections is really our network as a service capability. We create hybrid computing and networking environments that empower the enterprises to acquire, analyze and act on their data.

And looking over the Lumen platform, we enable new technologies and expanding our addressable market and we believe we’re in a great position to deliver. At the beginning of last year, we announced we’d have edge computing resources within five milliseconds, from 95% of U.S. enterprises. By the end of the year, we actually completed that somewhere in the middle of June, July, and today we’re around 97%. So we believe we have a great infrastructure tightly coupled with our fiber capabilities and we think there’s a great opportunity. Lumen and industry analysts agree, that is a major opportunity with 10s of billions of dollars in revenue potential. But it’s more than focusing on one product. It’s our ability to combine our services into holistic solutions for our enterprise customers.

Because we are a fiber-based platform… bringing our services to our customers with the connectivity of the fiber but also to cloud service providers, major data center providers,…private data centers of our customers [and] to eyeball networks,” he said, “we are in an excellent position to… help [customers] acquire their data, analyze their data [from] all of these different cloud options… and then act on their data.

In his opening remarks, Storey summed up Lumen’s strategic plan for 2022:

Our top priority is revenue growth, and we’re very focused on that, 2022 will be somewhat an investment year for Lumen, something CapEx and OpEx. CapEx is generally success-based initiatives that we have. But OpEx is a little more proactive investing in things like product development, marketing, brand, and other go-to-market initiatives that we have. We will continue to focus on investing and augmenting the Lumen platform, we believe it’s a great way to enable new technologies and expand our capabilities and our addressable market. We’ve already announced our accelerated quantum fiber bill, and plan to add more than 12 million locations over the coming years in the remaining 16 states that we operate in the states.

Lastly, we continue to invest in transforming our business for better customer experience, and operational efficiencies. We’ve done a great job of improving our customer experience, at the same time taking costs out of the business by using the technologies that we sell to our customers and then using other technologies in our business direct.

This strong increase in fiber deployment echoes what was said earlier this week at the 2022 CitiApps Economy Virtual Conference from Scott Beasley of Frontier Communications and AT&T’s CEO John Stankey. Also, from MSO Cable One’s joint venture with three private equity firms.

References:

Lumen’s Fiber Internet Offerings: https://www.lumen.com/en-us/networking/business-fiber.html

Webcast Replay: https://kvgo.com/citi-apps-economy-conference/lumen-technologies-jan-2022

CEO: Lumen Plans Fiber Deployment Rate of 5x its Historical Rate

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

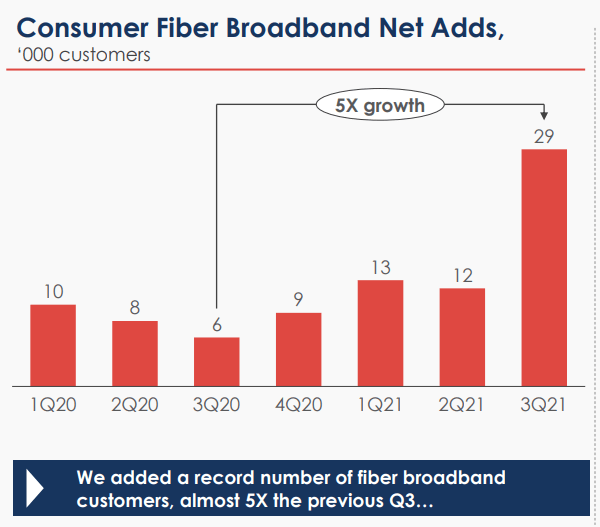

Frontier Communications added 45,000 fiber broadband subscribers in the fourth quarter, its best performance gains in five years, Frontier’s Scott Beasley said at the 2022 Citi Apps Economy Virtual Conference. The company hopes to expand by 1 million fiber locations this year as part of plan to reach 6 million by 2025.

Comment: That’s great progress for a company that filed for bankruptcy in April 2020 with a plan to cut more than $10 billion of its $17 billion debt load by handing ownership to bondholders. It was the biggest telecom filing since WorldCom in 2002, reflecting years of decline in its business of providing internet, TV and phone service in 29 states.

When combined with legacy DSL losses, Frontier added 9K net new broadband subscribers. Frontier is currently on an aggressive fiber build strategy that aims to add a total of 6 million locations by the end of 2025, resulting in 10 million locations reached in total. Beasley reports the company added 600K new fiber locations in 2021, with a goal of adding another million locations by the end of 2022. Beasley reports that the much discussed supply chain challenges facing the broadband industry have not had a significant impact at Frontier.

“We’ve managed through supply chain constraints and been able to perform very well in our fiber build and continue to ramp that up for 2022,” he said.

- This marked the first time in more than five years that the Company has posted total broadband customer growth in a quarter.

- The Company expects to continue growing the total broadband customer base as its fiber build accelerates.

Source: Frontier Communications Q3 2021 earnings presentation

Frontier has completed ‘wave 1’ of this fiber expansion. The company is now beginning ‘wave 2,’ which will take them through 2025, getting them to 6 million new locations. Build costs in wave 2 are a bit higher at $900 to $1,000 per fiber location.

Frontier envisions a ‘wave 3’ coming, but that’s outside the scope of their current committed-to fiber build. Beasley says Frontier will look to leverage government funding programs and other partnerships to help fund wave 3 fiber builds.

“There could be scenarios where we accelerate the build of some locations in wave 3 into wave 2,’ he said in discussing Frontier broadband growth. “That will likely be a destination of significant government funding as the roughly $45 billion of infrastructure bill funding that goes to broadband will be targeted at locations like wave 3.”

Asked about potential competition from fixed wireless access (FWA) and satellite broadband services, Beasley said neither presents a material threat just yet. While FWA may gain traction in some ultra-dense urban locations and satellite in extremely rural areas, Beasley asserted neither technology will be able to stand up against Frontier’s gigabit fiber offerings. The company already offers 1 Gbps and is planning the rollout of a 2 Gbps plan in the first half of this year as well as a 10 Gbps tier somewhere down the line. “It’s a technology we’re watching closely but don’t think it can compete with our core symmetrical speeds in fiber,” Beasley said of FWA.

“Against our core gigabit plus offers, 1 gig symmetrical speeds now, we’ve said we’re going to launch 2 gig in the first half of 2022, eventually we’ll move to 10 gig, the core network is 10 gig capable now, we’ve trialed 25 gig successfully in certain parts of the network,” he said. “I don’t think fixed wireless has the capacity to compete with that core infrastructure. It will be competitive in certain niches of the market…but I don’t think it can compete with our core symmetrical speeds and fiber,” he added.

References:

https://kvgo.com/citi-apps-economy-conference/frontier-jan-2022

With 45K New Fiber Subscribers, Frontier Sees First Positive Broadband Growth in 5 Years