Fiber to the building

AT&T Communications CEO optimistic about wireless revenue and fiber buildout

Speaking at Wells Fargo (Virtual) TMT Summit, AT&T Communications CEO Jeff McElfresh discussed momentum in AT&T’s wireless business, noting that AT&T’s consistent go-to-market strategy has driven improved market position supported by healthy wireless service revenue and EBITDA growth. McElfresh noted that over the past five quarters the company has delivered its best subscriber results in a decade, with nearly 4 million postpaid phone net additions, and 1.4 million fiber net additions. At the same time, wireless delivered its best-ever EBITDA in the third quarter of 2021, up 3.6% year over year.

McElfresh said his company added over 1.4 million fiber net adds in the last five quarters. That was based on AT&T’s conviction to reinvest in what they believe is a very future-forward technology in fiber that’s got superior advantages to any other kind of broadband connectivity offering (e.g. FWA, bundled copper pairs, cable, etc).

McElfresh told the audience that the company’s fiber expansion is “rekindling” its consumer broadband business and that he has a high degree of confidence that the company is hitting “game speed” when it comes to the number of homes passed with fiber that it is achieving every month.

AT&T had approximately 14 million homes passed with fiber as of year-end 2020 and is expected to increase that to 16.5 million homes passed by the end of this year. The company now has 5.7 million fiber to the premises/home customers, including Internet access, VPN, private line, virtual private line, etc.

McElfresh said that he believes AT&T has enough “weight” in the industry that it can work with vendors to overcome any supply chain delays (which the company warned about in July). He added that he has no concerns about achieving the 30 million locations by 2025 goal based upon the company’s current buildout pace. “I have no concerns about hitting the pace that we need to reach that,” he said.

“What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber optic based Internet access. He added that the telco is measuring the number of fiber net adds they can achieve in 30 days, 60 days and 90 days in those local markets. The company sees those fiber net add numbers accelerating during each of those time periods.

……………………………………………………………………………………………….

Looking forward, McElfresh is encouraged by underlying mobile industry trends and sees limited signs that suggest a near-term shift in demand levels. He said he believes AT&T’s momentum is sustainable with the company’s simplified plans, targeted subsegment approach, improved customer experience and network performance all helping AT&T retain and attract subscribers, leading to lower churn and increased customer lifetime value. Reiterating recent comments by CFO Pascal Desroches, McElfresh indicated that AT&T’s outlook for 2022 and beyond does not assume a continuation of outsized industry net adds. Should recent mobile industry trends continue, he believes the changes made to AT&T’s go-to-market strategy puts the company in a better position to capitalize on healthier than anticipated demand.

McElfresh noted that AT&T continues to see postpaid phone ARPU stabilizing in 2022 with an improvement in international roaming and subscribers adopting higher-ARPU plans balancing the impact of amortization accounting for device promotions. McElfresh said that fewer than a quarter of gross adds and upgrades in the third quarter traded in newer devices for premium promotional offers. As previously noted, only about 20% of AT&T’s postpaid smartphones are on Unlimited Elite – the company’s highest-ARPU and fastest-growing rate plan.

With postpaid phone ARPU stabilizing in 2022, AT&T expects higher wireless service revenues from a growing postpaid subscriber base. McElfresh also indicated that he believes AT&T can continue to profitably increase its wireless market share going forward and reiterated that the company continues to expect fourth-quarter EBITDA growth to exceed third-quarter levels.

When asked about fiber penetration levels, McElfresh responded, “What I am focused on more than penetration levels is that we are demonstrating that we can step up our net add performance quarter to quarter.” In the third quarter, AT&T added 289,000 fiber customers which was down year-on-year from 357,000. However, the company also said that 70% of its net adds were new to AT&T.

To help entice consumers to switch to AT&T’s fiber network, McElfresh said that the company has a dedicated fiber team within its consumer wireline business that is working in neighborhoods to sell fiber. He added that they are measuring the number of net adds they can achieve in 30 days, 60 days and 90 days in those local markets and they are seeing those numbers accelerate.

References:

https://about.att.com/story/2021/mcelfresh-wells-fargo-conference.html

https://www.fiercetelecom.com/broadband/atts-mcelfresh-company-hitting-game-speed-fiber-build

https://techblog.comsoc.org/2021/09/21/att-ceo-john-stankeys-30m-locations-could-be-passed-by-fiber/

Cowen Analysts: Telcos to lead FTTH buildout; total 82M homes to be passed by 2027

According to a new report titled Fiber to the Home: Navigating the Road to Gigabit America, a multi-sector by Cowen analysts, forecasts that telco fiber-to-the-home (FTTH) lines will pass 82 million American households by 2027, nearly double the 44 million households passed today. The four biggest U.S. wireline telcos (AT&T, Verizon, Frontier and Lumen) will account for the lion’s share of those deployments, together passing more than 71 million homes with fiber.

The Cowen report also projects that cable operators (cablecos or MSOs) will pass another 5 million homes with fiber lines over the next six years, largely because of Altice USA’s current big push in the New York metro area to match Verizon’s Fios rollout. Cable operators already pass about 5 million homes with fiber.

Overall, Cowen estimates that the US now has 50 million homes passed by fiber lines, with the telcos accounting for most of them. Here are a few other highlights from the report:

- Cowen expects state/federal funding of $130B for various broadband initiatives.

- That will close the digital divide and expand the addressable market for broadband access.

- FTTH will gain market share (compared to other fixed broadband access) to take ~70% of the net positive broadband subscriber adds by 2027.

- As a result, 35M FTTH subscribers (26% market share) are expected by 2027; up from 16M (14%) today.

- FTTH subs take speeds that are 54% faster than non-FTTH broadband subs.

- The increase in FTTH subs will lead to exciting next-gen home applications (not specified) and ARPU growth.

- FTTH subs have 13% higher ARPU compared to non-FTTH subs.

Large, midsized and small telcos will all participate in this massive fiber deployment, using FTTH to reverse nearly two decades of broadband market share losses to the cable industry, the Cowen analysts say. For instance, they project the nation’s biggest telcos will add a combined 7.7 million fiber subs over the next five years.

“The next few years will be historic in terms of telco FTTH upgrades, providing consumers speeds of 1 Gbit/s, closing the digital divide, expanding the total addressable market and achieving a ‘Gigabit America’,” the analysts wrote. “After years of hemorrhaging subscribers, we expect Big Telco to stem the tide of losses to Cable…”

However, the report does not say that telcos will be gaining broadband customers from cable operators. Instead, telcos will achieve broadband subscriber gains mainly by upgrading their own remaining 15 million DSL subs to FTTH.

“The cable decade of dominance of DSL-share stealing is over,” the analysts wrote, forecasting that the telcos will overtake the cable companies in broadband sub net gains by 2024. “Cable’s days of stealing DSL subs are over, though only losing modest share (DSL taking the brunt), as the focus will be on defense.”

The Cowen analysts expect cable’s broadband market share to drop very slightly from 61% today to 58% in 2027 while the telcos’ market share creeps up from 25% now to 27% in 2027.

“It’s far from doom-and-gloom for cable operators,” the analysts note. “With cable’s effective marketing plan and speed upgrades, the vast majority of subscriber losses will be from the 15 million DSL subscribers, not cable.”

The analysts expect fixed wireless access (FWA) to play a notable tole in the US broadband market by the middle of the decade, accounting for a small but increasing fraction of high-speed data customers throughout the 2020s. “FWA will establish a solid but niche foothold,” they wrote.

Cowen now expects U.S. service providers to add a collective 17 million broadband subs by 2027, enough to reach 97% penetration of occupied homes and 90% penetration of overall homes, up from 90% and 82% today. The analysts believe that broadband could achieve utility-like penetration levels of 98% or more, like wired phone service did at its peak last century.

All this fiber optic spending will be a boon for optical network equipment vendors. Specifically, the Cowen analysts single out Calix, Adtran, Ciena, Cisco, MasTec, Nokia and Juniper as likely beneficiaries.

The analysts also see potential for further market consolidation. Some scenarios they envision are Charter buying the Suddenlink portion of Altice USA’s footprint and Charter or Altice USA merging with T-Mobile to form a third converged player in the national market.

References:

Open Access Fiber Networks Explained; Underline’s Intelligent Community Network

In Open Access Fiber networks, the same physical network infrastructure is utilized by multiple providers delivering services to subscribers. The Open Access business model has been drawing attention globally as governments and municipalities find the concept of offering competition between providers and the freedom of choice for the subscriber is essential. It has also proved to be a feasible way to connect rural areas where service providers might have a hard time generating enough revenue to justify investing in their own network infrastructure.

Open access fiber networks can be the foundation for distributed healthcare, 5G, and resilient, modernized infrastructure—including responsible energy creation and secure community smart grids.

For subscribers to benefit from the freedom of choice and competition between providers that are delivering services using the same network infrastructure they will need a comprehensive way to browse the assortment of services offered.

Open Access network operators must keep track of:

- Every single subscriber in the network, their physical address, their “technical address” (switch, switch port, etc.).

- Which services they are buying from which provider/s.

- The total number of customers and/or services bought if you’re operating in a three-layer model where you have to report back to the network owners how their network is utilized.

……………………………………………………………………………………………………………………………………….

Already common in Europe with Sweden as the best known example, open access networks are just beginning to gain market traction in the U.S. While U.S. community-wide network operators like SiFi Networks and UTOPIA Fiber (Utah) have adopted a wholesale-like business model, newcomer Underline is taking a bit more of a direct approach.

“When people say open access in this country, they typically mean ISPs can come in and lease fiber and choose to build a given neighborhood that hasn’t been overbuilt yet. We mean something very different,” Underline CEO Robert Thompson told Fierce Telecom. “We are not a wholesale leaser of fiber. We are the fiber network literally to the doorbell.”

Underline isn’t just providing physical fiber-to-the-home infrastructure, but also a unified billing system and cybersecurity layer. The latter will allow the communities it serves to deploy smart city applications over an on-demand Layer 2 (Data Link layer) connection that will never touch the Layer 3 (Network layer) public internet, Thompson said.

“On the one hand, we directly face consumers and businesses, schools and so forth and we provide them network access connectivity and technology for a monthly connection fee. On the other hand, we look like a network infrastructure-as-a-service provider to the ISPs or content community,” Thompson said.

“We don’t provide IP,” he continued. “We’re going to move your traffic from your house ultrafast over fiber and we’re going to hand off you and your traffic to the internet service provider of your choosing. That ISP is then your IP, the routing of your traffic. They’re connecting you to that glorious world wide web,” he added.

Thompson said Underline will charge users directly on a monthly basis for connectivity, with their chosen ISP getting a portion of that cost. So, for instance, in the case where a subscriber takes a $65 per month symmetric gigabit plan, the ISP will get a $15 cut. Underline also plans to charge licensing and per subscriber fees for use of its technology stack.

Underline is now initiating construction in its first market: Colorado Springs, CO. The company will offer residential speeds up to 10 Gbps and enterprise service up to 100 Gbps, with qualifying households eligible to receive a discounted rate on Underline’s bottom tier symmetrical 500 Mbps plan.

The project will be completed in several stages, with a Phase I build set to connect 24,000 homes and 4,000 businesses with 225 route miles of fiber plant. Initial customers will include the the National Cybersecurity Center, the new Space Information Sharing and Analysis Center and Altia Software.

Thompson says that Phase II will cover roughly the same amount of ground and Underline also has a build agreement with an unnamed city “immediately surrounding” Colorado Springs. Taken together, construction in both phases and the second city will amount to “an exercise of approximately $125 million in total capital.”

“We are after this with a vengeance, and we are very thankfully supported by very strong capital,” Thompson said, noting a “drumbeat of steady announcements of drills in the dirt in new communities” is on the way.

Thompson said Underline is targeting communities with populations between 20,000 and 750,000. He noted that such communities have “historically been basically ignored by the incumbents (large telcos) and which by and large will not qualify” for federal support for broadband deployments.

Beyond that, he said Underline’s market assessments include factors like demand point density per fiber route mile, a population productivity ratio, a competition index and a social equity analysis. The latter is a key priority for Underline and “part of our social purpose,” Thompson explained.

“We want to understand and we actually want to target communities that have a significant portion of their demand points that have no internet at all or very poor internet at home because of socio economic status. This country’s got to have internet that’s fast, affordable and fair,” he concluded.

References:

https://www.fiercetelecom.com/operators/underline-has-a-different-vision-for-open-access-fiber-u-s

https://www.cossystems.com/about/open-access/

https://www.foresitegroup.net/what-you-need-to-know-about-open-access-networks-2/

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

AT&T CEO John Stankey was interviewed by Brett Feldman, Goldman’s U.S. telecom and cable analyst. AT&T is both a telecom and media company. We focus on the former for the IEEE Techblog. Here are selected telecom related comments Stankey made (BOLD font emphasis added):

We’re pulling (market) share back from our two largest competitors (Verizon and T-Mobile). I feel good about how we’re doing that. There’s more to be done as we invest in fiber, and we can compliment our wireless business with fiber. There’s opportunities for us to take communications further than what we’ve traditionally done at AT&T. And I think that business should be recognized for being a leading global communications business, like it is, very uniquely positioned with more fiber than any other communications company on the face of the planet, with a great wireless asset domestically in the U.S. and in Mexico, an opportunity to bring those things together, and run it incredibly effectively as a focused business. I think we’ve got a great story there.

I think AT&T is in a great position moving forward. I think the industry frankly is in a great position. I think there’s tremendous promise right now in what ubiquitous high capacity bandwidth with the kind of capabilities that 5G brings in terms of the density that it can afford, the number of devices, the ability to use technology to do things like network slice (requires 5G SA core network which Microsoft is building for AT&T) and begin to differentiate the network. I think this is going to be great for society. I think this is going to be great for the U.S. economy as a whole. If I had to bet, we don’t have the numbers for 2021, certainly can’t project 2022, but I have a sense of where this industry is going. (This author totally disagrees, largely because real, standards based 5G has yet to be deployed as there is only a standard for the RAN which doesn’t meet URLLC performance requirements. No standard for 5G SA core network.).

We’re probably going to see record infrastructure investment coming out of this industry in this period of time. And I think it’s going to equip the United States and our economy and our infrastructure in a way that we’ve never seen. I think that’s going to be incredibly powerful. And I think it’s not only going to be good for AT&T, because I think we have the right kind of wherewithal and the right kind of capability to be right alongside others that are investing at a high clip to bring that infrastructure forward. I think we’ll do just fine with where we are there. I believe when unleashed we have some of the best network minds in the country. I believe that dense fiber footprint that we have that’s denser than anybody else in the United States when engineered properly on top of a great spectrum assets and a great wireless business, it’s going to make our combined product offer and our business even better and more capable to deal with what customers need to do. So, I feel really comfortable about that. And I can do nothing more than not ask you to look at my prognostications, but look at how we’re performing in the market today.

We’ve now started doing some things quietly behind the scenes. We have another muscle to build here, which is how do we begin to work on software to differentiate our products and services in a way that makes our product better than what our competitors can do, because we do have a different asset base, and we are able to serve every corner of the market from the largest of enterprises to the smallest apartment somewhere in the United States. And I don’t think we’ve done as much as we can do in that vein, to actually make that real for our customers and the right products and the right services and the right offers. And so, rebuilding that product engine that we can do that and begin to differentiate allows us to do things that won’t necessarily just hinge on, can I get an attractive handset?

Brett Feldman: I believe your fiber network passes something around 15 million customer locations right now, you’re targeting to ultimately get to 30 million by 2025, that would still only be about half roughly half of the customer locations in the AT&T wireline footprint. Question we’ve gotten is how did you decide what the right target was? Why is it 30? And what really dictates the pace at which you build out fiber?

Stankey replied: Getting this kind of an engine (fiber optic build-out) ramped up to go from building 3 million to 4 million to 5 million homes (locations) past, working through the supply chain, all the logistics that are necessary to build network, it’s not a real simple undertaking. And as I’ve said, my goal is I feel very comfortable, we have places we can go to build 30 million homes (he really means residential and business locations combined) right now on an owned and operated basis, that have very attractive returns in the mid to upper teens. We’re demonstrating every day with our existing base, that we can operate that more effectively, we’ve now crossed over places where we have scale where we’re taking cost out of the business based on fiber replacement, the old infrastructure, we’re seeing that flow through in lower call rates, lower repair rates, better churn, all those things are going to continue to give us goodness moving forward.

Do I think there’s a magic number of 30? No, I don’t. I think there’s a combination of things. One is unlike the investment base, to recognize the good work we’ve been doing. And then in fact, we are building and adding value back to our shareholders. And when they start to recognize that in the form of the equity in the stock, do I believe my credibility and the team’s credibility goes up? Yes, do I believe there’s going to be other opportunities for us to come out, as we hit those scaling metrics that we have in place, the supply chain metrics that we might be able to go in and say, there’s more that we could possibly attack, I’d love to be in that position to do that. And I’ve kind of put that out as a challenge to the management team to say the only thing that stands in the way between you doing 30 million and doing more is your execution and performance.

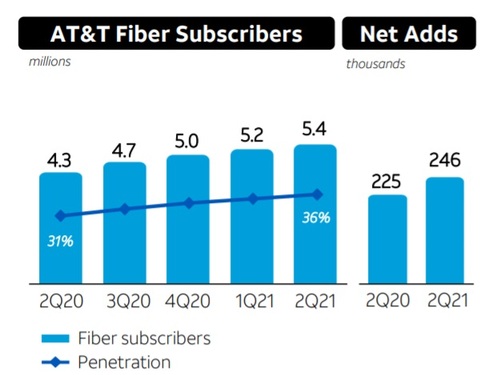

Brett Feldman: Speaking of execution, execution really has two pieces. It’s deploying the network, and then it’s driving penetration of that network. I believe you had about 5.4 million fiber subscribers as of your most recent quarters, that’s about 35% penetration [1.]. What do you think is the right target for your fiber penetration and how are you going to get there?

Note 1. Fiber-based broadband has clearly established itself as a growth engine for AT&T, which added another 246,000 fiber subscribers in Q2 2021, ending the period with 5.43 million. With about 80% of new fiber subscriber additions new to AT&T, overall broadband revenue growth at the company has finally surpassed declines in its legacy, non-fiber-to-the-premises (FTTP) broadband business.

………………………………………………………………………………………………………………………………………………..

Stankey replied: If I look what’s happening right now, and kind of where we are in our maturity scale, one of the things I’m most excited about is our new net adds to fiber right now good, almost 80% of them are new to AT&T. So, we’ve now gotten to this place where we’ve been managing the base. And we’re now shifting over where got a lot of new customers coming in. And in fact, as you saw last quarter, we’re starting to get ourselves to a point where that consumer business is a growth business today, despite the legacy drag on historic telecom products, parts and the like of legacy data products, that the fiber growth is beginning to outstrip that where we have real growth in that business. And we’re now starting to turn that corner real EBITDA growth in that business. And so, I would tell you as I step back from that, we’re going to see consistent growth. But I’m not going to be happy until we have a 50:50 share split in places where there’s two capable broadband providers. And I think there’s no reason with the product is capable as what we have out there and how fiber performs and what we’re able to do and the differentials we see in our customer satisfaction to our most significant competitor often cable in those markets, we were looking at 10, 15 points of difference in satisfaction levels, between other players in the market and ourselves, that we shouldn’t be able to achieve that over time.

Brett Feldman: You had earlier made a slight adjustment to your fiber deployment for this year, you were hoping to do 3 million homes, it’s going to be closer to two and half million and you noted some of the well reported supply chain issues as being a factor. Any update there, is there any further disruption in your supply chains and your ability to secure labor?

Stankey replied:

And we’re talking about what’s probably effectively about a 90 day delay for us to hit those numbers, and really primarily in this case, got to fiber assemblies. The way fibers built in the distribution network is we engineer it, we provide detailed engineering to our manufacturer, the manufacturer in the manufacturing facility, pre-splices and pre-assembles some of that fiber before we receive it. So, when it goes in, we’re doing less field splicing. And we’re able to basically put it up in the air or bring it through infrastructure in a way that lowers labor costs coming in. And we’re having some supply issues in the factory partly labor driven because of COVID, individuals getting sick not being able to run enough shifts, and carry through and partly some raw material issues. But those have been worked through right now our deliveries over the last 30 days have tracked to what our expectations are.

So, we feel like we’re through that dynamic right now. We should be fine with it. But look the supply chain is fragile at all levels. It’s fragile on everything. Last week, it was the number of generators, we’re deploying for power backup on cell sites, there’s, we’re going to miss a target on some of those by a couple 100 because there’s a resin base connector in the harness and we can’t get the resin. And that resin base connector, it’s a $15,000 generator that’s been held up on something that’s $0.25 part, you see these things popping up, left and right, every corner of the business. So, I don’t know what next week brings, we’re aggressively managing it. We’ve got a great supply chain organization. We’re a scaled provider, with all of our vendors. So, we lean into that, we were able to work through the fiber dynamics because we are the largest consumer of fiber in the United States. We use that ability and that expertise to make sure we get what we need to move through. So, I feel we’re managing through it, okay. I don’t think there’s anything around the challenges we’re dealing with, it gives me concern on guidance where we stand right now, but it’s going to be choppy and a little bumpy moving forward on some of these things as we move through the years.

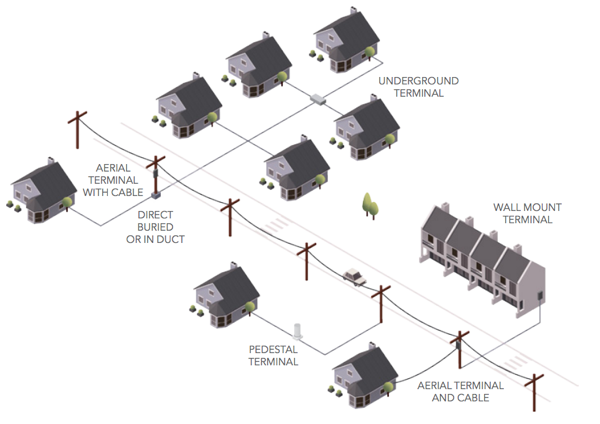

Typical fiber optic deployment to multiple homes via underground and aerial cable

……………………………………………………………………………………………………………………………………

Stankey wouldn’t say how the proposed U.S. infrastructure bill might also alter AT&T’s outlook in a way that encourages the company to explore a buildout that goes beyond 30 million locations.

“There’s a degree of uncertainty there,” he said of the bill. “But in its current form [and if] it does actually make its way into law, that’s going to change the landscape of the broadband business in this country … It will also change my posture and point of view on where we should be playing as a company.”

…………………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2021/08/12/atts-fiber-buildout-reduced-due-to-supply-constraints/

AT&T’s fiber buildout reduced due to supply constraints

AT&T has experienced recent disruptions in the supply of fiber optic cable, which has caused the company to trim back its planned fiber-to-the-premises (FTTP) buildout for 2021, according to senior EVP and CFO Pascal Desroches.

AT&T had previously said it would build out its fiber network to an additional 3 million homes passed this year. But that’s now been reduced by 1/2 million.

“Since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. We’re probably going to come in a little bit light of 3 million homes passed, probably around 2.5 million,” Desroches said Tuesday at the Oppenheimer Technology, Internet & Communications Conference, according to this transcript.

An AT&T technician working on a fiber project

………………………………………………………………………………………….

Specifically, this is what Pascal said:

But since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. And as a result of those dislocations, we had previously provided guidance of 3 million homes past this year (unedited- very bad grammar). We’re probably going to come in a little bit in light of that, probably around 2.5 million. We don’t think it’s going to impact us long term. But I think it’s really important context because if we’re feeling the pain of this, I can only imagine what others in the industry are experiencing.

John Stankey (AT&T CEO) has always been a believer in fiber. I think when he took over he identified that as a priority area because he understood from a technology standpoint, there is no better technology for connectivity. And therefore, in a world where the demands for symmetrical speed are increasing significantly, this is the technology to bet heavily on. And so we have a great position, and we are leaning into adding to that position. So it’s really a function of when you — and I think others are now recognizing it as a result of what you’ve seen in the last year in the pandemic, the need to do what we’re doing now, 2-way communication can only happen with symmetrical speed. So I think everyone has had an aha moment, like we need to deploy fiber. And so we’ve long believed that. John has long believed that, and this is just really leading into that opportunity.

As we deploy fiber, our goal is to get at least 40% penetration on homes passed. And we think in certain markets, we’ll have an opportunity to do better than that. And the other thing that is great about is when you lay fiber, you lay fiber to a community where there is both homes and businesses. So it also helps boost returns in your enterprise business. And so that’s why it is so critical that we roll this out because the ability to grow both your enterprise and your consumer business is attractive. And we think these investments will provide us with mid-teen returns over time.

I know we’re largest fiber purchaser in the country. And we have prices that are at the best and most competitive among the industry. So we feel really good about the ability to secure inventory, fiber inventory and at attractive price points and the ability to execute and the build-out at scale, something that many others don’t have.

Oppenheimer moderator question: “Can you talk a little bit about where your supply comes from, I guess, both the fiber and the optical components or any other key suppliers? Is that U.S. sourced? Or is it a lot of it outsourced internationally?”

Pascal’s answer: “It is a U.S. company which has locations both domestically and outside the U.S.” [We suspect that it’s Corning].

AT&T typically has had no problem getting fiber at a low cost, Desroches said. “We’re the largest fiber purchaser in the country and we have prices that are the best and most competitive in the industry,” he said. “We feel really good about the ability to secure fiber inventory at attractive price points and the ability to execute the buildout at scale, something that many others don’t have.”

AT&T expects to catch up to its original fiber-construction estimates in the years after 2021, largely because of what Desroches called its “preferred place in the supply chain” and “committed pricing.” As AT&T said in a news release yesterday, AT&T is “working closely with the broader fiber ecosystem to address this near-term dislocation” and “is confident it will achieve the company’s target of 30 million customer locations passed by the end of 2025.”

AT&T added another 246,000 fiber broadband subs in Q2 2021, extending its total to 5.43 million, and said last month it was on pace to add about 1 million net fiber subscribers for all of 2021.

AT&T has estimated that nearly 80% of new fiber subscribers are also new AT&T customers, reversing a previous trend that saw a sizable portion of its FTTP customer net adds coming from upgrades of existing AT&T high-speed Internet customers on older VDSL and DSL platforms (which have been largely discontinued).

Speaking on AT&T’s 2Q-2021 earnings call last month, Desroches stated that the company’s consumer wireline business had reached a “major inflection point” as broadband revenues continue to surpass legacy declines. Meanwhile, AT&T’s broadband average revenue per user (ARPU) reached $54.76 in Q2 2021, improving from $51.61 in the year-ago period.

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

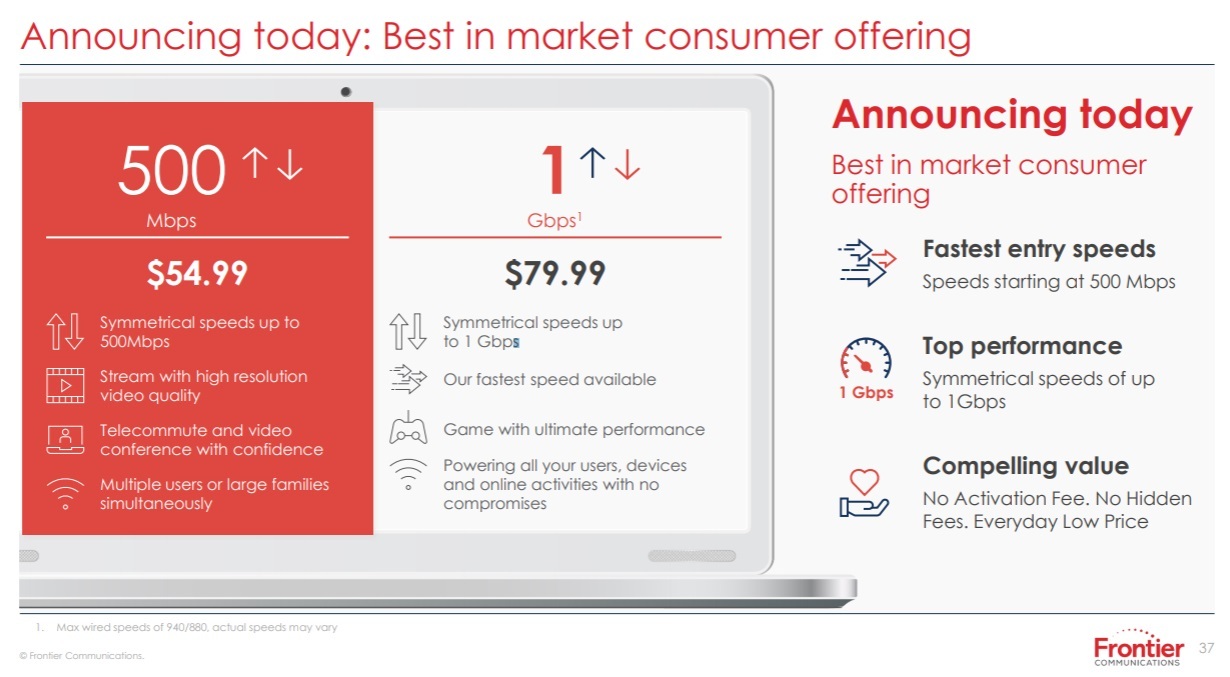

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

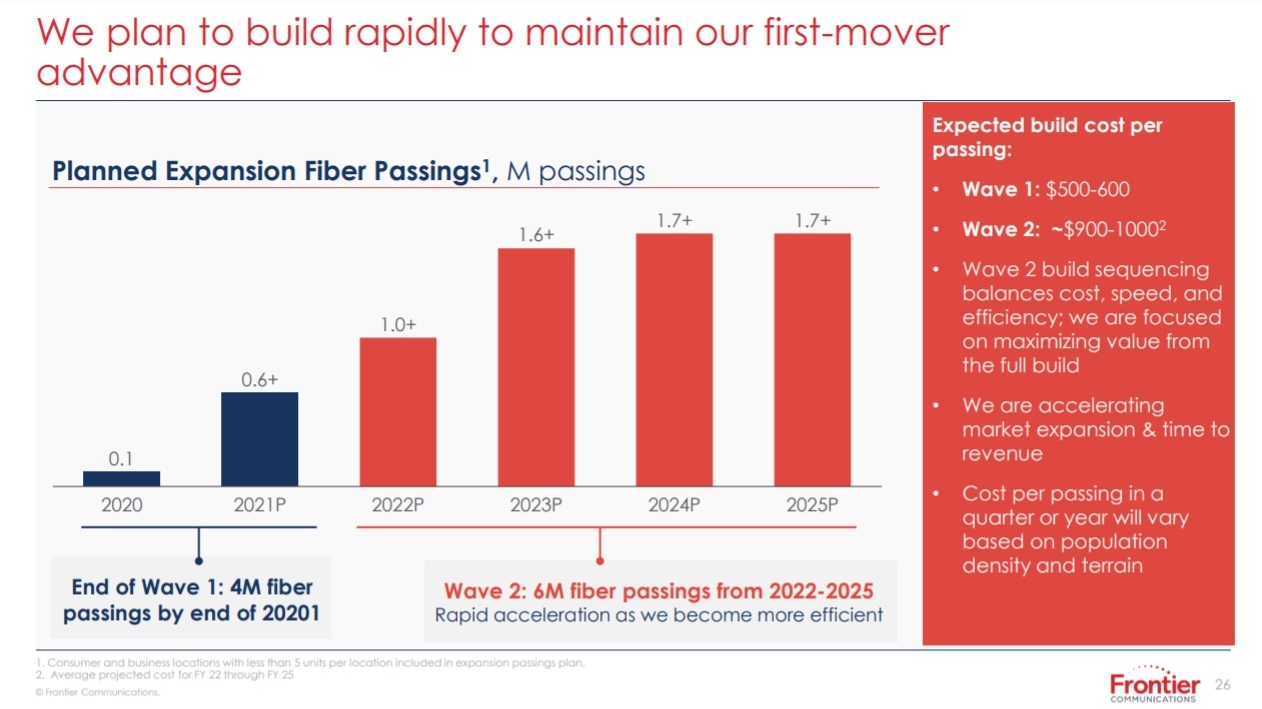

On August 5th, Frontier Communications announced an accelerated fiber optics buildout plan that will result in their fiber-to-the-premises (FTTP) network passing 10 million locations (homes/offices) by 2025. Frontier says they will end 2021 with 4 million locations passed by fiber and will then add another 6 million in a revised, multi-year “Wave 2” plan.

Nick Jeffery, President and Chief Executive Officer of Frontier, said, “The acceleration of our fiber network expansion is clear evidence that Frontier’s transformation is taking hold. Over the past several months, we’ve made real progress in executing our strategy – by adding world-class leadership, introducing a purpose-driven culture, improving the customer experience, and making our operations more efficient and sustainable.

“Demand for high-speed broadband is growing rapidly, and fiber is the best product to meet the needs of consumers and businesses. Frontier is already doing what customers want and cable can’t – delivering symmetrical download and upload speeds with far lower latency than our competition. Early next year, we will start delivering 2 gigabit per second services, further stretching our performance lead to where only fiber can compete. We have hard work ahead of us, but momentum is increasing as we rally the Frontier team around our mission to Build Gigabit America.”

Jeffery added, “Our second-quarter results reflect continuing momentum in our fiber expansion strategy, with all key fiber metrics in line or above expectations. In particular, we accelerated our fiber build out, continued our customer momentum with another strong quarter of consumer fiber net adds, and reduced our consumer churn. Taken together, it was another strong quarter that positions Frontier well as we head into the second half of the year.”

At its virtual investor day, Frontier provided an update on the fiber buildout and other priorities resulting from its strategic review. These include:

- Frontier’s current ability to provide a best-in-class offering featuring symmetrical 1 gigabit per second download and upload speeds;

- Plans to launch a symmetrical 2 gigabit per second offering in the first quarter of 2022 that will unlock next-generation digital experiences for customers;

- Plans to deploy fiber to reach 10 million locations by 2025; and

- A new target of $250 million run rate savings by 2023 from simplifying the Company’s operations and improving the customer experience.

Image Credit: Frontier Communications

……………………………………………………………………………………….

Frontier also offered some revised predictions on service penetration, expecting them to be in the mid-teens to 20% at the end of year one, rise to 25% to 30% at the end of year two, and then on up to 45%. Frontier introduced new pricing for residential fiber broadband service, with entry-level service at 500 Mbit/s.

MoffettNathanson analyst Nick Del Deo (a colleague) wrote in a note to clients:

The single most important data points from today’s analyst day relate to Frontier’s FTTH deployment plans (Exhibit 1). For 2021, the company increased its expectation for new passings from 495K to >600K, which will complete “wave one” of its fiber upgrade project and leave it with ~4M total FTTH passings. Between 2022 and 2025, the company plans to build to another 6M passings, bringing its total to 10M, or about two thirds of its broadband-enabled locations. The remaining 5M, part of wave three, are currently in a holding pattern, with the company working through the optimal approach: do nothing, upgrade, upgrade with government assistance, divest, swap, or do something more creative that we haven’t come up with.

Image Credit: Frontier Communications

…………………………………………………………………………………….

The company also announced it will start to introduce 2-Gig services over FTTP in early 2022, but didn’t disclose pricing.

Del Deo summarized his assessment of Frontier’s fiber buildout (emphasis added):

Frontier plans to build FTTH to 7M incremental homes through 2025, a rapid acceleration from its current pace. This will leave two thirds of its broadband-enabled footprint served by fiber, with the status of the remaining one third TBD. The deployment costs appear somewhat higher, and returns a bit lower, than what we would have expected, but we had haircut the value of its FTTH expansion in our prior work to account for such risks. The faster pace and certainty now reduce the need for such haircuts. The path to financing the build remains open, but the company will need at least a couple of billion dollars in fresh funding. It’s not clear to us that management’s optimism regarding the commercial unit is warranted, but time will tell whether it can engineer a turnaround.

Management has high hopes for the commercial part of its business, and we don’t doubt that growth can get better from where it is today, but we think this will continue to be a segment that weighs on the company’s overall results.

Light Reading’s Jeff Baumgartner opines that “Frontier’s accelerated FTTP buildout plan, revised pricing and plans for 2-Gig service should pressure cable competitors to match up with speeds and pricing. Frontier’s moves might also cause those cable operators to give more consideration to “mid-split” or “high-split” upgrades that dedicate more upstream capacity to their DOCSIS 3.1 networks, accelerate their pursuit of new DOCSIS 4.0 technologies, or shift to full FTTP upgrades in select areas.”

………………………………………………………………………………………….

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T added 235,000 fiber connections in the first quarter, ending the period with nearly 5.2 million total fiber customers. AT&T says they have a total of around 15 million fiber and non-fiber customers, so fiber access is approximately 1/3 of total customers now.

The company recently announced it plans to build fiber to 3 million new customer locations this year and 4 million next year. AT&T plans to double the number of locations where it offers fiber Internet, from approximately 15 million to about 30 million, by 2025. To do that, AT&T is planning to increase its annual capital expenses from $21 billion to around $24 billion.

AT&T’s new focus on connectivity over content is a direct result of its spinning off Warner Media to Discovery, as we chronicled in this IEEE Techblog post. Thaddeus Arroyo, head of AT&T’s consumer business, made that crystal clear at a recent BoA investor event:

“We expect capital expenditures of about $24 billion a year after the Warner Media discovery transaction closes. That’s an incremental investment that’s going to go to fiber to 5G capacity and 5G C-band deployment.

We have another great opportunity, the one we continue to talk around fiber. So as part of this capital, we’re going to be investing in fiber expansion to meet the growing needs for bandwidth that require a much more robust fiber network regardless of the last mile serving technology. Fiber is the foundation that fuels our network. Expanding our fiber reach serves multiple services hanging off at each strand of fiber. It includes macro cell sites, small cell sites, wholesale services, enterprise, small business, and fiber that’s extended directly into our customers’ homes and into businesses.

We plan to reach 30 million customer locations passed with fiber by the end of 2025. That’s going to double our existing fiber footprint. And investing in fiber drives solid returns because it’s a superior product. Where we have fiber we win, we’re improving share in our fiber footprint, and the penetration rates are accelerating and growing, given our increased financial flexibility. We’re comfortable in our ability to invest and achieve our leverage targets that we outlined of getting to 2.6% at close and below 2.5% by the end of 2023.”

Mo Katibeh, the AT&T executive responsible for fiber and 5G build-outs, added on via a recent post on LinkedIn: “We are building MORE Fiber to MORE homes and businesses. And we’re talking A LOT of fiber – MILLIONS of new locations every year, planning to cover 30 MILLION customer locations by the end of 2025! And you know what comes with all that investment in America? JOBS. Our AT&T Network Build team is GROWING..”

Previously, Katibeh wrote on LinkedIn : “Contributing to a large portion of the $105B Capital spend between 2016 and 2020 – our team is building out AT&T #Fiber to MILLIONS of new customer locations in 2021, as well as augmenting America’s best mobility network with more capacity, more speed – and more #5G (you know I love 5G!).”

…………………………………………………………………………………………………………………………………………………………..

So with all that said, will AT&T’s fiber build-out keep pace with cable companies/MSOs DOCSIS networks?

Tom Rutledge, Charter’s CEO, made a brief comment about plant upgrades on the earnings call (note – Dave Watson made similar comments on the Comcast earnings call):

“We’re continuously increasing the capacity in our core and hubs and augmenting our network to improve speed and performance at a pace dictated by customers in the marketplace. We have a cost-effective approach to using DOCSIS 3.1, which we’ve already deployed, to expand our network capacity 1.2 gigahertz, which gives us the ability to offer multi-gigabit speeds in the downstream and at least 1 gigabit per second in the upstream.”

According to Leichtman Research Group, the top cable companies had 68 million broadband subscribers, and top wireline telecom companies had 33.2 million subscribers at the end of 2019.

“Based on the currently available information, cable stole wired broadband market share in Verizon and AT&T markets as well. Oy vey!” said Jim Patterson of Patterson Advisory Group in his May 2, 2021 newsletter. “Think about Comcast and AT&T as having roughly the same number of homes passed (AT&T probably closer to 57 million homes versus the nearly 60 million shown for Comcast),” he added. Patterson noted that top cable companies Comcast, Charter and Altice managed to capture 86% of broadband customer growth in the U.S. in the first quarter of this year.

“(AT&T) fiber connections simply aren’t growing fast enough to keep up,” wrote colleague Craig Moffett of MoffettNathanson in a recent note to clients. Here’s more:

To be sure, there are questions about the extent to which these deployments will overlap cable (or will instead be focused on unserved rural communities), and the extent to which labor and supply chain contraints might limit acheivability of announced targets. Still, taken together, these deployments suggest that, after a precipitous decline in new fiber construction in 2020, planned fiber deployments do, indeed, rise over the next two years; we expect that both 2021 and 2022 will represent new all-time peaks in total number of fiber homes passed. Typically, the competitive impact from overbuilds is felt with some lag, suggesting the impact on cable operators will peak in 2024/2025.

At the same time, we expect that federal stimulus to accelerate broadband market growth in 2021 and 2022, perhaps significantly, with new household formation, in particular, driving upside to 2021 and 2022 forecasts.

Longer term, however, Cable operators will have to contend with more fiber overbuilds, as TelCos increasingly see both more favorable economics for fiber deployment and increasingly acknowledge that their copper plant faces imminent obsolescence without it. The forecasts for fiber deployment in this note suggest that 2021 will be a record for fiber construction – assuming labor and materials capacity can accommodate the TelCos’ own forecasts – and 2022 will step up higher still. After that, deployments are expected to abate, at least to a degree.

“Cable can upgrade its plant quickly and at low cost to offer at least 4.6Gbit/s down and 1.5Gbit/s up, well beyond current fiber offerings. They can do this before the move to DOCSIS 4.0, which is still years off,” wrote the financial analysts at New Street Research in a recent note to investors. The result, according to the New Street analysts, is that fiber providers like AT&T won’t necessarily be able to dominate the fiber market with a 1 Gbit/s FTTH/FTTP connection and take market share from cable incumbents.

“Cable will face new fiber competition in more of its markets over the next few years; however, there is little to no prospect of fiber delivering a service in those markets that cable can’t easily match or beat,” New Street concluded.

…………………………………………………………………………………………………………………………………………………………….

“Looking back and being a little critical, we probably allowed the cable companies to execute and to take share in that market in a significant way,” AT&T CFO Pascal Desroches said at a recent Credit Suisse investor event.

AT&T executives have said that the company’s fiber investment ultimately will generate internal returns of around 15%. Desroches said that return on investment will be due to a variety of factors. Fiber “supports not only consumer needs, it supports needs for our enterprise businesses as well as needs for potentially our reseller business. So being able to look across and integrate the planning for fiber deployment such that it not only serves consumer needs, but it serves these other market adjacencies as well is something that we haven’t been very good at historically, That’s why we’re really bullish and we believe we’re going to be able to execute really well here,” AT&T’s CFO concluded.

References:

https://www.lightreading.com/opticalip/is-atandts-fiber-investment-good-idea/d/d-id/770468?

https://www.linkedin.com/feed/update/urn:li:activity:6813211481950318592/

FTTH Council Europe: FTTH/B reaches nearly 183 million (>50% of all homes)

Europe has passed over half of homes able to receive fiber broadband. According to the latest figures compiled by Idate for the FTTH Council Europe, 52.5% of homes will be covered by FTTH/B at the end of September 2020. That’s up from 49.9% a year earlier.

FTTH Council Europe revealed the following:

• Number of homes passed by fiber (FTTH/B) reaches nearly 183 million homes in EU39.

• Europe’s fiber footprint (number of homes passed) expanded the most in the past year in France (+4.6M homes passed), Italy (+2.8M), Germany (+2.7M) and the UK (+1.7M).

• Three countries are accounting for almost 60% of homes left to be passed with fiber in the EU27+UK region.

• FTTH/B Coverage in Europe surpasses more than half of total homes.

• 16.6% growth in the number of fiber subscribers.

• Iceland leads the European FTTH/B league table second year in a row. 70.7% of its households having fiber connections. Belarus (70.4%) and Spain (62.6%) came in second and third.

• Belgium, Israel, Malta and Cyprus enter the FTTH/B ranking for the first time.

The above figures cover 39 countries across Europe, where nearly 183 million homes have fibre access. For the EU and UK alone, penetration reached 43.8 percent in September, up from 39.4 percent a year earlier.

The report also shows fiber take-up is accelerating, with a subscriber penetration of 44.9 percent of lines in the 39 countries, compared to 43 percent in September 2019. In total there were 81.9 million FTTH/B subscribers in September 2020, up 16.6 percent from a year earlier. Annual growth was again strongest in France, with nearly 2.8 million subscribers added in the 12 months, followed by Russia with 1.7 million and Spain with 1.4 million.

The countries with the highest fiber penetration across Europe are Iceland and Belarus, with over 70 percent of households using fiber broadband. Spain and Sweden are at over 60 percent, and Norway, Lithuania and Portugal over 50 percent.

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments

by reshaping how Europeans work, live and do business. As the most sustainable telecommunication

infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the

European Union’s economy more sustainable. Competitive investments in this technology should,

therefore, remain a high political priority and we look forward to working with the EU institutions,

national governments and NRAs towards removing barriers in a way to full-fibre Europe” said Vincent

Garnier, Director General of the FTTH Council Europe.

About the FTTH Council Europe:

The FTTH Council Europe is an industry organization with a mission to advance ubiquitous full fibre based connectivity to the whole of Europe. Our vision is that fiber connectivity will transform and

enhance the way we live, do business and interact, connecting everyone and everything,

everywhere.

Fiber is the future-proof, climate-friendly infrastructure which is a crucial prerequisite for

safeguarding Europe’s global competitiveness while playing a leading global role in sustainability.

The FTTH Council Europe consists of more than 150 member companies.

Contacts:

Eric Joyce, Chair, Market Intelligence Committee

[email protected]

Sergejs Mikaeljans. Communications and Public Affairs Officer

[email protected] Tel: +32 474 81 04 54

……………………………………………………………………………………………………………………

Separately, BT has increased its its total FTTP network build target from 20 million to 25 million premises by December 2026, with Openreach working to connect up to 4 million premises a year.

……………………………………………………………………………………………………………………..

References:

https://www.ftthcouncil.eu/documents/Fibre_Market_Panorama_2021_PR_final.pdf

https://register.gotowebinar.com/register/2424555495368131344 (webinar registration)

AT&T ends DSL sales while CWA criticizes AT&T’s broadband deployments

AT&T: DSL is Dead:

According to a message board post on DSL Reports, AT&T notified customers on billing statements in August that effective Oct. 1 it would no longer accept new orders for its copper-based DSL service. The notice also said that existing DSL subs will no longer be able to make speed changes to their respective DSL service.

The message board author wrote:

“On my August AT&T statement, traditional DSL is officially grandfathered effective October 1st. No new orders (moves, installs, speed change, etc.). Hopefully they will still allow promos….”

That’s no surprise to this author. AT&T’s DSL subscriber base has been eroding steadily – losing almost 350,000 subs over the past couple of years. In Q2 2020, AT&T shed 23,000 DSL subs, ending the period with just 463,000.

“We are focused on enhancing our network with more advanced, higher speed technologies like fiber and wireless, which consumers are demanding,” AT&T said in a statement. “We’re beginning to phase out outdated services like DSL and new orders for the service will no longer be supported after October 1. Current DSL customers will be able to continue their existing service or where possible upgrade to our 100% fiber network.”

……………………………………………………………………………………………………………………….

AT&T Fiber Update:

AT&T also announced three new price points for its AT&T Fiber tiers and said that all new and existing AT&T Fiber Internet 100, Internet 300 and Internet 1000 subscribers would enjoy unlimited data without additional charges. AT&T Fiber started offering the new deals as a standalone product with no annual contracts for new customers on Sunday.

As of Q2-2020, AT&T had 4.3 million AT&T Fiber customers with nearly two million of them on 1-gigabit speeds. Overall, AT&T has about 15.3 million broadband subscribers while Charter has 28 million and Comcast has over 29 million.

AT&T’s fiber tier announcement comes after AT&T CEO John Stankey told a Goldman Sachs investor conference in September that “priority number one” is investing in fiber for 5G and FTTP services.

The new prices are also an indication that AT&T intends to ramp up its drive on FTTP sales in the wake of a recent study showing that many of AT&T’s new subs were coming from existing customers upgrading to fiber rather than from gaining market share from cable Internet operators (MSOs).

………………………………………………………………………………………………….

CWA Calls Out AT&T’s broadband efforts:

Coincidently today, the Communications Workers of America (CWA) criticized AT&T’s lack of fiber deployments. The report, co-authored with the National Inclusion Alliance (NDIA) stated:

AT&T is making the digital divide worse and failing its customers and workers by not investing in crucial buildout of fiber-optic infrastructure that is the standard for broadband networks worldwide. The company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

An in-depth analysis of AT&T’s network shows the company has made fiber available to fewer than a third of households in its footprint, halting most residential deployment after mid-2019. The analysis also shows that 28% of households in AT&T’s footprint do not have access to service that meets the FCC’s standard for high-speed internet, and in rural counties 72% of households lack this access. In some places, AT&T is decommissioning its outdated DSL networks and leaving customers with no option but wireless service, which is not a substitute for wireline service.

In all, AT&T has made fiber-to-the-home available for fewer than one-third of the households in its network. AT&T’s employees — many of whom are Communications Workers of America (CWA) members — know that the company could be doing much more to connect its customers to high-speed Internet if it invested in upgrading its wireline network with fiber. They know the company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

CWA recommends that AT&T dedicate a substantial share of its free cash flow to investment in next-generation networks across rural and urban communities, make its low-income product offerings available widely, and stop laying off its skilled, unionized workers and outsourcing work to low-wage, irresponsible subcontractors.

Editor’s Note:

According to CWA, AT&T has deployed fiber-to-the-home (FTTH) to only 28% of the households in its fiber coverage area as of the end of June 30, 2019.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The CWA/NDIA report said AT&T has targeted more affluent, non-rural areas for its fiber upgrades. Houses with fiber have a median income that’s 34% higher than those with DSL only. Across the rural counties in AT&T’s 21-state footprint, only a miniscule 5% have access to fiber, according to the report.

According to the report, 14.93 million—out of almost 53 million households—have access to AT&T’s fiber service. Among states, AT&T’s FTTH build out is the lowest in Michigan with 14% have access followed by Mississippi (15%) and Arkansas (16%).

“AT&T is also failing to make fiber available to the majority of its customer base in cities,” according to the report. “While most of AT&T’s fiber build has focused on urban areas—96 percent of households with access to fiber in AT&T’s footprint are in predominantly urban counties—the company hasn’t built enough fiber to reach the majority of urban residents. Seventy percent of households in urban counties still lack access to fiber from AT&T because the company has made fiber available to only 14.7 million households out of 48.4 million total households in these counties.”

The report also said there were many areas in AT&T’s footprint where it doesn’t offer the Federal Communications Commission’s “broadband” definition of 25 Mbps downstream and 3 Mbps upstream.

“For 28% of the households in its network footprint, AT&T’s internet service does not meet the FCC’s 25/3 Mbps benchmark to be considered broadband,” the report said. A key recommendation is that “AT&T must upgrade its network in rural communities to meet the FCC’s broadband definition, at least, and renew its efforts to deploy next-generation fiber.”

The report noted that in some areas where AT&T doesn’t provide faster speeds, cable operators, such as Comcast and Charter do.

“Even where that access is available from another provider—typically a cable provider—consumers are deprived of the benefits of competition in price, choice and service quality,” the report said.

…………………………………………………………………………………………………………

AT&T is counting on fiber for both residential and commercial services, including AT&T TV. In order to win over customers from cable operators, AT&T has paired its 1-Gig service with AT&T TV.

Regarding DSL, the report states: “AT&T’s poor maintenance of its DSL networks, with limited capacity for new connections, results in would-be new customers in some areas being denied service entirely or told they can only subscribe to fixed wireless service (a 4G wireless connection for home use, designed for rural areas).”

As expected, AT&T refuted the claims made in the CWA/NDIA report in a statement to FierceTelecom and Broadband World News on Monday afternoon.

“Our investment decisions are based on the capacity needs of our network and demand for our services. We do not ‘redline’ internet access and any suggestion that we do is wrong. We have invested more in the United States over the past 5 years (2015-2019) than any other public company. We have spent more than $125 billion in our U.S. wireless and wireline networks, including capital investments and acquisition of wireless spectrum and operations. Our 5G network provides high-speed internet access nationwide, our fiber network serves more 18 million customer locations and we continue to invest to expand both networks.”

……………………………………………………………………………………………………………………………………………………..

New Fiber Optics Market Report:

Finally, a new report by Technavio forecasts that the global fiber optics market size will grow by USD 2.44 billion during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period.

Image Credit: Technavio

The increase in the number of FTTH homes and subscribers is the key factor driving the market growth. A higher number of customers are opting for fiber optic connections to leverage broadband services. This reduces the requirements for customer premises equipment (CPE) and distribution point unit (DPU).

References:

https://cwa-union.org/sites/default/files/20201005attdigitalredlining.pdf

https://www.fiercetelecom.com/telecom/cwa-calls-out-at-t-s-lack-fiber-its-dsl-footprint

http://www.broadbandworldnews.com/document.asp?doc_id=764417

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

https://www.businesswire.com/news/home/20201005005444/en/

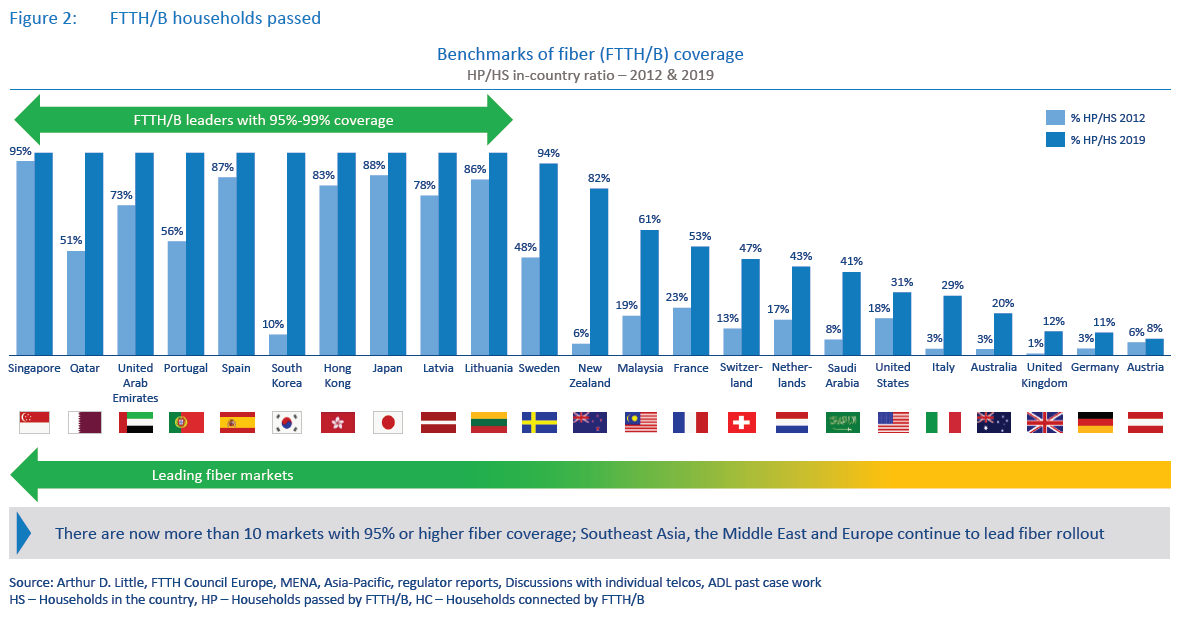

Arthur D Little: 10 countries provide >= 95% FTTH coverage; Gigabit Fiber driving take-up of new apps and services

Gigabit broadband can be delivered using cable DOCSIS, fiber or other 5G-based technologies. This ADL report focuses on the rollout, take-up and services delivered with fiber -based gigabit broadband networks. ADL especially considers the developments made in fiber take-up and gigabit services enabled by fiber. See the previous edition of this study, “Race to gigabit fiber: Telecom incumbents pick up pace”4 for further details on which markets are taking the lead on fiber rollout and the deployment models used for it.

Non-telecom entities such as energy companies, railway operators and local municipalities are also entering the market, with large fiber rollout plans in fiber-lagging countries such as Italy, Germany and Austria, to bridge the gigabit broadband gap.With 5G deployment models crystallizing, operators are also considering 5G-based technologies to complement high-cost,

last-mile fiber access, especially in rural areas.While there were big improvements in fiber rollout from 2012 to 2017, take-up was still lagging behind, even though several markets invested large amounts of capex into nationwide fiber. However, we now see take-up rapidly improving, driven by both effective migration of legacy customers to fiber and competition driving demand for higher-speed broadband adoption at home.As the fiber coverage and take-up rates continue to grow, incumbents are increasingly announcing plans to switch off and dismantle their legacy copper networks. Singtel in Singapore turned off its copper network in 2018 and migrated its copper and cable subscribers to fiber, allowing the incumbent Singtel and cable company StarHub to switch off their copper and cable networks. Another example is JT Global in Jersey, which already migrated its entire fixed broadband customer base to fiber and will switch off the copper infrastructure in 2020. Operators in at least three other countries plan to completely migrate their customer base to fiber in the next four to five years (see Figure 4 below).

However, before decommissioning their legacy networks, telcos will need to overcome regulatory and other obstacles, such as providing an alternative to existing regulatory wholesale products and replacing some copper-specific B2B use cases with other technologies. With legacy network switch off, incumbents hope to achieve cost efficiencies especially in network operations. In recent projects, we estimate that fiber networks have up to a 15x lower fault rate and use up to 85 percent less energy compared to legacy copper-based networks.

Fiber is undoubtedly an advanced fixed broadband technology that can efficiently deliver multi-gigabit speeds to a large volume of customers in real-life conditions, especially in dense urban areas. Offering 1 Gbps plans has become the norm in the leading Asian fiber markets such as Singapore, Japan, South Korea and Hong Kong, opening the way for multi-gigabit tariffs.

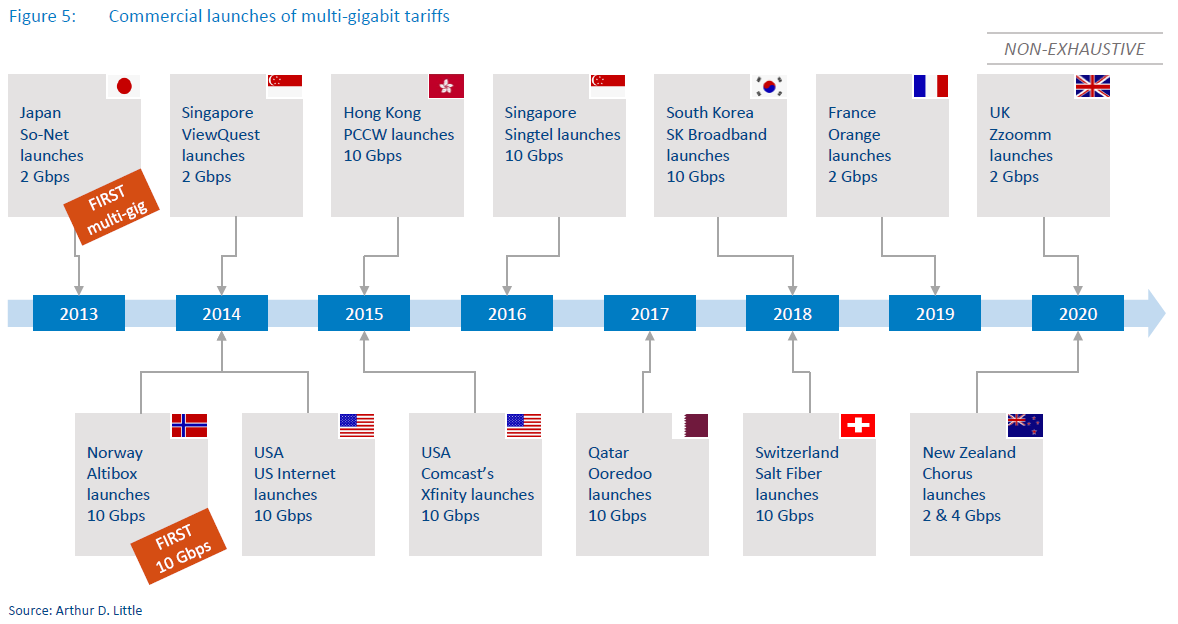

It has been more than five years since the first 10 Gbps plans were initially introduced in the US, Singapore, Hong Kong and Norway (see Figure 5. below). As of September 2020, we are not aware of any faster commercially available plan for the residential segment. Availability of multi-gigabit plans is still limited to a handful of markets and approximately 10-15 ISPs. However, just in the first half of 2020, there have been at least three ISPs that launched multi-gigabit offers: Zzoomm in the UK, Orange in France and Chorus in New Zealand.

Incumbent operator led deployments continue to play the leading role in fiber deployment today. However, we believe the importance of open access fiber providers will gain in significance, especially in important markets such as Italy, Germany, UK and Saudi Arabia, among others. Large-scale investment by non-telco entities such as energy companies and infrastructure funds, among others, will continue to expand fiber coverage in these markets. (For further details on open access fiber developments, please refer to our other report on this topic.)

An increasing number of incumbents acknowledge the inevitability of switching off and dismantling their legacy copper networks as fiber coverage becomes ubiquitous, while the cost economics of maintaining a fiber network are far superior to maintaining a legacy fixed network. Initiatives for legacy network switch off have been announced in multiple markets, and we expect to see results in larger markets such as Spain, France or Sweden soon. We also see regulators opening up to the idea that fiber-based solutions can eventually replace regulated legacy network–based products, giving a further impetus to open access fiber rollout in some regions.

Gigabit tariffs have become commonplace in developed fiber markets (mostly in Asia) and are increasingly being offered to customers worldwide. However, multi-gigabit speeds are still available only in a handful of markets. Salt in Switzerland is an example of a provider that uses its aggressively priced multigigabit offer to differentiate and disrupt the fiber market and not only as a marketing tool. We expect that, with new fiber rollouts and increasing competition on the broadband markets, the number of multi-gigabit offerings will continue to grow.

Note: This report, “The race to gigabit fiber,” is the 2020 update to Arthur D. Little’s Global FTTH study, published in 2010, 2013, 2016 and 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………..