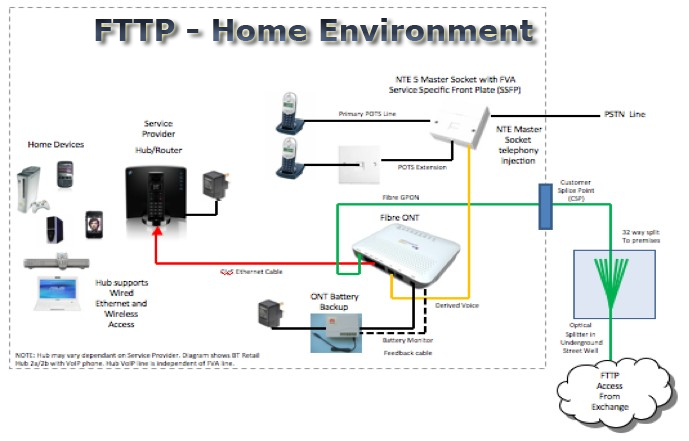

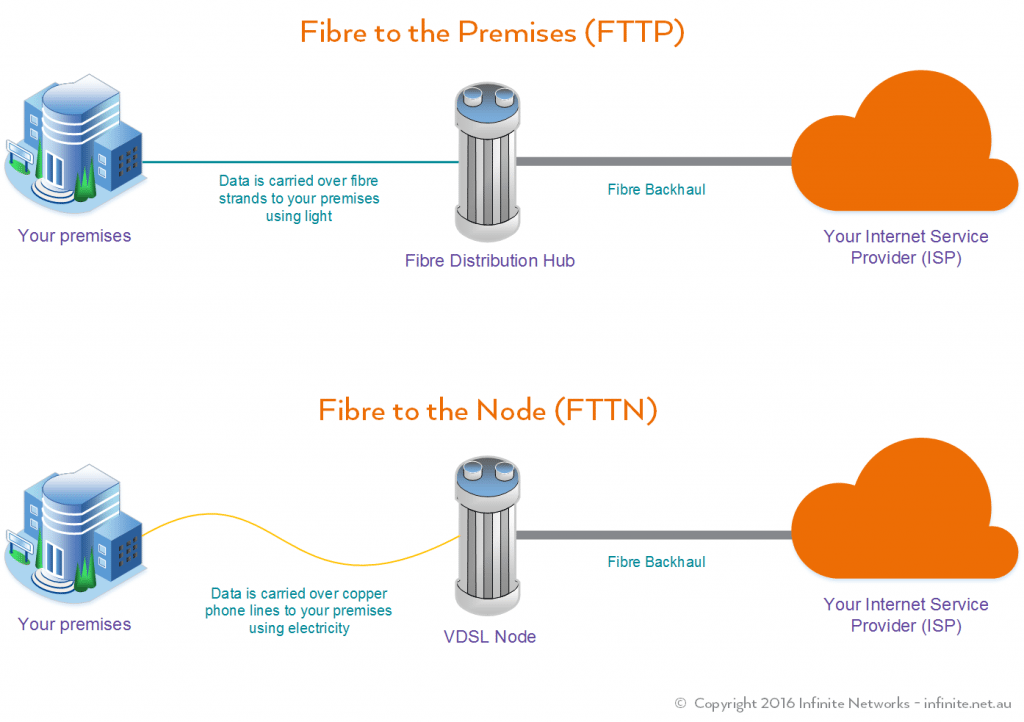

FTTP

Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

Several analysts believe the increased availability of Giga bit/sec FTTP (fiber to the premise) service offerings (with flat rates) could force cablecos to rethink their pricing strategy. For example, Jonathan Chaplin of New Street Research stated in a note to clients that cable’s promotional pricing is generally competitive with fiber offers. The problem, however, is that cable service ends up costing consumers significantly more than fiber based broadband access once those introductory rates disappear. “We have hypothesized for a couple of years that 1) Cable’s pricing strategy contributes to high churn and low NPS scores and 2) that it is unsustainable. We don’t think Cable has to cut price to remain competitive; we suspect they do have to fix the pricing model.”

Recon Analytics founder Roger Entner agreed, telling Fierce Telecom his research has shown price is the number one reason people join or leave a service provider. While consumers find promotional pricing very attractive, they’re generally unhappy when their promotions end. “So, for the cable companies, it’s both a gross addition driver and a churn driver as well,” he explained. While cable’s pricing strategy worked well when there was no competition to offer similar broadband speeds or features, that is now changing as fiber is becoming more broadly available, Entner said.

Indeed, fiber based telcos are already seizing on the opportunity to lure customers in with the promise of more simplistic pricing. For instance, AT&T used its recent launch of multi-gig fiber broadband plans as an opportunity to introduce new “straightforward” pricing which promises a flat rate with equipment and other fees included.

Speaking on an episode of Entner’s podcast, AT&T’s EVP and GM of Broadband Rick Welday stated there is “significant” demand in the market for simple pricing. “It’s obvious that consumers are done with this intro pricing where you see a fun, attractive, low rate advertised on television, you go sign up with that ISP and then 12 months later your rate jacks up considerably. Frankly, this is the model that cable has chosen. It seems to align with their video business and annual increases in carriage fees,” he said. Welday argued AT&T’s new cost model is a “game changer in terms of an ISP really obsessing over how to be transparent and upfront with the market.”

Chaplin said a shift by cable to the flat pricing model fiber players use might “weigh on gross adds initially.” However, he predicted net additions would ultimately “land in a similar place” over the course of a couple years while reduced churn would yield “lower costs and higher margins.”

Despite the potential benefits, Entner said he doesn’t expect cable to change its approach right away. “The system is still working and so you have a lot of inertia in the system. Only when cable is actually losing customers will this change,” he concluded.

Source: https://kitz.co.uk/adsl/fttp.htm

In addition, cablecos are planning FTTP deployments in the near future. I’ve heard that directly from an anonymous Comcast executive who told me to look out for their upcoming 10G bit/sec service.

We previously reported that a Cable One joint venture (JV) with three private equity firms is seeking to speed its expansion of fiber based Internet access to underserved markets. Clearwave Fiber is a newly formed joint venture that holds Clearwave Communications and certain fiber assets of Hargray Communications. Cravath is representing Cable One in connection with the transaction. With the formation of the JV, Clearwave Fiber intends to invest heavily in bringing Fiber-to-the-Premise (“FTTP”) service to residential and business customers across its existing footprint and near-adjacent areas.

Meanwhile, CableLabs has developed technologies that fall under the platform’s key tenets including capacity, security and speed. Increasing the number of bits per second that are delivered to subscribers can improve download and upload speed, a primary objective for the 10G platform. As data demands increase, many operators are considering increasing capacity on the existing optical access network.

To help operators better meet that demand, CableLabs recently published its first set of specifications for a new device, called the Coherent Termination Device, that enables operators to take advantage of coherent optics technologies in fiber-limited access networks.

References:

https://www.fiercetelecom.com/broadband/analysts-fiber-could-force-cable-overhaul-its-pricing-model

https://www.fiercetelecom.com/operators/at-t-puts-cable-companies-notice-fiber-plan

https://kitz.co.uk/adsl/fttp.htm

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

10-Gbps last-mile internet could become a reality within the decade from Futurology

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Cable One joint venture to expand fiber based internet access via FTTP

Lumen Technologies Fiber Build Out Plans Questioned by Analysts

Lumen Technologies is one of a large and growing number of telecom companies counting on a broad expansion of its fiber network. The Fiber Broadband Association (FBA) recently reported that the fiber industry is entering its “largest investment cycle ever” thanks to the efforts of companies like AT&T, Verizon and Lumen.

Lumen hopes to build its fiber network to 12 million new locations over the coming years. But it won’t be easy, according to Lumen CEO Jeff Storey.

“Supply chains are stressed, and we continue working very closely with our diverse and valued suppliers to mitigate risk as we execute on our growth objectives,” Storey said this week during his company’s quarterly conference call, according to a Seeking Alpha transcript. Others have issued similar warnings.

“I don’t want to overstate the issue, but it’s something that we are really paying attention to and working with vendors. We are starting to see some companies hold off on taking new orders. And as we see that, then we are working to put in our mitigation plans to make sure it’s factored into our build plan. But it is an issue that I will highlight as a real one that we have to mitigate.”

Lumen Technologies reported fourth-quarter results and 2022 expectations that generally fell below the forecasts of some financial analysts.

“Lumen’s 2022 guidance will fuel concerns that the company will have no choice but to eventually let leverage rise to inappropriate levels, dial back on investment, cut the dividend, or choose some combination thereof,” wrote the financial analysts at MoffettNathanson. “In particular, 2022 EBITDA [earnings before interest, taxes, depreciation, and amortization] guidance was noticeably below expectations at a time when capex will be elevated.”

“Results at this stage don’t give investors confidence in the company’s ability to earn an adequate return,” wrote the financial analysts at New Street Research.

Lumen and other fiber providers like Frontier Communications and AT&T are moving forward with their fiber buildout plans. Some, like AT&T and Frontier, are reporting big gains in the number of their new fiber customers. But others, like Lumen, are not.

“The past few quarters have been relatively weak for broadband net additions for Lumen, even for its higher-speed fiber offering,” MoffettNathanson said of Lumen’s consumer broadband business. “This quarter’s broadband net adds were at the low end of what the company has reported over the past few years and were shy of consensus estimates.”

The financial analysts at Evercore wrote that Lumen’s business segment drives three-quarters of the company’s revenue, and that too remains stressed. “The jury remains very much out on the company’s prospects in this sector,” they wrote, noting that sales in the company’s business segment declined slightly in the fourth quarter when compared with the third quarter of last year.

New Street analysts say a key metric for Lumen will be the percentage of customers in a given area who opt to purchase its new fiber optic access. If Lumen gets 40% of potential customers to sign up, the company likely will generate profits. “At 30%, the company would likely destroy value,” they warned.

Lumen CEO Storey stated that the company has already managed to get an average of around 29% of customers in its new fiber markets to sign up for its service. And that, he said, is with relatively little marketing.

He expects that number to be above 40% in the months and years to come. “If you look at the quality of the product that we have, we have a very effective competitive product and even with the limited marketing, we are doubling our penetration rates in our traditional copper areas,” Storey said.

New findings from the financial analysts at Cowen are supportive of Lumen’s fiber optic build out plans. The Cowen analysts recently conducted a nationwide survey of more than 1,000 respondents and found that fiber-to-the-home (FTTH) “take rates” reached 56% among those surveyed.

“Take rate, or more specifically, market penetration, is a key driver of the FTTH business case,” they wrote. “We have previously noted that a penetration rate of 30-35% is the typical minimum break-even threshold when underwriting FTTH projects. When there is one broadband competitor, fiber penetration can approach high-50s and even 60% penetration levels in mature markets.”

Lumen CMO Shaun Andrews said: “One of the things that really differentiates us right now is our focus on fiber as part of the core infrastructure to an edge experience versus a distraction with 5G or content. And being able to look an enterprise in the eye and say ‘Not only do we have these capabilities, but we will build the fiber to you where you are.’ That resonates with customers, and I think that’s a differentiator.”

…………………………………………………………………………………………………………………………

Last month, Lumen reported that they secured a massive $1.2 billion contract with the U.S. Department of Agriculture (USDA), setting it up to give one of the biggest government agency networks a major makeover.

Under the contract, Lumen will “completely transform” the USDA’s network covering 9,500 locations across the country. It will provide a range of services, including SD-WAN, managed trusted internet protocol, zero-trust networking, edge computing, remote access, virtual private networking, cloud connectivity, unified communications and collaboration, contact center, voice-over-internet protocol, ethernet transport, optical wavelength, and equipment and engineering.

References:

https://www.lightreading.com/opticalip/analysts-fret-over-lumens-fiber-plans/d/d-id/775229?

https://www.fiercetelecom.com/telecom/lumen-reels-12b-contract-overhaul-usdas-legacy-network

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

Lumen Technologies to empower customers to set up the wavelength subnetworks

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

Deutsche Telekom expands its fiber optic network in 78 cities and communities

Deutsche Telekom said it has expanded its fiber optic network for almost 7,000 companies in 78 cities and communities. Telekom is providing the companies with up to 1 Gbps speeds. The German based telco has connected industrial parks in the municipalities of Ahrensburg, Deggendorf, Lastrup, Lauf, Mainz and Mannheim among others.

Telekom is laying 560 km of fiber-optic networks to carry out the project and to connect the companies. It is using a trenching process to expand its fiber network.

“Telekom is Germany’s digital engine. That is why we are building our network seven days a week, 24 hours a day. In the city as well as in the countryside. We are massively accelerating our roll-out. In the coming year, we will go one better and invest around six billion euros in Germany. By 2030, every household and every company in Germany should have a fiber-optic connection. We will build a large part of this. But our competitors are also in demand,” said Srini Gopalan, Member of the Board of Management of Telekom Deutschland.

He also commented on the new German government’s plans in terms of digitization: “The new coalition is focusing on FTTH as THE technology of digitization. We explicitly welcome this. Faster processes – including for applications and approvals – will also help us to speed up fiber roll-out. We support the digital set off in our country. Digital networks should bring people together. Their roll-out should no longer be stuck in paper files.”

References:

https://www.telecompaper.com/news/deutsche-telekom-expands-network-for-7000-companies–1413189

https://www.telekom.com/en/media/media-information/archive/turbo-for-fiber-and-5g-643014

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

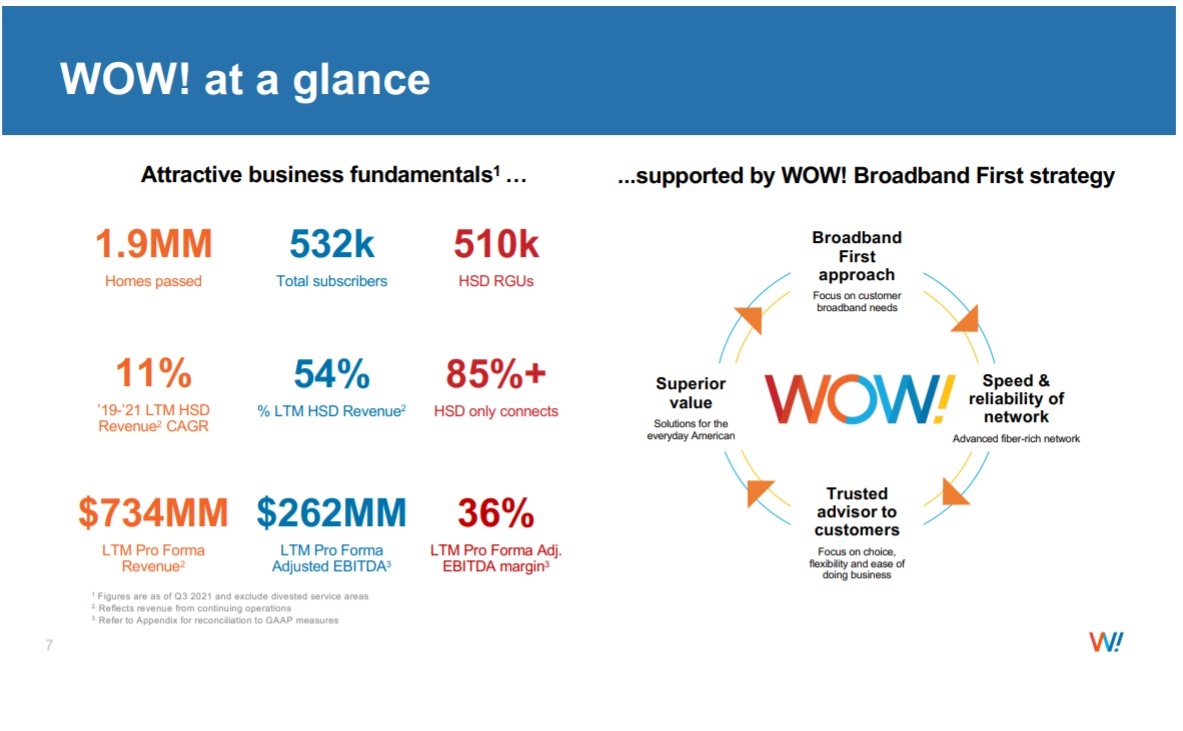

Like so many legacy and regional telcos, cablecos, WideOpenWest (WOW) [1.] is pursuing aggressive fiber-to-the-premises (FTTP) deployments. The company is targeting a part of Seminole County, Florida located near Orlando, as the first area for its ambitious plan to deploy FTTP Internet access to greenfield areas. Cableco Charter Communications currently provides broadband internet service to Seminole County.

This new expansion is part of the company’s larger Greenfield initiative to build new markets non-adjacent to its existing network and bring its advanced fiber technology and award-winning customer service to customers across its growing footprint. WOW! already serves Pinellas County and Panama City in Florida and identified Seminole County as a new community ripe for innovation and growth. The company plans to reach more than 60,000 homes passed upon completion of the project.

Note 1. WideOpenWest is the sixth largest cable operator in the United States with their network passing 3,248,600 homes and businesses. The company offers landline telephone, and broadband Internet services, and IPTV. As of December 31, 2020, WOW! has about 850,600 subscribers. They offer up to 1 Gb/sec downstream fiber internet service in some areas.

………………………………………………………………………………………………………………

WOW estimates it will invest at least $60 million in the county for its FTTP deployment. The estimated cost of $1,000 per passing is consistent with prior expectations.

“We are excited to announce Seminole County as the first service area to kick off our Greenfield initiative,” said Teresa Elder, CEO of WOW!. “We are delighted to offer communities in Seminole County a better broadband choice so they can work, learn and be entertained using WOW!’s multi-Gig fiber-to-the-home network. Area residents and businesses will be pleasantly surprised by our reliable network, super-fast speeds and choice of exceptional products to meet their broadband usage needs.”

Work on the new all-fiber infrastructure in Seminole County has already begun. Once completed, customers will benefit from WOW!’s innovative technology and product suite that provides the best in choice, reliability, speed and value. Customers will have access to multi-Gig HSD service, WOW!’s fastest broadband speed available, home and business WiFi solutions to support streaming, remote work and small business needs as well as WOW! tv+, its premier IP-based video service.

“Investing in Seminole county is investing in its community, its people, and its growth,” said Kirk Zerkle, VP of Market Expansion at WOW!. “We are thrilled to give residents and businesses in Seminole County the service they deserve. We know how important it is to be connected in every aspect of our lives and look forward to WOW! becoming an integral part of this county.”

The selection of Seminole county comes almost two months after WOW announced that building FTTP networks to greenfield markets [2.] will play a big role in fueling growth over the next five years. WOW recently sold off a handful of systems for $1.8 billion to help fund this growth initiative. The company intends to build out fiber networks to greenfield areas passing at least 200,000 homes and businesses by 2027, with the potential to expand that to 400,000 locations.

Note 2. WOW has identified greenfield areas as those that are not-adjacent to its existing markets which have low density. The company expects to announce additional greenfield markets later this year.

WOW! continues to pursue expansion opportunities across the country and expects to announce additional markets later this year.

“We’ve reached an inflection point in the industry where fiber-to-the-home build costs have reached parity with HFC [hybrid fiber/coax],” Henry Hryckiewicz, WOW’s chief technology officer, explained at an investor day held in December 2021.

About WOW! Internet, Cable & Phone:

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia.

With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years.

Source: WideOpenWest

………………………………………………………………………………………………………………….

Please visit wowway.com for more information.

………………………………………………………………………………………………………………….

WOW! Media Contact:

Jamie Mayer

[email protected]

References:

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Continuing with the massive U.S. fiber to the premises (FTTP) movement, regional fiber carrier MetroNet (headquartered in Evansville, Indiana) said it will bring fiber-optic internet access directly to homes and businesses throughout the Deltona, FL and neighboring communities, including DeBary and Orange City.

Deltona marks the third community in Florida that will have access to MetroNet services through a fully funded $35 million investment in the community. The three-year construction project is set to begin in the summer of 2022, with the first customers able to receive service as early as the fall of 2022.

Once completed, Deltona will join the country’s internet elite as a Gigabit City. Only about 40 percent of households in the U.S. have access to symmetrical upload and download gigabit (1,000 mbps) speeds that only fiber optic networks can provide.

“MetroNet is thrilled for Deltona residents and businesses to have access to our future-proof services that will allow sparkling 4k video streaming, glitch-free gaming, crystal-clear virtual meetings, and internet experiences of the future that we can only begin to imagine,” said John Cinelli, MetroNet’s CEO. “MetroNet is proud to soon be able to add Deltona to our growing list of Gigabit Cities.”

MetroNet plans to hire local market management positions, sales and customer service professionals, and service technicians to support the Deltona area. Those interested in joining the MetroNet team can visit MetroNetInc.com/careers to search available positions and to submit applications.

………………………………………………………………………………………………………………………

Last week, Metronet announced it has merged with fellow independent fiber based network provider Vexus Fiber. The combined companies will continue to operate under their existing brands and with their existing executive roster. Financial terms of the deal were not disclosed.

Vexus, based in Lubbock, TX, deploys and operates FTTP networks in Texas and Louisiana, with plans for expansion in New Mexico. Markets currently serving those states include Lubbock, Amarillo, Wichita Falls, Abilene and surrounding areas of Texas, as well as Hammond, Covington and Mandeville in Louisiana. New FTTP networks in the Rio Grande Valley are in various stages of deployment (see “Vexus Fiber to Build FTTH Network in Rio Grande Valley Region of Texas”), Tyler, Nacogdoches, and San Angelo, TX; Lake Charles, LA; and Albuquerque and Santa Fe, NM. Investors in the company included Pamlico Capital and Oak Hill Capital.

Metronet is operating or building FTTP networks in more than 120 communities in Indiana, Illinois, Iowa, Kentucky, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, and Missouri. It had received cash from KKR last April (see.) “KKR will take stake in Metronet as part of new funding round”) Oak Hill Capital is also an investor. Both companies provide gigabit or faster broadband services to their residential and business customers.

“We are very excited to welcome Vexus Fiber and their partners to Metronet,” said Metronet CEO John Cinelli. “Vexus has rapid growth and a high-customer-service mindset, similar to Metronet, and joining them allows us to expand our service area to even more Americans.”

“At Wexus, our mission is to bring our high-quality service to as many homes and businesses as possible in the Southwest,” said Jim Gleeson, president and CEO of Wexus. “With this merger, we can reach even more people faster.”

About MetroNet:

MetroNet is the nation’s largest independently owned, 100 percent fiber optic company headquartered in Evansville, Indiana. The customer-focused company provides cutting-edge fiber optic communication services, including high-speed Fiber Internet and full-featured Fiber Phone with a wide variety of programming.

MetroNet started in 2005 with one fiber optic network in Greencastle, Indiana, and has since grown to serving and constructing networks in more than 150 communities across Indiana, Illinois, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, Missouri, and New Mexico. MetroNet is committed to bringing state-of-the-art telecommunication services to communities — services that are comparable or superior to those offered in large metropolitan areas.

MetroNet has been recognized by PC Mag as one of the Top 10 Fastest ISPs in North Central United States in 2020 and Top 10 ISPs with Best Gaming Quality Index in 2021. Broadband Now has recognized MetroNet as the Top 3 Fastest Internet Providers and Fastest Fiber Providers in the Nation in 2020, and #1 Fastest Mid-Sized Internet Provider in two states in 2020. In 2020, MetroNet was awarded the Vectren Energy Safe Digging Partner Award from Vectren. For more information, visit www.MetroNetinc.com.

Media Contact: Katie Custer [email protected] 502.821.6784

References:

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

Ziply Fiber has launched two multi-gigabit, symmetrical broadband Internet tiers– at 2 Gbit/s and 5 Gbit/s – in 60 cities and towns in parts of Washington, Oregon, and Idaho. The two new fiber Internet service plans will initially be available to nearly 170,000 physical addresses in those three states. This comes after Ziply conducted a successful small market test in Kirkland, Washington. Customers in Montana will gain access to the multi-gig options later this quarter, with availability expected across most of the company’s existing footprint by the middle of the year.

Pricing for the 2-Gig tier runs $120 per month while the 5-Gig tier costs $300 per month. Both multi-gig tiers will require users to get a special router that includes WiFi 6 compatibility, a 10G WAN port and either a 2.5G LAN port for the 2-gig plan or a greater than 5G LAN port for the 5-gig option.

Ziply is the first among regional and national residential providers — those with a customer base of more than 1% of the US population — to deliver these speeds. By doing so, Ziply has become the fastest major internet provider not only in the Northwest, but across the entire U.S.

Ziply Fiber, formed in 2020 via the acquisition of Frontier Communications’ operations in Washington, Oregon, Idaho and Montana, expects to launch the new multi-Gig tiers to the rest of its footprint by the second quarter of 2022, and to make them available in every new fiber market launched thereafter, said Harold Zeitz, Ziply Fiber’s CEO.

Zeitz told Fierce Telecom that more than half of Ziply’s customers already take its 1 Gbps plan, “so we already have customers who seem to want faster speeds compared to others.” He added the December trial covered five markets across Washington and Oregon and included a sample group of “tens of customers” who proactively sought access to the faster speed tiers. “There were no problems whatsoever,” Zeitz said of the trial. “We were able to demonstrate measured speed and it gave us confidence to go ahead and launch it broadly.”

Ziply Fiber’s new uncapped and no-contract tiers follow the company’s ongoing deployment of a 10-Gig capable XGS-PON access network and underlying core network. Zeitz said the launches prove that consumers don’t have to live in a big city to get big speeds. “It’s a revitalization opportunity,” he said. “It demonstrates the future-proof element of the technology.”

The company also sells a 50Mbit/s tier for $20 per month and a 200Mbit/s service for $40 per month. Zeitz estimates that “well over half” of Ziply Fiber’s broadband customers choose the 1-Gig tier.

Zeitz said offering broadband without a cap or a contract puts welcome pressure on the company. “Yes, we think it’s a differentiator, but I also think it helps motivate us to make sure we’re delivering great service, he said.

Other Gig FTTP Internet competitors:

Ziply Fiber’s 5-Gig service appears to raise the bar on a fiber-to-the-premises (FTTP) residential broadband offering offered in multiple states. With the exception of Google Fiber and Xfinity, none of the top internet providers have dared to push the internet speed limit past a single gig. Google Fiber offers a 2-gigabit plan throughout most service areas while a limited few Xfinity customers can sign up for 3 gigs, but no 5 Gig yet. Among smaller regional players, EPB of Chattanooga, Tennessee, currently offers a residential 10-Gig service starting at $299 per month in select areas.North Dakota’s MLGC debuted a 5 Gbps service tier in 2020, while TDS rolled out a 2-gig offering and Dobson Fiber launched a 10 Gbps offering last year.

Here’s the current competitive status from nationwide FTTP providers:

- Comcast’s targeted residential FTTP service, Gigabit Pro, was recently upgraded to deliver speeds of 3 Gbit/s for $299.95 per month (with a two-year contract).

- Google Fiber has been expanding the availability of a fiber-based service that delivers 2 Gbit/s down by 1 Gbit/s up.

- AT&T has hinted that a multi-gigabit service is in the works, but has not announced pricing or launch timing.

Analysis:

The burning question this author has is how will Zipply customers use even a fraction of their allotted 2 Gig or 5 Gig upload and download speeds? I have over 10 connected WiFi devices in my home where my 100 Mb/sec download speed is sufficient.

“This is for people to develop new use cases, et cetera,” Zeitz concluded. “I think we don’t know all the things that people will do and so we’re an enabler.”

Also, the extra gear needed won’t be cheap. To open up any potential in-home bottlenecks, Ziply Fiber is recommending an Asus AX6000 Wi-Fi 6 router or a similar device. Customers will also need an SFP+ (enhanced small form-factor pluggable) with an RJ-45 connector that’s compatible with the router to deliver up to 5-Gig. Ziply Fiber is also selling such products online – an Asus router for $449.95, and the SFP+ for $42.99, or both bundled together for $492.94.

For the full 5-Gig, customers will need a wired Ethernet connection to the router. Depending on the performance capabilities the computer, a customer on Ziply Fiber’s multi-gig service will likely need an Ethernet adapter/dongle that supports 2.5-Gig or 5-Gig.

……………………………………………………………………………………………………………………………………………………..

24 January 2022 Update: AT&T can now equal 2 Gig and 5 Gig FTTP speeds

AT&T has boosted its existing fiber in parts of more than 70 metro areas around the U.S. to offer 2-Gig and 5-Gig symmetrical upload and download speeds.

“Where we’re launching 2-Gig and 5-Gig, we previously had 1-Gig speeds available,” said AT&T’s SVP of Broadband Product Development Cheryl Choy. The upgrades announced today affect about 5.2 million people out of about 16 million households that AT&T currently passes with gigabit speeds.

Asked why AT&T isn’t increasing speeds for all 16 million households that it passes with fiber, Choy said it’s because the company is “on a PON evolution.” It is in the process of moving from GPON to XGS PON via card upgrades and software improvements. These upgrades allow it to boost speeds above 1-Gig. Choy said that since 2019 all of AT&T’s newly laid fiber has been capable of multi-gig speeds.

Although the news of multi-gig fiber today did not require any new fiber to be laid, the company is also laying new fiber, and its goal is to cover 30 million customer locations with fiber by year-end 2025.

Pricing:

AT&T also announced it’s rolling out “straightforward pricing” across its AT&T Fiber portfolio. The 2-Gig fiber service costs $110 per month plus taxes with autopay; and the 5-Gig service costs $180 per month plus taxes with autopay.

Prices are a little higher for businesses at $225 per month for 2-Gig; and $395 per month for 5-Gig.

The company will not charge any equipment fees, nor will it require an annual contract or implement any data caps. The service also includes Wi-Fi.

Choy said, “We’ve amped up our Wi-Fi technology.” In late 2020 AT&T launched its Wi-Fi 6 enabled gateway, which provides more capacity for more connected devices. Those Wi-Fi devices will be able to take advantage of the new multi-gig speeds. AT&T’s Wi-Fi currently uses 2.4 Ghz and 5 Ghz spectrum.

According to a survey conducted in 2021 by Recon Analytics on behalf of AT&T, the average consumer has 13 connected devices in their home. But that’s expected to boom in the coming years, which will require more bandwidth.

Finally, as part of today’s news, AT&T said it has achieved up to 10-Gig speeds on fiber in its labs.

https://www.fiercetelecom.com/broadband/att-upgrades-its-fiber-network-offer-2-gig-5-gig-speeds

Ziply Fiber References:

https://www.fiercetelecom.com/broadband/ziply-debuts-2-gig-5-gig-internet-tiers-60-cities

https://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=774718&

https://ziplyfiber.com/news/release/735

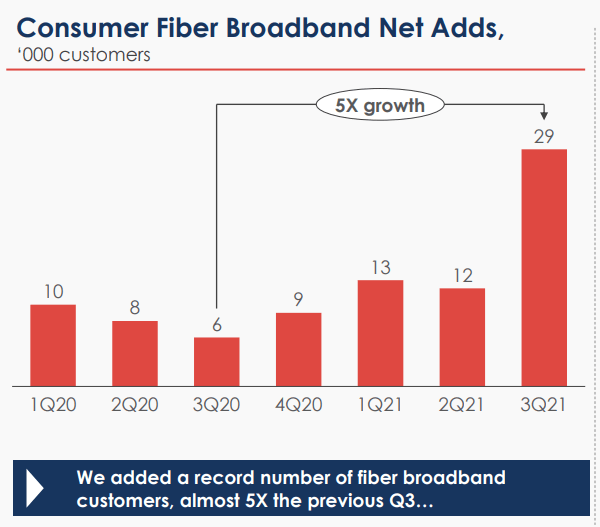

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier Communications added 45,000 fiber broadband subscribers in the fourth quarter, its best performance gains in five years, Frontier’s Scott Beasley said at the 2022 Citi Apps Economy Virtual Conference. The company hopes to expand by 1 million fiber locations this year as part of plan to reach 6 million by 2025.

Comment: That’s great progress for a company that filed for bankruptcy in April 2020 with a plan to cut more than $10 billion of its $17 billion debt load by handing ownership to bondholders. It was the biggest telecom filing since WorldCom in 2002, reflecting years of decline in its business of providing internet, TV and phone service in 29 states.

When combined with legacy DSL losses, Frontier added 9K net new broadband subscribers. Frontier is currently on an aggressive fiber build strategy that aims to add a total of 6 million locations by the end of 2025, resulting in 10 million locations reached in total. Beasley reports the company added 600K new fiber locations in 2021, with a goal of adding another million locations by the end of 2022. Beasley reports that the much discussed supply chain challenges facing the broadband industry have not had a significant impact at Frontier.

“We’ve managed through supply chain constraints and been able to perform very well in our fiber build and continue to ramp that up for 2022,” he said.

- This marked the first time in more than five years that the Company has posted total broadband customer growth in a quarter.

- The Company expects to continue growing the total broadband customer base as its fiber build accelerates.

Source: Frontier Communications Q3 2021 earnings presentation

Frontier has completed ‘wave 1’ of this fiber expansion. The company is now beginning ‘wave 2,’ which will take them through 2025, getting them to 6 million new locations. Build costs in wave 2 are a bit higher at $900 to $1,000 per fiber location.

Frontier envisions a ‘wave 3’ coming, but that’s outside the scope of their current committed-to fiber build. Beasley says Frontier will look to leverage government funding programs and other partnerships to help fund wave 3 fiber builds.

“There could be scenarios where we accelerate the build of some locations in wave 3 into wave 2,’ he said in discussing Frontier broadband growth. “That will likely be a destination of significant government funding as the roughly $45 billion of infrastructure bill funding that goes to broadband will be targeted at locations like wave 3.”

Asked about potential competition from fixed wireless access (FWA) and satellite broadband services, Beasley said neither presents a material threat just yet. While FWA may gain traction in some ultra-dense urban locations and satellite in extremely rural areas, Beasley asserted neither technology will be able to stand up against Frontier’s gigabit fiber offerings. The company already offers 1 Gbps and is planning the rollout of a 2 Gbps plan in the first half of this year as well as a 10 Gbps tier somewhere down the line. “It’s a technology we’re watching closely but don’t think it can compete with our core symmetrical speeds in fiber,” Beasley said of FWA.

“Against our core gigabit plus offers, 1 gig symmetrical speeds now, we’ve said we’re going to launch 2 gig in the first half of 2022, eventually we’ll move to 10 gig, the core network is 10 gig capable now, we’ve trialed 25 gig successfully in certain parts of the network,” he said. “I don’t think fixed wireless has the capacity to compete with that core infrastructure. It will be competitive in certain niches of the market…but I don’t think it can compete with our core symmetrical speeds and fiber,” he added.

References:

https://kvgo.com/citi-apps-economy-conference/frontier-jan-2022

With 45K New Fiber Subscribers, Frontier Sees First Positive Broadband Growth in 5 Years

Cable One joint venture to expand fiber based internet access via FTTP

Cable One [1.] (aka Sparklight) has announced a joint venture (JV) with three private equity firms, seeking to speed its expansion of fiber based Internet access to underserved markets.

The joint venture reflects a shared commitment from Cable One and the investors to provide fast and reliable connectivity via FTTP internet to underserved markets and will allow for more rapid expansion of fiber internet to homes and businesses in small cities and big towns. Cable One owns a majority of Clearwave Fiber and the private equity investors are committed to make substantial cash investments to support the acceleration of Clearwave Fiber’s expansion.

Clearwave Fiber will be led by Executive Chairman Michael Gottdenker and CEO David Armistead, both of whom were part of Hargray’s executive leadership team from 2007 until its 2021 sale to Cable One, providing continuity of proven leadership and a continued commitment to Cable One’s shared culture, purpose, and values.

“This strategic investment will help accelerate the deployment of fiber-based broadband services to a range of markets, including underserved areas of the country,” said Michael Gottdenker, Executive Chairman of Clearwave Fiber. “Our team is motivated by our shared core values of customer service and improving lives through connectivity and is excited to bring fast and reliable Clearwave Fiber broadband to homes and businesses across the country. We are thrilled to welcome GTCR, Stephens, and TPO to the Clearwave Fiber family and look forward to our continued partnership with Cable One.”

Julie Laulis, Cable One President and CEO said:

“We look forward to supporting and sharing in Clearwave Fiber’s growth over the coming years while remaining focused on our primary business, increasing penetration rates, integrating recently acquired companies and driving higher margins and greater free cash flow. We did not take lightly our choice of partners in this transaction and are excited to be working with like-minded individuals who share our core principles.”

“Five years ago, Gig speeds were virtually unheard of in non-urban markets across the U.S. We are proud to have been able to launch Gig service and level the playing field for rural markets where access to affordable, high-speed internet is just as vital as in more urban markets. A fast and reliable internet connection means rural residents can telecommute rather than having to move to find work. It means access to medical care via telehealth services; the ability to achieve a higher education online; and the cultivation of entrepreneurship and economic growth.”

…………………………………………………………………………………………………………….

KeyBanc Capital Markets analysts indicated in a research note the deal is a positive for Cable One, noting it will allow the company to effectively offload heavy investment in fiber to the JV while maintaining majority ownership. They drew a comparison to WideOpenWest’s recently announced fiber expansion plan, writing that “in contrast to CABO, WOW will fund the expansion on-balance sheet, while CABO’s transactions move off-balance sheet, neither being wrong, in our view.”

“We believe this shows there is a lot of FTTP build opportunity within and around CABO’s footprint (likely more than one Company can handle),” Keybanc’s team conclude

……………………………………………………………………………………………………………….

About Cable One:

Cable One, Inc. (NYSE:CABO) is a leading broadband communications provider committed to connecting customers and communities to what matters most. Through Sparklight® and the associated Cable One family of brands, the Company serves more than 1.1 million residential and business customers in 24 states. Over its fiber-optic infrastructure, the Cable One family of brands provide residential customers with a wide array of connectivity and entertainment services, including Gigabit speeds, advanced WiFi and video. For businesses ranging from small and mid-market up to enterprise, wholesale and carrier, the Company offers scalable, cost-effective solutions that enable businesses of all sizes to grow, compete and succeed.

References:

https://www.fiercetelecom.com/telecom/cable-one-targets-rapid-fiber-expansion-jv-deal

Open Access Fiber Networks Explained; Underline’s Intelligent Community Network

In Open Access Fiber networks, the same physical network infrastructure is utilized by multiple providers delivering services to subscribers. The Open Access business model has been drawing attention globally as governments and municipalities find the concept of offering competition between providers and the freedom of choice for the subscriber is essential. It has also proved to be a feasible way to connect rural areas where service providers might have a hard time generating enough revenue to justify investing in their own network infrastructure.

Open access fiber networks can be the foundation for distributed healthcare, 5G, and resilient, modernized infrastructure—including responsible energy creation and secure community smart grids.

For subscribers to benefit from the freedom of choice and competition between providers that are delivering services using the same network infrastructure they will need a comprehensive way to browse the assortment of services offered.

Open Access network operators must keep track of:

- Every single subscriber in the network, their physical address, their “technical address” (switch, switch port, etc.).

- Which services they are buying from which provider/s.

- The total number of customers and/or services bought if you’re operating in a three-layer model where you have to report back to the network owners how their network is utilized.

……………………………………………………………………………………………………………………………………….

Already common in Europe with Sweden as the best known example, open access networks are just beginning to gain market traction in the U.S. While U.S. community-wide network operators like SiFi Networks and UTOPIA Fiber (Utah) have adopted a wholesale-like business model, newcomer Underline is taking a bit more of a direct approach.

“When people say open access in this country, they typically mean ISPs can come in and lease fiber and choose to build a given neighborhood that hasn’t been overbuilt yet. We mean something very different,” Underline CEO Robert Thompson told Fierce Telecom. “We are not a wholesale leaser of fiber. We are the fiber network literally to the doorbell.”

Underline isn’t just providing physical fiber-to-the-home infrastructure, but also a unified billing system and cybersecurity layer. The latter will allow the communities it serves to deploy smart city applications over an on-demand Layer 2 (Data Link layer) connection that will never touch the Layer 3 (Network layer) public internet, Thompson said.

“On the one hand, we directly face consumers and businesses, schools and so forth and we provide them network access connectivity and technology for a monthly connection fee. On the other hand, we look like a network infrastructure-as-a-service provider to the ISPs or content community,” Thompson said.

“We don’t provide IP,” he continued. “We’re going to move your traffic from your house ultrafast over fiber and we’re going to hand off you and your traffic to the internet service provider of your choosing. That ISP is then your IP, the routing of your traffic. They’re connecting you to that glorious world wide web,” he added.

Thompson said Underline will charge users directly on a monthly basis for connectivity, with their chosen ISP getting a portion of that cost. So, for instance, in the case where a subscriber takes a $65 per month symmetric gigabit plan, the ISP will get a $15 cut. Underline also plans to charge licensing and per subscriber fees for use of its technology stack.

Underline is now initiating construction in its first market: Colorado Springs, CO. The company will offer residential speeds up to 10 Gbps and enterprise service up to 100 Gbps, with qualifying households eligible to receive a discounted rate on Underline’s bottom tier symmetrical 500 Mbps plan.

The project will be completed in several stages, with a Phase I build set to connect 24,000 homes and 4,000 businesses with 225 route miles of fiber plant. Initial customers will include the the National Cybersecurity Center, the new Space Information Sharing and Analysis Center and Altia Software.

Thompson says that Phase II will cover roughly the same amount of ground and Underline also has a build agreement with an unnamed city “immediately surrounding” Colorado Springs. Taken together, construction in both phases and the second city will amount to “an exercise of approximately $125 million in total capital.”

“We are after this with a vengeance, and we are very thankfully supported by very strong capital,” Thompson said, noting a “drumbeat of steady announcements of drills in the dirt in new communities” is on the way.

Thompson said Underline is targeting communities with populations between 20,000 and 750,000. He noted that such communities have “historically been basically ignored by the incumbents (large telcos) and which by and large will not qualify” for federal support for broadband deployments.

Beyond that, he said Underline’s market assessments include factors like demand point density per fiber route mile, a population productivity ratio, a competition index and a social equity analysis. The latter is a key priority for Underline and “part of our social purpose,” Thompson explained.

“We want to understand and we actually want to target communities that have a significant portion of their demand points that have no internet at all or very poor internet at home because of socio economic status. This country’s got to have internet that’s fast, affordable and fair,” he concluded.

References:

https://www.fiercetelecom.com/operators/underline-has-a-different-vision-for-open-access-fiber-u-s

https://www.cossystems.com/about/open-access/

https://www.foresitegroup.net/what-you-need-to-know-about-open-access-networks-2/

Orange España: commercial deployment of 10 Gbps fiber in 5 cities

Orange’s new 10Gbps fiber access will be at Love Total Plus and Love Total Plus 4 rates for residential customers, and at Love Empresa 3 and 5 rates for freelancers and small businesses. Adopting this speed will mean an increase of 10 euros /month on the price of the same.

In the 10Gbps offered by Digi, only 8Gbps was obtained, and it is expected that in the case of Orange it might be similar. It remains to be seen, what actual performance it offers.

References:

Orange launches 10Gbps symmetric fiber for individuals and companies, first in five major cities