FTTP

Chile’s Entel to sell fiber optic assets for $358 million to ON*NET Fibra

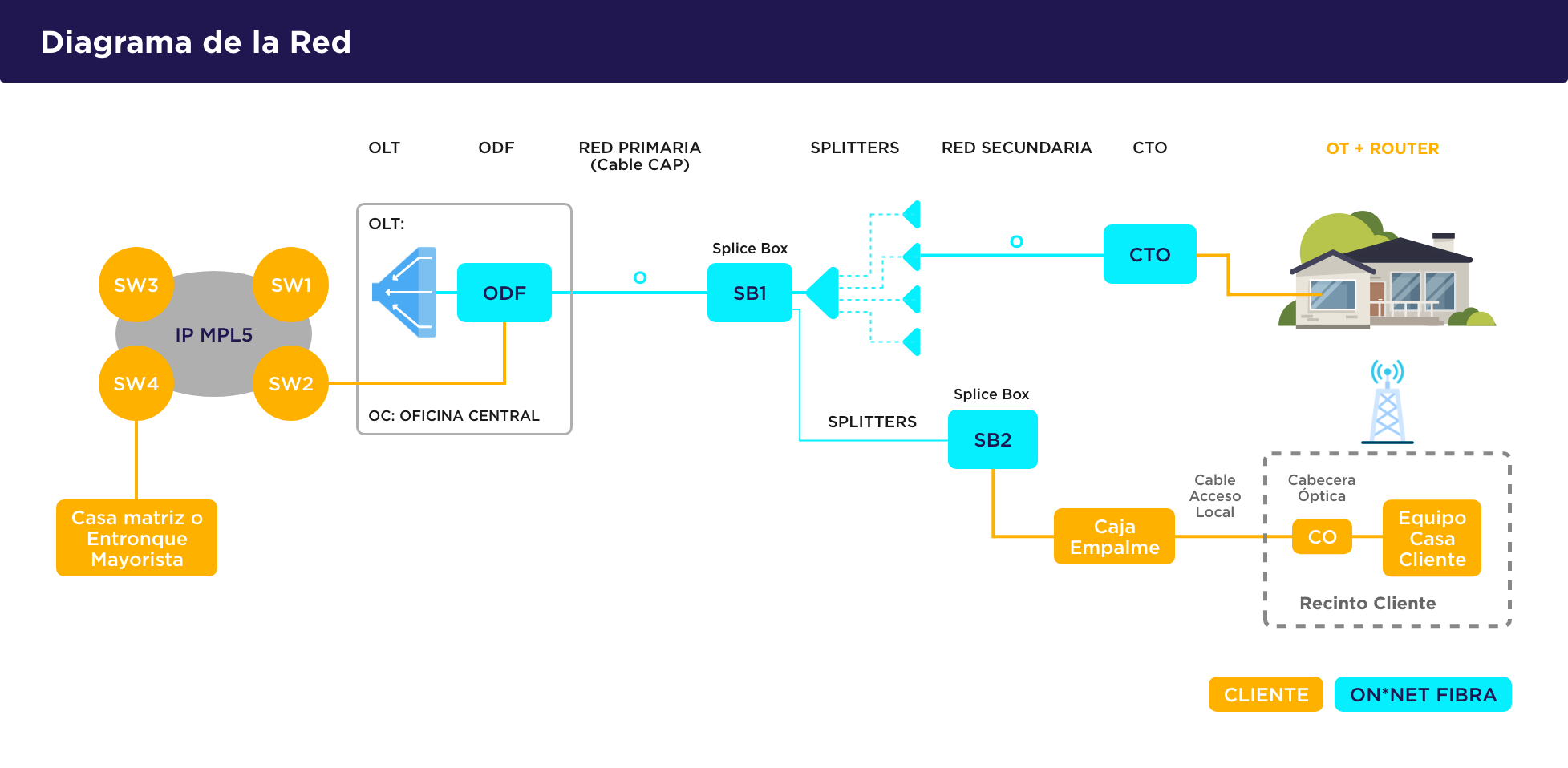

Chilean telecoms giant Entel (which this author consulted for in 2002 and 2005) said on Saturday it would sell the assets of its fiber optic business, which provides services to homes, to local company ON*NET Fibra (?) in a deal worth $358 million.

The sale, led by investment banks BNP Paribas, Santander and financial adviser Scotiabank, is subject to approval by Chile’s economic regulator, expected in the first half of 2023.

Entel and ON*NET Fibra signed an agreement as part of the deal that will enable Entel to continue offering internet services for residences on ON*NET’s network, Entel said in a statement.

…………………………………………………………………………………………………………………………………………………………….

“By selling our network, rather than leaving the fixed market, we are increasing coverage rapidly to offer our internet services to the home at efficient costs and without the need to invest the sums required for a fiber deployment with this coverage,” the statement added.

Following the closing of this transaction, ON*NET Fibra is expected to reach more than 4.3 million homes in 2024. Entel has operations in Chile and Peru and has more than 20 million mobile subscribers.

Source: ON*NET Fibra

……………………………………………………………………………………………………………………….

References:

New Hampshire Electric Cooperative and Conexon to deliver FTTH internet service to thousands of NH homes and businesses

Conexon, a rural fiber-optic network design and construction management leader, and New Hampshire Electric Cooperative (NHEC) are expanding their partnership to bring fiber-to-the-home (FTTH) service across the cooperative’s territory.

NHEC and Conexon have worked together to provide gigabit-speed internet access to two communities, Acworth and Sandwich, and will soon expand to 32 communities throughout Grafton County. NH Broadband, the co-op’s fiber subsidiary, will ultimately offer high-speed fiber internet service that spans nine counties and nearly 120 communities. Service is available today for customers in Acworth, Sandwich, Clarksville, Colebrook, Lempster and Stewartstown, and is expected to be available to initial customers in Grafton County by First Quarter 2023.

Conexon provides a comprehensive range of fiber broadband services including network design, construction project management, engineering and operations support. Additionally, through its internet service provider subsidiary, Conexon Connect, the company is also providing services including customer sign-ups, installations, billing, technical support and access to multi-gigabit speed packages.

“Over the past several years, I’ve heard people analogize rural broadband to the rural electrification movement of the 1930s and 1940s,” Conexon Partner Jonathan Chambers said. “To us, it isn’t an analogy; it’s a reality. The same companies that built electric networks across the nation are building broadband networks. Alyssa Clemsen Roberts was one of the first to recognize how electric cooperatives could solve the digital divide. In fact, Alyssa introduced me to that very idea when I was at the FCC. She also introduced me to Randy Klindt. I’m thrilled Alyssa has joined NHEC and will lead this new endeavor.”

The lightning-fast fiber-optic network offered by NH Broadband will give members access to symmetrical multi-gigabit internet capabilities – among the fastest and most robust in the nation. Additionally, it will enable enhancements and smart grid capabilities to the electrical infrastructure, including improved power outage response times, better load balancing and more efficient electricity delivery.

“Making high-speed, affordable internet available to all of our members who need it is a major undertaking, on par with the effort to bring light and power to these same locations more than 80 years ago,” NHEC President/CEO Alyssa Clemsen Roberts said. “We’re thrilled to have Conexon’s resources and experience available as we work to bring this next essential service to our members.”

Conexon brings to the project unmatched experience and expertise in deploying rural FTTH networks. The company has designed more than 200,000 miles of fiber for cooperative projects and builds more than 50,000 fiber miles of fiber annually. In addition, Conexon has created a broad ecosystem of equipment and labor resources specializing in rural fiber builds. Since forming six years ago, Conexon has assisted nearly 275 electric cooperatives, 75 of which are deploying fiber networks, with more than 500,000 connected fiber-to-the-home subscribers across the U.S.

“We’re excited to build on our current relationship with New Hampshire Electric Cooperative and make a difference in the lives of even more residents who are currently unserved or underserved with broadband,” Conexon Founding Partner Randy Klindt said. “We are pleased to have such a positive and productive partnership with Alyssa and her team, one that enables us to further our mission of closing the digital divide.”

New Hampshire Electric Cooperative is a member-owned not-for-profit electric utility, headquartered in Plymouth, N.H. NHEC connects its 85,000 members through 6,000 miles of energized lines, crossing 118 communities throughout New Hampshire.

Conexon works with Rural Electric Cooperatives to bring fiber to the home in rural communities. The company is comprised of professionals who have worked in electric cooperatives and the telecommunications industry, and offer decades of individual experience in business planning, building networks, marketing and selling telecommunications. Conexon offers its electric cooperative clients end-to-end broadband deployment and operations support, from a project’s conception all the way through to its long-term sustainability. It works with clients to analyze economic feasibility, secure financing, design the network, manage construction, provide operational support, optimize business performance and determine optimal partnerships. To date, Conexon has assisted more than 275 electric cooperatives, 75 of which are deploying fiber networks, with more than 500,000 rural Americans connected to fiber to the home. The company has secured nearly $2 billion in federal, state and local grants and subsidies for its clients.

Cindy Parks

913-526-6912

[email protected]

SOURCE Conexon

Altice USA bets on FTTP with multi-gigabit speeds by 2025; MVNO with T-Mobile

Dexter Goei, Altice USA’s outgoing CEO, continues to strongly defend the company’s decision to upgrade large portions of its network to fiber, stating that the product and business performance of the move make dollars and sense. Altice USA’s current plan is to upgrade about 6.5 million passings to fiber-to-the-premises (FTTP) by 2025 and back that up with multi-gigabit speeds, which Altice USA has begun to soft-launch in parts of its fiber upgrade areas.

At the Goldman Sachs Communacopia + Technology conference in San Francisco, Goei said while the company has made strides in deploying its fiber network — it expects to finish 2022 with up to 2.3 million homes passed with the technology — it is still seeing customer declines in its former Cablevision and Suddenlink footprints.

In Altice’s former Cablevision systems in metropolitan New York City, gross additions are lower, there is less move activity and churn levels are low, but the company also is competing against a telco — Verizon Communications — that has been extremely aggressive on price. In its Suddenlink markets mainly in the Midwest, gross addition activity is high but churn is high, especially in markets where it is being overbuilt.

“We’re still losing subs in both markets but for different reasons,” Goei said. “We feel good about the fourth quarter turning around and looking better next year.”

Altice USA lost about 3,000 subscribers in 2021 — the only major cable operator to do so — and shed more than 50,000 broadband customers in the first half of this year.

Altice began accelerating its fiber rollout last year, with a goal of passing 6.5 million homes by 2025. At the Goldman conference, Goei said the company expects to end 2022 with 2.2 million to 2.3 million homes passed with fiber (an increase of about 1 million homes), and should add another 1.6 million to 1.8 million households by the end of 2023.

While other cable operators have seen an increase in competition from fixed wireless access providers from telcos, Goei said most of Altice USA’s telco competition is replacing slower DSL lines with fiber, hence the acceleration of its own fiber buildout plans. But he shared his peers’ disdain for fixed wireless access (FWA), agreeing with some pundit predictions that the technology will reach a performance and penetration plateau in the next two or three years.

Goei announced his intention to step down as CEO earlier this month, and will become executive chairman of Altice USA on October 3. In his place the company named Comcast executive Dennis Mathew as CEO, also effective October 3. Mathew has 17 years of experience with Comcast, most recently as senior VP of its Freedom Region (Southeast Pennsylvania, New Jersey and Northern Delaware). He earlier served as senior VP for its Western New England Region (Connecticut, Vermont, Western Massachusetts and areas of New York and New Hampshire) and has extensive experience in running cable businesses.

Goei said at the Goldman conference that his main motivation for stepping down was a desire to return to Europe, where he spent his childhood and most of his professional career, with his family. He added that he notified the Altice USA board of his decision about a year ago, starting the search process for a replacement about six months ago. He believes he’s leaving Altice USA in capable hands.

“I interviewed many, many people during the process; Dennis fits the bill across the board,” Goei said, adding that Mathew has a proven track record in operations, running one of Comcast’s most high-profile regions (the Freedom Region) and will fit in well with the Altice team. “He’s just a great guy, a team player, will focus on the prize and is someone who would do very well with the executive team at Altice USA.”

The average revenues per user (ARPU) on Altice USA’s fiber-based products are 7% to 8% higher than ARPU on cable-based services, he said. Additionally, churn rates on fiber services are also coming in about 6% to 8% lower than on HFC, and the NPS (net promoter score) for the fiber product is also coming in higher.

“Every single metric that you can imagine – that you would anticipate – are better” on the fiber product, Goei said. He acknowledged, however, that the installation process for fiber customers getting a triple-play bundle that includes pay-TV and voice could be better.

As for Altice USA’s fiber network build update, the company finished almost 270,000 new homes in the second quarter of 2022, a record the company expects to beat in Q3 and, weather permitting, in Q4.

For 2022, Altice USA expects to complete an additional 1 million fiber passings, with 1.2 million as its “stretch target.” That will put Altice USA in a position to end the year with 2.2 million to 2.3 million homes passed with fiber.

In 2023, Goei said Altice USA expects to ratchet up the build to 1.6 million to 1.8 million homes passed as the operator starts to push fiber upgrades into the Suddenlink footprint.

Altice USA is also doing edge-out builds to areas adjacent to existing facilities and pursuing grants for fiber builds in underserved and unserved areas. Altice USA has won grants or subsidies covering 40,000 to 45,000 homes, a number that Goei predicts could rise to about 200,000 in the next 12 to 24 months.

Altice USA, which has been fielding M&A inquiries about the Suddenlink properties, believes its fiber focus will set the stage for a return to broadband subscriber growth as early as Q4 2022, and certainly by sometime in 2023.

Goei said 80% of gross broadband subscriber adds in fiber areas take a fiber-based service. Though Altice USA is trying to convert HFC customers to fiber proactively, exceptions include customers who want to keep their existing setup or who are in homes and locations where a landlord won’t allow a new fiber drop.

Altice USA has been building a fiber broadband network in its Optimum territory in the New York tri-state area (New York, New Jersey, Connecticut) with 1.2 million fiber passings available for sales as of December 31, 2021. For Suddenlink, construction is expected to begin this year in areas of Texas. Additional states in the Suddenlink footprint that will benefit from this fiber expansion plan include areas of Arizona, California, Louisiana, Missouri, North Carolina, New Mexico, Oklahoma, and West Virginia.

“Altice USA is proud to announce plans to invest further in our fiber deployment strategy by accelerating the build of a 100% fiber broadband network capable of delivering multi-gig speeds across our Optimum and Suddenlink footprint,” said Dexter Goei, Altice USA Chief Executive Officer. “Fiber is the future and given the progress we have made at Optimum with our fiber expansion, we’re excited to build on that success and break ground later this year at Suddenlink to bring our advanced network to more customers and communities.”

Goei touched briefly on Altice USA’s Optimum Mobile product, which is supported by an MVNO deal with T-Mobile. He agreed that there are benefits to bundling mobile with home broadband but lamented that mobile EBIDTA is challenged by “thin margins” being driven by a mobile marketplace that’s seeing falling ARPU and rising levels of promotions.

With that backdrop, Altice USA expects to market fiber more aggressively than mobile this year and into 2023. “For the balance of this year, I don’t think you should expect real big waves in the mobile product,” Goei said.

Goei also offered some additional commentary on the recent announcement that he will be stepping down as CEO to become executive chairman of the board. Comcast exec Dennis Mathew has been tapped to take the CEO slot effective October 3.

Goei reiterated that he is shifting gears for personal reasons, as he and his family want to return to Europe. He said he informed the board of his decision about a year ago. Altice USA started its CEO search roughly six months ago.

In his new role, Goei said he will focus on “large strategic stuff” and external elements such as government affairs and conversations with the financial community, so that Mathew can focus squarely on operations.

References:

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

The rebirth of Google Fiber?

After a long pause on network expansions and reducing some of its original commitments in 2016 (including Santa Clara, CA), Google Fiber has once again building out it fiber network. Google Fiber CEO Dinni Jain [1.] wrote in a recent blog post:

“We’ve been steadily building out our network in all of our cities and surrounding regions, from North Carolina to Utah. We’re connecting customers in West Des Moines – making Iowa our first new state in five years – and will soon start construction in neighboring Des Moines. And of course, we recently announced that we’ll build a network in Mesa, Arizona.

And that’s just the stuff we’ve been talking about. For the past several years, we’ve been even busier behind the scenes, focusing on our vision of providing the best possible gigabit internet service to our customers through relentless refinements to our service delivery and products.”

Note 1. Dinni Jain is a former cable industry executive with MSO’s such as Time Warner Cable and Insight Communications,

Google Fiber says it’s talking to city leaders in the following states, with the objective of bringing Google Fiber’s fiber-to-the-home service to their communities:

- Arizona, starting in Mesa as announced in July

- Colorado

- Nebraska

- Nevada

- Idaho

Jain also opened the door to communities interested in building their own fiber networks, pointing to the municipal-focused model Google Fiber has established with cities such as Huntsville, Alabama, and West Des Moines. “We’ll continue to look for ways to support similar efforts,” wrote Jain, who took the helm of Google’s access business unit in 2018.

Google Fiber’s current high-end service provides 2 Gbit/s down by 1 Gbit/s up for $100 per month. Google Fiber has all but phased out its own managed IPTV service, but instead promotes several virtual multichannel video programming distribution (vMVPD) services, including DirecTV Stream, FuboTV, Sling TV and Google’s own YouTube TV.

Google Fiber’s current and planned network and service deployments using FTTP or Webpass, its fixed-wireless platform is depicted in the table below:

| Google Fiber Market | FTTP or Webpass |

| Atlanta, Georgia | FTTP |

| Austin, Texas | FTTP |

| Charlotte, North Carolina | FTTP |

| Chicago, Illinois | Webpass |

| Colorado | FTTP* |

| Denver, Colorado | Webpass |

| Des Moines, Iowa | FTTP |

| Huntsville, Alabama | FTTP |

| Idaho | FTTP* |

| Kansas City, Kansas and Missouri | FTTP |

| Miami, Florida | Webpass |

| Nebraska | FTTP* |

| Nevada | FTTP* |

| Nashville, Tennessee | FTTP |

| Oakland, California | Webpass |

| Orange County, California | FTTP |

| Provo, Utah | FTTP |

| Salt Lake City, Utah | FTTP |

| San Antonio, Texas | FTTP |

| San Diego, California | Webpass |

| San Francisco, California | Webpass |

| Seattle, Washington | Webpass |

| The Triangle, North Carolina | FTTP |

| *Google Fiber FTTP deployments coming to cities yet to be announced. (Source: Google Fiber) |

|

References:

https://fiber.googleblog.com/2022/08/whats-next-for-google-fiber.html

https://www.fiercetelecom.com/telecom/google-fiber-taps-former-twc-exec-jain-as-ceo

https://www.wired.com/2017/03/google-fiber-was-doomed-from-the-start/

Google Fiber drops 100Mb/s; Goes ‘All In’ on 1 Gig Internet Access

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

Frontier Communications reported better than expected 2nd quarter 2022 results on Friday. Operating income was $166 million and net income was $101 million for the 2nd quarter 2022. Adjusted EBITDA was $535 million, representing sequential growth of 5.1% from the first quarter of 2022, driven by the sequential increase in Consumer revenue, accelerating cost reductions, and a one-time $8 million sales tax refund. Adjusted EBITDA declined from $628 million in the second quarter of 2021 primarily due to subsidy-related revenue declines, partially offset by lower operating expenses and cost savings initiatives.

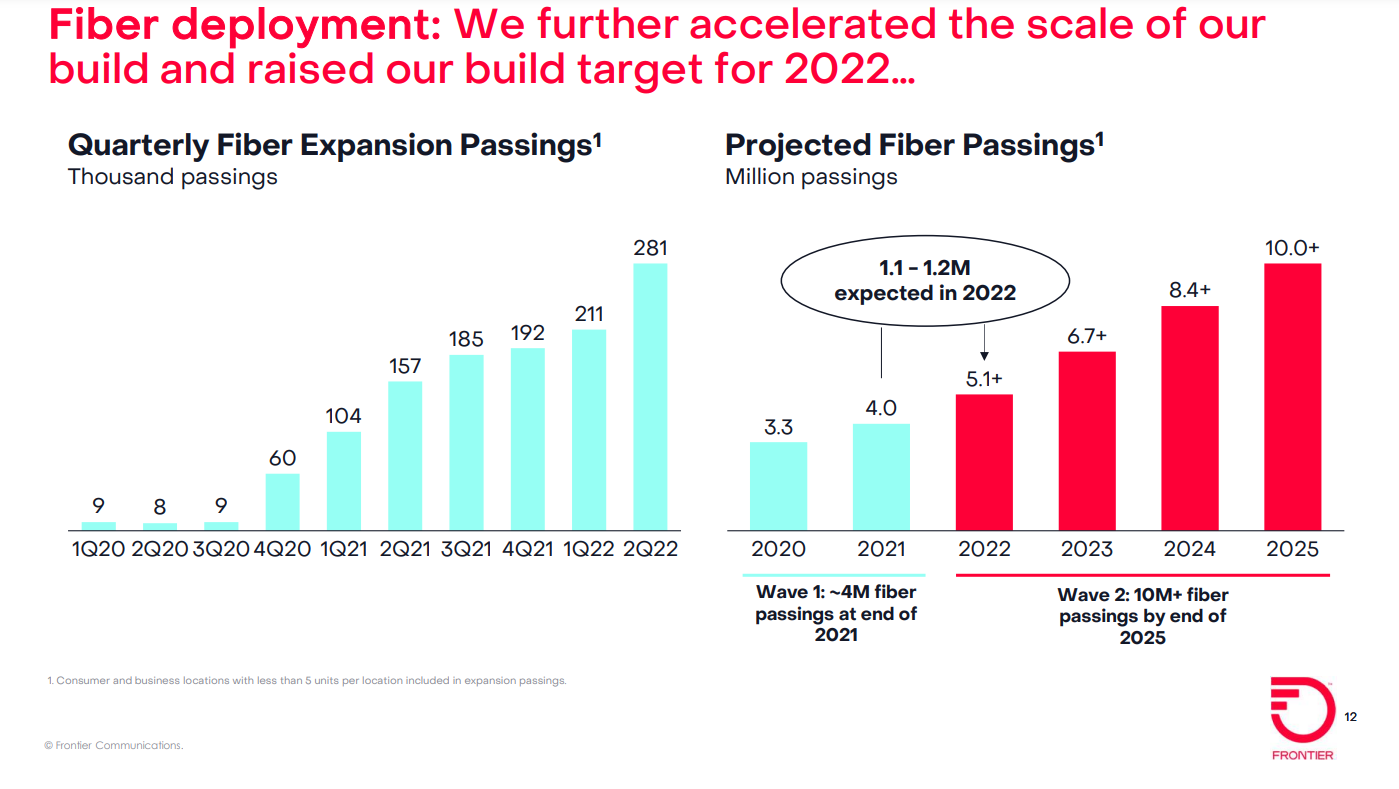

The fiber facilities based telco set another fiber network buildout record in the second quarter of 2022. Frontier also raised its fiber-to-the-premises (FTTP) buildout target for the full year to a range of 1.1 million to 1.2 million locations, up 10% to 20% from an earlier target of about 1 million locations.. Capital expenditures were $641 million, an increase from $385 million in the second quarter of 2021, as fiber expansion initiatives accelerated. Frontier’s fiber network passed 4.4 million locations (out of a total fiber footprint of 15 million locations covering parts of 25 states), a marker on the way to a grander plan to build FTTP to at least 10 million locations by 2025.

“Frontier is Building Gigabit America. We are deploying fiber and connecting people to the digital society at a record pace,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “We have the second-largest fiber build in the country and this expansion is unlocking new opportunities to meet increased consumer demand for blazing-fast fiber broadband while driving efficiencies across our business.”

Mr. Jeffery continued, “In the second quarter, we saw the impact of our operational success translate into financial growth, and we delivered sequential EBITDA growth ahead of schedule. Our team’s operational discipline over the last year has improved Frontier’s financial trajectory and positioned us as the preferred digital partner for customers across our footprint.”

Second-quarter 2022 Highlights:

- Built fiber to a record 281,000 locations

- Added 54,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 13.4% compared with the second quarter of 2021

- Revenue of $1.46 billion, net income of $101 million, and Adjusted EBITDA of $535 million

- Capital expenditures of $641 million, including $325 million of non-subsidy-related build capital expenditures

- Net cash from operations of $229 million, driven by healthy operating performance and increased focus on working capital management

- Raised $1.20 billion of debt in May, contributing to liquidity of approximately $3.70 billion

Frontier was able to accelerate its Q2 fiber buildout and expand its full 2022 target in the face of a “challenging supply chain and macroeconomic environment,” Jeffery said on the company’s Q2 earnings call on Friday August 5th. Jeffery noted that Frontier has diversified its fiber build into six additional states and plans to be building in at least 12 states by the end of the year. “This geographic diversity expands our opportunity to build fiber and provides redundancy for maintaining our build pace,” he said. Frontier is pairing that with additional contracts for both labor and equipment and realizing cost efficiencies using a blend of “cluster density” and new construction techniques – moves that are helping the company manage through both inflation and labor-related challenges, Jeffery added.

Frontier’s current FTTP buildout plan covering 10 million locations focuses on a portion of its footprint referred to as Wave 1 and Wave 2. The telco is also piecing together a plan for Wave 3 – a portion of its footprint with 5 million locations in rural areas deemed to be financially less attractive to build fiber.

However, Frontier execs said a fresh analysis indicates that between 1 million to 2 million of those Wave 3 locations can be converted to FTTP economically without government subsidies.

John Stratton, Frontier’s executive chairman, said the other 3 million to 4 million remaining locations in Wave 3 could also meet the company’s return-on-investment thresholds depending on how the distribution of some $42 billion in federal infrastructure funding pans out in the coming years. However, the overall funding plan for a Wave 3 build is still being ironed out. Frontier is also exploring other options for Wave 3, including partnerships and joint ventures.

As US cable operators and telcos struggled to gain broadband subs in Q2 2022, Frontier bucked the trend, adding 9,000 total broadband subs in the period when a loss of 41,000 legacy DSL/copper subs were included. Jeffery estimated that between 45% to 50% of all new Frontier fiber subs selected speeds of 1-Gig or more. Frontier launched a symmetrical 2-Gig fiber service in February.

Copper-to-fiber migrations are part of Frontier’s subscriber total, but the “vast majority” of those additions are coming from new customers, CFO Scott Beasley said.

“I think it’s clear to see from recent results that, as we’ve always said, fiber is a superior product to cable,” Jeffery said. “And while the cable and fiber market remains competitive, it’s also worth reminding ourselves that in our specific footprint, we have 84% of that where we have one or fewer competitors today. That said, in this quarter, we gained share against every competitor in every geography we operate in.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from Nick Del Deo, Senior Analyst at MoffettNathanson:

Frontier’s overall results in Q2 were solid, particularly with respect to financial metrics. On the subscriber front, Frontier continues to expand its fiber broadband base, adding 54K total fiber broadband customers (consumer and business), the same as in Q1, with a nice uptick in SMB adds (1K in Q4, 2K in Q1, and 4K in Q2). Gains came from both base markets and expansion markets. Copper losses also ticked up, but the company still added broadband customers overall, the third consecutive quarter it has done so. The company achieved this despite Q2 seasonality (primarily snowbirds in its Florida markets) and churning out nonpaying copper customers with the expiration of COVID-era requirements. Frontier is not seeing any deterioration in bad debt or customer payment trends with shifts in the macro environment.

In Q2, the cable industry posted total broadband net adds that were approximately zero, the first time this has happened since cable broadband was introduced about 25 years ago. Frontier’s telco peers reported weak results, too, with little change in fiber adds and heightened DSL losses. The management teams pegged the performance, to varying degrees, on: low gross connects stemming from low move rates; a return of seasonality that disappeared during the pandemic (e.g., college students); competition, most notably from fixed wireless (though this was not uniformly described as material); a pull-forward of some demand due to COVID over the past couple of years; and disconnects associated with government support programs rolling off. [Rightly or wrongly, market saturation has not been cited as a possible headwind.]

Frontier has banked the future of the company on broadband net adds, with a plan to upgrade a large portion of its footprint to FTTH and take share, primarily from the cable operators. The accelerating growth of Frontier’s fiber footprint offers some protection from market-wide trends, since it should mechanically gain net subscribers where it upgrades from copper to fiber. But Frontier has something else going for it, too: an ongoing transition from a company with weak management, a poorly received brand (to be generous), bad customer service, and no strategic focus to the opposite. These “softer” attributes matter.

Frontier stepped up the pace of its fiber expansion in Q2, adding 281K locations vs. 211K last quarter, and expects to reach 1.1-1.2M homes this year. While it remains early, Frontier’s expansion fiber cohort penetration rates remain encouraging; the 2020 build cohort stands at 22% at 12 months and 44% at 24 months, albeit on a small base of “golden” trials, while its larger 2021 build cohort stands at 17% at 12 months, right in the middle of its target range. While acknowledging “pockets” of expense pressure, the company remains confident in its $900-1,000 cost per location target. Management indicated that it now believes 1-2M of its 5M wave three locations, which have been set aside from an upgrade perspective, can be profitably converted to fiber without government subsidies (the 3-4M latter require support). The company did not announce specific changes to its fiber build plans with this update, but did note that some of these locations may be sprinkled in to the plans it has previously laid out. Management suggested these 1-2M locations would have a somewhat lower return profile than its wave two locations, in mid-teens rather than mid-to-high-teens. Financial results in Q2 were better than expected. Revenue was 0.8% ahead of consensus, with the effects of sustained fiber net adds and a jump in copper broadband ARPU driving the outperformance. EBITDA was 4.7% higher than consensus and was up sequentially.

References:

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

Global fixed access broadband subscribers reached nearly 1.3 billion at the end of Q1 2022, up by 1.7 percent from the previous quarter, according to the latest figures from Point Topic. The market research firm said the number of connections increased in 90 percent of the 131 countries researched, including the 20 largest markets. The global growth rate remains slightly less than a year ago.

For the first time ever, Fiber to the Home (FTTH) connections were more than half of all fixed broadband connections. Indeed, the share of FTTH in the total fixed broadband subscriptions continued to increase to 58 percent at the end of March 2022. Cable broadband connections were the next most common technology with a 17 percent share, while connections over all other technologies lost market shares to fibre. Compared to the end of 2021, FTTH connections increased 13.5 percent, while copper broadband lines were down 9.8 percent.

Main trends in Q1 2022:

-

Fixed broadband subscriber numbers grew in 90 per cent of the 131 countries covered in this report.

-

The share of FTTH in the total fixed broadband subscriptions continued to increase and stood at 58 per cent. Superfast and ultrafast cable broadband connections followed with an 17 per cent share. Connections over all other technologies lost market shares to fibre.

-

Between Q1 2022 and Q4 2021, the number of copper lines fell by 9.8 per cent, while FTTH connections increased by 13.5 per cent.

-

China added 14 million, Brazil 1.1 million and France a million fibre broadband subscriptions.

In Q1 2022, the quarterly fixed broadband subscriber growth rate stood at 1.7 per cent, with the number of connections reaching 1.3 bn (Figures 1 and 2). Similarly to Q4 2021, the growth rate was slightly lower than in the respective quarter a year ago.

WOW now offers 1.2G bps download speeds in all markets it serves

WOW! Internet, Cable & Phone, a leading broadband services provider, today announced the launch of its 1.2 Gig high speed data tier in all markets it serves. This highest speed tier is available for all new WOW! residential customers and available as an upgrade for existing residential customers.

The new speed tier offers 1.2 G Mbps download speeds and 50 Mbps upload speeds to support even faster Internet capabilities for residential customers – for work, entertainment, connecting with friends and family, and more – enabling simultaneous streaming, instantaneous downloads, professional-level gaming, and frictionless livestreaming.

“As part of our dedication to bringing customers the fastest, most reliable broadband speeds available, we’re now able to offer our fastest speeds yet across our markets with 1.2 Gig service,” said Henry Hryckiewicz, chief technology officer for WOW!. “Our ability to offer these speeds is just the latest demonstration of the deep capabilities available with our robust fiber network. Our customers now have even more options for staying connected and we look forward to seeing them benefit from it.”

Ongoing effects from the pandemic have reinforced WOW!’s commitment to bring even faster speeds to customers. With changing dynamics for how we work, learn and play, consumers need a reliable internet connection, with 81 percent of adults saying they’ve used bandwidth-hungry video calls since the onset of the pandemic according to Pew Research Center.

Along with its blazing fast 1.2 Gig speeds, WOW! is offering a free modem for the duration that the customer is subscribed to the plan, unlimited data usage where applicable and a $5.00 AutoPay discount.

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia. With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years. SOURCE WideOpenWest, Inc. Please visit wowway.com or call 800-560-1824 for more information. Areas served by WOW:

References:

Proximus to extend fiber coverage to 95% of Belgian premises

Belgian network operator Proximus is teaming up with private equity partners in a bid to deliver gigabit fiber service to 95% of the country. The telco is planning to reach a final joint venture (JV) agreement with I4B by the end of 2022.

The company this week inked a memorandum of understanding (MOU) with I4B – The Belgian Infrastructure Fund – whose founding investors are the Federal Holding and Investment Company (SFPI-FPIM), AG Insurance and Synatom, will act as an anchor investor to the project. I4B’s mission is to finance the development of infrastructure with a positive impact on Belgium’s economic development, while taking into account societal and environmental requirements.

One of the joint ventures will focus on rollouts in the French-speaking Wallonia region of the country while the other will zero in on Dutch-speaking Flanders. Proximus will serve as a minority shareholder for each JV and the anchor tenant on the networks built in each region.

Proximus and I4B plan to spend around €4 billion (approximately $4.2 billion) between the two JVs. Petra De Sutter, Belgium’s deputy prime minister, said in a statement the partnership between Proximus and I4B will help ensure internet access in areas with “no or insufficient connectivity today.”

According to a report released by the FTTH Council Europe in May, Belgium topped the list as the fastest growing fiber market in the European Union (including the U.K.) by percentage. Its figures showed Belgium’s number of homes passed grew 109% between September 2020 and September 2021, outpacing Israel (107%) Greece (90%), Cyprus (83% and the U.K. (80%).

FFTH Council Europe forecast the number of homes passed by fiber in Belgium will skyrocket 568% by 2027 to reach a total of 3.9 million.

References:

https://www.fiercetelecom.com/telecom/proximus-inks-mou-push-fiber-17m-more-locations-belgium

https://www.proximus.com/news/2022/20220629-fiber-rollout.html

FTTH Council Europe: 197 million homes passed in 2026 in EU27+UK

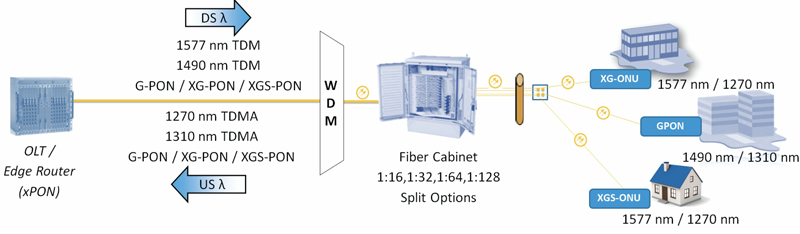

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022