O-RAN

Dell’Oro Group increases Open RAN radio and baseband revenue forecast

Dell’Oro Group has revised their Open RAN radio and baseband forecast. Total cumulative Open RAN revenues are now projected to approach $10B to $15B between 2020 and 2025.

“The momentum with both commercial deployments and the broader Open RAN movement continued to improve during 1H21, bolstering the thesis that Open RAN is here to stay,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “We are adjusting the forecast upward to reflect the higher baseline and the improved pipeline,” continued Pongratz.

Additional highlights from the Dell’Oro Group Open RAN Advanced Research Report:

- Open RAN revenues are expected to account for more than 10 percent of the overall RAN market by 2025, reflecting healthy traction in multiple regions with both basic and advanced radios.

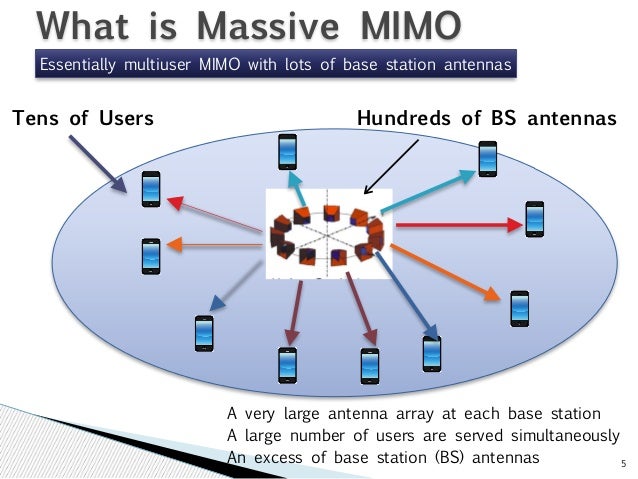

- Open RAN Massive MIMO projections have been revised upward to reflect the improved competitive landscape and the improved market sentiment with upper mid-band Open RAN.

- The shift towards Virtualized RAN (V-RAN) is progressing at a slightly slower pace than Open RAN. Still, total V-RAN projections remain relatively unchanged, with V-RAN expected to approach $2 B to $3 B by 2025.

Separately, Stefan wrote:

The long-term open RAN vision is built on three key pillars including open interfaces, virtualized technologies and vendor neutral multi-vendor deployments. In addition to leading the industry toward open and interoperable interfaces, the long-term roadmap maximizes the use of COTS hardware and minimizes the reliance on proprietary hardware (O-RAN Alliance).

Taking into consideration that one of the primary objectives is to capture the overall movement toward open RAN and the fact that it will take some time to realize the broader vision, it is somewhat implied that there will be room for interpretation when it comes to capturing this movement and tracking the open RAN market.

And within each of these pillars, there will be various degrees of compliance. Multi-vendor deployments are often associated with mixing and matching baseband and radio suppliers. But when Mavenir introduced the term “True Open RAN,” it meant true mixing and matching across the board – they want to work with anyone with any component. If someone gives them a radio they should be able to integrate it with their software. And vice versa, if another supplier provides the software “True Open RAN” would enable them to make it work with their Massive MIMO radios.

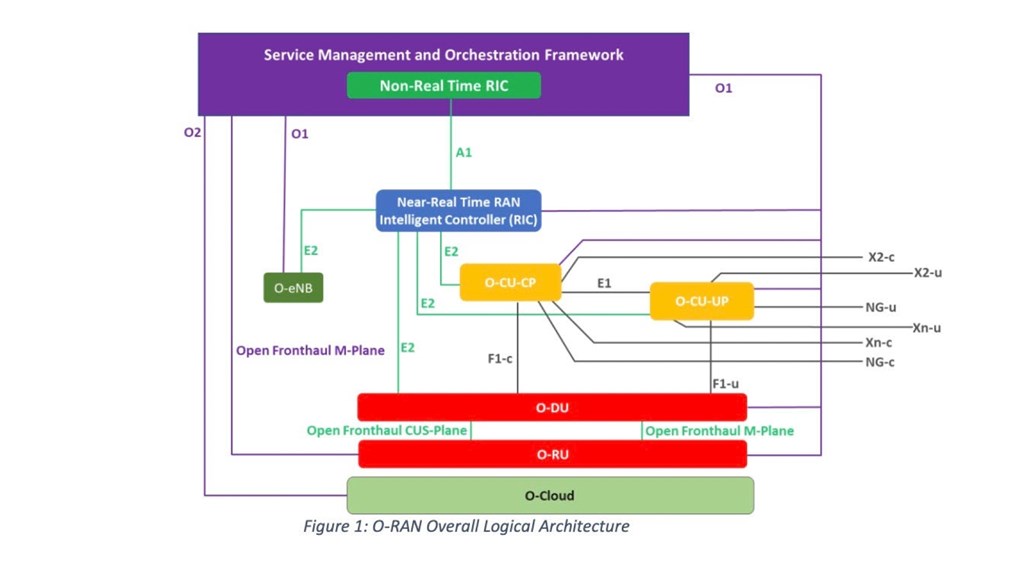

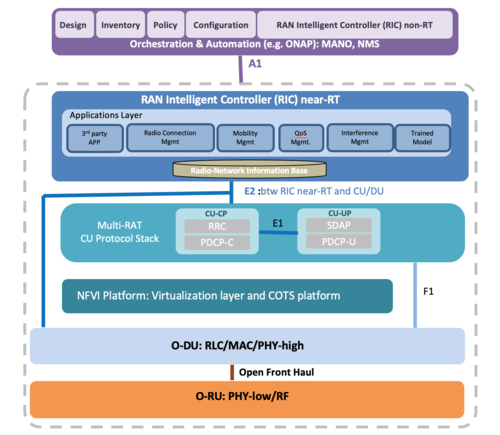

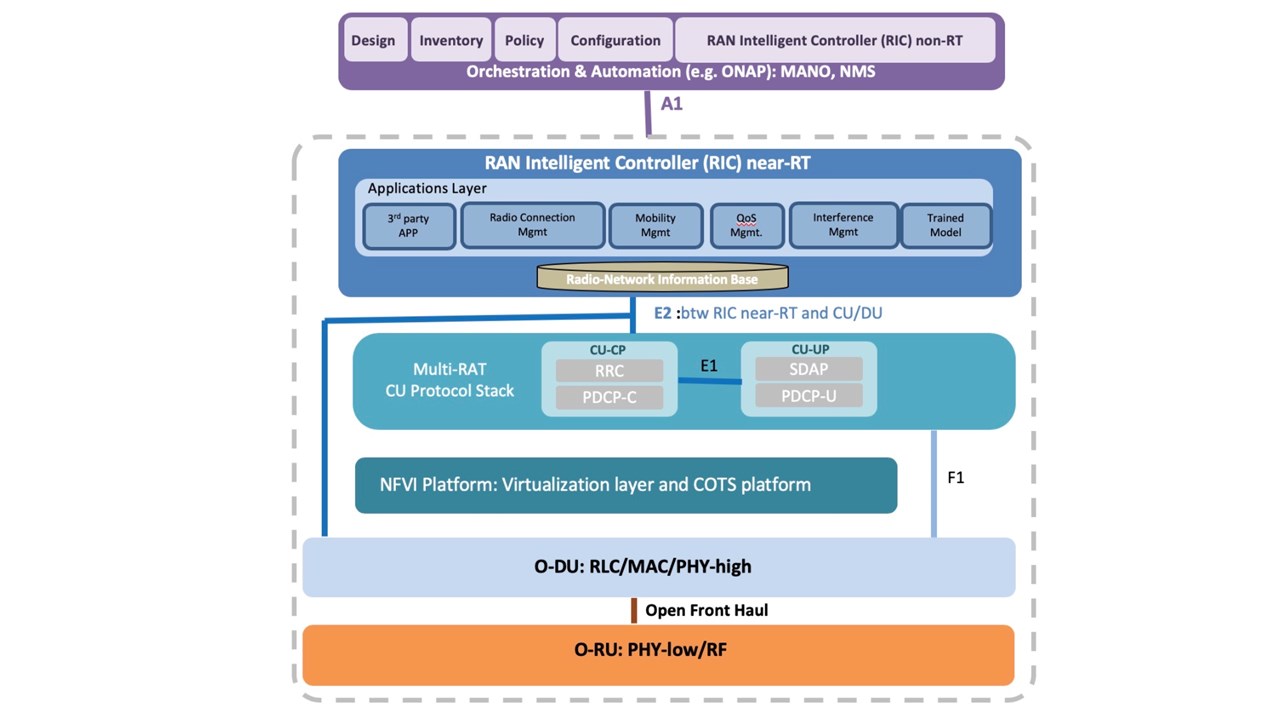

Not surprisingly, there is room for interpretation with the other building blocks as well. Open RAN compatible radios are now proliferating across the supplier landscape. But it is not always clear after browsing the data sheets what this entails from an open RAN specifications, customization and coverage perspective. With five interfaces (A1, E2, O1, O2, Open FH), multiple functions (SMO, Non-Real time RIC, Near-Real-Time RIC), and a confluence of profiles, there is not an abundance of confidence that the open RAN maturity would be consistent across the board.

The Dell’Oro Group Open RAN Advanced Research Report offers an overview of the Open RAN and Virtualized RAN potential with a 5-year forecast for various Open RAN segments including macro and small cell, regions, and baseband/radio. The report also includes projections for virtualized RAN along with a discussion about the vision, the ecosystem, the market potential, and the risks.

To purchase this report, please contact [email protected]

…………………………………………………………………………………………………………………………………..

Rebuttal: Open RAN Forecasts Way too High!

While not a market analyst cranking out forecasts, this author believes the Open RAN market will be a huge disappointment and revenues will be much lower than Dell’Oro and other market research firms forecast.

As Light Reading has correctly said, Open RAN is trading one type of vendor lock-in for another.

Trading one version of vendor ‘lock-in’ for another? Image Credit: Light Reading

That’s because the O-RAN Alliance specs have not led to vendor neutral interoperability, but rather partnerships amongst vendors to provide a complete Open RAN solution.

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

References:

Open RAN Forecast Revised Upward, According to Dell’Oro Group

https://www.fiercewireless.com/tech/not-all-open-ran-same-industry-voices-pongratz

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=1

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=2

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

Juniper Networks today announced plans to integrate its radio access network (RAN) intelligent controller (RIC) with Intel’s FlexRAN platform for Open RAN development.

This joint initiative between two companies is part of Juniper’s continuing efforts to bring openness and innovation to a traditionally closed-off part of the network, providing a faster route-to-market for service providers and enterprises to deliver 5G, edge computing and AI. Juniper views open RAN as an opportunistic endeavor and claims it’s currently testing the RIC integration in labs and trials with some tier-one operators. Juniper’s RIC takes direction from the O-RAN Alliance and adheres to open interfaces and APIs, but the specialized features it adds on top are proprietary.

Juniper has made major investments to lead the shift to Open RAN, beginning with the exclusive IP licensing agreement with Netsia (a subsidiary of Turk Telekom Group), and continuing with significant involvement in the O-RAN Alliance. Juniper is heavily engaged in expanding integrations with key partners and is part of the innovation team building joint customer solutions in Intel’s 5G Lab.

Spending on Radio Access Networks (RAN) is a significant amount of service providers’ CapEx, primarily due to limited vendor choice and closed architectures which lead to lock-in. Juniper recognizes that the RAN is a domain that demands openness and best-of-breed innovation to ensure the best experience for network operators and their customers, and is determined to lead the industry toward that vision.

Juniper’s collaboration with Intel includes the following:

- Juniper RAN Intelligent Controller (RIC) and Intel FlexRAN platform are pre-integrated and pre-validated to enhance usability of a full ORAN-compliant Intelligent RAN system

- Collaborative R&D work with Intel Labs for RIC platform-specific apps to improve customer experience, maximize ROI and drive rapid ORAN ecosystem innovation

- Joint customer testbeds with Intel to validate performance-improving implementation and speed of time-to-market

Juniper is an active member of the O-RAN Alliance, contributing to six working groups and serving as chair and co-chair of the slicing and use-case task groups, respectively. Juniper is also an editor of RIC specifications within the alliance.

Quotes:

“Juniper has always been committed to open infrastructures, which is why we are excited to support the work that Intel has undertaken with their FlexRAN ecosystem. By collaborating with Intel, we are able to deliver cloud-native routing, automation, intelligence and assurance solutions and services that are optimized for our customers’ needs, speeding time-to-market and enabling them to monetize faster.”

– Constantine Polychronopoulos, VP of 5G and Telco Cloud at Juniper Networks

“RIC is like the brain for open RAN, and we also call it essentially the operating system of the RAN,” said Jai Thattil, director of strategic technology marketing at Juniper Networks. Juniper intends to differentiate its RIC from others by pre-integrating and validating the technology so operators can adopt it as part of a more comprehensive offering combined with other services. “Juniper is kind of in a unique position, compared to a lot of other vendors” because of its experience in 5G transport, network cores, service management and orchestration, according to Thattil.

“The virtualization of the RAN continues to gain momentum across the industry as operators take advantage of cloud economics and the delivery of new services. This collaboration with Juniper and the validation of FlexRAN and RIC solutions will assist service providers to overcome integration challenges and accelerate time-to-market for future deployments.”

– Caroline Chan, VP Intel Corporation, GM of Network Business Incubator Division

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/juniper-nudges-open-ran-ric-into-intel-flexran/2021/09/

Additional Resources:

Media Relations:

Lori Langona

Juniper Networks

+1 (831) 818-8758

[email protected]

Strand Consult: What NTIA won’t tell the FCC about Open RAN

by John Strand, CEO and Founder of Strand Consult (see company profile and bio below)

Introduction:

In “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks,” (Docket Number: GN-Docket No. 21-63) the National Telecommunications and Information Administration (NTIA) makes many claims about Open RAN [1] and states what appears to be official U.S. Executive Branch policy promoting that technology. In particular:

As stated in the Implementation Plan of the National Strategy to Secure 5G, the U.S. Executive Branch agrees that “close coordination between the United States Government, private sector, academic, and international government partners is required to ensure adoption of policies, standards, guidelines, and procurement strategies that reinforce 5G vendor diversity and foster market competition.” One promising solution in line with these objectives is open, interoperable networks, including Open RAN. While this response focuses on Open RAN, the Executive Branch’s policy is to promote the development of Open RAN alongside other policies, technologies, and architectures that support 5G vendor diversity and foster market competition.

Strand Consult analyzes these claims, their references, and the assumptions underpinning them from security and economics perspectives. Strand Consult’s report also includes an appendix fact checking 35 claims by NTIA and well as 133 additional references to help investigate the technology.

OpenRAN (open radio access network) is an evolving topic. It is an industrial concept, not a technical standard. Stakeholders, including NTIA may define OpenRAN differently, provide different definitions, ascribe different purposes to it, and have different expectations.

Editor’s Note:

There are two Open RAN spec writing bodies- the O-RAN Alliance and the Telecom Infra Project Open RAN Group. Neither of them have a liaison with either 3GPP or ITU-R WP 5D which have produced specifications/standards for 4G-LTE Advanced and 5G RAN/RIT specifications (3GPP Release 10 and Release 15 & 16, respectively) and ITU-R standards (M.2012-4, and M.2150, respectively). The O-RAN Alliance does have a liaison arrangement with GSMA which this author claims was an Ultra-Oxymoron.

……………………………………………………………………………………….

Strand Consult’s research question is to determine if, when, and how OpenRAN and O-RAN will replace conventional RAN on a 1:1 basis without compromising network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality coverage and other factors.

Executive Summary:

We don’t believe NTIA’s comments provide insight to answer our questions. Strand Consult has found that most of the comments in NTIA’s report restate talking points from the OpenRAN industry and present policy arguments as if they were fact or technical analysis. As advisor to the US President and policy lead for the Executive Branch on telecommunications, NTIA is considered an authority and is expected to produce serious, objective policy. Indeed it would be welcome for an objective report from NTIA on OpenRAN with an authoritative list of critical references and information from test installations of the technology. Unfortunately NTIA’s report falls short of this expectation.

In our opinion, the main shortcoming of the report is that NTIA has either overlooked, ignored, or is unaware of the role of Chinese vendors in the OpenRAN industry. The separate but related ORAN Alliance has 44 Chinese vendors, many which are explicitly state-owned and military-aligned. At least 7 of these entities are on the US Dept of Commerce Entity List and others have lost their Federal Communications Commission operating license. NTIA has not conducted a security assessment of OpenRAN and yet it blesses the technology and pronounces that it is Executive Branch policy to pursue it. Strand Consult investigates NTIA’s other comments about the infrastructure market, competition, prices, and innovation and finds that many of them are either unevidenced or proffered by self-interested OpenRAN actors.

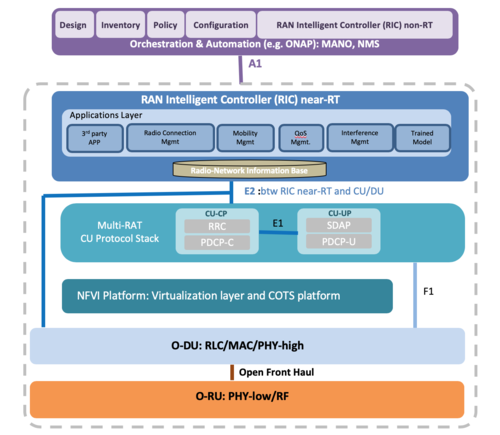

O-RAN Alliance Reference Architecture:

Image Credit: O-RAN Alliance

……………………………………………………………………………………………

Strand Consult’s Analysis:

In an effort to lift the level of policy discussion, Strand Consult reviewed “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks” from July 16th to the U.S. Federal Communications Commission’s (FCC) a part of the Inquiry in the proceeding on open radio access networks (Open RAN). The highly respected NTIA is chartered to advise the President and represent the Executive Branch view on telecommunications, and there is an expectation that NTIA’s reports are objective, authoritative, and empirical, particularly with its roster of employee scientists and technologists. The document submitted to the FCC appears to be written by staff lawyers and makes many debatable claims which are either unsupported or based on advocacy materials from the OpenRAN industry.

NTIA’s OpenRAN document does not live up to expectations for the following reasons:

Its lack of objectivity and empirical support

Its overlooking role of Chinese vendors in OpenRAN ecosystem

Its misunderstanding of the economics of infrastructure and innovation

Its unfounded assertions about competition and the role of OpenRAN.

Lack of objectivity and empirical support. Citing of interested parties as experts. The OpenRAN document published by NTIA offers very little empirical, or even academic policy, evidence for its assertions. Most of references cited, 55%, come from OpenRAN advocacy groups or companies with a financial interest in OpenRAN, for example self-described OpenRAN vendors. The main part of the document’s references are not technical studies but rather policy arguments.

Moreover, NTIA fails to disclose that its preferred sources are advocacy organizations. While there is nothing illegal about citing advocacy organizations, government agencies like NTIA are supposed to be above touting advocacy as fact, science, and official policy.

The O-RAN Alliance [2] develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) [3] like ITU-R and ITU-T. The O-RAN Alliance does not satisfy the openness criteria laid down in Word Trade Organization Principles [4] for the Development of International Standards, Guides and Recommendations.

The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification on top of 3GPP specifications and ITU-R standards for 4G and 5G.

While industrial cooperation is important, there can be no mobile networks without the basic work of organizations like ITU-R WP 5D, 3GPP (which is NOT a SDO) and its seven regional members (which are SDOs) [5].

OpenRAN concepts include: cloudification, automation and open RAN internal interfaces do follow some elements of 3GPP specifications.

It appears that NTIA is attempting to elevate the O-RAN Alliance, essentially a closed association, with established WTO compliant SDOs (e.g. ITU and IEEE) and global consortia like 3GPP. Such an elevation is false and deceptive, and NTIA should clarify why it promotes a closed association that doesn’t meet openness requirements in WTO.

NTIA could have balanced this shortcoming by referencing some the widely published critical reviews of OpenRAN. Unfortunately, it does not. For example, U.S. federal documents can create credibility by objectively stating competing views and discussing the merits, similar to the Congressional Research Service [6].

Because NTIA appears only to provide favorable views of OpenRAN from interested parties, its document is tainted with bias. It reads like a set of talking points from the OpenRAN Policy Coalition, the a front for the OpenRAN industry’s interests.

Overlooking the role of Chinese vendors in the OpenRAN ecosystem:

Another shortcoming is the apparent ignorance of the role of Chinese vendors in the OpenRAN ecosystem. NTIA forgets to name the 44 Chinese companies that make up the second largest national group in the O-RAN Alliance. It failed to disclose that seven of these actors are either on the U.S. Entity List [7] and have lost their FCC license to operate [8] . Those companies include: China Mobile, China Telecom, China Unicom, ZTE, Inspur, Phytium and Kindroid, companies

which are integrated with the Chinese government and military.

Nor does NTIA disclose that the European telco Memorandum of Understanding (MoU) [between Deutsche Telekom, Telefonica, TIM, Vodafone and Orange] that OpenRAN should be built on top of Kubernetes [9], which is a software

technology platform that has been infiltrated by the Chinese.

While it began life in 2014 as a Google project, Kubernetes currently is under the jurisdiction of the Cloud Native Computing Foundation, an offshoot of the Linux Foundation (perhaps the world’s largest open-source organization).

By late 2017, Huawei had gained a seat on the Kubernetes Steering Committee. Huawei claims to be the fifth-biggest contributor of software code to Kubernetes.

According to the “Report on the 2020 FOSS Contributor Survey” [10] from The Linux Foundation & The Laboratory for Innovation Science at Harvard, the open source community spends very little time responding to security issues (an average of 2.27% of their total contribution time) and reports that it does not desire to increase this metric significantly.

It appears to be a problem that Huawei and ZTE are increasingly involved in the leading open source technology 11 used by OpenRAN developers. It is not clear how this acceptance of Chinese involvement in OpenRAN is consistent with President Biden’s tough stance on security vis-à-vis China and other threat actors [12].

Conclusions:

NTIA’s document appears to endorse the O-RAN Alliance for the security of OpenRAN. However, NTIA doesn’t provide technical analysis or a security assessment of O-RAN Alliance specifications. It is not clear from the document whether NTIA had access to these specifications to conduct an assessment. In any event, ORAN Alliance members exchange specifications on OpenRAN every 6 months. This means that the 44 Chinese companies in the O-RAN Alliance get fresh OpenRAN “code” at least twice a year, NTIA provides no threat analysis, risk assessment nor potential mitigation of these processes.

–>This is a breathtaking omission that alone warrants further attention by the NTIA.

NTIA could have strengthened its credibility by providing an authoritative, empirical document to inform policymakers objectively about OpenRAN. Instead NTIA offers a document which merely restates the talking points of OpenRAN advocacy groups and industry. This fails the U.S. Executive branch and the American people who expect quality information and impartial judgement from an expert agency.

More importantly, the NTIA document mis-informs readers about the security risks of OpenRAN which greatly extends the cyber security attack surface with its many “open interfaces.”

Hopefully, NTIA will review the empirical information and update its assessment in a new report.

…………………………………………………………………………………….

Readers who know something about OpenRAN are welcome to weigh in with their comments in the box below this article.

…………………………………………………………………………………….

Notes & Hyperlinks:

https://www.ntia.gov/files/ntia/publications/ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf

2. https://www.o-ran.org/

3. https://en.wikipedia.org/wiki/Standards_organization 4. https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

5. https://www.3gpp.org/about-3gpp

6. Disruptive Analysis Report: Telecom & 5G Supply Diversification A long term view: demand diversification, Open

RAN & 6G path dependence

https://www.lightreading.com/open-ran/verizon-t-mobile-outline-their-open-ran-fears/d/d-id/769201 https://www.lightreading.com/open-ran/open-ran-has-missed-5g-boat-says-three-uk-boss/d/d-id/766258?

7. https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern/entity-list

8. https://www.fcc.gov/document/fcc-denies-china-mobile-telecom-services-application-0

https://www.reuters.com/article/us-usa-china-telecom-idUSKBN2B92FE 9.https://www.telefonica.com/documents/737979/146026852/Open-RAN-Technical-Priorities-Executive-Summary.pdf/cdbf0310-4cfe-5c2f-2dfb-c68b8c8a8186

10. Page 5 of: https://www.linuxfoundation.org/wp-content/uploads/2020FOSSContributorSurveyReport_121020.pdf

11. https://merics.org/en/short-analysis/china-bets-open-source-technologies-boost-domestic-innovation

12. https://www.reuters.com/article/us-usa-biden-cyber-war-idUSKBN2EX2S9

………………………………………………………………………………………………..

About Strand Consult:

Strand Consult is an independent consultancy with 25 years of telecom industry experience. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

John Strand (photo below) is CEO of Strand Consult. He founded Strand Consult in 1995.

The mobile industry exploded in the 1990s, and Strand Consult grew along with its new clients from the mobile industry, analyzing market trends, publishing reports and holding executive workshops that have helped telecom operators, mobile services providers, technology manufacturers all over the world focus on their business strategies and maximizing the return on their investments.

References:

ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf (doc.gov)

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consulting: Why the Quality of Mobile Networks Differs

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

by Prof. Kiran Kuchi, PhD & Dean of Research at Indian Institute of Technology Hyderabad (IITH) -edited by Alan J Weissberger, ScD EE

The development of 5G happens through a global forum called the 3rd Generation Partnership Project (3GPP). It’s a partnership between seven global Standards Development Organizations (SDOs) of which Telecommunications Standards Development Society, India (TSDSI) is a member. 3GPP kickstarted the 5G project in 2016 where we made substantial contributions to three successive releases of 5G specifications to date. IITH primarily led the efforts with significant support from CEWiT, IITM, and other Indian corporations (Tejas Networks and Reliance Jio are our major industry partners) with well over 300 technical documents submitted to date.

These sustained efforts led to the incorporation of several innovations introduced into the global 5G standards. One significant contribution that stands out is the introduction of a new transmit waveform, the only new waveform that is adopted in 5G, which is a generational change.

Both 4G and 5G adopted a waveform technology called OFDM (Orthogonal Frequency Division Multiplexing) that is quite suitable for the downlink transmission (that is the link between a base station (BS) and user equipment (UE)) but not so well suitable for the reverse link (that is the link between UE and BS). The limitations of OFDM owes to low-power efficiency (of about 10%). Prof Kuchi has designed a new waveform called “pi/2 BPSK with spectrum shaping” that provides close to 100% power efficiency and yet retains all the other advantages offered by OFDM.

This new transmit waveform allows the power amplifier in the UE to operate near its saturation level thus delivering a 3-4fold increase in the transmission power, and a hardware cost similar to that of OFDM. The overall gain in the cell range compared to OFDM will be at least twofold, hence this became a driver behind the design of the large cell 5G concept.

This indigenous waveform technology is developed for over a decade and is covered by a family of patents developed by IITH and CEWiT. There are well over 100 patents filed by IITH and WiSig to date. These patents will likely become the backbone of our indigenous 5G ecosystem. India’s 5G at ITU There are two parallel tracks that India took during the 5G development. The first effort is the aforementioned contributions to the 3GPP-based 5G standard, and our second noteworthy contribution is through TSDSI and the ITU (International Telecommunication Union). The second effort is led by IITM on the ITU front with significant backing and support from IITH, CEWiT (and Indian Industry such as Tejas networks, Reliance Jio).

ITU is a United Nations body that specifies requirements and radio standards for 5G known generically as IMT 2020. ITU-R WP5D had adopted India’s proposed Low-Mobility-Large-Cell (LMLC) use case as a mandatory 5G requirement in 2017. This requirement was adopted by ITU-R WP5D mainly as a result of sustained effort by the Indian entities through the Department of Telecommunications (DoT) to address the unique Indian rural broadband deployment scenario. Several countries supported this use case as they saw a similar need in their jurisdictions as well. TSDSI took this opportunity to develop the so-called LMLC based 5G technology that is a modification of 3GPP-based 5G specification.

This indigenously developed standard designated as 5Gi will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

This enhancement will ensure that 100% of India’s villages are covered from towers located at panchayat villages, whereas nearly a third of such villages would be out of coverage otherwise. Both 5G and 5Gi are fully compatible and interoperable systems that are being leveraged for the upcoming deployments in India. Adoption of the LMLC based 5G standards in India will enable India to leap forward in the 5G space, with key innovations introduced by Indian entities accepted as part of global wireless standards for the first time. The nation stands to gain enormously both in achieving the required 5G penetration in rural and urban areas as well as in nurturing the nascent Indian R&D ecosystem to make a global impact. The current national efforts are aligned with the national digital communication policy that promotes innovation, equipment design, and manufacturing out of India for the world market.

MeitY has been funding our wireless research for the past 10 years and these efforts have led to the development of larger wireless programs. More recently, the DoT (India Dept of Telecom) has sanctioned the “Indigenous 5G Testbed” program with a project outlay of 224 crores to IITH, IITM, CEWiT, IITK, IITB, IISc, and SAMEER.

This 3-year program, already close to completion, started yielding results in the form of prototype base stations, CPE/UE and NB-IoT chipsets. IITH stands out with major contributions to key 5G technologies such as cloud RAN base station with massive MIMO capability and cellular NB-IoT chipset for connecting sensors and meters to the internet. We are gearing towards full-fledged demonstration and field trials.

An upcoming player in the 5G space WiSig Networks (WiSig) is a 5G start-up incubated at the IITH tech incubator (i-tic foundation). WiSig has developed a 5G radio access network (5G-RAN) based on an emerging technology called O-RAN (Open-Radio-Access Network), that is being touted as the next major disruptor in the 5G landscape. This technology allows rapid deployment of low-cost, software upgradable 5G base stations in significantly higher volumes and larger densities than the current 4G network.

O-RAN is a disaggregated 4G/5G base station based on open interfaces and general purpose hardware. It is being defined by the O-RAN alliance, TIP Open RAN project and ONF SD-RAN v1.0 Software Platform for Open RAN.

Some operators have initiated the deployment of O-RAN based software-defined network and virtualization networks that enable self-organization, low operational cost and ease of introduction of new features and service upgrades. New 5G use cases can be introduced rapidly on the fly using software upgrades as opposed to costly and time-consuming hardware development cycles. WiSig has created commercial grade IP in this space and is well on track to carry out one of India’s first O-RAN compliant demonstrations of a software defined 5G massive MIMO base station. Overall, WiSig is well on its path to deliver 5G RAN intellectual property components to the global 5G supply chain.

LMLC based 5G technology is a modification of 3GPP-based 5G New Radio (NR) specification. This indigenously developed LMLC ITU-R standard, designated as 5Gi, will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

In contrast to high-speed mobile broadband, a vast number of IoT applications requires few bits to be exchanged with the internet intermittently. The key considerations of these kind of IoT devices are that they are ultra-low-cost and have a long battery life – up to 10 years. Narrowband IoT (NB-IoT) (Belongs to the 5G family of technologies is well suited for this purpose and is quietly emerging as a killer application for lowbit rate IoT applications. IITH and WiSig joined hands in commercializing a NB-IoT SoC (System on a Chip) that was successfully taped out in Q1 2021.

The chip is named “Koala” after an animal indigenous to Australia that sleeps about 20 hours a day – typical behavior of the NB-IoT modem.

Given that this is the first time a standards compliant cellular modem is designed in India and that both the software and hardware that goes into the chip is developed indigenously, this chip should preferably be leveraged to serve the security needs of critical national IoT infrastructure.

In summary, the investments made by Meity and DoT on 5G research have started to bear fruit in delivering the basic technological components and sub-systems required to build 5G. The time is ripe for the Government to nurture domestic design and manufacturing of 5G equipment. The country has enough talent and the technological depth required to support a domestic 5G ecosystem. With the right kind of policy support, then India is likely to see a 5G/IoT domestic manufacturing revolution within this decade. IITH will continue to play a pivotal role in shaping the 5G ecosystem not only in India but globally as well.

About Kiran Kumar Kuchi, PhD:

Kiran is a Professor Department of Electrical Engineering IIT-Hyderabad (IITH) and Dean of Research. He also started WiSig Networks that has been incubated at IITH. He received PhD and MS degrees in Electrical Engineering from the University of Texas at Arlington, TX. His current projects include: Cloud radio, Heterogeneous networks (HeNets), Next generation wireless test-bed development.

References:

https://pcr.iith.ac.in/Kiriith-Issue-6,April,20215GandNext-GenCommunicationTechnologies.pdf

5 European telcos publish Open RAN Technical Priorities Document

Five major European network operators have issued a white paper outlining their technical requirements for the open, disaggregated radio access network products they want to deploy in significant deployments starting next year.

The telco quintet – Deutsche Telekom, Orange, Telefónica, TIM (Telecom Italia) and Vodafone – signed the Memorandum of Understanding (MoU) on The Implementation of Open RAN Based Networks In Europe earlier this year and have now set out their technical stall so that the vendor community has some guidance with which to work.

The ‘Technical Priorities Document’ provides a set of “technical requirements that the signatories of the Open RAN MoU consider priorities for Open RAN architecture. It serves as a guidance to the RAN supplier industry on where to focus to accelerate market deployments in Europe, focusing on commercial product availability in the short term, as well as solution development in the medium term. In terms of timeframe, the operators wish to ensure the readiness of Open RAN solutions for large scale network roll-out from 2022 onwards. Macro deployment is identified as the primary target for the operators.”

The telco quintet say they are not seeking to develop new specifications or standards in this process, but simply identify their preferences in terms of technology and architecture that are based primarily on the specifications being developed by the O-RAN Alliance.

There are many requirements, particularly around the IT requirements underpinning the Open Cloud architecture that needs to support containerized cloud native functions (CNFs). You can read the full document here.

Opinion:

How many Open RAN technical requirements and spec writing consortiums/alliances are necessary? We already have O-RAN Alliance, TIP Open RAN Project, Open RAN Policy Committee, and slew of company alliances. That is NOT the way specifications are created as there are surely overlaps, duplications and gaps in one or more of these entities requirements documents. This will surely result in mass confusion and slow the market for Open RAN equipment.

The way to proceed, IMHO, is to have the operators work through the O-RAN Alliance to state which of their requirements are mandatory and which are optional. This is what PTT’s did from 1976-1996 within CCITT to standardize X.21, X.25, ISDN, Frame Relay, and ATM. They did likewise from 1998-2000 to standardize ADSL and VDSL within ITU-T.

……………………………………………………………………………………………………………………………………………….

The Open RAN Requirements document highlights multiple interfaces that need specific attention by technology developers. For example, adherence to an Open F1 interface for the centralized unit/distributed unit (CU/DU) split, as well as Open X2/Xn interfaces for connectivity between base stations – but stresses the importance of open fronthaul, described as “the prime interface to be supported in a fully interoperable manner, without compromising network performance, especially for Massive-MIMO.” The O-RAN Alliance 7.2x interface the preference of the five operators, though they note there is the need to “further investigate UL [uplink] enhancements for the 7.2x split in order to improve performance and robustness particularly in mobility scenarios.”

The paper also stresses that focus should be on 4G/5G in the 3.4-3.8 GHz bands as well as legacy FDD (frequency division duplex) bands. The operators believe that mmWave bands are more specific to certain markets and so not as important initially for this set of operators. As for interoperability with legacy mobile networks, the paper notes that “the operators are interested in inter-operability between 2G/3G baseband units and RUs, based on proprietary interfaces, since no open interface has been specified successfully. This applies mainly to hybrid Radio Units supporting 2G/3G/4G/5G, but also for legacy 2G/3G only RUs already deployed.”

In addition, the operators need to be sure that the Open RAN technology they deploy will enable RAN sharing: “While MORAN [multi-operator RAN] with shared O-RU only and MOCN [multi-operator core network] support is unanimously requested, both shared infra and dedicated infra per operator is relevant, depending on whether the infra is deployed on the same site or deployed autonomously by each operator in their target location (e.g. in their own cloud). Efficient RAN sharing management is required to allow sufficient independence between operators to manage their own CNFs on a shared infra, while avoiding any potential conflicts.”

References:

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consult is attempting to determine if, when, and how Open RAN (TIP project) and O-RAN (Alliance) will replace conventional RAN on a 1:1 basis without compromising the network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality, coverage, and other factors. Here are few things to keep in mind.

In general, mobile ARPU is falling. In many countries, operators are trying to shift the focus away from price by competing on innovation and quality. For example, US mobile operators compete on the quality and coverage of their 4G and 5G networks. Mobile operators are focused on rolling out technology quickly, maintaining customer satisfaction, and ensuring quality of experience and other key performance indicators (KPIs). Chief technology officers, network managers, and other technical staff are laser focused on these KPIs and are loath to make changes to which would negatively impact these indicators.

In general, Strand Consult observes that what public affairs officials say about OpenRAN differs significantly from what network managers say.

Strand Consult’s 10 parameters to evaluate OpenRAN:

Strand Consult’s investigation has been guided by 10 parameters or questions to determine the value of OpenRAN. Here is what we’ve learned.

- Whether OpenRAN is a technical standard. The O-RAN Alliance is a private organization that develops technical specifications for OpenRAN. It should not be confused with the OpenRAN Policy Coalition which is a public affairs organization. The O-RAN Alliance is not a standards development organization (SDO), but rather an industrial collaboration that builds solutions on top of 3GPP specifications. While industrial cooperation is important, there can be no mobile networks the 3rd Generation Partnership Project (3GPP), an umbrella term for many standards organizations which develop protocols for mobile telecommunications and define the technological inputs for cellular networks. Companies like Rakuten develop their own corporate and proprietary concepts for OpenRAN. These concepts that do not necessarily follow a particular standard (3GPP) or O-RAN Alliance specification.

- Whether OpenRAN can replace Chinese equipment. Some mobile operators have suggested that OpenRAN is the way to avoid Huawei and ZTE in mobile networks. However other Chinese companies are deeply involved with OpenRAN technical specifications, product roadmap, and strategy. One founding member of the O-RAN Alliance is China Mobile, a state-owned company and the world’s largest mobile operator with 950 million subscribers and 450,000 employees. The O-RAN Alliance has more than 40 Chinese member companies, many of which government-owned and military aligned (See Strand Consult’s research note 44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G). The Chinese members of 0-RAN Alliance outnumber the Europeans. China Mobile’s Chih-Lin has veto power over the organization. China Mobile leads or co lead 8 of the 9 O-RAN Alliance’s working groups either as chairman or vice-chairman.

- OpenRAN and 5G innovation. OpenRAN proponents claim it will have a revolutionary impact on 5G, however reports suggest that large scale deployment of OpenRAN won’t happen until 2025. This means that OpenRAN cannot replace existing RAN on a 1:1 basis today. The 5G networks rolled out today use the standards from 3GPP Release 15 with increased functionality forthcoming in Releases 16 and 17 within two years. There are more than 144 3GPP-5G commercial networks deployed but only one proprietary OpenRAN 5G network (Rakuten). If OpenRAN is to increase 5G innovation, it must evolve faster than 5G itself. Presently it is not on par with the 5G standards defined years ago. It is difficult to see how OpenRAN can catch up when the significant resources already supporting the 3GPP standards timeline.

- OpenRAN and 5G deployment. Today mobile operators are rolling out 5G at a faster than 4G and even fast than 3G. In practical terms, 5G networks already built in 2019 and 2020 and those to be built in 2021 and 2022 already have the standards roadmap in place. If OpenRAN can’t catch up by 2025, operators have only two choices, delay 5G until 2025 (when 6G will start to take root) or replace their 5G equipment in 4 to 5 years. OpenRAN may be too little, too late for 5G operators.

- OpenRAN and vendor diversity. OpenRAN proponents claim that it will create more competition in the network equipment market. The 5G network equipment vendor market has many vendors and segments. Omdia details more than a dozen full-service providers with additional providers in segments for antennas, basebands, remote radios, small cells, macro cells, phase shifters and so on. This idea that there are not many vendors for 5G equipment was likely created by Huawei to deter the security reviews and subsequent restrictions imposed on the military-aligned company. If anything, the restrictions on Huawei have helped to open the door to new equipment vendors which could not compete because of Huawei’s predatory pricing and anti-competitive tactics. For example, Samsung has quickly gained market share and is supply 5G rollouts in the US, Australia, and other countries.

- OpenRAN and network equipment cost. OpenRAN proponents suggest that it can lower the cost of network equipment. The cost competitiveness of OpenRAN versus RAN is not yet known. It may be that some OpenRAN providers can offer equipment more cheaply on some parameters, but the cost advantage may not be significant when considering all the costs such as supply, availability, energy consumption, security, warranty, network integration, equipment matching, new contracts and service level agreements etc. However, operators frequently reduce their number of vendors so that they can enjoy lower unit costs with volume purchasing, the company BUYIN is a great case. For an operator’s perspective, check out the comments from Neil McRae, Managing Director and Chief Architect at BT (Scroll to minute 51 minute in the video). McRae explains that when he took his job, he inherited a network portfolio with 50 vendors. He subsequently reduced it to 4 vendors and saved £1 billion in 3 years. He observed that too many vendors not only increased cost, it increased complexity. He is wary of notions of “open architectures” which require managing portfolios of 5-50 vendors. He noted that vendor reduction increased shareholder value and that he would pursue the same strategy again.

- OpenRAN and security. OpenRAN proponents suggest that OpenRAN technology and the “unbundling” of 5G hardware and software is the means reduce reliance on Huawei and hence greater security. However, it is not clear how trading one known insecure Chinese vendor for 50 unknown Chinese vendors is the path to greater security. The issue of backdoors is omnipresent on all Chinese hardware given the country’s disposition and associated intelligence and surveillance policies. Moreover, it is not clear how security is improved when network owners must vet not one, but multiple new OpenRAN vendors. The time and cost to perform this review would seem to be multiplied by the number of vendors the operators takes on.

- OpenRAN and energy efficiency. Energy efficiency is an increasingly important issue for mobile operators which expect to compete on carbon reduction strategies. Naturally if OpenRAN could offer a greener solution, that would be an advantage. However, it is reported that many OpenRAN installation use the Intel X86 processor, which is less efficient than specialized RAN chips. If anything, energy consumption could increase if signals must traverse a multitude of mix and match components instead of a single end-to-end system designed with energy efficiency in mind. To reduce energy, Apple developed tits own processer as an alternative to Intel X86.

- OpenRAN and Rakuten. The media has promoted a supposed Rakuten success story with OpenRAN success. However, Rakuten is not offering open-source tools, but rather proprietary OpenRAN solution. It offers this through a freemium model in which free service is offered for a period, and operators pay down the line. Some companies have success with freemium and loss leader models, but typically they need scale.

- OpenRAN and the indigenous movement. OpenRAN has been promoted as a way to support domestic innovation like India or Brazil or what Germany’s Economic Minister calls for European-only actors in 5G. Curiously many of these calls are coupled with operator strategies to keep Huawei equipment in place because OpenRAN will not be ready for some years. Policymakers have also pursued subsidies and other financial incentives to support local OpenRAN startups which may design the equipment in their respective country but manufacture it in China. Unfortunately, production in China and with Chinese partners could compromise security, as the Supermicro case demonstrates.

Conclusion

The many problems that OpenRAN is purported to solve is impressive. In fact, I have to go back to 3G in 2000 to find the level of hype observed today with OpenRAN. Indeed, the Huawei problem is so serious that people are desperate for a solution. However, in the enthusiasm for the OpenRAN solution, too many want to look past the inconvenient reality that China is shaping much of the Open RAN future particularly through the O-RAN Alliance.

It is important to develop secure alternatives to Huawei, but this is not a reason to oversell OpenRAN. While it may be commendable to pursue the goals proffered by OpenRAN proponents, the actual impact of OpenRAN must be measured by real world facts and experience.

The questions remain how OpenRAN will affect the CAPEX and OPEX mobile operators in the short, medium and long term and whether operators will buy OpenRAN as a serious 1:1 alternative to standard RAN in Paris, London, Berlin, Madrid, New York, Sao Paulo and Copenhagen. It seems that OpenRAN is falling short of expectations.

Separately, AT&T told the FCC it plans to begin adding open RAN-compliant equipment into its network “within the next year.”

That puts AT&T on roughly the same timeframe as Verizon. Verizon’s SVP Adam Koeppe told Light Reading earlier this year that the operator’s 5G hardware vendors – Ericsson, Samsung and Nokia – will begin supplying open RAN-compliant equipment starting later this year. And he expects that the bulk of their equipment shipments to Verizon will comply with open RAN specifications by next year. AT&T told the FCC it expects to implement similar changes into its own network.

“The challenge for an operator shifting to any open network architecture, including but not limited to O-RAN, will be maintaining network reliability, integrity and performance for customers during the transition,” the operator wrote in a filing. “For our part, AT&T serves multiple customer groups, with varied and often complex, service requirements. As we introduce O-RAN into our network, our goal will be maintaining the same high level of performance at scale. We are actively working in this direction.”

References:

https://www.lightreading.com/open-ran/atandt-to-launch-open-ran-by-next-year/d/d-id/769199?

AT&T to FCC: Promoting the Deployment of 5G Open Radio ) Access Networks – GN Docket No. 21-63

https://ecfsapi.fcc.gov/file/1042871504579/AT%26T%20Comments%20to%20FCC%20NOI%20(04.28.21).pdf

Mavenir and Xilinx Collaborate on Massive MIMO for Open RAN

Mavenir, an upstart end-to-end cloud-native network software provider and Xilinx, a leader in adaptive computing, announced today the companies are collaborating to bring to market a unified 4G/5G O-RAN massive MIMO (mMIMO) portfolio to enable Open RAN deployments. The first mMIMO 64TRX joint solution is expected to be available in Q4 2021.

Working together, the two companies have successfully completed end-to-end integration of a first-generation mMIMO solution using Open RAN principles. Held at the Mavenir Lab in Bangalore, India, the integration covered multiple deployment scenarios and was evaluated by six CSPs, all leading global operators. Mavenir delivered the Virtualized RAN (vRAN) support for mMIMO, including Core Network, CU and DU, with Xilinx providing the Category B O-RAN Radio Unit.

“This integration demonstrates an efficient Open RAN massive MIMO solution to achieve diversification of the telecommunications supply chain,” says Pardeep Kohli, President and CEO, Mavenir. “This is an important milestone in the delivery of open and interoperable interfaces enabling the deployment of mMIMO in high density, high mobile traffic metro areas.”

“We were early proponents of Open RAN technology along with Mavenir and actively led in standards development in the industry through many field trials around the world,” said Liam Madden, executive vice president and general manager, Wired and Wireless Group at Xilinx. “With the investment we have done on our market-leading wireless radio technology and massive MIMO R&D, we are excited to collaborate with Mavenir to bring our collective technology and radio system expertise together that will accelerate the deployment of market leading 5G O-RAN massive MIMO radio solutions.”

With history of leadership success in various 4G and 5G network deployments worldwide, the companies are jointly developing the next generation of mMIMO products which will bring the world’s first O-RAN compliant 64TRX mMIMO products that support up to 400MHz instantaneous bandwidth in a compact form factor. Mavenir’s vRAN software supports Multi-User MIMO with up to 16 layers, advanced receiver algorithms, full digital beamforming – all running on Mavenir’s open and flexible cloud-native platform, as well as on other cloud platforms.

These products will leverage Xilinx’s technology platform including RFSoC DFE and Versal AI for advanced beamforming, delivering a fully integrated hardware and software O-RAN compliant mMIMO solution.

The wireless industry’s focus is squarely set on massive MIMO as mid-band spectrum 5G deployments continue, particularly following the record high mid-band 5G spectrum auction that concluded in the U.S. earlier this year. Massive MIMO is especially important in mid-band 5G networks because it allows operators to densify network coverage, increase capacity and coverage, and reduce the need for incremental outdoor sites, all of which translates to less labor and lower costs.

Mavenir and Xilinx have not yet disclosed the specifications for the equipment, but claim the equipment at the top of the portfolio will feature a 64-antenna array for transmitting and receiving signals and support up to 400 megahertz of bandwidth. The initial supply of radios will support C-band spectrum in the U.S., and the companies plan to later support mid-band spectrum for 5G deployments in Europe, the Middle East, and India.

The vendors are coming together to prove that “open RAN massive MIMO radios are a reality, and we will deliver that to the market. Our first open RAN massive MIMO radio will be labs ready by early Q4 and field-trial ready by the end of the year,” said Gilles Garcia, a senior director at Xilinx.

“5G Open RAN has significant momentum in the market with ABI Research forecasting network vendor spending to reach $10 billion by 2026-27 and then surpass traditional RAN at $30 billion by 2030,” said Dimitris Mavrakis, senior research director of 5G at ABI Research.

“As Mavenir and Xilinx continue to work together to accelerate O-RAN-based massive MIMO adoption, their solutions will be well-timed to serve this high-growth market with the higher spectral efficiency, performance, power efficiency and cost needed as 5G demand intensifies.”

NTT DOCOMO selects Samsung for 5G and O-RAN network solutions

Samsung Electronics announced on Monday that it has been selected as a 5G network solutions provider for NTT DOCOMO, the leading mobile operator in Japan with 82 million customers. Samsung will support DOCOMO (now wholly owned by NTT Corp.) with its innovative 5G technology, including O-RAN-compliant solutions, to bring enriched 5G services to users, advance digital transformation for businesses, and improve society at large.

As part of its ongoing strategy to deliver an advanced network and provide customers an array of enhanced mobile services, DOCOMO leverages leading edge-technologies in its 5G network.

“As a leading mobile operator, our goal is to provide our customers the best possible services for creating innovative, fun and exciting experiences and finding solutions to social issues,” said Sadayuki Abeta, General Manager of the Radio Access Network Development Department at NTT DOCOMO. “We are excited to collaborate with Samsung for the next phase of 5G Open RAN and accelerate the expansion of our ‘Lightning Speed 5G’ coverage in the nation.”

“We are pleased to be part of DOCOMO’s 5G networks and look forward to continued collaboration in advancing 5G innovation for their customers,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “Our goal is to leverage Samsung’s technical leadership to bring the best network solutions to mobile operators around the world, so they can deliver the next generation of transformative 5G services and electrifying user experiences.”

“The agreement between NTT DOCOMO and Samsung is significant,” said Stefan Pongratz, Vice President at Dell’Oro. “NTT DOCOMO has a history of being at the forefront with new and innovative technologies and this announcement cements Samsung’s position as a major 5G RAN supplier.”

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

This is the latest in a series of recent contract awarded to Samsung. The company scored its biggest win when it received a $6.6 billion 5G contract from Verizon, replacing Nokia. It got a contract from Canada’s SaskTel earlier this month and is also in talks with European telecom operators to gain a foothold on the continent.

It is supplying 5G RAN to New Zealand’s Spark and last week announced it will be the sole 4G/5G core and RAN supplier to Sasktel. Samsung also supplies 5G RAN and core equipment to SK Telecom and KT in its home market.

NTT DoCoMo already has a broad slate of 5G vendors. Fujitsu supplies RAN equipment, NEC core and edge, Nokia baseband and Ericsson (a major supplier to rival KDDI) supplies RAN optimization. Six weeks after DoCoMo, a founding member of the O-RAN Alliance, unveiled its “5G Open RAN Ecosystem” aimed at “accelerating open RAN introduction to operators” worldwide. Members include NEC, Fujitsu, Mavenir, Intel and Qualcomm which are DoCoMo’s own team of preferred open RAN solution vendors.

………………………………………………………………………………………………………………………………………

References:

https://news.samsung.com/global/samsung-collaborates-with-ntt-docomo-on-5g

https://www.lightreading.com/asia/samsung-networks-lands-docomo-for-5g-open-ran/d/d-id/768255?

TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

The Telecom Infra Project (TIP), one of several industry consortiums creating specifications for open radio access networks (Open RAN), recently announced a new 5G Private Networks subgroup.

Editor’s Note:

We don’t know whether the TIP OpenRAN project or the O-RAN Alliance has (and will have) more industry influence and impact. In addition, there are many splinter partnerships forming; many of them led by Rakuten Mobile. What’s mind boggling is that none of the groups have liaison agreements with either ITU-R WP5D (responsible for all IMT standards, including 4G and 5G) or 3GPP (the prime spec writing organization for mobile networks).

……………………………………………………………………………………

5G Private Networks contribute to improve the quality of experience for 5G connectivity, including better coverage and capacity through on-premise radio equipment, the ability to support low latency and high bandwidth service requirements through edge compute & routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

For network operators, 5G Private Networks also create the opportunity to implement new network management and operational models, enabling full automation of the operation of the enterprise network while improving end customer application experience.

However, to fully capture the benefits of 5G Private Networks, a different approach is required, because traditional network architectures, focused on large scale deployments and operations don’t have the right economics or the operational flexibility to efficiently deliver on the emerging needs of enterprise customers.

The 5G Private Networks Solution Group will develop a new approach to manage and operate 5G Private Networks, based on a cloud-native architecture, and making use of a new class of software management tools, based on the paradigms currently used for the cloud, but adapted to deliver the requirements of a telecom network environment. Telefónica will test the solution in their local TIP Community Lab in Madrid and then move to field trials in Málaga (Spain).

Juan Carlos Garcia, SVP Technology Innovation & Ecosystem, Telefónica, and TIP Board Director said: “This new solution group will enable operators to address the exciting opportunities that 5G is creating in the enterprise segment, both through valuable features for our customers and more efficient network operations. The TIP community is the perfect environment for this innovation, as it will allow us to leverage multiple current project groups (Open Core Networks, OpenRAN) to deliver an end-to-end Minimum Viable Product that we will then test in Telefonica’s TIP Community Lab.”

In particular, the new Solutions Group will leverage previous work contributed to TIP’s OpenRAN Project Group, on a first version of a CI/CD platform that applies traditional IT methodologies to automate integration, testing and deployment of OpenRAN software.

Ihab Tarazi, CTO and SVP, Networking and Solutions, Dell Technologies and TIP Board Director, said: “For open networks to deliver their benefits, the telecom industry needs an abstraction layer that helps integrate different components into end-to-end solutions. New software management tools based on the ones currently used for the cloud can address this need, and this Solution Group is a timely initiative for the industry to collaborate on making this happen.”

Caroline Chan, VP and GM Network Business Incubation Division, Intel and TIP Board Director, said: “Through the recently launched solution groups, TIP is expanding its scope to include the validation of interoperability between different elements across the whole network, and insights and recommendations about how to operate them. The new 5G Private Networks Solution Group is a strong example of this approach. With dedicated local private high-performance network connectivity as a key emerging deployment model for 5G and edge buildout, this group can help foster important ecosystem collaboration.”

As a result, this new solution group will help drive:

- Improved network economics, through the use of commoditized hardware and open source software, and more efficient and flexible network operations and automation, enabled by the adoption of cloud-native technologies.

- Dedicated local high-performance 5G connectivity and edge computing infrastructure, appealing to multiple B2B & B2B2C verticals.

- Better network security and performance.

Telefónica is one of the five European telcos that announced that they will work together on open RANs for mobile networks. The others are Deutsche Telekom, Orange, TIM and Vodafone. A memorandum of understanding (MOU) for that grouping commits the five to the O-RAN Alliance, which has 27 network operator members from AT&T to Vodafone, and to “other industry initiatives, such as the Telecom Infra Project, that contribute to the development of open RAN and that aim to create a healthy and competitive open RAN ecosystem and advance R&D efforts.”

……………………………………………………………………………………………………………….

Separately, the charter of the new OpenRAN Orchestration and Management Automation (ROMA) subgroup was approved by the OpenRAN PG. ROMA focuses on aggregating and harmonizing mobile network operators requirements on Open RAN orchestration and lifecycle management automation, fostering ecosystem partners to develop products and solutions that meet ROMA requirements.

The goal of ROMA is to:

· Develop a common set of use cases for OpenRAN lifecycle management automation and orchestration that are agreed across multiple MNO and OpenRAN ecosystem members

· Develop Technical Requirements on products and solutions that support the identified use cases, including interfaces and data models

· Facilitate product and solution development through lab testing, field trials, participating TIP Plugfest and badging on TIP exchange etc.

· Support large scale OpenRAN deployment with lifecycle management automation, including Continuous Integration and Continuous Deployment (CI/CD) frameworks and tool sets.

It will bring better coverage and capacity through on-premise radio equipment, says TIP, and the ability to support low latency and high bandwidth service requirements through edge compute and routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

……………………………………………………………………

About the Telecom Infra Project:

The Telecom Infra Project (TIP) is a global community of companies and organizations that are driving infrastructure solutions to advance global connectivity. Half of the world’s population is still not connected to the internet, and for those who are, connectivity is often insufficient. This limits access to the multitude of consumer and commercial benefits provided by the internet, thereby impacting GDP growth globally. However, a lack of flexibility in the current solutions – exacerbated by a limited choice in technology providers – makes it challenging for operators to efficiently build and upgrade networks.

Founded in 2016, TIP is a community of diverse participants that includes hundreds of companies – from service providers and technology partners, to systems integrators and other connectivity stakeholders. We are working together to develop, test and deploy open, disaggregated, and standards-based solutions that deliver the high-quality connectivity that the world needs – now and in the decades to come.

Find out more: www.telecominfraproject.com

References:

Learn more and join the new 5G Private Networks Solution Group here.

https://telecominfraproject.com/tip-launches-5g-private-networks-solution-group/

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Four of Europe’s biggest network operators have signed a Memorandum of Understanding (MoU) to express their individual commitment to the implementation and deployment of Open Radio Access Network (Open RAN) as the technology of choice for future mobile networks across Europe. In a statement, Telefonica, Deutsche Telekom, Orange and Vodafone pledged to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

The four operators committed to working together with existing and new ecosystem partners, industry bodies like the O-RAN Alliance and the Telecom Infra Project (TIP), as well as European policy makers, to ensure Open RAN quickly reaches competitive parity with traditional RAN solutions. “This initiative is an important milestone towards a diverse, reinvigorated supplier ecosystem and the availability of carrier-grade Open RAN technology for a timely commercial deployment in Europe,” they said in a joint statement.

The MNOs added that the introduction of Open RAN, virtualisation and automation would pave the way for a fundamental change in the way operators manage networks and deliver services, allowing them to add or shift capacity more quickly for end users, automatically resolve network incidents or provide enterprise level services on-demand for industry 4.0.

The four operators also expressed the hope that the European Commission and national governments will agree to play an important role in fostering and developing the Open RAN ecosystem by funding early deployments, research and development, open test lab facilities as well as incentivising supply chain diversity by lowering barriers to entry for small suppliers and startups.

The MoU comes a few days after Telefonica announced plans to use open RAN technology at around 1,000 of its mobile sites in Germany. Vodafone made a similar commitment at around 2,600 of its masts and rooftops in the UK at the end of last year.

Without orders from numerous large operators, open RAN producers have struggled to increase volumes and generate the necessary economies of scale.

“This is like putting the band back together,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “The European operators are saying if we co-operate then we can have a meaningful influence and impact on the way open RAN develops.”

Operators are drawn to open RAN because it would allow them to mix and match vendors, using radio software from one vendor in tandem with general-purpose equipment developed by another. Traditional radio access networks typically force operators to buy all their components from the same supplier.

While today’s statement is light on details of firm commitments, Vodafone has already promised to use open RAN technology at around 2,600 of its mobile sites in the UK, while Telefónica this week said it would do the same at roughly 1,000 sites in Germany.

Deutsche Telekom, Germany’s telecom incumbent, has had less to say about rollout targets, although in December it revealed plans to build an “O-RAN town” in Neubrandenburg this year. “This will be a small-scale commercial deployment, which will encompass up to 150 cells, and will bring open RAN into a real 4G/5G network environment,” said a Deutsche Telekom spokesperson by email.

That leaves France’s Orange, which has now made a jaw-dropping commitment: Starting in 2025, it will buy only open RAN equipment when upgrading its European networks.

“From 2025, our intention is that all new equipment deployed by Orange in Europe should be based on open RAN,” says Arnaud Vamparys, Orange’s senior vice president of radio networks. “This is a good time to send a clear message.”

His expectation is that over this timeframe open RAN will reach “parity” with traditional RAN for deployment in a macro network. That would mean resolving some of the performance shortcomings that have mainly restricted open RAN to rural and less demanding conditions.

“2025 sounds about right,” says Brown. “The integrated systems are really setting a very high bar and open RAN is behind on features and performance right now.”

Brown told Light Reading he was encouraged by some of the recent open RAN activity in the semiconductor industry, citing baseband advances by Marvell and radio innovation by Xilinx. But he says it is too early to say open RAN will definitely be a mainstream success by the mid-2020s. “Can this be the best way to build a radio access network? If it isn’t, it is probably not going to succeed.”

“We continue to work to unlock the value of these European programs because clearly there are industry-leading initiatives of some of the manufacturing being brought back to Europe, especially on open RAN,” said Markus Haas, Telefónica Deutschland’s CEO, when asked during an analyst call this week if the telecom sector could be a beneficiary of Europe’s COVID-19 recovery fund.

“There is high interest so that the overall industry, the vendor landscape, might change or might be empowered by additional funds in order to progress and accelerate open RAN.”

While Ericsson and Nokia say they are now investing in open RAN technology, Vodafone looks determined to use alternative players for its 2,600-site rollout. Supplier diversification has topped the agenda for other service providers, as well.

“We want Europe to play a role in that evolution and it has to unite a bit to achieve this goal,” says Orange’s Vamparys. “There are lots of US and Japanese companies pushing strongly for the acceleration of open RAN. If we don’t communicate and help other companies, it could create an unbalanced situation.”

SOURCE: ORAN Alliance

Telefónica Deutschland named Altiostar, KMW, NEC and Supermicro as potential open RAN partners in a presentation it gave this week, while Deutsche Telekom has been in talks with Dell, Fujitsu, Mavenir, Nokia and NEC.

Vodafone has already carried out open RAN trials with Mavenir and Parallel Wireless.

The region’s biggest gap is probably in silicon, says Heavy Reading’s Brown. Most of the high-profile chipmakers developing open RAN technology, including Marvell and Xilinx, are based in the US.

Arm, a UK-based firm whose processor designs are used in many of the world’s smartphones, is a member of the O-RAN Alliance, the group responsible for open RAN specifications. But it is also currently the target of a $40 billion takeover move by Nvidia, a US semiconductor maker.

In the meantime, any plan to use part of the European recovery fund to support open RAN could meet with political resistance given the healthy state of the telecom sector compared with other industries, including airlines, hospitality, retail and tourism.

John Strand, the CEO of advisory firm Strand Consult, lashed out at the suggestion that open RAN could benefit from Europe’s COVID-19 stimulus package.

“Do these companies need subsidies? Is Telefónica in such a bad position that it needs public funding?” he told Light Reading. “We are living in a time when numbers of companies are in deep financial crisis because of COVID-19 and telecom operators, which definitely haven’t been hit, are asking for subsidies.”

Market forecasters now think open RAN will account for about one tenth of the overall market for radio access network products by the mid-2020s:

- Omdia expects industry revenues to increase from just $70 million in 2019 to about $3.2 billion in 2024, giving it a 9.4% share of the 4G and 5G market.

- Dell’Oro, another analyst firm, is in broad agreement: Last year, it predicted operators would spend somewhere north of $3 billion on open RAN products in 2024.

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/telefonica-vodafone-orange-dt-sign-open-ran-mou–1369273