O-RAN

Viavi Solutions and Mavenir collaborate to validate new SD, cloud-native RAN infrastructure

VIAVI Solutions Inc today announced that Mavenir, an upstart provider of end-to-end cloud-native network software for mobile operators, is collaborating with VIAVI for lab validation of radio access solutions in the U.S. VIAVI’s lab test platform, in use by almost every base station manufacturer in the world, provides scalable test systems for validating network performance as experienced by end users, across multiple cells and different radio access technologies.

The year 2020 marked a significant inflection point for mobile networks around the globe. With 229 million subscribers as of December 2020, 5G became the fastest growing mobile technology in history. New MNOs (like Dish Network) were granted licenses to establish greenfield networks to take advantage of this demand. Meanwhile, #1 base station maker Huawei was restricted from supplying infrastructure in markets around the globe. These trends have driven an expansion of the supply chain for mobile network solutions.

VIAVI tools are able to measure the complete performance of the network over multiple interfaces including O-RAN and RF through to the packet core. Capable of emulating one to many thousands of UEs, the platforms create a sophisticated and precise test environment, including comprehensive feature interactions, simulated RF and mobility, accurate replications of real-world user behavior profiles, together with mobility across the radio access network.

“Mavenir is proud to be a leading vendor to mobile operators around the globe, offering software-defined infrastructure that can adapt to evolving requirements for both brownfield and greenfield networks, large-scale to startup networks,” said Ramnik Kamo, EVP Quality, Systems and People, Mavenir. “VIAVI has been a highly collaborative partner with our two companies’ engineering teams working together to prove a new technology against very tight customer timescales.”

“As vendors across the industry develop open, cloud-native and disaggregated architectures, testing against user expectations of service quality will be critical to accelerate adoption at scale,” said Luiz Cesar Oliveira, Vice President, Americas, VIAVI. “We are excited to help Mavenir optimize their advanced radio access solutions based on our unique experience supporting over 200 service providers and virtually every network equipment manufacturer worldwide.”

About VIAVI

VIAVI (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn, Twitter, YouTube and Facebook.

………………………………………………………………………………………………………………………………………………………………….

References:

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

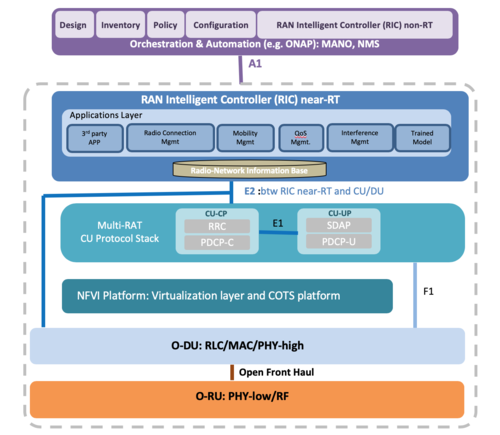

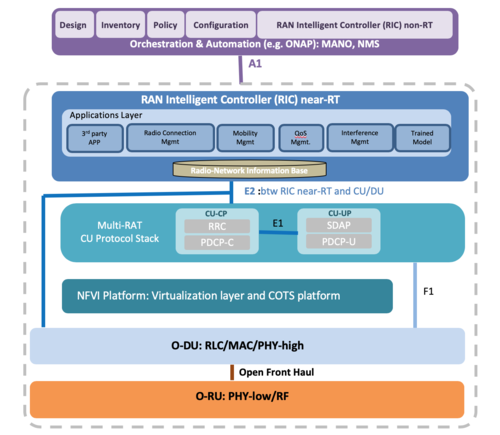

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

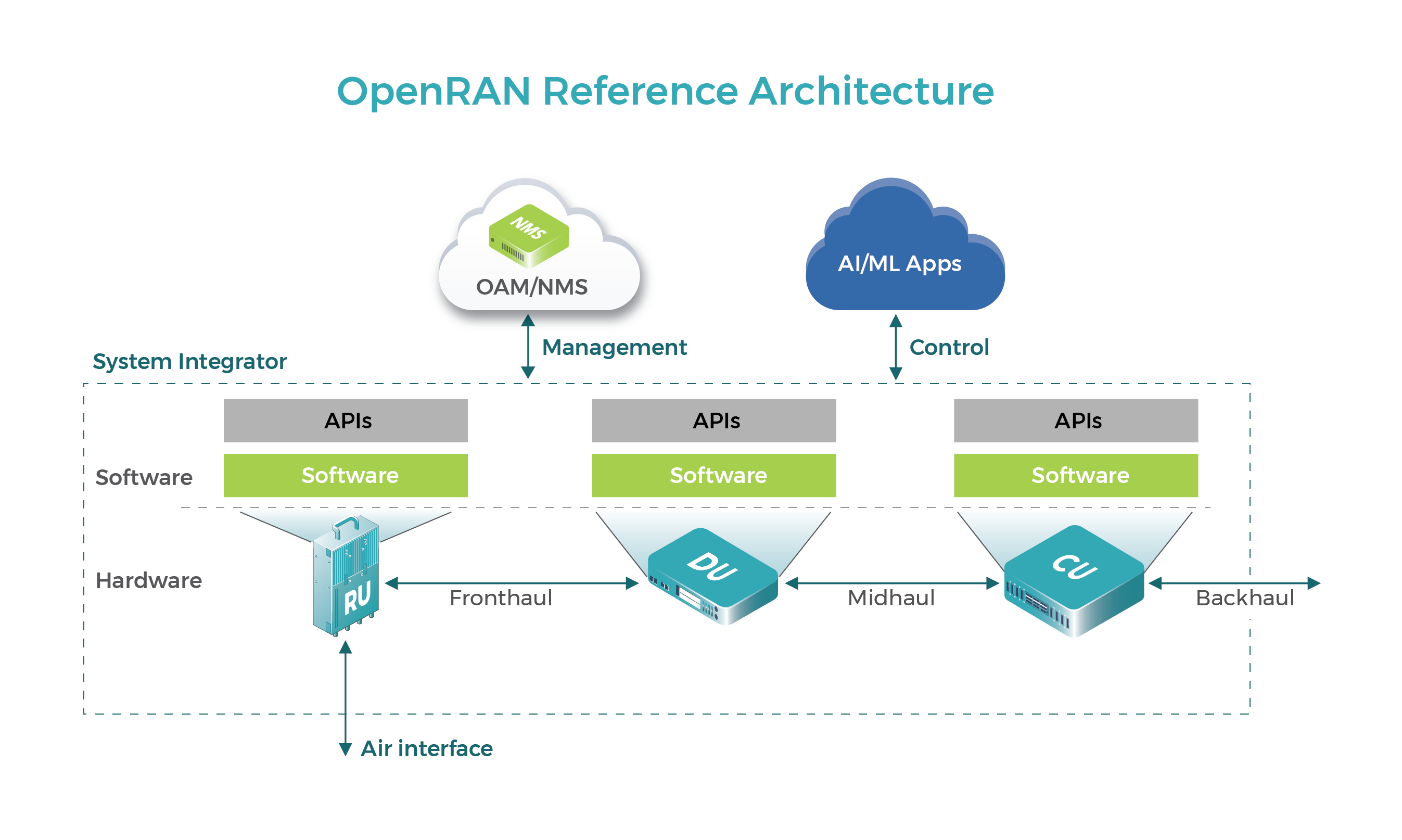

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

Progress in 5G private networks and Open RAN

Harry Baldock of Total Telecom writes, “The month of November was one of quiet progress for 5G, with more momentum steadily being gained for long-term trends towards private network deployments and open RAN innovation.”

Private 5G networks could be viable connectivity options for major industries like manufacturing and shipping, giving them not only access to the latest technologies to enhance efficiency, but also the flexibility to structure their network however they please.

In Europe, the German telecom regulator announced in November that it has awarded 88 licences for private 5G networks this year and expects more to come. For example, Nokia recently installed a private 5G network in Nuremburg for industrial IoT specialist MYNXG. In France, electronics manufacturer Lacroix is working with with Orange and Ericsson to create a 5G factory, and in the UK BT is installing a 5G network into Belfast Harbour, while Huawei is creating a private 5G testbed in Cambridge.

There has also been significant movement in the U.S., with General Motor’s new Factory ZERO installing a private 5G network from Verizon to manufacture the next generation of electric vehicles.

However, it should be remembered that despite its promise, private 5G networks are also still very much in their infancy, with a survey from STL Partners showing that the majority of enterprises still rely primarily on Wi-Fi and ethernet or fixed broadband for their connectivity needs.

Meanwhile, Open RAN has been gaining momentum for some months now as we reported yesterday in this IEEE Techblog post. In November, Dish and Qualcomm announced that they are set to work together on the U.S.’s first Open RAN-compliant (which spec?) 5G network. Similarly, in the UK, Vodafone’s August pilot for Open RAN, that took place in Wales, is being scaled up to 2,600 Open RAN sites in Wales and England, potentially using them to replace Huawei gear.

Meanwhile, companies like Mavenir continue to rapidly develop open RAN solutions, recently boasting of supporting 2G–5G for its open RAN packet core, thanks to a recent acquisition of ip.access.

Baldock concludes, “it seems fair to say that Open RAN is here to stay and is no longer something of a novelty. While many issues remain around things like standardization (e.g. no liaison with either ITU, ETSI or 3GPP) the movement is beginning to see increasing interest from operators and policymakers alike.”

…………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Global O-RAN Plugfests Across 5 Countries with 4G and 5G Lab and Field Test Platforms

Plugfests in Europe and India have been demonstrating the interoperability of telecom equipment using the Open Radio Access Network (O-RAN) specifications. The plugfests were organized by the leading telecom communications service providers (CSPs) and the O-RAN Alliance with a series of on-site demonstrations in multiple countries. The plugfest involved a series of on-site demonstrations in multiple countries, conducted in September and October 2020. In a multi-vendor based O-RAN environment, ensuring interoperability will become the network operator’s principal concern.

O-RAN Plugfest 2020 Integration and Testing Configuration

Image Credits: O-RAN Alliance

………………………………………………………………………………………………………………………………………………………………………..

Test equipment provider Viavi was involved in the plugfests with its Test Suite for O-RAN Specifications to validate that all interfaces are working correctly, including the RF, signaling and interoperability, timing and synchronization. The VIAVI Test Suite for O-RAN Specifications offers comprehensive, integrated solutions to validate that all interfaces are working correctly – including RF, signaling and interoperability, timing and synchronization – and equipment is performing to specifications even under load and stress. In the lab, the TM500 and TeraVM families deliver UE, O-RAN subsystem and core network simulation to enable conformance, interoperability and performance testing of both complete base station and core network testing as well as wraparound testing of individual O-RAN subsystems and core network elements. In both the lab and the field, T-BERD/MTS-5800 validates critical synchronization parameters with necessary precision using its Timing Extension Module (TEM), delivering a highly stable reference signal for synchronizing test equipment and O-RAN components. CellAdvisor 5G characterizes and analyzes 4G and 5G RF signals. ONT-800 tests transport network performance up to 800G.

- The plugfest in Berlin, Germany, was hosted by Deutsche Telekom, with demonstrations of radio access equipment from Baicells, Benetel, Foxconn, QCT, Wind River, Wiwynn and other vendors. Viavi provided its TM500 including UE emulation for performance testing and O-DU emulation for O-RU subsystem testing; TeraVM for core emulation and traffic generation; MTS-5800 for transport and synchronization test; and CellAdvisor 5G for RF signal analysis.

- In a plugfest in Torino, Italy, hosted by TIM, VIAVI provided the MTS-5800 for timing and synchronization in demonstrations of radio access equipment from Commscope, WNC, Wiwynn and other vendors.

- Madrid, Spain plugfest was hosted by a major Spanish service provider, with demonstrations of O-RAN x-haul (fronthaul and midhaul) transport with equipment from multiple vendors. VIAVI provided the MTS-5800 for timing and synchronization, and ONT-800 for multi-port transport test.

- Bengaluru (Bangalore), India plugfest was hosted by Airtel, with demonstrations of multi-vendor integration of O-RAN compliant radio access software and equipment from Altiostar, NEC, VVDN and Xilinx. The VIAVI TM500-C-5G 5G NR UE emulator and TM500 O-RU emulator were used for in-depth verification of the O-DU’s compliance to the WG4 open fronthaul (C/U/S planes) specification. • Tokyo, Japan. This plugfest was hosted by Japanese service providers, with demonstrations of radio equipment from major O-DU/O-CU and O-RU vendors. VIAVI provided the TM500 for 5G NR UE emulation.

“As a champion of interoperability test methodologies, and the first company to introduce a comprehensive test suite for O-RAN specifications, VIAVI has worked closely with ecosystem partners and operators worldwide to help identify, isolate and resolve performance issues with disaggregated networks,” said Sameh Yamany, Chief Technology Officer, VIAVI. “The successful results of the global O-RAN ALLIANCE plugfest represent a significant step forward in the advancement of multi-vendor O-RAN environments, which are essential to scaling and sustaining 5G networks.”

………………………………………………………………………………………………………………………………………………………………………………………………………..

Viavi is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………

References:

Vodafone and NEC Europe trial Open RAN technology with voice call

Vodafone and NEC Europe Ltd., a wholly owned subsidiary of NEC Corporation, in partnership with Altiostar, have jointly announced the first successful voice call made on an open virtual Radio Access Network (Open RAN) on Vodafone’s network in the Netherlands.

Open RAN technology holds promise and potential for next-generation wireless infrastructure. It’s being driven by innovation and open specifications from various consortiums (O-RAN, TIP Open RAN, and ONF). Today’s announcement demonstrates Vodafone’s strong commitment to sustaining its technological leadership, by bringing in such technological advances.

During the course of this trial, Vodafone and NEC intend to integrate solutions of leading Open RAN technology vendors, such as Altiostar [1.] and various other radio vendors, including NEC’s own 5G radio products, using commercial off the shelf (COTS) hardware from third parties, enabling Vodafone to transform its network to a software-based one suiting multiple deployment scenarios.

Note 1. It’s somewhat surprising that Altiostar was the only OpenRAN software vendor to be mentioned. Altiostar is part-owned by Rakuten and must therefore be near the front of the queue for its OpenRAN vendors. Rakuten has said it would make its Open RAN platform technology available to other operators. If successful, NEC and Altiostar will be involved in more deals as OpenRAN gathers momentum. Separately, there is the Rakuten-NEC 5G Core network (based on 3GPP 5G core “vision” specs) that Rakuten also wants to sell to global network operators.

…………………………………………………………………………………………………………………………………………………………………………………………

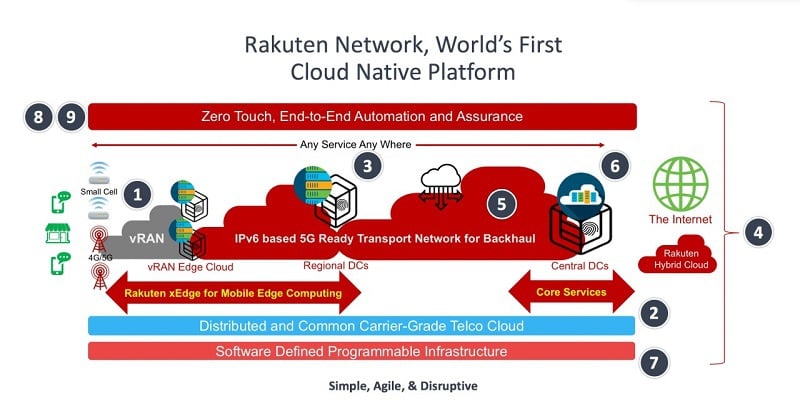

Image Credit: Rakuten Mobile

“We are proud to embark on this journey together with Vodafone that will transform mobile network economics, while deploying technology with greater flexibility, greater efficiencies, and more agility,” said Yogarajah Gopikrishna, GM at NEC Europe. “By integrating best of breed solutions, NEC, as an experienced Open RAN System Integrator, is committed to bring transformative change to the telecommunications space leveraging our long history and experience in mobile network solutions.”

“We are delighted to work together with NEC towards the first live Open RAN site,” said Ruud Koeyvoets, Vodafone Mobile Networks’ Director. “The introduction of the technology enables us to introduce new suppliers, such as Altiostar, giving us greater flexibility when rolling out our mobile network. We’re proud to be pioneering the development of Open RAN and will be monitoring the performance of this pilot.”

…………………………………………………………………………………………………………………………………………

About Vodafone

VodafoneZiggo is a leading Dutch company that provides fixed, mobile and integrated communication and entertainment services to consumers and businesses. As of June 30, 2020 we have more than 5 million mobile, nearly 4 million TV, nearly 3.4 million fixed broadband internet and 2.4 million fixed telephony subscriptions. VodafoneZiggo is a joint venture by Liberty Global, the largest international TV and broadband internet company, and Vodafone Group, one of the world’s largest telecommunication companies.

About NEC Europe Ltd.

NEC Europe Ltd. is a wholly owned subsidiary of NEC Corporation, a leader in the integration of IT network technologies that benefit businesses and people around the world. NEC Europe Ltd. is building upon its heritage and reputation for innovation and quality by providing its expertise, solutions and services to a broad range of customers, from telecom operators to enterprises and the public sector. For additional information, please visit the NEC Europe Ltd. home page at:

http://uk.nec.com/

References:

https://www.nec.com/en/press/202010/global_20201019_04.html

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Analysis of Open Network Foundation new 5G SD-RAN™ Project

Executive Summary:

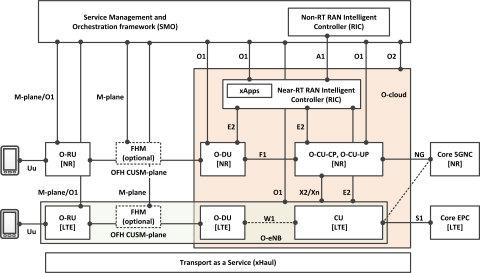

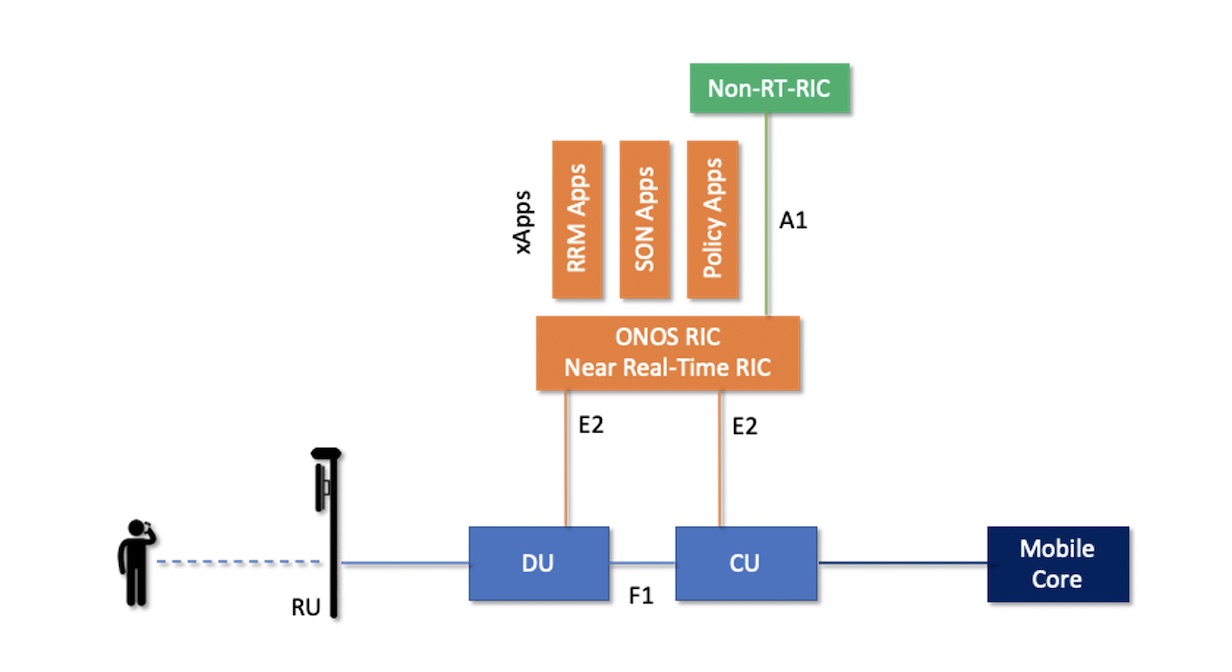

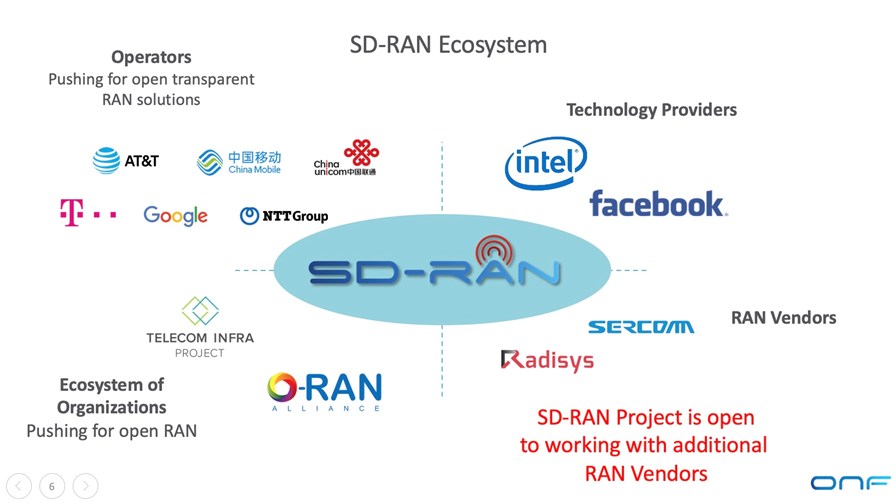

In a move that will help promote multi-vendor interoperability, the Open Networking Foundation (ONF) today announced the formation of the SD-RAN project (Software Defined Radio Access Network) to pursue the creation of open source software platforms and multi-vendor solutions for mobile 4G and 5G RAN deployments. Initially, the project will focus on building an open source Near Real-Time RAN Intelligent Controller (nRT-RIC) compatible with the O-RAN architecture.

The new SD-RAN project is backed by a consortium of leading operators and aligned technology companies and organizations that together are committed to creating a truly open RAN ecosystem. Founding members include AT&T, China Mobile, China Unicom, Deutsche Telekom, Facebook, Google, Intel, NTT, Radisys and Sercomm. All the project members will be actively contributing, and this includes the operators contributing use cases and trialing the results, according to the ONF. However, the larger cellular base station vendors that are ONF members, Nokia, Samsung, ZTE, Fujitsu, NEC were silent on their participation in this SD-RAN project.

There may be some confusion caused by ONF’s SD-RAN project as it is the third Open RAN consortium. The O-RAN Alliance and TIP Open RAN project are working on open source hardware and open interfaces for disaggregated RAN equipment, like a 4G/5G combo base station.

In a brief video chat yesterday, Timon Sloane, VP of Ecosystem and Marketing for ONF told me that this new ONF SD-RAN project would be in close contact with the other two Open RAN consortiums and distinguished itself from them by producing OPEN SOURCE SOFTWARE for disaggregated RAN equipment—something he said the O-RAN Alliance and TIP Open RAN project were NOT doing.

That should go a long way in dispelling that confusion, but it nonetheless presents a challenge on how three consortiums can effectively work together to produce meaningful open source software code (ONF) and hardware (O-RAN Alliance and TIP) specifications with joint compliance testing to ensure multi-vendor interoperability.

Sloane told Matt Kapko of SDXCentral: “The operators really are pushing for separation of hardware and software and for enabling new innovations to come in in software without it being tightly coupled to the hardware that they purchase. And xApps are where the functionality of the RAN is to be housed, and so in order to do this in a meaningful way you have to be able to do meaningful functions in these xApps,” Sloane said.

However, no mention was made in the ONF press release of a liaison with either 3GPP or ITU-R WP5D which are producing the standards and specs for 5G and have already done so for 4G-LTE. Neither of the aforementioned O-RAN consortiums have liaisons with those entities either.

There are other complications with Open RAN (independent of SD-RAN), such as U.S. government’s attempt to cripple Huawei and other China telecom equipment vendors, need for a parallel wireless infrastructure, legacy vs greenfield carriers. These are addressed in Comment and Analysis section below.

µONOS-RIC:

Central to the project is the development of an open source near-real time RIC called µONOS-RIC (pronounced “micro-ONOS-RIC”).

µONOS is a microservices-based SDN controller created by the refactoring and enhancement of ONOS, the leading SDN controller for operators in production tier-1 networks worldwide. µONOS-RIC is built on µONOS, and hence features a cloud-native design supporting active-active clustering for scalability, performance and high availability along with the real-time capabilities needed for intelligent RAN control.

µONOS-RIC is designed to control an array of multi-vendor open RAN equipment consistent with the O-RAN ALLIANCE architecture. In particular, the O-RAN ALLIANCE E2 interface is used to interface between µONOS-RIC and vendor supplied RAN RU/DU/CU RAN components.

xApps running on top of the µONOS-RIC are responsible for functionality that traditionally has been implemented in vendor-proprietary implementations. A primary goal of the SD-RAN project (and, not coincidentally, for the operators who founded the O-RAN consortium) is to enable an external intelligent controller to control the RAN so that operators have both visibility and control over their RAN networks, thus giving operators ownership and control over how spectrum is utilized and optimized along with the tools to deliver an optimal experience for users and applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

Relationship to O-RAN Alliance, O-RAN Software Community and TIP:

The participating members of the SD-RAN project plan to implement, prototype and trial an advanced architecture that enables intelligent RIC xApps to control a broad spectrum of SON and RRM functionality that historically has been implemented as vendor-proprietary features on bespoke base station equipment and platforms. SD-RAN’s focus and goals are complementary to various efforts across the industry, including work taking place within the O-RAN ALLIANCE, the O-RAN Software Community and the TIP OpenRAN Project Group.

SD-RAN will follow O-RAN specifications as they are developed and will also make use of components of existing open source to facilitate interoperability. As the project pioneers new functionality, all extensions and learnings that come from building the system will be contributed back to O-RAN ALLIANCE, with the intent that these extensions can inform and advance the O-RAN specifications.

The SD-RAN work inside the ONF community will take place in parallel with work being contributed to the O-RAN Software Community. The intent is for interoperable implementations to come out of both efforts, so that a mix of open source and vendor proprietary components can be demonstrated and ultimately deployed.

Timing and Availability:

The SD-RAN project already has a working skeleton prototype of the µONOS-RIC controller above a RAN emulation platform through the E2 interface. This implementation is demonstrating handover and load balancing at scale, supporting over 100 base stations and 100,000 user devices with less than 50ms handover latency (less than 10ms latency for 99% of all handovers).

The SD-RAN community is advancing towards a field trial by early 2021, working with RAN vendors to integrate carrier-grade RU/DU/CU components while in parallel implementing xApps to demonstrate SON and RRM functionality. Interested parties are encouraged to contact ONF for additional information.

Quotes Supporting the SD-RAN Project:

“AT&T strongly supports the development of specifications and components that can help drive openness and innovation in the RAN ecosystem. The O-RAN ALLIANCE’s specifications are enabling the ecosystem, with a range of companies and organizations creating both open source and proprietary implementations that are bringing the open specifications to life. The ONF SD-RAN project, along with the O-RAN OSC, will expand the ecosystem with an nRT-RIC that can support xApps and help demonstrate their interoperability. This project will help accelerate the transition to an open RAN future.”

Andre Fuetsch, President and Chief Technology Officer, AT&T Labs

“China Mobile co-founded O-RAN in order to promote both the opening of the RAN ecosystem for multi-vendor solutions and the realization of RAN with native intelligence for performance and cost improvement. An open nRT-RIC with support for open xApps that go beyond policy-based control and SON to also enhance Radio Resource Management (RRM) will make it possible for operators to optimize resource utilization and application performance. We are excited to see the development of an open nRT-RIC and xApps in the SD-RAN project led by ONF, and expect this work to help advance the state-of-art for open and intelligent RAN.”

Dr. Chih-Lin I, Chief Scientist, Wireless Technologies, China Mobile

“China Unicom has been a long-term partner with ONF. We continue to see the benefits of the ONF’s work and the impact it has on our industry. The SD-RAN project is now applying the ONF’s proven strategy for disaggregating and creating open source implementations to the 5G RAN space in order to foster innovation and ecosystem transformation. We are excited by this work, and are committed to trialing a solution as it becomes available.”

Dr. Xiongyan Tang, Network Technology Research Institute, China Unicom

“Deutsche Telekom is a huge believer in applying disaggregation and open source principles for our next-generation networks. DT has ONF’s mobile core platform (OMEC) in production and we are taking ONF’s broadband access (SEBA/VOLTHA) platform to production towards the end of 2020. This journey has shown us the tremendous value that is created when we can build solutions based on interoperable multi-vendor components intermixed with open source components. ONF’s SD-RAN project is leveraging these same principles to help accelerate innovation in the RAN domain, and we are excited to be an active collaborator in this journey.”

Dr. Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom

“Connectivity is an integral part of Facebook’s focus to bring people closer together. We work closely with partners to develop programs and technologies that make connectivity more affordable and accessible. Through our collaboration with ONF on their SD-RAN project, we look forward to engaging with the community to improve connectivity experiences for many people around the world.”

Aaron Bernstein, Facebook’s Director of Connectivity Ecosystem Programs

“Google is an advocate for SDN, disaggregation and open source, and we are excited to see these principles now being applied to the RAN domain. ONF’s SD-RAN project’s ambition to create an open source RIC can help invigorate innovation across the mobile domain.”

Ankur Jain, Distinguished Engineer, Google

“Intel is an active participant of the ONF’s SD-RAN project to advance the development of open RAN implementations on high volume servers. ONF has been leading the industry with advanced open source implementations in the areas of disaggregated Mobile Core, e.g. the Open Mobile Evolved Core (OMEC), and we look forward to continuing to innovate by applying proven principles of disaggregation, open source and AI/ML to the next stepping stone in this journey – the RAN. SD-RAN will be optimized to leverage powerful performance, AI/ML, and security enhancements, which are essential for 5G and available in Intel® Xeon® Scalable Processors, network adapters and switching technologies, including Data-Plane Development Kit (DPDK) and Intel® Software Guard Extensions (Intel SGX).”

Pranav Mehta, Vice President of Systems and Software Research, Intel Labs

“NTT sees great value in transforming the RAN domain in order to foster innovation and multi-vendor interoperability. We are excited to be part of the SD-RAN ecosystem, and look forward to working with the community to develop open source components that can be intermixed with vendor proprietary elements using standard O-RAN interfaces.”

Dai Kashiwa, Evangelist, Director of NTT Communications

“Radisys is excited to be a founding member of the SD-RAN project, and we are committed to integrating our RAN software implementation (CU & DU) with O-RAN interfaces to the µONOS-RIC controller and xApps being developed by the SD-RAN project community. This effort has the potential to accelerate the adoption of O-RAN based RIC implementation and xApps, and we are committed to working with this community to advance the open RAN agenda.”

Arun Bhikshesvaran, CEO, Radisys

“As a leading manufacturer of small cell RAN equipment and an avid supporter of the open RAN movement, Sercomm is excited to collaborate with the SD-RAN community to open E2 interfaces and migrate some of our near-real-time functionalities from the RAN equipment into xApps running the μONOS-RIC controller. This is a nascent yet dynamic area full of potential, and we are committed to working with the SD-RAN ecosystem to build solutions ready for trials and deployment.”

Ben Lin, CTO and Co-Founder, Sercomm

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core and Services. We are excited about the collaboration between our RIA subgroup and ONF’s SD-RAN project to accelerate RAN disaggregation and adoption of open interfaces. Through this collaboration we will enable the OpenRAN ecosystem to leverage the strengths of data science and AI/ML technologies to set new industry benchmarks on performance, efficiency and total cost of ownership.”

Attilio Zani, Executive Director for Telecom Infra Project (TIP)

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis of Open RAN Market:

Disclaimer: Like all IEEE Techblog posts, opinions, comment and analysis are ALWAYS by the authors and do NOT EVER represent an opinion or position by IEEE or the IEEE Communications Society. This should be obvious to all in the 11 1/2 years of this author’s contribution to the IEEE Techblog and its predecessor- ComSoc Community blogs.

…………………………………………………………………………………………………………………………………………………………………………

Besides NOT having a liaison with either 3GPP or ITU-R, the following Open RAN issues may limit its market potential. These are NOT specific to the ONF SD-RAN project, but generic to Open RAN deployments.

- U.S. officials promoting Open RAN as a way to decrease the dominance of Huawei, the world’s biggest vendor of mobile equipment by market share and also to thwart the rise of other vendors like ZTE and China Information and Communication Technology Group (CICT) which recently won a small part of s China Mobile contract. Obviously, China’s government will fight back and NOT allow any version of Open RAN to be deployed in China (likely to be the world’s biggest 5G market by far)! That despite China Mobile and China Unicom’s expressed interest in Open RAN (see Quotes above). Remember, that the three big China carriers (China Mobile, China Telecom, China Unicom) are all state owned.

- Dual infrastructure: If a legacy wireless carrier deploys Open RAN, existing wireless infrastructure equipment (base stations, small cells, cell tower equipment, backhaul, etc) must remain in place to support its customers. Open RAN gear (with new fronthaul and backhaul) won’t have wide coverage area for many years. Therefore, current customers can’t simply be switched over from legacy wireless infrastructure to Open RAN gear. That means that a separate separate and distinct WIRELESS INFRASTRUCTURE NETWORK must be built and physically installed for Open RAN gear. Yet no one seems to talk or write about that! Why not?

- Open RAN is really only for greenfield carriers with NO EMBEDDED WIRELESS INFRASTRUCTURE. Rakuten and Dish Network are two such carriers ideally suited to Open RAN. That despite a lot of noise from AT&T and Deutsche Telekom about Open RAN trials. All the supporting quotes from legacy carriers are indicative of their interest in open source software AND hardware: to break the stranglehold the huge wireless equipment vendors have on cellular infrastructure and its relatively high costs of their proprietary network equipment and element management systems.

- Open RAN should definitely lower initial deployment costs (CAPEX), but may result in INCREASED maintenance cost (OPEX) due to the difficulty of ensuring multi-vendor interoperability, systems integration and MOST IMPORTANTLY tech support with fault detection and rapid restoration of service.

Conclusions:

Considering all of the above, one may conclude that traditional cellular infrastructure, based on vendor specific equipment and proprietary interfaces, will remain in place for many years to come. As a result, Open RAN becomes a decent market for greenfield carriers and a small market (trial or pilot networks) for legacy carriers, which become brownfield carriers after Open RAN is commercially available to provide their cellular services.

Given a smaller than commonly believed market for Open RAN, this author believes the SD-RAN project is a very good idea. That’s because it will make open source software available for Open RAN equipment, something that neither the O-RAN Alliance of TIP Open RAN project are doing. Of course, having more vendors producing Open RAN white boxes and software does add to the systems integration and tech support that only large (tier 1) telcos (like AT&T, Deutsche Telekom, NTT and cloud companies (like Google, Facebook, Microsoft) have the staff to support.

In a follow up phone conversation today, Timon Sloane told me that network operators want a fully functional and powerful RAN Intelligent Controller (RIC) to gain visibility and control over their RANs, but that has yet to be realized. To date, such controllers have been proprietary, rather than open source software.

The ONF µONOS-RIC is a key software module to realize that vision, Timon said. It is very much like a (near) real time operating system for an Open RAN. If successful, it will go a long way to promote multi-vendor interoperability for Open RAN deployments. Success and good luck ONF!

………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.prnewswire.com/news-releases/onf-announces-new-5g-sd-ran-project-301117481.html

https://www.sdxcentral.com/articles/news/onf-picks-up-where-o-ran-alliance-falls-short/2020/08/

Assessment: Nokia and Samsung tout new equipment for Open RAN and Virtual RAN

For years, Huawei, Ericsson, Nokia, Samsung and ZTE supplied most of the wireless network infrastructure equipment (base stations, small cells, core network, etc) for building cellular networks and mobile operators can only pick one for each part of their network. That may change with the movement of legacy telecom equipment companies like Nokia and Samsung announcing Open RAN products.

Nokia today became the first major telecom equipment maker to commit to adding open interfaces in its products that will allow mobile operators to build networks that are not tied to a vendor. It’s Open Radio Access Network (Open RAN), aims to reduce reliance on any one vendor by making every part of a wireless 3G/4G/5G base station modular and interoperable which permits network operators to choose different suppliers for different components. The company bolded stated in its press release:

“Nokia Open RAN (O-RAN) solutions will deliver world-class performance and security to the O-RAN ecosystem.”

As part of its implementation plan, Nokia plans to deploy Open RAN interfaces in its baseband and radio units, a spokesman said. An initial set of Open RAN functionalities will become available this year, while the full suite of interfaces is expected to be available in 2021, the company said.

Nokia, unlike other Ericsson, Huawei, and other base station vendors, has participated in the development of open RAN technology and have joined the O-RAN Alliance and TIP Open RAN project.

The Finnish telecom giant (which includes what’s left of Alcatel-Lucent) promised an initial set of O-RAN functionalities this year and a “full suite” of O-RAN-defined interfaces in 2021. Nokia’s press release, made no mention of external partners/customers.

“Several operators have now committed to Open RAN, due to the enhanced flexibility that O-RAN can bring. New operators are fully committing to Open RAN and alternative hardware vendors throughout their networks, and legacy operators are using O-RAN to create opportunities for innovative new products to fit into their complex networks. This overall trend strengthens the ecosystem and allows for specialty radios to address the infinite variety of real-world applications. Nokia is the only major vendor that has fully committed to actively developing the O-RAN interfaces, ensuring that its 5G RAN solutions will support the future open ecosystem the operators are seeking,” said Joe Madden, a principal analyst at Mobile Experts.

Tommi Uitto, President of Mobile Networks at Nokia, said: “Nokia is committed to leading the open mobile future by investing in Open RAN and Cloud RAN solutions with the aim of enabling a robust telecom ecosystem with strong network performance and security. Nokia’s Cloud RAN solution leads the market and is continuing to evolve to a cloud-native architecture. We have the scale and capabilities to address the increased customer demand for this technology, underpinned by the world-class network performance and security that only Nokia can deliver.”

………………………………………………………………………………………………………………………………………..

Samsung followed Nokia’s announcement today, announcing RAN products that are fully “virtualized” baseband and radio units. The South Korean conglomerate said in its press release that it’s fully-virtualized 5G Radio Access Network (vRAN) solution will be commercially available this quarter.

“The solution provides a new option for mobile operators seeking improved efficiencies, cost savings, and management benefits from deploying a software-based 5G radio infrastructure,” according to that press release.

Samsung’s 5G vRAN consists of a virtualized Central Unit (vCU), a virtualized Distributed Unit (vDU), and a wide range of radio units to enable a smooth migration to 5G. By replacing the dedicated baseband hardware used in a traditional RAN architecture with software elements on a general-purpose computing platform, mobile operators can scale 5G capacity and performance more easily, add new features quickly, and have flexibility to support multiple architectures. Samsung’s vRAN solution operates on x86-based COTS servers, either with or without hardware accelerators depending on factors such as total bandwidth. The company said:

“When combined with Samsung’s virtualized 4G/5G Core (network), the operator will be able to implement an end-to-end software-based radio and core network running on COTS x86 servers.”

Samsung already commercialized its virtualized Central Unit (vCU) in April 2019, which operates in live networks in Japan, South Korea, and the U.S. The new 5G vRAN solution has expanded to include a virtualized baseband or Distributed Unit (vDU).

“Samsung’s 5G vRAN validates a software-based alternative to vendor-specific hardware, while offering high performance, flexibility, and stability,” said Jaeho Jeon, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Once the solution becomes commercially available this quarter, we look forward to providing carriers with additional architectural options for building innovative and open 5G networks.”

“Samsung is a big believer in open systems,” explained Alok Shah, Samsung’s VP of strategy, marketing and business development. “It’s what our customers are asking for.”

“Now, more than ever, mobile operators recognize the need for quality-driven, flexible, scalable, and cost-efficient network architectures while planning for 5G network success,” said Peter Jarich, Head of GSMA Intelligence. “RAN virtualization will be an important tool in helping to deliver on those demands and Samsung’s continuing vRAN innovation positions it well to deliver.”

Derek Johnston, Samsung’s head of marketing and 5G business development for the Networks unit, said the company completed a final validation test performed for customers this past April. The press release said: “Samsung demonstrated its vRAN capabilities to customers in April 2020, proving the feasibility of full virtualization by operating 5G New Radio (NR) baseband functions in software running on an x86-based COTS server.”

…………………………………………………………………………………………………………………………………………………

Samsung is a RAN equipment supplier to cellular networks in Korea, U.S., and most recently Japan, where the majority of worldwide 5G subscribers are currently located. In addition, Samsung is further expanding its global footprint rapidly to new markets from Europe to Canada and New Zealand. It has recently closed contracts with Videotron and Telus in Canada, KDDI in Japan and Spark in New Zealand.

In the U.S., it is one of the suppliers for AT&T and Verizon’s 5G networks. Earlier this year the South Korean vendor received a 5G RAN contract with U.S. Cellular. Field trials of the vRAN kit will happen with North American customers in the second half of 2020, according to Johnston.

………………………………………………………………………………………………………………………………………………

Assessment, Comment and Analysis:

1. Samsung is a smaller player in the RAN market, so likely is going after greenfield or brown field carriers with its Open RAN offerings. Perhaps, U.S. rural wireless carriers will be fertile ground for the Korean giant, as many have been forced to “rip and replace” Huawei gear.

Samsung named several technology partners, including Qualcomm, HPE, Marvell and Xilinx for its base station products. Samsung, for example, has a deal with HPE to work on 5G core software and edge computing offerings, according to Mike Dano of Light Reading. For many years, we have been very skeptical about vRANs for many reasons. While it would greatly reduce the cost and OPEX of dedicated, purpose built RAN infrastructure equipment, it represents a single point of failure, an exponentially enlarged malware attack target, and lower performance, especially latency and jitter (delay variation) requirements for critical real time applications.

2. Nokia made no reference to other firms (partners or customers) in its O-RAN announcement today. In May, the company said it had joined the Open RAN Policy Coalition to help enable a comprehensive and secure approach to 5G and future network generations.

One has to wonder if Nokia is using their O-RAN/Open RAN Policy Coalition announcements as an optional check-off item for wireless carriers that will buy purpose built RAN equipment today, but want the option of going Open RAN in the future, when the smoke clears?

Much more significant is potential multi-vendor interoperability problems with Open RAN. There are two independent consortiums generating open source hardware/software specs for it (the O-RAN Alliance and TIP Open RAN project), which have some sort of undescribed relationship.

In an earlier Techblog post, we noted that two vendors from the O-RAN Alliance had to generate their own spec for an O-RAN radio and its interface to the baseband module.

I always thought that an open hardware project (e.g. O-RAN Alliance) would completely specify all hardware modules (like OCP does). In this case, radios used in 4G/5G cellular networks within an Open RAN environment. Evidently, I was wrong!

The Open RAN interoperability problem is highlighted by these two quotes in that article:

“Very few companies are participating in the current (OpenRAN) supply chain and mostly offering proprietary radio solutions lacking open interfaces that are not interoperable with other network elements. In addition, the requirement to procure products from trusted vendors in the US market is also causing operators to reconsider supplier options. OpenRAN radios provide new possibilities for operators to implement a secure, cost effective and best of breed solution as networks move to 5G and beyond.”

Parallel Wireless CEO Steve Papa commented to Light Reading that Open RAN (aka O-RAN) “will only be as good as the radios that are available,” he said. “If Ericsson and Nokia are struggling to be competitive with Huawei’s radios, we should not expect O-RAN to magically solve this problem by using the same semiconductors available to Ericsson and Nokia at present.”

Until it can demonstrate full interoperability between its own products and those made by other O-RAN suppliers, Nokia (along with every other Open RAN supplier) will find it quite difficult to sell O-RAN products.

References:

https://www.fiercewireless.com/tech/samsung-unveils-commercial-5g-vran

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

The GSMA and O-RAN Alliance are cooperating to accelerate the adoption of Open Radio Access Network (RAN) products and solutions that take advantage of new open virtualized architectures, software and hardware. The organizations will work together to harmonize the open networking ecosystem and agree on an industry roadmap for network solutions, thereby making access networks as open and flexible as possible for new market entrants.

GSMA. made up with established wireless telcos and incumbent network equipment vendors, says that “5G will facilitate the opportunity to create even more agile, purpose-built networks tailored to the different needs of citizens, enterprises and society. For example, 5G is an essential ingredient of the European Commission’s recently launched Industrial Strategy and will help shape its future.”

O-RAN Alliance is a world-wide community of more than 170 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. It’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN standards will enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN-compliant mobile networks will at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators.

……………………………………………………………………………………………………………………………………………….

Author’s Opinion:

So here we have an upstart consortium (O-RAN Alliance), cooperating with an established mobile ecosystem marketing machine (GSMA) to promote “open and interoperable mobile networks.” Yet the only way for that to be realized is through adherence to “open” standards and cooperating closely with recognized standards bodies. That is the way interoperability is obtained- by defining open interfaces, layers and protocols!

Instead, O-RAN is making their own specifications (e.g. virtual RAN) that are not part of any 5G standard or 3GPP spec! In particular, the O-RAN Alliance has no liaisons with either 3GPP or ITU-R or ITU-T. How is then possible to specify open hardware and software without any inter-change of documents with those standards organizations? One would think that liaisons, spec iterations, close cooperation with feedback would be essential for success, e.g. a closed loop ecosystem between standards bodies and open source consortiums is urgently needed!

……………………………………………………………………………………………………………………………………………….

In its latest Mobile Economy Report, the GSMA predicts that operators will invest more than a trillion dollars over the next five years globally to serve both consumer and enterprise customers, 80 per cent of which will be on 5G networks.

“When 5G reaches its potential, it will become the first generation of mobile networks to have a bigger impact on enterprises than consumers,” said Alex Sinclair, Chief Technology Officer, GSMA. “In the enterprise sector alone, we forecast $700 billion worth of economic value to be created by the 5G opportunity. The growth of the open networking ecosystem will be essential to meeting enterprise coverage and services needs in the 5G era.”

“As the demand for data and vastly expanded mobile communications grow in the 5G era, a global, cross-border approach is needed to rethink the RAN,” said Andre Fuetsch, Chairman of the O-RAN ALLIANCE, and Executive Vice President and Chief Technology Officer, AT&T. “The GSMA collaboration with the O-RAN ALLIANCE is exactly the sort of global effort that’s needed for everyone, operators and vendors alike, to succeed in this new generation.”

Mobile operators are re-evaluating the way that their networks are deployed. New virtualised architectures with open interfaces can drive cost efficiencies and allow operators to accelerate the deployment of 5G networks. Also, open interfaces can help diversify and reinvigorate the supply chain promoting competition and innovation – for example, by building and operating a RAN based on mix-and-match components from different vendors.

The GSMA and O-RAN ALLIANCE collaboration complements the recently announced inter-working between the GSMA and Telecom Infra Project (TIP), and the O-RAN Alliance and TIP. The goal for these collaborations is to help avoid fragmentation and accelerate the successful evolution of the industry towards a more intelligent, open, virtualized and fully interoperable RAN (see Author’s Opinion above) why this is highly unlikely to happen).

Image Credit: O-RAN Alliance

…………………………………………………………………………………………………………………………………………………

June 12, 2020 Update: Press Release from Mavenir and Aliostar:

“Very few companies are participating in the current (OpenRAN) supply chain and mostly offering proprietary radio solutions lacking open interfaces that are not interoperable with other network elements. In addition, the requirement to procure products from trusted vendors in the US market is also causing operators to reconsider supplier options. OpenRAN radios provide new possibilities for operators to implement a secure, cost effective and best of breed solution as networks move to 5G and beyond.”

Mavenir and Altiostar Collaborate to Deliver OpenRAN Radios for US Market

……………………………………………………………………………………………………………………………………………………….About the GSMA

The GSMA represents the interests of mobile operators worldwide, uniting nearly 750 operators with almost 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai, Mobile World Congress Americas and the Mobile 360 Series of conferences.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

About O-RAN ALLIANCE

O-RAN ALLIANCE is a world-wide community of more than 170 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, O-RAN ALLIANCE’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN standards will enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN-compliant mobile networks will at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, O-RAN ALLIANCE publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

For a short video describing O-RAN’s progress, see www.o-ran.org/videos

For more information please visit www.o-ran.org

Media Contacts:

For the GSMA

Alia Ilyas

+44 (0) 7970 637622

[email protected]

GSMA Press Office

[email protected]

O-RAN ALLIANCE:

Zbynek Dalecky

[email protected]

O-RAN Alliance e.V.

Buschkauler Weg 27

53347 Alfter/Germany

……………………………………………………………………………………………………………………………………………..

References:

GSMA and O-RAN Alliance Collaborate on Opening up 5G Networks

5G breaks from proprietary systems, embraces open source RANs