O-RAN

TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

The Telecom Infra Project (TIP), one of several industry consortiums creating specifications for open radio access networks (Open RAN), recently announced a new 5G Private Networks subgroup.

Editor’s Note:

We don’t know whether the TIP OpenRAN project or the O-RAN Alliance has (and will have) more industry influence and impact. In addition, there are many splinter partnerships forming; many of them led by Rakuten Mobile. What’s mind boggling is that none of the groups have liaison agreements with either ITU-R WP5D (responsible for all IMT standards, including 4G and 5G) or 3GPP (the prime spec writing organization for mobile networks).

……………………………………………………………………………………

5G Private Networks contribute to improve the quality of experience for 5G connectivity, including better coverage and capacity through on-premise radio equipment, the ability to support low latency and high bandwidth service requirements through edge compute & routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

For network operators, 5G Private Networks also create the opportunity to implement new network management and operational models, enabling full automation of the operation of the enterprise network while improving end customer application experience.

However, to fully capture the benefits of 5G Private Networks, a different approach is required, because traditional network architectures, focused on large scale deployments and operations don’t have the right economics or the operational flexibility to efficiently deliver on the emerging needs of enterprise customers.

The 5G Private Networks Solution Group will develop a new approach to manage and operate 5G Private Networks, based on a cloud-native architecture, and making use of a new class of software management tools, based on the paradigms currently used for the cloud, but adapted to deliver the requirements of a telecom network environment. Telefónica will test the solution in their local TIP Community Lab in Madrid and then move to field trials in Málaga (Spain).

Juan Carlos Garcia, SVP Technology Innovation & Ecosystem, Telefónica, and TIP Board Director said: “This new solution group will enable operators to address the exciting opportunities that 5G is creating in the enterprise segment, both through valuable features for our customers and more efficient network operations. The TIP community is the perfect environment for this innovation, as it will allow us to leverage multiple current project groups (Open Core Networks, OpenRAN) to deliver an end-to-end Minimum Viable Product that we will then test in Telefonica’s TIP Community Lab.”

In particular, the new Solutions Group will leverage previous work contributed to TIP’s OpenRAN Project Group, on a first version of a CI/CD platform that applies traditional IT methodologies to automate integration, testing and deployment of OpenRAN software.

Ihab Tarazi, CTO and SVP, Networking and Solutions, Dell Technologies and TIP Board Director, said: “For open networks to deliver their benefits, the telecom industry needs an abstraction layer that helps integrate different components into end-to-end solutions. New software management tools based on the ones currently used for the cloud can address this need, and this Solution Group is a timely initiative for the industry to collaborate on making this happen.”

Caroline Chan, VP and GM Network Business Incubation Division, Intel and TIP Board Director, said: “Through the recently launched solution groups, TIP is expanding its scope to include the validation of interoperability between different elements across the whole network, and insights and recommendations about how to operate them. The new 5G Private Networks Solution Group is a strong example of this approach. With dedicated local private high-performance network connectivity as a key emerging deployment model for 5G and edge buildout, this group can help foster important ecosystem collaboration.”

As a result, this new solution group will help drive:

- Improved network economics, through the use of commoditized hardware and open source software, and more efficient and flexible network operations and automation, enabled by the adoption of cloud-native technologies.

- Dedicated local high-performance 5G connectivity and edge computing infrastructure, appealing to multiple B2B & B2B2C verticals.

- Better network security and performance.

Telefónica is one of the five European telcos that announced that they will work together on open RANs for mobile networks. The others are Deutsche Telekom, Orange, TIM and Vodafone. A memorandum of understanding (MOU) for that grouping commits the five to the O-RAN Alliance, which has 27 network operator members from AT&T to Vodafone, and to “other industry initiatives, such as the Telecom Infra Project, that contribute to the development of open RAN and that aim to create a healthy and competitive open RAN ecosystem and advance R&D efforts.”

……………………………………………………………………………………………………………….

Separately, the charter of the new OpenRAN Orchestration and Management Automation (ROMA) subgroup was approved by the OpenRAN PG. ROMA focuses on aggregating and harmonizing mobile network operators requirements on Open RAN orchestration and lifecycle management automation, fostering ecosystem partners to develop products and solutions that meet ROMA requirements.

The goal of ROMA is to:

· Develop a common set of use cases for OpenRAN lifecycle management automation and orchestration that are agreed across multiple MNO and OpenRAN ecosystem members

· Develop Technical Requirements on products and solutions that support the identified use cases, including interfaces and data models

· Facilitate product and solution development through lab testing, field trials, participating TIP Plugfest and badging on TIP exchange etc.

· Support large scale OpenRAN deployment with lifecycle management automation, including Continuous Integration and Continuous Deployment (CI/CD) frameworks and tool sets.

It will bring better coverage and capacity through on-premise radio equipment, says TIP, and the ability to support low latency and high bandwidth service requirements through edge compute and routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

……………………………………………………………………

About the Telecom Infra Project:

The Telecom Infra Project (TIP) is a global community of companies and organizations that are driving infrastructure solutions to advance global connectivity. Half of the world’s population is still not connected to the internet, and for those who are, connectivity is often insufficient. This limits access to the multitude of consumer and commercial benefits provided by the internet, thereby impacting GDP growth globally. However, a lack of flexibility in the current solutions – exacerbated by a limited choice in technology providers – makes it challenging for operators to efficiently build and upgrade networks.

Founded in 2016, TIP is a community of diverse participants that includes hundreds of companies – from service providers and technology partners, to systems integrators and other connectivity stakeholders. We are working together to develop, test and deploy open, disaggregated, and standards-based solutions that deliver the high-quality connectivity that the world needs – now and in the decades to come.

Find out more: www.telecominfraproject.com

References:

Learn more and join the new 5G Private Networks Solution Group here.

https://telecominfraproject.com/tip-launches-5g-private-networks-solution-group/

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Four of Europe’s biggest network operators have signed a Memorandum of Understanding (MoU) to express their individual commitment to the implementation and deployment of Open Radio Access Network (Open RAN) as the technology of choice for future mobile networks across Europe. In a statement, Telefonica, Deutsche Telekom, Orange and Vodafone pledged to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

The four operators committed to working together with existing and new ecosystem partners, industry bodies like the O-RAN Alliance and the Telecom Infra Project (TIP), as well as European policy makers, to ensure Open RAN quickly reaches competitive parity with traditional RAN solutions. “This initiative is an important milestone towards a diverse, reinvigorated supplier ecosystem and the availability of carrier-grade Open RAN technology for a timely commercial deployment in Europe,” they said in a joint statement.

The MNOs added that the introduction of Open RAN, virtualisation and automation would pave the way for a fundamental change in the way operators manage networks and deliver services, allowing them to add or shift capacity more quickly for end users, automatically resolve network incidents or provide enterprise level services on-demand for industry 4.0.

The four operators also expressed the hope that the European Commission and national governments will agree to play an important role in fostering and developing the Open RAN ecosystem by funding early deployments, research and development, open test lab facilities as well as incentivising supply chain diversity by lowering barriers to entry for small suppliers and startups.

The MoU comes a few days after Telefonica announced plans to use open RAN technology at around 1,000 of its mobile sites in Germany. Vodafone made a similar commitment at around 2,600 of its masts and rooftops in the UK at the end of last year.

Without orders from numerous large operators, open RAN producers have struggled to increase volumes and generate the necessary economies of scale.

“This is like putting the band back together,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “The European operators are saying if we co-operate then we can have a meaningful influence and impact on the way open RAN develops.”

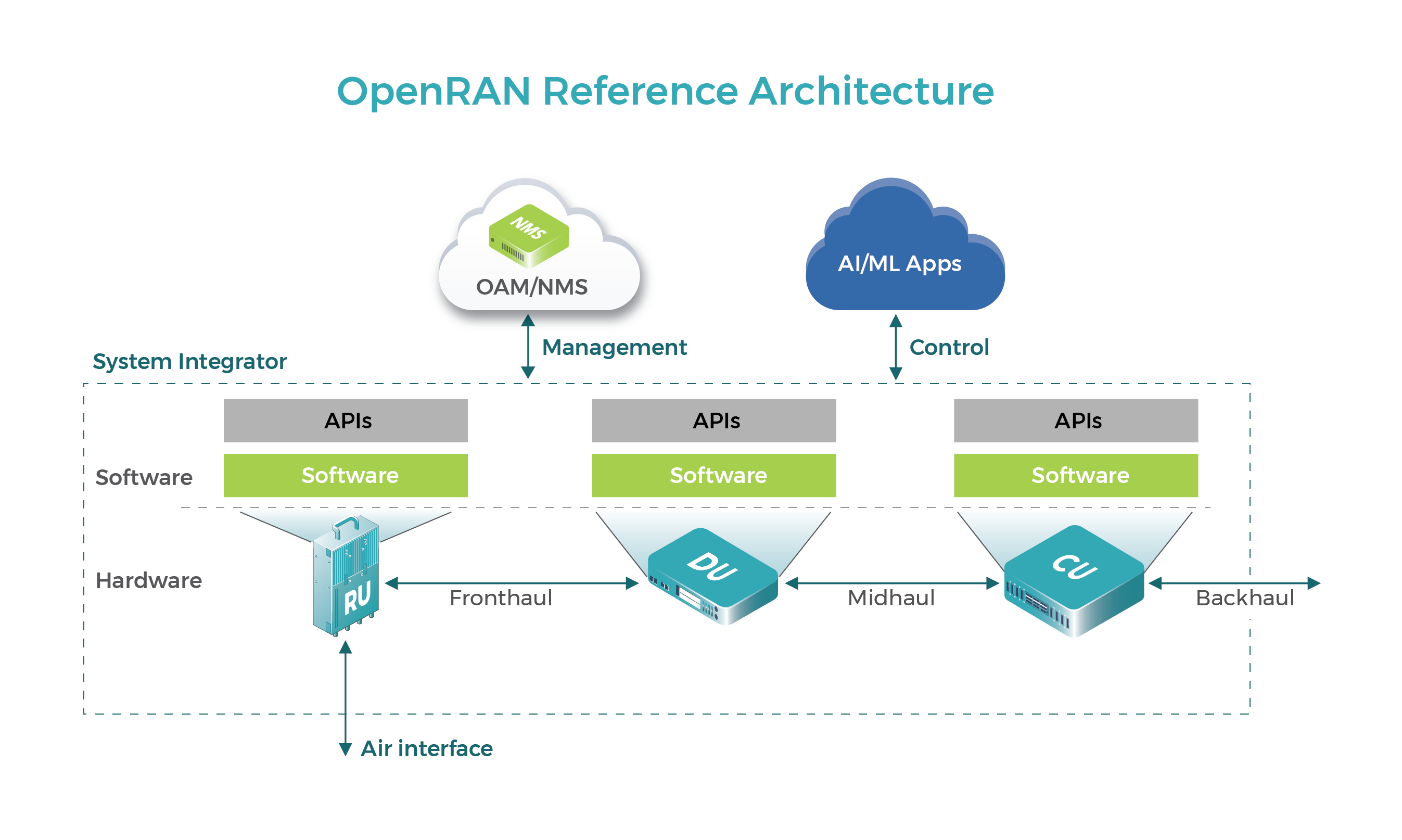

Operators are drawn to open RAN because it would allow them to mix and match vendors, using radio software from one vendor in tandem with general-purpose equipment developed by another. Traditional radio access networks typically force operators to buy all their components from the same supplier.

While today’s statement is light on details of firm commitments, Vodafone has already promised to use open RAN technology at around 2,600 of its mobile sites in the UK, while Telefónica this week said it would do the same at roughly 1,000 sites in Germany.

Deutsche Telekom, Germany’s telecom incumbent, has had less to say about rollout targets, although in December it revealed plans to build an “O-RAN town” in Neubrandenburg this year. “This will be a small-scale commercial deployment, which will encompass up to 150 cells, and will bring open RAN into a real 4G/5G network environment,” said a Deutsche Telekom spokesperson by email.

That leaves France’s Orange, which has now made a jaw-dropping commitment: Starting in 2025, it will buy only open RAN equipment when upgrading its European networks.

“From 2025, our intention is that all new equipment deployed by Orange in Europe should be based on open RAN,” says Arnaud Vamparys, Orange’s senior vice president of radio networks. “This is a good time to send a clear message.”

His expectation is that over this timeframe open RAN will reach “parity” with traditional RAN for deployment in a macro network. That would mean resolving some of the performance shortcomings that have mainly restricted open RAN to rural and less demanding conditions.

“2025 sounds about right,” says Brown. “The integrated systems are really setting a very high bar and open RAN is behind on features and performance right now.”

Brown told Light Reading he was encouraged by some of the recent open RAN activity in the semiconductor industry, citing baseband advances by Marvell and radio innovation by Xilinx. But he says it is too early to say open RAN will definitely be a mainstream success by the mid-2020s. “Can this be the best way to build a radio access network? If it isn’t, it is probably not going to succeed.”

“We continue to work to unlock the value of these European programs because clearly there are industry-leading initiatives of some of the manufacturing being brought back to Europe, especially on open RAN,” said Markus Haas, Telefónica Deutschland’s CEO, when asked during an analyst call this week if the telecom sector could be a beneficiary of Europe’s COVID-19 recovery fund.

“There is high interest so that the overall industry, the vendor landscape, might change or might be empowered by additional funds in order to progress and accelerate open RAN.”

While Ericsson and Nokia say they are now investing in open RAN technology, Vodafone looks determined to use alternative players for its 2,600-site rollout. Supplier diversification has topped the agenda for other service providers, as well.

“We want Europe to play a role in that evolution and it has to unite a bit to achieve this goal,” says Orange’s Vamparys. “There are lots of US and Japanese companies pushing strongly for the acceleration of open RAN. If we don’t communicate and help other companies, it could create an unbalanced situation.”

SOURCE: ORAN Alliance

Telefónica Deutschland named Altiostar, KMW, NEC and Supermicro as potential open RAN partners in a presentation it gave this week, while Deutsche Telekom has been in talks with Dell, Fujitsu, Mavenir, Nokia and NEC.

Vodafone has already carried out open RAN trials with Mavenir and Parallel Wireless.

The region’s biggest gap is probably in silicon, says Heavy Reading’s Brown. Most of the high-profile chipmakers developing open RAN technology, including Marvell and Xilinx, are based in the US.

Arm, a UK-based firm whose processor designs are used in many of the world’s smartphones, is a member of the O-RAN Alliance, the group responsible for open RAN specifications. But it is also currently the target of a $40 billion takeover move by Nvidia, a US semiconductor maker.

In the meantime, any plan to use part of the European recovery fund to support open RAN could meet with political resistance given the healthy state of the telecom sector compared with other industries, including airlines, hospitality, retail and tourism.

John Strand, the CEO of advisory firm Strand Consult, lashed out at the suggestion that open RAN could benefit from Europe’s COVID-19 stimulus package.

“Do these companies need subsidies? Is Telefónica in such a bad position that it needs public funding?” he told Light Reading. “We are living in a time when numbers of companies are in deep financial crisis because of COVID-19 and telecom operators, which definitely haven’t been hit, are asking for subsidies.”

Market forecasters now think open RAN will account for about one tenth of the overall market for radio access network products by the mid-2020s:

- Omdia expects industry revenues to increase from just $70 million in 2019 to about $3.2 billion in 2024, giving it a 9.4% share of the 4G and 5G market.

- Dell’Oro, another analyst firm, is in broad agreement: Last year, it predicted operators would spend somewhere north of $3 billion on open RAN products in 2024.

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/telefonica-vodafone-orange-dt-sign-open-ran-mou–1369273

Viavi Solutions and Mavenir collaborate to validate new SD, cloud-native RAN infrastructure

VIAVI Solutions Inc today announced that Mavenir, an upstart provider of end-to-end cloud-native network software for mobile operators, is collaborating with VIAVI for lab validation of radio access solutions in the U.S. VIAVI’s lab test platform, in use by almost every base station manufacturer in the world, provides scalable test systems for validating network performance as experienced by end users, across multiple cells and different radio access technologies.

The year 2020 marked a significant inflection point for mobile networks around the globe. With 229 million subscribers as of December 2020, 5G became the fastest growing mobile technology in history. New MNOs (like Dish Network) were granted licenses to establish greenfield networks to take advantage of this demand. Meanwhile, #1 base station maker Huawei was restricted from supplying infrastructure in markets around the globe. These trends have driven an expansion of the supply chain for mobile network solutions.

VIAVI tools are able to measure the complete performance of the network over multiple interfaces including O-RAN and RF through to the packet core. Capable of emulating one to many thousands of UEs, the platforms create a sophisticated and precise test environment, including comprehensive feature interactions, simulated RF and mobility, accurate replications of real-world user behavior profiles, together with mobility across the radio access network.

“Mavenir is proud to be a leading vendor to mobile operators around the globe, offering software-defined infrastructure that can adapt to evolving requirements for both brownfield and greenfield networks, large-scale to startup networks,” said Ramnik Kamo, EVP Quality, Systems and People, Mavenir. “VIAVI has been a highly collaborative partner with our two companies’ engineering teams working together to prove a new technology against very tight customer timescales.”

“As vendors across the industry develop open, cloud-native and disaggregated architectures, testing against user expectations of service quality will be critical to accelerate adoption at scale,” said Luiz Cesar Oliveira, Vice President, Americas, VIAVI. “We are excited to help Mavenir optimize their advanced radio access solutions based on our unique experience supporting over 200 service providers and virtually every network equipment manufacturer worldwide.”

About VIAVI

VIAVI (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn, Twitter, YouTube and Facebook.

………………………………………………………………………………………………………………………………………………………………….

References:

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

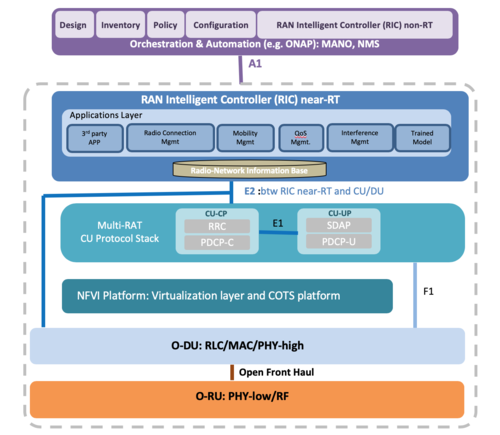

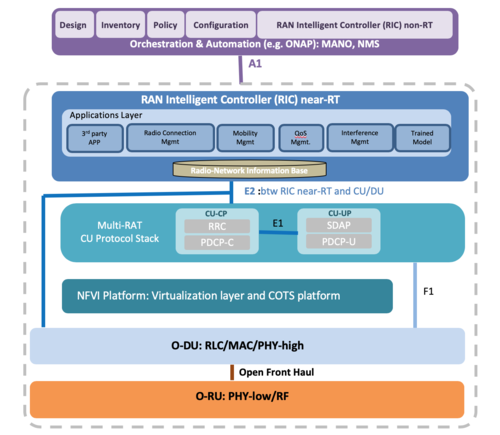

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

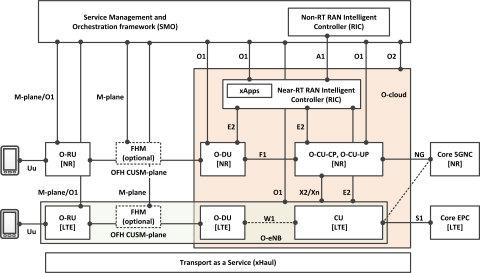

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

Progress in 5G private networks and Open RAN

Harry Baldock of Total Telecom writes, “The month of November was one of quiet progress for 5G, with more momentum steadily being gained for long-term trends towards private network deployments and open RAN innovation.”

Private 5G networks could be viable connectivity options for major industries like manufacturing and shipping, giving them not only access to the latest technologies to enhance efficiency, but also the flexibility to structure their network however they please.

In Europe, the German telecom regulator announced in November that it has awarded 88 licences for private 5G networks this year and expects more to come. For example, Nokia recently installed a private 5G network in Nuremburg for industrial IoT specialist MYNXG. In France, electronics manufacturer Lacroix is working with with Orange and Ericsson to create a 5G factory, and in the UK BT is installing a 5G network into Belfast Harbour, while Huawei is creating a private 5G testbed in Cambridge.

There has also been significant movement in the U.S., with General Motor’s new Factory ZERO installing a private 5G network from Verizon to manufacture the next generation of electric vehicles.

However, it should be remembered that despite its promise, private 5G networks are also still very much in their infancy, with a survey from STL Partners showing that the majority of enterprises still rely primarily on Wi-Fi and ethernet or fixed broadband for their connectivity needs.

Meanwhile, Open RAN has been gaining momentum for some months now as we reported yesterday in this IEEE Techblog post. In November, Dish and Qualcomm announced that they are set to work together on the U.S.’s first Open RAN-compliant (which spec?) 5G network. Similarly, in the UK, Vodafone’s August pilot for Open RAN, that took place in Wales, is being scaled up to 2,600 Open RAN sites in Wales and England, potentially using them to replace Huawei gear.

Meanwhile, companies like Mavenir continue to rapidly develop open RAN solutions, recently boasting of supporting 2G–5G for its open RAN packet core, thanks to a recent acquisition of ip.access.

Baldock concludes, “it seems fair to say that Open RAN is here to stay and is no longer something of a novelty. While many issues remain around things like standardization (e.g. no liaison with either ITU, ETSI or 3GPP) the movement is beginning to see increasing interest from operators and policymakers alike.”

…………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Global O-RAN Plugfests Across 5 Countries with 4G and 5G Lab and Field Test Platforms

Plugfests in Europe and India have been demonstrating the interoperability of telecom equipment using the Open Radio Access Network (O-RAN) specifications. The plugfests were organized by the leading telecom communications service providers (CSPs) and the O-RAN Alliance with a series of on-site demonstrations in multiple countries. The plugfest involved a series of on-site demonstrations in multiple countries, conducted in September and October 2020. In a multi-vendor based O-RAN environment, ensuring interoperability will become the network operator’s principal concern.

O-RAN Plugfest 2020 Integration and Testing Configuration

Image Credits: O-RAN Alliance

………………………………………………………………………………………………………………………………………………………………………..

Test equipment provider Viavi was involved in the plugfests with its Test Suite for O-RAN Specifications to validate that all interfaces are working correctly, including the RF, signaling and interoperability, timing and synchronization. The VIAVI Test Suite for O-RAN Specifications offers comprehensive, integrated solutions to validate that all interfaces are working correctly – including RF, signaling and interoperability, timing and synchronization – and equipment is performing to specifications even under load and stress. In the lab, the TM500 and TeraVM families deliver UE, O-RAN subsystem and core network simulation to enable conformance, interoperability and performance testing of both complete base station and core network testing as well as wraparound testing of individual O-RAN subsystems and core network elements. In both the lab and the field, T-BERD/MTS-5800 validates critical synchronization parameters with necessary precision using its Timing Extension Module (TEM), delivering a highly stable reference signal for synchronizing test equipment and O-RAN components. CellAdvisor 5G characterizes and analyzes 4G and 5G RF signals. ONT-800 tests transport network performance up to 800G.

- The plugfest in Berlin, Germany, was hosted by Deutsche Telekom, with demonstrations of radio access equipment from Baicells, Benetel, Foxconn, QCT, Wind River, Wiwynn and other vendors. Viavi provided its TM500 including UE emulation for performance testing and O-DU emulation for O-RU subsystem testing; TeraVM for core emulation and traffic generation; MTS-5800 for transport and synchronization test; and CellAdvisor 5G for RF signal analysis.

- In a plugfest in Torino, Italy, hosted by TIM, VIAVI provided the MTS-5800 for timing and synchronization in demonstrations of radio access equipment from Commscope, WNC, Wiwynn and other vendors.

- Madrid, Spain plugfest was hosted by a major Spanish service provider, with demonstrations of O-RAN x-haul (fronthaul and midhaul) transport with equipment from multiple vendors. VIAVI provided the MTS-5800 for timing and synchronization, and ONT-800 for multi-port transport test.

- Bengaluru (Bangalore), India plugfest was hosted by Airtel, with demonstrations of multi-vendor integration of O-RAN compliant radio access software and equipment from Altiostar, NEC, VVDN and Xilinx. The VIAVI TM500-C-5G 5G NR UE emulator and TM500 O-RU emulator were used for in-depth verification of the O-DU’s compliance to the WG4 open fronthaul (C/U/S planes) specification. • Tokyo, Japan. This plugfest was hosted by Japanese service providers, with demonstrations of radio equipment from major O-DU/O-CU and O-RU vendors. VIAVI provided the TM500 for 5G NR UE emulation.

“As a champion of interoperability test methodologies, and the first company to introduce a comprehensive test suite for O-RAN specifications, VIAVI has worked closely with ecosystem partners and operators worldwide to help identify, isolate and resolve performance issues with disaggregated networks,” said Sameh Yamany, Chief Technology Officer, VIAVI. “The successful results of the global O-RAN ALLIANCE plugfest represent a significant step forward in the advancement of multi-vendor O-RAN environments, which are essential to scaling and sustaining 5G networks.”

………………………………………………………………………………………………………………………………………………………………………………………………………..

Viavi is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………

References:

Vodafone and NEC Europe trial Open RAN technology with voice call

Vodafone and NEC Europe Ltd., a wholly owned subsidiary of NEC Corporation, in partnership with Altiostar, have jointly announced the first successful voice call made on an open virtual Radio Access Network (Open RAN) on Vodafone’s network in the Netherlands.

Open RAN technology holds promise and potential for next-generation wireless infrastructure. It’s being driven by innovation and open specifications from various consortiums (O-RAN, TIP Open RAN, and ONF). Today’s announcement demonstrates Vodafone’s strong commitment to sustaining its technological leadership, by bringing in such technological advances.

During the course of this trial, Vodafone and NEC intend to integrate solutions of leading Open RAN technology vendors, such as Altiostar [1.] and various other radio vendors, including NEC’s own 5G radio products, using commercial off the shelf (COTS) hardware from third parties, enabling Vodafone to transform its network to a software-based one suiting multiple deployment scenarios.

Note 1. It’s somewhat surprising that Altiostar was the only OpenRAN software vendor to be mentioned. Altiostar is part-owned by Rakuten and must therefore be near the front of the queue for its OpenRAN vendors. Rakuten has said it would make its Open RAN platform technology available to other operators. If successful, NEC and Altiostar will be involved in more deals as OpenRAN gathers momentum. Separately, there is the Rakuten-NEC 5G Core network (based on 3GPP 5G core “vision” specs) that Rakuten also wants to sell to global network operators.

…………………………………………………………………………………………………………………………………………………………………………………………

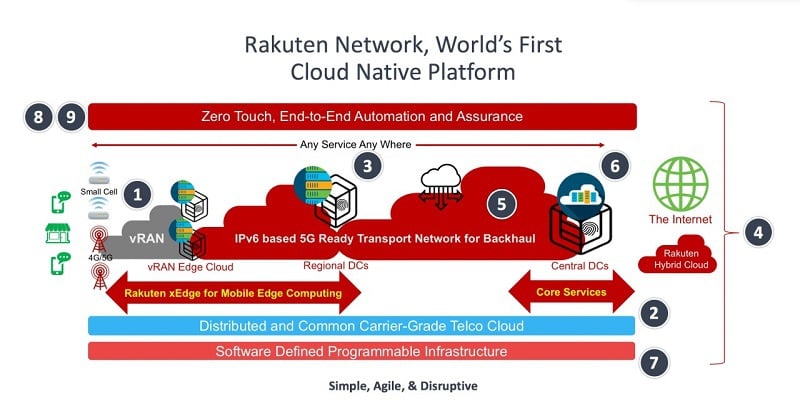

Image Credit: Rakuten Mobile

“We are proud to embark on this journey together with Vodafone that will transform mobile network economics, while deploying technology with greater flexibility, greater efficiencies, and more agility,” said Yogarajah Gopikrishna, GM at NEC Europe. “By integrating best of breed solutions, NEC, as an experienced Open RAN System Integrator, is committed to bring transformative change to the telecommunications space leveraging our long history and experience in mobile network solutions.”

“We are delighted to work together with NEC towards the first live Open RAN site,” said Ruud Koeyvoets, Vodafone Mobile Networks’ Director. “The introduction of the technology enables us to introduce new suppliers, such as Altiostar, giving us greater flexibility when rolling out our mobile network. We’re proud to be pioneering the development of Open RAN and will be monitoring the performance of this pilot.”

…………………………………………………………………………………………………………………………………………

About Vodafone

VodafoneZiggo is a leading Dutch company that provides fixed, mobile and integrated communication and entertainment services to consumers and businesses. As of June 30, 2020 we have more than 5 million mobile, nearly 4 million TV, nearly 3.4 million fixed broadband internet and 2.4 million fixed telephony subscriptions. VodafoneZiggo is a joint venture by Liberty Global, the largest international TV and broadband internet company, and Vodafone Group, one of the world’s largest telecommunication companies.

About NEC Europe Ltd.

NEC Europe Ltd. is a wholly owned subsidiary of NEC Corporation, a leader in the integration of IT network technologies that benefit businesses and people around the world. NEC Europe Ltd. is building upon its heritage and reputation for innovation and quality by providing its expertise, solutions and services to a broad range of customers, from telecom operators to enterprises and the public sector. For additional information, please visit the NEC Europe Ltd. home page at:

http://uk.nec.com/

References:

https://www.nec.com/en/press/202010/global_20201019_04.html

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Analysis of Open Network Foundation new 5G SD-RAN™ Project

Executive Summary:

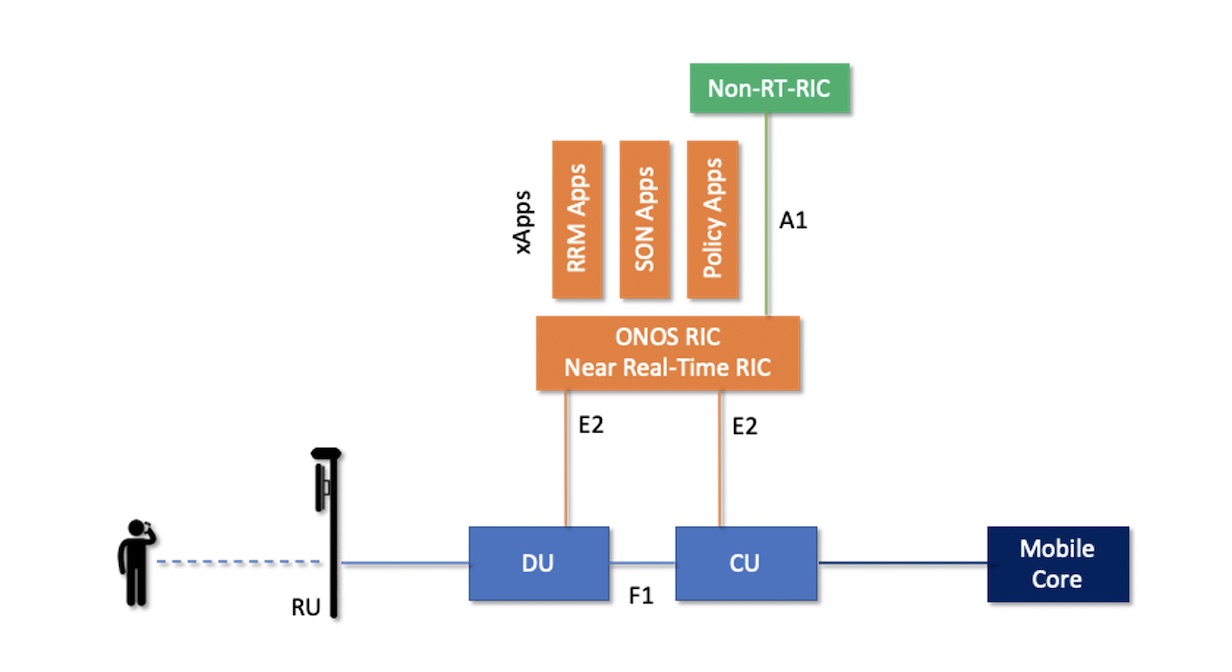

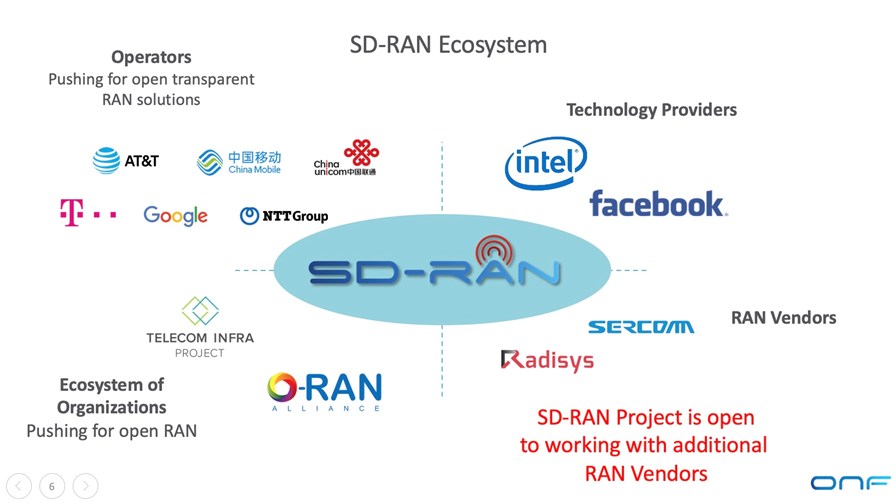

In a move that will help promote multi-vendor interoperability, the Open Networking Foundation (ONF) today announced the formation of the SD-RAN project (Software Defined Radio Access Network) to pursue the creation of open source software platforms and multi-vendor solutions for mobile 4G and 5G RAN deployments. Initially, the project will focus on building an open source Near Real-Time RAN Intelligent Controller (nRT-RIC) compatible with the O-RAN architecture.

The new SD-RAN project is backed by a consortium of leading operators and aligned technology companies and organizations that together are committed to creating a truly open RAN ecosystem. Founding members include AT&T, China Mobile, China Unicom, Deutsche Telekom, Facebook, Google, Intel, NTT, Radisys and Sercomm. All the project members will be actively contributing, and this includes the operators contributing use cases and trialing the results, according to the ONF. However, the larger cellular base station vendors that are ONF members, Nokia, Samsung, ZTE, Fujitsu, NEC were silent on their participation in this SD-RAN project.

There may be some confusion caused by ONF’s SD-RAN project as it is the third Open RAN consortium. The O-RAN Alliance and TIP Open RAN project are working on open source hardware and open interfaces for disaggregated RAN equipment, like a 4G/5G combo base station.

In a brief video chat yesterday, Timon Sloane, VP of Ecosystem and Marketing for ONF told me that this new ONF SD-RAN project would be in close contact with the other two Open RAN consortiums and distinguished itself from them by producing OPEN SOURCE SOFTWARE for disaggregated RAN equipment—something he said the O-RAN Alliance and TIP Open RAN project were NOT doing.

That should go a long way in dispelling that confusion, but it nonetheless presents a challenge on how three consortiums can effectively work together to produce meaningful open source software code (ONF) and hardware (O-RAN Alliance and TIP) specifications with joint compliance testing to ensure multi-vendor interoperability.

Sloane told Matt Kapko of SDXCentral: “The operators really are pushing for separation of hardware and software and for enabling new innovations to come in in software without it being tightly coupled to the hardware that they purchase. And xApps are where the functionality of the RAN is to be housed, and so in order to do this in a meaningful way you have to be able to do meaningful functions in these xApps,” Sloane said.

However, no mention was made in the ONF press release of a liaison with either 3GPP or ITU-R WP5D which are producing the standards and specs for 5G and have already done so for 4G-LTE. Neither of the aforementioned O-RAN consortiums have liaisons with those entities either.

There are other complications with Open RAN (independent of SD-RAN), such as U.S. government’s attempt to cripple Huawei and other China telecom equipment vendors, need for a parallel wireless infrastructure, legacy vs greenfield carriers. These are addressed in Comment and Analysis section below.

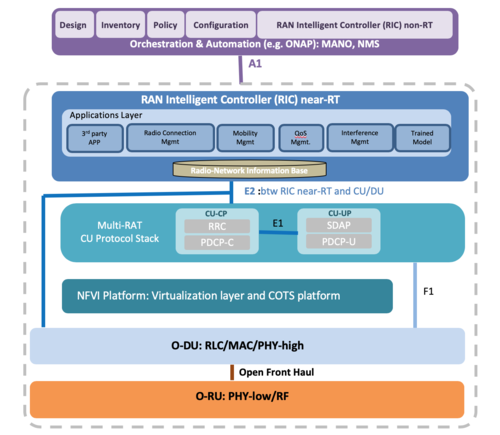

µONOS-RIC:

Central to the project is the development of an open source near-real time RIC called µONOS-RIC (pronounced “micro-ONOS-RIC”).

µONOS is a microservices-based SDN controller created by the refactoring and enhancement of ONOS, the leading SDN controller for operators in production tier-1 networks worldwide. µONOS-RIC is built on µONOS, and hence features a cloud-native design supporting active-active clustering for scalability, performance and high availability along with the real-time capabilities needed for intelligent RAN control.

µONOS-RIC is designed to control an array of multi-vendor open RAN equipment consistent with the O-RAN ALLIANCE architecture. In particular, the O-RAN ALLIANCE E2 interface is used to interface between µONOS-RIC and vendor supplied RAN RU/DU/CU RAN components.

xApps running on top of the µONOS-RIC are responsible for functionality that traditionally has been implemented in vendor-proprietary implementations. A primary goal of the SD-RAN project (and, not coincidentally, for the operators who founded the O-RAN consortium) is to enable an external intelligent controller to control the RAN so that operators have both visibility and control over their RAN networks, thus giving operators ownership and control over how spectrum is utilized and optimized along with the tools to deliver an optimal experience for users and applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

Relationship to O-RAN Alliance, O-RAN Software Community and TIP:

The participating members of the SD-RAN project plan to implement, prototype and trial an advanced architecture that enables intelligent RIC xApps to control a broad spectrum of SON and RRM functionality that historically has been implemented as vendor-proprietary features on bespoke base station equipment and platforms. SD-RAN’s focus and goals are complementary to various efforts across the industry, including work taking place within the O-RAN ALLIANCE, the O-RAN Software Community and the TIP OpenRAN Project Group.

SD-RAN will follow O-RAN specifications as they are developed and will also make use of components of existing open source to facilitate interoperability. As the project pioneers new functionality, all extensions and learnings that come from building the system will be contributed back to O-RAN ALLIANCE, with the intent that these extensions can inform and advance the O-RAN specifications.

The SD-RAN work inside the ONF community will take place in parallel with work being contributed to the O-RAN Software Community. The intent is for interoperable implementations to come out of both efforts, so that a mix of open source and vendor proprietary components can be demonstrated and ultimately deployed.

Timing and Availability:

The SD-RAN project already has a working skeleton prototype of the µONOS-RIC controller above a RAN emulation platform through the E2 interface. This implementation is demonstrating handover and load balancing at scale, supporting over 100 base stations and 100,000 user devices with less than 50ms handover latency (less than 10ms latency for 99% of all handovers).

The SD-RAN community is advancing towards a field trial by early 2021, working with RAN vendors to integrate carrier-grade RU/DU/CU components while in parallel implementing xApps to demonstrate SON and RRM functionality. Interested parties are encouraged to contact ONF for additional information.

Quotes Supporting the SD-RAN Project:

“AT&T strongly supports the development of specifications and components that can help drive openness and innovation in the RAN ecosystem. The O-RAN ALLIANCE’s specifications are enabling the ecosystem, with a range of companies and organizations creating both open source and proprietary implementations that are bringing the open specifications to life. The ONF SD-RAN project, along with the O-RAN OSC, will expand the ecosystem with an nRT-RIC that can support xApps and help demonstrate their interoperability. This project will help accelerate the transition to an open RAN future.”

Andre Fuetsch, President and Chief Technology Officer, AT&T Labs

“China Mobile co-founded O-RAN in order to promote both the opening of the RAN ecosystem for multi-vendor solutions and the realization of RAN with native intelligence for performance and cost improvement. An open nRT-RIC with support for open xApps that go beyond policy-based control and SON to also enhance Radio Resource Management (RRM) will make it possible for operators to optimize resource utilization and application performance. We are excited to see the development of an open nRT-RIC and xApps in the SD-RAN project led by ONF, and expect this work to help advance the state-of-art for open and intelligent RAN.”

Dr. Chih-Lin I, Chief Scientist, Wireless Technologies, China Mobile

“China Unicom has been a long-term partner with ONF. We continue to see the benefits of the ONF’s work and the impact it has on our industry. The SD-RAN project is now applying the ONF’s proven strategy for disaggregating and creating open source implementations to the 5G RAN space in order to foster innovation and ecosystem transformation. We are excited by this work, and are committed to trialing a solution as it becomes available.”

Dr. Xiongyan Tang, Network Technology Research Institute, China Unicom

“Deutsche Telekom is a huge believer in applying disaggregation and open source principles for our next-generation networks. DT has ONF’s mobile core platform (OMEC) in production and we are taking ONF’s broadband access (SEBA/VOLTHA) platform to production towards the end of 2020. This journey has shown us the tremendous value that is created when we can build solutions based on interoperable multi-vendor components intermixed with open source components. ONF’s SD-RAN project is leveraging these same principles to help accelerate innovation in the RAN domain, and we are excited to be an active collaborator in this journey.”

Dr. Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom

“Connectivity is an integral part of Facebook’s focus to bring people closer together. We work closely with partners to develop programs and technologies that make connectivity more affordable and accessible. Through our collaboration with ONF on their SD-RAN project, we look forward to engaging with the community to improve connectivity experiences for many people around the world.”

Aaron Bernstein, Facebook’s Director of Connectivity Ecosystem Programs

“Google is an advocate for SDN, disaggregation and open source, and we are excited to see these principles now being applied to the RAN domain. ONF’s SD-RAN project’s ambition to create an open source RIC can help invigorate innovation across the mobile domain.”

Ankur Jain, Distinguished Engineer, Google

“Intel is an active participant of the ONF’s SD-RAN project to advance the development of open RAN implementations on high volume servers. ONF has been leading the industry with advanced open source implementations in the areas of disaggregated Mobile Core, e.g. the Open Mobile Evolved Core (OMEC), and we look forward to continuing to innovate by applying proven principles of disaggregation, open source and AI/ML to the next stepping stone in this journey – the RAN. SD-RAN will be optimized to leverage powerful performance, AI/ML, and security enhancements, which are essential for 5G and available in Intel® Xeon® Scalable Processors, network adapters and switching technologies, including Data-Plane Development Kit (DPDK) and Intel® Software Guard Extensions (Intel SGX).”

Pranav Mehta, Vice President of Systems and Software Research, Intel Labs

“NTT sees great value in transforming the RAN domain in order to foster innovation and multi-vendor interoperability. We are excited to be part of the SD-RAN ecosystem, and look forward to working with the community to develop open source components that can be intermixed with vendor proprietary elements using standard O-RAN interfaces.”

Dai Kashiwa, Evangelist, Director of NTT Communications

“Radisys is excited to be a founding member of the SD-RAN project, and we are committed to integrating our RAN software implementation (CU & DU) with O-RAN interfaces to the µONOS-RIC controller and xApps being developed by the SD-RAN project community. This effort has the potential to accelerate the adoption of O-RAN based RIC implementation and xApps, and we are committed to working with this community to advance the open RAN agenda.”

Arun Bhikshesvaran, CEO, Radisys

“As a leading manufacturer of small cell RAN equipment and an avid supporter of the open RAN movement, Sercomm is excited to collaborate with the SD-RAN community to open E2 interfaces and migrate some of our near-real-time functionalities from the RAN equipment into xApps running the μONOS-RIC controller. This is a nascent yet dynamic area full of potential, and we are committed to working with the SD-RAN ecosystem to build solutions ready for trials and deployment.”

Ben Lin, CTO and Co-Founder, Sercomm

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core and Services. We are excited about the collaboration between our RIA subgroup and ONF’s SD-RAN project to accelerate RAN disaggregation and adoption of open interfaces. Through this collaboration we will enable the OpenRAN ecosystem to leverage the strengths of data science and AI/ML technologies to set new industry benchmarks on performance, efficiency and total cost of ownership.”

Attilio Zani, Executive Director for Telecom Infra Project (TIP)

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis of Open RAN Market:

Disclaimer: Like all IEEE Techblog posts, opinions, comment and analysis are ALWAYS by the authors and do NOT EVER represent an opinion or position by IEEE or the IEEE Communications Society. This should be obvious to all in the 11 1/2 years of this author’s contribution to the IEEE Techblog and its predecessor- ComSoc Community blogs.

…………………………………………………………………………………………………………………………………………………………………………

Besides NOT having a liaison with either 3GPP or ITU-R, the following Open RAN issues may limit its market potential. These are NOT specific to the ONF SD-RAN project, but generic to Open RAN deployments.

- U.S. officials promoting Open RAN as a way to decrease the dominance of Huawei, the world’s biggest vendor of mobile equipment by market share and also to thwart the rise of other vendors like ZTE and China Information and Communication Technology Group (CICT) which recently won a small part of s China Mobile contract. Obviously, China’s government will fight back and NOT allow any version of Open RAN to be deployed in China (likely to be the world’s biggest 5G market by far)! That despite China Mobile and China Unicom’s expressed interest in Open RAN (see Quotes above). Remember, that the three big China carriers (China Mobile, China Telecom, China Unicom) are all state owned.

- Dual infrastructure: If a legacy wireless carrier deploys Open RAN, existing wireless infrastructure equipment (base stations, small cells, cell tower equipment, backhaul, etc) must remain in place to support its customers. Open RAN gear (with new fronthaul and backhaul) won’t have wide coverage area for many years. Therefore, current customers can’t simply be switched over from legacy wireless infrastructure to Open RAN gear. That means that a separate separate and distinct WIRELESS INFRASTRUCTURE NETWORK must be built and physically installed for Open RAN gear. Yet no one seems to talk or write about that! Why not?

- Open RAN is really only for greenfield carriers with NO EMBEDDED WIRELESS INFRASTRUCTURE. Rakuten and Dish Network are two such carriers ideally suited to Open RAN. That despite a lot of noise from AT&T and Deutsche Telekom about Open RAN trials. All the supporting quotes from legacy carriers are indicative of their interest in open source software AND hardware: to break the stranglehold the huge wireless equipment vendors have on cellular infrastructure and its relatively high costs of their proprietary network equipment and element management systems.

- Open RAN should definitely lower initial deployment costs (CAPEX), but may result in INCREASED maintenance cost (OPEX) due to the difficulty of ensuring multi-vendor interoperability, systems integration and MOST IMPORTANTLY tech support with fault detection and rapid restoration of service.

Conclusions:

Considering all of the above, one may conclude that traditional cellular infrastructure, based on vendor specific equipment and proprietary interfaces, will remain in place for many years to come. As a result, Open RAN becomes a decent market for greenfield carriers and a small market (trial or pilot networks) for legacy carriers, which become brownfield carriers after Open RAN is commercially available to provide their cellular services.

Given a smaller than commonly believed market for Open RAN, this author believes the SD-RAN project is a very good idea. That’s because it will make open source software available for Open RAN equipment, something that neither the O-RAN Alliance of TIP Open RAN project are doing. Of course, having more vendors producing Open RAN white boxes and software does add to the systems integration and tech support that only large (tier 1) telcos (like AT&T, Deutsche Telekom, NTT and cloud companies (like Google, Facebook, Microsoft) have the staff to support.

In a follow up phone conversation today, Timon Sloane told me that network operators want a fully functional and powerful RAN Intelligent Controller (RIC) to gain visibility and control over their RANs, but that has yet to be realized. To date, such controllers have been proprietary, rather than open source software.

The ONF µONOS-RIC is a key software module to realize that vision, Timon said. It is very much like a (near) real time operating system for an Open RAN. If successful, it will go a long way to promote multi-vendor interoperability for Open RAN deployments. Success and good luck ONF!

………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.prnewswire.com/news-releases/onf-announces-new-5g-sd-ran-project-301117481.html

https://www.sdxcentral.com/articles/news/onf-picks-up-where-o-ran-alliance-falls-short/2020/08/