OpenRAN

Juniper Networks, Vodafone and Parallel Wireless in RIC Open RAN Trial

Juniper Networks is working with Vodafone and Parallel Wireless, a pioneer in Open RAN solutions, conducting a multivendor RAN Intelligent Controller (RIC) trial for “tenant-aware admission control” use cases. The trial, initially running in Vodafone’s test labs in Turkey and with plans to move into its test infrastructure, supports O-RAN interfaces and addresses the key business challenges faced by mobile operators around personalized user experience, viable revenue generation and reduction in both CAPEX and OPEX for 4G and 5G services.

The trial is based on an open, software-driven architecture that leverages virtualization to deliver more programmable, automated granular-by-user traffic management. The initial focus is on delivering tenant-aware admission control capability, enabling operators to personalize services and provide superior user experiences. Real-time tracking and enforcement of radio resources across the RAN enables mission-critical users – for example, hospitals and schools – to receive prioritized mobile data services delivery. This capability is enabled by Juniper’s rApp/xApp cloud-based software tools that manage network functions in near real-time, along with Parallel Wireless cloud-native Open RAN functions.

The trial’s design philosophy is focused on demonstrating the potential of enabling open, agile resource management and mobile data delivery in any software-driven RAN environment. This approach enables services and applications to be managed, optimized and mitigated automatically by the RAN, built on real-time data insights from its own performance.

All three organizations are active operators/contributors of the O-RAN ALLIANCE and the Telecom Infra Project (TIP), underlining their shared commitment to industry innovation and standards.

Juniper’s RIC solution is architected as an open platform supporting open interfaces on the north bound and south bound side, enabling easier integration with Open RAN partners in the ecosystem. Juniper’s RIC platform will also enable easy integration of third-party rApps/xApps, using UI-based onboarding and deployment tools coupled with flexibility to select between either network-based or SDK-based APIs (Application Programming Interfaces).

Parallel Wireless brings cloud-native Open RAN solutions – which are now integrated with the leading-edge RAN Intelligent Controller (RIC) based on O-RAN ALLIANCE specifications from Juniper Networks, giving operators more choices to build the best-of-breed RAN.

In January 2022, Vodafone announced that it had teamed with Samsung Networks Europe to switch on the UK’s first Open RAN site to carry live 5G traffic, marking a milestone in the commercial deployment of Open RAN network architectures in Europe, with more than 2,500 additional sites to follow.

Source: The Fast Mode

……………………………………………………………………………………………………………………………………………………………………………

Supporting Quotes:

“Vodafone has a clear vision that all mobile network radio infrastructure should be open – enabling rapid adoption of innovative services. We see this as a key stepping stone to rich innovation and collaboration, the only way that groundbreaking new use cases in 4G and 5G can be developed and cost-effectiveness maximized. In order to accelerate progress in this exciting journey, I am very pleased that Vodafone is hosting a lab and field trial for tenant-aware admission control using O-RAN interfaces, alongside an ecosystem of like-minded technology partners, including Juniper Networks and Parallel Wireless. By working together, we will be able to build smarter networks, better user experiences and drive stronger sustainability measures for B2B use cases.”

– Paco Martin, Head of Open RAN at Vodafone Group

“This multivendor trial at Vodafone has provided the perfect opportunity to demonstrate how Juniper’s RIC, and our focus on enabling seamless application portability, are able to unlock the true potential of Open RAN. By coupling our innovations with those of Parallel Wireless and Vodafone’s operational experience, we are able to achieve a real-world use case that can deliver value and better user experiences with improved economics for operators.”

– Constantine Polychronopoulos, VP, 5G & Telco Cloud at Juniper Networks

“Vodafone has been leading in Open RAN innovation since the early days. As the next stage of Open RAN adoption we are excited to partner with Vodafone and Juniper Networks, integrating our state-of-the-art cloud-native, O-RAN ALLIANCE compliant, Open RAN solutions with the leading edge RAN Intelligent Controller from Juniper. ”

– Keith Johnson, President at Parallel Wireless

Heavy Reading Comments about RIC:

According to Heavy Reading analyst Gabriel Brown, wireless network operators this year will likely be testing RIC technology in the field. He doesn’t expect full-blown products until the end of this year at the earliest. Vendors in the space range from Juniper Networks to VMware to some open source offerings from the likes of the Open Networking Foundation (ONF).

RICs could eventually replace self-organizing networks (SON) in classic RAN architectures. RICs help control base stations from a variety of vendors. Specifically, they can support various dynamic networking features such as switching off radios during non-peak times to cut energy costs. As a result, RICs are key to Open RAN which facilitates the mix and match network elements/base station modules from different vendors, rather than being locked into a tightly integrated stack of components supplied by just one vendor.

RICs come in two flavors: near-real time RICs and non-real time RICS. Brown expects most of the early RIC deployments to be of the non-real time variety because those specifications are farther along and less tightly coupled with the control of baseband scheduling.

About Juniper Networks:

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and other trademarks listed here are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

References:

https://www.juniper.net/us/en/research-topics/what-is-ric.html

https://www.lightreading.com/open-ran/growth-in-ric-how-open-ran-could-get-smarter/d/d-id/775108

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

Additional Resources:

YouTube: RAN Intelligent Controller (RIC) – Unlocking the True Potential of O-RAN

Open RAN Solutions: Juniper Networks

Research Topic: What is a RAN Intelligent Controller?

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

by John Strand, CEO of Strand Consult with Alan J Weissberger

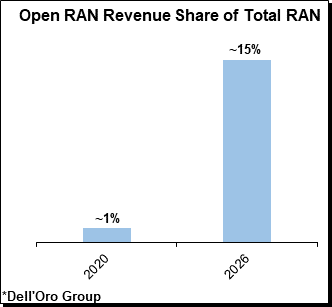

A recent Dell’Oro Group report suggests that “total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G.”

The Dell’Oro Group report author Stefan Pongratz added, “So, given where we are today, we can safely conclude that the movement has come much further than expected both from a commitment perspective and from a commercialization perspective.”

I respectfully disagree. The OpenRAN story is not driven by commercial demand for equipment. Instead, it is driven by people who make a living from hype. There is probably more money being made in generating hype about OpenRAN than in the actual purchase of OpenRAN equipment.

While there’s a lot of talk about OpenRAN, it’s still a technology that operators are testing – not deploying.

The hype cycle likely explains the Dell’Oro Group’s recent report that the OpenRAN market will increase. However, for all their unique expertise, Dell’Oro has not committed to publishing how many sites will use OpenRAN in the future (% of installed base) and other vital specifics like what proportion of the mobile companies’ traffic and revenue will go through OpenRAN sites and how much shareholders may gain by operators switching to OpenRAN.

Over 200 5G networks have gone live globally. All of these use 3GPP release 15 and 16 compliant network equipment. None use OpenRAN gear.

Note that neither 3GPP release 15 or 16 5G RAN specs or ITU-R 5G standard (ITU-R M.2150) include any reference to OpenRAN specifications (from either the O-RAN Alliance or TIP OpenRAN project). In fact, the 3GPP website calls out the conundrum of multiple OpenRAN-like specifications:

Open RAN is made possible through standardized (???)open network interfaces, defined in 3GPP, O-RAN Alliance, IEEE (???), and other SDOs (???) and industry fora (e.g. TIP Open RAN project). To cater to all the diverse 5G use cases and operator’s deployment constraints, the standards define multiple NG-RAN architecture options and the associated open network interfaces. While these options are crucial in making 5G suitable to address all the requirements and challenges of the next generation mobile network, figuring out which option fits a particular practical use case is sometimes challenging. This is further exacerbated by the fact that relevant standards are scattered across multiple SDOs.

Rakuten is the only deployed, purpose-built OpenRAN network (4G now, 5G later), and it uses proprietary network equipment, which is not interoperable with any other 4G/5G network. The much advertised 4G/5G OpenRAN Dish Network continues to be delayed with a launch date of sometime in 2022.

There are hundreds, if not thousands, of stories about OpenRAN, but they don’t focus on these key questions:

- How much do telecom stakeholders gain by you switching from classic 3GPP RAN to OpenRAN? At what point does it make sense to shift? In other words, how much do operators save and how does that translate to the bottom line? Strand Consult’s research shows that the operators’ RAN costs make up about 3% of ARPU. In practice, even the most optimistic savings from OpenRAN will not meaningfully affect the mobile operator’s earnings.

- If OpenRAN products win market share of 15% in 2026, what share of that installed base will be OpenRAN in 2025 and 2030? Strand Consult believes that OpenRAN will struggle with market share, barely reach 3% of the installed 5G sites by 2030.

- How will mobile subscribers experience the shift towards OpenRAN? Will they gain access to more features on their smartphones as a result? If OpenRAN achieves 3% market share of mobile sites, what incentives are there for application developers to build for OpenRAN? Imagine that voice and SMS were services that were available on only 3% of an operators’ mobile sites.

There is a need for greater transparency in the OpenRAN market, including testing, operator trials, units sold etc. While it is one thing for an operator to conduct OpenRAN trials and tests, it is quite another for the operator to purchase the equipment. To fuel the hype, some stories have suggested that a trial of OpenRAN equipment was a purchase.

OpenRAN benefits, however good they sound now, remain to be seen. We have yet to see any actual benefits created from the mix and match of OpenRAN modules/components. Moreover, we have yet to see how easy it will be to replace one OpenRAN vendor with another in a large scale commercial 4G/5G network.

For 25 years, Strand Consult has been the opposite of hype. We make our living being critical of pie in the sky scenarios. Our clients are executives and boards members of mobile operators who want credible and critical knowledge.

Strand Consult’s report Debunking 25 Myths of OpenRAN, analyzes the 25 myths that OpenRAN hype machine loves to cultivate. Close to one thousand people have requested that new report. Outside of three emails noting minor typos in our report, Strand Consult has yet to receive feedback to dispute the report’s analyses and conclusions.

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

………………………………………………………………………………………………………

References:

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

https://www.lightreading.com/open-ran/open-ran-moving-faster-than-expected—-delloro/d/d-id/774780?

https://www.3gpp.org/news-events/2150-open_ran

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

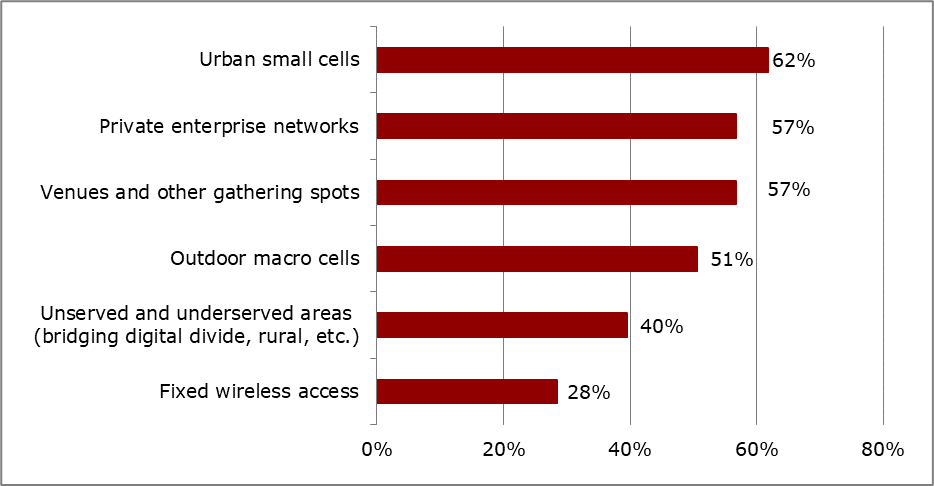

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?

Heavy Reading: How network operators will deploy Open RAN and cloud native vRAN

Heavy Reading conducted an operator survey in association with Quanta Cloud Technology (QCT) to explore how and why operators are likely to deploy Open RAN. The data was collected in November 2021 and includes North American, European and Asian operator respondents in roughly equal proportions.

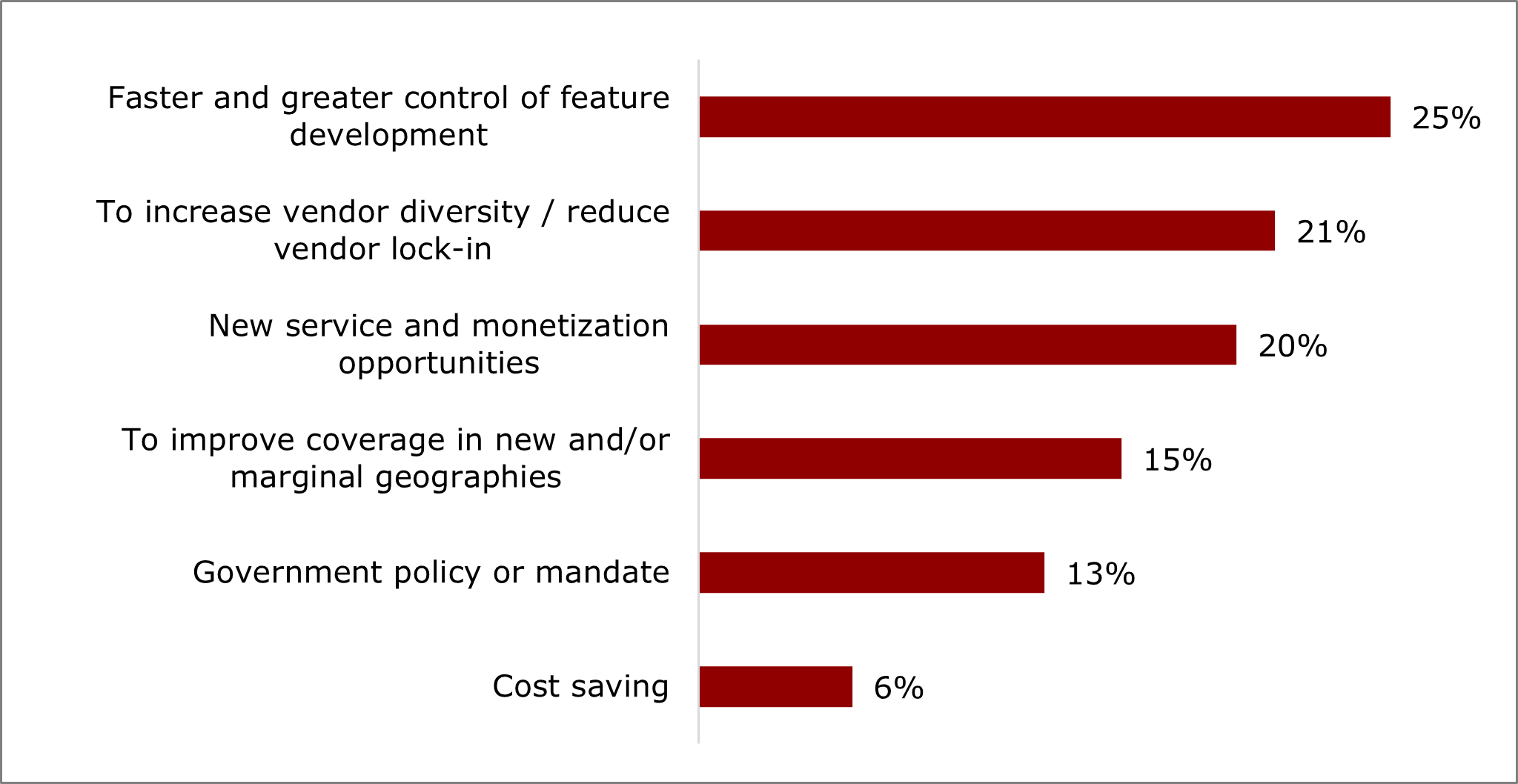

The first question in the survey that asked about the business justification for Open RAN. Here’s the result:

The lead response is for “faster greater control of feature development” with 25%, just ahead of “increase vendor diversity” at 21%, and “new service and monetization opportunities” at 20%.

The absence of an overriding reason to pursue open RAN is consistent with previous Heavy Reading operator surveys. These results indicate the business case will be founded on an accumulation of benefits that will deliver value relative to a classic, single-vendor RAN. They also point to the view that open RAN has not yet found — or at least, has not yet proven — a compelling business justification and that this diversity of views reflects an ongoing search for a business case.

Note that cost savings at 6% of respondents, indicates lower cost is not really a business reason to deploy Open RAN. There are likely two explanations for this:

- Open RAN has a similar bill of materials to classic single-vendor RAN. Ericsson and Nokia say Open RAN is more expensive than integrated, single vendor RAN.

- Operators in leading markets will not compromise on user experience simply to save a small percentage on RAN equipment costs.

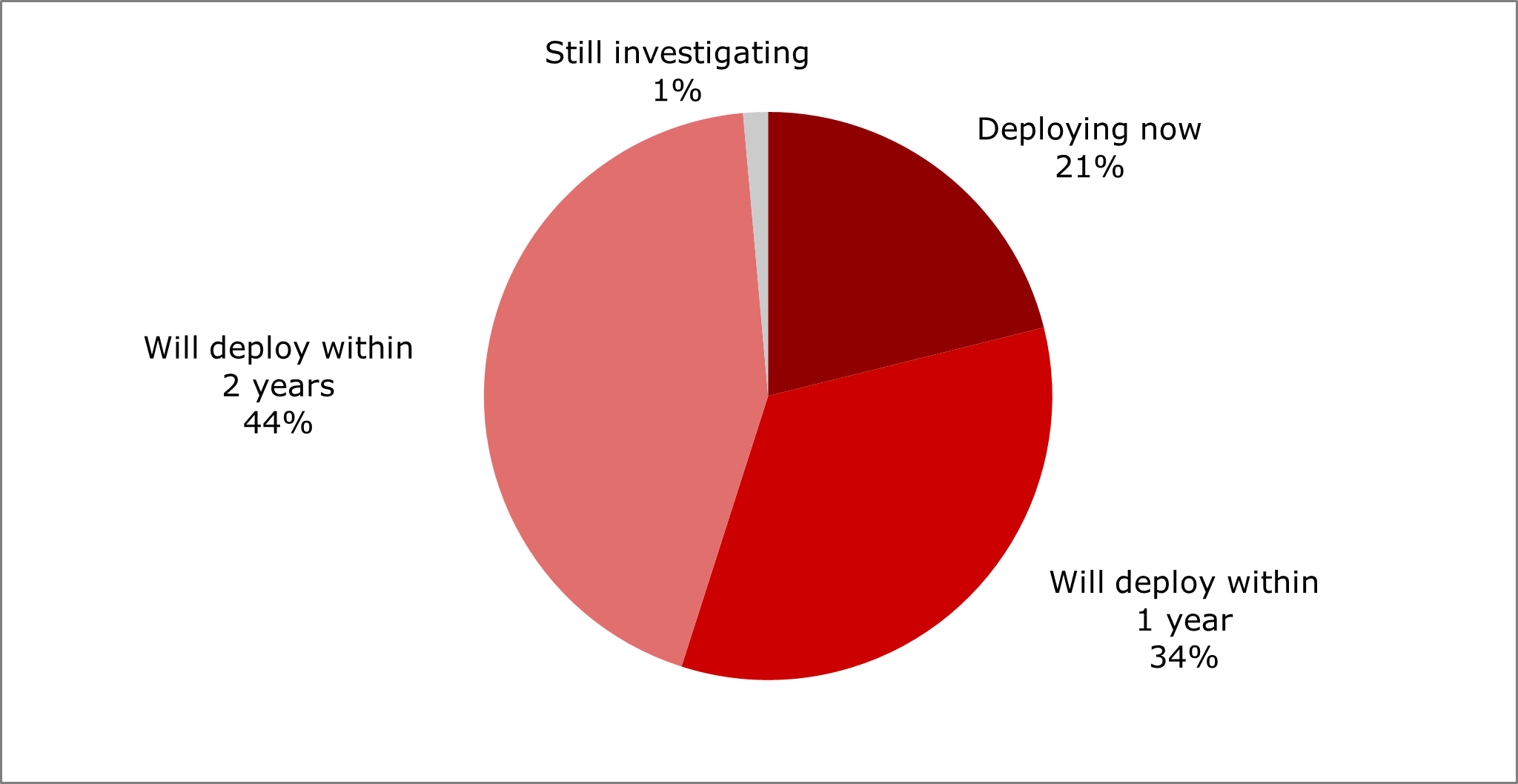

With respect to cloud native vRAN (RAN software that is deployed in containers and centrally orchestrated) the survey asked when operators plan to deploy a containerized Distributed Unit (DU) vRAN application in their commercial network. 21% of respondents said they are “deploying now,” and a further 34% “will deploy within 1 year.”

While this response this looks overly optimistic, containerized DU products are now available and are commercially deployed and operational. Heavy Reading expects deployment of this technology to scale quickly. So even if this data seems too optimistic on the timeline, it is a good indicator of sentiment among operators that are likely to already be positive on vRAN.

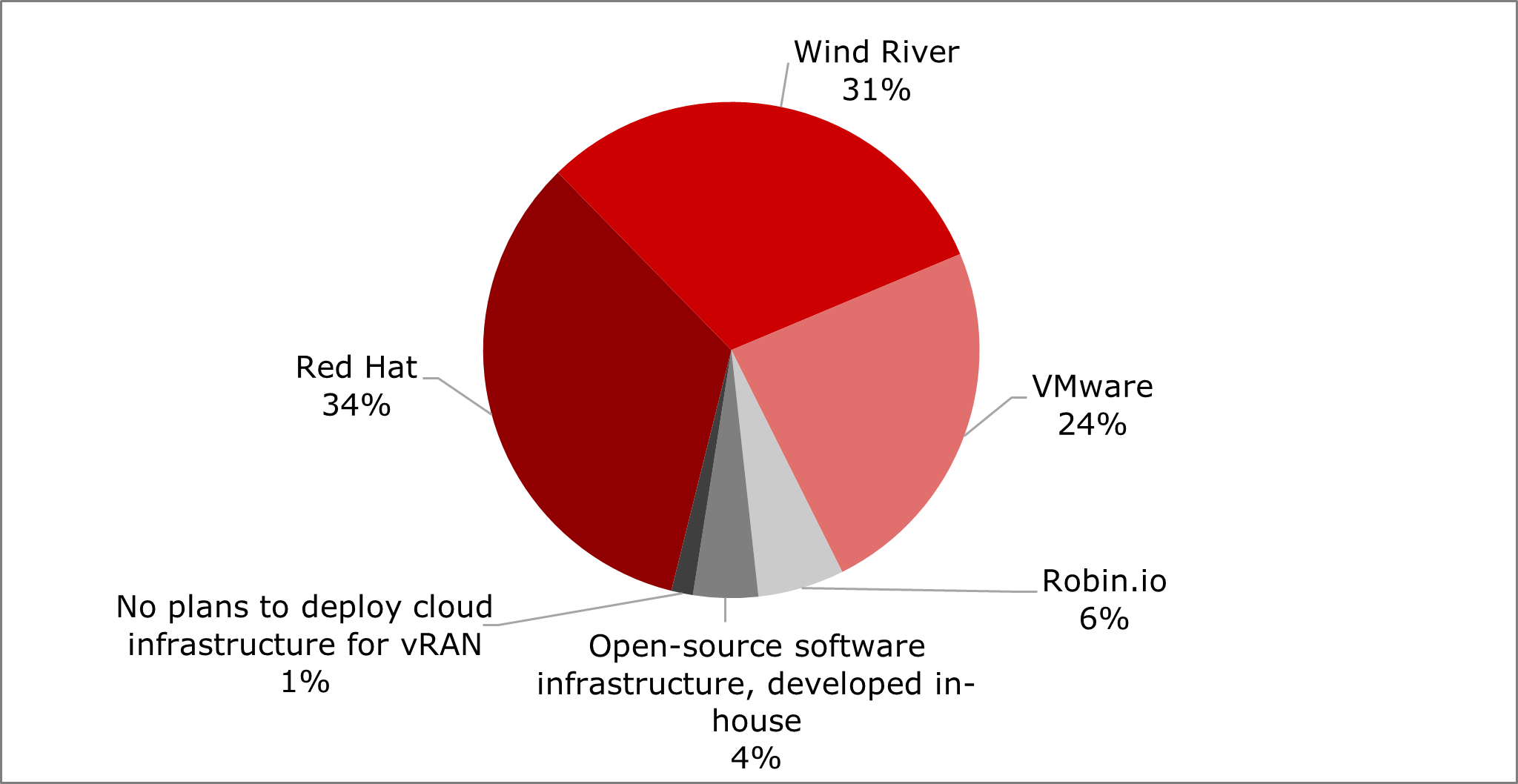

Network operators must deploy RAN software — either in virtual machines, containers or both — on cloud infrastructure. A key question is which software infrastructure platform to use?

The chart below shows three leading operator preferences:

For vRAN software suppliers and DU server vendors that want to help accelerate open vRAN deployments, the three main cloud environments to pre-integrate with appear to be Red Hat, Wind River and VMware.

These are well-known solutions in the telco cloud and core network, and it is logical operators will want to extend their existing telco cloud to the edge to support vRAN. An interesting third option also emerges from this data. Wind River, which offers cloud infrastructure software focused on smaller footprint edge devices that can be optimized for RAN applications, also scores highly at 31%. This is consistent with several Tier 1 operator vRAN deals that reference Wind River publicly.

To learn more about this Heavy Reading operator survey, register for the archived Light Reading webinar on Designing and Deploying Cloud Native Open RAN.

— Gabriel Brown, Principal Analyst, Heavy Reading

……………………………………………………………………………………………………………………………………………………..

A Red Hat survey found that communication service providers (CSPs) now realize the role and benefits of cloud-native network functions (CNFs) and container-based cloud platforms as the means to advance their infrastructures. Benefits include features and efficiency, automation, scalability, and flexibility that will help further lower overall costs. Respondents confirmed their rollout of 5G services would utilize container-based 5G infrastructure, with three-quarters of those respondents indicating the use of container-based platforms in over 25% of their networks by 2022.

In a recent report from Heavy Reading based on a survey of respondents from 77 CSPs, the steady uptick of service providers evolving their RAN has been significant, with the following observations:

-

50% of service providers have deployed a vRAN in over a quarter of their network compared to the fourth quarter of 2019, when only 35% of respondents had achieved the same rollout.

-

vRAN deployment has doubled in service provider 4G-only networks and vRAN in service provider 5G-only networks has increased by 66% since the survey in Q4 of 2019.

-

By the end of 2023 , the above numbers are expected to be flipped, with the majority of service providers deploying vRAN into both their 4G and 5G networks and not 4G alone.

As service providers’ experience with network transformation grows, they are embracing horizontal cloud platforms over vertically integrated solutions. The increased flexibility provided by containers, coupled with automation, can take full advantage of horizontal platforms.

A common cloud-native application platform deployed across any footprint and any cloud provides a simplified operational model and allows greater choice of CNFs. This is important to fit service providers’ business needs and to deploy and scale where needed, so they can make future additions and changes more easily. A Kuberenetes-based platform offers other direct benefits for RAN workloads, such as reduced latency, higher throughput and precision timing.

In summary, service providers are evolving their RAN to deliver new 5G services that are adaptable, scalable and efficient. Successful vRAN deployments will build upon a telco-grade container platform solution that takes automation and flexibility to the next level. With that, disaggregated vRAN architectures can be optimized to deliver the lowest latency and highest performance. This infrastructure needs to be a consistent cloud-native platform that can support multiple RAN functions and that spans the entire service provider network from edge to core to cloud.

Red Hat OpenShift is an application platform that not only boosts developer productivity but can orchestrate both containers and VMs in production environments. OpenShift helps simplify workflows and reduce overall total cost of ownership (TCO). As an answer to ever-changing marketplace demands, Red Hat’s extensive partner ecosystem provides choices to select software functions and hardware from multiple vendors, while accommodating present needs and anticipating those in the future.

References:

https://www.lightreading.com/open-ran/designing-and-deploying-cloud-native-open-ran/a/d-id/774302?

https://www.redhat.com/en/blog/adoption-evolved-vran-propels-network-enhancements

https://www.redhat.com/en/resources/virtualized-ran-insights-2021-analyst-paper

Vodafone and Mavenir complete VoLTE call over a containerized Open RAN lab environment

Upstart network software provider Mavenir, announced today that it completed the first data and Voice over LTE (VoLTE) call across a containerized 4G small cell Open RAN solution in a Vodafone lab environment. The completed tests are the latest steps forward to delivering an open and vendor-interoperable 4G connectivity solution for small to medium-sized office locations.

Having first started work on a containerized indoor enterprise connectivity solution in January 2021, Vodafone has completed tests for an important stage of the technology roadmap. The plug-and-play small cell equipment can ensure comprehensive mobile coverage in every corner of the office. The solution will provide 4G coverage initially, making use of radio hardware from Sercomm and software from Mavenir (Open RAN). Containerization means that software can be seamlessly transferred between equipment, platforms, and applications. Wind River provided its Containers as a Service (CaaS) software, part of Wind River Studio.

This demonstration of a containerized solution is a major milestone in the evolution of connectivity equipment away from physical infrastructure to a digital cloud-based environment. Containerization provides greater flexibility for customers, but also significant benefits in terms of speed and cost of deployment.

Open RAN technology separates software from hardware, meaning more flexibility for mobile operators and customers. This approach aims to see many companies providing the components that make up a mobile network site, where previously one vendor would have delivered the whole solution. The technology is controversial, but accepted by many as a potential disruptor for the telecommunications industry. Vodafone claims to be one of the industry leaders in supporting the development of the Open RAN vendor ecosystem.

Whereas much of the focus for Open RAN has been directed towards network infrastructure deployment on mobile sites throughout the UK, the technology can be implemented in an enterprise environment to support local connectivity requirements. As an interoperable and standardized (there are no standards for Open RAN!) technology, Open RAN solutions can be integrated with little disruption in a “plug and play” manner, interoperable with other Open RAN compliant vendors.

Andrea Dona, Chief Network Officer, Vodafone UK, said: “Open RAN is opening doors to simplified and intuitive connectivity solutions. For our wider network deployment strategy, Open RAN is enabling us to work with a wider pool of suppliers and to avoid vendor lock-in scenarios that might prevent us from taking advantage of the latest innovations. The same could be said for enterprise connectivity solutions.”

“From the moment Open RAN is deployed in an office environment, customers are no-longer locked into a single upgrade path. Working alongside Vodafone, customers can be more flexible in how connectivity solutions are adapted and upgraded as demands evolve in the future.”

Stefano Cantarelli, Executive Vice President and Chief Marketing Officer, Mavenir, said; “Cloud Native and Open Solutions are becoming the new reality of the mobile world, and these include Radio Access and its containerized implementation. Open vRAN is a very flexible architecture that can serve any type of segment and Mavenir is really pleased to work with Vodafone in the enterprise business and achieved another first together. It is an opportunity to show that automated and AI controlled systems will simplify life to business and industry.”

“Mavenir is delighted to partner with Vodafone in Open RAN and to work in the U.K. on their radio network transformation initiative, proving the extreme flexibility of Open vRAN,” Virtyt Koshi, SVP of Mavenir EMEA, said. “We are particularly proud in working in the field within the Vodafone commercial network and in the Newbury Open RAN Test and Verification lab, supporting the Vodafone effort to boost the ecosystem.”

Moving forward, Vodafone and Mavenir will focus on finalizing the packaging and automation of the solution before beginning trials with selected customers.

References:

Vodafone and Mavenir create indoor OpenRAN solution for business customers

Vodafone partners with Mavenir to leverage Open RAN for in-building enterprise 4G

Picocom PC802 SoC: 1st 5G NR/LTE small cell SoC designed for Open RAN

5G open RAN semiconductor and software upstart Picocom has announced the PC802 SoC (system on a chip), which the company calls the world’s first 4G/5G device for use in small cells with integrated support for open RAN specifications (there are no Open RAN standards). It supports disaggregated 5G small cell platforms, including indoor residential, enterprise and industrial networks, neutral host networks and outdoor networks.

The PC802 is a purpose-designed PHY SoC for 5G NR/LTE small cell disaggregated and integrated RAN architectures that includes support for 4G. The SoC supports Open RAN specifications and interfaces with a layer 2/3 stack via the SCF FAPI interface over PCIe. The PC802 supports interfacing to Radio Units (O-RU) via the O-RAN Open Fronthaul (eCPRI) interface or directly to RFICs with a standardised JESD204B high-speed serial interface.

The PC802 SoC is optimized for disaggregated small cells. It employs the FAPI protocol (defined by the Small Cell Forum) to communicate with and provide physical layer services to the MAC. It has an integrated O-RAN Alliance Open Fronthaul interface (based on eCPRI) to connect and communicate with Open RAN (remote) radio units, as well as JESD204B interfaces to connect with commonly available radio transceivers.

The PC802 supports 3GPP 5GNR releases 15 and 16, with flexibility for future releases. The PC802 also supports simultaneous 5GNR/LTE mode, flexible multi-RAT, multi-carrier component configurations and Dynamic Spectrum Sharing (DSS) support.

“We believe we’ve hit the ‘sweet spot’ in addressing the need for optimized silicon to power Open RAN,” commented said Oliver Davies, VP of marketing at Picocom. “We are delighted with the pre-launch interest in PC802 and the positive feedback we’ve received on its specification. For successful deployments, it’s clear that Open RAN needs optimized silicon, and PC802 SoC delivers. We expect to see PC802 in end-products commencing field trials during 2022.”

Key Features:

◆Silicon runs Picocom’s 5GNR and LTE PHY (lower and upper) software

◆SCF FAPI interfaces

◆Ceva XC12 5G-optimised 1280-bit vector signal processors

◆RISC-V scalar processor clusters

◆Codecs: LDPC, Turbo and Polar

◆Fourier transforms: FFT, iFFT

◆Equalisers: MMSE/MMSE-IRC/MLD

◆Digital Front End (DFE)

◆O-RAN eCPRI Open Fronthaul

◆IQ compression/decompression

◆Secure on-chip boot capability

◆Debug and device monitoring

References:

https://picocom.com/products/socs/pc802/

https://picocom.com/wp-content/uploads/2021/11/PC802-Product-Brief.pdf

Picocom introduces the industry’s first 5G NR small cell system on chip designed for Open RAN

Picocom hits the ‘sweet spot’ with new small cell SoC for Open RAN

Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

In a letter to the FCC, Jared M. Carlson, Ericsson’s Vice President, Government Affairs and Public Policy expressed his company’s concern with the O-RAN Alliance. In particular, an August report of the European Commission could not determine whether the O-RAN Alliance was complying with various WTO criteria, including transparency and open procedures, and also noted a concern that any one of the five founding members could effectively veto any proposed specification.

Some O-RAN Alliance specifications are proceeding slowly, according to Ericsson. One reason why can be explained simply by the resources devoted to the group. For example, O-RAN front-haul meetings (a more mature O-RAN specification) sees about 60 members attending, with only about ten members actively contributing. In contrast, in a typical 3GPP RAN Plenary, there are approximately 600 members delivering 1000 contributions per quarter.

The lack of completed O-RAN specifications means that any such deployments require individual vendors to come to mutual agreements—a far cry from the “plug-and-play” vision of a complete set of Open RAN network interface standards. Light Reading referred to that months ago as another form of “vendor lock-in.”

Mike Murphy, CTO, Ericsson North America told the FCC that Ericsson has dedicated a number of resources to making O-RAN Alliance specifications successful, delivering about 1000 of 7000 total specifications,” the company told the FCC, citing Murphy’s presentation. “Indeed, without Ericsson’s contributions to the O-RAN Alliance, the timeline for more fully developed standards would likely be even further out in the future.”

Regarding security, Mr. Murphy noted that, again, Ericsson is one the top three contributors to the O-RAN Alliance Security working group. Yet there are no security specifications from the O-RAN Alliance Security group—there is only a set of requirements. He also noted that the performance of Open RAN does not compare to (vendor specific, purpose built) integrated RAN. Even if the so called 40% cost saving estimates were true on a per-unit cost basis, the two different types of RAN equipment would not deliver the same level of performance.

Furthermore, Ericsson’s own estimates have indicated that Open RAN is more expensive than integrated RAN given the need for more equipment to accomplish what purpose-built solutions can deliver and increased systems integration costs. That’s quite shocking considering that many upstarts (e.g. Rakuten, Inland Cellular, etc) have stated Open RAN is cheaper. For example, “Open RAN will allow for cost savings over proprietary architectures,” Open RAN vendor Mavenir declared in its own recent meeting with FCC officials. The company said open RAN equipment can reduce network providers’ operating expenses by 40% and total cost of ownership by 36%.

Ericsson isn’t the only 5G company cautioning the FCC on Open RAN. Nokia – another major 5G equipment vendor – made similar arguments in a recent presentation to the FCC. “While there are some vendors that only offer open RAN architecture and/or limited RAN products, Nokia is able to provide a choice of classical or open RAN depending on the desires of our customers,” Nokia explained. “To date, the vast majority of service providers have chosen classical RAN solutions, deferring investment in open RAN until further commercial maturity has been demonstrated.”

Nokia also took issue with the notion that open RAN equipment is dramatically cheaper than traditional, classic RAN equipment. “The draft cost catalog also demonstrates that there are not cost savings being offered through open RAN equipment estimates compared to integrated RAN estimates,” Nokia wrote to the FCC in April following the release of the agency’s initial, draft pricing catalogue.

Many telecom professionals, like John Strand, argue that open RAN is not yet mature. They contend that government mandates that would require the use of the technology – in a furtherance of geopolitical goals – would be misguided. “The US has clearly demonstrated that open and intense competition, not government mandates, is the most effective way to mobilize the telecom industry to enable unprecedented innovation and value creation,” Ericsson told the FCC. “The US led the world in 4G and the ‘app economy’ not by insisting on any particular network standard, but by creating an open, predictable and attractive investment climate for all industry stakeholders and allowing operators to select the best technology based on their needs.”

Mr. Murphy concluded that the Commission and the U.S. government more generally should continue to “keep their eyes on the prize.” Notably, ensuring that the U.S. continues to smooth the way for 5G deployments will continue to pay dividends for the U.S. economy, with over $500 Billion added to the U.S. economy from 5G-enabled business, is the critical job of the day. The key step the Commission can take is to continue to foster the deployment of 5G.

References:

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20Open%20RAN%20ex%20parte%20Nov%2017%20FINAL.pdf

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20O-RAN%20Update%20FINAL.pdf

https://www.lightreading.com/open-ran/ericsson-actually-open-ran-is-more-expensive/d/d-id/773617?

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Addendum -Tuesday 23 November 2021:

German study warns of security risks in Open RAN standards

Open Radio Access Networks (Open RAN) based on the standards of the O-RAN Alliance carry significant security risks in their current form, according to a study commissioned by Germany’s Federal Office for Information Security (BSI). The analysis was carried out by the Barkhausen Institute, an independent research institution, in cooperation with the group Advancing Individual Networks in Dresden and the company Secunet Security Networks.

The implementation of Open RAN standards by the O-RAN Alliance is based on the 5G-RAN specifications developed by the 3GPP. Using a best / worst case scenarios analysis, the German study demonstrated that the Open RAN standards have not yet been sufficiently specified in terms of ‘security by design’, and in some cases carry security risks. The BSI called for the study’s findings to be taken into account in the further development of the Open RAN ecosystem, in order to support the rapid growth of the market with security from the start.

The open RAN project is supported by all three mobile operators in Germany – Deutsche Telekom, Vodafone and Telefonica – as well as the 1&1, which is building a fourth network in the country. The German government also recently awarded EUR 32 million in subsidies to support further development of the open RAN technology.

https://www.telecompaper.com/news/german-study-warns-of-security-risks-in-open-ran-standards–1405252

Samsung partners with Orange to deliver 5G vRAN and O-RAN compliant base stations

Samsung Electronics has announced that it is collaborating with the France headquartered telecom operator Orange, to disaggregate the software and hardware elements of traditional RAN. The South Korea based tech giant will provide its virtualized RAN (vRAN), “which has been proven in the field through commercial deployments with global Tier one operators including the U.S.”

As one of the world’s leading telecommunications operators, Orange provides mobile services to 222 million users in 26 countries along with Europe, Africa, and the Middle East. Through this partnership, Samsung and Orange aim to deploy O-RAN Alliance-compliant base stations beginning with rural and indoor configurations and then, expanding to new deployments in the future.

“Open RAN is a major evolution of radio access that requires deeper cooperation within the industry. With our European peers, we want to accelerate the development of Open RAN solutions that meet our needs. After the publication of common specifications, Orange’s Open RAN Integration Center will support the development and tuning of solutions from a broad variety of actors,” said Arnaud Vamparys, Senior Vice President of Radio Access Networks and Microwaves at Orange.

Samsung’s vRAN solutions can help ensure more network flexibility, greater scalability and resource efficiency for network operation by replacing dedicated baseband hardware with software elements. Additionally, Samsung’s vRAN supports both low and mid-band spectrums, as well as indoor and outdoor solutions. Samsung is the only major network vendor that has conducted vRAN commercial deployments with Tier one operators in North America, Europe and Asia.

“We are pleased to participate in Orange’s innovative laboratory,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “Through this collaboration, we look forward to taking networks to new heights in the European market, enabling operators to offer more immersive mobile services to their users.”

By opening its Open RAN Integration Center in Châtillon, near Paris, Orange will enable the testing and deployment of networks capable of operating with innovative technologies, which will serve as the backbone of the operator’s future networks. At the center, Samsung and Orange will conduct trials to verify capabilities and performance of Samsung’s vRAN, radio and Massive MIMO radio.

With a vRAN approach, carriers are able to rapidly shift capacity to address customer needs. For business customers, vRAN can drive more efficient access to private 5G networks through easy deployment of baseband software in Multi-access Edge Computing (MEC) facilities.

“We are committed to providing reliable, secure, and flexible network solutions that deliver the power of 5G around the world,” said Magnus Ojert, Vice President, Networks Division, Samsung Electronics America. “We believe vRAN’s next phase of innovation will accelerate what’s possible for society and look forward to collaborating with an industry-leader like Verizon to make 5G a reality for millions in 2021.”

Samsung says they have “pioneered the successful delivery of 5G end-to-end infrastructure solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.”

References:

https://news.samsung.com/global/samsung-and-orange-collaborate-to-advance-5g-networks-to-a-new-level

https://www.samsung.com/global/business/networks/products/radio-access/virtualized-ran/

Samsung’s 5G vRAN adoption could be a key turning point for the industry

Open RAN: A game-changer for mobile communications in India?

The author is a former Advisor, Department of Telecommunications (DoT), Government of India

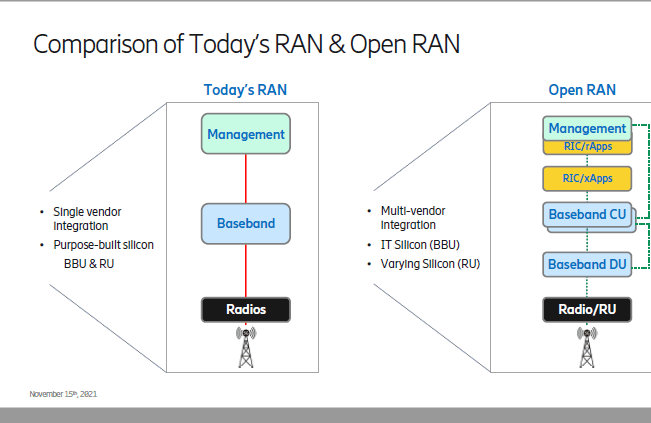

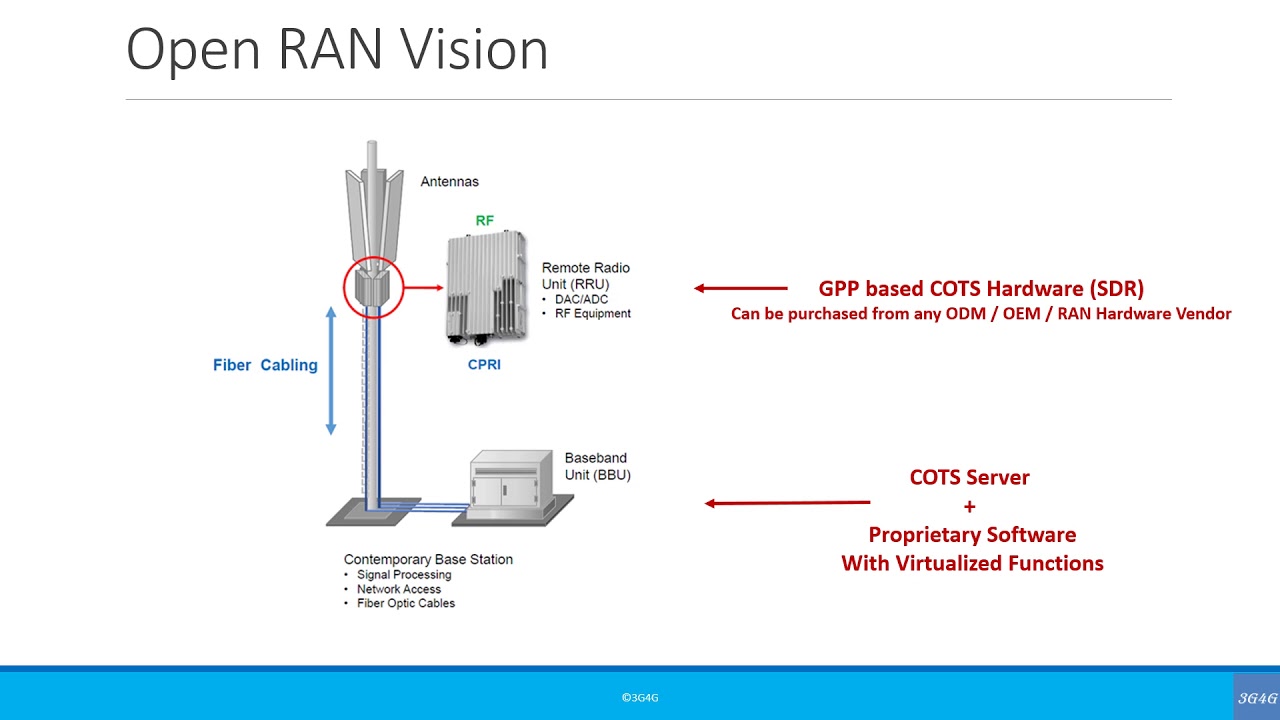

The mobile network comprises two domains: The Radio Access Network (RAN) and the Core Network. The RAN is the final link between the network and the phone. It includes an antenna on the tower plus the base station. Though it was possible for the operators to have one vendor for the core and a separate vendor for the RAN, the same was not done because of interoperability issues.

Open RAN is the hot topic now-a-days and most talked about technology, both in diplomatic and technical circles. This is a three year old technology and fifty operators in more than two fifty countries have deployed open RAN. First it was deployed in the network of Rakuten mobile, a Japanese telecom service provider. This technology makes RAN agnostic to vendors, programmable and converts it to plug & play type. Open RAN is at the epicentre of the digital transformation and plays a critical role in bringing more diversity to the 5G ecosystem. It is required for faster 5G rollout. Domestic (India) vendors may get the opportunity to supply the building blocks of RAN and so it is an initiative towards ‘self-reliant India.’

The RAN accounts for 60 per cent of capex/opex of mobile networks and so a lot of focus is there to reduce RAN costs. 5G signals have a shorter range than previous generation signals. As a result 5G networks require more base stations to provide the required coverage. So in 5G networks this percentage may be still higher.

Open RAN implementation reduces RAN costs. Instead of concentrating on making end-to-end open, opening the RAN ecosystem is given priority by the operators. The open RAN standards aim to undo the siloed nature of the RAN market where a handful of RAN vendors only offer equipment and software that is totally proprietary. Proprietary products are typically more expensive than their generic counterparts. Cellular networks have been evolving with various innovations. It has evolved from 1G to 5G. With these evolutions networks are evolving towards open networks having open interface and interoperability. Open RAN is a term used for industry wide standards for RAN interfaces that support interoperation between different vendor’s equipment and offer network flexibility at a lower cost. The main purpose of open RAN is to have an interoperability standard for RAN elements including non-proprietary hardware and software from different vendors. An open environment means an expanded ecosystem, with more vendors providing the building blocks. Open RAN helps the operators to overcome “Vendor lock in” introducing ‘best of breed’ network solutions.

There will be more innovations and more options for the operators. With a multi -vendor catalog of technologies, network operators have the flexibility to tailor the functionality of their RANs to the operators’ needs. They can add new services easily. Open RAN gives new equipment vendors the chance to enter the market with Commercial off the shelf (COTS) hardware. An influx of new vendors will spur competition. Cell site deployment will be faster. Third Party products can communicate with the main RAN vendor’s infrastructure. New features can be added more quickly for end users.

Current RAN technology is provided as a hardware and software integrated platform. The aim of open RAN is to create a multi supplier RAN solution that allows for the separation or disaggregation between hardware and software with open interface. Open RAN is about disaggregated RAN functionality built using open interface specifications between blocks. It can be implemented in vendor neutral hardware and software based on open interfaces and community developed standards.

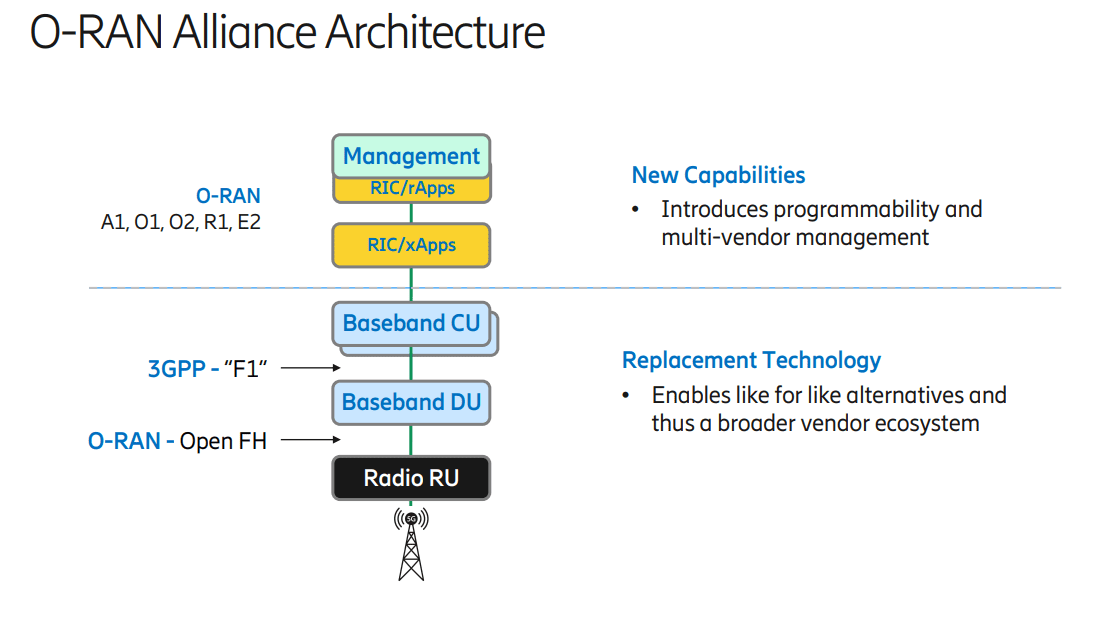

In an open RAN environment, the RAN is disaggregated into three main building blocks:

- Radio Unit (RU)

- Distribution unit (DU)

- Centralized unit(CU)

The RU is where the radiofrequency signals are transmitted, received, amplified and digitized. It is located near or integrated into the antenna. The DU and CU are parts of the base station that send the digitized radio signal into the network. The DU is physically located at or near the RU whereas the CU can be located nearer the Core. DU is connected with RU on Optical Fiber cable. The concept of open RAN is opening the protocols and interfaces between these building blocks (radio, hardware and software) in the RAN.

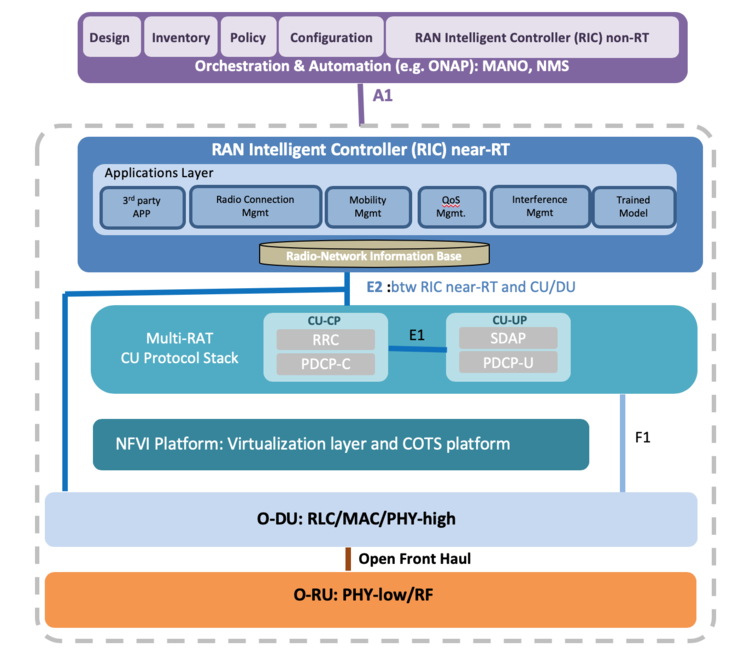

Another feature of Open RAN is the RAN Intelligent Controller (RIC) which adds programmability to the RAN. For example, Artificial Intelligence can be introduced via the RIC to optimise the performance of the network in the vicinity of a cricket stadium on a match day. The RIC works by exposing an API (Application Programming Interface) which lets software talk to each other. There are two types of RIC: near-real time and non real time. Both perform logical functions for controlling and optimizing the elements and resources of open RAN. A near-real time RIC (response time on the order of 10’s of milliseconds) controls and optimizes elements and resources with data collection and communication. A non-real time RIC (response time greater than one second) uses AI and Machine Learning (ML) workflows that include model training, where the workflows learn how to better control and optimize the RAN elements and resources.

The O-RAN alliance has defined eleven different interfaces within the RAN including those for:

Front haul between RU and DU Mid haul between DU and CU Backhaul connecting the RAN to the Core (also called as transport network)

O-RAN alliance is a specification group defining next generation RAN infrastructures, empowered by principles of intelligence and openness. Openness allows smaller players in the RAN market to launch their own services. It was founded in 2018.

O-RAN alliance is a worldwide community of around two hundred mobile operators, vendors and research and academic institutions operating in the Radio Access Network industry. Its goals include to build mechanisms for enabling AI and ML for more efficient network management and orchestration. It supports its members in testing and implementation of their open RAN implementation. O-RAN conducts world wide plug tests to demonstrate the functionality as well as the multi vendor interoperability of open network equipment. O-RAN alliance develops, drives and enforces standards to ensure that equipment from multiple vendors interoperate with each other. It creates standards where none are available, for example Front haul and creates profiles for interoperability testing where standards are available.

Open RAN challenges:

1. Integration of equipment from multiple vendors

2. Since equipment is from different vendors, operators have to have multiple Service Level Agreements (SLAs)

3. Network latency may increase

4. Reliability and availability may be a challenge

5. Staff has to acquire multiple skill sets

6. Security Concerns

Open RAN offers a golden opportunity for software developers to become a global hub for offering RAN solutions. This technology leads to a great disruption to the traditional ecosystem and accelerates the adoption of more innovative technologies. The disaggregation of RAN has also added further advantages by enabling better network slicing and edge compute capabilities.

References:

https://www.telecomtv.com/content/open-ran/how-vran-can-be-a-game-changer-for-5g-40019/

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=1

Symware: Carrier-grade Open RAN platform leveraging cloud-native architecture

“We have a great opportunity to disrupt this industry, we have a great opportunity to really connect everything and bring better value to overall society and Rakuten Symphony is the platform idea for all the software technology stack that we have built into Japan. We wanted to take four years of lessons and package them into solutions that deliver immediate benefits to our customers and the telecoms industry,” said Tareq Amin, CEO of Rakuten Symphony.

“Rakuten Symphony constantly looks to introduce leading-edge innovations to accelerate network transformations. With our partners, we have developed a cost-performance optimized appliance that simplifies the cell site deployment for 4G, 5G and future generations of mobile technology. Symware provides operators with the ultimate future-proof cell site solution that enables them to flexibly densify their network and accommodate various network topologies at the lowest cost.”

Tareq Amin, CEO of Rakuten Symphony speaking at 2021 MWC-LA

The Symware multipurpose edge appliance combines the containerized cell site routing functionality and a containerized Distributed Unit on a single general purpose server platform, which significantly reduces the capital and operating expenditures for an operator. Offering consistent carrier-grade routing stack across both physical and virtual Radio Access Networks, the solution readily enables 5G network slicing features both in RAN and transport domains including slice isolation, slice monitoring and dynamic traffic steering through segment routing. The solution supports automation with zero-touch provisioning, rolling updates, telemetry and analytics for all the components, and is based on the Kubernetes® ecosystem for orchestration and networking. Rakuten Symphony believes the solution will help slash total cost of ownership, fast track RAN innovation and provide greater agility, smart security and new levels of automation.

Dan Rodriguez, Intel corporate vice president and general manager, Network Platforms Group added, “We continue to see the industry shift to take advantage of the many benefits provided by the cloudification of the RAN. By utilizing our Next Generation Intel® Xeon® D Processors and FlexRANTM reference software, this collaboration showcases how RAN workloads can be consolidated onto a single server and meet the performance, capacity and cost requirements of 5G RAN deployments.”

Raj Yavatkar, Juniper’s CTO, stated, “Removing the obstacles of deploying ORAN in disaggregated production networks is critical for 5G growth. Integrated routing and ORAN in a single platform delivers cost and operational benefits for network operators. Combined with industry leading Intel technology and Rakuten’s DU software, Juniper’s disaggregated and state-of-art routing stack offers operators a unique solution for delivering differentiated 5G services including network slicing.”

Developed with Rakuten Symphony’s know-how and experience with cloud-native and Open RAN-based networks, leading containerized RAN software from Altiostar, a Rakuten Symphony company, Next Generation Intel® Xeon® D Processors and FlexRANTM reference software, and Juniper’s carrier-hardened cloud-native routing stack, Symware will give operators more opportunity to create innovations within their networks, while broadening and securing their supply chain.

* KUBERNETES ® is a registered trademark of the Linux Foundation in the United States and other countries.

* Intel and Xeon are trademarks of Intel Corporation or its subsidiaries.

About Intel

Intel is an industry leader, creating world-changing technology that enables global progress and enriches lives. Inspired by Moore’s Law, we continuously work to advance the design and manufacturing of semiconductors to help address our customers’ greatest challenges. By embedding intelligence in the cloud, network, edge and every kind of computing device, we unleash the potential of data to transform business and society for the better. To learn more about Intel’s innovations, go to newsroom.intel.com and intel.com.

About Juniper Networks

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

About Rakuten Symphony

Rakuten Symphony, a Rakuten Group organization with operations across Japan, Singapore, India, EMEA, and the United States, develops and brings to the global marketplace cloud-native, Open RAN telco infrastructure platforms, services and solutions, through the Rakuten Communications Platform. For more information visit https://symphony.rakuten.com/.

…………………………………………………………………………………………………………………………………….

In related news, Rakuten Mobile (parent company of Rakuten Symphony) recently announced an agreement to acquire Estmob, a South Korean peer-to-peer file transfer solution start-up. The Japanese carrier said that the acquisition will establish a research and development presence in South Korea for Rakuten Symphony.