OpenRAN

Telefónica Deutschland/O2 “pure 5G” with DSS, Open RAN and 5G SA

One year after the 5G launch, Telefónica Deutschland / O2 confirms their 5G network will cover over 50 percent of the German population by the end of 2022. The company is also on track to cover of over 30 percent of the population by the end of 2021. The basis for this 5G network expansion is the investment of around four billion euros until the end of 2022.

The focus of this 5G network expansion is on so-called “pure 5G” via the mid-band 3.6 GHz frequency. The 3,000th 3.6 GHz antenna just went live in the O2 5G network. Meanwhile, Telefónica Deutschland / O2 is installing around 180 of these 5G antennas in the network every week, tendency further increasing. The company is expanding 5G twice as fast overall compared to 4G and is fully on track to supply all of Germany with 5G by the end of 2025.

As with 2G, 3G and 4G, we are also bringing 5G to mass market readiness in Germany through rapid network expansion, network investments in the billions and products with the best price-performance ratio,” said CEO Markus Haas on the first anniversary of the 5G launch in the O2 network.

“Since the beginning, we have aligned the 5G roll-out with the concrete benefits for private customers and businesses. This is the most effective way for us to drive forward the urgently needed digitisation for business and consumers. Today, one year after the launch, our 5G network is already live in a hundred cities. And current international tests confirm that it is the fastest 5G network in Germany. Now we will also quickly bring the O2 5G network to the area.”

The added value of 5G for private customers in this early expansion phase, beyond the performance advantages, lies primarily in the additional network capacities provided by the new mobile communications standard. In the first half of 2021, the O2 mobile network transported 1 billion gigabytes of data, an absolute record. Cities are data traffic hotspots. The growing number of urban 5G users is increasingly shifting parts of this data traffic to the 5G network, thus relieving the 4G network. In this way, the O2 5G network also ensures a consistently good network experience for 4G users of all Telefónica Deutschland / O2 brands and partner brands.

Market penetration with 5G is visibly gaining speed. In the meantime, 5G smartphones account for more than 50 percent of all end devices sold through Telefónica Deutschland / O2 sales channels. In line with this, Telefónica Deutschland / O2 is now moving the 5G network expansion more strongly into the area. Here, too, the telecommunications company is focusing on so-called “pure 5G” via the 3.6 GHz frequency. In the future, it will provide private and business users with multiple gigabit data speeds and response times (latency) of just a few milliseconds.

This is where “pure 5G” differs from the combined 4G/5G via Dynamic Spectrum Sharing (DSS), which currently prevails in other German 5G networks [1.]. 5G shares lower frequency bands with 4G at comparable performance levels. Where it is a useful 4G extension in selected areas, the company will also use Dynamic Spectrum Sharing. In addition, it is partially rolling out 5G purely over the 700 MHz frequency to accelerate area rollout and lay the groundwork for the upcoming 5G Stand Alone in the O2 network. The first sites are already live.

Note 1. Both Vodafone Germany and Telekom Deutschland use DSS to facilitate the rollout of 5G by sharing spectrum between 4G and 5G networks: Vodafone has deployed the technology to switch 700MHz frequencies back and forth between 4G and 5G, while Telekom Deutschland is rolling out DSS as part of a 5G expansion drive and is apportioning 5MHz of its 2.1GHz resource for 4G and 5G as needed. Telefónica Deutschland, which has already said it would use DSS for deployment in rural areas, conceded it will use DSS for 4G expansion in “selected areas.” The operator also appeared to indicate that its 5G deployment over 700MHz will be only partially “pure,” in order to accelerate its network expansion.

Photo Credits: Henning Koepke / Telefónica Deutschland

Photo Credits: Henning Koepke / Telefónica Deutschland

Telefónica Deutschland / O2 is continuously increasing its 5G network expansion despite parallel major projects such as the 3G switch-off and densification of the 4G network. In addition, the company has set the course for its 5G network of the future in the last twelve months. Telefónica Deutschland / O2 was the first German network operator to bring the innovative open architecture Open RAN for the mobile access network out of the laboratory and into live operation.

The conversion to Open RAN will start before the end of this year. It will give the company greater flexibility in the choice of manufacturers and, as a primarily software-based solution, simplify and accelerate the upgrading of base stations. Telefónica Group has appointed NEC as systems integrator for open RAN trials in its four main markets – Spain, Germany, the UK and Brazil.

O2 plans to deploy Open RAN later this year

In addition, Telefónica Deutschland / O2 achieved the first frequency bundling in the 5G live network in this country via carrier aggregation, which further accelerates 5G for customers and ensures a stable high data throughput. The O2 network also recently saw the German premiere of the first voice call directly via the 5G live network. These 5G calls do not take a diversion via the 4G network and thus no longer interrupt ongoing 5G data connections. Finally, Telefónica Deutschland / O2 now operates an independent 5G core network (no explanation given for what that means?).

The company has thus created the basis for freeing the new network from its technical dependence on 4G and will provide a 5G core network for 5G Stand Alone (SA). In future, this will enable private and business customers to use even the most demanding 5G applications. Technically, the company is already in a position to roll out a nationwide 5G Stand Alone network.

As soon as 5G Stand Alone offers real added value for customers, O2 will activate the technology. For example, when enough end devices in the market support 5G SA. Telefónica Deutschland is working with Ericsson for its 5G core network, but noted that the deployment of open radio access network (RAN) technology will ensure access to a wider group of vendors.

Over the past year of 5G service, Telefónica Deutschland / O2 has started to move their 5G core network for industrial applications to the cloud. This will significantly simplify the establishment of 5G campus networks, accelerate the introduction of new industrial applications for companies and shorten the time to market for new products and applications, according to the company.

The rapid expansion of the 5G network helps Telefónica Deutschland / O2 to pursue its corporate goal of offering its customers the greenest mobile network in Germany by 2025. 5G transmits significantly more energy-efficiently than the predecessor standards. The conversion of 3G to 4G and 5G network technology alone will reduce the power consumption of the O2 network by up to 90 percent per transported byte. In addition, the company will make a significant contribution to achieving Germany’s climate targets overall. Its 5G network will pave the way for digital solutions and all-round connectivity, helping other industries to save CO2 emissions and develop sustainable business models.

References:

https://www.lightreading.com/5g/o2-germany-boasts-of-pure-5g-but-concedes-dss-need/d/d-id/772583?

Rakuten Symphony Inc. to provide 4G and 5G infrastructure and platform solutions to the global market

Japan’s Rakuten Group today announced that they have resolved to incorporate Rakuten Symphony, a business organization of the Company, and start considering a capital and business alliance (in other words, investments).

As announced on August 4, 2021 in “Rakuten launches Rakuten Symphony to accelerate adoption of cloud-native, open RAN-based mobile networks worldwide,” alongside Rakuten Communications Platform (hereafter “RCP“), Rakuten Symphony, a new business organization, was newly launched by consolidating the products and services to be implemented.

Rakuten Symphony aims to provide a future-proof, cost-effective, communication cloud platform for carriers, businesses and government agencies around the world.

Rakuten Symphony is a global business organization that develops solution businesses in Japan, the United States, Singapore, India, Europe, and the Middle East / Africa. Through this incorporation, accountability (duties) will be clarified, flexible decision-making and business execution will be possible, and products, services, and solutions for telecommunications carriers will be consolidated across the board.

“We will be ready to provide 4G and 5G infrastructure and platform solutions to the global market.”

In addition, as announced in “1&1 and Rakuten agree far-reaching partnership to build Europe’s first fully virtualized mobile network based on new Open RAN technology” also on August 4, 1&1 has agreed to comprehensively adopt RCP. This business has been steadily accumulating its achievements. In order to further accelerate the global expansion of innovative mobile network solutions, Rakuten Symphony, Inc., a newly established corporation, will consider accepting capital, etc. in addition to business partnerships with strategic partners.

The Company will establish its position as a global leader in cloud-centric and virtualized Open RAN-based mobile networks, by expanding its communication platform business overseas, as well as its track record of expanding its mobile carrier business in Japan.

Mike Dano of Light Reading wrote:

It’s no surprise that Rakuten is pulling out all the stops to make Symphony a success. The operation’s Symphony contract with flagship customer 1&1 in Germany is worth between $2.3 billion and $2.7 billion over a ten-year period, reports Nikkei Asia. By contrast, Rakuten made about $1.8 billion in revenues at its Japanese mobile business in the last year.

“This business has been steadily accumulating its achievements,” Rakuten wrote this week, pointing specifically to its 1&1 deal.

Light Reading reported in March 2020 of Rakuten’s plans to sell a networking platform internationally. The offering was initially dubbed Rakuten Mobile Platform (RMP), and then Rakuten Communications Platform (RCP), but the company in August named it Symphony and said the operation targeted an addressable market of up to $100 billion.

Symphony is essentially the portfolio of technologies Rakuten uses in its Japanese mobile network – alongside other offerings from its partners – that it is now pitching to other service providers and networking hopefuls worldwide. According to Rakuten, companies can purchase all or parts of Symphony in order to quickly and easily roll out their own open RAN 5G networks.

Thus, Symphony is now on a collision course with a wide range of other players selling similar offerings. Ericsson, Amazon, Google and Mavenir are among the many providers hoping to assemble a product portfolio stretching across core networking, radio hardware and associated software and services, and then to rope in deals with customers ranging from enterprises to government agencies.

References:

https://global.rakuten.com/corp/news/press/2021/0930_03.html

https://www.lightreading.com/the-core/rakuten-rearranges-symphony-for-investments/d/d-id/772501?

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

The O-RAN Alliance reiterated its commitment towards Open and intelligent Radio Access Network (RAN) and said its board has approved changes to O-RAN “participation documents and procedures” to allay concerns of some participants who may be subjected to U.S. export regulations.

The O-RAN Alliance became aware of concerns regarding some participants that may be subject to U.S. export regulations, and has been working with O-RAN participants to address these concerns. The O-RAN Board has approved changes to O-RAN participation documents and procedures. While it is up to each O-RAN participant to make their own evaluation of these changes, O-RAN is optimistic that the changes will address the concerns and facilitate O-RAN’s mission.

“O-RAN is an open and collaborative global alliance operating in a way that promotes transparency and participation of our member companies in the development and adoption of global open specifications and standards,” said Andre Fuetsch, Chairman of the O-RAN ALLIANCE and Chief Technology Officer of AT&T.

“We remain fully committed to working together in the alliance to achieve the goals and objectives of O-RAN as quickly as possible,” said Alex Jinsung Choi, Chief Operating Officer of the O-RAN ALLIANCE and SVP of Strategy and Technology Innovation, Deutsche Telekom.

This comes after Nokia halted its work in the Open RAN industry alliance over concerns that it may face penalties from the U.S. government for working with blacklisted Chinese entities.

John Strand’s comments:

This statement is not solving the Chinese security problem. Even with the proposed changes, the five founding members, including China Mobile, still have a veto. The statement from O-RAN Alliance raises more questions than it answers. Who are the member companies, do the network operators agree with the O-RAN Alliance statement? How about contributors and the license adopters?

Strand Consult wants to create the transparency O-RAN Alliance are fighting against, and I share the concerns of the EU and the U.S. House Foreign Affairs Committee when it comes to transparency. At the same time, we believe it is a great idea for O-RAN Alliance to become WTO (World Trade Organization) compliant like other professional telecom standard bodies. What’s the problem for ORAN Alliance to be WTO compliant? It’s hard to see any downside.

Strand Consult doesn’t believe the changes will satisfy WTO requirements nor does it align with the practices of professional standards organizations nor with shareholder practices of U.S. and EU publicly traded companies.

Last year Strand Consult exposed the 44 Chinese companies involved in the O-RAN Alliance three of them on the entity list.

The O-RAN Alliance proposes changes to mitigate Chinese involvement. However these changes will probably not satisfy WTO compliance rules. Here are some relevant report from EU/WTO and European Commission (EC) on OpenRAN: https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

https://ec.europa.eu/newsroom/dae/redirection/document/78778 (page 76).

The EC’s report is based on publicly available information and an interview with a legal expert on the WTO rules and EU Regulation No 1025/2012. It notes the following concerns with the O-RAN Alliance’s proposed changes:

- First, the required transparency, i.e. all essential information is easily accessible to all interested parties, is only partly fulfilled, e.g. the O-RAN specifications are not accessible at the homepage.

- Second, the procedure is not open in a non-discriminatory manner during all stages of the standard-setting process, because the founding members have access to more information than the contributors during the process.

- Third, although interested contributors have opportunities to contribute to the elaboration of the specifications, the founding members have a privilege, because they have the necessary minority of more than 25% to block proposals.

Overall, proof that the O-RAN Alliance complies with the various WTO criteria is still missing, although some of their members assure this compliance is in place. “Consequently, such an independent assessment is needed, which, however, cannot be realized within the context of this project.”

The O-RAN Alliance does not satisfy the openness criteria laid down in WTO Principles for the Development of International Standards, Guides and Recommendations. The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification over and above 3GPP specifications or ITU-R recommendations.

3GPP was formed after 2G (GSM) was developed this means that 3GPP did not develop 2G but 3GPP ensured backward compatibility for every G. Note that 3GPP specifications define the technical specifications for a complete mobile cellular network 2G/3G/4G/5G. ITU-R recommendations only cover the radio access interface technologies, e.g. ITU M.2150/IMT 2020 for “5G.”

It is possible that some U.S. firms could be satisfied with the O-RAN Alliances proposals, but the fact remains that Chinese companies still exert disproportionate authority on this industry group. It is not yet clear with U.S. President Biden or the NTIA will weigh in on the matter. If not, this could be interpreted as placating, or even going soft on China.

Strand Consult discloses on its website that it is a company providing knowledge to the mobile industry, specifically mobile operators and their managers, executives, and boards of directors. Strand Consult only sells knowledge to mobile operators, and Strand Consult has done this for 25 years (see About Strand Consult below).

About O-RAN ALLIANCE:

The O-RAN ALLIANCE is a world-wide community of over 300 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, the O-RAN ALLIANCE’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN standards will enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN based mobile networks will at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, the O-RAN ALLIANCE publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

About Strand Consult:

There are six focus areas:

– The mobile broadband market

– The MVNO market

– The market for Value Added Services

– Next Generation Prepaid Services

– The Smartphone market

– Digital strategy for the Telecom and Media industry.

We have spent many man years researching and publishing a series of comprehensive reports and workshops focused on these areas. Market players that have ambitions of being successful within these areas can either try to gain an overview themselves, find solutions and purchase external consultants to help them on their way, or alternatively use Strand Consult’s reports – with or without workshops -to acquire the knowledge they need to be successful in the future.

You can read more about some of our reports here:

Successful Strategies for the Mobile Broadband Market

References:

Huawei CTO Says No to Open RAN and Virtualized RAN

Paul Scanlan, CTO of Huawei Carrier Business Group made clear what everyone already knew- that the Chinese tech giant doesn’t support Open RAN or Virtualized RAN (vRAN). On a media call today, Scanlan noted that Open RAN has a lot of problems: It isn’t standardized, it can’t be easily integrated with existing network infrastructure, and it’s not ready for the most intense period of 5G deployments coming up with 5G SA core networks.

“It’s not that it’s not going to happen, and I believe it will in different guises but I’m not sure whether … from a commercial perspective, is it too late practically? The challenge is it’s not standardized. It’s an association. Because things are not standardized, no standards, you don’t get cooperation, you don’t get competition, you don’t get innovation to drive this,” Scanlan said, describing groups such as the O-RAN Alliance as “just a bunch of friends.”

Absent standardization, technologies like open RAN become fragmented and lack interoperability — two outcomes that most network operators are unwilling to accept, according to Scanlan.

The IEEE Techblog has noted from day one that neither the O-RAN Alliance or TIP Open RAN project are standards development organizations (SDOs). Worse, is they don’t even have liaisons with ITU-R, ETSI, or 3GPP which are (although 3GPP specs must be transposed by SDOs like ETSI or submitted to ITU-R WP 5D to become binding standards).

In June, Scanlan told Asia Times that Huawei has already built enterprise networks for 2,000 manufacturing companies and plans to build 16,000 next year. The Chinese tech giant has also built 5,300 private networks for mining companies, Scanlan stated. Today, he said that the real cost for network operators is opex, rather than capex.

“The telecom operator’s problem is not capex, it’s actually opex,” he said, adding that opex eats up about 65% of the average cost per site for site rental, backhaul, and energy. RAN comprises about 12% of opex costs per site on average, he said. The implication is that Open RAN opex will be higher than that of conventional RANs with purpose built network equipment from legacy base station vendors.

Another challenge for open RAN involves security and point of responsibility. That’s because of many more exposed interfaces between different vendor equipment. In a typical open RAN deployment “you’ve got three or four vendors all providing components (modules) that are going to be patched together. Scanlan asked, “Who’s responsible for making sure that it’s going to be secure or it’s going to deliver” on performance and fall in line with guaranteed operating costs?”

“Everybody says from a cybersecurity perspective it’ll be more secure. Well, I don’t agree with that. I mean, who’s going to be responsible?”

Critics of O-RAN argue that the much-touted alternative to Huawei will be costly, cumbersome and ineffective. Henry Kressel wrote in Asia Times on December 29, 2020:

O-RAN proposes to open up only part of the proprietary wireless network, namely the part that goes from the antenna to the delivery of transportable data packets to the extended interconnection network that routs the packets to their ultimate destination. These functions are currently performed using equipment and software proprietary to each equipment vendor.

This is a big ,multiyear project that requires the collaborative efforts of industry and governments. These technologies are complex and require extremely high levels of reliability – hence, extensive and costly testing.

The O-RAN Coalition has recommended that US federal sources put $1 billion into the project. But even if government money is forthcoming, it will be only the beginning of a costly development project. One estimate from a reliable industry expert states that at least five years might be needed before competitive products meeting the new standards could reach the market.

“So many people just throw out (?) virtualization or throw out (?) vRAN, or open RAN, and all the rest for different types of reasons,” he said. “If you’ve not been either developing the technology or you’re not at the operator’s point to understand the challenges and the pain points of each of them, then often a lot of the reasons why we want to do something is perhaps for political reasons [1.] and just haven’t been very well thought out.”

Note 1. Many believe the motivation and impetus for Open RAN is to permit new base station vendors, particularly skilled in virtualization software, to enter the 4G/5G market. Two particular politically inspired vendor targets are Huawei and ZTE who are not permitted to join either O-RAN or TIP projects.

Of course there are also performance issues with the commoditized chips that will be used for Open RAN. Several years ago, Huawei explored the use of commoditized silicon in its 5G network equipment, but “the problem was that the jitter at the substrate level was too high. It would not achieve the targets that we wanted in terms of latency, so we had to develop the chip ourselves,” Scanlan said.

“For virtualized RAN, what do you want to do with virtualization, what’s the target objective? When we put things in a cloud the first thing we’re really trying to do is create flexibility and resource scaling. And because it’s software driven, we’re able to change those things and downstream everything can operate from it,” Scanlon explained.

“Within the next two or three years, there are no commercial opportunities for open RAN because of technological maturity,” Victor Zhang, Huawei’s vice president, told Light Reading when asked what Huawei was doing to support the concept. “There is still a long way to go with open RAN.”

One problem is that the general-purpose processors used in open RAN baseband equipment are less power-efficient than customized gear. Huawei summed this up in 2019. “There is a specific R&D team doing research on using white boxes with Intel CPUs [central processing units] in 4G basestations and the power consumption is ten times more,” said Peter Zhou, the chief marketing officer of Huawei’s wireless products line, at a London event. “5G is [even] more complicated and an Intel CPU gives you a problem with jitter. In terms of existing CPU technology, we haven’t seen the possibility of using that with 5G basestations.”

John Strand, the CEO of Strand Consult, thinks it inconceivable that Huawei is not privy to the O-RAN Alliance’s activities. Smaller Chinese vendors could even be representing Huawei, he has suggested. It seems highly likely that links between China Mobile and Huawei are much stronger than connections between a European operator and its main supplier.

References:

https://www.sdxcentral.com/articles/news/huawei-cto-disses-virtualized-open-ran/2021/09/

Dell’Oro Group increases Open RAN radio and baseband revenue forecast

Dell’Oro Group increases Open RAN radio and baseband revenue forecast

Dell’Oro Group has revised their Open RAN radio and baseband forecast. Total cumulative Open RAN revenues are now projected to approach $10B to $15B between 2020 and 2025.

“The momentum with both commercial deployments and the broader Open RAN movement continued to improve during 1H21, bolstering the thesis that Open RAN is here to stay,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “We are adjusting the forecast upward to reflect the higher baseline and the improved pipeline,” continued Pongratz.

Additional highlights from the Dell’Oro Group Open RAN Advanced Research Report:

- Open RAN revenues are expected to account for more than 10 percent of the overall RAN market by 2025, reflecting healthy traction in multiple regions with both basic and advanced radios.

- Open RAN Massive MIMO projections have been revised upward to reflect the improved competitive landscape and the improved market sentiment with upper mid-band Open RAN.

- The shift towards Virtualized RAN (V-RAN) is progressing at a slightly slower pace than Open RAN. Still, total V-RAN projections remain relatively unchanged, with V-RAN expected to approach $2 B to $3 B by 2025.

Separately, Stefan wrote:

The long-term open RAN vision is built on three key pillars including open interfaces, virtualized technologies and vendor neutral multi-vendor deployments. In addition to leading the industry toward open and interoperable interfaces, the long-term roadmap maximizes the use of COTS hardware and minimizes the reliance on proprietary hardware (O-RAN Alliance).

Taking into consideration that one of the primary objectives is to capture the overall movement toward open RAN and the fact that it will take some time to realize the broader vision, it is somewhat implied that there will be room for interpretation when it comes to capturing this movement and tracking the open RAN market.

And within each of these pillars, there will be various degrees of compliance. Multi-vendor deployments are often associated with mixing and matching baseband and radio suppliers. But when Mavenir introduced the term “True Open RAN,” it meant true mixing and matching across the board – they want to work with anyone with any component. If someone gives them a radio they should be able to integrate it with their software. And vice versa, if another supplier provides the software “True Open RAN” would enable them to make it work with their Massive MIMO radios.

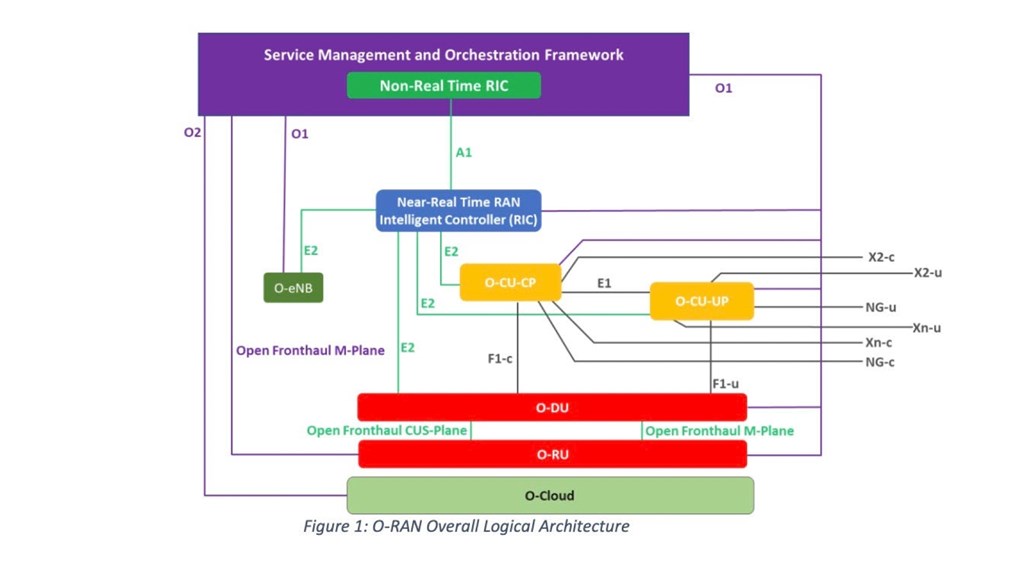

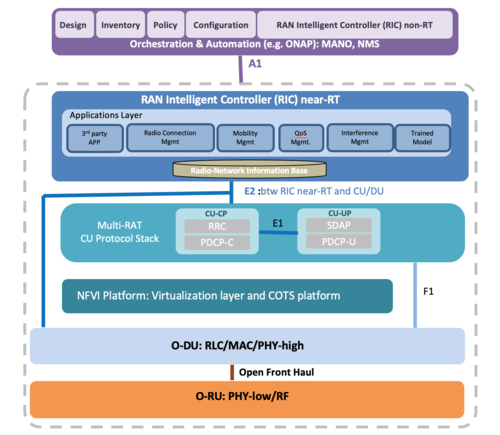

Not surprisingly, there is room for interpretation with the other building blocks as well. Open RAN compatible radios are now proliferating across the supplier landscape. But it is not always clear after browsing the data sheets what this entails from an open RAN specifications, customization and coverage perspective. With five interfaces (A1, E2, O1, O2, Open FH), multiple functions (SMO, Non-Real time RIC, Near-Real-Time RIC), and a confluence of profiles, there is not an abundance of confidence that the open RAN maturity would be consistent across the board.

The Dell’Oro Group Open RAN Advanced Research Report offers an overview of the Open RAN and Virtualized RAN potential with a 5-year forecast for various Open RAN segments including macro and small cell, regions, and baseband/radio. The report also includes projections for virtualized RAN along with a discussion about the vision, the ecosystem, the market potential, and the risks.

To purchase this report, please contact [email protected]

…………………………………………………………………………………………………………………………………..

Rebuttal: Open RAN Forecasts Way too High!

While not a market analyst cranking out forecasts, this author believes the Open RAN market will be a huge disappointment and revenues will be much lower than Dell’Oro and other market research firms forecast.

As Light Reading has correctly said, Open RAN is trading one type of vendor lock-in for another.

Trading one version of vendor ‘lock-in’ for another? Image Credit: Light Reading

That’s because the O-RAN Alliance specs have not led to vendor neutral interoperability, but rather partnerships amongst vendors to provide a complete Open RAN solution.

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

References:

Open RAN Forecast Revised Upward, According to Dell’Oro Group

https://www.fiercewireless.com/tech/not-all-open-ran-same-industry-voices-pongratz

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=1

https://techblog.comsoc.org/?q=Open%20RAN#gsc.tab=0&gsc.q=Open%20RAN&gsc.page=2

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

Juniper Networks today announced plans to integrate its radio access network (RAN) intelligent controller (RIC) with Intel’s FlexRAN platform for Open RAN development.

This joint initiative between two companies is part of Juniper’s continuing efforts to bring openness and innovation to a traditionally closed-off part of the network, providing a faster route-to-market for service providers and enterprises to deliver 5G, edge computing and AI. Juniper views open RAN as an opportunistic endeavor and claims it’s currently testing the RIC integration in labs and trials with some tier-one operators. Juniper’s RIC takes direction from the O-RAN Alliance and adheres to open interfaces and APIs, but the specialized features it adds on top are proprietary.

Juniper has made major investments to lead the shift to Open RAN, beginning with the exclusive IP licensing agreement with Netsia (a subsidiary of Turk Telekom Group), and continuing with significant involvement in the O-RAN Alliance. Juniper is heavily engaged in expanding integrations with key partners and is part of the innovation team building joint customer solutions in Intel’s 5G Lab.

Spending on Radio Access Networks (RAN) is a significant amount of service providers’ CapEx, primarily due to limited vendor choice and closed architectures which lead to lock-in. Juniper recognizes that the RAN is a domain that demands openness and best-of-breed innovation to ensure the best experience for network operators and their customers, and is determined to lead the industry toward that vision.

Juniper’s collaboration with Intel includes the following:

- Juniper RAN Intelligent Controller (RIC) and Intel FlexRAN platform are pre-integrated and pre-validated to enhance usability of a full ORAN-compliant Intelligent RAN system

- Collaborative R&D work with Intel Labs for RIC platform-specific apps to improve customer experience, maximize ROI and drive rapid ORAN ecosystem innovation

- Joint customer testbeds with Intel to validate performance-improving implementation and speed of time-to-market

Juniper is an active member of the O-RAN Alliance, contributing to six working groups and serving as chair and co-chair of the slicing and use-case task groups, respectively. Juniper is also an editor of RIC specifications within the alliance.

Quotes:

“Juniper has always been committed to open infrastructures, which is why we are excited to support the work that Intel has undertaken with their FlexRAN ecosystem. By collaborating with Intel, we are able to deliver cloud-native routing, automation, intelligence and assurance solutions and services that are optimized for our customers’ needs, speeding time-to-market and enabling them to monetize faster.”

– Constantine Polychronopoulos, VP of 5G and Telco Cloud at Juniper Networks

“RIC is like the brain for open RAN, and we also call it essentially the operating system of the RAN,” said Jai Thattil, director of strategic technology marketing at Juniper Networks. Juniper intends to differentiate its RIC from others by pre-integrating and validating the technology so operators can adopt it as part of a more comprehensive offering combined with other services. “Juniper is kind of in a unique position, compared to a lot of other vendors” because of its experience in 5G transport, network cores, service management and orchestration, according to Thattil.

“The virtualization of the RAN continues to gain momentum across the industry as operators take advantage of cloud economics and the delivery of new services. This collaboration with Juniper and the validation of FlexRAN and RIC solutions will assist service providers to overcome integration challenges and accelerate time-to-market for future deployments.”

– Caroline Chan, VP Intel Corporation, GM of Network Business Incubator Division

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/juniper-nudges-open-ran-ric-into-intel-flexran/2021/09/

Additional Resources:

Media Relations:

Lori Langona

Juniper Networks

+1 (831) 818-8758

[email protected]

Triangle Communications replaces Huawei gear with Mavenir 4G/5G Open RAN radios and software

Montana service provider Triangle Communications is swapping out Huawei gear from its network and implementing 4G/5G open RAN products from upstart tech vendor Mavenir.

Late October is the target timeline as to when the FCC’s rip and replace reimbursement program opens. However, Triangle Communications is already at work to overhaul equipment for its fixed wireless access service. Texas-based Mavenir was chosen for Triangle’s entire network replacement and will act as systems integrator for the project, which qualifies for the FCC funding.

“This is a complete network swap out, so everything in the entire network from core to RAN [radio access network] and replacing it all with virtualized solutions,” Mavenir’s Sr VP John Baker said in an interview with Fierce Wireless.

Mavenir is providing a containerized evolved packet core (vEPC) IMS, open virtualized RAN (Open vRAN) compliant with O-RAN Alliance specifications for open interfaces, and the Mavenir Webscale platform that will enable Triangle to run applications on private, public or hybrid clouds.

It’s deploying the O-RAN Alliance 7.2 open interfaces for the 4G-LTE radios. All of the equipment will also be 5G ready. Triangle is using band 12/700 MHz spectrum.

Once Triangle gets equipment that’s virtualized up and running, Mavenir said the operator’s ability to respond to changes and the market should be significantly faster. It’s notable that the Triangle is planning to deploy open RAN architecture and technology.

In filings with the FCC, Triangle said that it doesn’t see any disadvantages in taking an open RAN approach. According to an April filing (PDF), the service provider’s own research “found ORAN equipment to be competitively priced and fully functional compared to legacy vendors’ equipment options which lock you into always using their equipment.”

“This will be the first network that will be deployed using Mavenir designed radios,” Baker said, and the first of several Mavenir-branded commissioned radios the software vendor plans to introduce over the next couple of quarters. Mavenir has done radios before, but it’s the first the vendor commissioned, designed, manufactured, and deployed in the U.S. market and for U.S. frequency bands.

As an open RAN vendor, and vocal champion, Mavenir has been clear on its stance of the need for U.S.-based radio suppliers in a market currently dominated by Ericsson and Nokia as RAN vendors.

Triangle and Mavenir did not disclose the value of their new deal, but the companies said Triangle’s core network swap-out is underway and that work on the radio access network (RAN) would stretch into next year.

Perhaps the most noteworthy element in Mavenir’s deal with Triangle is that it encompasses both the company’s hardware and software. Mavenir entered the RAN hardware business (mostly radios which are outsourced to Asian suppliers) in order to complement its existing software offerings.

Mavenir last year described its new open RAN hardware strategy as an attempt to “break the incumbent’s monopoly in the global market.” But the company’s efforts also highlight the complexity of the open RAN market considering open RAN technologies are intended to allow operators to mix and match equipment from a variety of vendors rather than buying everything from one source.

This could be the first of many U.S. ongoing “rip and replace” program as the FCC’s program to eliminate Huawei equipment gathers steam.

……………………………………………………………………………………….

Triangle Communications Serving Area in Montana:

Triangle Telephone Cooperative (TTC) is a company owned by its members. The cooperative was incorporated on March 24, 1953 in Havre, Montana by rural residents of Central Montana. In 1994, TTC purchased 13 exchanges from US West (now CenturyLink/Lumen Technologies) and formed a subsidiary named Central Montana Communication (CMC). Triangle Communications is the name TTC and its subsidiaries have chosen to do business as since 2008.

………………………………………………………………………………………….

References:

https://www.fiercewireless.com/tech/mavenir-swaps-out-triangle-s-huawei-gear-for-open-ran

https://itstriangle.com/about-us

Strand Consult: What NTIA won’t tell the FCC about Open RAN

by John Strand, CEO and Founder of Strand Consult (see company profile and bio below)

Introduction:

In “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks,” (Docket Number: GN-Docket No. 21-63) the National Telecommunications and Information Administration (NTIA) makes many claims about Open RAN [1] and states what appears to be official U.S. Executive Branch policy promoting that technology. In particular:

As stated in the Implementation Plan of the National Strategy to Secure 5G, the U.S. Executive Branch agrees that “close coordination between the United States Government, private sector, academic, and international government partners is required to ensure adoption of policies, standards, guidelines, and procurement strategies that reinforce 5G vendor diversity and foster market competition.” One promising solution in line with these objectives is open, interoperable networks, including Open RAN. While this response focuses on Open RAN, the Executive Branch’s policy is to promote the development of Open RAN alongside other policies, technologies, and architectures that support 5G vendor diversity and foster market competition.

Strand Consult analyzes these claims, their references, and the assumptions underpinning them from security and economics perspectives. Strand Consult’s report also includes an appendix fact checking 35 claims by NTIA and well as 133 additional references to help investigate the technology.

OpenRAN (open radio access network) is an evolving topic. It is an industrial concept, not a technical standard. Stakeholders, including NTIA may define OpenRAN differently, provide different definitions, ascribe different purposes to it, and have different expectations.

Editor’s Note:

There are two Open RAN spec writing bodies- the O-RAN Alliance and the Telecom Infra Project Open RAN Group. Neither of them have a liaison with either 3GPP or ITU-R WP 5D which have produced specifications/standards for 4G-LTE Advanced and 5G RAN/RIT specifications (3GPP Release 10 and Release 15 & 16, respectively) and ITU-R standards (M.2012-4, and M.2150, respectively). The O-RAN Alliance does have a liaison arrangement with GSMA which this author claims was an Ultra-Oxymoron.

……………………………………………………………………………………….

Strand Consult’s research question is to determine if, when, and how OpenRAN and O-RAN will replace conventional RAN on a 1:1 basis without compromising network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality coverage and other factors.

Executive Summary:

We don’t believe NTIA’s comments provide insight to answer our questions. Strand Consult has found that most of the comments in NTIA’s report restate talking points from the OpenRAN industry and present policy arguments as if they were fact or technical analysis. As advisor to the US President and policy lead for the Executive Branch on telecommunications, NTIA is considered an authority and is expected to produce serious, objective policy. Indeed it would be welcome for an objective report from NTIA on OpenRAN with an authoritative list of critical references and information from test installations of the technology. Unfortunately NTIA’s report falls short of this expectation.

In our opinion, the main shortcoming of the report is that NTIA has either overlooked, ignored, or is unaware of the role of Chinese vendors in the OpenRAN industry. The separate but related ORAN Alliance has 44 Chinese vendors, many which are explicitly state-owned and military-aligned. At least 7 of these entities are on the US Dept of Commerce Entity List and others have lost their Federal Communications Commission operating license. NTIA has not conducted a security assessment of OpenRAN and yet it blesses the technology and pronounces that it is Executive Branch policy to pursue it. Strand Consult investigates NTIA’s other comments about the infrastructure market, competition, prices, and innovation and finds that many of them are either unevidenced or proffered by self-interested OpenRAN actors.

O-RAN Alliance Reference Architecture:

Image Credit: O-RAN Alliance

……………………………………………………………………………………………

Strand Consult’s Analysis:

In an effort to lift the level of policy discussion, Strand Consult reviewed “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks” from July 16th to the U.S. Federal Communications Commission’s (FCC) a part of the Inquiry in the proceeding on open radio access networks (Open RAN). The highly respected NTIA is chartered to advise the President and represent the Executive Branch view on telecommunications, and there is an expectation that NTIA’s reports are objective, authoritative, and empirical, particularly with its roster of employee scientists and technologists. The document submitted to the FCC appears to be written by staff lawyers and makes many debatable claims which are either unsupported or based on advocacy materials from the OpenRAN industry.

NTIA’s OpenRAN document does not live up to expectations for the following reasons:

Its lack of objectivity and empirical support

Its overlooking role of Chinese vendors in OpenRAN ecosystem

Its misunderstanding of the economics of infrastructure and innovation

Its unfounded assertions about competition and the role of OpenRAN.

Lack of objectivity and empirical support. Citing of interested parties as experts. The OpenRAN document published by NTIA offers very little empirical, or even academic policy, evidence for its assertions. Most of references cited, 55%, come from OpenRAN advocacy groups or companies with a financial interest in OpenRAN, for example self-described OpenRAN vendors. The main part of the document’s references are not technical studies but rather policy arguments.

Moreover, NTIA fails to disclose that its preferred sources are advocacy organizations. While there is nothing illegal about citing advocacy organizations, government agencies like NTIA are supposed to be above touting advocacy as fact, science, and official policy.

The O-RAN Alliance [2] develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) [3] like ITU-R and ITU-T. The O-RAN Alliance does not satisfy the openness criteria laid down in Word Trade Organization Principles [4] for the Development of International Standards, Guides and Recommendations.

The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification on top of 3GPP specifications and ITU-R standards for 4G and 5G.

While industrial cooperation is important, there can be no mobile networks without the basic work of organizations like ITU-R WP 5D, 3GPP (which is NOT a SDO) and its seven regional members (which are SDOs) [5].

OpenRAN concepts include: cloudification, automation and open RAN internal interfaces do follow some elements of 3GPP specifications.

It appears that NTIA is attempting to elevate the O-RAN Alliance, essentially a closed association, with established WTO compliant SDOs (e.g. ITU and IEEE) and global consortia like 3GPP. Such an elevation is false and deceptive, and NTIA should clarify why it promotes a closed association that doesn’t meet openness requirements in WTO.

NTIA could have balanced this shortcoming by referencing some the widely published critical reviews of OpenRAN. Unfortunately, it does not. For example, U.S. federal documents can create credibility by objectively stating competing views and discussing the merits, similar to the Congressional Research Service [6].

Because NTIA appears only to provide favorable views of OpenRAN from interested parties, its document is tainted with bias. It reads like a set of talking points from the OpenRAN Policy Coalition, the a front for the OpenRAN industry’s interests.

Overlooking the role of Chinese vendors in the OpenRAN ecosystem:

Another shortcoming is the apparent ignorance of the role of Chinese vendors in the OpenRAN ecosystem. NTIA forgets to name the 44 Chinese companies that make up the second largest national group in the O-RAN Alliance. It failed to disclose that seven of these actors are either on the U.S. Entity List [7] and have lost their FCC license to operate [8] . Those companies include: China Mobile, China Telecom, China Unicom, ZTE, Inspur, Phytium and Kindroid, companies

which are integrated with the Chinese government and military.

Nor does NTIA disclose that the European telco Memorandum of Understanding (MoU) [between Deutsche Telekom, Telefonica, TIM, Vodafone and Orange] that OpenRAN should be built on top of Kubernetes [9], which is a software

technology platform that has been infiltrated by the Chinese.

While it began life in 2014 as a Google project, Kubernetes currently is under the jurisdiction of the Cloud Native Computing Foundation, an offshoot of the Linux Foundation (perhaps the world’s largest open-source organization).

By late 2017, Huawei had gained a seat on the Kubernetes Steering Committee. Huawei claims to be the fifth-biggest contributor of software code to Kubernetes.

According to the “Report on the 2020 FOSS Contributor Survey” [10] from The Linux Foundation & The Laboratory for Innovation Science at Harvard, the open source community spends very little time responding to security issues (an average of 2.27% of their total contribution time) and reports that it does not desire to increase this metric significantly.

It appears to be a problem that Huawei and ZTE are increasingly involved in the leading open source technology 11 used by OpenRAN developers. It is not clear how this acceptance of Chinese involvement in OpenRAN is consistent with President Biden’s tough stance on security vis-à-vis China and other threat actors [12].

Conclusions:

NTIA’s document appears to endorse the O-RAN Alliance for the security of OpenRAN. However, NTIA doesn’t provide technical analysis or a security assessment of O-RAN Alliance specifications. It is not clear from the document whether NTIA had access to these specifications to conduct an assessment. In any event, ORAN Alliance members exchange specifications on OpenRAN every 6 months. This means that the 44 Chinese companies in the O-RAN Alliance get fresh OpenRAN “code” at least twice a year, NTIA provides no threat analysis, risk assessment nor potential mitigation of these processes.

–>This is a breathtaking omission that alone warrants further attention by the NTIA.

NTIA could have strengthened its credibility by providing an authoritative, empirical document to inform policymakers objectively about OpenRAN. Instead NTIA offers a document which merely restates the talking points of OpenRAN advocacy groups and industry. This fails the U.S. Executive branch and the American people who expect quality information and impartial judgement from an expert agency.

More importantly, the NTIA document mis-informs readers about the security risks of OpenRAN which greatly extends the cyber security attack surface with its many “open interfaces.”

Hopefully, NTIA will review the empirical information and update its assessment in a new report.

…………………………………………………………………………………….

Readers who know something about OpenRAN are welcome to weigh in with their comments in the box below this article.

…………………………………………………………………………………….

Notes & Hyperlinks:

https://www.ntia.gov/files/ntia/publications/ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf

2. https://www.o-ran.org/

3. https://en.wikipedia.org/wiki/Standards_organization 4. https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

5. https://www.3gpp.org/about-3gpp

6. Disruptive Analysis Report: Telecom & 5G Supply Diversification A long term view: demand diversification, Open

RAN & 6G path dependence

https://www.lightreading.com/open-ran/verizon-t-mobile-outline-their-open-ran-fears/d/d-id/769201 https://www.lightreading.com/open-ran/open-ran-has-missed-5g-boat-says-three-uk-boss/d/d-id/766258?

7. https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern/entity-list

8. https://www.fcc.gov/document/fcc-denies-china-mobile-telecom-services-application-0

https://www.reuters.com/article/us-usa-china-telecom-idUSKBN2B92FE 9.https://www.telefonica.com/documents/737979/146026852/Open-RAN-Technical-Priorities-Executive-Summary.pdf/cdbf0310-4cfe-5c2f-2dfb-c68b8c8a8186

10. Page 5 of: https://www.linuxfoundation.org/wp-content/uploads/2020FOSSContributorSurveyReport_121020.pdf

11. https://merics.org/en/short-analysis/china-bets-open-source-technologies-boost-domestic-innovation

12. https://www.reuters.com/article/us-usa-biden-cyber-war-idUSKBN2EX2S9

………………………………………………………………………………………………..

About Strand Consult:

Strand Consult is an independent consultancy with 25 years of telecom industry experience. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

John Strand (photo below) is CEO of Strand Consult. He founded Strand Consult in 1995.

The mobile industry exploded in the 1990s, and Strand Consult grew along with its new clients from the mobile industry, analyzing market trends, publishing reports and holding executive workshops that have helped telecom operators, mobile services providers, technology manufacturers all over the world focus on their business strategies and maximizing the return on their investments.

References:

ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf (doc.gov)

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consulting: Why the Quality of Mobile Networks Differs

Vodafone and Mavenir create indoor OpenRAN solution for business customers

Vodafone and Mavenir have developed small cell OpenRAN technology for indoor network coverage. The solution is designed for businesses with medium to large office spaces and uses OpenRAN to support interoperability and (supposedly) to prevent vendor lock-in. The new indoor OpenRAN solution provides 4G LTE coverage “initially.”

The design of the indoor small cell solution is based on the OpenRAN philosophy of interoperability (yet to be proven). In this case, the software will be provided by Mavenir (Open vRAN), while Sercomm will provide the radio hardware. The design and flexibility of the small cell solution means it will be interoperable with other OpenRAN compliant vendors.

A powerful, indoor small cell solution can offer several advantages to business customers, according to Vodafone. The simple plug and play installation means coverage can be instantly deployed, enabling seamless connectivity for every device in the office. The interoperability (???) of the OpenRAN ecosystem paves the way for long-term flexibility to work with a wider array of vendors for elements such as radio units, baseband hardware, and gateways.

Editor’s Note: OpenRAN deployments have yet to demonstrate neutral vendor interoperability, technological advantages over purpose built network equipment, and/or cost reductions (OPEX and/or CAPEX). Light Reading has said OpenRAN substitutes one form of vendor lock-in for another (partnerships amongst OpenRAN vendors).

…………………………………………………………………………………………………………………………………………………………………………

Andrea Dona, Chief Network Officer at Vodafone UK, said:

“So far, OpenRAN deployment has focused on outdoor connectivity, but there is significant potential for this technology in the office environment.

A simple plug-and-play product, which includes all the attractive benefits of the OpenRAN philosophy, is one that can build on our strength of providing indoor coverage through both our macro network and our bespoke solutions.”

The convenience offered by plug-and-play enables the small cell equipment to be placed virtually anywhere to ensure coverage across the entire office.

Mavenir’s Open vRAN software is being used for the solution while Sercomm is providing the radio hardware.

Virtyt Koshi, SVP at Mavenir EMEA, commented:

“Mavenir is delighted to partner with Vodafone in Open RAN and to work in the UK on their radio network transformation initiative, proving the extreme flexibility of Open vRAN.

We are particularly proud in working in the field within the Vodafone commercial network and in the Newbury Open RAN Test and Verification lab, supporting the Vodafone effort to boost the ecosystem.”

The development of an indoor small cell solution is the next stage of a long-standing relationship between Vodafone and Mavenir. In August 2020, Vodafone deployed the first OpenRAN site to carry live traffic in the UK. The sites, including the Royal Welsh Showground in Powys, feature Mavenir software and Sunwave radio units. Vodafone and Mavenir will continue this partnership to deploy more OpenRAN sites in the future.

References:

Vodafone creating indoor OpenRAN solution for business customers

Samsung & NEC selected by Vodafone for Open RAN deployment

Vodafone has selected its Open RAN vendors: Dell, Samsung, NEC, Wind River, Keysight Technologies and Capgemini Engineering will jointly develop the first Open Radio Access Network commercial deployment in Europe. This is important because Vodafone will now be a “brownfield” telco vs greenfield telcos like Rakuten Mobile and Dish Network that are building 4G/5G Open RANs.

Furthermore, established telecom vendors Samsung and NEC beat competition from Altiostar, Mavenir and Parallel Wireless, the U.S. firms that have been involved in other open RAN deployments.

Wind River is providing the cloud software infrastructure for orchestration, while Keysight and Capgemini – the only European supplier in the mix – look after conformance and interoperability testing to make sure the set-up actually works.

The partnership will initially focus on the 2,500 UK sites that Vodafone committed to Open RAN in autumn 2020. One of the largest Open RAN deployments worldwide, this will be built in partnership with Samsung, NEC, Dell and Wind River. Vodafone will also use new radio equipment through the Evenstar program, with Keysight and Capgemini providing supports for network component interoperability.

Starting in 2021, the vendors and Vodafone will work to increase 4G/5G coverage to more rural areas across the SW of England and most of Wales, before turning to urban areas in a later stage. Vodafone is also working to deploy Open RAN technology in Africa and other markets across Europe. This announcement builds on the group’s new Open RAN lab in Newbury, UK, and planned digital skills hubs in Dresden (Germany) and Malaga (Spain).

Johan Wibergh, Vodafone Chief Technology Officer, said: “Open RAN provides huge advantages for customers. Our network will become highly programmable and automated meaning we can release new features simultaneously across multiple sites, add or direct capacity more quickly, resolve outages instantly and provide businesses with on-demand connectivity.”

“Open RAN is also reinvigorating our industry. It will boost the digital economy by stimulating greater tech innovation from a wider pool of vendors, bringing much needed diversity to the supply chain.”

“Samsung performed well on TIP evaluations they talked about a year and a half ago and so in that sense it is not a surprise,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “Samsung is taking advantage of open RAN to extend its reach.”

“This partnership represents a major breakthrough for Samsung and a strong validation for its 5G RAN portfolio,” said Richard Webb, an analyst with CCS Insight, in emailed comments. “This contract win adds to its credibility and could be a signal for other European operators to consider Samsung as an option.”

Samsung has built its open RAN software on top of Intel’s FlexRAN platform, Light Reading was able to confirm with Vodafone. Asked if that would preclude the use of Arm-based processors in future, the operator insisted open RAN’s flexibility would allow software to evolve as desired.

Heavy Reading’s Brown thinks NEC would have been a natural choice as a supplier of radio units because the Japanese market has already taken advantage of open fronthaul capability. “They have been using radios and baseband from different vendors for a long time and are world leaders in this,” he says. “NEC and Fujitsu have been working in that area for some time.”

…………………………………………………………………………………………………………………………………..

Vodafone Statement:

Vodafone is working with other operators to lower the entry barriers for smaller vendors and startups. Recently published Open RAN technical requirements by Vodafone and other telecommunications companies will provide a blueprint to help expedite the development of new products and services based on industry specifications from the O-RAN Alliance (of which Vodafone is a member) and eventually (????) ETSI standards (from the European Telecommunications Standards Institute), always compatible with 3GPP (which does not have ANY Open RAN projects at this time).

……………………………………………………………………………………………………………………………………………

References:

https://www.vodafone.com/news/press-release/vodafone-europe-first-commercial-open-ran-network