Telco Business Models

Fierce Network Research report examines telcos role in the AI economy and profiles early AI adopters

The telecommunications industry is at a critical crossroads. As AI reshapes global value chains, communications service providers (CSPs) must determine their strategic position: will they remain infrastructure enablers or evolve into full-scale participants in the AI economy?

A new Fierce Network Research report — “Risk, Reward and Revenue: Defining Telcos’ Role in the AI Economy” — examines this identity challenge — and how network operators are recalibrating for the next generation of network-driven intelligence. Based on a global survey of 500 technology decision-makers across 40 countries, the findings reveal a pronounced industry divide. A majority (57%) of operators see their core opportunity in infrastructure — networks, data centers, and secure connectivity — while 43% advocate for a more integrated position, aspiring to orchestrate AI ecosystems (19%) or participate fully in the AI value chain (24%).

Some of the industry’s early adopters are already showing what that future might look like.

- AT&T reports a twofold increase in cash flow for every dollar it invests in AI, emphasizing measurable outcomes over vague productivity gains. An AT&T executive said that success in the AI era depends on “Goldilocks governance” — a balance not too rigid to stifle innovation, and not too loose to compromise compliance and trust.

- Bell Canada is moving in a similar direction, targeting a doubling of enterprise AI revenue by 2028 and positioning its Ateko subsidiary and AI Fabric platform as the backbone of a “sovereign digital spine” for Canada.

- “We’re using AI to enhance our products and services and make them better,” Ed Fox, MetTel CTO. The company provides a private network to deliver integrated communications and IT services to U.S. businesses and government agencies, including voice, data, network, cloud, mobility, IoT and security solutions. MetTel also provides managed network services such as SD-WAN and secure access service edge (SASE).

- Rick Lievano, Microsoft CTO for the worldwide telecommunications industry, sees operators expanding their use of AI beyond efficiency. “Initially, the first place where telcos began to experiment with AI is around efficiency gains — how can I save money, and how can I do more with fewer people? That’s been the target of the first couple of waves of AI,” Lievano said. “However, their eyes light up when we talk with them about new revenue opportunities,” Lievano said.

The research highlights that telcos possess critical assets few other industries can match: globally distributed data center capacity, secure and resilient networks, and deep, long-standing relationships with enterprise and government customers. But the barriers are equally significant — from proving the business case for AI infrastructure to navigating a shortage of data science and AI talent. Legacy technology debt continues to drag, with one executive lamenting that 145 years of accumulated systems make modern data integration “extraordinarily complex.”

A new Fierce Network Research report reveals how communication service providers are navigating the AI economy amid uncertainty about their role and strategy. (Google Gemini)

The bottom line is clear: to remain relevant in the AI-driven economy, telcos must modernize both infrastructure and business models — transforming from connectivity providers into intelligent digital enablers. However, we’ve heard that cry for telco transformation from dumb pipes to intelligent and autonomous network and IT providers, but it has yet to be realized. Will this time be any different?

References:

https://www.fierce-network.com/cloud/dumb-pipes-or-ai-powerhouses-telcos-face-identity-crisis

Full REPORT: “Risk, Reward and Revenue: Defining telcos’ role in the AI economy.”

Private 5G networks move to include automation, autonomous systems, edge computing & AI operations

Palo Alto Networks and Google Cloud expand partnership with advanced AI infrastructure and cloud security

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Markets and Markets: Global AI in Networks market worth $10.9 billion in 2024; projected to reach $46.8 billion by 2029

Ericsson integrates Agentic AI into its NetCloud platform for self healing and autonomous 5G private networks

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

New Linux Foundation white paper: How to integrate AI applications with telecom networks using standardized CAMARA APIs and the Model Context Protocol (MCP)

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Telco spending on radio access network (RAN) infrastructure, which is the largest share of capex, has dropped sharply in the last couple of years. It fell 11% in 2023, to about $40 billion, according to Informa owned market research firm Omdia (see References below for Dell’Oro’s numbers).

For 2024, Omdia predicts another decline of between 7% and 9%. Instead of buying new equipment, telcos have used existing supplies in their where houses.

Traffic growth rates also appear to have slowed. The graphic used in Ericsson’s latest mobility report pictures this very clearly, showing a church steeple of a traffic spike in 2019 and 2020 before a shallower downward-sloping gradient to the first half of 2024. That’s shown in this chart:

.jpg?width=700&auto=webp&quality=80&disable=upscale)

Source: Ericsson

Ericsson’s latest numbers, available through its mobility visualizer tool, shows the monthly volume of global mobile data rose by just 4.34% in the second quarter of 2024, compared with the first quarter. This is much lower than the rate of 10.76% Ericsson observed in the corresponding quarter four years earlier. The actual increase in 2024 was 6.27 exabytes. In 2020, it was 4.86 exabytes.

RAN product revenues have been falling at their sharpest rate in many years despite the 6.27-exabyte increase in monthly data volumes that happened in the second quarter. There are no signs that current 4G and 5G networks are about to keel over beneath an avalanche of data. It remains to be seen whether mobile networks are sufficiently robust to cope with many more exabytes of mobile data traffic or if telcos care about any service problems caused by congestion due to increased traffic.

There is also no obvious correlation between traffic growth and expenditure, according to Coleago Consulting. Spain’s Telefónica supported 17,054 petabytes of data on its global networks in 2015, its annual reports show. By 2023, the amount had rocketed to 146,074. Yet its capital intensity has fallen from more than 17% to just 14% over this period. Energy use, a proxy for operating costs, is also down, dropping from about 6,578 gigawatt hours in 2015 to 6,012 last year. Despite all that data consumption by its customers, Elisa’s capital intensity last year was less than 15%.

In Germany, the average monthly data usage per mobile customer (rather than per capita) amounted to 7.4 Gbytes and this may have risen to around 8 Gbytes in 1H 2024. In 2024, mobile data consumption in Finland was around 10 times higher compared to Germany. In Finland mobile operators have implemented 5G-SA and sell a user experience in terms of speed (Mbits/s) as opposed to data volume (Gbytes). As of October 2024, Elisa Finland offered a speed of 300 Mbits/s with unlimited data volume for €34.99. By contrast, in Germany, Telekom’s offer for 20 Gbytes is priced at €39.95 per month. For unlimited data usage Telekom charges €84.95, which is 2.5 times more costly than Elisa’s unlimited offer. It is unreasonable to assume that there is no price elasticity of demand. Surely, if prices in Germany were like those in Finland, monthly mobile data usage per customer would be much higher.

Monthly average revenue per user (ARPU) for a postpaid customer of Deutsche Telekom, Germany’s biggest telco, has fallen from €22 (US$23.7) before the launch of 5G to about €20 ($21.6) for the most recent quarter. Clearly, cost realities are especially awkward for Europe’s telcos, which have refused to give up their “fair share” argument that big content companies should pay for network usage because of all the traffic they supposedly generate. Critics disagree, saying that the telco’s own customers are the traffic generators, and they have already paid for it, even if pricing schemes do not help telcos to grow their sales.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/data-traffic-growth-or-decline-there-s-no-upside-for-telecom

https://www.coleago.com/insights/the-end-of-telecoms-history-not-really/

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

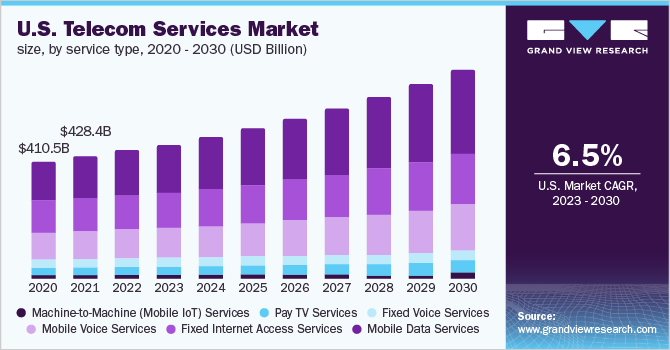

Grandview Research: global telecom services market to compound at 6.2% from 2023 to 2030

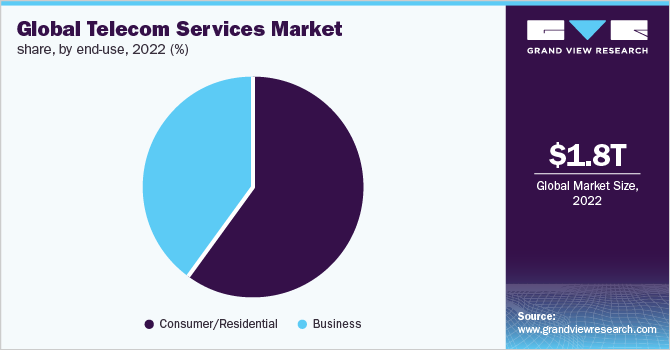

According to Grandview Research, the global telecom services market size was valued at USD 1,805.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030.

Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry. An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.

In 2022, the wireless networks accounted for a market share of more than 76.0% in the global market. The advent of cloud-computing technologies, artificial intelligence, and IoT is presumed to majorly contribute to the growth of wireless communication channels worldwide. Over the years, there has been a rapid deployment of systems for Wireless Local Area Networks (WLANs) that has enabled internet access to cellular devices in private homes, public spaces, airports, office buildings, cafeterias, and other areas. Such wireless densification to simplify work processes and automate routine test actions is presumed to prove beneficial, hence registering a robust CAGR in the forthcoming years.

In 2022, the consumer/residential segment accounted for the largest revenue share of more than 59.0% and is projected to maintain its lead over the forecast period. The significant growth is ascribed to the proliferation of smartphones worldwide. There were more than 8 billion mobile subscribers recorded globally in 2020, wherein more than 60% of the population was using smartphones. The private telecom operators account for a larger subscriber base as compared to government-owned companies. In addition, the growing demand for OTT applications is contemplating the users to subscribe to wireless internet offerings, thereby significantly contributing to the deployment of communication networks at a broader level. Additionally, the growing trend of using ultra-high-definition videos and online gaming is expected to boost the segment growth over the forecast period.

In 2022, the Asia Pacific captured more than 33.0% of share and is expected to grow at a CAGR of 7.0% from 2023 to 2030. The region is likely to attract more than half of the new mobile subscribers by 2030. The regional market is primarily driven by e-commerce and retailer buy-in platforms, smartphone ubiquity, and investments in 5G networks. China, Japan, and India have emerged as significant contributors to regional market growth. According to industry expert analysis, in February 2022, China recorded 1.02 billion internet users, which is more than three times the number of the third-placed United States, which had just over 307 million. India recorded the second highest internet users in February 2022.

Some prominent players in the global telecom services market include:

- AT&T Inc.

- Verizon Communications Inc.

- Nippon Telegraph and Telephone Corporation (NTT)

- China Mobile Ltd.

- Deutsche Telekom AG

- SoftBank Group Corp.

- China Telecom Corp Ltd.

- Telefonica SA

- Vodafone Group

- KT Corporation

- Bharati Airtel Limited

- Reliance Jio Infocomm Limited

- KDDI Corporation

- Orange SA

- BT Group plc

- Comcast Corporation

Telecom Services Market Report Scope

| Report Attribute | Details |

| Market size value in 2023 | USD 1,885.41 billion |

| Revenue forecast in 2030 | USD 2,874.76 billion |

| Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Base year for estimation | 2022 |

| Historical period | 2017 – 2021 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Service type, transmission, end-use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Mexico |

| Key companies profiled | AT&T Inc.; Verizon Communications Inc.; NTT; China Mobile Ltd.; Deutsche Telekom AG; SoftBank Group Corp.; China Telecom Corp Ltd.; Telefonica SA; Vodafone Group; KT Corporation; Bharati Airtel Limited; Reliance Jio Infocomm Limited; KDDI Corporation; Orange SA; BT Group plc; Comcast Corporation |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

References:

https://www.grandviewresearch.com/industry-analysis/global-telecom-services-market

Technavio: APAC region leads global telecom services market with 33% growth

Canalys: Global cloud infrastructure services spending up 16% in Q3-2023

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

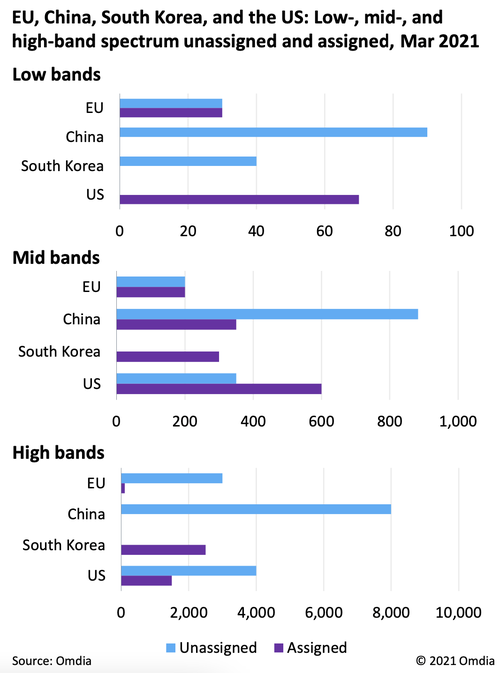

Omdia: Regulatory activity to impact telecom in 2022; Global 5G status

According to market research dynamo Omdia, 2022 will be rife with regulatory activity that will impact the telecommunications market for years to come.

“As technology evolves, regulation will become more important than ever in the TMT industry,” said Sarah McBride, senior analyst for regulation at Omdia.

Omdia identified several trends it says will be “at the heart of regulatory activity” next year, including spectrum licensing, fiber networks, the digital divide and 6G (even though 5G spectrum has not been standardized by ITU-R in a revision to M.1036).

Regarding the digital divide (between the broadband haves and have nots), Omdia says “governments should learn from the pandemic and recognize the need for these broadband services to be affordable to all.”

The Omdia analysts say that governments must define a “comprehensive national digital strategy that includes providing state-aid tools to improve broadband availability and affordability.”

Such a strategy should go beyond deployment to “ensure citizens can use connectivity transformatively to bring about innovation and growth.” Doing so will encourage more deployment and investment, writes Omdia.

However, to avoid too much government intervention, Omdia also stresses the need for cooperation by service providers.

“Experience shows that market-led development, not a reliance on government intervention, is the most effective model for effective allocation of resources. However, economic viability is lower in some rural and sparsely populated areas than in populous areas,” Omdia said. The firm recommends that network operators collaborate by sharing infrastructure to reduce deployment costs and create shared wireless networks to “remove the need for regulators to set ambitious coverage obligations as part of spectrum licenses or universal service obligations.”

According to Omdia’s tracker for 5G networks, more than 150 5G networks have been launched around the world to date, which the research firm says will continue to drive demand for more spectrum.

“5G will profoundly affect society because of its ultrafast speeds, low latency, and high reliability, which enable digital transformation and support new use cases,” writes Omdia.

Regulators need to effectively manage spectrum allocation, “allowing access to the right amount of internationally harmonized spectrum (e.g., 700MHz, 3.6GHz, and 26GHz bands in the EU) in a timely manner to keep costs down.”

As operators continue to build out their 5G networks, Omdia tells policymakers it’s important to plan ahead on 6G standards, given the role these networks will play in the digital economy and the danger posed by a lack of cohesion.

Specifically, the firm warns against further splintering the telecom and Internet ecosystem, or what it calls “the splinternet.”

“It is especially important that regulators and policymakers prepare for future network generations by ensuring agreement is reached on 6G standards. A fragmentation of standards must be avoided to prevent any further separation of the telecoms and internet ecosystem, a ‘splinternet’,” writes Omdia.

Acknowledging that plans for 6G are in their infancy, Omdia further tells policymakers to begin identifying appropriate spectrum bands, though it notes that such plans “will need to be balanced with the need to release spectrum for 5G.”

Part of the rush to deploy high-speed internet everywhere includes a migration to fiber, whether through new builds or upgrades of existing cable networks. Omdia says that as network operators migrate to fiber, regulators should focus on promoting competition, pricing strategies and raising awareness amongst consumers about fiber access.

The firm further states that regulators should include fiber access in wholesale obligations, “once sufficient fiber coverage is reached.”

It’s important for network operators to collaborate with regulators on network upgrade plans and give wholesale customers advance warning to avoid disruption.

“Operators need to give their wholesale customers a sufficient notice period when withdrawing copper networks. This includes providing formal notifications that outline the timeframes involved, the replacement products on offer, and the new price terms,” writes Omdia.

……………………………………………………………………………………………..

In a separate report titled, 2022 Trends to Watch: Global 5G, Omdia says that 5G network rollouts are still in the early stages, especially in developing regions.

“But there are compelling reasons for telcos to commit to 5G so they can differentiate around an improved network experience, as well as realize network efficiencies and lower operating costs. Moreover, 5G’s enhancements over 4G – most noticeably speed and latency – will come to be appreciated by consumers more next year as an increasing number of data-intensive services and applications become popular in the mass market,” the research firm said.

“A surprise to many next year may be the rapid emergence of satellite to augment telcos’ terrestrial network coverage,” Omdia observed.

“A key driver for hybrid satellite-cellular deployments is the need for ubiquitous high-speed data coverage, something which telcos can greatly benefit from if their rivals’ 5G network coverage remains patchy.”

Major telcos including BT, Deutsche Telekom, Telecom Italia and Verizon signed significant deals with satellite internet providers in 2021 to offer a hybrid approach to targeted residential, enterprise and industrial markets.

Omdia believes that the likely success of these satellite internet initiatives could jump-start a flurry of new activity in this area in 2022.

“Although most end users aren’t rushing to buy 5G, the quality of their network experience in terms of reliability, speed, and coverage is increasingly important to them. As such, 5G offers telcos a better opportunity than 4G to differentiate, especially for ones that can claim they offer the best-in-market network experience,” Omdia said.

Omdia thinks that partnership strategies will be even more important for telco 5G success in 2022.

“How good telcos are at partnering, whether for content, service, or technology development, will increasingly define how successful they are in consumer, enterprise, and industrial markets. Because of its enhanced capabilities over 4G, 5G enables telcos to offer much more, and they will have to partner effectively to capitalize on this.”

“Except for 5G MEC (really ?), the ecosystem and markets for advanced 5G technologies are still in their infancy. However, 5G front-runners are already launching them, placing them in a strong position to gain a first-mover advantage when the market is ready to adopt them,” Omdia said.

References:

https://www.broadbandworldnews.com/document.asp?doc_id=774240&

https://techblog.comsoc.org/2021/12/18/etsi-mec-standard-explained-part-ii/

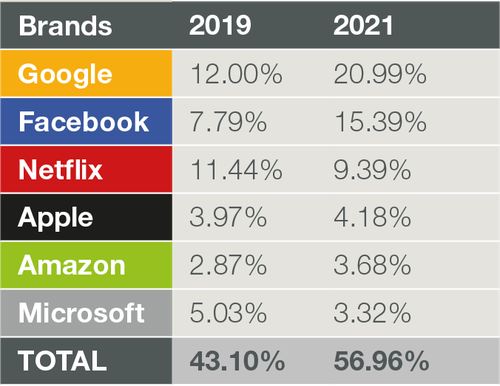

Telco business models must change as Big Tech generates the majority of internet traffic

In a blog post today, network intelligence firm Sandvine states that Google, Facebook, and other ‘top-6’ digital brands generate more than 56% of global network traffic. The company’s upcoming 2022 “Global Internet Phenomenon Report,” takes this a step further by showing that the top-6 – Google, Facebook, Netflix, Amazon, Microsoft, and Apple – are generating more than 56% of global network traffic.

For the first time, the biggest digital players account for more traffic than everyone else (telcos, MSOs/cablecos, satellite internet, state & local governments, municipalities, etc), combined! And that trend is likely to continue to increase. as OpenVault recently reported that average monthly home internet data consumption in the U.S. rose to 434.9 GBytes in the third quarter of 2021, up 13% over the same period in 2020.

The chart below shows the percentage of traffic that the six biggest Internet companies generated across global networks.

Source: Sandvine

For Communications service providers (CSPs), this is a watershed moment: they must deliver the benefits of 5G (are there any?), cloud, the IoT, AR/VR, AI, the metaverse (?), etc. and they must assure a good QoE (Quality of Experience) for the current and next generation of apps.

Sandvine believes the shift to more mission-critical enterprise and industry services will trigger a need for flawless connectivity (ultra high reliability/availability) and optimal performance for manufacturing robotics, remote healthcare, autonomous driving, public safety, and other critical services.

Recently, the CEOs of Deutsche Telekom, Telefonica, Vodafone, and 11 other influential service providers published an open letter stating that “a large and increasing part of network traffic is generated and monetized by Big Tech platforms.”

They cited the fact that it is the telecommunications sector that is bearing the “continuous, intensive network investment and planning” that ultimately drives the unprecedented profitability of the biggest tech brands.

“A large and increasing part of network traffic is generated and monetized by Big Tech platforms, but it requires continuous, intensive network investment and planning by the telecommunications sector,” the CEOs said in the joint statement seen by Reuters.

In other words, telcos are subsidizing Big Tech who reap the benefits of those same telco networks. MSOs/cablecos broadband internet providers, like Comcast, Charter, and Cox Communications, could likely make the same argument.

The CEOs did not mention any big tech firms by name, but Reuters understands that U.S.-listed giants such as Netflix and Facebook are companies they have in mind.

According to Reuters, the investments in Europe’s telco sector rose to 52.5 billion euros ($59.4 billion) last year, a six-year high. Those investments include the networks, 5G trials, licenses, planning, and deployment that fuel app QoE. In return, the European telcos received modest usage fees from subscribers.

In addition to wanting a fair ROI for their substantial investments, CSPs also want to protect their networks and brands. The recent Facebook, AWS, and Tesla outages demonstrated how pronounced and far reaching the impacts on networks can be now that apps and services are far more intertwined and interdependent than ever before. QoE for both related and unrelated apps and services were affected.

Source: Sandvine

Sandvine says CSPs need predictive insights that help identify macro trends across their millions of subscribers, billions of devices, and thousands of applications to answer key questions that can drive business actions and outcomes.

Here are a few such questions CSPs should address, according to Sandvine:

- Which apps are consuming and generating the most traffic, downstream and upstream?

- What’s the impact of app complexity in terms of mashups, embedded video, payments, chat, and other features?

- How are QUIC (a new multiplexed transport built on top of UDP), HTTP/3, iCloud Private Relay, and encryption affecting the network?

- Who are the “heavy users” in the upgrade from 4G to 5G?

The above questions are just some that Sandvine will explore in detail in their upcoming “Global Internet Phenomenon Report.”

………………………………………………………………………………………………………………………………..

Meanwhile, a growing number of professionals are calling for “Big Tech” to contribute to the Universal Service Fund (USF). The FCC instituted the USF in 1997 to help fund the construction of broadband networks in rural and unserved areas of the country, and to help low-income Americans afford telecom services. But the primary sources of funding for the USF are network operators (which redirect the USF fees paid by their customers each month).

FCC Commissioner Brendan Carr said that the best way to fund the FCC’s Universal Service Fund advanced communications subsidies is to make Big Tech pay the freight. Citing a new study from economist Hal Singer and Ted Tatos, Carr said that the current method of assessing dwindling traditional telecom services is unsustainable, and that shifting to assessing wireless broadband would continue to hit consumers in the pocketbook–the USF fees are passed on by telecoms onto their customers’ bills.

Car argues that the FCC should make Big Tech companies like Google and Facebook pay the USF fees, which would be very difficult for them to pass on to consumers and which would, “significantly reduce consumers’ costs, properly align incentives, and unlike assessing wireline broadband revenues, would not raise consumers’ monthly bill for internet services,” Carr said citing the study,

References:

https://www.sandvine.com/blog/telco-business-models-reaching-tipping-point-in-digital-era

https://www.nexttv.com/news/fccs-carr-make-big-tech-pay-for-usf-subsidies