Uncategorized

Intel to make custom 5G system-on-chip (SoC) for Ericsson

Intel has agreed to manufacture custom 5G system-on-chip (SoC)s for Ericsson, which the Swedish wireless equipment company will use to develop what promises to be “highly differentiated” networking products. The chips will be based on Intel’s latest fabrication process, 18A (1.8nm), which is so new that it has yet to begin commercial production.

When it does, the chips will offer up to a 10% improvement in performance per watt compared to current production processes. This is important because the faster the processor, the faster the network (think lower latency).

Highlights:

- Announcement signals confidence in 18A process technology and underscores progress on Intel’s five-nodes-in-four-years roadmap to regain process leadership.

- News shows continued collaboration between the companies to optimize standard Intel® Xeon® Scalable processor-based platforms for Ericsson’s Cloud RAN solutions.

- Industry leaders advance the adoption of 5G, building sustainable and resilient networks of the future.

Intel and Ericsson have also agreed to work more closely together to optimize the performance of Intel’s latest Xeon RAN processors on Ericsson’s cloud RAN hardware, taking aim at capacity, energy efficiency, flexibility and scalability.

In June, Ericsson laid claim to being the first vendor to use the new chip – the 4th Gen Intel Xeon Scalable processor with Intel vRAN Boost, to use its official but not exactly succinct name – to carry out an end-to-end cloud RAN call. That in itself was an achievement given that the processor made its official debut at Mobile World Congress a few months earlier.

“As our work together evolves, this is a significant milestone with Ericsson to partner broadly on their next-generation optimized 5G infrastructure. This agreement exemplifies our shared vision to innovate and transform network connectivity, and it reinforces the growing customer confidence in our process and manufacturing technology,” said Sachin Katti, senior vice president and general manager of the Network and Edge group at Intel. “We look forward to working together with Ericsson, an industry leader, to build networks that are open, reliable and ready for the future.”

18A is Intel’s most advanced node on the company’s five-nodes-in-four-years roadmap. After new gate-all-around transistor architecture – known as RibbonFET – and backside power delivery – called PowerVia – appear first in Intel 20A, Intel will deliver ribbon architecture innovation and increased performance along with continued metal linewidth reduction in 18A. Combined, these technologies will put Intel back in the process leadership position in 2025, elevating future offerings its customers bring to market.

“Ericsson has a long history of close collaboration with Intel, and we are pleased to expand this further as we utilize Intel to manufacture our future custom 5G SoCs on their 18A process node, which is in line with Ericsson’s long-term strategy for a more resilient and sustainable supply chain,” said Fredrik Jejdling, executive vice president and head of Networks at Ericsson. “In addition, we will be expanding our collaboration that we announced at MWC 2023 to work together with the ecosystem to accelerate industry-scale open RAN utilizing standard Intel Xeon-based platforms.”

As 5G deployments continue, the future lies in fully programmable, open software-defined networks powered by the same cloud-native technologies that transformed the data center, delivering unparalleled agility and automation.

To realize the best performance, innovation and global scale, the industry needs to work together and continue to synchronize network specifications as part of one global set of standards. Intel and Ericsson collaborate with other leading technology companies to bring these benefits to their customers toward industry-scale open RAN.

References:

https://telecoms.com/522857/intel-to-produce-custom-5g-chips-for-ericsson/

Deutsche Telekom Global Carrier Launches New Point-of-Presence (PoP) in Miami, Florida

Wholesale network operator Deutsche Telekom Global Carrier has announced the launch of a new Point-of-Presence (PoP) in Miami, Florida. The PoP, hosted within the Equinix data center, offers bandwidths of 1/10/100 gigabits per second (n x 1, n x 10, n x 100 Gbps). According to the official statement, this expansion aims to strengthen Deutsche Telekom’s global IPX and IP network footprint.

By establishing the new IPX and IP PoP in Miami, Deutsche Telekom Global Carrier says its clients can now enjoy direct access to its Tier 1 IP and IPX network, one of the largest in the world. This move comes in response to the growing demand for high-speed connectivity, as businesses increasingly require efficient implementation of digital applications and emerging technologies.

“The launch of our new IPX PoP in Miami, Florida, is an important step for Deutsche Telekom Global Carrier in addressing customer needs on the American continent. Even with Today’s ever-growing data volumes, users’ expectations continue to rise, and low-latency data roaming is crucial. Our newly implemented IPX PoP addresses the demand increase and helps us provide our customers and partners with premium quality global connectivity.”

Deutsche Telekom Global Carrier emphasized the significance of the Miami PoP: “At Deutsche Telekom Global Carrier, we are always several steps ahead of demand because we’re committed to providing our customers and partners with superior, future-proof connectivity and quality. This new PoP is part of that promise,” said the company in its press release.

With this latest development, Deutsche Telekom Global Carrier ensures businesses have the essential infrastructure required for seamless digital operations.

Image Credit: Deutsche Telekom

Csaba Füzesi, Head of Product Management Voice & Mobile Services at Deutsche Telekom Global Carrier, said: “The launch of our new IPX PoP in Miami, Florida is an important step for Deutsche Telekom Global Carrier in addressing customer needs on the American continent. Even with today’s ever-growing data volumes, expectations of users continue to rise, and low-latency data roaming is crucial. Our newly implemented IPX PoP addresses the increase in demand and helps us to provide our customers and partners with premium quality global connectivity.”

Miles McWilliams, Head of Sales Internet & Content Services at Deutsche Telekom Global Carrier, said: “Today’s ever-growing data volumes match the rising expectations of users. At Deutsche Telekom Global Carrier we are always several steps ahead of demand because we’re committed to providing our customers and partners with superior, future-proof connectivity and quality. This new PoP is part of that promise.”

Deutsche Telekom has extended its autonomous AS 3320 network around the Equinix site in Miami, which is America’s largest data center campus. The MI1 data center is located in downtown Miami, with a colocation area of 255,512 square feet.

References:

https://telecomtalk.info/deutsche-telekom-global-carrier-pop-miami-florida/783941/

China Mobile verifies optimized 5G algorithm based on universal quantum computer

China has achieved the country’s first algorithm verification of a communication network optimization based on a universal quantum computer, according to the Quantum Computing Engineering Research Center in east China’s Anhui Province.

China Mobile, the country’s largest mobile carrier, is currently in the stage of 5G network operation and 6G research and development. Compared with 5G, 6G will face computing problems such as larger-scale business optimization, network optimization, signal processing and machine learning, bringing about great pressure to the classical computation and algorithms, said Cui Chunfeng, an official from the China Mobile Research Institution (CMRI).

The tremendous computing power is the main characteristic of quantum computers. “We try to start from small-scale problems in some typical scenarios to evaluate and verify the application feasibility of quantum computing in communication networks, especially in 6G,” Cui said.

The CMRI and the Origin Quantum Computing Technology Corporation signed a cooperation memorandum on June 30 to jointly promote the integration of quantum computing into the communication network and arithmetic network as the core of the mobile information network.

Aiming at the optimization of large-scale antenna parameters of 5G base stations, the Origin Quantum has preliminarily proved the feasibility of quantum algorithm in the specific problem through effective modeling, algorithm design and real-machine verification, said Dou Manghan, director of the software center of the Origin Quantum.

He noted that the company has the country’s first case of using quantum computers with real machines for communication network algorithm verification, achieving a good start for the application of quantum computing.

A quantum computer in China Photo: VCG

In the future, China Mobile will design quantum algorithms with better performance, boost the integrated development of quantum computing and communication industry, and explore a leapfrog path for the development of mobile information networks, Cui said.

Source(s): Xinhua News Agency

References:

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

MTN Consulting reports [1.] that the top three Telco Network Infrastructure (NI) equipment vendors continue to be Huawei, Ericsson, and Nokia. They account for 37.4% of the total market in annualized 1Q23, or 34.8% in 1Q23 alone. While the trio has captured >40% share of the market for most of 2016-22, Huawei’s share has fallen recently, and all three giants have been pressured by vendors in the cloud and IT services space (e.g. Amazon, Microsoft, Alphabet, Dell, VMWare…).

Note 1. This MTN Consulting study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-1Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

Focusing on the top three, Huawei has dropped in the last three periods (due to global sanctions), but remains dominant due to China.

Ericsson’s share decline was a function of lower RAN spending among its largest customers as the 5G rollout pace ebbs. The Swedish vendor hopes to offset this decline soon with new revenues from its blockbuster acquisition of network API platform vendor, Vonage. It expects the first revenues from the acquisition later this year and a ramp up further in the next two years.

Nokia, including (Alcatel-Lucent) ALU for pre-acquisition years, has also dipped as 5G RAN rollouts slowed. But it gained market share slightly in 1Q23 on account of 45% growth in its optical networks business along with some benefits from catch-up sales related to the supply chain challenges it witnessed in 2022.

China Comservice and ZTE have been trading the 4 and 5 spots off and on since early 2019. Notably, though, China Comservice is majority owned by Chinese telcos, and is not truly independent. Intel is in the 6th position due to data center, virtualization, edge compute and other telco projects, some done directly and some on an OEM basis.

CommScope remained at seventh position while NEC managed to surpass Cisco in the latest annualized 1Q23 period, as Cisco (9th position) witnessed a stark drop in its Telco NI revenues in 1Q23. Cisco’s decline is worrying, as its largest market (the U.S.) has a growing focus on 5G core, which Cisco has flagged in the past as key to the company growing telco revenues. Amdocs is ranked 10th due to its strength in network software.

Biggest Telco NI revenue changes on a YoY basis:

Three out of the top five vendors, in terms of YoY revenue growth, are the same for both single quarter and annualized 1Q23: Alphabet, Microsoft, and Lenovo. Two of these are cloud vendors (Alphabet and Microsoft) who are steadily improving their penetration of the telco vertical market with a range of solutions – digital transformation, service design, 5G core, workload offshift, etc. Lenovo is gaining traction with its disaggregated, virtual radio access network (vRAN), and multi-access edge computing (MEC) solutions. Clearfield is a small fiber company focused on the booming US market.

Other companies to show improvement in both periods include Tejas Networks which bagged a mega deal for a BSNL-MTNL 4G network; Rakuten Group (Symphony) benefiting from key deployments of its cloud-based Open RAN solutions; Harmonic which has benefited from strong cable access spending and a growing customer list; YOFC (a Chinese fiber company), and two large US-based engineering services-focused companies (DyCom and MasTec) benefiting from a fiber boom.

Declines in the 1Q23 annualized period include Cisco which continues to be worrisome on account of lower customer spending, though it noted improvement in supply chain constraints in the latest quarter. Extreme Networks, Casa, and Airspan all dipped, but noted that the supply chain challenges of previous quarters are improving. Cisco, the largest among the annualized decliners, remains optimistic about prospects as telcos move to 5G SA cores.

Supply chain issues improving:

For the past two years, vendors in the Telco NI market have been plagued with supply chain constraints. The situation is now easing though, if a review of vendor earnings from 1Q23 is anything to go by. Most significant vendors confirm the assessment of three months ago: shortages in specific component areas continue to be an issue but are improving with time, with normalcy likely in 2H23.

Nokia notes that “Going forward, growth rates are expected to slow in the coming quarters as Q1 benefited from some catch-up, as supply chains normalize”. Ericsson echoed this, saying that “…the big effect really comes from the ongoing inventory adjustments, and that comes because they build up large inventories when supply chain was tight and those inventory levels are now normalizing. We expect these adjustments to be completed during Q2, but some could slip into Q3 clearly”.

Juniper has a slightly more cautious view – “While supply has improved for the majority of our products, we continue to experience supply constraints for certain components, and supply chain costs remain elevated”.

Casa, Calix, and Ciena are also witnessing good improvements in supply chain and are expecting further improvements over the course of 2023. F5 Networks is benefiting from its strategy of redesigning the “hardest-to-get components” and “opening up new supply” sources.

Spending outlook:

Most large vendors appear to be cautiously optimistic about the spending outlook in Telco NI. While supply chain issues are expected to clear up by 2Q or 3Q 2023, MTN Consulting expects the market will start to flatten in the next few quarters. Per our latest official forecast, we expect telco capex – the main driver of Telco NI market – to reach $330B in 2023, and a small decline to $325B in 2024. However, it’s likely that both figures may be $5B or more too high. Ericsson, a key telco vendor, has signaled a cautious telco capex spend outlook in its latest earnings call: “In the second quarter, we expect operators to remain cautious with CapEx similar to Q1 and continue with the inventory adjustment that we have described”.

Lower expectations have been apparent on many 4Q22 earnings calls. DT, for instance, expects US capex will see a “strong decrease” in 2023, and thereafter stability. Verizon’s capex is set to fall nearly 20% YoY in 2023. Charter Communications cut its capex outlook for 2023 by about $500M, hitting both the low & high range. Orange expects a “strong decrease” (same wording) in total “ecapex” this year as its FTTH deployment peak has passed and it aims to increase its dividend. Canada’s BCE says that 2022 was the peak year in its accelerated capex program, and capex will begin to fall this year until capital intensity is back down to pre-COVID levels. Vodafone expects group capex in its current fiscal year to be flat to slightly down, as it pursues a “disciplined approach to capital allocation.” Telefonica says its declining capital intensity is proof that the investment peak is behind it. The MTN Group says capital intensity will decline from 18% to 15% over the next few years.

There are several factors to help explain lower expectations: some are company-specific, e.g. BCE is naturally reaching a latter phase in its buildout. There are also general factors, such as: rising interest rates; higher operating costs due to inflation, especially in energy; 5G’s failure to lift service revenues, leaving telcos highly dependent on volatile device revenues for any topline growth; and, cloud providers’ continually more aggressive pitches of new solutions to telcos. Cloud-based offerings can shift some capex to opex.

Amid all the cautious optimism, India as a market has emerged as a bright spot for the vendors. In 1Q23, Ericsson saw strong growth for its Networks business in India where it continues to rapidly roll out 5G. “It will make India a leading 5G nation and the leading nation for digitalization. And what we see is that the subscribers on 5G are using even more data than on 4G…” said Ericsson in its earnings call.

Ciena attributed its 60% YoY revenue growth in the Asia Pacific region to India, “which was up 88% year-over-year in Q2 to about $70 million, reflecting consistent strong demand from service providers in that market. India is going through a big cycle of 5G rollout and extension. And I think that’s going to happen over the next 1 to 3 years”.

Nokia also witnessed double-digit growth in both its Network Infrastructure and Mobile Networks divisions, reflecting the rapid 5G deployments in India: “…Q1 largely played out as we expected, with 5G deployments in India heavily influencing our Q1 top line.”

Telco Revenues Continue to Decline:

In 4Q22, global telco revenues plunged the most in more than a decade to post $429.6B, or -9.3% YoY – the fifth consecutive slump in a row. This impacted annual revenues and its growth rate for the year 2022 – they were $1,779.9B, down 5.9% YoY over the previous year. The sluggish top-line turned telcos cautious around spending on capex, the main driver for the Telco NI market, which declined for the second straight quarter to post $87.9B in 4Q22, down 5.1% YoY. This decline also knocked down annualized capex to $322.1B in 4Q22, from the peak of $330.0B in 2Q22.

On the brighter side, capex has held out better than revenues, pushing annualized capital intensity to a new all-time high of 18.1% in 4Q22. This was driven by a few countries who are in the midst of deploying 5G networks, notably India; while many more continue to scale up 5G to reach mass market coverage, and deploy fiber to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G.

Cloud vendors are also making critical inroads into the telco sector, aided by a growing number of stand-alone 5G core networks.

References:

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

OneWeb Expands Connectivity Services in Europe and U.S.

OneWeb, the global Low Earth orbit (LEO) satellite network service provider, announced the expansion of its connectivity services throughout Europe and the majority of the United States. The expanded network availability marks a significant step as OneWeb progresses towards global services.

OneWeb said the expansion, which became first active at the end of May, adds service to 37 new European countries, including Austria, Italy, France, and Portugal, as well as the entire western US coast from Washington to California, the northeast coast from Maine to Virginia, and across the Midwest. This expansion also further enhances connectivity across Canada and additional maritime regions.

Stephen Beynon, OneWeb’s Chief Customer Officer, said: “This expansion is a significant step in our journey to delivering global commercial service for our customers. We are seeing increased demand for our service as we have expanded coverage and grown our portfolio of user terminals for different markets. Our technical experience in all corners of the globe, as well as the strong relationships we have with existing partners in Alaska, Canada and Europe, means OneWeb is well placed to support customers in these new regions as well as welcoming new partners to activate services for the first time. As our network coverage continues to grow, I am incredibly excited to serve more maritime, government, enterprise, and aviation customers than ever before.”

OneWeb completed launching its global constellation earlier this year and the business is working towards offering fully global service by the year end. OneWeb and its partners are continuing to add new ground stations and add further service across the world, as more of its over 600 satellites reach their final position in the constellation. OneWeb is on track to complete the full global rollout of ground stations by the end of the year.

Already delivering connectivity at 50 degrees north, OneWeb has been working alongside Distribution Partners to provide community broadband solutions, cellular backhaul, corporate enterprise services, and more throughout the Arctic region, connecting locations in Alaska, Canada, the UK, and beyond.

With the recent expansion, OneWeb’s partners are now expanding their services to new regions and enabling additional partners to integrate OneWeb’s LEO network into their solutions.

OneWeb says as a wholesale connectivity provider, it offers its services through partners such as telecommunications companies and internet service providers. These partners can seamlessly integrate OneWeb’s service into their suite of connectivity offerings, ensuring that end customers can enjoy high-speed, resilient, and low-latency internet connections, regardless of their geographical location.

Having completed the launch of its global satellite constellation earlier this year, OneWeb is working towards offering fully global service by the end of this year. The company, in collaboration with its partners, is actively adding new ground stations and expanding its services across the globe as over 600 satellites reach their designated positions within the constellation.

OneWeb said it remains on track to complete the full global rollout of ground stations by the end of the year, solidifying its commitment to connecting the world.

References:

https://oneweb.net/resources/oneweb-expands-services-launches-commercial-service-across-large-parts-europe-and-us

Biden administration announces $40+ Billion grants for broadband internet access

The Biden administration today revealed new details about how $40+ billion from the Bipartisan Infrastructure Law will be spent in the years ahead to connect more Americans to high-speed internet. The funds will flow into a Commerce Department program with checks set to begin flowing to states early next year.

High-speed internet is no longer a luxury – it is necessary for Americans to do their jobs, to participate equally in school, access health care, and to stay connected with family and friends. Yet, more than 8.5 million households and small businesses are in areas where there is no high-speed internet infrastructure, and millions more struggle with limited or unreliable internet options.

High-speed internet infrastructure deployment will be funded by the Broadband Equity Access and Deployment (BEAD) program—a $42.45 billion grant program created in the Bipartisan Infrastructure Law and administered by the Department of Commerce. This announcement—the largest internet funding announcement in history—kicks off the three-week Administration-wide Investing in America tour, where President Biden, Vice President Harris, First Lady Jill Biden, Cabinet members, and Senior Administration Officials will fan out across the country to highlight investments, jobs, and projects made possible by President Biden’s economic agenda.

Highlights:

- Awards range from $27 million to over $3.3 Billion, with every state receiving a minimum of $107 million.

- 19 states received allocations over $1 billion with the top 10 allocations in Alabama, California, Georgia, Louisiana, Michigan, Missouri, North Carolina, Texas, Virginia and Washington.

- With these allocations and other Biden administration investments, all 50 states, DC, and the territories now have the resources to connect every resident and small business to reliable, affordable high-speed internet by 2030.

Details related to the BEAD allocation for the states, D.C., and territories, as well as the total Federal investment in high-speed internet in each State and Territory are available here.

In addition to helping connect everyone in America to high-speed internet, this funding will support manufacturing jobs and crowd in private sector investment by using materials Made in America. For example, anticipating this major investment in high-speed internet infrastructure deployment, earlier this year, fiber optic cable manufacturers CommScope and Corning announced $47 million and $500 million expansions of their domestic manufacturing capacity, which will create hundreds of good-paying American jobs in North Carolina.

These investments are part of the nearly $500 billion in private sector manufacturing and clean energy investments spurred by the President’s Investing in America agenda. The Investing in America agenda represents the most significant upgrade to our nation’s infrastructure in generations—an investment larger than FDR’s Rural Electrification effort, Eisenhower’s effort to build the Interstate Highway system, and the construction of the Panama Canal.

President Biden’s American Rescue Plan also included over $25 billion for high-speed internet, including:

- The Department of Treasury’s Capital Projects Fund (CPF) provides $10 billion to states, territories, and Tribes for which high-speed internet is an eligible use. Today, over $7 billion has already been dedicated to high-speed internet deployment and connectivity across 45 states;

- The Coronavirus State and Local Fiscal Recovery Funds (SLFRF) delivered funding across the country to support the response to and recovery from the COVID-19 pandemic. About $8 billion is being used by states, territories, Tribes, and local governments for high-speed internet deployment and connectivity; and,

- The Federal Communications Commission’s (FCC) $7 billion Emergency Connectivity Fund program helped schools and libraries close the “homework gap,” providing schools and libraries with 10.5 million connected devices and over 5 million internet connections.

NTIA will issue a formal notice of allocation to recipients on June 30. Once they receive that notice, eligible entities (all 50 states, the District of Columbia and U.S. territories) will have 180 days to submit initial proposals describing how they plan to run their grant programs. Initial proposals can be submitted beginning July 1st. Once NTIA approves a state’s initial proposal, that state will be able to request access to at least 20% of its BEAD allotment.

Additional information on Biden-Harris high-speed internet programs and funding is available at InternetForAll.Gov.

References:

Lumen, Google and Microsoft create ExaSwitch™ – a new on-demand, optical networking ecosystem

Lumen Technologies today announced a new network interconnection ecosystem called ExaSwitch™, created in collaboration with Google and Microsoft. This platform empowers organizations with high bandwidth needs to route their traffic dynamically and quickly between networks, and without third-party intervention.

This ExaSwitch project was created by the initial participants to route traffic between large internet and cloud networks. Early adopters include Lumen, Google Cloud, Microsoft Azure and an additional large cloud provider. The ExaSwitch ecosystem will continue to strengthen as additional participants join, making it easier to automate, scale and manage capacity between the members.

ExaSwitch users will be able to connect their edge sites, data centers and central offices to the platform. With a self-service portal, they can set up connections in 400G increments, which can then be consumed on demand in 100G increments. Lumen, the administrator for the initial ExaSwitch deployments, will be responsible for installing optical hardware at the location of each participant. Users can choose their own fiber source for connecting into ExaSwitch, which they can do either via the self-service portal or an application programming interface (API) portal managed by Lumen.

“The days of slow, legacy cross connects are over; ExaSwitch is the future of network interconnections,” said Andrew Dugan, Chief Technology Officer, Lumen. “Large network backbones no longer need a physical location to connect. Instead, optical switching will be used to establish high-capacity optical links between metro sites. And it’s so much more than just internet peering; it’s an on-demand network connection for quickly deploying needed capacity across all types of data traffic exchanges.”

“We like the ease, speed and cost efficiency of performing interconnects to network partners directly from our main sites,” said Steve Walter, Global VP of Network Operations, Google. “ExaSwitch provides an agile, on-demand platform using proven technology that achieves that.”

“Creating a geographically distributed yet automated interconnection platform creates so many options to improve connectivity, resiliency, and speed to add capacity on to one’s network,” said Frank Rey, Partner, Azure Networking, Microsoft. “We are pleased at the opportunity ExaSwitch has to change the interconnection ecosystem.”

The ExaSwitch administrator will install optical hardware at the preferred location for each participant, who will choose their own fiber source for connecting into ExaSwitch. When two participants agree to connect, they can join quickly through self-provisioning, or an API portal driven and managed by the administrator. The real-time capacity deployment allows them to easily order, modify and delete services as needed. Lumen is acting as the administrator for the initial deployments.

Key benefits:

- Participants use a self-service portal to configure and turn up connectivity with other participants much faster than they can now.

- Connections are set up in 400G increments and can be consumed on demand in 100G increments, with each site capable of up to 25.6 Tbps of optical cross connects.

- Participants will have the ability to connect their edge sites, data centers and central offices in major markets to gain diversity and save costs on cross connects.

“The ExaSwitch optical switching platform is an innovative on-demand ecosystem for automating, scaling and managing high-value interconnect services,” said Courtney Monroe, VP of Telecommunications Research for IDC. “It is poised to disrupt legacy manual platforms, as well as the way enterprises, and the IT ecosystem interconnect, procure and manage interconnectivity.”

Lumen is currently operating the ExaSwitch platform in three of the largest US interconnection hubs – Chicago, Dallas and Virginia – with plans to expand to all major markets in North America with large internet hubs. ISPs, cloud providers, large content providers and enterprises can go to http://exaswitch.net to learn more about ExaSwitch and how to join this growing ecosystem.

Lumen earlier this year completed 400G wavelength upgrades covering 70 U.S. markets. The company’s SVP of Core Network Solutions told Fierce Telecom in January a single 400G wave requires only two cross-connects, which offers “huge cost benefits for the customers.”

About Lumen Technologies:

Lumen connects the world. We are dedicated to furthering human progress through technology by connecting people, data, and applications – quickly, securely, and effortlessly. Everything we do at Lumen takes advantage of our network strength. From metro connectivity to long-haul data transport to our edge cloud, security, and managed service capabilities, we meet our customers’ needs today and as they build for tomorrow. For news and insights visit news.lumen.com, LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies, and YouTube: /lumentechnologies.

SOURCE: Lumen Technologies

References:

https://www.fiercetelecom.com/telecom/lumen-google-microsoft-unveil-new-optical-networking-platform

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

Lumen to provide mission-critical communications services to the U.S. Department of Defense

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

Lumen: DDOS attacks on the rise with telcos accounting for 76% in 1Q-2022

FT: A global satellite blackout is a real threat; how to counter a cyber-attack?

by John Thornhill, Innovation Editor at the Financial Times (FT)

What if the satellite communications networks encircling our planet ever go down? Mobile phones will stop working, navigation systems will crash, television screens will go dark and financial transactions will fail.

The three most likely ways this might happen are: an intense geomagnetic storm resulting from a solar flare like that which occurred in 1859, known as the Carrington event; a cascading collision of space debris, called the Kessler effect; or a deliberate cyber attack.

On Sunday, a SpaceX rocket blasted off from Cape Canaveral with a special payload designed to reduce the last of those dangers. On board was a US government Moonlighter satellite, described as “the world’s first and only hacking sandbox in space.”

Once the satellite is deployed, five so-called “white hat” — or ethical — hacking teams at the Hack-A-Sat 4 competition in Las Vegas will try to hijack the Moonlighter and win a $50,000 prize for exposing its vulnerabilities.

“With Moonlighter, we’re trying to get in front of the problem before it is a problem,” one project leader told The Register.

Last year, on the day Russia invaded Ukraine, hackers launched a malware attack against Viasat’s KA-SAT satellite. They temporarily disrupted the communications of thousands of broadband users in Ukraine, as well as in Poland, Italy and Germany, where 5,800 wind turbines were also affected.

“We are all aware that the first ‘shot’ in the current Ukraine conflict was a cyber attack against a U.S. space company,” Kemba Walden, America’s acting national cyber director, has said.

Leaked CIA intelligence, reported by the Financial Times this year, warned that China was also building sophisticated cyber weapons to “deny, exploit or hijack” enemy satellites. The U.S. has not revealed its own offensive capabilities in this domain. But it is not only Chinese spy balloons Washington is worrying about. Whereas space used to be solely the domain of nation states, private companies are increasingly dominating the game as launch costs fall and satellites shrink in size.

Last year, the U.S. launched 1,796 objects into space, 32 times more than in 2000. The lines between the military and civilian have also blurred as a result of dual-use applications, such as global positioning systems, making commercial satellites a target. And because of the difficulties of fixing satellites in space, designers add a lot of back-up parts, increasing the “attack surfaces” that hackers can exploit.

Viasat says it has learnt lessons from last year’s attack and has strengthened its defences. Basic cyber hygiene is essential in every link in the communications chain (the hackers accessed a misconfigured ground-based virtual private network appliance). Constant vigilance is required: the US company has been persistently attacked since the war began. And rapid response teams must be ready to re-establish control if a system is compromised.

“Anybody who claims perfect security is either lying or they do not know what they are talking about,” Craig Miller, Viasat’s president of government systems, tells me. “You have to be able to respond very quickly.”

There are three main ways to hack a satellite, according to James Pavur, a cyber security engineer at Istari, a US start-up. The first target is ground infrastructure, the most accessible attack surface but usually the best protected. Then, hackers can aim to intercept wireless communications between ground stations and the satellites — or spoof them. The third, and hardest, approach is to go after the “bird in orbit” by building, or exploiting, security backdoors in satellite components. So operators must secure their entire supply chain.

Most hacking attacks are hard to trace. Only four countries have the known capability to take out a satellite with a rocket — the US, China, India and Russia — although such attacks risk triggering the Kessler effect. But anyone from anywhere at any time can hack software. White hat hackers are a particularly valuable community in helping to secure critical satellite infrastructure, argues Pavur.

“There is a mindset of security through obscurity. But a sufficiently motivated adversary will find an ‘exploit’,” he says. Far better to discover those vulnerabilities first and fix them rather than trying to shelter in obscurity. The idea of crowdsourcing security sounds like an oxymoron. But white hat hackers have won round sceptics over the past decade. As software developers say: “Given enough eyeballs, all bugs are shallow.” That rule may even apply in space.

Write to: [email protected]

References:

https://www.ft.com/content/d5df1e81-f126-4a48-9a42-5b4aca842dcb

https://www.lse.ac.uk/ideas/projects/space-policy/publications/Cyberattacks-on-Satellites

https://interactive.satellitetoday.com/the-growing-risk-of-a-major-satellite-cyber-attack/

Reuters: Telcos draft proposal to charge Big Tech for EU 5G rollout; Meta offers a rebuttal

Big tech companies accounting for more than 5% of a telecoms provider’s peak average internet traffic should help fund the rollout of 5G and broadband across Europe, according to a draft proposal by the telecoms industry. The proposal is part of feedback to the European Commission which launched a consultation into the issue in February. The deadline for responses is Friday.

Alphabet’s Google, Apple Facebook-owner Meta, Amazon, Netflix and TikTok would most likely be hit with fees, according to industry estimates. Google, Apple, Meta, Netflix, Amazon and Microsoft together account for more than half of data internet traffic.

The document, which was reviewed by Reuters and has not been published, was compiled by telecoms lobbying groups GSMA and ETNO. They represent 160 operators in Europe, including Deutsche Telekom, Orange, Telefonica and Telecom Italia. Telecom operators have lobbied for years for leading technology companies to help foot the bill for 5G and broadband roll-out, saying that they create a huge part of the region’s internet traffic. This is the first time they have tried to define a threshold for who should pay.

“We propose a clear threshold to ensure that only large traffic generators, who impact substantially on operators’ networks, fall within the scope,” the draft stated. “Large traffic generators would only be those companies that account for more than 5% of an operator’s yearly average busy hour traffic measured at the individual network level,” it said. The European Commission declined to comment.

Meta on Wednesday urged Brussels to reject any proposals to charge Big Tech for additional network costs. In a Facebook blog post, Markus Reinisch, Meta’s VP for Public Policy for Europe, described potential fees as a “private sector handout for selected telecom operators” that would disincentivize innovation and investment, and distort competition. “We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concerns, and abandon these misguided proposals as quickly as possible,” he said. Here are Meta’s takeaways:

- Network fee proposals misunderstand the value that content platforms bring to the digital ecosystem.

- We support the Commission’s goal of “ensuring access to excellent connectivity for everyone,” but network fee proposals will hurt European consumers and businesses.

- We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concern, and drop these proposals.

References:

Network Fee Proposals Will Ultimately Hurt European Businesses and Consumers

https://www.euractiv.com/section/5g/news/eu-telcos-call-for-big-tech-to-share-5g-network-costs/

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

European telcos need to address very high 5G energy consumption

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

Satellite network operators are being forced to expand their addressable markets in the near term, due to several factors: rising competition, with the emergence of players such as SpaceX along with several upstarts including AST SpaceMobile and Lynk. A difficult funding climate resulting from a grim economic outlook and rising interest rates is a challenge. There are also market concentration risks arising from the current focus on satellite broadband internet.

To address these challenges, satellite network operators are raising stakes in new pursuits and developing new offerings. MTN Consulting expects three new potential addressable markets to provide transformational opportunities for satellite operators in the next 2-4 years. These include Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services.

Looking at these market opportunities, a thought may arise whether satellite operators are trying to disrupt the traditional telecom market. But the reality is that telcos will continue to be the primary service provider for wireless access. Telcos are also going to benefit from partnerships with satellite operators as they will aid in providing an enhanced experience for telco customers, reinforced by ubiquitous coverage. For satellite operators though, navigating the regulatory hurdles and ensuring constant capital flow are key concerns; several players from the current herd will vanish in the next 3-5 years.

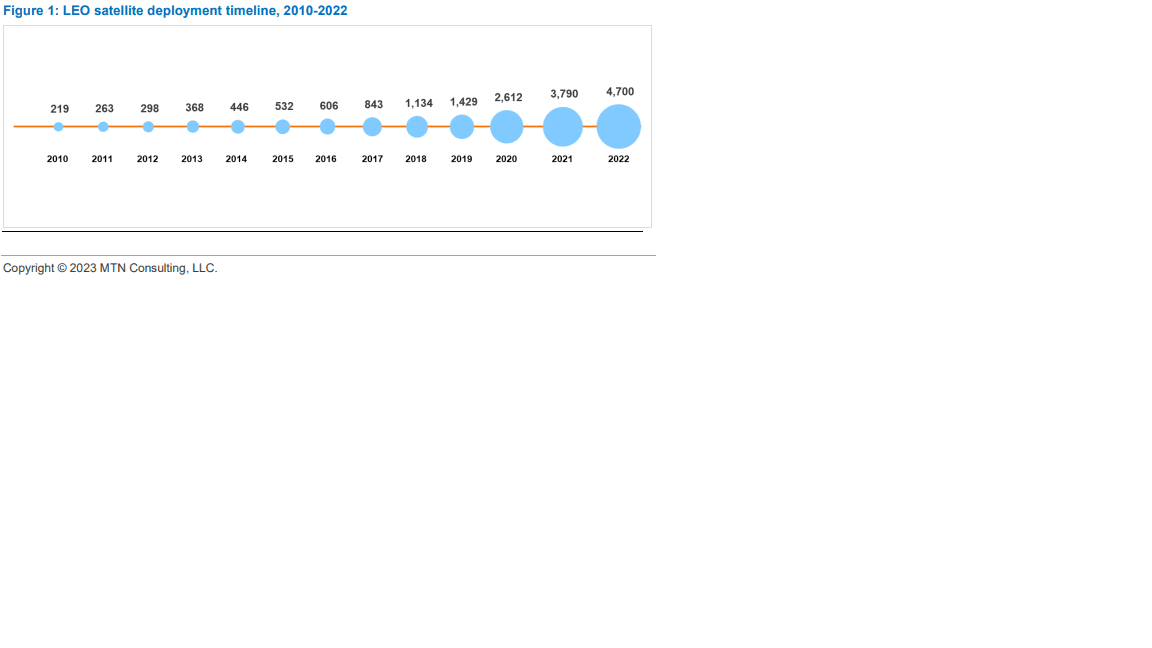

The battle for space based Internet gained momentum in the year 2022 as several satellite operators, notwithstanding their size and years of operations, shifted gears with the launch of commercial broadband internet through low earth orbit (LEO) satellites. The space rush, aided by the advancement in satellite development and large-scale manufacturing, witnessed the sudden surge in large fleets of LEO satellites being deployed in recent years, as shown in Figure 1. As of May 2022, about 4,700 active LEO satellites are girdling the planet; that’s 16x the number of active LEO satellites deployed a decade ago.

Separately, MTN found that a number of large telcos have high debt, low margins, and/or weak top line growth, and may have to curtail spending in 2023-2024 in order to cope with this reality. In particular:

- Total telco debt in 4Q22 was $1.14 trillion, 17% due in next year

- Software capex as a % of revenues was 1.9% in 2022, up a bit from 1.8% in 2021.

- Spending on acquisitions amounted to 0.5% of revenues in 2022, the lowest figure since 2012.

- At the industry level, the ratio of net debt to EBITDA in 2022 was 1.9, a bit up from 2021 but down from 2020.

- A number of large telcos face short-term debt levels over 30% of total debt

- Average margins for the industry in 2022 disappointed: free cash flow margin for the telco industry in 2022 was 11.4%, down from 12.6% in 2021; EBITDA margin was 33.7% (2021: 34.0%), and EBIT margin was 14.4% (2021: 14.9%).

References:

Satellite players bet on direct-to-device (D2D), IoT, and cloud for next big liftoff