Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Global telco revenues from 5G Fixed Wireless Access (FWA) will rise from $515 million in 2022 to $2.5 billion next year, according to a new report from Juniper Research. FWA includes services that provide high-speed Internet connectivity through cellular‑enabled CPE (Customer Premises Equipment) for uses including broadband and IoT networks.

The research predicts that operators’ 5G FWA revenue will reach $24 billion globally by 2027. It identified the consumer market as the sector generating the highest revenue for network operators, representing 96% of global 5G FWA revenue. However, it warns that operators must provide a compelling user proposition for FWA solutions through the bundling of services such as video streaming, gaming and smart home security to enrich user experience and gain competitive advantage against incumbent high‑speed connectivity technologies, such as FTTP (Fibre‑to‑the‑Premises).

| Key Market Statistics | |

| Market size in 2022: | $515m |

| Market size in 2023: | $2.5bn |

| 2022 – 2027 Market Growth: | 480% |

Juniper Research author Elisha Sudlow-Poole remarked: “The benefits of FWA are now comparable with services using fibre-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

Juniper Research notes that the increase in 5G subscribers will be driven mainly by “the accelerating migration of cellular subscriptions to 5G networks, owing to operator strategies that minimize or remove any premium over existing 4G subscription offerings,” and that 600 million additional 5G subscriptions are expected be created next year, “despite the anticipated economic downturn in 2023.”

The report predicts that the growth of 5G networks will continue, and over 80% of global operator‑billed revenue will be attributable to 5G connections by 2027. The telecommunications industry demonstrated its robustness against the impact of the COVID-19 pandemic, and the report forecasts that the growth of 5G will also be resilient against this economic downturn due to the vital importance of mobile Internet connectivity today.

Juniper Research co-author Olivia Williams noted: “Despite the growth of the Internet of Things, revenue from consumer connections will continue to be the cornerstone of 5G operator revenue increase. Over 95% of global 5G connections in 2027 will be connected personal devices such as smartphones, tablets and mobile broadband routers.”

Private 5G Networks Represent a Key Opportunity for Operators:

In addition, the report predicts that the ability of standalone 5G networks to offer ‘network slicing’ will act as the ideal platform for the growth of 5G private network revenue. 5G Standalone (SA) uses 5G core networks supporting network slicing technology, which can be used to take a ‘slice’ of public 5G infrastructure and provide it to private network users. In turn, this helps mitigate the cost of private 5G network hardware and increase its overall value proposition, all against a background of deteriorating macro-economic conditions.

The report recommends that operators use 5G FWA to facilitate the last mile-solution by treating the relationship between FWA and fibre networks as wholly collaborative to maximize network performance and return on investment.

References:

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

5G Service Revenue to Reach $315 Billion Globally in 2023 | TelecomTV

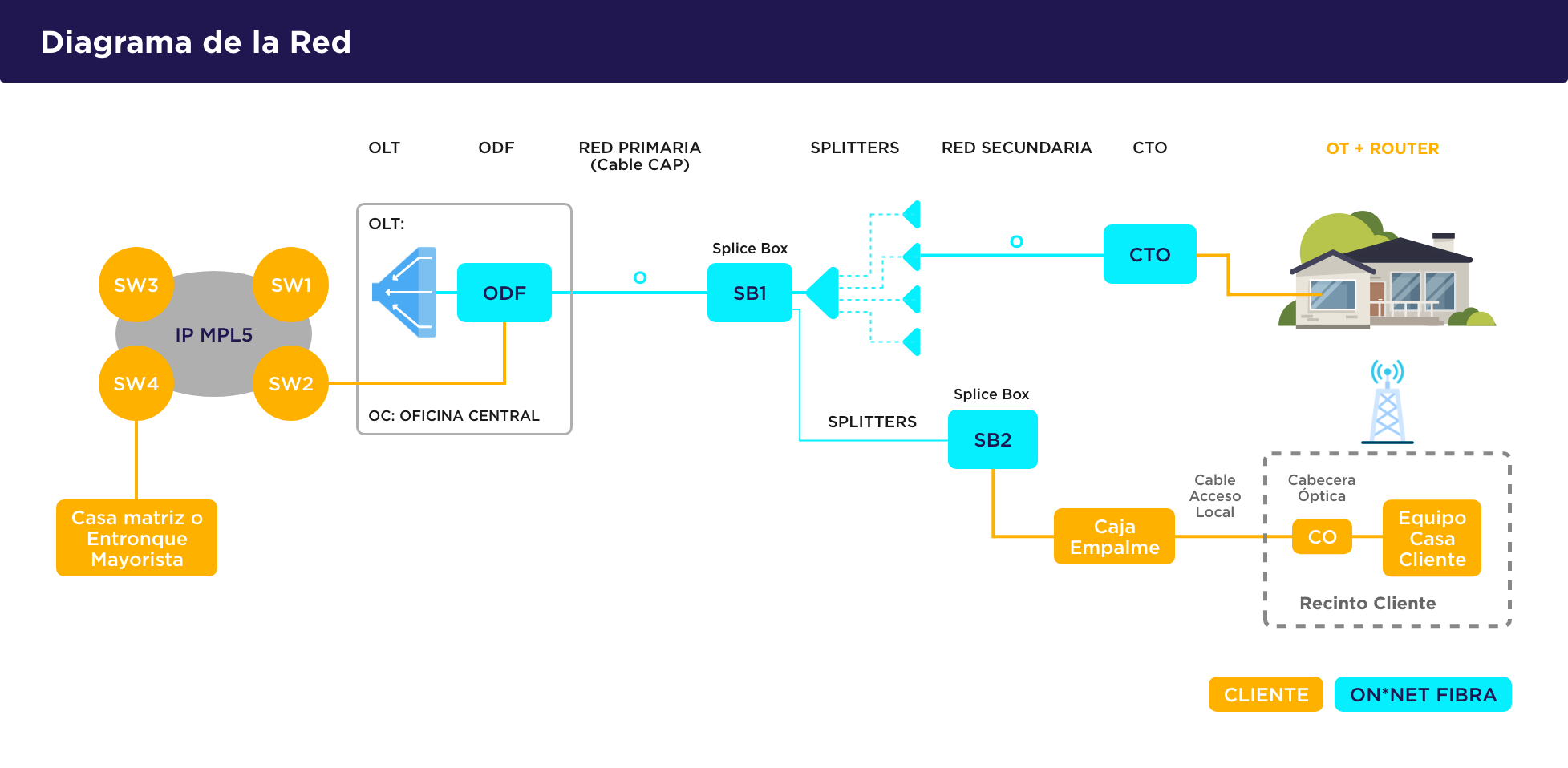

Chile’s Entel to sell fiber optic assets for $358 million to ON*NET Fibra

Chilean telecoms giant Entel (which this author consulted for in 2002 and 2005) said on Saturday it would sell the assets of its fiber optic business, which provides services to homes, to local company ON*NET Fibra (?) in a deal worth $358 million.

The sale, led by investment banks BNP Paribas, Santander and financial adviser Scotiabank, is subject to approval by Chile’s economic regulator, expected in the first half of 2023.

Entel and ON*NET Fibra signed an agreement as part of the deal that will enable Entel to continue offering internet services for residences on ON*NET’s network, Entel said in a statement.

…………………………………………………………………………………………………………………………………………………………….

“By selling our network, rather than leaving the fixed market, we are increasing coverage rapidly to offer our internet services to the home at efficient costs and without the need to invest the sums required for a fiber deployment with this coverage,” the statement added.

Following the closing of this transaction, ON*NET Fibra is expected to reach more than 4.3 million homes in 2024. Entel has operations in Chile and Peru and has more than 20 million mobile subscribers.

Source: ON*NET Fibra

……………………………………………………………………………………………………………………….

References:

A Tale of two Telcos: AT&T up (fiber & mid-band 5G); VZ down (net income falls; cost-cutting coming)

AT&T said on Thursday that it added 708,000 postpaid cellular end point connections, a metric investors use to measure the strength of a cellular carrier’s main profit center. For the third consecutive quarter, the tally easily topped forecasts of Wall Street analysts, who had been expecting 552,300 connections in the third quarter. AT&T executives said their core wireless business overshot their expectations during the third quarter, driving higher revenue and profits despite lingering worries about inflation.

“We’re in a much better place than the broader economy,” finance chief Pascal Desroches said in an interview. The company raised its targets for profit and core wireless revenue this year.

AT&T said that it has added more than 2.2 million wireless subscribers through three quarters, which it said it expected to top rivals.

Wireless-service revenue climbed 5.6%, an improvement the company attributed to rate increases, roaming fees and customer upgrades to premium plans. AT&T now expects full-year wireless service revenue to reach the high end of its previously forecast 4.5% to 5% growth range.

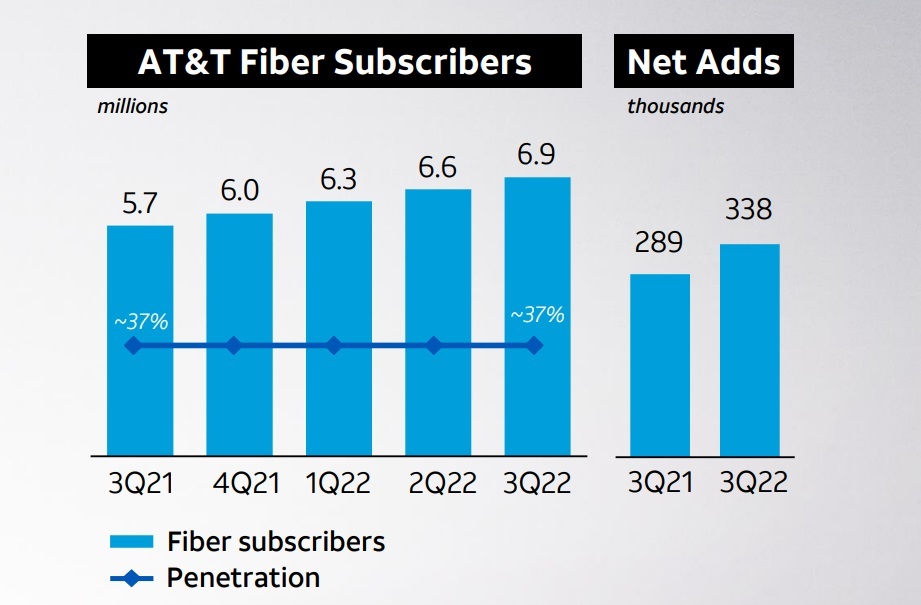

AT&T also added 338,000 customers to its fiber-optic network in the third quarter up from year ago additions of 289,000. That left AT&T with a fiber base of 6.93 million.. Chief Executive John Stankey said building new fiber optic lines remains a priority for the company.

Source: AT&T Q3 2022 earnings presentation

AT&T’s fiber strategy is driving average revenue per user (ARPU) upward. AT&T’s fiber ARPU for Q3 clocked in at $62.62, up from $58.17 in the year-ago period. Its general broadband ARPU in Q3 hit $58.63, up from $55.16 a year ago.

AT&T added another 500,000 fiber locations in Q3, extending its total to 18.5 million. Though the analysts at New Street Research thought that build cadence was a bit weak (they’ve been expecting AT&T to pass a fiber build rate exceeding 1 million per quarter this year), AT&T CEO John Stankey said on today’s earnings call that the company remains on track to achieve a target of 30 million-plus fiber locations by the end of 2025.

AT&T’s fiber penetration in Q3, at 37%, was unchanged even as the company continues to build out and light up more fiber locations. Stankey stressed that AT&T has been able to hit penetration rates of 30% “relatively quickly” with fiber, but acknowledged that the “next 20% takes a little bit longer.”

“I think the biggest change that’s occurred and penetration is how quickly we’re getting to the 20% level, versus historic numbers,” Stankey said. “But we’ve not made any assumption that once you hit that 30% level that the back end is going to go any faster.”

AT&T said it expects an adjusted full-year per-share profit of at least $2.50 from its continuing operations, a few cents higher than previously expected. And the company said its free cash flow, projected around $14 billion this year, should grow in 2023.

…………………………………………………………………………………………………………………………………

In sharp contrast, Verizon (the largest U.S. cellular carrier in terms of subscribers) reported a net gain of 8,000 phone connections under postpaid billing plans during the September quarter, a sign that recent rate increases had prompted many of its most reliable customers to leave the service.

Verizon’s overall net income, excluding profits from interests in non-controlling entities, fell nearly 24% to $4.9 billion in the September quarter. Higher overhead costs and interest expenses contributed to the weaker earnings, though the company’s adjusted profit still topped Wall Street analysts’ expectations, according to data from FactSet.

Verizon also said its consumer business lost 189,000 wireless retail postpaid connections. That was offset by Verizon’s business unit, which added 197,000 postpaid phone connections, giving the operator a total of 8,000 net new wireless connections.

Finance chief executive Matt Ellis said in an interview that the improving profitability in Verizon’s core wireless business showed that its strategy was pointing it in the right direction. Many subscribers were paying their bills on time and upgrading to more expensive plans over the past quarter despite signs of stress in the broader economy, he added.

“We can continue to bring customers in and step them up to grow revenue” with more full-featured plans, Ellis said. “If there’s opportunities to increase pricing, we obviously won’t be shy about doing that,” he added.

Verizon ended a four-year, $10 billion cost-cutting program last year, but has just started another one. The company revealed a new cost-cutting program on Friday that executives said will save $2 billion to $3 billion a year by 2025. The company didn’t detail how the initiative would trim expenses or how many, if any, jobs the move would affect.

“To further mitigate inflation impacts, we’ve started a new cost-savings program that we expect will provide a reduction in annual costs of $2-3 billion by 2025,” explained Verizon CFO Matt Ellis during the operator’s Q3 2022 conference call Friday. “This program will be focused on several areas in the business, including digitalization efforts to enhance the customer experience and streamlining internal operations with automation and process enhancements.”

Verizon’s headcount has declined from around 155,000 in 2017 to just 118,000 last year.

Verizon said it now covers 160 million people with its speedy C-band network, and expects to expand that number to 200 million in the first quarter of next year.

In contrast, AT&T said it is on track to cover 130 million people with its own midband 5G network by the end of this year, far ahead of the company’s initial projections.

During Verizon’s quarterly earnings call, CEO Hans Vestberg reiterated the company’s broad profit strategy: to gain new customers and to encourage existing customers to spend more money with the carrier. Specifically, he said Verizon is working to “step up” customers into more expensive service plans by offering goodies like streaming video subscriptions and faster 5G services.

Along those lines, Vestberg said 81% of Verizon’s customer base now subscribes to an unlimited data plan, and that 42% have selected one of its “premium” unlimited plans. He added that 60% of Verizon’s new customers selected a premium unlimited plan.

References:

https://www.wsj.com/articles/verizon-vz-q3-earnings-report-2022-11666355231

TIP launches Metaverse-Ready Networks Project Group

The Telecom Infra Project (TIP) has formed a new project group that, it says “addresses one of the central topics in today’s telecommunications industry, metaverse-ready networks… The TIP Metaverse-Ready Networks Project Group’s primary objective is to accelerate the development of solutions and architectures that improve network readiness to support metaverse experiences.”

Meta Platforms, Microsoft, T-Mobile US, Telefónica and Sparkle will be the initial co-chairs of the project group.

Alex Harmand, head of network platforms at Telefónica and co-chair of the new group, stated: “This new group will enable operators to address the exciting opportunities that the metaverse is creating in both the consumer and enterprise segments. Telefónica is looking forward to collaborating to define the network capabilities and associated APIs needed to enhance metaverse services. The TIP community is the perfect environment for this initiative as it will allow us to leverage multiple current project groups, such as OpenWIFI, OpenRAN, Open Optical and Packet Transport, to deliver end-to-end architectures and solutions that we will then test in Telefónica’s and other TIP Community Labs.”

Ron Marquardt, Vice President of Advanced Technologies & Innovation at T-Mobile said: “As one of the major upcoming revolutions in the telco industry, the metaverse has to be built through industry collaboration. We want to encourage other CSPs, technology makers and content creators to join us in this journey.”

Rashan Jibowu, Product Manager at Meta Platforms and Co-Chair of the MRN Project Group said: “The metaverse is the next chapter of the internet. In the early stages of its development, it’s critical that we work together as an industry to determine what it means for networks to be “metaverse-ready,” and what we need to do collectively to get there. We look forward to collaborating with the TIP community to lay this important groundwork and build toward our common goal of bringing the metaverse to life.”

Fabio Panunzi Capuano, Executive Vice President Business Development at Sparkle and Co-Chair of the MRN Project Group said: “The telecom industry will act as a key enabler for the metaverse by providing the performing network architectures and services that will support growing bandwidth requests and quality of experience generated by new business models. The Metaverse-Ready Networks Project Group, as one voice of the industry, has the challenging task to define new connectivity requirements supporting the end-to-end metaverse experience and Sparkle, with its assets and experience, is at the forefront in cooperating to shape the future.”

Ricardo Villarreal, Director of Product Management at Microsoft, Azure for Operators and Co-Chair of the MRN Project Group said: “The metaverse might be in a nascent state, but it is imperative to start building today the networks needed to realize the promise of a complete convergence of our physical and digital lives. Cross-industry collaboration is the only way to achieve this.”

The Project Group will be hosting its first open doors session at Fyuz in Madrid Oct 25-27th.

TIP Launches Metaverse-Ready Networks Project Group – Telecom Infra Project

Reliance Jio’s “Home Grown” 5G? Ericsson and Nokia in multi-year deals with Jio to build a mega 5G network

What ever happened to “Home Grown 5G” at Reliance Jio? Over two years ago, Jio Chairman Mukesh Ambani said his company had developed its own 5G solution “from scratch.”

“Jio plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Since then we haven’t heard anything about Jio’s indigenously built 5G network. Jio has not disclosed whose network equipment is being used for its current 5G roll-out in India which started this month.

In stark contrast, telecom equipment vendors Ericsson and Nokia have signed separate multi-year deals with Reliance Jio to build a mega 5G network. The announcements neither divulged the deal sizes or time frames. They came amid large network deployments across India for 5G services.

- Swedish telecom gear maker Ericsson announced a long-term strategic 5G contract with Reliance Jio to roll out a 5G standalone (SA) network in the country.

- Finland headquartered Nokia will supply Reliance Jio, which has more than 420 million customers, with 5G radio access network (RAN) equipment in a multi-year deal, the Finnish company said in a statement.

Announcing the partnership with Ericsson, Akash Ambani, Chairman, Reliance Jio, says: “We are delighted to partner with Ericsson for Jio’s 5G SA rollout. Jio transformed the digital landscape in India with the launch of LTE services in 2016. We are confident that Jio’s 5G network will accelerate India’s digitalization and will serve as the foundation for achieving our nation’s ‘Digital India’ vision.”

Ericsson’s 5G RAN products and solutions from Ericsson Radio System and E-band microwave mobile transport solution will be deployed in the 5G network for Jio, the equipment company said. This is the first partnership between Jio and Ericsson for radio access network deployment in the country, according to the previously referenced press release.

Ericsson recently topped the Frost Radar™: Global 5G Network Infrastructure Market ranking for second year in a row. Ericsson was also named a Leader in the 2022 Magic Quadrant for 5G Network Infrastructure for Communications Service Providers report by Gartner. The Company invests around 18 percent of global revenue in R&D and holds the leading patent portfolio in the industry, with more than 60,000 granted patents worldwide. It is also the holder of the most 5G essential patents.

“Nokia will supply equipment from its AirScale portfolio, including base stations, high-capacity 5G Massive MIMO antennas, and Remote Radio Heads to support different spectrum bands, and self-organizing network software,” the company said. Nokia has a long-standing presence in India. This new deal will mean that Nokia is now supplying India’s three largest mobile operators.

Pekka Lundmark, President and CEO at Nokia stated: “This is a significant win for Nokia in an important market and a new customer with one of the largest RAN footprints in the world. This ambitious project will introduce millions of people across India to premium 5G services, enabled by our industry-leading AirScale portfolio. We are proud that Reliance Jio has placed its trust in our technology and we look forward to a long and productive partnership with them.”

5G data speeds in India are expected to be about 10 times faster than those of 4G, with the network seen as vital for emerging technologies like self-driving cars and artificial intelligence. Reliance snapped up airwaves worth $11 billion in a $19 billion 5G spectrum auction in August and had launched 5G services in select cities. It is also working with Alphabet Inc’s Google to launch a budget 5G smartphone. As India’s telecom service providers roll out 5G services, the government is also pushing top mobile phone manufacturers, like Apple Inc, Samsung and others to prioritise rolling out software upgrades to support 5G, amid concerns that many of their models are not ready for the high-speed service. The Reliance-Nokia deal comes at a time some gover nments, including India, have either banned or discouraged the use of China’s Huawei in national networks.

“Jio is committed to continuously investing in the latest network technologies to enhance the experience of customers,” Akash Ambani, chairman of Reliance Jio, said. Meanwhile, Jio is planning to raise an additional $1.5 billion via external commercial borrowings to fund its 5G capital expenditure plans, reports said. ABP Pvt. Ltd.

Analysts said the 5G rollout in the country would be much slower than 4G or 3G as the main revenue for the service would be generated from enterprise solutions. Indian telco deals with the equipment makers are meant for areas where enterprises would demand the service. Retail consumers will be wary of paying a higher price just for speed, they said.

References:

https://www.jio.com/5g-banner-3.jpg

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

AT&T Launching a dozen 5G “Edge Zones” across the U.S.; Seeking Federal Funds for Fiber Optic Network Expansion

AT&T is expanding its 5G standalone (SA) core network through “edge zones” that can more quickly connect to cloud service providers including Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP).

AT&T CTO Jeremy Legg noted in a blog post that the carrier currently has 10 of these edge zones up and running across the U.S., with plans to add at least two more of these “localized 5G network capabilities” before the end of the year. Many more will follow in 2023 and beyond.

These edge zones are powered by AT&T’s regional 5G SA network cores and are located near connection points that can quickly access cloud service provider data centers. Legg explained AT&T will explore different options on how to make the edge zones accessible to developers, either through stores operated by hyperscale companies or SDKs.

The edge zones are based on three key elements:

- Local standalone network cores

- Local public cloud or private data center computing resources

- Software-defined network capabilities and virtualized network functions

AT&T commenced work on edge networks in 2021, when it previewed a network in conjunction with Microsoft Azure.

Alongside its SA 5G network, AT&T is employing local public cloud and private data centre resources, and software-defined network elements in its edge zones. It situated the capabilities in data centres close to facilities with connections to nearby cloud providers including Microsoft Azure, Google Cloud and AWS.

An AT&T representative told Mobile World Live that Equinix is providing the cross-connect capabilities. Legg noted the edge zones enable AT&T to offer customised managed services. “It’s an exciting time for us. We’re at the dawn of a new age of killer apps almost everywhere you look,” he concluded.

Jeremy Legg, AT&T CTO

……………………………………………………………………………………………………………….

Separately, Bloomberg reports that AT&T is counting on U.S. government stimulus grants to help fund its fiber optic buildout. The telco wants small towns to use federal economic recovery money to pay it to provide landline high-speed internet to rural and remote areas.

Evansville, Indiana is a showcase for how AT&T is working with local governments to reach people with little or no internet access. While Indiana is part of AT&T’s 21-state telecommunications service region, the company will soon announce a widening expansion into markets outside its traditional territory, according to people familiar with the plan who didn’t want to tip off competitors before the announcement. The first was Mesa, Ariz., where AT&T promised to deliver fiber connections to a market where it had offered only wireless service. That marked the first move in decades outside its existing footprint.

AT&T CEO Stankey’s seven-hour, six-stop tour in Indiana was focused on a public-private partnership, one of several in the region for AT&T. The contract with Vanderburgh County calls for the company to put $29.7 million toward building out fiber networks that will serve superfast broadband to at least 20,000 homes and businesses. An additional $9.9 million will come from the county’s American Rescue Plan money, an injection of federal funds to help with recovery from the Covid-19 pandemic.

………………………………………………………………………………………………………………………………………………………………….

References:

https://www.att.com/es-us/sdabout/blogs/2022/legg-5g-edge-zones.html

Ookla Ranks Internet Performance in the World’s Largest Cities: China is #1

Internet connectivity benchmarking firm Ookla, which maintains the popular Speedtest.net service, has updated their ranking of broadband performance in countries around the world to include internet speed rankings for some of the “world’s largest cities.” Ookla’s new list ranks median internet download speeds in nearly 200 cities all over the world.

Overall, China topped the list with Shanghai as the fastest city on their list for mobile broadband with a median download speed of 158.63Mbps (24.32Mbps upload and 17ms latency), while Beijing was fastest for fixed broadband during September 2022 at 238.86Mbps (37.75Mbps upload and 7ms latency).

Beijing (China) and Valparaiso (Chile) were ranked highest in the fixed broadband category, with average speeds of 239 Mbps and 223 Mbps, respectively, followed by Shanghai (222 Mbps), New York (218 Mbps), Bangkok (217 Mbps) and Madrid (197 Mbps).

Fastest Broadband Speeds for the World’s Largest Cities 2022

| Fastest Cities for Mobile (Mbps) | Fastest Cities for Fixed Broadband (Mbps) | ||

| Shanghai, China | 158.63 | Beijing, China | 238.86 |

| Copenhagen, Denmark | 157.54 | Valparaíso, Chile | 222.67 |

| Oslo, Norway | 155.19 | Shanghai, China | 221.85 |

| Busan, South Korea | 147.55 | New York, United States | 218.04 |

| Beijing, China | 145.76 | Bangkok, Thailand | 217.19 |

| Sofia, Bulgaria | 145.28 | Madrid, Spain | 196.7 |

| Ar-Rayyan, Qatar | 140.69 | Bucharest, Romania | 195.6 |

| Abu Dhabi, United Arab Emirates | 137.48 | Lyon, France | 193.34 |

| Dubai, United Arab Emirates | 135.52 | Chon Buri, Thailand | 188.25 |

| Riyadh, Saudi Arabia | 133.65 | Tokyo, Japan | 185.04 |

| Stockholm, Sweden | 126.4 | Los Angeles, United States | 184.15 |

| Antwerp, Belgium | 121.33 | Geneva, Switzerland | 182.84 |

| Gothenburg, Sweden | 120.71 | Abu Dhabi, United Arab Emirates | 178.17 |

| Doha, Qatar | 114 | Zürich, Switzerland | 177.6 |

| Seoul, South Korea | 113.36 | Santiago, Chile | 176.58 |

| Melbourne (Greater), Australia | 111.78 | Copenhagen, Denmark | 175.31 |

| Sydney, Australia | 108.04 | Barcelona, Spain | 173.71 |

| New York, United States | 106.57 | Osaka, Japan | 169.18 |

| Rotterdam, Netherlands | 100.85 | Toronto, Canada | 164.93 |

| Skopje, North Macedonia | 99.02 | Paris, France | 155.24 |

| Toronto, Canada | 98.29 | Auckland, New Zealand | 149.22 |

| Amsterdam, Netherlands | 96.79 | Budapest, Hungary | 147.82 |

| Los Angeles, United States | 95.4 | Taipei, Taiwan | 144.35 |

| Zürich, Switzerland | 89.17 | Kraków, Poland | 138.75 |

| Montreal, Canada | 84.25 | Warsaw, Poland | 138.64 |

| Helsinki, Finland | 83.57 | São Paulo, Brazil | 124.05 |

| Zagreb, Croatia | 82.36 | Dubai, United Arab Emirates | 118.99 |

| Muscat, Oman | 79.66 | New Taipei, Taiwan | 115.36 |

| Auckland, New Zealand | 77.91 | Gothenburg, Sweden | 111.29 |

| Lisbon, Portugal | 76.23 | Porto, Portugal | 110.91 |

| Manama, Bahrain | 72.72 | Stockholm, Sweden | 109.59 |

| Kuwait City, Kuwait | 72.61 | Haifa, Israel | 108.46 |

| Porto, Portugal | 72.16 | Seoul, South Korea | 106.48 |

| Paris, France | 72.12 | Chisinau, Moldova | 105.05 |

| Jeddah, Saudi Arabia | 71.92 | Panama City, Panama | 104.25 |

| Geneva, Switzerland | 70.88 | Oslo, Norway | 102.76 |

| Berlin, Germany | 70.02 | Montevideo, Uruguay | 102.57 |

| Vilnius, Lithuania | 67.7 | Rio de Janeiro, Brazil | 100.49 |

| Manchester, United Kingdom | 67.07 | Amsterdam, Netherlands | 99.66 |

| London, United Kingdom | 66.36 | Milan, Italy | 98.57 |

| Taipei, Taiwan | 65.18 | Rotterdam, Netherlands | 95.39 |

| Vienna, Austria | 65.08 | Kuwait City, Kuwait | 94.65 |

| New Taipei, Taiwan | 64.69 | Medellín, Colombia | 94.48 |

| Brussels, Belgium | 58.78 | Busan, South Korea | 94.43 |

| Rio de Janeiro, Brazil | 58.64 | Bogotá, Colombia | 94.38 |

| Athens, Greece | 57.23 | Vilnius, Lithuania | 94.28 |

| Hamburg, Germany | 56.77 | Ar-Rayyan, Qatar | 94.16 |

| São Paulo, Brazil | 56.58 | Riyadh, Saudi Arabia | 93.71 |

| Thessaloniki, Greece | 56.57 | Lisbon, Portugal | 93.13 |

| Lyon, France | 56.08 | Dublin, Ireland | 91.63 |

| Prague, Czechia | 55.25 | Moscow, Russia | 91.26 |

| Belgrade, Serbia | 53.27 | Riga, Latvia | 91.14 |

| Bucharest, Romania | 52.03 | Montreal, Canada | 90.06 |

| Osaka, Japan | 51.53 | Kuala Lumpur, Malaysia | 89.38 |

| Milan, Italy | 51.27 | Vienna, Austria | 88.05 |

| Budapest, Hungary | 49.88 | Belgrade, Serbia | 87.88 |

| Tokyo, Japan | 49.86 | Antwerp, Belgium | 87.17 |

| Riga, Latvia | 45.88 | Berlin, Germany | 86.65 |

| Kraków, Poland | 44.42 | Doha, Qatar | 86.62 |

| Warsaw, Poland | 43.48 | Hamburg, Germany | 85.35 |

| Barcelona, Spain | 42.88 | Johor Bahru, Malaysia | 85.03 |

| Rabat, Morocco | 41.98 | Tel Aviv-Yafo, Israel | 84.96 |

| Madrid, Spain | 40.78 | Ho Chi Minh City, Vietnam | 84.32 |

| Johannesburg, South Africa | 40.38 | Helsinki, Finland | 84.11 |

| Hanoi, Vietnam | 40.01 | Saint Petersburg, Russia | 83.33 |

| Rome, Italy | 40 | Amman, Jordan | 80.37 |

| Dublin, Ireland | 39.96 | Kiev, Ukraine | 77.42 |

| Bangkok, Thailand | 39.3 | Jeddah, Saudi Arabia | 76.81 |

| Haifa, Israel | 39.05 | Davao City, Philippines | 75.23 |

| Chon Buri, Thailand | 39.03 | Asuncion, Paraguay | 74.18 |

| Baku, Azerbaijan | 37.12 | London, United Kingdom | 73.93 |

| Tbilisi, Georgia | 37.08 | Hanoi, Vietnam | 73.67 |

| Chisinau, Moldova | 36.3 | Sofia, Bulgaria | 73.66 |

| Ho Chi Minh City, Vietnam | 36.09 | Manila, Philippines | 73.47 |

| Johor Bahru, Malaysia | 35.67 | Manchester, United Kingdom | 73.43 |

| Cape Town, South Africa | 35.42 | Port of Spain, Trinidad and Tobago | 73.2 |

| Ankara, Turkey | 35.27 | Brussels, Belgium | 71.71 |

| Montevideo, Uruguay | 34.82 | Buenos Aires, Argentina | 71.41 |

| Istanbul, Turkey | 34.7 | Muscat, Oman | 69.46 |

| Tehran, Iran | 34.24 | Az-Zarqa, Jordan | 67.53 |

| Guadalajara, Mexico | 32.77 | Kharkiv, Ukraine | 67.05 |

| Mashhad, Iran | 32.71 | Rome, Italy | 64.92 |

| Beirut, Lebanon | 32.35 | Zagreb, Croatia | 63.92 |

| Tel Aviv-Yafo, Israel | 31.69 | Delhi, India | 63.2 |

| Kharkiv, Ukraine | 31.06 | San José, Costa Rica | 61.44 |

| Yangon, Myanmar (Burma) | 30.98 | Prague, Czechia | 60.67 |

| Casablanca, Morocco | 30.84 | Mexico City, Mexico | 59.56 |

| Mosul, Iraq | 30.77 | Minsk, Belarus | 59.14 |

| Sfax, Tunisia | 30.74 | Maracaibo, Venezuela | 57.31 |

| Kuala Lumpur, Malaysia | 30.1 | Guadalajara, Mexico | 55.63 |

| Kingston, Jamaica | 29.89 | Lima, Peru | 53.68 |

| Moscow, Russia | 29.74 | Sydney, Australia | 53.64 |

| Baghdad, Iraq | 29.62 | Melbourne (Greater), Australia | 53.45 |

| Mexico City, Mexico | 28.28 | Arequipa, Peru | 53.4 |

| Mandalay, Myanmar (Burma) | 28.21 | Gomel, Belarus | 52.91 |

| Samarkand, Uzbekistan | 28.2 | Ulaanbaatar, Mongolia | 52.79 |

| Vientiane, Laos | 28.15 | Kathmandu, Nepal | 52.68 |

| Kiev, Ukraine | 28.15 | Guayaquil, Ecuador | 51.87 |

| Guatemala City, Guatemala | 27.89 | Johannesburg, South Africa | 51.79 |

| Buenos Aires, Argentina | 26.49 | Córdoba, Argentina | 51.67 |

| Almaty, Kazakhstan | 26.44 | Alexandria, Egypt | 51.07 |

| Manila, Philippines | 26.16 | Nur-Sultan, Kazakhstan | 50.05 |

| Tunis, Tunisia | 25.87 | Skopje, North Macedonia | 48.09 |

| Córdoba, Argentina | 25.3 | Bishkek, Kyrgyzstan | 47.85 |

| Valparaíso, Chile | 24.16 | Manama, Bahrain | 47.69 |

| Yerevan, Armenia | 23.98 | Quito, Ecuador | 47.36 |

| Tegucigalpa, Honduras | 23.93 | Almaty, Kazakhstan | 47.21 |

| Luanda, Angola | 23.93 | Tashkent, Uzbekistan | 46.27 |

| San Pedro Sula, Honduras | 23.83 | Kingston, Jamaica | 45.75 |

| Santo Domingo, Dominican Republic | 23.81 | Thessaloniki, Greece | 44.35 |

| Santiago De Los Caballeros, Dominican Republic | 23.64 | Mumbai, India | 43.56 |

| Saint Petersburg, Russia | 21.19 | Ouagadougou, Burkina Faso | 43.14 |

| San Salvador, El Salvador | 20.58 | Managua, Nicaragua | 42.68 |

| Alexandria, Egypt | 20.46 | Dhaka, Bangladesh | 40.38 |

| Cairo, Egypt | 20.43 | Yerevan, Armenia | 40.34 |

| Az-Zarqa, Jordan | 20.4 | Athens, Greece | 40 |

| Davao City, Philippines | 20.35 | Cape Town, South Africa | 39.5 |

| Amman, Jordan | 20.13 | Abidjan, Côte d’Ivoire | 38.44 |

| Kampala, Uganda | 20.01 | Ankara, Turkey | 37.42 |

| Santiago, Chile | 19.87 | Istanbul, Turkey | 36.75 |

| Nur-Sultan, Kazakhstan | 19.79 | Libreville, Gabon | 36.13 |

| Phnom Penh, Cambodia | 18.94 | Tegucigalpa, Honduras | 33.55 |

| Quito, Ecuador | 18.89 | Antananarivo, Madagascar | 33.34 |

| Lagos, Nigeria | 18.85 | Chittagong, Bangladesh | 33.02 |

| Managua, Nicaragua | 18.64 | Lome, Togo | 31.97 |

| Bishkek, Kyrgyzstan | 18.37 | Samarkand, Uzbekistan | 31.58 |

| Addis Ababa, Ethiopia | 17.29 | San Pedro Sula, Honduras | 31.53 |

| Abidjan, Côte d’Ivoire | 17.22 | San Salvador, El Salvador | 31.36 |

| San José, Costa Rica | 17.21 | Santo Domingo, Dominican Republic | 30.87 |

| Nairobi, Kenya | 17.09 | Pointe-Noire, Congo | 30.11 |

| Colombo, Sri Lanka | 16.95 | Guatemala City, Guatemala | 29.53 |

| Tashkent, Uzbekistan | 16.69 | Vientiane, Laos | 29.04 |

| Guayaquil, Ecuador | 16.6 | Accra, Ghana | 28.71 |

| Bekasi, Indonesia | 16.47 | Baku, Azerbaijan | 28.69 |

| Misrata, Libya | 16.46 | Brazzaville, Congo | 27.55 |

| South Jakarta, Indonesia | 16.14 | Bekasi, Indonesia | 27.04 |

| Dakar, Senegal | 16.13 | South Jakarta, Indonesia | 27 |

| Asuncion, Paraguay | 15.93 | Santa Cruz de la Sierra, Bolivia | 26.28 |

| Ulaanbaatar, Mongolia | 15.8 | Tbilisi, Georgia | 26.12 |

| Panama City, Panama | 15.75 | Bamako, Mali | 24.37 |

| Oran, Algeria | 15.57 | Dakar, Senegal | 23.41 |

| Lahore, Pakistan | 15.01 | La Paz, Bolivia | 23.25 |

| Delhi, India | 14.99 | Cairo, Egypt | 22.42 |

| Dhaka, Bangladesh | 14.98 | Nouakchott, Mauritania | 21.75 |

| Kathmandu, Nepal | 14.94 | Baghdad, Iraq | 21.58 |

| Lima, Peru | 14.65 | Casablanca, Morocco | 20.23 |

| Dar es Salaam, Tanzania | 14.51 | Phnom Penh, Cambodia | 19.78 |

| Arequipa, Peru | 13.5 | Dushanbe, Tajikistan | 19.61 |

| Algiers, Algeria | 13.49 | Mandalay, Myanmar (Burma) | 19.37 |

| Damascus, Syria | 12.83 | Yangon, Myanmar (Burma) | 19.03 |

| Tripoli, Libya | 12.36 | Rabat, Morocco | 17.57 |

| Mumbai, India | 12.29 | Colombo, Sri Lanka | 16.65 |

| Bogotá, Colombia | 11.99 | Cotonou, Benin | 15.97 |

| Karachi, Pakistan | 11.92 | Karachi, Pakistan | 14.82 |

| Minsk, Belarus | 11.33 | Port-au-Prince, Haiti | 14.7 |

| La Paz, Bolivia | 10.76 | Luanda, Angola | 14.18 |

| Khartoum, Sudan | 10.66 | Mombasa, Kenya | 14.08 |

| Medellín, Colombia | 10.4 | Dar es Salaam, Tanzania | 13.74 |

| Santa Cruz de la Sierra, Bolivia | 10.07 | Mosul, Iraq | 12.43 |

| Sana’a, Yemen | 9.96 | Lagos, Nigeria | 12.22 |

| Aleppo, Syria | 9.18 | Oran, Algeria | 12.09 |

| Chittagong, Bangladesh | 8.84 | Tehran, Iran | 11.9 |

| Dushanbe, Tajikistan | 8.83 | Algiers, Algeria | 11.87 |

| Gomel, Belarus | 8.72 | Santiago De Los Caballeros, Dominican Republic | 11.71 |

| Maracaibo, Venezuela | 7.75 | Lahore, Pakistan | 10.88 |

| Caracas, Venezuela | 7.16 | Kampala, Uganda | 10.6 |

| Accra, Ghana | 6.41 | Kigali, Rwanda | 9.65 |

| Kabul, Afghanistan | 5.15 | Nairobi, Kenya | 9.58 |

| Port-au-Prince, Haiti | 4.82 | Lusaka, Zambia | 9.12 |

| Havana, Cuba | 4.51 | Tunis, Tunisia | 8.54 |

North America

- United States: T-Mobile was the fastest mobile operator with a median download speed of 116.14 Mbps. Spectrum was fastest for fixed broadband at 211.66 Mbps.

- Canada: TELUS was the fastest mobile operator in Canada with a median download speed of 76.03 Mbps. Rogers was fastest for fixed broadband (223.89 Mbps).

- Mexico: Telcel had the fastest median download speed over mobile at 36.07 Mbps. Totalplay was fastest for fixed broadband at 74.64 Mbps.

Europe

- Albania: Vodafone was the fastest mobile operator with a median download speed of 46.75 Mbps. Digicom was fastest for fixed broadband at 77.83 Mbps.

- Belgium: Telenet had the fastest median download speed over fixed broadband at 126.79 Mbps.

- Denmark: YouSee was the fastest mobile operator in Denmark with a median download speed of 118.32 Mbps. Fastspeed was fastest for fixed broadband at 270.80 Mbps.

- Estonia: The fastest operator in Estonia was Telia with a median download speed of 72.95 Mbps. Elisa was fastest over fixed broadband at 84.09 Mbps.

- Finland: DNA had the fastest median download speed over mobile at 74.65 Mbps. Lounea was fastest for fixed broadband at 103.79 Mbps.

- Germany: Telekom was the fastest mobile operator in Germany with a median download speed of 78.85 Mbps. Vodafone was fastest for fixed broadband at 112.58 Mbps.

- Latvia: LMT had the fastest median download speed over mobile at 63.59 Mbps. Balticom was fastest for fixed broadband at 203.31 Mbps.

- Lithuania: The operator with the fastest median download speed was Telia with 102.09 Mbps. Cgates was fastest for fixed broadband at 131.63 Mbps.

- Poland: Orange had the fastest median download speed over mobile at 43.02 Mbps. UPC was fastest for fixed broadband at 206.22 Mbps.

- Turkey: Turkcell was the fastest mobile operator in Turkey with a median download speed of 51.92 Mbps. TurkNet was fastest for fixed broadband at 50.94 Mbps.

References:

https://www.ookla.com/articles/global-index-cities-announcement

UK Struggles in Ranking of World’s Fastest Cities for Broadband

Nokia announces Lightspan MF-14 platform as “most advanced in the world”

Nokia has unveiled what it boldly claims is the “most advanced fiber broadband platform in the world,” one it’s calling the “fiber-for-everything” world. According to the vendor, the new Lightspan MF-14 platform extends the upper reaches of its fiber broadband range, bringing “unmatched” capacity, low latency, intelligence, reliability and efficiency. The platform, which falls into “Generation 6” of such things, is already being tried out by customers looking to build 25Gbit/s-capable network in Europe, North America and the Asia-Pacific region. Lightspan MF-14 is being premiered at the Network X event in Amsterdam from 18 to 20 October.

The industry is entering a ‘fiber-for-everything’ era. Once operators have deployed fiber-to-the-home, their networks pass every other building in the street, as well as the homes, meaning they can connect businesses and other services. Fiber PON will be capable of supporting high bandwidth consumer services, industry 4.0 applications, business connectivity, 5G transport and smart city services. This creates more revenue opportunities, lowers TCO and significantly reduces overall power consumption. This new broadband era, designated Broadband 6 by the World Broadband Association (WBBA), requires a new technical solution. Nokia’s pioneering Lightspan MF-14 is the first Gen 6 optical line terminal (OLT) in the world and has already been selected by customers building 25 Gb/second capable networks in Europe, North America and Asia Pacific.

Geert Heyninck, Nokia’s VP Broadband Networks, said: “Fiber-to-the-home is becoming fiber-for-everything. This is enabled by several technology advances, most notably higher speed PON technologies to accommodate all new services, and SDN to bring more intelligence in the network. If you think about it, the massive number of connection points on fiber make it a challenge to get an instant view of everything that happens in your network, fully automate network control, and perform actions with no service interruption. Our current portfolio is doing an excellent job in supporting many of these requirements for today’s and tomorrow’s services, but we are looking ahead. The MF-14 platform will suit operators who are planning large scale 25G PON, 50G and even 100G PON within the same environment.”

In his recent report* Erik Keith, Senior Research Analyst for Broadband Infrastructure at S&P Global, says: “The PON market is at a pivotal moment in the evolution of networks, where fiber broadband means so much more than residential connectivity. There is a huge opportunity for service providers to connect everything much more efficiently by leveraging their existing fiber broadband networks. After all, the same fiber cables that were originally laid in residential areas also pass commercial buildings such as office blocks, hospitals and government properties. This approach eliminates multiple overlay networks, minimizes digging up the streets, and lowers energy use substantially. The new Lightspan MF-14 OLT can enable operators to deploy a solution that will last for decades, while providing a platform that can increase network performance exponentially compared to most networks in use today.”

Based on new, advanced hardware and disaggregated software design, MF-14 is a generation leap in fiber access solutions. It is the highest capacity platform in the industry and the only solution ready for mass delivery of 25G, 50G and 100G PON services. It’s also the industry’s first OLT with the six-nines availability and sub-millisecond latency needed for mission critical industry 4.0 and 5G transport services.

Frontier Communications, the first in the U.S. to trial 25G PON, is also the first to evaluate MF-14 in its live network. Frontier’s Scott Mispagel, SVP National Architecture and Engineering, said: “We are proud to be the first to embrace this next-generation platform. This is another way for us to provide customers with the fastest broadband available. The MF-14 platform will support our path to 100G using our existing fiber network and future-proof our network with speeds that will continue to outpace cable and other technologies for generations to come.”

Nokia Lightspan MF-14

In July this year CityFibre – the UK’s largest independent full fibre infrastructure platform – signed a 10-year equipment agreement to support its nationwide network upgrade. John Franklin, CTIO, CityFibre said: “As we accelerate our full fibre rollout to serve a third of the UK market by 2025, the demand placed on those networks will also accelerate. MF-14’s flexibility and capacity will help us to meet the needs of our partner’s and their customers for generations to come.”

* From “Nokia launches 6th generation flagship fiber platform” published by S&P Global Market Intelligence.

Resources

Lightspan MF-14, a generation leap in fiber access solutions

- 4x higher capacity than previous generation, ensures smooth evolution to massive connectivity with 25, 50, 100.

- No single point of failures, ensuring the highest availability (six nines) in the market. This is important because consumers and business depend on broadband non-stop

- Sub millisecond latency for 5G transport and new array of industry 4.0 applications

- 20% higher power efficiency than the industry average so operators can decrease overall power consumption as they connect more points on fiber network and meet sustainability targets

- Modular software architecture for more agility for upgrading software and onboarding of new functionality, with much less effort and time.

- SDN programmability and open APIs to enable control function by Nokia or 3rd party network control functions

- Fast telemetry and digital mirror in the cloud for enhanced network overview

- For more details visit the web page

Fiber for everything website

World Broadband Association (WBBA) BB6 network characteristics, published in Next-Generation Broadband Roadmap white paper, Oct 2022

- Residential speed. Up to 50Gbps *

- Enterprise speed. Up to 1.6–3.2Tbps

- Intelligence. Fully autonomous

- Reliability & latency. Deterministic reliability / <1ms latency (hard guarantee) / very low jitter

- Trustworthy & green. 10×-plus better per bit energy efficient, very fast problem detection and response (seconds)

- Connectivity. Fiber sensors, 10 times more IoT terminals

- Sensing Capability. Fiber sensing for applications, application and computing awareness, AI

*Speeds listed are speculative given the timeframe, and further work by the WBBA will explore this in more detail in future reports.

California begins construction of $3.8B middle mile fiber network

California began work on an ambitious fiber project which aims to deliver statewide open access middle mile connectivity by the end of 2026. The project, which was announced in 2021, is being fueled by $3.8 billion in federal and state funds.

The sate’s network design calls for a total of 10,000 miles of fiber. The largest portion of the project will run through San Bernadino County, which will be home to 850 miles of fiber. Kern County (544 miles), Riverside County (535 miles) and Los Angeles County (525 miles) will also account for substantial portions of the system.

California’s Department of Transportation (Caltrans) is working with the state’s Department of Technology to complete the project.

During a project meeting in September, Caltrans’ Acting Assistant Deputy Director for the Middle Mile Broadband Initiative Janice Benton said preconstruction work – including environmental, permitting and design tasks – was already underway for 93% of the project’s fiber miles.

She added 114 miles of the project are expected to go into construction in 2022, with another 300 miles to come in 2023. The first leg of its work got underway this week.

The state of California has already advertised contracts covering 900 miles of the project. And by October 14, it was planning to have 60% of the middle mile network out for construction bids. It is aiming to have 100% of the system under contract by May 2023.Once the network is complete, ISPs will be able to tap into it to provide last mile connectivity. Those efforts will also get a funding boost. The same 2021 legislation that allocated $3.25 billion for the middle mile project (which was subsequently supplemented by another $550 million from the 2022 state budget) also set aside $2 billion for the rollout of last mile connections.

The 10,000-mile “middle mile” network is expected to cost $3.8 billion and help connect the roughly one in five Californians do not have access to reliable and affordable high-speed internet.

“We are thrilled to see construction begin on the middle-mile network,” said Secretary Tong. “Too many rural and urban areas lack adequate broadband infrastructure, forcing residents to attempt to connect via mobile hotspots and unreliable satellite service, which leaves out too many Californians.”

Former Los Angeles Mayor Antonio Villaraigosa, who was named by the Governor in August to serve as Infrastructure Advisor to the State of California, joined the event Thursday to highlight the substantial federal resources coming to the state for infrastructure investments like broadband networks.

“This broadband network is one of the most ambitious and impactful infrastructure projects in California – and we’re thrilled that construction is underway starting today,” Mayor Villaraigosa said. “With billions more in federal infrastructure dollars on the way, we’re getting ready to celebrate many more groundbreakings for innovative projects across California. This goes far beyond infrastructure, this is about building the future of our state and creating thousands of good-paying jobs along the way.”

CDT Director Liana Bailey-Crimmins said construction on the first segment of the Middle Mile network follows more than a year of planning.

“The rapid planning by the Middle Mile team as well as our local partners is coming to fruition. It’s wonderful to see the hard work paying off, to make a difference in the lives of Californians who live in unserved areas like this one.”

Caltrans Director Tony Tavares said each of the Department’s 12 districts is working to build segments of the Middle Mile network on an ambitious timeline in the hope of capturing the maximum amount of federal funding available.

“This project provides a wonderful opportunity for us to ‘dig smart’ and highlights the benefits of coordination among state agencies and with our local partners. Caltrans is proud to partner with the Department of Technology to create a broadband Middle Mile network, providing equitable, high-speed broadband service to all Californians.”

Once the Middle Mile network is complete, local carriers will have access to the network to provide communities with direct service to homes and businesses as well as reduced-cost or free broadband internet service for those who are eligible.

References:

https://www.fiercetelecom.com/telecom/california-kicks-construction-38b-middle-mile-fiber-network

Huawei Connect 2022: Intelligent Cloud-Network Upgrades Announced

During HUAWEI CONNECT 2022 in Dubai, Huawei unveiled the upgraded capabilities of its Intelligent Cloud-Network Solution at the “Intelligent Cloud-Network, Unleashing Digital Productivity” summit. These capabilities, which center on three major scenarios —CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0— are provided to meet network development trends. Huawei also released the L3.5 Data Center Autonomous Driving Network White Paper, together with IEEE-UAE Section and pioneering customers, to contribute to the thriving data communications industry and unleash digital productivity.

The changes in enterprise business are driving the development of enterprise ICT infrastructure, and IP networks — serving as the bridge between IT and CT and covering all production and office procedures of enterprises, constitute the connectivity foundation for industry digital transformation. Networks have never been more important than they are today.

Daniel Tang, CTO of Huawei Data Communication Product Line, shed light on how to respond to future development trends and address network challenges. According to Daniel Tang, Huawei keeps innovating data communications technologies in areas such as Wi-Fi 7, 400GE, IPv6 Enhanced, multi-cloud synergy, autonomous driving network, and ubiquitous security. With these innovative technologies, Huawei has upgraded its capabilities in three scenarios: CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0.

Huawei CloudFabric 3.0 offers full-lifecycle intelligent capabilities for multi-cloud and multi-vendor networks based on L3.5 ADN technology. Stand-out features include unified management and control, flexible orchestration and collaboration, simulation & verification, risk prediction, and unified O&M for applications and networks. Plus, this solution facilitates easy interconnection with customers’ IT management systems to achieve end-to-end automation. Key results include easy deployment, easy O&M, and easy evolution.

By leveraging Huawei’s ADN and hyper-converged Ethernet technologies, Ankabut is building the world’s first HPC supercomputing center with Ethernet and InfiniBand co-cluster.

At the summit, Huawei, together with IEEE-UAE Section, Ankabut of UAE, and CBK of Kuwait, released the L3.5 Data Center Autonomous Driving Network White Paper.

- CloudCampus 3.0

Huawei further upgraded its CloudCampus 3.0 offerings by unveiling a host of flagship products, including the first enterprise-class Wi-Fi 7 AP AirEngine 8771-X1T, next-generation flagship core switch CloudEngine S16700, and 4-in-1 hyper-converged enterprise gateway NetEngine AR5710.

Huawei CloudCampus 3.0 helps enterprises simplify their campus networks from four aspects: access, architecture, branch, and Operations and Maintenance (O&M).

- CloudWAN 3.0

In the WAN field, Huawei continues to innovate technologies such as SRv6, FlexE slicing, and application-based IFIT measurement, and all of these technologies rely on IPv6 Enhanced. Huawei has further upgraded its CloudWAN 3.0 offerings to achieve agile connectivity, deterministic experience, and agile O&M and launched an ultra-high-density multi-service aggregation router — NetEngine 8000 F8 — to improve digital productivity with agile connectivity.

With Huawei’s help, the Gauteng province successfully deployed the first 100GE private network in South Africa — GBN.

The future digital world is full of uncertainties. As the saying goes, “If you want to go fast, go alone. If you want to go far, go together.” Mindful of this, Huawei strongly advocates partnerships and will continue to cooperate and innovate with more customers and partners in the data communication field. Vincent Liu, President of Huawei’s Global Enterprise Network Marketing & Solutions Sales Dept, highlighted that Huawei has set up many regional joint innovation labs and OpenLabs. Through these labs, Huawei is well poised to jointly innovate with customers from sectors such as public service, oil and gas, electric power, finance, education, and ISP. These concerted efforts pay off in many high-value application scenarios and achieve remarkable results. To date, Huawei has already trained and certified 188,000 data communication engineers, providing a large pool of ICT talent for digital transformation across industries.

Photo – https://mma.prnewswire.com/media/1921355/image_986294_38236382.jpg

SOURCE Huawei

SOURCE Huawei

References: