Verizon, KT and Samsung team up for SECRET “5G” Super Bowl Demo

Verizon, KT and Samsung have teamed up such that the CEO’s of the two telcos could have a secret video call with each other during the Superbowl.

- Verizon set up a temporary (and secret) 5G network at Super Bowl LII.

- Using the 5G network, guests were able to watch high-resolution streams of instant replays.

- Meanwhile, in New York City, engineers were able to view a stereoscopic 180-degree video of the game in nearly real time.

The video call was yet another pre standard “5G” demonstration taking place between Minneapolis, MN and Seoul, Korea. The trio have also stated, quite illogically, that such a grounded use case is an indication of how close the reality of 5G actually is.

“The fact that 5G is no longer a dream owes its debt to the collaborations we have carried out with operators like Verizon and vendors like Samsung,” said Hong-beom Jeon, Head of Infra laboratory at KT. “Our efforts have enabled some of the most demanding tasks to come to fruition.”

“Seeing Samsung’s 5G end-to-end solutions in action, including a working prototype 5G tablet, underscores how important our collaborative relationship has been in helping accelerate the availability of commercial 5G mobility for customers,” said Ed Chan, Senior Vice President and Chief Technology Architect, Verizon.

“As we say at Verizon, ‘we don’t wait for the future, we build it.’ We are glad to be working with like-minded partners to build the 5G future globally.”

Looking at the nitty gritty side, Samsung supplied the network Infrastructure composed of 28GHz 5G access units, 5G home routers(CPEs), virtualized RAN, virtualized core network and prototype 5G devices. The trio claim the exercise successfully demonstrated how to bring one of the smallest 5G radio base stations and 5G home routers (CPEs) to market.

As well as allowing the two telco CEOs to whisper sweet nothings across thousands of miles with no threat of buffering or losing sync between video and audio, Samsung also took the opportunity to showcase a new 5G tablet. The Samsung tablet is capable of running on multi-gigabit per second speeds via 5G networks, as well as the latest 4G LTE network speeds.

Sanyogita Shamsunder, the Executive Director of 5G Ecosystems and Innovation at Verizon, said, “This latest demonstration at Super Bowl LII and in New York City is another example of how we’re pushing 5G to exploit never-before-imagined uses cases and applications.”

This is not the first time Verizon has used football to demonstrate the power of 5G. A few days earlier, two football players in virtual reality headsets were able to pass a football and complete plays without ever physically looking at each other. The 5G network their helmets were connected to was so fast that the milliseconds of latency didn’t affect their ability to interact in nearly real time.

There’s currently an arms race going on between the four major telecommunications companies in the United States, for which will be the first to roll out a commercial 5G network. What does this show of 5G power say about Big Red’s stakes in the race?

References:

http://telecoms.com/487589/verizon-kt-and-samsung-team-up-for-yet-another-5g-proclamation/

https://www.androidauthority.com/verizon-secretly-5g-test-super-bowl-lii-835383/

Sprint to increase CAPEX to focus on mobile 5G deployment in 1H-2019

Sprint will increase its network capital expenditure by at least $1 billion for the coming year as promised on Friday morning’s earnings call. The #4 U.S. wireless carrier plans to deliver mobile 5G in the first half of 2019.

–>That’s 1 year before the IMT 2020 standards will be completed!

Sprint Corp talked about its mobile 5G plans: “We’re working with Qualcomm [and others] in order to deliver the first truly mobile 5G network in the US in the first half of 2019,” CEO Marcello Claure said on the call.

Mr Claure said that Sprint will be able to deploy mobile 5G nationwide on 2.5GHz band in 100MHz channels. “We have the spectrum to lead on 5G, and basically lead in a different way,” he noted. Claure said later in the question and answer session that Sprint had a commitment from a “leading Korean” device vendor that it will have a 5G device ready within its 2019 timeframe.

This implies an increase in capital expenditure spending for Sprint’s network for fiscal 2018, new CFO Michel Combes said. Sprint’s total capex spending for fiscal 2017 will be in the $3.5-$4 range. Capex will hit $5-$6 billion in fiscal 2018, which starts in April 2018.

Sprint will spend to increase the number macro cell sites by 20%, and support its 2.5GHz, 1900MHz, and 850MHz bands on nearly all of its existing macro sites. Currently, around half of its macro sites have tri-band support.

The CEO added that Sprint plans to deploy more than 40,000 outdoor small cells, and “more than 1 million Magic Boxes,” the wireless small cells that it uses to improve in-home coverage.

In the field, Sprint expects to update sites with multiple-antenna array hardware, or “Massive MIMO” in 2018. “Massive MIMO will serve as Sprint’s bridge to 5G,” Claure said. (See Sprint Says No to mmWave, Yes to Mobile 5G.)

This is because the MIMO hardware can be updated to 5G NR standard over-the-air, the CEO said.

Our strategy is predicated on creating on amazing customer-experience, offering customers the best products and services, while delivering superior financial results. First, we recognize that to be a truly great company we have to have a great product, which for us is our network. While our network is much improved, we believe our next-gen network will truly differentiate Sprint over the next couple of years, due to our strong spectrum assets that enables Sprint to be the leader in the true mobile 5G.

This is the biggest network capital program in many years. And I will share more details of our network strategy in a few moments. I cannot wait to, once and for all, be able to sell the product that is best in the industry with competitive coverage, the fastest speed and the highest capacity.

Second, we will continue to deliver the most compelling value proposition to our customers across all of our segments. We will continue to play from a position of strength by leveraging our spectrum holdings and continue to lead with the best-only net offering in the market. Data usage strength are projected to grow exponentially, especially with 5G.

By having the most spectrum, combined with new technology that massively increases our capacity, we’re certain that we’ll be best position for to support unlimited data in the future.

Third, we will continue to drive a smart distribution strategy, with over 1,000 new stores open year-to-date across our Sprint and Boost brand, and several hundred several hundred throughout next year. We have designed a dynamic distribution model that allows to continuously optimize the right balance of physical and distribution – and digital distribution.

Sprint will also leverage its partnerships with Altice and Cox Communications Inc. to expand its backhaul capabilities for LTE-Advanced and 5G. Sprint CTO John Saw chimed in briefly on the call to say that some of the capex spend could be on “dark fiber” for backhaul needs.

Against this backdrop, Claure said there would be continuing job cuts at Sprint, including at the executive level, aiming for “a leaner and more agile company across our non-customer-facing workforce.” Sprint has cut thousands of jobs during the past couple of years.

True to his reputation as a “turnaround specialist,” new CFO Michel Combes said he is looking at more ways to “decrease cost structures” at Sprint. He promised to reveal more details in the March quarter. (See Sprint Appoints Ex-AlcaLu Boss Combes as CFO.)

For the quarter, Sprint reported revenue of $8.24 billion, down from $8.55 billion a year ago. Net income for the quarter was $7.16 billion (or $1.76 per share) thanks almost entirely to tax reform gains of about $7.1 billion, compared with a net loss of $479 million a year ago.

References:

Deutsche Telekom to deploy 1 Gb/sec fiber optic lines to 7,600 enterprises

Deutsche Telekom says it will begin the second phase of its fiber-optic network for business parks, which will provide internet connections at speeds of up to 1 Gb/sec to as many as 7,600 enterprises.

Deutsche Telekom’s latest fiber project will include laying almost 500 km of fiber-optic cables and connecting company locations directly to the fiber-optic network in 33 German towns and cities. The company says it is using sustainable, cost-effective micro trenching technology during construction to avoid inconveniencing town and city residents.

The German towns and cities whose business parks are being upgraded include: Amberg, Bielefeld, Bochum, Bonn, Braunschweig, Bremen, Cologne, Dippoldiswalde, Dresden, Düsseldorf, Flörsheim, Frankfurt, Frechen, Großbeeren, Hamburg, Hermsdorf, Hildburghausen, Hürth, Kelkheim, Kriftel, Langen, Leipzig, Lindlar, Lübeck, Mannheim, Markkleeberg, Nienburg, Oldenburg, Pinneberg, Planegg, Potsdam, Sandersdorf-Brehna and Seevetal.

Deutsche Telekom will connect companies at no additional charge should they make the switch to its business parks’ fiber-optic network “early on.” (timing unspecified?)

Fiber-optic lines for about 7,600 enterprises: In 33 business parks the companies that decide “early on” to switch to DT’s fiber-optic network will be connected at no additional charge.

……………………………………………………………………………………………………………..

The range of fiber-optic rate plans runs from asymmetric 100 Mbps business customer lines through to symmetric 1 Gbps lines. The line growth follows previous expansion in 2016 and 2017, during which Deutsche Telekom invested nearly €5 billion annually on its network (see “Deutsche Telekom touts fiber-optic network investments”).

Deutsche Telekom currently operates a fiber-optic network of 455,000 km, with business parks a focus of its fiber to the home (FTTH) efforts, alongside subsidized expansion activities and partnerships with competitors (see “Deutsche Telekom pilots small town FTTH”).

“Business parks are at the heart of our fiber-optic build-out strategy,” said Hagen Rickmann, Telekom Deutschland director for business customers. “We are thinking nationwide, urban and rural, north, south, east and west. The decisive factor for us is customer demand, and we are pleased to be able to offer our business customers fiber-optic lines in a further 33 communities across the country.”

“We will execute this project quickly and supply the businesses with ultramodern technology, offering them the best infrastructure for the digital transformation. The build-out continues, and our interim goal is to connect 3,000 business parks across Germany to our fiber-optic network (FTTH).”

Deutsche Telekom invests around five billion euros every year and operates Europe’s largest fiber-optic network.

…………………………………………………………………………………………………………………

More information at:

Hotline: + 49 (0)800 330 1362 77 (toll-free)

E-mail: [email protected]

www.telekom.de/vollglas

References:

https://www.youtube.com/watch?v=N4r1Wb0O2Sk&feature=youtu.be

Telcos need to do much more to gain significant cloud market share

Synergy Research Group said that the global cloud computing and storage market grew 24% annually for the period ending September 2017. The market research firm said that of the six cloud services and infrastructure market segments, operator and vendor revenues, IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) had the highest growth rate at 47%, followed by enterprise SaaS (Software as a Service) at 31%, and hosted private cloud infrastructure services at 30%.

Data suggested that 2017 widened the gap between cloud services spending vs. hardware and software used to build public and private clouds. Synergy noted that 2016 was the year in which spending on cloud services overtook spending on cloud infrastructure.

John Dinsdale, a chief analyst and research director at Synergy Research Group, noted that in 2015 cloud became mainstream and by 2016 it started to dominate many IT market segments.

“Major barriers to cloud adoption are now almost a thing of the past, with previously perceived weaknesses such as security now often seen as strengths. Cloud technologies are now generating massive revenues for cloud service providers and technology vendors and we forecast that current market growth rates will decline only slowly over the next five years,” he concluded.

The researcher noted eight cloud services vendors were among the 2017 market segment leaders.

Figure 1: Movers and shakers in 2017 cloud market

…………………………………………………………………………………………………………….

Over the period Q4 2016 to Q3 2017, total spend on hardware and software to build cloud infrastructure approached $80 billion, split evenly between public and private clouds, though spend on public cloud is growing more rapidly.

Infrastructure investments by cloud service providers helped them to generate over $100 billion in revenues from cloud infrastructure services (IaaS, PaaS, hosted private cloud services) and enterprise SaaS – in addition to which that cloud provider infrastructure supports internet services such as search, social networking, email, e-commerce and gaming.

Meanwhile UCaaS (Unified Communications as a Service), while in many aspects is a different market, is also growing strongly and is driving some radical changes in business communications.

Carriers, for their part, are not standing still. According to Gartner Group, communications service providers (CSPs) worldwide face profound challenges related to traditional telco network-based to cloud-based service delivery across several functional and technical domains.

Gartner research director Martina Kurth said “CSPs are embarking upon an evolutionary path that unifies cloud instances of SDN/NFV, OSS/BSS (e.g. Paas/SaaS/Iaas) and enterprise IT. Coupled with microservices, container based service design principles and cloud integration services, CSPs endeavor to create synergies between their various cloud domains and drive flexibility and agility across their cloud deployments.”

Gartner predicts that vendors which are well positioned in the end-to-end Telco Cloud stack market, are also likely to take market share in corresponding future network and/or IT technology markets such as digital technology platforms and ecosystems, Data/AI, IoT and 5G.

Gartner Group says that a fully integrated, interoperable, cloud and virtualied telco protocol stack will pave the evolutionary technology adoption path from SDN/NFV to network slicing to 5G and IoT in the future. But no time frame was given for that to be realized.

IHS Operator Survey: Smart Central Offices in 85% of Service Provider Networks in 2018

By Michael Howard, executive director, research and analysis, carrier networks, IHS Markit, and Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights:

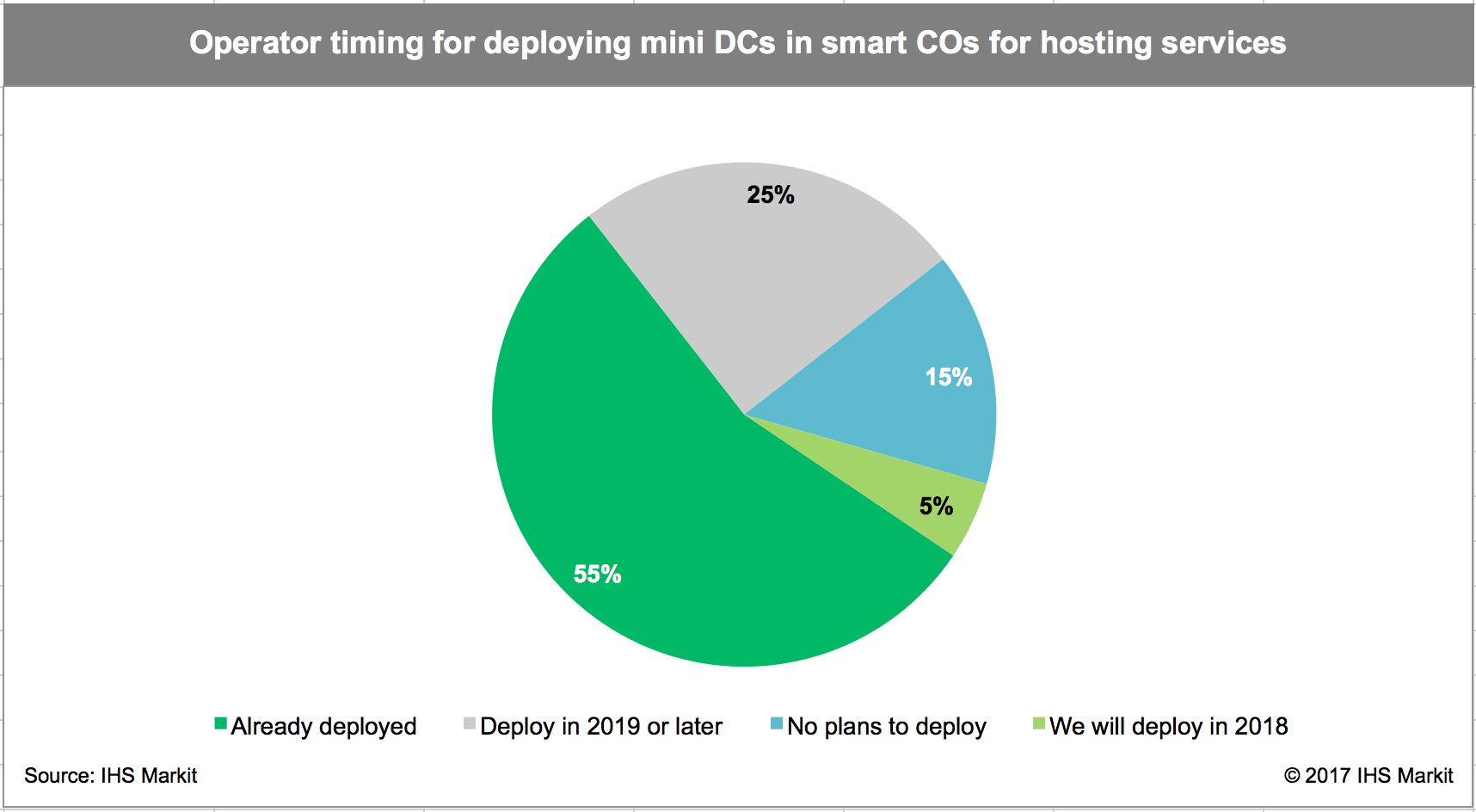

- In 2018, 85% of operator respondents to an IHS-Markit survey plan to create, or will have already deployed, smart central offices — that is, installing servers, storage and switching to create mini data centers in selected central offices. These mini data centers are used to offer cloud services, and as the network functions virtualization (NFV) infrastructure on which to run virtualized network functions (VNFs) such as vRouter, firewall, CG-NAT and IP/MPLS VPNs.

- More than half of operators (55%) surveyed plan to move each of 10 different router functions from physical edge routers to VNFs running on commercial servers in mini data centers in smart central offices, including customer edge (CE) router, route reflector (RR) and others.

- Seven out of 10 respondents plan to deploy central office rearchitected as a data center (CORD) in smart central offices.

- Operators expect 44% of their central offices will have mini data centers (or smart central offices) by 2023, and deploy CORD (Central Office Re-architected as a Data center) in half of those central offices.

IHS-Markit Analysis:

SDN and NFV are spurring fundamental changes in network architecture, network operations and how carriers are organized, which is illustrated by the purchasing decisions of operators worldwide. Nearly every operator around the world is undertaking major efforts.

More importantly, the move to SDN and NFV is changing the way operators make equipment purchase decisions, placing a greater focus on software. Although hardware will always be required, its functions will be refined, and software will drive services and operational agility.

A basic architectural change in motion is the deployment of new functions in large central offices that are closer to end customers. These also serve as locations for distributed broadband network gateways (BNGs), content delivery networks (CDNs), mini data centers and other new functions. Mini data centers (i.e., servers and storage) are used to deliver cloud services within a metropolitan area and house applications including augmented and virtual reality and gaming, to give users better response time as well as provide a place for NFV and VNFs, including vRouters, which run on servers. These central offices with mini data centers are known as “cloud central offices” or “smart central offices.”

Cloud services for business, and internet usage in general, have caused carrier network traffic patterns to change dramatically in and out of data centers. This is true not only for the hyperscale data centers of Google, Apple, Facebook, Amazon, Microsoft, Baidu, Alibaba and Tencent, but also for their smaller metro and regional megascale data centers, and large enterprises, as well as smaller data centers used by enterprises and government.

In a large metropolitan area, there might be 10 or more smart central offices aggregating traffic from smaller end offices. Based on our discussions with operators around the world, a common long-range plan is to identify 10 percent to 25 percent of central offices as smart central office locations — all candidates for CORD. The smart central office is the new location of the IP edge, which is creating a need for a new class of optical transport equipment and a new class of routers designed for data center interconnect (DCI) applications.

Routing, NFV and Packet-Optical Survey Synopsis

The 30-page 2017 IHS Markit routing, NFV and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control a third of worldwide telecom capex and 27 percent of revenue. The survey covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge. It looks at deployment plans, strategies and locations, router bypass, 100GE port mix, price per port and more.

…………………………………………………………………………………………………………………………………………

Notes & Clarifications:

- Smart central offices are simply central offices containing mini data centers that have servers, storage, and switching. Mini data centers can offer cloud services and typically include NFV infrastructure that supports virtualized network functions (VNFs) including vRouter, firewalls, carrier grade network address translation (CG-NAT), and IP/MPLS VPNs.

- IHS concluded that the reason more operators are leaning this direction is that deploying these functions in central offices brings them close to the end-user. This is part of the greater push by operators and service providers to focus on software to drive services, while refining hardware functions.

- If network operators re-architect their networks by distributing the core network, it would be closer to the end user. Virtualization allows operators to quickly deploy a core anywhere and to scale it at will. Edge computing could be deployed closer to the user without breaking the network topology. This is a major advantage that the telcos have over the cloud players – but they have not been able to capitalize on it. By pushing the core closer to the edge, and through virtualization of the network, operators could capitalize on this advantage.

- As operators push away from hardware into software, the smart central office is a new IP edge, and thus requires a class of routers for data center interconnect (DCI) applications and optical transport equipment.

CCS Insight: China to lead global 5G adoption which will take longer than 4G

CCS Insight forecasts that 5G connections will reach 1 billion worldwide in mid-2023, taking less time than 4G LTE to reach that milestone.

- As early as 2022, China will account for more than half of all 5G subscribers. By 2025 — following deployment in most world regions — it will still represent more than four in ten 5G connections globally.

- South Korea, Japan and the U.S. are fighting it out to be the first to launch commercial 5G networks, but China will take an early lead in the number of subscribers.

- 5G roll-out in Europe will trail by at least a year.

“We see China playing a far more influential role in 5G than it did in 4G. Size, scale and economic growth give China an obvious head start, but we expect network deployments to be much faster than in the early days of 4G,” CCS Insight VP of forecasting Marina Koytcheva said.

“China will dominate 5G thanks to its political ambition to lead technology development, the inexorable rise of local manufacturer Huawei and the breakneck speed at which consumers have upgraded to 4G connections in the recent past.”

As early as 2022, China will account for more than half of all 5G subscribers. Even by 2025 — following deployment in most world regions — it will still represent more than four in ten 5G connections globally. South Korea, Japan and the US are fighting it out to be the first to launch commercial 5G networks, but China will take an early lead in the number of subscribers. Despite the EU’s lofty ambitions, network roll-out in Europe will trail by at least a year.

The chart below provides a summary of CCS Insight’s 5G forecast:

5G subscriptions, 2018-2025

Source: CCS Insight Market Forecast: 5G Subscriptions, 2018-2015

……………………………………………………………………………………………………………………………………..

In the longer term, CCS Insight sees 5G adoption taking a broadly similar path to 4G LTE technology. Subscriptions to 5G networks will reach 2.6 billion in 2025, equivalent to more than one in every five mobile connections. However, CCS Insight cautions there are still some uncertainties.

These include how and where network operators will deploy vast numbers of new base stations, the lack of clear business case for operators, and consumers’ willingness to upgrade their smartphones. In Europe, market fragmentation, the availability of spectrum and the influence of regulators bring additional challenges.

CCS Insight sees mobile broadband access on smartphones as the principal area of 5G adoption. By 2025, it will represent a colossal 99% of total 5G connections, according to the forecast.

“The unrelenting hype that has surrounded 5G for several years has seen a diverse range of applications put forward as the main drivers of adoption,” CCS Insight principal analyst for operators Kester Mann said.

“Some of them will be relevant at different times of the technology’s development, but the never-ending need for speed and people’s apparently limitless demand for video consumption will dominate 5G networks.”

Nevertheless, CCS Insight says fixed wireless access, positioned as a complementary service to fixed-line broadband, as 5G’s first commercial application (but not standardized by ITU-R or specified by 3GPP). The U.S. will be an early adopter, led by leading advocates like AT&T and Verizon. However, the long-term opportunity will remain small and the forecast sees it representing only a tiny fraction of total connections.

Despite the industry’s seeming obsession that in the future everything will be connected, 5G will account for a relatively low number of connections in the Internet of Things (IoT) during the forecast period.

Here, 4G networks will satisfy demand until narrowband technology is fully supported within the 5G standard. Network operators have only recently begun investing in LTE related LP-WAN technologies such as NB-IoT and Cat-M to support devices that have life spans of several years. Significant numbers of 5G connections in this area are unlikely before the second half of the 2020s, according to the forecast.

So called “mission critical” services such as autonomous driving — regularly touted as a “killer” application in 5G — will have to wait even longer to come to fruition.

Geoff Blaber, VP Research, Americas at CCS Insight commented that “5G is about creating a network that can scale up and adapt to radically new applications. For operators, network capacity is the near-term justification; the Internet of Things (IoT) and mission-critical services may not see exponential growth in the next few years but they remain a central part of the vision for 5G. Operators will have to carefully balance the period between investment and generating revenue from new services.”

5G enthusiasm in Asia:

“High-income Asian markets are likely to be among the first 5G markets,” says the GSMA Intelligence Unit report. “For Korea and Japan, their Olympics in 2018 and 2020 [respectively] provide global showcases. China has a national ICT agenda with 5G an integral part.”

But the industry body cautioned against expecting too much too soon. “We anticipate 5G adoption will take longer than 4G because of slower network rollouts and uncertainties around the value proposition relative to LTE,” says the report. “Europe is a possible exception. The EU sees 5G as an opportunity to retake a leadership position in technology, and even now 4G is still relatively immature.”

Lukasz Nowicki, a principal at research firm Delta Partners was bullish on APAC’s 5G prospects in an October 2017 research note. “From the moment Ericsson showcased the potential of 5G networks in a Swedish lab in 2014, operators, equipment vendors, and device manufacturers joined the chorus of 5G enthusiasts,” says Nowicki. “They praise the near-zero-latency and above 1Gbps speeds enabling the emergence of futuristic and aspirational use-cases like augmented reality, virtual reality, and low latency ultra-reliable IoT.”

“Asia is an attractive market for 5G, with the estimated number of users reaching 670 million by 2025, accounting for 60% of the global 5G market,” says Nowicki.

References:

https://www.telecomasia.net/content/china-tipped-lead-global-5g-adoption-2023

https://www.telecomasia.net/content/5g-starts-find-traction

India: 5G roll-outs expected before 4G LTE is extensively deployed

by Rekha Jain of Livemint.com

Since 5G roll-outs in India are likely even before 4G LTE is extensively deployed, the adopted road map for 5G should ensure that the existing and near-future investments in 4G can be leveraged.

……………………………………………………………………………………………………………………

Even while telecom operators in India are in the midst of rolling out 4G LTE networks, the minister for telecom has announced that India would roll-out 5G networks by 2020 – a time frame that has been accepted by service providers in many parts of the world. South Korea and Japan want to showcase leading 5G applications in the Winter and Summer Olympics in January 2018 and Summer of 2020, respectively.

However, Indian operators face several challenges for 5G roll-outs from a business point of view. They have far less spectrum in comparison to international operators. This increases their cost of operations. Many of them are also weighed down by debt. Ever faster rounds of new technology introduction when prior technology investments have not been recouped add further complexity. This juggernaut of ever evolving generations of technology and forthcoming 5G require a supportive policy and regulatory environment. Without it, the telecom sector’s health and India’s economic competitiveness would be greatly impaired. The imperatives of remaining competitive and consumer demands of faster and higher quality services leave little choice to operators but to invest in 5G.

Google Expands Cloud Network Infrastructure via 3 New Undersea Cables & 5 New Regions

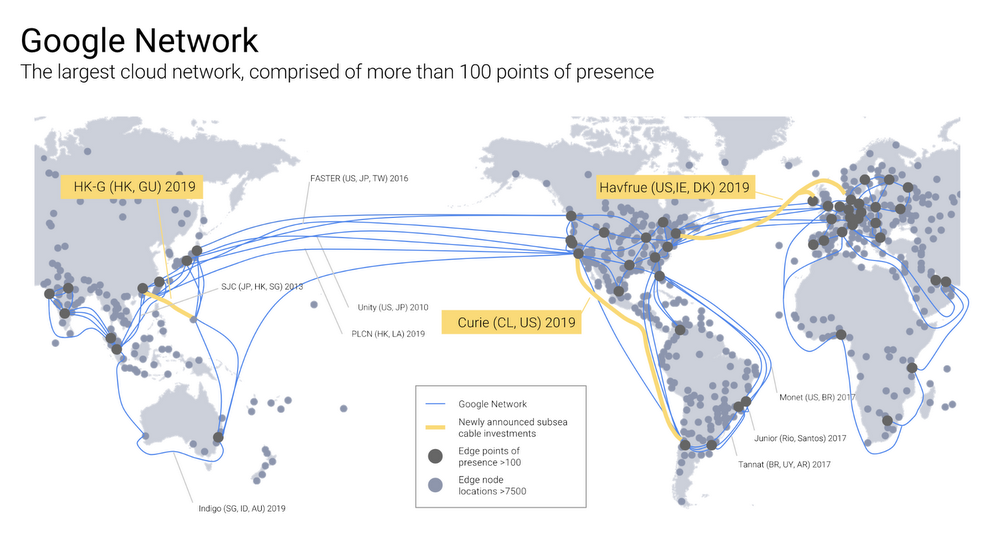

Google has plans to build three new undersea cables in 2019 to support its Google Cloud customers. The company plans to co-commission the Hong Kong-Guam (HK-G) cable system as part of a consortium. In a blog post by Ben Treynor Sloss, vice president of Google’s cloud platform, three undersea cables and five new regions were announced..

The HK-G will be an extension of the SEA-US cable system, and will have a design capacity of more than 48Tbps. It is being built by RTI-C and NEC. Google said that together with Indigo and other cable systems, HK-G will create multiple scalable, diverse paths to Australia. In addition, Google plans to commission Curie, a private cable connecting Chile to Los Angeles and Hvfrue, a consortium cable connecting the US to Denmark and Ireland as shown in the figure below.

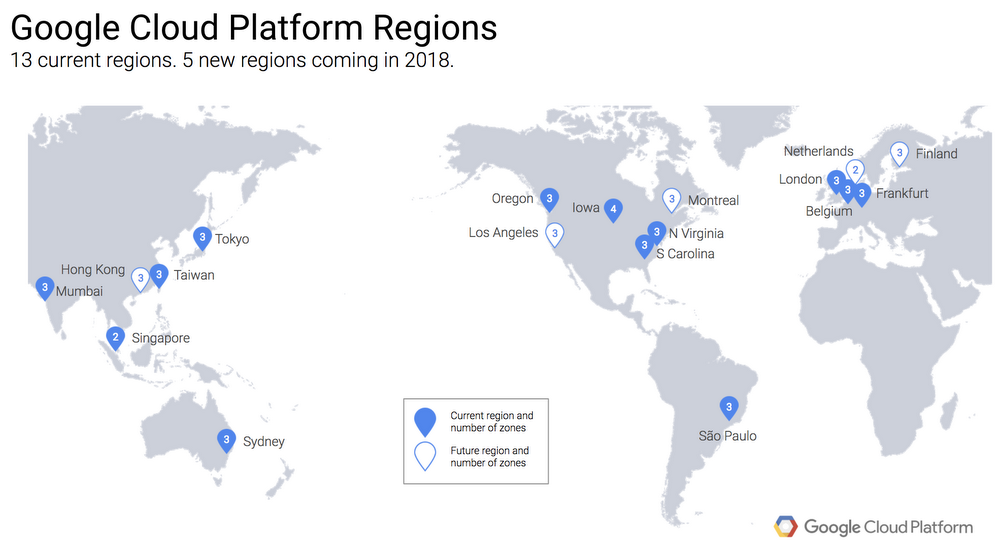

Late last year, Google also revealed plans to open a Google Cloud Platform region in Hong Kong in 2018 to join its recently launched Mumbai, Sydney, and Singapore regions, as well as Taiwan and Tokyo.

Of the five new Google Cloud regions, Netherlands and Montreal will be online in the first quarter of 2018. Three others in Los Angeles, Finland, and Hong Kong will come online later this year. The Hong Kong region will be designed for high availability, launching with three zones to protect against service disruptions. The HK-G cable will provide improved network capacity for the cloud region. Google promises they are not done yet and there will be additional announcements of other regions.

In an earlier announcement last week, Google revealed that it has implemented a compile-time patch for its Google Cloud Platform infrastructure to address the major CPU security flaw disclosed by Google’s Project Zero zero-day vulnerability unit at the beginning of this year.

Diane Greene, who heads up Google’s cloud unit, often marvels at how much her company invests in Google Cloud infrastructure. It’s with good reason. Over the past three years since Greene came on board, the company has spent a whopping $30 billion beefing up the infrastructure.

Google has direct investment in 11 cables, including those planned or under construction. The three cables highlighted in yellow are being announced in this blog post. (In addition to these 11 cables where Google has direct ownership, the company also leases capacity on numerous additional submarine cables.)

In the referenced Google blog post, Mr Treynor Sloss wrote:

At Google, we’ve spent $30 billion improving our infrastructure over three years, and we’re not done yet. From data centers to subsea cables, Google is committed to connecting the world and serving our Cloud customers, and today we’re excited to announce that we’re adding three new submarine cables, and five new regions.

We’ll open our Netherlands and Montreal regions in the first quarter of 2018, followed by Los Angeles, Finland, and Hong Kong – with more to come. Then, in 2019 we’ll commission three subsea cables: Curie, a private cable connecting Chile to Los Angeles; Havfrue, a consortium cable connecting the U.S. to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G), a consortium cable interconnecting major subsea communication hubs in Asia.

Together, these investments further improve our network—the world’s largest—which by some accounts delivers 25% of worldwide internet traffic……………….l.l….

Simply put, it wouldn’t be possible to deliver products like Machine Learning Engine, Spanner, BigQuery and other Google Cloud Platform and G Suite services at the quality of service users expect without the Google network. Our cable systems provide the speed, capacity and reliability Google is known for worldwide, and at Google Cloud, our customers are able to to make use of the same network infrastructure that powers Google’s own services.

While we haven’t hastened the speed of light, we have built a superior cloud network as a result of the well-provisioned direct paths between our cloud and end-users, as shown in the figure below.

According to Ben: “The Google network offers better reliability, speed and security performance as compared with the nondeterministic performance of the public internet, or other cloud networks. The Google network consists of fiber optic links and subsea cables between 100+ points of presence, 7500+ edge node locations, 90+ Cloud CDN locations, 47 dedicated interconnect locations and 15 GCP regions.”

……………………………………………………………………………………………………………………………………………………………………………………………

Reference:

Cogent Communications CEO: MPLS VPNs to be replaced by VPLS & SD-WANs; Reasons to Deploy SD-WANs?

Dave Schaeffer, CEO of Cogent Communications, told investors during last week’s 2018 Citi Global TMT West Conference that there is a migration away from MPLS VPNs to Ethernet VPLS (Virtual Private LAN Service) [1] and SD-WANs.

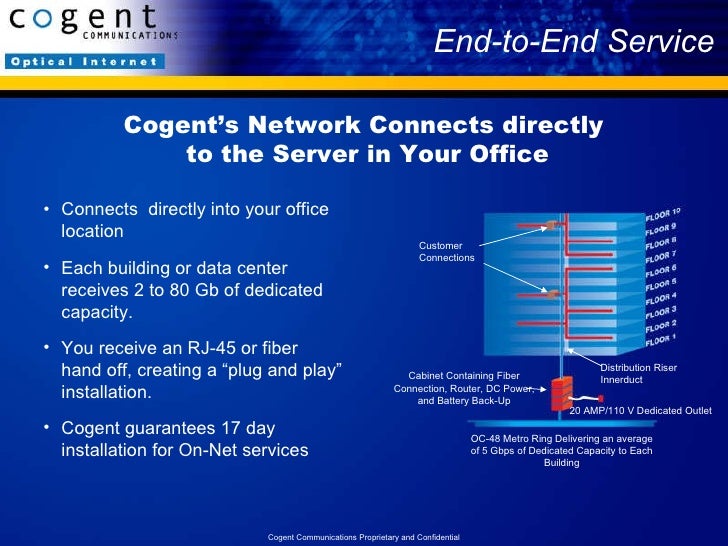

“Cogent has focused on selling dedicated Internet access which is still the primary product (actually service) of our company. However, VPN services represent 17% of total revenues and 25% of corporate revenues. Most corporate customers supplement Internet access with a private network. The vast majority of those private networks are based on MPLS based services (e.g. MPLS VPNs), which are very difficult to install, manage, or modify. They’re also very expensive on a per transmitted bit basis.”

- VPLS, which is based on MPLS in the core network, has been a very successful offering for Cogent (see reference below). Shaeffer said that at the end of Q3-2017 an average of 12.5 customers out of 50 in a commercial building are using it (in addition to Internet access). VPLS has a huge advantage on a cost per bit basis over MPLS VPNs.

Note 1. Virtual Private LAN Service (VPLS) is a way to provide Ethernet-based multi-point to multi-point communication over IP or MPLS networks. It allows geographically dispersed sites to share an Ethernet broadcast domain by connecting sites through pseudo-wires.

- SD-WANs are very effective at low speeds. SD-WAN vendors are consolidating on IP SEC with 2**32 bit encryption (15% encryption overhead). At higher bandwidths (10M-100Mb/sec), the encryption tax has been 40% to 50% which resulted in a very low adoption of higher speed SD-WANs.

“As the equipment vendors have improved the efficiency of their processors, allowing encryption to occur in a multipath format through the processor instead of serially we’re seeing that efficiency go from like 40 or 50% to the high 80%. As that occurs, SD-WAN will become the dominant platform for location-to-location private networking and will replace MPLS,” Schaeffer added.

“The result for Cogent is an expansion in our addressable market. As we think about our corporate business in the U.S. and Canada, it is a $9 billion dedicated internet access market of which 10% of the market is on-net for Cogent and 90% is off-net.”

Schaeffer added that “out of the 90% off-net, roughly 40% of that total market is addressable through circuits we can buy from one of 90 off-net fiber providers.” However, approximately 1/2 of potential corporate customers don’t have fiber to their buildings.

“Fifty percent of corporate locations still don’t have fiber to them today and are therefore out of Cogent’s addressable market because we have made a conscious decision not to support fixed wireless, coax or twisted pair as a last mile connection due to low reliability, long provisioning times and low throughput,” Schaeffer said.

Since Cogent has decided not to use twisted pair, coax or fixed wireless for last mile access, there’s a large portion of the corporate market that it isn’t now able to address. But that might change with SD-WANs gaining popularity.

“What SD-WAN does is expands the market by allowing customers to bring their own bandwidth from locations that we are unwilling to purchase those sub optimal (non fiber based) tail circuits.”

Schaeffer said “the MPLS market is predicated on bandwidth costing 15 times as much per megabit as DIA (Dedicated Internet Access) bandwidth and that’s unsustainable. The U.S. MPLS addressable market, now worth $45 billion annually, will collapse to a $3 billion market (Schaeffer didn’t say when that would happen).” When that happens, Cogent believes their business will expand.

“We benefit two ways: our addressable market got a third bigger and we got a second reason for a customer to buy services from Cogent,” Schaeffer said. “That’s why we feel so confident about our corporate business continuing to perform even though our footprint expansion has continued to slow down.”

Author’s Note: It’s not clear how that will happen as Schaeffer didn’t say Cogent would offer SD-WANs.

Cogent’s network stretches over 199 markets throughout 41 countries in North America, Europe and Asia, with over 57,400 route miles of long-haul fiber and more than 31,070 miles of metropolitan fiber serving over 720 metropolitan rings.

Our end-to-end optical transport network consists of IP-over-WDM fiber links running up to 1200 Gbps intercity capacity and 320 Gbps on metropolitan rings, located in Cogent’s major markets throughout North America, Europe and Asia.

On the IP layer, Cogent’s Tier 1, IPv6 and MPLS enabled network has direct IP connectivity to more than 6,075 AS (Autonomous System) networks around the world with over 162.4 Tbps internetworking capacity.

Being a facilities-based carrier, Cogent takes advantage of full end-to-end control over its transport and routing technology to provide reliable and scalable service.

………………………………………………………………………………………………..

Separately, a survey from the SIP School asked this question:

What are the main reasons for you to deploy or investigate SD WAN solutions?

Answers from survey respondents:

- Better Use of Existing Links – 158

- Cost Savings – 148

- Improved WAN Performance – 114

- Failover – 95

- Security – 87

- Intelligent Routing – 83

- Analytics & Visibility – 50

…………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/cogent-s-ceo-multi-location-sd-wan-services-will-replace-mpls

https://www.veracast.com/webcasts/citigroup/tmt2018/69111247817.cfm?0.0889053993034

China’s 5 Year Optical Component Plan to aid domestic parts makers

In December 2017, China’s Ministry of Industry and Information Technology (MIIT) released a five-year plan outlining a road map for commercial and technological progress in a broad set of optical technologies.

China has optical component makers, but they have generally produce lower-speed devices that lag U.S. companies by a product generation. China’s efforts to develop a domestic optical industry aims to support optical network equipment makers, such as Huawei and ZTE, according to Jefferies analyst Rex Wu.

The 63-page MIIT document is written in Chinese (Mandarin), but Cignal AI commissioned a professional English translation which summarizes the section of the plan about the Chinese optical components industry.

The goals and objectives outlined in the plan are exceptionally ambitious and should gravely concern incumbent component vendors. This document outlines strategic rather than rational economic objectives to catalyze market progress in Chinese component companies. Our interpretation is that this will increase the number of non-rational economic actors participating in the component market.

If executed, this plan will greatly increase the level of competition in an already fractured industry. It will also reduce or in some cases eliminate access for western component vendors to the largest market for optical communications components in the world – China.

……………………………………………………………………………………………………………

NeoPhotonics, Oclaro, Acacia, Lumentum, and Finisar sell the most optical components to China, says a UBS report. Those optical parts makers took a hit in 2017 as demand weakened from China’s telecom service providers. Analysts have been expecting a rebound in 2018 spurred by spending on fiber-optic networks, 5G wireless backhaul and data centers designed for cloud computing services.

China’s domestic optical component makers include O-Net, Accelink and Innolight.

“The government aims to have two to three Chinese optics companies in global top 10 in 2020, and one company in global top 3 in 2022,” Mr. Wu wrote in a Jefferies report to clients. “The market share of Chinese optics companies will reach over 30% worldwide in 2022,” according to the government’s plan, he added.

References:

https://cignal.ai/2018/01/chinas-5-year-optical-component-plan/