Cignal AI

Cignal AI: Datacom optical component revenue +27% to reach $4.7B in 2021

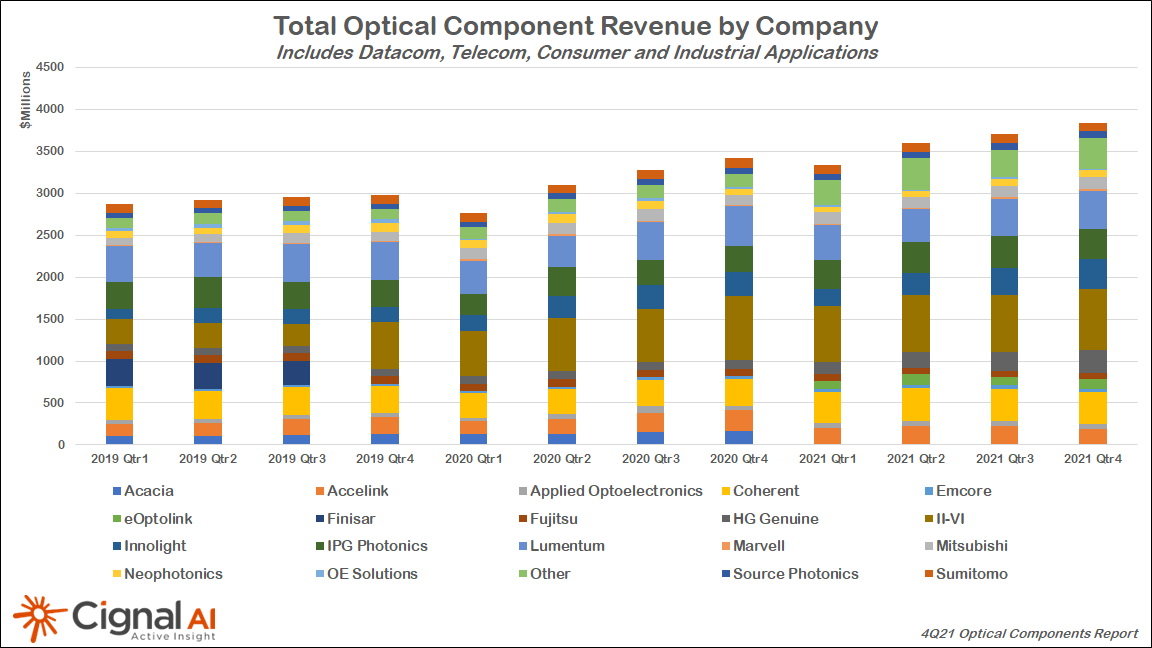

Cignal AI reports that total revenue for optical components, a category that includes optical transceivers, grew 15% in 2021. Components for datacom optical network applications led the way, growing 27% to account for $4.7 billion of the total $14.5 billion component sales registered for the year within the datacom, telecom, industrial, and consumer markets, the market research firm states in its latest Optical Components Report.

A transition by large cloud service providers and some enterprise network operators toward 400-Gbps transmission helped spur this growth. For example, 1.8 million QSFP-DD and OSFP datacom modules shipped during 2021, most of which were DR4 format. Meanwhile, more than 60,000 400G pluggable coherent modules shipped at the same time, with QSFP-DD ZR devices accounting for the majority.

“The transition to 400GbE is well underway, and pluggable coherent 400Gbps technology is revolutionizing the design of the optical networks that connect datacenters,” said Scott Wilkinson, Lead Optical Component Analyst at Cignal AI. “400Gbps speeds will drive spending and bandwidth growth both inside and outside the datacenter in 2022,” Scott added.

More Key Findings from the 4Q21 Optical Components Report:

- Supply chain difficulties limited Telecom optical components market growth the most in 2021. However, the segment is forecast to grow more than 8% in 2022.

- Consumer component revenue for 3D sensing applications was flat YoY as lower-cost components offset higher unit shipments.

- Industrial optical components used for welding and medical applications grew 18% in 2021, following a weak 2020. Following the acquisition of Coherent, II-VI is poised to control over 50% of this market.

- 1.8M QSFP-DD Datacom modules shipped during 2021, most of which were DR4 format. The report also tracks SR4, FR4, and LR4 Datacom transceivers.

- Over 60k 400Gbps pluggable coherent modules shipped last year, the majority of which were QSFP-DD ZR. The report captures the shipment details of all the emerging derivatives of this format, including ZR, ZR+, 0dB ZR+, and CFP2 based ZR+.

- Shipments of 200Gbps coherent CFP2 modules grew 17% to just over 200k units during 2021 as Chinese OEMs ramp this speed (which is less dependent on western technology) for longer distance metro and long haul applications.

References:

Cignal AI: NA Optical Network Spending to Accelerate; IEEE 802.3ct; NeoPhotonics 400G Multi-Rate Transceiver

|

||

|

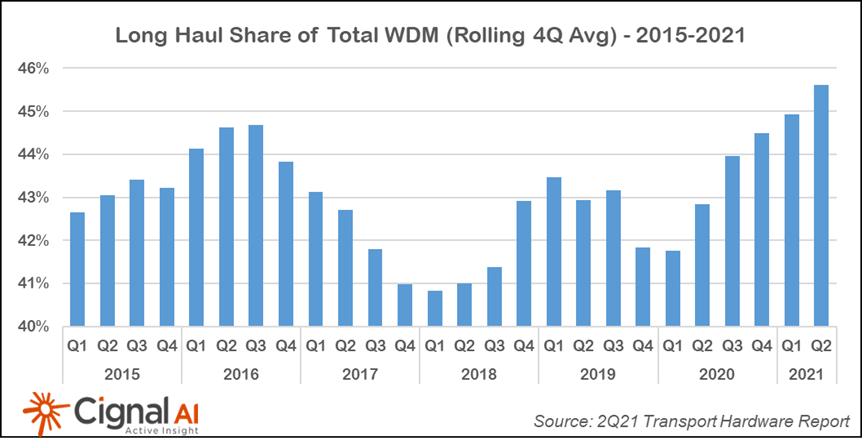

Additional 2Q21 Transport Hardware Report Findings:

- The spending mix between long-haul and metro WDM reached a record level following 5 quarters of investment in advanced coherent and line system technology. Carriers may be deferring metro expenditures considering the imminent availability of transport system upgrades utilizing 400G coherent pluggables.

- Chinese optical and packet hardware spending collapsed, resulting in the largest single quarterly decline on record and the first instance of consecutive quarters with YoY declines.

- Sales of optical hardware in EMEA were up significantly YoY as the region continues to produce steady single-digit growth. Despite strategic wins by Nokia and observations of increasing replacement activity from Ciena, Huawei’s footprint in EMEA shows no noticeable impact from geopolitical factors.

- North American packet transport sales were up slightly, with market leader Cisco realizing gains in Core as its 8000 series routers ramp.

- Component shortages weighed on smaller equipment manufacturers as constrained global semiconductor production increased lead times. ADVA and Infinera quantified the effect on sales (10% and 6% of revenue, respectively), though larger vendors reported minimal impact on their sales. Vendors do not anticipate resolution of these issues until 2022.

Editor’s Note: IEEE 802.3ct and 100GBASE‑ZR

It will be interesting to see if optical packet transport will evolve from to Ethernet MAC frames directly over DWDM systems. IEEE 802.3ct “Physical Layers and Management Parameters for 100 Gb/s Operation over DWDM Systems” standard was approved in June 2021 for that purpose.

Extended reach (i.e., 80 km ~50 miles or longer) optical Ethernet solutions primarily support television distribution (e.g., cable and direct-broadcast satellite) and mobile/cellular backhaul aggregation networks. A need was identified to not only support 100 Gb/s extended reach operation for these applications, but also to support up to 48 multiplexed 100 Gb/s channels over a single lane of single-mode optical fiber cabling. This amendment defines one Physical Layer (PHY) specification and management parameter for extended reach 100 Gb/s operation.

The new PHY specification is 100GBASE-ZR: A Physical layer specification supporting 100 Gb/s operation on a single wavelength capable of at least 80 km over a DWDM system. Specifically, 100 Gb/s transmission using 2‑level pulse amplitude modulation and dual polarization differential quadrature phase shift keying (DP-DQPSK) modulation over single‑mode fiber (2 fibers total), with reach up to at least 80 km.

In addition, 100GBASE-ZR is specified as part of a Dense Wavelength Division Multiplexed (DWDM) system. In this system, up to 48 100GBASE‑ZR optical signals, transmitting between the 1528.77 nm and 1566.31 nm wavelengths, can be multiplexed for operation over 2‑fiber single‑mode optical cabling referred to as a “black link”. Black link refers to a link where only the input and output link and transfer characteristics (e.g., chromatic dispersion, optical return loss, and inter-channel crosstalk) are specified, with interoperability ensured at these locations. The amendment does not specify how the black link is designed, constructed, configured, or operated. DWDM network elements inside the black link may include an optical multiplexer, an optical de‑multiplexer, and one or more optical amplifiers and no assurance of interoperability at these multichannel points is provided.

…………………………………………………………………………………………………………………………………………..

Separately, NeoPhotonics Corporation, a leading developer of silicon photonics and advanced hybrid photonic integrated circuit-based lasers, modules and subsystems for bandwidth-intensive, high speed communications networks, today announced a new, high output power version of its 400G Multi-Rate CFP2-DCO coherent pluggable transceiver with 0 dBm output power and designed to operate in metro, regional and long haul ROADM based optical networks.

“Our newest CFP2-DCO coherent pluggable module, with high output power, robust ROADM filtering tolerance and demonstrated transmission over 1500 km, allows customers to use one coherent pluggable solution to cover essentially all metro ROADM use cases, simplifying network design, enabling disaggregation, and lowering inventory costs.” said Tim Jenks, Chairman and CEO of NeoPhotonics. “The key to achieving line card equivalent performance in a pluggable module, but with significantly lower power than a line card, is the vertical integration of our optical solution and Nano tunable laser,” concluded Mr. Jenks.

References:

https://www.neophotonics.com/press-releases/?newsId=12741

North American Cloud and Traditional Telco CapEx Drops in 4th Quarter 2020

Subhead: Exceptional 4Q Cloud & Colo Operator Spending in APAC

|

||||

|

||||

More Key Findings from the 4Q20 Transport Customer Markets Report:

Separately, Cignal AI said on March 16th that Ciena’s revenue decline this quarter was steeper than forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e fifth generation coherent technology. On March 2nd, Cignal AI said that Infinera originally expected its ICE6 technology to enter the market in the second half of 2020. The company’s current guidance now indicates a 2H21 arrival. Infinera reports a strong order pipeline, but has not specified exactly when the first ICE6 will ship for revenue. About the Transport Customer Markets Report:

About Cignal AI:

References:https://cignal.ai/opteq-hw-dashboard/https://cignal.ai/free-articles/

|

Cignal AI: COVID-19 Continued to Pressure Optical Network Supply Chain in Q2-2020

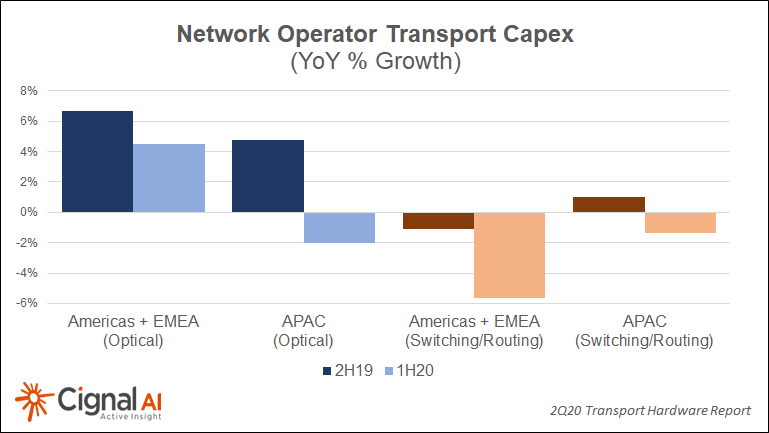

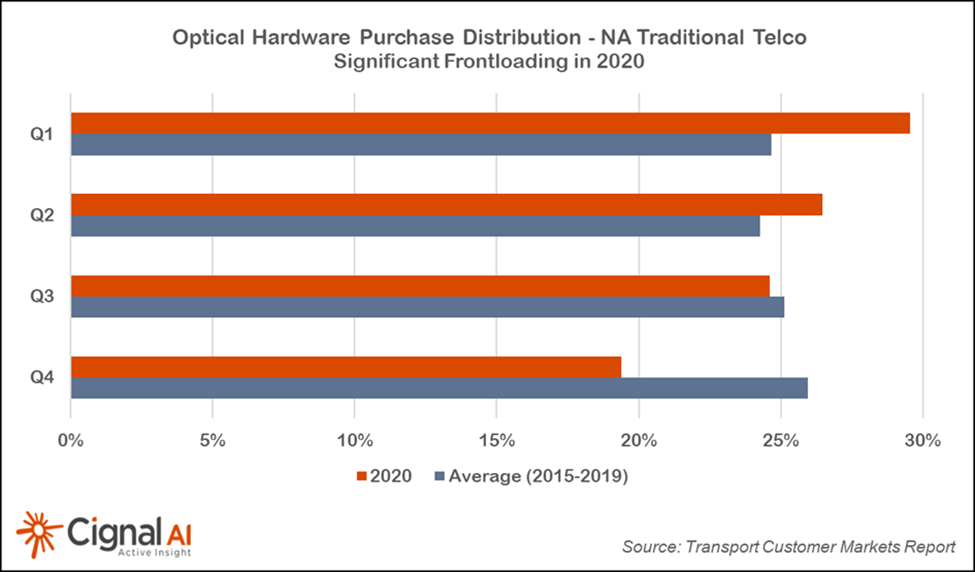

Delayed order fulfillment due to COVID supply chain impact earlier this year was expected to spur sales growth in 2Q20, but instead the results were mixed, according to the most recent Transport Hardware Report from research firm Cignal AI. Forecasted growth in Q2 from sales pushed out from Q1 did not materialize, and network operators indicated that annual CapEx would not increase (see chart below). As a result, spending on optical and switching/routing equipment will be flat to down in the second half of the year.

“COVID operational issues slowed deliveries and revenue recognition in the second quarter, although optical hardware sales increased in NA and EMEA due to high demand for inventory,” stated Cignal AI Lead Analyst Scott Wilkinson. “Growth is not expected to continue in the second half as carriers have pulled forward annual CapEx spending and networks are now able to cope with COVID-related surges.”

Some regions did shine in 2Q20. North American optical sales were up sharply YoY in both metro and long haul WDM, though the second half of the year is expected to be flat or down. Japan’s extraordinary growth in optical sales expanded to packet sales this quarter, with sales to both market segments up substantially YoY.

Additional 2Q20 Transport Hardware Report Findings:

- In addition to COVID woes, RoAPAC continues to suffer from the CapEx limitations in India, and optical sales declined -20% for the quarter while packet sales also declined.

- China has overcome its COVID related issues and returned to optical and packet spending growth this quarter, with increasing growth forecasted for Q3.

- EMEA optical spending increased YoY but was weighed down by weak Nokia sales. Nokia predicts that Q3 sales increases will offset Q2 declines.

Real-Time Market Data:

Cignal AI’s Transport Hardware Dashboardis available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

Contact: sales@@cignal.ai

References:

https://cignal.ai/2020/08/transport-hardware-misses-expected-bounce-back-in-2q20/

Addendum:

According to Industry Research, the global Optical Transport Network (OTN) Equipment (optical transport and switching) market is projected to reach USD 20360 million by 2026, from USD 15810 million in 2020, at a CAGR of 4.3% during 2021-2026.

The Optical Transport Network (OTN) Equipment market is segmented into the following categories:

- Mobile Backhaul Solutions

- Triple Play Solutions

- Business Services Solution

- Industry and Public Sector

- Others

With respect to data rates, the Optical Transport Network (OTN) Equipment market is segmented into three categories:

- < 10G

- 10G-100G

- 100-400G

https://www.industryresearch.co/global-optical-transport-network-otn-equipment-market-16157288

Cignal AI: Optical Network Equipment Sales +25% in 4Q2019 + 650 Group

Cignal AI:

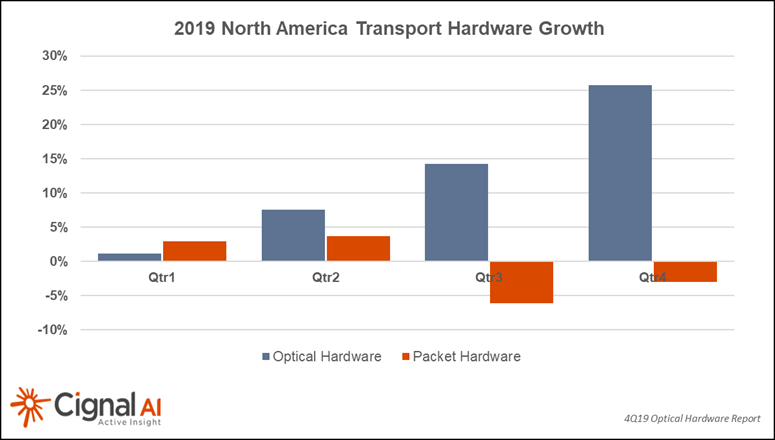

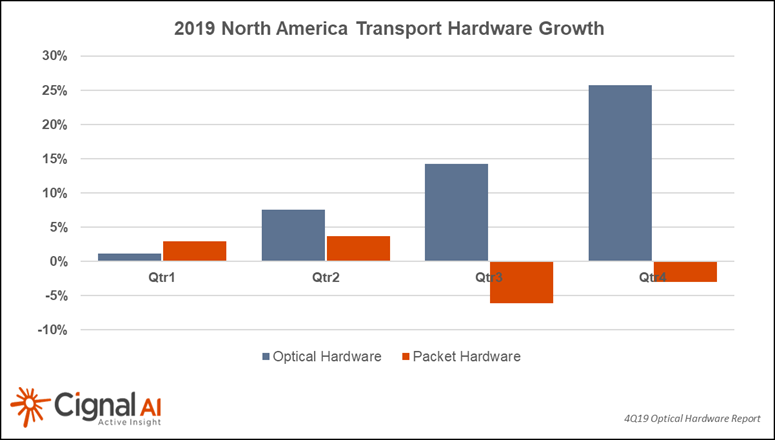

Recent optical network equipment sales in North America were quite encouraging – up more than 25% for 4Q19 and 10% for all of 2019, according to the most recent Transport Hardware Report.

“After three years of North American spending declines as operators focused capex on wireless and access, optical hardware sales in the region revived and grew at a healthy pace for 2019, while packet hardware sales remained flat,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Market leaders Ciena, Infinera, and Cisco all achieved optical sales growth exceeding 25% in 2019.”

Manufacturing at Huawei in Dongguan appears to be close to resuming normal levels of operation, although installation activity underway in China is still not clear. Ciena indicated a revenue impact of $30M during an earnings call in early March. It’s unclear right now what the ultimate impact will be; time will tell. We will revisit projections in April with the hope that events will be more certain at that time.

OFC was severely impacted when almost all major exhibitors pulled out of the show as health concerns mounted. The organizers did an admirable job of salvaging the technical sessions via Zoom teleconference.

Cignal AI will deliver a wrap-up report summarizing many of the important announcements that companies intended to make during the show. Look for it in the coming weeks, and if you have important news or perspective to share – contact us!

……………………………………………………………………………………………

Separately, a newly released report by 650 Group states that the Optical Transport Network market revenues increased 5% Y/Y in 4Q19. Revenues in four of the six geographic theatres experienced year over year growth, with North America having been the most robust.

“For the full year 2019, the top five Hyperscalers experienced the most growth out of any customer segment we track and has consistently been a top-performing customer segment in recent years,” said Chris DePuy, Technology Analyst and Founder at 650 Group. “Top vendors in the market are expecting their 800 Gbps optical transport technology to contribute to revenues towards the end of this year, 2020. We expect that optical transport systems companies that ship this new technology early will be well-positioned to take on the potential substitution threat of optical modules on switches and routers in the coming years.”

The forecast section of this report has been updated to reflect changes in both demand and supply related to health fears that have emerged in 1Q20. The report also reflects quantitative Data Center Interconnect (DCI) deployment scenarios across long-haul, metro, cloud, colocation, and telecom service providers.

For more information about the report, contact:

[email protected] or www.650group.com

Cignal AI: North American Optical Sales Rebound In 2019

|

||||

|

||||

Additional 4Q19 Transport Hardware Report Findings:

Transport Hardware Superdashboard:

|

||||

About the Transport Hardware Report

About Cignal AI:

Contact Cignal AI/Purchase Report:

|

Cignal AI: Japan’s Optical Hardware Growth Soars in 1Q2019; North America Remains Weak

by Scott Wilkinson and Andrew Schmitt of Cignal AI (edited by Alan J Weissberger)

Metro Bandwidth Growth Outpaces Long Haul; North America Remains Weak

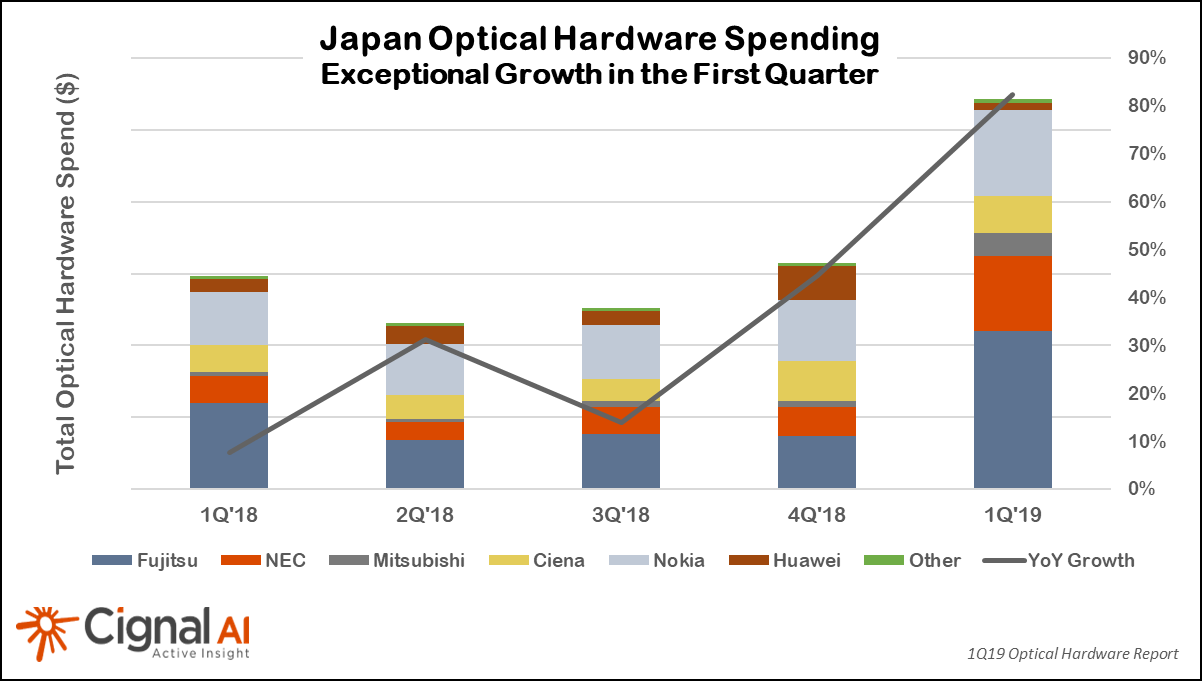

Japan continued its recent hot streak as 1Q2019 marked the fourth quarter in a row of growth with an extraordinary 82% increase, according to the most recent (1Q2019) Optical Hardware Report from research firm Cignal AI. Japan registered an extraordinary 82% year-over-year increase in optical networking hardware sales in the first quarter of 2019. Prime beneficiaries were domestic suppliers NEC, Mitsubishi and Fujitsu along with Ciena and Nokia, all of which posted significant gains during the quarter.

“The exceptional optical market growth in Japan is the story to watch for 2019,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Network operators have begun significant network rebuilds and expansions, and domestic as well as non-Japanese vendors continue to grow sales in the region at remarkable rates.”

North American growth continued to disappoint as slow optical hardware spending among traditional telco operators obscured growth in sales to cloud and colo operators (e.g. multi-tenant data centers).

Additional key findings in the 1Q19 Optical Hardware Report:

- Metro Bandwidth Outpaces Long Haul – While long haul spending grew at a higher rate than metro, analysis reveals that metro bandwidth is growing more rapidly.

- Growth in China Decelerates – Growth in China moderated into the single-digits during 1Q19, as 2018’s high spending by Chinese carriers could not continue indefinitely.

- EMEA Posted Solid Gains – Both metro and long haul spending grew during the quarter, with growth led by both traditional and cloud & colo operators.

- CALA Continues Lackluster Performance –Q1 showed no improvement for the region. Relief may be coming, as vendors believe major carriers in the region will return to spending later this year.

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on overall spending trends for equipment types within the regions.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Cignal AI’s interactive Optical Hardware Superdashboard is available to clients of the Optical Hardware Report and provides up-to-date market data for real-time visibility on individual vendors’ results. Users can manipulate data online and see information in a variety of useful ways.

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. In addition to the interactive tracker, the analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

|

|

|

Cignal AI: Long-Haul WDM Deployment Growth Sets Stage for Increased Spending in 2019

|

|

|

Cignal AI Raises Forecast for Asia Optical Hardware Market while NA declined for 8th consecutive quarter

|

|

|

Optical Vendor Summary Reports

A new feature of the Optical Hardware Report this quarter are Optical Vendor Summary Reports which examine in depth the most recent quarterly results and items of interest about vendors in the optical market. Reports this quarter cover ADVA, Ciena, Fujitsu, Huawei, Infinera/Coriant and Nokia.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. The analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Cignal AI’s real-time news briefs on current market events, Active Insight.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, Tejas, Xtera and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.