Ookla

Dell’Oro: Mobile Core Networks +15% in 2025; Ookla: Global Reality Check on 5G SA and 5G Advanced in 2026

A recent Dell’Oro market research report estimates that 4G/5G Mobile Core Network (MCN) revenues rose 15% YoY in 2025, which was the fastest growth since 2014. For the first time, the 5G MCN market accounted for 50% share of the total MCN market.

Editor’s Note: The 4G and 5G Non Standalone (NSA) mobile core network market (Evolved Packet Core) is experiencing long-term decline as investments are finally shifting toward 5G standalone (SA) networks.

“In 2025, the MCN market recorded its highest year-over-year revenue growth rate since 2014,” stated Dave Bolan, Research Director at Dell’Oro Group. “This was driven by record-setting growth rates in all market segments: 4G MCN (highest since 2019), 5G MCN (highest since 2022), and Voice Core (highest since 2007). 4G MCN gains came from Caribbean and Latin America (CALA) and Europe, Middle East, Africa (EMEA) regions; 5G MCN from all regions; and Voice Core, primarily from Asia Pacific and EMEA regions.

“5G MCNs led the way in 2025 growth, as 5G Standalone (5G SA) networks reached an inflection point and moved towards mass market appeal, as more 5G SA networks expand in population coverage in urban, suburban, and rural areas. Voice Core was the next major contributor to growth in 2025, driven by planned 3G MCN shutdowns, which required upgrades from Circuit Switched Core to IMS Core, and IMS Core modernization to a cloud-native IMS Core for VoNR in 5G SA networks. Meanwhile, 4G MCNs expanded due to subscriber growth in Africa and South America,” added Bolan.

Additional highlights from the 4Q 2025 Mobile Core Network and Multi-Access Edge Computing Report include:

- The top four vendors (Huawei, Ericsson, Nokia, and ZTE) posted very strong growth rates in 2025. Collectively, they accounted for about the same amount of market share as in 2024.

- The Multi-access and Edge Computing (MEC) market segment (a subsegment of the 5G MCN market) attained the highest growth rate of any MCN segment in 2025, with the China region remaining the dominant region for MEC implementations.

- Standard-setting bodies, vendors, and Mobile Network Operators (MNOs) communities are collaborating to expand the ecosystem with new products, applications, and monetization features that are expected to deliver future benefits.

- Examples include RedCap radios, which reduce the cost of IoT devices for consumer wearables and industrial applications; network slicing for both mission-critical and on-demand applications; IMS data channels to increase monetization opportunities and enhance user experience; and Open APIs that enable developers to scale their applications across all MNOs, attracting the app development community.

- Agentic AI is expected to change data traffic patterns and alter the duration that subscribers remain connected to the network as agents operate on their behalf. This could represent a paradigm shift in the future, requiring increased MCN capacity, expanded vendor opportunities, and enhanced monetization for MNOs through pricing tiers.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Traditional Packet Core, Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, Signaling, Circuit Switched Core, and IMS Core by geographic regions. To purchase this report, please contact us at [email protected].

…………………………………………………………………………………………………………………………………………………………………………………………………..

Related: The second edition of Ookla and Omdia’s report on the global state of 5G Standalone core network confirms that the technology has moved beyond launch announcements into an execution-driven phase. By the close of 2025, the “coverage gap” between major economic blocs had narrowed, but a more consequential “capability gap” has emerged, reflecting divergent spectrum strategies, investment depth, and the extent to which operators have moved beyond baseline SA deployment toward end-to-end network optimization.

For government and regulatory bodies, 5G Standalone (SA) has evolved into a high-stakes strategic imperative. The intersection of national competitiveness, digital sovereignty, and AI readiness is fundamentally reshaping Capex priorities across Tier-1 markets.

- User Equipment (UE) Performance: Impact of 5G SA on battery life and the transition to Voice over New Radio (VoNR).

- Application-Layer QoE: Benchmarking latency and jitter for cloud-native and gaming infrastructure.

- Commercial Monetization: A review of the first commercial deployments of Network Slicing, Enterprise SLAs, and 5G-Advanced (Release 18) segmentation.

- Geopolitical Drivers: Assessing how sovereign AI strategies in the GCC and legislative shifts in Europe are dictating the global SA evolutionary path.

……………………………………………………………………………………………………………………………………………………………………………………………..

5G Core network investment is accelerating as monetization transitions from concept to selective execution:

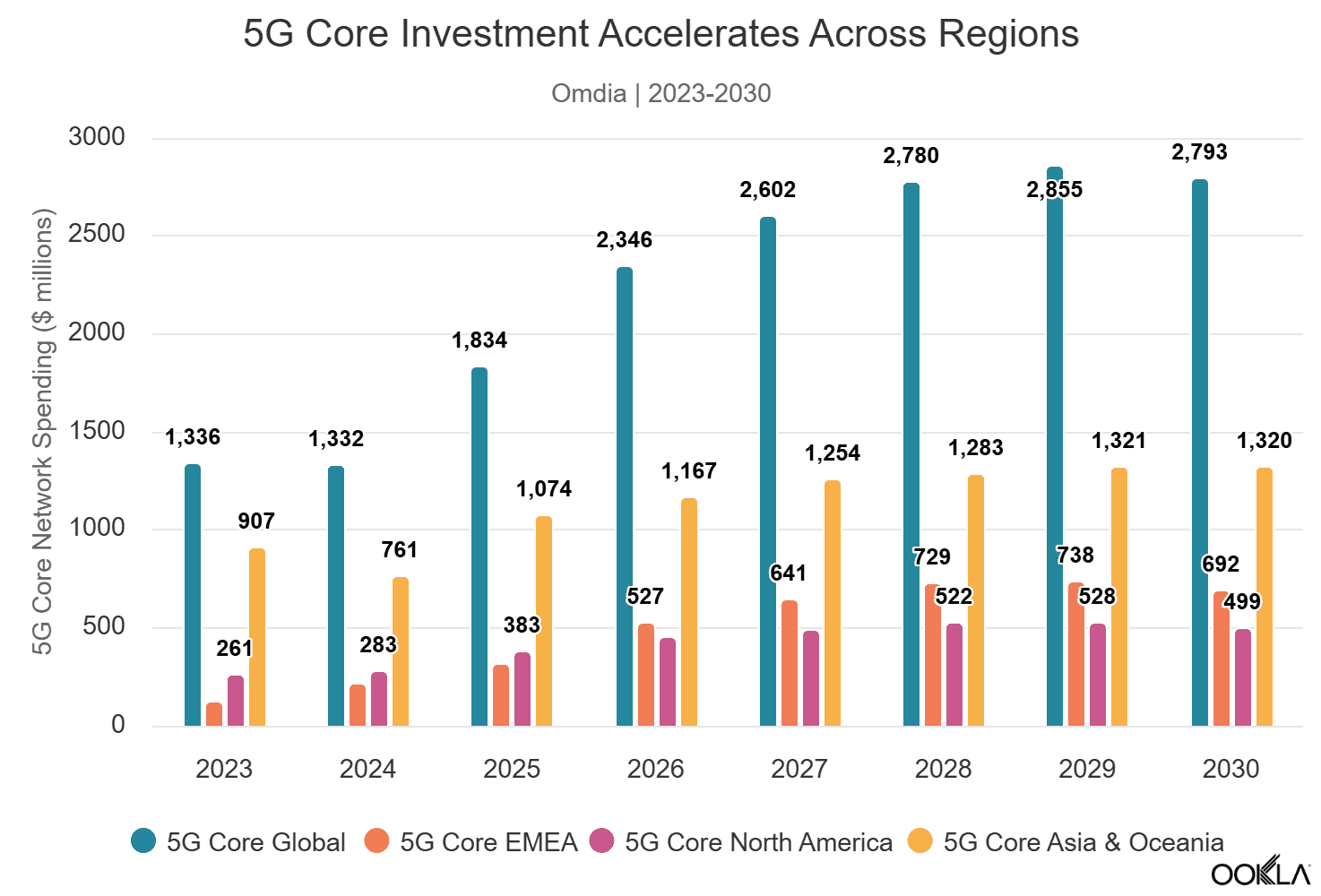

Omdia’s latest forecasts confirm the industry’s shift toward software-defined core capability as the primary driver of next-cycle investment. Global 5G SA core network software spending is projected to grow at an 8.8% CAGR between 2025 and 2030, with EMEA leading at 16.7%, significantly outpacing North America (5.5%) and Asia & Oceania (4.2%). This reflects EMEA’s later position in the deployment cycle, as the region is entering its period of peak 5G core adoption, while North America’s 5G core spending trajectory is expected to have peaked in 2025 following the commercial launches by AT&T and Verizon. By end of Q3 2025, 83 operators worldwide had deployed 5G core networks, with 5G core investment accounting for 63.6% of global core network function software spending.

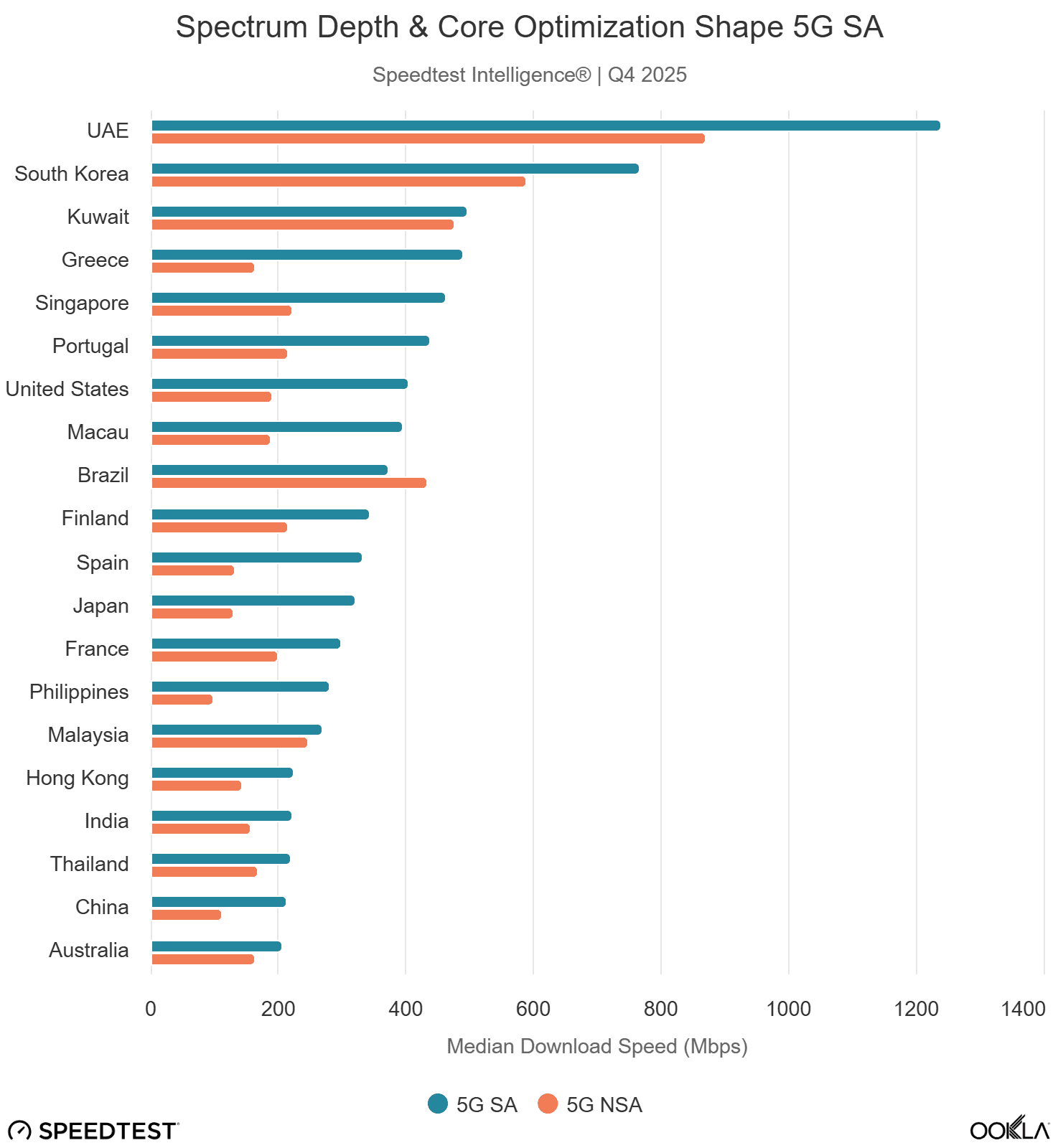

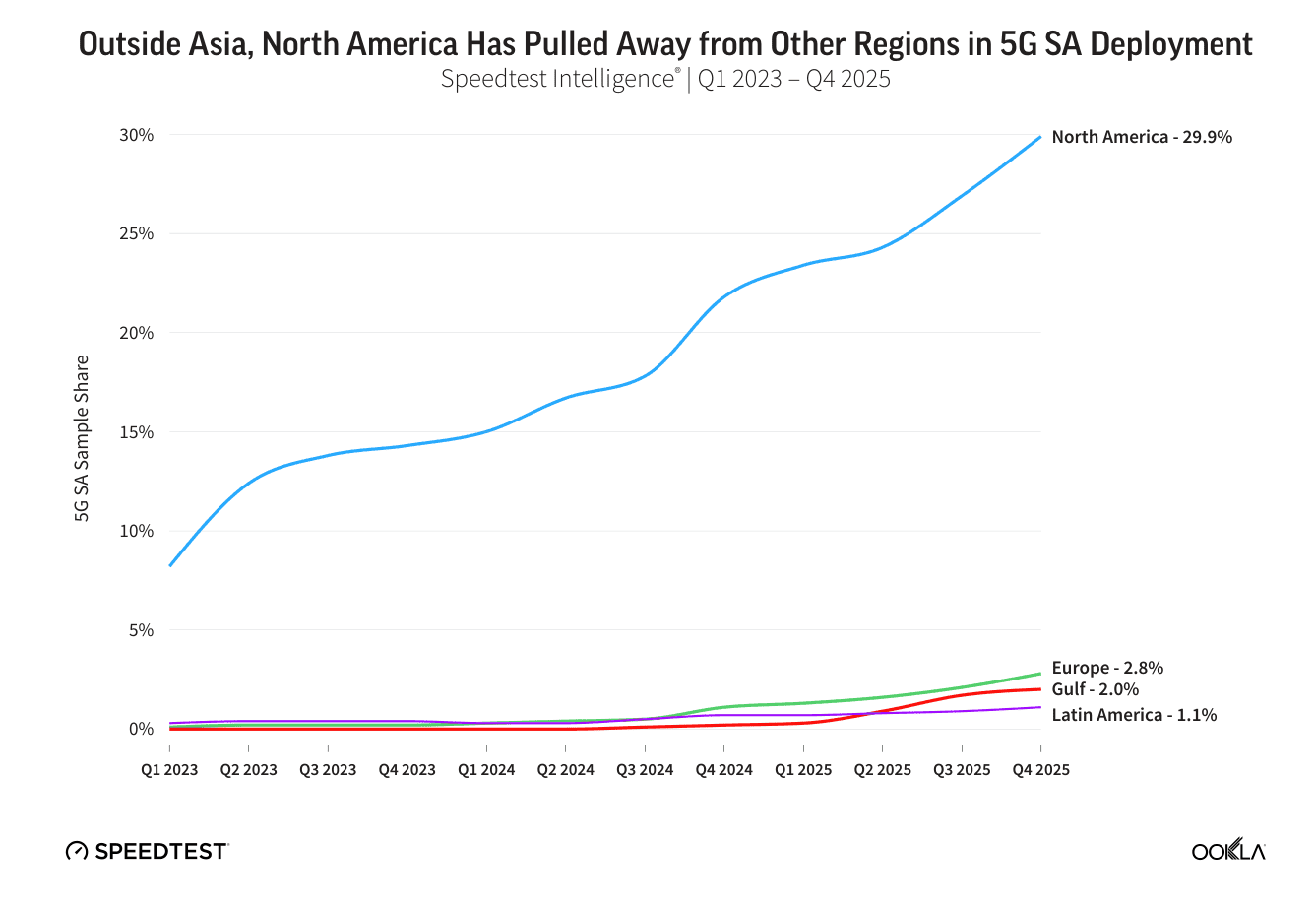

- 5G SA availability based on Speedtest® sample share reached 17.6% in Q4 2025, up modestly from 16.2% a year earlier, indicating that roughly one in six 5G Speedtests worldwide now occurs on a 5G standalone network. The headline global median SA download speed of 269.51 Mbps represents a 52% premium over non-standalone networks, though this figure masks significant regional variation driven by spectrum allocation depth, carrier aggregation maturity, and user-plane engineering.

- Asia leads in 5G availability: China continues to dominate with 80.9% 5G SA sample share and over 10 million 5G Advanced subscribers.

- Globally, 5G SA connections delivered a 52% download speed premium to 5G NSA (mostly an artifact of rich spectrum allocation and lower network load) and improved median multi-server latency by over 6% compared to NSA. However, this year’s report finds that a standalone core migration alone does not guarantee a better end-user experience. Quality of experience analysis reveals a nuanced picture: SA improves video and cloud infrastructure latency in Europe versus NSA, but underperforms NSA for gaming latency within the same region. North America records the lowest absolute SA cloud and gaming latency, consistent with dense hyperscaler adjacency and mature interconnect ecosystems.

- The Gulf Cooperation Council (GCC) was the global 5G SA performance leader, with the UAE setting the speed benchmark Led by e& and du’s aggressive 5G Advanced deployments, the delivered the world’s fastest 5G SA median download speeds in Q4 2025 at 1.13 Gbps, nearly five times that of Europe. The UAE alone reached a median of 1.24 Gbps on SA networks, a speed that would be considered exceptional even for full-fiber broadband in developed markets. The deployment of four-carrier aggregation and enhanced MIMO technology, coupled with the strategic allocation of premium mid-band spectrum to the SA network, demonstrates the performance ceiling that a fully realized 5G SA architecture can achieve.

- South Korea followed at 767 Mbps, driven by wide 3.5 GHz channel bandwidth, with the U.S. at 404 Mbps following the completion of nationwide SA deployments by all three Tier-1 operators. Europe, at 205 Mbps, trails all developed regions, though the region’s SA networks still deliver a 45% download speed premium over NSA, confirming the performance value of the SA transition where material spectrum depth is allocated.

Europe’s 5G SA sample share more than doubled from 1.1% to 2.8% between Q4 2024 and Q4 2025, driven by accelerated deployments in Austria (8.7%), Spain (8.3%), the United Kingdom (7.0%), and France (5.9%). These four markets now account for the vast majority of European SA connections. The United Kingdom and France registered the strongest year-on-year acceleration in Europe, each gaining 5.3 percentage points, reflecting the impact of investment-linked merger conditions and competition in the United Kingdom, as well as targeted R&D policy support in France.

Among European markets, France (41ms to cloud endpoints), Austria (48ms), and Finland (50ms) demonstrate what is achievable where backbone quality, peering density, and routing discipline are strong. These outcomes reflect an underappreciated end-to-end network stack optimization dividend, encompassing data-center proximity, fiber backhaul depth, and user-plane topology, rather than a pure “SA dividend” alone.

However, Europe still trails North America by 27% and emerging Asia by 30%. At the global level, the U.S. remains the largest accelerator in absolute terms over the last year, with SA sample share rising 8.2 percentage points to 31.6% year-on-year, driven by the sequential rollout of SA across all Tier-1 operators beyond T-Mobile. Firmware fragmentation, where handset OEMs gatekeep SA network access pending individual carrier certification, and tariff structures that fail to incentivize migration from NSA, remain the primary barriers to faster European adoption.

The report also presents early evidence that battery life is a tangible consumer benefit of 5G SA. In the UK, devices on EE’s 5G SA network recorded median discharge times approximately 22% longer than those on 5G NSA, with O2 showing an 11% advantage. These gains likely stem from features like SA’s unified control plane, which eliminates the dual-connectivity overhead of NSA configurations.

Consumer strategies now span speed tiers (primarily Europe), 5G network slicing (Singapore, France, and the U.S.), and 5G Advanced segmentation packages (China). Enterprise 5G network slicing presents the much larger long-term revenue opportunity, with T-Mobile’s SuperMobile representing the first nationwide commercial B2B slicing service in the U.S. Countries with coordinated regulatory frameworks, implementing clear coverage obligations, investment incentives, or infrastructure consolidation policies with deployment remedies, consistently outperform those with fragmented or reactive approaches, reinforcing the report’s finding that policy has emerged as a primary competitive differentiator in 5G SA outcomes globally.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

MCN Market Roared Back in 2025 With 15 Percent Growth, According to Dell’Oro Group

https://www.ookla.com/articles/5g-sa-2026

Dell’Oro: RAN market stable, Mobile Core Network market +14% Y/Y with 72 5G SA core networks deployed

AT&T deploys nationwide 5G SA while Verizon lags and T-Mobile leads

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

Téral Research: 5G SA core network deployments accelerate after a very slow start

Google Fiber and Nokia demo network slicing for home broadband in GFiber Labs

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

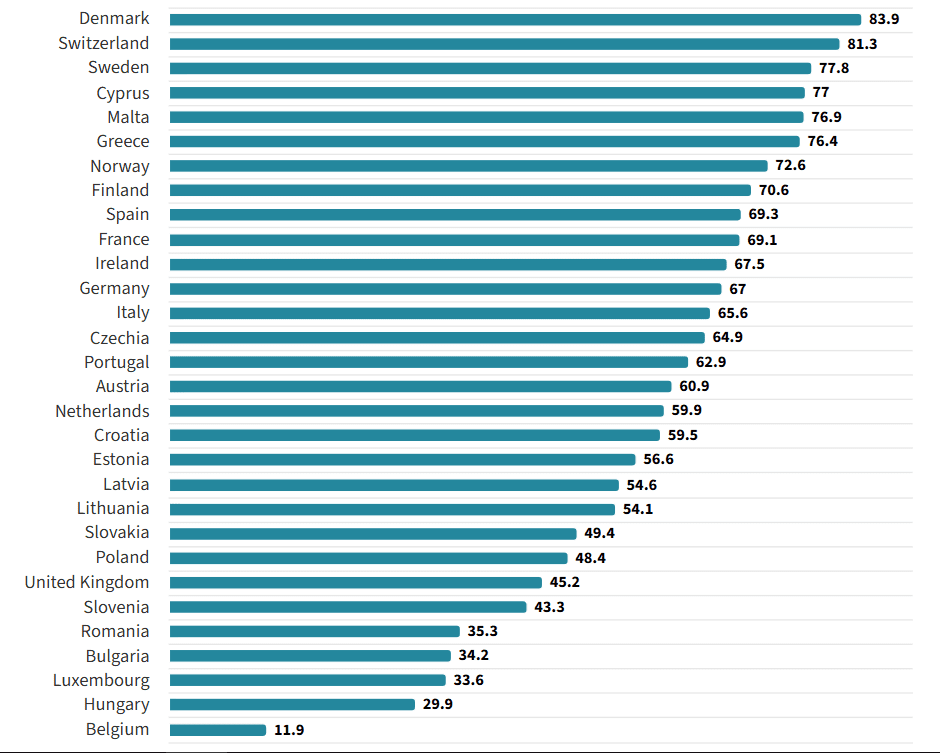

According to Ookla, Europe is a “two-speed” 5G competitiveness landscape,” with some countries surging ahead and others falling well behind, In Q2-2025, Nordic and southern Europe countries maintained a substantial lead in 5G availability, helped by recent 700MHz band deployments in countries such as Sweden and Italy. By contrast, 5G availability in central and western European laggard countries such as Belgium, the UK and Hungary remains less than half that of the 5G pacemakers, says the study. On average, mobile subscribers in the EU spent 44.5% of their time connected to 5G networks in Q2 2025, up from 32.8% a year earlier.

The deployment and adoption of 5G SA in Europe remain sluggish, increasing slowly from a very low base and further widening the region’s gap with North America and Asia. Spain stands out as a clear leader in 5G SA deployment, reaching an 8% Speedtest® sample share compared with the EU average of just 1.3% as of Q2 2025. This progress has been driven by Spain’s proactive use of EU recovery funds to subsidize 5G SA rollouts in underserved areas, with a particular focus on bridging the rural-urban digital divide. However, the U.S. and China are still far ahead, with 5G SA sample shares above 20% and 80% respectively, reflecting a much greater pace of coverage and adoption in those markets.

Northern Europe Maintains 5G Availability Lead – Speed Test Intelligence Q2-2025:

Fragmented 5G Availability across Europe is driven by a complex mix of national policies on spectrum assignment and broader economic factors, rather than by simple geographic or demographic differences. 5G Availability is more strongly correlated with policy-driven factors such as spectrum allocation timelines and costs, coverage obligations, subsidy mechanisms, and regulations for infrastructure sharing and permitting, than with structural factors like urbanization rates or the number of operators. This indicates that 5G competitiveness is shaped less by technology gaps or inherent market imbalances and more by effective policy execution.

Northern Europe Maintains 5G Availability Lead; Other Countries Lag:

Fragmentation remains a persistent theme, shaping stark 5G deployment asymmetries that cannot be explained by geography or demographics alone. Northern and Southern European countries such as Denmark (83.9%), Sweden (77.8%), and Greece (76.4%) are disproportionately represented among the countries with the highest 5G Availability in Q2 2025, with coverage rates up to twice as high as those in Western and Eastern countries like the United Kingdom (45.2%), Hungary (29.9%), and Belgium (11.9%).

Low-band deployment and DSS use continue to lift 5G availability in lagging countries:

Recent advances in 5G Availability have been driven by low-band deployments and the use of DSS, raising the average proportion of time spent on 5G networks in the EU from 32.8% in Q2 2024 to 44.5% in Q2 2025. The pace of coverage growth, and the corresponding increase in 5G usage, has primarily reflected each country’s starting point. Lagging countries like Latvia, Poland, and Slovenia have seen double-digit gains in 5G Availability from a low base. By contrast, leading countries such as Switzerland and Denmark, where 5G coverage is now nearly ubiquitous, have shifted their focus to targeted capacity upgrades through site densification and mid-band expansion.

About Ookla:

Ookla, a global leader in connectivity intelligence, brings together the trusted expertise of Speedtest®, Downdetector®, Ekahau®, and RootMetrics® to deliver unmatched network and connectivity insights. By combining multi-source data with industry-leading expertise, we transform network performance metrics into strategic, actionable insights. Solutions empower service providers, enterprises, and governments with the critical data and insights needed to optimize networks, enhance digital experiences, and help close the digital divide. At the same time, we amplify the real-world experiences of individuals and businesses that rely on connectivity to work, learn, and communicate. From measuring and analyzing connectivity to driving industry innovation, Ookla helps the world stay connected.

Ookla is a division of Ziff Davis, a vertically focused digital media and internet company whose portfolio includes leading brands in technology, entertainment, shopping, health, cybersecurity, and martech.

……………………………………………………………………………………………………………………………………………………………………………………

Mobile Matters report from communications regulator Ofcom discusses 5G’s share of network connections in UK. Ofcom’s analysis – based on crowdsourced data collected by Opensignal and covering the period October 2024 to March 2025 – showed that 28% of connections were on 5G, with 71% still on 4G, 0.7% on 3G and a holdout 0.2% on 2G. In terms of mobile network operators, BT-owned EE had the highest proportion of network connections on 5G, at 32%, while Vodafone had the lowest, at 24%. O2, which is now the mobile arm of Virgin Media, had the lowest share of 4G connections (68%) and the highest proportion on 3G (3%).

5G standalone vs 5G non-standalone performance:

• 5G standalone (SA) accounted for 2% of all 5G connection attempts in the six months to March 2025. UK MNOs have started to offer 5G SA but its use is currently low.

• Standalone 5G’s average response time (latency) was about 15% lower (better) than for 5G NSA. However, our analysis also indicated that 5G SA had a lower average connection success rate (95.9%) than 5G NSA (97.6%), although this was slightly higher than 4G’s.

• 5G SA provided significantly higher download speeds than 5G NSA. Seventy per cent of 5G SA download speeds measurements were at 100 Mbit/s or higher, compared to 46% for 5G NSA, and 2MB, 5MB and 10MB file download times, on average, were about 45% faster on 5G SA than over 5G NSA.

• The picture was more mixed for uploads. While 5G NSA had a higher proportion of low-speed connections (18% of 5G NSA upload speeds provided less than 2 Mbit/s compared to 10% on 5G SA) it also had a slightly higher share of higher-speed connections (30% of 5G NSA uploads were 20 Mbit/s or higher vs 28% on 5G SA).

References:

https://www.ookla.com/articles/europe-5g-q2-2025

Ookla: Europe severely lagging in 5G SA deployments and performance

Téral Research: 5G SA core network deployments accelerate after a very slow start

Ookla: Europe severely lagging in 5G SA deployments and performance

According to a new joint study from Omdia and Ookla, Europe has had the poorest 5G SA availability and performance among major regions. In Q4 2024, China (80%), India (52%), and the United States (24%) led the world in 5G SA availability based on Speedtest® sample share, markedly ahead of Europe (2%).

The European region also lagged behind its peers in performance, with the median European consumer experiencing 5G SA download speeds of 221.17 Mbps—lower than those in the Americas (384.42 Mbps) and both Developed (237.04 Mbps) and Emerging (259.73 Mbps) Asia Pacific. The interplay of earlier deployments, a more diversified multi-band spectrum strategy, and greater operator willingness to invest in the 5G core to monetize new use cases have driven rollouts at a faster pace in regions outside Europe.

The European Commission has championed measures to accelerate private investment in 5G SA, highlighting network slicing—a flagship capability of cloud-native core networks—as a key potential driver of its broader industrial strategy in sectors such as precision manufacturing, defense and clean energy. Up until this point, high-quality public data examining Europe’s progress in 5G SA—and benchmarking its competitive position relative to other global regions—has been scarce. In its latest annual report, Connect Europe, the trade body representing Europe’s telecoms operators, noted that “there is limited information available about the extent of operators’ rollout of 5G SA.”

Advanced network capabilities enabled by the technology remain stubbornly limited to just a few operators in leading markets such as the U.S., according to the study, while Europe lags behind its peers on several 5G SA performance indicators, “raising concerns about the bloc’s competitiveness in the technology.”

Network operator investment per capita also lags in Europe as per the below chart:

When faced with choices among investments in fiber, 5G RAN, and 5G SA core, the latter frequently loses out, since operators can still launch a “5G” network by leveraging alternative technologies. There is also a lack of 5G SA-compatible devices, especially devices with User Equipment Routing Selection Policy (URSP) technology, which allows a device to dynamically select a slice (or multiple slices) provisioned by an operator. However, only Android 12/iOS 17 mobile devices support that largely unknown technology.

While capital spending on the 5G core transition is now increasing rapidly, European network operators will remain committed to strict cost discipline Based on Omdia’s Q3 2024 quarterly core software market share and forecast, the research firm believes that the global core market revenue from both 4G and 5G network functions will grow with a five-year CAGR of 3.2% between 2023 and 2028. When considering the spending in 5G core software, the forecasted growth with a five-year CAGR during the same period is of 17.0%.

Omdia now forecasts that 5G SA core spending in EMEA will grow with a five-year CAGR of 26.2% between 2023 and 2028. Nonetheless, as a prerequisite, deploying the 5G core also requires a good 5G radio coverage, to avoid a degraded experience where the 5G coverage is limited or nonexistent, and where the user falls back on 4G-LTE or 2G/3G. This means operators must invest in 5G RAN, which is usually considered the highest capex draining activity for an operator. While 5G is known for very high throughput speeds using mid-band (and particularly C-band) spectrum, these bands need to be complemented by sub-GHz spectrum deployment, in order to offer improved in-building and wide area coverage. This rollout has been slow in many European markets, with 5G availability in all countries outside the Nordics remaining significantly lower than that in the United States and China, according to Ookla’s Q4 2024 Speedtest Intelligence® data.

One bright spot is that Europe has made progress on achieving low latency on its 5G networks. In Q4 2024, the average country-wide median latency in Europe was 32 milliseconds (ms) compared to 35 ms in the Americas and 36 ms in Emerging Asia Pacific region.

References:

https://www.lightreading.com/5g/eurobites-europe-behind-on-5g-sa-study

https://www.ookla.com/s/media/2025/02/ookla_omdia-5GSA_0225.pdf

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

Nokia and Eolo deploy 5G SA mmWave “Cloud RAN” network

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

Highlights of Ookla’s 1st Half 2024 U.S. Connectivity Report

Ookla reported that:

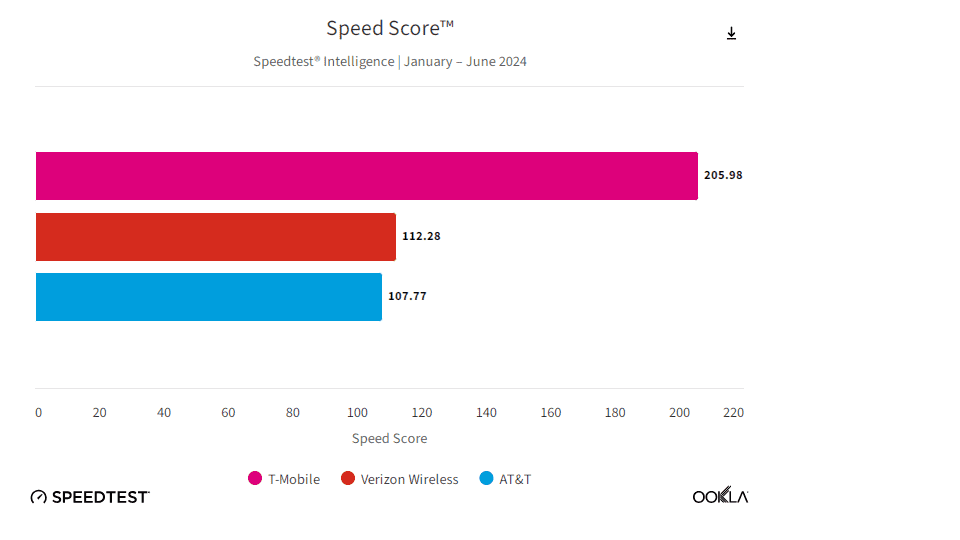

- 5G continues to expand (but without new 5G SA core network deployments), with T-Mobile leading on top-line performance, and the rest of the market playing catch-up. Fixed broadband speeds are also on the rise, driven by greater fiber deployment, and cable technology upgrades.

- T-Mobile continues to dominate the mobile landscape in the U.S., boasting the fastest speeds, best consistency, and top user ratings. T-Mobile was the fastest mobile provider in the U.S. during this period, based on Speedtest Intelligence® data for all technologies combined, with a Speed Score (which is NOT an actual speed) of 205.98. Its median download speed was 234.82 Mbps, a strong increase from 164.14 Mbps during the same period the previous year.

- Verizon Wireless and AT&T were runners up, with both driving increases in median download speeds.

- T-Mobile also led on median upload speed, with 13.30 Mbps, and on latency, with 48 ms.

- Connecticut topped the state rankings for fixed broadband download speeds, with a median almost 160 Mbps faster than last placed Alaska. Mobile was a similar story, with Illinois leading, some 120 Mbps faster than Alaska.

- Pittsburgh, Pennsylvania had the fastest median mobile download speed among the 100 most populous cities in the U.S. at 321.06 Mbps. Kansas City, Missouri was second; Raleigh, North Carolina was third; Indianapolis, Indiana fourth; and Nashville, Tennessee was fifth.

- Anchorage, Alaska had the slowest median mobile download speed at 58.63 Mbps. Reno, Nevada was second slowest; Honolulu, Hawaii third slowest; Orlando, Florida fourth slowest; and Toledo, Ohio was fifth slowest.

- T-Mobile was the fastest provider in 73 of the 100 most populous cities in the U.S.. Verizon Wireless was the fastest provider in Denver, Colorado; El Paso, Texas; Henderson, Nevada; Hialeah, Florida; Miami, Florida; and Newark, New Jersey. AT&T was fastest in San Francisco, California. Results were statistically too close to call in 20 cities.

- Verizon has started making inroads on performance, and recorded the best 5G Gaming Experience (who cares about that?).

- AT&T Fiber led in speed and consistency, while Verizon was best for video and gaming experiences.

“With this report, there should now be no doubt that T-Mobile has reigned as the nation’s network champion for years,” said Ulf Ewaldsson, president of technology at T-Mobile. “As 5G solutions continue to evolve, we will be right there, driving the industry forward as we have done since launching the first nationwide 5G network in 2019.”

In a separate report last month, Ookla noted that T-Mobile in March gained access to additional 2.5-GHz spectrum it won at auction 108 in 2022. Similarly, AT&T and Verizon have both benefited from the recent early vacation of C-band spectrum by satellite providers. Furthermore, AT&T acquired additional 3.45-GHz licenses that it won at auction 110 in January 2022.

“Speedtest Intelligence data shows a clear correlation between the release of additional mid-band spectrum, 5G performance, and consumer sentiment for 5G networks, with all three national wireless providers benefiting over the past six months,” said report author Mark Giles, lead industry analyst at Ookla. As a result, he expects 2024 “to drive renewed competitive pressure” between all US service providers.

References:

https://www.ookla.com/research/market-reports/united-states-speedtest-connectivity-report-h12024

https://www.telecoms.com/5g-6g/t-mobile-tops-another-speed-test-as-mid-band-spices-up-the-us

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

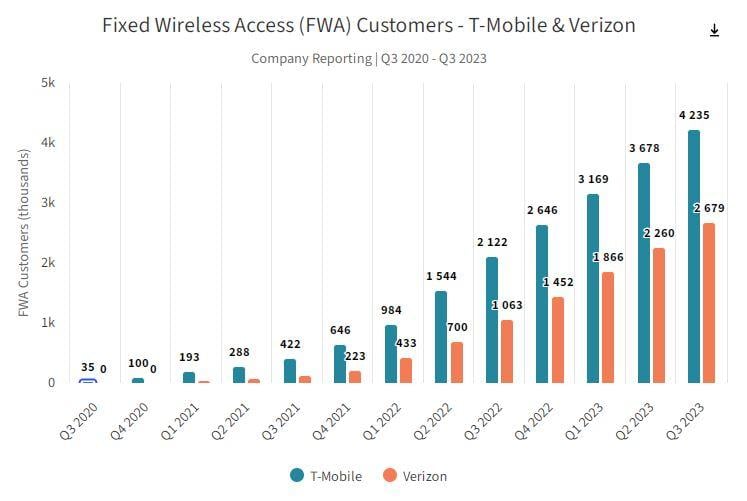

The U.S. is at the forefront of fixed wireless access (FWA) deployments, with many major wireless carriers, including T-Mobile, Verizon, AT&T and UScellular targeting expansion.

T-Mobile has built up a lead in terms of 5G fixed-wireless market share, with Verizon following closely, and AT&T recently launching a new FWA service – AT&T Internet Air. We examined Ookla Speedtest data to understand how FWA performance is evolving in the U.S., and how it is impacting churn in the market.

Key Points:

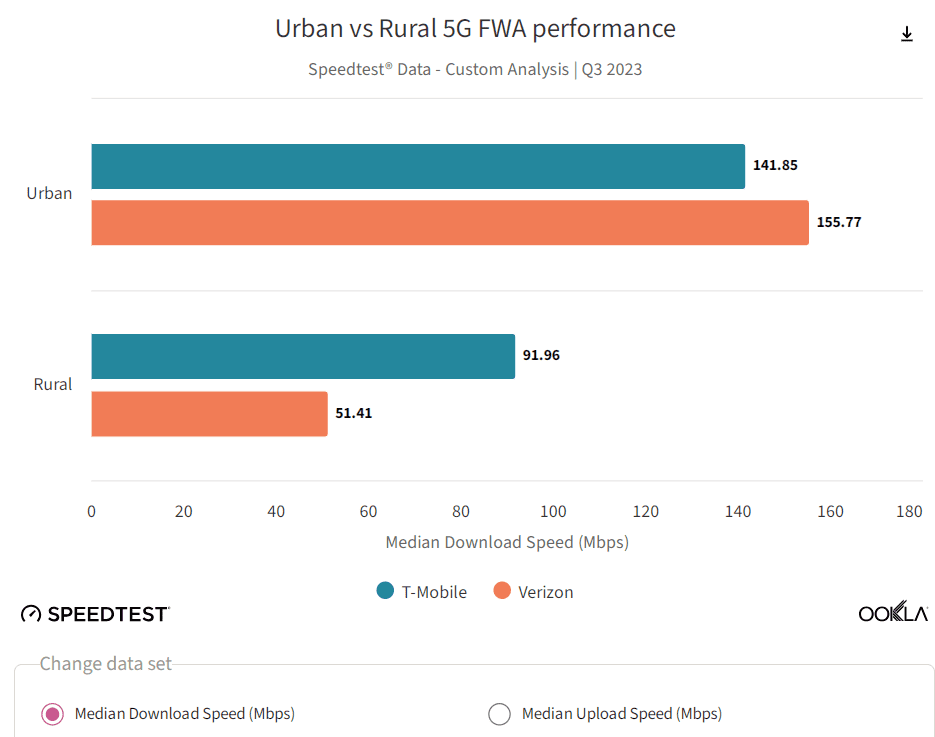

- T-Mobile & Verizon 5G FWA performance holding up well nationally. Despite strong customer growth, both T-Mobile and Verizon have maintained performance levels over the past year according to Speedtest data. Both ISPs recorded similar median download speeds in Q3 2023, although T-Mobile maintains an edge on median upload performance. Despite this, there are significant differences in performance at a State-level, and for urban versus rural locations.

- Cable & DSL providers bear the brunt of user churn. The FWA value proposition is clearly resonating most with existing cable and DSL customers, which make up the vast bulk of churners to both T-Mobile’s and Verizon’s FWA services. It’s not one-way traffic however, with T-Mobile’s larger user base in particular showing some attrition to cable providers. In rural locations where options are more limited, FWA services are increasingly going head to head, with over 10% of users joining Verizon’s FWA service coming from T-Mobile.

- Clear signs that download performance could be a key contributor to churn in the market. Our analysis of the customers of major ISPs in the US that have churned to T-Mobile’s FWA service shows that their median download performance before churning was below the median performance of all customers of these ISPs, indicating a performance short-fall that is likely contributing towards churn.

- Further C-band spectrum will serve to strengthen FWA’s case. The release and deployment of additional C-band spectrum for all three national cellular carriers, and AT&T’s new FWA service will drive further performance gains, and further competitive pressure in 2024.

T-Mobile and Verizon FWA scaling strongly and national performance holding up well:

Launched during the COVID-19 pandemic, FWA services from T-Mobile and Verizon have seen strong growth over the past three years. Aided by disruptive pricing strategies, no annual contracts, and ease of installation (self-install), net additions remain strong for both ISPs. T-Mobile’s current FWA plan retails for $50/month, but that falls to $30/month for customers subscribing to its Magenta MAX mobile plan. Verizon prices at a slight premium to T-Mobile, with its FWA service currently retailing for $60/month, but falling to $35/month with select 5G mobile plans. On the back of their success we’ve also recently seen AT&T update its FWA strategy, launching AT&T Internet Air in August 2023, with a similar pricing strategy.

Utilizing the same 5G spectrum that its mobile customer base accesses, both T-Mobile and Verizon have been at pains to point out how they manage the on-boarding of new FWA customers, in order to limit any negative impact on performance for both cellular and FWA customers. The release and rollout of additional C-band spectrum for all three operators will provide extra headroom and the potential for improved 5G FWA performance, while T-Mobile has begun testing 5G Standalone mmWave, and has indicated that this could be utilized for 5G FWA in the future.

Performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs. The median download speed across the US for all fixed providers combined in Q3 2023 was 207.42 Mbps. T-Mobile has recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, down from 19.76 Mbps in Q4 2022, to 17.09 Mbps in Q3 2023. Verizon on the other hand improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps.

Ookla’s Speedtest data was used to identify the number of churned users since Q2 2022, when FWA services really started to scale and impact the rest of the market. The bulk of churn for both T-Mobile’s and Verizon’s 5G FWA services are coming from cable and DSL providers, confirming what the service providers have said.

The market research firm said that performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs.

Ookla clocked the median download speed across the U.S. for all fixed providers combined in Q3 2023 at 207.42 Mbps. T-Mobile recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, from 19.76 Mbps in Q4 2022 to 17.09 Mbps in Q3 2023.

Meanwhile, Verizon improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps, Ookla said.

While median performance has remained fairly steady for both operators over the past year, Ookla said it’s a different story when it comes to regional performance and between urban and rural regions.

Rural locations – predictably – fared worse than urban locations for both T-Mobile and Verizon 5G FWA service, given differences in spectrum availability and distance from cell sites, although the difference was starker for Verizon’s FWA service, Ookla said. Verizon’s FWA service recorded a median of 155.77 Mbps in urban locations during Q3 2023, but only 51.41 Mbps in rural locations.

T-Mobile increased rural FWA performance, from 82.20 Mbps in Q4 of 2022 to 91.96 Mbps in Q3 2023. Verizon’s performance in urban locations improved, with the 155.77 Mbps it achieved in Q3 2023 representing a sizable increase on the 125.55 Mbps it recorded in Q4 2022.

All of the big mobile operators, including AT&T with Internet Air, will see improved 5G FWA performance with additional C-band spectrum, and T-Mobile could potentially use millimeter wave on its 5G standalone (SA) network for FWA, Ookla noted.

References:

https://www.ookla.com/articles/fixed-wireless-access-us-q3-2023

https://www.fiercewireless.com/wireless/t-mobile-verizon-5g-fwa-performance-holds-ookla

Ookla Q2-2023 Mobile Network Operator Speed Tests: T-Mobile is #1 in U.S. in all categories!

Ookla’s U.S. Mobile and Wireline Speed Overview:

T-Mobile was the fastest mobile operator with a median download speed of 164.76 Mbps. T-Mobile also had the fastest median 5G download speed at 220.00 Mbps, and lowest 5G multi-server latency of 51 ms.

Spectrum edged out Cox as the fastest fixed wireline broadband provider with a median download speed of 243.02 Mbps. Verizon had the lowest median multi-server latency on fixed broadband at 15 ms.

Source: Ookla

……………………………………………………………………………………………………………………….

Ookla’s Speedtest Intelligence® reveals T-Mobile was the fastest mobile operator in the United States during Q2 2023 with a median download speed of 164.76 Mbps on modern chipsets, a slight decline from 165.22 Mbps during Q1 2023. Verizon Wireless and AT&T were distant runners up and both saw minor declines in download speed.

T-Mobile had the fastest median upload speed among top mobile operators in the U.S. at 12.16 Mbps during Q2 2023. Verizon Wireless was second and AT&T finished third.

Calculating median multi-server latency for the three top mobile operators in the U.S. during Q2 2023, T-Mobile had the lowest multi-server latency at 54 ms. Verizon Wireless was a close second at 58 ms. AT&T was third at 63 ms. As latency becomes an increasingly important measure, we’ll be sure to watch latency metrics closely.

In measuring the Consistency of each operator’s performance, we found that T-Mobile had the highest Consistency in the U.S. during Q2 2023, with 86.1% of results showing at least 5 Mbps download and 1 Mbps upload speeds. Verizon Wireless and AT&T followed at 81.5% and 79.2%, respectively.

In measuring the Video Score of each mobile operator’s video performance, we found that T-Mobile had the highest Video Score in the U.S. at 74.39 during Q2 2023. Verizon Wireless was a close second at 70.89 and AT&T was third at 68.16.

Looking at the 5G Video Score of each operator’s video performance over a 5G connection, T-Mobile had the highest 5G Video Score in Q2 2023 at 78.70. Verizon Wireless recorded a 5G Video Score of 77.39 and AT&T had a score of 70.40.

Looking only at tests taken on a 5G connection, T-Mobile had the fastest median 5G download speed in the U.S. at 220.00 Mbps during Q2 2023, in line with its performance during Q1 2023. Verizon Wireless remained second and saw a slight increase to 133.50 Mbps in Q2 2023. AT&T remained third at 86.01 Mbps. The bars shown in the chart below are 95% confidence intervals, which represent the range of values in which the true median is likely to be. For a complete view of commercially available 5G deployments in the U.S. to-date, visit the Ookla 5G Map™.

Our mobile 5G multi-server latency results in Q2 2023 showed that among top providers, T-Mobile registered the lowest median 5G multi-server latency in the United States. Latency was a tight race, but our testing showed that with a median value of 51 ms, T-Mobile users saw better multi-server latency values than those of their nearest competitor, Verizon Wireless (53 ms).

In measuring the Consistency of each operator’s performance over a 5G connection in the U.S. during Q2 2023, we found that there was no statistical winner for highest 5G Consistency.

Our analysis of the most popular devices in the U.S. during Q2 2023 showed no statistical winner for fastest median download speed, with the Samsung Galaxy S23 Ultra and Samsung Galaxy Z Fold4 both recording similar speeds, followed by the Google Pixel 7 Pro, the Apple iPhone 14 Pro Max, and the Samsung Galaxy S22 Ultra.

We examined combined performance by major cell phone manufacturers and found that Samsung devices had the fastest median download speed in the U.S. at 90.83 Mbps during Q2 2023. Apple followed at 75.65 Mbps.

Looking at popular chipsets in the U.S., Ookla found no statistical winner for median download performance between Qualcomm’s Snapdragon 8 Gen 2 at 141.58 Mbps and its previous generation Snapdragon 8+ Gen 1 at 136.85 Mbps. Qualcomm’s Snapdragon X65 5G registered a median download speed of 125.05 Mbps, Google’s Tensor G2 was next on the list at 124.77 Mbps, while Qualcomm’s Snapdragon 8 Gen 1 followed at 117.59 Mbps.

Kansas City, Missouri had the fastest median mobile download speed among the 100 most populous cities in the U.S. at 151.15 Mbps during Q2 2023. Scottsdale, Arizona was second; Columbus, Ohio was third; Plano, Texas fourth; and St. Paul, Minnesota was fifth.

Reno, Nevada had the slowest median mobile download speed among the U.S.’s 100 most populous cities during Q2 2023 at 51.06 Mbps. Anchorage, Alaska was second slowest; Lincoln, Nebraska third slowest; Laredo, Texas fourth slowest; and Tulsa, Oklahoma was fifth slowest.

T-Mobile was the fastest operator in 87 of the 100 most populous cities in the U.S. during Q2 2023. Verizon Wireless was the fastest provider in El Paso, Texas, and results were statistically too close to call in 12 cities.

References:

https://www.speedtest.net/global-index/united-states#market-analysis

Ookla: Fixed Broadband Speeds Increasing Faster than Mobile: 28.4% vs 16.8%

Ookla: State of 5G Worldwide in 2022 & Countries Where 5G is Not Available

Ookla Ranks Internet Performance in the World’s Largest Cities: China is #1

Ookla: Fixed Broadband Speeds Increasing Faster than Mobile: 28.4% vs 16.8%

A new report from Ookla shows that fixed broadband speeds are gaining faster than mobile speeds globally. Speedtest Global Index™, tracks countries’ internet speeds and the overall global median internet speeds which are increasing across the world as countries continue to invest in fiber and 5G. Fixed broadband download speeds increased by 28% over the past year. That’s compared to a nearly 17% increase for mobile speeds, according to Speedtest Global Index™ data from November 2021 to November 2022.

Here are selected charts from their report:

Ookla is excited to see how global speeds and rankings change over the next year as individual countries and their providers choose to invest and expand different technologies, particularly in 5G and fiber. Be sure to track your country’s and check in on our monthly updates on the Speedtest Global Index. If you want more in-depth analyses and updates, subscribe to Ookla Insights™.

References:

https://www.ookla.com/articles/global-index-internet-speed-growth-2022

Ookla: State of 5G Worldwide in 2022 & Countries Where 5G is Not Available

Performance analysis of big 3 U.S. mobile operators; 5G is disappointing customers

Ookla: State of 5G Worldwide in 2022 & Countries Where 5G is Not Available

Executive Summary:

In a new blog post, Ookla asseses The State of Worldwide 5G in 2022. The market research firm examined Speedtest Intelligence® data from Q3 2022 Speedtest® results to see how 5G performance has changed since last year, where download speeds are the fastest at the country level, and how satellite technologies are offering additional options to connect. Ookla also looked at countries that don’t yet have 5G to understand where consumers are seeing improvements in 4G LTE access.

Editor’s Note: for some unknown reason, China is not included in Ookla’s report

- 5G speeds were stable at the global level with:

a] Median global 5G download speed of 168.27 Mbps in Q3 2022 as compared to 166.13 Mbps in Q3 2021

b] Median upload speed over 5G slowed slightly to 18.71 Mbps (from 21.08 Mbps) during the same period

- Ookla® 5G Map™: 127,509 5G deployments in 128 countries as of November 30, 2022, compared to 85,602 in 112 countries the year prior

- South Korea and the United Arab Emirates led countries for 5G speeds

- 5G Availability points to on-going challenges

5G Availability measures the proportion of Speedtest users with 5G-capable handsets, who spend a majority of time connected to 5G networks. It’s therefore a function of 5G coverage and adoption. We see wide disparity in 5G Availability among markets worldwide, with for example the U.S. recording 54.3% in Q3 2022, well ahead of markets such as Sweden and the U.A.E., with 8.6% and 8.3% respectively.

Critical levers for mobile operators to increase 5G Availability include:

- Increasing 5G coverage by deploying additional base stations

- Obtaining access to, or refarming, sub-GHz spectrum, to help broaden 5G coverage, as sub-GHz spectrum has superior propagation properties than that of higher frequency spectrum bands.

- Encouraging 5G adoption among users with 5G-capable handsets.

Speedtest Intelligence points to 5G adoption challenges in some markets, with 5G Availability dropping in Bulgaria, South Korea, the Netherlands, and the U.A.E. As more users acquire 5G-capable devices, operators need to balance their pricing models to ensure users have sufficient incentives to purchase a 5G tariff.

Countries where 5G is not readily available:

Speedtest Intelligence showed 29 countries in the world where more than 20% of samples were from 2G and 3G connections (combined) during Q3 2022 and met our statistical threshold to be included (down from 70 in Q3 2021). These are mostly countries where 5G is still aspirational for a majority of the population, which is being left behind technologically, having to rely on decades-old technologies that are only sufficient for basic voice and texting, social media, and navigation apps. We’re glad to see so many countries fall off this list, but having so many consumers on 2G and 3G also prevents mobile operators from making 4G and 5G networks more efficient. If operators and regulators are able to work to upgrade their users to 4G and higher, everyone will benefit.

Countries That Still Rely Heavily on 2G and 3G Connections

Speedtest IntelligenceⓇ | Q3 2021

| Country | 2G & 3G Samples |

|---|---|

| Central African Republic | 76.2% |

| Turkmenistan | 58.5% |

| Kiribati | 51.6% |

| Micronesia | 47.4% |

| Rwanda | 41.1% |

| Belarus | 39.7% |

| Equatorial Guinea | 37.7% |

| Afghanistan | 36.7% |

| Palestine | 33.5% |

| Madagascar | 27.5% |

| Sudan | 27.4% |

| Lesotho | 26.5% |

| South Sudan | 26.3% |

| Benin | 26.0% |

| Guinea | 25.5% |

| Cape Verde | 24.3% |

| Tonga | 24.3% |

| Syria | 23.4% |

| The Gambia | 23.4% |

| Ghana | 23.3% |

| Palau | 22.9% |

| Niger | 22.8% |

| Tajikistan | 22.7% |

| Mozambique | 22.4% |

| Guyana | 21.8% |

| Togo | 21.8% |

| Congo | 21.1% |

| Moldova | 20.8% |

| Saint Kitts and Nevis | 20.0% |

Conclusions:

Ookla was glad to see performance levels normalize as 5G expands to more and more countries and access improves and we are optimistic that 2023 will bring further improvements. Keep track of how well your country is performing on Ookla’s Speedtest Global Index™ or track performance in thousands of cities worldwide with the Speedtest Performance Directory™.

References:

Performance analysis of big 3 U.S. mobile operators; 5G is disappointing customers

Speedtest Intelligence® from Ookla reveals T-Mobile was the fastest mobile operator in the United States during Q1 2021 with a Speed Score™ of 50.21 on modern chipsets. AT&T was second and Verizon Wireless third.

Note that this is the first quarter Ookla is reporting on the country as a whole, rather than using competitive geographies. Ookla says that expanding its focus to include rural areas will show drops in performance, decreasing speed and increasing latency when compared with prior reports.

In Q1 2021, T-Mobile had the fastest median 5G network download speed in the U.S. at 82.35 Mbps. AT&T was second at 76.60 Mbps and Verizon Wireless third at 67.24 Mbps. For a complete view of commercially available 5G deployments in the U.S. to-date, visit the Ookla 5G Map™.

Ookla discovered that during Q1 2021 that T-Mobile subscribers with 5G-capable devices were connected to a 5G service 65.4% of the time. 5G “time spent” on Verizon Wireless’ network was at 36.2% and at 31% on AT&T’s network.

In measuring each operator’s ability to provide consistent speeds, Ookla found that T-Mobile had the highest Consistency Score™ in the U.S. during Q1 2021, with 84.8% of results showing at least 5 Mbps download and 1 Mbps upload speeds. AT&T was second and Verizon Wireless third. All three U.S. mobile carriers were above 80% in terms of consistency.

Here’s the current status of Worldwide median 5G Speeds as of Q3-2022:

…………………………………………………………………………………………………………………………………..

Earlier this week a new report from becnhmarking company Rootmetrics found that T-Mobile US is leading in 5G availability across U.S. cities. Rootmetrics found that AT&T’s 5G provides the best performance, and AT&T and Verizon both won high marks for 5G reliability.

“While we’ve seen strong and improving 5G availability and speeds from the carriers in many cities, it’s important to keep in mind that with the major U.S. networks utilizing different types of spectrum for 5G, the 5G availability and speeds that consumers experience can vary a great deal for different carriers across or even within different markets,” Rootmetrics concluded.

Rootmetrics tested 5G networks in 45 cities across the U.S. between January and March of this year. It recorded at least some 5G availability from all three carriers in nearly all of them. T-Mobile US was the only carrier with a 5G network presence in all 45 of the cities, AT&T had 5G service in 44 out of the 45, and Rootmetrics saw 5G availability for Verizon in 43 out of the 45 cities.

The availability of T-Mobile’s 5G was one common theme across both testing reports. Rootmetrics’ testing, conducted in the first half of 2021, said that T-Mobile had 5G availability in all 45 of the markets it tested and showed the highest percentages of 5G availability in the most markets: More than 55% availability in 30 markets, with the lowest tested market being Sarasota, FL, where Rootmetrics’ testing showed T-Mo 5G available for a device to connect to only about 19% of the time.

…………………………………………………………………………………………………………………………………………

Separately, Light Reading’s Mike Dano writes that “AT&T, Verizon and T-Mobile offer unlimited 5G disappointment.” In a subhead titled, “T-Muddle” Dano writes:

In 2019, T-Mobile boasted that “5G speed will be up to 10x faster, compared to LTE.” But when it first launched its 5G network on its lowband 600MHz spectrum, speeds were only 20% faster than its LTE network. Then, after T-Mobile closed its acquisition of Sprint’s 2.5GHz midband spectrum, it quickly began offering 5G speeds up to 1Gbit/s. The operator even debuted a new 5G lexicon for its offerings: “5G Ultra Capacity” refers to its speedy 2.5GHz network, while “Extended Range 5G” refers to its slower 600MHz network.

So it would stand to reason that customers might want to see which flavor of T-Mobile 5G they can access, right? A quick check of T-Mobile’s coverage map reveals none of these details. The operator only offers a generic “5G” coverage layer that does not provide details about whether it’s 600MHz or 2.5GHz. One is slightly faster than LTE while the other provides average speeds of 300Mbit/s. Prospective T-Mobile customers are left in the dark.

T-Mobile isn’t the only operator seemingly content to hide behind 5G obfuscation. AT&T has debuted no fewer than three different 5G brands – 5G+, 5Ge and 5G – yet it does not offer any details to prospective customers about how it might charge for those offerings. The operator’s pricing plans mention only “5G” and do not specify whether that means 5G+, 5Ge or 5G, or all three.

Regarding Verizon’s 5G pricing plans, Dano stated:

The operator offers a truly dizzying array of 5G plans and pricing options – one observer described Verizon’s pricing plans as “a series of nesting dolls.”

In 5G, Verizon is reserving its faster “Ultra Wideband” technology only for its expensive unlimited plans. Customers on its cheapest Start Unlimited plan can either pay $10 extra for 5G specifically, or they can spend that same $10 to upgrade to a more expensive unlimited plan that offers 5G as well as other goodies, such as more mobile hotspot data. Why the two different upgrade options? “We always like to give customers choices,” explained a Verizon spokesperson.

But what that really means is that customers are simply left to fend for themselves. They’re left to pick from among a dizzying number of pricing options, all promising “unlimited” data, but all limiting that data in various ways. Customers are left to figure out why messages from iPhones to Android phones won’t show delivery receipts. They’re left to discover why they’re still receiving robocalls, and what they might need to do to block them. They’re left to uncover what kind of 5G they can get and whether it’s any different from 4G.

In conclusion, Dano says that “AT&T, Verizon and T-Mobile continue to be very interested in outdoing one another in their 5G pricing schemes and big, new network claims.” However, they’re not succeeding in pleasing their customers who remain frustrated and disappointed.

Cartoon courtesy of long time IEEE contributor Geoff Thompson:

…………………………………………………………………………………………………………………………………………

References:

https://www.speedtest.net/global-index/united-states#market-analysis

https://rootmetrics.com/en-US/content/5g-in-the-us-1H-2021