Reliance Jio

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

Indian network operator Reliance Jio is said to be in negotiations with Tesla for the deployment of a private 5G network for the latter’s manufacturing plant in India, according to India press reports. The reports noted that the electric vehicle manufacturer is seeking to get the permit to set up its first manufacturing location in India. As part of these discussions, Reliance Jio Infocomm has allegedly offered Tesla to set up a 5G private network for its future manufacturing facility in the Asian nation. The network is expected to support connected car solutions and automated production processes.

A report by Financial Express suggests that the Mukesh Ambani-headed telco is in early talks with Tesla for the setup of the private network, and further progress will only happen if Tesla finalizes its plans to set up a manufacturing plant in the country. “The talks between Jio and Tesla are at a preliminary stage, and any further developments are expected only when the latter firms up its plans for setting up a manufacturing unit in India,” an unnamed industry source revealed to the publication.

The report suggests that Jio is also reaching out to firms across automobile, healthcare, manufacturing, and other industries with possible use cases of 5G, offering to build and manage their private networks. The captive private 5G network setup from the telco will help these firms achieve high data speed and data carrying capacity within their premises, which is not possible if they depend on public networks. Notably, the private 5G solutions will also help industries benefit from the next technological advancement – Industry 4.0 – a new technology wave that is said to revolutionize the way companies manufacture, improve, and distribute their products.

In December 2022, rival operator Bharti Airtel announced a partnership with Indian company Tech Mahindra to set up a private 5G network at Mahindra’s Chakan facility. With this collaboration, the Chakan facility became the first 5G-enabled manufacturing unit in India.

Reliance Jio Infocomm has already deployed its 5G service in 4,786 towns and cities across 36 states in India, according to the carrier’s website. Jio has already deployed over 50,000 base stations and 300,000 cells to support its 5G service, according to recent press reports.

Shyam Mardikar, Jio’s CTO recently said that the company expected to complete full urban coverage before the end of May. Jio started to deploy its 5G Standalone (SA) network in October 2022 and has recently stated that it is on track to cover all towns and cities by December 2023. The telco had initially launched the beta trial of its 5G services in Mumbai, Delhi, Kolkata and Varanasi.

Jio is offering the 5G connectivity on an invitational basis, with users living in 5G-enabled cities who have 5G compatible smartphones receiving invitations.

Last year, Reliance Jio Infocomm announced 5G contracts with network equipment vendors Ericsson and Nokia. The deal with Ericsson marks the first partnership between Jio and Ericsson for radio access network deployment in the country.

References:

Jio aims to deploy private network for Tesla’s future plant: Report

Bharti Airtel to launch 5G services in India this August; Reliance Jio to follow

After numerous delays, India’s government finally completed its 5G spectrum auction on its seventh day. 5G spectrum worth 1.5 trillion Indian rupees (US $18.99 billion) being sold to the country’s three mobile network operators – Reliance Jio, Bharti Airtel, Vodafone Idea – and Adani Group, with Jio emerging as the top bidder, according to media reports.

Bharti Airtel has announced that it has awarded its first 5G contract in the country to Ericsson with 5G deployment to get underway in August 2022. Ericsson is Airtel’s long-standing connectivity partner and pan-India managed services provider, with a partnership spanning more than 25 years. The latest 5G partnership follows the close of 5G spectrum auctions in India. In a statement, Airtel said that it will deploy power-efficient 5G Radio Access Network (RAN) products and solutions from the Ericsson Radio System and Ericsson microwave mobile transport solutions.

The company also signed agreements with Nokia and Samsung to build 5G capacity in India. Under the agreement, Nokia will provide equipment for AirScale portfolio, including modular and scalable baseband as well as high-capacity 5G massive MIMO radios.

Meanwhile, Ericsson will be providing 5G connectivity in 12 circles for Bharti Airtel. In addition to an enhanced user experience for Airtel customers – spanning ultra-high-speeds, low latency and large data handling capabilities – Ericsson 5G network products and solutions will also enable Bharti Airtel to pursue new, innovative use cases with its enterprise and industry customers, claimed the company.

Bharti Airtel has announced that it has acquired 19,800 MHz spectrum by securing a pan-India footprint of 3.5 GHz and 26 GHz bands. This spectrum bank was secured for a total consideration of Rs 43,084 crore in the latest spectrum auction conducted by the Department of Telecom, Government of India. Airtel acquired 19,867.8 MHz spectrum in 900 MHz, 1800 MHz, 2100MHz, 3300 MHz and 26 GHz frequency bands for Rs 43,084 crore. Airtel has secured 5G spectrum for 20 years in this auction.

Airtel CEO Gopal Vittal, MD and chief executive officer said, “As our trusted, long-term technology partner, we are delighted to award our first 5G contract to Ericsson for 5G deployment in India. “5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

“5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises and the socio-economic development of India. With our 5G network, we aim to deliver the full benefits of 5G connectivity, fuel India’s journey towards a digital economy and strengthen the country’s position on the world stage.”

Börje Ekholm, President and CEO, Ericsson, says: “We look forward to supporting Bharti Airtel with its deployment of 5G in India. With Ericsson’s unrivaled, global 5G deployment experience, we will help Bharti Airtel deliver the full benefits of 5G to Indian consumers and enterprises, while seamlessly evolving the Bharti network from 4G to 5G. 5G will enable India to realize its Digital India vision and foster inclusive development of the country.”

Reliance Jio may also launch 5G in August:

It is likely that arch rival Reliance Jio too may launch the 5G services this month. “We will celebrate ‘Azadi ka Amrit Mahotsav’ with a pan India 5G rollout. Jio is committed to offering world-class, affordable 5G and 5G-enabled services. We will provide services, platforms and solutions that will accelerate India’s digital revolution, especially in crucial sectors like education, healthcare, agriculture, manufacturing and e-governance,” said Akash M Ambani, Chairman, Reliance Jio Infocomm.

However, no disclosure of Jio’s 5G vendor(s) over two years after Ambani said Jio was developing its own “homegrown” 5G network equipment. The Business Standard reports that Jio had selected Samsung to build its pan-India 5G network.

References:

Reliance Jio trials connected robotics on its “indigenously developed” 5G network

Aayush Bhatnagar, SVP, of Reliance Jio said in a Linkedin post Friday:

Jio has successfully performed trials of Connected Robotics over its indigenously developed 5G RAN and 5G SA core network. This underlines the true potential of 5G Standalone networks in realizing real-life industrial use cases.

Jio 5G Robotics have implemented a wide canvas of services – from heavy lifting and logistics at manufacturing warehouses, to healthcare robots assisting medical staff – from remote ultrasound enablement to industrial automation robots.

This development opens up exciting possibilities for value creation in Industry 4.0, with direct relevance to businesses and the economy.

Jio’s Bhatnagar has said India’s top telco has undertaken use case trials such as Voice and Messaging over 5G NR (VoNR) using its own home grown 5G RAN and Core network, which it plans to export or license once its 5G technology is tested and deployed throughout India. Of course, that can’t happen till after the repeatedly delayed 5G spectrum auction (now scheduled for April or May 2022 if not delayed yet again).

Earlier this month, Jio reported it successfully trialed connected drones on its indigenous 5G network, the telco’s senior vice president Aayush Bhatnagar said. The trial involved a precision command and control of drones over 5G using a fleet management system running in the Cloud to perform tasks such as image recognition, track-and-trace, discrete payload pickup, and delivery, drone route sorties, video imagery, real-time drone control, and other applications, the executive added.

“5G-connected drones will enable future use cases across industries and enterprises,” Bhatnagar said. “At Jio, we have taken another major stride in “Making 5G real” – beyond speed tests and demos. Jio has successfully conducted trials of connected drones on its indigenous 5G network,” Bhatnagar said in a Linkedin post.

Jio has not disclosed all the other companies are helping to design, develop and test their indigenous 5G RAN and Core network. In July, Intel said that it is helping Reliance Jio make the transition from 4G to 5G as part of their 5G infrastructure deal. Intel and Jio are collaborating in the areas of 5G radio, core, cloud, edge and artificial intelligence.

“…our collaboration spans those areas, and it’s co-innovation. So, we have got our engineering and business unit teams working closely with Reliance Jio in those areas. And we are committed towards helping customers and partners like Reliance Jio to make the transition from 4G to 5G,” Prakash Mallya, vice president and Managing Director of sales, marketing and communications group at Intel told Economic Times.

Intel’s investment arm, Intel Capital, had in 2020 invested Rs 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

While speaking at Reliance Industries Ltd’s 44th AGM, RIL Chairman Mukesh Ambani said that:

“Jio’s engineers have developed a 100 per cent home-grown and comprehensive 5G solution that is fully cloud native, software defined, and digitally managed. Jio’s ‘Made in India‘ solution is complete and globally competitive.”

Ambani also said that his company has achieved 1Gbps download speed on its 5G trial network.

As for Jio’s 5G competitors:

- Bharti Airtel previously said that it was collaborating with global consulting firm Accenture, along with Amazon Web Service (AWS), Cisco, Ericsson, Google Cloud, Nokia, Tata Consultancy, and unnamed others to demonstrate enterprise-grade use cases using high-speed, low-latency 5G networks.

- Airtel has been working on the 5 G-based solutions with Apollo Hospitals, Flipkart, and other manufacturing companies.

- Vodafone Idea (VI) has partnered with Nokia and Ericsson to work on several 5 G-powered applications, including enhanced mobile broadband (emBB), ultra-reliable low latency communications (uRLLC), multi-access edge computing (MEC), and AR/VR.

5G trials began earlier this year in May and in June:

- Jio reported achieving speeds over 1Gbps during the trial.

- Airtel also reported achieving over 1Gbps peak speed during its 5G network trial.

- VI claims to achieve a peak 5G speed of 3.7Gbps on the mmWave spectrum during the network trials in Pune.

Last month, India’s Department of Telecom (DoT) granted a six-month extension for 5G trials in India to telecom operators, including Jio, Airtel, and VI, upon their request. The telecom operators are currently conducting 5G trials in various parts of the country and have achieved tremendous results. However, the extension means that the 5G spectrum auction won’t happen anytime soon. So any 5G commercial launch is still a long way off in India.

https://www.linkedin.com/feed/update/urn:li:activity:6879954283375267840/

Intel working with Reliance Jio and Bharti Airtel on 5G for India

Intel said that it is helping Reliance Jio make the transition from 4G to 5G as part of their 5G infrastructure deal. Intel and Jio are collaborating in the areas of 5G radio, core, cloud, edge and artificial intelligence.

“…our collaboration spans those areas, and it’s co.innovation. So, we have got our engineering and business unit teams working closely with Reliance Jio in those areas. And we are committed towards helping customers and partners like Reliance Jio to make the transition from 4G to 5G,” Prakash Mallya, vice president and MD of sales, marketing and communications group at Intel told ET.

Intel’s investment arm, Intel Capital, had in 2020 invested Rs 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

Separately, Bharti Airtel Wednesday said it is collaborating with Intel for working towards 5G network development by leveraging Virtualized Radio Access Network (vRAN) and O-RAN technologies.

This is Intel’s second 5G-related partnership in India. As per the above, Intel is collaborating with Reliance Jio to help India’s #1 telco with its 5G network development, including in the areas of 5G radio, core, cloud, edge, and artificial intelligence.

Airtel will deploy Intel’s 3rd-generation Xeon Scalable processors, FPGAs, and eASICS, and Ethernet 800 series across its network to build a foundation for rolling out wide-scale 5G, mobile edge computing (MEC) and network slicing which requires a 5G SA core network.

The partnership will also allow Airtel to tap into the hyperconnected world where Industry 4.0, cloud gaming, and virtual/augmented reality (VR/AR) become an integral part of daily lives, according to an official statement.

Earlier this year, Airtel became the first telecom operator in India to demonstrate 5G over a live network in Hyderabad using liberalized spectrum.

The Sunil Mittal-led Bharti is also conducting 5G trials in major cities such as Gurgaon’s Cyber Hub in the Millennium city and in Mumbai’s Phoenix Mall in Lower Parel, in partnership with Swedish Ericsson and Finland’s Nokia, respectively, ET previously reported.

Airtel also entered into a partnership with Tata Sons and Tata Consultancy Services to deploy OpenRAN 5G solutions, including radio and core. It plans to begin pilot in January 2022.

Jio has developed and tested its homegrown 5G solutions together with its partners in India and plans to export the solutions to global markets once proven at a pan-India scale.

Prakash Mallya, vice president and MD of sales, marketing and communications group at Intel recently told ET that the company is helping Indian telecom operators. On Jio partnership, he said that Intel is helping the Mukesh Ambani-led telco transition from 4G to 5G as part of their 5G infrastructure deal.

Intel’s investment arm, Intel Capital, had in 2020 invested India Rupees 1,894.50 crore to buy a 0.39% equity stake in Jio Platforms.

Randeep Sekhon, CTO – Bharti Airtel said, “Airtel is delighted to have Intel as a part of its rapidly expanding partner ecosystem for 5G. Intel’s cutting-edge technologies and experience will contribute immensely to Airtel’s mission of serving India with world-class 5G services. We also look forward to working with Intel and home-grown companies to unlock India’s potential as a global 5G hub.”

“Airtel is delivering their next-generation enhanced network with a breadth of Intel technology, including Intel Xeon Scalable processors and FlexRAN software to optimize RAN workloads with embedded intelligence, to scale their infrastructure and deliver on the promise of a connected India,” Dan Rodriguez, Intel corporate vice president, Network Platforms Group said in a joint statement.

References:

https://www.intel.com/content/www/us/en/wireless-network/5g-business-opportunity-infographic.html

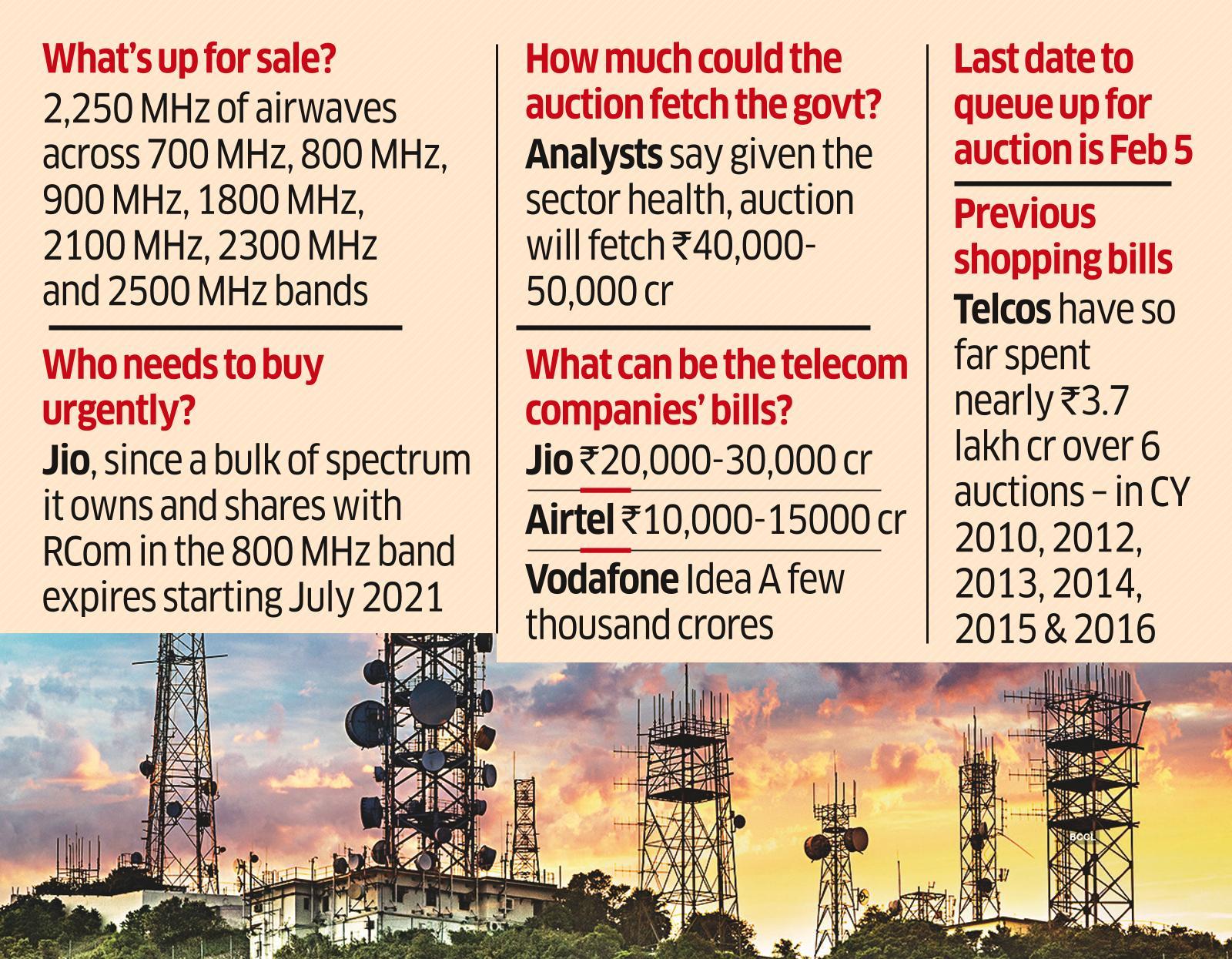

India to start long delayed spectrum auction on March 1st

India is FINALLY set to hold its first spectrum auction for four years on March 1st when it offers up 2,250 MHz of spectrum across seven bands ranging from 700 MHz to 2.5 GHz. Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) are expected to bid for airwaves worth Rs 3.92 lakh crore at base price. Industry analysts see a muted response, given the strained condition of the telecom sector, and expect the government to generate only Rs 40,000-50,000 crore from the sale.

Editors Note:

One rupee crore, as of 2014, is approximately equivalent to $163,720, using the exchange rate of 61.07 rupees per U.S. dollar. In the south Asian numbering system, a crore is equivalent to 10 million.

A lakh is a unit in the Indian numbering system equal to one hundred thousand (

………………………………………………………………………………………………………………………………………………………………………………………………

The sale will help Reliance Jio renew a chunk of expiring spectrum permits and offer Bharti Airtel and Vi a chance to add to their bandwidth holdings as data usage rises. Experts expect Jio, the only profit-making carrier, to be the main buyer and spend close to Rs 20,000-30,000 crore, followed by Airtel at Rs 10,000-15,000 crore, and Vi pitching in with a few thousand crores by bidding for only some airwaves. The spending will add to the telcos’ debt, making tariff hikes more likely.

SOURCE: Economic Times of India

…………………………………………………………………………………………………………………………………………………………………………………………..

The main objectives of the auction were to obtain a “market-determined price for the spectrum on offer, ensure efficient use of spectrum and avoid hoarding,” stimulate competition in the sector and maximize revenue proceeds, the Department of Telecommunications (DoT) said in the NIA.

The government is putting on sale 660 MHz in the 700 MHz band, 230 MHz in 800 MHz band, 81.4 MHz in 900 MHz band, 313.6 MHz in 1800 MHz band, 175 MHz in 2100 MHz band, 560 MHz in 2300 MHz band and 230 MHz in 2500 MHz band. Indian telcos have spent nearly Rs 3.7 lakh crore over six spectrum auctions since 2010. But this is the first time there are likely to be only three bidders.

COAI, the industry body that represents the telcos, said the government had addressed the requirement for availability of more spectrum. But lower reserve prices would have provided additional resources for network expansion for the telcos. “High reserve prices (in the past) have resulted in large amounts of spectrum remaining unsold,” said COAI in a statement.

COAI said the auction will enable the industry to cater to the exponential increase in data usage which will facilitate in supporting the Digital India vision. “While the government has addressed the requirement for the availability of more spectrum, lowering the reserve prices would have provided additional resources for network expansion to the telcos. High reserve prices in past auctions have resulted in large amounts of spectrum remaining unsold. We hope the Govt. will take additional measures to boost the financial health of the industry, which is the backbone of a digitally connected India,” COAI DG SP Kochhar said.

In the premium 4G spectrum (700 MHz), Trai had reduced the reserve price by 43% compared to 2016 auctions, at Rs 6,568 crore per MHz, for a pan-India 5 MHz block, still, operators would have to shell out Rs 32,840 crore, which is seen as quite high. In the 2016 auctions, the government had mopped a total amount of Rs 65,789 crore, 4% over the reserve price, from the country’s six operators who participated in the bidding. However, this was a lukewarm response as only 965 MHz spectra got sold against a total of 2,353 MHz put up on sale, meaning that only 40% got sold.

According to analysts, Reliance Jio may be the only buyer of some airwaves in the premium 700 MHz band, with its rivals likely giving it a miss, despite a 43% cut in the base price from the 2016 sale, when they went unsold. This band alone is valued at Rs 2.3 lakh crore, with the rest of the bands worth Rs 1.62 lakh crore, at base price, according to brokerage Motilal Oswal.

While the NIA has clauses to factor in new entrants, including foreign players, industry experts say it’s unlikely that any new player will join the fray, given the dire state of the industry with debt of over Rs 8 lakh crore, weak pricing power and only one profit-making telco.

“Jio will focus on 800 MHz for renewal and adding capacity as its market share increases. Vi may look at optimization of spectrum since it has surplus airwaves in the 1800 MHz while Airtel will look at 1800 MHz as well,” said Rajiv Sharma, a telecom expert. “…this auction will further add to the operators’ debt, which in turn gets them closer to tariff hikes.”

The base rate of airwaves in the efficient 800 MHz band was pegged at Rs 4,745 crore a unit, which is around 20% less than the previously recommended minimum of Rs 5,819 crore a unit for 2016. The starting price for 1800 MHz spectrum though was set higher at Rs 3,291 crore a unit, compared with Rs 2,873 crore a unit previously.

A substantial portion of Jio’s own airwaves and those it shares with Reliance Communications in the 800 MHz band expires in 12 and 14 circles, respectively, starting July 2021. Without these airwaves, Jio’s services in these circles will be impacted, making it imperative that the telco bid for them, analysts said. Jio, with over 406 million subscribers, also needs additional airwaves to cater to surging data demand and a rapidly growing user base that it expects to touch 500 million.

Airtel and Vi – with about 294 and 272 million users, respectively – own less expensive spectrum, mostly in the 1800 MHz band, set to expire across eight circles each from July. Both of those telcos have backup airwaves in most service areas. Airtel CEO Gopal Vittal has previously said that the company will look mainly for for sub-1 GHz spectrum.

For spectrum which isn’t immediately available and which will be assigned beyond one month of the close of this auction, the component of the upfront payment payable will be 10% of the bid amount for sub-1 GHz bands, and 20% of the bid amount for other bands. “…and the balance component of upfront payment (total of which is 25% for sub-1 GHz and 50% for other bands) shall be made one month prior to the ‘effective date’,” the DoT said.

References:

https://www.financialexpress.com/industry/government-to-hold-spectrum-auction-on-march-1/2165852/4

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

Reliance Jio may deploy 5G SA while Bharti Airtel to trial both 5G NSA and SA

Reliance Jio may launch its much touted 5G services using the next generation 5G standalone (GSMA Option 2) architecture for its network, Business Standard reported.

The telco may skip the current non-standalone 5G. The NSA 5G architecture enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs. Mukesh Ambani recently said that Jio intends to roll-out 5G services in India in the second half of 2021.

Image Credit: Reliance Jio

Conversely, Sunil Mittal of Bharti Airtel said that 5G will take 2-3 years to reach mass scale in India’s market. Nonetheless, Airtel recently applied for both NSA and SA 5G trials to test its network architecture.

“Even though the majority of countries are offering 5G using NSA, SA is also being used for 5G services. Airtel feels it’s a good time to test its network using both modes,” a person familiar with the development told ETTelecom.

Airtel is planning to do Standalone 5G trials in Karnataka and Kolkata using Nokia and Ericsson 5G gear, respectively. In both circles, ZTE and Huawei currently power the Sunil Mittal-led telco’s 4G network.

Non-standalone (NSA) and standalone (SA) are two 5G tracks that communication service providers can opt for when transitioning from 4G to the next-generation mobile technology. In NSA, the existing 4G LTE network is used for everything except the 5G data plane, which is usually based on 3GPP Release 15 version of 5G NR. 5G NSA enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs, but it can’t support new 5G features such as network slicing.

Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL recently submitted a list of “preferred vendors” which includes European and American companies for 5G field trials with the telecom department (DoT).

Jio had submitted fresh applications for 5G trials with Samsung, Nokia, Ericsson, and for its own 5G technology. The largest Indian telco recently submitted an application trial of its own 5G technology in South Mumbai and Navi Mumbai areas, while it intends to do trials with Samsung in other areas like Bandra Kurla complex, Kamothe Navi Mumbai, and Solapur with Maharashtra.

Jio intends to 5G trials with Nokia in Pune and Ahmednagar, and with Ericsson in Delhi areas like Chandani chowk and Shashtri Nagar and in Dabwali in Haryana.

References:

Ambani: Reliance Jio to deploy 5G network in second half of 2021

Ambani: Reliance Jio to deploy 5G network in second half of 2021

Reliance Jio today announced that it will roll-out 5G services in India in the second half of 2021. The announcement was made by the company’s CEO, Mukesh Ambani (Asia’s richest man) at the fourth annual (online this year due to COVID-19) of the India Mobile Congress.

Ambani revealed that the company plans to implement 5G service in the second half of 2021, while restating that the 5G network by the company will be built indigenously. Jio is likely to be the first service provider to bring the technology to the country. It’s believed to be based on Open RAN technology, but that has yet to be confirmed by Jio.

“India is today among the best digitally connected nations in the world. In order to maintain this lead, policy steps are needed to accelerate the early rollout of 5G, and to make it affordable and available everywhere. I assure you that Jio will pioneer the 5G Revolution in India in the second half of 2021. It will be powered by the indigenous-developed network, hardware and technology components.”

Jio has developed its own 5G solution, which it hopes to sell in different countries after deploying it in its own network. Jio Platforms, with over 20 startup partners, is building capabilities in artificial intelligence (AI), cloud computing, big data, machine learning and blockchain. Jio Platforms raised funding of more than $20 billion earlier this year. Several firms, including Qualcomm, Google and Facebook, invested in the company.

“Jio’s 5G service will be a testimony to your inspiring vision of Atma Nirbhar Bharat. I can say with utmost confidence that 5G will enable India to not only participate in the Fourth Industrial Revolution but also to lead it.”

“The Indian economy will not only bounce back but will also grow with unprecedented acceleration. India can — and India will — prove cynics wrong by becoming a $5 trillion economy. It will be a More Equal India… With increased incomes, increased employment, and improved quality of life for 1 billion Indians at the Middle and Bottom of the Economic Pyramid.”

You can watch a video of Ambani’s speech here along with news reporter commentary.

Earlier this year, Qualcomm had announced that it was working with Jio Platforms and its wholly owned subsidiary, Radisys Corporation, to develop open and interoperable interface compliant architecture based 5G solutions with a virtualized RAN. The two companies had achieved the 1Gbit/s milestone on Jio’s 5G New Radio (NR) software.

While Jio has been asking the government to expedite the 5G spectrum auction, the other private telcos, Bharti Airtel and Vodafone Idea, believe India is not yet ready for 5G technology. In particular, Bharti Airtel’s chairman Sunil Mittal claiming that the rollout of 5G technology in India will take another two-three years. Mittal has said that the next generation of mobile technology will need more time to be rolled out across the country. Airtel’s decision makers, including its chief executive, Gopal Vittal, has said in the past that the ecosystem for 5G is underdeveloped and that spectrum is expensive.

Ambani concluded his address saying, ” We are about to step into a glorious decade of the India story, with the Digital India Mission playing the role of the principal accelerator. Nothing can stop India’s rise, not even COVID-19. This is our chance to create history.”

References:

https://www.lightreading.com/asia/indias-jio-to-launch-5g-in-2021/d/d-id/765966?

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Indian wireless upstart Reliance Jio has developed its own 5G solution “from scratch,” according to Jio Chairman Mukesh Ambani (India’s richest man). The company plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Please see references 1. and 2. below for video clips of Ambani’s speech.

The company’s equipment is ready for deployment this year, as soon as 5G spectrum is available, Ambani said (more details below). A roll-out will be relatively easy, thanks to its existing all-IP 4G network, according to Ambani.

The development supports the India government’s local production push, to develop home-grown alternatives to technology from China (Huawei, ZTE), Ericsson, Nokia, Samsung, etc. Ambani did not outline the exact components developed, but he said the company would look to export the 5G system to other countries as well.

Nor did he comment on India’s IMT 2020 Low Mobility Large Cell (LMLC) submission from TSDSI which is moving forward as a 5G Radio Interface Technology (RIT) that will be standardized by ITU-R in IMT-2020.SPECS late this year.

The regulatory environment for Jio has been incredibly benign for its entire existence, from being given a special national license to the crippling historical license fees being imposed on its competitors. As a result Jio now sees itself as the world’s first ‘super operator’ and it seems to have the full backing of the Indian state in that ambition.

…………………………………………………………………………………………………………………………………………………………………….

The Business Standard reports that Jio has applied to the Department of Telecom for trial 5G spectrum. The company is reportedly seeking 800 MHz in the mmWave bands 26 and 24 GHz and 100 MHz in the 3.5 GHz band for field trials of its new network in a few metro areas.

If Jio really does have 5G Radio and Core technology, it will be in competition with global wireless network infrastructure giants, such as Huawei, ZTE, Ericsson, Nokia, and Samsung, which dominate the global wireless telecom market.

According to India Department of Telecom (DOT) sources, Jio has said its 5G network solution is ready and it can start trials immediately after spectrum is allocated. It has also revealed that it took the company three years and a few hundred engineers to turn this dream into reality. DOT sources say that, in a communication on July 17th, Jio made a strong pitch for spectrum in the mmwave band, arguing that countries like the US, South Korea, Japan, and Canada are veering towards preference of the 28- GHZ band for 5G deployment, while others like Australia, the UK, and European countries want to be in the 26- GHZ band.

Jio’s reasoning is that, given its plans to offer its 5G products in the global market, it is essential for it to have trial runs of the technology on these crucial frequency bands. It plans to test and successfully deploy the 5G technology on its own network, after which it can be sold overseas to other wireless telcos.

Moreover, it would like to test the technology in dense urban environments in India. Once it has proved itself there, it’s likely to work well in large big cities overseas.

As a result, Jio has requested that 800 MHZ of spectrum be assigned to it in 26.5–29.5 GHZ and 24.25-27.5 GHZ in the mmWave bands. It has also asked for 100 MHZ in the 3.5- GHZ mid spectrum band.

The government’s upcoming auction process is expected to kick-start by August, but it might be limited to only 4G spectrum. The Telecom Regulatory Authority of India has currently given its recommendation for the base price of spectrum in the 3.5-GHZ band for 5G auctions and not for mmwave bands. The DOT is expected to inform the regulator soon about the pricing of the mmwave bands for auction.

The Jio announcement comes at a time when Chinese telecom gear makers Huawei and ZTE face serious challenges, with numerous countries banning the use of their 5G equipment which they allege is, or can be, used by China to spy on them. Samsung is one player that is overly dependent on Jio as it is Jio’s largest client for 4G telecom gear and had earlier applied to the government to undertake 5G trial runs together. Jio’s 5G technology is based on a ‘virtualised 5G network’, which will ensure the current hardware-dependent networks shift to software-centric platforms.

This poses a challenge to current networks, which are based on proprietary technology, where both the hardware and software have to be bought from the same vendor, who then maintains and upgrades the system, leaving operators with limited flexibility.

The new networks being developed will be built on open platforms, so that operators will have the choice of buying hardware or software separately from different vendors or even building the latter on their own on an open platform. They could also ally with information technology companies to undertake system integration between the hardware and software and run the networks.

Apart from flexibility, this will bring down network costs substantially for 5G. According to cloud-native network software provider Mavenir, the new virtualized networks would lead to a saving of 40 per cent in capital expenditure and 34 per cent in terms of lower operations cost for operators.

………………………………………………………………………………………………………………………………………………………………….

References:

https://www.pressreader.com/india/business-standard/20200720/281573768006663

https://telecoms.com/505654/jio-lobbies-for-a-head-start-on-its-5g-network/

Massive MIMO Deployments in India: Bharti Airtel vs. Vodafone Idea?

by Danish Khan (edited and augmented by Alan J Weissberger)

The deployment of massive MIMO [1] technology has led to a series of claims and counter claims between India wireless network operators Vodafone Idea Ltd. (VIL) and Bharti Airtel. Both privately held telcos claim that they lead in terms of the deployment size of this pre-5G technology.

Note 1. Massive multiple-input, multiple-output, or massive MIMO, is an extension of MIMO, which essentially groups together antennas at the transmitter and receiver to provide better throughput and better spectrum efficiency.

Moving from MIMO to massive MIMO, according to IEEE, involves making “a clean break with current practice through the use of a large excess of service antennas over active terminals and time-division duplex operation. Extra antennas help by focusing energy into ever smaller regions of space to bring huge improvements in throughput and radiated energy efficiency.”

Many different configurations and deployment scenarios for the actual antenna arrays used by a massive MIMO system can be envisioned (see Fig. 1). Each antenna unit would be small and active, preferably fed via an optical or electric digital bus.

Figure 1. Some possible antenna configurations and deployment scenarios for a massive MIMO base station.

……………………………………………………………………………………………………………………………………………………………………………………………………..

In a statement, Huawei said that Bharti Airtel has deployed more than 100 hops of enhanced MIMO microwave link based on the latest MIMO technology developed by the Chinese gear maker. The deployment, Huawei said, will deliver 1Gbps capacity over a single 28 Mhz spectrum, improving the backhaul capacity by four times.

“Bharti implements the largest-scale MIMO deployment around the world,” Huawei said in the statement. Airtel had made its first commercial deployment of massive MIMO in September 2017.

Bharti Airtel today (Sept 26, 2017) announced the deployment of India’s first state-of-the-art Massive Multiple-Input Multiple-Output (MIMO) technology which is a key enabler for 5G networks. As one of the few commercial deployment of Massive MIMO globally, the deployment puts India on the world map of technology advancement and digital revolution. Airtel is starting with the first round of deployment in Bangalore & Kolkata and will expand to other parts of the country.

Deployed as part of Airtel’s ongoing network transformation program, Project Leap, the Massive MIMO technology will expand existing network capacity by five to seven times using the existing spectrum, thereby improving spectral efficiency. Customers will now be able to experience two to three times superfast speeds on the existing 4G network. Data speeds will now also be seamless, offering enhanced user experience even indoors, in crowded places and high rise buildings. It would enable multiple users and multiple devices to work simultaneously without facing any congestion or experience issues especially at hotspot locations.

But in an interview with ET last week, Vodafone Idea chief technology officer, Vishant Vora had claimed that it was the leader in MIMO deployments in India. “We have deployed over 10,000 massive MIMOs in India. This is the largest deployment of massive MIMOs in India and neither of my two competitors has that. They are 100-200 and we are at 10,000 plus. This is the largest deployment outside China and in the world,” Vora said.

Vodafone Idea told ET this past March:

Vodafone Idea has deployed more than 5000 massive MIMO, small cells and TDD sites across Church gate, Prabhadevi, Pali hill, Lokhandwala, Versova, Andheri, Jogeshwari, Bandra and Dadar among other regions. The telco has also installed over 1900 indoor coverage solutions for high rises and commercial places.

“With meticulous pre-merger planning and rigorous post-merger execution, we have ensured that our customers remain confidently connected and enjoy uninterrupted services even as we integrate and optimize our network in a phased manner across circles,” said Vishant Vora, CTO, Vodafone Idea.

………………………………………………………………………………………………………………………………………………………………………………………………

Huawei is also providing 4G equipment and massive MIMO technology to Vodafone Idea in seven circles. Huawei didn’t provide additional information.

The MIMO technology achieves four times capacity with same spectrum, allowing a telecom operator to build a 5G-ready transport network without investment in additional spectrum . MIMO deployment also allows telcos to address the capacity-related network issues in urban areas in India, besides deploying new sites to provide coverage in rural parts.

Mukesh Ambani-led Reliance Jio has also started to deploy massive MIMO technology in some of the metro cities that are seeing huge traffic growth resulting in bad data speed experience.

………………………………………………………………………………………………………………………………………………………………………………………………

References:

UBS: 5G capex at $30 billion for India telcos; 5G spectrum auction by January 2020?

UBS analysts say that India’s top three telecom operators will have to spend a little over $30 billion on 5G base stations and fiber infrastructure. According to UBS, the need for a dense site footprint and fiber backhaul for 5G access networks will likely shift the balance of power towards larger and integrated operators with strong balance sheets.

Bharti Airtel and Vodafone Idea would need $10 billion capex each over the next five years.

“Bharti has solidly defended its market share and has narrowed the gap with Jio on 4G network reach, with improving 4G net adds. The company recently revamped its digital offering and launched converged digital proposition ‘Airtel Xstream’ offering digital content across TV, PC and mobile devices along with IoT solutions for connected homes. Further, Jio’s recently announced fixed broadband plans starting at Rs 699 are not as aggressive as we (and the market) feared and, therefore, do not pose significant pricing pressure on Bharti’s broadband average revenue per user,” UBS said in a research note to clients.

Reliance Jio’s incremental 5G capex is estimated somewhat lower at around $8 billion. That’s because Jio already has more 5G-ready fiberised towers than the incumbents, having already spent around $2 billion on tower fiberization.

Analysts were skeptical about Vodafone Idea’s ability to sustain such big-ticket capex spends given its continuing market share losses and weak financials, which they said could limit its 5G deployment ambitions.

They also said the need for a dense site footprint and fibre backhaul in 5G would shift the balance of power towards larger and integrated operators with strong balance sheets like Jio and Airtel, while those with high gearing levels are at risk given the sustained high capex needs.

“Airtel and Vodafone Idea will each need to spend $2 billion annually on 5G radio and fiber capex spread across 5 years,” UBS said in a report, implying 65% and 85% of Airtel’s and Vodafone Idea’s current annual India capex run rates respectively.

By contrast, Jio’s 5G capex, “would be lower due to its larger tower footprint and higher proportion of towers on fibre backhaul compared with Airtel and Vodafone Idea.” The brokerage firm also expects Jio to transition to 5G in a “time-efficient manner,” given its in-house data centres and investments in a content distribution network (CDN).

“Vodafone Idea’s stretched balance sheet will limit its participation in the 5G opportunity, and the company will require a significant improvement in network quality to arrest market share loss and revert to revenue growth,” UBS said.

Credit Suisse backed the view, saying, “Vodafone Idea will lose the most market share, and will need additional equity capital by FY2021, given our expectation of no price increase”.

UBS estimates that Airtel’s India mobile revenue will grow 5-6% in this financial year and the next even if interconnect usage charges – a source of revenue for incumbents – get scrapped from January 2020.

According to analysts, the India telecom sector can reduce overall estimated $30.5 billion 5G capex spends by 15-20% if Airtel, Vodafone Idea and Jio share towers and fiber resources. However, there is currently no progress on that front.

“We estimate the sector can reduce overall capex by 15-20 per cent if the three Indian telcos share towers and fiber (either commercially or driven by the regulator) – third-party tenancy poses upside risks to our estimates,” UBS said in its report.

……………………………………………………………………………………………………………

India’s Department of Telecommunications wants to hold a 5G spectrum sale by January 2020 at the latest, according to referenced sources.

Credit Suisse doesn’t expect that 5G spectrum sale to attract much interest. That’s due to a mix of “high reserve prices, telcos’ focus on monetising 4G investments, stretched balance sheets, a nascent 5G ecosystem and lack of significant 5G use cases for mass consumption.”

Rajiv Sharma, co-head of research at SBICap Securities, said that Vodafone Idea is unlikely to bid for 5G spectrum at current base prices “as the telco doesn’t have an existing pan-India 4G network that is essential for any telco planning to spend top dollars on 5G,” according to the report.

Analysts believe that Reliance Jio will probably take part in the process, as it is the only profit-making telco in the Indian market.

The Department of Telecommunications (DoT) had recently asked the Trai to lower the starting prices, which the regulator refused. “There was a chance for the Trai to reduce 5G prices. Let’s see what the DoT does now. But at current rates, Airtel won’t buy,” Airtel’s executive reportedly said.

Vodafone Idea CEO Balesh Sharma has previously said that the prices recommended by the regulator were ‘exorbitant.’ The telco said it will participate in the next auction but did not confirm if it would buy 5G spectrum.

Hemant Joshi, partner at Deloitte India, said it would be “prudent to defer the 5G auction till 2020 at least since at Trai’s recommended base prices, the industry response may be very lukewarm.” He also said that the reserve prices need to be lowered, taking into account the experiences in countries where 5G spectrum was recently auctioned.

……………………………………………………………………………………………

Analysts said there are three things that India’s Centre for Telecom Excellence (within the DoT) must do immediately to hasten the adoption of 5G:

First, lay down a clear roadmap of spectrum availability and specify frequency bands aligned with global standards (IMT 2020 from ITU-R). Given that 5G services will be supporting massive data applications, operators will need adequate spectrum.

Editor’s Note: India’s TSDSI has proposed a candidate IMT 2020 RIT based on Low Mobility Large Cell (LMLC), but it hasn’t yet been accepted by ITU-R WP 5D. TSDSI posted a revised and more comprehensive proposal on 10 September 2019, which will be evaluated at the next ITU-R WP 5D meeting in December.

………………………………………………………………………………………………….

Second, there is a need to move away from the existing mechanism of pricing spectrum on a per MHz basis. 5G services require at least 80-100 Mhz of contiguous spectrum per operator. If the Centre were to fix the floor price based on the per Mhz price realised in the last auction then no operator would be able to afford buying 5G spectrum. The pricing, therefore, will have to be worked out anew, keeping in mind the financial stress in the telecom sector and affordability of services.

Finally, the Centre must rapidly complete the national fiber optic network rollout as 5G high speed services will require huge back-haul support for which existing microwave platforms will not be sufficient.