Year: 2020

3GPP delays Release 16 and 17 Freeze by 3 months; IMT 2020 impact unclear

3GPP stated on its website that the timeline for the completion of two of their upcoming releases that include 5G specifications will be delayed.

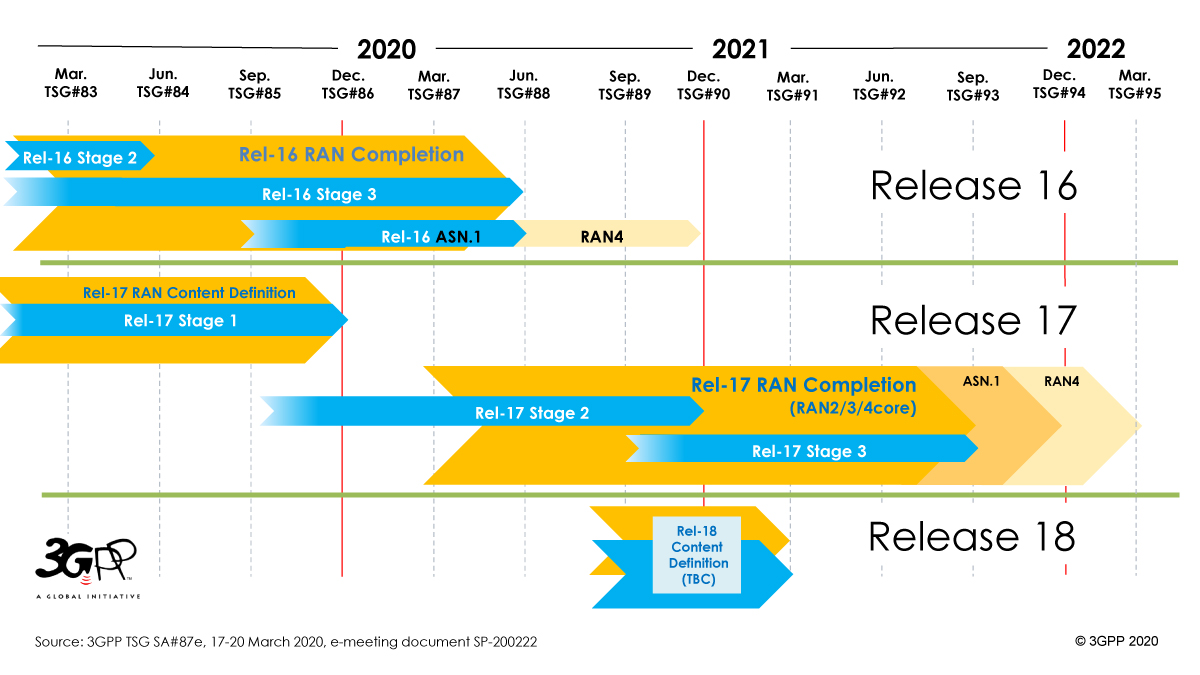

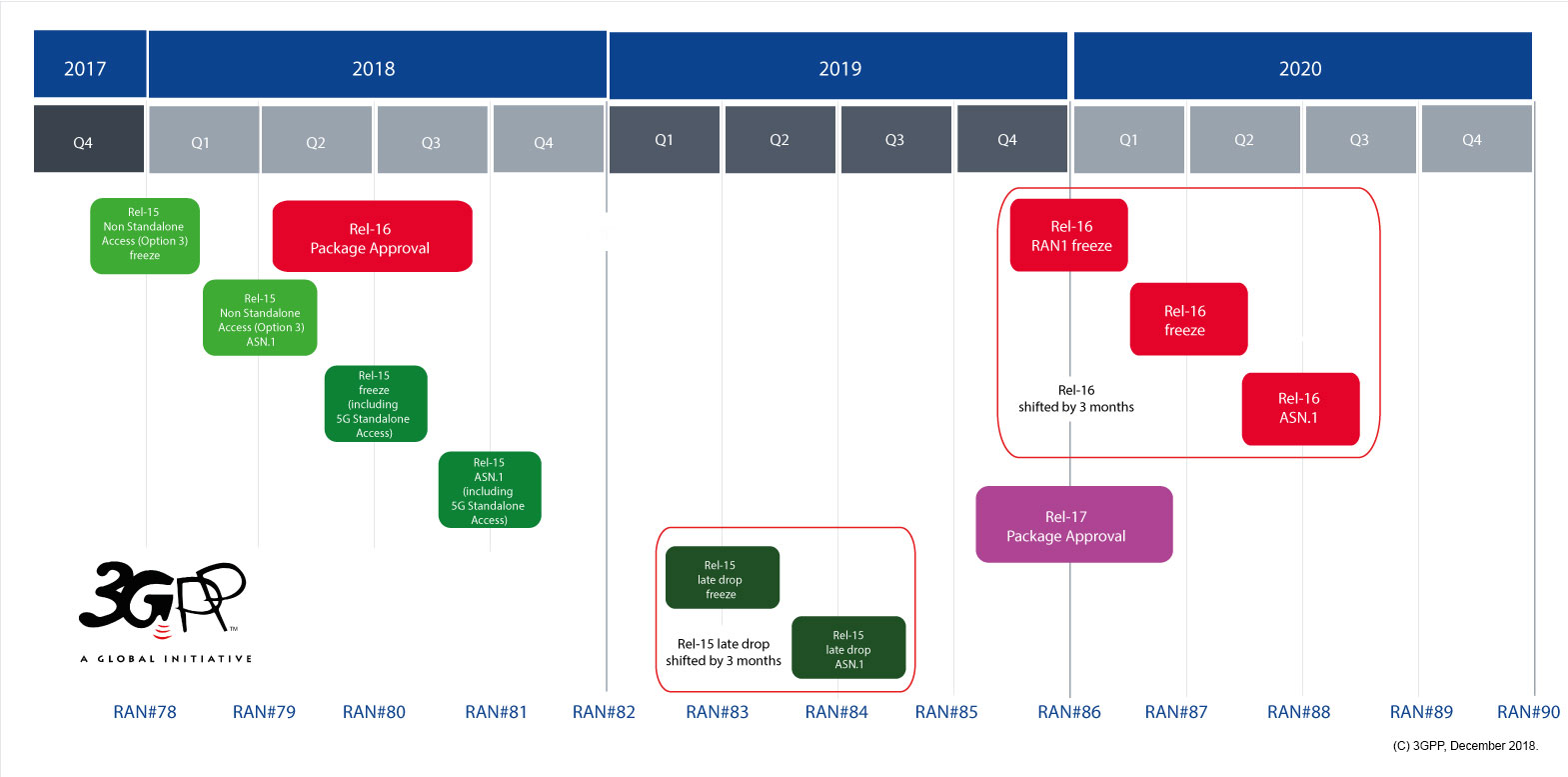

A shift of the Release 16 timeline was approved at the 3GPP March 20th TSG#87 plenary e-meetings.

- Rel-16 Stage 3 freeze now June 2020 (shifted by 3 months)

- Rel-16 ASN.1 and OpenAPI specification freeze will also be complete in June 2020 (stays as planned)

Freezing stage 3 of a 3GPP release essentially means no further functions can be added to the spec. ASN.1 refers to abstract syntax notation object identifiers maintained by ETSI.

3GPP SA Plenary Chairman Georg Mayer wrote in an email to this author:

“Whilst 3GPP shifted the R16 stage 3 freeze by three months, we kept the code freeze in June.

It is from my perspective incorrect to say that we shifted R16 by three months. Just the stage 3 freeze and the code freeze are now coinciding. This was also clearly stated in the approved discussion papers in all groups. Those are the source of information people should go to when they look for guidance.”

3GPP RAN Chairman Belasz Bertenyi wrote in an email to this author:

“The Release-16 ASN.1 and OpenAPI code freeze timeline is kept unchanged, and is still targeting June 2020.”

…………………………………………………………………………….

New 3GPP Release Timeline:

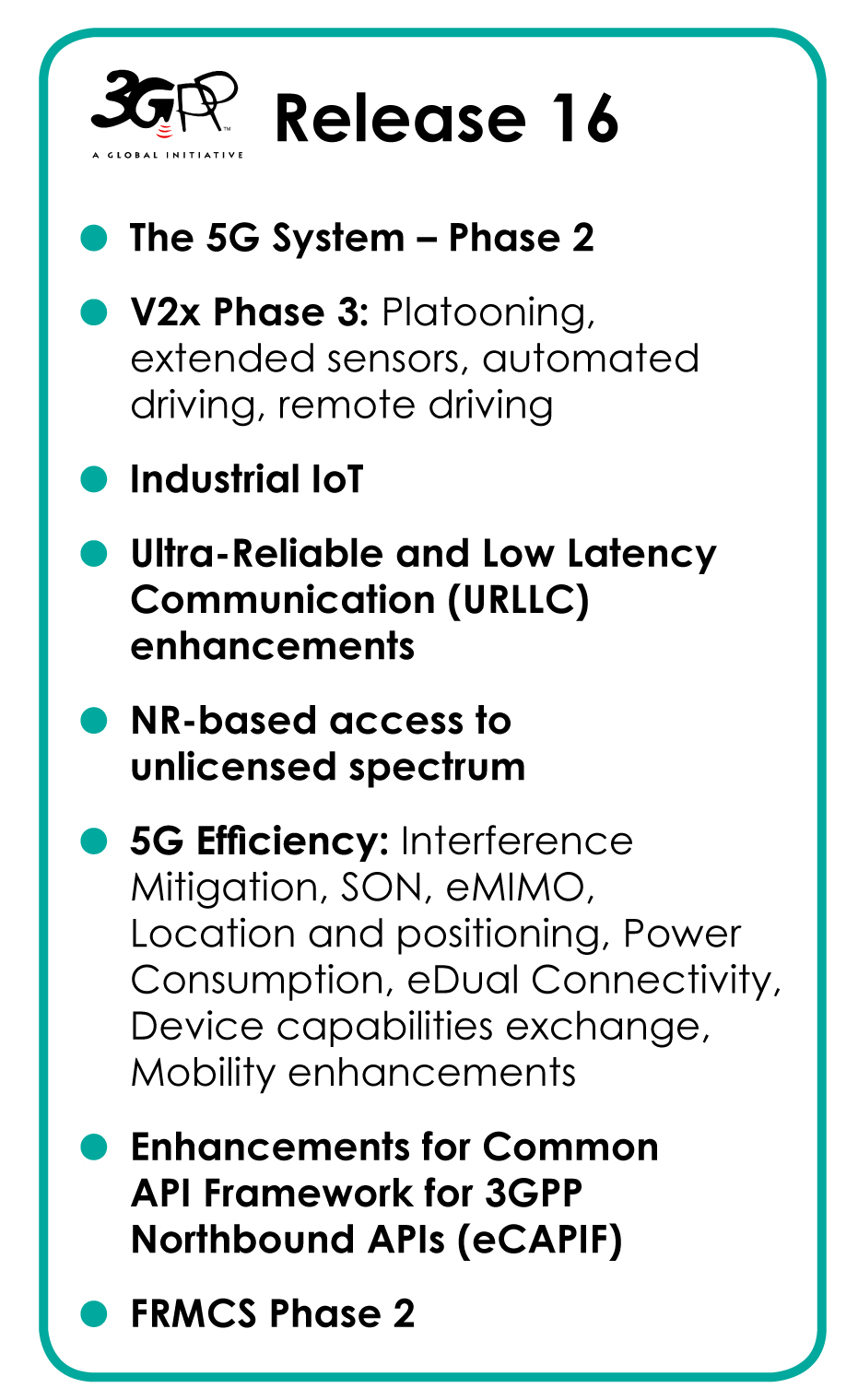

The “Release 16 Description: Summary of Rel-16 Work Items” (TR21.916) is now in production, with the Work Plan manager adding summary notes about each of the Features that it will bring, to the 3GPP system. As the Release approaches its Freeze date and completion (June 2020) – TR21.916 will start to expand and fill with useful detail about the main purpose and state of each feature.

The schedule for Release 17 is to be shifted by three months, such that the freezing of stage 3 will take place in September 2021. [Release 17 is to include further 5G system enhancements such as 5G wearables and faster network performance.] The specification freeze for Release 17 ASN.1 and OpenAPI is now scheduled for December 2021.

……………………………………………………………………………………………

The move had been expected after 3GPP announced it would cancel its face-to-face meetings in February and March due to concerns about the spreading coronavirus.

While 3GPP’s face-to-face meetings have been canceled through May, the organization has scheduled online meetings to continue its work despite the pandemic and will hopefully be able to keep their specifications on schedule going forward.

However, the impact of 3GPP’s Release 16 delay will surely push back the roll-out of true 5G deployments. It remains to be seen if the much touted but not yet completed Enhancement of Ultra-Reliable (UR) Low Latency Communications (URLLC) in 3GPP Release 16 will be submitted to ITU-R WP5D at their June 2020 meeting for inclusion in the IMT 2020 RIT/SRIT standard.

This author suspects ITU-R WP 5D leaders are looking at how to adjust their meeting plans in light of the global pandemic. Their next meeting is scheduled for June 23 to July 1, 2020 in Geneva.

Balasz says that “whatever the IMT 2020 schedule, 3GPP is continuously committed to make sure its IMT 2020 submissions will arrive in time and with high specification quality.”

………………………………………………………………………………………….

Reference:

https://www.3gpp.org/specifications/releases

…………………………………………………………………………………………..

15 April 2020 Update:

VERY IMPORTANT to note that unless it’s delayed till 2021, ITU-R IMT 2020 standard will NOT specify ultra low latency/ultra high reliability cause those capabilities are in 3GPP Rel 16 which won’t be frozen till July 3rd when their next meeting ends. ITU-R WP5D meeting ends July 1st. Hence, it will not be possible for 3GPP to submit 5G portions of Rel 16 till after WP5D’s July 1st meeting which will be too late to be included in the 1st version of IMT 2020 scheduled for late November 2020. The alternative is for WP 5D to delay their IMT 2020 completion schedule at their June-July 2020 meeting so we’ll watch that 5D meeting very closely to keep readers informed.

Background on Release 16:

- See the full Release 16 Description – TR21.916 (Available at Release freeze)

- RAN Rel-16 progress and Rel-17 potential work areas (July 18, 2019)

- Early progress on Rel-16 bands for 5G (April 2, 2019)

- “Working towards full 5G in Rel-16″…See a webinar presentation (July 3, 2018)

- Preparing the ground for IMT-2020

- SA1 completes its study into 5G requirements

Details of the features and work items under each 3GPP Release are kept in the corresponding, on-line, list of features and study items.

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

A Nokia press release today, Nokia announces over 3,000 5G patent declarations, the company declared more than 3,000 patent families to the European Telecommunications Standards Institute (ETSI) which were said to be “essential for the 5G standard.”

We wonder what 5G standard is that as IMT 2020 has not yet been completed? Neither has 3GPP Release 16 (5G phase 2) which when combined with Release 16 (5G Phase 1) will be the REAL (but unofficial) 5G standard.

Nokia wrote in the aforementioned press release:

With the latest declarations, the portfolio of Nokia cellular standard essential patents (SEPs) [1] declared to one or more of the 2G, 3G, 4G and 5G standards spans more than 3,400 patent families, of which more than 3,000 are relevant to 5G standards. This SEP portfolio has more than doubled in size over the past five years, with Nokia having a leading market share. Nokia Bell Labs produces the majority of these SEPs, and Nokia Technologies business manages and licenses this patent portfolio, with more than 200 licensees, including most major smartphone vendors and many automotive brands.

NOTE 1. HOW ARE SEPs DETERMINED IF A STANDARD LIKE 5G HAS NOT YET BEEN COMPLETED?

…………………………………………………………………………………………………….

Marcus Weldon, Nokia Chief Technology Officer and President of Nokia Bell Labs, said: “Nokia has defined many of the fundamental technologies used in virtually all mobile devices and digital systems and networks, and these inventions are critical to the new Industrial Internet of Things era. We standardize these inventions to allow widespread utilization and adoption. The benefits of 5G are initially in massive amounts of new capacity for consumers, but as the new technology and network architecture develops, it will enable new applications for enterprises and industrial businesses, with end-to-end 5G networks forming the critical fabric for the Fourth Industrial Revolution, with Nokia Bell Labs once again at the heart of this revolution.”

Jenni Lukander, President of Nokia Technologies, said: “I am thrilled that our R&D efforts are creating new opportunities for the consumer and industrial technology ecosystem, as the 5G era gathers momentum. As an inventor for the long-term, Nokia is able to innovate for a 5G future because of the fair reward we earn through licensing the standardized technologies created from our extensive R&D investments. This virtuous cycle creates vast new potential in 5G technologies, and I am excited for the possibilities ahead.”

Resource:

5G standards and research leadership (Nokia)

…………………………………………………………………………………………………

Comment and Analysis:

We previously reported that Samsung had licensed some of Nokia’s “5G” patents in this blog post.

Nokia’s so called “milestone” was positioned as a major step forward from the previous one six months ago declaring 2,000 patents. The clear intention was to create the impression that Nokia’s 5G R&D efforts have improved by 50% in the last six months, but it’s very difficult to verify that claim since it contains so many unknowns.

Is all that blah, blah, blah just PR or the truth? Let’s examine this 5G Patent War issue in some detail.

………………………………………………………………………………………………….

In a December 11, 2019 letter to the WSJ, Jenny Beth Martin wrote:

Nothing could be further from the truth. Qualcomm today is the undisputed leader in the 5G space for the simple reason that no other companies can keep up with the San Diego-based innovator. Qualcomm holds a staggering 140,000 patents and patent applications for 5G technologies.

………………………………………………………………………………………………………..

On March 12, 2020, Huawei was the clear leader in a European Patent Office (EPO) report titled Digital technologies take top spot in European patent applications. For the first time in more than a decade, the EPO said that digital technologies have taken the lead in patent applications filed. According to the EPO Patent Index 2019, the surge in the fields of digital communications (+19.6%) and computer technology (+10.2%) is fuelling the sustained growth in patent filings.

Statista says Huawei is leading in 5G patents. With more than 3,000 patent applications filed and more than 1,200 of these granted, Chinese manufacturer Huawei took first place in a ranking complied by IPlytics and the Technical University of Berlin.

Scott Bicheno of telecoms.com says about half of Huawei’s 5G patent applications seem to have been filed in China, and those account for half of all such applications made in China. While there’s nothing intrinsically wrong with that, it’s worth noting that Samsung and LG, which are in the top three 5G patent applicants alongside Qualcomm, have hardly filed any applications in South Korea. It’s almost as if the barrier to entry for patent filing in China is lower.

………………………………………………………………………………………………..

This author is also very skeptical about 5G patents, in light of the REALITY that many of the key 5G attributes, e.g. ultra high reliability, ultra low latency, 5G packet core, etc have not been completed yet by 3GPP.

So how can those and many other important features of “not yet completed” 5G standards be patented at this time?

Also, 5G builds on 4G-LTE so some of the so called “5G” patents might be more related to the latter.

…………………………………………………………………………………………………………

In a blog post from October 2019 titled Why you shouldn’t believe everything you read about 5G patents, Christina Petersson, CIPO and Head of IPR & Licensing at Ericsson, argues that when you apply certain essentiality filters, Ericsson is number one when it comes to 5G patents.

The patent intelligence division of the law firm of Bird & Bird, twoBirds Pattern, examined news articles and studies around 5G standard essential patents (SEPs) and found that the people writing about patents often get it wrong concerning which companies own the largest 5G SEP portfolios. They found that studies, in addition to being premature at this stage, are often over-simplistic or flawed, and that seemingly small corrections produce dramatically different results.

…………………………………………………………………………………………………..

Bicheno concludes:

That this patent war is being waged in Europe probably isn’t a coincidence either, as that is the primary battleground in the geopolitical battle of wills between the US and China. Every time a European country refuses to ban Huawei that represents a win for the Chinese state and its belt-and-road strategy of economic imperialism.

The fact remains, however, that nearly all of the patent announcements being chucked out there are largely meaningless given the lack of qualification and context attached to them. Most patent applications made now won’t be processed for around four years, and it’s only then that we’ll know who the 5G technology leader is. Until then the industry would be well advised to take any such claims with a big pinch of salt. We certainly will.

It’s quite clear that heavy cross-licensing, patent litigation, and patent pooling generate billions of dollars of legal liability and 5G will spark new and unpreceded patent wars that will dwarf previous ones.

………………………………………………………………………………………………..

References:

https://telecoms.com/503274/5g-patent-chest-beating-is-an-unhelpful-distraction/

https://www.wsj.com/articles/qualcomm-5g-security-and-patent-wars-11576096074

https://www.iplytics.com/wp-content/uploads/2020/02/5G-patent-study_TU-Berlin_IPlytics-2020.pdf

ITU Global Resiliency Platform to keep information networks ‘safer, stronger’ throughout COVID-19 pandemic

ITU Tweet March 23, 2020:

Global Network Resiliency Platform to help countries + industry cope with the increasing stress put on global networks during the #COVID19 crisis itu.int/en/mediacentre#REG4COVID

Telecommunication networks have never before been as vital to “our health and safety, and to keep our economy and society working” as they are during the current crisis, where millions are being encouraged to stay put at home, the ITU chief maintained.

He has asked instructed his team to “leverage without any delay” the new platform in aid of existing networks “to help countries and industry cope with the increasing stress being put on global networks”.

“At stake is our ability, as one human family, to give health workers everywhere, the tools they need to carry out their duties, to allow all those that can to work from home, to trade online, to ensure that hundreds of millions of children and young people keep up with their studies, and to keep in touch with loved ones, wherever they are”, he detailed.

The Global Network Resiliency Platform will also share best practices and initiatives that have been put in place during the COVID-19 crisis to ensure that telecommunication services are available to the maximum extent possible.

The portal will collect relevant information and expertise on actions that telecommunication policymakers and others in the regulatory community can use to ensure that their networks serve their country’s needs.

“This new ITU platform will provide countries struggling to find appropriate solutions to ensure their networks’ resiliency with relevant and trustworthy information and expertise on how to cope with the stresses faced by their infrastructure”, assured the agency chief.

“And because time is of the essence, it will give those countries that still have time to prepare an opportunity to learn from what is being done elsewhere – from emergency spectrum reassignments to guidelines for consumers on responsible use.”

Serving initially as an informative tool, the portal will soon be expanded to provide an interactive and engaging platform for continuous sharing throughout the pandemic and beyond.

“The crisis we are in today calls for solidarity”, he spelled out. “In these uncertain times, we should not forget all those around the world who still lack access to the Internet”.

ITU has long promoted universal, reliable and affordable connectivity, and will continue to push on all these fronts and advocate until everyone is connected.

“I call on all ITU members, from the public and private sector alike, to come together to build the best platform we can so that information and communication technology can help defeat COVID-19 and make us safer, stronger and more connected,” concluded the ITU Secretary-General.

………………………………………………………………………………………………..

Coronavirus Portal Updates:

References:

China Telcos Lose Subscribers; 5G “Co-build and Co-share” agreement to accelerate

Decrease in China’s Mobile Subscribers:

China’s wireless carriers are reporting substantial drops in subscribers as the coronavirus crisis reduces business activity.

China Mobile Ltd., the world’s largest wireless carrier, reported its first net decline since starting to report monthly data in 2000. China Mobile subscriptions fell by more than 8 million over January and February, data on the company’s website show.

China Telecom Corp. said it lost 5.6 million users in February, while China Unicom Hong Kong Ltd. subscribers fell by 1.2 million in January.

The across the board China subscriber slump indicates that the coronavirus pandemic crisis, which first emerged in China late last year, is crimping growth, even at businesses that provide essential services and earn monthly revenue. ARPU will likely also decline, according to analysts.

Chris Lane, an analyst at Sanford C. Bernstein & Co said that part of the decrease in wireless subscribers could be due to migrant workers — who often have one subscription for where they work and another for their home region — canceling their work-region account after the virus prevented them from returning to work after the Lunar New Year holidays which began in late January.

While the drop in users is unusual, the total is small relative to total wireless subscriptions, which have risen to a combined 1.6 billion for the three carriers. Things may improve starting this month as work in factories and other businesses in China resumes, Lane said.

Net income fell 9.5% last year at China Mobile, partly on government mandates to cut prices and improve service, but also due to a spike in financing costs – up from RMB144 million ($20.2 million) to RMB3.25 billion ($460 million).

The company, which reported earnings last week, told analysts revenue would remain stable this year, a sign management was not worried about the fall in subscribers.

China Unicom overcame flat revenue growth to post an 11.1% increase in net earnings for 2019. The state-owned telco slashed opex by 22% and marketing cost by 5% to record a 11.3 billion yuan ($1.6 billion) full-year profit.

“In 2019, the domestic telecommunications industry development experienced a short-term pain with weak revenue growth and pressure on industry value,” Chairman and CEO Wang Xiaochu said.

………………………………………………………………………………………..

Co-build and Co-share Agreement:

In September 2019, China Unicom entered into a cooperation agreement with China Telecom to jointly build one 5G access network across the country. China Unicom would be doubling it’s own 5G network coverage, bandwidth, capacity and transmission speed, providing users with better experience.

China Unicom said it will actively step up the “co-build and co-share” with China Telecom in areas such as 4G indoor distributed antenna systems, server rooms, optical fiber and pipelines to further enhance network advantages and corporate value.

References:

https://www.bnnbloomberg.ca/china-s-mobile-carriers-lose-15-million-users-as-virus-bites-1.1410626

https://www.telecomlead.com/5g/china-unicom-reveals-5g-network-capex-plans-94530

AT&T boosts wireless network capacity in spectrum-sharing deal with DISH Network

DISH Network is loaning AT&T 20 MHz of spectrum in the AWS-4 band, as well as its entire supply of 700 MHz airwaves, for two months. This is the third spectrum-sharing arrangement that the satellite provider has made since Sunday as telecom network providers prepare for extra data traffic from people working at home.

“DISH is proud to join forces with AT&T to achieve a common, critical goal: supporting the connectivity needs of Americans during this challenging time,” said Jeff Blum, DISH SVP of public policy and government affairs, in a statement.

This follows last week’s news that DISH would lend its complete 600 MHz portfolio of spectrum to T-Mobile. In addition to loaning spectrum to T-Mobile and AT&T, DISH was given permission yesterday by the FCC to also loan spectrum to Verizon.

/cdn.vox-cdn.com/uploads/chorus_image/image/66528643/DSC_4155.0.jpg)

According to analyst Jonathan Chaplin at New Street Research, AT&T will be able to deploy the AWS-4 spectrum quickly and easily using its AWS-1 and AWS-3 equipment. In addition, AT&T can use Dish’s 700 MHz E-Block in conjunction with the D-Block that AT&T has started deploying in some markets. Analysts are speculating that these loans during the COVID-19 crisis might later be turned into ongoing leases.

Chaplin wrote: “All told, DISH has now loaned out spectrum that could be leased at an annual run rate of $940 million. They still have the PCS H-Block and another 20 MHz of AWS-4, which would be worth another $580 million.”

Chaplin of New Street says: “All we know at this stage is that DISH is helping in a crisis; we don’t know that either side would be willing to convert the loan to a lease.”

DISH’s generosity in lending its spectrum during the coronavirus scare is highlighting how helpful the spectrum is to other operators in order to increase their capacity.

Wells Fargo analyst Jennifer Fritzsche wrote, “Once this crisis passes, we believe the heavy demand on wireless and wired networks will shine the light on the need for additional spectrum allocation and continued programs to support push-out of broadband into rural areas to lessen the digital divide.”

………………………………………………………………………………….

PC Magazine has a breakdown of how Dish is distributing its unused spectrum over the next 60 days. Each provider is getting spectrum that can temporarily help bolster its 4G LTE data network and increase speeds. In AT&T’s case, Segan estimates that wireless customers could notice up to a 20Mbps uptick in data performance while the spectrum loan is in effect.

DISH has often been criticized for hoarding spectrum and not putting it to any actual use. The company even risked fines from the FCC for failing to build an actual wireless network with the spectrum it owns. But that was before the company was brought into the T-Mobile and Sprint deal and positioned as the replacement fourth “major” carrier once the merger is finalized.

Earlier today, T-Mobile issued a news release stating that the company remains prepared to close the merger with Sprint even as financial markets are in turmoil due to the coronavirus pandemic. All necessary US regulators have already approved it and the two providers emerged victorious over a challenge from several US states.

References:

https://www.fiercewireless.com/wireless/dish-lends-spectrum-to-at-t-during-covid-19-pandemic

https://www.pcmag.com/news/att-4g-gets-a-big-capacity-boost-in-coronavirus-crisis

China Mobile has 15.4 million 5G customers; 5G+ is primary focus area

China Mobile today published its 2019 annual financial report, stating that the company’s operating revenue reached CNY745.9 billion -a year-on-year increase of 1.2% – and its net profit was CNY106.6 billion ($15 billion) – a year-on-year decrease of 9.5%.

The fall in net profits was largely due to a spike in financing costs – up from RMB144 million ($20.2 million) to RMB3.25 billion ($460 million).

Operating revenue was just 1.2% higher, at RMB745.9 billion ($104.8 billion), while telecom services revenue improved by a meager 0.5%.

A few highlights:

- The largest China telecom network provider acquired 15.4 million 5G customers in the first three months after launch.

- In 2019, China Mobile’s mobile users increased by 25.21 million, reaching a total of 950 million. Its mobile Internet data traffic increased by 90.3% year-on-year and its mobile Internet DOU reached 6.7GB.

- Wireline broadband customers grew by 30.35 million to a total of 187 million.

- China Mobile’s family broadband users reached 172 million, an increase of 17.1% year-on-year. Its family broadband comprehensive ARPU reached CNY35.3.

- At the end of 2019, China Mobile’s government and corporate clients reached 10.28 million, a year-on-year increase of 43.2%. The company’s international business revenue saw a year-on-year increase of 31.4%.

Mr. Yang Jie, China Mobile’s Chairman of the Board said in the press release:

“We were faced with a challenging and complicated operating environment in 2019 where the upside of data traffic was rapidly diminishing and competition within the telecommunications industry and from cross-sector players was becoming ever more intense. Coupled with this was the impact of government policies, including the continued implementation of the “speed upgrade and tariff reduction.”

Against this backdrop, all of us at China Mobile joined together to overcome these hurdles and work towards our ultimate goal of becoming a world-class enterprise by building a dynamic “Powerhouse”. This was centred on the key strategy of high-quality development, supported by a value-driven operating system that leverages our advantages of scale to drive further convergence, integration and digitization across the board.

We structured our organization to enable effective and synergetic capability building and collaborative growth, while nurturing internal vitality. In addition, we further implemented our “5G+” plan to spearhead the development of “four growth engines”, comprising the “customer,” “home,” “business” and “new” markets. These measures have helped us obtain positive momentum in overall operating results, which was a hard-earned achievement for us in a tough year.”

Yang noted that the COVID-19 epidemic had driven more and more businesses and consumers online and encouraged greater takeup of digital and cloud-based services. “We will leverage these opportunities, as well as the 5G network, to further develop the information and communications services market.”

Business Market:

The “business” market was China Mobile’s new growth engine and we strove to nurture new growth points by fully leveraging our cloud and network convergence advantages, building on our DICT (data, information and communications technology) infrastructure comprising IDC, ICT, Mobile Cloud, big data and other corporate applications and information services. Buoyed by active promotion of our “Network + Cloud + DICT” smart services, customers and revenue recorded rapid growth.

As of the end of 2019, the number of corporate customers increased to 10.28 million, representing year-on-year growth of 43.2%.

Focusing on key sectors such as industry, agriculture, education, public administration, healthcare, transportation and finance, the company deepened go-to-market resources to promote DICT solutions that cater to sector-specific scenarios. This strategy has boosted DICT revenue to RMB26.1 billion, or growth of 48.3% year-on-year, contributing a larger portion of our overall revenue.

“5G+” Achieved a Good Start:

China Mobile sped up the development of 5G and have been fully implementing its “5G+” plan since June 2019, when we were granted the 5G licence. These initiatives have shown good initial results.

The company actively participated in setting international standards for 5G to drive technological development. It led 61 key projects in relation to 5G international standards setting and own more than 2,000 5G patents. It also helped to continuously strengthen the Standalone 5G (within 3GPP Release 15 and 16).

Its “six international standards (3GPP specifications are not standards) on 5G system architecture” and “38 international standards including 5G NR (New Radio) terminals and base station radio frequency” scooped all the top prizes in the 2019 Science and Technology Awards presented by the China Communications Standards Association, demonstrating our leadership in 5G communications standards.

At the same time, the company accelerated the implementation of “5G+” by formulating well- coordinated development of 5G and 4G. It constructed and began operating more than 50,000 5G base stations and launched 5G commercial services in 50 cities. Emerging technologies such as AI, IoT (Internet of Things), cloud computing, big data and edge computing were assimilated into 5G (5G+AICDE) and developed more than 200 critical capabilities, while making breakthroughs in over 100 5G joint projects.

In terms of 5G+Eco, we aimed to develop the ecosystem with other industry players. Through its 5G Innovation Centre and 5G Industry Digital Alliance, more than 1,900 partners were attracted.

The 5G Device Forerunner Initiative, guiding manufacturers to launch 32 5G devices, was established. The level of maturity was basically the same between the 2.6 GHz and 3.5 GHz industry chains. Benefiting from forward-looking planning and effective execution, we expanded 5G+X, where “X” stands for the wider application of 5G, in applications that have been adopted by a plethora of industry sectors, as well as the mass market. For the latter, we launched exclusive plans for 5G customers and feature services such as ultra-high definition videos, cloud-based games and full-screen video connecting tones. As of the end of February 2020, our 5G plans attracted 15.40 million package customers – maintaining an industry-leading position.

In terms of vertical sector, China Mobile explored the possibility of combining 5G with AICDE capabilities, extending collaboration in the industry and deep-diving into classic manufacturing scenarios to develop our leadership in 5G smart manufacturing, 5G remote medical services and 5G automated mining, among other sectors. A total of 50 group-level demo application projects were implemented.

Looking ahead, 5G presents infinite possibilities. China Mobile will continue to take a systematic approach to planning and steadily implementing our “5G+” initiatives. The company will speed up technology, network, application, operations and ecosystem upgrades, accelerate industry transformation by converging technologies, integrate data to strengthen information transmission in society, and introduce digitized management to build the foundation for digital society development. By doing so, China Mobile will seek more extensive 5G deployment, covering more sectors and creating greater efficiency and social value.

…………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=226450

https://www.chinatechnews.com/2020/03/19/26442-china-mobile-net-profit-down-9-5-in-2019

https://www.lightreading.com/asia/china-mobile-reports-154m-5g-customers/d/d-id/758329?

Telefónica and partners pursue development of 4G/5G Open RAN technology

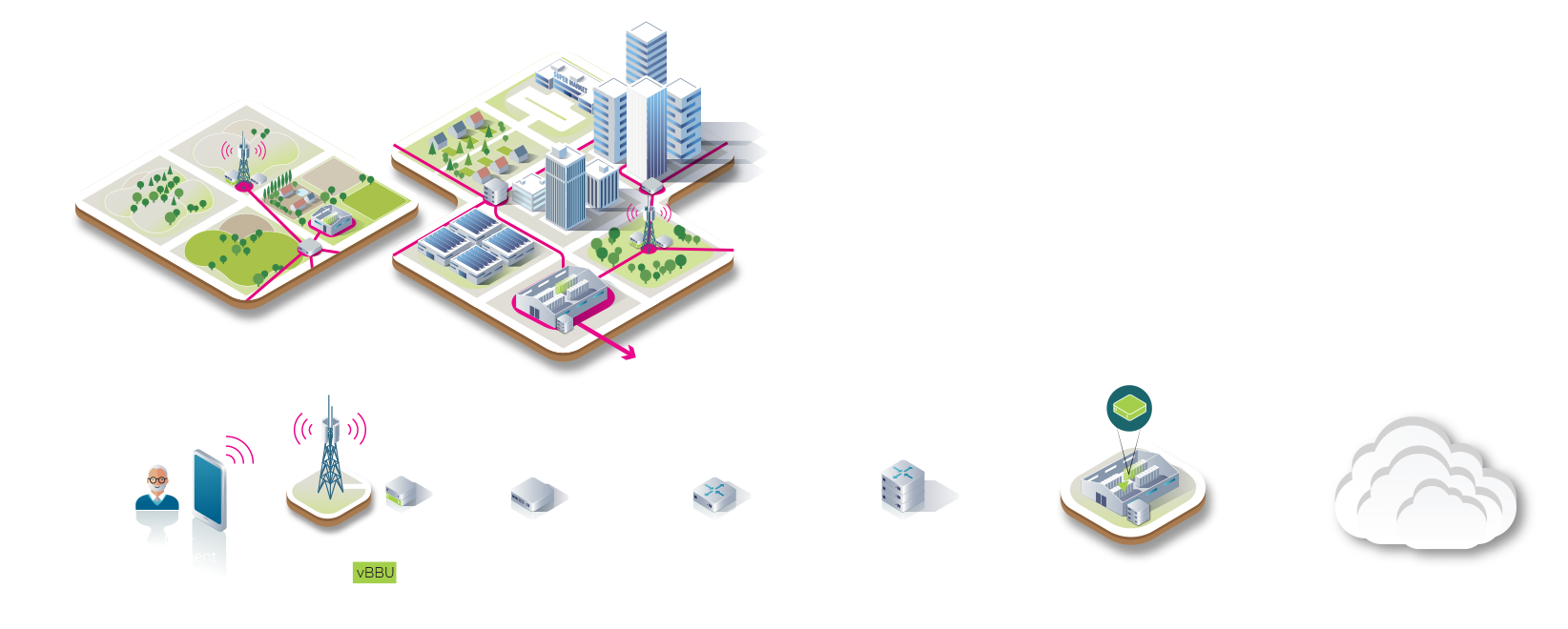

Telefónica has announced an agreement to develop 4G and 5G Open RAN technology with partner companies Altiostar, Gigatera Communications, Intel, Supermicro and Xilinx. The Spain based pan European network operator also said it intends to launch vendor-neutral 4G and 5G Open RAN trials in UK, Germany, Spain and Brazil this year.

Telefonica said this latest collaboration comprises the necessary design and developments, integration efforts, operational procedures and testing activities required to deploy Open RAN in its networks. The Spanish network operator says this is part of its continuing efforts to lead network transformation towards 5G and that the collaboration would progress the design, development, optimisation, testing and industrialisation of Open RAN technologies across its footprint this year.

The collaboration focuses on the distributed units (DUs) and remote radio units (RRUs). The DUs implement part of the baseband radio functions using the FlexRAN software reference platform and servers based on the Intel Xeon processor. The RRUs connect through open interfaces, based on O-RAN Alliance’s fronthaul specification, and software that manages the connectivity in an open cloud RAN architecture.

Telefonica said DUs and RRUs will be designed with 5G-ready capabilities, meaning they can work in either 4G or 5G mode by means of a remote software upgrade. It will be testing the 4G and 5G hardware and software components in the lab and in the field this year, integrating an Open RAN model as part of its UNICA Next virtualization program.

……………………………………………………………………………………………….

The premise is that Open RAN will be cheaper as it encourages more suppliers into the market, especially in terms of the baseband hardware where economies of scale from using standard IT can be deployed.

A cloudified open radio access architecture can also enable faster software innovation and advanced features like network automation, self-optimization of radio resources and coordination of radio access nodes.

The main goal of the trial is to define precisely the hardware and software components in 4G and 5G to guarantee seamless interoperability. This includes:

• Testing the complete solution in the lab and in the field,

• Integrating the Open RAN model as part of the end-to-end virtualisation program (UNICA Next),

• Maturing the operational model, and

• Demonstrating new services and automation capabilities as offered by the Open RAN model.

The DUs and RRUs are designed with 5G-ready capabilities and so can work in 4G or 5G mode by means of a remote software upgrade.

…………………………………………………………………………………………………………

The OpenRAN trial also supports exposure to third-party, multi-access edge computing (MEC) applications through open Application Programming Interfaces (APIs), and integration with the virtualisation activities in the core and transport networks. Open interfaces also mean that operators can upgrade specific parts of the network without impacting others.

Telefónica describes this openness to third-party MEC applications as “the cornerstone” to bringing added-value to the customers by enabling a variety of rich 5G services, like virtual and augmented reality, online gaming, connected car, the industrial internet of things (IoT) and more.

Edge-computing applications running in the telco cloud can benefit from the strong capillarity of the access network, so services can be tailored instantly to match the users’ needs and the status of the live network.

……………………………………………………………………………………………..

Quotes:

Enrique Blanco, Telefónica’s CTIO: “Once again, Telefónica is leading the transformation towards having the best-in-class networks in our Operations with our customers as key pillars. Open RAN is a fundamental piece for that purpose while widening the ecosystem.”

“Telefónica is known for its leading-edge network and has been championing open vRAN implementations to bring greater network service agility and flexibility,” said Pierre Kahhale, Altiostar Vice President of Field Operations. “By bringing together the best-of-breed innovation, Telefonica is looking to achieve this vision into their network. We look forward to supporting this transformation of Telefonica’s network.”

Heavy Reading principal analyst Gabriel Brown: “Up to now, the open RAN action has been all about 4G. In 5G, the major integrated systems vendors [Ericsson, Huawei, Nokia, Samsung, ZTE] have been supplying their state-of-the-art systems to the market for about 18 months,” creating a big gap between what is available from them and what can be sourced from the open RAN community, says the analyst. “This move by Telefónica could help to stop that gap getting too much wider.”

“Gigatera Communications and Telefonica has been actively working to ensure state of the art technologies are being deployed. We truly value our partnership as we engage and revolutionize the industry.”, Daniel Kim, President.

“Open RAN offers a way for service providers to enhance customer experiences and enable new revenue-generating applications,” said Dan Rodriguez, vice president and general manager of Intel’s Network Platforms Group. “We are collaborating closely with Telefonica and the broader ecosystem, and also participating in initiatives like the O-RAN Alliance, to help accelerate innovation in the industry.”

“Supermicro is excited to partner with Telefónica, a premier telecommunications provider, to deliver server-class 5G solutions based on Open RAN architecture,”, Charles Liang, president and CEO of Supermicro. “Working closely with Telefónica on the deployment of 5G in the significant EMEA region, Supermicro’s history of rapid time-to-market for advanced, high-performance, resource-saving solutions is a key component for the successful implementation of next-generation applications, especially as x86 compute designs migrate to the telco market.”

“Xilinx is excited to collaborate with the disruptive mobile operator Telefónica as it leads the move to O-RAN” said Liam Madden, executive vice president and general manager, Wired and Wireless Group, Xilinx. “Our adaptable technology supports multiple standards, multiple bands and multiple sub-networks, providing Telefónica with a unique and flexible platform for radio, fronthaul, and acceleration for 4G and 5G networks.”

………………………………………………………………………………………………..

References:

https://www.mobileeurope.co.uk/press-wire/telefonica-partners-to-launch-4g-and-5g-open-ran-trials

https://www.totaltele.com/505252/Telefonica-rallies-a-posse-of-Open-RAN-vendors-to-take-on-5G

https://telecominfraproject.com/openran/

https://www.lightreading.com/4g-3g-wifi/telefonica-takes-open-ran-into-5g-territory/d/d-id/758293?

Strategy Analytics: Huawei 1st among top 5 contributors to 3GPP 5G specs

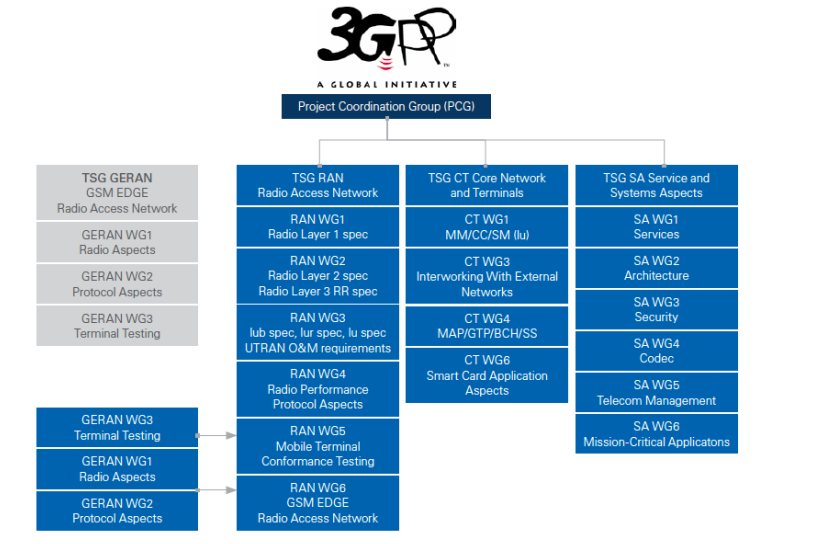

Even though there are more than 600 member companies participating in 3GPP, their 5G specification process is actually led by only a few leading telecom companies. New research from Strategy Analytics analyzes the contributions to 3GPP 5G specifications (Release 15 and Release 16) and finds that 13 companies contributed more than 78% 5G related papers and led 77% of the 5G related Work Items and Study Items.

The Strategy Analytics report “Who Are the Leading Players in 5G Standardization? An Assessment for 3GPP 5G Activities” is available to clients and registered guests here . The report assesses the 13 leading companies’ contributions to 3GPP 5G standards for the period of Releases 15 and 16 so far, based on the following criteria:

- Volume of 5G related papers, including submitted papers, approved/agreed papers and the ratio of approved/agreed papers to total submissions in all Technical Specification Groups (TSGs) and Working Groups (WGs)

- Chairmanship positions, i.e. Chairman and Vice Chairmen for all TSGs and WGs

- Rapporteurs of 5G related Work Items (WIs) / Study Items (SIs) in all TSGs and WGs

The results indicate that the top 5 companies in 3GPP 5G specification activities are Huawei, Ericsson, Nokia, Qualcomm and China Mobile.

Guang Yang , Director at Strategy Analytics, noted, “3GPP plays the central role in the ecosystem of global 5G standardization. By analyzing the contributions of industry players to 3GPP 5G standards, we can get an idea of different companies’ positions in 5G innovation as well as their influence in the global mobile industry. So we looked at 3GPP organization and work procedures to assess each company’s influence from multiple aspects.”

Sue Rudd , Director Networks and Service Platforms service, added, “According to our assessment, leading infrastructure vendors – Huawei , Ericsson and Nokia – made more significant contributions to 5G standards than other studied companies. Huawei leads in terms of overall contributions to the end-to-end 5G standards, while Ericsson leads in TSG/WG chairmanship and Nokia in approved/agreed ratio of 5G contribution papers .”

Phil Kendall , Executive Director at Strategy Analytics, added, “It is important to remember that the true nature of the standardization process is actually one of industry collaboration rather than competition. 3GPP standardization continues to be a dynamic process. It is expected that emerging players and new market requirements will increasingly impact priorities for 3GPP Release 17 standards.”

3GPP Timeline:

……………………………………………………………………………………………………

Mike Dano of Lightreading says “Huawei being the biggest contributor to the 3GPP’s 5G specs will undoubtedly worry U.S. lawmakers and regulators, who for years have argued the company poses a security threat to the nation. Huawei denies those allegations.”

“We must have a vocal presence at the standards bodies that are defining the rules for 5G. We have been woefully absent and need to make participation a priority,” wrote Mike Rogers in a recent opinion column. Rogers is a former US representative who co-authored the 2012 US government report initially outlining the security threats posed by Chinese equipment vendors like Huawei and ZTE.

“We need to work with our allies to staunch the spread of Huawei and other Chinese companies owned by the state. We need to better communicate what Chinese dominance of 5G means. This is something we have not successfully done, as shown by Britain deciding to allow Huawei into certain elements of the 5G network,” Rogers added.

Rogers now chairs the “5G Action Now” 501(c)4 advocacy organization, which has been working with the now-disbanded C-Band Alliance to speed up the C-Band spectrum auction in the US for 5G.

Indeed, legislation introduced early this year would require the Trump administration to develop a strategy to “promote United States leadership at international standards-setting bodies for equipment, systems, software, and virtually-defined networks relevant to 5th and future generation mobile telecommunications systems and infrastructure, taking into account the different processes followed by the various international standard-setting bodies.” That legislation passed the House and is now headed to the Senate.

Companies’ 3GPP contributions to the 5G specs [1.] don’t necessarily translate into revenues. For that, companies must patent their inventions.

Note 1. 3GPP specs vs 5G standards:

3GPP 5G specs in Release 15 and 16 have and will continue to be input to ITU-R WP 5D, but only some of those contributions will be in IMT 2020 which is currently restricted to the Radio Interface Technologies (RITs) or sets of RITs (SRITs). Other essential 5G specs like signaling, 5G packet core, 5G network management, etc will be standardized by SDOs (like ETSI) but the real work is done in 3GPP. Also note that IMT 2020 will have several NON 3GPP RITs from ETSI/DECT Forum and India (TSDSI).

…………………………………………………………………………………………………….

According to one study, Huawei leads in that respect also. IPlytics recently reported that the Chinese firm has far and away the most “declared 5G families” of patents, and the most filed since 2012.

However, it’s worth noting that UK law firm Bird & Bird argues that the reliance on such patent calculations isn’t very insightful, and that different methodologies yield different results.

………………………………………………………………………………………………

References:

Cignal AI: Optical Network Equipment Sales +25% in 4Q2019 + 650 Group

Cignal AI:

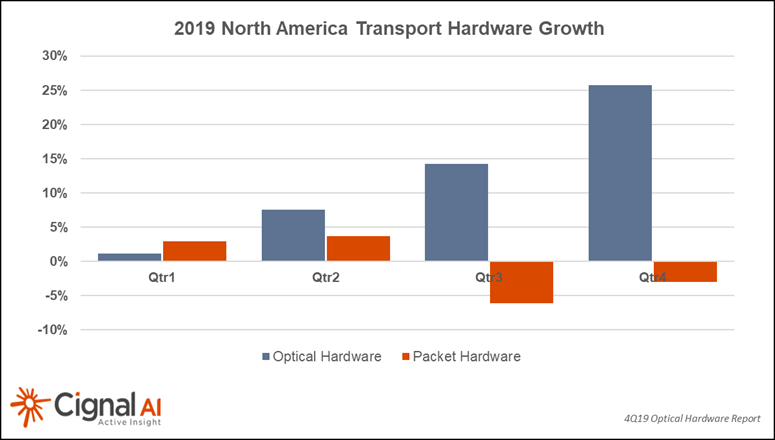

Recent optical network equipment sales in North America were quite encouraging – up more than 25% for 4Q19 and 10% for all of 2019, according to the most recent Transport Hardware Report.

“After three years of North American spending declines as operators focused capex on wireless and access, optical hardware sales in the region revived and grew at a healthy pace for 2019, while packet hardware sales remained flat,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Market leaders Ciena, Infinera, and Cisco all achieved optical sales growth exceeding 25% in 2019.”

Manufacturing at Huawei in Dongguan appears to be close to resuming normal levels of operation, although installation activity underway in China is still not clear. Ciena indicated a revenue impact of $30M during an earnings call in early March. It’s unclear right now what the ultimate impact will be; time will tell. We will revisit projections in April with the hope that events will be more certain at that time.

OFC was severely impacted when almost all major exhibitors pulled out of the show as health concerns mounted. The organizers did an admirable job of salvaging the technical sessions via Zoom teleconference.

Cignal AI will deliver a wrap-up report summarizing many of the important announcements that companies intended to make during the show. Look for it in the coming weeks, and if you have important news or perspective to share – contact us!

……………………………………………………………………………………………

Separately, a newly released report by 650 Group states that the Optical Transport Network market revenues increased 5% Y/Y in 4Q19. Revenues in four of the six geographic theatres experienced year over year growth, with North America having been the most robust.

“For the full year 2019, the top five Hyperscalers experienced the most growth out of any customer segment we track and has consistently been a top-performing customer segment in recent years,” said Chris DePuy, Technology Analyst and Founder at 650 Group. “Top vendors in the market are expecting their 800 Gbps optical transport technology to contribute to revenues towards the end of this year, 2020. We expect that optical transport systems companies that ship this new technology early will be well-positioned to take on the potential substitution threat of optical modules on switches and routers in the coming years.”

The forecast section of this report has been updated to reflect changes in both demand and supply related to health fears that have emerged in 1Q20. The report also reflects quantitative Data Center Interconnect (DCI) deployment scenarios across long-haul, metro, cloud, colocation, and telecom service providers.

For more information about the report, contact:

[email protected] or www.650group.com

Gartner: Top 10 Trends for Communications Service Providers (CSPs) in 2020

Key Findings:

-

Compared with previous cellular generations, the multilayered architecture of 5G creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbent CSPs in the 5G ecosystem.

-

Increasingly, network-based CSPs are exploring options to spin off network-related infrastructure into a separate entity, thereby unlocking funds needed for network upgrades and expansion while still meeting shareholder dividend commitments.

-

As live streaming of TV, games and e-sports enters the mainstream, the need to reduce latency and lower cost is driving hyperscale cloud providers, device manufacturers and developers to expand their influence out to the edge of CSPs’ networks.

-

Data, analytics and artificial intelligence (AI) now play an expansive and critical role in generating new business value, lowering costs and improving customer advocacy.

-

Cloud-native CSPs are emerging as aggressive challengers, and leading incumbent CSPs are expanding on efforts to virtualize their networks and adopt cloud-native capabilities.

Recommendations:

-

Pursue new capabilities and partnerships for 5G and streaming content by investigating how ecosystem approaches could be employed to meet business strategy goals.

-

Accelerate migration to cloud-native capabilities by appointing leaders who understand the business and technical implications that will arise.

-

Facilitate organizational alignment to become data-driven by establishing executive-level accountability and cross-functional oversight for data intelligence activities.

-

Maintain free cash flow from traditional telecommunications services by adopting automation, analytics and AI to improve operational efficiency and drive down costs.

Discussion:

Among the topics Gartner has observed as top of mind for CSPs include network virtualization and artificial intelligence. These are embellished in sections Becoming Data-Driven Becomes Critical and Cloud-Native as a Network Foundation, which explain the imperative needed to address what are becoming foundational capabilities. AI Enters the Workforce addresses the people context of AI, and how the move to automated provisioning and operations can, in the midterm, lead to augmentation, rather than wholesale replacement.

In the consumer market, digital content is well and truly dominating the strategy agenda. Livestreaming of TV, games, e-sports and other digital content is now mainstream. The need to improve performance and lower cost is driving the ecosystem of hyper-scale cloud providers, device manufacturers and developers to expand its influence into what was previously the exclusive domain of network-based CSPs.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Assessment:

5G is viewed by mobile-network-based CSPs as a significant opportunity for growth, particularly in B2B. It also presents a challenge in terms of the level of investment required for coverage and capacity demands. At the same time, digital ecosystems are increasingly dominating the way industries function and, subsequently, how technology solutions are defined. This presents compelling opportunities for competitive market entrants looking to exploit opportunities to reinvent processes and define new operating models for industries.

-

Compared with previous cellular generations, the multilayered architecture of 5G (network plus software and services) creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbents in the 5G ecosystem.

-

CSPs aspire to derive value from 5G through enterprise solutions that expand the mobile ecosystem to new industries, enabling opportunities to participate in concepts such as factory of the future, autonomous transportation, remote healthcare, agriculture, digitized logistics and retail.

-

CSPs have found it difficult to identify strong monetization and operation efficiency opportunities for enterprise 5G, partly because of a lack of insight into key vertical markets.

5G improves drastically on previous generations of mobile cellular connectivity (3G and 4G), with peak data speeds of up to 20 Gbps, much higher network capacity and significantly lower latency. As such, 5G-capable handsets and smart devices will give rise to new experiences for consumers, such as gaming, esports, content streaming and virtual reality (VR), to name a few.

However, for CSPs, the enterprise segment will be key to monetizing higher-margin opportunities. To be successful, it will require a significant shift from 3G or 4G, where the focus was on delivering horizontal product and service offerings related to connectivity. By taking a platform approach to 5G, CSPs can potentially unlock new value through delivering industry-specific solutions.

The software-centric approach of disaggregating hardware and software (e.g. Open RAN) creates opportunities for new providers to offer solutions or services in the 5G ecosystem. It will enable enterprises to procure services from multiple providers in the ecosystem, enabling service flexibility and diversity, rather than being locked in with a single CSP.

The concept of 5G as a platform leverages a broad range of capabilities (beyond those related to connectivity, such as edge computing and network slicing). It also encompasses the use of data analytics, AI and machine learning, data aggregation, and service orchestration. Security will play an important role. Thus, the concept of 5G as a platform includes horizontal capabilities (common across industries) and vertical capabilities (specific to industries) that can enable CSPs to participate in emerging digital ecosystems.

Since the technology specifics of 5G are still a work in progress, there will be shifts in product or service offerings. Technology alliances and partnerships between diverse stakeholders are likely to arise. Such a nebulous market can be confusing for enterprises and participants, especially in the context of evolving standards.

An industry-platform-centric approach to 5G has the potential to enhance a CSP’s ability to deliver better business outcomes to their enterprise customers. However, new operating practices are required. The isolationist nature of processes, systems and methodologies within the network and IT will also need to be addressed (see “Unlocking the Value of Network and IT Fusion in CSPs”).

Most CSPs have begun implementing some of the foundational capabilities for treating 5G as a platform, such as software-defined networking and network function virtualization (NFV). These provide for the ability to divide services into smaller, software-driven functions, which allows businesses, operators and cloud providers to deploy and configure these services in a more-flexible manner. But again, these solutions and networks often lack interoperability.

Although it’s still early days for the 5G private network opportunity, regulators and standards bodies are beginning to put initiatives in place targeting this opportunity. CSPs have the potential to deliver turnkey network solutions into the industrial space. Equipment vendors would also have the option to do this directly.