Month: January 2021

India to start long delayed spectrum auction on March 1st

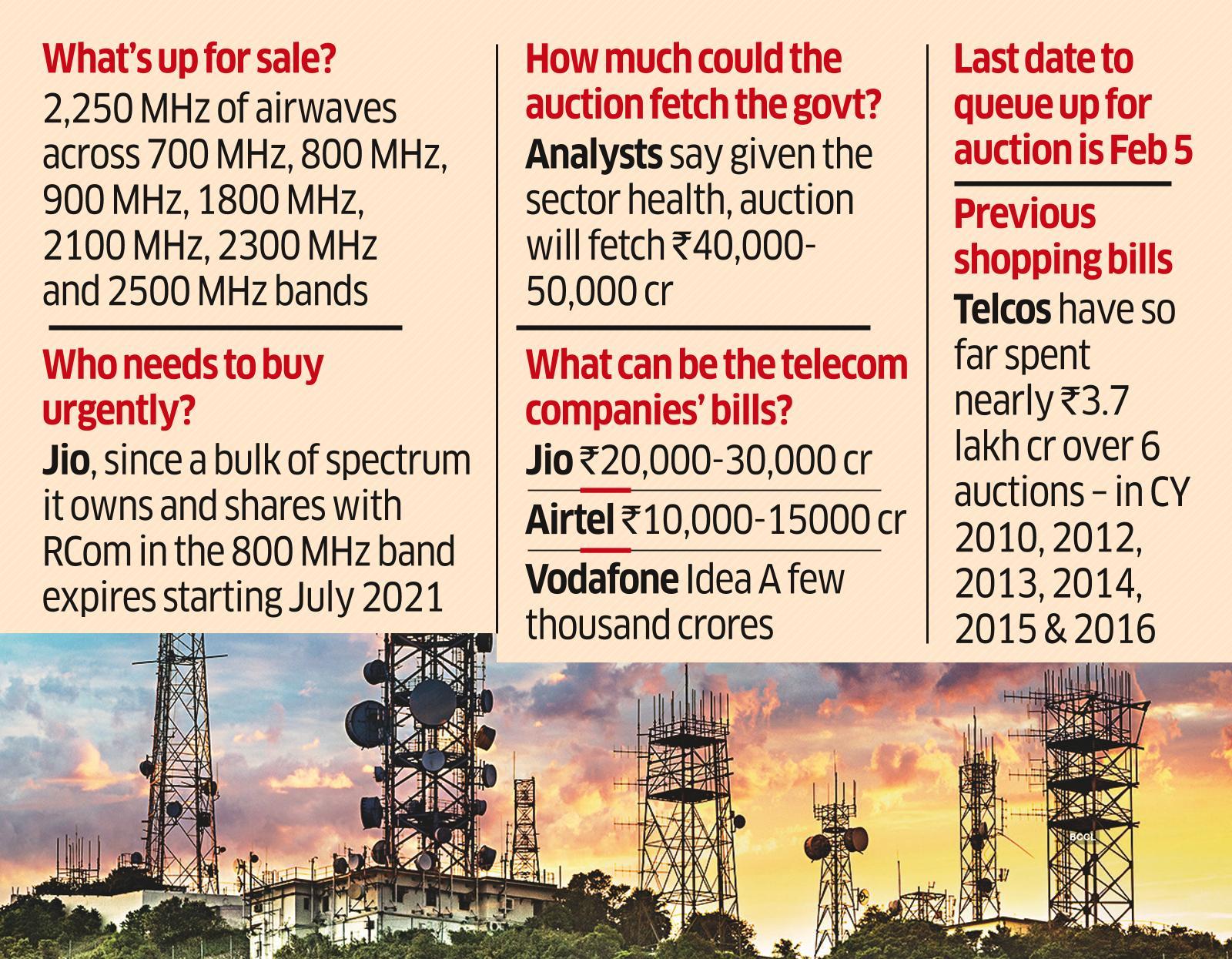

India is FINALLY set to hold its first spectrum auction for four years on March 1st when it offers up 2,250 MHz of spectrum across seven bands ranging from 700 MHz to 2.5 GHz. Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) are expected to bid for airwaves worth Rs 3.92 lakh crore at base price. Industry analysts see a muted response, given the strained condition of the telecom sector, and expect the government to generate only Rs 40,000-50,000 crore from the sale.

Editors Note:

One rupee crore, as of 2014, is approximately equivalent to $163,720, using the exchange rate of 61.07 rupees per U.S. dollar. In the south Asian numbering system, a crore is equivalent to 10 million.

A lakh is a unit in the Indian numbering system equal to one hundred thousand (

………………………………………………………………………………………………………………………………………………………………………………………………

The sale will help Reliance Jio renew a chunk of expiring spectrum permits and offer Bharti Airtel and Vi a chance to add to their bandwidth holdings as data usage rises. Experts expect Jio, the only profit-making carrier, to be the main buyer and spend close to Rs 20,000-30,000 crore, followed by Airtel at Rs 10,000-15,000 crore, and Vi pitching in with a few thousand crores by bidding for only some airwaves. The spending will add to the telcos’ debt, making tariff hikes more likely.

SOURCE: Economic Times of India

…………………………………………………………………………………………………………………………………………………………………………………………..

The main objectives of the auction were to obtain a “market-determined price for the spectrum on offer, ensure efficient use of spectrum and avoid hoarding,” stimulate competition in the sector and maximize revenue proceeds, the Department of Telecommunications (DoT) said in the NIA.

The government is putting on sale 660 MHz in the 700 MHz band, 230 MHz in 800 MHz band, 81.4 MHz in 900 MHz band, 313.6 MHz in 1800 MHz band, 175 MHz in 2100 MHz band, 560 MHz in 2300 MHz band and 230 MHz in 2500 MHz band. Indian telcos have spent nearly Rs 3.7 lakh crore over six spectrum auctions since 2010. But this is the first time there are likely to be only three bidders.

COAI, the industry body that represents the telcos, said the government had addressed the requirement for availability of more spectrum. But lower reserve prices would have provided additional resources for network expansion for the telcos. “High reserve prices (in the past) have resulted in large amounts of spectrum remaining unsold,” said COAI in a statement.

COAI said the auction will enable the industry to cater to the exponential increase in data usage which will facilitate in supporting the Digital India vision. “While the government has addressed the requirement for the availability of more spectrum, lowering the reserve prices would have provided additional resources for network expansion to the telcos. High reserve prices in past auctions have resulted in large amounts of spectrum remaining unsold. We hope the Govt. will take additional measures to boost the financial health of the industry, which is the backbone of a digitally connected India,” COAI DG SP Kochhar said.

In the premium 4G spectrum (700 MHz), Trai had reduced the reserve price by 43% compared to 2016 auctions, at Rs 6,568 crore per MHz, for a pan-India 5 MHz block, still, operators would have to shell out Rs 32,840 crore, which is seen as quite high. In the 2016 auctions, the government had mopped a total amount of Rs 65,789 crore, 4% over the reserve price, from the country’s six operators who participated in the bidding. However, this was a lukewarm response as only 965 MHz spectra got sold against a total of 2,353 MHz put up on sale, meaning that only 40% got sold.

According to analysts, Reliance Jio may be the only buyer of some airwaves in the premium 700 MHz band, with its rivals likely giving it a miss, despite a 43% cut in the base price from the 2016 sale, when they went unsold. This band alone is valued at Rs 2.3 lakh crore, with the rest of the bands worth Rs 1.62 lakh crore, at base price, according to brokerage Motilal Oswal.

While the NIA has clauses to factor in new entrants, including foreign players, industry experts say it’s unlikely that any new player will join the fray, given the dire state of the industry with debt of over Rs 8 lakh crore, weak pricing power and only one profit-making telco.

“Jio will focus on 800 MHz for renewal and adding capacity as its market share increases. Vi may look at optimization of spectrum since it has surplus airwaves in the 1800 MHz while Airtel will look at 1800 MHz as well,” said Rajiv Sharma, a telecom expert. “…this auction will further add to the operators’ debt, which in turn gets them closer to tariff hikes.”

The base rate of airwaves in the efficient 800 MHz band was pegged at Rs 4,745 crore a unit, which is around 20% less than the previously recommended minimum of Rs 5,819 crore a unit for 2016. The starting price for 1800 MHz spectrum though was set higher at Rs 3,291 crore a unit, compared with Rs 2,873 crore a unit previously.

A substantial portion of Jio’s own airwaves and those it shares with Reliance Communications in the 800 MHz band expires in 12 and 14 circles, respectively, starting July 2021. Without these airwaves, Jio’s services in these circles will be impacted, making it imperative that the telco bid for them, analysts said. Jio, with over 406 million subscribers, also needs additional airwaves to cater to surging data demand and a rapidly growing user base that it expects to touch 500 million.

Airtel and Vi – with about 294 and 272 million users, respectively – own less expensive spectrum, mostly in the 1800 MHz band, set to expire across eight circles each from July. Both of those telcos have backup airwaves in most service areas. Airtel CEO Gopal Vittal has previously said that the company will look mainly for for sub-1 GHz spectrum.

For spectrum which isn’t immediately available and which will be assigned beyond one month of the close of this auction, the component of the upfront payment payable will be 10% of the bid amount for sub-1 GHz bands, and 20% of the bid amount for other bands. “…and the balance component of upfront payment (total of which is 25% for sub-1 GHz and 50% for other bands) shall be made one month prior to the ‘effective date’,” the DoT said.

References:

https://www.financialexpress.com/industry/government-to-hold-spectrum-auction-on-march-1/2165852/4

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

European Court of Auditors Concern: EU’s Divergent Approach to Security of 5G Networks

EU nations are ‘progressing at different paces’ in terms of cyber security protocols introduced by the European Commission in order to ensure the safety of next-generation telecommunications networks, the European Court of Auditors has said.

The news comes at the beginning of a year-long probe into the EU’s security of 5G networks by auditors, while the European Commission has also confirmed to EURACTIV that nations across the bloc have missed deadlines set out in law, which had bound countries to assign 5G spectrum frequencies by the end of 2020.

Auditors say their research has already unearthed evidence of a divergent approach to 5G security across member states [1.], as well as differences in deployment timelines for the technology across the continent. As part of a series of measures unveiled by the Commission in their 2020 5G Toolbox, member states were tasked with assessing the risk profile of telecom providers, with a view to applying restrictions for those vendors considered to be high-risk.

Note 1. Of course, there is an inconsistent approach to 5G security as there are no standards for same from ITU and the 3GPP Release 16 specs for 5G Security are incomplete (delayed to Release 17). That was all described in this IEEE Techblog post.

The toolbox highlighted that “a particular threat stems from cyber offensive initiatives of non-EU countries,” in a veiled reference to Chinese telecommunications providers Huawei and ZTE.

![]()

“Several member states have identified that certain non-EU countries (China?) represent a particular cyber threat to their national interests based on previous modus operandi of attacks by certain entities or on the existence of an offensive cyber program of a given third state against them,” the toolbox adds.

A progress report on the plans in July pressed member states to make ‘urgent progress’ on mitigating the risks to 5G telecommunications networks posed by certain high-risk suppliers.

Speaking on Thursday (7 January 2021), the European Court of Auditors’ Paolo Pesce, part of the team conducting the 12-month review, said harmonization across the bloc on such security standards had not happened yet. “Member states have developed and started implementing necessary security measures to mitigate risks,” Pesce said. “But from the information gathered so far, member states seem to be progressing at a different pace as we implement this measure.”

Annemie Turtelboom, the ECA member leading the audit, added that the report will seek to probe the trade-off EU nations seem to be making with regards to security and speed of deployment.

“The coronavirus crisis has made electronic communications including mobile communications even more vital for the citizens and businesses while making it more difficult to timely prepare authorization procedures so that several member states have recently expressed their intention to delay their national spectrum auction procedures,” a spokesperson told EURACTIV.

“The Commission will follow the matter closely and take any difficulty into consideration considering the impact of the current public health crisis.”

However, it appears that the security concerns of contracting various suppliers have been just as relevant in the delays as has the coronavirus pandemic.

In one recent example, Sweden had to sideline auctions for its 3.4-3.6 GHz and 3.6-3.8 GHz bands, after telecoms regulators PTS prohibited the use of equipment from Chinese firms Huawei and ZTE. Earlier this week, Huawei announced that it had lodged an appeal to the supreme administrative court for being frozen out of the auctions.

By mid-December, member states, including the UK, had assigned on average only 36.1% of the 5G pioneer bands, the European Commission informed EURACTIV. Under the 2018 Electronic Communications Code, all spectrum in the 700MHz band should have been awarded by June 30, 2020, with allocations of 3.6GHz and 26GHz airwaves wrapped up by December 31, 2020.

References:

Commission presses member states to take action on high-risk 5G vendors

5G Security Vulnerabilities detailed by Positive Technologies; ITU-T and 3GPP 5G Security specs

Lumen Technologies to empower customers to set up the wavelength subnetworks

Ed Morche, president of strategic enterprise and government markets at Lumen Technologies (formerly CenturyLink) was interviewed by Citi’s Mike Rollins at the Citi 2021 Global TMT West Virtual Conference. Mr. Morche said that Lumen will offer a wavelength topology tool in beta over the coming weeks in order to help its enterprise customers work in a more seamless fashion. The company’s top priority was to constantly improve the customer experience for enterprises. The focus on customer experience is part of Lumen’s digital first strategy, which includes customers ordering, operating and interacting with Lumen on their own terms.

“So making sure that our products and capabilities are completely digitally enabled so that our customers externally can choose when and how they interact with us,” said Morche when explaining Lumen’s digital first strategy. “They’re not reliant on human interaction. We’re here for them if they want us to be. But for those customers who are more independent, or want to work different hours, or just want to be on their own, (we’re) ensuring that they can do that in a very seamless way. And then internally, that allows for a lot of bureaucracy and optics to move out of the organization and into more creative roles,” he added.

Lumen launched hyper WAN last year, which allows customers to go online to order SD-WAN and MPLS services at the same time with security, hyper DDoS—which allows customers to either work with Lumen’s SoC or order it online— and dynamic capacity without going through Lumen’s sales team.

“Then what we’ll see coming from us in beta in the next couple of weeks is a wave topology tool, which I’m really excited about,” Morche said. “So we operate, I would say the largest network in the world, but I’ll say it here, it’s one of the largest networks in the world, and wavelength is a huge part of what we provide to our customers. So they might interact with us looking to provide their own diversity. They already have a route from somebody else, (but) they want to purchase diversity from us.”

Morche said normally customers would work directly with Lumen’s sales team and a sales engineer on setting up their wavelength topologies.

“There would be a lot of collaboration back and forth, or they may want to build an entire diverse wavelength backbone on their own,” Morche said. “So we have opened up the fabric of our network so our customers can see all the points that they can set up wavelengths, all the different routes between those points, and where we have capacity.”

“The customer says ‘Yes, that’s what I want,’ and we authorize that. It flows through into delivery and into assurance. So that tool, from the very beginning of customer interaction, collaborating with us using our network, but not necessarily our people, flows all the way through as an ‘as built’ to the very end.”

If a customer loses its diversity, Morche said Lumen automatically creates a trouble ticket and starts working on the problem as it notifies the customer. “That automatic auditing of capability, that intelligent networking, that unearthing of capability and network is so important to improving customer experience,” Morche said. “So that’s really the first thing that we’re focused on.”

……………………………………………………………………………………………………………………………………………………………………………………………………

Chris Wallendal wrote in a Seeking Alpha column: “Lumen is investing in new capabilities and services to target the large client International and Global Accounts Management (“IGAM”) and Enterprise segments with their extensive networks. The Small and Medium Business (“SMB”) segment is challenged for growth by a large portion of legacy voice services, while the wholesale segment is volatile and faces commodity like competitive pressures. The Consumer segment is still working off no longer supported video and legacy wireline services, but its largest revenue comes from broadband services which is showing growth from demand for high bandwidth (>100Mbps) customers.”

References:

https://kvgo.com/citi/lumen-technologies-january-2021

https://www.lumen.com/en-us/home.html

https://seekingalpha.com/article/4396578-shedding-light-on-lumen-technologies

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT‘s latest research report indicates that annual spending on (3GPP specified) 5G NR and LTE small cell RAN (Radio Access Network) infrastructure operating in shared spectrum [1.] will reach nearly $4 Billion by 2024 to support a variety of uses including private cellular networks for enterprises and vertical industries, densification of mobile operator networks, FWA (Fixed Wireless Access), and neutral host connectivity.

Note 1. Spectrum sharing is the simultaneous usage of a specific radio frequency band, in a specific geographical area, by a number of independent entities (usually wireless telcos). In other words, it is the “cooperative use of common spectrum” by multiple users. Spectrum sharing also can take many forms, coordinated and uncoordinated.

Release Date: January 2021 Number of Pages: 592 Number of Tables and Figures: 94

………………………………………………………………………………………………………………………………………………………………………………………………………….

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum, most notably the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses. Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

In addition, the 3GPP cellular wireless ecosystem is also accelerating its foray into vast swaths of globally and regionally harmonized unlicensed spectrum bands. Although existing commercial activity is largely centered around LTE-based LAA (Licensed Assisted Access) technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, the introduction of 5G NR-U in 3GPP’s Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation.

Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in 5G NR and LTE small cell RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

The “Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2021 till 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 12 frequency band ranges, seven use cases and five regional markets.

Important research findings from the report include the following:

- Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in LTE and 5G NR RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum.

- Notable examples include the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses.

- Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. For example, Germany’s national telecommunications regulator BNetzA (Federal Network Agency) has received more than a hundred applications for private 5G licenses in 2020 alone. Dozens of purpose-built 5G networks are already in operational use by the likes of aircraft maintenance specialist Lufthansa Technik, industrial conglomerate Bosch, automakers and other manufacturing giants.

- Since the commencement of its local 5G spectrum licensing scheme, Japan has been showing a similar appetite for industrial-grade 5G networks, with initial field trials and deployments being spearheaded by many of the country’s largest industrial players including Fujitsu, Mitsubishi Electric, Sumitomo Corporation and Kawasaki Heavy Industries.

- Among other examples, the 3.5 GHz CBRS shared spectrum band is being utilized to set up private LTE networks across the United States for applications as diverse as remote learning and COVID-19 response efforts in healthcare facilities. 5G NR-based CBRS implementations are also expected to emerge between 2021 and 2022 to better support industrial IoT requirements. Multiple companies including agriculture and construction equipment manufacturer John Deere have already made commitments to deploy private 5G networks in CBRS spectrum.

- Mobile operators and other cellular ecosystem stakeholders are also seeking to tap into vast swaths of globally and regionally harmonized unlicensed spectrum bands for the operation of 3GPP technologies. Although existing deployments are largely based on LTE-LAA technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, standalone cellular networks that can operate solely in unlicensed spectrum – without requiring an anchor carrier in licensed spectrum – are beginning to emerge as well.

- In the coming years, with the commercial maturity of 5G NR-U technology, we also anticipate to see 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation using the 5 GHz and 6 GHz bands as well as higher frequencies in the millimeter wave range – for example, Australia’s 24.25-25.1 GHz band that is being made available for uncoordinated deployments of private 5G networks servicing locations such as factories, mining sites, hospitals and educational institutions.

The report will be of value to current and future potential investors into the shared and unlicensed spectrum LTE/5G network market, as well as LTE/5G equipment suppliers, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “The Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.com/shared-spectrum

For a sample please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to wireless networks, 5G, LTE, SDN (Software Defined Networking), NFV (Network Functions Virtualization), IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References:

Verizon realizes operational efficiencies as massive cost cutting continues; 4G-LTE Home (Fixed Wireless Access)

Speaking at the Citi 2021 Global TMT investor conference on January 5, 2021, Verizon executive Ronan Dunne said the telco’s operational efficiency has continued to increase, largely due to cutting $10 billion in costs, which was first announced four years ago by then CEO Lowell McAdam.

Dunne said Verizon has been reaping billions of dollars every year in operational efficiencies from the core of how it builds network to the efficient way it carries traffic on that network with its One Fiber strategies. Verizon’s One Fiber project, which has been underway for five years, combined all of the telco’s fiber needs and planning into one project. It also allows Verizon to plot out its fiber uses cases and purchasing plans across all of its sectors.

“But as regards (to) the focus of operational efficiency, it’s a ruthless, consistent focus inside the business in exactly the same way as balance sheet strength has always been a watchword of Verizon. And so rest assured those will continue to be as important in ’21 and ’22 as they have been in the last few years.”

Regarding cost cutting, Dunne had this to say: “So yes, Matt (Verizon CFO Matt Ellis) has talked about our commitment to a $10 billion cost program, and we’ve made excellent progress on that. But in my time in the wireless business originally and then consumer, we’ve made significant strides. We’re talking about billions of dollars every year in operational efficiencies. From — right from the core of how we build the network, to be highly, highly efficient, how we carry traffic on the network with our One Fiber strategies to how we serve customers and deliver experiences. And across all of those vectors, we see continued opportunity.”

In addition to densification of the wireless network, backhaul and fronthaul, and enabling wireline access, having fiber deep is key for supporting radio access networks (RAN) as well as provisioning an increasing number of small cells. Verizon CTO Kyle Malady built the telco’s Intelligent Edge Network, which has allowed Verizon to lower its operational costs by benefiting “from efficiencies within the core and right through the business.”

“The particular area that I’m focused on in my part of the business is really AI at scale,” Dunne said. “That really allows us to improve our CRM (Customer Relationship Management) efficiency. So the efficiency of every dollar invested in acquisition and retention. Also the efficiency of every dollar invested in those elements that are customer service elements, and distribution elements,” he added.

Dunne opined that when you think about Verizon you recognize its network as a platform, it’s distribution as a platform and it’s billing and services platforms. He believes the opportunity to improve the efficiency of those platforms through investment in technology.

He also talked about the relationships with Microsoft and AWS for edge computing as a new platform capability that’s available both to us internally but also available to customers and partners. “So that’s the strategy. So we see the opportunity to grow highly efficiently as well as serve the existing base more efficiently and lots more to come there.”

“I’m not building a fixed wireless access network,” said Dunne, expressing a bit of frustration regarding a question of whether the company is on target to hit that 30 million homes passed goal. “I’m building a 5G mobility network with a second use case where it’s appropriate, where it covers 5G Office and 5G Home, so we just shouldn’t lose sight of that.”

Dunne says that he believes they are still on track, but the reality on the ground has Verizon constantly updating its 5G mobility strategy of where and how the service gets deployed. That reality impacts the ramp up of 5G Home, potentially slowing its deployment. The service is currently in 12 markets, with very limited footprints in those markets.

Verizon’s recently launched 4G LTE Home fixed wireless service (intended for rural subscribers) should also be included in a discussion of the company’s overall fixed wireless goals. The carrier’s 5G Home service and the goals associated with it pre-date the launch of the new 4G LTE based fixed wireless service, that Verizon initially said would target smaller markets.

Image Credit: Getty

……………………………………………………………………………………………………………………………………………………………………………………………….

“One of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G Home and we’ve seen significant response to that,” said Dunne. “My addressable market for Home, for me, has always been not limited to the specific of a 5G fixed wireless, but a broader ambition to be able to participate in the home.”

4G LTE fixed wireless access offers peak speeds of 50 Mbps for now, compared to its 5G Home service which claims average speeds of 300 Mbps. Nevertheless, Dunne sees this broader footprint of 4G and 5G fixed wireless combined with mobility, as a formidable competitor to cable broadband, and its fixed wireless homes passed goal attainment should be agnostic to the underlying wireless technology.

Can 5G fixed wireless access be an alternative to cable?

“Well, then my strong view is, yes, it can. But to be clear, we only build where there’s a mobility case to build. We’re not building a stand-alone 5G fixed wireless network. So sometimes when respectfully, people get frustrated with us and say, well, hold on a second. What about — I want to see all your discrete reporting of 5G fixed wireless or why aren’t you there or there or there? The answer, which — forgive me, but I keep repeating is because I’m not building a fixed wireless access network. I’m building a 5G mobility network with a second use case, where it’s appropriate, where it covers 5G office and 5G home. So we shouldn’t lose sight of that.

So as I build over that sort of 7-, 8-year horizon, one of the realities is that I will be updating my mobility deployment patterns all the time. So we’re not really — we’re not saying that, that sort of 7, 8 years for the 30 million homes time line is shifting. But what I am saying is we continue to optimize the mobility 5G deployment strategy. And as a result, we continue to finesse and update the practicalities of that relative to the homes past. But one of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G home, and we’ve seen significant response to that. And yes, that’s a maybe a 50 meg product rather than a 500 meg product. But for a lot of people, that’s important. And that also affords us this opportunity that as we build out 5G, as we put more nodes in place, but also as we put more carriers out there, deploy more spectrum, et cetera, we have this ability to build a home portfolio, which is carrier — basically bearer-agnostic. And I think the thing for us is that we see the opportunities to participate in tens of millions of homes across the U.S. as really attractive.

What I want to do is have toolkit that says, in my Fios footprint, if fiber is the right thing to do, great. If anywhere in the U.S. 5G ultra-wideband is available to me, I have that. And in other places, I have my 4G increasingly enhanced performance in that network, which may ultimately be a 5G nationwide solution. So my addressable market for home for me has always been not limited to the specific of a 5G fixed wireless but a broader ambition to be able to participate in the home and to bring the scale benefits of that to my customers who see Verizon as the partner of choice.”

We think we have a very strong growth opportunity, which is stimulate the base, spread through our network and distribution as

a platform, our access to the market across all of the available segments and really execute on a very strong, high performance, both network, but also a set of experiences….

References:

https://www.verizon.com/about/investors/citi-2021-global-tmt-west-virtual-conference

https://www.verizon.com/about/sites/default/files/2021-01/Citi-Conf-Transcript-01052021.pdf

https://www.fiercetelecom.com/telecom/verizon-closes-its-10-billion-cost-cutting-goal

https://www.pcmag.com/news/verizon-launches-unlimited-4g-home-internet-for-rural-users-here-are-the

5G in South Korea at 15.5% of mobile subscribers vs 30% expected by end of 2020

South Korea has racked up a considerable 5G user base since the networks’ commercialization in April 2019 — 10.9 million subscribers as of end-November, accounting for around 15.5 percent of the total 70 million mobile subscriptions. SK Telecom had the most 5G subscriptions in November at 5.1 million, followed by KT at 3.3 million and LG Uplus at 2.5 million.

The average 5G user consumed 26 gigabytes of data in November, according to government data. A recent South Korea ministry report found that the country’s 5G networks had an average 5G download speed reaching 690.47 Mbps, just over four times faster than current 4G LTE speeds.

Graph Credit: RootMetrics

Median download speeds shown above reflect combined 4G and 5G speeds; pure 5G connections are faster.

RootMetrics’ says South Korean “blueprint” for rapid 5G success is based on several factors. Two of the three South Korean carriers are using 100MHz of 5G bandwidth, and the third uses 80MHz, all around the “mid band” 3.5GHz frequency. Contrast that with U.S. carriers which have struggled for regulatory reasons to get access to both mid band spectrum and similarly large spectrum blocks.

The South Korean carriers have also been able to deploy plenty of network hardware across South Korean cities and have seen relatively little performance degradation indoors compared with outdoors, unlike early U.S. 5G millimeter wave deployments. In other words, the key to performant 5G is widely deployed mid band networking gear, which a major domestic vendor and government coordination can make considerably easier.

South Korea has benefited significantly from the availability of Samsung 5G networking hardware and devices. RootMetrics expects that the belated launches of 5G-compatible iPhones could encourage other countries and carriers to achieve parity with the current 5G leader, as global demand for 5G will be driven at least as much by consumer devices as industrial applications. The report suggests that the one-year pace of the performance uptick “suggest[s] that networks in other countries could follow suit, which would level the worldwide 5G playing field” despite the “commanding lead” South Korea currently holds.

……………………………………………………………………………………………………………………………………………………………………………………………………

User migration from 4G LTE to 5G has fallen short of expectations, prompting competitive pay plans by the three carriers. The companies had initially shot for 5G subscriptions to account for up to 30 percent of their mobile users by the end of last year. A recent Korea ministry report found that the country’s 5G networks had an average 5G download speed reaching 690.47 megabits per second (Mbps), just over four times faster than current 4G LTE speeds.

Carriers are still betting on the lower prices to give the shove the local 5G market needs for faster migration. LG Uplus Corp. said Tuesday it will release a new monthly data plan, offering 6 gigabytes of data at 5G speeds for 47,000 won (US$43), following rival carrier KT Corp., which also launched late last year a monthly 5G plan at 45,000 won for 5 gigabytes of data. The new data plans are relatively more affordable than most existing 5G data plans that cost over 50,000 won a month.

“By creating low-to-mid priced plans, we hope to both reduce telecommunication costs and expand the 5G market,” an LG Uplus official said.

SK Telecom Co., the country’s largest carrier, has also lowered the price of its 5G data plans, pending government review.

SK Telecom, KT Corp. and LG Uplus are currently preparing to commercialize 5G stand alone networks and 5G millimeter wave.

In July of 2020, the big three Korean mobile operators agreed to invest a total of KRW 25.7 trillion ($22 billion) through 2022 to boost 5G infrastructure across the country. That investment primarily focuses on enhancing 5G quality in Seoul and six other metropolitan cities. The investment plan also stipulates the deployment of 5G in 2,000 multi-purpose facilities, on Seoul Metro lines 2 and 9 and along major highways. In 2021, the carriers committed to expand 5G connectivity to an additional 85 districts, including 4,000 multi-purpose facilities, subways and all train stations, as well as 20 additional highways.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Samsung Electronics Co. is expected to remain the world’s top smartphone producer this year, according to a report by according to market researcher TrendForce. However, the company’s market share is likely to decrease as other brands will ramp up production with the recovery of mobile demand.

…………………………………………………………………………………………………………………………………………………………………………………………………………

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Samsung Electronics Co. is expected to remain the world’s top smartphone producer this year, according to a report by according to market researcher TrendForce. However, the company’s market share is likely to decrease as other brands will ramp up production with the recovery of mobile demand.

The top six smartphone brands ranked by production volume for 2020, in order, are Samsung, Apple, Huawei, Xiaomi, OPPO, and Vivo. The most glaring change from the previous year is Huawei’s market share.

Thanks to the Chinese government’s aggressive push for 5G commercialization in 2020, global 5G smartphone production for the year reached about 240 million units, a 19% penetration rate, with Chinese brands accounting for almost a 60% market share. While 5G will remain a major topic in the smartphone market this year, various countries will also resume their 5G infrastructure build-out, and mobile processor manufacturers will continue to release entry-level and mid-range 5G chips. As such, the penetration rate of 5G smartphones is expected to undergo a rapid increase to 37% in 2021, for a yearly production of about 500 million units.

Global smartphone production was projected to increase 9 percent on-year to 1.36 billion units in 2021. Trendforce predicted that device replacement demand and growth in emerging markets will lead to gradual recovery of the smartphone market.

…………………………………………………………………………………………………………………………………………………………………………………………………….

TrendForce indicates that smartphone brands’ recent bullish outlook towards the 2021 market and their attempt to secure more semiconductor supplies by increasing their smartphone production targets can potentially lead these brands to overbook certain components at foundries. However, smartphone brands may adjust their component inventories from 2Q21 to 3Q21 and reduce their semiconductor procurement activities if actual sales performances fall short of expectations, or if component bottlenecks remain unresolved, leading to a widening inventory gap between bottlenecked and non-bottlenecked parts. Even so, TrendForce still forecasts an above-90% capacity utilization rate for foundries in 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………

References:

http://www.trendforce.com/presscenter/news/20210105-10630.html

Assessment of COVID-19 impact on telecom industry; C-Band Spectrum Update

COVID-19 Impact on Telcos:

Source: Analysys Mason

The telecommunications industry has suffered limited damage as a result of the COVID-19 pandemic. Revenue figures for most network operators have fallen slightly, but few have encountered anything that is particularly severe or long-lasting. As a result, few telcos have made significant changes to their strategy.

However, some aspects of the telecoms sector have been significantly affected by the pandemic. The most obvious is business services; revenue in this segment declined sharply for most operators in 2020 and prospects for 2021 are uncertain. Operators may have to rethink important parts of their strategies related to these aspects.

The telecoms industry has been affected by the pandemic in many different ways, and have been grouped these into three main categories depicted in the figure below:

Summary of the impact of the COVID-19 pandemic on the telecoms industry

Assumptions of a stable economy and a continuation of existing service and technology trends often underpin an operator’s strategic plan. For some of the services offered by operators, business services in particular, these assumptions look outdated and may need a rethink.

………………………………………………………………………………………………………………………………………………………………………………………..

C-Band Auction Update:

Source: MoffettNathanson Research

Heading into the FCC’s C-Band auction, Wall Street analysts saw Verizon as the leading bidder for 5G wireless radio spectrum. Bidding for licensed spectrum in the telecom industry’s most expensive auction ever reached more than $75 billion on Monday amid speculation over how much each of the big wireless telcos and cable companies have paid.

In a note to clients, analyst/colleague Craig Moffett of MoffettNathanson is assuming that Verizon will end up being the largest buyer at the ongoing auction of mid-band spectrum targeted for new 5G deployments. As a result, Verizon’s balance sheet will be more heavily burdened and more of their future cash flows will be diverted to debt service so their future profits will be lower.

AT&T, on the other hand, will “be disadvantaged for a generation” if they don’t get a significant chunk of the mid-band spectrum being auctioned. Craig believes that AT&T was probably “one of the two big bidders that more or less backed away after round 24 or round 38.”

An important issue is “whether “winners” in this auction acquired reasonably uniform contiguous blocks, or whether they instead (worst case scenario) ended up with a patchwork of licenses and a hefty bill to burden the balance sheet. If so, will their footprints be largely erased by subsequent topping bids from others.”

With respect to using the purchased mid-band spectrum for accelerated 5G deployments, Craig wrote: “At best, the huge sums paid here for spectrum risk displacing the capital investment needed to put the acquired spectrum to use. At worst, they risk financially destabilizing one or more players.”

In conclusion, Craig asks if the large amounts of money being spent for an asset (licensed mid-band spectrum) that is best thought of as simply maintaining the status quo will be worth the price paid? “Again, the most important question is this: is anyone going to change their revenue forecast just because the industry had to spend twice as much as expected to buy spectrum for 5G.”

………………………………………………………………………………………………………………………………………………………………………………………

References:

Mid-band Spectrum for 5G: FCC C-Band Auction at $70B Shattering Records

India ramps up supply chain for 5G service launch in 2021 pending spectrum auction

There is excitement about the anticipated launch of 5G telecom services in India, but the government’s spectrum pricing strategy may be a damper. While the evolving ancillary segments are working on the backbone infrastructure for the 5G roll-out following Reliance Industries Ltd chairman Mukesh Ambani’s assurance that Reliance Jio Infocomm Ltd will launch 5G wireless service in the second half of 2021, experts, however, said that India is not 100% ready.

India telecom equipment company Sterlite Technologies Ltd (STL) said India has been developing 5G infrastructure, but a pan-India roll out will require improving the device, spectrum, wireless and fiber optic ecosystem. “India has the capability of rolling out 5G as we have been building the infrastructure for years now. However, for a countrywide end-to-end deployment, India is not 100% ready… At STL, we will start commercial deployment of open-RAN (open radio access) that is required for 5G by second half of 2021,” said Anand Agarwal, group chief executive at STL. The primary impact of 5G roll-out will be on the commercial ecosystem. According to Agarwal, global supply chains have already matured and are 5G-ready, which makes it easier to import raw material (this author finds that very difficult to believe).

Experts said stressed financials of Bharti Airtel Ltd and Vodafone Idea Ltd (Vi) could discourage them to participate in the 5G launch, in view of the costs involving fiberization and the pricing of spectrum. Airtel and Vi are sitting on massive debts but continue to offer among the lowest tariffs in the world. The telcos have also called for affordable spectrum.

Analysts said the spectrum auction in March may see limited participation from Airtel and Vi due to high reserve prices. Jio, however, is likely to buy spectrum in the 700 megahertz (MHz) band, which is best suited for 5G.

Meanwhile, phone makers have also started producing 5G devices too. Faisal Kawoosa, the founder of techARC, said that India imported nearly two million 5G smartphones in 2020. “While most of these were in ultra-premium range, this year, any new smartphone priced above ₹30,000 should support 5G,” Kawoosa said, adding that 7-9% of all smartphones sold in India in 2021 are likely to support 5G, making it nearly four times the imports. However, will those so called “5G” users actually get 5G service, especially when roaming?

………………………………………………………………………………………………………………………………………………………………….

The big 3 Indian telcos are likely to voice their concerns to the Department of Telecommunications (DoT) as the National Frequency Allocation Plan (NFAP-2018) has not been updated by the department’s wireless planning cell (WPC) more than a year after several new airwave bands, including the 26 Ghz spectrum, were identified by the ITU-R WRC 19 for 5G deployments worldwide, including in India.

The NFAP is a central policy roadmap that defines future spectrum usage by all bodies in the country, including DoT, the Department of Space and the defence ministry. Telcos want it revised quickly as any further delay could potentially hinder the auctioning of the premium millimetre-wave 5G bands.

“The NFAP-2018 needs to be revised expeditiously by the WPC to align different stakeholders if a meaningful 5G auction is to happen later this year, and the industry will take up the matter with DoT,” a senior industry executive told ET.

In November 2019, WRC-19 identified a set of new airwaves, including the 24.25-27.5 Ghz (popularly known as the 26 Ghz band), 37-43.5 Ghz, 45.5-47 Ghz, 47.2-48.2 Ghz and 66-71 Ghz bands for 5G services. However, none of these bands (primarily the mm waves) have been included in India’s NFAP. Note also that ITU-R WP5D has not yet agreed on a revision of ITU-R M.1036 which would include the new frequency arrangements agreed during WRC 19 for terrestrial IMT deployments.

Analysis and Implications: China’s 3 Major Telecom Operators to be delisted by NYSE

The New York Stock Exchange (NYSE) said it will delist China’s three large state owned telecom carriers. The move was expected after a November U.S. government order barring Americans from investing in companies it says help the Chinese military.

- China Mobile, which is among the most valuable of China’s listed state-owned enterprises, will be removed from the Big Board after more than two decades.

- China Unicom Hong Kong will also be delisted along with China Telecom.

The NYSE said it would suspend trading in securities issued by China Mobile, China Telecom and China Unicom by January 11th. The big board also said it would also halt trading in closed-end funds and in exchange-traded products listed on its NYSE Arca exchange if they hold banned China stocks.

The U.S. Defense Department (DoD) had previously listed the three companies as having significant connections to Chinese military and security forces. The delisting highlights the faltering of long-established business ties between the United States and China, which were set up over decades as China sought to internationalize and reform its state-run corporate behemoths (see China-U.S. Cold War backgrounder below).

The NYSE decision is the latest setback for these companies, which rank among the largest global telecommunications providers. The exchange’s decision is unlikely to seriously harm the Chinese telecom giants in the near term. Mounting pressure from Washington has already stymied their ability to operate in the U.S., a country that makes up a negligible amount of their international business.

China’s top three network providers still benefit from hundreds of millions of customers in their home country. That has attracted investors to their Chinese-listed shares. The cellphone carriers have spent billions of dollars on new fifth-generation wireless networks over the past two years with support from officials in Beijing, who have called 5G upgrades a national priority.

All three telecoms companies operate under Beijing’s firm control. They are ultimately owned by a government agency, the State-owned Assets Supervision and Administration Commission, and are often ordered to pursue Beijing’s goals. China’s ruling Communist Party sometimes shuffles executives among the three companies.

They are the only three companies in China that are permitted to provide broad telecommunications network services, which Beijing regards as a strategic industry that must remain under state control.

Xi Jinping, China’s top leader (President of the People’s Republic of China 中华人民共和国主席), has talked about making state companies bigger and stronger rather than more streamlined. That has led to concerns among some economists and entrepreneurs that the Chinese government is taking a greater role in private enterprise.

…………………………………………………………………………………………………………………………………………………………………………………

Impact of the Delisting:

At the same time, the imminent delisting of several major Chinese companies will get the attention of portfolio managers, after a year long push to ensure Chinese firms’ compliance with U.S. audit rules. While the final outcome of that effort is unclear, the NYSE decision underscores the fraught politics of the U.S.-China relationship as the Trump administration comes to a close.

“The delisting issue is a live one with financial clients,” said Leland Miller, chief executive of China Beige Book International, which provides data on China’s economy to international investors. “There are some jittery people out there.”

On Friday, China Unicom said it would release a statement in due course. Neither China Telecom or China Mobile responded to WSJ requests for comment.

……………………………………………………………………………………………………………………………………………………………………………….

China Telecoms Shares Greatly Underperform:

China Mobile’s U.S. stock is thinly traded compared with its Hong Kong securities, FactSet data shows. About 2.1 million American depositary receipts traded daily on average over the past three months, compared with 34 million Hong Kong shares a day. Each ADR is equivalent to five ordinary shares in Hong Kong.

U.S. shares in China Mobile, the largest of the three companies by market value, declined 29% over the past year, according to FactSet, while China Telecom dropped 30% and China Unicom fell 39%. Over the same span, the S&P 500 index returned 18% and the communications-services sector of the MSCI World Index rose 22%. All figures reflect total returns, including dividends.

Over the past decade, China Mobile shares have declined 15% including dividend payments, FactSet data show, while China Telecom has dropped 32% and China Unicom has fallen 54%. The S&P 500 has gained 267% on the same basis and the MSCI World communications sector has gained 165%.

…………………………………………………………………………………………………………………………………………………………………………………

Backgrounder: China vs U.S. Cold War:

An executive order signed by President Trump in November will block Americans from investing in a list of companies the U.S. government says supply and support China’s military, intelligence and security services. The ban starts on Jan. 11 and investors have until November to divest themselves of their holdings.

The list currently includes 35 companies—including China’s largest chip maker—as well as surveillance, aerospace, shipbuilding, construction and technology companies.

It wasn’t initially clear whether the order covered subsidiaries as well as parent companies, and U.S. government leaders clashed over how broad the blacklist should be, The Wall Street Journal reported in December.

The Chinese government has accused Washington of misusing national security as an excuse to hamper competition and has warned that Trump’s order would hurt U.S. and other investors worldwide.

Political analysts expect little change in policy under President-elect Joe Biden due to widespread frustration with China’s trade and human rights records and accusations of spying and technology theft.

U.S. officials have complained that China’s ruling Communist Party (CCP) takes advantage of access to American technology and investment to expand its military, already one of the world’s biggest and most heavily armed.

………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.wsj.com/articles/nyse-to-delist-chinas-major-telecommunications-operators-11609498750

https://www.nytimes.com/2021/01/01/business/nyse-delist-china-mobile.html

https://apnews.com/article/donald-trump-business-hong-kong-china-08e71111b26c119048c523c5ba3ebde5

……………………………………………………………………………………………………………………………………………………………………..

January 5, 2021 UPDATE:

The New York Stock Exchange reversed its decision to delist China Mobile, China Telecom, and China Unicom before it becomes effective.

NYSE said that “in light of further consultation with relevant regulatory authorities in connection with Office of Foreign Assets Control FAQ 857, available here, the New York Stock Exchange LLC (“NYSE”) announced today that NYSE Regulation no longer intends to move forward with the delisting action in relation to the three issuers enumerated below (the “Issuers”) which was announced on December 31, 2020.”

Meanwhile, the reversal is not yet final, as the NYSE maintained that it would “continue to evaluate the applicability of Executive Order 13959 to these Issuers and their continued listing status.” There is no substantiated evidence that pressure from China or intervention from the incoming Biden administration has played a role in the change of mind by NYSE.

Technically all the three Chinese state-owned telcos are listed on the Stock Exchange of Hong Kong (HKEX), and what’s traded in New York is an instrument called American depositary receipts (ADRs), which enables American investors to trade on foreign companies listed elsewhere.

On Monday, as a response to NYSE’s delisting announcement, the three telcos updated the market that ADRs represent between 3.3% and 8% of their total tradable shares. According to an earlier response by China Securities Regulatory Commission (CSRC) to NYSE’s original decision, the three operators’ ADRs only account for less than 2.2% of the equity shares of these companies, with “a total market capitalization of less than 20 billion RMB yuan” ($3.1 billion). China Mobile is the heaviest user of this instrument, accounting for 90% of the total value.

According to the Treasury Department, if NYSE’s original decision to delist were to go ahead, these companies would also need to be eliminated from other financial instruments, including derivatives, depositary receipts, exchange-traded funds, index funds, and mutual funds. The reversal of decision may have taken away the requirement for traders to make immediate changes in their products, some measures may still be needed as a precaution, and the actions may not be limited to the three telcos.

In December two index providers, FTSE Russell and S&P Dow Jones have both removed a number of Chinese companies from some of their indexes following the executive order. There are 35 companies on the Treasury Department’s list compiled for this particular executive order, including, in additions to the three operators, the usual suspects like Huawei and SMIC.

January 6, 2021 Update:

New York Stock Exchange Reverses Course Again, Will Delist 3 Chinese Telecom Firms After All!