Year: 2023

BT to offer HPE Aruba managed wireless LAN service

UK network operator BT announced a partnership with HPE’s Aruba division [1.] to offer customers a new managed wireless LAN service powered by HPE Aruba Networking delivering improved performance, flexibility and control of local area networks (LANs). It combines BT’s global reach and extensive experience in the design, deployment and management of in-building wired and wireless connectivity with the latest HPE Aruba Networking LAN solutions.

Note 1. On March 2, 2015, Hewlett-Packard announced it would acquire Aruba Networks for approximately $3 billion. It’s interesting that enterprise LANs are now moving from Ethernet to WiFi where Aruba has been a leader (see IDC chart below).

Many legacy LANs struggle to support hybrid workers’ expectations when accessing apps in offices, branches, warehouses, factories or campuses. This is exacerbated by increasing use of bandwidth-hungry video collaboration tools. Colleagues also expect consistent and reliable Wi-Fi connectivity around the building. The increasing number of connected devices, including internet of things (IoT), adds further complexity and cyber security risks.

BT’s new HPE Aruba Networking Managed LAN service will allow customers to securely modernise connectivity to support changing workstyles and keep apace of IoT demands.

As a first step, BT audits the LAN to identify what is already in place and what could be re-used and anything that should be replaced. HPE Aruba Networking provides interoperable technology that can avoid the need to replace the entire network. BT will work collaboratively with the customer to manage costs by providing a staged approach to modernisation with benefits realised at each stage.

BT then evaluates how to secure and protect connected devices. It simplifies visibility by giving customers a single dashboard hosted in the cloud. This centralises reporting, analytics, security, scalability and resilience in one platform to help customers deliver a consistent end-user experience. It can also identify redundant devices using unnecessary power and automate network and energy optimisation.

Andrew Small, director of voice and digital work, Business, BT Group, said: “It’s clear that legacy in-building networks can’t handle modern hybrid working and IoT devices, never mind what comes next. That’s why we’re expanding customer choice of managed LAN solutions by partnering with HPE Aruba Networking. This will offer the visibility, flexibility and security customers need to deliver productive, trusted wired and wireless connectivity.”

“Global customers that are building their connectivity strategies are focusing on modern enterprise networks that are secure, agile, responsive to business needs and simple to operate, while being powerful drivers of transformation,” said Phil Mottram, executive vice president and general manager, HPE Aruba Networking. “HPE Aruba Networking is at the forefront of reinventing how customers and partners can consume or deliver business-outcome focused networking, and by integrating our AI, security, automation, and Network as a Service capabilities, our global managed LAN service with BT is an example of how the network is helping customers achieve their business objectives.

Benefits from Aruba LAN managed by BT:

- Visibility across your network: Through cloud-native management console and single operating system that simplifies visibility and improves performance.

- Optimized existing assets: A solution that integrates and optimizes existing LAN infrastructure, so you are future-ready.

- Supported by BT’s experience in managing and transforming multi-vendor solutions to a more simplified and efficient network.

- Remove the skills gaps: With a trusted partnership that has the combined breadth and depth of our expertise to deliver standalone LAN, campus-wide LAN, and wider transformation solutions.

- Secure and automate: End-to-end managed service and deployment. Scale up or down as needed. Implement additional services, such as advanced security to gain greater insight into your network and apps.

- Innovate and grow: Through centralised reporting, analytics, security, scalability, and resilience all in one platform that helps you deliver a consistent end-user experience and build a robust and innovative LAN.

- Sustainable solution: BT’s Aruba LAN can identify redundant devices using unnecessary power. In addition, it uses automation to optimise network management and energy efficiency.

Market Assessment:

According to Dell’Oro group, enterprise WLAN revenues surged 48% year-on-year in the first quarter of the year, reaching $2.7 billion. Dell’Oro’s Wireless LAN research director Siân Morgan noted that the market hasn’t seen such consistent y-o-y revenue growth for 10 years. Dell’Oro expects revenues to reach $10 billion this year. Dell’Oro said the growth in Q1 appears to have been driven by backlogged orders being filled, and that this is actually masking a decline in new orders.

IDC published its own figures this month that put global enterprise Wireless LAN (WLAN) revenue at $2.8 billion in the first quarter, up 43.3 percent on last year. Similarly to Dell’Oro, IDC said growth was driven by the easing of component shortages and supply constraints, allowing suppliers to catch up with back orders.

In terms of vendors, IDC ranks HPE Aruba second by Q1 market share at 16 percent, noting that its revenue grew 39.5%. Cisco is still the clear leader, with a market share of 47.1% and impressive enterprise WLAN revenue growth of 62.7% (see chart).

References:

https://newsroom.bt.com/bt-and-hpe-partner-for-new-global-managed-lan-service/

https://www.globalservices.bt.com/en/solutions/products/aruba-lan

https://www.arubanetworks.com/products/wireless/access-points/indoor-access-points/

https://telecoms.com/522453/bt-taps-hpe-for-global-managed-lan-service/

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

MTN Consulting reports [1.] that the top three Telco Network Infrastructure (NI) equipment vendors continue to be Huawei, Ericsson, and Nokia. They account for 37.4% of the total market in annualized 1Q23, or 34.8% in 1Q23 alone. While the trio has captured >40% share of the market for most of 2016-22, Huawei’s share has fallen recently, and all three giants have been pressured by vendors in the cloud and IT services space (e.g. Amazon, Microsoft, Alphabet, Dell, VMWare…).

Note 1. This MTN Consulting study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-1Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

Focusing on the top three, Huawei has dropped in the last three periods (due to global sanctions), but remains dominant due to China.

Ericsson’s share decline was a function of lower RAN spending among its largest customers as the 5G rollout pace ebbs. The Swedish vendor hopes to offset this decline soon with new revenues from its blockbuster acquisition of network API platform vendor, Vonage. It expects the first revenues from the acquisition later this year and a ramp up further in the next two years.

Nokia, including (Alcatel-Lucent) ALU for pre-acquisition years, has also dipped as 5G RAN rollouts slowed. But it gained market share slightly in 1Q23 on account of 45% growth in its optical networks business along with some benefits from catch-up sales related to the supply chain challenges it witnessed in 2022.

China Comservice and ZTE have been trading the 4 and 5 spots off and on since early 2019. Notably, though, China Comservice is majority owned by Chinese telcos, and is not truly independent. Intel is in the 6th position due to data center, virtualization, edge compute and other telco projects, some done directly and some on an OEM basis.

CommScope remained at seventh position while NEC managed to surpass Cisco in the latest annualized 1Q23 period, as Cisco (9th position) witnessed a stark drop in its Telco NI revenues in 1Q23. Cisco’s decline is worrying, as its largest market (the U.S.) has a growing focus on 5G core, which Cisco has flagged in the past as key to the company growing telco revenues. Amdocs is ranked 10th due to its strength in network software.

Biggest Telco NI revenue changes on a YoY basis:

Three out of the top five vendors, in terms of YoY revenue growth, are the same for both single quarter and annualized 1Q23: Alphabet, Microsoft, and Lenovo. Two of these are cloud vendors (Alphabet and Microsoft) who are steadily improving their penetration of the telco vertical market with a range of solutions – digital transformation, service design, 5G core, workload offshift, etc. Lenovo is gaining traction with its disaggregated, virtual radio access network (vRAN), and multi-access edge computing (MEC) solutions. Clearfield is a small fiber company focused on the booming US market.

Other companies to show improvement in both periods include Tejas Networks which bagged a mega deal for a BSNL-MTNL 4G network; Rakuten Group (Symphony) benefiting from key deployments of its cloud-based Open RAN solutions; Harmonic which has benefited from strong cable access spending and a growing customer list; YOFC (a Chinese fiber company), and two large US-based engineering services-focused companies (DyCom and MasTec) benefiting from a fiber boom.

Declines in the 1Q23 annualized period include Cisco which continues to be worrisome on account of lower customer spending, though it noted improvement in supply chain constraints in the latest quarter. Extreme Networks, Casa, and Airspan all dipped, but noted that the supply chain challenges of previous quarters are improving. Cisco, the largest among the annualized decliners, remains optimistic about prospects as telcos move to 5G SA cores.

Supply chain issues improving:

For the past two years, vendors in the Telco NI market have been plagued with supply chain constraints. The situation is now easing though, if a review of vendor earnings from 1Q23 is anything to go by. Most significant vendors confirm the assessment of three months ago: shortages in specific component areas continue to be an issue but are improving with time, with normalcy likely in 2H23.

Nokia notes that “Going forward, growth rates are expected to slow in the coming quarters as Q1 benefited from some catch-up, as supply chains normalize”. Ericsson echoed this, saying that “…the big effect really comes from the ongoing inventory adjustments, and that comes because they build up large inventories when supply chain was tight and those inventory levels are now normalizing. We expect these adjustments to be completed during Q2, but some could slip into Q3 clearly”.

Juniper has a slightly more cautious view – “While supply has improved for the majority of our products, we continue to experience supply constraints for certain components, and supply chain costs remain elevated”.

Casa, Calix, and Ciena are also witnessing good improvements in supply chain and are expecting further improvements over the course of 2023. F5 Networks is benefiting from its strategy of redesigning the “hardest-to-get components” and “opening up new supply” sources.

Spending outlook:

Most large vendors appear to be cautiously optimistic about the spending outlook in Telco NI. While supply chain issues are expected to clear up by 2Q or 3Q 2023, MTN Consulting expects the market will start to flatten in the next few quarters. Per our latest official forecast, we expect telco capex – the main driver of Telco NI market – to reach $330B in 2023, and a small decline to $325B in 2024. However, it’s likely that both figures may be $5B or more too high. Ericsson, a key telco vendor, has signaled a cautious telco capex spend outlook in its latest earnings call: “In the second quarter, we expect operators to remain cautious with CapEx similar to Q1 and continue with the inventory adjustment that we have described”.

Lower expectations have been apparent on many 4Q22 earnings calls. DT, for instance, expects US capex will see a “strong decrease” in 2023, and thereafter stability. Verizon’s capex is set to fall nearly 20% YoY in 2023. Charter Communications cut its capex outlook for 2023 by about $500M, hitting both the low & high range. Orange expects a “strong decrease” (same wording) in total “ecapex” this year as its FTTH deployment peak has passed and it aims to increase its dividend. Canada’s BCE says that 2022 was the peak year in its accelerated capex program, and capex will begin to fall this year until capital intensity is back down to pre-COVID levels. Vodafone expects group capex in its current fiscal year to be flat to slightly down, as it pursues a “disciplined approach to capital allocation.” Telefonica says its declining capital intensity is proof that the investment peak is behind it. The MTN Group says capital intensity will decline from 18% to 15% over the next few years.

There are several factors to help explain lower expectations: some are company-specific, e.g. BCE is naturally reaching a latter phase in its buildout. There are also general factors, such as: rising interest rates; higher operating costs due to inflation, especially in energy; 5G’s failure to lift service revenues, leaving telcos highly dependent on volatile device revenues for any topline growth; and, cloud providers’ continually more aggressive pitches of new solutions to telcos. Cloud-based offerings can shift some capex to opex.

Amid all the cautious optimism, India as a market has emerged as a bright spot for the vendors. In 1Q23, Ericsson saw strong growth for its Networks business in India where it continues to rapidly roll out 5G. “It will make India a leading 5G nation and the leading nation for digitalization. And what we see is that the subscribers on 5G are using even more data than on 4G…” said Ericsson in its earnings call.

Ciena attributed its 60% YoY revenue growth in the Asia Pacific region to India, “which was up 88% year-over-year in Q2 to about $70 million, reflecting consistent strong demand from service providers in that market. India is going through a big cycle of 5G rollout and extension. And I think that’s going to happen over the next 1 to 3 years”.

Nokia also witnessed double-digit growth in both its Network Infrastructure and Mobile Networks divisions, reflecting the rapid 5G deployments in India: “…Q1 largely played out as we expected, with 5G deployments in India heavily influencing our Q1 top line.”

Telco Revenues Continue to Decline:

In 4Q22, global telco revenues plunged the most in more than a decade to post $429.6B, or -9.3% YoY – the fifth consecutive slump in a row. This impacted annual revenues and its growth rate for the year 2022 – they were $1,779.9B, down 5.9% YoY over the previous year. The sluggish top-line turned telcos cautious around spending on capex, the main driver for the Telco NI market, which declined for the second straight quarter to post $87.9B in 4Q22, down 5.1% YoY. This decline also knocked down annualized capex to $322.1B in 4Q22, from the peak of $330.0B in 2Q22.

On the brighter side, capex has held out better than revenues, pushing annualized capital intensity to a new all-time high of 18.1% in 4Q22. This was driven by a few countries who are in the midst of deploying 5G networks, notably India; while many more continue to scale up 5G to reach mass market coverage, and deploy fiber to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G.

Cloud vendors are also making critical inroads into the telco sector, aided by a growing number of stand-alone 5G core networks.

References:

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

LightCounting: Will Network Transformation resolve telecom’s paradox?

|

Christel Heydemann, the CEO of Orange, used her MWC ’23 keynote to highlight the paradox of the telecom market: telecom is a critical enabler of our digital future, yet a 2022 PwC report stated that nearly half (46%) of the global telecom CEOs surveyed thought their companies won’t survive another decade (the average figure for all industries surveyed was 39%). PwC cited the reason as telecoms’ poor record making money from technology.

Telecoms is a profitable business, yet competition and regulation are hampering its growth. Telecoms spends eye-watering amounts in investment – European CSPs alone are estimated to have spent $650 billion on technology in the last decade – yet the industry is one of the worse at getting a return on the investment.

|

|

|

Much of the spend has been on implementing the 5G wireless standard. 5G may be much vaunted by the CSPs but its impact is yet to be felt. That is because the wireless standard as envisaged is still to be implemented. What has been rolled out since 2019 is 5G non-standalone (NSA): a 4G networking/ 5G radio hybrid. It is 5G Standalone (5G SA) that delivers the tools other industries can benefit from: low latency wireless networking and clever network segmentation in the form of slicing.

Overall, some 40 CSPs had deployed 5G SA by the start of 2023, a small fraction of overall 5G deployments. Yet if 5G SA is what will grow revenues via the digitalization programs of different sectors, should there not be a greater urgency to deploy it?

The CSPs also must transform their businesses, their organizations, their staff development, address sustainability, and embrace a development that promises huge returns; artificial intelligence (AI).

Telecoms is built on the engineering disciplines of communications and computing and the CSPs have strong engineering teams. How can CSPs, that want to serve other industries in their digital transformation journeys, be so far behind when it comes to AI? Another paradox.

Network transformation’s impact on the future of the CSPsWhat will be the impact of network transformation and transformation in general on the future of the CSPs?

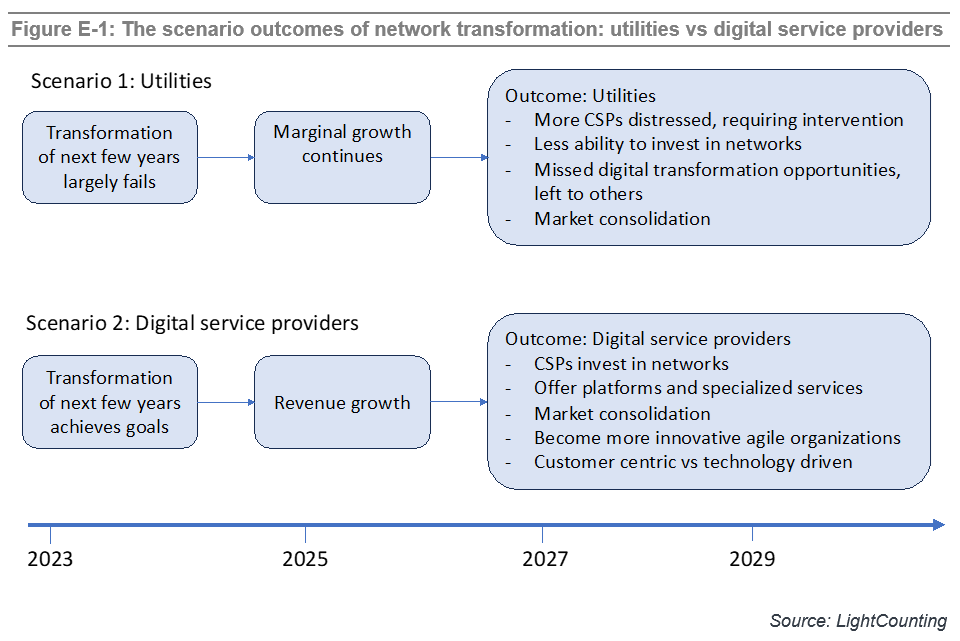

In the latest Network Transformation report, LightCounting defines two scenarios that bound the possible outcomes: Scenario 1 is where CSPs become utilities while Scenario 2 sees CSPs transform into Digital Service Providers.

In Scenario 1, dubbed Utilities, the transformation efforts fail to create the revenue growth needed nor enable the CSPs long-term aspirations to become digital service providers. The CSPs continue as businesses but are consigned to the infrastructure provider layer delivering connectivity services, limiting their ability to invest in their networks. They may still be ongoing businesses but will miss the digitalization opportunities thus bounding their business prospects.

Scenario 2, dubbed Digital Service Providers, is that network transformation achieves its goals. Successful network transformation will allow CSPs to play not only as infrastructure/ connectivity players but as platform providers and specialists addressing vertical markets.

LightCounting believes that some CSPs will be successful and become digital service providers. They will be able to acquire their less successful competitors, further improving scale of their business. Large scale will be very critical for the success of CSPs and their ability to compete with ICPs in offering new services.

Anti-monopoly regulators will have to find the right balance to limit the scale of CSPs, while letting them prosper. It is the huge success of ICPs which attracts attention of the regulators now. It is long overdue. Curbing the scale of ICP monopolies will also help CSPs to sustain their business, but they still need to transform themselves. The recent revelation that Amazon wants to bundle a phone service offering as part of Amazon Prime shows how vulnerable the CSPs are.

LightCounting defined this period as pivotal for the CSPs in last year’s network transformation report. One year on, this remains the case although what is at stake is clearer. We see more determination among CSPs to transform into digital service providers of the future. There is no viable alternative.

More information about the report is available at: Network Transformation

References:

|

Highlights of 2023 Mobile World Congress Shanghai, China

Mobile World Congress Shanghai (from June 28-30, 2023) showcased the impact of 5G networks on global businesses in Asia. This fourth anniversary of commercial 5G adoption offered a chance for network operators and vendors alike to reflect on the benefits of the latest network technology and what’s needed for broader 5G adoption.

According to Robert Clark of Light Reading, “Industry leaders returned after a four-year hiatus with little to say and even less to announce.” That’s nothing new. Shira Ovide, writing for the Washington Post in June 2023, called claims about 5G’s benefits for retail customers “mostly hot air.”

China Mobile talked up its prospects in two new 5G consumer services:

- Cloud phones, which could be tailored to meet the needs of different user segments – general-purpose use, gaming, streaming and so on. The apps, OS and processing of cloud phone voice and data are all running in the cloud, according to Li Bin, vice president of subsidiary China Mobile Internet Co.

- 5G new calling – an enhancement to VoNR that is meant to transform the voice call experience. It enables integration of other apps into a phone call, like real-time translation, or multi-party video or remote guidance.

Source: Grid Scheduler on Flickr (public domain)

……………………………………………………………………………………………………………………………………………

Meng Wanzhou Deputy Chairwoman, Rotating Chairwoman, CFO, daughter of Huawei founder Ren Zhengfei:

“5-point-5G is the next step forward for 5G. 5-point-5G will feature 10-gigabit downlink speeds, gigabit uplink speeds, the ability to support 100-billion connections, and native AI.” With much higher speeds, it’s believed 5-point-5G will offer greater levels of targeted support for industrial needs, in domains like IoT, sensing and advanced manufacturing.

A partnership between Huawei and Shaanxi Coal Industry Co. mines installed sensors that can deliver real-time data about dangerous gas levels and instability in mine tunnels, to alert control centers above ground as needed to ensure worker safety.

5G network technology in Tianjin, China, leverages Huawei’s 5GtoB solutions for remote operators. Higher network speeds allow for more efficient operations that yield meaningful results for port operator’s bottom lines, while consumers benefit by receiving goods faster.

In the manufacturing sector, companies are seeing a significant transformation in operations, as digitalization increases production capacity. A factory in Jingzhou, China, operated by Midea Group, became the world’s first fully 5G-connected electrical appliance factory. Powered by advanced mobile solutions from China Mobile and Huawei, production line capacity significantly increased — reducing inventory needs and delivering savings which can be passed on to consumers. As data volume requirements for operating modern businesses rise, 5G networks’ efficiency can be both more cost-efficient and require less energy.

Huawei made a bold claim that it would provide all the necessary components for running a 5.5G network by next year. However, no-one can define what 5.5G even is.

Yang Chaobin, the director and president of ICT Products & Solutions at Huawei, announced the company’s ambitious plans, stating that the launch would signify the beginning of the 5.5G era for the industry.

However, the term “5.5G” is currently not recognized by the 3rd Generation Partnership Project (3GPP), the organisation responsible for defining 5G and related standards.

The 3GPP is currently focused on evolving 5G through its work on Release 18, known as “5G-Advanced,” which includes significant enhancements like 10Gbps connections and the utilization of mmWave frequencies.

Huawei’s use of the term 5.5G seems to be an attempt to position Release 18 as the next iteration of 5G. Despite the lack of formal recognition, Huawei is confident in its ability to deliver advanced technologies, including AI-native capabilities, to enhance network performance and availability.

“With a clearly defined standardization schedule, the 5.5G Era is already poised for technological and commercial verification. In 2024, Huawei will launch a complete set of commercial 5.5G network equipment to be prepared for the commercial deployment of 5.5G,” Yang said. He claims that Huawei’s approach will enable the deployment of AI capabilities throughout the network.

Huawei’s involvement in 5G infrastructure has raised concerns among many governments due to security risks associated with the company. Several countries have even banned or restricted the use of Huawei’s 5G and 4G equipment. Consequently, it is unlikely that a significant number of global buyers will consider Huawei’s 5.5G offerings.

However, Huawei’s announcement could still garner positive attention domestically. Developing nations may also be attracted by Huawei’s competitively-priced communication equipment.

While Huawei’s claim to offer comprehensive solutions for a 5.5G network is ambitious, the term itself lacks formal recognition from standardization bodies. The company’s emphasis on AI capabilities and network enhancements may resonate with certain markets, but the geopolitical challenges it faces could limit its global reach.

References:

OneWeb Expands Connectivity Services in Europe and U.S.

OneWeb, the global Low Earth orbit (LEO) satellite network service provider, announced the expansion of its connectivity services throughout Europe and the majority of the United States. The expanded network availability marks a significant step as OneWeb progresses towards global services.

OneWeb said the expansion, which became first active at the end of May, adds service to 37 new European countries, including Austria, Italy, France, and Portugal, as well as the entire western US coast from Washington to California, the northeast coast from Maine to Virginia, and across the Midwest. This expansion also further enhances connectivity across Canada and additional maritime regions.

Stephen Beynon, OneWeb’s Chief Customer Officer, said: “This expansion is a significant step in our journey to delivering global commercial service for our customers. We are seeing increased demand for our service as we have expanded coverage and grown our portfolio of user terminals for different markets. Our technical experience in all corners of the globe, as well as the strong relationships we have with existing partners in Alaska, Canada and Europe, means OneWeb is well placed to support customers in these new regions as well as welcoming new partners to activate services for the first time. As our network coverage continues to grow, I am incredibly excited to serve more maritime, government, enterprise, and aviation customers than ever before.”

OneWeb completed launching its global constellation earlier this year and the business is working towards offering fully global service by the year end. OneWeb and its partners are continuing to add new ground stations and add further service across the world, as more of its over 600 satellites reach their final position in the constellation. OneWeb is on track to complete the full global rollout of ground stations by the end of the year.

Already delivering connectivity at 50 degrees north, OneWeb has been working alongside Distribution Partners to provide community broadband solutions, cellular backhaul, corporate enterprise services, and more throughout the Arctic region, connecting locations in Alaska, Canada, the UK, and beyond.

With the recent expansion, OneWeb’s partners are now expanding their services to new regions and enabling additional partners to integrate OneWeb’s LEO network into their solutions.

OneWeb says as a wholesale connectivity provider, it offers its services through partners such as telecommunications companies and internet service providers. These partners can seamlessly integrate OneWeb’s service into their suite of connectivity offerings, ensuring that end customers can enjoy high-speed, resilient, and low-latency internet connections, regardless of their geographical location.

Having completed the launch of its global satellite constellation earlier this year, OneWeb is working towards offering fully global service by the end of this year. The company, in collaboration with its partners, is actively adding new ground stations and expanding its services across the globe as over 600 satellites reach their designated positions within the constellation.

OneWeb said it remains on track to complete the full global rollout of ground stations by the end of the year, solidifying its commitment to connecting the world.

References:

https://oneweb.net/resources/oneweb-expands-services-launches-commercial-service-across-large-parts-europe-and-us

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Telefonica d’Espagne wants to pursue private mobile networks for businesses in the Latin American region and has enlisted Nokia assist. The Spain-based telecoms group and its network equipment vendor partner are talking up their ability to bring about digital transformation for enterprises in Latin America. Through their newly-announced partnership the pair intend to offer Nokia’s portfolio of industrial-grade private wireless network and digitalization platform solutions, concentrating primarily on what they describe as “the most promising industries in the region;” that’s ports, mining, energy and manufacturing.

Juan Vicente Martín, Director for B2B at Telefonica Movistar Empresas Hispanoamérica, said: “In this unprecedented alliance, the benefits of LTE & 5G private wireless will enable Industry 4.0 across industries. With our strategic partner Nokia, we provide the best connectivity, enable greater optimization of operations, achieving important productivity and efficiency rates and contributing to the digitalization of the industrial sectors throughout Latin America.”

Néstor González, Head of Customer Team for Telefonica Corporate, Nokia, said: “We are thrilled to partner with Telefonica, combining our leading Industrial-grade private wireless solutions with Telefónica Hispanoamérica’s growing B2B solutions and services footprint, to jointly reach a wide variety of enterprises and industries throughout the region. We are very excited to be at the forefront of digital transformation for enterprises in Latin America which have tremendous potential for productivity gains from Industry 4.0. We thank Telefónica Hispanoamérica for their confidence in Nokia and we are looking forward to jointly deploying many new networks”.

Nokia has deployed mission-critical networks to more than 2,600 leading enterprise customers in the transport, energy, large enterprise, manufacturing, webscale, and public sector segments around the globe. It has also extended its footprint to more than 595 private wireless customers worldwide across an array of industrial sectors and has been cited by numerous industry analysts as the leading provider of private wireless networking worldwide.

Nokia has statistics to help encourage enterprises to make the leap into private wireless. According to a late 2022 survey by Nokia and GlobalData there were 79 multinationals that have deployed Nokia industrial-grade private wireless solutions. Nearly 80 percent of survey respondents expected to achieve ROI within six months of deployment.

Currently, private mobile networks based on 4G are probably more of an opportunity for Telefonica than 5G-based rollouts, the latest generation of mobile technology being still very much in its infancy in the region.

Indeed, according to the latest iteration of Ericsson’s mobility report, published a week ago, 4G subscriptions accounted for a massive 74% of total mobile connections in the region at the end of last year, with 5G barely figuring at all. The Swedish vendor calculated that there were just 7 million 5G subscriptions in total in Latin America at year-end, while operators added over 60 million 4G subs over the 12 months.

However, Ericsson predicts that 5G uptake will become more meaningful from 2024 onwards and that by the end of 2028 the technology will account for 42% of all mobile subscriptions in the region.

Consumer uptake of 5G does not necessarily directly translate to the state of play in the private wireless market, of course. But it gives us an idea of the maturity of the overall market.

Last September, Ericsson declared a “digital revolution…underway in Latin America,” when it announced the deployment of what it said was the region’s first private 5G standalone network with a wholly on-premises network architecture, operating completely separately from the public mobile network. The customer was conglomerate Nestlé, in Brazil, and the pair worked with network operators Claro and Embratel.

While Nestlé might be the kind of customer telcos and vendors dream about, there is clearly an opportunity to serve smaller and less well-known outfits too, regardless of the state of deployment of 5G.

Nokia noted that it has more the 595 private wireless customers worldwide across various industrial sectors, although it did not mention how many of those are in Latin America. Quite likely a few at most, but as the technology develops in the region, so will the market opportunity.

References:

https://telecoms.com/522425/telefonica-and-nokia-partner-to-target-private-5g-market-in-latam/

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

Enterprise networking and IT cybersecurity professionals are turning to managed SD-WAN (software-defined wide area networking) and SASE (secure access service edge) services to deal with the increasing challenges caused by network complexity, according to a new report from market research firm Futuriom.

SD-WAN and SASE have been evolving and maturing for several years now, but the market is far from mature. It is still growing and is highly fragmented, both in terms of the companies involved in providing services and technology to enterprise users and in how SD-WAN and SASE capabilities are deployed and consumed by enterprises.

What’s needed more than ever are software-based platforms for integrating the management of network and security functions at the same time. This approach was first initiated by SD-WAN, which separated the software control from the hardware for branch-office networking. SD-WAN evolved and grew by adapting security functionality (SASE), which could be integrated into the network platform.

The market has expanded to include SASE functionality, which provides cybersecurity functions such as secure web gateway (SWG), cloud access security broker (CASB), firewall-as-a-service (FWaaS), intrusion detection, zero-trust network access (ZTNA), and many others to protect enterprise access to public networks and SaaS apps.

Futuriom’s survey took place in March and April of 2023. The total audience of 196 respondents came from three countries: the U.S. (127 respondents), Germany (37), and India (32).

Report Highlights and Key Findings:

- Survey respondents indicate strong demand for SD-WAN and SASE managed services. Our survey data and discussions with end users indicate that SD-WAN/SASE technology helps professionals with network and security challenges, including the growing complexity created by distributed applications, cloud connectivity, and sprawling security risks.

- Managing network complexity is the largest challenge driving managed services demand. When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%). (Multiple responses were allowed.)

- Hybrid work and the need for zero-trust network access (ZTNA) are key drivers of SD-WAN/SASE technology. In the survey, 98% of respondents said that hybrid work has increased demand for SASE and ZTNA. When we asked respondents if ZTNA is a crucial component of SASE and SD-WAN offerings, 92% said yes.

- Hybrid (cloud/edge deployment) and single-pass architectures will be important components of SASE/SD-WAN services going forward. When respondents were asked if they wanted a hybrid solution that can accommodate networking and security both on premises and using cloud points of presence (PoPs), 98% said yes. In addition, 94% of respondents said they prefer a single-pass architecture.

- There will continue to be a diversity of SD-WAN/SASE deployment models. The two most popular models for deployment are best-of-breed combination (34%) and single-vendor (23%), but survey results show a wide diversity of deployment models.

Companies covered in this report: Aryaka, Amazon, AT&T, British Telecom, Cato Networks, Check Point Software, Cisco, Colt, Comcast, Deutsche Telekom/T-Systems, Forcepoint, Fortinet, HPE (Aruba), Hughes, Juniper Networks, Lumen Technology, NTT, Orange, Palo Alto Networks, Tata Communications, Telefónica, Telstra, VMware, Verizon, Versa Networks, Vodafone, Windstream, Zscaler.

…………………………………………………………………………………………………………………………

Separately, Dell’Oro Group reported that the portion of the SASE market, where vendors offer both SD-WAN and SSE (security service edge) solutions, grew an impressive 55% year-over-year (YoY) in 1Q 2023. By doing so, single-vendor SASE overtook the multi-vendor SASE portion of the market, consisting of vendors that can only offer the SD-WAN or SSE component. The overall SASE market revenue rose by over 30 percent for the fifth consecutive quarter in 1Q 2023 and, by doing so, was not far off the $2B mark.

“Even as enterprises have been more judicious in how they spend security budget, the robust growth of the SASE market is a testament to the strong commitment by enterprises and the value they bring to secure users’ access to cloud-based applications from anywhere,” said Mauricio Sanchez, Research Director at Dell’Oro Group. “The vendors that can offer both the SD-WAN and SSE components are setting themselves apart in an extremely competitive market,” added Sanchez.

Additional highlights from the 1Q 2023 SASE and SD-WAN Quarterly Report:

- For the first time since Dell’Oro started tracking SASE in 1Q 2019, there was a revenue position change in the number one spot, with Zscaler overtook Cisco.

- Palo Alto Networks overtook Broadcom (Symantec) for the number three overall SASE revenue position.

- Check Point, HPE/Aruba, and Netskope became single-vendor SASE players.

- Both SSE and SD-WAN revenue grew above 30 percent YoY.

- Unified SASE solutions–defined as SASE solutions where SD-WAN and SSE have been tightly integrated into a single technology stack–eclipsed $200M for the third consecutive quarter, representing over 140% growth.

- Overall SASE revenue growth on a regional basis varied from 27% in North America to 49% percent in the Caribbean and Latin America.

- The Access Router market revenue surged forward by over 15% YoY on improved hardware supply.

The Dell’Oro Group SASE & SD-WAN report includes manufacturers’ revenue covering the SASE and Access Router markets. In addition, the report analyzes the SASE market from two perspectives, technology (SD-WAN networking and SSE security) and implementation (unified and disaggregated). The report also provides unit information for the Access Router market. To purchase this report, please contact us at [email protected].

References:

https://www.futuriom.com/articles/news/results-from-our-sd-wan-sase-managed-services-survey/2023/06

Bloomberg: China Lures Billionaires Into Race to Catch U.S. in AI

China’s tech sector has a new obsession: competing with U.S. titans like Google and Microsoft Corp. in the breakneck global artificial intelligence race. A ChatGPT-inspired global wave of AI activity is only just beginning in the next battle for supremacy in technology.

Billionaire entrepreneurs, mid-level engineers and veterans of foreign firms alike now harbor a remarkably consistent ambition: to outdo China’s geopolitical rival in a technology that may determine the global power stakes. Among them is internet mogul Wang Xiaochuan, who entered the field after OpenAI’s ChatGPT debuted to a social media firestorm in November. He joins the ranks of Chinese scientists, programmers and financiers — including former employees of ByteDance Ltd., e-commerce platform JD.com Inc. and Google — expected to propel some $15 billion of spending on AI technology this year.

For Wang, who founded the search engine Sogou that Tencent Holdings Ltd. bought out in a $3.5 billion deal less than two years ago, the opportunity came fast. By April, the computer science graduate had already set up his own startup and secured $50 million in seed capital. He reached out to former subordinates at Sogou, many of whom he convinced to come on board. By June, his firm had launched an open-source large language model and it’s already in use by researchers at China’s two most prominent universities.

“We all heard the sound of the starter pistol in the race. Tech companies, big or small, are all on the same starting line,” Wang, who named his startup Baichuan or “A Hundred Rivers,” told Bloomberg News. “China is still three years behind the US, but we may not need three years to catch up.”

The top-flight Chinese talent and financing flowing into AI mirrors a wave of activity convulsing Silicon Valley, which has deep implications for Beijing’s escalating conflict with Washington. Analysts and executives believe AI will shape the technology leaders of the future, much like the internet and smartphone created a corps of global titans. Moreover, it could propel applications from supercomputing to military prowess — potentially tilting the geopolitical balance.

China is a vastly different landscape — one reined in by US tech sanctions, regulators’ data and censorship demands, and Western distrust that limits the international expansion of its national champions. All that will make it harder to play catch-up with the US.

AI investments in the US dwarf that of China, totaling $26.6 billion in the year to mid-June versus China’s $4 billion, according to previously unreported data collated by consultancy Preqin.

China’s Catch-Up Game

The aggregate size of US deals in AI still outpaces China’s in 2023

Source: Preqin

Note: 2023 data up to June 14th

Yet that gap is already gradually narrowing, at least in terms of deal flow. The number of Chinese venture deals in AI comprised more than two-thirds of the US total of about 447 in the year to mid-June, versus about 50% over the previous two years. China-based AI venture deals also outpaced consumer tech in 2022 and early 2023, according to Preqin.

All this is not lost on Beijing. Xi Jinping’s administration realizes that AI, much like semiconductors, will be critical to maintaining China’s ascendancy and is likely to mobilize the nation’s resources to drive advances. While startup investment cratered during the years Beijing went after tech giants and “reckless expansion of capital,” the feeling is the Party encourages AI exploration.

It’s a familiar challenge for Chinese tech players. During the mobile era, a generation of startups led by Tencent, Alibaba Group Holding Ltd. and TikTok-owner ByteDance built an industry that could genuinely rival Silicon Valley. It helped that Facebook, YouTube and WhatsApp were shut out of the booming market of 1.4 billion people. At one point in 2018, venture capital funding in China was even on track to surpass that of the U.S. — until the trade war exacerbated an economic downturn. That situation, where local firms thrive when U.S. rivals are absent, is likely to play out once more in an AI arena from which ChatGPT and Google’s Bard are effectively barred.

Large AI models could eventually behave much like the smartphone operating systems Android and iOS, which provided the infrastructure or platforms on which Tencent, ByteDance and Ant Group Co. broke new ground: in social media with WeChat, video with Douyin and Tiktok, and payments with Alipay. The idea is that generative AI services could speed the emergence of new platforms to host a wave of revolutionary apps for businesses and consumers.

That’s a potential gold mine for an industry just emerging from the trauma of Xi’s two-year internet crackdown, which starved tech companies of the heady growth of years past. No one today wants to miss out on what Nvidia Corp. CEO Jensen Huang called the “iPhone moment” of their generation.

“This is an AI arms race going on both in the US and China,” said Daniel Ives, a senior analyst at Wedbush Securities. “China tech is dealing with a stricter regulatory environment around AI, which puts one hand behind the back in this ‘Game of Thrones’ battle. This is an $800 billion market opportunity globally over the next decade we estimate around AI, and we are only on the very early stages.”

The resolve to catch OpenAI is apparent in the seemingly haphazard fashion in which incumbents from Baidu Inc. and SenseTime Group Inc. to Alibaba have trotted out AI bots in the span of months.

Joining them are some of the biggest names in the industry. Their ranks include Wang Changhu, the former director of ByteDance’s AI Lab; Zhou Bowen, ex-president of JD.com Inc.’s AI and cloud computing division; Meituan co-founder Wang Huiwen and current boss Wang Xing; and venture capitalist Kai-fu Lee, who made his name backing Baidu.

Ex-Baidu President Zhang Yaqin, now dean of Tsinghua University’s Institute for AI Industry Research and overseer of a number of budding projects, told Chinese media in March that investors sought him out almost daily that month. He estimates there’re as many as 50 firms working on large language models across the country. Wang Changhu, former lead researcher at Microsoft Research before he joined Bytedance in 2017, said dozens of investors approached him on WeChat in a single day when he was preparing to set up his generative AI startup.

“This is at least a once-in-a-decade opportunity, an opportunity for startups to create companies comparable to the behemoths,” Wang told Bloomberg News.

Many of the fledgling firms are squarely aimed at the home crowd, given growing concern in the West about Chinese technology. Even so, there’s an open field in a consumer market ringfenced to themselves, which also happens to be the world’s largest internet arena. In the works are AI-fueled applications, from a chatbot to help manufacturers track consumption trends, to an intelligent operating system offering companionship to counter depression, and smart enterprise tools to transcribe and analyze meetings.

Still, Chinese demos so far make it clear that most have a long way to go. The skeptical point out true innovation requires the free-wheeling exploration and experimentation that the US cultivates but is restrained in China. Pervasive censorship in turn means the datasets that China’s aspirants are using are inherently flawed and artificially constrained, they argue.

“Investors are chasing the concept,” said Grant Pan, chief financial officer of Noah Holdings, whose subsidiary Gopher invests in over 100 funds including Sequoia China (now HongShan) and ZhenFund in China. “However, the commercial use and impact to industry chains are not clear yet.”

Then there are Beijing’s regulations on generative AI, with its top internet overseer signaling that the onus for training algorithms and implementing censorship will fall on platform providers.

China Closing the Gap in AI Dealmaking

The number of AI startup deals in China is on a path to parity with the US

Source: Preqin

Note: 2023 data up to June 14

“Beijing’s censorship regime will put China’s ChatGPT-like applications at a serious disadvantage vis-à-vis their US peers,” said Xiaomeng Lu, director of the Eurasia Group’s geotechnology practice.

Last but not least, powerful chipsets from the likes of Nvidia and Advanced Micro Devices Inc. are crucial in training large AI models — but Washington bars the most capable from the country. The Biden administration is now considering tightening restrictions as soon as in coming months, essentially eliminating less-capable chips that Nvidia has devised for Chinese customers, the Wall Street Journal reported, citing anonymous sources.

But these hurdles haven’t stopped the ambitious in China, from Baidu and iFlytek Co. to the slew of new startups, from setting their sights on matching and surpassing the US on AI.

Executives, including from Tencent, argue models can tack on more chipsets to make up for lesser performance. Baichuan’s Wang said it got by with Nvidia’s A800 chips, and will obtain more capable H800s in June.

Others like Lan Zhenzhong, a veteran of Google’s AI Research Institute who founded Hangzhou-based Westlake Xinchen in 2021, employ a costly hybrid approach. The Baidu Ventures-backed company uses fewer than 1,000 GPUs for model training, then deploys domestic cloud services for inference, or sustaining the program. Lan said it cost about 7 to 8 yuan per hour to rent an A100 chip from cloud services: “Very expensive.”

Billionaire Baidu founder Robin Li, who in March unfurled China’s first answer to ChatGPT, has said the US and China both account for roughly a third of the world’s computing power. But that alone won’t make the difference because “innovation is not something you can buy.”

“Why aren’t people willing to invest in the longer-term and dream big?” asked Wayne Shiong, a partner at China Growth Capital. “Now that we’ve been handed this assignment by the other side, China will be able to play catch-up.”

References:

Read more about the US-China AI war:

- Xi Remade China’s Tech Industry in His Own Image With Crackdown

- Baidu Leads China AI Rally After Chat Bot Scores Strong Reviews

- AI Unicorns Are Everywhere and Their Founders Are Getting Rich

- How China Aims to Counter US Efforts at ‘Containment’: QuickTake

Other References:

Qualcomm CEO: AI will become pervasive, at the edge, and run on Snapdragon SoC devices

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Impact of Generative AI on Jobs and Workers

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

After building the world’s largest 5G network with 2.3 million 5G base stations by the end of 2022, China is on track add over 600,000 5G base stations and reach 2.9 million by the end 2023, according to new Omdia market research (owned by Informa). A key milestone in terms of China’s co-building and co-sharing 5G networks recently took place in May 2023, through the 5G network collaboration between all the four service providers in China. Under the organization and guidance of the Ministry of Industry and Information Technology (MIIT), the four major mobile operators in China – China Mobile, China Telecom, China Unicom, and China Broadnet, jointly announced the launch of what they claimed as the world’s first 5G inter-network roaming service trial. The service enables customers to access other telecom operators’ 5G networks and continue using 5G services when outside the range of their original operators’ 5G network.

Ramona Zhao, Research Manager at Omdia said: “Omdia expects inter-network roaming to improve operators’ 5G network coverage particularly in rural areas. Driven by better 5G network coverage, 5G will overtake 4G’s leading position and become the largest technology in China’s mobile market by 2026. By the end of 2028, we anticipate 5G will account for 65.1% of the total mobile subscriptions (including IoT connections).”

An advertisement for 5G mobile service at Shanghai Pudong International Airport. Image Credit: DIGITIMES

Omdia deems China as a 5G pioneer in terms of many areas, including technology innovation, network deployment, and 5G use cases. Driven by the increasing 5G adoption, Chinese service providers’ mobile service revenue and reported mobile (non-IoT) ARPU have all achieved year-on-year (YoY) growth in 2022. China Telecom reported an increase of 3.7% in its mobile service revenue; China Unicom‘s mobile service revenue saw a YoY increase of 3.6%; while China Mobile’s mobile service revenue also increased by 2.5% YoY.

Owing to the digital transformation demand from various state-owned enterprises, cloud services are also considered a growing business for Chinese service providers.

“Omdia recommends that Chinese service providers innovate more applications through the integration of cloud and the 5G network. This will be vital to enable the digital transformation of various industries and the acquisition of new revenue streams,” concludes Zhao.

According to a previous GSMA report, dubbed “The Mobile Economy China 2023”, 5G technology will add $290 billion to the Chinese economy in 2030, with benefits spread across industries.

“Mainland China is the largest 5G market in the world, accounting for more than 60% of global 5G connections at the end of 2022. With strong takeup of 5G among consumers, the focus of operators is now increasingly shifting to 5G for enterprises. This offers opportunities to grow revenues beyond connectivity in adjacent areas such as cloud services – a segment where operators in China have recently made significant progress,” the GSMA report reads.

5G will overtake 4G in 2024 to become the dominant mobile technology in China, according to the report. “4G and 5G dominance in China means legacy networks are now being phased out. While most users have been migrated to 4G and 5G, legacy networks continue to support various IoT services. However, some estimates suggest that legacy networks could be almost entirely shut down in China by 2025,” the study reads.

Chinese vendor Huawei Technologies has secured over half of a major contract to deploy 5G mobile base stations for local carrier China Mobile, according to recent reports by Chinese media.

Huawei obtained over 50% of the total of China Mobile’s centralized procurement program in 2023.

The report also stated that Huawei will provide 5G base stations for different frequency bands. The bands ranging from 2.6 GHz to 4.9 GHz will have around 63,800 stations, divided into two projects, while the number of base stations to operate in the 700 MHz band will be 23,100, divided into three projects. ZTE was the second-biggest winner in terms of base stations, followed by Datang Mobile Communications Equipment, Ericsson and Nokia Shanghai Bell.

References:

Technavio: APAC region leads global telecom services market with 33% growth

According to a new report by Technavio, the telecom services market is forecast to grow by $625.5 billion from 2022 to 2027, progressing at a CAGR of 6.13% during the forecast period. APAC is estimated to contribute 33% market growth (more details below). The report offers an up-to-date analysis regarding the current global market scenario, the latest trends and drivers, and the overall market environment.

Increased demand for broadband is the key factor driving the growth of the global telecom services market. The demand for high-speed broadband connections has increased due to the rise in the number of internet users globally. As a result, the companies are providing faster speeds and higher bandwidths by upgrading their network infrastructure. The world is becoming connected through the internet so the demand for telecom services is growing rapidly. Furthermore, people and businesses require fast and reliable connectivity to access information and services, stay connected with each other, and conduct their daily activities. Hence, these factors will boost the growth of the telecom services market during the forecast period.

Telecom service is provided by a telecommunication provider or a specified set of user-information transfer capabilities provided to a group of users by a telecommunication system. Telecom services include all forms of voice telephony and data transmission as well as leasing of circuit capacity.

Market Drivers:

- Increased demand for broadband

- Mergers and acquisitions

- Increase in global mobile data traffic

- Technological advancements

- Adoption of 5g technology

- High investment by vendors

Challenges:

- Regulatory compliance

- Increasing competition among vendors

- Growing concerns for environment

APAC region leading:

- APAC dominated the global telecom services market with the largest market share in 2022.

- APAC is the world’s most populous continent, and its population is increasing rapidly.

- As the population grows, so does the demand for telecom services, such as mobile phones and Internet access.

- Many APAC countries are experiencing rapid economic development, which is increasing the demand for telecom services.

- As people become more affluent, they are more likely to want access to mobile phones and high-speed Internet. APAC is experiencing a significant shift from rural to urban living.

- As people move to cities, they require more advanced telecom services to stay connected and conduct business.

- The rapid pace of technological change is transforming the way people live, work, and communicate.

- In APAC, there is a strong focus on digital transformation, which is driving the demand for telecom services.

- Thus, due to population growth, economic development, urbanization, and digital transformation, the demand for telecom services is booming in APAC, which may positively impact the growth of the global telecom services market during the forecast period.In 2020, the COVID-19 pandemic increased the demand for telecom services as more people work, learn, and socialize from home.

- As a result, there has been a surge in the demand for high-speed Internet, video conferencing, and online entertainment services.

- The increased demand for telecom services has also led to network congestion in some areas.

- With more people using the Internet simultaneously, network speeds can slow down, making it difficult for people to work and communicate effectively.

- The pandemic has disrupted global supply chains, which has impacted the availability of telecom equipment and devices.

- This has led to delays in the rollout of new infrastructure and has impacted the supply of mobile devices.

- However, in late 2020, the initiation of large-scale vaccination programs led to the lifting of lockdown restrictions and the resumption of industrial operations, which increased the demand for telecom services in commercial end-users as many people started going to offices.

References: