Author: Alan Weissberger

Gartner: Worldwide 5G Network Infrastructure Revenues to Grow 39% in 2021

Worldwide 5G network infrastructure revenue is on pace to grow 39% to total $19.1 billion in 2021, up from $13.7 billion in 2020, according to the latest forecast by Gartner, Inc.

Communications service providers (CSPs) in mature markets accelerated 5G development in 2020 and 2021 with 5G representing 39% of total wireless infrastructure revenue this year.

“The COVID-19 pandemic spiked demand for optimized and ultrafast broadband connectivity to support work-from-home and bandwidth-hungry applications, such as streaming video, online gaming and social media applications,” said Michael Porowski, senior principal research analyst at Gartner.

5G is the fastest growing segment in the wireless network infrastructure market (see Table 1). Of the segments that comprise wireless infrastructure in this forecast, the only significant opportunity for investment growth is in 5G. Investment in legacy wireless generations is rapidly deteriorating across all regions and spending on non-5G small cells is poised to decline as CSPs move to 5G small cells.

Table 1: Wireless Network Infrastructure Revenue Forecast, Worldwide (Millions of U.S. Dollars)

| Segment | 2020 Revenue | 2021 Revenue | 2022 Revenue |

| 5G | 13,768.0 | 19,128.9 | 23,254.6 |

| LTE and 4G | 17,127.8 | 14,569.1 | 12,114.0 |

| 3G and 2G | 3,159.6 | 1,948.2 | 1,095.2 |

| Small Cells Non-5G | 6,588.5 | 7,117.9 | 7,113.9 |

| Mobile Core | 5,714.6 | 6,056.2 | 6,273.3 |

| Total | 46,358.5 | 48,820.2 | 49,851.0 |

Source: Gartner (August 2021)

Regionally, CSPs in North America are set to grow 5G revenue from $2.9 billion in 2020 to $4.3 billion in 2021, due, in part, to increased adoption of dynamic spectrum sharing and millimeter wave base stations. In Western Europe, CSPs will prioritize on licensing spectrum, modernizing mobile core infrastructure and navigating regulatory processes with 5G revenue expected to increase from $794 million in 2020 to $1.6 billion in 2021.

Greater China is expected to maintain the No.1 global position in global 5G revenue reaching $9.1 billion in 2021, up from $7.4 billion in 2020. With China’s government funding 5G development for the three state owned carriers, that’s no surprise.

The big beneficiaries of China’s 5G infrastructure spending will be its domestic equipment makers, Huawei, ZTE, and (state owned) Datang Telecom. Despite clamoring for Sweden to permit Huawei 5G equipment to be deployed, Ericsson only received 3% of a joint 5G radio contracts from China Telecom, China Unicom and 2% from China Mobile, according to Reuters. Nokia, which was expected to take away Ericsson’s market share in China, did not receive any share, according to a tender document published by the Chinese companies.

In a way that’s a win for the Swedish vendor – and a brief share price hike backs up that statement – which won just 2% of an earlier deal from China Mobile. But if they want to secure their share of the multiple billions of dollars of global 5G infrastructure revenues forecast by Gartner, the likes of Ericsson and Nokia will need to keep winning contracts in their home markets.

5G Coverage in Tier-1 Cities Will Reach 60% in 2024:

While 10% of CSPs in 2020 provided commercialized 5G services, which could achieve multiregional availability, Gartner predicts that this number will increase to 60% by 2024, which is a similar rate of adoption for 4G- LTE in the past.

“Business and customer demand is an influencing factor in this growth. As consumers return to the office, they will continue to upgrade or switch to gigabit fiber to the home (FTTH) service as connectivity has become an essential remote work service,” said Porowski. “Users will also increasingly scrutinize CSPs for both office and remote work needs.”

This rapid shift in customer behavior is driving growth in the global passive optical network (PON) market as a preferred technology. The 10-Gigabit-capable symmetric-PON (XGS-PON) is not a new technology and with the price difference with other technologies narrowing, CSPs are willing to invest in XGS-PON to differentiate themselves in customer experience and network quality. Gartner estimates that by 2025, 60% of Tier-1 CSPs will adopt XGS-PON technology at large-scale to deliver ultrafast broadband services to residential and business users, up from less than 30% in 2020.

Gartner clients can learn more in the reports “Forecast Analysis: Communications Service Provider Operational Technology, Worldwide” and “Forecast: Communications Service Provider Operational Technology, Worldwide, 2019-2025, 2Q21 Update.”

…………………………………………………………………………………………

Small Cells?

While Gartner did not split out small cells’ contribution to the overall 5G infrastructure segment, evidence thus far suggests the market is progressing more slowly than many had once believed.

Last month, Crown Castle increased its guidance for the second time this year due to a strong cell towers market, but halved the number of small cells it expects to deploy in 2021 to 5,000. The company noted that wireless network operators have focused on tower-based 5G rollouts at the expense of small cells.

References:

5G network kit revenues to near $20 billion this year — report

Singapore’s M1 launches True 5G SA network market trial

- 4x FASTER SPEEDS THAN 5G NON-STANDALONE NETWORKS

- 10X FASTER SPEEDS THAN EXISTING 4G NETWORKS

- 2X BETTER NETWORK RESPONSE, WITH INCREASED RELIABILITY

M1 customers can enjoy an elevated call experience via the world’s first Voice over 5G New Radio (VoNR) service [1.] on M1’s 5G SA network that reinforces the experience of crystal clear high-definition voice calls, improved productivity with 5G speeds on data-driven activities throughout the duration of the calls as well as faster call setup time.

Note 1. Deutsche Telekom claims to have completed VoNR call this past June, which we documented here.

…………………………………………………………………………….

M1 is working closely with some of Singapore’s most exciting enterprises and SMEs to reimagine and redefine how businesses can leverage 5G to boost efficiency, fast-track innovation, and meet customer demands. Working in close synergy with its key shareholder, Keppel Corporation, M1 will continue to explore and develop more 5G-enabled business opportunities and collaborations across the Keppel group of businesses and open up limitless possibilities for corporations.

About M1:

M1, a subsidiary of Keppel Corporation, is Singapore’s first digital network operator, providing a suite of communications services, including mobile, fixed line, and fiber offerings to over two million customers.

Since the launch of its commercial services in 1997, M1 has achieved many firsts – becoming one of the first operators to be awarded one of Singapore’s two nationwide 5G standalone network licences, being the first operator to offer nationwide 4G service, ultra-high-speed fixed broadband, fixed voice, and other services on the Next Generation Nationwide Broadband Network (NGNBN).

M1’s mission is to drive transformation and evolution in Singapore’s telecommunications landscape through cutting-edge technology and its made-to-measure offerings.

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

Introduction:

RAN Research, a division of Rethink Technology Research, says in a new report that private 5G network deployments will surge over the next few years faster than public 5G, reaching a peak in 2027 when they will generate $19.3 billion in equipment sales, before subsiding after that as saturation approaches.

There will be a similar boom in deployment of enterprise WiFi networks around the WiFi 6E standard (IEEE 802.11ax endpoints that are capable of operating at 6 GHz, as well as in the 2.4 GHz and 5 GHz spectra already used by Wi-Fi 6). They will offer greater capacity and performance than the current WiFi generation (IEEE 802.11ac, 802.11n, etc).

WiFi growth will be confined largely to North America and Europe, and will peak earlier in 2024, after which an increasing number of sites will swing to 5G for more demanding use cases.

Private 5G networks will generate annual revenues of US$19.3 billion worldwide in 2027, up from $1.5 billion this year, according to a new report written by Rethink analyst Caroline Gabriel. Growth will be at its fastest in the 2022-2025 period, peaking in 2027 and then declining towards the end of the decade as market saturation approaches, she notes.

By 2028 there will be 26.6 million private 5G networks deployed globally, a significant increase on the 1.1 million expected to be rolled out this year.

Image Courtesy of Qualcomm

These are key findings of the latest report, “Private Networks Driving Opportunities in 5G and WiFi” from RAN Research, the wireless forecasting arm of Rethink Technology Research. The forecast drills down into regions and vertical industry sectors, identifying manufacturing as a major driver for private enterprise 5G in line with the industry 4.0 revolution, but with strong growth across the board. Healthcare, transportation, energy and government stand out as other industry vertical where deployments of private 5G and WiFi 6E will flourish.

Executive Summary:

Private 5G networks are on the verge of rapid take off to generate a surge in annual revenues for network equipment from $1.5 billion in 2021 to $19.3 billion in 2027. Growth will be fastest in most markets from 2022 to 2025 before tailing off and declining towards the end of the period after 2027 as saturation approaches.

By 2028 there will be 26.6 million private 5G networks deployed around the world, up from 1.1 million in 2021. This growth will occur in all regions but will be most striking in the four countries leading the private 5G field now, the U.S., Germany, China and Japan. Of these four, China stands out for facing stronger regulatory resistance to private 5G where roll out is dominated by the three great stateowned monopolies, China Mobile, China Telecom and China Unicom. But strong upsurge from enterprises, including government agencies as well as manufacturers, looks like opening up the country ’ enterprise 5G field to rapid growth.

Image Courtesy of Qualcomm

Private wireless networks will be deployed at a faster rate than 5G as a whole in most markets, as mobile networks combined with edge compute become capable of meeting more use cases and enabling new applications in manufacturing process, UAVs, remote healthcare, advanced transportation and others.

WiFi 6E is on course for a similar growth trajectory as private 5G, tailing off later in the forecast period. It is true though that only the next generation WiFi 7 that will start being deployed after 2024 will close the gap on 5G in peak performance, capacity and low latency. Our forecast numbers for WiFi 6E also include early deployments of WiFi 7 without making any distinction. Certainly, until that 7th generation comes along, WiFi will lack the deterministic behavior required for the most demanding ultra low latency real time applications, such as control of UAVs. In these scenarios 5G will be preferred but WiFi will continue to coexist for applications where best effort performance is adequate. This will include some of those use cases touted for 5G under the eMBB category concerned mostly with high capacity, although WiFi 6E itself still has to justify investment in the upgrade from WiFi 5. 5G will emerge in some cases as an immediate alternative to WiFi 6E. There are also common factors affecting both private 5G and WiFi 6E roll out, such as chip shortages and other continuing impacts of the global Covid19 pandemic. All these will impede deployments in the short and medium term, with both service providers and their equipment suppliers reporting a slowdown resulting from changed working practices during the pandemic and disruptions within the supply chain.

For some enterprises where blanket indoor coverage is established there will be more concerted migration from WiFi to cellular for private wireless communications. But unless such 5G coverage is almost ubiquitous, users will continue with WiFi and indeed penetration will increase around new best effort use cases.

Copyright © 2021 Rethink Research, All rights reserved.

………………………………………………………………………………………………

References:

https://rethinkresearch.biz/reports-category/ran-research/

China to drive private 5G network growth despite regulatory headwind– research

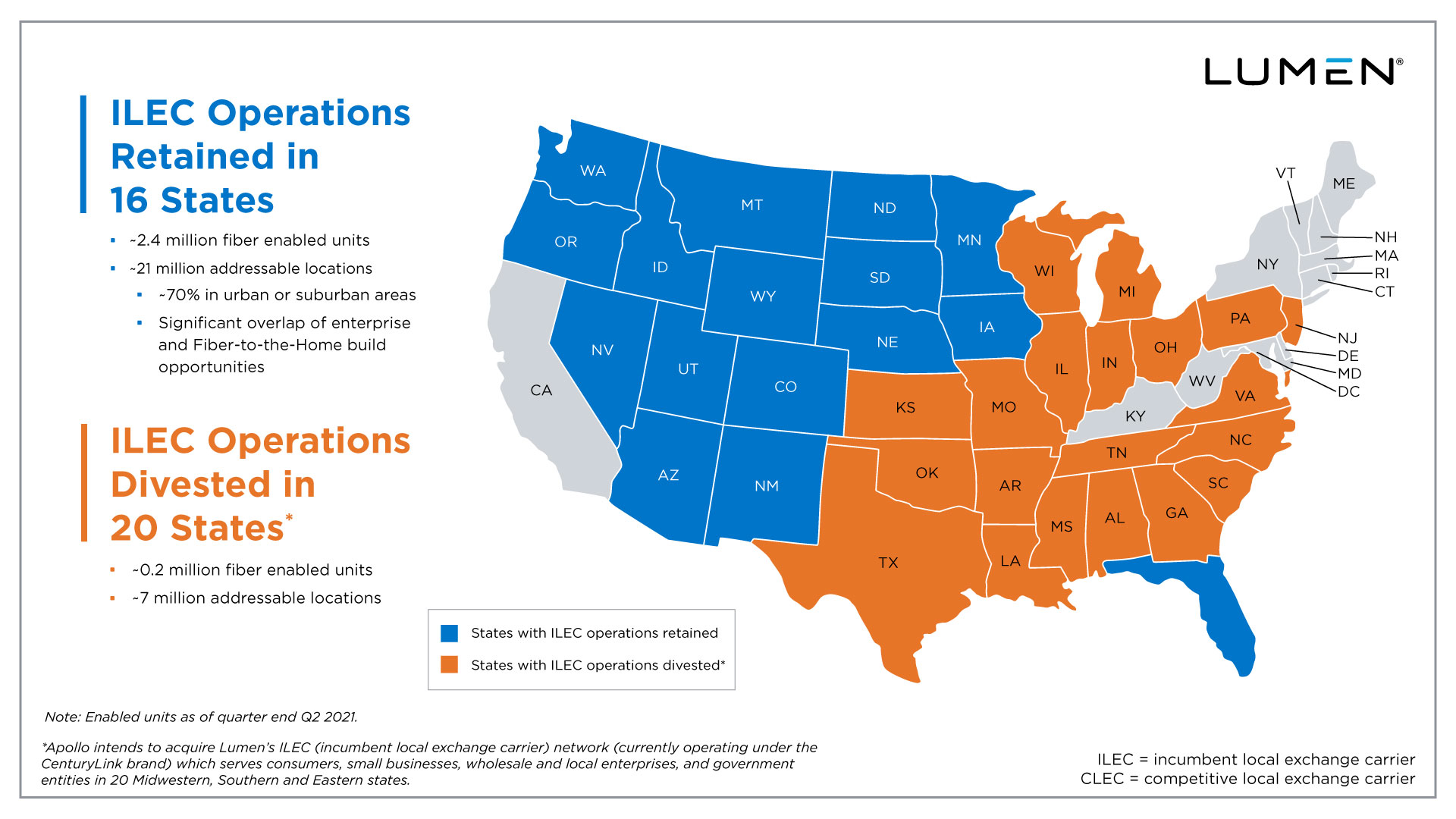

Lumen to sell local incumbent carrier operations in 20 states to Apollo Funds for $7.5 billion

Lumen Technologies, formerly known as CenturyLink, has agreed to sell a large part of its U.S. network to Apollo Global Management for $7.5 billion, according to a report by The Wall Street Journal on Tuesday. The report was later confirmed by Lumen.

A collection of telephone lines and broadband infrastructure (which cover 6 million residential and business customers across 20 states, mostly in the U.S. Midwest and Southeast) are included in the deal. So is $1.4 billion of assumed debt by Lumen.

“If you look at the markets that we’re transferring to Apollo, these are markets that Lumen would not have invested as heavily in,” Lumen CEO Jeff Storey said in an interview. “Apollo will put the investment into these markets that we believe they can sustain.”

Lumen’s remaining operations will focus on large business clients, which generate most of its revenue, as well as home-broadband subscribers in 16 states including Colorado, Florida and Washington.

The sale is the latest course change for Lumen, the company known as CenturyLink until its 2020 rebranding. CenturyLink was among the few remnants of the former AT&T monopoly (e.g. US West then Qwest) to survive into the 21st Century, though it avoided copying peers’ pursuit of wireless customers and focused its attention on landlines. In July, Lumen said it was selling its Latin American assets to infrastructure investor Stonepeak Partners LP for $2.7 billion.

CenturyLink grew much bigger after it agreed in 2016 to merge with Level 3 Communications, a network operator focused on large U.S. business customers. The combination yielded billions of dollars in savings and tax advantages, though executives faced challenges stitching together the business cultures of CenturyLink, based in Monroe, LA, and the operations inherited from Level 3 in Broomfield, CO.

For Apollo, the Lumen deal plays into a thesis the firm has developed with the new company’s executives around the need for fiber-based broadband to be expanded in the U.S. While fiber is a superior consumer broadband technology, many potential providers of fiber have lacked the access to capital to upgrade their sprawling networks, according to Aaron Sobel, the Apollo partner who led the deal. As a standalone company, the new entity won’t have other capital needs that take priority.

“It’s very difficult to carve out these states from a large telco,” Mr. Sobel said. “You’re dealing with a business that is legacy and theoretically declining and returning it to growth.”

Lumen is keeping the customers and pieces of its consumer broadband network that seem like a good fit for its fiber business. Everything else it had no plans to invest in is headed to the new company, as it discussed would happen just a few weeks ago.

“We are actively looking at selling non-core assets to unlock value in our business,” Lumen CEO Jeff Storey said during an earnings conference call in May. “If we find transactions that are positive to shareholders, we won’t hesitate to move forward.”

Apollo’s plans aren’t laid out in detail in The WSJ’s article, but it did identify several former Verizon executives who would be leading the new telecom concern absorbing Lumen’s mostly copper-based customers. They include Bob Mudge, Chris Creager and Tom Maguire, a group that helped launch Verizon’s FiOS FTTH service.

Just last week Lumen announced it was selling its Latin American business to Stonepeak, an investment firm, for $2.7 billion. In that transaction, Lumen formed a U.S.-based company that would be in Stonespeak’s portfolio to operate and run its divested network and other assets.

About the Transaction

|

What Does Lumen Retain? |

What Will Apollo Acquire? |

|

21mm Enabled Units |

7mm Enabled Units |

|

2.4mm Fiber Enabled Units |

0.2mm Fiber Enabled Units |

|

3.4mm Broadband Subscribers |

~1.3mm Broadband Subscribers |

|

687k Fiber Subscribers |

59k Fiber Subscribers |

………………………………………………………………………….

MoffetNathanson’s Nick Del Deo, CFA, wrote in a note to clients:

During its Q1 earnings call, Lumen made clear that it was actively looking to optimize its portfolio and was open to asset sales. Moreover, it indicated that share repurchases might be under consideration if the stock price remained at what the company believes to be depressed levels. The company delivered on both fronts.

Last week, Lumen announced it had agreed to sell its Latin American unit to Stonepeak for $2.7B at a ~9x EBITDA multiple.

Not content with one deal, today it announced another to sell about one quarter if its ILEC business to Apollo for $7.5B at a ~5.5x EBITDA headline multiple. And it announced that its Board has approved a $1B share repurchase program that management may use opportunistically over the next two years.

Lumen secured a solid price for the ILEC assets that it is selling to Apollo. However, when considered in tandem with the LatAm deal, they are unlikely to be materially de-levering.

References:

https://news.lumen.com/apollo-transaction-resource-center

Rootmetrics: U.S. 5G carriers in close race; South Korea 5G is worldwide #1

Executive Summary:

Rootmetrics (a division of IHS Markit) has just reported on how the U.S. carriers fared in delivering the key combination of widespread 5G availability plus higher speeds (than 4G LTE) and data reliability performances in 1H 2021.

“5G is quickly becoming more widespread, speeds are getting faster, and we expect the end-user … experience to become even better going forward as the networks continue to mature and bolster their spectrum holdings,” Rootmetrics said in its most recent report on carrier network performance testing results from the 125 most populous U.S. metropolitan areas.

Rootmetrics awards rankings across three categories: Availability, Reliability and Speed.

Here are how the top three U.S. wireless carriers fared:

- AT&T took the top honors in Rootmetrics’ “best Everyday 5G” category. AT&T had a much narrower win in fastest download speeds, winning in 20 markets while Verizon was fastest in 16 markets and T-Mo in 13. AT&T was second in reliability to Verizon.

- T-Mobile US was rated best in 5G availability and recognized as having “excellent” 5G availability. “T-Mobile also showed much faster speeds since [the second half of 2020]—in large part because of its increased usage of mid-band spectrum—as well as good data reliability in most cities,” Rootmetrics reported.

- Verizon was first in reliability and improving speeds and availability. Rootmetrics said that Verizon’s network is showing “rapid 5G expansion, providing users with 5G in far more cities than it did in [the second half of 2020]. What’s more, Verizon’s speeds were close to those of AT&T and stronger than those of T-Mobile.”

Rootmetrics said that AT&T most often provided what it judged to be the best combination of availability, speed and reliability, “until 5G becomes ubiquitous, consumers will, at times, need to weigh the benefits of high availability and lower performance or lower availability and high performance.”

“The mobile landscape—and the 5G race in particular—is highly dynamic and prone to rapid change, so it wouldn’t be a surprise to see the leaderboard shift as we move further into 2021 and beyond,” Rootmetrics stated.

Mid-band spectrum could change the 5G speed landscape going forward, according to the market research company. With the carriers investing billions at the C-Band auction earlier this year—and Verizon’s spend of $45B more than those of AT&T ($23B) and T-Mobile ($9B) combined—speeds for all three carriers could get much faster going forward. The move toward more mid-band 5G, however, has already begun. T-Mobile, which merged with Sprint primarily to acquire Sprint’s vast and coveted midband spectrum holdings, has an early lead on the competition in terms of implementing mid-band spectrum into its 5G. In fact, T-Mobile’s speeds have increased because of its additional usage of mid-band spectrum since 2H 2020.

………………………………………………………………………………………………..

Global 5G Assessment:

While this report only rated U.S. 5G carriers, Rootmetrics stated that South Korean network operators are providing the most widespread 5G in the world.

While 5G is growing fast in the U.S., South Korea still holds a commanding lead in the worldwide 5G race. With South Korean carriers the first in the world to deploy 5G on a wide scale, doing so in early April of 2019, it’s perhaps no surprise that the 5G results we’ve seen in South Korea have been outstanding and better than those in Switzerland, the UK, or the US. To see how 5G compares in major cities around the world, we looked at the highest 5G availability in South Korea’s biggest city (Seoul) compared to that in the most populated cities in Switzerland, the UK, and the U.S.

Note that with 5G availability approaching 100% for LG U+ in Seoul, Rootmetrics looked at 5G-only availability results for this comparison, which show how 5G would perform if it were ubiquitous today; all other metrics in this report reflect Everyday 5G performance.

5G availability recorded in Seoul was far higher than that in London, New York City, or Zurich. Speeds in South Korea are also much faster than those in other countries. While Everyday 5G median download speeds in the UK almost always exceed 100 Mbps in every city we test, speeds above 100 Mbps in the US are rare. In South Korea, on the other hand, we’ve seen Everyday 5G median download speeds in excess of 400 Mbps from all three major operators in multiple cities.

Conclusions:

The 5G race in the US is heating up fast. AT&T took home the top prize for providing the Best 5G experience, with the strongest combination of availability plus performance.

Even though some carriers are further ahead of others when it comes to delivering on the key combination of availability plus performance, all three major carriers showed improved Everyday 5G results compared to those in 2H 2020. As the carriers continue to make greater use of mid-band spectrum, whether from DSS, CBRS, the C-Band auction, or from T-Mobile’s already vast mid-band holdings, 5G in the US is clearly poised for better performance to come.

In fact, as 5G continues to expand across the country and more mid-band is deployed, we expect to see much stronger availability and performance over time. As we saw with T-Mobile (as well as

operators in the UK and South Korea), mid-band spectrum can certainly help contribute to faster Everyday 5G speeds.

Indeed, while it might take another year or more, the mid-band spectrum acquired at the C-Band auction could mark a watershed moment on the path toward a fully realized 5G experience in the US—perhaps one that rivals that in South Korea, where all three

major operators use mid-band spectrum for 5G.

In the meantime, stay tuned to RootMetrics for more on the Everyday 5G experience. Rootmetrics says they will continue testing the networks to keep an eye on the state of 5G in the US and around the world.

………………………………………………………………………………………..

References:

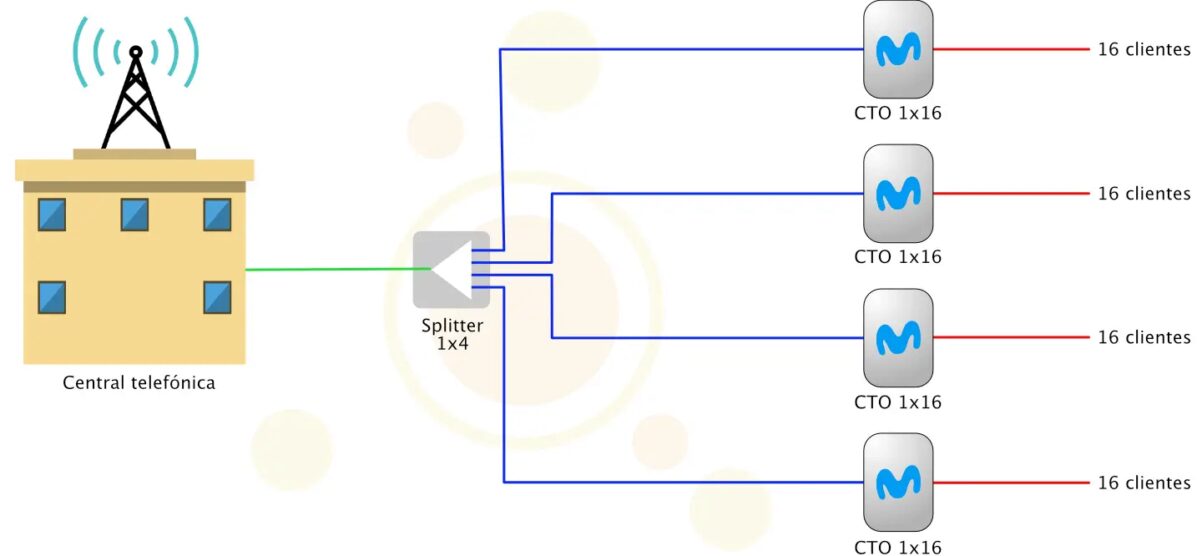

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Telefonica España will begin the commercial deployment of a 10 Gbps fiber broadband network using XGS-PON technology in Spain in the first half of 2022, reports website bandaancha.eu.

The gradual rollout is part of Telefonica’s ‘Banda Ancha Abierta‘ (Open Broadband) project to install an efficient, open, scalable and virtualized network model that will facilitate fixed-mobile convergence (fixed access with mobile backhaul), Multi-access Edge Computing capabilities ( MEC), and the deployment of third-party applications.

Telefónica’s FTTH network in Spain passes 26.1 million homes as of June 2021, for which 4,726,700 clients are served through the Movistar and O2 brands. In addition, there are 2,801,700 clients of other operators served through indirect fiber optics.

The introduction of XGS-PON will introduce two new lambdas or wavelengths on the existing GPON fiber infrastructure. The same fiber cable will carry wavelengths corresponding to GPON and in parallel new colors of the laser for XGS-PON so that the two technologies do not interfere with each other.

XGS-PON raises the available throughput for an entire fiber branch to 10 Gbps downstream and 10 Gbps upstream for up to 64 client endpoints. That will permit Telefonica to commercialize speeds of up to 2.5 Gbps symmetric and, in the medium term, up to 10 Gbps.

XGS-PON requires new customer premises equipment. Telefónica customers have been waiting for years for the new XHGU router that the operator announced in 2018 and that is compatible with XG-PON, in addition to bringing high-penetration WiFi 6.

With the arrival of XGS-PON, Movistar will begin to distribute this new router or temporarily provide an ONT XGS-PON.

……………………………………………………………………………………….

In a related story, DELTA Fiber has attracted 2 billion euros to back a planned roll-out of XGS-PON technology throughout the Netherlands. The 10G PON deployment will expand DELTA Fiber’s network to 2 million fiber connections in 2025. It currently expects to reach 1 million connections by the end of this year.

The company expects to begin rolling out XGS-PON this September. It will use the technology exclusively in its future builds with an eye toward making gigabit broadband widely available.

DELTA Fiber also said it plans to deploy 25G PON in the future. Along these lines, the company recently announced a partnership with Proximus of Belgium to deploy fiber to the home networks in Flanders. Proximus has already adopted 25G PON technology.

References:

https://bandaancha.eu/articulos/movistar-actualizara-velocidad-red-fibra-9973

Verizon and Samsung Complete Fully Virtualized 5G Data Session on C-band Spectrum

Introduction:

Verizon and Samsung Electronics recently completed an end-to-end fully virtualized 5G data session over C-band spectrum in a live network environment. The new milestone was reached in preparation for its upcoming 5G Ultra Wideband expansion using its newly acquired C Band spectrum.

This trial used cloud-native end-to-end virtualization and Massive MIMO technology to optimize 5G performance on C-band spectrum.

“We have been driving the industry to large scale virtualization using the advanced architecture we have built into our network from the core to the far edge. This recent accomplishment paves the way for a more programmable, efficient, and scalable 5G network,” said Adam Koeppe, Senior Vice President of Technology Planning at Verizon. “Customers deserve more than mere access to 5G. They deserve 5G built with the highest, gold-standard engineering practices that have positioned Verizon as the most reliable industry leader for years.”

Virtualization Is Important for 5G Performance Optimization:

The trials, conducted over Verizon’s network (using C-band Special Temporary Authority granted to Verizon by the FCC) in Texas, Connecticut and Massachusetts, used Samsung’s fully virtualized RAN (vRAN) solution built on its own software stack and C-band 64T64R Massive MIMO radio in coordination with Verizon’s virtualized core. The trials achieved speeds commensurate with traditional hardware-based equipment

Virtualization is critical to delivering the services promised by advanced 5G networks. Key 5G use cases such as massive scale IOT solutions, more robust consumer devices and solutions, AR/VR, remote healthcare, autonomous robotics in manufacturing environments, and ubiquitous smart city solutions, will heavily rely on the programmability of virtualized networks.

Cloud native virtualized architecture leads to greater flexibility, faster delivery of services, greater scalability, and improved cost efficiency in networks, paving the way for wide-scale mobile edge computing and network slicing. This technology enables Verizon to rapidly respond to customers’ varied latency and computing needs. Virtualization will also lower the barrier to entry for new vendors in the ecosystem. New entrants will accelerate innovation, reduce operating costs, and lay the groundwork for flexible network and cloud infrastructure closer to the customer, eventually leading to single digit millisecond latency.

“We’re proud to mark another milestone following our first large-scale commercial 5G vRAN deployment for Verizon, which is currently servicing millions of users. This trial reinforces our commitment to helping operators evolve their advanced 5G networks,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “This achievement represents our dedicated efforts in leading the transition to virtualization, and helping Verizon realize greater efficiency, scalability and flexibility. vRAN is a powerful enabler for network transformation, and we aim to continue leading this journey.”

Why Massive MIMO Is Important for 5G Performance Optimization:

Massive MIMO is an evolution in antenna arrays that uses a high number of transmitters which enables more possible signal paths between a device and a cell tower. It also reduces interference through beamforming, which directs the beam from the cell site directly to where the customer is resulting in higher and more consistent speeds for customers using apps and uploading and downloading files. This trial used Samsung’s C-band 64T64R Massive MIMO radios that support digital/dynamic beamforming, SU-MIMO, MU-MIMO and dual connectivity and carrier aggregation.

“Incorporating full, cloud-native virtualization, Massive MIMO and beamforming into our network design and deployment will result in so much more than our customers merely seeing a 5G icon on their devices. This is 5G service optimized for peak performance,” said Koeppe.

Today’s milestone follows Samsung’s recent announcement on expanding its vRAN capability to support mid-band Massive MIMO radios—a first for the industry. Samsung’s C-band Massive MIMO radio is part of a complete C-band solutions portfolio.

Verizon on Track To Deliver 5G Over C-band:

This virtualization work comes on the heels of other work to speed the expansion of 5G Ultra Wideband service using C-band spectrum including:

- Successful trials integrating C-band with mmWave licensed spectrum,

- Securing new agreements with Verizon’s tower partners, which provide for process improvements including standardizing and reducing forms and minimizing legal reviews, and…

- Installation of C-band equipment.

These combined efforts, along with ongoing lab and field trials to optimize 5G technology on C-band spectrum will allow Verizon to offer expanded mobility and broadband services to millions more consumers and businesses as soon as the spectrum is cleared.

In the first quarter of 2022, Verizon expects to put its new 5G C-band spectrum into service in the initial 46 markets and to provide 5G Ultra Wideband service to 100 million people. Over 2022 and 2023, coverage is expected to increase to more than 175 million people and by 2024 and beyond, when the remaining C-band spectrum is cleared, more than 250 million people are expected to have access to Verizon’s 5G Ultra Wideband service on C-band spectrum.

About Verizon Communications Inc.

Verizon Communications Inc. was formed on June 30, 2000 and is one of the world’s leading providers of technology, communications, information and entertainment products and services. Headquartered in New York City and with a presence around the world, Verizon generated revenues of $128.3 billion in 2020. The company offers data, video and voice services and solutions on its award-winning networks and platforms, delivering on customers’ demand for mobility, reliable network connectivity, security and control.

References:

https://www.verizon.com/about/news/verizon-announces-c-band-auction-results

Canada’s 3.5 GHz spectrum auction raises record US $7.2B

Canada’s 3.5GHz auction ended this week with a total of $7.2 billion (C $8.9B with US $1 = 1.2444 Canadian dollars) in winning bids. Bell Canada (BCE), Rogers Communications and Telus captured roughly 80% of the spectrum offered for sale by Canada’s government.

Out of 1,504 available licenses, 1,495 were awarded to 15 Canadian companies, including 757 licenses to small and regional providers, Innovation Minister Francois-Philippe Champagne said in a statement on Thursday.

The results would boost competition, he added, a reference to Ottawa’s push to open up a market dominated by BCE Inc, Telus Corp, and Rogers Communications Inc, known as the big three.

Canadian consumers have complained of steep wireless bills, which are among the highest in the world, and Prime Minister Justin Trudeau’s Liberal government has asked operators to cut prices by a quarter by 2021.

Preliminary results showed that BCE Inc spent C$2.1 billion, Rogers C$3.3 billion and Telus Corp C$1.9 billion.

The 3500 MHz range frequencies are seen as important to provide 5G wireless services as they carry larger volumes of data over longer distances (than mmWave, for example). Mid-band spectrum also offers faster upload and download speeds and help power everything from smart cities to driverless cars.

Vidéotron, owned by Quebecor Inc, spent C$830 million to expand its geographic footprint in Canada, buying licenses not just in its native Quebec but also in Ontario, Manitoba, Alberta and British Columbia.

The move indicates that Quebecor plans to become a service provider in those areas, said Mark Goldberg, an industry analyst. He noted that the areas where the company did not bid – Saskatchewan and Atlantic Canada – both have preexisting strong fourth competitors to the big three.

“They’re prepared to be the fourth service provider… This is showing pretty close to a billion dollars in investment in spectrum,” Goldberg said.

Vidéotron said in a statement that the investment would help the company to “realize its ambition of boosting healthy competition in telecom beyond the borders of Québec.”

Bell, Rogers and Telus said their investments will help to provide reliable 5G services.

The auction, initially set to take place in June 2020 and delayed due to the COVID-19 pandemic, closed after eight days and 103 rounds of bidding, the government said.

………………………………………………………………………………………

Xona Partners analyst Frank Rayal noted the Canadian auction clocked in at an average of $1.83 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors. Rayal said that’s a record price for mid-band spectrum and far higher than the $0.94 per MHz-POP that U.S. operators paid for similar C-band spectrum in the FCC auction earlier this year.

“Underscoring the Bell team’s goal to advance how Canadians connect with each other and the world, acquiring this significant additional 3500MHz spectrum will drive Bell’s ongoing leadership in 5G, a critical component in our multibillion-dollar program to accelerate investment in Canada’s next-generation network infrastructure and services,” Mirko Bibic, president and CEO of BCE and Bell Canada, said in a press release.

References:

Sparkle to Build Blue and Raman Submarine Cable Systems in Collaboration with Google Cloud

Each cable system will contain 16 fiber optic pairs while adhering to the innovative concepts of open cable, supporting multiple fiber tenants, and open landing station, enabling competitive access to the cable termination points, the two systems set a new reference in terms of diversification, scalability and latency throughout these geographies.

Blue will be deployed along a new northbound route in the Mediterranean, crossing the Strait of Messina, rather than following the traditional route through Sicily Channel.

As a result, Internet Service Providers, Carriers, Telecom Operators, Content Providers, Enterprises and Institutions will benefit from high-speed Internet and state-of-the-art capacity services with unparalleled diversity and performances.

Within the Blue System, BlueMed submarine cable is now Sparkle’s own private domain sharing its wet components with four additional fibre pairs and an initial design capacity of more than 25 Tbps per fibre pair, and is extended up to Jordan (Aqaba) with additional private branches into France (Corsica), Greece (Chania – Crete), Italy (Golfo Aranci – Sardinia and Rome), Algeria, Tunisia, Libya, Turkey, Cyprus and more in the future.

BlueMed flexible design allows both seamless express connections throughout the Mediterranean Basin, with unprecedented latency and spectral efficiency, and sophisticated regional subsystems, based on specific customer requirements.

In addition, Sparkle’s Genoa Open Landing Platform is set to become the alternative priority access for other upcoming submarine cables looking for a diversified entry to Europe, backhauled to the Milan’s rich digital marketplace, and thus a new reference gateway between Africa, the Middle East, Asia and Europe.

Blue and Raman are expected to be ready for service in 2024, with the Tyrrhenian part of BlueMed planned to be operational already in 2022.

“We are extremely proud to bring our collaboration with Google to the next level with this cutting-edge intercontinental infrastructure”, comments Elisabetta Romano, CEO of Sparkle. “With Blue and Raman Submarine Cable Systems, Sparkle boosts its capabilities in the strategic routes between Asia, Middle East and Europe and the enhanced BlueMed strengthens our presence in the greater Mediterranean area”

Comcast: cable business firing on all cylinders, wireless doing well, video revenue up

Comcast added another 354,000 total broadband subscribers (334,000 residential and 20,000 business) in the second quarter of 2021, beating the 323,000 it added in the year-ago period. The U.S.’s largest broadband wireline provider ended the quarter with 31.38 million residential and business broadband customers, by far the most in the U.S.

Comcast’s broadband subscriber growth rate is very impressive, at 6.7% YoY, which was unchanged versus last quarter. Comcast Business was also a bright spot, with a strong acceleration in growth. Business services revenues were up 9.9% YoY, a huge acceleration from the 6.1% YoY rise last quarter and a beat versus consensus growth of 8.8%.

The strong results are way better than Comcast’s two largest competitors – AT&T and Verizon – which both reported poor Business Wireline results.

New Street Research analysts noted Comcast’s broadband net additions were “well above estimates,” noting it had previously forecast gains of 253,000 and the market consensus estimate was 270,000. Cavanaugh said the operator is now expecting total broadband net additions for 2021 to be up in the “mid-teens” compared to the 1.4 million net adds it posted in 2019.

Other highlights:

- Cable Segment revenue growth of 10.9% was fully 200 bps ahead of Wall Street consensus for 8.9% YoY growth – but indeed for every sub-segment.

- Broadband revenues were up 14.3% YoY on a reported basis (versus 13.6% consensus); adjusted for RSN credits in Q2 2020, broadband revenues were up 12.6% YoY.

- Business Services revenues were up 9.9% YoY (versus 8.8% consensus).

- Wireless revenues were up 70.6% YoY (versus 63.4%).

- Comcast’s Xfinity Mobile service added 280,000 mobile lines, a quarterly record for the company, up from adds of 126,000 in the year-ago period. Comcast, which launched mobile (via its MVNO with Verizon) in 2017, ended Q2 2021 with 3.38 million mobile lines. Mobile revenues rose 70.4%, to $556 million.

Dave Watson, CEO of Comcast Cable, said mobile is now tied into every sales channel. And the launch of a new unlimited plans focused on multi-line customers has also led to a “nice shift in mix,” he said.

Cable Communications CAPEX of $1.7 billion was up 16.8% year-on-year in Q2, accounting for 10.6% of the division’s revenue compared to 10.1% of revenue in the year-ago period.

In addition to investments in scalable infrastructure to increase network capacity, Comcast CFO Michael Cavanaugh said on an earnings call the money was spent on broadband CPE and line extensions.

“We have decided to move a bit faster to the next phase of DOCSIS using very cost-effective technology,” he said.

CEO Brian Roberts noted the company has been trialing gigabit and multi-gigabit symmetrical speeds since October 2020 “to great success.” While upstream traffic comprises only 10% of broadband usage on its network and “we don’t really have a consumer use case” for symmetrical speeds yet, “the strategy for our network is to plan ahead,” he said.

“We’re investing in architecture that allows us to go beyond where consumers are, and we can do all of this in a way that won’t affect the capital intensity ratios we currently enjoy,” he added.

Video sub losses continue but less than expected:

Comcast lost another 399,000 total video subs (364,000 residential and 34,000 business) in the period, improved from a year-ago loss of 477,000 customers. Comcast ended Q2 2021 with 18.95 million total video subs.

Nevertheless, video revenues were up 2.6% YoY (versus 0.8% consensus). Adjusted for Regional Sports Networks (RSN) credits in Q2 2020, video revenues were up 0.5% YoY.

Comcast remains excited about Flex, a video streaming/smart home product it offers for no added cost to broadband-only subscribers. Watson said Comcast has deployed more than 3.8 million Flex boxes, up from the 3.5 million the company reported in May.

Summary:

Consolidated revenue of $28.5 billion grew 20.4% year-on-year, with net income attributable to Comcast up 25.1% to $3.7 billion. Sales for the Cable Communications business increased 10.9% year-on-year to $16 billion.

Broadband revenue was up 14.3% to $5.7 billion, video revenue increased 2.6% to nearly $5.6 billion, business services revenue increased 9.9% to $2.2 billion and wireless revenue jumped 70.4% to $556 million.

……………………………………………………………………………….

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-2nd-quarter-2021-results

https://www.cmcsa.com/static-files/c53499bd-4ff5-4e44-b793-74f8743a96dc

https://www.cmcsa.com/financials/earnings

https://www.fiercetelecom.com/financial/comcast-notches-record-q2-broadband-adds-354-000