Author: Alan Weissberger

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Samsung Electronics and MediaTek have successfully conducted 5G standalone (SA) uplink tests, using three transmit (3Tx) antennas instead of the typical two, to demonstrate the potential for improved upload experiences with current smartphones and customer premise equipment (CPE).

Until recently, most talk about 5G SA industry firsts have focused on the downlink. However, the demands on uplink performance are increasing with the rise of live streaming, multi-player gaming and video conferences. Upload speeds determine how fast your device can send data to gaming servers or transmit high-resolution videos to the cloud. As more consumers seek to document and share their experiences with the world in real-time, enhanced uplink experiences provide an opportunity to use the network to improve how they map out their route home, check player stats online and upload videos and selfies to share with friends and followers.

While current smartphones and customer premise equipment (CPEs) can only support 2Tx antennas, this industry-first demonstration validated the enhanced mobile capability of 3Tx antenna support. This approach not only improves upload speeds but also enhances spectrum and data transmission efficiency, as well as overall network performance.

The test was conducted in Samsung’s lab, based in Suwon, Korea. Samsung provided its industry-leading 5G network solutions, including its C-Band Massive MIMO radios, virtualized Distributed Unit (vDU) and core. The MediaTek test device featuring its new M80-based CPE chipset began with one uplink channel apiece at 1,900MHz and 3.7GHz, but added an extra uplink flow using MIMO on 3.7GHz. Both companies achieved a peak throughput rate of 363Mbps, an uplink speed that is near theoretical peak using 3Tx antennas.

Source: ZTE

“We are excited to have successfully achieved this industry breakthrough with MediaTek, bringing greater efficiency and performance to consumer devices,” said Dongwoo Lee, Head of Technology Solution Group, Networks Business at Samsung Electronics. “Faster uplink speeds bring new possibilities and have the potential to transform user experiences. This milestone further demonstrates our commitment to improving our customers’ networks using the most advanced technology available.”

“Enhancing uplink performance using groundbreaking tri-antenna and 5G UL infrastructure technologies will ensure next-generation 5G experiences continue to impress users globally,” said HC Hwang, General Manager of Wireless Communication System and Partnership at MediaTek. “Our collaboration with Samsung has proved our combined technical capabilities to overcome previous limits, enhancing network performance and efficiency, opening up new possibilities for service providers and consumers to enjoy faster and more reliable 5G data connectivity.”

“With demands on mobile networks rising, enhancing upload performance is essential to improving consumer and enterprise connectivity, as well as application experiences,” said Will Townsend, VP & Principal Analyst at Moor Insights & Strategy. “Samsung and MediaTek have achieved an important 5G Standalone milestone in a demonstration which underscores a tangible network benefit and does so in a way that can help operators maximize efficiency.”

Samsung has pioneered the successful delivery of 5G end-to-end solutions, including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio, from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company currently provides network solutions to mobile operators that deliver connectivity to hundreds of millions of users worldwide.

References:

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Nokia achieves extended range mmWave 5G speed record in Finland

Huawei and China Telecom Jointly Release 5G Super Uplink Innovation Solution

https://www.telecomhall.net/t/5g-uplink-enhancement-technology-by-zte-white-paper/20183

Perú’s First Open Access Wholesale Fiber Optic Network

KKR, Telefónica Hispanoamérica, and Entel today announced agreements under which KKR will acquire a majority interest in PangeaCo and the existing fiber optic networks of Telefónica del Perú and Entel Perú to build Perú’s first nationwide open access wholesale fiber optics company with the mission to bring greater access to fiber optics connectivity across the country. The transaction will combine the existing fiber optic networks of PangeaCo, Telefónica del Perú, and Entel Perú into an independent company controlled by KKR. The newly formed network will be open access, allowing usage to all internet service providers for the first time. KKR plans to make approximately US$200 million of additional investment to more than double the ultra-fast fiber network from more than 2 million homes passed today to reach 5.2 million homes passed across 86 provinces by the end of 2026.

Telefonica did not disclose the value of the transaction but said the deal would cut its debt by 200 million euros ($217.8 million). According to a banking source close to the deal, the transaction valued 100% of the unit at about 550 million euros, including debt.

Under the terms of the agreement, KKR will acquire a controlling interest in PangeaCo, which will subsequently acquire the existing fiber optic networks of Telefónica del Perú and Entel Perú. Through the combination of these networks, KKR will establish ON*NET Fibra de Perú as the new name for the platform which will independently build and operate the nation’s largest fiber optic network with world-class quality standards. KKR will own a 54% interest in ON*NET Fibra de Perú alongside Telefónica Hispanoamérica, which will own 36%, and Entel Perú, which will own 10%.

The entire ON*NET Fibra de Perú fiber optic network will be open to use by all internet service providers, increasing competition in the wholesale market. Telefónica del Perú and Entel Perú will be anchor tenants on the expanded open access network, enabling both providers to reach a greater number of customers with ultra-high-speed offerings. The transaction does not impact the services provided by existing customers of PangeaCo, Telefónica del Perú or Entel Perú. Upon closing of the transaction, customers will benefit from the scale of the larger network.

In Perú, approximately 88% of households have mobile or fixed internet service, but less than 35% have access to high-speed fiber optic networks.1 KKR, as the controlling shareholder, intends for ON*NET Fibra de Perú to more than double the households reached by fiber optic network, including reaching municipal areas outside of Lima as well as middle- and low-income households. This transaction demonstrates continued investor confidence in Peruvian infrastructure and the commitment of the companies to contribute to the sustainable development of the digital connectivity in the country.

Today’s announcement builds on KKR’s success in expanding nationwide connectivity and increasing competition in Chile and Colombia. ON*NET Fibra de Chile has expanded access from 2.4 million homes passed to 3.7 million homes passed since KKR signed the acquisition in February 2021 and ON*NET Fibra de Colombia has increased homes passed from 1.2 million to 2.4 million since signing in July 2021.2 Both companies have attracted multiple internet service providers to utilize their open access networks.

KKR is making the investment through its KKR Global Infrastructure Investors III fund and plans to provide operational support to ON*NET Fibra de Perú through NEXO LatAm, a digital infrastructure business supporting KKR’s Infrastructure strategy across Latin America. KKR and NEXO LatAm have significant experience supporting the successful expansion of open access fiber optic investments. The transaction is subject to regulatory approvals, including the approval of the Peruvian antitrust agency (INDECOPI).

…………………………………………………………………………………………………………………………………………………….

From telecoms.com:

When Telefonica first sold a stake in its Chilean fibre business to KKR it had a footprint of 2.4 million homes passed. The deal valued the entire business at $1 billion. The Colombian fiber business that KKR bought into was valued at half that amount and just over half the footprint:1.2 million homes. Admittedly, the Colombia deal was inked two years ago and Chile even longer ago, and a fair bit has changed in the economic situation in that time. However, we can get a sense of the scale of spend we might be looking at.

KKR wants to share the progress made by those Chilean and Colombian ventures. ON*NET Fibra de Chile passed 3.7 million homes as of the end of 2022, while ON*NET Fibra de Colombia had doubled the number of homes passed to 2.4 million, it said, adding that both have attracted multiple ISP customers.

That surely bodes well for the new venture’s aims in Peru, where at present around 88% of households have mobile or fixed internet service, but less than 35% have access to high-speed fibre networks, KKR said, citing data from regulator OSIPTEL and market research firm Omdia (owned by Informa).

It should also help smooth the regulatory process. The deal needs a number of approvals, including that of Peruvian antitrust agency INDECOPI, but it’s hard to foresee any major difficulties, given that this is an established model across the region and one that seems to be working.

References:

https://telecoms.com/522583/telefonica-entel-and-kkr-ink-peru-fibre-deal/

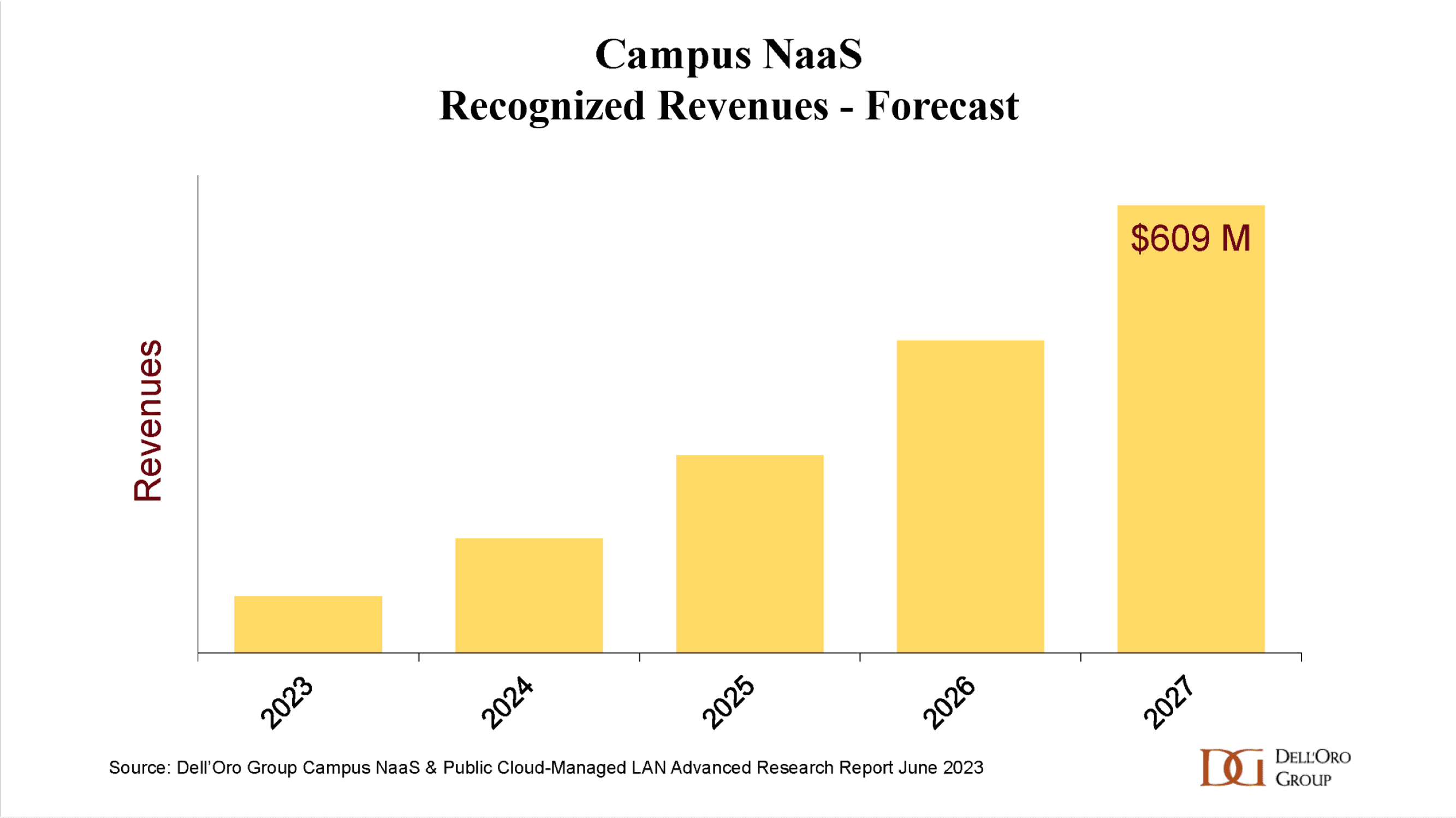

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

|

||

|

Reliance Jio to sign $1.5 billion 5G network equipment deal with Nokia (“Home grown 5G” never happened)

Whatever happened to Jio’s claim of “home grown 5G“? Answer: It was a big bold faced lie! Almost 3 years ago, Jio Chairman Mukesh Ambani said his company had developed its own 5G solution “from scratch.” He said at the time, “Jio plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

…………………………………………………………………………………………………………………………………………………………….

Fast forward to today. Jio, India’s largest telecoms operator, is set to sign a contract at Nokia’s Headquarters in Helsinki, Finland, according to sources speaking to the Economic Times.

The purchase will be financed by several global banks, including HSBC, Citigroup, and JP Morgan, whose combined loans will total around $4 billion. Finnish state-owned export credit agency Finnvera is set to issue guarantees to the lenders. Representatives from the banks are likely to be present at the signing, as well as Senior Executives from Reliance Group.

At the time, financial details of the deals were not disclosed; however, media reports have since suggested that the deal with Ericsson was worth $2.1 billion. Now, this deal with Nokia will see the total 5G investment reach roughly $3.6 billion.

Earlier this year, Jio’s president Mathew Oommen said the company aimed to become “the largest 5G SA (standalone) only network operator in the world in the second half of 2023”, with the company targeting nationwide coverage by the end of the year.

In October 2022, Jio signed 5G equipment contracts with both Nokia and Ericsson.

In related news, earlier this week, Reliance Industries announced the launch of a budget 4G phone, (costing $12), aiming to convert the 250 million 2G users in India to 4G. The company says its goal is to pass the benefits of the internet-capable mobile technology to every Indian.

References:

https://totaltele.com/indias-jio-to-sign-1-5-billion-5g-equipment-deal-with-nokia/

Reliance Jio’s “Home Grown” 5G? Ericsson and Nokia in multi-year deals with Jio to build a mega 5G network

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Do ITU Radio Regulations Matter? China allocates 6 GHz spectrum for 5G and 6G services prior to WRC 23; CTIA objects!

China’s regulators allocated spectrum in the 6 GHz frequency band for 5G and 6G services, asserting it was the first country to reserve the resource expected by the mobile industry to enable future connectivity. In a translated statement, the country’s Ministry of Industry and Information Technology (MIIT) highlighted the band was the only one with sufficiently-large bandwidth in the mid-range frequency band.

In a blog published on the opening day of MWC 2023 Shanghai, GSMA head of spectrum Luciana Camargos highlighted China had identified the upper part of the band for International Mobile Telecommunications (IMT) systems:

“China’s efforts towards the 6GHz band don’t come as a surprise,” Camargos wrote, adding. “Conducive spectrum policies for the mid-bands, especially the 2.6GHz and 3.5GHz, have helped China to deploy the world’s largest 5G networks with over 2.7 million 5G base stations by the end of April 2023 and to be on track to become the first country to reach 1 billion 5G connections in 2025.”

Note: The GSMA has been pushing the case for the use of 6 GHz by the mobile industry ahead of the ITU World Radiocommunication Conference 2023 (IRC 23) in Dubai, UAE in November 2023. WRC 19 did not authorize use of the 6 GHz band for IMT and so it is not in ITU-R M.1036 revision 6 “Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications in the bands identified for IMT in the Radio Regulations” which specifies all terrestrial IMT frequencies.

During the Ajit Pai administration, the FCC allocated virtually the entire 6 GHz band – 1,200 megahertz stretching across 5.925 GHz–7.125 GHz – for unlicensed uses, primarily Wi-Fi rather than IMT which uses licensed spectrum.

–>Please refer to References below.

………………………………………………………………………………………………………………………………………………………..

The CTIA was alarmed by China’s decision and posted this on Twitter:

BREAKING NEWS: China announces plans to free up far more #5G spectrum than the United States. Congress must restore @FCC auction authority and identify new spectrum to secure our leadership of the industries and innovations of the future.

“We risk having Chinese networks that are materially better at enabling the industries of the future,” wrote Doug Brake, a policy official at CTIA, the U.S. wireless industry’s main trade association. “If a mobile video platform like TikTok is a national security threat, why should we surrender advantage in a technology like 5G that enables transformation throughout the economy?”

“We need a breakthrough on spectrum policy that prioritizes full-power, licensed, midband spectrum for 5G to secure our industries of the future in the face of increasingly capable Chinese networks and the market dominance of Chinese vendors. This requires a coordinated effort, starting with Congress establishing an auction pipeline, NTIA identifying at least 1500 megahertz of licensed midband spectrum for 5G as part of the National Spectrum Strategy,” Brake wrote.

The NTIA plans to release a U.S. spectrum strategy this November.

…………………………………………………………………………………………………………………………………………………………..

A number of countries in North and South America, and in Asia, have already allocated the 6GHz band for unlicensed uses, according to Dean Bubley of Disruptive Analysis.

Others countries haven’t yet decided what to do with the band. For example, officials in the UK just this week opened an investigation into the possibility of sharing the 6GHz band between Wi-Fi and 5G users.

“Rather than choosing between the two, we believe an alternative approach is possible. We are exploring options that would enable the use of both Wi-Fi and mobile in the band. We are calling this ‘hybrid sharing,'” wrote regulator Ofcom in a post.

According to Disruptive Wireless analyst Bubley, Ofcom’s proposal isn’t that simple. “This would need new technical mechanisms for networks, devices and databases / sensing, and how to manage and enforce any prioritisations,” he wrote in a new LinkedIn post. “There are various options for automation, dynamic vs. fixed sharing and so on. There may be constraints on power or ‘polite’ protocols. Ideally these would be internationally standardized – perhaps just in Europe, but more broad adoption would obviously be preferable.”

Meanwhile, others continue to urge global regulators to allocate the 6GHz band for 5G. For example, the GSMA – the world’s biggest 5G trade association – recently reiterated its position that 6GHz will be necessary for 5G networks to keep pace with demand.

According to Bubley, the debate will likely come to a head later this year at the ITU-R’s 2023 World Radiocommunications Conference (WRC-23) in Dubai, United Arab Emirates (UAE). That’s where global telecom regulators work to harmonize their plans in order to score global economies of scale among equipment suppliers. The result is a set of Radio Regulations which are approved frequencies to be used for IMT and other wireless services.

……………………………………………………………………………………………………………………………………………………………………..

References:

6 GHz band proposed for WiFi/5G in Asia Pacific region, but it’s not in ITU-R M.1036

CTIA commissioned study: U.S. running out of licensed spectrum; 5G FWA to be impacted first by network overloads

GMSA vs ITU-R, FCC & U.S. Tech Companies on use of 6GHz band: Licensed 5G or Unlicensed WiFi?

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)

FCC to vote April 23rd to open up 1200 MHz of 6 GHz spectrum for WiFi

U.S. Launches National Spectrum Strategy and Industry Reacts

5G SA networks (real 5G) remain conspicuous by their absence

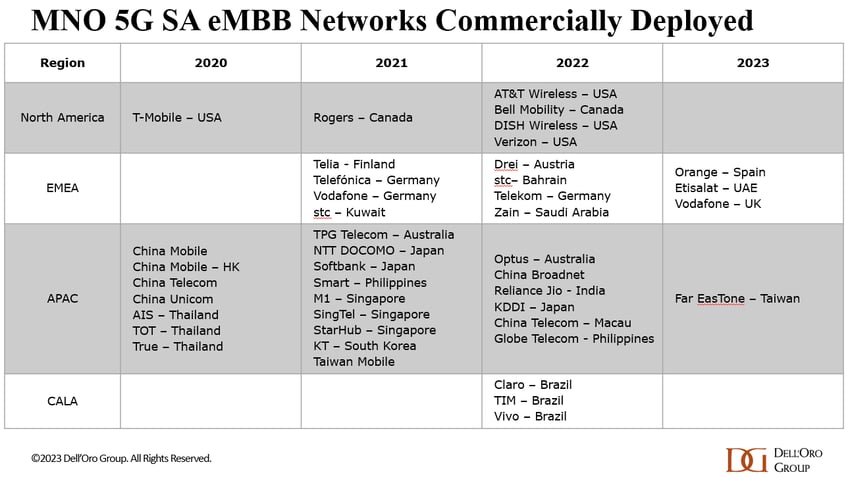

According to a May 2023 report from the Global mobile Suppliers Association (GSA), just 35 network operators in 24 countries and territories “are now understood to have launched or deployed public 5G SA networks.” That’s out of approximately 240 service providers which have now launched commercial 5G services, as per the recent Ericsson Mobility Report.

Dell’Oro’s Dave Bolan said, “Currently we count 43 live 5G SA networks for eMMB [enhanced mobile broadband]. For 2023, four [mobile network operators] have launched 5G SA networks,” he added. It should be noted that Dell’Oro doesn’t factor in fixed wireless access (FWA) or private 5G networks in its SA totals.

In Europe, Vodafone UK and Telefónica Spain join what remains a small set of network operators that have launched 5G SA, including Orange Spain and Vodafone Germany. Spain should provide an interesting study of what happens when two rival operators launch 5G SA service.

There are some glimmers of hope that 5G SA launches will accelerate soon. GSA (aka GSMA) has identified at least 1,063 announced devices with declared support for standalone 5G in sub-6GHz bands, 864 of which are commercially available. Furthermore, it said 116 operators in 53 countries and territories are now investing in 5G SA, including those that have actually deployed a public network. “This equates to 22.1% of the 524 operators known to be investing in 5G licenses, trials or deployments of any type,” the GSA said.

Separately, analysts say that 5G SA branding by network operators is quite confusing (we agree). Vodafone UK’s decision to use 5G Ultra for its 5G SA branding vs Telefonica using 5G+ are examples of that.

Gabriel Brown of Heavy Reading said, “customers don’t really know what it means, other than it denotes some form of technical advance.” He points out that 5G SA “requires a lot of investment and deep engineering expertise; this makes it a useful proxy for network quality. Operators need to take all the technical marketing opportunities they can get.”

“What happens when BT launches? Are they going to call it 5G+ or 5G Super Ultra or something like that? That’s going to make it even more confusing,” said Kester Mann, an analyst with CCS Insight. At the same time, he agrees that 5G standalone is a significant network upgrade and it makes sense that operators would want to gain a marketing edge over rivals that have yet to launch the service.

Notably, neither Vodafone nor Telefónica is charging extra for the more advanced 5G service, and both have focused on the improved speeds and reliability it will bring. They also emphasize eco-friendly aspects, such as lower energy consumption. However, Mann questioned Vodafone’s claim that customers with an eligible 5G Ultra device can expect up to 25% longer battery life. “Twenty-five percent faster than what?” he asked. “It’s a bit unclear.” However, such a claim would certainly be welcome news to consumers. “In a lot of our consumer research, battery life comes out as one of the common bugbears among people using mobile phones,” said Mann.

In the U.S., T-Mobile is the only network operator that’s deployed a 5G SA network. AT&T and Verizon have been talking about it for years, but the time frame for deployment has been pushed back several times.

Deloitte Global said it expects the number of mobile network operators investing in 5G SA networks via trials, planned deployments or rollouts to grow from more than 100 operators in 2022 to at least 200 by the end of this year.

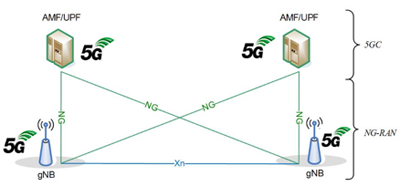

One reason why there are relatively few 5G SA networks deployed is there are no implementation standards. 3GPP 5G Architecture specs, rubber stamped by ETSI, provide several options to realize a 5G cloud-native core network which leads to different implementations. 3GPP decided NOT to liaise their 5G non-radio aspects specs (including 5G Architecture and 5G Security) to ITU-T.

Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

The latest 3GPP 5G Architecture spec is System architecture for the 5G System (5GS) (3GPP TS 23.501 version 17.9.0 Release 17), published by ETSI on July 5, 2023.

Source: 3GPP

Hence, the ITU JCA on IMT2020 and Beyond is dependent on other organizations for inputs to their roadmap. “The scope of JCA-IMT2020 is coordination of the ITU-T IMT-2020 standardization work with focus on non-radio aspects and beyond IMT2020 within ITU-T and coordination of the communication with standards development organizations, consortia and forums also working on IMT2020 and beyong IMT-2020 related standards.”

References:

https://www.silverliningsinfo.com/5g/5g-sa-springs-action

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

https://urgentcomm.com/2023/01/19/standalone-5g-progress-remains-a-disappointment/

https://www.3gpp.org/technologies/5g-system-overview

https://www.itu.int/en/ITU-T/jca/imt2020/Pages/ToR.aspx

Telstra partners with Starlink for home phone service and LEO satellite broadband services

Telstra, Australia’s #1 telco, will partner with SpaceX’s Starlink to provide phone and broadband services to rural Australia using Low Earth Orbit (LEO) satellites. Telstra said it planned to offer the new services before year’s end according to a blog post. It also promises higher download speeds compared to copper-based ADSL internet access.

Starlink, operated by Elon Musk’s SpaceX (private company). has built a fast-growing network of more than 3,500 satellites in Low-Earth Orbit that can provide connectivity in remote areas.

“Telstra will be able to provide home phone service and Starlink broadband services to Aussies as a bundle offer, as well as local tech support and the option of professional installation,” the telco said in the same blogpost. “This agreement also provides connectivity options for our business customers, with a higher bandwidth business option available in areas without fixed and mobile connectivity. The business offer will be available to purchase from Telstra both locally and in select countries overseas.”

Using LEO satellites will bring new capabilities to commercial satellite services in Australia, including faster communications. Signal distances travelled are shorter, as LEO satellites are vastly closer to earth compared to geostationary satellites at around 35,000 km above earth. It requires less power for an earthbound device to transmit to a satellite and there’s a reduced latency (delay) in transmission time.

Telstra said in its blog post:

One of the benefits of LEO satellites are that they are much closer than geostationary satellites to Earth with multiple satellites that are a part of a “constellation”, allowing them to send and receive signals much faster. As well as offering great data throughput, the proximity of these satellites reduces latency making them a great and more consistent option for services that need low latency, like voice and video calls.

The latency, download speeds and general experience in most circumstances will be far superior to copper-based ADSL and be better suited for most modern connectivity needs. Our team has been testing out in the field Starlink’s service and how we can best offer it to customers, including evolving our own modem specifically to support Starlink connectivity and Aussie households. We’re extremely excited to show you what this looks like later in the year.

Partnerships between telcos and LEO satellite providers will allow consumers to make satellite-connected calls using their regular smartphone from almost anywhere on the planet, whether there is a local cellular network or not. In Australia, mobile calls and even video calls will be possible on regular smartphones operating in remote and rural regions of Australia.

At Mobile World Congress held in Barcelona in March 2023, Telstra told ChannelNews it was working on adding LEO satellite audio and video calls to its network. Taiwanese chip designer MediaTek demonstrated the chips that phones would use for LEO satellite communications at the same conference.

UK phone maker Bullitt Group announced it was working with Motorola to bring satellite texting to regular phones in Australia this year, with video calling via LEO satellites to come within another two years. Their texting service has already rolled out in Europe and the US.

Telstra’s move is in line with emerging partnerships between telcos and satellite providers in the US, with T-Mobile forging a deal with Starlink and AT&T with AST SpaceMobile. T-Mobile and Starlink began testing their service in March.

Optus is yet to announce any service involving LEO satellite services locally, although it has been conducting tests. In November last year, Optus demonstrated satellite direct-to-mobile calls in partnership with LEO satellite provider Lynk.

Vodafone meanwhile has launched LEO satellite trials in Turkey with local operator partner SatCo.

It is a major coup for Telstra to be first among Australia-based Telcos to announce a specific service, however longer term, LEO satellites will allow Optus and Vodafone to be more formidable competition in rural and regional Australia, as LEO satellites will give them a reach that they don’t enjoy due to their lack of ground-based cellular infrastructure compared to Telstra.

Further, the Australian telco market will be opening up to increased international competition if offshore telcos want to join in. In March, ChannelNews reported that Amazon was gearing to take on the NBN with a fast satellite-based internet service.

Nevertheless LEO satellites are a fillip for Telstra in light of the Australian Competition and Consumer Commission’s (ACCC) decision late last year to veto a deal between Telstra and TPG Telecom to consolidate their presence in rural and fringe areas of the country through an infrastructure and service swap.

The coming of LEO satellite services also will be a test for the ACCC. To what extent does its jurisdiction cover LEO-satellite-based communications, particularly when it involves telecommunication services provided by foreign companies from space?

References:

We’re working with Starlink to connect more people in remote Australia

Telstra to partner with Elon Musk’s Starlink for satellite calls and broadband

Telefónica launches 5G SA in >700 towns and cities in Spain

Telefónica has followed Orange with the official launch of a 5G standalone (SA) network in more than 700 towns and cities throughout Spain. The service is branded Movistar 5G+ even though it is just 3GPP defined real 5G (with its own core network , rather than 5G NSA which uses LTE core network). The new Telefónica 5G SA network uses Ericsson and Nokia network equipment. Huawei has been excluded from it because the European Commission wants to ban Huawei in the EU for its alleged espionage work for the Chinese government.

Telefonica said its 5G NSA service in the 700 MHz band is currently available to around 85 percent of the Spanish population across 2,200 municipalities. The Spanish operator also uses the 3.5 GHz band for 5G and invested EUR 20 million to secure the maximum possible 1 GHz of spectrum in the 2.6 GHz band.

“Movistar customers will be able to enjoy 5G+ automatically and at no additional cost both in large cities and in small municipalities thanks to a highly capillarity deployment that will allow ultra-fast speeds and very low latency to be obtained in practically all of Spain,” the company explained in a statement.

The launch of 5G+, which offers greater coverage and browsing speeds of up to 1,600 megabits per second (Mbps), will take place within the scope of Movistar’s deployment in the 3,500 MHz band. In practice, 5G+ translates into better mobile experience in content downloads at the speed of fiber optics, streaming High quality and uninterrupted gaming. It also offers greater coverage in crowded spaces such as a sporting event or a music concert, according to Telefónica.

Movistar currently covers a total of 11 cities with 5G SA: Madrid, Barcelona, Malaga, Seville, Palma de Mallorca, Las Palmas de Gran Canaria, Ávila, Segovia, Castellón, El Ferrol and Vigo. The goal for the end of the year is to have “extensive 5G SA coverage in most cities with more than 250,000 inhabitants,” as well as in smaller towns, so that the capillarity of the service continues to be consolidated. However, in order to enjoy this service it is necessary to have a mobile that supports 5G SA. For the moment, Movistar has the new Xiaomi terminals to which new brands will be added.

Gabriel Brown, principal analyst at Heavy Reading, notes that Movistar operates the biggest network in Spain and has the largest number of live 3.5GHz sites, according to the independent AntenasMoviles website.

Said deployment is completed with the coverage in the 700 MHz band that Movistar has been offering since last year and currently reaches more than 2,200 municipalities, with advantages such as improved indoor coverage. The so-called low band is complemented in 5G with that of 3,500 MHz, ideal for services that require a user experience at a very high transmission speed, both for rural areas and large urban centers. In this way, Movistar already offers 5G coverage to more than 85% of the population, reports the company.–

Orange leads 5G SA coverage as it already reaches more than twenty cities that cover 30% of the population in Spain. In the case of Vodafone and MásMóvil, 5G SA is expected to be available before March 2024.

Heavy Reading’s Brown said, “It will be interesting to see if this gives it an edge in SA. Orange Spain, meanwhile, says it will launch network slicing before the end of the year.”

References:

https://euro.eseuro.com/business/572316.html

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

NTT DOCOMO is leveraging its expertise to support the Open RAN efforts of network operators worldwide. Earlier in 2023, DOCOMO adopted the OREX (Open RAN Ecosystem Experience) brand to strengthen the support scheme for international telecom operators in delivering the Open RAN system.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world,” explains Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN and OREX Evangelist. “OREX is committed to making 2023 the defining year for Open RAN. Our ultimate goal is to eliminate global communication gaps through the OREX initiative.”

NTT DOCOMO is the number one mobile operator in Japan. Having launched its first-generation service in 1979, since then the company has pioneered new technologies.

Today DOCOMO has three business segments: enterprise, smart life, and telecommunications. It has 87m subscribers, with 20m subscribers enjoying its 5G Open RAN services, with a total revenue of around US$44bn.

An expert in the mobile industry for more than 25 years, Abeta’s career at NTT DOCOMO started as a researcher for 4G in 1997.

“My career at NTT DOCOMO started as a researcher for 4G in 1997,” he explains. “Then, we brought our ideas to 3GPP and I participated in 3GPP standardisation from 2005.

“With 3GPP, I served as the Vice Chair of 3GPP RAN1 and the rapporteur of LTE and LTE-A. After the completion of the LTE standard specification, I led the development of eNB and gNB commercial products and network optimization in the commercial network as the General Manager of the Radio Access Network Development department.”

In 1997 the second-generation mobile system was introduced in Japan. Instead of GSM, Japan utilised the Personal Digital Cellular (PDC) system. “During this time, data services over the mobile network were initiated, but the data rate was incredibly low, starting at only 2.4kbps,” Abeta explains. “It’s hard to imagine today, but at that time, only small text messages could be transferred over the mobile network. Eventually, the data rate increased to 28.8kbps.

“In 1999, we launched the i-mode service, marking the beginning of internet services over the mobile network.”

In 2000, 3G was introduced, with DOCOMO playing a significant role in contributing to the 3GPP standard specification work. “We led technical discussions and managed the discussions as one of the officials, serving as the Chair. We were the first operator to deploy 3G networks nationwide and provided rich content via the 3G network. However, the data rate was still limited to 64Kbps or 384kbps. Later, HSPA technology was introduced, enabling much higher throughput.

“Moving forward, we proposed LTE together with our partners and launched 4G services in 2010,” Abeta describes. “Our 4G radio access network (RAN) was fully multi-vendor interoperable. We defined interfaces that were not initially defined by 3GPP, making us the first operator to deploy a multi-vendor interoperable RAN. The rise of smartphones in conjunction with our 4G services revolutionised the user experience, and its benefits are well-known.”

While DOCOMO’s communication services continued to thrive, the company also expanded its non-communication services, evolving into the smart-life service segment.

When it comes to the rollout of 5G, DOCOMO has contributed not only to 3GPP but also to the O-RAN alliance to realise multi-vendor interoperable Open RAN solutions. “In 2018, we established the 5G Open Partner Program, aiming to create new services and address social issues by collaborating with vertical players,” Abeta adds. “Currently, this program has attracted participation from 5,300 companies and organisations.”

In this exclusive interview, Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN Solutions and OREX Evangelist discussed its OREX brand, which offers a pre-integrated solution that simplifies integration, interoperability and lifecycle management.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world.”

NTT DOCOMO has been featured in the July issue of Mobile Magazine

Mobile Magazine is the ‘Digital Community’ for the global Telecoms industry. Mobile Magazine covers 5G, IoT, Technology, AI, Connectivity, Mobile Operators, Wireless networks and Media – connecting the world’s largest community of Telecoms executives. Mobile Magazine focuses on telecoms news, key telecoms interviews, telecoms videos, along with an ever-expanding range of focused telecoms white papers and webinars.

References:

https://mobile-magazine.com/magazines

SDFI: Denmark Achieves 94.5% Gigabit Broadband Internet Coverage

New data from the Broadband Mapping 2023 report by the Danish Agency for Data Supply and Efficiency (SDFI) reveals that 97.5% of homes and businesses in Denmark now have access to high-speed broadband internet access.

The latest report from the Styrelsen for Dataforsyning og Infrastruktur (SDFI) sheds light on Denmark’s regional broadband coverage rates. The Region North Jutland has almost reached a 100 percent coverage rate.

According to the report, the coverage rate in Northern Jutland stands at an impressive 98.9%. Central Jutland closely follows with 97.7% coverage, while Southern Denmark boasts a coverage rate of 98.3%t. Zealand, the country’s largest island, achieves a solid coverage rate of 98%.

Although the country has made progress in digital connectivity, according to SDFI, there are still regional disparities in coverage. The Capital Region of Hovedstaden lags behind the other regions with a coverage rate of 96.2% (compared to Northern Jutland with 98.9%). Further, 94.5% of all households in Denmark can access Gigabit speeds, an increase of 2.6 percentage points year-on-year.

The report highlights the ongoing efforts of telecommunications companies in deploying broadband across the country. According to SDFI, 97.5% of homes and businesses currently can access fast broadband with speeds of at least 100 Mbps download and 30 Mbps upload. Moreover, 94.5% of users have access to gigabit speeds, representing a 2.6 percent increase from last year.

The findings of the SDFI report demonstrate Denmark’s commitment to improving broadband infrastructure and connectivity nationwide. As the country continues to prioritize digital transformation, it will pave the way for a more connected and digitally empowered society.

References:

https://www.commsupdate.com/articles/2023/06/30/95-of-danish-households-covered-by-gigabit-speeds/

https://telecomtalk.info/denmark-achieves-945percent-gigabit-broadband-coverage-sdfi/727153/

https://digital-strategy.ec.europa.eu/en/node/9828/printable/pdf