4G

Revision of ITU-R Handbook on Global Trends in International Mobile Telecommunications (IMT)

ITU-R WP5D has initiated the development of a draft new edition of the Handbook on Global Trends in International Mobile Telecommunications (IMT). Fast development of mobile broadband worldwide urgently requires up-to-date general guidance on issues related to the deployment of IMT systems and the introduction/development of their IMT-2000, IMT-Advanced and IMT-2020 networks.

The Handbook on Global Trends in International Mobile Telecommunications (IMT) provides general information such as service requirements, application trends, system characteristics, as well as substantive information on spectrum, regulatory issues, guidelines for evolution and migration, and core network evolution. Since this Handbook was published in 2015, it requires urgent substantial updates to be a valid reference publication for the ITU membership.

Working Party 5D has invited contributions from the membership with the objective of completing the draft for consideration for approval by Working Party 5D at its 7-18 February 2022 meeting, with a deadline for contributions of 1600 hours UTC, 31 January 2022.

……………………………………………………………………………………………………………………………………………

Introduction:

This Handbook identifies International Mobile Telecommunications (IMT) and provides the general information such as service requirements, application trends, system characteristics, and substantive information on spectrum, regulatory issues, guideline for the evolution and migration, and core network evolution on IMT.

This Handbook also addresses a variety of issues related to the deployment of IMT systems.

Purpose and scope:

The purpose and scope of this Handbook is to provide general guidance to ITU Members, network operators and other relevant parties on issues related to the deployment of IMT systems to facilitate decisions on selection of options and strategies for introduction of their IMT‑2000, IMT‑Advanced and IMT-2020 networks.

The Handbook focuses on the technical, operational and spectrum related aspects of IMT systems, including information on the deployment and technical characteristics of IMT as well as the services and applications supported by IMT.

This Handbook updates previous information on IMT-2000 and IMT-Advanced. It also includes new information on IMT‑2020 from Recommendation ITU-R M.2150. In addition, the work from Report ITU-R M.2243 – Assessment of the global mobile broadband deployments and forecasts for International Mobile Telecommunications, is referenced regarding any future considerations that are identified. This Handbook has been and will continue to be a collaborative effort involving groups in the three ITU Sectors with ITU-R Working Party 5D assuming the lead, coordinating role and responsibility for developing text for the terrestrial aspects; with ITU-R Working Party 4B responsible for the satellite aspects, ITU-T Study Group 13 responsible for the core network aspects and ITU-D Q.25/2 responsible for the developing countries aspects.

Special attention has been given to needs of developing countries responding to the first part of Question ITU‑R 77/5 which decides that WP 5D should continue to study the urgent needs of developing countries for cost effective access to the global telecommunication networks.

This Handbook also includes summary of deliverables and on-going activities of WP 5D in order to provide an update for countries which are not able to attend 5D meetings.

References:

https://www.itu.int/pub/R-HDB-62

https://www.itu.int/en/publications/ITU-R/pages/publications.aspx?parent=R-HDB-62-2015&media=paper

Rakuten Symphony Inc. to provide 4G and 5G infrastructure and platform solutions to the global market

Japan’s Rakuten Group today announced that they have resolved to incorporate Rakuten Symphony, a business organization of the Company, and start considering a capital and business alliance (in other words, investments).

As announced on August 4, 2021 in “Rakuten launches Rakuten Symphony to accelerate adoption of cloud-native, open RAN-based mobile networks worldwide,” alongside Rakuten Communications Platform (hereafter “RCP“), Rakuten Symphony, a new business organization, was newly launched by consolidating the products and services to be implemented.

Rakuten Symphony aims to provide a future-proof, cost-effective, communication cloud platform for carriers, businesses and government agencies around the world.

Rakuten Symphony is a global business organization that develops solution businesses in Japan, the United States, Singapore, India, Europe, and the Middle East / Africa. Through this incorporation, accountability (duties) will be clarified, flexible decision-making and business execution will be possible, and products, services, and solutions for telecommunications carriers will be consolidated across the board.

“We will be ready to provide 4G and 5G infrastructure and platform solutions to the global market.”

In addition, as announced in “1&1 and Rakuten agree far-reaching partnership to build Europe’s first fully virtualized mobile network based on new Open RAN technology” also on August 4, 1&1 has agreed to comprehensively adopt RCP. This business has been steadily accumulating its achievements. In order to further accelerate the global expansion of innovative mobile network solutions, Rakuten Symphony, Inc., a newly established corporation, will consider accepting capital, etc. in addition to business partnerships with strategic partners.

The Company will establish its position as a global leader in cloud-centric and virtualized Open RAN-based mobile networks, by expanding its communication platform business overseas, as well as its track record of expanding its mobile carrier business in Japan.

Mike Dano of Light Reading wrote:

It’s no surprise that Rakuten is pulling out all the stops to make Symphony a success. The operation’s Symphony contract with flagship customer 1&1 in Germany is worth between $2.3 billion and $2.7 billion over a ten-year period, reports Nikkei Asia. By contrast, Rakuten made about $1.8 billion in revenues at its Japanese mobile business in the last year.

“This business has been steadily accumulating its achievements,” Rakuten wrote this week, pointing specifically to its 1&1 deal.

Light Reading reported in March 2020 of Rakuten’s plans to sell a networking platform internationally. The offering was initially dubbed Rakuten Mobile Platform (RMP), and then Rakuten Communications Platform (RCP), but the company in August named it Symphony and said the operation targeted an addressable market of up to $100 billion.

Symphony is essentially the portfolio of technologies Rakuten uses in its Japanese mobile network – alongside other offerings from its partners – that it is now pitching to other service providers and networking hopefuls worldwide. According to Rakuten, companies can purchase all or parts of Symphony in order to quickly and easily roll out their own open RAN 5G networks.

Thus, Symphony is now on a collision course with a wide range of other players selling similar offerings. Ericsson, Amazon, Google and Mavenir are among the many providers hoping to assemble a product portfolio stretching across core networking, radio hardware and associated software and services, and then to rope in deals with customers ranging from enterprises to government agencies.

References:

https://global.rakuten.com/corp/news/press/2021/0930_03.html

https://www.lightreading.com/the-core/rakuten-rearranges-symphony-for-investments/d/d-id/772501?

Russia’s Norilsk Nickel to deploy private 5G network without a network operator

Russian metallurgy company Norilsk Nickel is considering applying for a license to use 5G frequencies, reports Comnews.ru citing CEO Alexander Kudinov’s remarks during the GSMA Mobile 360 Eurasia conference in Russia last week. The company plans to deploy a private 5G network on its own, without cooperating with any telecommunications network operator.

Norilsk Nickel is interested in working with equipment vendors directly. The idea of deploying a private 5G network independently is based on security rather than economic issues.

“At Norilsk Nickel, work directly with the vendor is being worked out very actively. We are considering this model not for economic reasons, but from the point of view of IT security. But such a model of cooperation cannot exist at the moment. There are many incomprehensible points in the law that the government still has. In my opinion, operators have more experience. But Norilsk Nickel is interested in working directly with vendors, “emphasizes Alexander Kudinov.

Dmitry Lakontsev, head of the Skoltech-based NTI Competence Center for wireless communication or the Internet of Things, emphasizes that there is no threat to the operators’ business. Vice versa. The more companies build 5G networks, the higher the demand for equipment will be. And this, in turn, will lead to the growth of the entire industry through additional investment. “It is also worth recalling that it is the industry that gets the maximum effect from the introduction of 5G. Therefore, the creation of private mobile 5G / LTE networks by the enterprises themselves is quite logical,” he says.

According to Dmitry Lakontsev, most companies note such advantages of private networks as full control over data that does not leave the enterprise network perimeter, exact correspondence of the network to use scenarios and the radio environment of the enterprise, and quick setup, reconfiguration and expansion when needs change. In addition, private networks have such advantages as the further development of their own distributed computing resources, at the right point, at the right time, with the necessary characteristics and guaranteed reliability. Also, a private mobile network is a strategic asset of the enterprise and an essential competence.

The disadvantages of private networks are the need to create new competencies for the deployment, optimization and operation of mobile networks, the cost of building a new network and wireless infrastructure, as well as, emphasizes Dmitry Lakontsev, its maintenance and updating. Due to the lack of economies of scale, the purchase of equipment and services takes place on less favorable terms than for mobile operators and owners of a tower business (infrastructure operator). Also the disadvantage is the need to meet the requirements of regulators, which for private 5G networks are still vague and lagging behind technological progress.

At the same time, Dmitry Lakontsev notes, obtaining a license, as a rule, is one of the smallest lines in expenses. To create your own communications infrastructure, you need serious money and relevant competencies. Not all companies can afford it, so this story is unlikely to be massive. However, the demand for private networks is and is only growing, mainly from the largest enterprises. Globally, we are talking about thousands of installations, and on a Russian scale, about dozens, which is quite a lot.

Semyon Zakharov, Director of Project Implementation for Corporate Business of MegaFon PJSC, emphasizes that the operator sees a great interest in private LTE and 5G networks from the corporate market.

The participation of the telecom operator in the construction of private LTE / 5G will allow corporate clients to avoid mistakes when planning a network, taking into account the peculiarities of the territory in which the enterprise is located and the tasks that it faces. “For the same reason, it is more profitable for companies to transfer the operation of networks to operators. If an enterprise builds a network on its own, it must not only obtain frequencies, but also legalize the network itself, carry out radio control and other necessary processes. As a result, the network becomes a non-core asset, which requires significant financial and human resources. Over time, the majority of enterprises give up such non-core activities,” said Semyon Zakharov.

……………………………………………………………………………………………………………………………….

References:

https://www.comnews.ru/content/216481/2021-09-17/2021-w37/nornikel-sdelaet-5g-dlya-sebya

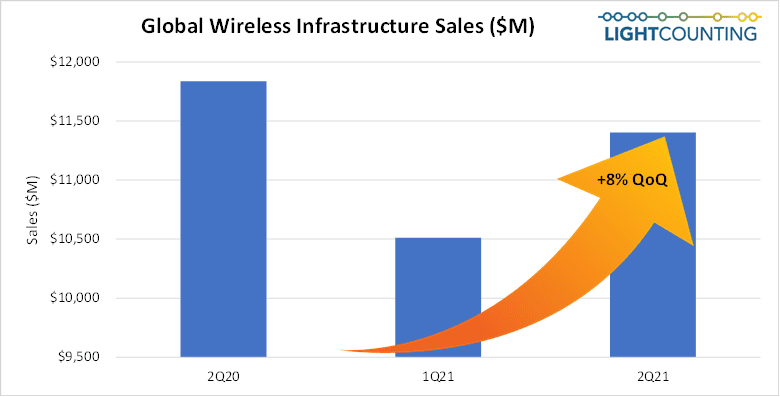

LightCounting: Wireless Infrastructure Market to Grow at 5% in 2021; 8% in 2Q-2021

LightCounting says the 2nd quarter of 2021 was robust for the wireless infrastructure market, as a second quarter typically is, but below 2Q20 that was revved up by China’s 5G catch-up after a massive COVID-19 lockdown. The 5G rollout momentum seen in North America, and Northeast Asia reported in 2H-2020 and 1Q-2021 continued in 2Q-2021 and was augmented by strong activity in Europe, and 4G expansion in India.

As a result, the global wireless infrastructure market grew sequentially, driven by RAN, open vRAN—again mostly fueled by Rakuten Mobile’s 5G network buildout, and 5G and 4G core network elements.

“2Q21 was somewhat reminiscent of the golden GSM era and I could not find anyone malcontent as sales of all 4G and 5G network nodes performed magnificently. Regarding the vendors’ market shares, the gradual rise of Ericsson and Nokia was most immediately induced by the fall of Huawei.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

LightCounting once again had to increase their North American forecast to reflect a strong start in C-band activity and Ericsson’s 5-year $8B 5G contract with Verizon and decrease their Asia Pacific’s 5G forecast due to uncertainties in China and India. As a result, the global wireless infrastructure market’s growth stayed intact at 5% over 2020.

In the long run, factoring in the strong North American 5G activity which is expected to last until 2025 our model’s market peak has moved by a year to 2023. Our service-provider 20-year wireless infrastructure footprint pattern analysis points to a 2020-2026 CAGR of 1% characterized by low single-digit growth through 2023, followed by a 1% decline in 2024, flatness in 2025, and a 4% drop in 2026. This lumpy pattern reflects the differences in regional and national agendas.

About the report:

2Q21 Wireless Infrastructure Market Size, Share, and Forecast report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2020, quarterly market size and vendor market shares, and a detailed market forecast through 2026 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America). The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

More information on the report is available at:

https://www.lightcounting.com/report/august-2021-wireless-infrastructure-2q21-116

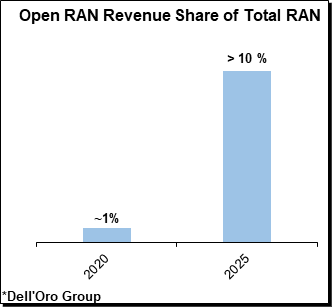

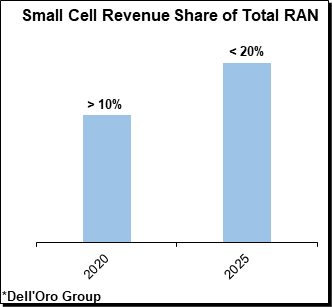

Dell’Oro: Total RAN market to grow 10-15% in 2021; Microwave Transmission equipment grows 11% YoY

Dell’Oro Group has once again upgraded its forecast for the total RAN market, now projecting it to grow 10-15% this year. As expected, Huawei and ZTE are gaining market share in China, while Ericsson and Nokia are gaining everywhere else. Ericsson and Samsung increased their RAN revenue outside of China.

“The underlying long-term growth drivers have not changed and continue reflect the shift from 4G to 5G, new FWA (Fixed Wireless Access) and enterprise capex, and the transitions towards active antenna systems,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “At the same time, a string of indicators suggest this output acceleration is still largely driven by the shift from 4G to 5G, which continued at a torrid pace in the quarter (but only for the RAN; not for the 5G SA core network), even as LTE surprised on the upside,” continued Pongratz.

“With the improved outcome in Latin America, we estimate that four out of the six regions we track increased at a double-digit rate in the second quarter,” Stefan said via email. He was kind enough to send me these charts:

Additional highlights from Dell’Oro’s 2Q 2021 RAN report:

- RAN rankings did not change – Huawei and ZTE were the No.1 and No.2 suppliers in China while Ericsson and Nokia maintained their No.1 and No.2 positions outside of China.

- Revenue shares changed slightly – preliminary estimates suggest Ericsson and Samsung recorded revenue share gains outside of China, while Huawei and ZTE improved their positions in China.

- The combined share of the smaller RAN suppliers, excluding the top five vendors, improved by ~1% between 2020 and the first half of 2021, in part as a result of the ongoing Open RAN greenfield deployments in Japan and the U.S. “It’s all relative and it will take some time before open RAN moves the needle,” Pongrantz said.

- The RAN market remains on track for a fourth consecutive year of growth. The short-term outlook has been revised upward – total RAN is now projected to advance 10 to 15% in 2021.

………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceiver, macro cell, small cell BTS shipments, and Open RAN for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, and LTE. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook.

- Segments: LTE, Sub 6 GHz 5G NR, Millimeter Wave 5G NR, Massive MIMO, Macro Cell, Small Cell, Open RAN

- Regions: North America, Europe, Middle East & Africa, Asia Pacific, China and CALA (Caribbean and Latin America)

To purchase this report, please contact: [email protected]

References:

2021 Outlook Upgraded for RAN Market, According to Dell’Oro Group

…………………………………………………………………………………………………………………………………..

Separately, Dell’Oro Group says that the demand for Microwave Transmission equipment grew 11% year-over-year in the first half of 2021, driven by LTE and 5G. In that period, microwave revenue from mobile backhaul application grew 16 percent.

“The Microwave Transmission market is recovering from the decline caused by the spread of COVID-19 as evidenced by the strong growth in the first half of 2021,” stated Jimmy Yu, Vice President at Dell’Oro Group. “Almost all of the vendors in this industry are benefiting from the improving mobile backhaul market, especially the top vendors. Since demand is rising, each vendor’s performance this year will come down to how well they navigate the supply issues created by the pandemic and semiconductor shortages,” added Yu.

Highlights from the 2Q 2021 Quarterly Report:

- All regions contributed to the positive market growth this quarter with the exception of Latin America. Latin America declined year-over-year for a ninth consecutive quarter, shrinking to its lowest quarterly revenue level that we have on record.

- The top three vendors in the quarter continued to be Huawei, Ericsson, and Nokia. In 2Q 2021, Huawei regained most of the market share lost in the previous quarter and returned to holding a 10 percentage point lead over Ericsson.

- E/V Band revenue growth remained positive for another consecutive quarter and held its double-digit year-over-year growth rate.

The Dell’Oro Group Microwave Transmission & Mobile Backhaul Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and E/V Band). The report tracks point-to-point TDM, Packet, and Hybrid Microwave as well as full indoor and full outdoor unit configurations.

The following markets are covered in the report:

- TDM, Packet, and Hybrid Microwave

- Microwave Transmission by Application: Mobile Backhaul and Verticals

- Split mount units, Full indoor units, and full outdoor units

- E/V Band systems

To purchase this report, please contact [email protected]

References:

5G and LTE Drive Mobile Backhaul Microwave Market 16 Percent in 1H 2021, According to Dell’Oro Group

Triangle Communications replaces Huawei gear with Mavenir 4G/5G Open RAN radios and software

Montana service provider Triangle Communications is swapping out Huawei gear from its network and implementing 4G/5G open RAN products from upstart tech vendor Mavenir.

Late October is the target timeline as to when the FCC’s rip and replace reimbursement program opens. However, Triangle Communications is already at work to overhaul equipment for its fixed wireless access service. Texas-based Mavenir was chosen for Triangle’s entire network replacement and will act as systems integrator for the project, which qualifies for the FCC funding.

“This is a complete network swap out, so everything in the entire network from core to RAN [radio access network] and replacing it all with virtualized solutions,” Mavenir’s Sr VP John Baker said in an interview with Fierce Wireless.

Mavenir is providing a containerized evolved packet core (vEPC) IMS, open virtualized RAN (Open vRAN) compliant with O-RAN Alliance specifications for open interfaces, and the Mavenir Webscale platform that will enable Triangle to run applications on private, public or hybrid clouds.

It’s deploying the O-RAN Alliance 7.2 open interfaces for the 4G-LTE radios. All of the equipment will also be 5G ready. Triangle is using band 12/700 MHz spectrum.

Once Triangle gets equipment that’s virtualized up and running, Mavenir said the operator’s ability to respond to changes and the market should be significantly faster. It’s notable that the Triangle is planning to deploy open RAN architecture and technology.

In filings with the FCC, Triangle said that it doesn’t see any disadvantages in taking an open RAN approach. According to an April filing (PDF), the service provider’s own research “found ORAN equipment to be competitively priced and fully functional compared to legacy vendors’ equipment options which lock you into always using their equipment.”

“This will be the first network that will be deployed using Mavenir designed radios,” Baker said, and the first of several Mavenir-branded commissioned radios the software vendor plans to introduce over the next couple of quarters. Mavenir has done radios before, but it’s the first the vendor commissioned, designed, manufactured, and deployed in the U.S. market and for U.S. frequency bands.

As an open RAN vendor, and vocal champion, Mavenir has been clear on its stance of the need for U.S.-based radio suppliers in a market currently dominated by Ericsson and Nokia as RAN vendors.

Triangle and Mavenir did not disclose the value of their new deal, but the companies said Triangle’s core network swap-out is underway and that work on the radio access network (RAN) would stretch into next year.

Perhaps the most noteworthy element in Mavenir’s deal with Triangle is that it encompasses both the company’s hardware and software. Mavenir entered the RAN hardware business (mostly radios which are outsourced to Asian suppliers) in order to complement its existing software offerings.

Mavenir last year described its new open RAN hardware strategy as an attempt to “break the incumbent’s monopoly in the global market.” But the company’s efforts also highlight the complexity of the open RAN market considering open RAN technologies are intended to allow operators to mix and match equipment from a variety of vendors rather than buying everything from one source.

This could be the first of many U.S. ongoing “rip and replace” program as the FCC’s program to eliminate Huawei equipment gathers steam.

……………………………………………………………………………………….

Triangle Communications Serving Area in Montana:

Triangle Telephone Cooperative (TTC) is a company owned by its members. The cooperative was incorporated on March 24, 1953 in Havre, Montana by rural residents of Central Montana. In 1994, TTC purchased 13 exchanges from US West (now CenturyLink/Lumen Technologies) and formed a subsidiary named Central Montana Communication (CMC). Triangle Communications is the name TTC and its subsidiaries have chosen to do business as since 2008.

………………………………………………………………………………………….

References:

https://www.fiercewireless.com/tech/mavenir-swaps-out-triangle-s-huawei-gear-for-open-ran

https://itstriangle.com/about-us

GSMA Mobile Economy 2021: 5G has momentum, 4G has peaked, global mobile subscriber growth slowing

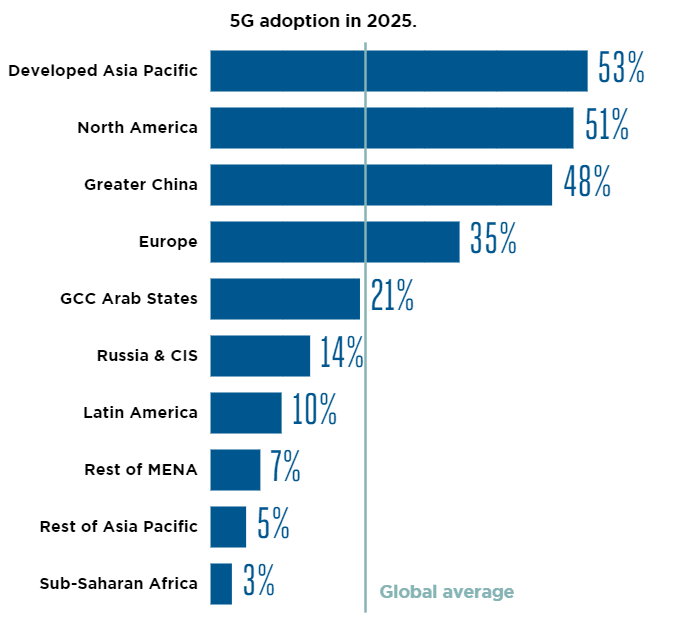

The launch of commercial 5G services in Latin America and Sub-Saharan Africa over the last year means that 5G technology is now available in every region of the world. The pandemic has had little impact on 5G momentum; in some instances, it has even resulted in operators speeding up their network rollouts, with governments and operators looking to boost capacity at a time of increased demand. By the end of 2025, 5G will account for just over a fifth of total mobile connections and more than two in five people around the world will live within reach of a 5G network. In leading 5G markets, such as China, South Korea and the U.S.

4G – LTE has peaked and, in some cases, begun to decline. In many other countries, particularly in developing regions, 4G still has significant headroom for growth. Much of the growth in 4G will come from existing 4G – LTE infrastructure, as 5G will account for 80% of total capex over the next five years. Globally, 4G adoption will peak at just under 60% by 2023 as 5G begins to gain traction in new markets.

Subscriber growth is slowing, but mobile’s contribution to the global economy remains significant. By the end of 2020, 5.2 billion people subscribed to mobile services, representing 67% of the global population. Adding new subscribers is increasingly difficult, as markets are becoming saturated and the economics of reaching rural populations are becoming more difficult to justify in a challenging financial climate for mobile operators. That said, there will be nearly half a billion new subscribers by 2025, taking the total number of subscribers to 5.7 billion (70% of the global population). Large under-penetrated markets in Asia and Sub-Saharan Africa will account for the majority of new subscribers. In 2020, mobile technologies and services generated $4.4 trillion of economic value added (5.1% of GDP) globally. This figure will grow by $480 billion by 2025 to nearly $5 trillion as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services. 5G is expected to benefit all economic sectors of the global economy during this period, with services and manufacturing seeing the most impact.

At the end of 2020, 67% of the world’s population had a mobile network subscription of some sort. This means 5.2 billion people, generating $4.4 trillion of world GDP through mobile technologies and services. This also means adding new subscribers is increasingly difficult, with markets getting saturated. Plus a challenging financial climate for mobile operators is making them less tempted to invest to reach untapped rural populations.

There will be a half billion new subscribers between now and 2025. Most of them – nearly two thirds – will be in large, under-reached markets in Asia and sub-Saharan Africa. Not to mention a billion more mobile Internet subscribers. Mobile Internet users, now 51% of the world’s population at 4.0 billion, will reach 60% or 5 billion by 2025, the GSMA forecasts.

We will quickly get smarter, too – smartphones will make up 81% of mobile connections in 2025, up from 68% in 2020. End point devices will also get smarter, and fast. There will be 24.0 billion Internet of Things (IoT) connections in 2025, up by 85% from 13.0 billion in 2020. Still, COVID is stretching out replacement cycles – from 2.25 years on average, up to three years or more. With many consumers pinched in the pocket, there’s a pivot to lower-cost handsets, with average retail prices for 5G handsets falling more than a third since 2019.

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/06/GSMA_MobileEconomy2021.pdf

FCC Grants Facebook permission to test converged WiFi/LTE indoor network in Menlo Park, CA

Following last month’s FCC filing to test a small 5G network, Facebook has filed another FCC Special Temporary Authority (STA) petition to test a “converged wireless system” that could potentially support concurrent communications across Wi-Fi and cellular networks in Menlo Park, CA (Facebook corporate headquarters).

In its FCC filing (granted June 23,2021), Facebook said “The experiment involves short-term testing of a LTE over-the-air setup for an indoor demonstration that is not likely to last more than six months, making an STA more appropriate than a conventional experimental license.”

Also, that it is researching a “proof of concept for a converged wireless system that will operate at the 2.4GHz Wi-Fi band and at Band 3 (1710MHz to 2495 MHz). The goal of the proof of concept is to create a demonstration and see if such a system may be viable. The system that will be tested will have a simple radio head that will be able to operate as a Wi-Fi Radio at 2.4 GHz and as a Band 3 cellular radio (LTE) concurrently. We will wirelessly connect dedicated client devices to demonstrate performance.”

The FCC approved Facebook’s request on June 23,2021. It will remain in effect until its scheduled expiration date of November 10, 2021. Facebook petition was filed under the “FCL Tech” name, which the company has been used for previous wireless tests in the 6GHz band.

Facebook will be using five units of unspecified AVX wireless network gear (E 102289 model). AVX is a Kyocera Group company. Their website states:

AVX Corporation is a leading international manufacturer and supplier of advanced electronic components and interconnect, sensor, control and antenna solutions with 33 manufacturing facilities in 16 countries around the world.

We offer a broad range of devices including capacitors, resistors, filters, couplers, sensors, controls, circuit protection devices, connectors and antennas. AVX components can be found in many electronic devices and systems worldwide.

Since WiFi at 2.4 GHz is in unlicensed spectrum (and being used indoors), one would assume that Facebook would also like to operate LTE in unlicensed spectrum in their converged network.

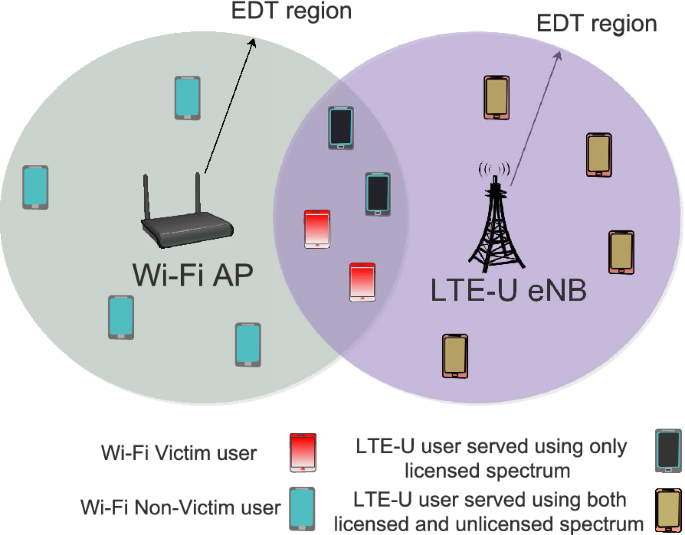

LTE in unlicensed spectrum (LTE-Unlicensed, LTE-U) is a proposed extension of the 4G-LTE wireless standard intended to allow cellular network operators to offload some of their data traffic by accessing the unlicensed 5 GHz frequency band. LTE-Unlicensed is a proposal, originally developed by Qualcomm, for the use of the 4G LTE radio communications technology in unlicensed spectrum, such as the 5 GHz band used by IEEE 802.11a and 802.11ac compliant Wi-Fi equipment. It would serve as an alternative to carrier-owned Wi-Fi hotspots. Currently, there are a number of variants of LTE operation in the unlicensed band, namely LTE-U, License Assisted Access (LAA), and MulteFire.

License Assisted Access (LAA) is a feature of LTE that leverages the unlicensed 5 GHz band in combination with licensed spectrum to increase performance. It uses carrier aggregation in the downlink to combine LTE in unlicensed 5 GHz band with LTE in the licensed band to provide better data rates and a better user experience.

However, Facebook’s STA is only for the band between 1710-2495 MHz – not the 5 GHz band.

……………………………………………………………………………………………………………………………………………………

References:

https://apps.fcc.gov/oetcf/els/reports/GetApplicationInfo.cfm?id_file_num=0769-EX-ST-2021

https://apps.fcc.gov/oetcf/els/reports/STA_Print.cfm?mode=current&application_seq=107558

Samsung & NEC selected by Vodafone for Open RAN deployment

Vodafone has selected its Open RAN vendors: Dell, Samsung, NEC, Wind River, Keysight Technologies and Capgemini Engineering will jointly develop the first Open Radio Access Network commercial deployment in Europe. This is important because Vodafone will now be a “brownfield” telco vs greenfield telcos like Rakuten Mobile and Dish Network that are building 4G/5G Open RANs.

Furthermore, established telecom vendors Samsung and NEC beat competition from Altiostar, Mavenir and Parallel Wireless, the U.S. firms that have been involved in other open RAN deployments.

Wind River is providing the cloud software infrastructure for orchestration, while Keysight and Capgemini – the only European supplier in the mix – look after conformance and interoperability testing to make sure the set-up actually works.

The partnership will initially focus on the 2,500 UK sites that Vodafone committed to Open RAN in autumn 2020. One of the largest Open RAN deployments worldwide, this will be built in partnership with Samsung, NEC, Dell and Wind River. Vodafone will also use new radio equipment through the Evenstar program, with Keysight and Capgemini providing supports for network component interoperability.

Starting in 2021, the vendors and Vodafone will work to increase 4G/5G coverage to more rural areas across the SW of England and most of Wales, before turning to urban areas in a later stage. Vodafone is also working to deploy Open RAN technology in Africa and other markets across Europe. This announcement builds on the group’s new Open RAN lab in Newbury, UK, and planned digital skills hubs in Dresden (Germany) and Malaga (Spain).

Johan Wibergh, Vodafone Chief Technology Officer, said: “Open RAN provides huge advantages for customers. Our network will become highly programmable and automated meaning we can release new features simultaneously across multiple sites, add or direct capacity more quickly, resolve outages instantly and provide businesses with on-demand connectivity.”

“Open RAN is also reinvigorating our industry. It will boost the digital economy by stimulating greater tech innovation from a wider pool of vendors, bringing much needed diversity to the supply chain.”

“Samsung performed well on TIP evaluations they talked about a year and a half ago and so in that sense it is not a surprise,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “Samsung is taking advantage of open RAN to extend its reach.”

“This partnership represents a major breakthrough for Samsung and a strong validation for its 5G RAN portfolio,” said Richard Webb, an analyst with CCS Insight, in emailed comments. “This contract win adds to its credibility and could be a signal for other European operators to consider Samsung as an option.”

Samsung has built its open RAN software on top of Intel’s FlexRAN platform, Light Reading was able to confirm with Vodafone. Asked if that would preclude the use of Arm-based processors in future, the operator insisted open RAN’s flexibility would allow software to evolve as desired.

Heavy Reading’s Brown thinks NEC would have been a natural choice as a supplier of radio units because the Japanese market has already taken advantage of open fronthaul capability. “They have been using radios and baseband from different vendors for a long time and are world leaders in this,” he says. “NEC and Fujitsu have been working in that area for some time.”

…………………………………………………………………………………………………………………………………..

Vodafone Statement:

Vodafone is working with other operators to lower the entry barriers for smaller vendors and startups. Recently published Open RAN technical requirements by Vodafone and other telecommunications companies will provide a blueprint to help expedite the development of new products and services based on industry specifications from the O-RAN Alliance (of which Vodafone is a member) and eventually (????) ETSI standards (from the European Telecommunications Standards Institute), always compatible with 3GPP (which does not have ANY Open RAN projects at this time).

……………………………………………………………………………………………………………………………………………

References:

https://www.vodafone.com/news/press-release/vodafone-europe-first-commercial-open-ran-network

Telecom Italia to be first Open RAN network operator in Italy

Telecom Italia (TIM) is among the first operators in Europe and the only one in Italy to launch the Open RAN deployment program to innovate 4G and 5G radio access networks.

The initiative is covered by the signing of a Memorandum of Understanding (MoU) last February with the main European operators to promote Open RAN technology with the aim of speeding up the implementation of new generation mobile networks, in particular 5G, Cloud and Edge Computing.

TIM said it signed up to the MoU to commit to the development of innovative mobile network systems that use open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

The first city in Italy to adopt this open network model is Faenza. Through collaboration with JMA Wireless – a leader in mobile coverage and the development of Open RAN software – TIM will use a solution that decouples or disaggregates the components (hardware and software) of the radio access network.

The radio node on the 4G network has been built by combining JMA’s software baseband with the radio units provided by Microelectronics Technology (MTI). Going forward, this venture will also extend to 5G solutions.

The deployment of Open RAN solutions in an open environment, in line with the objectives of TIM’s 2021-2023 ‘Beyond Connectivity’ plan, will unite the potential of the cloud and Artificial Intelligence with the evolution of the mobile network. Moreover, it will enable operators to further strengthen security standards, improve network performances and optimize costs in order to provide ever more advanced digital services such as those linked to the new solutions for Industry 4.0, the smart city and autonomous driving.

TIM is a member of the European Open RAN alliance launched earlier this year by Deutsche Telekom, Orange, Telefonica and Vodafone to work together on developing and implementing open RANs for mobile. TIM said that the initiative will provide strong impetus to the introduction of the broadband mobile network’s new functionalities, in particular the 5G ones, promoting an increasingly widespread deployment and improving its management.

That consortium may be in competition with the 5G Open RAN Ecosystem, which includes the following companies: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Of course there is also the O-RAN Alliance and the TIP Open RAN project group. Yet no standards body (like ITU, ETSI, IEEE, etc) is involved and neither is 3GPP which is the main spec writing body for cellular networks.

…………………………………………………………………………………….

References:

https://www.gruppotim.it/en/press-archive/corporate/2021/CS-TIM-ORAN-Faenza-26-aprile2021-EN.html

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

https://www.gruppotim.it/en/press-archive/corporate/2021/PR-TIM-ORAN-en.html