5G private networks

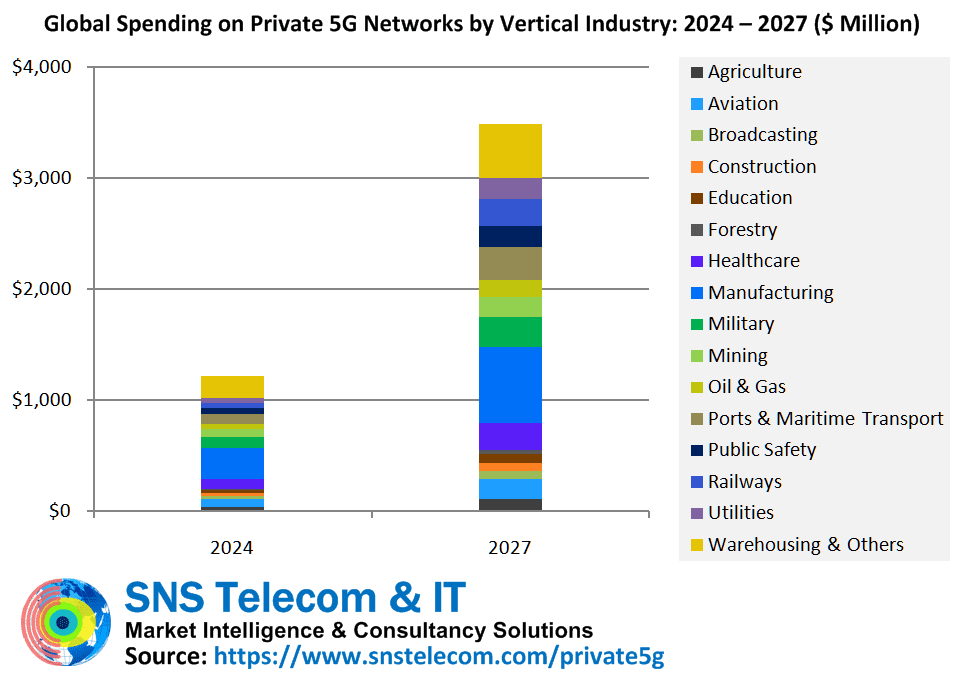

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT’s new “Private 5G Networks: 2024 – 2030” report exclusively focuses on the market for private networks built using the 3GPP-defined 5G specifications (there are no ITU-R recommendations for private 5G networks or ITU-T recommendations for 5G SA core networks). In addition to vendor consultations, it has taken us several months of end user surveys in early adopter national markets to compile the contents and key findings of this report. A major focus of the report is to highlight the practical and tangible benefits of production-grade private 5G networks in real-world settings, as well as to provide a detailed review of their applicability and realistic market size projections across 16 vertical sectors based on both supply side and demand side considerations.

The report states report that the real-world impact of private 5G networks – which are estimated to account for $3.5 Billion in annual spending by 2027 – is becoming ever more visible, with diverse practical and tangible benefits such as productivity gains through reduced dependency on unlicensed wireless and hard-wired connections in industrial facilities, allowing workers to remotely operate cranes and mining equipment from a safer distance and significant, quantifiable cost savings enabled by 5G-connected patrol robots and image analytics in Wagyu beef production.

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Although much of this growth will be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries, sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced becomes a commercial reality. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernization and FRMCS (Future Railway Mobile Communication System).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure segment – iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations and other initial installations date back to the early 2010s. However, in most national markets, private cellular networks or NPNs (Non-Public Networks) based on the 3GPP-defined 5G specs are just beginning to move beyond PoC (Proof-of-Concept) trials and small-scale deployments to production-grade implementations of standalone 5G networks, which are laying the foundation for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, local 5G or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots and control systems. Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

It is worth noting that China is an outlier and the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities and ports. To provide some context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements. For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of approximately 104 acres, steelmaker WISCO (Wuhan Iron & Steel Corporation) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its steel plant in Wuhan (Hubei), and Fujian-based manufacturer Wanhua Chemical has recently built a customized wireless network that will serve upwards of 8,000 5G RedCap (Reduced Capability) devices, primarily surveillance cameras and IoT sensors.

As end user organizations in the United States, Germany, France, Japan, South Korea, Taiwan and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, BVLOS (Beyond Visual Line-of-Sight) operation of drones, digital twin models of complex industrial systems, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance operations, XR (Extended Reality)-based military training, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, and optimization of cattle fattening and breeding for Wagyu beef production.

Despite prolonged teething problems in the form of a lack of variety of non-smartphone devices, high 5G IoT module costs due to low shipment volumes, limited competence of end user organizations in cellular wireless systems and conservatism with regards to new technology, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators. Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include but are not limited to:

- Tesla’s private 5G implementation on the shop floor of its Giga-factory Berlin-Brandenburg plant in Brandenburg, Germany, has helped in overcoming up to 90 percent of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America and Europe. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by ten percent.

- Lufthansa Technik’s 5G campus network at its Hamburg facility has removed the need for its civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40 percent while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated significant cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- NEC Corporation has improved production efficiency by 30 percent through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10 percent through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20 percent productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30 percent reduction in pest-related agricultural losses and a 15 percent boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70 percent since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50 percent and achieving a steel defect detection rate of more than 90 percent, which equates to $7 Million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50 percent reduction in manpower requirements and a 10 percent increase in production efficiency – which translates to more than $1 Million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 Million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20 percent using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, 16 vertical industries and five regional markets. The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2’2024.

The key findings of the report include:

- SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Much of this growth will be driven by highly localized 5G networks covering geographically limited areas for high-throughput and low-latency Industry 4.0 applications in manufacturing and process industries.

- Sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced – 5G’s next evolutionarily phase – becomes a commercial reality.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control and intralogistics processes in the range of 20 to 90%, cost savings of up to 40% at an intermodal terminal, reduction of worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- Some of the most technically advanced features of 5G Advanced are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For example, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Spain, Netherlands, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

New classes of private network service providers have also found success in the market. Notable examples include but are not limited to Celona, Federated Wireless, Betacom, InfiniG, Ataya, Smart Mobile Labs, MUGLER, Alsatis, Telent, Logicalis, Telet Research, Citymesh, Netmore, RADTONICS, Combitech, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens and Comsol, and the private 5G business units of neutral host infrastructure providers such as Boldyn Networks, American Tower, Boingo Wireless, Crown Castle, Freshwave and Digita.

NTT, Kyndryl, Accenture, Capgemini, EY (Ernst & Young), Deloitte, KPMG and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) acquisition of Italian mobile core technology provider Athonet.

The service provider segment is not immune to consolidation either. For example, Boldyn Networks has recently acquired Cellnex’s private networks business unit, which largely includes Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden and the United Kingdom.

Among other examples, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – an Australian pioneer in private LTE and 5G networks, while mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless solutions provider Aqura Technologies.

The report will be of value to current and future potential investors into the private 5G network market, as well as 5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies and vertical applications.

References:

https://www.snstelecom.com/private5g

What is 5G Advanced and is it ready for deployment any time soon?

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

https://www.kyndryl.com/us/en/about-us/news/2024/02/it-ot-convergence-in-manufacturing

India Telcos say private networks will kill their 5G business

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

Ericsson and ACES partner to revolutionize indoor 5G connectivity in Saudi Arabia

Ericsson and Advanced Communications and Electronics Systems (ACES) [1.] have signed a strategic three-year Neutral Host Provider (NHP) agreement, to address the surging demand for indoor 5G connectivity and 5G technology. This agreement aims to create a neutral host ecosystem, allowing service providers to share infrastructure and deliver high-performance 5G connectivity in high-traffic indoor locations in Saudi Arabia.

Note 1. Advanced Communications & Electronic Systems Company (ACES) is a leading international neutral host operator and a digital infrastructure company based in Saudi Arabia. Established in early 1990s, ACES is specialized in implementing total solutions and turn-key projects in wireless communication, network monitoring & testing and information technology systems.

……………………………………………………………………………………………………………….

Using multi-operator infrastructure sharing to address rising demand for indoor connectivity will significantly improve user experience. With the rise of high-attraction landmarks and the need for network densification, it has become crucial to provide reliable and high-performing indoor solutions for portability, agility and flexibility.

The NHP agreement allows ACES to provide Ericsson indoor 5G products to service providers, enabling them to share the same infrastructure, and ensure cost-effective coverage expansion and efficient utilization of resources.

This agreement will establish a neutral host ecosystem, supporting CSPs in enhancing their indoor 5G coverage with flexibility and ease of operation and maintenance. It will contribute to the footprint expansion of indoor 5G networks across the Kingdom.

Image Credit: Ericsson

By deploying Ericsson’s Radio Dot System, CSPs can deliver high-performing 5G connectivity to users in large locations such as airports, hotels, hospitals, stadiums, and shopping malls.

One of the key activations as a result of this agreement is enhancing the 5G indoor connectivity at an international airport in the Kingdom that welcomes millions of visitors regularly. The agreement paves the way for a resilient infrastructure in high-density locations.

Akram Aburas, Chief Executive Officer of ACES, says: “At ACES, we seek to empower businesses and individuals with a transformative digital experience, and our agreement with Ericsson is a momentous step towards that. With Ericsson’s cutting-edge indoor 5G solutions, we aim to create a neutral host ecosystem that offers seamless and high-performance connectivity in high-traffic indoor locations across the Kingdom. Our agreement with Ericsson will support and meet the surging demand for indoor connectivity across Saudi Arabia and unlock unparalleled opportunities for telecom operators to enrich their offerings and deliver exceptional user experiences.”

Ericsson’s indoor 5G solutions, powered by the Radio Dot System, will enable faster and more reliable network performance in indoor environments and will cater to the increasing need for seamless connectivity.

Håkan Cervell, Vice President and Head of Ericsson Saudi Arabia and Egypt at Ericsson Middle East and Africa, says: “By fostering a neutral host ecosystem, we are enabling communications service providers to embrace unprecedented flexibility and cost efficiency in their network expansion. Our indoor 5G solutions, powered by the Radio Dot System, will enhance how businesses and individuals experience seamless connectivity within indoor environments. We look forward to this agreement with ACES, which will ensure robust indoor 5G connectivity across the Kingdom, in line with Saudi Vision 2030, while setting new benchmarks for network performance that propel Saudi Arabia to the forefront of the global 5G revolution.”

To date, the Ericsson Radio Dot System has been deployed in more than 115 countries around the world in high-traffic indoor venues.

References:

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Ericsson expects continuing network equipment sales challenges in 2024

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Ligado Networks and Ubiik to offer private LTE network using Band 54 spectrum at 1670-1675 MHz

U.S. satellite communications service provider Ligado Networks plans to offer a private LTE network using advanced metering infrastructure (AMI) from Taiwan based Ubiik. Using Band 54 spectrum at 1670-1675 MHz, the private LTE network is intended for the utilities sector and other mission-critical customers. Band 54 is standardized for 3GPP-based cellular technologies; it is available contiguously across the US.

Ubiik gained considerable success in Taiwan, including a $17 million tender from Taiwan Power Company (Taipower) at the start of 2023. The company has developed a private LTE base station for Band 54 spectrum, under the brand goRAN; the 5MHz chunk at 1670-1675 MHz, affording time-division (rather than frequency division) duplexing (TDD), is presented as a useful private network addition for low-power IoT projects.

On October 6th, Ubiik partnered with Electricity Canada with the aim of contributing to Canada’s clean energy future through developments in wireless connectivity. Ubiik will collaborate with Electricity Canada’s members and partners to deliver pLTE networks for utilities in Canada, using its innovative goRAN™ LTE Base Station and LTE-M end devices that support the 1.8GHz, 900MHz, and 1.4GHz spectrum.

The goRAN™ base station integrates a full-software 3GPP Release 15 Radio Access Network (RAN) optimized for private networks, with multi-carrier standalone NB-IoT support as well as standalone LTE-M in 1.4MHz, 3MHz and 5MHz bandwidths, including VoLTE. It can operate as a Base Station connecting to an external Evolved Packet Core (EPC) via the S1 interface, as well as an Access Point with its built-in EPC and integrated HSS (external HSS via S6a is also supported).

…………………………………………………………………………………………………………………………….

It is a “golden opportunity” for critical industries, said Ubiik. TDD separates the uplink and downlink signals by allocating different time slots in the same frequency band, allowing for asymmetric flow for uplink and downlink transmission. Ligado Networks said: “[It] equips utility users with significant flexibility, as different ratios of uplink versus downlink slots may be used to address requirements of mission-critical applications.”

A news release said: “The Band 54 goRAN™ LTE Base Station will be particularly useful for utilities deploying private networks which is why the companies plan to showcase a demonstration version of the device during the 2023 Utility Broadband Alliance (UBBA) Summit & Plugfest Event in Minneapolis next week from October 10-12, 2023.”

Sachin Chhibber, chief technology officer at Ligado Networks emphasized how the announcement represents another building block in the expansion of the ecosystem which utilizes Band 54 frequencies. He stated: “Ubiik’s goRAN base station is a significant enhancement to the opportunities the band affords to the critical infrastructure industry – especially utility and other enterprise organisations planning private networks… By eliminating the requirement to pair channels for uplink and downlink, we will be able to offer partners the flexibility to use the spectrum exactly how they need, and with greater efficiencies.”

Chhibber reiterated how specific attributes of Band 54 – particularly its Time Division Duplex (TDD) capabilities – equip utility users with significant flexibility, as different ratios of uplink versus downlink slots may be used to address requirements of mission-critical applications. “By eliminating the requirement to pair channels for uplink and downlink, we will be able to offer our partners the flexibility necessary to use the spectrum exactly how they need, and with greater efficiencies,” Chhibber noted. He added that uplink-heavy users such as utilities – for monitoring purposes, as an example – will be able to deploy tailormade networks to achieve their priorities.

Tienhaw Peng, chief executive at Ubiik, said: “Given the scarcity of spectrum, being able to secure an optimal 5 MHz slice to build out a private network is a golden opportunity for critical infrastructure customers. Our goRAN base station offers the perfect mix of affordability and ease of deployment combined with the spectral efficiency, interoperability and security brought by LTE. With Ligado, we look forward to providing a solution-in-a-box for building an LTE network – by either utilising a user’s specified core network or one directly built into the base station.”

Peng also explained that the goRAN™ Base Station will integrate with chipsets supporting Band 54 and with a utility-hardened LTE endpoint module currently in development. Ubiik’s recent acquisition of utility networks provider Mimomax Wireless will provide North American utilities with additional expertise in the deployment of multiple large-scale wireless networks.

Ubiik’s recent acquisition of utility networks provider Mimomax Wireless will provide North American utilities with additional expertise in the deployment of multiple large-scale wireless networks, the company said.

References:

Ligado Networks teams up with Ubiik to offer US utilities Band-54 private LTE at 1670-1675 MHz

New VMware Private Mobile Network Service to be delivered by Federated Wireless

Federated Wireless, a shared spectrum and private wireless network operator, today announced it will deliver private 4G and 5G networks-as-a-service for enterprises in the form of the new VMware Private Mobile Network Service. Federated Wireless will build and operate private 4G and 5G radio access network (RAN) infrastructure to be deployed on customers’ premises. VMware will provide its Private Mobile Network Orchestrator to manage the end-to-end network and integrate it with existing IT environments.

The streamlined solution provides the performance, coverage, and security benefits of private cellular networks without the complexity of building and operating standalone infrastructure.

Key features and benefits of the joint solution include:

- Streamlined deployment of private 4G/5G RAN at enterprise locations

- Simplified private mobile core integrated with existing IT management platforms

- Centralized orchestration and automation of the end-to-end networks

- Enhanced security and more optimized connectivity for business- and mission-critical applications

- Carrier-grade performance with SLAs tailored to enterprise requirements

- Ability to leverage CBRS shared spectrum as well as privately licensed spectrum

“Enterprises are looking to private cellular networks to enable business transformation, but need solutions that integrate with their existing infrastructure,” said Kevin McCartney, Vice President of Alliances at Federated Wireless. “Through the strength of our combined solutioning with VMware, we’re giving customers in difficult-to-cover environments an easy on-ramp to private 4G and 5G with the performance and scale they require.”

“VMware is committed to helping customers modernize their networks through innovative software solutions,” said Saadat Malik, Vice President and General Manager, Edge Computing at VMware. “With Federated Wireless and a growing partner ecosystem, we’re making it simpler for enterprises to deploy and run private networks in a model that aligns with their business needs.”

The solution will be delivered by Federated Wireless as part of its private wireless managed service and will be available to both direct customers and channel partners.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

VMware today is also introducing new and enhanced orchestration capabilities for the edge. VMware Edge Cloud Orchestrator (formerly VMware SASE Orchestrator) will provide unified management for VMware SASE and the VMware Edge Compute Stack—an industry-first offering to bridge the gap between edge networking and edge compute. Enhancements to the orchestrator will help customers plan, deploy, run, visualize, and manage their edge environments in a friction-free manner—allowing them to run edge-native applications focused on business outcomes. The VMware Edge Cloud Orchestrator (VECO) will deliver holistic edge management by providing a single console to manage edge compute infrastructure, networking, and security.

VMware defines the software-defined edge as a distributed digital Infrastructure that runs workloads across a number of locations, close to endpoints that are producing and consuming data. It extends to where the users and devices are—whether they are in the office, on the road or on the factory floor. Enterprises need solutions to connect these elements more securely and reliably to the larger enterprise network in a scalable manner. VMware Edge Cloud Orchestrator is key to enabling a software-defined edge approach. VMware’s approach to the software-defined edge features right-sized infrastructure (shrinking the stack to the smallest possible footprint); pull-based orchestration (security and administrative updates are “pulled” by the workload); and network programmability (defined by APIs and code).

“Audi wants to take factory automation to the next level and benefit from a scalable edge infrastructure at its factories worldwide,” said Jörg Spindler, Global Head of Manufacturing Engineering, Audi. “Audi’s Edge Cloud 4 Production will be the key component of this digital transformation, replacing individual PCs and hardware on the shop floor. Ultimately, it will increase factory uptime, agility, and the speed of rolling out new applications and tools across the production line. VMware Edge Compute Stack (ECS) and the VMware Edge Cloud Orchestrator (VECO) will offer a scalable way for Audi to operate a distributed edge infrastructure, manage resources more efficiently, and lower its operations costs.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

VMware also announced that the VMware Private Mobile Network, a managed connectivity service to accelerate edge digital transformation, will become initially available in the current quarter (FY24 Q3). VMware partners with wireless service providers to help remove the complexity associated with private mobile networks and enable enterprises to focus on their strategic business outcomes. Built on VMware Edge Compute Stack, VMware Private Mobile Network offers service providers trusted VMware technology, seamlessly integrated into existing IT management platforms. This enables rapid deployment and effortless management and orchestration. VMware is also pleased to announce that it is working with Betacom, Boingo Wireless, and Federated Wireless as the initial beta wireless service provider partners for this new offering.

Supporting Diverse Use Cases at the Edge:

VMware offers enterprises the right edge solution to address diverse use cases at the right price. It is collaborating with customers to successfully address the following edge use cases:

- Manufacturing – Support for autonomous vehicles, digital twin, inventory management, safety, and security;

- Retail – Support for loss prevention, inventory management, safety, security, and computer vision;

- Energy – Enable increased production visibility and efficiency, reduced unplanned downtime, maintain regulatory compliance; and,

- Healthcare – Support for IoT wearables, smart utilities, and surgical robotics.

End Quote:

“Boingo is collaborating with VMware to enhance our managed private 5G networks that connect mobile and IoT devices at airports, stadiums and large venues. VMware’s Private Mobile Network simplifies network integration and management, helping us accelerate deployments.” – Dr. Derek Peterson, chief technology officer, Boingo

References:

https://www.federatedwireless.com/products/private-wireless/

https://go.federatedwireless.com/l/940493/2023-06-12/3pj9f/940493/1686554112NWvEuSUE/WhyFederatedWireless_SolutionBrief.pdf

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT‘s latest research report indicates that global spending on private LTE and 5G network infrastructure for vertical industries – which includes RAN (Radio Access Network), mobile core and transport network equipment – will account for more than $6.4 Billion by the end of 2026.

Private cellular networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

With the 3GPP-led standardization [1.] of features such as MCX (Mission-Critical PTT, Video & Data), URLLC (Ultra-Reliable, Low-Latency Communications), TSC (Time-Sensitive Communications), SNPNs (Standalone NPNs), PNI-NPNs (Public Network-Integrated NPNs) and network slicing, private networks based on LTE and 5G technologies have gained recognition as an all-inclusive connectivity platform for critical communications, Industry 4.0 and enterprise transformation-related applications. Traditionally, these sectors have been dominated by LMR (Land Mobile Radio), Wi-Fi, industrial Ethernet, fiber and other disparate networks.

Note 1. 3GPP specs become standards when they are “rubber stamped” by ETSI. Some are also contributed to ITU-R WP5D by ATIS, e.g. 3GPP NR became the essence of ITU-R M.2150 recommendation for 5G RANs.

The liberalization of spectrum is another factor that is accelerating the adoption of private LTE and 5G networks. National regulators across the globe have released or are in the process of granting access to shared and local area licensed spectrum.

Examples include, but are not limited to, the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Canada’s planned NCL (Non-Competitive Local) licensing framework, United Kingdom’s shared and local access licensing model, Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, France’s vertical spectrum and sub-letting arrangements, Netherlands’ geographically restricted mid-band spectrum assignments, Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band, Poland’s spectrum assignment for local government units and enterprises, Bahrain’s private 5G network licenses, Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong’s LWBS (Localized Wireless Broadband System) licenses, Australia’s apparatus licensing approach, India’s CNPN (Captive Non-Public Network) leasing framework and Brazil’s SLP (Private Limited Service) licenses. Even China – where mobile operators have been at the forefront of initial private 5G installations – has started allocating private 5G spectrum licenses directly to end user organizations.

Vast swaths of globally and regionally harmonized license-exempt spectrum are also available worldwide that can be used for the operation of unlicensed LTE and 5G NR-U equipment for private networks. In addition, dedicated national spectrum in sub-1 GHz and higher frequencies has been allocated for specific critical communications-related applications in many countries.

LTE and 5G-based private cellular networks come in many different shapes and sizes, including isolated end-to-end NPNs in industrial and enterprise settings, local RAN equipment for targeted cellular coverage, dedicated on-premise core network functions, virtual sliced private networks, secure MVNO (Mobile Virtual Network Operator) platforms for critical communications, and wide area networks for application scenarios such as PPDR (Public Protection & Disaster Relief) broadband, smart utility grids, railway communications and A2G (Air-to-Ground) connectivity.

However, it is important to note that equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players have slightly different perceptions as to what exactly constitutes a private cellular network. While there is near universal consensus that private LTE and 5G networks refer to purpose-built cellular communications systems intended for the exclusive use of vertical industries and enterprises, some industry participants extend this definition to also include other market segments – for example, 3GPP-based community and residential broadband networks deployed by non-traditional service providers. Another closely related segment is multi-operator or shared neutral host infrastructure, which may be employed to support NPN services in specific scenarios.

Key findings:

-

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 18% between 2023 and 2026, eventually accounting for more than $6.4 Billion by the end of 2026.

-

As much as 40% of these investments – nearly $2.8 Billion – will be directed towards the build-out of standalone private 5G networks that will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries.

-

This unprecedented level of growth in the coming years is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s.

-

Existing private cellular network deployments range from localized wireless systems in industrial and enterprise settings to sub-1 GHz private wireless broadband networks for utilities, FRMCS-ready networks for train-to-ground communications, and hybrid government-commercial public safety broadband networks, as well as rapidly deployable LTE/5G systems that deliver temporary or on-demand cellular connectivity.

-

As for the practical and quantifiable benefits of private LTE and 5G networks, end user organizations across manufacturing, mining, oil and gas, ports and other vertical industries have credited private cellular network installations with productivity and efficiency gains in the range of 30 to 70%, cost savings of more than 20%, and an uplift of up to 80% in worker safety and accident reduction.

-

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private LTE and 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Netherlands, Finland, Sweden, Norway, Poland, Bahrain, Japan, South Korea, Taiwan, China, Hong Kong, Australia, India and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

-

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a strong foothold in the private LTE and 5G network market. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to nationwide public safety broadband networks.

-

New classes of private network operators have also found success in the market. Notable examples include but are not limited to Celona, Betacom, Kajeet, BearCom, Ambra Solutions, iNET (Infrastructure Networks), Tampnet, Smart Mobile Labs, MUGLER, Telent, Logicalis, Citymesh, Netmore, RADTONICS, Combitech, Grape One (Japan), NS Solutions, OPTAGE, Wave-In Communication and the private 4G/5G business units of neutral host infrastructure providers such as Boingo Wireless, Crown Castle, Cellnex Telecom, BAI Communications/Boldyn Networks, Freshwave and Digita.

-

NTT, Kyndryl and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances and early commercial wins. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

-

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) recent acquisition of Italian mobile core technology provider Athonet.

-

The service provider segment is not immune to consolidation either. For example, in Australia, mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless specialist Aqura Technologies. More recently, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – another Australian pioneer in private LTE and 5G networks.

Summary of Private LTE/5G Engagements:

Some of the existing and planned private LTE and 5G engagements are in the following industry verticals:

-

Agriculture: Private cellular network installations in the agriculture industry range from custom-built 250 MHz LTE networks that provide wide area cellular coverage for agribusiness machinery, vehicles, sensors and field workers in Brazil to Japan’s standalone local 5G networks supporting 4K UHD (Ultra-High Definition) video transmission, mobile robotics, remote-controlled tractors and other advanced smart agriculture-related application capabilities.

-

Aviation: Private LTE and 5G networks have been deployed or are being trialed to support internal operations at some of the busiest international and domestic airports, including Hong Kong, Shanghai Pudong and Hongqiao, Tokyo Narita, London Heathrow, Paris-Charles de Gaulle, Orly and Le Bourget, Frankfurt, Cologne Bonn, Brussels, Amsterdam Schiphol, Vienna, Athens, Oslo, Helsinki, Bahrain, Chicago O’Hare, DFW (Dallas Fort Worth), Dallas Love Field and MSP (Minneapolis-St. Paul). Lufthansa Technik and JAL (Japan Airlines), among others, are leveraging private 5G connectivity for aircraft maintenance operations. In addition, national and cross-border A2G (Air-to-Ground) networks for inflight broadband and critical airborne communications are also beginning to gain significant traction.

-

Broadcasting: Within the broadcasting industry, FOX Sports, BBC (British Broadcasting Corporation), BT Group, RTÈ (Raidió Teilifís Éireann), Media Broadcast, WDR (Westdeutscher Rundfunk Köln), RTVE (Radiotelevisión Española), SVT (Sveriges Television), NRK (Norwegian Broadcasting Corporation), TV 2, TVBS, CMG (China Media Group) and several other media and broadcast players are utilizing private 5G networks – both temporary and fixed installations – to support live production and other use cases.

-

Construction: Mortenson, Ferrovial, BAM Nuttall (Royal BAM Group), Fira (Finland), Kumagai Gumi, Obayashi Corporation, Shimizu Corporation, Taisei Corporation, Takenaka Corporation, CSCEC (China State Construction Engineering Corporation), Hoban Construction, Hip Hing Engineering, Gammon Construction and Hyundai E&C (Engineering & Construction) are notable examples of companies that have employed the use of private LTE and 5G networks to enhance productivity and worker safety at construction sites.

-

Education: Higher education institutes are at the forefront of hosting on-premise 5G networks in campus environments. Tokyo Metropolitan University, McMaster University, Texas A&M University, Purdue University, Cal Poly (California Polytechnic State University), Northeastern University, UWM (University of Wisconsin-Milwaukee), RWTH Aachen University, TU Kaiserslautern (Technical University of Kaiserslautern) and CTU (Czech Technical University in Prague) are among the many universities that have deployed private 5G networks for experimental research or smart campus-related applications. Another prevalent theme in the education sector is the growing number of purpose-built LTE networks aimed at eliminating the digital divide for remote learning – particularly CBRS networks for school districts in the United States.

-

Forestry: There is considerable interest in private cellular networks to fulfill the communications needs of the forestry industry for both industrial and environmental purposes. For example, Swedish forestry company SCA (Svenska Cellulosa Aktiebolaget) is deploying local 5G networks to facilitate digitization and automation at its timber terminals and paper mills, while Tolko Industries and Resolute Forest Products are utilizing portable LTE systems to support their remote forestry operations in remote locations in Quebec and British Columbia, Canada, where cellular coverage has previously been scarce or non-existent.

-

Healthcare: Dedicated 5G campus networks have been installed or are being implemented to support smart healthcare applications in many hospitals, including Nagasaki University Hospital, West China Second University Hospital (Sichuan University), SMC (Samsung Medical Center), Ewha Womans University Mokdong Hospital, Bethlem Royal Hospital, Frankfurt University Hospital, Helios Park Hospital Leipzig, UKD (University Hospital of Düsseldorf), UKSH (University Hospital Schleswig-Holstein), UKB (University Hospital Bonn), Cleveland Clinic’s Mentor Hospital and Hospital das Clínicas (São Paulo). In addition, on-premise LTE networks are also operational at many hospitals and medical complexes across the globe.

-

Manufacturing: AGC, Airbus, Arçelik, ASN (Alcatel Submarine Networks), Atlas Copco, BASF, BMW, BorgWarner, British Sugar, Calpak, China Baowu Steel Group, COMAC (Commercial Aircraft Corporation of China), Del Conca, Delta Electronics, Dow, Ford, Foxconn, GM (General Motors), Gerdau, Glanbia, Haier, Holmen Iggesund, Inventec, John Deere, Logan Aluminum, Magna Steyr, Mercedes-Benz, Midea, Miele, Navantia, Renault, Ricoh, Saab, SANY Heavy Industry, Schneider Electric, SIBUR, Whirlpool, X Shore and Yara International and dozens of additional manufacturers – including LTE/5G equipment suppliers themselves – have already integrated private cellular connectivity into their production operations at their factories. Many others – including ArcelorMittal, Bayer, Bosch, Hyundai, KAI (Korea Aerospace Industries), Nestlé, Nissan, SEAT, Siemens, Stellantis, Toyota, Volkswagen and WEG – are treading cautiously in their planned transition from initial pilot installations to live 5G networks for Industry 4.0 applications.

-

Military: Led by the U.S. DOD’s (Department of Defense) “5G-to-Next G” initiative, several programs are underway to accelerate the adoption of private 5G networks at military bases and training facilities, defense-specific network slices and portable cellular systems for tactical communications. The U.S. military, Canadian Army, Bundeswehr (German Armed Forces), Italian Army, Norwegian Armed Forces, Finnish Defense Forces, Latvian Ministry of Defense, Qatar Armed Forces, ADF (Australian Defence Force), ROK (Republic of Korea) Armed Forces and Brazilian Army are among the many adopters of private cellular networks in the military sector.

-

Mining: Mining companies are increasingly deploying 3GPP-based private wireless networks at their surface and underground mining operations to support mine-wide communications between workers, real-time video monitoring, teleoperation of mining equipment, fleet management, self-driving trucks and other applications. Some noteworthy examples include Agnico Eagle, Albemarle, Anglo American, AngloGold Ashanti, Antofagasta Minerals, BHP, Boliden, Codelco, China Shenhua Energy, China National Coal, Eldorado Gold, Exxaro, Fortescue Metals, Freeport-McMoRan, Glencore, Gold Fields, Jiangxi Copper, Metalloinvest, Newcrest Mining, Newmont, Northern Star Resources, Nornickel (Norilsk Nickel), Nutrien, Polyus, Polymetal International, Rio Tinto, Roy Hill, Severstal, Shaanxi Coal, South32, Southern Copper (Grupo México), Teck Resources, Vale, Yankuang Energy and Zijin Mining.

-

Oil & Gas: Arrow Energy, BP, Centrica, Chevron, CNOOC (China National Offshore Oil Corporation), ConocoPhillips, Equinor, ExxonMobil, Gazprom Neft, Neste, PCK Raffinerie, Petrobras, PetroChina/CNPC (China National Petroleum Corporation), Phillips 66, PKN ORLEN, Repsol, Santos, Schlumberger, Shell, Sinopec (China Petroleum & Chemical Corporation), TotalEnergies and many others in the oil and gas industry are utilizing private cellular networks. Some companies are pursuing a multi-faceted approach to address their diverse connectivity requirements. For instance, Aramco (Saudi Arabian Oil Company) is adopting a 450 MHz LTE network for critical communications, LEO satellite-based NB-IoT coverage to enable connectivity for remote IoT assets, and private 5G networks for advanced Industry 4.0-related applications.

-

Ports & Maritime Transport: Many port and terminal operators are investing in private LTE and 5G networks to provide high-speed and low-latency wireless connectivity for applications such as AGVs (Automated Guided Vehicles), remote-controlled cranes, smart cargo handling and predictive maintenance. Prominent examples include but are not limited to APM Terminals (Maersk), CMPort (China Merchants Port Holdings), COSCO Shipping Ports, Hutchison Ports, PSA International, SSA Marine (Carrix) and Steveco. In the maritime transport segment, onboard private cellular networks – supported by satellite backhaul links – are widely being utilized to provide voice, data, messaging and IoT connectivity services for both passenger and cargo vessels while at sea.

-

Public Safety: A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN (Multi-Operator Core Network)-based public safety LTE networks are operational or in the process of being rolled out throughout the globe, ranging from national mission-critical broadband platforms such as FirstNet, South Korea’s Safe-Net, France’s RRF (Radio Network of the Future), Spain’s SIRDEE and Finland’s VIRVE 2.0 to the Royal Thai Police’s 800 MHz LTE network and Halton-Peel region PSBN (Public Safety Broadband Network) in Canada’s Ontario province. 5G NR-equipped PPDR (Public Protection & Disaster Relief) broadband systems are also starting to be adopted by first responder agencies. For example, Taiwan’s Hsinchu City Fire Department is using an emergency response vehicle – which features a satellite-backhauled private 5G network based on Open RAN standards – to establish high-bandwidth, low-latency emergency communications in disaster zones.

-

Railways: Although the GSM-R to FRMCS (Future Railway Mobile Communication System) transition is not expected until the late 2020s, a number of LTE and 5G-based networks for railway communications are being deployed, including Adif AV’s private 5G network for logistics terminals, SGP’s (Société du Grand Paris) private LTE network for the Grand Paris Express metro system, PTA’s (Public Transport Authority of Western Australia) radio systems replacement project, NCRTC’s (National Capital Regional Transport Corporation) private LTE network for the Delhi-Meerut RRTS (Regional Rapid Transit System) corridor, KRNA’s (Korea Rail Network Authority) LTE-R network and China State Railway Group’s 5G-R program. DB (Deutsche Bahn), SNCF (French National Railways), Network Rail and others are also progressing their 5G-based rail connectivity projects prior to operational deployment.

-

Utilities: Private cellular networks in the utilities industry range from wide area 3GPP networks – operating in 410 MHz, 450 MHz, 900 MHz and other sub-1 GHz spectrum bands – for smart grid communications to purpose-built LTE and 5G networks aimed at providing localized wireless connectivity in critical infrastructure facilities such as power plants, substations and offshore wind farms. Some examples of end user adopters include Ameren, CNNC (China National Nuclear Corporation), CPFL Energia, CSG (China Southern Power Grid), E.ON, Edesur Dominicana, EDF, Enel, ESB Networks, Bahrain EWA (Electricity and Water Authority), Evergy, Fortum, Hokkaido Electric Power, Iberdrola, Kansai Electric Power, KEPCO (Korea Electric Power Corporation), LCRA (Lower Colorado River Authority), Osaka Gas, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), SGCC (State Grid Corporation of China), Southern Company, Tampa Electric (Emera) and Xcel Energy.

-

Other Sectors: Private LTE and 5G networks have also been deployed in other vertical sectors, extending from sports, arts and culture to retail, hospitality and public services. From a horizontal perspective, enterprise RAN systems for indoor coverage enhancement are relatively common and end-to-end private networks are also starting to be implemented in office buildings and campuses. BlackRock, Imagin’Office (Icade), Mitsui Fudosan, NAVER, Rudin Management Company and WISTA Management are among the companies that have deployed on-premise private 5G networks in office environments.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Wipro and Cisco Launch Managed Private 5G Network-as-a-Service Solution

Wipro has announced a managed private 5G-as-a-Service solution in partnership with Cisco. The new offering enables enterprise customers to achieve better business outcomes through the seamless integration of private 5G with their existing LAN/WAN/Cloud infrastructure.

Managed private 5G from Cisco and Wipro supports organizations looking to enjoy the advantages of a private 5G network without having to acquire, run, and maintain one. The as-a-service solution benefits enterprise customers by minimizing the risks associated with upfront capital expenditure (Capex) investments and expedites technology adoption as Wipro and Cisco take on the technical, operational, and commercial risks of implementing the solution.

“Private 5G is already enabling connectivity for a wide range of use cases in factories, supply chains, university and enterprise campuses, entertainment venues, hospitals, and more,” said Masum Mir, Senior Vice President and General Manager, Provider Mobility, Cisco Networking. “We’ve created a simplified and intuitive private 5G solution with Wipro, leveraging the advantages of 5G, IoT, Edge and Wi-Fi6 technologies to improve customer outcomes.”

The managed private 5G solution is built on Cisco’s 4G/5G mobile core technology and Internet of Things (IoT) portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. The solution is seamlessly built, run, and managed by Wipro for customers. To support the partnership, Wipro has created a dedicated private 5G lab to build, test, and demonstrate industry use-cases.

“Wipro and Cisco have a long history of building secure networks for enterprises and industries,” said Jo Debecker, Global Head of Wipro FullStride Cloud. “We are both dedicated to the partnership and delivering a secure, cloud-managed private 5G service to our customers. Because it is an as-a-service solution, it provides maximum benefits while minimizing the human resources and costs associated with owning a private network.”

Lourdes Charles, Vice President, 5G / Connectivity Services, Wipro Limited said, “Private 5G integration will put organizations on the cusp of a new revolution. We are delighted to expand our long-standing strategic relationship between Cisco and Wipro to include managed private 5G solutions for enterprise customers. To simplify the customer experience, the solution will validate mission-critical use cases, operations Service-Level Agreements, and lifecycle management. Wipro is fully committed through our 5G Def-i platform, to assist customers with their private 5G networks through best-in-class technology, pricing, and performance.”

“Wipro believes Cisco is very well positioned with extensive products and services to provide the complete stack for enterprise-converged network and security solutions,” the firm noted in an email to SDxCentral. “Cisco also brings integration with enterprise infrastructure and applications.”

IoT Analytics recently ranked Cisco as one of the market’s top software providers, touting its Cisco Edge Intelligence and IoT security offerings. The analyst firm also noted that spending on IoT software hit $53 billion in 2022, with the installed base of connected IoT devices surging to 14.4 billion units. The firm expects that device number to surge to 30 billion units by 2027.

Wipro says that 5G cellular network for enterprise running on both licenses and shared spectrum lays the foundation for:

ABI Research this week reported that more than 1,000 enterprise private networks have been deployed worldwide, despite a slowdown in public proclamations.

“This is actually a good sign for the private networks market,” Leo Gergs, senior analyst for 5G Markets at ABI Research, wrote. “Enterprises are beginning to see the deployment of private cellular connectivity as a competitive advantage and, therefore, do not want to talk about it too openly. Which is important as the market moves from the experimental phase toward commercializing private network deployments.”

Gergs added that this growth has now placed more pressure on the telecommunications industry to ensure those networks can handle increasingly complex and revenue-generating use cases. “The telco industry urgently needs to deliver on promises made to the enterprise community now. Otherwise, enterprise 5G will enter the history books as the technology that always overpromised and under-delivered.”

United Kingdom-based managed service provider Logicalis recently deployed Cisco’s private network with Logicalis overseeing the on-site engineering, including site preparation, ordering of solution components, organization of the spectrum, SIM management, staging, creation of customer profiles and core and RAN installation.

Chris Calvert, VP of private wireless services for Logicalis US, explained that Cisco is providing its Private 5G platform, which includes the 4G/5G core network that Logicalis’s 4G LTE and 5G service requires. That core is available as a single standalone (SA) core or a high-availability three-server cluster.

“Cisco really wanted this to be a managed services-only solution,” Calvert said. “Basically, Logicalis is Cisco’s customer. The combination of the industry expertise and the fact that we have a large managed-services practice were really the driving forces behind Cisco selecting Logicalis as one of only two manufacturers that can actually provide this solution currently.”

About Wipro Limited:

Wipro Limited is a leading technology services and consulting company focused on building innovative solutions that address clients’ most complex digital transformation needs. Leveraging our holistic portfolio of capabilities in consulting, design, engineering, and operations, we help clients realize their boldest ambitions and build future-ready, sustainable businesses. With over 250,000 employees and business partners across 66 countries, we deliver on the promise of helping our customers, colleagues, and communities thrive in an ever-changing world. For additional information, visit us at www.wipro.com.

About Cisco:

Cisco offers an industry-leading portfolio of technology innovations. With networking, security, collaboration, cloud management, and more, we help to securely connect industries and communities. Information about Cisco’s products is here.

References:

Cisco’s Private 5G story: https://www.youtube.com/watch?v=kdsyhsXicNk

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

Indian network operator Reliance Jio is said to be in negotiations with Tesla for the deployment of a private 5G network for the latter’s manufacturing plant in India, according to India press reports. The reports noted that the electric vehicle manufacturer is seeking to get the permit to set up its first manufacturing location in India. As part of these discussions, Reliance Jio Infocomm has allegedly offered Tesla to set up a 5G private network for its future manufacturing facility in the Asian nation. The network is expected to support connected car solutions and automated production processes.

A report by Financial Express suggests that the Mukesh Ambani-headed telco is in early talks with Tesla for the setup of the private network, and further progress will only happen if Tesla finalizes its plans to set up a manufacturing plant in the country. “The talks between Jio and Tesla are at a preliminary stage, and any further developments are expected only when the latter firms up its plans for setting up a manufacturing unit in India,” an unnamed industry source revealed to the publication.

The report suggests that Jio is also reaching out to firms across automobile, healthcare, manufacturing, and other industries with possible use cases of 5G, offering to build and manage their private networks. The captive private 5G network setup from the telco will help these firms achieve high data speed and data carrying capacity within their premises, which is not possible if they depend on public networks. Notably, the private 5G solutions will also help industries benefit from the next technological advancement – Industry 4.0 – a new technology wave that is said to revolutionize the way companies manufacture, improve, and distribute their products.

In December 2022, rival operator Bharti Airtel announced a partnership with Indian company Tech Mahindra to set up a private 5G network at Mahindra’s Chakan facility. With this collaboration, the Chakan facility became the first 5G-enabled manufacturing unit in India.

Reliance Jio Infocomm has already deployed its 5G service in 4,786 towns and cities across 36 states in India, according to the carrier’s website. Jio has already deployed over 50,000 base stations and 300,000 cells to support its 5G service, according to recent press reports.

Shyam Mardikar, Jio’s CTO recently said that the company expected to complete full urban coverage before the end of May. Jio started to deploy its 5G Standalone (SA) network in October 2022 and has recently stated that it is on track to cover all towns and cities by December 2023. The telco had initially launched the beta trial of its 5G services in Mumbai, Delhi, Kolkata and Varanasi.

Jio is offering the 5G connectivity on an invitational basis, with users living in 5G-enabled cities who have 5G compatible smartphones receiving invitations.

Last year, Reliance Jio Infocomm announced 5G contracts with network equipment vendors Ericsson and Nokia. The deal with Ericsson marks the first partnership between Jio and Ericsson for radio access network deployment in the country.

References:

Jio aims to deploy private network for Tesla’s future plant: Report

AT&T to provide free WiFi and private 5G at DFW airport; will invest $10 million worth of network upgrades

Dallas Fort Worth International Airport (DFW) entered into a partnership with AT&T, to provide the airport with a comprehensive wireless platform (CWP) that will enhance connectivity and critical infrastructure. As part of the proposed agreement, AT&T will invest $10 million worth of network upgrades in modernizing and expanding the network covering the DFW airport, to support airport operations and advance the free public Wi-Fi in the Airport’s terminals. This includes installing 200 new access points — and updating the 800 access points DFW already provides — to enable better coverage and faster speeds for customers. AT&T will also deploy a private 5G network for the Airport’s internal use to meet the rising demand for Internet of Things (IoT) uses cases and the digitization of airport operations.

“We know that being connected to the internet is an absolute must-have service for our customers. This proposed agreement signifies our commitment to ensure our customers will always remain connected at DFW Airport, so they can reliably stay online for work or entertainment while traveling,” said Mike Youngs, Vice President of Information Technology Services at DFW Airport.

The CWP will provide enhanced connectivity throughout the airport, including indoor and outdoor spaces, parking lots and runways. This faster connectivity means that travelers will have even faster access to airport services through the DFW Airport or airline app such as automated check-in, baggage tracking and lounge access.

The private cellular 5G network will offer more reliability and security, lower latency and greater capacity, providing operations teams with optimal connectivity that can be used for future use cases such as real-time data analytics and enhanced communication with critical airport systems. With these use cases, the airport’s management team will be better able to monitor and manage passenger traffic, security systems and baggage handling – improving efficiency and safety.

Image Credit: AT&T

“Modernizing airport technology needs to focus on both improving the efficiency and convenience for airlines and airport operations and the overall travel experience for passengers, while ensuring the safety and security of all those who pass through its gates,” said Jason Inskeep, Assistant Vice President, 5G Center of Excellence at AT&T. “We’re proud to work alongside DFW Airport and look forward to continuing our collaboration to bring the best connectivity solutions for all.”

DFW and AT&T will begin upgrading the network this summer, with the enhancements coming online by the fall. The project is contingent upon a final contract between AT&T and the DFW. Dallas Fort Worth International Airport is one of the most connected airports in the world and serves as a major job generator for the North Texas region by connecting people through business and leisure travel. With 168 gates in five terminals and an area spanning 18,000 acres, DFW Airport is the third-largest airport in the world by size.

In February 2021, AT&T and Boingo Wireless said in a press release that they were “working to deploy” AT&T 5G+ in 12 airports nationwide, including John F. Kennedy International Airport and LaGuardia Airport in New York City and Chicago O’Hare International Airport and Midway International Airport. Dallas Love Field Airport in also was among the airports announced.

References:

https://about.att.com/story/2021/5g_plus_boingo.html

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

AT&T realizes huge value from AI; will use full suite of NVIDIA AI offerings

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

A Tale of two Telcos: AT&T up (fiber & mid-band 5G); VZ down (net income falls; cost-cutting coming)

New DT campus network solution with industrial 5G spectrum

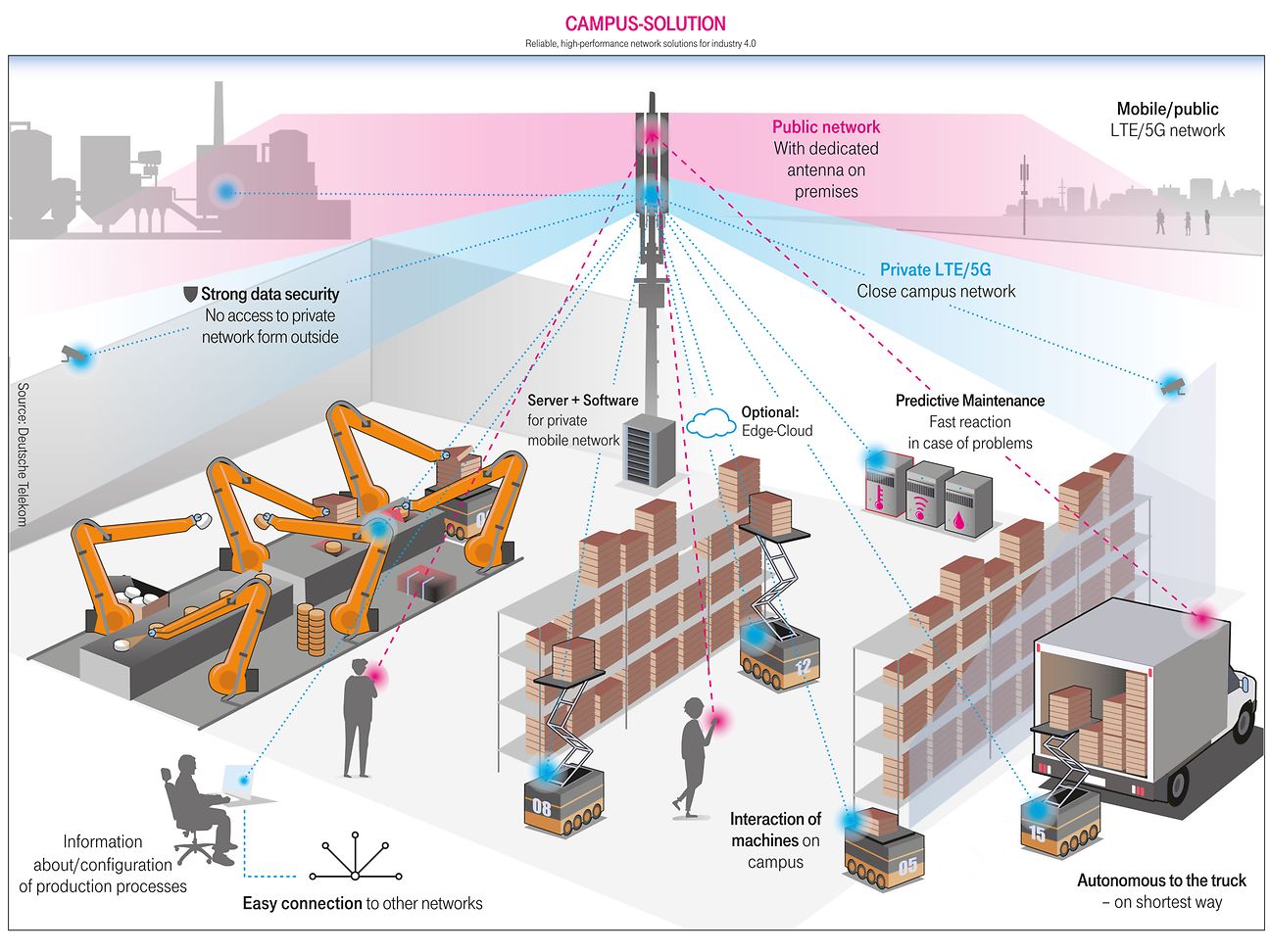

Deutsche Telekom (DT) announced a new campus network solution for business customers. The new service, named “Campus Network M with Industrial Frequencies,” will offer business customers all the benefits of a private 5G network — without the need for additional investments in their own 5G SA core network.

- New Deutsche Telekom business customer offer enables cost-effective use of own 5G industrial frequencies in the 3.7 to 3.8 GHz range

- Solution combines advantages of public and fully private mobile networks for industrial applications

- Successful pilot with German machine manufacturer Arburg. The commercial launch followed successful tests in the 5G Campus network of the injection molding machine manufacturer Arburg in January 2023.

- Based on a 5G campus infrastructure within Telekom’s public network, with the new product companies can additionally use their own 5G industrial frequencies in the 3.7 to 3.8 Gigahertz (GHz) range exclusively.