AT&T

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

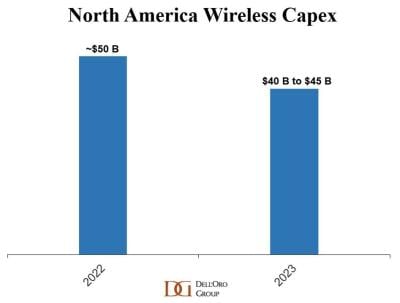

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

FCC Grants Experimental License to AST SpaceMobile for BlueWalker 3 Satellite using Spectrum from AT&T

The FCC will permit AST SpaceMobile to test transmissions from smartphones directly to its new satellite. Apparently, AST SpaceMobile’s testing in the U.S. will use spectrum licenses owned by AT&T.

AST SpaceMobile said it will conduct the testing “using 3GPP low-band cellular frequencies and Q/V-band frequencies,” though it did not provide details. However, the company’s FCC application, approved Monday, lists three spectrum licenses that are owned by AT&T.

Brian Goemmer, founder of spectrum-tracking company AllNet Insights & Analytics, said AST SpaceMobile will use AT&T’s 846.5-849MHz license in Midland, Texas; its 845-846.5MHz license in Honolulu; and its 788-798MHz license in Pine Springs, Texas. The last one is notable because it’s connected to FirstNet, a government agency working with AT&T to build a nationwide broadband network for public safety users.

Light Reading first reported of a connection between AST SpaceMobile and AT&T in 2020. However, the companies have remained relatively quiet about their work together. Officials from AST SpaceMobile and AT&T did not immediately respond to questions from Light Reading about the planned testing.

According to FierceWireless, AST SpaceMobile will also test its service in Japan with Rakuten Mobile. AST SpaceMobile has also announced deals with the likes of Vodafone, Smart Communications, Africell and UT Mobile.

AST SpaceMobile said it expects to begin testing its offering after it launches its new BlueWalker 3 sometime this summer. The company had hoped to launch the satellite sometime in March or April, but that effort was delayed.

Broadly, both Lynk and AST SpaceMobile promise to connect existing, unmodified cell phones to their low-Earth orbit (LEO) satellites by conducting transmissions in the licensed spectrum bands of their mobile network operator partners. Lynk has promised to launch commercial services by next year, while AST SpaceMobile has promised a 2023 commercial launch.

The authorization comes as the company prepares for the planned summer 2022 launch of BlueWalker 3, its test satellite with an aperture of 693 square feet that is designed to communicate directly with cell phones via 3GPP standard frequencies.

“We appreciate the diligent support of the FCC in providing the experimental license for our upcoming satellite launch,” said AST SpaceMobile Founder, Chairman and CEO Abel Avellan. “Together with other testing around the world, this license will enable us to conduct some of our most important testing here, at home, in the United States.”

AST SpaceMobile continues to pursue additional authorizations with the FCC related to its planned constellation of BlueBird satellites.

AST SpaceMobile’s mission is to eliminate the connectivity gaps faced by today’s five billion mobile subscribers moving in and out of coverage zones, and bring cellular broadband to approximately half of the world’s population who remain unconnected. Partners in this effort are leading global wireless infrastructure companies, including Rakuten Mobile, Vodafone and American Tower.

The company’s announcement this week caps a few busy months for AST SpaceMobile. Cogent Communications’ CFO, Sean Wallace, recently signed on as AST SpaceMobile’s new CFO. And the company signed a new Memorandum of Understanding (MoU) with Globe Telecom in the Philippines.

About AST SpaceMobile:

AST SpaceMobile is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on Facebook, Twitter, LinkedIn and YouTube. Watch this video for an overview of the SpaceMobile mission.

References:

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

Lightshed Partners says absolutely! “This is the year for 5G Wireless Home Broadband,” as it emerges as a viable competitor to cable based Internet access.

The market research firm believes that the recent deployment of large blocks of spectrum by wireless operators will enable them to offer viable home broadband service to a notable segment of the market.

T-Mobile is already adding more than 200k home broadband subs per quarter, and Verizon is about to unleash rate plans that drop as low as $25/month. Verizon is also layering additional commission opportunities for their sales group. The vast majority of cell phone upgrades in the U.S. are still done in a cellular operator’s store. That provides wireless network operators with a familiar opportunity to sell home broadband and they are incenting their salesforce to do so.

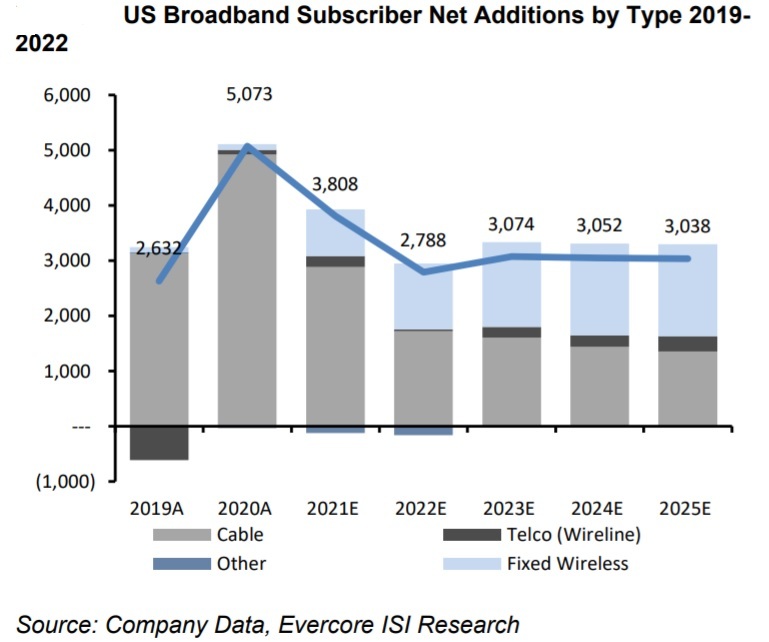

Fixed wireless access (FWA) services into homes and offices, have approximately 7 million users around the U.S. The new efforts by Verizon and T-Mobile appear poised to push the technology into the cable industry’s core domain.

“We forecast that Verizon and T-Mobile will add 1.8 million wireless home broadband customers in 2022, more than doubling the 750,000 added in 2021,” the LightShed analysts forecast. “To put that growth in context, Comcast, Charter and Altice combined added 2.4 million broadband subscribers in 2021 and 2.7 million in 2019. Investors expect these three cable companies to add more than 2 million broadband subs in 2022, but even that reduced level of growth from recent years may prove to be too aggressive.”

5G fixed wireless access (FWA) services could serve 8.4 million rural households—nearly half the rural homes in the U.S.—with a “future-proof”, rapidly deployable, and cost-effective high-speed broadband option, according to a new Accenture study commissioned by CTIA, the wireless industry association.

Other analysts agree. “Fixed wireless probably cost Comcast and Charter, in aggregate, about 180,000 subscribers in the second half of 2021,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

“The great risk seems to lie in late 2022 and 2023. As Verizon, T-Mobile and AT&T deploy initial and subsequent blocks of C-band spectrum and as T-Mobile expands its 2.5GHz coverage to the last 1/3rd of US households, the availability of fixed wireless should expand,” Bernstein analysts wrote.

The financial analysts at Evercore predict that FWA services will gain a growing share of U.S. broadband new subscribe additions. Light Reading’s Mike Dano wrote the reasons are as follows:

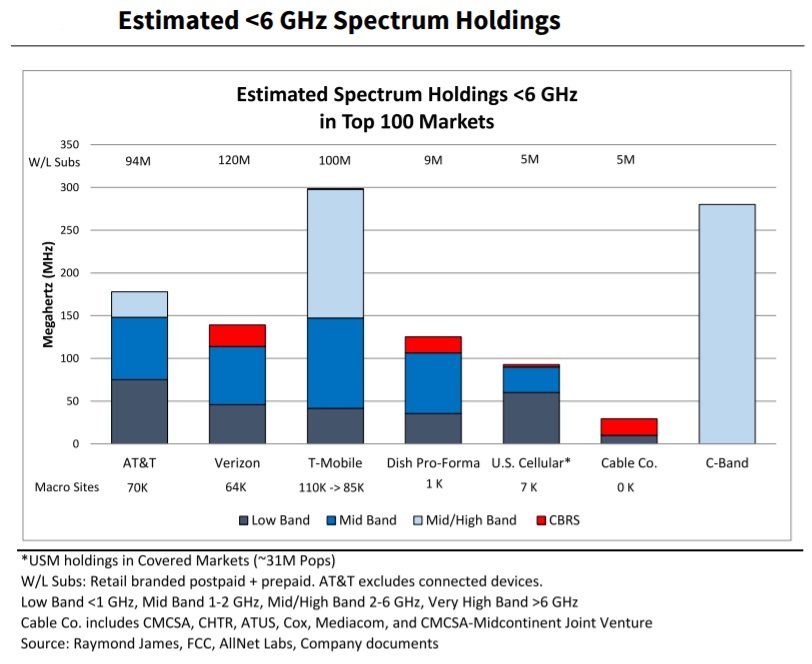

- Verizon and T-Mobile are in the midst of deploying significant amounts of new spectrum into their networks. The addition of C-band spectrum (for Verizon) and 2.5GHz spectrum (for T-Mobile) will give them far more network capacity. And that’s important considering the average Internet household chews through almost 500 GB per month, according to OpenVault. The average smartphone user, meanwhile, consumes just 12 GB per month, according to Ericsson.

- Verizon and T-Mobile have finally shifted their FWA offerings from the test phase into the deployment phase. Although Verizon has been discussing FWA services for years, it finally started reporting actual customer numbers late last year (it ended the third quarter of 2021 with a total of 150,000 customers). Similarly, T-Mobile first outlined its FWA strategy in 2018, but officially launched its 5G FWA service in April – the company ended 2021 with 646,000 in-home Internet customers, well above its goal of 500,000. And both companies have recently cut FWA prices.

- The cable industry appears to be in the early stages of what MoffettNathanson analyst firm described as the “great deceleration.” According to the principal analyst Craig Moffett, this cable industry slowdown stems from such factors as a decrease in the rate of new household formation, increased competition from fiber providers – and FWA. He described the situation as a “concerning issue for cable investors, particularly if it appears that this is just a taste of what lies ahead.”

However, Craig is not convinced that FWA from telcos will mount a serious threat to cablecos Internet, partly because of capacity challenges operators will face as they bring subscribers onto the platform. They also wonder if it makes sense for mobile operators to get too aggressive with FWA, considering the much higher value on a per-gigabit basis they get from their respective mobile bases.

MoffettNathanson does acknowledge that both Verizon and T-Mobile have ramped up their focus on FWA even as AT&T takes a more cautious, targeted approach. Last week at an investor conference, AT&T CEO John Stankey said:

I believe that having some fixed high bandwidth infrastructure is going to be essential to being an effective networking company moving forward… Is fixed wireless going to be the best way to get a lot of bandwidth out to less densely populated rural areas? Yes, it probably will be. So is there a segment of the market where fixed wireless will apply and be effective? Sure, it will, and we’ll be in a position to have the right product to address those places.

But I don’t want to just simply say, well, that is the single solution that’s going to deal with what I would call the 70% of the business community, the 70% of the consumer population that are going to be pretty intensive users in some location, indeed, to have fixed infrastructure to support that over the long haul, given all the innovation that’s going to come……I see an opportunity for us to be very targeted and very disciplined around what we do (in FWA) and what used to be I hate using the term but traditional out of region markets, where good fiber deployment that supplements the strength of our wireless network.

Moffett wrote in a note to clients today:

There’s been a sea change in the rhetoric about fixed wireless broadband. We’re admittedly still struggling to understand it.

Until recently, Verizon and T-Mobile had, by turns, swung between aggressiveness and reticence. Investors will recall that in 2018, Verizon made bold claims about millimeter wave-based FWA. T-Mobile was rather skeptical at the time, not just about mmWave but even about FWA-over-mid-band. By 2019, Verizon had pulled in their horns, just as T-Mobile was first committing to bring FWA to rural Americans in a bid to sell their Sprint merger to regulators. At the start of last year, when all three of Verizon, AT&T, and T-Mobile held analyst days, T-Mobile upped the ante, forecasting 7-8M FWA customers by 2025. But Verizon was by then more cautious, committing only to a paltry $1B in revenue by 2024 (equating to perhaps 1.7M customers) and warning that their participation would be back end loaded. And AT&T was more cautious still, arguing that the capacity utilization implications made FWA unattractive.

Now, for the first time, Verizon and T-Mobile are pounding the table at the same time. What has changed? And what does it mean for the many plans for fiber overbuilds?

First, it’s important to consider the network capacity implications of fixed wireless. Most investors understand that the burden of serving homes with a wired broadband replacement is far greater than that of serving individual phones for mobility. But investors will also understand that network utilization isn’t uniform across all cell sites; there are cell sites with more excess capacity and there are cell sites with less.

The challenge for operators is to ensure that their FWA subscriptions fit as neatly as possible into the cell sites, or sectors of cell sites, with the most available capacity (a cell site will typically be divided into three sectors, each covering a 120 degree arc).

No operator wants to risk their high-value mobile service experience for the benefit of a few incremental low-value fixed subscriptions (as we’ll see shortly, the revenue per bit from a mobile customer is 30 to 50x higher than that for fixed).

Still, both T-Mobile and Verizon see FWA as promising. T-Mobile expects to have between 7 million to 8 million FWA subs by 2025, and views an addressable market of about 30 million homes that are suitable from a signal quality and capacity standpoint. T-Mobile has already noted that their 664K FWA customers include a mix of customers from relatively rural areas with limited or no wired broadband availability and those from suburbia who were previously cable subscribers.

Verizon, meanwhile, is committing to about $1 billion in FWA revenues by 2024, which MoffettNathanson equates to roughly 1.7 million customers (Verizon ended Q3 2021 with about 150,000 FWA subscribers).

Craig questions whether there’s enough bandwidth to go around to fulfill subscriber targets, and if getting aggressive with FWA makes business sense. He indicates that 5G telcos are getting desperate to find revenues after spending billions of dollars for licensed spectrum and 5G RAN buildouts.

With tens of billions of dollars of investment in spectrum already sunk, and with tens of billions more to come for network densification, one might imagine that carriers are desperate to find a more tangible revenue opportunity than one that depends on beating Amazon AWS at what is essentially just a next iteration of cloud services.

And when all is said and done, Craig is as puzzled as this author:

As we said at the outset… we’re struggling to understand. We’re struggling to understand why Verizon and T-Mobile suddenly see this (FWA) relatively low value use of network resources as attractive. We’re struggling to understand how, after an initial burst of growth, they will sustain that growth as sectors “fill up.” We’re struggling to understand why they have set such ambitious targets so publicly. And we’re struggling to understand why cable investors have come to expect that deployments of FWA and fiber should be treated as independent, or additive, risks. It doesn’t seem, to us, that it all adds up.

Opinion: We think an undisclosed reason for telco interest in FWA is that 5G mobile offers few, if any advantages over 4G and there is no roaming. Therefore, the 5G enhanced mobile broadband use case will continue to fail to gain market traction. 5G FWA can work well with a proprietary telco/cloud native 5G SA core network which could be shared by both 5G mobile and FWA subscribers (perhaps using the over hyped “network slicing”). So even though FWA was NOT an ITU IMT 2020 use case, it still has a lot of room to grow into a revenue generating service for wireless telcos.

References:

MoffettNathanson research note (only available to the firm’s clients)

Complete and Comprehensive Highlights of AT&T CEO’s Remarks at Citi Conference

AT&T and OneWeb: Satellite Access for Business in Remote U.S. Areas

AT&T Communications has signed a strategic agreement with OneWeb, the low Earth orbit (LEO) satellite communications company, to harness the capabilities of satellite technology to improve access for AT&T business customers into remote and challenging geographic locations. The new connectivity will complement existing AT&T access technologies.

Why is this important? AT&T’s leading business fiber network enables high-speed connections to over 2.5 million U.S. business customer locations. Nationwide, more than 9 million business customer locations are within 1,000 feet of AT&T fiber. However, there are still remote areas that existing networks can’t reach with the high-speed, low-latency broadband essential to business operations.

Who can use this: AT&T will use this technology to enhance connectivity when connecting to its enterprise, small and medium-sized business and government customers as well as hard-to-reach cell towers.

Where will it work: AT&T says that more than 9 million business customer locations are within 1,000 feet of its fiber network, but that there are remote areas that remain out of reach. By riding OneWeb’s LEO-based broadband satellite constellation, AT&T believes it will be able to deliver high-speed, low-latency services to small, medium and enterprise-sized business customers in those locations.

The AT&T service will be supported by OneWeb’s network of satellites. OneWeb has launched 288 satellites and expects to attain global coverage with a total fleet of 648 satellites by the end of 2022. AT&T business and government customers in Alaska and northern U.S. states will be covered later this year.

Image source: Roscosmos, Space-Center-Vostochny and TsENKi

……………………………………………………………………………………………………………………………………….

What are people saying:

“Working with OneWeb, we’ll be able to enhance high-speed connectivity in places that we don’t serve today and meet our customers wherever they are,” said Scott Mair, President, Network Engineering and Operations, AT&T. “We’re expanding our network with one more option to help ensure that our business customers have the high-speed, low-latency connectivity they need to thrive as the nation recovers from COVID-19.”

“OneWeb’s enterprise-grade network has a unique capability to serve hard-to-reach businesses and communities. Our work with AT&T will focus on how satellite technology can support improved capacity and coverage in remote, rural and challenging geographic locations,” said Neil Masterson, OneWeb Chief Executive Officer. “Today’s agreement with AT&T demonstrates OneWeb’s execution momentum and the confidence customers such as AT&T have in its services and offering.”

About OneWeb:

OneWeb is a global communications network powered from space, headquartered in London, enabling connectivity for governments, businesses, and communities. It is implementing a constellation of Low Earth Orbit satellites with a network of global gateway stations and a range of user terminals to provide an affordable, fast, high-bandwidth and low-latency communications service, connected to the IoT future and a pathway to 5G for everyone, everywhere. Find out more at http://www.oneweb.world

Light Reading – Satellite Internet Competition:

OneWeb’s win with AT&T also surfaces amid growing competition in the satellite broadband sector.

Enterprise and business customers are among the targets for Viasat, which is in the process of providing global coverage with a growing fleet of high-power geosynchronous (GEO) satellites. SES also focuses on the business and government services market, and intends to hit those markets harder as it moves ahead with O3b mPower, a new global connectivity platform that will ultimately comprise a constellation of 11 medium Earth-orbit (MEO) satellites. Starlink, SpaceX’s LEO-based satellite broadband service, has largely focused on the home broadband market, but has hinted at ambitions to serve connectivity to planes, trucks and other moving vehicles.

OneWeb recently landed a $300 million investment from South Korean conglomerate Hanwha Systems, which secured an 8.8% stake in OneWeb and a board seat. Other investors include India’s Bharti Airtel (35% stake), the UK government (almost 20%), and Japan’s SoftBank Group, France’s Eutelsat and Hughes Network Systems.

Earlier this month, OneWeb inked a $1 billion-plus insurance agreement through broker/risk advisor Marsh as it prepares for its next phase of deployments.

…………………………………………………………………………………………………………………………………………

About AT&T Communications:

AT&T helps family, friends and neighbors connect in meaningful ways every day. From the first phone call 140+ years ago to mobile video streaming, we @ATT innovate to improve lives. AT&T Communications is part of AT&T Inc. (NYSE:T). For more information, please visit us at att.com

References:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

AT&T will run its 5G SA Core network on Microsoft’s Azure public cloud computing platform. Microsoft AZURE, which is the second largest cloud computing provider by revenue behind rival Amazon Web Services, has been building out specific cloud computing offering to attract carriers. AT&T is Microsoft’s first major deal in the 5G SA Core network space.

The two giant companies said that Microsoft will purchase software and intellectual property developed by AT&T to help build out its offerings for carriers. The companies did not disclose the terms of the deals, but said that Microsoft will make job offers to several hundred AT&T Network Cloud engineers.

Microsoft will use AT&T’s software and IP to grow its telecom flagship offering, Azure for Operators. Microsoft is acquiring AT&T’s carrier-grade Network Cloud platform technology, which AT&T’s 5G core network (when completed) will run on.

The companies disclosed a few key details about their new deal, but did not provide any firm numbers or any financial arrangements/guidance:

- Microsoft will “assume responsibility for both software development and deployment of AT&T’s Network Cloud immediately,” according to the companies, and will transition AT&T’s existing network cloud operations into Azure over the next three years. Eventually, all of AT&T’s mobile network traffic will run over Microsoft’s Azure.

- The effort will start with AT&T’s 5G core, but will eventually include virtually all of the company’s network operations, including its 4G core.

- Microsoft will be the company to certify all of AT&T’s software-powered network operations for inclusion in the AT&T network. That will include software from other vendors. AT&T has not yet named its 5G core network vendors.

- Microsoft will acquire AT&T’s Network Cloud technology – including its AT&T engineering and lifecycle management software – and its cloud-network operations team. The companies did not disclose exactly how many AT&T employees that transaction might cover, but an AT&T official suggested it will be in the “low hundreds.” Microsoft will then incorporate AT&T’s intellectual property into its Azure for Operators offering, which is for sale to other 5G network operators.

- Microsoft and AT&T did not provide the logistics of their deal, including exactly how many Azure computing locations might be necessary to power AT&T’s network. It’s an important issue considering AT&T’s cellular network spans an estimated 70,000 cell towers across the country, and the operation of the radios on top of those towers might eventually be handled by programs running inside of Microsoft’s cloud. A top Microsoft executive involved in the deal told Light Reading that Microsoft’s Azure software will be installed into some of AT&T’s existing computing locations. Several of those compute server locations are staffed by AT&T technicians.

- AT&T said the company plans to continue to run its network workloads inside of its own data centers and facilities. However, AT&T added that the deal today is focused on AT&T’s 5G core network and that the companies might explore additional elements of the network such as Open Radio Access Network (O-RAN) technology over the course of the agreement.

…………………………………………………………………………………………………………………………………………………

Sidebar: 5G SA Core networks to run on cloud service provider platforms:

- In late April, Dish Network made a similar deal to have Amazon run its 5G core network on AWS.

- In late May, Telefónica said it had validated AWS Outposts as option for 5G SA core deployment in Brazil.

- Earlier this week, TIM said it was building its 5G SA Core network on “Google’s cloud solutions” (whatever that means?)

Do you think the cloud service providers will essentially take over the implementation, operations, and maintenance of 5G SA Core networks, especially since they will likely all be “cloud native.” Please post a comment in the box below this article to express your opinion and why. Thanks!

………………………………………………………………………………………………………………………………………………………………………

“This deal is not exclusive, so I fully expect Azure will try to assert itself as the telecom cloud provider for many carriers around the world,” said Roger Entner of Recon Analytics LLC.

“It’s the first time a Tier One operator has trusted their existing consumer subscriber base to hyper-scaler technology,” Microsoft’s Shawn Hakl, VP of the company’s 5G strategy, told Light Reading. Before joining Microsoft in 2020, Hakl was a longtime Verizon executive.

The deal follows a $2 billion agreement in 2019 in which AT&T said it would start using Microsoft’s cloud for software development and other tasks. At that time, AT&T said it would continue to run its core networking functions in its own private data centers.

Andre Fuetsch, AT&T’s chief technology officer, said that shifting to a public cloud vendor will let AT&T take advantage of a larger ecosystem of software developers who are working on technologies such as wringing more use out of pricey 5G spectrum or creating new features for users. “That’s what we at AT&T want to do, and we think working with Microsoft gives us that advantage,” Fuetsch told Reuters in an interview.

“AT&T has one of the world’s most powerful global backbone networks serving hundreds of millions of subscribers. Our Network Cloud team has proved that running a network in the cloud drives speed, security, cost improvements and innovation. Microsoft’s decision to acquire these assets is a testament to AT&T’s leadership in network virtualization, culture of innovation, and realization of a telco-grade cloud stack,” said Andre Fuetsch, executive vice president and chief technology officer, AT&T. “The next step is making this capability accessible to operators around the world and ensuring it has the resources behind it to continue to evolve and improve. And do it securely. Microsoft’s cloud expertise and global reach make them the perfect fit for this next phase.”

Microsoft intends to use the newly acquired technology – plus the experience gained helping AT&T run the network – to build out a product it calls Azure for Operators, which it will use to pursue 5G core network business from telecommunications companies in the 60 regions of the world where it operates.

https://azure.microsoft.com/en-us/industries/telecommunications/

https://about.att.com/story/2021/att_microsoft_azure.html

https://www.reuters.com/business/media-telecom/att-run-core-5g-network-microsofts-cloud-2021-06-30/

https://www.lightreading.com/the-core/atandt-to-offload-5g-into-microsofts-cloud/d/d-id/770600?

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

The FCC’s latest auction has raised more than $69.8 billion after three weeks of bidding, a record sum that could alter cellphone carriers’ prospects for 5G and the next decade. The C-band auction, offering 280-megahertz of spectrum, started on December 8th. Just within two weeks, it’s by far the biggest U.S. spectrum auction ever. The auction will now pause for the Christmas holidays until Jan. 4th , when total bids could move even higher.

The radio frequencies being offered range between 3.7 GHz and 4 GHz, a middle-of-the-road range considered well-suited for 5G service. New 5G smartphones can already connect to those frequencies in other countries that have licensed equivalent mid-band spectrum. The U.S. is also selling big chunks of spectrum all at once, enhancing its value.

The high offers benefit the U.S. Treasury, which will collect a windfall after the winners pay for their licenses. The victors will also need to spend at least $13 billion more to help modify equipment for a group of satellite companies that already use the frequencies. The satellite operators agreed to an FCC plan that shifts their TV transmissions to a narrower portion of the radio spectrum.

The current auction proceeds have already topped the $44.9 billion in provisional bids in a 2015 FCC sale of mid-band spectrum licenses, which U.S. cellphone carriers used at the time to enhance their 4G LTE service. Those telcos are now investing billions of dollars in 5G coverage. Some higher-end estimates for the auction had ranged from $35.2 to $51 billion.

After 45 rounds, the average nationwide price per MHz PoP price for licenses was of $0.81. That rises to $0.96 across categories when factoring in accelerated clearing payments and relocation costs to move satellite operators out of the band band, estimated at $9.7 billion and $3.3 billion respectively.

Editors Notes: The B block consists of 100 megahertz (five 20-megahertz sub-blocks) from 3.8-3.9 GHz) and the C block makes up the final 80 megahertz with four 20-megahertz sub-blocks; there are 406 available Partial Economic Areas (PEAs) across the United States. 406 available Partial Economic Areas across the United States.

…………………………………………………………………………………………………………………………….

Analysts had estimated C-band licenses would be between $0.20-$0.50 per MHz PoP (Point of Presence). The nationwide price for A block licenses per MHz Pop was $1.21 as of Wednesday, while BC prices were $1.11 per MHz PoP according to tracking by BitPath COO Sasha Javid.

Demand for most of the category A blocks (which includes the first 100-megahertz tranche of spectrum in 46 of the top 50 markets that has a clearing schedule of December 2021) has evened out. In the top 20 PEAs at the end of round 43 there were still 12 markets that had competition, mostly for BC blocks, but also a few category A, including PEAs of Miami, Phoenix, and Minneapolis-St.Paul.

PHOTO: ADREES LATIF/REUTERS

……………………………………………………………………………………………………………………………………………………

The recent bids have blown past Wall Street’s highest forecasts, suggesting that several companies are fighting over the most valuable wireless rights.

There are 57 participants in the clock phase of this auction, but each bid is cloaked in secrecy until the auction process ends. Industry analysts expect mega telcos like AT&T and Verizon Communications to obtain a large share of the licenses to match the trove of 2.5 GHz assets that rival T-Mobile US acquired from Sprint.

Wall Street analyst firms like Wells Fargo, believe Verizon will spend the most, previously estimating around $22 billion in gross proceeds to acquire 120 MHz of mid-band spectrum. AT&T could spend anywhere from $4.3 billion to $20 billion for the C-band.

All three major U.S. wireless carriers have rolled out nationwide 5G either using low-band spectrum or dynamic spectrum sharing (DSS) technology, but performance hasn’t proved better than 4G LTE. Verizon has deployed 5G with high-band millimeter wave in parts of 60 cities, and AT&T has a few mmWave markets, but mid-band is seen as the sweet spot in delivering both capacity and coverage.

Meanwhile, T-Mobile says its 2.5 GHz can deliver 300 Mbps and peak speeds up to 1 Gbps.

……………………………………………………………………………………………………………………………………………………………………………………………………..

“Mid-band spectrum will be where 5G lives,” said Walt Piecyk, a telecom analyst for research firm LightShed Partners. He added that T-Mobile’s merger with Sprint “clearly put pressure on Verizon and AT&T” to match their rival’s war chest. “When the numbers get this big, you have to assume that everybody’s getting more aggressive,” Mr. Piecyk said.

“Gross proceeds have been driven by surprisingly robust and persistent demand,” wrote Javid in an analysis Tuesday morning. “In Round 36, I suspect that a large bidder pulled back significantly in the largest markets given that all the top 10 markets experienced a drop in demand.”

Mobile service providers are also bidding against investment firms and new market entrants. Satellite provider Dish Network Corp. won many of the licenses sold in the 2015 auction. The company this month raised more cash through a $2 billion convertible-note offering to help fund more network investments. Dish is building its own 5G network after buying spectrum assets and about 8 million customers from Sprint.

Cable internet providers (MSOs) could also influence the auction’s outcome after years of experimentation with wireless services. Comcast Corp. and Charter Communications Inc. teamed up to bid in the current auction after they spent nearly $1 billion on a smaller license sale earlier this year.

…………………………………………………………………………………………………………………………………

Cellphone carriers can afford to commit to big payments given their low borrowing costs and relatively stable service revenue (AT&T is an exception due to its high debt), said Raymond James analyst Frank Louthan. “Investors see these companies as some of the most secure around,” Mr. Louthan said. “I don’t think a slight change in a debt ratio would make much of a difference. Time to market matters. We generally see prices get high when you can deploy spectrum quickly.”

The FCC won’t reveal the auction’s winners for several days after the auction ends, meaning the broader telecom industry could remain in suspense until February. Federal rules against coordinated bidding also limit what the auction participants can say about the process, restricting their ability to raise capital or discuss major deals involving spectrum.

The auction is a first step in a multiyear process. Wireless customers might not see the full band cleared for cellphone service until late 2023, though there is an early tranche slated to move by late 2021. Auction winners with no time to spare could also pay the incumbent satellite users larger fees to quicken their relocation. That would allow some companies to repurpose spectrum in base stations and related cell-tower equipment that is already transmitting data on other frequencies–just not the bands in question. The change could result in faster and more reliable 5G service.

………………………………………………………………………………………………………………………………………….

This author is astonished there has been no concern expressed regarding C-Band Auction’s Threat to Aviation. Viodi View principal Ken Pyle wrote:

The RTCA is recommending that the mobile wireless and aviation industries work with their respective regulators to take appropriate steps to mitigate the risk associated with the deployment of 5G in the C-Band. The question is what impact will this interference risk have on the rollout of 5G in the C-band?

It will be interesting to see how the potential interference risks raised by RTCA impact the rollout of 5G in the C-Band.

On December 7th, Reuters reported that House Committee on Transportation and Infrastructure Chair Peter DeFazio urged a delay in the FCC auction of C-Band spectrum over concerns it could jeopardize aviation safety. He cited a six-month review of 5G network emissions with safety-critical radio altimeter performance by the Radio Technical Commission for Aeronautics (RTCA) that found serious risks of harmful interference on all types of aircraft.

Caveat Emptor!

References:

https://www.wsj.com/articles/5g-auction-shatters-record-as-bidding-tops-66-billion-11608731335 (on-line subscription required)

https://www.fiercewireless.com/5g/c-band-nears-70b-rockets-above-prior-us-spectrum-auctions

https://www.rcrwireless.com/20201223/spectrum/fccs-auction-holiday-haul-closing-in-on-70-billion

https://viodi.com/2020/11/30/c-band-5gs-threat-to-aviation/

https://www.wsj.com/articles/everything-you-need-to-know-about-5g-11605024717

……………………………………………………………………………………………………………………………………

January 18, 2021 Update:

The Federal Communications Commission has completed the first round of the auction of the 3.7-3.98 GHz band, raising the most ever in a spectrum auction in the US. All 5,684 blocks on offer were acquired, with total bids of USD 80.9 billion, nearly twice the previous record for a FCC auction.

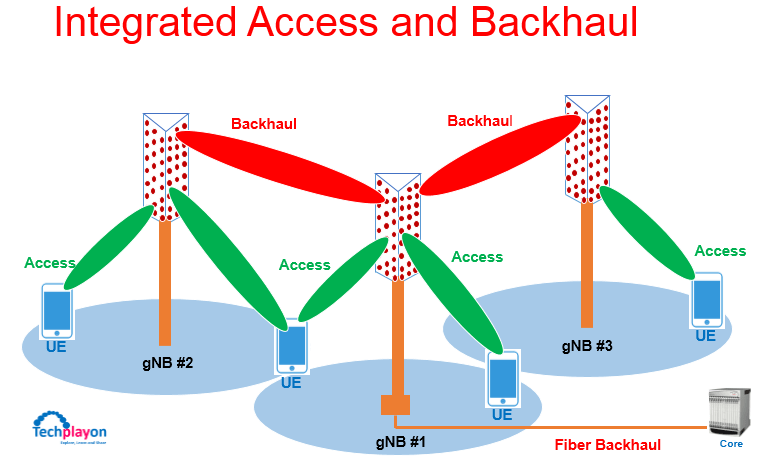

AT&T and Verizon to use Integrated Access and Backhaul for 2021 5G networks

AT&T sketched out its plans to start testing Integrated Access and Backhaul (IAB) technology during 2020, saying it can prove a reliable backhaul alternative to fiber in certain cases, such as expanding millimeter-wave locations to reach more isolated areas. Verizon also confirmed, without adding any details, that it plans to use IAB, which is an architecture for the 5G cellular networks in which the same infrastructure and spectral resources will be used for both access and backhaul. IAB will be described in 3GPP Release 16 (see 3GPP section below for more details).

…………………………………………………………………………………………………………………………………………..

“Fiber is still required in close proximity to serve the capacity coming from the nodes, so if it can be extended to each of the nodes, it will be the first choice,” said Gordon Mansfield, VP of Converged Access and Device Technology at AT&T. in an statement emailed to FierceWireless.

“From there, IAB can be used to extend to hard to reach and temporary locations that are in close proximity. As far as timing, we will do some testing in 2020 but 2021 is when we expect it to be used more widely,” he said.

Verizon also told Fierce that it has plans to incorporate IAB as a tool. It doesn’t have any details to share at this time, but “it’s certainly on the roadmap,” an unknown Verizon representative said.

Earlier this year, Mike Dano of Lightreading reported:

Verizon’s Glenn Wellbrock said he expects to add “Integrated Access Backhaul” technology to the operator’s network-deployment toolkit next year, which would allow Verizon to deploy 5G more easily and cheaply into locations where it can’t get fiber.

“It’s a really powerful tool,” Glenn Wellbrock, director of architecture, design and planning for Verizon’s optical transport network, explained during a keynote presentation here Thursday at Light Reading’s 5G Transport & the Edge event.

Wellbrock said IAB will be part of the 3GPP’s “Release 16” set of 5G specifications, which is expected to be completed by July 2020. However, Wellbrock said it will likely take equipment vendors some time to implement the technology in actual, physical products. That means 2020 would be the earliest that Verizon could begin deploying the technology, he added.

Wellbrock said IAB would allow Verizon to install 5G antennas into locations where routing a fiber cable could be difficult or expensive, such as across a set of train tracks.

However, Wellbrock said that IAB will be but one tool in Verizon’s network-deployment toolbox, and that Verizon will continue to use fiber for the bulk of its backhaul needs. Indeed, he pointed out that Verizon is now deploying roughly 1,400 miles of new fiber lines per month in dozens of cities around the country.

He said Verizon could ultimately use IAB in up to 10-20% of its 5G sites, once the technology is widely available. He said that would represent an increase from Verizon’s current use of wireless backhaul technologies running in the E-band; he said less than 10% of the operator’s sites currently use wireless backhaul. He said IAB is better than current wireless backhaul technologies like those that use the E-band because it won’t require a separate antenna for the backhaul link. As indicated by the “integrated” portion of the “integrated access backhaul” moniker, IAB supports wireless connections both for regular 5G users and for backhaul links using the same antenna.

………………………………………………………………………………………………………………………………………..

According to 5G Americas, the larger bandwidths associated with 5G New Radio (NR), such as those found in mmWave spectrum, as well as the native support of massive MIMO and multi-beams, are expected to facilitate and/or optimize the design and performance of IAB.

5G Americas maintains that the primary goals of IAB are to:

- Improve capacity by supporting networks with a higher density of access points in areas with only sparse fiber availability.

- Improve coverage by extending the range of the wireless network, and by providing coverage for isolated coverage gaps. For example, if the user equipment (UE) is behind a building, an access point can provide coverage to that UE with the access point being connected wirelessly to the donor cell.

- Provide indoor coverage, such as with an IAB access point on top of a building that serves users within the building.

5G Americas also said that in practice, IAB is more relevant for mmWave because lower frequency spectrum may be seen as too valuable (and also too slow) to use for backhaul. The backhaul link, where both endpoints of the link are stationary, is especially suitable for the massive beam-forming possible at the higher frequencies.

……………………………………………………………………………………………………………

3GPP Release 16 status of work items related to IAB:

(Note: Study is 100% complete, but others are 0% or 50% complete):

| 750047 | FS_NR_IAB | … Study onNR_IAB | 100% |

| 820170 | NR_IAB-Core | … Core part: NR_IAB | 0% |

| 820270 | NR_IAB-Performance | 850002 | – | … CT aspects of NR_IAB | 0% |

| 830021 | FS_NR_IAB_Sec | … Study on Security for NR_IAB | 50% |

| 850020 | – | … Security for NR_IAB | 0% |

| 850002 | – | … CT aspects of NR_IAB | 0% |

References:

https://www.fiercewireless.com/wireless/at-t-expects-to-test-iab-2020-use-it-more-widely-2021

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

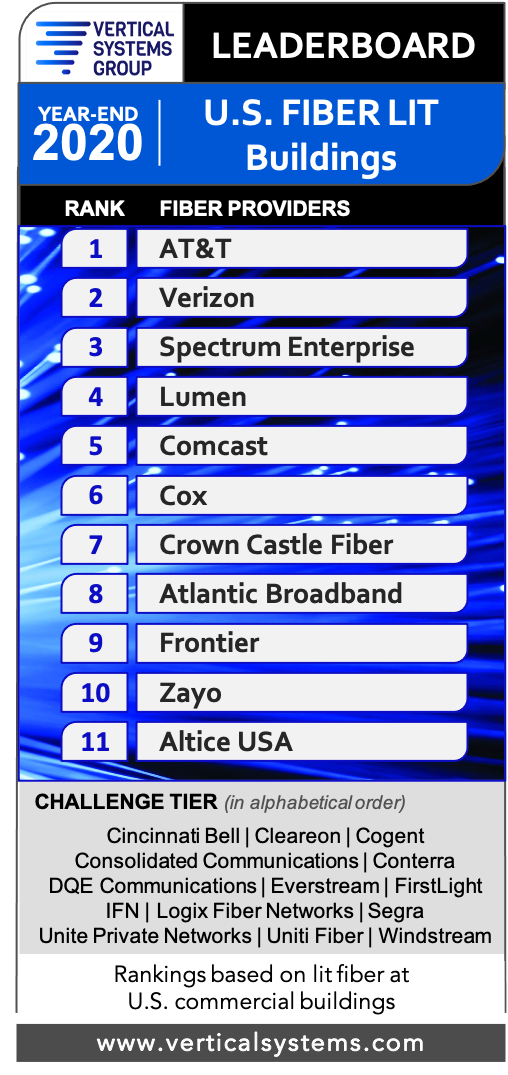

Vertical Systems Group’s 2020 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of on-net fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast, Cox, Crown Castle Fiber, Atlantic Broadband, Frontier, Zayo and Altice USA. These eleven retail and wholesale fiber providers qualify for this benchmark with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2020.

Additionally, fourteen companies qualify for the 2020 Challenge Tier as follows (in alphabetical order): Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, Conterra, DQE Communications, Everstream, FirstLight, IFN, Logix Fiber Networks, Segra, Unite Private Networks, Uniti Fiber and Windstream. These fiber providers each qualify for the 2020 Challenge Tier with between 2,000 and 14,999 U.S. fiber lit commercial buildings.

“The base of fiber lit buildings in the U.S. expanded in 2020, although the pace of new installations was hampered by the pandemic. Challenges for fiber providers ranged from impeded installations due to commercial building closures and business shutdowns to supply chain disruptions,” said Rosemary Cochran, principal of Vertical Systems Group. “As the economy rebounds in 2021, fiber providers have opportunities to monetize the millions of small and medium U.S. commercial buildings without fiber, as well as larger multi-tenant buildings with only a single fiber provider. However it remains uncertain how changes in U.S. regulatory policies and federal funding could alter fiber investments and deployment plans in the next several years.”

2020 Fiber Provider Research Highlights:

- AT&T retains the top rank on the U.S. Fiber Lit Buildings LEADERBOARD for the fifth consecutive year.

- The threshold for a rank position on the 2020 Fiber LEADERBOARD is 15,000 fiber lit buildings, up from 10,000 buildings previously.

- Atlantic Broadband advanced to eighth position on the LEADERBOARD, up from eleventh in the previous year.

- Windstream and Consolidated Communications move into the Challenge Tier from the LEADERBOARD.

- Vertical Systems Group’s 2020 U.S. fiber research analysis for five building sizes shows that fiber availability varies significantly based on number of employees. The Fiber 20+ segment, which covers four building sizes with twenty or more employees, has a 69.2% fiber lit availability rate. This compares to 14.1% availability for the Fiber <20 segment, which covers buildings with fewer than twenty employees.

Market Players include all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The 2020 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): ACD.net, Armstrong Business Solutions, C Spire, Centracom, CTS Telecom, Douglas Fast Net, EnTouch Business, ExteNet Systems, Fatbeam, FiberLight, Fusion Connect, Google Fiber, GTT, Hunter Communications, LS Networks, Mediacom Business, MetroNet Business, Midco Business, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, Wave Broadband, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

SCWS Americas: Verizon and AT&T 5G Roadmaps Differ on FWA vs mobile “5G”

Verizon has no plans for linear or on-demand (or any other form) of pay TV for its “5G” FWA (Fixed Wireless Access) based residential/Verizon Home broadband service, according to Bill Stone, the company”s VP of technology development and planning. Stone stated that in a question from this author (during the Q&A session after his second presentation) at the excellent SCWS Americas conference in Santa Clara, CA on December 5, 2018. Instead, Verizon has a partnership with YouTube TV (first three months free) to provide OTT video to its FWA customers. Verizon Home customers get a free Apple TV 4K or Google Chromecast Ultra (Internet TV adapters with HDMI connection to the customer’s TV) when they sign up for 5G Home service.

Stone also said that Verizon’s FiOS will continue to offer higher speeds than its 5G Home service, which will transition from its proprietary “5G TF” spec to 3GPP release 15 5G NR NSA (non stand alone) in the near future. He told me privately that any wireless base station vendor that supports 5G NR would be able to interoperate on the carrier’s 5G FWA network (we don’t think so for many reasons). Verizon’s 5G Home service is currently available in Houston, Indianapolis, Los Angeles and Sacramento.

Stone noted with pride that the mega carrier continues to bolster its 4G LTE network with new technologies. “LTE has a lot of runway left,” Bill said to the audience.

Verizon currently says that customers of its 5G Home service will receive download speeds of at least 300 Mbps. A video was shown of satisfied customers who all got download speeds of 800 Mbps or higher. The mega carrier said that speeds can range up to 1 Gbps depending on customers’ location in relation to the towers for the service.

Verizon currently charges new customers $70 per month for 5G Home service, but only $50 per month for existing customers (with 1st three months free) who also subscribe to the carrier’s $30/month mobile data plan. Voice is offered along with high speed Internet access, but no pay TV is available as with FiOS.

“The peak data rates here in millimeter-wave will definitely increase,” Stone told the audience. Verizon currently runs its 5G Home service in its 28 GHz licensed spectrum in 400 MHz channels. But he said the carrier has the ability to increase that spectrum allotment to 600 MHz and 800 MHz channels (Verizon owns huge amounts of millimeter-wave spectrum via its purchases of XO and Straight Path). Stone explained that expanding the service’s spectrum channels would both increase user speeds and increase Verizon’s network capacity. Verizon will move from 400 MHz to 800 MHz, and that will result in the speeds and capacity available would double as a result.

Currently, the antennas and receivers for Verizon’s Home broadband service are installed by “white glove” professional technicians. In the future, the carrier is planning to offer a self-installation option for its 5G Home service. “Over time the goal is to introduce the ability to drop ship equipment that the customer can install on their own,”

Stone said, without providing a timeline for such a move. tone touched on several other data points for its FWA home broadband service:

- 50% of Verizon’s 5G Home customers do not subscribe to the operator’s mobile service.

- The service can transmit 1 Gbps downstream up to 3,000 feet.

- The millimeter-wave service works in conditions including rain, snow and non-line-of-sight scenarios. Indeed, Stone said some transmissions work better in non-line-of-sight scenarios than when customers are within sight of the tower, due to the fact that millimeter-wave transmissions can reflect off various objects in order to reach their intended destination.

- Verizon’s 5G Home customers are switching to the carrier from a variety of other service providers, though no details were provided.

- Verizon ultimately expects to expand 5G Home to 30 million households at some unspecified time in the future, though Dunne said the carrier may revisit that figure as the company’s rollout progresses.

- Verizon won’t build any more locations with its 5GTF equipment, and will instead wait for 3GPP release 15 5G NR equipment to become available before expanding to additional neighborhoods and cities. However, the implementation of 5G NR by vendors will initially be non stand alone (NSA), which means its dependent on a LTE core network and LTE signaling. That may differ amongst wireless base station vendors as will the frequencies used for different 5G NR carrier networks.

- Verizon is making significant progress toward implementing vRAN technology on its 5G network, working with its vendors—including Ericsson, Samsung and Nokia—to virtualize the lower layers of its network in addition to the upper layers. The process of virtualizing the baseband functions in the RAN is part of a broader trend in the wireless and wider telecom industry in which operators are increasingly looking to move away from expensive, dedicated hardware from traditional suppliers and toward general-purpose compute servers running (mostly) open source software.

- Verizon remains interested in providing edge computing services, services he said the operator could sell to companies looking to provide offerings ranging from drones to autonomous vehicles. Verizon’s efforts in edge computing stem from the carrier’s moves to densify its network and to virtualize parts of its network functions. Those efforts, Stone said, would create a foundation for Verizon to eventually run edge computing sevices for third parties.

5G Home is one of many services Verizon plans to offer via 5G network technology with mobile 5G (again, based on 3GPP release 15 “5G NR”o NSA) being the next “5G” offering. When mobile “5G” is deployed in the 11st half of 2019, the Motorola moto z3 smartphone, paired with the 5G moto mod and a Samsung 5G smartphone will be available. So will an Inseego 5G hotspot that can access Verizon’s mobile network.

Addendum: 5G is one network, multiple use cases, Verizon CEO says

Last week at the UBS Global Media and Communications Conference, Verizon CEO Hans Vestberg touted the carrier’s 5G home residential broadband service as complementing its wired Fios offering while extending the ability to provide a wireless alternative to home connectivity. While the fixed wireless access service is only available in four markets, the carrier said half of the customers are new to the company.

In a discussion with John Hodulik of UBS Investment Bank and HSBC analyst Sunil Rajgopal, Vestberg said 5G Home comes with a guaranteed 300 Mbps but its millimeter wave spectrum can support up to 800 Mbps or 900 Mbps.

“It’s a totally different way to doing broadband, meaning, instead of having a cord into the house, you have a wireless wave into the house, but the experience is the same in the house. And I think that’s a big opportunity for us. We have one footprint of Home, and that’s the Northeast where we have our Fios footprint. For the rest of the country, we don’t have it. So of course, we see that as an opportunity.”

…………………………………………………………………………………………………………………………………………………………………………………………………….

In a SCWS Americas keynote speech, title “Building our 5G network,” Al Burke, AT&T Assistant Vice President – RAN Hardware and Software Development, described the progress the carrier has made in upgrading its network for 5G. The key points he made were:

- 5G will facilitate and support new applications such as VR/AR, remote surgery (Bill said he doesn’t want to be one of the first patients), connected cars, etc.

- Small cells will be an integral part of 5G networks and “bring them to fruition”

- By the ned of 2017, 55% of AT&Ts network functions were virtualized (I take that to mean they were implemented as software running on commodity compute servers)

- There have been huge shifts in AT&Ts network in the last few years:

1. From hardware to software implementations (e.g SDN, NFV);

2. From centralized to decentralized control (e.g. EDGE computing)

3. From observation (of network events, alerts, alarms) to insight via AI/ML (e.g.AT&T’s INDIGO)

- Open RAN (ORAN) is the way to move forward. Via disaggregation of RAN functions with well defined interfaces, ORAN is “open, modular, enables automation, and is lower cost. ORAN results in interchangeable network modules (from different vendors) vs vendor proprietary equipment.

AT&T’s 5G Roadmap (only mobile 5G was shown on Al Burke’s slide – nothing on fixed 5G):

- 2019: 5G NR access with LTE Core network and LTE Access (=signaling?). The spectrum for AT&Ts initial mobile 5G rollout was not disclosed, but many believe it will be mmWave.

- 2020-2022+: 5G NR access with 5G Core network (3GPP Release 16 SA or IMT 2020?); also LTE Core with LTE Access

- 2019-2022+: mmWave NR : Evolution to Ultra High Speed and lower latency

- End of 2019-2022+: (unspecified time frame?), AT&T will provide sub 6 GHz 5G coverage in the U.S. speed and latency; dedicated & shared spectrum (LTE-NR-Coexistence)

…………………………………………………………………………………………………………………………………………………………………………………………………………….

When AT&T introduces its “5G” FWA residential service it will be based on LTE, according to Mr. Burke. In answer to a question from this author during the Q&A session, he said it would start as LTE but then transition to 5G NR based FWA. The spectrum to be used was not revealed, but you can assume it will be mmWave (like Verizon’s 5G Home).

Author’s Closing Comments:

A claim we’ve heard before (by Ericsson and Vodafone), but don’t believe: LTE network and terminal equipment will upgrade to 5G NR via “only a software upgrade.”As noted many times by this author and others,

AT&T has repeatedly stated they would roll out “standards based 5G” in 12 cities by the end of 2018 (they have only 3 weeks to fulfill that promise) and 19 cities in 2019. Some of the cities identified by AT&T for the 2018 launch include Houston TX, Dallas TX, Atlanta TX, Waco TX, Charlotte NC, Raleigh NC, Oklahoma City OK, Jacksonville FL, Louisville, KY, New Orleans LA, Indianapolis IN, and San Antonio TX.

How long can AT&T claim their “5G” network is standards based when they only support 3GPP release 15 “5G NR” NSA access with a LTE core network and LTE signaling? The ONLY 5G RAN/RIT standard is IMT 2020 which won’t be completed till the end of 2020.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Fierce Wireless writes about what to expect from AT&T’s 5G mobile service. We’d like to know How much will it cost? And who will subscribe when only a WiFi hotspot with 5G backhaul is offered?

SCWS Americas: Verizon and AT&T 5G Roadmaps Differ on FWA vs mobile “5G”

Verizon has no plans for linear or on-demand (or any other form) of pay TV for its “5G” FWA (Fixed Wireless Access) based residential/Verizon Home broadband service, according to Bill Stone, the company”s VP of technology development and planning. Stone stated that in a question from this author (during the Q&A session after his second presentation) at the excellent SCWS Americas conference in Santa Clara, CA on December 5, 2018. Instead, Verizon has a partnership with YouTube TV (first three months free) to provide OTT video to its FWA customers. Verizon Home customers get a free Apple TV 4K or Google Chromecast Ultra (Internet TV adapters with HDMI connection to the customer’s TV) when they sign up for 5G Home service.

Stone also said that Verizon’s FiOS will continue to offer higher speeds than its 5G Home service, which will transition from its proprietary “5G TF” spec to 3GPP release 15 5G NR NSA (non stand alone) in the near future. He told me privately that any wireless base station vendor that supports 5G NR would be able to interoperate on the carrier’s 5G FWA network (we don’t think so for many reasons). Verizon’s 5G Home service is currently available in Houston, Indianapolis, Los Angeles and Sacramento.

Stone noted with pride that the mega carrier continues to bolster its 4G LTE network with new technologies. “LTE has a lot of runway left,” Bill said to the audience.

Verizon currently says that customers of its 5G Home service will receive download speeds of at least 300 Mbps. A video was shown of satisfied customers who all got download speeds of 800 Mbps or higher. The mega carrier said that speeds can range up to 1 Gbps depending on customers’ location in relation to the towers for the service.

Verizon currently charges new customers $70 per month for 5G Home service, but only $50 per month for existing customers (with 1st three months free) who also subscribe to the carrier’s $30/month mobile data plan. Voice is offered along with high speed Internet access, but no pay TV is available as with FiOS.

“The peak data rates here in millimeter-wave will definitely increase,” Stone told the audience. Verizon currently runs its 5G Home service in its 28 GHz licensed spectrum in 400 MHz channels. But he said the carrier has the ability to increase that spectrum allotment to 600 MHz and 800 MHz channels (Verizon owns huge amounts of millimeter-wave spectrum via its purchases of XO and Straight Path). Stone explained that expanding the service’s spectrum channels would both increase user speeds and increase Verizon’s network capacity. Verizon will move from 400 MHz to 800 MHz, and that will result in the speeds and capacity available would double as a result.

Currently, the antennas and receivers for Verizon’s Home broadband service are installed by “white glove” professional technicians. In the future, the carrier is planning to offer a self-installation option for its 5G Home service. “Over time the goal is to introduce the ability to drop ship equipment that the customer can install on their own,”

Stone said, without providing a timeline for such a move. tone touched on several other data points for its FWA home broadband service:

- 50% of Verizon’s 5G Home customers do not subscribe to the operator’s mobile service.

- The service can transmit 1 Gbps downstream up to 3,000 feet.

- The millimeter-wave service works in conditions including rain, snow and non-line-of-sight scenarios. Indeed, Stone said some transmissions work better in non-line-of-sight scenarios than when customers are within sight of the tower, due to the fact that millimeter-wave transmissions can reflect off various objects in order to reach their intended destination.

- Verizon’s 5G Home customers are switching to the carrier from a variety of other service providers, though no details were provided.

- Verizon ultimately expects to expand 5G Home to 30 million households at some unspecified time in the future, though Dunne said the carrier may revisit that figure as the company’s rollout progresses.

- Verizon won’t build any more locations with its 5GTF equipment, and will instead wait for 3GPP release 15 5G NR equipment to become available before expanding to additional neighborhoods and cities. However, the implementation of 5G NR by vendors will initially be non stand alone (NSA), which means its dependent on a LTE core network and LTE signaling. That may differ amongst wireless base station vendors as will the frequencies used for different 5G NR carrier networks.

- Verizon is making significant progress toward implementing vRAN technology on its 5G network, working with its vendors—including Ericsson, Samsung and Nokia—to virtualize the lower layers of its network in addition to the upper layers. The process of virtualizing the baseband functions in the RAN is part of a broader trend in the wireless and wider telecom industry in which operators are increasingly looking to move away from expensive, dedicated hardware from traditional suppliers and toward general-purpose compute servers running (mostly) open source software.

- Verizon remains interested in providing edge computing services, services he said the operator could sell to companies looking to provide offerings ranging from drones to autonomous vehicles. Verizon’s efforts in edge computing stem from the carrier’s moves to densify its network and to virtualize parts of its network functions. Those efforts, Stone said, would create a foundation for Verizon to eventually run edge computing sevices for third parties.

5G Home is one of many services Verizon plans to offer via 5G network technology with mobile 5G (again, based on 3GPP release 15 “5G NR”o NSA) being the next “5G” offering. When mobile “5G” is deployed in the 11st half of 2019, the Motorola moto z3 smartphone, paired with the 5G moto mod and a Samsung 5G smartphone will be available. So will an Inseego 5G hotspot that can access Verizon’s mobile network.

Addendum: 5G is one network, multiple use cases, Verizon CEO says

Last week at the UBS Global Media and Communications Conference, Verizon CEO Hans Vestberg touted the carrier’s 5G home residential broadband service as complementing its wired Fios offering while extending the ability to provide a wireless alternative to home connectivity. While the fixed wireless access service is only available in four markets, the carrier said half of the customers are new to the company.

In a discussion with John Hodulik of UBS Investment Bank and HSBC analyst Sunil Rajgopal, Vestberg said 5G Home comes with a guaranteed 300 Mbps but its millimeter wave spectrum can support up to 800 Mbps or 900 Mbps.

“It’s a totally different way to doing broadband, meaning, instead of having a cord into the house, you have a wireless wave into the house, but the experience is the same in the house. And I think that’s a big opportunity for us. We have one footprint of Home, and that’s the Northeast where we have our Fios footprint. For the rest of the country, we don’t have it. So of course, we see that as an opportunity.”

…………………………………………………………………………………………………………………………………………………………………………………………………….

In a SCWS Americas keynote speech, title “Building our 5G network,” Al Burke, AT&T Assistant Vice President – RAN Hardware and Software Development, described the progress the carrier has made in upgrading its network for 5G. The key points he made were:

- 5G will facilitate and support new applications such as VR/AR, remote surgery (Bill said he doesn’t want to be one of the first patients), connected cars, etc.

- Small cells will be an integral part of 5G networks and “bring them to fruition”

- By the ned of 2017, 55% of AT&Ts network functions were virtualized (I take that to mean they were implemented as software running on commodity compute servers)

- There have been huge shifts in AT&Ts network in the last few years:

1. From hardware to software implementations (e.g SDN, NFV);

2. From centralized to decentralized control (e.g. EDGE computing)

3. From observation (of network events, alerts, alarms) to insight via AI/ML (e.g.AT&T’s INDIGO)

- Open RAN (ORAN) is the way to move forward. Via disaggregation of RAN functions with well defined interfaces, ORAN is “open, modular, enables automation, and is lower cost. ORAN results in interchangeable network modules (from different vendors) vs vendor proprietary equipment.

AT&T’s 5G Roadmap (only mobile 5G was shown on Al Burke’s slide – nothing on fixed 5G):

- 2019: 5G NR access with LTE Core network and LTE Access (=signaling?). The spectrum for AT&Ts initial mobile 5G rollout was not disclosed, but many believe it will be mmWave.

- 2020-2022+: 5G NR access with 5G Core network (3GPP Release 16 SA or IMT 2020?); also LTE Core with LTE Access

- 2019-2022+: mmWave NR : Evolution to Ultra High Speed and lower latency

- End of 2019-2022+: (unspecified time frame?), AT&T will provide sub 6 GHz 5G coverage in the U.S. speed and latency; dedicated & shared spectrum (LTE-NR-Coexistence)

…………………………………………………………………………………………………………………………………………………………………………………………………………….

When AT&T introduces its “5G” FWA residential service it will be based on LTE, according to Mr. Burke. In answer to a question from this author during the Q&A session, he said it would start as LTE but then transition to 5G NR based FWA. The spectrum to be used was not revealed, but you can assume it will be mmWave (like Verizon’s 5G Home).

Author’s Closing Comments:

A claim we’ve heard before (by Ericsson and Vodafone), but don’t believe: LTE network and terminal equipment will upgrade to 5G NR via “only a software upgrade.”As noted many times by this author and others,

AT&T has repeatedly stated they would roll out “standards based 5G” in 12 cities by the end of 2018 (they have only 3 weeks to fulfill that promise) and 19 cities in 2019. Some of the cities identified by AT&T for the 2018 launch include Houston TX, Dallas TX, Atlanta TX, Waco TX, Charlotte NC, Raleigh NC, Oklahoma City OK, Jacksonville FL, Louisville, KY, New Orleans LA, Indianapolis IN, and San Antonio TX.

How long can AT&T claim their “5G” network is standards based when they only support 3GPP release 15 “5G NR” NSA access with a LTE core network and LTE signaling? The ONLY 5G RAN/RIT standard is IMT 2020 which won’t be completed till the end of 2020.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Fierce Wireless writes about what to expect from AT&T’s 5G mobile service. We’d like to know How much will it cost? And who will subscribe when only a WiFi hotspot with 5G backhaul is offered?