Cloud Computing

Huawei Cloud Review and Global Sales Partner Policies for 2026

Huawei Cloud is the cloud computing platform of Huawei Technologies Co. Ltd., offering a comprehensive suite of cloud services and solutions for enterprises and individual consumers. It’s ranked as the second-largest cloud service provider in China by market share, consistently placing behind the market leader, Alibaba Cloud.

Huawei Cloud provides a full range of services including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), supporting public, private, and hybrid cloud architectures. Cloud services include:

- Compute Services such as Elastic Cloud Servers (ECS), Bare Metal Servers (BMS), and container management via the Cloud Container Engine (CCE).

- Storage and Data Management Offerings include Object Storage Service (OBS), Elastic Volume Service (EVS), backup and disaster recovery solutions, and a range of database options like GaussDB and RDS for MySQL.

- Networking Services cover Virtual Private Cloud (VPC), Elastic IP (EIP), load balancing, and content delivery networks (CDN) to ensure fast and reliable connectivity.

- AI and Analytics This is a key focus area, featuring AI development platforms like ModelArts, pre-trained Pangu models, big data analytics services (MapReduce Service, Data Warehouse Service), and various AI-powered solutions for specific industries.

- Security and Compliance The platform offers robust security measures including firewalls, anti-DDoS services, data encryption, identity and access management (IAM), and comprehensive security operations centers.

- Developer and Management Tools A variety of tools for application development, operations management (O&M), migration, and governance.

Charles Yang, Huawei Senior Vice President, highlighted that the intelligent era presents immense opportunities and challenges for Huawei Cloud and its partners.

…………………………………………………………………………………………………………………………………………………….

- Global Visibility: Amplifying partner visibility through Huawei Cloud’s international media channels.

- Brand Enhancement: Assisting partners in improving their brand image using established global communication benchmarks.

- Enhanced Benefits: Upgrading partner benefits, including an increased Market Development Fund and comprehensive promotional support.

- Collaborative Marketing: Inviting partners to participate in Huawei Cloud’s own global marketing initiatives.

- Executive Level (CXO): Facilitating strategic exchanges on industry trends, digital transformation, and AI strategy to ensure vision alignment.

- Core Teams: Offering courses focused on business operations, industry analysis, and growth strategies.

- Sales and Technical Roles (BDs, SAs, CSMs): Providing hands-on training, including sales simulations and technical workshops, to enhance practical expertise.

References:

https://thetimes.com.au/news/press-releases?rkey=20260123AE69710&filter=24774

HUAWEI CLOUD launches partner programs in LatAm and Caribbean

Huawei’s Electric Vehicle Charging Technology & Top 10 Charging Trends

Huawei launches CloudMatrix 384 AI System to rival Nvidia’s most advanced AI system

Huawei to Double Output of Ascend AI chips in 2026; OpenAI orders HBM chips from SK Hynix & Samsung for Stargate UAE project

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Palo Alto Networks and Google Cloud expand partnership with advanced AI infrastructure and cloud security

- End-to-End AI Security from Code to Cloud: Customers can protect live AI workloads and data on Google Cloud, including instances on Vertex AI and Agent Engine, using Palo Alto Networks Prisma AIRS. Securing key developer tools like the Agent Development Kit (ADK) with Prisma AIRS provides a secure foundation for developing next-generation AI applications on Google Cloud. This includes capabilities such as AI Posture Management, AI Runtime Security™, AI Agent Security for autonomous systems, AI Red Teaming, and AI Model Security.

- AI-Driven, Next-Generation Software Firewall (SWFW): Palo Alto Networks VM-Series firewalls, designed for securing cloud and virtualized environments via deep packet inspection and Threat Prevention, will feature deep integrations with Google Cloud to help customers maintain robust security policies and accelerate cloud adoption.

- AI-Driven Secure Access Service Edge (SASE) Platform: Palo Alto Networks Prisma SASE platform secures access and networking for remote users and branch offices. Deeper integration with Google Cloud’s native AI services will improve the user experience by leveraging Google’s network for Prisma Access execution and utilizing Google Cloud Interconnect for consistent security policies across multi-cloud WAN infrastructure.

- Simplified and Unified Security Experience: The deep engineering alignment ensures that joint solutions are pre-vetted and optimized for seamless interoperability, reducing integration complexity and operational overhead for security teams. This enables faster deployment of protective measures, simplified compliance, and a unified security posture across the entire hybrid multicloud ecosystem.

- BJ Jenkins, President, Palo Alto Networks: “The critical question for modern governance boards is how to leverage AI without introducing undue risk. This partnership provides the definitive answer. We are eliminating the operational friction between security and development, delivering a unified platform where cutting-edge security is an inherent component of innovation. By embedding our AI-powered security deeply into the Google Cloud infrastructure, we are transforming the platform into a proactive defense system.”

- Matt Renner, President and Chief Revenue Officer, Google Cloud: “Enterprises increasingly rely on the combined capabilities of Google Cloud and Palo Alto Networks for seamless application and data security. This partnership expansion guarantees our joint clientele access to the necessary solutions for securing their most critical AI infrastructure and developing secure-by-design AI agents from inception.”

About Palo Alto Networks:

As the global AI and cybersecurity leader, Palo Alto Networks (NASDAQ: PANW) is dedicated to protecting our digital way of life via continuous innovation. Trusted by more than 70,000 organizations worldwide, we provide comprehensive AI-powered security solutions across network, cloud, security operations and AI, enhanced by the expertise and threat intelligence of Unit 42®. Our focus on platformization allows enterprises to streamline security at scale, ensuring protection fuels innovation. Explore more at www.paloaltonetworks.com.

Palo Alto Networks, Prisma, Prisma AIRS, and the Palo Alto Networks logo are trademarks of Palo Alto Networks, Inc. in the United States and in jurisdictions throughout the world. All other trademarks, trade names, or service marks used or mentioned herein belong to their respective owners.

About Google Cloud:

Google Cloud is the new way to the cloud, providing AI, infrastructure, developer, data, security, and collaboration tools built for today and tomorrow. Google Cloud offers a powerful, fully integrated and optimized AI stack with its own planet-scale infrastructure, custom-built chips, generative AI models and development platform, as well as AI-powered applications, to help organizations transform. Customers in more than 200 countries and territories turn to Google Cloud as their trusted technology partner.

- Learn more about Palo Alto Networks and the Google Cloud partnership here.

- Please see References below for Google Cloud initiatives

……………………………………………………………………………………………………………………………………………………………….

References:

https://www.paloaltonetworks.com/engage/global-multi-platform-security/palo-alto-devops-in

NTT Data and Google Cloud partner to offer industry-specific cloud and AI solutions

Google Cloud targets telco network functions, while AWS and Azure are in holding patterns

Deutsche Telekom and Google Cloud partner on “RAN Guardian” AI agent

Google Cloud announces TalayLink subsea cable and new connectivity hubs in Thailand and Australia

Ericsson and Google Cloud expand partnership with Cloud RAN solution

Google Cloud infrastructure enhancements: AI accelerator, cross-cloud network and distributed cloud

T-Mobile and Google Cloud collaborate on 5G and edge compute

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Google Cloud expands footprint with 34 global regions

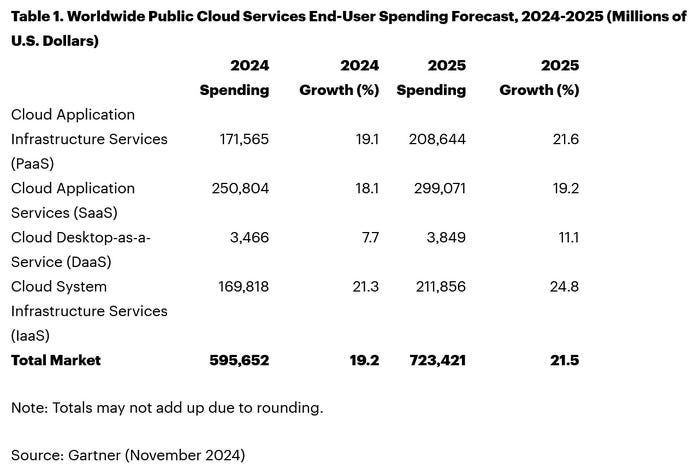

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

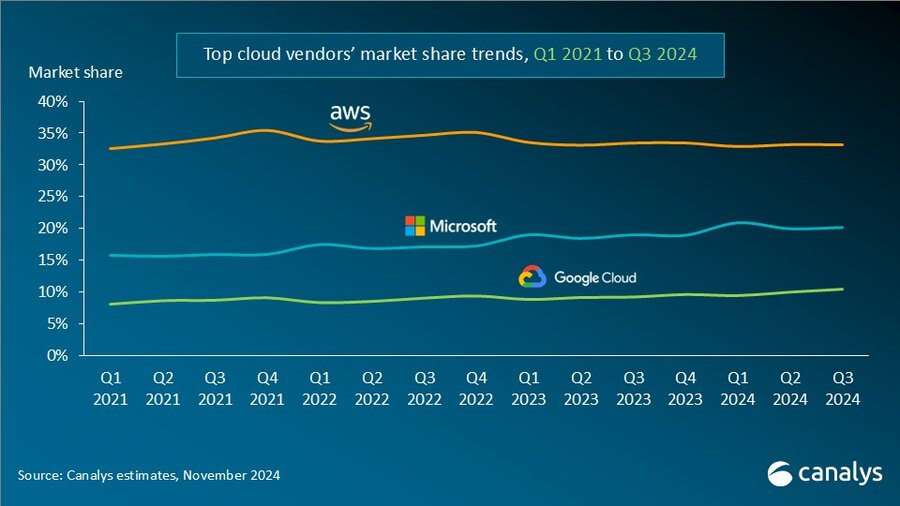

According to market research firm Canalys, global spending on cloud infrastructure services [1.] increased by 21% year on year, reaching US$82.0 billion in the 3rd quarter of 2024. Customer investment in the hyperscalers’ AI offerings fueled growth, prompting leading cloud vendors to escalate their investments in AI.

Note 1. Canalys defines cloud infrastructure services as services providing infrastructure (IaaS and bare metal) and platforms that are hosted by third-party providers and made available to users via the Internet.

The rankings of the top three cloud service providers – Amazon AWS, Microsoft Azure and Google Cloud – remained stable from the previous quarter, with these providers together accounting for 64% of total expenditure. Total combined spending with these three providers grew by 26% year on year, and all three reported sequential growth. Market leader AWS maintained a year-on-year growth rate of 19%, consistent with the previous quarter. That was outpaced by both Microsoft, with 33% growth, and Google Cloud, with 36% growth. In actual dollar terms, however, AWS outgrew both Microsoft and Google Cloud, increasing sales by almost US$4.4 billion on the previous year.

In Q3 2024, the cloud services market saw strong, steady growth. All three cloud hyperscalers reported positive returns on their AI investments, which have begun to contribute to their overall cloud business performance. These returns reflect a growing reliance on AI as a key driver for innovation and competitive advantage in the cloud.

With the increasing adoption of AI technologies, demand for high-performance computing and storage continues to rise, putting pressure on cloud providers to expand their infrastructure. In response, leading cloud providers are prioritizing large-scale investments in next-generation AI infrastructure. To mitigate the risks associated with under-investment – such as being unprepared for future demand or missing key opportunities – they have adopted over-investment strategies, ensuring their ability to scale offerings in line with the growing needs of their AI customers. Enterprises are convinced that AI will deliver an unprecedented boost in efficiency and productivity, so they are pouring money into hyperscalers’ AI solutions. Accordingly, cloud service provider capital spending (CAPEX) will sustain their rapid growth trajectories and are expected to continue on this path into 2025.

“Continued substantial expenditure will present new challenges, requiring cloud vendors to carefully balance their investments in AI with the cost discipline needed to fund these initiatives,” said Rachel Brindley, Senior Director at Canalys. “While companies should invest sufficiently in AI to capitalize on technological growth, they must also exercise caution to avoid overspending or inefficient resource allocation. Ensuring the sustainability of these investments over time will be vital to maintaining long-term financial health and competitive advantage.”

“On the other hand, the three leading cloud providers are also expediting the update and iteration of their AI foundational models, continuously expanding their associated product portfolios,” said Yi Zhang, Analyst at Canalys. “As these AI foundational models mature, cloud providers are focused on leveraging their enhanced capabilities to empower a broader range of core products and services. By integrating these advanced models into their existing offerings, they aim to enhance functionality, improve performance and increase user engagement across their platforms, thereby unlocking new revenue streams.”

Amazon Web Services (AWS) maintained its lead in the global cloud market in Q3 2024, capturing a 33% market share and achieving 19% year-on-year revenue growth. It continued to enhance and broaden its AI offerings by launching new models through Amazon Bedrock and SageMaker, including Anthropic’s upgraded Claude 3.5 Sonnet and Meta’s Llama 3.2. It reported a triple-digit year-on-year increase in AI-related revenue, outpacing its overall growth by more than three times. Over the past 18 months, AWS has introduced nearly twice as many machine learning and generative AI features as the combined offerings of the other leading cloud providers. In terms of capital expenditure, AWS announced plans to further increase investment, with projected spending of approximately US$75 billion in 2024. This investment will primarily be allocated to expanding technology infrastructure to meet the rising demand for AI services, underscoring AWS’ commitment to staying at the forefront of technological innovation and service capability.

Microsoft Azure remains the second-largest cloud provider, with a 20% market share and impressive annual growth of 33%. This growth was partly driven by AI services, which contributed approximately 12% to the overall increase. Over the past six months, use of Azure OpenAI has more than doubled, driven by increased adoption by both digital-native companies and established enterprises transitioning their applications from testing phases to full-scale production environments. To further enhance its offerings, Microsoft is expanding Azure AI by introducing industry-specific models, including advanced multimodal medical imaging models, aimed at providing tailored solutions for a broader customer base. Additionally, the company announced new cloud and AI infrastructure investments in Brazil, Italy, Mexico and Sweden to expand capacity in alignment with long-term demand forecasts.

Google Cloud, the third-largest provider, maintained a 10% market share, achieving robust year-on-year growth of 36%. It showed the strongest AI-driven revenue growth among the leading providers, with a clear acceleration compared with the previous quarter. As of September 2024, its revenue backlog increased to US$86.8 billion, up from US$78.8 billion in Q2, signaling continued momentum in the near term. Its enterprise AI platform, Vertex, has garnered substantial user adoption, with Gemini API calls increasing nearly 14-fold over the past six months. Google Cloud is actively seeking and developing new ways to apply AI tools across different scenarios and use cases. It introduced the GenAI Partner Companion, an AI-driven advisory tool designed to offer service partners personalized access to training resources, enhancing learning and supporting successful project execution. In Q3 2024, Google announced over US$7 billion in planned data center investments, with nearly US$6 billion allocated to projects within the United States.

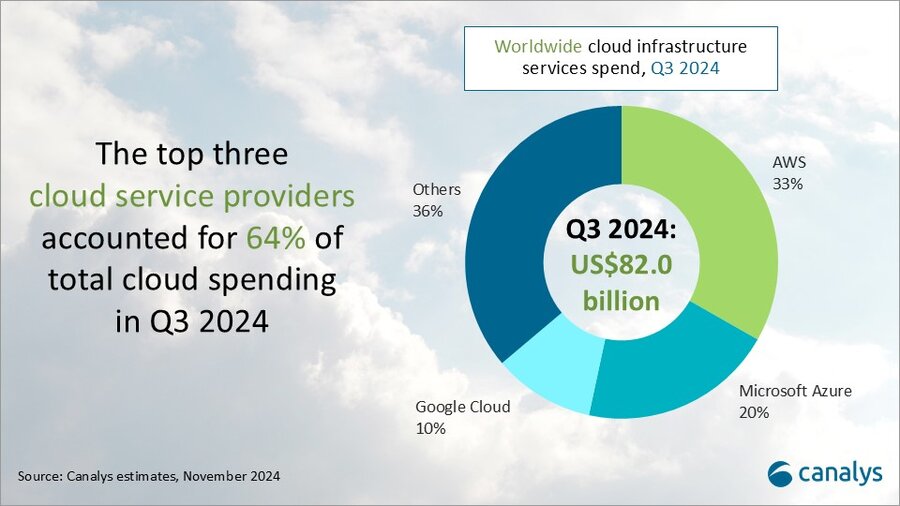

Separate statistics from Gartner corroborate hyperscale CAPEX optimism. Gartner predicts that worldwide end-user spending on public cloud services is on course to reach $723.4 billion next year, up from a projected $595.7 billion in 2024. All segments of the cloud market – platform-as-a-service (PaaS), software-as-a-service (SaaS), desktop-as-a-service (DaaS), and infrastructure-as-a-service (IaaS) – are expected to achieve double-digit growth.

While SaaS will be the biggest single segment, accounting for $299.1 billion, IaaS will grow the fastest, jumping 24.8 percent to $211.9 million.

Like Canalys, Gartner also singles out AI for special attention. “The use of AI technologies in IT and business operations is unabatedly accelerating the role of cloud computing in supporting business operations and outcomes,” said Sid Nag, vice president analyst at Gartner. “Cloud use cases continue to expand with increasing focus on distributed, hybrid, cloud-native, and multicloud environments supported by a cross-cloud framework, making the public cloud services market achieve a 21.5 percent growth in 2025.”

……………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://canalys.com/newsroom/global-cloud-services-q3-2024

https://www.telecoms.com/public-cloud/ai-hype-fuels-21-percent-jump-in-q3-cloud-spending

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

Synergy Research: Microsoft and Amazon (AWS) Dominate IT Vendor Revenue & Growth; Popularity of Multi-cloud in 2021

Google Cloud revenues up 54% YoY; Cloud native security is a top priority

Cloud Hosting- A Deep Dive into a Rapidly Growing Market

By Paribhasha Tiwari, Market Analyst and Content Curator

What is Cloud Hosting?

Cloud hosting is a type of web hosting that uses a network of virtual servers to host websites, applications, or data. Unlike traditional hosting, which relies on a single server, cloud hosting spreads the load across multiple interconnected servers, ensuring better scalability, reliability, and performance.

As digital transformation continues to accelerate across the globe, the Cloud Hosting Market is emerging as a key enabler of business agility, scalability, and innovation. Whether its large enterprises seeking to optimize their IT infrastructure or startups aiming to minimize overhead, cloud hosting has become the go-to solution. With the market poised for substantial growth, driven by the demands of modern business environments, this post will explore the factors fueling the expansion of cloud hosting, the challenges that must be navigated, and the future trends shaping this dynamic industry.

The Growth of Cloud Hosting- A Market Overview:

The global cloud hosting market has experienced tremendous growth over the past decade, becoming one of the most critical components of the broader cloud services ecosystem. According to market research, the cloud hosting market was valued at $60 billion in 2021 and is projected to reach over $100 billion by 2026, reflecting a CAGR of 18% during the forecast period. This growth can be attributed to several factors, including the increasing adoption of digital services, the rise of e-commerce, and the surge in remote working practices following the COVID-19 pandemic.

The transition from on-premises infrastructure to cloud-based hosting solutions offers businesses greater flexibility in scaling their operations. Unlike traditional hosting services, where companies are locked into a fixed amount of server capacity, cloud hosting allows for on-demand resource allocation, ensuring businesses only pay for what they use. This model provides substantial cost savings, particularly for industries with fluctuating traffic and demand, such as retail, media, and financial services.

Why Businesses are Migrating to Cloud Hosting Solutions?

Cloud hosting’s advantages extend far beyond cost savings. Companies today are looking for more than just affordable IT infrastructure—they need reliability, performance, and scalability. These three elements have made cloud hosting the preferred choice for businesses of all sizes. Here’s why-

- Scalability and Flexibility– The most compelling reason businesses are moving to the cloud is the ability to scale IT resources dynamically. Whether it’s handling a sudden spike in website traffic or expanding business operations globally, cloud hosting allows enterprises to scale resources up or down based on real-time needs. This elasticity ensures businesses remain agile and responsive to market conditions without worrying about over-provisioning or underutilization of hardware.

- Cost Efficiency– Cloud hosting significantly reduces the capital expenditure (CapEx) associated with setting up and maintaining physical servers. Instead of investing in costly infrastructure, businesses can convert these expenses to operational expenditures (OpEx) by paying only for the computing power they need. This is especially beneficial for startups and small-to-medium enterprises (SMEs) that need to manage their budgets tightly while still accessing world-class hosting services.

- Performance and Uptime– Leading cloud hosting providers guarantee uptime of 99.99% or higher, thanks to their globally distributed data centers and redundant systems. Downtime can be catastrophic, especially for e-commerce platforms, fintech companies, and digital service providers where revenue and customer satisfaction are directly tied to system availability. With cloud hosting, businesses can rely on seamless performance, even during peak demand periods.

- Disaster Recovery and Business Continuity– Another critical advantage of cloud hosting is the ability to integrate disaster recovery (DR) strategies into the hosting plan. In traditional hosting, implementing a comprehensive DR plan is complex and costly. Cloud hosting, however, offers built-in DR features like data backups, redundancy, and geo-replication, ensuring businesses can recover swiftly from any unplanned outage or data loss event.

Survey of Cloud Network Access Alternatives- Wireless and Wireline Solutions:

The growing adoption of cloud hosting has raised an important question for businesses- How should they connect to the cloud? Network access plays a critical role in determining the performance, reliability, and cost-efficiency of cloud hosting services. As businesses weigh their options, they typically consider two main types of cloud access solutions- wireline (fixed-line) and wireless alternatives.

- Wireline Access– Traditionally, businesses have relied on fixed-line connections, such as fiber-optic, DSL, or Ethernet, for cloud access. These wireline solutions provide stable, high-bandwidth connections and are often favored by enterprises with high-performance computing needs or large volumes of data traffic. Fiber-optic connections, in particular, offer ultra-high speeds and low latency, making them ideal for industries like finance, healthcare, and media, where data-intensive operations are critical.

- Advantages of Wireline Access– Wireline access is known for its reliability and low-latency performance, making it an excellent choice for mission-critical applications that require real-time data processing. Additionally, wireline connections tend to offer better security and dedicated bandwidth, reducing the risk of network congestion.

- Challenges of Wireline Access– The main downside to wireline solutions is the lack of mobility and flexibility. Fixed-line connections are geographically limited, which can pose challenges for businesses with distributed workforces or operations in remote areas.

- Wireless Access– As cloud technology evolves, wireless access solutions, particularly through 4G LTE, 5G, and Wi-Fi 6, are becoming increasingly popular. Wireless cloud access is particularly appealing for businesses with remote or mobile operations, where flexibility and mobility are critical. The advent of 5G has been a game-changer, offering near fiber-optic speeds, reduced latency, and massive device connectivity—all of which are crucial for sectors like logistics, manufacturing, and retail.

- Advantages of Wireless Access– Wireless solutions enable businesses to connect to the cloud from virtually anywhere, without the need for fixed infrastructure. This is particularly beneficial for businesses with multiple locations or a high degree of mobility. Wireless connections, particularly with 5G and Wi-Fi 6, provide speeds and performance that rival many traditional wireline solutions, making wireless access a viable alternative for many use cases.

- Challenges of Wireless Access– Despite its flexibility, wireless cloud access can be more prone to latency and security concerns compared to wireline solutions. While advances in 5G and Wi-Fi technology are helping to mitigate these issues, businesses must carefully assess their wireless infrastructure to ensure performance and security standards are met.

Security and Compliance- Addressing Concerns in the Cloud:

For many businesses, security remains a primary concern when moving to the cloud. Despite the growing adoption of cloud services, there are lingering worries about data breaches, hacking attempts, and regulatory compliance. However, cloud hosting providers have significantly improved their security protocols, and many offer industry-leading security measures that far surpass traditional on-premises hosting.

- Advanced Encryption– Data is often stored in encrypted formats, both at rest and in transit, ensuring that unauthorized users cannot access sensitive information. Leading cloud providers offer 256-bit encryption standards, along with secure key management systems to further bolster security.

- Compliance with Regulatory Standards– Cloud hosting platforms comply with major regulatory standards, including GDPR, HIPAA, SOC 2, and ISO 27001 certifications. This compliance ensures that businesses operating in regulated industries such as healthcare, finance, and retail can meet legal requirements without having to manage their own data compliance infrastructure.

- Multi-factor Authentication (MFA) and Identity Management– Cloud providers also implement stringent access controls, using technologies like MFA, identity and access management (IAM) systems, and biometric authentication to safeguard user data.

Challenges Facing the Cloud Hosting Market:

Despite its numerous benefits, the cloud hosting sector still faces challenges that need to be addressed for continued growth-

- Latency and Regional Data Centers– One of the key challenges is latency, particularly for businesses with a global customer base. To ensure minimal latency, cloud hosting providers need to offer data centers in geographically diverse locations. However, regions with limited data center infrastructure, such as parts of Africa and Latin America, may still face connectivity and latency issues.

- Data Sovereignty and Privacy– Another challenge is navigating data sovereignty laws, which dictate that certain types of data must be stored within specific geographical regions. Businesses operating across borders must ensure compliance with local data regulations, which may complicate cloud hosting strategies.

- Vendor Lock-In– Vendor lock-in occurs when a business becomes too dependent on a single cloud hosting provider, limiting its flexibility to switch providers or adopt new technologies. While many cloud providers offer tools to mitigate lock-in, businesses must carefully plan their cloud strategy to avoid over-reliance on a single vendor.

What’s Next for Cloud Hosting- Key Emerging Trends:

As the market continues to grow, several trends are emerging that will shape its future trajectory-

- Hybrid and Multi-Cloud Strategies– Businesses are increasingly adopting hybrid and multi-cloud strategies, combining public and private cloud environments to optimize cost, performance, and security. Hybrid cloud allows companies to store sensitive data in a private cloud while taking advantage of the scalability of the public cloud for less sensitive workloads.

- Edge Computing– With the rise of Internet of Things (IoT) devices and the need for low-latency computing, edge computing is becoming a critical component of cloud hosting. By bringing computing resources closer to the data source, edge computing reduces latency, enhances real-time processing, and improves the overall performance of IoT applications.

- AI and Automation in Cloud Hosting– Artificial Intelligence (AI) and automation are transforming cloud hosting services. AI-powered cloud infrastructure can optimize resource allocation, predict maintenance needs, and enhance cybersecurity. Automation tools are also helping businesses manage their cloud environments more efficiently, reducing the need for manual intervention.

Conclusion- Making the Most of Cloud Hosting:

The cloud hosting industry is not just growing, it is evolving to meet the complex demands of modern businesses. With its scalable, secure, and cost-effective infrastructure, cloud hosting offers unparalleled opportunities for companies to innovate and stay competitive in an increasingly digital world. By understanding the benefits, challenges, and future trends, businesses can make informed decisions to maximize the potential of their cloud hosting strategies and drive long-term growth.

Author: Paribhasha Tiwari, Market Analyst and Content Curator

………………………………………………………………………………………………………………

References:

What is Cloud Hosting? Benefits and Risks

https://aws.amazon.com/what-is/cloud-hosting/

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

https://www.forbes.com/advisor/business/software/best-cloud-hosting/

AWS, Google, Microsoft, Oracle win $9B DoD cloud computing contract (JWCC)

The U.S. Department of Defense (DoD) finally revealed the awards for its revamped cloud contract “Joint Warfighting Cloud Capability (JWCC),” with Amazon Web Services (AWS), Microsoft, Google and Oracle collectively getting $9 billion to improve the agency’s IT operations. The contracts run through 2028 the Pentagon said in a news release.

JWCC is a multiple-award contract vehicle that will provide the DoD the opportunity to acquire commercial cloud capabilities and services directly from the commercial Cloud Service Providers (CSPs) at the speed of mission, at all classification levels, from headquarters to the tactical edge.

This Indefinite-Delivery, Indefinite-Quantity (IDIQ) contract vehicle offers commercial pricing, or better, and streamlined provisioning of cloud services. With JWCC, warfighters will now have the opportunity to acquire the following capabilities under one contract:

- global accessibility

- available and resilient services

- centralized management and distributed control

- ease of use

- commercial parity

- elastic computing, storage, and network infrastructure

- advanced data analytics

- fortified security

- tactical edge devices

To get started using JWCC or to learn more, visit to contact the Defense Information Systems Agency (DISA) Hosting and Compute Center (HaCC) or to log-in to the JWCC Customer Portal. DISA has developed user-friendly cloud accelerators to make it easier for DOD customers to purchase, provision, and onboard into the cloud.

Photo of the U.S. Pentagon/DoD

The decision to award contracts to four companies was a shift for the Pentagon, three years after it had given a $10 billion cloud-computing contract to Microsoft. That contract, for the Joint Enterprise Defense Infrastructure, known as JEDI, became part of a legal battle over claims that President Donald J. Trump interfered in a process that favored Microsoft over its rival bidder, Amazon. In 2021, the Defense Department said it would not move forward with the Microsoft contract, as it “was developed at a time when the department’s needs were different and our cloud conversancy less mature.”

Instead, the Pentagon said, it would seek bids from multiple technology companies for the Joint Warfighting Cloud Capability. While market research indicated that Microsoft and Amazon would be best positioned to meet the needs, officials said they would also reach out to IBM, Oracle and Google.

“This is the biggest cloud Beltway deal in history and was a key deal to win for all the software vendors in this multiyear soap opera,” Dan Ives, a tech analyst with Wedbush Securities, said in an email. “It’s good to finally end this chapter and get a cloud deal finally done for the Pentagon after years of a roller coaster,” he added.

An AWS spokesperson said in an email, “We are honored to have been selected for the Joint Warfighting Cloud Capability contract and look forward to continuing our support for the Department of Defense. From the enterprise to the tactical edge, we are ready to deliver industry-leading cloud services to enable the DoD to achieve its critical mission.”

References:

Cloud Computing Giants Growth Slows; Recession Looms, Layoffs Begin

Among the megatrends driving the technology industry, cloud computing has been a major force. But for the first time in its brief history, the cloud has grown stormy as third-quarter cloud giant earnings details made very clear:

- Amazon Web Services (AWS) fell short of the mark on both earnings and revenue. Reports say parent Amazon.com (AMZN) has frozen hiring at its cloud computing unit and will be laying off 10,000 employees.

- Microsoft’s (MSFT) Azure cloud business at posted an unexpected slowdown in cloud computing growth. At Microsoft, “Intelligent Cloud” revenue rose 24% to $25.7 billion during the company’s fiscal first quarter, including Azure’s 35% growth to $14.4 billion. Excluding the impact of currency exchange rates, Azure revenue climbed 42%

- Alphabet’s (GOOGL) Google Cloud business came in ahead of forecasts, but Oppenheimer analyst Tim Horan said in a note to clients that it has “no line of sight to meaningful profits.”

Note: We don’t consider Facebook/Meta Platforms a cloud service provider, even though they build the IT infrastructure for their cloud resident data centers. They are first and foremost a social network provider that’s now desperately trying to create a market for the Metaverse, which really does not exist and may never be!

In late October, Synergy Research reported that Amazon, Microsoft and Google combined had a 66% share of the worldwide cloud services market in the 3rd quarter, up from 61% a year ago. Alibaba and IBM placed fourth and fifth, respectively according to Synergy. In aggregate, all cloud service providers excluding the big three have tripled their revenues since late 2017, yet their collective market share has plunged from 50% to 34% as their growth rates remain far below the market leaders.

In 2022, capital spending on internet data centers by the three big cloud computing companies will jump a healthy 25% to $74 billion, estimates Dell’Oro Group. In 2023, spending on warehouse-size data centers packed with computer servers and data storage gear is expected to slow. Dell’Oro puts growth at just 7%, which would take the market up to $79 billion.

Oppenheimer’s Horan wrote, “Cloud providers remain very bullish on long-term trends, but investors have been surprised at how economically sensitive the sector is. “Sales cycles in cloud services have elongated and customers are looking to cut cloud spending by becoming more efficient. Despite the deceleration, cloud is now a $160 billion-plus industry. But investors will be concerned given this is our first real cloud recession, which makes forecasts difficult.”

“This macro slowdown clearly will impact all aspects of tech spending over the next 12 to 18 months. Cloud spending is not immune to the dark macro backdrop as seen during earnings season over the past few weeks,” Wedbush analyst Daniel Ives told Investor’s Business Daily via an email. “That said, we estimate 45% of workloads have moved to the cloud globally and (the share is) poised to hit 70% by 2025 in a massive $1 trillion shift. Enterprises will aggressively push to the cloud and we do not believe this near-term period takes that broader thesis off course. The near-term environment is more of a speed bump rather than a brick wall on the cloud transformation underway. Microsoft, Amazon, Google, IBM (IBM) and Oracle (ORCL) will be clear beneficiaries of this cloud shift over the coming years and will power through this Category 5 (hurricane) economic storm.”

Bank of America expects a boost from next-generation cloud services that cater to “edge computing.” Amazon, Microsoft and Google are “treating the edge as an extension of their public cloud,” said a BofA report. The giant cloud computing companies have all partnered with telecom firms AT&T (T), Verizon (VZ) and T-Mobile US (TMUS). Their aim to embed their cloud services within 5G wireless networks. “Telcos are leveraging the hyperscale cloud to launch their own edge compute businesses,” BofA said.

At BMO Capital Markets, analyst Keith Bachman says investors need to reset their expectations as the coronavirus pandemic eases. The corporate switch to working from home spurred demand for cloud services. Online shopping boomed. And consumers turned to internet video and online gaming for entertainment.

“We think many organizations accelerated the journey to the cloud as Covid and hybrid work requirements exposed weaknesses in existing on-premise IT capabilities,” Bachman said in a note. “While spend remains healthy in the cloud category, growth has decelerated for the past few quarters. We believe economic forces are at work as well as a slower pace of cloud migrations post-Covid.”

Market research heavyweight Gartner updated its global cloud computing growth forecast Oct. 31. The new forecast was completed before third-quarter earnings were released by Amazon, Microsoft and Google. Gartner forecasted worldwide end-user spending on public cloud services will grow 20.7% in 2023 to $591.8 billion. That’s up from 18.8% growth in 2022.

In a press release, Gartner analyst Sid Nag cautioned: “Organizations can only spend what they have. Cloud spending could decrease if overall IT budgets shrink, given that cloud continues to be the largest chunk of IT spend and proportionate budget growth.

AWS, Microsoft Azure and Google’s cloud computing units are all growing at an above-industry-average rate. Still, AWS and Azure are slowing, perhaps a bit due to size as well as the economy.

- At Wolfe Research, MSFT stock analyst Alex Zukin said in his note: “The damage in Microsoft’s case came from another Azure miss in the quarter, but the bigger surprise was the guide of 37%. That is the largest sequential growth deceleration on record.”

- Google’s cloud computing revenue rose 38% to $6.28 billion. That’s up 2% from the previous quarter and topped estimates from GOOGL stock analysts by 4%. However, the company reported an operating loss of $644 million for the cloud business versus a $699 million loss a year earlier. Hoping to take market share from bigger AWS and Microsoft’s Azure, Google has priced cloud services aggressively, analysts say. It also stepped up hiring and spending on data centers. And it acquired cybersecurity firm Mandiant for $5.4 billion.

- “Amazon noted it has seen an uptick in AWS customers focused on controlling costs and is working to help customers cost-optimize,” Amazon stock analyst Youssef Squali at Truist Securities said in a report to clients. “The company is also seeing slower growth from certain industries (financial services, mortgage and crypto sectors),” he added.

- Oppenheimer’s Horan estimates that AWS will produce $13.9 billion in free cash flow in 2022. But he sees Google’s cloud unit having $10.6 billion in negative free cash flow.

Nonetheless, Deutsche Bank analyst Brad Zelnick remains upbeat on the cloud computing business. He wrote in a research note:

“We see a temporary slowdown in bringing new workloads to the cloud, though importantly not a change in organizations’ long-term cloud ambitions. The near-term forces of optimization can obscure what we believe remain very supportive underlying trends. We remain confident that we are in the early innings of a generational shift to cloud.”

References:

The First Real Cloud Computing Recession Is Here — What It Means For Tech Stocks

Synergy: Q3 Cloud Spending Up Over $11 Billion YoY; Google Cloud gained market share in 3Q-2022

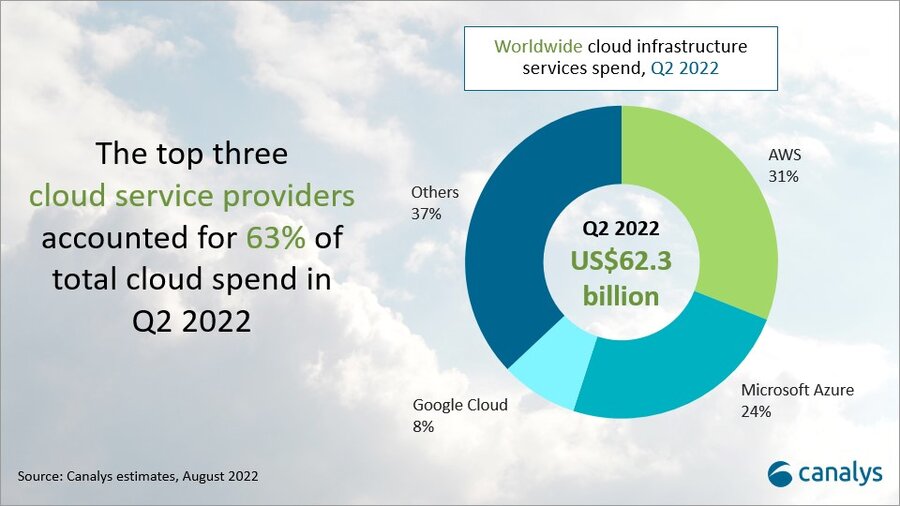

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

According to market research firm Canalys, cloud infrastructure services continued to be in high demand in Q2 2022. Worldwide cloud spending increased 33% year on year to US$62.3 billion, driven by a range of factors, including demand for data analytics and machine learning, data center consolidation, application migration, cloud-native development and service delivery. The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. The latest Canalys data shows expenditure was over US$6 billion more than in the previous quarter and US$15 billion more than in Q2 2021.

The top three vendors in Q2 2022, Amazon Web Services (AWS), Microsoft Azure and Google Cloud, together accounted for 63% of global spending in Q2 2022 and collectively grew 42%. The key to increasing global market share is continually growing and upgrading cloud data center infrastructure, which all big three cloud service providers are working on.

- AWS accounted for 31% of total cloud infrastructure services spend in Q2 2022, making it the leading cloud service provider. It grew 33% on an annual basis.

- Microsoft Azure was the second largest cloud service provider in Q2, with a 24% market share after growing 40% annually.

- Google Cloud grew 45% in the latest quarter and accounted for an 8% market share.

In the next year, AWS plans to launch 24 new availability zones in eight regions, and Microsoft plans to launch 10 new cloud regions. Google Cloud, which accounted for 8% of Q2 cloud spend, recently announced Latin America expansion plans.

The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival. Fueling this growth, Microsoft had a record number of larger multi-year deals in both the US$100 million-plus and US$1 billion-plus segments. Microsoft also said it plans to increase the efficiency of its server and network equipment by extending the depreciable useful life from four years to six.

A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS in the race to be #1 in cloud services.

“Cloud remains the strong growth segment in tech,” said Canalys VP Alex Smith. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure. AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.

“Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology,” said Smith. “This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

Beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”

Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact: Alex Smith: [email protected] OR Yi Zhang: [email protected]

References:

Oracle and Microsoft Enhance Interoperability of their Cloud Platforms (facilitating multi-cloud)

At Microsoft Inspire, an online event for Microsoft partners, Oracle and Microsoft announced a deeper interoperability of their cloud platforms which will permit customers to more easily run projects across their two cloud platforms. The new service connects Oracle’s database service directly to the Azure cloud, eliminating custom work that previously would have been required.

With the general availability of Oracle Database Service for Microsoft Azure, Microsoft Azure customers can easily provision, access, and monitor enterprise-grade Oracle Database services in Oracle Cloud Infrastructure (OCI) with a familiar experience. Users can migrate or build new applications on Azure and then connect to high-performance and high-availability managed Oracle Database services such as Autonomous Database running on OCI.

Years ago, many cloud providers tried to lock customers into a single platform, but that is no longer feasible as the cloud has become more central to operations. Customers typically use multiple clouds, and cloud platform providers such as Microsoft and Oracle are adapting to that multi-cloud environment. About two-thirds of enterprise-level companies use multiple clouds (AKA multi-cloud), according to a May 2021 report by Boston Consulting Group.

Since 2019, when Oracle and Microsoft partnered to deliver the Oracle Interconnect for Microsoft Azure, hundreds of organizations have used the secure and private interconnections in 11 global regions.

Microsoft and Oracle are extending this collaboration to further simplify the multicloud experience with Oracle Database Service for Microsoft Azure. Many joint customers, including some of the world’s largest corporations such as AT&T, Marriott International, Veritas and SGS, want to choose the best services across cloud providers to optimize performance, scalability, and the ability to accelerate their business modernization efforts. The Oracle Database Service for Microsoft Azure builds upon the core capabilities of the Oracle Interconnect for Azure and enables customers to more easily integrate workloads on Microsoft Azure with Oracle Database services on OCI. Customers are not charged for using the Oracle Database Service for Microsoft Azure or for the underlying network interconnection, data egress, or data ingress between Azure and OCI. Customers will pay only for the other Azure or Oracle services they consume, such as Azure Synapse or Oracle Autonomous Database.

“Over the last couple years we have had a lot of success with Oracle Interconnect for Microsoft Azure. And we also got a lot of customer feedback. And one of the things that customers (said) was, ‘Hey, it’s great you are working together, but we really would like a more integrated experience,’” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Microsoft and Oracle have a long history of working together to support the needs of our joint customers, and this partnership is an example of how we offer customer choice and flexibility as they digitally transform with cloud technology. Oracle’s decision to select Microsoft as its preferred partner deepens the relationship between our two companies and provides customers with the assurance of working with two industry leaders,” said Corey Sanders, corporate vice president, Microsoft Cloud for Industry and Global Expansion. “The ability to benefit from both clouds, and the flexibility, is a real win for customers,” Sanders added.

“There’s a well-known myth that you can’t run real applications across two clouds. We can now dispel that myth as we give Oracle and Microsoft customers the ability to easily test and demonstrate the value of combining Oracle databases with Azure applications. There is no need for deep skills on either of our platforms or complex configurations—anyone can use the Azure Portal to harness the power of our two clouds together,” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Multi-cloud takes on a whole new meaning with the launch of the Oracle Database Service for Microsoft Azure. This service, designed to provide intuitive, simple access to the Exadata Database Service and Autonomous Database to Azure users in a transparent manner, responds to the critical need of Azure and Oracle customers to apply the benefits of the latest in Oracle Database technology to their Azure workloads. This combined and interactive connection of services across public clouds sets the stage for what a multi-cloud experience should be, and is a bold statement about where the future of cloud is heading. It should deliver huge benefits for customers, developers, and the cloud services landscape overall,” said Carl Olofson, research vice president, Data Management Software, IDC.

With the new Oracle Database Service for Microsoft Azure, in just a few clicks users can connect their Azure subscriptions to their OCI tenancy. The service automatically configures everything required to link the two cloud environments and federates Azure Active Directory identities, making it easy for Azure customers to use the service. It also provides a familiar dashboard for Oracle Database Services on OCI using Azure terminology and monitoring with Azure Application Insights.

“Many of our mission-critical workloads are running Oracle databases on-premises at massive scale. As we move these workloads to the cloud, Oracle Database Service for Azure enables us to modernize these Oracle databases to services such as Autonomous Database in OCI while leveraging Microsoft Azure for the application tier,” said Jeremy Legg, chief technology officer, AT&T. Watch the video.

“Multi-cloud architectures enable us to choose the best cloud provider for each workload based on capabilities, performance, and price. The OCI and Azure partnership integrates the capabilities of two major cloud providers, including the Oracle Database services in OCI and Azure’s application development capabilities,” said Naveen Manga, chief technology officer, Marriott International. Watch the video.

“Oracle Database Service for Microsoft Azure has simplified the use of a multicloud environment for data analytics. We were able to easily ingest large volumes of data hosted by Oracle Exadata Database Service on OCI to Azure Data Factory where we are using Azure Synapse for analysis,” said Jane Zhu, senior vice president and chief information officer, Corporate Operations, Veritas.

“Oracle Database Service for Microsoft Azure simplifies our multi-cloud approach. We’re going to be able to leverage the best of Oracle databases in Azure, and we are going to be able to keep our infrastructure in Azure. This is a great opportunity to have the best of the two worlds that eases our migration to the cloud and improves the skills of our people in IT,” said David Plaza, chief information officer, SGS. Watch the video.

References:

https://www.oracle.com/bd/news/announcement/oracle-database-service-for-microsoft-azure-2022-07-20/

https://www.spiceworks.com/tech/cloud/articles/multi-cloud-vs-hybrid-cloud/

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multi-cloud and hybrid cloud environments. DIsh is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

The worldwide public cloud services market, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service – System Infrastructure Software (SaaS – SIS), and Software as a Service – Applications, grew 29.0% year over year in 2021 with revenues totaling $408.6 billion, according to the International Data Corporation (IDC) Worldwide Semiannual Public Cloud Services Tracker.

Spending continued to consolidate in 2021 with the combined revenue of the top 5 public cloud service providers (Microsoft, Amazon Web Services, Salesforce Inc., Google, and SAP) capturing nearly 40% of the worldwide total and growing 36.6% year over year. With offerings in all four deployment categories, Microsoft captured the top position in the overall public cloud services market with 14.4% share in 2021, followed closely by Amazon Web Services with 13.7% share.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” said Rick Villars, group vice president, Worldwide Research at IDC. “For the next several years, leading cloud providers will play a critical role in helping enterprises navigate the current storms of disruption (inflation, supply chain, and geopolitical tensions), but IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services.”

While the overall public cloud services market grew 29.0% in 2021, revenue for foundational cloud services* that support digital-first strategies saw revenue growth of 38.5%. This highlights the increasing reliance of enterprises on a cloud innovation platform built around widely deployed compute services, data/AI services, and app framework services to drive innovation. IDC expects spending on foundational cloud services (especially IaaS and PaaS elements) to continue growing at a higher rate than the overall cloud market as enterprises leverage cloud to overcome the current disruptions and accelerate their shift toward digital business.

“The last few years have demonstrated that in challenging times, businesses increasingly rely on cloud services to modernize their operations and deliver more value to customers,” said Dave McCarthy, research vice president, Cloud and Edge Infrastructure Services. “This trend is expected to continue as public cloud providers offer more ways of extending cloud services to on-premises datacenters and edge locations. These expanded deployment options reduce many barriers to migration and will facilitate the next wave of cloud adoption.”

“In the digital-first world, enterprises that are serious about competing for the long term use the lens of business outcomes to evaluate strategic technology decisions, which fuels the fast-growing ecosystem seen in the public cloud market,” said Lara Greden, research director, Platform as a Service, IDC. “Cloud service providers showed relentless drive to enhance the productivity of developers and overall speed of application delivery, including emphasis on containers-first and serverless-first approaches.”

“SaaS applications remain the largest and most mature segment of public cloud, with 2021 revenues that have now reached $177 billion. The tailwinds of the pandemic continued to fuel expedited upgrades and replacements of older systems in 2021, though company goals haven’t changed. Companies seek applications that will help increase enterprise intelligence, improve operational efficiency, and drive better decision making. Ease of use, ease of implementation and integration, streamlined workflows, data and analytical accessibility, and time to value are the key criteria driving purchasing decisions, though verticalization has also steadily increased as a key priority,” said Eric Newmark, group vice president and general manager of IDC’s SaaS, Enterprise Software, and Worldwide Services division.

| Worldwide Public Cloud Services Revenue and Year-over-Year Growth, Calendar Year 2021 (revenues in US$ billions) | |||||

| Deployment Category | 2021 Revenue | Market Share | 2020 Revenue | Market Share | Year-over-Year Growth |

| IaaS | $91.3 | 22.4% | $67.3 | 21.3% | 35.6% |

| PaaS | $68.2 | 16.7% | $49.1 | 15.5% | 39.1% |

| SaaS – Applications | $177.8 | 43.5% | $143.9 | 45.4% | 23.5% |

| SaaS – System Infrastructure Software | $71.2 | 17.4% | $56.4 | 17.8% | 26.4% |

| Total | $408.6 | 100% | $316.7 | 100% | 29.0% |

| Source: IDC Worldwide Semiannual Public Cloud Services Tracker, 2H 2021 | |||||

While both the foundational cloud services market and the SaaS – Applications market are led by a small number of companies, there continues to be a healthy long tail of companies delivering cloud services around the globe. In the foundational cloud services market, these leading companies account for nearly three quarters of the market’s revenues with targeted use case-specific PaaS services or cross-cloud compute, data, or network governance services. The long tail is more pronounced in the SaaS– Applications market, where customers’ growing focus on specific outcomes ensures that over two thirds of the spending is captured outside the top 5.

Analysis:

We remain SUPER SKEPTICAL about IDC’s claim that Microsoft beat out cloud rival Amazon Web Services (AWS) in capturing the largest share of global public cloud services revenue last year. That conflicts with all our other resource checks!!!

IDC reported that Microsoft accumulated 14.4% of the market’s $408.6 billion in revenues last year, just a whisker ahead of the 13.7% that AWS snared. Microsoft has offerings in all four sections of the public cloud services market lumped by IDC into its report, including infrastructure as a service (IaaS), platform as a service (PaaS), system infrastructure SaaS, and application SaaS.

Salesforce, Google, and SAP rounded out the top five in IDC’s ranking, with those vendors capturing 40% of the total market. Overall market revenues increased 29% compared to the previous year.

SaaS applications brought in the most cloud services revenue with $177.8 billion, representing 23.5% growth from the year prior. IaaS accounted for $91.3 billion of revenue, followed by system infrastructure SaaS and PaaS.

Of the categories comprising IDC’s public cloud foundational services, PaaS saw the highest year-over-year growth at 39.1%, though it brought in the least 2021 revenue at $68.2 billion.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” IDC VP Rick Villars said in a statement.

In an increasingly digital world, enterprises that are truly thinking ahead use a business outcomes lens to make strategic decisions, and this is what fuels public cloud ecosystem growth, IDC PaaS Research Director Lara Greden explained.

Cloud service providers played their part in that growth this year with a “relentless drive” to improve developer productivity and speed of application delivery, “including emphasis on containers-first and serverless-first approaches,” she added.

Villars expects these cloud giants will continue to have a crucial role in helping enterprises solve persistent market challenges like supply chain disruption, inflation, and geopolitical tension.

“IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services,” Villars added.

……………………………………………………………………………………………………………………………………..

* Note: IDC defines Foundational Cloud Services as the Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service – System Infrastructure Software (SaaS – SIS) market segments where the top eight public cloud services providers (Amazon Web Services, Microsoft, Google, Alibaba Group, IBM, Tencent, Huawei, and Oracle) account for most of the revenue. These include the following key service portfolios:

- Compute Services: Virtualized x86 Compute, Bare Metal Compute, Block Storage, Accelerated Compute, Other Compute, and Software-Defined Compute Software.

- Data Services: Data Management Systems, Object Storage, File Storage, and Event Stream Processing Software.

- App Framework Services: Developer-centric software to develop and deploy applications in the cloud, including lifecycle management. These services include Integration Software, Deployment-Centric Application Platforms, and AI Lifecycle Software.

- Usage Multiplier Services: Services that encourage greater/more effective use of high value services by making it easier to adopt, connect, deploy, track, secure, and update those services. Includes load balancing and DNS as well as marketplaces and bundles of open-source software solutions.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49420022

IDC’s New Public Cloud Numbers: Microsoft Azure Edged Out AWS in 2021

IDC: Microsoft Azure now tied with AWS as top global cloud services provider