Ericsson

Vodafone Germany deploys Ericsson 5G radio to cut energy use up to 40%

Vodafone Germany has partnered with Ericsson to deploy new power-saving radio technology on its 5G network. The radio unit 6646 bundles three different frequencies (900, 800 and 700 MHz) and radio cells in one system in the control center located at the bottom of a mobile base station. By bundling the active technology, 5G base stations function with 32-40% less power.

The advantage of mobile radio stations with area frequencies is that they provide particularly large areas with stable and reliable mobile radio coverage. By bundling the active technology of different frequency ranges and several radio cells in one unit, they now require between 32 and 40 percent less energy, according to trials on the Vodafone network. Following successful tests in the North Rhine-Westphalia (NRW) region, the telecommunications group is now successively activating the technology in the live network together with its technology partner Ericsson.

The new energy-saving radio from Ericsson has been intensively tested in the live network in Wachtendonk in the Lower Rhine region over the past few weeks. The positive test results demonstrate an energy-saving potential of up to 40 percent per 5G base station and are the reason for today’s large-scale rollout. The new technology will be installed and automatically activated in NRW, Rhineland-Palatinate, Hesse, Saarland and Baden-Württemberg during routine maintenance and modernization work.

Test results on the Vodafone network show that energy requirements can be reduced by more than 2,500 kilowatt hours (kWh) per mobile phone site per year by bundling the active technology. This is roughly equivalent to the annual energy requirement of a two-person household per mobile phone station. If the technology is activated on a large scale in the network, significantly more than 30 million kilowatt hours of electricity can be saved each year. At the same time, stable and reliable network coverage will also be strengthened in rural regions.

Vodafone Germany CEO Philippe Rogge, says: “For the first time, we are bundling the active antenna technology of different area frequencies in mobile communications. This is good for smartphone users in rural areas and good for our planet. Because with the new technology, we are bringing fast and reliable 5G networks even better to people in rural areas and deep into buildings. At the same time, we are reducing the energy requirements of our mobile phone antennas. We expect to be able to save more than 30 million kilowatt hours of electricity per year with large-scale activation in our network.”

Daniel Leimbach, Head of Western Europe at Ericsson, says: “Energy consumption reduced by up to 40 percent, weight reduced by 60 percent – around a year ago, we celebrated a world premiere at the launch of the Radio 6646 at the Eurolab in Aachen. At the Imagine Live Innovation Day in the research and development center, our experts presented the innovative 5G technology for the first time. We are all the more pleased that Vodafone is convinced of its performance and energy efficiency and is installing the technology in the area. Because only innovations that are scalable, economical and powerful at the same time deliver the full benefits for mobile customers and sustainability.

The technology in Ericsson’s new radio:

Ericsson’s new remote radio combines the different 5G area frequencies 900, 800 and 700 MHz as well as the components of several radio cells into one compact system in a more sustainable way. By bundling three frequencies and several radio cells, the transmission technology consumes significantly less energy for each individual frequency range at full power. In addition, the new radio is 60 percent lighter and therefore requires less energy and material in the manufacturing process.

On the way to CO2 neutrality:

The new antenna product is another building block on Vodafone’s path to becoming more sustainable step by step. The Düsseldorf-based company has set itself specific targets to be CO2-neutral by 2025. The network is the biggest and most important lever here. Vodafone Germany has therefore been sourcing 100 percent of its electricity from renewable sources since 2020. It is also constantly testing new technologies and solutions to make the German mobile network more sustainable and conserve resources. For example, the dynamic energy-saving mode in the mobile network has already been ensuring an intelligent adjustment between actual energy demand and consumption around the clock for over a year.

………………………………………………………………………………………………………………………………..

References:

Ericsson and Vodafone deploy new energy-efficient, light 5G radio in London

Ericsson and U.S. PAWR 5G SA network for rural agricultural research

TDC NET with Ericsson launch first 5G Standalone network in Denmark

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

Ericsson announces 5G standalone NR software and 2 new Massive MIMO radios

Ericsson, Vodafone and Qualcomm: 1st Reduced Capability 5G data call in Europe

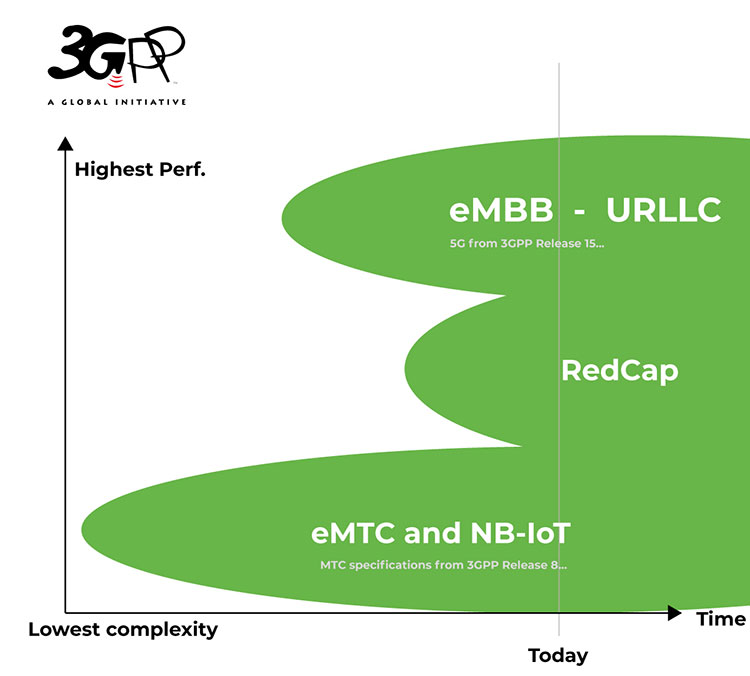

Ericsson, Vodafone and Qualcomm have demonstrated the first RAN Reduced Capability (RedCap) [1.] 5G data sessions on a European network, paving the way for a multitude of IoT and other connected devices to transmit data more simply and efficiently.

Note 1. 3GPP RedCap is a variation of 5G technology that was introduced in 3GPP Release 17 in mid-2022 and will be included in ITU-R M.2150-1. It provides reduced capability 5G New Radio (NR) devices for the mid-range segment. RedCap NR features include: Reduced UE complexity Fewer RX/TX antennas Reduced UE bandwidth use Lower UE power consumption Relaxed data rates Relaxed UE processing time and processing capability RedCap’s speeds, latency, and spectrum use are similar to advanced LTE capabilities. It’s considered the 5G heir to LTE Cat-4, with speeds of tens to hundreds of Mbps.

……………………………………………………………………………………………………………………………

The successful demo took place on 21 September 2023 in the Spanish city of Ciudad Real, running on Ericsson’s RedCap RAN software using Vodafone Spain’s live testing 5G network ‘CREATE’ (Ciudad Real España Advanced Testing Environment).

RedCap enables connectivity for simpler device types, allowing many more devices to connect to 5G networks and transmit data at low power and lower cost, enhancing existing 5G use cases and unlocking new ones. These advantages apply to many different devices, from consumer wearables such as smartwatches to a wide range of IoT devices like smart water meters.

The technology, called New Radio Light (NR-Light), works with less complex devices that can be smaller, more cost-efficient, and enjoy longer battery life than traditional mobile broadband devices. NR-Light can also complement the network APIs developed by Vodafone for its customers to extend the battery life of their devices.

The joint demonstration in Spain leveraged the Qualcomm Snapdragon® X35 platform, the world’s first NR-Light modem RF. The Snapdragon X35 platform bridges the complexity gap between high-speed mobile broadband devices, and low-bandwidth, low-power devices. The demo is part of preparations for the introduction of Snapdragon-based commercial devices which are expected in 2024.

“This successful demonstration is an exciting moment for OEMs, network operators and network users, because it highlights a clear path to new devices and commercial use cases,” said Dino Flore, Vice President, Technology, Qualcomm Europe Inc. “The use of commercial 5G networks for lower-bandwidth applications is an important milestone, not least because this offers a migratory path for low-power devices with a 5G architecture, which also draws on the current and future benefits offered by 5G standalone (5G SA). We will continue to work with customers, industry and our partners to accelerate the creation of 5G devices which present exciting new use cases for enterprises and consumers.”

“Vodafone is able to continually evolve and improve its network for customers by being first to test the latest technologies. We are delighted that our unique multi-vendor 5G network, CREATE, was able to host and validate such an innovative trial in collaboration with Qualcomm and Ericsson,” said Francisco Martín, Head of Open RAN, Vodafone. “The results show that networks will be able to support many more energy efficient connected devices in the future.”

“We are very happy to be partnering with Vodafone and Qualcomm to perform Europe’s first 5G Reduced Capability data call,” said Isidro Nieto, Global Customer Unit Vodafone, Head of Technology Networks, Ericsson. “5G Redcap opens up new use cases for both enterprise and consumer segments such as industrial sensors, lower cost 5G routers as well as wearables. Ericsson embraces new ways to fully realize the value of 5G services and this joint demo shows that that the support for RedCap is gaining market momentum.”

…………………………………………………………………………………………………………………………..

Earlier this year, Juniper Research said the number of 5G IoT roaming connections will reach 142 million by 2027, up from just 15 million this year. IoT will account for 27% of all 5G roaming connections in four years time.

References:

https://www.3gpp.org/technologies/redcap

https://www.techradar.com/pro/iot-is-set-to-push-5g-connections-into-the-billions

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

Ericsson’s India 6G Research Program at its Chennai R&D Center

Today at the India Mobile Congress 2023, Ericsson announced the launch of its ‘India 6G‘ program with the establishment of an India 6G Research team at its Chennai R&D Center. Ericsson stated that the ‘India 6G’ team consists of senior research members and a team of experienced researchers in Radio, Networks, AI, and Cloud. They have been tasked with developing fundamental solutions for the future.

The India Research team, in collaboration with Ericsson research teams in Sweden and the US, will work together to develop the technology that will enable the delivery of a cyber-physical continuum. In this continuum, networks will provide critical services, immersive communications, and omnipresent IoT, all while ensuring the integrity of the delivered information.

The 6G Research team in India, in collaboration with Ericsson Global Research teams, will develop novel solutions. The teams are working on various projects, including Channel Modelling and Hybrid Beamforming, Low-energy Networks, Cloud Evolution and Sustainable Computing, Trustworthy, Explainable, and Bias-Free AI algorithms, Autonomous Agents for Intent Management Functions, Integrated Sensing and Communication Functions for the Man-Machine Continuum, and Compute Offload to Edge-Computing Cloud, among others.

“By establishing a dedicated 6G research team for in-country research, contextual to India’s need and collaborating with the world class research programs across international research labs, we look forward to incorporating the needs of India into the mainstream of telecommunication technology evolution. “stated Magnus Frodigh, Head of Research at Ericsson.

Ericsson says it is partnering with premier institutes in India for Radio, AI and Cloud Research. The company said, “AI Research is of high importance to Ericsson as the 6G networks would be autonomously driven by AI algorithms. Ericsson is also looking to partner with other premier engineering institutes in India for 6G related research.”

The Centre for Responsible AI is an interdisciplinary research centre that envisions becoming a premier research centre for both fundamental and applied research in Responsible AI with immediate impact in deploying AI systems in the Indian ecosystem. AI Research is of high importance to Ericsson as the 6G networks would be autonomously driven by AI algorithms. Ericsson is also looking to partner with other premier engineering institutes in India for 6G related research.

Ericsson in India:

Ericsson is reportedly partnering with Communication Service Providers, Bharti Airtel, and Reliance Jio to deploy 5G in the country.

According to the statement, Ericsson has been present in India since 1903, and the Ericsson Research team was established in 2010. With the establishment of 6G Research in India, Ericsson looks forward to playing a key role in advancing this technology in the country.

The company has three R&D centres in India, located in Chennai, Bengaluru, and Gurgaon.

References:

https://www.ericsson.com/en/press-releases/2/2023/10/ericsson-initiates-india-6g-program-in-india

https://telecomtalk.info/ericsson-announces-india-6g-program-at-imc2023/889172/

India unveils Bharat 6G vision document, launches 6G research and development testbed

Enable-6G: Yet another 6G R&D effort spearheaded by Telefónica de España

Nokia to open 5G and 6G research lab in Amadora, Portugal

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

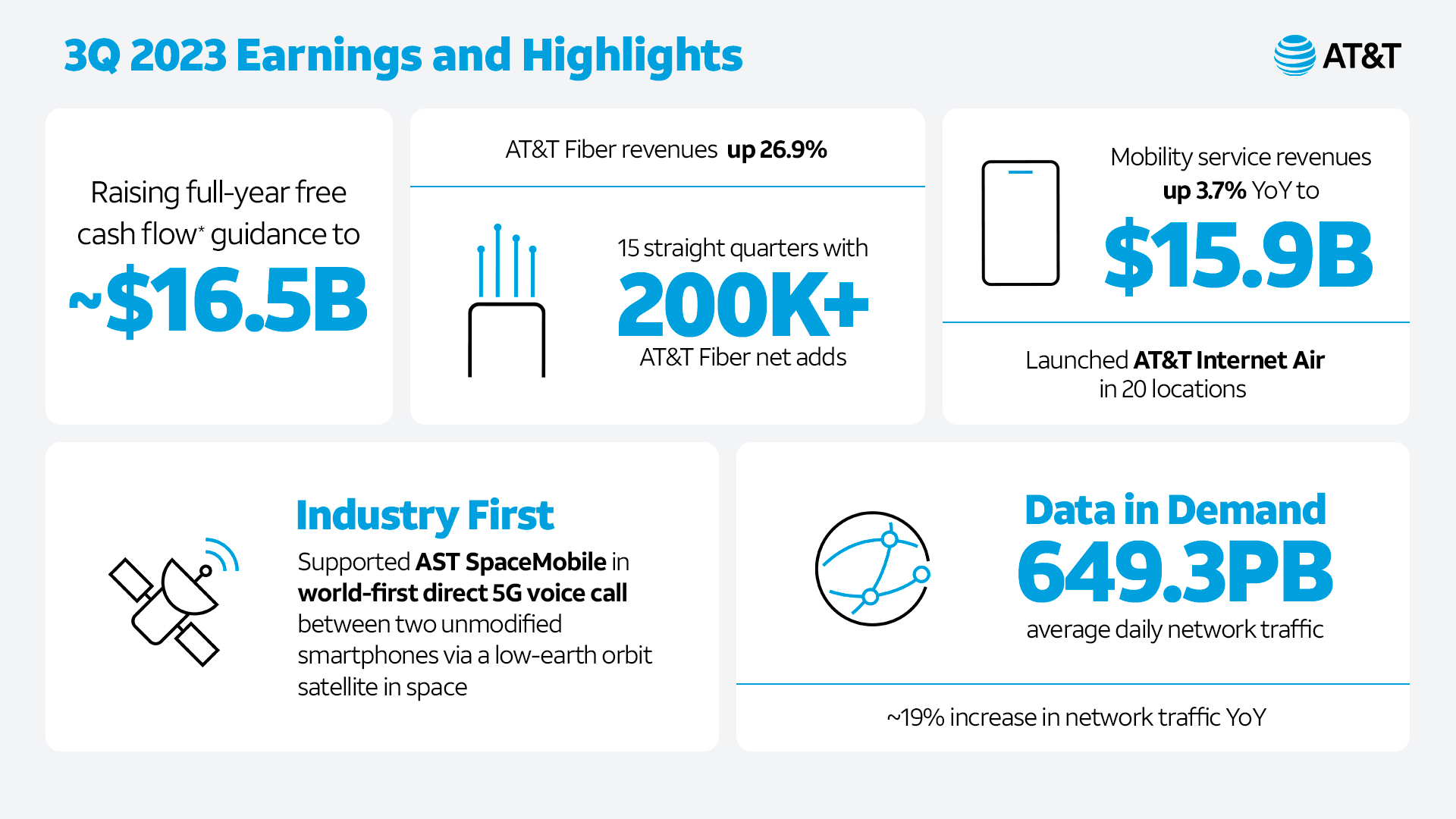

As we have repeatedly stated, the entire telecom industry is in a funk and the 2024 outlook is looks just as gloomy as this year. MTN claims that telecom is a zero growth industry (see References below) and that certainly seems to be true. Let’s start with AT&T – the largest telco in the U.S. with 229.2M wireless subscribers as of Q2-2022.

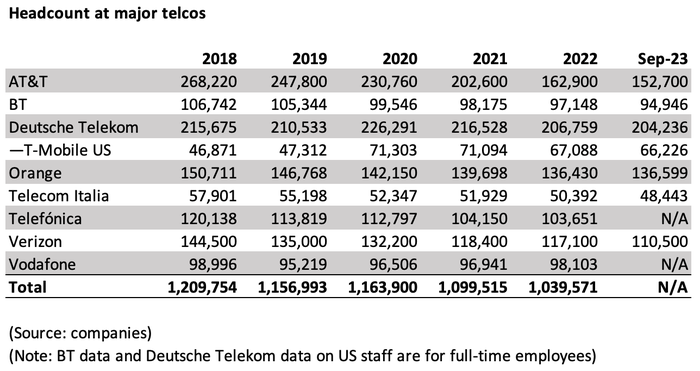

In the first nine months of 2023, AT&T has shed 10,200 employees, including nearly 4,000 in the recent third quarter alone. AT&T cut many more jobs – 39,700 in total – in 2022 when it was in the process of spinning out Warner Media to Warner Brothers Discovery (the deal closed on April 8, 2022).

AT&T’s CEO told reporters last week that the U.S. based teclo plans to reduce costs by another $2 billion over the next three years. That’s after Stankey boasted that the company has cut costs by $6 billion in the last three and in an “inflationary environment.”

AT&T is hardly a growth company and has tons of debt. In the 3rd quarter of 2023, AT&T reported revenues of $30.4 billion, up only 1% year over year. Yet Stankey had the audacity to say in a press release, “Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance.”

Today, LightReading announced the departure of a key AT&T executive. Jason Inskeep, previously the senior assistant VP for AT&T’s 5G Center of Excellence and focusing on the operator’s work in private wireless networking and edge computing, recently left the company for a senior director position at consulting firm Slalom.

Iain Morris of LightReading wrote on October 20th, “The future AT&T is conceivably a cohort of antenna-carrying robots, some AI that writes code and Stankey with his feet up on the table, providing the only whiff of humanity.”

AT&T is not the only U.S. telco reducing its workforce. Earlier this year, T-Mobile announced that it will be laying off ~5,000 workers or around 7% of its workforce. This latest job cutting move will primarily impact employees in corporate, back-office, and technology roles, while those in retail or customer care positions will not be affected.

……………………………………………………………………………………………………………………………….

Network Equipment Vendors Layoffs and Gloomy Outlook:

Last week, Nokia said the company plans to cut at least 9,000 jobs and as many as 14,000 over the next three years. That’s mainly due to weak 5G equipment demand. Nokia CEO Pekka Lundmark told reporters that Nokia’s sales have plummeted in North America (sales were down 40%) and that India’s 5G rollout is now slowing down as expected.

Over the next three years, his latest target is to reduce annual costs by between €800 million (US$843 million) and €1.2 billion ($1.3 billion). It’s a move that will reduce Nokia’s headcount by at least 9,000 roles from its current level of roughly 86,000. And at the upper end of the range, it will see an exodus of 14,000 employees, more than 16% of the total.

Ericsson CEO Borje Ekholm cautioned of persistent macroeconomic uncertainty into 2024 which it expects will impact customers’ investment ability, as the wireless network equipment vendor reported a year-on-year net loss of SEK30.5 billion ($2.8 billion) from net income of SEK5.4 billion in Q2 2022, due to a SEK32 billion charge related to the acquisition of cloud company Vonage in 2022. In February, Reuters reported that Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, a memo sent to employees.

……………………………………………………………………………………………………………………..

Semiconductor Layoffs:

Wireless network chip maker Qualcomm is slashing 1,258 jobs in California, including nearly 200 in the Bay Area, in the latest tech layoffs to hit the region. Qualcomm said in state filings that it will lay off approximately 194 workers in its Santa Clara offices and another 1,094 employees at its San Diego headquarters. The cuts are slated to begin Dec. 13th, based on a notice submitted to state officials this week. The job cuts represent roughly 2.5% of Qualcomm’s workforce and mark the second round of layoffs for the wireless semiconductor company this year.

The Qualcomm layoff news comes about a month after the company announced a deal with Apple to provide 5G chips through at least 2026. Qualcomm is also the chip supplier for the newly announced Meta Quest 3. It is only 1 of 2 companies that sell 5G end point silicon on the merchant market (Taiwan based MediaTek is the other one).

It’s not a pretty picture to say the least for telecom industry employees.

References:

https://www.lightreading.com/ai-machine-learning/at-t-seems-on-a-mission-to-be-a-zero-employee-telco

https://www.lightreading.com/private-networks/at-t-s-private-wireless-chief-departs

https://about.att.com/story/2023/q3-earnings.html

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

High Tech Layoffs Explained: The End of the Free Money Party

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

Ericsson and Google Cloud expand partnership with Cloud RAN solution

Ericsson has announced an expansion of its successful and long-standing partnership with Google Cloud to develop an Ericsson Cloud RAN solution on Google Distributed Cloud (GDC) [1.] that offers integrated automation and orchestration and leverages AI/ML for additional communications service providers (CSP) benefits. The companies have successfully demonstrated the full implementation of the Ericsson vDU and vCU on GDC Edge and the solution is running live in the Ericsson Open Lab in Ottawa, Canada, with joint ambition for market development.

Note 1. GDC is a portfolio of fully managed hardware and software solutions which extends Google Cloud’s infrastructure and services to the edge and into your data centers.

Deploying Ericsson Cloud RAN on GDC Edge enables the delivery of a fully automated and very large-scale distributed cloud, resulting in an efficient, reliable, highly performant and secured software centric radio access network infrastructure. In this setup, the on-premises GDC Edge is managed using functions such as fleet management from the public cloud through a dedicated secure connection between on-prem hardware and the cloud, while also addressing sovereignty and privacy requirements of the CSP customers. This architecture ensures the clear path for CSPs toward the implementation of a fully hybrid cloud solution for RAN.

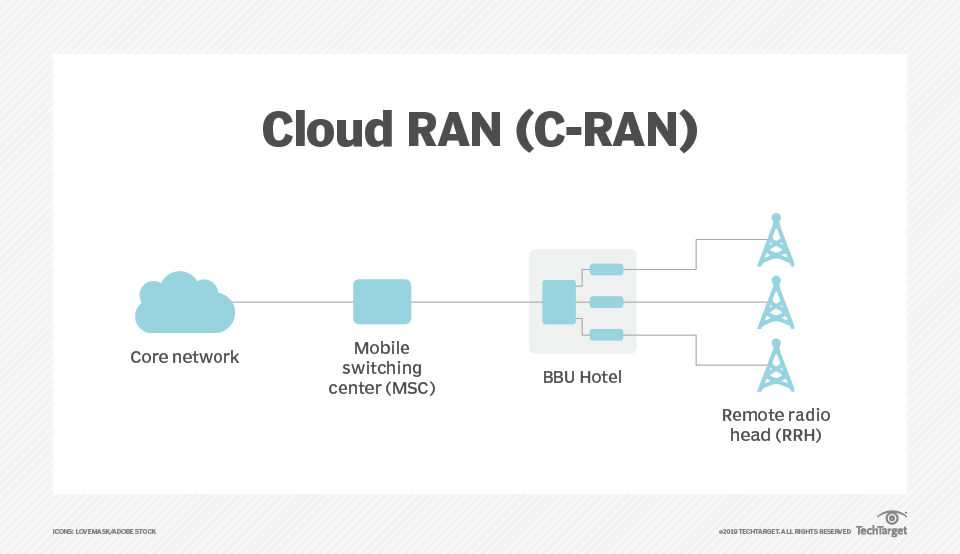

Cloud RAN comprises a mobile switching center, a BBU hotel and a remote radio head

C-RAN networks comprise three primary components:

- A BBU hotel. This is a centralized site that functions as a data or processing center. Individual units can stack together without direct linkage or interconnect to dynamically allocate resources based on network needs. Communication between units has high bandwidth and low latency.

- A remote radio unit (RRU) network. Also known as a remote radio head, an RRU is a traditional network that connects wireless devices to access points.

- A fronthaul or transport network. Also known as a mobile switching center, a fronthaul or transport network is the connection layer between a BBU and a set of RRUs that use optical fiber, cellular or mmWave communication.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Running Ericsson Cloud RAN on GDC Edge will enable CSPs to utilize Google Cloud Vertex AI, BigQuery and other cloud services, to improve the usability of the massive data sets being provided by Cloud RAN applications. This in turn, will open a number of opportunities for CSPs to control, inspect, configure, and optimize their RAN infrastructure.

Ericsson Cloud RAN provides CSPs additional choice for creating networks based on open standards and interfaces using multiple vendors. The Ericsson Cloud RAN solution is infrastructure agnostic, allowing RAN applications to be deployed on any infrastructure chosen by the CSP. Ericsson is continuously collaborating with ecosystem partners and adapting its Cloud RAN applications to work on different infrastructures and configurations.

To further a cloud-native automation approach to network workloads, Ericsson and Google Cloud are jointly enhancing the solution through the Linux Foundation open-source project Nephio (a Kubernetes-based automation platform for deploying and managing highly distributed, interconnected workloads such as 5G network functions), where we jointly drive standardization of critical functionality.

Mårten Lerner, Head of Product Line Cloud RAN, Ericsson, says: “This partnership enables us to deepen and expand our valuable collaboration with Google Cloud, and it opens new opportunities for operators to utilize the benefits of cloud-native solutions and automation. Ericsson remains committed to ensuring the adaptability of its Cloud RAN applications on diverse cloud infrastructures, offering operators enhanced flexibility and choice in deploying Cloud RAN as well as supporting the evolving hybrid cloud architectures together with Google Cloud.”

Gabriele Di Piazza, Senior Director, Telecom Products, Google Cloud, says:

“We’re proud to enable Ericsson Cloud RAN to run on Google Distributed Cloud Edge infrastructure, which includes access to our AI/ML capabilities as well as cloud-native automations. We’re delighted to recognize Ericsson as a distinguished Google Cloud Partner and look forward to a continued strong partnership in support of our mutual customers.”

https://www.techtarget.com/searchnetworking/definition/cloud-radio-access-network-C-RAN

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

Vodafone Trials Nokia’s Cloud RAN; Other 5G Research Partnerships

Nokia launches anyRAN to drive CloudRAN partnerships for mobile network operators and enterprises

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Ericsson and U.S. PAWR 5G SA network for rural agricultural research

Ericsson in cooperation with the U.S. National Science Foundation’s (NSF) Platforms for Advanced Wireless Research (PAWR) program announced the launch of its 5G SA network for public research together with the Agriculture and Rural Communities (ARA) team at Iowa State University (ISU). Powered by Ericsson, the network is part of ARA’s multi-modal platform for wireless research, based on the ISU campus with coverage extending to local crop and livestock farms and parts of the city of Ames.

The Ericsson-powered 5G SA network will be used to support precision agriculture applications, along with other research initiatives, and is already connecting farm sites that previously had little to no broadband access. ARA is partnering with the ISU Department of Agriculture and Biosystems Engineering as well as the College of Agriculture of Life Sciences for initial precision agriculture research projects.

Ericsson and PAWR light up 5G network for rural agricultural research

Image Credit: Ericsson

“As we continue to unlock 5G’s full potential, we’re excited to support ARA’s cutting-edge research on precision agriculture, rural broadband, renewable energy, and public safety for smart and connected rural communities,” said Per Wahlen, Vice President and Head of Business Development, Ericsson North America.

Sample agriculture research will include using connected robots (PhenoBots) to collect plant phenotyping data with stereoscopic cameras generating 800 megabits per second worth of sensor data per camera. It will also include livestock monitoring with high-resolution cameras, as well as agriculture automation.

The Ericsson-powered network consists of a 5G core operating in SA mode and NR radios which operate in both mid-band and millimeter wave spectrum bands with a high aggregate throughput up to 3Gbps. The outdoor network will run 5G SA with mid and high band New Radio-Dual Connectivity (NR-DC) with a downlink exceeding 2.5Gbps in outdoor live testing. With ultra-low latency, increased capacity and coverage, and support for end-to-end network slicing, Ericsson’s 5G SA solutions ensure instant response times and enable new use cases.

ARA is part of the National Science Foundation-funded Platforms for Advanced Wireless Research (PAWR) program that works to create wireless testbeds through public-private partnerships to accelerate the nation’s wireless ecosystem.

“As ARA aims to help close the gap between academic and industry research in the wireless and agricultural sectors, we’re excited to announce the Ericsson network component, which is open for joint opportunities for both academic and industry research endeavors,” said Hongwei Zhang, Principal Investigator of ARA and Director of the Center for Wireless, Communities and Innovation, Iowa State University.

Andrew Wooden of telecoms.com wrote:

The concept of the smart farm – like the smart city – made up part of the hype fodder for the initial 5G launch. Since 5G SA is considered ‘proper’ 5G the line seems to now be that it will be the required driving force behind all sorts of industries being revolutionised by high bandwidth and low latency mobile connectivity.

How large a commercial market applications like this represents for kit vendors like Ericsson in the near future remains to be seen, but if it does represent a teaser of how food can be grown better or more abundantly – as is presumably the end goal – we can think of much more frivolous use cases presented over the years.

These 5G SA networks my play an important role in the future of the U.S. agricultural ecosystem. ARA and Ericsson are in forward-leaning positions to support the realization of recently proposed bipartisan legislation surrounding the issue of broadband access to unserved rural farms, through applied research and innovative use case development to assist farmers and rural communities.

TDC NET with Ericsson launch first 5G Standalone network in Denmark

Danish digital infrastructure provider TDC NET, together with Ericsson, have launched the first 5G Standalone (5G SA) network in Denmark. The transition to high-performance 5G SA technology will enhance the regional 5G ecosystem, accelerate innovation across industries, and unlock exciting possibilities for consumers.

In September 2020, TDC NET went live with the first non-standalone (NSA) 5G network in Denmark, which worked alongside the existing 4G infrastructure provided by Ericsson.

Ericsson press release states: “This milestone signifies a monumental leap forward in connectivity, enabling transformative advancements and placing Denmark at the forefront of technological progress.”

“A 5G Standalone network provides lower latency, higher efficiency, better spectrum utilization, more reliable connectivity, and lower device battery consumption than other networks. It unlocks more use cases for consumers, critical IoT, enterprises and industrial automation. 5G SA also facilitates network slicing benefits for multiple customer segments, offering an infrastructure for businesses to enable, for instance, smart manufacturing and IoT-driven innovation, while giving consumers better and more consistent service experience. It is also a big step forward for communications service providers as it enables a more flexible approach to service creation and provision for subscribers.”

–>Those are all nice features but do any of them represent a monumental leap forward? 5G SA, aka true 5G (vs fake 5G=5G NSA=4G infrastructure/core with a 5G NR RAN) has yet to prove that in its limited global deployments. Where are the new 5G SA revenue streams?

Jakob Dirksen CTO of TDC NET, says: “We were the first to introduce 5G in Denmark and now we are taking the next big step by switching on 5G Standalone. This will offer consumers, enterprises and industries enhanced efficiency, safety, and a range of opportunities across everything from self-driving cars, remote work, healthcare, as well as mission-critical operations by authorities. In addition, 5G Standalone will also enable energy efficiency improvements thanks to more data being transmitted with the same amount of energy and faster access to content.”

One of the key benefits of 5G SA will be improved speed capabilities. Over a 5G SA network, TDC NET and Ericsson have already achieved an impressive 7Gbps downlink peak throughput in a live site environment that has been equipped with Ericsson Radio System products supporting millimeter wave and mid-band spectrum. Enabling New Radio Dual Connectivity (NR-DC) mode through Ericsson’s 5G Core and high modulation scheme have been key to this achievement.

A 5G trial at the Tour de France 2022 in Copenhagen, Denmark used Ericsson Massive MIMO radios on 5G TDD (time division duplex) spectrum. It delivered up to 13 times more data with the same energy consumption compared to LTE FDD (frequency division duplex).

Niclas Backlund, Country Manager for Ericsson Denmark, says: “With the 5G Standalone network, we are now able to accelerate the Danish 5G ecosystem and provide a world-class mobile network with a range of new opportunities for consumers and businesses by enabling slicing, and thereby providing service differentiation. By modernizing legacy networks and then upgrading to 5G, communication service providers can lower operating costs thanks to greater energy efficiency and thus reduce total cost of ownership. And, at the same time, they can future-proof their networks for anticipated higher capacity needs and offer customers value through new services and capabilities.”

In addition, 5G SA uses a dedicated 5G core network, which means that data transmission requires less signaling than with 5G NSA. This is because 5G SA devices do not need to switch between the 4G and 5G core networks, which can reduce latency and improve performance.

The 5G Standalone deployment in TDC´s commercial network is expected to contribute to the service provider’s roadmap towards Net Zero emissions target by 2030, says Ericsson. Also, the 5G SA network was said to signal major overall progress in TDC NET’s technological transformation as it adopts cloud-native software architecture, leading to fast and reliable service innovation for subscribers with service providers using TDC NET’s 5G network, while maintaining improved efficiency and network performance.

References:

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

BT and Ericsson wideband FDD trial over live 5G SA network in the UK

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Bouygues Telecom picks Ericsson for cloud native 5G SA core network

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

Ericsson: Global 5G subscriptions close to 1.3 billion in Q2-2023

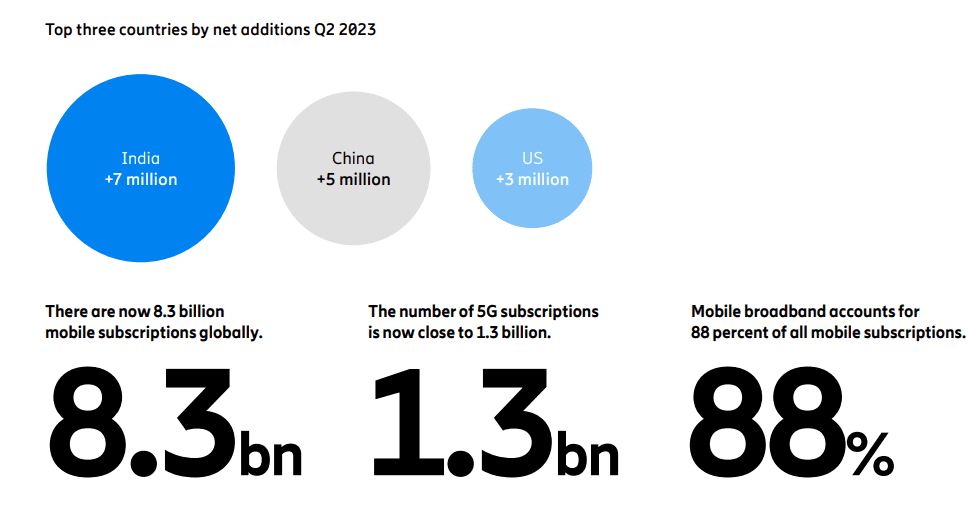

According to Ericsson’s Mobility Report update, approximately 260 communications service providers (CSPs) have launched commercial 5G services. About 35 CSPs have launched 5G standalone (SA) networks. The Q2-2023 additions bring the global number of 5G subscriptions close to 1.3 billion.

India continues to lead the world in 5G subscription growth rate with more than seven million of the 175 million global subscriptions added between April and June (the second financial quarter – Q2) 2023 accounted for in the country.

China had the second highest country growth rate with more than five million 5G additions during Q2.

The United States was in third place with more than three million 5G subscription additions.

The four-page August 31 update is an addendum to the full edition of the Ericsson Mobility Report, published in June 2023. It focuses on recent updates to the quarterly subscription and traffic data sections.

Other information in the Q2-2023 update includes:

- In Q2 2023, the number of mobile subscriptions totalled 8.3 billion, with a net addition of 40 million subscriptions during the quarter. The number of unique mobile subscribers is 6.1 billion.

- Global mobile subscription penetration was 105 percent.

- The number of mobile broadband subscriptions grew by about 100 million in the quarter, totalling 7.4 billion, a year-on-year increase of five percent. Mobile broadband now accounts for 88 percent of all mobile subscriptions.

- Mobile data traffic grew by 33 percent between Q2 2022 and Q2 2023.

- 4G subscriptions increased by 11 million, totalling about 5.2 billion and representing 62 percent of all mobile subscriptions.

- WCDMA/HSPA subscriptions declined by 85 million and GSM/EDGE-only subscriptions dropped by 59 million during the quarter. Other technologies fell by about two million.

References:

https://www.ericsson.com/en/news/2023/8/emr-q2-2023-update

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/june-2023

Ericsson Mobility Report: 5G monetization depends on network performance

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

Huawei and Ericsson renew global patent cross-licensing agreement

The top two global RAN equipment makers, Huawei and Ericsson, have announced the renewal of a multi-year global patent cross-licensing agreement, which enables each to use the other’s standardized (3GPP, ITU, IEEE, and IETF standards for 3G, 4G, and 5G cellular technologies) and patented technologies. The patent sharing agreement includes network infrastructure, as well as endpoint devices.

“We are delighted to reach a long-term global cross-licensing agreement with Ericsson,” said Alan Fan, Head of Huawei’s Intellectual Property Department. “As major contributors of standard essential patents (SEPs) for mobile communication, the companies recognize the value of each other’s intellectual property, and this agreement creates a stronger patent environment. It demonstrates the commitment both parties have forged that intellectual property should be properly respected and protected.”

“Both companies are major contributors to mobile communication standards and recognize the value of each other’s intellectual property. This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly, driving healthy, sustainable industry development for the benefit of consumers and enterprises everywhere.”

Over the past 20 years, Huawei has been a major contributor to mainstream ICT standards, including those for cellular, Wi-Fi, and multimedia codecs. In 2022, Huawei topped the European Patent Office’s applicant ranking for number of patent applications filed, with 4,505 applications.

“Our commitment to sharing leading technological innovations will drive healthy, sustainable industry development and provide consumers with more robust products and services,” added Fan.

Huawei is both a holder and implementer of SEPs and seeks to take a balanced approach to licensing. Through the signing of this agreement, it is both giving and receiving access to key technologies. Fan said, “This agreement is the result of intensive discussions that ensured the interests of both patent holders and implementers are served fairly.”

Christina Petersson, Ericsson’s chief IP officer said, “This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly.”

The last time the two companies extended a cross-licensing agreement was in 2016. Over the past few years, both companies have actively contributed to developing key mobile standards.

Earlier this year, the European Patent Office published the EPO Patent Index 2022: with 4,505 patents filed, Huawei was the top contributor, while Ericsson came in fifth with 1,827. Currently, according to the Financial Times, Huawei owns 20% of global patents which makes it the world’s largest 5G patent owner. Ericsson says they’ve been granted 60,000 patents.

Both Huawei and Ericsson are part of the Avanci patent pool, although the Chinese company is a recent addition following Avanci’s launch of a 5G vehicular programme earlier this month, which it says will “simplify the licensing of the cellular technologies used in next generation connected vehicles.”

Other Avanci patent licencees include Samsung, Philips, Panasonic and ZTE.

However, while Huawei and Ericsson have not engaged in active patent litigation, towards the end of last year Huawei demonstrated an intention to be more litigious over its patent portfolio. This included filing lawsuits against car manufacturer Stellantis over mobile phone patents, as well as launching a series of lawsuits over Wi-Fi 6 patents against Amazon, Netgear and AVM.

Around the same time, in the midst of a US FRAND trial, Ericsson and Apple signed a global patent licence agreement. This ended one of the largest disputes over implementation patents and SEPs in recent years, which spanned the US, Germany, the Netherlands, Belgium, the UK, Colombia and Brazil.

References:

Nikkei Asia: Huawei demands royalties from Japanese companies

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

Ericsson and Vodafone Ireland have partnered to install a cutting-edge 5G Standalone Mobile Private Network (MPN) solution for the Irish rugby team to supply fast and reliable in-play data analysis ahead of the 2023 Rugby World Cup in September.

Previously the team relied on standard WiFi across stadiums and training facilities both at home and away. Now giving instant feedback on team plays and tactics, the 5G Standalone MPN solution and artificial intelligence technology ensures faster download and upload speeds and lower latency, which can be utilised for real-time performance analysis and decisions on the pitch.

Using this reliable connectivity, up to eight high-resolution video streams are captured by multiple cameras and a 5G connected drone and then analysed in real-time to collate data on team performance. The technology helps to improve the communication between management, coaches and players and maximises the time on pitch where the smallest tweak to a running line or defensive position, can have a significant impact on the weekend’s game.

Vodafone Ireland and Ericsson have worked closely with the IRFU and their Head of Analytics and Innovation, Vinny Hammond and his analysis team of John Buckley, Alan Walsh and Jack Hannon. This collaboration has led to a clear understanding of the specific performance outcomes sought by such an elite sports team and has supported the design and installation of the Ericsson Private 5G solution, which now enables the management team, coaches and players to feel the real benefit of instant feedback to enhance the ability to make decisions quikcly.

The new solution has been tested at the Irish team’s High Performance Centre and will be brought to France in a bespoke 5G connected van for the World Cup in September.

Vodafone Ireland Network Director, Sheila Kavanagh says: “At Vodafone, we are so proud of our support for the Irish Rugby team, so we’re delighted to bring further value through the delivery of this cutting-edge technology solution. Performance analysis has experienced massive changes in the past couple of decades. What started with pen and paper-based methods for collecting notational data has evolved to using cutting-edge computer-based technologies and artificial intelligence to collect ever increasing amounts of real-time information. Distilling and delivering this data back to the team at top speed requires a reliable, secure and scalable connectivity solution.”

“This 5G MPN, drone and additional technology will support Vinny Hammond and his analytics team to quickly breakdown and organise unstructured data and present it back in a clear manner to other coaching staff and management – helping them understand the performance of the plays and overall team, without delay. It’s fantastic to see it in use in the HPC, but we’re also really excited to support the team with 5G connectivity throughout their time at the World Cup in France with our fully kitted Connected Van. Our 5G MPN technology is a demonstration of how technology and connectivity innovation can enhance the business of sport and the performance of teams, bringing added layers of data and analysis to coaches, management, and their players.”

IRFU Head of Analytics and Innovation, Vinny Hammond says: “So much of our roles revolve around moving large quantities of data so we can analyse performance to understand what is working and what is not. Vodafone’s 5G MPN stretches the boundaries of what we can do in terms of how quickly we can analyse multiple high-resolution cameras and drone footage which ultimately informs our strategic decision making. The work John and Alan have done on this project in conjunction with Vodafone and Ericson has enabled us to push new boundaries at this years RWC. Being on our own 5G network also gives us that level of security and reliability that we really need, and we’ll have the added benefit of that connectivity with our 5G Connected Van, linking back to our High Performance centre, to reduce reliance on third party connectivity.”

John Griffin, Head of Ericsson Ireland, says: “5G is the ultimate platform of future innovation and our successful partnership with Vodafone continues to ensure new organisations like the IRFU can benefit from the low latency, high bandwidth, and secure connectivity of a 5G standalone private network. Our global leadership in 5G technology and accelerated software availability mean the IRFU will be one step ahead of their competitors on and off the field, giving them the best chance of success at an elite level of performance and revolutionizing the future of a key function within the sports industry.”

References:

https://www.ericsson.com/en/news/3/2023/ericsson-and-vodafone-help-irish-rugby-team-adopt-5g-technology-to-get-fast-in-play-data-analysis