Ericsson

Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

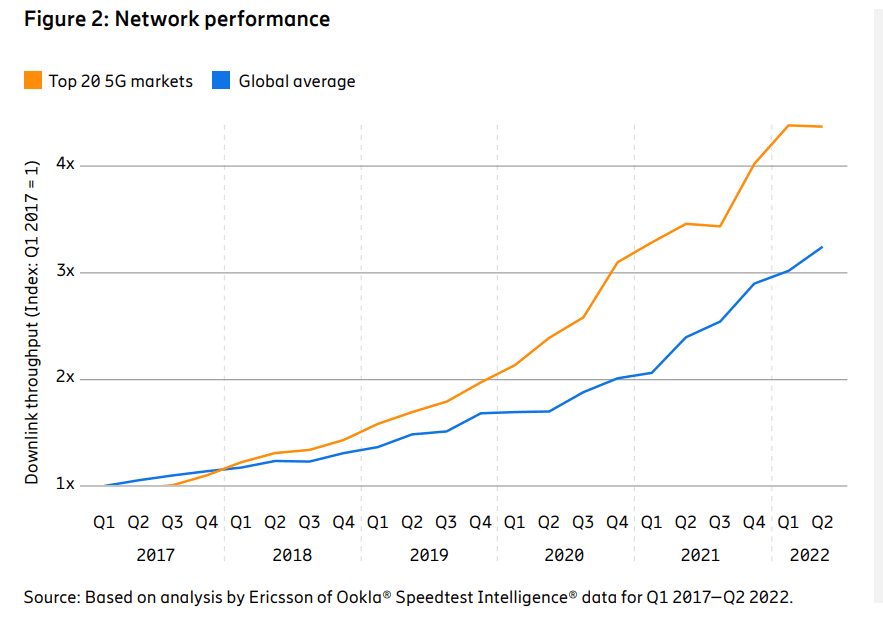

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

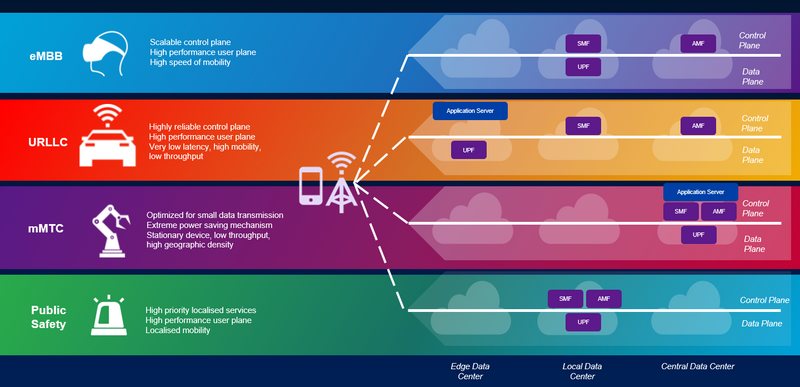

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

Ericsson & Mobily enhance network performance through Artificial Intelligence (AI)

Ericsson has developed an AI system for automated network management which has now been included in Saudi Arabia operator Mobily’s wireless network. The companies have successfully deployed the ‘Ericsson AI-based network solution’ into Mobily’s network in Saudi Arabia in order to enable some ‘enhanced and smart end-user experiences.’

This AI system will provide 5G network diagnostics, root cause analysis and recommendations for ‘superior user experiences.’ The network diagnostics capabilities within the cognitive software suite provides ‘proactive network optimization’, allowing the operator to identify and resolve network anomalies and providing reliable connectivity, we are told.

Ericsson’s AI-based network solution delivers comprehensive Machine Learning (ML) based 5G network diagnostics, root cause analysis and recommendations for superior user experiences. The smart, automated network diagnostics capabilities of Ericsson’s cognitive software suite results in proactive network optimization, supporting Mobily, the leading digital partner of the international technical conference LEAP 23, in identifying and resolving network anomalies and constantly providing reliable connectivity.

Ericsson is so excited by the product in fact that it says it ‘redefines the very nature of network operations,’ alongside the presence of Big Data and ‘ever-expanding and more accessible computing power.’

“From people in remote locations to large gatherings, individuals often expect uninterrupted and quality connectivity,” said Alaa Malki, Chief Technology Officer from Mobily. “Ericsson’s Artificial Intelligence (AI)-based solution enables our customers to enjoy superior and uninterrupted 5G connectivity to stay connected with loved ones or to document key moments anytime, anywhere. Our partnership with Ericsson has once more reinforced our commitment to Unlock Possibilities during times that matter most, and we look forward to carrying our mission forward. I want to thank Ericsson for its support which allowed us to use this data-driven concept to make all kinds of changes and optimizations within short timeframes.”

Ekow Nelson, Vice President at Ericsson Middle East and Africa said: “For numerous years, our partnership with Mobily has provided customers with assured and superior connectivity to stream live experiences and benefit from a multitude of services even in the most challenging environments. Our success relied on Ericsson’s Artificial Intelligence-based network solution built with Machine Learning models that learn from the live network using the multiple sources of data to deliver near real-time improvements, thus avoiding interruptions during critical and peak times.”

How AI interacts and disrupts different industries looks likely to be an increasingly prominent issue in the years to come, for all sorts of reasons. In an interview with Telecoms.com recently, Beerud Sheth – CEO of conversational AI firm Gupshup said, “Like almost any industry, telcos will also have to figure out how they see this disruption… it creates opportunities and threats. And I think you have to lean into the opportunities, and maybe mitigate the threats a little bit. It changes a lot of things, it changes consumer expectations, it changes what people expect and what they want to do and can do, and they have to keep pace with all of it. So, there’s a lot of work for telco executives.”

References:

Ericsson, Mobily successfully enhance network performance through Artificial Intelligence

Ericsson warns profit margins at RAN business set to worsen

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson, Intel and Microsoft successfully demonstrating end-to-end 5G standalone (SA) network slicing capabilities on a Windows laptop at Ericsson’s Lab in Sweden. This pioneering trial demonstrates the applicability of the technology on devices beyond smartphones, paving the way for new business/enterprise opportunities and for consumer use cases such as mobile gaming and collaboration applications for 5G cellular-connected laptops.

The trial used User Equipment Route Selection Policy (URSP), which enables devices to automatically select between different slices according to which application they are using. It also used Ericsson’s Dynamic Network Slicing Selection, Ericsson’s dual-mode 5G Core, and Ericsson’s RAN Slicing capabilities to ‘secure end-user service differentiation.’

Network slicing has long been seen as vital to capturing the value that a 5G network can provide for communications service providers (CSPs) and enterprises. The market for network slicing alone in the enterprise segment is projected at USD 300 billion by 2025, according to the GSMA. By demonstrating a single Windows 11 device can make use of multiple slices, which are used according to the on-device usage profiles and network policies defined at the CSP level, the partners show the flexibility and range of potential use cases available using this technology.

This trial illustrates the opportunities for 5G monetization beyond smartphone devices and opens the door to a wider 5G device ecosystem, allowing CSPs and other members of the telecoms and IT world to expand their horizons when considering opportunities to generate profitable use cases for 5G. Laptop type devices, in particular, are vital to enterprise productivity. The inclusion of Windows 11 laptops in the ranks of devices that can be used for commercializing 5G network slicing is a sign of the ecosystem maturing. Network slicing capabilities will benefit consumer and enterprise segments by defining specific Service Level Agreement per slice for existing and emerging Windows applications and use cases, such as real-time enterprise applications like Microsoft Teams and Office365, game/media streaming, and emerging AI and augmented reality/extended reality (AR/XR) applications.

Sibel Tombaz, Head of Product Line 5G RAN at Ericsson, said: “Expanding the range of devices for network slicing to include laptops will allow new business segments to create a variety of use cases for consumer and enterprises. We have shown, together with Intel and Microsoft, how ecosystem collaboration can open new possibilities. We will continue to strengthen Ericsson’s network slicing capabilities and work with industry partners to enable more applications on several devices, spreading the benefits of 5G in the consumer and enterprise segments.”

Ian LeGrow, Microsoft Corporate Vice-President of Core OS Innovation said: “We are thrilled to showcase our cutting-edge technology and its ability to deliver fast, dependable and secure 5G connectivity on Windows 11. Partnering with Intel and Ericsson only further solidifies our commitment to innovation and openness in our platform.”

This ground-breaking network slicing demo will be showcased jointly with Intel and Microsoft in the Ericsson Hall during MWC Barcelona 2023 from February 27 to March 2.

Andrew Wooden of telecoms.com wrote:

“There are so many tests and trials going on, and while technically seem to signal a bit of incremental progress each time, it can be easy to lose the context of what is supposed to be offered while digging around in the weeds of experimental telecoms architecture. That said if trials like this can keep the emphasis on how they provide some extra money-making opportunities for those in the business of flogging 5G, and some genuine benefits for the rest of us, perhaps it will gain some traction when they show it off in Barcelona.”

Source: Viavi Solutions

…………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ericsson.com/en/news/2023/2/ericsson-intel-and-microsoft-show-network-slicing-capabilities-on-a-laptop-for-consumer-and-enterprise-applications

https://www.ericsson.com/en/network-slicing#dynamicnetworksliceselection

https://www.ericsson.com/en/core-network/5g-core

https://telecoms.com/519733/ericsson-intel-and-microsoft-slice-up-a-network-and-feed-it-to-a-laptop/

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

https://www.viavisolutions.com/en-us/5g-network-slicing

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Ericsson warns profit margins at RAN business set to worsen

Ericsson on Friday reported lower than expected 4th-quarter core earnings as sales of 5G equipment slowed in high-margin markets such as the United States, sending the Swedish company’s shares to their lowest since 2018.

Ericsson is the latest tech company to show the impact of customers tightening belts amid concerns about a global economic slowdown. Others have been cutting staff, including Microsoft (10,000) and Google parent Alphabet (12,000) which have announced thousands of job cuts this week while Amazon had announce 10,000 layoffs several weeks ago.

Ericsson has already announced plans to cut costs by 9 billion crowns ($880 million) by the end of 2023.

Chief Financial Officer Carl Mellander told Reuters that would involve reducing consultants, real estate and also employee headcount. “It’s different from geography to geography, some are starting now, and we’ll take it unit by unit, considering the labour laws of different countries,” Mellander said, referring to the cuts.

Mellander declined to say if the job cuts would be similar to 2017 when Ericsson laid off thousands of employees and focused on research to return the company to profitability.

Last week, the company said it would book a 2.3 billion Swedish crown ($220 million) provision for an expected fine from U.S. authorities for breach of a settlement reached in 2019.

Ericsson’s net sales rose in the fourth quarter, but margins, net income and core earnings fell. Its gross margin for the fourth quarter of 2022 fell to 41.4% from 43.2%.

Ericsson said it expected a fall in margin in its Networks business to persist through the first half of 2023, but the effect of cost savings to emerge in the second quarter.

JPMorgan analysts said given the fall in margins and higher investments, they would expect 2023 earnings to decline by a double digit percentage.

Inge Heydorn, partner and fund manager at investment firm GP Bullhound, said: “The fourth quarter shows once again that the U.S. has a big impact on Ericsson’s margins.”

With U.S. customers such as Verizon tightening their purse strings, Ericsson is hoping newer markets such as India can provide some growth. Its South East Asia, Oceania and India market was the only one to grow in the quarter, rising 21%, accounting for 13% of the company’s business.

The company’s fourth-quarter adjusted operating earnings, excluding restructuring charges, fell to 9.3 billion Swedish crowns from 12.8 billion a year earlier. That was short of the 11.22 billion expected by analysts, Refinitiv Eikon data showed. Net sales rose 21% to 86 billion crowns, beating estimates of 84.2 billion.

A settlement of a patent deal with Apple (AAPL.O) last month resulted in revenue of 6 billion crowns, but Ericsson also took 4 billion crowns in charges, including a provision for a potential fine from U.S. regulators and divestments.

However, there was some good news.

- Ericsson said it expects significant patent revenue growth over the coming 18-24 months.

- Ericsson, outside China, remains the company to beat in 5G. Its share of the market for radio access networks (RANs) appears to have increased several years in a row – from 33% in 2017 to 39% now.

- Ericsson is healthily profitable, which could not be said when CEO Ekholm took charge in 2017.

- Boosted by recent takeover activity and a major licensing deal with Apple, its headline sales for the final quarter of 2022 were up 21%, to 86 billion Swedish kronor (US$8.4 billion), compared with the same period a year before.

However, Ericsson has experienced one of its biggest profit slumps since the first half of Ekholm’s tenure. Hurt by higher costs and SEK4 billion ($390 million) worth of one-off charges – relating to US fines, write-downs and divestiture – its net income dropped by 39%, to SEK6.2 billion ($600 billion). Worse, all the various profit margins thinned, with Ericsson’s closely monitored EBIT (earnings before interest and tax) margin shrinking to just 9.1%, from 16.1% a year earlier. And the outlook is frosty.

The mini-boom in 5G spending appears to be over – temporarily, at least. Last year, the market for RAN products, where Ericsson now generates about 70% of its revenues, grew by around 5%, according to data from Dell’Oro, a market research firm that Ericsson uses. This year, RAN market sales are expected to fall by 1%. And in North America, responsible for nearly 30% of Ericsson’s overall revenues, Dell’Oro predicts they will drop by a worrying 7%.

After investing heavily in network rollouts during the last couple of years, many operators are cutting their expenditure amid signs of an economic downturn, and reducing the equipment stockpiles they built up when supplies were tight. “We expect operators to adjust inventory levels as the supply situation eases and we plan for these trends to continue during the first half of 2023,” said Ekholm on Ericsson’s earnings call today.

“The first half is really where we’ll see the sizeable inventory adjustments,” said Ekholm, answering questions asked by analysts. “Operators can sweat assets for a couple of quarters but it cannot be done much more [than that] because of the traffic growth underneath. That is the way to model it.” Ericsson’s expectation is that total mobile data traffic worldwide will grow by a factor of five between 2022 and 2028.

Given the market slowdown, turbulence of the last year and seemingly endless difficulties at smaller units, it is easy to forget that Ericsson remains a solid and successful business. But it has become more reliant on RAN sales under Ekholm – generating more than 70% of its revenues in that market last year, compared with just 47% in 2016. Ekholm clearly restored Ericsson’s reputation as a RAN provider. Amid the slowdown in that sector (zero growth forecast by Dell’Oro through 2027), his big challenge now is to prove it can thrive elsewhere.

Andrew Gardiner, analyst at Citi, said the announcements demonstrated the “significant challenges” the company faced this year. “We view Ericsson’s outlook as one of fundamentals deteriorating in the next quarter or two, as it aims to improve in the second half and beyond,” he added.

References:

https://www.reuters.com/technology/ericsson-quarterly-earnings-miss-expectations-2023-01-20/

https://www.ft.com/content/dd5cb329-f5bd-4b78-bde1-ca7510daaa7a

Ericsson expects RAN market to be flat with 5G build-out still in its early days; U.S. cellular industry growth to slow in 2023

Ericsson is planning for a flat RAN market and is structuring its cost base and operations accordingly. Underlying the flat market is a technology shift to 5G from earlier generation. 5G build-out is still in its early days with only about 20% of all base station sites outside China installed with 5G mid-band. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits.

Given the rapid increase in network traffic levels, operators’ investment in performance and capacity is expected to remain robust. The 5G RAN market is expected to grow by over 11% per annum over the next three years, with potential further upside from areas such as Fixed Wireless Access, Enterprise connectivity, XR and Mission Critical Services (which require URLLC which meets performance requirements in ITU M.2410).

In Networks, Ericsson expects to expand its global footprint and enhance gross income through continued investments in technology for performance and cost leadership and, in addition, improve productivity and capital efficiency across the supply chain. In particular the Segment will continue investing in enhanced portfolio energy performance, enabled by Ericsson Silicon and innovating next-generation open architecture, such as Cloud RAN – key areas of strategic importance for its operator customers. Cloud RAN also offers potential in the enterprise segment.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, Morgan Stanley analysts forecast that the U.S. wireless industry growth will slow in 2023.

“Carriers could move to cut pricing in order to maintain their subscriber bases,” the Morgan Stanley analysts wrote in a report to investors issued Thursday. That could reduce the operators’ ability to make money, they noted. “A continued adoption of premium plans could also support wireless service revenue growth,” they added.

Morgan Stanley analysts expect the U.S. wireless industry – including Verizon, AT&T, T-Mobile, Dish Network and cable companies like Comcast and Charter Communications – to collectively add 8.7 million new postpaid phone customers during 2023. That’s down only slightly from 8.9 million during 2022 and just below the record 10 million that providers collectively added over the course of 2021.

“We see the biggest slowdown in 2023 adds at AT&T, while Verizon could grow adds modestly yoy [year over year] off a low base, and T-Mobile can do slightly better given this year saw the impact of the Sprint network shutdown,” the Morgan Stanley analysts wrote. “We will be watching the growing deployment of eSIM technology to see if it opens the door to higher switching activity, while it should also help carriers lower costs through an easier activation process.”

References:

https://www.prnewswire.com/news-releases/ericsson-capital-markets-day-2022-301704231.html

https://telecoms.com/519003/ericsson-expects-ran-market-growth-to-be-flat-for-years/

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

According to Ericsson, total global FWA [1.] subscriptions will grow at 19 percent year-on-year during the 2022 to 2028 period to reach more than 300 million by 2028, the vast majority of which will be based on 5G.

Note 1. FWA is a connection that provides primary broadband access through mobile network-enabled customer premises equipment (CPE). This includes various form factors of CPE, such as indoor (desktop and window) and outdoor (rooftop and wall-mounted). It does not include portable battery-based Wi-Fi routers or dongles.

………………………………………………………………………………………………………………………………………………………..

The use of FWA for home and even business broadband is proving to be a major early use case for 5G, especially in regions where the fixed broadband market is lacking. FWA growth is in part driven by India and will also come in other emerging markets. Its data shows that almost 40 percent of 5G FWA launches came in emerging markets in the past year, with services now on offer in densely populated countries like Mexico, South Africa and the Philippines.

Key findings:

- More than three-quarters of service providers surveyed in over 100 countries are now offering Fixed Wireless Access (FWA) services.

- Nearly one-third of service providers now offer FWA over 5G, compared to one-fifth a year ago.

- The number of 5G FWA connections are expected to grow to around 235 million by 2028, representing almost 80 percent of the total FWA connections.

Source: Ericsson

“Following the 5G spectrum auction in India in July, a major service provider has expressed a goal to serve 100 million homes and millions of businesses with 5G FWA services,” Ericsson stated. 5G has only just come to market in India; its big operators launched services in early October. But operators are rolling out the technology at pace and with the price of 5G smartphones coming down, customer numbers will go up. 5G subscriptions in the India region – which includes Nepal and Bhutan – should reach 31 million by the end of this year and 690 million by end-2028, accounting for more than half of all mobile subscriptions – 1.3 billion – by that date.

“Higher volumes of 5G FWA in large high-growth countries such as India have the potential to drive economies of scale for the overall 5G FWA ecosystem, resulting in affordable CPE that will have a positive impact across low-income markets,” Ericsson added.

Globally, 5G subscriptions will hit 5 billion by the end of 2028, Ericsson predicts, despite the economic challenges much of the world is facing.

Service providers together added 110 million 5G subscriptions in the July-September period, bringing the worldwide total to around 870 million. With that sort of uptake, the 1 billion by year-end figure looks comfortably attainable, and will come two years earlier than the same milestone following the launch of 4G. Growth is being driven by device availability, falling prices and large-scale deployments in China, Ericsson said.

Ericsson added that North East Asia as a whole and North America are witnessing strong 5G growth, with penetration in those markets likely to reach around the 35 percent mark by the end of this year. Given that the world’s first 5G launches came in the US and in Korea back in 2019, it makes sense that those areas are leading the way in terms of uptake.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/dataforecasts/fwa-outlook

https://www.ericsson.com/en/fixed-wireless-access#

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

Ericsson to build 5G network in Greenland; demos 5G microwave backhaul with O2 Telefónica

Swedish telecom equipment maker Ericsson has been contracted to build a 5G network in Greenland, initially covering three towns, local telecom service provider Tusass said on Friday.

Deploying Ericsson equipment and Netgear routers, Tusass will bring high-speed wireless internet to the sparsely populated island without resorting to expensive and hard-to-deploy cables, the company said. A further 10 towns, including Greenland’s capital Nuuk, are set to follow next.

Tusass said it plans to invest around 1 billion Danish crowns ($131.3 million) to secure and expand Greenland’s infrastructure and improve communication.

Greenland, an island of just 56,000 people, is part of the Kingdom of Denmark but has broad autonomy.

…………………………………………………………………………………………………………………………………………….

Separately, Ericsson and O2 Telefónica successfully demo 5G wireless backhaul for non-urban areas. In the latest of their joint projects in mobile transport, Ericsson and O2 Telefónica have successfully demoed 5G wireless backhaul for rural and suburban coverage. This technology milestone has shown that the companies can deliver speeds of up to 10 Gbps over a distance of more than 10 km and demonstrate fiber-like microwave connectivity.

The result of this important demo showed that microwave backhaul over traditional bands can support the continued build-out of high-performing 5G networks and enhanced mobile broadband services from urban to suburban and rural areas – one of the key challenges facing communications service providers in scaling up their 5G deployment.

“We deliver fast mobile 5G connections to millions of customers across Germany. Bringing digitalization to suburban and rural areas through mobile connectivity and fast 5G network rollout has therefore priority for us,” says Aysenur Senyer, Director of Transport Networks at O2 Telefónica.

“Together with our partner Ericsson, we are pioneering new powerful microwave solutions using Carrier Aggregation and MIMO technology to backhaul 5G traffic over long distances in rural areas, when fiber is not an option. This type of technology enables us to deliver fiber-like connectivity via microwave and further accelerate our 5G deployment.”

Ricardo Queirós, Head of Microwave Systems, Business Area Networks, Ericsson, says: “Access to high-speed mobile services is key to bridging the digital divide. This joint demo with O2 Telefónica in Germany demonstrates how microwave backhaul can efficiently spread high-performing 5G to regions outside the traditional dense urban areas.”

“Wireless backhaul has been instrumental to the success of mobile networks and their nationwide coverage. Now it is time to push the boundaries and evolve microwave transmission technology to enable high-performance 5G coverage on a much broader scale,” Queirós adds.

The shift to working from home during the Covid-19 pandemic illustrated the need for fast and reliable connectivity in non-urban environments, and the challenge has been to maintain telecom-grade availability beyond distances of two to three kilometers.

The ability to deliver such high data speeds over distances of more than 10 km – the cruising altitude of a commercial jet – opens up a new world of possibilities for the delivery of low-latency, reliable broadband in harder-to-reach areas.

Traditionally, such areas have been difficult to service, as high capacities require broad bandwidths that usually only have been available in millimeter wave frequency bands (E-band). The E-band is more impacted by rain compared to the lower frequency bands, which makes it more difficult to deliver consistent service over long distances during adverse weather conditions.

Technical details

In the joint demo with O2 Telefónica in Germany, the key innovation is the ability to use MIMO with high modulation in the 112MHz channels (commercial MIMO solutions support up to 56 MHz channels), which were combined with Carrier Aggregation to enable similar capacities to E-band in the lower frequency bands. The demo solution has extended the hop-length with extremely high capacity even in less favorable weather conditions.

The backhaul link utilized the 18GHz frequency band, dual antennas in a MIMO configuration, and commercial MINI-LINK radios together with a pre-commercial baseband algorithm that allowed the use of MIMO in 2x 112 MHz channels. MIMO ensures the efficient use of limited spectrum resources. The same capacity without MIMO would demand a 448 MHz bandwidth in a cross-polar setup.

Microwave backhaul is commonly seen as a more cost- and time-efficient option compared to fiber deployment. The O2 Telefónica demo has shown that high availability and high capacity can also be achieved with wireless transport.

The demo is the latest in a series of collaborations with O2 Telefónica in Germany stretching back over several years. Ericsson is one of the service provider’s main suppliers in all areas of microwave technology and the two companies have carried out several successful joint projects around microwave technology, with more planned for the future.

References:

https://www.reuters.com/business/media-telecom/ericsson-wins-greenland-5g-deal-2022-09-30/

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)

According to the latest Ericsson Mobility Report, total mobile subscriptions increased by 52 million to reach 8.3 billion.

Global 5G subscriptions grew by 70 million in the second quarter of 2022, reaching 690 million in the second quarter of 2022, according to Ericsson. Despite the challenges and obstacles, 5G adoption is progressing faster than 4G (we disagree).

Ericsson’s Mobility Report also details how people are using their mobile phones, with mobile data usage increasing dramatically year-on-year. Between Q2 2021 and Q2 2022, network data traffic increased by 39%. The growth from Q1 2022 to Q2 2022 was also 8%.

Ericsson attributes the growth to increased consumption of media on mobile devices driven by faster speeds offered by 5G. Here are the report’s highlights:

•In Q2 2022, the total number of mobile subscriptions was around 8.3 billion, with a net addition of 52 million subscriptions during the quarter. Mobile broadband accounts for 86 percent of all mobile subscriptions.

• 5G subscriptions total 690 million (but in China, there are many 5G plan subscribers who can only get 4G service).

• China accounted for the most net additions during the quarter (+10 million), followed by India (+7 million) and Indonesia (+4 million).

• Global mobile subscription penetration was 106 percent. That means more than one mobile device per person!

• The number of mobile broadband subscriptions grew by about 100 million in the quarter to reach 7.2 billion, a year-on-year increase of 6 percent. Mobile broadband now accounts for 86 percent of all mobile subscriptions.

• The number of unique mobile subscribers is 6.1 billion. The difference between the number of subscriptions and the number of subscribers is due to inactive subscriptions, multiple device ownership and/or the optimization of subscriptions for different types of calls.

• 5G subscriptions grew by 70 million during the quarter, lifting the total to 690 million. Meanwhile, 218 communications service providers have launched commercial 5G services and 24 have launched 5G standalone (SA) networks.

• 4G subscriptions increased by 77 million to around 5 billion, representing 60 percent of all mobile subscriptions, while WCDMA/HSPA subscriptions declined by 41 million. GSM/EDGE-only subscriptions dropped by 48 million during the quarter, and other technologies3 decreased by about 6 million.

Mobile network data traffic grew 39 percent between Q2 2021 and Q2 2022 and reached 100ExaBytes per month. The quarter-on-quarter mobile network data traffic growth between Q1 2022 and Q2 2022 was 8 percent. Total monthly global mobile network data traffic reached 100EB. Over the long term, traffic5 growth is driven by both the rising number of smartphone subscriptions and an increasing average data volume per subscription, fueled primarily by increased viewing of video content. There are large differences in traffic levels between markets, regions and service providers.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

In separate announcements today, Ericsson and Nokia stated they had completed 5G Network Slicing trials with Google on Pixel 6 Pro smart phones running the Android 13 mobile OS [1.].

Network Slicing is perhaps the most highly touted benefits of 5G, but its commercial realization is taking much longer than most of the 5G cheerleaders expected. That is because Network Slicing, like all 5G features, can only be realized on a 5G standalone (SA) network, very few of which have been deployed by wireless network operators. Network slicing software must be resident in the 5G SA Core network and the 5G endpoint device, in this case the Google Pixel 6 Pro smartphone.

Note 1. On August 15, 2022, Google released Android 13 -the latest version of its mobile OS. It comes with a number of new features and improvements, as well as offers better security and performance fixes. However, it’s implementation on smartphones will be fragmented and slow according to this blog post.

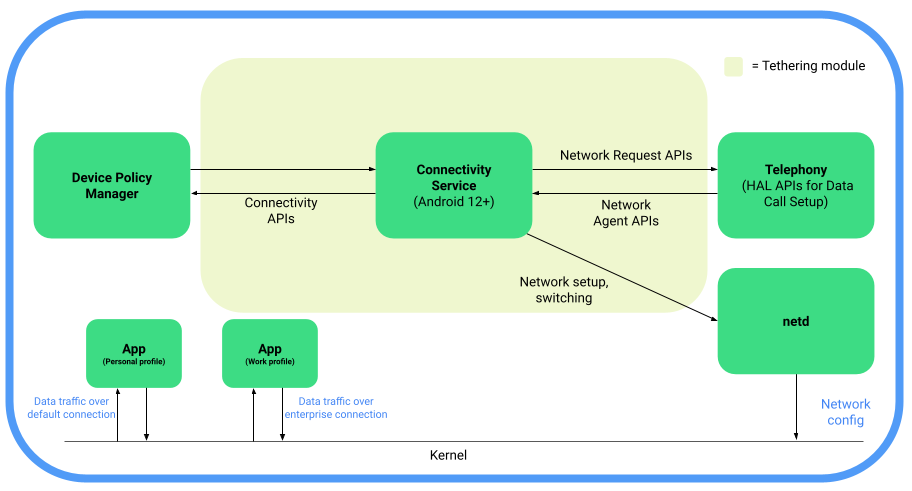

For devices running Android 12 or higher, Android provides support for 5G Network Slicing, the use of network virtualization to divide single network connections into multiple distinct virtual connections that provide different amounts of resources to different types of traffic. 5G network slicing allows network operators to dedicate a portion of the network to providing specific features for a particular segment of customers. Android 12 introduces the following 5G enterprise network slicing capabilities, which network operators can provide to their enterprise clients.

Android 12 introduces support for 5G network slicing through additions to the telephony codebase in the Android Open Source Project (AOSP) and the Tethering module to incorporate existing connectivity APIs that are required for network slicing.

Here’s a functional block diagram depicting 5G network slicing architecture in AOSP:

Image Credit: Android Open Source Project

1. Ericsson and Google demonstrated support on Ericsson network infrastructure for multiple slices on a single device running Android 13, supporting both enterprise (work profile) and consumer applications. In addition, for the first time, a slice for carrier branded services will allow communications service providers (CSP) to provide extra flexibility for customized offerings and capabilities. A single device can make use of multiple slices, which are used according to the on-device user profiles and network policies defined at the CSP level.

The results were achieved in an Interoperability Device Testing (IODT) environment on Google Pixel 6 (Pro) devices using Android 13. The new release sees an expansion of the capabilities for enterprises assigning network slicing to applications through User Equipment Route Selection Policy (URSP ) rules, which is the feature that enables one device using Android to connect to multiple network slices simultaneously.

Two different types of slices were made available on a device’s consumer profile, apart from the default mobile broadband (MBB) slice. App developers can now request what connectivity category (latency or bandwidth) their app will need and then an appropriate slice, whose characteristics are defined by the mobile network, will be selected. In this way either latency or bandwidth can be prioritized, according to the app’s requirements. For example, the app could use a low-latency slice that has been pre-defined by the mobile network for online gaming, or a pre-defined high-bandwidth slice to stream or take part in high-definition video calling.

In an expansion of the network slicing support offered by Android 12, Android 13 will also allow for up to five enterprise-defined slices to be used by the device’s work profile. In situations where no USRP rules are available, carriers can configure their network so traffic from work profile apps can revert to a pre-configured enterprise APN (Access Point Name) connection – meaning the device will always keep a separate mobile data connection for enterprise- related traffic even if the network does not support URSP delivery.

Monica Zethzon, Head of Solution Area Packet Core at Ericsson said: “As carriers and enterprises seek a return on their investment in 5G networks, the ability to provide for a wide and varied selection of use cases is of crucial importance. Communications Service Providers and enterprises who can offer customers the flexibility to take advantage of tailored network slices for both work and personal profiles on a single Android device are opening up a vast reserve of different uses of those devices. By confirming that the new network slicing capabilities offered by Android 13 will work fully with Ericsson network technology, we are marking a significant step forward in helping the full mobile ecosystem realize the true value of 5G.”

Ericsson and partners have delivered multiple pioneering network slicing projects using the Android 12 device ecosystem. In July, Telefonica and Ericsson announced a breakthrough in end-to-end, automated network slicing in 5G Standalone mode.

2. Nokia and Google announced that they have successfully trialed innovative network slice selection functionality on 4G/5G networks using UE Route Selection Policy (URSP) [2.] technology and Google Pixel 6 (Pro) phones running Android 13. Once deployed, the solution will enable operators to provide new 5G network slicing services and enhance the customer application experience of devices with Android 13. Specifically, URSP capabilities enable a smartphone to connect to multiple network slices simultaneously via different enterprise and consumer applications depending on a subscriber’s specific requirements. The trial, which took place at Nokia’s network slicing development center in Tampere, Finland, also included LTE-5G New Radio slice interworking functionality. This will enable operators to maximally utilize existing network assets such as spectrum and coverage.

Note 2. User Equipment Route Selection (URSP) is the feature that enables one device using Android to connect to multiple network slices simultaneously. It’s a feature that both Nokia and Google are supporting.

URSP capabilities extend network slicing to new types of applications and use cases, allowing network slices to be tailored based on network performance, traffic routing, latency, and security. For example, an enterprise customer could send business-sensitive information using a secure and high-performing network slice while participating in a video call using another slice at the same time. Additionally, consumers could receive personalized network slicing services for example for cloud gaming or high-quality video streaming. The URSP-based network slicing solution is also compatible with Nokia’s new 5G radio resource allocation mechanisms as well as slice continuity capabilities over 4G and 5G networks.

The trial was conducted using Nokia’s end-to-end 4G/5G network slicing product portfolio across RAN-transport-core as well as related control and management systems. The trial included 5G network slice selection and connectivity based on enterprise and consumer application categories as well as 5G NR-LTE slice interworking functionalities.

Nokia is the industry leader in 4G/5G network slicing and was the first to demonstrate 4G/5G network slicing across RAN-Transport-Core with management and assurance. Nokia’s network slicing solution supports all LTE, 5G NSA, and 5G SA devices, enabling mobile operators to utilize a huge device ecosystem and provide slice continuity over 4G and 5G.

Nokia has carried out several live network deployments and trials with Nokia’s global customer base including deployments of new slicing capabilities such as Edge Slicing in Virtual Private Networks, LTE-NSA-SA end-to-end network slicing, Fixed Wireless Access slicing, Sliced Private Wireless as well as Slice Management Automation and Orchestration.

Ari Kynäslahti, Head of Strategy and Technology at Nokia Mobile Networks, said: “New application-based URSP slicing solutions widen operator’s 5G network business opportunities. We are excited to develop and test new standards-based URSP technologies with Android that will ensure that our customers can provide leading-edge enterprise and consumer services using Android devices and Nokia’s 4G/5G networks.”

Resources:

…………………………………………………………………………………………………………………………………………………………….

Addendum:

- Google’s Pixel 6 and Pixel 6 Pro, which run on Android 12, are the first two devices certified on Rogers 5G SA network in Canada, which was deployed in October 2021. However, 5G network slicing hasn’t been announced yet.

- Telia deployed a commercial 5G standalone network in Finland using gear from Nokia and the operator highlighted its ability to introduce network slicing now that it has a 5G SA core.

- OPPO, a Chinese consumer electronics and mobile communications company headquartered in Dongguan, Guangdong, recently demonstrated the pre-commercial 5G enterprise network slicing product at its 5G Communications Lab in collaboration with Ericsson and Qualcomm. OPPO has been conducting research and development in 5G network slicing together with network operators and other partners for a number of years now.

- Earlier this month, Nokia and Safaricom completed Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial.

References:

https://source.android.com/docs/core/connect/5g-slicing

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial