Fiber deployments

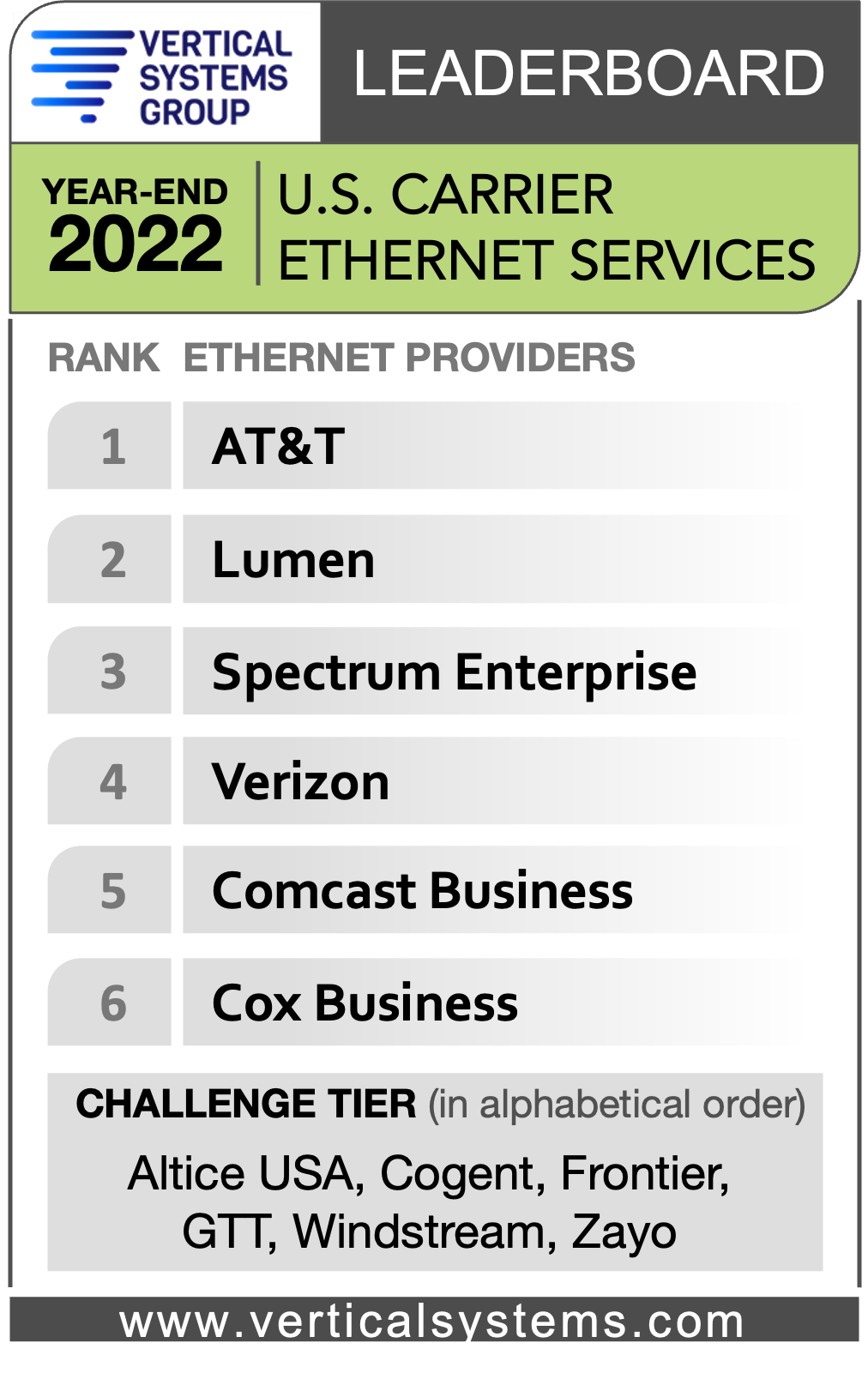

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T is expanding its network of fiber-optic cables to deliver fast internet speeds for customers, including those in places where it doesn’t already provide broadband. The plan will cost billions of dollars over the next several years, a price tag that the company—whose debt load outstrips its annual revenue—will not carry alone. AT&T formed a joint venture with BlackRock to fund the project and also wants to access government funding to accelerate the build-out. AT&T and BlackRock have collectively invested $1.5 billion in the venture—named Gigapower—to date, the company said.

Gigapower plans to provide a state-of-the-art fiber network to internet service providers and other businesses in parts of select metro areas throughout the country using a commercial wholesale open access platform. Both companies believe now is the time to create the United States’ largest commercial wholesale open access fiber network to bring high-speed connectivity to more Americans.

AT&T will serve as the anchor tenant of the Gigapower network, but other companies could also provide internet service over the network. That so-called open-access model has become common throughout Europe, but has yet to be widely embraced in the U.S. Gigapower recently introduced plans to build out fiber in Las Vegas, northeastern Pennsylvania and parts of Arizona, Alabama and Florida.

Doubling down on fiber optics sets AT&T on a different path than its rivals Verizon and T-Mobile US, which are relying on improved technology that beams broadband internet service from the same cellular towers that link their millions of mobile smartphone customers. AT&T is testing a similar fixed wireless access service but on a smaller scale, but executives say fiber remains the long-term focus.

AT&T updated shareholders on its vision for fiber internet and 5G cellular networks at its annual meeting, but the documentation/replay was not available at press time. AT&T spent about $24 billion on its fiber and 5G networks last year, and it forecast a similar level of spending this year. The company is confident it will get a very good return on investment (ROI).

The Dallas-based company and its peers face heightened competition in the cellphone business—their core profit engine. After the Covid-19 pandemic brought a surge in new accounts, the cellphone business has cooled, pushing companies to seek alternate paths for growth. AT&T, which has nearly 14 million consumer broadband customers, has provided internet service for years, and executives say that keeping customers plugged in requires faster connections as more data is used.

“We should be putting more fiber out faster, quicker and in more places than anybody else,” AT&T Chief Executive John Stankey said in a recent interview. “If we do that, that means our network is always going to be ahead of anybody else’s.”

Fiber-optic cables, wired directly to or near Americans’ homes, contain easy-to-upgrade glass strands that can carry much more data than radio waves. That higher capacity is crucial for video calls, streaming, videogames and other services, which use more internet data than most smartphone apps. As of last year, fiber was available at some 63 million homes, or more than half of primary residences, according to the Fiber Broadband Association.

AT&T wants its fiber network to cover more than 30 million homes and businesses within its current service area by the end of 2025. In many cases, fiber will replace internet connections over copper wirelines.

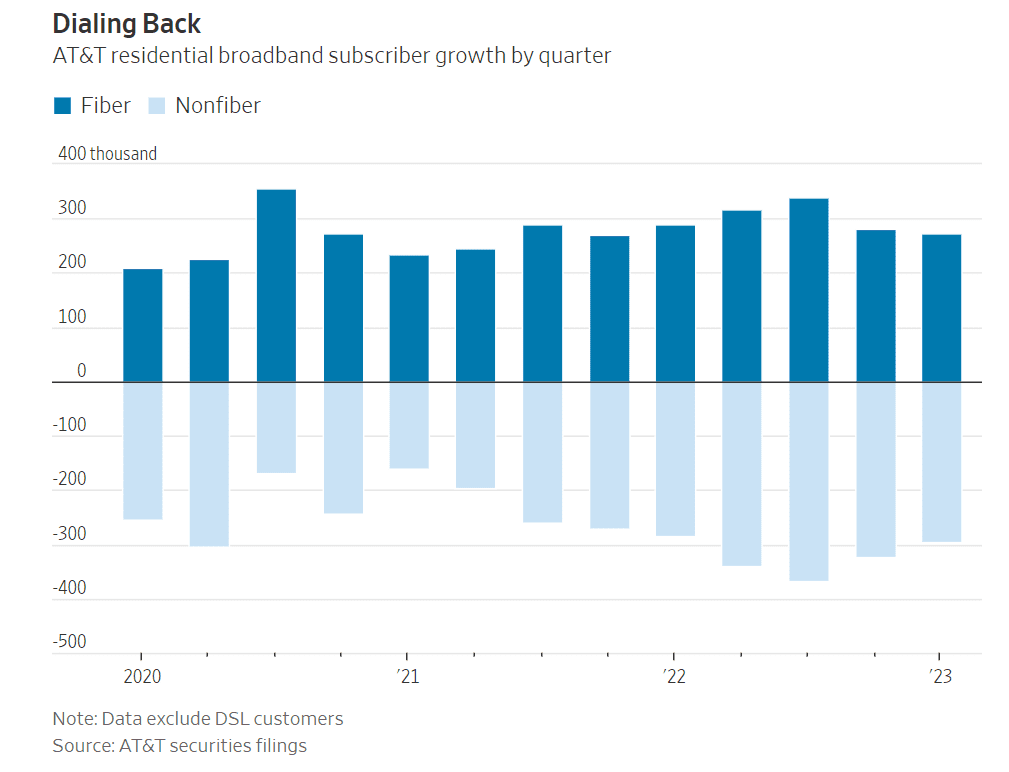

Laying the fiber is one thing, but progress in getting customer sign-ups has been slower than some analysts expected. In the first three months of the year, AT&T signed up 272,000 home fiber subscribers, a deceleration from the December quarter and the same period last year.

The results also marked the fourth straight quarter during which residential fiber sign-ups failed to offset declines in broadband customers overall. Stankey said he isn’t expecting the trend to reverse this year.

AT&T offers its fiber service at various speed tiers, starting at $55 a month for downloads up to 300 megabits a second. Prices run as high as $180 a month for 5-gigabit speeds.

In the March quarter, the average AT&T fiber internet customer paid about $66 a month. That total was up 9% from last year but still slightly less than the sums paid by customers of cable rivals Charter Communications and Comcast, according to Roger Entner, the founder of Recon Analytics.

While AT&T’s fiber build-out continues, it hopes its Internet Air service—which uses cell towers to beam broadband to homes—can stem customer defections in the short term. The service, which costs $55 a month, isn’t yet widely available, said Stankey, who took over as CEO in 2020 and unwound AT&T’s bet on entertainment.

Deutsche Telekom’s fiber optic expansion in 140 of the 179 municipalities within the Gigabit region of Stuttgart

Deutsche Telekom said it has deployed its fiber optic network in more than 140 of the 179 municipalities covered by its agreement with the “gigabit region” of Stuttgart. The German network operator has developed its network in the districts of Boeblingen, Esslingen, Goeppingen, Ludwigsburg and Rems-Murr districts.With ongoing expansion efforts at over 58 construction sites, the company is making significant progress, particularly in nine districts in Stuttgart, according to the statement from the company.

Since 2019, Telekom has accounted for more than 90 percent of the growth in fiber optic infrastructure. As the sole company expanding into both rural and urban areas, Telekom has established itself as a reliable partner, delivering on all construction projects and cooperation agreements, according to the broadband officer of the region and managing director of Gigabit Region Stuttgart (GRS).

In Ludwigsburg and Esslingen alone, Telekom has already been awarded contracts for 76 funding projects. The recent collaboration with Stadtwerke Nuertingen serves as a prime example of Telekom’s cooperative efforts.

Currently, approximately 30,000 households in expansion areas under this partnership can already subscribe to Telekom’s fibre optic connections. The long-term goal is to enable 185,000 households within cooperative areas with municipal utilities to choose their preferred communication provider for fibre optic connections by 2030.

The combined efforts of self-expansion, collaborations, and subsidized projects have granted around 335,000 households throughout the region access to the fibre optic network, Telekom said.

The core focus of the gigabit project is to expand the ultra-fast fiber optic network through strategic partnerships. Currently, 177 municipalities, including Stuttgart and the neighbouring districts of Boeblingen, Esslingen, Goeppingen, Ludwigsburg, and Rems-Murr, are participating in the expansion program.

The project aims to provide 50 percent of households, all companies, and schools with fiber optic connectivity by 2025. By 2030, the target is to achieve 90 percent household coverage. With a population of approximately 2.8 million in the conurbation, other companies in the Stuttgart region are also actively involved in fiber optic expansion initiatives said Telekom.

Telekom includes provisions for rapidly expanding the performance of its 5G network. Presently, almost 95 percent of households can already access 5G in Telekom’s mobile network, while over 99 percent of the population can utilize 4G/LTE connectivity.

Significance of DT Tower Sales:

Deutsche Telekom said proceeds from the sale of its tower business helped reduce net debt excluding leases by over 10 billion euros compared with the end of 2022, to 93 billion euros. The transaction was also the main factor behind the near quadrupling of net profit, to 15.4 billion euros, compared with the same period last year, the company said.

Deutsche Telekom had agreed in July 2022 to sell 51% of its tower business in Germany and Austria to a consortium of Canada’s Brookfield and U.S. private equity firm DigitalBridge after they made a surprise last-minute bid that valued the unit at 17.5 billion euros ($17.5 billion).

References:

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

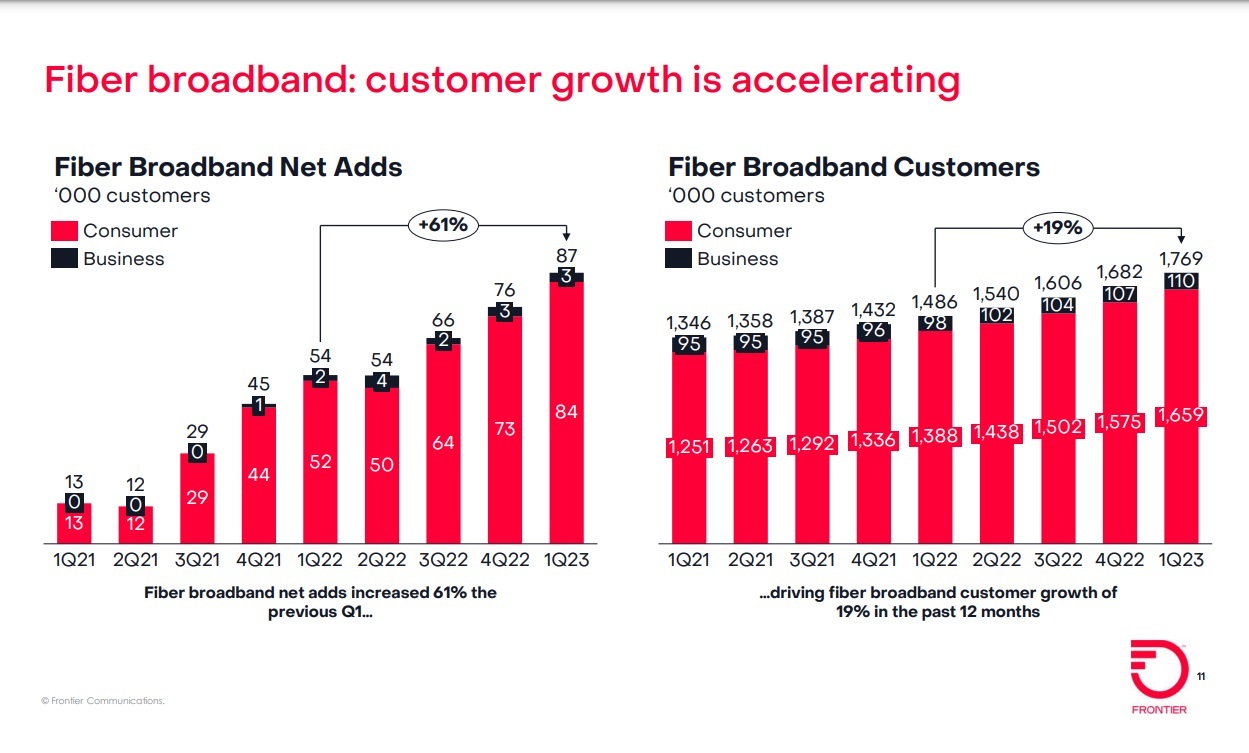

Frontier Communications added record number of fiber broadband customers in the 1st quarter of 2023. The fiber facility based network operator added 87,000 fiber subscribers (including 83,000 residential subs) in the first quarter of 2023, up from +54,000 in the year-ago quarter. Those results beat the 76,000 residential fiber subs Frontier was expected to add in the period. Frontier ended the quarter with 1.76 million fiber customers: 1.65 million residential subscribers and 110,000 business customers.

“We delivered another strong quarter and reached a critical milestone in our transformation. Thanks to our team’s consistent operational performance, we achieved EBITDA growth for the first time in five years,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“We are creating an internet company that people love. Over the last two years, we have rallied around our purpose of Building Gigabit America, invested in fiber, enhanced our product, put the customer at the center of everything we do and made it easier to do business with us. We are quickly becoming an agile, digital infrastructure company, and I’m confident we will return to growth this year.”

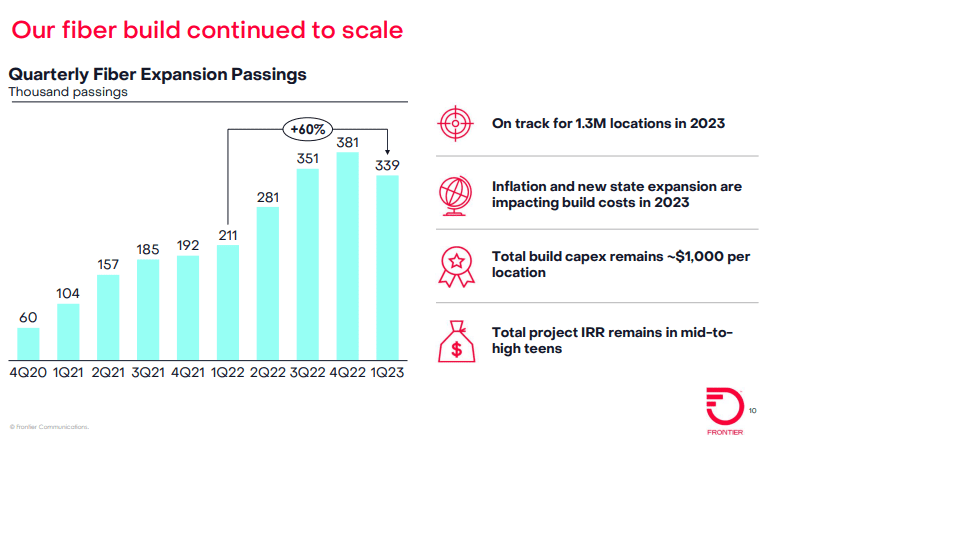

Frontier said it built fiber to an additional 339,000 locations in Q1 2023, up 60% from the 211,000 it built in the year-ago period. Frontier’s Q1 buildout was better than the 300,000 locations expected by the analysts at New Street Research. Frontier ended the quarter with 5.5 million fiber passings and 15.4 million total passings.

First-Quarter 2023 Consolidated Financial Results:

• Revenue of $1.44 billion decreased 0.5% from the first quarter of 2022 as growth in consumer, business and wholesale fiber was more than offset by declines in legacy copper

• Operating income was $143 million and net income was $3 million

• Adjusted EBITDA of $519 million increased 2.0% over the first quarter of 2022 as revenue declines were more than offset by lower content, selling, general and administrative expenses, and cost-saving initiatives

• Adjusted EBITDA margin of 36.0% increased from 35.2% in the first quarter of 2022

• Capital expenditures of $1.15 billion increased from $0.45 billion in the first quarter of 2022 as fiber expansion initiatives accelerated First-Quarter 2023

Consumer Results:

• Consumer revenue of $761 million decreased 1.9% from the first quarter of 2022 as strong growth in fiber broadband was more than offset by declines in legacy copper broadband and voice

• Consumer fiber revenue of $448 million increased 10.1% over the first quarter of 2022 as growth in consumer broadband, voice, and other more than offset declines in video

• Consumer fiber broadband revenue of $298 million increased 17.3% over the first quarter of 2022 driven by growth in fiber broadband customers

• Consumer fiber broadband customer net additions of 84,000 resulted in consumer fiber broadband customer growth of 19.5% from the first quarter of 2022

• Consumer fiber broadband customer churn of 1.20% was roughly flat with churn of 1.19% in the first quarter of 2022

• Consumer fiber broadband ARPU of $61.44 decreased 1.1% from the first quarter of 2022 driven primarily by the autopay and gift-card incentives introduced in the third quarter of 2021 First-Quarter 2023

Business and Wholesale Results:

• Business and wholesale revenue of $657 million decreased 1.4% from the first quarter of 2022 as growth in fiber was more than offset by declines in copper

• Business and wholesale fiber revenue of $281 million increased 6.0% over the first quarter of 2022 as growth in business was partly offset by modest declines in wholesale

• Business fiber broadband customer churn of 1.45% increased from 1.24% in the first quarter of 2022

• Business fiber broadband ARPU of $104.38 decreased 1.2% from the first quarter of 2022

………………………………………………………………………………………………………………………………..

While Frontier’s fiber growth engine continues to hum along, the company is dealing with higher costs related to its fiber initiative. The company raised its 2023 capex guidance to a range of $3 billion to $3.2 billion, up from an original outlook of $2.8 billion.

Frontier blamed the increase on a couple of factors – a decision to build inventory opportunistically where it saw supply chains ease a bit in the quarter and higher build costs as it scales its build into new geographies. Frontier is also seeing higher labor costs being driven by general inflation and higher rates as some of its multi-year labor contracts come up for renewal.

The anticipated increase in capex this year concerned investors. Frontier shares were down $2.33 (-10.94%) to $19.13 each in Friday morning trading.

Overall, Frontier expects fiber build costs in 2023 to be in the range of $1,000 to $1,100. But it’s confident that total project build costs will remain at about $1,000 per location as it mixes in lower-cost locations in some new-build states and benefits from aerial builds and an increased focus on multiple dwelling units (MDUs), Frontier CFO Scott Beasley said on Friday’s earnings call.

The current capex picture isn’t expected to impact Frontier’s overall fiber buildout/upgrade plan. “We’re confident that the 10 million locations is still attractive to build out,” Beasley said. Frontier is also continuing to explore an additional 1 million to 2 million additional fiber passings beyond the original 10 million target.

Frontier says it’s too early to tell how this year’s cost headwinds might impact future opportunities coming by way of the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program. New Street Research estimates that there are 1.2 million BEAD-eligible locations in Frontier’s footprint. New Street Research expects ARPU pressure at Frontier to ease in the second quarter of the year and return to growth in the third quarter.

Frontier recently initiated several consumer pricing changes for value-added services that were previously free. Whole-home Wi-Fi, for example, now costs $10 per month, its Home Shield Elite product is now $6 per month extra and the company is now charging $50 for professional installs. Those actions are driving new fiber customer monthly ARPU to a range of $65 to $70, the company said.

Frontier is also speeding up its original cost savings target to $500 million by the end of 2024. Its prior target was $400 million by the end of 2024. Frontier is approaching that target through a range of streamlining and simplification initiatives, including improved field operations, self-service capabilities, the consolidation of call centers and an ongoing reduction in copper infrastructure.

Frontier’s guidance for the full year 2023:

• Adjusted EBITDA of $2.11 – $2.16 billion, unchanged from prior guidance

• Fiber build of 1.3 million new locations, unchanged from prior guidance

• Cash capital expenditures of $3.00 – $3.20 billion, an increase from prior guidance of $2.80 billion, reflecting higher inventory levels and fiber build costs

• Cash taxes of approximately $20 million, unchanged from prior guidance

• Net cash interest payments of approximately $655 million, an increase from prior guidance of $630 million, reflecting the $750 million of debt raised in March 2023

• Pension and OPEB expense of approximately $50 million (net of capitalization), unchanged from prior guidance

• Cash pension and OPEB contributions of approximately $125 million, unchanged from prior guidance

References:

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

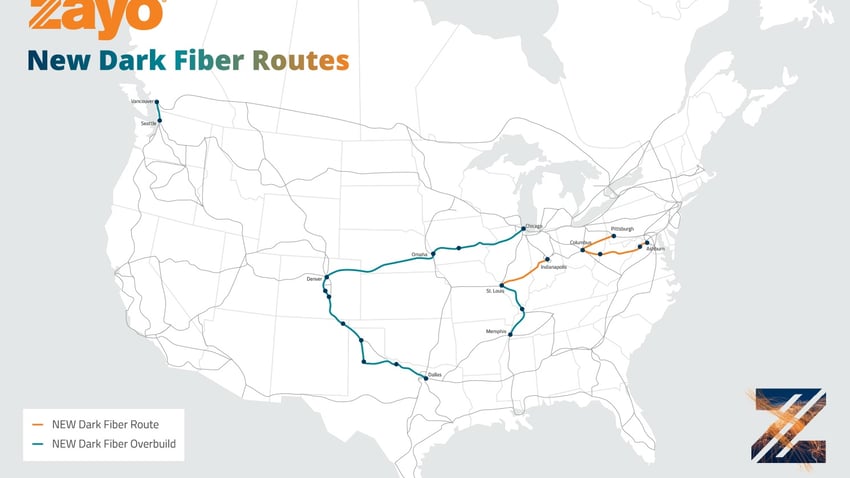

Zayo announces “Waves on Demand,” security enhancements, and network growth

Zayo Group Holdings, Inc (Zayo) today announced a series of expansions and enhancements to its network and services. These include enhanced network protection and an industry-first, on-demand connectivity service, as well as significant growth of its long-haul dark fiber and 400G-enabled routes and modernization of its IP core network. In particular, Zayo plans to build eight new long-haul fiber routes and debuted a new Waves on Demand service for customers looking to rapidly light up added bandwidth. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available. Five additional routes are planned. More details below.

“Yesterday’s network can’t deliver tomorrow’s ideas,” said Andrés Irlando, President of Zayo. “Zayo’s global network provides game-changing performance, scale, security, resilience and value for our customers. Our goal is to revolutionize the industry by constantly improving our network and prioritizing our customers’ needs. Our teams are focused on providing them with the best possible experience.”

Providing an On-Demand Network:

For large bandwidth customers who need data center connectivity quickly and easily, Zayo is launching Waves on Demand to enable same-day turn-up on the most in-demand routes, with significantly shortened delivery times. Zayo will be the only provider to enable customers to provision wavelengths within a day.

This industry-first means customers can quickly provision “Wavelength on Demand” between key data center locations across its market-leading network footprint, including its highest-demand routes. In 2023, Zayo launched 8 new Waves on Demand routes, with 5 additional routes planned for the future.

Zayo’s Completed Waves on Demand routes include:

- Newark, NJ – New York, NY (up to 400G)

- Ashburn, VA – New York, NY

- Hillsboro, OR – Seattle, WA

- Ashburn, VA – Newark, NJ

- Atlanta, GA – Dallas, TX

- Los Angeles, CA – San Jose, CA

- Inter-Los Angeles, CA

- Los Angeles, CA – San Jose, CA (alt)

Zayo’s Planned Waves on Demand Routes include:

- Toronto, ON – Chicago, IL

- San Jose, CA – Seattle, WA

- Newark, NJ – Chicago, IL

- Chicago, IL – Secaucus, NJ

- Englewood, FL – Chicago, IL

Chaz Kramer, Zayo’s VP of Product Management, told Fierce that Waves on Demand will cut the time required to add wavelengths from 45 days or more to just hours. said, “80% of our services right now are 100G services at the moment. Our focus is trying to solve the customer requirement for that time lag in terms of service delivery,” he said.

“The only way to stay ahead of the digital curve is to continuously transform. Transformative ideas need a reliable, resilient and on-demand network,” said Bill Long, Chief Product Officer at Zayo. “Zayo is leading the industry with network automation and self-service options, ensuring customers have unprecedented speed and resilience with more flexibility and elasticity, while enhancing security and value, so our customers can focus on making progress toward their business goals instead of worrying about their network.”

Security Enhancements:

Security has never been more important across the tech industry, and beyond. As more and more companies face the realities of route hijacking, Zayo has taken security protection for customers one step further.

In addition to deploying Resource Public Key Infrastructure (RPKI) filtering – a component of Mutually Agreed Norms for Routing Security (MANRS) compliance designed to secure the internet’s routing infrastructure – Zayo now requires two-factor authentication process for Border Gateway Protocol (BGP) route management. As one of the first communications infrastructure providers to implement a two-factor authentication process for BGP updates, this will provide improved security for the broader internet community and prevent inadvertent or malicious route hijacks from bad actors.

Network Growth and Modernization

This year Zayo began IP Core upgrades to support 400G connectivity, providing better routing performance, stability, high bandwidth and reduced pricing for customers. Zayo has partnered with Juniper Networks®, a global leader in IP networking, cloud and connected security solutions for next-gen IP Core connectivity.

“Juniper Networks is dedicated to delivering state-of-the-art solutions, including systems optimized for our customers’ current and future core throughput demands. We are pleased to partner with Zayo as they construct and fortify their next-generation IP Core network, equipped with 400G,” said Sally Bament, Vice President of Service Provider Marketing at Juniper Networks. “By employing Juniper’s core routers, Zayo can ensure their customers enjoy high-speed bandwidth services that can support growing performance and capacity demands of end users.”

The Growth of Zayo’s Network:

- In 2022, Zayo added 5,200 route miles to its network, resulting in more than 1.35M fiber miles.

- Zayo now has 224 400G-enabled wavelength points of presence (PoPs) and 145 100G-enabled PoPs.

- Zayo deployed 24 long-haul waves routes in 2022 with 926TB of wavelength capacity, enabling 400G services across these routes, spanning more than 20,000 route miles. In 2023, Zayo will exceed the number of new Long Haul Dark Fiber routes deployed in 2022.

- Zayo will complete 8 long-haul construction projects in 2023, totaling 2,951 route miles and 708,000 fiber miles.

- Zayo is estimated to complete 32 400G routes in 2023 with 14 completed in the first half of the year.

Zayo’s 2023 planned new and augmented dark fiber routes:

- New – St. Louis, MO to Indianapolis, IN

- Overbuild – Denver, CO to Dallas, TX

- Overbuild – Chicago, IL to Omaha, NE

- Overbuild – Omaha, NE to Denver, CO

- Overbuild – Seattle, WA to Vancouver, WA

- New – Columbus, OH to Pittsburgh, PA

- Overbuild – St. Louis, MO to Memphis, TN

- New – Columbus, OH to Ashburn, VA

Zayo’s New Tier 1 400G Routes:

- Albany, NY – Newark, NJ

- Bend, OR – Umatilla, OR

- Chicago, IL – Cleveland, OH

- Albany, NY – Boston, MA

- Atlanta, GA – Washington, DC

- Dallas, TX – St. Louis, MO

- Denver, CO – Dallas, TX

- Kansas City, MO – Indianapolis, IN

- Las Vegas, NV – Phoenix, AZ

- Montreal, QC (Canada) – Quebec City, QC (Canada)

- Columbus, OH – Ashburn, VA

- Columbus, OH – Cleveland, OH

- Columbus, OH – Pittsburg, PA

- Chicago, IL – Clinton, KY

- Clinton, KY – Ponchatoula, LA

- Toronto, ON (Canada) – Waterloo, ON (Canada) (Crosslake)

- Toronto, ON (Canada) – Montreal, QC (South) (Canada)

- Toronto, ON (Canada) – Montreal, QC (North) (Canada)

- Indianapolis, IN – Columbus, OH

- Ashburn, VA – Baltimore, MD

- Salt Lake City, UT – Seattle, WA

- Los Angeles, CA – San Jose, CA

Additional tier 2 and 3 routes will also be added throughout 2023, totaling 32 new routes.

“We believe that technology plays a critical role in preparing students for the future. We chose Zayo’s future-ready network because of its resilience and performance,” said Dr. Thomas Weeks, Chief Technology Officer at Hillsborough County Public Schools. “We trust Zayo because they invest in their world-class network. The Zayo team worked with us to tailor a solution that met the unique needs of our school district and enhances our effectiveness to help students and staff achieve.”

Enhancing Service Delivery and Customer Experience:

Zayo has also set out to change the trajectory of customer experience. Zayo optimized its service delivery with rebuilt processes that utilize automation to make working with Zayo easier for customers. Since implementing these changes, Zayo had its largest install quarter in history in Q4 2022.

To learn more about Zayo’s network and how it can help you connect what’s next, please visit https://www.zayo.com/info/network-expansion/

About Zayo Group Holdings, Inc:

For more than 15 years, Zayo has empowered some of the world’s largest and most innovative companies to connect what’s next for their business. Zayo’s future-ready network spans over 16 million fiber miles and 139,000 route miles. Zayo’s tailored connectivity and edge solutions enable carriers, cloud providers, data centers, schools, and enterprises to deliver exceptional experiences, from core to cloud to edge. Discover how Zayo connects what’s next at www.zayo.com and follow us on LinkedIn and Twitter.

References:

https://www.fiercetelecom.com/telecom/zayo-slashes-time-turn-bandwidth-waves-demand

Zayo to deploy 400G b/s network across North America and Western Europe

Digital Realty & Zayo plan next gen fiber interconnection and security capabilities

Shentel joins Frontier and Altice USA with 5-gig broadband service

Shenandoah Telecommunications (Shentel) became the latest wireline network operator to roll out a symmetrical 5 Gbps internet tier, making it available to all 147,000 passings where it currently offers Glo Fiber service. Over 147,000 homes across Virginia, West Virginia, Maryland and Pennsylvania will have access to the fastest fiber speeds available in these markets.

The average U.S. household now has approximately 20 connected devices, and that number is expected to continue to grow. In addition, with more consumers working remotely long-term, video conferencing is here to stay. Multi-gig speeds are designed for these growing demands and will provide more bandwidth to run a multitude of connected devices at once.

“Adding 5 Gig internet service to our multi-gig product portfolio allows Glo Fiber to meet the demands of our customers and communities. 5 Gig is a premium residential service designed to connect multiple devices at their fastest possible speeds over a reliable, 100% fiber optic network,” said Ed McKay, Shentel Chief Operating Officer.

As of the end of Q4 2022, Glo Fiber was live in 17 markets across four states, including Maryland, Pennsylvania, Virginia and West Virginia. Jeff Manning, Shentel’s VP of Product and Network Strategy, said that by the end of 2023, Glo Fiber and the new 5-gig offering will be available to just under 250,000 passings across 23 markets.

“It feels like the right time to launch,” Manning said. “When you look at the number of devices in homes, the average is well over 20 devices in every home now. So, 5-gig service gives you the capability to ensure every device in the home is fully supported with the capacity it needs.”

The regional network operator already offers 600 Mbps, 1.2 Gbps and 2.4 Gbps service tiers at price points ranging from $65 to $135. The new 5-gig tier will cost $285 per month and require customers to bring their own router.

Manning said the reason it is asking 5-gig customers to bring their own router is because that will enable them to select a device with the level of performance they need. That and there aren’t routers on the market yet which are fully capable of delivering 5 gigs over Wi-Fi. When that changes, he said, Shentel will look at options to package routers with the 5-gig plan.

As a leading broadband internet provider in the Mid-Atlantic region, Glo Fiber takes great pride in several key differentiators compared to their competitors:

- Fiber-to-the-home technology with exceptional reliability

- Symmetrical download and upload speeds

- Easy, straight-forward pricing

- Prompt local customer service

Frontier has 125,000 fiber passings in West Virginia and recently announced plans to build another 100,000 there this year. It also provides fiber service in parts of Pennsylvania, including near Harrisburg and Lancaster, areas Shentel is eyeing for its expansion.

Altice also offers its Optimum fiber service in parts of Pennsylvania, including the areas west of Carlisle, which are similarly situated in the general area of a market Shentel is targeting. AT&T and Google Fiber offer 5-gig service tiers as well but don’t appear to operate within Shentel’s footprint. Frontier’s 5-gig service currently runs $164.99 per month while Altice’s costs $180 per month.

Watkins said the majority of Glo Fiber customers today are landing in its 1-gig and 2-gig buckets, though only around 10% fall into the latter. Thus, it’s not expecting huge take rates for the 5-gig product. Instead of mass market appeal, he said it’s designed to cater to select segments of the population with high bandwidth needs.

About Glo Fiber:

Glo Fiber (Glo) provides next-generation fiber-to-the-home (FTTH) multi-gigabit broadband internet access, live streaming TV, and digital home phone service powered by Shentel (Nasdaq: SHEN). Glo provides the fastest available service to residents leveraging XGS-PON, a state-of-the-art technology capable of symmetrical internet speeds up to 10 Gbps. To learn more about Glo Fiber, please visit www.glofiber.com or 1-800-IWANTGLO (1-877-492-6845).

About Shenandoah Telecommunications:

Shenandoah Telecommunications Company (Shentel) provides broadband services through its high speed, state-of-the-art fiber-optic and cable networks to customers in the Mid-Atlantic United States. The Company’s services include: broadband internet, video, and voice; fiber optic Ethernet, wavelength and leasing; and tower colocation leasing. The Company owns an extensive regional network with over 8,300 route miles of fiber and over 220 macro cellular towers. For more information, please visit www.shentel.com.

References:

https://www.fiercetelecom.com/broadband/shentel-targets-power-users-5-gig-broadband-plan

Shentel plots launch of fiber in 6 greenfield markets in 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Ziply® Fiber agrees to acquire Ptera as U.S. fiber buildouts slow

Ziply® Fiber [1.] has announced an agreement to acquire Ptera, Inc, a fiber internet and fixed wireless internet service provider (WISP) serving four counties across Eastern Washington and Northern Idaho. The acquisition, Ziply’s fourth since June 2022, is scheduled to close later this year, pending regulatory approvals. Financial terms of the buyout were not disclosed.

Note 1. Ziply was created in May 2020 after Frontier Communications sold its operations and assets in Washington, Oregon, Idaho and Montana to WaveDivision Capital in partnership with Searchlight Capital Partners for $1.35 billion. Ziply won just over $57 million in Rural Digital Opportunity Fund (RDOF) support to build fiber to more than 21,000 locations. It has also been working with state and local broadband officials on additional opportunities and plans to participate in the Broadband Equity, Access, and Deployment (BEAD) Program.

Image Credit: Ziply® Fiber

……………………………………………………………………………………………………………………

Founded in 2001 and headquartered in Liberty Lake, WA, Ptera serves more than 4,000 customers in the cities of Airway Heights, Cheney, Liberty Lake, Medical Lake, Otis Orchards and more. All Ptera employees will join the Ziply Fiber team as part of the acquisition.

“Both Ptera and Ziply Fiber were born here in the Northwest, and both of our companies have been focused on a similar mission to connect communities that have been underserved when it comes to reliable, high-speed internet,” said Harold Zeitz, CEO of Ziply Fiber. “We look forward to having the Ptera employees join the Ziply Fiber team and continue the work underway to expand their fiber network to reach more addresses in the region.”

Zeitz told Fierce Wireless the deal will not only help fill in a gap in its fiber map, but will also give it fixed wireless access expertise which may help it secure more customers in the future. Zeitz said, “We’re not going to build fiber generally where there is fiber. So, rather than skip those areas that we think fit what we ultimately want as our network, it makes sense ultimately to join forces rather than skip an area or build over fiber.”

Zeitz told Fierce Wireless on Friday that it now serves fiber to approximately 800,000 locations – and remains on track to hit its goal to deploy fiber to 80% to 85% of its territory. But for the 15% to 20% of locations that fall outside its economic threshold for building fiber, Zeitz said it will either use grants to help fund its build or just use fixed wireless. Its recent acquisitions “give us an opportunity to have teams that are experienced with that.”

“There’s definitely a part of the footprint that’s just too expensive to get to but they deserve better internet, so fixed wireless is a good alternative for that cross section of the population,” he said. “We may build fiber where there is fixed wireless [today] but we’ll likely have some fixed wireless and we may extend the fixed wireless. We’re in the process of thinking through how we would do that.”

Steven Wilson, CEO of Ptera, said, “Ptera has been a family-owned business for more than 20 years, and I’m very proud of the work our team has done to earn the trust and support of our customers across the Inland Northwest. I’m excited about this next chapter for the company and our future together with Ziply Fiber.”

Current Ptera customers will not see any immediate changes to their service or working relationships. Once the acquisition officially closes (which can take months), customers will benefit from expanded customer service capabilities and access to new products such as SD-WAN and improved network management capabilities.

……………………………………………………………………………………………………………………………

Meanwhile, the fiber buildout boom shows signs of slowing due to inflationary pressures for labor and equipment with a higher interest rates (i.e. cost of capital). In a new report to MoffettNathanson clients, Craig Moffett found that incremental telco fiber passings in 2022 were about 500,000, roughly 8% below year-ago expectations. Meanwhile, combined guidance for 2023 has dipped by 3.1 million, or 40%, he added, noting that this doesn’t include the build activities of private companies such as Windstream, Brightspeed, Ziply Fiber and Cincinnati Bell (altafiber).

AT&T has reduced the pace of future fiber buildouts to 2 million to 2.5 million per year, down from the prior suggested run-rate of 3.5 million to 4 million. That doesn’t include the AT&T-BlackRock joint venture initially targeting the buildout of 1.5 million fiber locations outside AT&T’s current footprint.

Lumen’s build also dropped about 33% from its year-ago guidance amid a broader company “reset”. Frontier Communications’ expected 2023 build has been cut back by about 300,000 passings, though its target to build fiber to 10 million locations by 2025 hasn’t changed.

Altice USA has also reduced its original fiber upgrade plans, putting more emphasis on DOCSIS upgrades in rural footprint.

Moffett doesn’t see any near-term relief as more government funds are released to support rural builds. “We expect labor cost pressures, in particular, to worsen,” he wrote. “We are inching ever closer to the allocation of rural subsidy BEAD [Broadband Equity, Access, and Deployment] funds to states, and then to individual grantees. Those projects will introduce an enormous new source of demand for labor (and for crews from contract builders such as Dycom).”

……………………………………………………………………………………………………………………………….

About Ziply Fiber:

Ziply Fiber is local in the Northwest, headquartered in Kirkland, Washington, and has major offices in Everett, Washington; Beaverton, Oregon; and Hayden, Idaho. Most of Ziply Fiber’s executive team, which consists of former executives from AT&T, CenturyLink, and Wave Broadband, either grew up in the Northwest or have spent the better part of 30 years living here. That local ownership and market familiarity is an important part of the company mindset and culture. Ziply Fiber’s primary service offerings are Fiber Internet and phone for residential customers, Business Fiber Internet and Ziply Voice services for small businesses, and a variety of Internet, networking, and voice solutions for enterprise customers. The company also continues to support Ziply Internet (DSL) customers and its TV customers in Washington and Oregon.

Ziply Fiber has committed to invest hundreds of millions of dollars to build an advanced, 100-percent fiber network to both suburban and rural communities across the Northwest that have been underserved when it comes to internet access. The company has been actively building fiber across the Northwest since June 2020 and has plans to build and deploy new fiber-optic cables, local hubs, new offices, and new hardware to run the network as part of hundreds of additional projects across its 250,000-square-mile footprint.

A full listing of products and services can be found at ziplyfiber.com.

About Ptera:

Ptera, a Liberty Lake, WA based telecommunications corporation, was founded in 2001 as a family-owned business. Today, Ptera is a pioneering wireless internet service provider operating a network with coverage in four counties across Eastern Washington and Northern Idaho. Ptera also offers hosted voice over IP phone solutions serving customers across the country. The company’s service has no data caps on fiber internet and the lowest latency in town, even lower than DSL or cable providers. Ptera’s VoIP service offers crystal clear digital phone calls over an Internet connection utilizing your current handset or Cisco office phone.

For more, visit ptera.com.

References:

https://www.fiercetelecom.com/telecom/ziply-buys-ptera-fiber-expansion-rolls-mulls-fwa-strategy

https://www.lightreading.com/broadband/spotlight-turns-to-arpu-in-us-broadband-battle/d/d-id/783742?

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications Parent, Inc. (“Frontier”) reported impressive 4th quarter and full-year 2022 results today. The fiber facilities based carrier added a record 76,000 fiber subs in the last quarter, more than two times what it added in the year-ago quarter. The bulk of those fiber subscriber gains are coming from cable competitors, execs said.

Frontier ended 2022 with 1.7 million fiber customers, a figure that represents the majority of its total base of 2.8 million broadband subs. Frontier also built out a record 381,000 new fiber locations in Q4, ending 2022 with 5.2 million fiber locations. That gets Frontier past the halfway point toward a goal of building fiber-to-the-premises to 10 million locations by 2025.

Total revenues were down year-over-year, but consumer fiber revenues rose 7.7% to $436 million versus the prior year period, offsetting declines in video. Consumer fiber broadband revenues surged 15.5%, to $283 million.

“We ended the year strong with another quarter of record operational results. We now have the fiber engine we need to power our growing digital infrastructure business. This is how we advance our purpose of Building Gigabit America,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“This year, we will accelerate our fiber build and give customers more reasons to choose the un-cable provider. The team is fired up and ready to return to growth in 2023.”

Frontier expects to accelerate its fiber build to 1.3 million homes in 2023 – about 20% faster than its 2022 pace – and end the year with 6.5 million fiber locations. Frontier is also exploring fiber builds beyond its initial goal of 10 million. The company has identified 1 million to 2 million copper locations where it can upgrade to fiber cost-effectively. There’s another 3 million to 4 million locations in its footprint that remain financially unattractive but could get over the hump with government subsidies or partnerships.

Even with its faster build pace, Frontier expects 2023 capital expenditures to reach $2.8 billion, essentially flat versus 2022’s $2.74 billion. Frontier anticipates its fiber buildout costs will stay in its envelope of $900 to $1,000 per location passed.

Frontier believes it’s set to grow its average revenue per user (ARPU) by 2% to 3% in 2023. Tied in, it’s updating its pricing and looking to upsell customers to higher speeds (more than half of new subs are choosing speeds of 1-Gig or more) while also reducing its reliance on perks such as gift cards.

Source: Frontier Q4 2022 earnings presentation

……………………………………………………………………………………………………………………………………………………………………

On the wholesale side, Frontier has fiber tower deals with AT&T, Verizon and T-Mobile and recently inked an expanded deal with AT&T to connect it to Frontier’s central offices. Company President and CEO Nick Jeffery suggested that the same model could apply to the likes of Amazon, Microsoft and other cloud companies that are distributing data and could make use of cache locations where data is being consumed.

But that handwork with wireless network operators has yet to drive Frontier toward deals that could enable it to add mobile services to the bundle, and follow the path being taken by major cable operators such as Comcast and Charter Communications.

Jeffery reiterated a position that Frontier is keeping close watch on potential MVNO partnerships but that no such agreement is imminent. Such a deal could be a “distraction of our capital,” he said.

“For the moment, we don’t see the need to launch with an MVNO and bundle with our core broadband offer,” Jeffery explained. “We think it’s something we could spin up relatively quickly and efficiently if we needed to.”

Full-Year 2022 Highlights:

- Built fiber to 1.2 million locations, bringing total fiber passings to 5.2 million by the end of 2022 – more than halfway to our target of 10 million fiber locations.

- Added a record 250,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 17.5% from 2021.

- Revenue of $5.79 billion, net income of $441 million, and Adjusted EBITDA of $2.08 billion.

- Capital expenditures of $2.74 billion, including $1.52 billion of non-subsidy-related build capital expenditures and $0.06 billion of subsidy-related build capital expenditures.

- Surpassed our $250 million gross annualized cost savings target more than one year ahead of plan and raised our target to $400 million by the end of 2024.

4th-Quarter 2022 Highlights:

- Built fiber to a record 381,000 locations

- Added a record 76,000 fiber broadband customers

- Revenue of $1.44 billion, net income of $155 million, and Adjusted EBITDA of $528 million

- Capital expenditures of $878 million, including $517 million of non-subsidy-related build capital expenditures and $33 million of subsidy-related build capital expenditures

- Net cash from operations of $360 million, driven by strong operating performance and increased focus on working capital management

- Achieved annualized run-rate cost savings of $336 million

4th-Quarter 2022 Consolidated Financial Results:

- Frontier reported revenue for the quarter ended December 31, 2022, of $1.44 billion, a 6.9% decline compared with the quarter ended December 31, 2021, as growth in consumer, business and wholesale fiber was more than offset by declines in copper and subsidy.

- Revenue growth was negatively impacted by the expiration of CAF II funding at the end of the fourth quarter of 2021.

- Excluding subsidy-related revenue, revenue for the quarter ended December 31, 2022, declined 2.5% compared with the quarter ended December 31, 2021, an improvement in the year-over-year rate of decline reported for the quarter ended September 30, 2022.

- Fourth-quarter 2022 operating income was $136 million and net income was $155 million.

- Capital expenditures were $878 million, an increase from $559 million in the fourth quarter of 2021, as fiber expansion initiatives accelerated.

4th-Quarter 2022 Consumer Results:

- Consumer revenue of $764 million declined 2.3% from the fourth quarter of 2021, as strong growth in fiber broadband was more than offset by declines in legacy video and voice.

- Consumer fiber revenue of $436 million increased 7.7% over the fourth quarter of 2021, as growth in consumer broadband, voice, and other more than offset declines in video.

- Consumer fiber broadband revenue of $283 million increased 15.5% over the fourth quarter of 2021, driven by growth in fiber broadband customers.

- Consumer fiber broadband customer net additions of 73,000 resulted in consumer fiber broadband customer growth of 17.9% from the fourth quarter of 2021.

- Consumer fiber broadband customer churn of 1.32% was flat with the fourth quarter of 2021.

- Consumer fiber broadband ARPU of $61.20 declined 1.6% from the fourth quarter of 2021, as price increases and speed upgrades were more than offset by the autopay and gift-card incentives introduced in the third quarter of 2021.

- Excluding the impact of gift-card incentives, consumer fiber broadband ARPU increased 0.9% over the fourth quarter of 2021.

4th-Quarter 2022 Business and Wholesale Results:

- Business and wholesale revenue of $659 million declined 2.6% from the fourth quarter of 2021, as growth in our fiber footprint was more than offset by declines in our copper footprint.

- Business and wholesale fiber revenue of $285 million increased 5.5% over the fourth quarter of 2021, driven by growth in both business and wholesale.

- Business fiber broadband customer churn of 1.33% increased from 1.23% in the fourth quarter of 2021.

- Business fiber broadband ARPU of $107.68 increased 0.8% from the fourth quarter of 2021.

…………………………………………………………………………………………………………………………………………………..

Separately, Frontier introduced its Fiber Innovation Labs yesterday – National Innovation Day – designed for inventing and testing new patents, technologies and processes that will advance its fiber-optic network. Improving the customer experience and driving efficiencies are key to accelerating Frontier’s fiber-first strategy. Frontier’s labs serve as a testing ground to find new technologies and procedures to advance the way it delivers blazing-fast fiber internet to consumers and businesses across the country.

“The work we are doing in our Fiber Innovation Labs will change the way we serve our customers and will ultimately change the industry,” said Veronica Bloodworth, Frontier’s Chief Network Officer. “We have the best team in the business – they live and breathe innovation. They have been awarded several patents and are in the process of bringing those new inventions to life to deliver the best ‘un-cable’ internet experience to our customers. Be prepared to be amazed.”

As part of Frontier’s Fiber Innovation Labs, the company has launched its first-ever outside plant facility in Lewisville, Texas. The facility is designed as a miniature suburban neighborhood that mimics the real-life experiences of its techs serving customers every day. It features roads, sidewalks, a state-of-the-art central office, a small house and a reconstructed manhole system. It also simulates weather elements and temperature changes. Here, the Frontier team can test and learn new methods in real-world environments to install and maintain its fiber-optic network.

References:

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

\

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications and AT&T today announced a deal that will enable AT&T cell towers to connect to Frontier’s ultra-fast fiber network. Specifically, AT&T will use Frontier’s fiber infrastructure [1.] in areas where AT&T doesn’t currently own fiber. This will improve the resiliency, reliability and speed of the wireless service that AT&T offers to its customers. AT&T is the first tenant to rent space in Frontier’s hyper-local offices and will utilize Frontier’s fiber-optic network to connect with its cell towers that are in Frontier’s network.

Note 1. Frontier’s fiber network is available in 25 states.

Frontier’s footprint is complementary to AT&T’s existing network, which will help accelerate the company’s 5G deployment. AT&T will tap into Frontier’s fiber-to-the-tower (FTTT) infrastructure to connect to AT&T’s wireless cell towers. AT&T is the first tenant to rent space in Frontier’s local central office facilities, they said.

This deal is an extension of AT&T and Frontier’s 2021 agreement that brought the two complementary fiber networks together to power business customers nationwide. That multi-year agreement, focused on Frontier service territories in parts of 25 states, also mentioned support for deployment of AT&T’s 5G network.

The deal comes together as Frontier pushes ahead with a fiber upgrade and buildout plan. Frontier announced late last year that it had neared the halfway point toward a goal of reaching at least 10 million locations with fiber by the end of 2025. While a good portion of that work is focused on delivering services to Frontier’s own residential and business customers, the agreement with AT&T highlights the buildout’s wholesale opportunity.

Fiber backhaul is increasingly critical to support the data demands of wireless networks, including 5G. This agreement enables AT&T to stay ahead of those demands and build on an existing relationship between the two companies. Also, fiber backhaul could help spark a wholesale business that’s been in decline. Frontier’s overall business and wholesale revenues dropped 7.5% in Q3 2022 year-over-year, primarily due to declines in its copper footprint. Meanwhile, business and wholesale fiber revenues rose 1.1%, to $267 million, sequentially.

As illustrated in the figure below, backhaul comprises the Transport network, that connects the Tower / Access Point (mobile base station), which is part of the Radio Access Network (RAN), to the Core Network, where most computing resources are located.

“We’re excited to collaborate with AT&T in strengthening their wireless service with our fiber infrastructure,” said Vishal Dixit, Frontier’s Chief Strategy Officer & EVP Wholesale. “As one of the largest fiber builders in the country, our fiber infrastructure offers an attractive opportunity for tech companies to use this future-proof foundation for their wireless services. This is another example of how innovation is helping to transform Frontier.”

”Fiber is central to our wireless strategy and to our overall connectivity approach,” said Cheryl Choy, Senior Vice President, Network Planning & Engineering, AT&T. “This expanded collaboration with Frontier is a win for both companies, as they can fully utilize their fiber infrastructure, and we can continue to ensure our wireless services are powered by the unparalleled capacity of fiber optic networks.”

About Frontier:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Media Contacts:

Chrissy Murray

VP, Corporate Communications

[email protected]

Anne Tidrick

Director, Corporate Communications

+1 469-516-5862

[email protected]

References:

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Google Fiber making a 5-gig internet tier available in 12 markets after expanding service in CO and TX

Google Fiber is making a 5-gig internet tier available to customers in four of its 12 existing metro markets. Customers in West Des Moines, Iowa; Kansas City, Kansas/Missouri; and Salt Lake City and Provo, Utah can now sign up for the symmetrical service for $125 per month. That cost compares to $70 per month for its symmetrical 1-gig plan and $100 per month for its asymmetrical 2-gig offering.

In particular, Google Fiber’s 5 Gig tier offers symmetrical upload and download speeds with a Wi-Fi 6 router (or you can easily use your own), up to two mesh extenders and professional installation, all for $125 a month. Installation also includes an upgraded 10 Gig Fiber Jack, which means your home will be prepared for even more internet when the time comes.

As homes get “smarter” and every device is set up to stream, having access to higher speed, higher bandwidth internet becomes even more important. 5 Gig is designed to handle the demands of heavy internet users — for example, creative professionals, people working in the cloud or with large data, households with large shared internet demands. 5 Gig will make it easier to upload and download simultaneously, no matter the file size, and will make streaming a dream even with multiple devices.

The 5 Gig tier will be expanded to additional cities later this year and Google Fiber reiterated plans to debut an 8-gig offering in the near future as well. Google noted in a blog that those who opt for the 5-gig plan will be upgraded to a 10-gig fiber jack during installation, teeing customers up to receive “even more internet when the time comes.”

Here’s their Valentine’s Day message:

.jpg)

The operator is the latest to move up the multi-gig stack, following in the footsteps of AT&T, Altice USA, Frontier Communications, Greenlight Networks and Ziply Fiber. Once it launches its 8-gig service, it will join the likes of Lumen Technologies, TDS Telecom and Frontier Communications as per this post.

Earlier this week Google Fiber announced that it will expand services to Westminster, Colorado, and Chandler, Arizona. The move will pit Google Fiber up against incumbents that include Comcast and Lumen in Colorado, and Cox Communications and Lumen in Arizona. Data from BroadbandNow notes that Google Fiber competes with AT&T in Kansas City, Kansas and Missouri.

References:

https://fiber.google.com/blog/2023/02/fall-in-love-with-fast-5-gig-is-here.html

https://fiber.google.com/blog/2023/02/google-fiber-continues-to-grow-next-up.html

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service