Fixed Wireless Access (FWA)

UScellular’s Home Internet/FWA now has >100K customers

UScellular now has more than 100,000 Home Internet/Fixed Wireless Access (FWA) customers and it anticipates even more growth over the coming years.

In 2022, fixed wireless services accounted for 90% of home broadband net additions, according to Leichtman Research Group. In the U.S., Verizon is by far the leader in 4G/5G FWA ending 2022 with 1.452 million fixed wireless home internet customers. The telco added 384K, 393K, 379K, and 342K in the last four quarters. It now has 2.229 million FWA internet subscribers.

In a press release on Tuesday, UScellular Chief Marketing Officer Eric Jagher said they knew rural areas in particular would see great benefit from having a FWA solution.

“We continue to enhance our Home Internet experience for customers, and the growth and positive response we’ve received to this service has us excited for the future. As we celebrate this milestone, we look forward to further updating the service so we can soon surpass hundreds of thousands of Home Internet customers,” Jagher stated.

As UScellular continues to build out its 5G mid-band network, more customers will be able to realize the fast, dependable connectivity that Home Internet provides. Earlier this year, UScellular launched its 5G mid-band network in parts of 10 states and expects to cover 1 million households by the end of the year and 3 million households by the end of 2024. This network can deliver speeds up to 10x faster than its 4G LTE network and low-band 5G.

UScellular initially offered Home Internet on its 4G LTE network and has upgraded the service with low-band, mid-band and mmWave 5G in select markets across the country. Most customers today can access 5G speeds on the service, which has led to a doubling of the customer base over the last 18 months. The company currently offers self-install, plug-and-play internal antennas and routers and a professionally installed external antenna in certain areas. Later this year, the company expects to have additional self-install options available to help meet the evolving needs of customers.

Additionally, UScellular offers a free Internet Setup Coach for all new customers. Experts from Asurion are available via phone to help customers with router placement for the best speeds and getting all essential devices – like computers, TVs and doorbells – connected to their home’s Wi-Fi network.

As UScellular looks to further enhance and expand its Home Internet service especially in rural areas, funding from the National Telecommunications and Information Administration’s Broadband Equity Access and Deployment (BEAD) program will be important. Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States.

Indeed, UScellular has made it clear that it wants to use funds from the BEAD program to build more towers and serve more rural areas with FWA while increasing its 5G mobile coverage.

The telco this week reiterated the importance of that BEAD funding. “Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States,” the company stated.

About UScellular:

UScellular is the fourth-largest full-service wireless carrier in the United States, providing national network coverage and industry-leading innovations designed to help customers stay connected to the things that matter most. The Chicago-based carrier provides a strong, reliable network supported by the latest technology and offers a wide range of communication services that enhance consumers’ lives, increase the competitiveness of local businesses and improve the efficiency of government operations. Through its After School Access Project, the company has pledged to provide hotspots and service to help up to 50,000 youth connect to reliable internet. Additionally, UScellular has price protected all of its plans, promising not to increase prices through at least the end of 2024. To learn more about UScellular, visit one of its retail stores or www.uscellular.com. To get the latest news, visit newsroom.uscellular.com.

References:

For more information about UScellular’s efforts:

https://newsroom.uscellular.com/connecting-us/

https://www.fiercewireless.com/5g/uscellular-marks-100000-fwa-customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

GSA FWA Report: 38 commercially launched 5G FWA networks in the EU; Speeds revealed

GSA has been tracking the FWA broadband market to determine the evolving extent and nature of availability of services based on LTE or 5G technologies around the world. The number of network operators delivering FWA services varies widely by region, as Figures 3 and 4 show.

There are more operators marketing FWA services in Europe than any other region, particularly in the 27 countries that make up the EU, which has 38 commercially launched 5G FWA networks. An operator’s decision about whether to offer services will depend on various factors: how well covered with fixed-line broadband services the country or territory is; whether there are many remote regions with little to no broadband availability; whether that operator provides a fixed network at all and how advanced that network is from a technology perspective; and whether its rivals have introduced a FWA service. Where one operator introduces such a service, its rivals often quickly follow.

FWA Service Speeds:

Operators are often opaque about the FWA service speeds their LTE and 5G customers should expect. We believe this is because actual network performance depends on distance from cell towers, speed of movement or local interference — from walls or other physical or electronic objects — and other factors.

Operators often do not provide speed information or are deliberately vague talking about the types of speed that LTE, LTE-Advanced and 5G can theoretically provide, mentioning the maximum theoretical speed a customer might get (in a perfect scenario), mentioning speeds measured by third parties or, occasionally, offering average speed information.

GSA collected information about the fastest download speeds quoted by operators for their FWA services where data was available. The maximum speeds promoted for LTE FWA services range from 1 Mbps to 2.5 Gbps. The average of the marketed maximum peak download speeds that GSA identified was 173.3 Mbps, up significantly from 155.2 Mbps in November 2022 (based on maximum speed data for 333 operators, up from 317 operators identified as promoting their LTE FWA speeds in November 2022).

Data on 5G FWA maximum download speeds was collected from 72 operators (compared with 36 in June 2021). Quoted peak speeds ranged from 10 Mbps to 5400 Mbps in the downlink, with half of them sitting in the 250Mbps to 2300 Mbps range. The average 5G FWA maximum peak download speed identified by GSA is 1077 Mbps, up significantly from 875 Mbps in November 2022 and from 863 Mbps in June 2022.

Where information was made available to GSA, the average or typical peak download speed marketed to customers was lower at an estimated 31.8 Mbps for LTE networks, compared with 32.7 Mbps in November 2022 and 38.5 Mbps at the end of 2020; and just over an estimated 236.2 Mbps for 5G FWA services, down from 248.3 Mbps in November 2022 and up from 147 Mbps in November 2020. It should be noted that the sample sizes of operators quoting their average speeds were much smaller than the sample sizes of those quoting maximum speeds, at 35 for LTE and 14 operators for 5G, and that some quoted average ranges (where we used the midpoint in the range).

Conclusions:

The promotion of LTE and 5G networks as a mainstream mechanism for the delivery of broadband services to homes and businesses is now well established, with lots of services available from network operators, supported by a wide range of devices from many vendors.

FWA services are being offered as an alternative or complement to fixed broadband; the nature of the message is dependent on whether an operator already owns a large fixed broadband network it wishes to continue to sell.

As more operator networks are upgraded to LTE-Advanced, as more 5G networks are built out and as more (particularly 5G) CPE devices are commercialised, GSA expects the number of FWA services to rise. This study will be updated in November 2023

ABI Research joins the chorus: 5G FWA is a competitive alternative to wired broadband access

5G Fixed Wireless Access (FWA) allows Mobile Network Operators (MNOs) to provide Quality of Service (QoS) offerings with higher speeds and unlimited data, creating a demand for 5G FWA, which will continue to grow over the next few years. Global technology intelligence firm ABI Research forecasts that 5G FWA subscriptions will reach 72 million by 2027, representing 35% of the total FWA market in 2027.

Although LTE FWA services have already been widely deployed worldwide, they often cannot provide the speed needed to compete with wired broadband connections. 5G FWA is set to offer data rates rivaling the range of fiber, making it a competitive alternative to wired broadband solutions. “FWA is one of the few use cases that utilize 5G Massive Multiple-Input Multiple-Output (mMIMO) networks to their full extent, with a typical monthly utilization that could be as high as 1TB per subscriber. Many MNOs that have launched 5G are expected to offer FWA services, driving 5G FWA market growth,” explains Fei Liu, 5G and Mobile Network Infrastructure Industry Analyst at ABI Research.

Both developed and emerging markets benefit from 5G FWA. North America, Western Europe, and Asia Pacific are driving 5G FWA deployments. In North America and Western Europe, MNOs are using 5G FWA to compete with DSL broadband services. Major U.S. operators, like T-Mobile, see a huge opportunity with 5G FWA because two-thirds of its residential customers living in urban and suburban areas are dissatisfied cable customers, making up a significant amount of its 5G FWA customers. In Western Europe, EE UK launched 5G FWA in 2019 and plans to cover 90% of the UK with 5G by 2028. Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025. There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.

“MNOs should launch 5G FWA to utilize their network capacity to make additional revenue. However, they need to be vigilant on how many FWA subscribers they can support, and which type of service they wish to offer (best effort or QoS). In the long term, MNOs need to apply Artificial Intelligence (AI) techniques such as Machine Learning (ML) to evaluate their network resource, network capacity, and spectrum to ensure a steady 5G FWA growth,” Liu recommends. “When the 5G FWA service starts to challenge their network capacity, these MNOs may have to deploy millimeter wave (mmWave) to guarantee the quality of their FWA services and overall network capacity,” Liu concludes.

These findings are from ABI Research’s Fixed Wireless Access market data report. This market data is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

Fixed-wireless access antennas can be placed near windows or on roofs as shown in this diagram:

Image credit: Qualcomm

……………………………………………………………………………………………………………………………………………….

Other Market Rearch Firm Findings and Forecasts for 5G FWA:

A study published by Leichtman Research Group earlier this month claimed that FWA services accounted for 90% of U.S. net broadband additions last year, compared to 20% in 2021. Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

Verizon VP Sampath Sowmyanarayan recently said that Verizon’s FWA is winning 50 to 60% of its consumer segment customers and about half of its business segment customers from cablecos, with only a minority of subscribers coming from unserved and/or rural areas. The rural percentage may rise in the future due to growing availability and C Band deployment in rural markets, but not because capacity constraints are limiting it in urban and suburban markets. Outside the U.S.:

- EE UK launched 5G FWA in 2019 and plans to cover 90 percent of the UK with 5G by 2028.

- Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025.

- “There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.” Admittedly Jio has yet to offer a time frame for hitting that target, but if it makes good on its pledge to offer nationwide 5G coverage by the end of this year, 100 million FWA customers by 2027 seems eminently achievable.

Other bullish forecasts for the global 5G FWA market from JC Market Research and Research & Markets are here and here.

Regarding, telco 5G FWA revenues, a Juniper Research forecast last September was $2.5 billion globally this year, up from $515 million in 2022. It expects that number to climb to $24 billion by 2027 driven by consumers switching from fixed broadband.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

…………………………………………………………………………………………………………………………………………………

References:

https://telecoms.com/520843/5g-fwa-emerging-as-a-competitive-alternative-to-fixed-broadband/

https://telecoms.com/517535/telco-5g-fixed-wireless-revenues-set-to-rocket/

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 95% of the market – acquired about 3,500,000 net additional broadband Internet subscribers in 2022, compared to a pro forma gain of about 3,725,000 subscribers in 2021.

These top broadband providers account for about 110.5 million subscribers, with top cable companies having 75.6 million broadband subscribers, top wireline phone companies having 30.8 million subscribers, and top fixed wireless services having 4.1 million subscribers.

LRG’s findings for 2022 include:

- Overall, broadband additions in 2022 were 94% of those in 2021.

- The top cable companies added about 515,000 subscribers in 2022 – compared to about 2.8 million net adds in 2021.

- The top wireline phone companies lost about 180,000 total broadband subscribers in 2022 – compared to about 210,000 net adds in 2021.

- Wireline Telcos had about 2.4 million net adds via fiber in 2022, offset by about 2.6 million non-fiber net losses.

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

“Top broadband providers added about 3.5 million subscribers in 2022. Fixed wireless services (FWA) accounted for 90% of the net broadband additions in 2022, compared to 20% of the net adds in 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Total broadband net adds in 2022 were slightly lower than last year, and down from about 5 million in 2020, but were more than in any year from 2012-2019.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

FWA in the Spotlight:

A recent survey of some T-Mobile fixed wireless customers, conducted by the financial analysts at Wolfe Research, “T-Mobile Fixed Wireless Consumer Survey & Broadband Industry Implications,” found that 90% rated their service as “good enough.” The firm surveyed Facebook’s T-Mobile FWA user group, totalling over 15,000 members, in December 2022. Based on the 60 replies it received, 90% said they were mostly satisfied. The firm also found that 42% of respondents previously subscribed to a cable connection, 37% hailed from DSL operators, and 6% previously used fiber. Around 8% had no prior broadband service. Moreover, the financial analysts at Evercore expect T-Mobile to accumulate around 450,000 new fixed wireless customers in the first quarter of 2023, down from the 524,000 the operator reported in the fourth quarter of 2022.

Verizon added 262,000 residential FWA customers in Q4, up from +38,000 in the year-ago period, to end 2022 with 884,000 residential FWA subscribers. The company also signed on 117,000 business FWA subs in the quarter, up from +40,000 in the year-ago period, ending 2022 with 568,000 business FWA customers. About 70% of the consumer fixed wireless gross additions have come from bundling an existing wireless service, while 30% are new to Verizon. Interestingly, the experience is flipped for Verizon Business, where 70% of FWA customers were new to Verizon.

In contrast to the widely-held view that FWA is a “lower quality” service than wired broadband, Verizon says their principal selling point is FWA network’s greater reliability versus wireline alternatives. Cable’s outside plant issues can take days to resolve, a particularly critical issue in B2B, where cablecos (like Comcast Business) have increased their market share.

Image Credit: Verizon

The Wireless Internet Service Providers Association (WISPA) kicked off its annual trade show this week in Louisville, Kentucky, stating that WISPs service a total of 9 million Americans, many of whom live in the hardest to reach and serve parts of the country

According to Fierce Wireless, Cox is using 5G technology to test FWA services near Macon, Georgia; Tucson, Arizona; and Oklahoma City, Oklahoma.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

| Broadband Providers | Subscribers at end of 2022 | Net Adds in 2022 |

| Cable Companies | ||

| Comcast | 32,151,000 | 250,000 |

| Charter | 30,433,000 | 344,000 |

| Cox* | 5,560,000 | 30,000 |

| Altice | 4,282,900 | (103,300) |

| Mediacom* | 1,468,000 | 5,000 |

| Cable One** | 1,060,400 | 14,400 |

| Breezeline** | 693,781 | (22,997) |

| Total Top Cable | 75,649,081 | 517,103 |

| Wireline Phone Companies | ||

| AT&T | 15,386,000 | (118,000) |

| Verizon | 7,484,000 | 119,000 |

| Lumen^ | 3,037,000 | (253,000) |

| Frontier | 2,839,000 | 40,000 |

| Windstream* | 1,175,000 | 10,300 |

| TDS | 510,000 | 19,700 |

| Consolidated** | 367,458 | 724 |

| Total Top Wireline Phone | 30,798,458 | (181,276) |

| Fixed Wireless Services | ||

| T-Mobile | 2,646,000 | 2,000,000 |

| Verizon | 1,452,000 | 1,171,000 |

| Total Top Fixed Wireless | 4,098,000 | 3,171,000 |

| Total Top Broadband | 110,545,539 | 3,506,827 |

* LRG estimate

** Includes LRG estimate of pro forma net adds

^ Includes the impact of a divestiture completed in October 2022

- TDS residential subscribers, includes 305,200 wireline subscribers and 204,800 cable subscribers

- Company subscriber counts may not solely represent residential households – about 6.5% of the total are non-residential

- Top broadband providers represent approximately 95% of all subscribers

- Net additions reflect pro forma results from system sales and acquisitions, reporting adjustments, and the addition of new providers to the list – therefore, comparing totals in this release to prior releases will not produce accurate findings

About Leichtman Research Group, Inc:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com

References:

https://wispa.org/news_manager.php?page=29725

https://www.verizon.com/about/blog/fixed-wireless-access

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

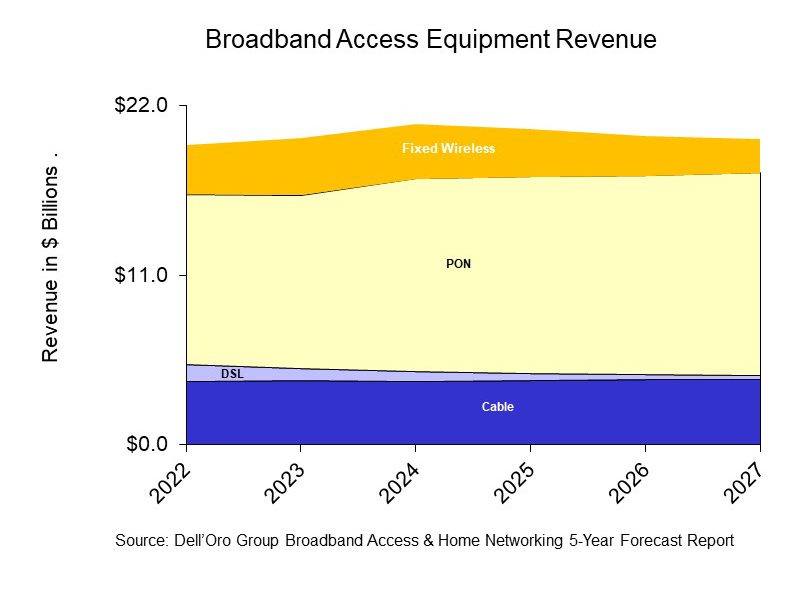

A newly published report by Dell’Oro Group predicts that sales of PON (Passive Optical Network) equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will all increase from 2022 to 2027, as service providers continue to expand their fiber and DOCSIS 4.0 networks, while expanding the types of services they deliver to residential subscribers.

“Service providers around the world continue to transition their broadband networks to fiber and retire their existing copper and DSL networks,” said Jeff Heynen, Vice President at Dell’Oro Group. “With markets expected to become more competitive, broadband providers will have to continue spending in order to differentiate their services not only by increasing advertised speeds, but also improving latency and expanding managed Wi-Fi services,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.0 B in 2022 to $13.2 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs [1.]) is expected to reach $1.5 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE [2.] is expected to reach $2.2 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

Note 1. Remote OLTs (Optical Line Terminals) can be deployed in distributed access nodes to support targeted deployments of FTTP. Comcast is already doing that for its next-gen HFC network. But others, such as Charter Communications, are also ramping up their respective efforts and pursuing similar deployment models.

“You’re now talking about a whole new architecture with remote OLTs, virtual CMTSs and remote PHY. It will take longer to operationalize. It’s a slower burn than it used to be in the past,” Heynan said. He expects cable access network spending to continue climbing past 2027 as other cablecos join the mix.

Note 2. Heynen expects FWA CPE spending to stay steady through 2024, but notes that some providers might run into capacity issues that curtail growth and will also be faced with fiercer competition from fiber and newly upgraded HFC networks. “That puts a ceiling on how much growth can happen for fixed wireless,” he said. While T-Mobile and Verizon are now driving FWA growth in the U.S., we wonder how the future will shake out for the WISP (wireless ISP) sector, which is also seeing steady growth at the moment. As WISPs (Wireless Internet Service Providers) seek out government subsidy opportunities, some may need to consider licensed spectrum or transition to fiber across their footprint.

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Broadband network spending set to climb as cable gets its groove back | Light Reading

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: PON ONT spending +15% Year over Year

Dell’Oro: 5G Fixed Wireless Access (FWA) deployments to be driven by lower cost CPE

Passive Optical Network (PON) technologies moving to 10G and 25G

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

From two recent research reports to clients, MoffettNathanson chief analyst Craig Moffett wrote:

There is no question that there will be a great deal of new fiber deployed in the U.S. But we expect it will be considerably less than current worst-case scenarios for two reasons.

- There simply isn’t sufficient labor availability for all operators to meet the projections they’ve set forth (this issue will be significantly exacerbated by the upcoming rural Broadband Equity, Access, and Deployment (BEAD) program, which will introduce a dramatic new source of labor demand).

- The expected return from fiber overbuilds will be disappointing, in our view, both because deployment costs (including the cost of capital) have risen sharply, and because expected densities of available markets are falling sharply.

We are skeptical about the returns that will be generated by fiber builds, as costs are rising and densities are falling. The spiraling costs of fiber deployment also make it likely that there will be upward, not downward, pressure on broadband ARPU in competitive markets, as overbuilders scramble to cost-justify not only their existing projects, but, perhaps more importantly, the projects on which they have not yet broken ground (and which, without a more generous ARPU assumption, can no longer be return-justified). Craig had argued earlier this year that the fiber buildout bubble may pop.

Wireless operators have an enormous cost advantage in offering fixed wireless access (FWA) service on preexisting network facilities; the marginal cost of offering FWA is zero if it is simply using excess capacity. The capacity available for such a strategy is relatively limited, making the strategic leverage of FWA relatively limited as well. Cable operators have a smaller, but still significant, cost advantage in offering wireless services that can offload at least some of their traffic onto existing infrastructure. And unlike wireless operators offering FWA, their capacity to do so is unlimited.

Almost no telecom investor with whom we have spoken views FWA as an important part of the story for the companies that actually offer it. Investors seem to have already come to the view (for the wireless operators, at least) that FWA is at best a costly sideline in rural markets. Longer term, the bigger threat to cable broadband is likely fiber rather than fixed wireless, Moffett said. But even with that, the analyst seems to be less concerned that cable operators will overspend on fiber or that overbuilders will present more competition.

The convergence arguments for fiber to the home (FTTH) are arguably even weaker. As we’ve pointed out often, AT&T’s wireline footprint covers but 45% or so of the U.S. (by population), and of that, just a third is wired for fiber. In total, then, AT&T can deliver a bundled solution to just 15% or so of the population. In our view, a strategy (bundling) that “works” in 15% of the country isn’t a strategy.

We certainly aren’t convinced that the U.S. market will be fundamentally shaped by convergence. But if it is, the cable operators, not the telcos, are positioned to benefit.

References:

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

According to Ericsson, total global FWA [1.] subscriptions will grow at 19 percent year-on-year during the 2022 to 2028 period to reach more than 300 million by 2028, the vast majority of which will be based on 5G.

Note 1. FWA is a connection that provides primary broadband access through mobile network-enabled customer premises equipment (CPE). This includes various form factors of CPE, such as indoor (desktop and window) and outdoor (rooftop and wall-mounted). It does not include portable battery-based Wi-Fi routers or dongles.

………………………………………………………………………………………………………………………………………………………..

The use of FWA for home and even business broadband is proving to be a major early use case for 5G, especially in regions where the fixed broadband market is lacking. FWA growth is in part driven by India and will also come in other emerging markets. Its data shows that almost 40 percent of 5G FWA launches came in emerging markets in the past year, with services now on offer in densely populated countries like Mexico, South Africa and the Philippines.

Key findings:

- More than three-quarters of service providers surveyed in over 100 countries are now offering Fixed Wireless Access (FWA) services.

- Nearly one-third of service providers now offer FWA over 5G, compared to one-fifth a year ago.

- The number of 5G FWA connections are expected to grow to around 235 million by 2028, representing almost 80 percent of the total FWA connections.

Source: Ericsson

“Following the 5G spectrum auction in India in July, a major service provider has expressed a goal to serve 100 million homes and millions of businesses with 5G FWA services,” Ericsson stated. 5G has only just come to market in India; its big operators launched services in early October. But operators are rolling out the technology at pace and with the price of 5G smartphones coming down, customer numbers will go up. 5G subscriptions in the India region – which includes Nepal and Bhutan – should reach 31 million by the end of this year and 690 million by end-2028, accounting for more than half of all mobile subscriptions – 1.3 billion – by that date.

“Higher volumes of 5G FWA in large high-growth countries such as India have the potential to drive economies of scale for the overall 5G FWA ecosystem, resulting in affordable CPE that will have a positive impact across low-income markets,” Ericsson added.

Globally, 5G subscriptions will hit 5 billion by the end of 2028, Ericsson predicts, despite the economic challenges much of the world is facing.

Service providers together added 110 million 5G subscriptions in the July-September period, bringing the worldwide total to around 870 million. With that sort of uptake, the 1 billion by year-end figure looks comfortably attainable, and will come two years earlier than the same milestone following the launch of 4G. Growth is being driven by device availability, falling prices and large-scale deployments in China, Ericsson said.

Ericsson added that North East Asia as a whole and North America are witnessing strong 5G growth, with penetration in those markets likely to reach around the 35 percent mark by the end of this year. Given that the world’s first 5G launches came in the US and in Korea back in 2019, it makes sense that those areas are leading the way in terms of uptake.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/dataforecasts/fwa-outlook

https://www.ericsson.com/en/fixed-wireless-access#

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

The global 5G fixed wireless access (FWA) market is expected to grow from $1642.62 million in 2021 to $3074.07 million in 2022 at a compound annual growth rate (CAGR) of 87.1%, according to a new Research & Markets report. The change in growth trend is mainly due to the companies stabilizing their output after catering to the demand that grew exponentially during the COVID-19 pandemic in 2021. The market is expected to reach $38173.20 million in 2026 at a CAGR of 87.1%.

The main types of 5G fixed wireless access are hardware and services. Hardware refers to physical parts that enable fixed wireless access such as mobile phones and devices that have MIMO antenna technology built into the device for the mmWave frequencies. 5G small cell networks and RAN towers are the most important hardware elements of 5G technology infrastructure. The different demographics include urban, semi-urban and rural. It is implemented in various market segments such as residential, commercial, industrial and government.

North America was the largest region in the 5G fixed wireless access market in 2021. Europe was the second largest market in 5G fixed wireless access market. The regions covered in this report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Image Credit: Everything RF

The increasing adoption of 5G networks is expected to fuel the growth of the 5G fixed wireless access market in the coming years. 5G is the fifth generation of mobile data technology designed to significantly improve wireless network speed and flexibility. With the introduction of 5G, mobile technology can meet the demands of fixed-line networks and price ranges. According to Future Networks, a UK-based telecommunications company 5G will account for 1.2 billion connections by the end of 2025. Moreover, according to vXchnge, a US-based company that offers data centers and colocation services, 5G networks will cover 40% of the world and handle 25% of all mobile traffic data by 2024. Therefore, the increasing adoption of 5G networks drives the growth of the 5G fixed wireless access.

Technological innovations are shaping the 5G fixed wireless access market. Major companies operating in the 5G fixed wireless access sector is focused on developing technological solutions for 5G fixed wireless access. For instance, in February 2020, Huawei, a China-based telecommunications equipment company launched LampSite EE based on Huawei’s 5G technology. LampSite EE is the business version of 5G LampSite for industrial scenarios. The version is an update from Huawei’s pioneer LampSite 5G indoor radio connectivity solution, and it is geared toward smart manufacturing, smart hospitals, smart transportation, and smart warehouses, among other industries.

References:

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

https://www.everythingrf.com/community/what-is-fixed-wireless-access

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

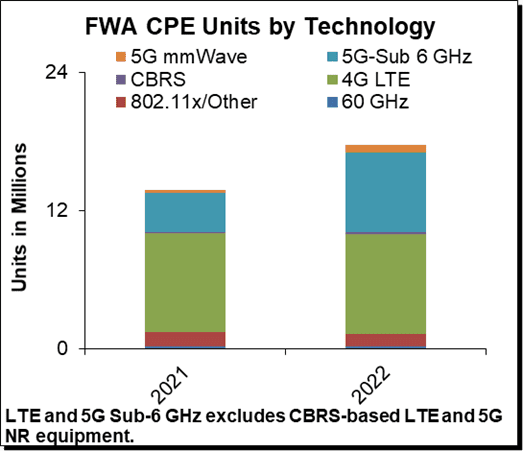

Dell’Oro Group announced today the launch of its new Fixed Wireless Access Infrastructure and CPE advanced research report (ARR). Preliminary findings suggest total Fixed Wireless Access (FWA) revenues, including both RAN equipment and CPE revenue remain on track to advance 35% in 2022, driven largely by subscriber growth in North America.

“Fixed Wireless Access has become a key component to bridging the digital divide and connecting rural and underserved markets globally. What we are also seeing is that FWA can effectively compete with existing fixed broadband technologies, especially with the advent of 5G and other higher-throughput, non-3GPP technologies,” said Jeff Heynen, Vice President and analyst with the Dell’Oro Group.

“Right now, CPE for fixed wireless access using 5G sub-6GHz technologies are growing the fastest. We do expect these units to tail off over time as current investments in fiber networks, along with cable’s DOCSIS 4.0 and fiber upgrades, will limit the addressable market for large-scale fixed wireless services,” Jeff added.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Global FWA revenues are projected to surpass $5 B by 2026, reflecting sustained investment and subscriber growth in both 3GPP- and non-3GPP-based network deployments.

- The North American market remains the most dynamic in terms of deployed FWA technology options, with CBRS and other sub-6GHz options growing alongside 5G NR and 60GHz options.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets, thanks to LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at [email protected].

Note: The IEEE Techblog has featured many FWA success stories and that FWA is probably the top 5G use case to date. The main reason is that a 5G FWA network doesn’t involve roaming or a 5G SA core network for which there are no ITU/ETSI standards or 3GPP implementation specs. As long as the FWA CPE supports 5G NR (via ITU M.2150 recommendation or 3GPP Release 16) all the other functions can be customized in software which only has to work with the network provider offering the FWA service.

References:

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

South Korea’s Samsung Electronics says it has achieved record-setting average downlink speeds of 1.75 Gbps and uplink speeds of 61.5 Mbps over a 10 km (6.2 miles) 5G mmWave network in a recent field trial conducted with Australia’s NBN Co. As the farthest 28 GHz 5G mmWave Fixed Wireless Access (FWA) connection recorded by Samsung, this milestone demonstrates the expanded reach possible with this powerful spectrum, and its ability to efficiently deliver widespread broadband coverage across the country.

Source: Accton

To achieve average downlink speeds of 1.75 Gbps at such extended range, the trial by Samsung and NBN utilized eight component carriers (8CC), which is an aggregation of 800MHz of mmWave spectrum. The potential to support large amounts of bandwidth is a key advantage of the mmWave spectrum and Samsung’s beamforming technology enables the aggregation of such large amounts of bandwidth at long distance. At its peak, the company also reached a top downlink speed of 2.7Gbps over a 10km distance from the radio.

“The results of these trials with Samsung are a significant milestone and demonstrate how we are pushing the boundaries of innovation in support of the digital capabilities in Australia,” said Ray Owen, Chief Technology Officer at NBN Co. “As we roll out the next evolution of our network to extend its reach for the benefit of homes and businesses across the country, we are excited to demonstrate the potential for 5G mmWave. nbn will be among the first in the world to deploy 5G mmWave technology at this scale, and achievements like Samsung’s 10km milestone will pave the way for further developments in the ecosystem.”

There’s a total of AUD $750 million investment in the nbn Fixed Wireless network (made up of AUD $480 million from the Australian Government and supported by an additional AUD $270 million from nbn). NBN will use software enhancements and advances in 5G technology, and in particular 5G mmWave technology, to extend the reach of the existing fixed wireless footprint by up to 50 percent and introduce two new wholesale high-speed tiers. The nbn FWA network covers nearly 650,000 premises in the country. The company wants to add at least 120,000 locations in Australia that are currently served by a satellite-based service.

“This new 5G record proves the massive potential of mmWave technology, and its ability to deliver enhanced connectivity and capacity for addressing the last mile challenges in rural areas,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “We are excited to work with nbn to push the boundaries of 5G technology even further in Australia and tap the power of mmWave for customer benefit.”

As demonstrated in the trials, 5G mmWave spectrum is not only viable for the deployment of high-capacity 5G networks in dense urban areas, but also for wider FWA coverage. Extending the effective range of 5G data signals on mmWave will help address the connectivity gap, providing access to rural and remote areas where fiber cannot reach.

For the trial, Samsung used its 28GHz Compact Macro and third-party 5G mmWave customer premise equipment (CPE). Samsung’s Compact Macro is the industry’s first integrated radio for mmWave spectrum, bringing together a baseband, radio and antenna into a single form factor. This compact and lightweight solution can support all frequencies within the mmWave spectrum, simplifying deployment, and is currently deployed in commercial 5G networks across the globe, including Japan, Korea and the U.S.

Since launching the world’s first 5G mmWave FWA services in 2018 in the U.S., Samsung has been leading the industry, offering an end-to-end portfolio of 5G mmWave solutions — including in-house chipsets and radios — and advancing the 5G mmWave momentum globally.

The nbn® network is Australia’s digital backbone that helps deliver reliable and resilient broadband across a continent spanning more than seven million square kilometers. nbn is committed to responding to the digital connectivity needs of people across Australia, working with industry, governments, regulators and community partners to increase the digital capability of Australia.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

Nokia had previously announced it was supplying 5G FWA mmWave CPE equipment for nbn’s efforts that also operates in the 28 GHz band with similar performance characteristics stated by Samsung for its test, including a range of up to 6.2 miles from the transmission tower. However, Samsung said that Nokia’s equipment was not part of its test.

Nokia noted that its CPE includes an antenna installed on the roof of a premises that is linked using a 2.5 Gb/s power over Ethernet (PoE) connection to an indoor unit that powers the on-premises internet connectivity.

Related Articles:

- Samsung Electronics Supports NTT East’s Continued Expansion of Private 5G Networks in Japan

- Samsung Electronics Tapped To Support Comcast’s 5G Connectivity Efforts

- Samsung Electronics To Deliver Private 5G Network Solutions to Korea’s Public and Private Sectors

References:

https://www.sdxcentral.com/articles/news/samsung-nokia-power-5g-mmwave-potential/2022/11/