Fixed Wireless Access (FWA)

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G. I’ve had a 5G Samsung phone for almost 2 years and I don’t notice any difference in performance from my previous 4G Samsung phone.

Jennifer Fritzsche, managing director at investment bank Greenhill & Company wrote on January 16th:“As carriers pulled back on capex and focused on Free Cash Flow, “5G” mentions saw a precipitous decline on almost every carrier earnings call last year.” However, she is somewhat optimistic for 2024, “2024 will be the year when carriers will need to justify the spectrum spend they paid billions of dollars for only a few short years ago. Although the 5G consumer killer app may already be here (FWA [1.]), the key trend to watch is the development of enterprise solutions for 5G. If carriers can tap into their deep enterprise relationships to play ball here – this 5G thing becomes a lot more real.”

Note 1. It’s quite surprising that Fixed Wireless Access (FWA) has emerged as the most popular 5G deployment, especially from T-Mobile US and Verizon. That’s because it was NOT one of the three 5G use cases defined by ITU-R (Enhanced Mobile Broadband, Machine to Machine Communications and URLLC).

Midband spectrum is a key element supporting the fixed wireless access (FWA) services from all of the big US wireless network operators. FWA promises to supplant wired Internet connections inside homes and offices with 5G connections. Yet network operators aren’t boasting about their midband network buildouts like they were a few years ago. Instead, they’re talking about plans to reduce spending (CAPEX) on their networks in order to boost revenues.

“We’ve been telling you [in 2024] our capital intensity was going to tail off from kind of the peak levels we’ve been at the last couple of years,” AT&T CEO John Stankey said at a recent UBS investor conference. “I expect that’s going to be the case,” he added. AT&T officials have said the company will spend between $21 billion and $22 billion on capital expenses (capex) during 2024, down from $24 billion in 2023. Other operators are signaling similar drawdowns.

“We’ve spent a lot of money over the past five years, a lot of money building the world’s best 5G plant, and it’s time to be able to enjoy having that in the ground and be able to realize the benefits of that,” Sievert, T-Mobile’s CEO, explained.

Financial analysts at Evercore recently wrote that they expect U.S. capex to decline “as the 5G investment cycle tapers off. There should not be another capex cycle for the next few years adding some comfort to the FCF [free cash flow] outlook in a world of fundamental uncertainty.”

RAN revenue continues to decline Year-over-Year. Dell’Oro’s preliminary findings from 1Q23-3Q23 data reveal that the North America RAN market is declining at a much steeper rate than anticipated. Interestingly, the capex decline in the U.S. aligns with operators’ communications, but the North America wireless RAN/capex ratio is on track to reach the sub-15% range, highlighting the disconnect lies not in capex decline but in the proportion allocated to the RAN. Yet RAN excluding North America is actually coming in stronger than what we outlined going into 2023, in part because of the incredible 5G ascent in India. Putting things together, it appears that the surprise on the downside in the U.S. is more than enough to offset the stronger-than expected showing in the Asia Pacific region.

Looking ahead, Dell’Oro is forecasting global RAN to record a second consecutive year of RAN contractions in 2024, though the pace of the decline should be more moderate. The regional dynamics will change as the pendulum swings towards the negative in India. Wireless capex in the US is still on track to decline. Yet we are forecasting the North America RAN market to grow, implying a greater portion of the capex will be allocated towards the RAN segment in 2024

Dell’Oro’s Stefan Pongratz concludes:

In summary, 2024 is unlikely to emerge as the most exhilarating year from a broader RAN revenue growth perspective. Even so, within the market, there will be pockets undergoing significant changes. While some of the upcoming growth areas will remain relatively small, 2024 is poised to be an important transition year for various wireless sub-segments. As always, the competitive RAN landscape will continue to be fierce. Despite the anticipated decline in certain aspects of the RAN market, it should be an eventful year.

References:

https://www.igr-inc.com/communications-infrastructure/fritzsches-forum/240116/

https://www.lightreading.com/5g/america-s-5g-buildouts-move-into-unknown-territory

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

Dell’Oro: RAN revenues declined sharply in 2023 and remain challenging in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

https://www.delloro.com/news/worldwide-telecom-capex-to-drop-7-percent-by-2025/

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

https://www.lightreading.com/fixed-wireless-access/fwa-to-remain-biggest-disruptor-through-2024

https://www.lightreading.com/5g/what-they-re-saying-about-5g-capex-in-2023-and-2024

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

The U.S. is at the forefront of fixed wireless access (FWA) deployments, with many major wireless carriers, including T-Mobile, Verizon, AT&T and UScellular targeting expansion.

T-Mobile has built up a lead in terms of 5G fixed-wireless market share, with Verizon following closely, and AT&T recently launching a new FWA service – AT&T Internet Air. We examined Ookla Speedtest data to understand how FWA performance is evolving in the U.S., and how it is impacting churn in the market.

Key Points:

- T-Mobile & Verizon 5G FWA performance holding up well nationally. Despite strong customer growth, both T-Mobile and Verizon have maintained performance levels over the past year according to Speedtest data. Both ISPs recorded similar median download speeds in Q3 2023, although T-Mobile maintains an edge on median upload performance. Despite this, there are significant differences in performance at a State-level, and for urban versus rural locations.

- Cable & DSL providers bear the brunt of user churn. The FWA value proposition is clearly resonating most with existing cable and DSL customers, which make up the vast bulk of churners to both T-Mobile’s and Verizon’s FWA services. It’s not one-way traffic however, with T-Mobile’s larger user base in particular showing some attrition to cable providers. In rural locations where options are more limited, FWA services are increasingly going head to head, with over 10% of users joining Verizon’s FWA service coming from T-Mobile.

- Clear signs that download performance could be a key contributor to churn in the market. Our analysis of the customers of major ISPs in the US that have churned to T-Mobile’s FWA service shows that their median download performance before churning was below the median performance of all customers of these ISPs, indicating a performance short-fall that is likely contributing towards churn.

- Further C-band spectrum will serve to strengthen FWA’s case. The release and deployment of additional C-band spectrum for all three national cellular carriers, and AT&T’s new FWA service will drive further performance gains, and further competitive pressure in 2024.

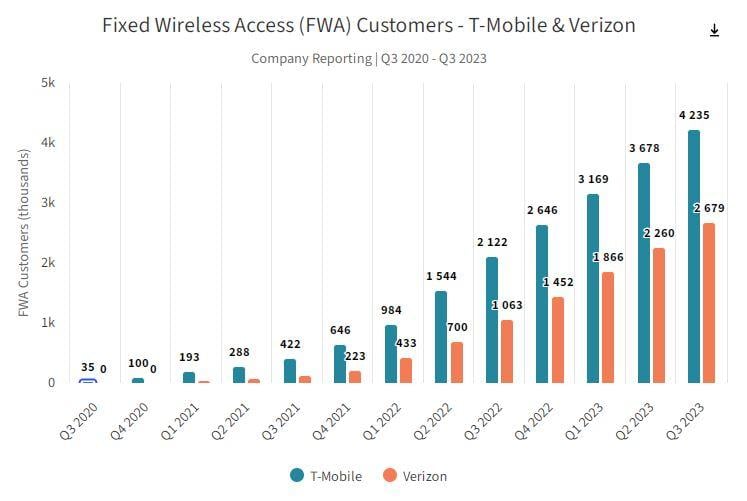

T-Mobile and Verizon FWA scaling strongly and national performance holding up well:

Launched during the COVID-19 pandemic, FWA services from T-Mobile and Verizon have seen strong growth over the past three years. Aided by disruptive pricing strategies, no annual contracts, and ease of installation (self-install), net additions remain strong for both ISPs. T-Mobile’s current FWA plan retails for $50/month, but that falls to $30/month for customers subscribing to its Magenta MAX mobile plan. Verizon prices at a slight premium to T-Mobile, with its FWA service currently retailing for $60/month, but falling to $35/month with select 5G mobile plans. On the back of their success we’ve also recently seen AT&T update its FWA strategy, launching AT&T Internet Air in August 2023, with a similar pricing strategy.

Utilizing the same 5G spectrum that its mobile customer base accesses, both T-Mobile and Verizon have been at pains to point out how they manage the on-boarding of new FWA customers, in order to limit any negative impact on performance for both cellular and FWA customers. The release and rollout of additional C-band spectrum for all three operators will provide extra headroom and the potential for improved 5G FWA performance, while T-Mobile has begun testing 5G Standalone mmWave, and has indicated that this could be utilized for 5G FWA in the future.

Performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs. The median download speed across the US for all fixed providers combined in Q3 2023 was 207.42 Mbps. T-Mobile has recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, down from 19.76 Mbps in Q4 2022, to 17.09 Mbps in Q3 2023. Verizon on the other hand improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps.

Ookla’s Speedtest data was used to identify the number of churned users since Q2 2022, when FWA services really started to scale and impact the rest of the market. The bulk of churn for both T-Mobile’s and Verizon’s 5G FWA services are coming from cable and DSL providers, confirming what the service providers have said.

The market research firm said that performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs.

Ookla clocked the median download speed across the U.S. for all fixed providers combined in Q3 2023 at 207.42 Mbps. T-Mobile recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, from 19.76 Mbps in Q4 2022 to 17.09 Mbps in Q3 2023.

Meanwhile, Verizon improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps, Ookla said.

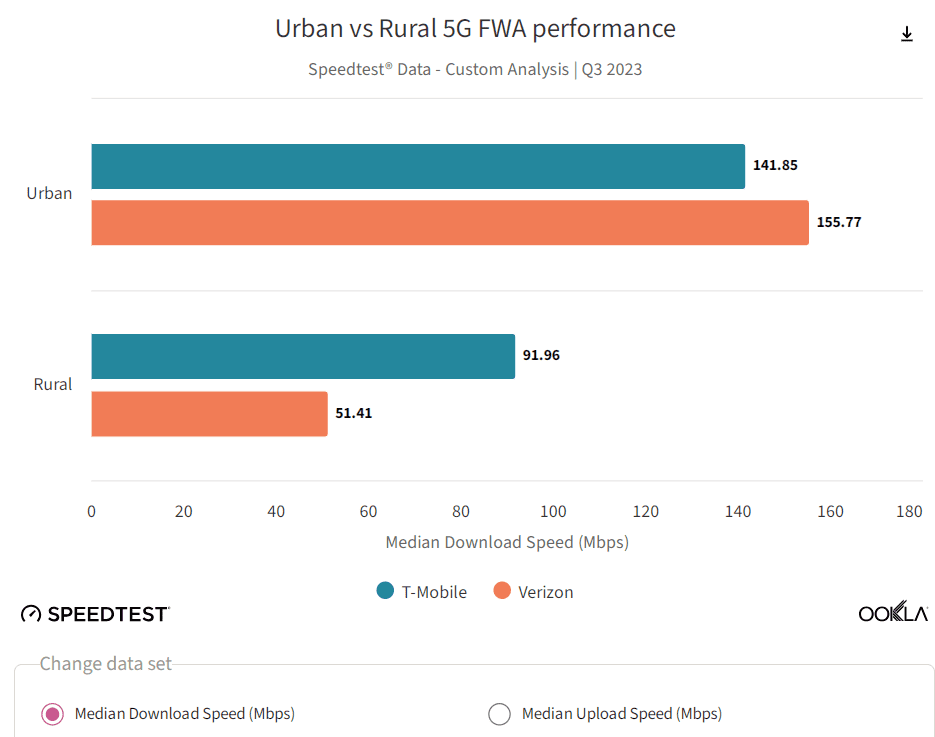

While median performance has remained fairly steady for both operators over the past year, Ookla said it’s a different story when it comes to regional performance and between urban and rural regions.

Rural locations – predictably – fared worse than urban locations for both T-Mobile and Verizon 5G FWA service, given differences in spectrum availability and distance from cell sites, although the difference was starker for Verizon’s FWA service, Ookla said. Verizon’s FWA service recorded a median of 155.77 Mbps in urban locations during Q3 2023, but only 51.41 Mbps in rural locations.

T-Mobile increased rural FWA performance, from 82.20 Mbps in Q4 of 2022 to 91.96 Mbps in Q3 2023. Verizon’s performance in urban locations improved, with the 155.77 Mbps it achieved in Q3 2023 representing a sizable increase on the 125.55 Mbps it recorded in Q4 2022.

All of the big mobile operators, including AT&T with Internet Air, will see improved 5G FWA performance with additional C-band spectrum, and T-Mobile could potentially use millimeter wave on its 5G standalone (SA) network for FWA, Ookla noted.

References:

https://www.ookla.com/articles/fixed-wireless-access-us-q3-2023

https://www.fiercewireless.com/wireless/t-mobile-verizon-5g-fwa-performance-holds-ookla

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

UAE network operator “etisalat by e&” achieves 5G mmWave distance milestone

UAE network operator etisalat by e& today claimed the world’s first deployment of 5G mmWave covering more than 10 kilometres, as it highlighted the potential of the range to support fixed wireless access (FWA) and industrial applications over private networks. In a statement, e& explained the pilot used the 26Ghz band and delivered high speeds. The test forms part of a push to address demand for mobile networks capable of delivering large amounts of data reliably and securely.

The UAE telco claimed its test demonstrated the network’s ability to uplink heavy video and real-time data transfer with faster speed and lower latency, supporting “industries operating over vast areas.”

Alongside citing opportunities for FWA, the operator highlighted the potential of private networks using the frequencies across various industry verticals, citing healthcare, manufacturing and public safety.

The implementation of 5G mmWave (FR2 only) network capability was steered as part of etisalat by e& vision to deliver state of art technologies to the society. This is considered as a global first 5G deployment on mmWave @ 26Ghz, FR2 only over 10 km with high speeds. The step aimed at addressing the demand of consumers and enterprises to have a solution following the highest standards of data security and digitalisation over mobile network that’s also capable to deliver large amounts of data reliably and securely.

The mmWave spectrum generally refers to above 24GHz, that can deliver extreme capacity, ultra-high throughput and ultra-low latency which has huge potential in multiple applications for consumers as well as enterprises.

The solution demonstrates the ability of 5G networks to enable uplink heavy video and real-time data transfer scenarios over a specific geographical area, effectively paving the way toward the digital transformation of industries operating over vast areas.

Marwan Bin Shakar, SVP Access Network Development, etisalat by e& said: “This deployment is a commitment to unleashing the full potential of 5G network and pushing the boundaries to redefine the world of connectivity. This is a significant milestone for 5G mmWave, especially that the demand for data has increased exponentially, and this plays a pivotal role in increasing network capacity. Our partnerships with technology leaders has also contributed to setting these benchmarks in the industry and bring advanced solutions to the country making sure we address customer digitalization’s requirements and enabling quicker time to market.”

This achievement will support the use of 5G network for FWA subscribers who can enjoy fiber like user experience over wireless network and also accelerate the adoption of 5G private network technology in other sectors like oil and gas, public safety, healthcare, manufacturing and more to have complete control over their user data with on-premise hosted MEC (Multi-access edge computing) and use their enterprise data and security policies to manage data delivered from a private 5G network.

References:

UAE’s “etisalat by e&” announces first software defined quantum satellite network

AT&T Internet Air FWA home internet service now available in 16 markets

AT&T announced today that its new fixed wireless access (FWA) home internet service, named Internet Air, is now available in more than a dozen markets across the U.S. The emphasis here is on the customer installation process, which AT&T says can be done in five easy steps, with the customer up and running in less than 15 minutes. No tech dispatch or truck rolls are necessary to install this FWA home internet service.

AT&T is now the third nationwide mobile network operator (MNO) to launch a 5G FWA home internet service. Verizon is the current FWA leader, followed by T-Mobile. USCellular has also launched a 5G FWA service in the area it serves (not nationwide).

AT&T says they’ve already deployed Internet Air to existing copper-based (DSL) customers with great success. The company is now hyper-focused on selecting locations with enough wireless coverage and capacity to deliver not only a great in-home experience, but also maintain a top-notch wireless service for our existing mobile users.

Installation: Upon opening the box, customers will scan a QR code to access a step-by-step guide providing clear instructions. AT&T Smart Home Manager app makes set-up fool-proof with the use of a unique feature that helps you find the best spot in your home with the strongest connection. We also offer add-on Wi-Fi extenders to create a whole-home mesh Wi-Fi eliminating dead zones. While connectivity will always be our focus, we understand customers want a product that is visually appealing and easy to use. AT&T Internet Air sports a sleek and modern look that seamlessly blends into any design aesthetic.

AT&T Internet Air complements AT&T Fiber, expanding our footprint into new locations including areas of Los Angeles, CA; Philadelphia, PA: Cincinnati, OH; Harrisburg-Lancaster-Lebanon, PA; Pittsburgh, PA; Las Vegas, NV; Phoenix (Prescott), AZ; Chicago, IL; Detroit, MI; Flint-Saginaw-Bay City, MI; Hartford-New Haven, CT; Minneapolis-St. Paul, MN; Portland, OR; Salt Lake City, UT; Seattle-Tacoma, WA; and Tampa-St. Petersburg (Sarasota), FL.

Los Angeles is Charter’s largest market and a T-Mobile FWA stronghold. Philadelphia is Comcast’s home market, and Seattle is T-Mobile’s FWA home market.

Gigapower, a joint venture of AT&T and BlackRock, is building out fiber in Mesa, AZ. While the two are about 100 miles apart, it will be interesting to see how fiber and FWA technologies will be adopted in the same market.

AT&T Internet Air costs $55 a month plus taxes. AT&T Internet Air has no overage fees, no price increase at 12 months, no equipment fees and no annual contract. Coupled with AT&T ActiveArmorSM internet security included, customers can stream and surf the web with peace of mind. New and existing AT&T cellular customers with an eligible wireless plan can get Internet Air at $35/month.

AT&T Internet Air is also eligible for the Affordable Connectivity Program (ACP) providing eligible households with a benefit of up to $30 a month (up to $75 a month on qualifying Tribal lands) to reduce the cost of broadband service.

References:

https://about.att.com/blogs/2023/internet-air.html

https://www.att.com/internet/internet-air/

https://www.fiercewireless.com/wireless/fwa-and-then-there-were-three-entner

ABI Research joins the chorus: 5G FWA is a competitive alternative to wired broadband access

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

IBD – Controversy over 5G FWA: T-Mobile and Verizon are in; AT&T is out

Verizon broadband – a combination of FWA and Fios (but not so much pay TV)

Verizon makes 5G Business Internet (FWA) available in 24 U.S. cities

Saudi Arabia’s Stc Achieves 10 Gbps Speeds in 5G mmWave Trials

Saudi Arabia’s Stc (Saudi Telecom Company) Group announced the successful completion of the first live trials of advanced 5G technology in the Middle East and North Africa. The trials demonstrated speeds exceeding 10 Gbps using Millimeter Wave (mmWave) technology. The trials are an extension of the robust infrastructure of the advanced 5.5G network in the Kingdom

According to the company, these trials complement the existing advanced 5.5G network in the kingdom, enabling data transfer at new record speeds in a live working environment.

“This achievement signifies a new stage in facilitating digital transformation in the region and places the Kingdom of Saudi Arabia at the forefront of advanced nations in the field of telecommunications.”

The Kingdom’s residents can now anticipate faster and more efficient data connectivity than before. The company said that the success of these trials is an essential aspect of stc’s “Dare” strategy. The goal is to offer access to new services and enhance customer experiences to new heights, aligned with the Saudi Vision 2030 and supporting digital transformation in the region.

The latest progress in advanced 5G technology puts Saudi Arabia at the forefront of technological innovation in the region, paving the way for even more advancements. By adopting this technology, the country is preparing itself for upcoming developments and the digital age.

References:

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro Group predicts the broadband equipment market will surpass $120 billion in cumulative spending between 2022 and 2027. The market research firm says sales of PON equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will show a 0.2% Compounded Annual Growth Rate (CAGR) from 2022 to 2027. Service providers continue to expand their fiber and DOCSIS 3.1/4.0 networks, while also increasing the reliability and sustainability of their broadband access networks.

“After three consecutive years of tremendous broadband network expansions and upgrades, 2023 is expected to show a return to normalized levels of spending,” said Jeff Heynen, Vice President of Broadband Access and Home Networking research at Dell’Oro Group. “After 2023, spending is expected to increase through 2026 and 2027, driven by 25 Gbps and 50 Gbps PON, Fixed Wireless CPE, as well as DAA and DOCSIS 4.0 deployments.”

Labor markets are “still being challenged” and a number of fiber based network operators (AT&T, Altice USA, Frontier) have reduced their expansion plans and homes passed targets. “To close out 2022 we did see a significant uptake in equipment purchases, and what happened there was supply chains appeased. A lot of orders that had been on the books for a long time have been fulfilled.”

Network equipment vendors are working through that inventory they had built up while taking on “additional equipment purchases.

Additional highlights from the Broadband Access & Home Networking 5-Year July 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.8 B in 2022 to $13.3 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs) is expected to reach $1.6 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.7 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

- Revenue for Residential Wi-Fi Routers will surpass $5.2 B in 2027, owing to massive shipments of Wi-Fi 7 units.

“Which isn’t going to float to manufacturers until you know, late 2024, really into 2025,” he said. “I think in the interim, XGS-PON in the European market is certainly going to catch up. We’re also seeing considerable growth in XGS-PON deployments now in China.”

In Dell’Oro’s five-year forecast published in January, Heynen expected fixed wireless subscriber growth, particularly in North America, would “start to moderate” beginning in 2024, due to factors like “capacity issues and fiber expansion.”

Heynen has increased his revenue predictions for the fixed wireless CPE market – which he previously tipped would hit $2.2 billion in five years – and now predicts subscriber growth to continue into 2025.

“Part of that is because of the net reduction in homes passed for fiber,” he said. “In the meantime, fixed wireless will be able to cover more ground while the operators who are building out fiber kind of extend their overall deployment plans.”

Further, operators like T-Mobile and Verizon “are seeing fixed wireless as a way to secure broadband subscribers away from cable operators. The U.S. market is really dynamic in terms of how services can be marketed.”

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

https://www.fiercetelecom.com/telecom/broadband-equipment-market-eclipse-120b-2027-delloro

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

UScellular’s Home Internet/FWA now has >100K customers

UScellular now has more than 100,000 Home Internet/Fixed Wireless Access (FWA) customers and it anticipates even more growth over the coming years.

In 2022, fixed wireless services accounted for 90% of home broadband net additions, according to Leichtman Research Group. In the U.S., Verizon is by far the leader in 4G/5G FWA ending 2022 with 1.452 million fixed wireless home internet customers. The telco added 384K, 393K, 379K, and 342K in the last four quarters. It now has 2.229 million FWA internet subscribers.

In a press release on Tuesday, UScellular Chief Marketing Officer Eric Jagher said they knew rural areas in particular would see great benefit from having a FWA solution.

“We continue to enhance our Home Internet experience for customers, and the growth and positive response we’ve received to this service has us excited for the future. As we celebrate this milestone, we look forward to further updating the service so we can soon surpass hundreds of thousands of Home Internet customers,” Jagher stated.

As UScellular continues to build out its 5G mid-band network, more customers will be able to realize the fast, dependable connectivity that Home Internet provides. Earlier this year, UScellular launched its 5G mid-band network in parts of 10 states and expects to cover 1 million households by the end of the year and 3 million households by the end of 2024. This network can deliver speeds up to 10x faster than its 4G LTE network and low-band 5G.

UScellular initially offered Home Internet on its 4G LTE network and has upgraded the service with low-band, mid-band and mmWave 5G in select markets across the country. Most customers today can access 5G speeds on the service, which has led to a doubling of the customer base over the last 18 months. The company currently offers self-install, plug-and-play internal antennas and routers and a professionally installed external antenna in certain areas. Later this year, the company expects to have additional self-install options available to help meet the evolving needs of customers.

Additionally, UScellular offers a free Internet Setup Coach for all new customers. Experts from Asurion are available via phone to help customers with router placement for the best speeds and getting all essential devices – like computers, TVs and doorbells – connected to their home’s Wi-Fi network.

As UScellular looks to further enhance and expand its Home Internet service especially in rural areas, funding from the National Telecommunications and Information Administration’s Broadband Equity Access and Deployment (BEAD) program will be important. Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States.

Indeed, UScellular has made it clear that it wants to use funds from the BEAD program to build more towers and serve more rural areas with FWA while increasing its 5G mobile coverage.

The telco this week reiterated the importance of that BEAD funding. “Fixed wireless technology will likely be the best and most affordable option in many under- and un-served areas to help bridge the digital divide in the United States,” the company stated.

About UScellular:

UScellular is the fourth-largest full-service wireless carrier in the United States, providing national network coverage and industry-leading innovations designed to help customers stay connected to the things that matter most. The Chicago-based carrier provides a strong, reliable network supported by the latest technology and offers a wide range of communication services that enhance consumers’ lives, increase the competitiveness of local businesses and improve the efficiency of government operations. Through its After School Access Project, the company has pledged to provide hotspots and service to help up to 50,000 youth connect to reliable internet. Additionally, UScellular has price protected all of its plans, promising not to increase prices through at least the end of 2024. To learn more about UScellular, visit one of its retail stores or www.uscellular.com. To get the latest news, visit newsroom.uscellular.com.

References:

For more information about UScellular’s efforts:

https://newsroom.uscellular.com/connecting-us/

https://www.fiercewireless.com/5g/uscellular-marks-100000-fwa-customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

GSA FWA Report: 38 commercially launched 5G FWA networks in the EU; Speeds revealed

GSA has been tracking the FWA broadband market to determine the evolving extent and nature of availability of services based on LTE or 5G technologies around the world. The number of network operators delivering FWA services varies widely by region, as Figures 3 and 4 show.

There are more operators marketing FWA services in Europe than any other region, particularly in the 27 countries that make up the EU, which has 38 commercially launched 5G FWA networks. An operator’s decision about whether to offer services will depend on various factors: how well covered with fixed-line broadband services the country or territory is; whether there are many remote regions with little to no broadband availability; whether that operator provides a fixed network at all and how advanced that network is from a technology perspective; and whether its rivals have introduced a FWA service. Where one operator introduces such a service, its rivals often quickly follow.

FWA Service Speeds:

Operators are often opaque about the FWA service speeds their LTE and 5G customers should expect. We believe this is because actual network performance depends on distance from cell towers, speed of movement or local interference — from walls or other physical or electronic objects — and other factors.

Operators often do not provide speed information or are deliberately vague talking about the types of speed that LTE, LTE-Advanced and 5G can theoretically provide, mentioning the maximum theoretical speed a customer might get (in a perfect scenario), mentioning speeds measured by third parties or, occasionally, offering average speed information.

GSA collected information about the fastest download speeds quoted by operators for their FWA services where data was available. The maximum speeds promoted for LTE FWA services range from 1 Mbps to 2.5 Gbps. The average of the marketed maximum peak download speeds that GSA identified was 173.3 Mbps, up significantly from 155.2 Mbps in November 2022 (based on maximum speed data for 333 operators, up from 317 operators identified as promoting their LTE FWA speeds in November 2022).

Data on 5G FWA maximum download speeds was collected from 72 operators (compared with 36 in June 2021). Quoted peak speeds ranged from 10 Mbps to 5400 Mbps in the downlink, with half of them sitting in the 250Mbps to 2300 Mbps range. The average 5G FWA maximum peak download speed identified by GSA is 1077 Mbps, up significantly from 875 Mbps in November 2022 and from 863 Mbps in June 2022.

Where information was made available to GSA, the average or typical peak download speed marketed to customers was lower at an estimated 31.8 Mbps for LTE networks, compared with 32.7 Mbps in November 2022 and 38.5 Mbps at the end of 2020; and just over an estimated 236.2 Mbps for 5G FWA services, down from 248.3 Mbps in November 2022 and up from 147 Mbps in November 2020. It should be noted that the sample sizes of operators quoting their average speeds were much smaller than the sample sizes of those quoting maximum speeds, at 35 for LTE and 14 operators for 5G, and that some quoted average ranges (where we used the midpoint in the range).

Conclusions:

The promotion of LTE and 5G networks as a mainstream mechanism for the delivery of broadband services to homes and businesses is now well established, with lots of services available from network operators, supported by a wide range of devices from many vendors.

FWA services are being offered as an alternative or complement to fixed broadband; the nature of the message is dependent on whether an operator already owns a large fixed broadband network it wishes to continue to sell.

As more operator networks are upgraded to LTE-Advanced, as more 5G networks are built out and as more (particularly 5G) CPE devices are commercialised, GSA expects the number of FWA services to rise. This study will be updated in November 2023

ABI Research joins the chorus: 5G FWA is a competitive alternative to wired broadband access

5G Fixed Wireless Access (FWA) allows Mobile Network Operators (MNOs) to provide Quality of Service (QoS) offerings with higher speeds and unlimited data, creating a demand for 5G FWA, which will continue to grow over the next few years. Global technology intelligence firm ABI Research forecasts that 5G FWA subscriptions will reach 72 million by 2027, representing 35% of the total FWA market in 2027.

Although LTE FWA services have already been widely deployed worldwide, they often cannot provide the speed needed to compete with wired broadband connections. 5G FWA is set to offer data rates rivaling the range of fiber, making it a competitive alternative to wired broadband solutions. “FWA is one of the few use cases that utilize 5G Massive Multiple-Input Multiple-Output (mMIMO) networks to their full extent, with a typical monthly utilization that could be as high as 1TB per subscriber. Many MNOs that have launched 5G are expected to offer FWA services, driving 5G FWA market growth,” explains Fei Liu, 5G and Mobile Network Infrastructure Industry Analyst at ABI Research.

Both developed and emerging markets benefit from 5G FWA. North America, Western Europe, and Asia Pacific are driving 5G FWA deployments. In North America and Western Europe, MNOs are using 5G FWA to compete with DSL broadband services. Major U.S. operators, like T-Mobile, see a huge opportunity with 5G FWA because two-thirds of its residential customers living in urban and suburban areas are dissatisfied cable customers, making up a significant amount of its 5G FWA customers. In Western Europe, EE UK launched 5G FWA in 2019 and plans to cover 90% of the UK with 5G by 2028. Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025. There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.

“MNOs should launch 5G FWA to utilize their network capacity to make additional revenue. However, they need to be vigilant on how many FWA subscribers they can support, and which type of service they wish to offer (best effort or QoS). In the long term, MNOs need to apply Artificial Intelligence (AI) techniques such as Machine Learning (ML) to evaluate their network resource, network capacity, and spectrum to ensure a steady 5G FWA growth,” Liu recommends. “When the 5G FWA service starts to challenge their network capacity, these MNOs may have to deploy millimeter wave (mmWave) to guarantee the quality of their FWA services and overall network capacity,” Liu concludes.

These findings are from ABI Research’s Fixed Wireless Access market data report. This market data is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets comprise deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight into where opportunities lie.

Fixed-wireless access antennas can be placed near windows or on roofs as shown in this diagram:

Image credit: Qualcomm

……………………………………………………………………………………………………………………………………………….

Other Market Rearch Firm Findings and Forecasts for 5G FWA:

A study published by Leichtman Research Group earlier this month claimed that FWA services accounted for 90% of U.S. net broadband additions last year, compared to 20% in 2021. Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

Verizon VP Sampath Sowmyanarayan recently said that Verizon’s FWA is winning 50 to 60% of its consumer segment customers and about half of its business segment customers from cablecos, with only a minority of subscribers coming from unserved and/or rural areas. The rural percentage may rise in the future due to growing availability and C Band deployment in rural markets, but not because capacity constraints are limiting it in urban and suburban markets. Outside the U.S.:

- EE UK launched 5G FWA in 2019 and plans to cover 90 percent of the UK with 5G by 2028.

- Fastweb in Italy launched 5G FWA in 2020 and plans to cover 12.5 million homes and businesses by 2025.

- “There is growing interest in the Asia Pacific as Reliance Jio eyes 100 million homes through 5G FWA.” Admittedly Jio has yet to offer a time frame for hitting that target, but if it makes good on its pledge to offer nationwide 5G coverage by the end of this year, 100 million FWA customers by 2027 seems eminently achievable.

Other bullish forecasts for the global 5G FWA market from JC Market Research and Research & Markets are here and here.

Regarding, telco 5G FWA revenues, a Juniper Research forecast last September was $2.5 billion globally this year, up from $515 million in 2022. It expects that number to climb to $24 billion by 2027 driven by consumers switching from fixed broadband.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

…………………………………………………………………………………………………………………………………………………

References:

https://telecoms.com/520843/5g-fwa-emerging-as-a-competitive-alternative-to-fixed-broadband/

https://telecoms.com/517535/telco-5g-fixed-wireless-revenues-set-to-rocket/

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile