FTTP

NTT to launch 25 Gps FTTH service in Tokyo starting March 2026

NTT East plans to launch a 25 Gbps Fiber-to-the-Home (FTTH) service in Tokyo starting March 2026, according to Telecompaper, The service will offer significantly faster residential broadband, building on their existing fiber services and recent developments in higher-speed business options. Currently, the highest speed Fiber-to-the-Home (FTTH) access plan commercially available in Japan is 10 Gbps offered by multiple fiber optic network providers, including NTT East/West and Sony-backed NURO Hikari.

NTT’s forthcoming Flet Hikari 25G service will be a best-effort FTTH access product, utilizing shared subscriber fiber to connect customers to their chosen Internet Service Providers (ISPs).

The launch is part of NTT’s broader initiative to develop next-generation digital infrastructure, which also includes the development of key devices for an ultrafast optical network under its “Innovative Optical and Wireless Network” (IOWN) project in 2026.

Source: NTT Access Service Systems Laboratories

Separately, researchers in Japan have set world records for internet transmission speeds using experimental fiber optic technology, reaching speeds of over 1 petabit per second (which is over a million gigabits per second) in laboratory settings. These are research achievements and not a commercially available service for everyday use.

References:

https://www.ntt-review.jp/archive/ntttechnical.php?contents=ntr201604fa6.html

https://www.telecompaper.com/news/ntt-east-and-west-launch-10-gbps-service–1538339

NTT’s IOWN provides ultra low latency and energy efficiency in Japan and Hong Kong

NTT Data and Google Cloud partner to offer industry-specific cloud and AI solutions

Sony and NTT (with IOWN) collaborate on remote broadcast production platform

NTT & Yomiuri: ‘Social Order Could Collapse’ in AI Era

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

T-Mobile and EQT (a purpose-driven global investment organization) announced the successful close of their joint venture (JV) to acquire fiber-to-the-home provider Lumos. As part of the transaction, many Lumos customers will soon become T-Mobile Fiber customers and begin enjoying new offers and benefits as they’re welcomed into the Magenta family.

This deal marks a major milestone in T-Mobile’s broadband growth and builds on the Un-carrier’s success in delivering best-in-class connectivity. By bringing more value and choice to the millions of Americans who have previously been underserved, T-Mobile continues to deliver on its mission to change broadband for good. T-Mobile will take full ownership of the customer experience, using its proven brand, nationwide retail footprint, differentiated marketing and customer-first service model to attract new subscribers.

Currently, Lumos operates a 7,500-mile fiber network, providing high-speed connectivity to 475,000 homes across the Mid-Atlantic. The joint venture combines the Un-carrier’s unique assets with EQT’s fiber infrastructure expertise, and Lumos’ scalable build capabilities to drive rapid network expansion, with the goal of reaching 3.5 million homes by the end of 2028. To fuel this growth, T-Mobile invested $950 million into the joint venture, with an additional $500 million planned between 2027 and 2028 to support further expansion. T-Mobile will provide an update to its full year 2025 guidance resulting from this transaction during its Q1 earnings call.

“T-Mobile is already the fastest-growing broadband provider in America, and expanding into fiber helps us take the next big step in delivering what customers truly want – faster, more reliable internet that simply works,” said Mike Katz, T-Mobile President of Marketing, Strategy and Products. “People deserve better when it comes to their home internet: fewer disruptions, more value, and support that actually feels supportive. We’re excited to welcome Lumos customers to the T-Mobile family and bring them the Un-carrier experience – built around their needs, fueled by innovation, and focused on making life easier.”

As Lumos customers continue to enjoy the same high-speed fiber internet they rely on today at low monthly prices, they’ll now also enjoy the value-add benefits they get from simply being a part of the T-Mobile family. They will have access to T-Mobile’s best-in-class customer experience and nationwide retail presence. Every plan also comes with unlimited data plus Wi-Fi equipment and installation included, so customers can enjoy the freedom and flexibility of reliable internet. Additionally, new and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure.

“We’re excited to begin this joint venture and even more energized about what’s ahead,” said Brian Stading, CEO of Lumos. “Partnering with EQT and T-Mobile, we’re ready to scale faster, deliver cutting-edge fiber technology to more people, and change even more lives. This is about more than just internet – it’s about building the infrastructure of the future and creating lasting opportunity, connection, and impact for communities.”

“We are thrilled to officially embark on this next chapter of growth with Lumos alongside our partners at T-Mobile,” said Nirav Shah, Partner within EQT’s Infrastructure Advisory team. “This joint venture represents a powerful combination of EQT’s digital infrastructure expertise, Lumos’ proven fiber deployment capabilities, and T-Mobile’s customer-first approach and national reach. Together, we are well-positioned to accelerate access to high-quality fiber broadband to millions of underserved Americans and look forward to executing on our plans to deliver the critical connectivity that empowers communities across the country.”

As the fifth-largest and fastest-growing Internet service provider in the U.S., T-Mobile offers 5G Home Internet to 70 million homes, serving more than 6.4 million customers nationwide as of the end of 2024, and has introduced T-Mobile Fiber in parts of 32 U.S. markets. Fiber-to-the-home complements T-Mobile’s successful 5G Home Internet offering, which currently has over 1 million customers on its waitlist. This expansion in fiber opens an additional avenue to meet the growing demand for T-Mobile broadband. Through its strategic fiber partnerships and joint ventures, the Un-carrier expects to reach 12 to 15 million households, or more, with fiber by the end of 2030.

References:

https://www.t-mobile.com/news/business/t-mobile-eqt-close-lumos-fiber-jv

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

AT&T’s leads the pack of U.S. fiber optic network service providers

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Verizon to buy Frontier Communications

Wall Street Journal reported today that Verizon is on the verge of buying Frontier Communications for as much as $7 billion in a deal that would bolster the company’s fiber network to compete with rivals notably AT&T. With a market value of over $7 billion, Dallas, TX based Frontier provides broadband (mostly fiber optic) connections to about three million locations across 25 states. Frontier is in the midst of upgrading its legacy copper landline network to cutting-edge fiber. Rising interest rates sparked fears among investors, however, that the business would run out of cash and not be able to raise more before completing those upgrades. Frontier has a 25-state footprint and serves largely rural areas. It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products and bills itself as “largest pure-play fiber internet company in the US.”

An all-cash deal between the two companies could be announced as soon as Thursday, a person familiar with the negotiations told Bloomberg.

Fiber M&A has heated up as telecom companies and financial firms pour capital into neighborhoods that lack high-speed broadband or offer only one internet provider, usually from a cable-TV company. New fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets.

Verizon, with a market valuation of around $175 billion, will be under pressure from shareholders to justify any big purchase after the company paid more than $45 billion to secure C-band 5G wireless spectrum licenses and spent billions more to use them. Executives have said they are focused on trimming the telecom giant’s leverage to put it on a firmer financial footing.

Verizon, the top cellphone carrier by subscribers, has faced increased pressure from competitors and from cable-TV companies that offer discounted wireless service backed by Verizon’s own cellular network. Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. It has both 5G fixed wireless access (FWA) and its Fios-branded fiber to the premises network.

T-Mobile is the only major U.S. cellphone carrier that lacks a large landline business. Since its 2020 takeover of rival carrier Sprint, the company has focused on 5G dominance and succeeded in growing its cellphone business faster than rivals. That network has also linked millions of customers to its fixed 5G broadband service, which offers cablelike service over the air. T-Mobile’s strategy has shifted in recent months, however, as the company dabbles in partnerships and wholesale leasing agreements with companies that build fiber lines to homes and businesses. The wireless “un-carrier” in July agreed to spend about $4.9 billion through a joint venture with private-equity giant KKR to buy Metronet, a Midwestern broadband provider.

Photo Credit: Jeenah Moon/Bloomberg News

…………………………………………………………………………………………………………………………………………………………

A deal for Frontier would be a round trip of sorts for some of the network infrastructure that Frontier bought from Verizon in 2016 for $10.54 billion in cash. Frontier later filed for Chapter 11 bankruptcy in April 2020 as it burned through cash and was burdened by a heavy debt load. It emerged as a leaner business in 2021 with about $11 billion less debt and focused on building a next-generation fiber optic network.

Frontier’s biggest investors today include private-equity firms Ares Management and Cerberus Capital Management. The company drew the attention of activist Jana Partners last year, which built a stake in the business. Jana delivered a letter to Frontier’s board late last year asking the company to take steps immediately to help reverse its sinking share price, including a possible outright sale.

…………………………………………………………………………………………………………………………………………………………..

AT&T has focused on expanding its fiber network since spinning off its WarnerMedia assets in 2022 to Warner Brothers Discovery. AT&T has 27.8 million fiber homes/businesses passed, growing at ~2.4 million per year, plus more locations passed via its Gigapower joint venture. AT&T’s fiber internet business is expected to contribute to an increase in consumer broadband and wireline revenue. AT&T expects broadband revenue to increase by at least 7% in 2024, which is more than double the rate of growth for wireless service revenue. In contrast, Verizon only has about 18 million fiber locations, growing at about 500,000 per year.

Other recent deals in the fiber transport market sector include the $3.1 billion acquisition, including debt, of fiber provider Consolidated Communications in late 2023 by Searchlight Capital Partners and British Columbia Investment Management.

………………………………………………………………………………………………………………………………………………………….

It’s All About Convergence (fiber based home internet combined with mobile service):

Speaking at a Bank of America investors conference today, Verizon’s CEO for the Consumer Group Sowmyanarayan Sampath said when Verizon bundles Fios with wireless, it sees a 50% reduction in mobile churn and a 40% reduction in broadband churn. He said they don’t see the same benefits with FWA. Sampath was scheduled to speak at the Mobile Future Forward conference tomorrow, but he canceled at the last minute, which may be a sign that this deal for Frontier is imminent.

The analysts at New Street Research led by Jonathan Chaplin said Verizon’s rationale for the purchase is “convergence baby.” They wrote, wrote, “Verizon seemed complacent. No longer.” Indeed, Verizon CEO Hans Vestberg was challenged on the company’s second quarter 2024 earnings call by analysts who questioned whether Verizon had a big enough fiber footprint to compete in the future. The New Street analysts said Sampath’s comments today “marked a shift in rhetoric from: ‘convergence is important, but we can do it with FWA.”

The analysts at New Street wrote today, “We have been arguing for a couple of years that all the fiber assets would eventually be rolled up into the three big national carriers (AT&T, Verizon, T-Mobile). We always knew that if one carrier started the process, others would have to follow swiftly because there are three wireless carriers and only one fiber asset in every market with a fiber asset.”

Other potential fiber companies that the big three national carriers might be eyeing include Google Fiber, Windstream, Stealth Communications and TDS Telecom.

After its annual summer conference in August in Boulder, Colorado, the analysts at TD Cowen, led by Michael Elias, said there was a lot of conversation about the wireline-wireless “convergence” frenzy. “We believe convergence is a race to the bottom, but if one player is going in with a slight advantage (AT&T), the others must reluctantly follow,” wrote TD Cowen. In the mid-term they speculated that T-Mobile might look at fiber roll-ups with Ziply or Lumen (formerly or other regional players.

References:

https://www.wsj.com/business/deals/verizon-nearing-deal-for-frontier-communications-9e402bb4

https://www.fierce-network.com/broadband/verizon-rumored-buy-frontier-its-convergence-game

https://finance.yahoo.com/news/verizon-talks-buy-frontier-communications-180419091.html

https://videos.frontier.com/detail/videos/internet/video/6322692427112/why-fiber

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Highlights of FiberConnect 2024: PON-related products dominate

The Fiber Broadband Association’s flagship conference, FiberConnect 2024, concluded July 31, 2024, in Nashville, Tennessee. It featuring 275 speakers and 286 exhibitors in the Expo Hall, with about half the attendees from operators and half representing vendors. The show provided a great opportunity to gauge the pulse of the fiber based broadband industry in North America.

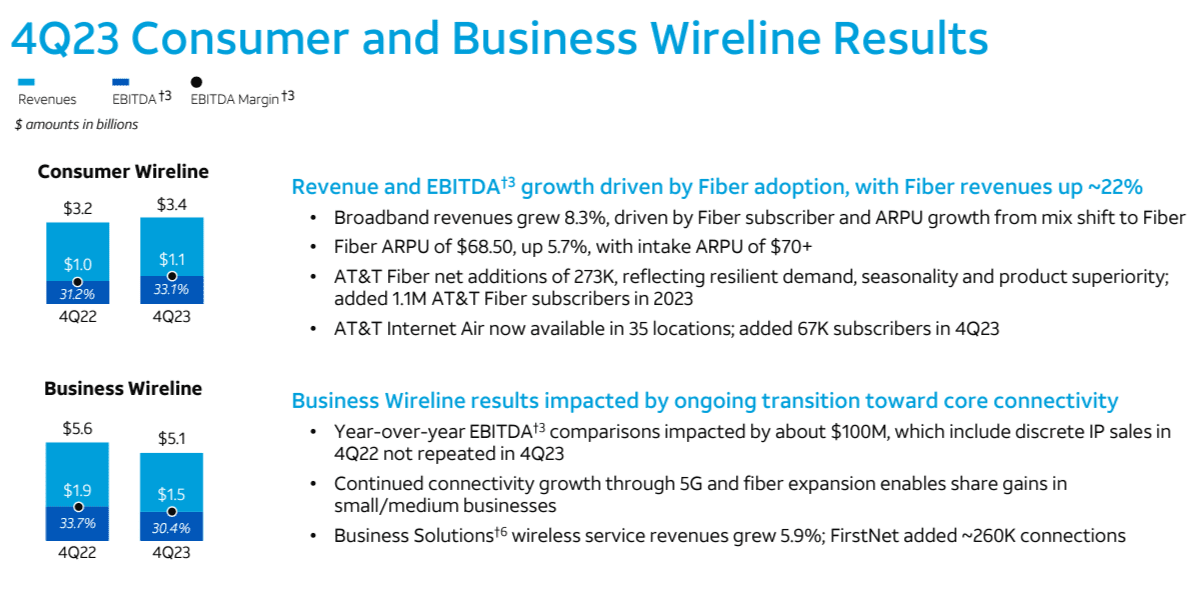

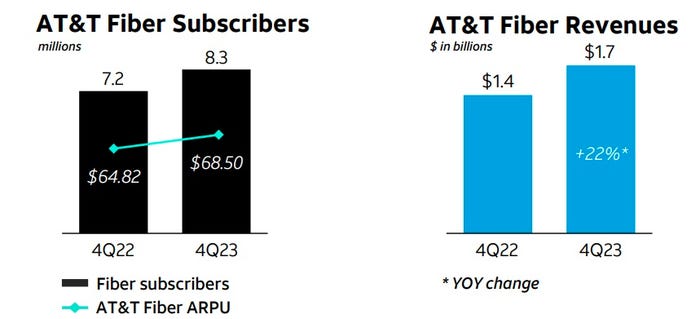

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

AT&T added 273,000 residential fiber subs in Q4, down slightly from year-ago adds of +280,000 and a gain of +296,000 in the prior quarter. AT&T ended 2023 with 8.3 million fiber subs. The U.S. based carrier added about 400,000 fiber locations in Q4, extending that reach to 21.1 million. AT&T remains committed to expanding its fiber-to-the-premises (FTTP) footprint to 30 million locations by 2025, Stankey said.

Fiber-related revenues hit $1.67 billion, up from $1.37 billion in the year-ago quarter. Fiber average revenue per user (ARPU) reached $68.50, up from $64.82 a year earlier.

AT&T says it has the nation’s largest fiber network, which now passes 26 million+ consumer and business locations; on track to pass 30 million+ locations with fiber by the end of 2025.

…………………………………………………………………………………………………………………

AT&T’s new fixed wireless access (FWA) service dubbed “Internet Air” gained ground in the fourth quarter of 2023. Internet Air added 67,000 subscribers in Q4 of 2023, extending its total to 93,000. Those quarterly FWA subscriber additions were a “surprise,” New Street Research analyst Jonathan Chaplin said in a research note issued after AT&T posted earnings. Yet they are way below Verizon’s FWA numbers which came in at 375,000 FWA subs added in the Q4 of 2023.

However, AT&T’s FWA offering will remain a limited and targeted product in the operator’s home broadband arsenal. “I don’t expect that we are going to be pushing the [Internet Air] product the same way that some others in the market are pushing it today,” AT&T CEO John Stankey said on today’s earnings call. “We made a conscious choice as a company that we want to dedicate capital to invest in fiber, which we believe is a more sustainable long-term means to deal with stationary and fixed broadband needs.”

AT&T will continue to use Internet Air on a selective basis, relying on it as an alternative for customers transitioning off of the telco’s aging copper plant, in pockets of some markets where AT&T offers fiber service, as well as markets where AT&T has no existing wireline business.

……………………………………………………………………………………………………………………….

AT&T claims it has the largest and most reliable wireless network in North America. Its mid-band 5G spectrum now covers 210 million+ people, achieving its end-of-year targets. It expects wireless service revenue growth in the 3% range for 2024.

Stankey said 2024 will be the “proving year” for the Gigapower joint venture with BlackRock that will initially bring open access fiber networks to about 1.5 million locations outside of AT&T’s legacy wireline footprint. Initial Gigapower markets include Las Vegas, three cities in Arizona (Mesa, Chandler and Gilbert), parts of northeastern Pennsylvania (including Wilkes-Barre and Scranton) and segments of Alabama and Florida.

AT&T also said that it now has a FirstNet customer base consisting of more than 5.5 million connections.

“We accomplished exactly what we said we would in 2023, delivering sustainable growth and consistent business performance, resulting in full-year free cash flow of $16.8 billion, ahead of our raised guidance. As we advance our lead in converged connectivity, we will continue to scale our best-in-class 5G and fiber networks to meet customers’ growing demand for seamless, ubiquitous broadband, and drive durable growth for shareholders,” said CEO John Stankey.

References:

https://about.att.com/story/2024/q4-earnings-2023.html

https://edge.media-server.com/mmc/p/keicd3et/ (4Q 2023 earnings call)

https://investors.att.com/news-and-events/events-and-presentations

https://www.lightreading.com/fixed-wireless-access/at-t-nears-100k-internet-air-subs

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

2023 Deutsche Telekom (DT) Highlights:

- Fiber offensive: more than 2.5 million new fiber connections made possible in 2023, reaching a total of more than ten million fiber households in 2024

- 5G front-runner: 5G population coverage of 96%, 5G Standalone also for private customers in 2024

- State-of-the-art technologies: Artificial intelligence supports fiber and mobile rollout

- EURO 2024: Deutsche Telekom connects all stadiums, fan zones & team quarters, data gift for all mobile customers

………………………………………………………………………………………………………………………………………

DT Network Day photo courtesy of Deutsche Telekom

………………………………………………………………………………………………………………………………………

Deutsche Telekom announced that it has successfully enabled more than 2.5 million new fiber connections this year, thereby realizing its fiber plant expansion target. The company invested EUR 2.5 billion in fiber expansion, expanding coverage in almost 3,500 towns and municipalities. According to the announcement, the company projects a total investment of EUR 30 billion in the fiber optic rollout by 2030.

Its Fiber-to-the-home (FTTH) network is set to reach eight million households by the end of the year, with plans to extend this to ten million fiber optic connections by 2024.

………………………………………………………………………………………………………………………………………..

In mobile, Deutsche Telekom currently provides 5G coverage to 96 percent of the population, serving 80 million people through a network of over 80,000 5G antennas, including 10,000 in the 3.5 GHz band spread across more than 800 cities and municipalities. The network delivers download speeds of up to 1 Gbps.

The company aims to achieve 99 percent 5G coverage for the German population by 2025 and plans to launch 5G Standalone (SA) core network for private customers in 2024. DT indicates that 10,000 antennas are compatible with 5G SA in the 3.6 GHz band, covering more than 800 cities and municipalities. This is up from 9,700 antennas in August 2023.

Deutsche Telekom’s business customers are already using 5G SA technology with functions such as network slicing. For example, for live TV transmission of media or in 5G campus networks for industry and research. “In the coming year, 5G SA should then offer all customers real added value,” DT said.

Meanwhile, rival operators Telefónica Deutschland (O2 Germany) and Vodafone Germany already offer standalone 5G services.

…………………………………………………………………………………………………………………………

DT began the deployment of its open radio access network (O-RAN) in Germany in December, in collaboration with Nokia and Fujitsu. The first O-RAN commercial deployment will be in Neubrandenburg. Nokia and Fujitsu are supplying the necessary technology components.

“Open RAN increases the choice of manufacturers and therefore our flexibility. The open access network enables more automation. And makes our networks even more resilient. This benefits the people that our mobile network connects,” says Claudia Nemat.

The German telco expects to have 3,000 O-RAN compatible antennas by the end of 2026.

…………………………………………………………………………………………………………………………

Deutsche Telekom also says it’s using Artificial Intelligence (AI) in network expansion and mobile communications. AI aids in analyzing and evaluating cell usage and capacity utilization, with the ongoing development of a large language model for telco-specific applications in collaboration with SK Telekom. Additionally, AI contributes to enhanced network security through automated pattern recognition, according to the company.

References:

https://www.telekom.com/en/media/media-information/archive/telekom-network-day-2023-1055364

https://www.fiercewireless.com/wireless/deutsche-telekom-plans-5g-standalone-launch-2024

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications has nearly three million broadband internet subscribers across 25 states, on a network that reaches about 5.5 million homes and businesses via fiber and another 10 million via copper. About a third of Frontier’s potential fiber customers subscribe, three times the rate of those on copper lines. Frontier built fiber to an additional 339,000 locations in Q1 2023, ending the quarter with 5.5 million fiber passings and 15.4 million total passings. The company also added a record 87,000 fiber subs in the period, extending that customer total to 1.76 million (1.65 million residential and 110,000 business customers).

However, building out its fiber network will cost more than Frontier’s management forecast when the company emerged from bankruptcy in early 2021. Its latest two million locations cost an average of $830 to deploy. In May, management said it expects the remainder of this year’s build to cost between $1,000 and $1,100 per location. It costs Frontier another $600 or so to send a technician to a customer’s home to plug in all the necessary equipment and the like.

Light Reading reports that Vikash Harlalka, telecom analyst at New Street Research, estimates that Frontier’s fiber buildout plan faces a funding gap of about $2.3 billion. However, Frontier Communications’ plan to offer $1.05 billion in securitized debt, with the potential to upsize it, will significantly cut down the company’s funding gap to build fiber to 10 million locations by 2025. The company said:

An indirect subsidiary of the Company intends to offer approximately $1.05 billion aggregate principal amount of secured fiber network revenue term notes (the “Notes”), with the potential to upsize, subject to market conditions and other factors. The Notes will be secured by certain of Frontier’s fiber assets and associated customer contracts in the Dallas metropolitan area and constitute the first offering of green bonds by a Frontier subsidiary.

“The offering should close nearly half the gap (more than half, if the offering is upsized. It takes most of the funding risk off the table,” Harlalka explained in a research note, adding that the move also unlocks a new market for Frontier to tap into for its funding needs. Harlalka noted that Frontier had about $2.7 billion in liquidity at the end of the first quarter of 2023 – enough to meet the company’s capital needs until mid-2024. “This new debt raise should extend that beyond 2024,” he added.

Frontier said the debt offer will be secured by a portion of the company’s fiber assets and associated customer contracts in the Dallas metropolitan area, and marks the first offering of “green bonds” by a Frontier subsidiary. The offer will go toward capital expenditures and research and development, “in line with Frontier’s fiber expansion and copper migration strategies,” the company said.

Last week, Frontier stock dropped 21.3% after The Wall Street Journal reported on potential health risks posed by lead-sheathed copper wires in old networks across the U.S. Frontier declined to comment. The stock decline continued on Monday July 17th with FYBR hitting a low of $11.65 on huge volume of 12,063,100 shares. It rebounded 43.95% in the next four trading days to close at $16.77 on Friday July 21st (albeit on very light volume).

New Street analyst Jonathan Chaplin estimates that remediation costs to Frontier could reach $6 billion if it is required to rip out all the lead-covered copper on its own dime within five years. But there’s overlap with upgrading those same lines to fiber, and Chaplin calculates a $75 fair value for the stock in this unlikely scenario. “Even if it comes to pass, we see upside to the stock,” he writes.

Frontier is scheduled to announce Q2 2023 results on Friday, August 4th.

References:

https://www.barrons.com/articles/buy-frontier-communications-stock-price-pick-a2f82599

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

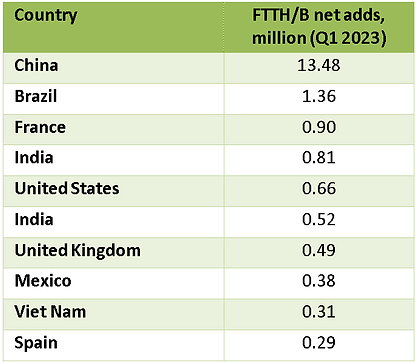

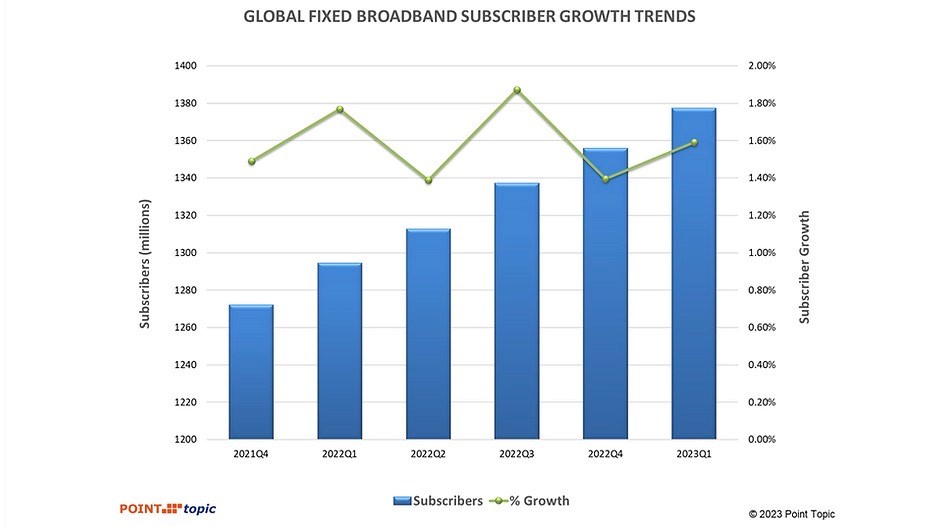

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

Global fixed broadband connections reached 1.377 billion as of Q1-2023, up by 83 million from a year earlier and reflecting an annual growth rate of 1.59%, according to Point Topic.

There was a decline in fixed broadband subscriptions in 18 countries[1] which mainly include emerging markets, as well as some saturated markets such as Singapore. However, while there were fluctuations in growth rates across regions and markets, the overall trend indicates a steady expansion of global broadband connectivity.

Highlights:

-

Among global regions, Africa, East Asia and America Other saw the fastest growth in broadband connections (2.9%, 2.2% and 1.8%), not least due to healthy increases in broadband subscribers in the vast markets of Egypt, Brazil and China.

-

The share of FTTH/B in the total fixed broadband subscriptions continued to increase and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA).

-

VDSL subscriber numbers grew in ten countries, while they dropped in at least 22 markets as consumers migrated to FTTH/B.

-

The highest FTTH/B broadband subscriber growth rates in Q1 2023 were in Algeria, Peru and UK.

At 21.6 million, the quarterly net adds were close to the figure we recorded a year ago, though the growth rate (1.59%) was slower, compared to 1.77% in Q1 2022, with global inflation and economic instability having an impact.

East Asia continued to dominate in Q1 2023, maintaining its position as the largest market with a 49.6% share of global fixed broadband subscribers. This substantial market share is primarily driven by China with its vast population.

In Q1 2023, broadband subscriber base grew faster in China, Hong Kong and Korea, compared to Q4 2022. As a result, the region’s net adds share globally went up from 63.2% to 68.8%. Asia Other accounted for 10.8% of the global broadband market, similarly to the previous quarter, though the region’s net adds share went down from 12.8% to 9.4%.

Europe’s market shares remained rather consistent, though Eastern Europe saw their net adds share decline from 3.4% to 0.5%, as a result of slower growth in almost all markets and the decline in broadband subscribers in Russia having an especially significant impact due to its market size.

Similarly, Americas maintained relatively stable market shares of 10.3% and 8.1% respectively, while America – Other’s net adds share increased from 7.8% to 9%, driven by higher growth in such sizeable markets as Brazil, Mexico, Colombia and Chile, to name a few.

Next Point Topic looks at fixed broadband penetration among population, comparing it to growth rates across the regions.

Africa and Asia Other continue to have relatively low fixed broadband penetration rates among their populations. In Q1 2023, this metric in Africa stood at 4.6%, while Asia Other reached 5.6%. These figures indicate the potential for future expansion in these regions. Not surprisingly, Africa also recorded the highest quarterly growth rate of 2.9%.

The markets of East Asia and America Other followed closely with growth rates of 2.2% and 1.8% respectively, despite East Asia already having the highest population penetration at 41.9%. This reflects a widespread adoption of fixed broadband services in East Asia, while America Other showcases steady growth in a region with significant potential, where broadband penetration is among the lowest, at 17.2%.

Eastern Europe displayed a modest growth rate of 0.2% with a population penetration of 24.8%. Some markets in this region still have a lot of headspace when it comes to broadband adoption but the growth was sluggish, likely due to economic pressures. Other European regions showed a slightly higher growth rate, with Europe Other at 0.5%, coupled with the second highest population penetration of 39.4%. These figures indicate a mature market with limited growth opportunities.

Among the largest twenty broadband markets all but one saw fixed broadband subscribers grow in Q1 2023, although in ten of them the growth was slower than in the Q4 2022. There was a slight drop in broadband subscribers in Russia which is under international sanctions.

The less saturated broadband markets of India, Egypt, Brazil and Mexico recorded the highest quarterly growth rates in Q1 2023, all higher than 2%. China recorded an above 2% growth as well. At the other end of the spectrum, the mature markets of Germany, France, Japan, UK, and Italy saw modest growth rates at below 0.5%. At the same time, Italy was among the countries that saw one of the largest improvements in growth rates, from -0.44% in Q4 2022 to 0.04% in Q1 2023, as its GDP growth also went from negative to positive in that period[2]. Mexico, China and Brazil recorded the largest improvements in their growth rates, at +1.14.%, +0.52% and +0.41% respectively.

Between Q4 2022 and Q1 2023, the share of FTTH/B connections in the total fixed broadband subscriptions went up by 0.7% and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA), which remained stable.

FTTx (mainly VDSL) share stood at 6.7%[3]. VDSL subscriber numbers grew in ten countries (including modest quarterly increase in the large VDSL markets of Turkey, Czech Republic, Greece and Germany, for example), while they fell in 22 other markets as consumers migrated to FTTH/B.

It remains to be seen whether consumers will continue to gravitate toward fibre broadband offerings, particularly as global economies face potential slowdown and inflationary pressures.

In terms of FTTH/B broadband net additions in Q1 2023, China continued to maintain a significant lead with 13.5 million while Brazil added 1.4 million. Mexico is back in the top ten league, having pushed out Argentina this quarter.

Satellite broadband also saw a modest growth of 1.3% while wireless broadband demonstrated continued relevance with a respectable growth rate of 4.9%. These trends can be attributed to the demand for connectivity in remote or underserved areas where traditional broadband infrastructure is not feasible.

The diverse growth rates among different broadband technologies highlight the dynamic nature of the industry as consumers seek more reliable and high-speed connections. The significant increase in FTTH/B connections and the growth of satellite and wireless broadband underline the ongoing efforts to bridge the digital divide and ensure connectivity for all.

The top ten countries by fixed broadband subscribers remained unchanged (Figure 5). As of Q1 2023, China exceeded 0.6 billion fixed broadband subscribers, having added 14.6 million in the quarter. Also, the country is approaching 1.2 billion 5G subscribers, with the service now being used by 84% of the population.

Overall, the latest fixed broadband subscriber data reveals a clear trend towards advanced, high-speed broadband solutions like FTTH/B, while older technologies such as copper-based broadband (ADSL and VDSL) are experiencing a decline, suggesting that the broadband landscape is continuously evolving to meet the growing demand for faster and more reliable connectivity.

References:

https://www.point-topic.com/post/global-broadband-subscriptions-q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

USDA awards $714M for high speed internet access in rural areas

The U.S. Department of Agriculture (USDA) has awarded $714 million worth of grants and loans to small telecom companies for the provision of high-speed Internet in rural areas in 19 states. This award forms part of the fourth round of funding allocation under the ReConnect program, whose remit is to financially support the build out or improvement of infrastructure required to provide decent broadband in rural communities. The multi-billion-dollar program has been ongoing for around five years and this latest award is the third to take place under round four, the other two much smaller awards having happened earlier this year.

Essentially, the money is going into full fiber deployments. All of the 33 projects receiving funding in this latest allocation centre on the build out of fiber-to-the-premises (FTTP) infrastructure.

As noted by a USDA press release, connecting all communities across the United States to high-speed internet is a central part of President Biden’s ‘Investing in America’ agenda to rebuild the national economy “from the bottom up and middle out” by rebuilding the nation’s infrastructure, which the agency notes “is driving over $470 billion in private sector manufacturing investments and creating good-paying jobs.”

To add some colour, there are three projects receiving grants of just under the $35 million mark: two are in Alaska and involve the Interior Telephone Company and Mukluk Telephone Company, while a third will see the Nemont Telephone Cooperative roll out FTTP to homes, businesses, farms and schools in Montana.

The biggest loan, at just shy of $50 million, will go to the Craw-Kan Telephone Cooperative in Kansas, where a new FTTP network will reach 4,189 people, 149 businesses, 821 farms and three educational facilities in five counties.

The government itself highlighted the Kansas projects, as well as others in South Carolina, Arkansas, Oregon, California and Missouri that will all reach significant numbers of people. In all, the grants and loans will go to telcos serving communities in 19 states.

“High-speed internet is a key to prosperity for people who live and work in rural communities,” said U.S. Department of Agriculture (USDA) Secretary Tom Vilsack. “Thanks to President Biden’s Bipartisan Infrastructure Law, we can ensure that rural communities have access to the internet connectivity needed to continue to expand the economy from the bottom up and middle out and to make sure rural America remains a place of opportunity to live, work, and raise a family.”

The Bipartisan Infrastructure Law, inked in late 2021, provides $550 billion in investment in infrastructure over the 2022-2026 period into transport, waterways, power and broadband; the last has $65 billion allocated to it. Companies awarded grants and/or loans under the ReConnect program are required to apply to participate in the Bipartisan Infrastructure Law’s Affordable Connectivity Program (ACP), which provides discounts on Internet connectivity for low-income households.

Naturally, the announcement of the latest funding round under ReConnect is peppered with rhetoric on the current administration’s efforts to plough money into connectivity and ignores any part played by the previous administration in the project. ‘Twas ever thus in politics. However, the important point here is that those in the White House at present are showing a strong commitment to pushing on with funding broadband network rollout in those areas that are uneconomic to the big telcos, and that has to be a good thing.

References:

https://www.usda.gov/reconnect

https://telecoms.com/522239/us-throws-700-million-at-rural-fibre/

FTTH was ~60% of France fixed broadband market in Q1-2023

FTTH lines made up nearly 60% of French fixed broadband market in Q1-2023. FTTH subscriptions across mainland France and the overseas territories reached a 59.4% share of the country’s fixed broadband market at the end-March 2023, up by 10 percentage points from Q1 2022.

Viva La France!

According to the latest update from France regulator Arcep, the FTTH installed base added 895,000 net connections since December for a total of 19.02 million (+965,000 in Q4), representing a 22.8% increase year-on-year. As of March 31, 2023, 35.3 million premises (apartments, houses, offices, etc.) can be connected via FTTH i.e. a little over 80% of premises in the national territory. If you add cable internet that gives us 37.6 million locals who potentially have access to very high speed on wired networks in France. This represents a growth of approximately 3.6 million over the past year.

96% of Paris is connectable to optical fiber, but it’s only 50% in Lille. No explanation is given for this slowdown which is not in line with the France Very High Speed Plan which aims to generalize optical fiber throughout France by 2025.

Other high-speed networks (cable, VDSL and fixed wireless/LTE) continued to see their combined installed base decline quarter-on-quarter (-129,000) to stand at 3.25 million. As a result, the number of overall lines delivering download speeds of at least 30 Mbps reached 22.27 million at end-March.

The ADSL segment maintained its downward trend, leading to a further drop in connections delivering less than 30 Mbps. This brought the installed base across all fixed broadband networks to 32.04 million, up by 99,000 since December. This compares to with 63,000 market net additions in the previous quarter and 133,000 in Q1 2022.

Looking at progress in the ongoing fibre roll-outs, French operators brought FTTH connectivity to 840,000 million additional premises in the three months to March, for an overall footprint of 35.29 million. The pace of deployment slowed down from 1.3 million premises passed with fibre in the December quarter, and 1.1 million in Q1 2022.

On a year-on-year basis, the volume of new premises passed with fibre roughly halved across both densely populated metropolitan areas and mid-sized towns with privately funded roll-outs, while recording a 10% fall in public initiative fibre networks under deployment in rural communities. The latter reached a footprint of 12.8 million premises eligible for FTTH services at end-March, representing 610,000 additional premises since December.

Associated documents:

- Scorecard for fixed broadband and superfast broadband services – figures for Q1 2023

- Maconnexioninternet.arcep.fr, to obtain detailed information on fixed internet access coverage, particularly thanks to FttH rollout maps (which are also still available athttps://cartefibre.arcep.fr/)

- Open data:data on fibreand data on all access technologies

References: