O-RAN

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

NTT DOCOMO is leveraging its expertise to support the Open RAN efforts of network operators worldwide. Earlier in 2023, DOCOMO adopted the OREX (Open RAN Ecosystem Experience) brand to strengthen the support scheme for international telecom operators in delivering the Open RAN system.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world,” explains Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN and OREX Evangelist. “OREX is committed to making 2023 the defining year for Open RAN. Our ultimate goal is to eliminate global communication gaps through the OREX initiative.”

NTT DOCOMO is the number one mobile operator in Japan. Having launched its first-generation service in 1979, since then the company has pioneered new technologies.

Today DOCOMO has three business segments: enterprise, smart life, and telecommunications. It has 87m subscribers, with 20m subscribers enjoying its 5G Open RAN services, with a total revenue of around US$44bn.

An expert in the mobile industry for more than 25 years, Abeta’s career at NTT DOCOMO started as a researcher for 4G in 1997.

“My career at NTT DOCOMO started as a researcher for 4G in 1997,” he explains. “Then, we brought our ideas to 3GPP and I participated in 3GPP standardisation from 2005.

“With 3GPP, I served as the Vice Chair of 3GPP RAN1 and the rapporteur of LTE and LTE-A. After the completion of the LTE standard specification, I led the development of eNB and gNB commercial products and network optimization in the commercial network as the General Manager of the Radio Access Network Development department.”

In 1997 the second-generation mobile system was introduced in Japan. Instead of GSM, Japan utilised the Personal Digital Cellular (PDC) system. “During this time, data services over the mobile network were initiated, but the data rate was incredibly low, starting at only 2.4kbps,” Abeta explains. “It’s hard to imagine today, but at that time, only small text messages could be transferred over the mobile network. Eventually, the data rate increased to 28.8kbps.

“In 1999, we launched the i-mode service, marking the beginning of internet services over the mobile network.”

In 2000, 3G was introduced, with DOCOMO playing a significant role in contributing to the 3GPP standard specification work. “We led technical discussions and managed the discussions as one of the officials, serving as the Chair. We were the first operator to deploy 3G networks nationwide and provided rich content via the 3G network. However, the data rate was still limited to 64Kbps or 384kbps. Later, HSPA technology was introduced, enabling much higher throughput.

“Moving forward, we proposed LTE together with our partners and launched 4G services in 2010,” Abeta describes. “Our 4G radio access network (RAN) was fully multi-vendor interoperable. We defined interfaces that were not initially defined by 3GPP, making us the first operator to deploy a multi-vendor interoperable RAN. The rise of smartphones in conjunction with our 4G services revolutionised the user experience, and its benefits are well-known.”

While DOCOMO’s communication services continued to thrive, the company also expanded its non-communication services, evolving into the smart-life service segment.

When it comes to the rollout of 5G, DOCOMO has contributed not only to 3GPP but also to the O-RAN alliance to realise multi-vendor interoperable Open RAN solutions. “In 2018, we established the 5G Open Partner Program, aiming to create new services and address social issues by collaborating with vertical players,” Abeta adds. “Currently, this program has attracted participation from 5,300 companies and organisations.”

In this exclusive interview, Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN Solutions and OREX Evangelist discussed its OREX brand, which offers a pre-integrated solution that simplifies integration, interoperability and lifecycle management.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world.”

NTT DOCOMO has been featured in the July issue of Mobile Magazine

Mobile Magazine is the ‘Digital Community’ for the global Telecoms industry. Mobile Magazine covers 5G, IoT, Technology, AI, Connectivity, Mobile Operators, Wireless networks and Media – connecting the world’s largest community of Telecoms executives. Mobile Magazine focuses on telecoms news, key telecoms interviews, telecoms videos, along with an ever-expanding range of focused telecoms white papers and webinars.

References:

https://mobile-magazine.com/magazines

Multi-G Initiative to drive Open RAN Software Interfaces and increase innovation

Cohere Technologies, Intel, Juniper Networks, Mavenir and VMware intend to collaborate to develop the industry’s first framework for a multi-generational (Multi-G), software-based Open RAN architecture. The Multi-G initiative would define frameworks, interfaces, interoperability testing, and evaluation criteria that would provide the interfaces to support full coexistence of 4G, 5G, and future waveforms.

Intel’s FlexRAN platform is used by most current virtualized RAN (vRAN) deployments; Mavenir has a strong presence in providing open RAN equipment and software; and Juniper Networks and VMware are both contributing their work with the RAN intelligent controller (RIC). Cohere’s contribution is through its Universal Spectrum Multiplier software that can be integrated by RAN vendors or as an “app” into a telco cloud platform.

Intel’s involvement in this initiative is significant from an industry perspective due to the breadth of FlexRAN adoption. It also puts the chip giant a step ahead of competitors like Qualcomm, Arm and AMD that are aggressively targeting the Open RAN silicon market.

The new Multi-G framework would disaggregate RAN intelligence and scheduling functions, enabling future code releases of Intel’s FlexRAN reference architecture to support higher capacity, software-defined deployments for 4G, 5G and next generation wireless waveforms and standards.

This effort would help drive higher performance and connectivity across satellite, private and ad-hoc networks, and autonomous vehicles, increasing new service and revenue opportunities for telecommunications and mobile operators.

“This is going to make the network programmable all the way from layer one to the highest layers of the architecture,” said Cohere Technologies’ CEO Ray Dolan. “It’s not that open RAN is incomplete or not vibrant or not working, it is.” Right now, it has opened most of the parts that are what I’ll say are less controversial than the E2 interface. It’s opened the radio interfaces and the antenna interfaces, and so it’s established. But it hasn’t established the proper E2 interfaces completely. And that’s widely accepted as a fact. And in order for, I believe, for open RAN to really achieve its full vision, it needs to open that E2 interface because that’s where the innovation will come. Because that’s where all of the complexity in the marketplace is.”

The E2 work basically taps into the near real-time xApps running in a RIC to monitor and optimize an operator’s RAN deployment – typically either a vRAN or open RAN – and across different spectrum bands. This in turn allows an operator to support more stringent service-level agreements (SLAs) and private network deployments that can generate more revenues.

Ahead of the group’s first meeting in May 2023, telecommunications leaders worldwide are already sharing support for the collaborative initiative:

Vodafone Group

“This commitment from Intel, Mavenir, Juniper Networks, and Cohere, with a software programmable L1 stack, is fully aligned with the vision of Open RAN and will bring us one step closer to the scale deployment of software-defined RAN,” said Yago Tenorio, Vodafone Fellow and Director of Network Architecture, and Chairman of the Telecom Infra Project (TIP). “This has huge potential for significant performance and capacity benefits for all existing cellular networks. We strongly endorse this initiative, and we look forward to seeing the critical interfaces published into the relevant O-RAN Alliance and TIP Working Groups.”

Telstra

“Cohere’s Universal Spectrum Multiplier technology has the potential to unlock new architectural capabilities and opportunities for the RAN beyond today’s architecture,” said Iskra Nikolova, Network and Infrastructure Engineering Executive at Telstra. “We’re pleased to support this initiative and look forward to working with Cohere and the group to define the framework and accompanying critical interfaces.”

Bell

“A genuine Multi-G framework will enhance the benefits of Cohere’s Universal Spectrum Multiplier, strengthen Open RAN vendor flexibility down to the silicon layer, and allow old and new waveforms to coexist— beyond 5G,” said Mark McDonald, Bell’s Vice President, Wireless Access. “Bell looks forward to working with Cohere and partners later this year to further test this architecture.”

Hear from the Collaborators:

Intel Corporation

“This Multi-G framework, enabled by Intel FlexRAN – which is fully software programmable down to L1 – will enable faster O-RAN adoption and unlock new innovations,” said Sachin Katti, senior vice president and general manager of the Network and Edge Group at Intel Corporation.

Mavenir

“As the leading Open RAN partner, we’re excited to be part of the Multi-G initiative which promises to bring 4G and 5G spectral efficiencies gains not possible with incumbent solutions,” said Bejoy Pankajakshan, EVP-Chief Technology and Strategy Officer at Mavenir. “Unlike traditional DSS (Dynamic Spectrum Sharing) techniques which reduces 4G and 5G performance, with our Multi-G collaboration with Cohere and Intel, Mavenir can provide a true spectrum co-existence solution, which deploys 5G on the same spectrum assets as 4G dramatically improving the ROI per Hz on the existing 4G spectrum.”

Juniper Networks

“As more 5G deployments are underway, there is still a large installed base of 4G networks that can benefit from the intelligence, control and automation enabled by an Open RAN Intelligent Controller (RIC) architecture,” said Raj Yavatkar, CTO of Juniper Networks. “Juniper Networks has already demonstrated innovative 4G and 5G use cases with our Juniper Non-RealTime RIC and Near-RealTime RIC that can provide more flexibility to network operators. We are excited to add our expertise and join the Multi-G framework initiative, which will not only help to accelerate Open RAN adoptions but will also spur further innovation across multiple generations of mobile networks to enhance the network operator experience.”

VMware

“VMware is already paving the way for more programmable and intelligent Open RAN networks with our VMware RIC and our Service Management Orchestration Framework (SMO) for end-to-end RAN automation, assurance and optimization,” said Sanjay Uppal, GM & SVP, Service Provider Business Unit, VMware. “We are pleased to join other industry leaders to pioneer in the development of the industry’s first framework for a Multi-G, software-programmable architecture that will further encourage innovation and fast-track the adoption of Open RAN globally.”

Open RAN Policy Coalition

“Defining new interfaces that supercharge developing and future networks is critical for the success of open networks,” said Diane Rinaldo, Executive Director of the Open RAN Policy Coalition. “This will foster innovation and add flexibility, which will improve our competitiveness.”

Cohere Technologies

“We are pleased to work with world-class partners and operators to accelerate the deployment of Multi-G, open networks with significant performance improvements,” said Ray Dolan, CEO of Cohere Technologies. “Cohere is committed to a software-based, open architecture that can drive faster innovation and deliver critical revenue growth and profitability for the industry.”

………………………………………………………………………………………………………………………………………………………….

About Cohere Technologies:

Cohere is the innovator of Universal Spectrum Multiplier (USM) software for 4G, 5G, and Multi-G O-RAN. USM improves mobile networks up to 2x by MU-MIMO, enabling existing devices in any FDD and TDD spectrum band. Cohere is the creator of the Orthogonal Time Frequency Space (OTFS) wireless system, and is headquartered in San Jose, Calif. (USA). Website: www.cohere-tech.com Twitter: @Cohere_MultiG

References:

https://www.cohere-tech.com/press-releases/multi-g-initiative

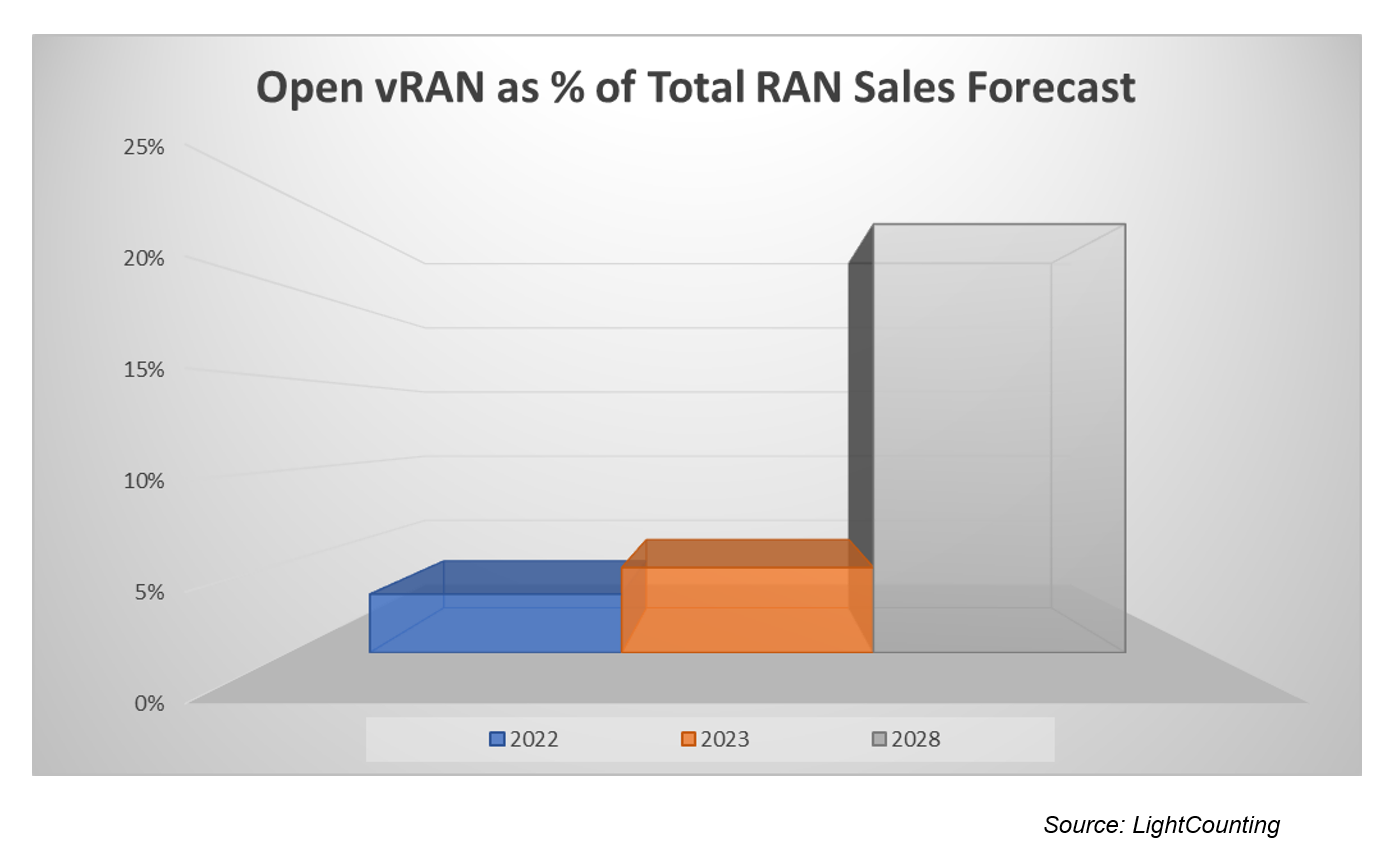

LightCounting: Open RAN/vRAN market is pausing and regrouping

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

LightCounting: Open RAN/vRAN market is pausing and regrouping

Paradise Mobile’s Open RAN 4G/5G core network to run on AWS cloud

Paradise Mobile, a new Mobile Network Operator (MNO) building a greenfield, cloud-native, Open RAN (oRAN) 4G/5G mobile network from the ground up in Bermuda, today announced the selection of Amazon Web Services, Inc. (AWS) as its preferred cloud provider to help build an Open RAN 4G/5G network and bring innovative services to Bermuda for the first time.

Paradise Mobile will leverage AWS for digital platform workloads, with agreements to roll out AWS edge services on island to host the wireless core and Open RAN DU and CU workloads. Paradise Mobile is also working to bring AWS services to the island, which will provide local businesses and innovators in the IoT industry the necessary tools and infrastructure to rapidly develop, test and deploy cutting edge products and services. The new environment will provide the ability for a secure, scalable, and high-performance network, optimized for businesses to develop and launch their next big thing.

Sam Tabbara, Co-Founder and CEO, Paradise Mobile, said: “We see Amazon as a strategic long-term collaborator who shares our vision and values, and has the ability to significantly accelerate our roadmap of innovative new products and services we want to launch in Bermuda. This relationship will allow us to provide our customers with the best possible experience and create a hub for IoT innovation in Bermuda and beyond.”

Tabbara said Paradise plans to run its 5G network operations – including management software from Mavenir – directly inside a Kubernetes stack running on AWS. To do so, Tabbara explained that Paradise will install an instance of AWS inside a LinkBermuda data center and will run AWS at the base of each of its roughly two dozen planned cell towers. “The opportunity for us with AWS is to accelerate that [5G] future,” Tabbara told Light Reading.

The new IoT environment will also provide businesses with access to a wide range of AWS services. These services will give businesses the ability to process and analyze vast amounts of data in real-time, enabling them to create new and innovative products and services.

Sameer Vuyyuru, head of worldwide business development at AWS, said: “Leveraging AWS helps reduce time-to-market as well as create a new path to deliver innovation to customers. Our work with Paradise Mobile will not only help Paradise Mobile rapidly build, scale, and manage its mobile network but also offer secure solutions to accelerate innovation across Bermuda.”

Paradise intends to build specific network-based applications and services that can be used by other operators. Drone operations is one of the first 5G use cases that Paradise plans to support. Tabbara said that the company is in discussions with an unnamed drone startup that may use the Paradise 5G network for testing.

AWS will play a key role in that strategy, according to Tabbara. He explained that enterprise developers are already familiar with AWS’ cloud computing platform and therefore will be able to add networking into the mix as Paradise lights up its 5G operations. “Anyone who knows how to code applications … if you are able to code within that [AWS] ecosystem, then there’s value add for us to be in that same ecosystem,” Tabbara said. The drone startup plans to do its development work inside the relatively familiar confines of Amazon’s cloud computing platform. “We’re already co-developing some of these solutions,” Tabbara said.

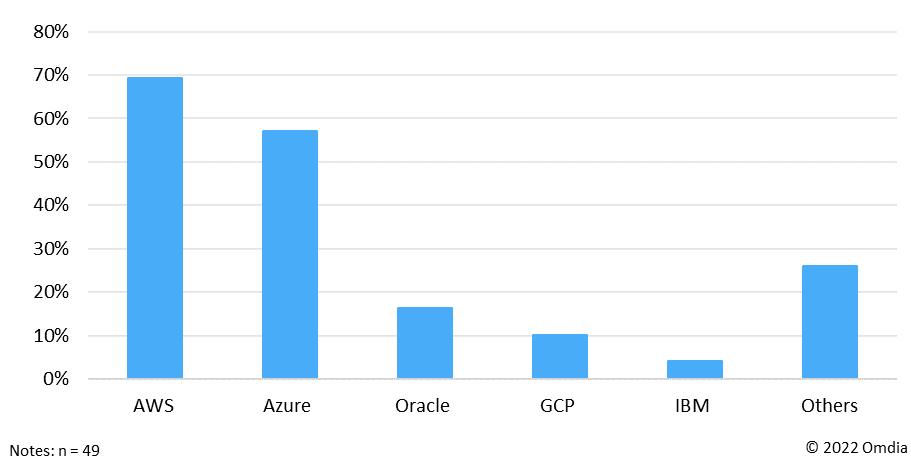

The announcement is yet another win for AWS as the hyperscaler competes against Oracle, Microsoft and Google Cloud for the telecom business. Omdia asked 49 telecom executives to list which public cloud or clouds their company is currently using to run any network functions, and respondents could select all that apply. Here was their response:

Note: Azure is Microsoft’s cloud offering, Google Cloud Platform is Google/Alphabet’s

…………………………………………………………………………………………………………………………………

Paradise Mobile is building a next generation wireless net network in Bermuda, followed by other CARICOM markets to be announced in the near future.

About Paradise Mobile:

Paradise Mobile is building a world of effortless connection with a next generation wireless network launching in multiple markets and countries, starting with Bermuda in 2023. Visit www.paradisemobile.com to learn more.

References:

ATIS and O-RAN Alliance MOU may be a prelude to Open RAN standards in North America

ATIS today announced it has executed a memorandum of understanding (MoU) with the O-RAN ALLIANCE to further both organizations’ mutual objectives to advance the industry towards more intelligent, open, virtualized and global standards-compliant mobile networks.

The MoU notes that ATIS and the O-RAN ALLIANCE will collaborate on advancing the state-of-the-art of open radio access network, including Open RAN security and stakeholder requirements for Open RAN. It also addresses the opportunity for ATIS translation of O-RAN ALLIANCE specifications to Open RAN standards to advance the adoption of Open RAN in North America.

“This agreement with the O-RAN ALLIANCE brings the power of ATIS’ 3GPP leadership and its contributions to the continued evolution of 5G, coupled with ATIS’ leadership for 6G and beyond as part of its Next G Alliance, to advance the development of open RAN technologies,” said ATIS President and CEO Susan Miller. “The MoU combines the forces of ATIS and the O-RAN ALLIANCE to connect the present to the future for the open RAN ecosystem, advancing the promise of a robust open RAN marketplace.”

“Continuing the work toward open radio access networks is critical in unlocking the full potential of 5G in North America and will lay the foundation for future generations of wireless technology,” said Igal Elbaz, Chair of ATIS Board of Directors and Network CTO of AT&T. “ATIS and the O-RAN ALLIANCE combining their expertise and resources and ATIS’ adoption of O-RAN specifications to ATIS Open RAN standards will help accelerate the industry’s implementation of open RAN.”

The MoU also addresses participation, by invitation, in meetings of each other’s working groups where appropriate, and promoting and endorsing each other’s events (e.g., conferences and plugfests) or activities (e.g., publication of work results) in areas of mutual interest and with prior consent of the other party.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Analysis:

ATIS’ board is composed of top executives from AT&T, Verizon, T-Mobile, Ciena and Comcast. It’s the group that has previously addressed topics including secure supply chain, robocalls and hearing aid compatibility for cellphones. And it’s also the association behind the new Next G Alliance, which is working to organize a comprehensive U.S. strategy around future 6G technologies.

Also note that ATIS represents 3GPP in ITU-R WP 5D and presents all their IMT contributions on 5G/IMT 2020/ITU-R M.2150. If 3GPP ever includes Open RAN in its specifications, it’s very likely that those will be presented by ATIS to ITU-R for 5G or even 4G LTE.

“Standards-based open RAN will help create a more receptive marketplace for open RAN technology, advance its development and drive adoption in North America,” added ATIS’ VP of technology and solutions, Mike Nawrocki, in a statement to Light Reading.

In the U.S., Dish Network is in the midst of building a nationwide 5G network that adheres to Open RAN specifications. However, it’s unclear whether Dish will be able to profit from its embrace of open RAN. AT&T has told this author they are interested in deploying Open RAN for 5G if it is more economical than legacy RANs. Neither Verizon or T-Mobile has expressed interest in Open RAN.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About ATIS:

As a leading technology and solutions development organization, the Alliance for Telecommunications Industry Solutions (ATIS) brings together the top global ICT companies to advance the industry’s business priorities. Our Next G Alliance is building the foundation for North American leadership in 6G and beyond. ATIS’ 160 member companies are also currently working to address 5G, illegal robocall mitigation, quantum computing, artificial intelligence-enabled networks, distributed ledger/blockchain technology, cybersecurity, IoT, emergency services, quality of service, billing support, operations and much more. These priorities follow a fast-track development lifecycle from design and innovation through standards, specifications, requirements, business use cases, software toolkits, open-source solutions and interoperability testing.

ATIS is accredited by the American National Standards Institute (ANSI). The organization is the North American Organizational Partner for the 3rd Generation Partnership Project (3GPP), a founding partner of the oneM2M global initiative, a member of the International Telecommunication Union (ITU) and a member of the InterAmerican Telecommunication Commission (CITEL). For more information, visit www.atis.org. Follow ATIS on Twitter and on LinkedIn.

About O-RAN ALLIANCE:

The O-RAN ALLIANCE is a world-wide community of more than 300 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, the O-RAN ALLIANCE’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN specifications enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN based mobile networks at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, the O-RAN ALLIANCE publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

For more information, please visit www.o-ran.org.

References:

https://www.lightreading.com/open-ran/open-ran-gets-helping-hand-in-us/d/d-id/782703?

https://www.lightreading.com/open-ran/the-growing-pains-of-open-ran-/a/d-id/782247

https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9946966

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network to FCC on its “game changing” OpenRAN deployment

Through disaggregation of the Radio Access Network (RAN) into functional blocks/modules and defining open interfaces between those modules, OpenRAN technology promises to allow newer, smaller players to sell into the 4G/5G equipment market. The intent is to offer more choices for cellular network operators who buy most of their gear from 4 or 5 big base station vendors.

Open RAN has been endorsed by 5G upstarts like Dish Network and Rakuten in Japan, but also by five big European carriers – Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone – which want to build an Open RAN ecosystem in Europe. AT&T has also expressed interest in the technology. However, there remains a lot of skepticism, especially for brownfield carriers.

…………………………………………………………………………………………………………………..

On March 14th, Dish Network executives participated in a video conference with a several FCC officials to discuss the company’s plans to launch a nationwide 5G network using Open RAN technology. Present on behalf of DISH were Stephen Bye, Chief Commercial Officer; Marc Rouanne, Chief Network Officer; Jeffrey Blum, Executive Vice President, External and Legislative Affairs; Sidd Chenumolu, Vice President, Technology Development; Alison Minea, Vice President, Regulatory Affairs; William Beckwith, Director of Wireless Regulatory Affairs; Hadass Kogan, Director & Senior Counsel, Regulatory Affairs; and Michael Essington, Senior Manager, Public Policy.

According to a Dish filing, the FCC requested the meeting to learn more about how Dish plans to deploy OpenRAN, rather than traditional purpose built RAN equipment, to build their 5G cellular network.

Ahead of its June 14, 2022 buildout milestone, DISH is launching a first-of-its-kind, cloud native, virtualized O-RAN 5G network in several major metropolitan areas of the country. Because DISH is building a greenfield network, we have the flexibility to choose the best technology to enter the market. While legacy carriers built closed end-to-end networks, DISH chose O-RAN because, among other reasons, it offers lower capital and operating costs, and is more resilient, secure, and energy efficient. In cooperation with more than 30 technology partners, DISH will offer a real-world example of the benefits of O-RAN as our 5G network rolls out to customers this year.

If more American carriers see the benefits of O-RAN and are able to adopt it as their networks evolve, the United States will be a stronger competitor in the global market. O-RAN is a game changer, among reasons, because:

- O-RAN networks increase vendor diversity

- O-RAN enhances spectrum utilization and enables network slicing

- O-RAN supports national security and cybersecurity objectives

- O-RAN networks are more secure and more agileO-RAN networks are more secure and more agile

In February 2021, the FCC published an OpenRAN Notice of Inquiry, stating:

Some parties assert that open radio access networks (Open RAN) are a potential path to drive 5G innovation, with industry proponents arguing that it could provide opportunities for more secure networks, foster greater vendor diversity, allow for more flexible network architectures, lower capital and operating expenses, and lead to new services tailored to unique use cases and consumer needs; others contend that Open RAN is still in its most formative stages, and that while promising, significant work remains before the benefits of the concept can fully be realized.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

The financial analysts at New Street Research, say that U.S. government legislation could pave the way for “$1.5 billion for the Public Wireless Supply Chain Innovation Fund to deploy Open RAN equipment to spur movement toward open architecture, software-based wireless technologies and funding innovative leap-ahead technologies in the US mobile broadband market.”

The analysts added, “That provision might be of particular value to Dish, which is building out its network based on that technology.”

References:

https://www.lightreading.com/open-ran/fcc-calls-on-dish-about-open-ran/d/d-id/776166?

https://www.nokia.com/about-us/newsroom/articles/open-ran-explained/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.sdxcentral.com/articles/news/dish-missed-every-5g-commitment-it-made-in-2021/2021/12/

Dell’Oro Group: Open RAN Momentum Is Solid; RAN equipment prices to increase

by Stefan Pongratz, VP at Dell’Oro Group

Introduction:

Open RAN ended 2021 on a solid footing. Preliminary estimates suggest that total Open RAN revenues—including O-RAN and OpenRAN radios and baseband—more than doubled for the full year 2021, ending at a much higher level than had been expected going into the year. Adoption has been mixed, however. In this blog, we review three Open RAN-related topics: (1) a recap of 2021, (2) Mobile World Congress (MWC) takeaways, and (3) expectations for 2022.

2021 Recap:

Looking back to the outlook we outlined a year ago, full-year Open RAN revenues accelerated at a faster pace than we originally expected. This gap in the output ramp is primarily the result of higher prices. LTE and 5G macro volumes were fairly consistent with expectations, but the revenue per Open RAN base stations was higher than we modeled going into 2021, especially with regard to brownfield networks. Asymmetric investment patterns between the radio and the baseband also contributed to the divergence, though this is expected to normalize as deployments increase. In addition, we underestimated the 5G price points with some of the configurations in both the Japanese and US markets.

Not surprisingly, the Asia-Pacific (APAC) region dominated the Open RAN market in 2021, supported by large-scale greenfield OpenRAN and brownfield O-RAN deployments in Japan.

From a technology perspective, LTE dominated the revenue mix initially but 5G NR is now powering the majority of investments, reflecting progress both in APAC and North America.

Mobile World Congress (MWC) Barcelona 2022:

Open RAN revenues are coming in ahead of schedule, bolstering the narrative that operators want open interfaces. Meanwhile, the progress of the technology, especially with some of the non-traditional or non-top 5 RAN suppliers has perhaps not advanced at the same pace. This, taken together with the fact that the bulk of the share movements in the RAN market is confined to traditional suppliers, is resulting in some concerns about the technology gap between the traditional RAN and emerging suppliers. A preliminary assessment of Open RAN-related radio and baseband system, component, and partnership announcements at the MWC 2022 suggests this was a mixed bag, with some suppliers announcing major portfolio enhancements.

Among the announcements that most stood out is the one relating to Mavenir’s OpenBeam radio platform. After focusing initially on software and vRAN, Mavenir decided the best way to accelerate the O-RAN ecosystem is to expand its own scope to include a broad radio portfolio. The recently announced OpenBeam family includes multiple O-RAN 7.2 macro and micro radio products supporting mmWave, sub 6 GHz Massive MIMO, and sub 6 GHz Non-Massive MIMO.

NEC announced a major expansion of its O-RAN portfolio, adding 18 new O-RUs, covering both Massive MIMO and non-Massive MIMO (4T4R, 8T8R, 32T32R, 64T64R). NEC also recently announced its intention to acquire Blue Danube.

Another major announcement was Rakuten Symphony’s entry into the Massive MIMO radio market. Rakuten Symphony is working with Qualcomm, with the objective of having a commercial Massive MIMO product ready by the end of 2023.

Recent Massive MIMO announcements should help to dispel the premise that the O-RAN architecture is not ideal for wide-band sub-6 GHz Massive MIMO deployments. We are still catching up on briefings, so it is possible that we missed some updates. But for now, we believe there are six non-top 5 RAN suppliers with commercial or upcoming O-RAN Sub-6 GHz Massive MIMO GA: Airspan, Fujitsu, Mavenir, NEC, Rakuten Symphony, and Saankhya Labs.

Putting things into the appropriate perspective, we estimate that there are more than 20 suppliers with commercial or pending O-RAN radio products, most prominently: Acceleran*, Airspan, Askey*, Baicells*, Benetel*, BLiNQ*, Blue Danube, Comba, CommScope*, Corning*, Ericsson, Fairwaves, Fujitsu, JMA*, KMW, Mavenir, MTI, NEC, Nokia, Parallel Wireless, Rakuten Symphony, Saankhya Labs, Samsung, STL, and Verana Networks* (with the asterisk at the end of a name indicating small cell only).

The asymmetric progress between basic and advanced radios can be partially attributed to the power, energy, and capex tradeoffs between typical GPP architectures and highly optimized baseband using dedicated silicon. As we discussed in a recent vRAN blog, both traditional and new macro baseband component suppliers—including Marvell, Intel, Qualcomm, and Xilinx—announced new solutions and partnerships at the MWC Barcelona 2022 event, promising to close the gap. Dell and Marvell’s new open RAN accelerator card offers performance parity with traditional RAN systems, while Qualcomm and HPE have announced a new accelerator card that will allegedly reduce operator TCO by 60%.

2022 Outlook:

Encouraged by the current state of the market, we have revised our Open RAN outlook upward for 2022, to reflect the higher baseline. After more than doubling in 2021, the relative growth rates are expected to slow somewhat, as more challenging comparisons with some of the larger deployments weigh on the market. Even with the upward short-term adjustments, we are not making any changes at this time to the long-term forecast. Open RAN is still projected to approach 15% of total RAN by 2026.

In summary, although operators want greater openness in the RAN, there is still much work ahead to realize the broader Open RAN vision, including not just open interfaces but also improved supplier diversity. Recent Open RAN activities—taken together with the MWC announcements—will help to ameliorate some of these concerns about the technology readiness, though clearly not all. Nonetheless, MWC was a step in the right direction. The continued transition from PowerPoint to trials and live networks over the next year should yield a fuller picture.

Addendum:

“Following twenty years of average macro base station price declines in the 5% to 10% range, we are now modeling RAN [radio access network] prices to increase, reflecting a wide range of factors,” Stefan Pongratz, an analyst at research and consulting firm Dell’Oro Group, wrote in response to questions from Light Reading. “In addition to the changing vendor landscape and regional aspects coming into play with China’s overall share expected to decline going forward, we have also assumed there will be some COGS [cost of goods sold] inflation due to supply-demand mismatches, though the ability for everyone to pass this on [to their customers] remains limited.”

About the Author:

Stefan Pongratz joined Dell’Oro Group in 2010 and is responsible for the firm’s Mobile RAN market and Telecom Capex research programs. While at the firm, Mr. Pongratz has expanded the RAN research and authored multiple Advanced Research Reports to ensure the program is evolving to address new RAN technologies and opportunities including small cells, 5G, Open RAN, Massive MIMO, mmWave, IoT, private wireless, and CBRS. He built the Telecom Capex coverage detailing revenues and investments of over 50 carriers worldwide.

MTN and Rakuten MoU: Open RAN trials using RCP in South Africa, Nigeria and Liberia

Africa’s largest mobile network operator MTN Group and Rakuten Symphony signed a Memorandum of Understanding (MoU) to run live 4G and 5G OpenRAN Proof of Concept (PoC) trials in South Africa, Nigeria and Liberia using the Rakuten Communications Platform (RCP). The trials will start in 2022 and combine RCP OpenRAN equipment with advanced automation and autonomous network capabilities. The products are currently deployed by Rakuten Mobile in Japan and include cloud orchestration, zero-touch provisioning and automation of radio site commissioning and network integration.

The trials will enable the launch of new services more quickly, cost-effectively and seamlessly, MTN said. The mobile operator and Rakuten Symphony will be collaborating with systems integrators Accenture and Tech Mahindra to conduct the trials in the three countries.

“We are pleased to announce our partnership with Rakuten Symphony to deploy live 4G and 5G Open RAN trials across South Africa, Nigeria and Liberia. In line with our belief that everyone deserves the benefits of a modern connected life, we are committed to actively driving the rapid expansion of affordable 4G and 5G coverage across markets in Africa,” said Mazen Mroue, MTN Group Chief Technology & Information Systems Officer. “We have announced our support towards the deployment of Open RAN technology in 2021 to modernize our radio access network footprint. Through this partnership we hope to target innovation and cost efficiencies that will enable us to continue delivering an exceptional customer experience.”

The solutions, currently deployed by Rakuten Mobile in Japan, include cloud orchestration, Zero-Touch Provisioning (ZTP) and automation of radio site commissioning and network integration.

Image – left to right: Amith Maharaj, MTN Group Executive, Network Planning and Design; Tareq Amin, CEO Rakuten Symphony; Rabih Dabboussi, Chief Revenue Officer, Rakuten Symphony.

“We’re excited to take this next step in our partnership with MTN,” said Rabih Dabboussi, Chief Revenue Officer of Rakuten Symphony. “This PoC will demonstrate how one of the world’s top-tier brownfield mobile operators can utilize Rakuten Symphony’s network automation and orchestration solutions for cost-effective network transformation and timely deployment of next-generation network services to their customers across Africa.”

Rakuten Mobile made a full-scale launch of commercial services on the world’s first fully virtualized cloud-native mobile network in 2020 in Japan, and launched Rakuten Symphony in 2021 to bring its innovations to other operators. Rakuten Symphony brings together Rakuten’s telco products, services and systems under a single banner to offer 4G and 5G infrastructure and platforms to customers worldwide.

MTN has already been testing open RAN equipment in several markets and is an active member of the Telecom Infra Project. The network operator announced several other Open RAN suppliers last year which were: Altiostar, Mavenir, Parallel Wireless, Tech Mahindra and Voyage.

About the MTN Group:

Launched in 1994, the MTN Group is a leading emerging market operator with a clear vision to lead the delivery of a bold new digital world to our customers. We are inspired by our belief that everyone deserves the benefits of a modern connected life. The MTN Group is listed on the JSE Securities Exchange in South Africa under the share code ‘MTN’. Our strategy is Ambition 2025: Leading digital solutions for Africa’s progress.

About Rakuten Symphony:

Rakuten Symphony is reimagining telecom, changing supply chain norms and disrupting outmoded thinking that threatens the industry’s pursuit of rapid innovation and growth. Based on proven modern infrastructure practices, its open interface platforms make it possible to launch and operate advanced mobile services in a fraction of the time and cost of conventional approaches, with no compromise to network quality or security. Rakuten Symphony has headquarters in Japan and local presence in the United States, Singapore, India, Europe and the Middle East Africa region.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://symphony.rakuten.com/newsroom/mtn-group-and-rakuten-symphony-mou

https://www.telecompaper.com/news/mtn-picks-suppliers-for-openran-roll-out-in-africa–1386900

Telefónica Germany and NEC partner to deliver 1st Open RAN with small cells in Germany

Telefónica Germany and NEC Corporation announced their successful collaboration in launching the first Open and virtual RAN architecture-based small cells in Germany. The service has initially launched in the city center of Munich to enhance the customer experience by providing increased capacity to the existing mobile network in this dense, urban area. NEC serves as the prime system integrator in the four countries of Telefónica S.A. and NEC’s program to explore ways to apply Open RAN in various geographies (urban, sub-urban, rural) and use cases. Telefónica Germany had previously said it planned to deploy pure 5G Open RAN mini-radio cells in Munich later this year.

In this German deployment, the flexibility of Open RAN is leveraged through the use of small cells to improve capacity in dense, urban areas. One of the key advantages of Open RAN over a traditional architecture is that it allows wider choice of vendor options. NEC integrated a multi-vendor architecture that includes Airspan Networks* unique Airspeed plug-and-play solution and Rakuten Symphony’s Open vRAN software for O2 / Telefónica Germany’s small cells to complement the existing multi-vendor based macro cells in its network.

The adoption of Open RAN small cells combined with macro cells will pave the way for 5G network densification. This will be especially beneficial in Germany, where multiple industries and enterprises are seeking ways to utilize cellular service functionalities in a particular area or in shared physical spaces.

Source: Telecom Infra Project

……………………………………………………………………………………………………………………………………………………

O2 / Telefónica Germany and NEC will continue their collaboration leveraging innovative Open RAN technologies, as well as automation, to validate and deploy advanced networks that efficiently deliver superior customer experiences in the 5G era, with collaboration from key partners.

“We are proud to have launched Germany’s first small cells built on innovative Open RAN technologies that help to complete the delivery of granular, high-quality connectivity in dense urban areas,” said Matthias Sauder, Director Mobile Access & Transport at O2 / Telefónica Germany. “NEC became our partner in this innovative project, with its underlying technological background and experiences of Open RAN technologies.”

“The potential of Open RAN technologies in the 5G era is infinite,” said Shigeru Okuya, Senior Vice President, NEC Corporation. “NEC is honored to be the strategic partner to O2 / Telefónica Germany, jointly leading the industry with practical and effective use cases that prove the value of Open RAN.”

………………………………………………………………………………………………………..

Germany seems to be a focal point for OpenRAN deployments. For example, greenfield operator 1 & 1 is deploying a fully-virtualized, Open RAN mobile network built by Rakuten Symphony. That partnership began in the fourth quarter of 2021.

At Mobile World Congress this week, Vodafone announced that it plans to use OpenRAN in 30 percent of its masts in Europe – which includes Germany, of course – by 2030. Last November it emerged that it is working with Nokia and network software provider Mavenir to transform Plauen in Germany into a so-called ‘OpenRAN city’ that will be a live testbed for new OpenRAN-based products.

Deutsche Telekom is also a big fan of OpenRAN. Last June it claimed Europe’s first live OpenRAN deployment in Neubrandenburg, which has been dubbed ‘O-RAN Town’. It has partnered with a broad range of suppliers, including NEC, Fujitsu, Dell, Intel, Mavenir and SuperMicro.

Last December, semiconductor/SoC start-up Picocom made headlines in the Open RAN community by releasing the “industrt’s first” 5G NR small cell SoC for Open RAN. This new product, dubbed the PC802, is described as PHY SoC for 5G NR and LTE small cell decentralized and integrated RAN architectures, including support for leading Open RAN specifications. The PC802 allows for interfacing to radio units using either the O-RAN Open Fronthaul eCPRI interface or a JESD204B high-speed serial interface. Optimized explicitly for decentralized small cells, the PC082 employs a FAPI protocol to allow communication and physical layer services to the MAC.

…………………………………………………………………………………………………………………………………………………………..

OpenRAN has been a recurring topic at this week’s Mobile World Congress in Barcelona, with Mavenir, Qualcomm, and Rakuten Symphony, etc. all making product pitches. However, it remains to be seen if Open RAN will actually be able to deliver on its promise of mix and match network modules and lower the cost of network deployment with the performance, security and reliability that network operators must provide to their customers.

…………………………………………………………………………………………………………………………………………………………..

References:

https://www.nec.com/en/press/202203/global_20220302_04.html

Mavenir at MWC 2022: Nokia and Ericsson are not serious OpenRAN vendors

Picocom PC802 SoC: 1st 5G NR/LTE small cell SoC designed for Open RAN

Mavenir at MWC 2022: Nokia and Ericsson are not serious OpenRAN vendors

Andrew Wooden of telecoms.com talked with Mavenir’s SVP of business development John Baker and CMO Stefano Cantarelli to gauge how industry is feeling towards OpenRAN. Here are a few quotes:

“Clearly the (OpenRAN) train has left the station, there’s a lot of buzz about OpenRAN – it’s back to the haves and have nots,” Baker told us. “I see a lot of interest from network operators and a lot of interest from the component suppliers. But on the other side of it, about [Nokia’s recent statement about OpenRAN] – they’re full of it. Because they’re a startup in OpenRAN themselves but are not doing anything. They’re trying to pass on a message that the OpenRAN community is confused, that there are no real OpenRAN players out there, and they’re trying to position themselves as the real OpenRAN player. Digging underneath that, we’re having to call out the Nokia’s and Ericsson’s for confusing the story and trying to keep the confusion running around the marketplace, about the status of OpenRAN.”

“Ericsson has been clear right up front that [they’re] not going to participate in OpenRAN. They name their products as Cloud RAN but you can’t mix and match, so they don’t they don’t meet the OpenRAN requirements. I stand very firm that unless you’ve got two suppliers interworked, then you haven’t got OpenRAN.” Of course, this author agrees 100%!

Regarding Nokia, Baker said: “We’ve been asking for the last two years, every month almost, we’re ready to interwork, when are you ready? And they never get there. So our view is Nokia doesn’t have anything, they’re just trying to protect an old silicon strategy. And that’s their problem. They’ve had two failed attempts, in my opinion, of their silicon strategy – first time they got it completely wrong. Second time they got it too late for the industry because software is now replacing where they are with silicon. I think at the end of the day those two logos are going to disappear in the distance.”

Cantarelli added: “I think Ericsson and Nokia are not stupid. They know OpenRAN is the future, it’s just at the beginning they didn’t think about it, and now they’re a bit late. So they’re protecting their legacy. And they’re waiting for when they’re going to be ready, so it’s purely a delaying technique.”

Some observers think OpenRAN is immediate, and of singular importance, but others don’t think it will be as disruptive as that, at least not right now. This author is in the latter camp. We’ve explained why many times why: without implementation standards there is no interoperability!

References:

Mavenir slams Nokia and Ericsson for confusing the OpenRAN story

Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

Vodafone and Mavenir create indoor OpenRAN solution for business customers

https://www.nokia.com/networks/radio-access-networks/open-ran/

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

_1646295038.JPG)