Optical Components

Light Counting on Silicon Photonics and Optical Switching at SC22

Silicon photonics continues to progress but is yet to be adopted for high-performance computing and server architectures, according to market research firm Light Counting.

However, the Super Compute 2022 (SC22) conference hosted two silicon photonics firsts:

- Professor Keren Bergman of Columbia University reported a working 5Tbit/s transmitter optical chiplet implemented using 80 channels and 3D packaging. The accompanying receiver chip is working and is being lab-tested.

- Ayar Labs demonstrated its 2Tbit/s TeraPHY chiplet in an end-to-end link, sending and receiving data.

During the panel discussion on high-performance computing and silicon photonics, Intel’s Fabrizio Petrini addressed head-on why optics had such a low profile at the show. “The reality is there is a lot of skepticism about this technology. The adoption is not going to happen anytime soon,” he said.

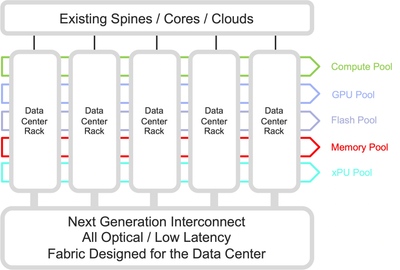

Systems designers don’t see the implications until they embrace this technology. But factors are aligning for change, and a transition point is being approached in how systems are built, he says; the implications for systems and disaggregation are enormous.

Optical switching is another technology that has been on the fringes of the market for decades. It was all the rage from 1998-2001, but then fizzled out as there weren’t any large scale commercial deployments of photonic switches.

LightCounting reported in August that Google had been using photonic circuit switching in its cloud resident data centers for several years. The 136×136 port optical circuit switch is Google’s own design.

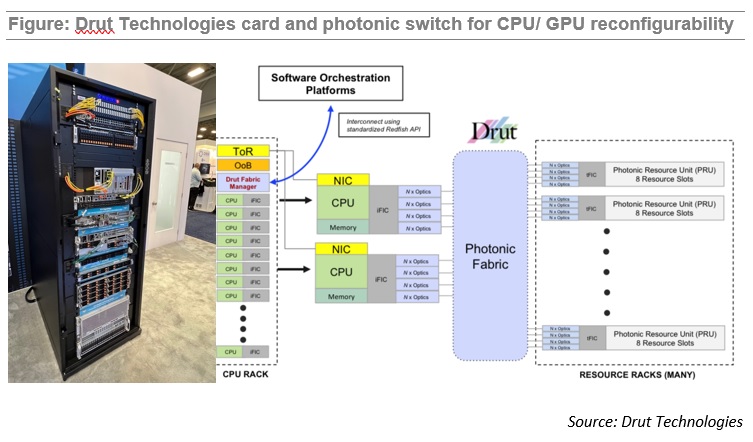

At SC22, a start-up, Drut Technologies, demonstrated its interface card working with a photonic switch at the top of a SuperMicro server rack. The system allows the server’s CPUs to dynamically configure the resources they need (memory, GPUs) tailored for workloads.

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cisco’s Restructuring Plan:

Cisco plans to lay off over 4,100 employees or 5% of its workforce, the company announced yesterday. That move is part of a restructuring plan to realign its workforce over the coming months to strengthen its optical networking, security and platform offerings. Cisco noted in financial filings it expects to spend a total of $600 million, with half of that outlay coming in the current quarter. The company will also reduce its real estate portfolio to reflect an increase in hybrid work.

In a transcript of Cisco’s Q1 2023 Earnings Call on November 17th, Cisco Chief Financial Officer Scott Herren characterized the move as a “rebalancing.” On that call, Chairman and Chief Executive Officer Chuck Robbins said the company was “rightsizing certain businesses.”

Herren and CEO Chuck Robbins said the company is looking to put more resources behind its enterprise networking, platform, security and cloud-based products. In the long run, analysts expect Cisco margins to improve as more revenue comes from security and software products.

By inference Cisco is de-emphasizing sales of routers to service providers who are moving towards white boxes/bare metal switches and/or designing their own switch/routers.

A Cisco representative told Fierce Telecom:

“This decision was not taken lightly, and we will do all we can to offer support to those impacted, including generous severance packages, job placement services and other benefits wherever possible. The job placement assistance will include doing “everything we can do” to help affected employees step into other open positions at the company.”

Cisco implemented a similar restructuring plan in mid-2020 which included a substantial number of layoffs.

Growth through Acquisitions:

Much of Cisco’s revenue growth over the years has come from acquisitions. The acquisitions included Ethernet switch companies like Crescendo Communications. Kalpana and Grand Junction from 1993-1995. Prior to those acquisitions, Cisco had not developed its own LAN switches and was primarily a company selling routers to enterprises, telcos and ISPs.

Here are a few of Cisco’s acquisitions over the last five years:

- In 2017, Cisco acquired software maker AppDynamics for $3.7 billion. It bought BroadSoft for $1.9 billion in late 2017.

- In July 2019, Cisco acquired Duo Security for $2.35 billion, marking its biggest cybersecurity acquisition since its purchase of Sourcefire in 2013. Acquiring Duo Security bolstered Cisco in an emerging category called zero trust cybersecurity.

- In late 2019, Cisco agreed to buy U.K.-based IMImobile, which sells cloud communications software, in a deal valued at $730 million.

- In May 2020, Cisco acquired ThousandEyes, a networking intelligence company, for about $1 billion.

Aside from acquisitions, new accounting rules have been a plus for revenue recognition. The rules known as ASC 606 require upfront recognition of multiyear software licenses.

One bright spot for Cisco have been sales of the Catalyst 9000 Ethernet switches. The company claims they are the first purpose-built platform designed for complete access control using the Cisco DNA architecture and software-defined SD access. This means that this series of switches simplifies the design, provision and maintenance of security across the entire access network to the network core.

There is also an opportunity for Cisco in data center upgrades. The so-called “internet cloud” is made up of warehouse-sized data centers. They’re packed with racks of computer servers, data storage systems and networking gear. Most cloud computing data centers now use 100 gigabit-per-second communications gear. A data center upgrade cycle to 400G technology has been delayed.

Routed Optical Networking:

Cisco in 2019 agreed to buy optical components maker Acacia Communications for $2.6 billion in cash. China’s government delayed approval of the deal. In January 2021, Cisco upped its offer for Acacia to $4.5 billion and the deal finally closed on March 1, 2021. Acacia designs, manufactures, and sells a complete portfolio of high-speed optical interconnect technologies addressing a range of applications across datacenter, metro, regional, long-haul, and undersea networks.

Acacia’s Bright 400ZR+ pluggable coherent optical modules can plug into Cisco routers, enabling service providers to deploy simpler and more scalable architectures consisting of Routed Optical Networking, combining innovations in silicon, optics and routing systems.

Routed Optical Networking works by merging IP and private line services onto a single layer where all the switching is done at Layer 3. Routers are connected with standardized 400G ZR/ZR+ coherent pluggable optics.

With a single service layer based upon IP, flexible management tools can leverage telemetry and model-driven programmability to streamline lifecycle operations. This simplified architecture integrates open data models and standard APIs, enabling a provider to focus on automation initiatives for a simpler topology. It may be a big winner for Cisco in the near future as service providers move to 400G transport.

References:

https://www.fiercetelecom.com/telecom/cisco-plans-cut-5-workforce-under-600m-restructuring-plan

https://www.cisco.com/site/us/en/products/networking/switches/catalyst-9000-switches/index.html

https://www.cisco.com/c/en/us/about/corporate-strategy-office/acquisitions/acacia.html

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

To understand the future of high speed coherent optics, Heavy Reading launched the Coherent Optics Market Leadership Program with industry partners Ciena, Effect Photonics, Infinera and Ribbon. The 2022 project was based on a global network operator survey, conducted in August, that attracted 87 qualified responses.

Heavy Reading reports that network operators are using or evaluating coherent optics for 400G transport services for both internal and external applications, as well as 100G data rates for the metro edge.

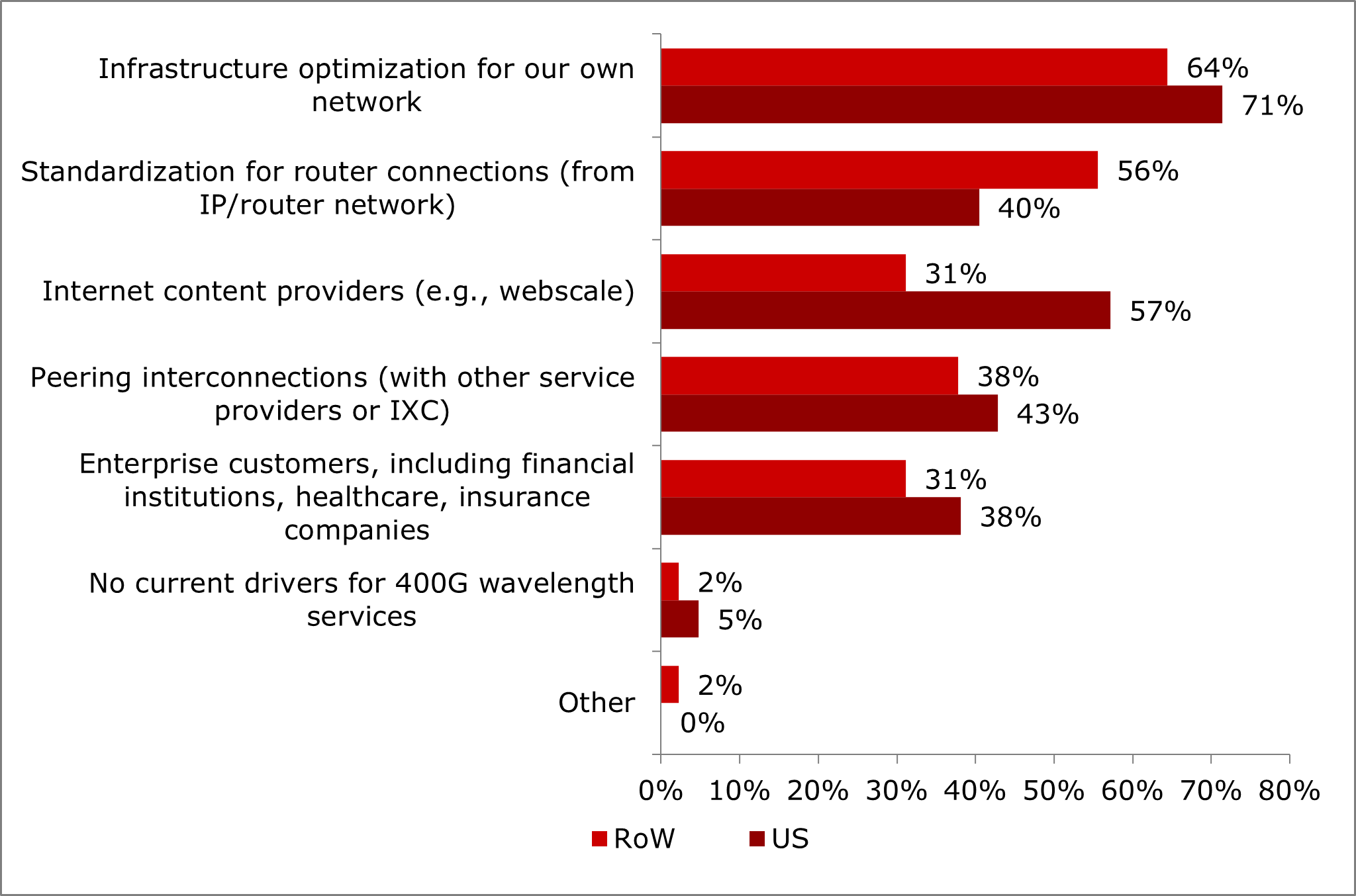

Nearly half of operator respondents in Heavy Reading’s survey will have deployed 400G transport services in their network between now and the end of 2023. But what are their top motivations for offering 400G transport services? Globally, the top driver for 400G services by far is infrastructure optimization for internal networks. This driver was selected by more than two-thirds of operators surveyed and well ahead of the second choice, standardization of router connections.

The data suggests that, for the global audience of operators, there are not that many customers currently that require full 400Gbit/s connectivity. Yet, there is value in grooming internal traffic up to 400G for greater efficiency and lower costs (e.g., fewer ports, lower cost per bit, etc.).

Beyond internal infrastructure, however, the drivers vary significantly by region, particularly when separating U.S. respondents from their Rest of World (RoW) counterparts. 57% of U.S.operators surveyed identified hyperscalers (or Internet content providers) as a 400G service driver — a strong showing and second only to internal infrastructure in the U.S. In contrast, just 31% of RoW operators identified Internet content providers as a top driver.

What are your top drivers for 400G wavelength (or optical) transport services?

High launch power optics are widely seen as essential for 400G+ pluggables in telecom applications, which are typically brownfield networks with lots of ROADM nodes. However, when filtering the survey results to include optical specialists only (i.e., those who identify as working in optical transport), higher launch power is the number one requirement, well ahead of remote diagnostics. It is likely that, at this early stage, optical specialists within operators understand the criticality of this particular technical requirement better than their peers.

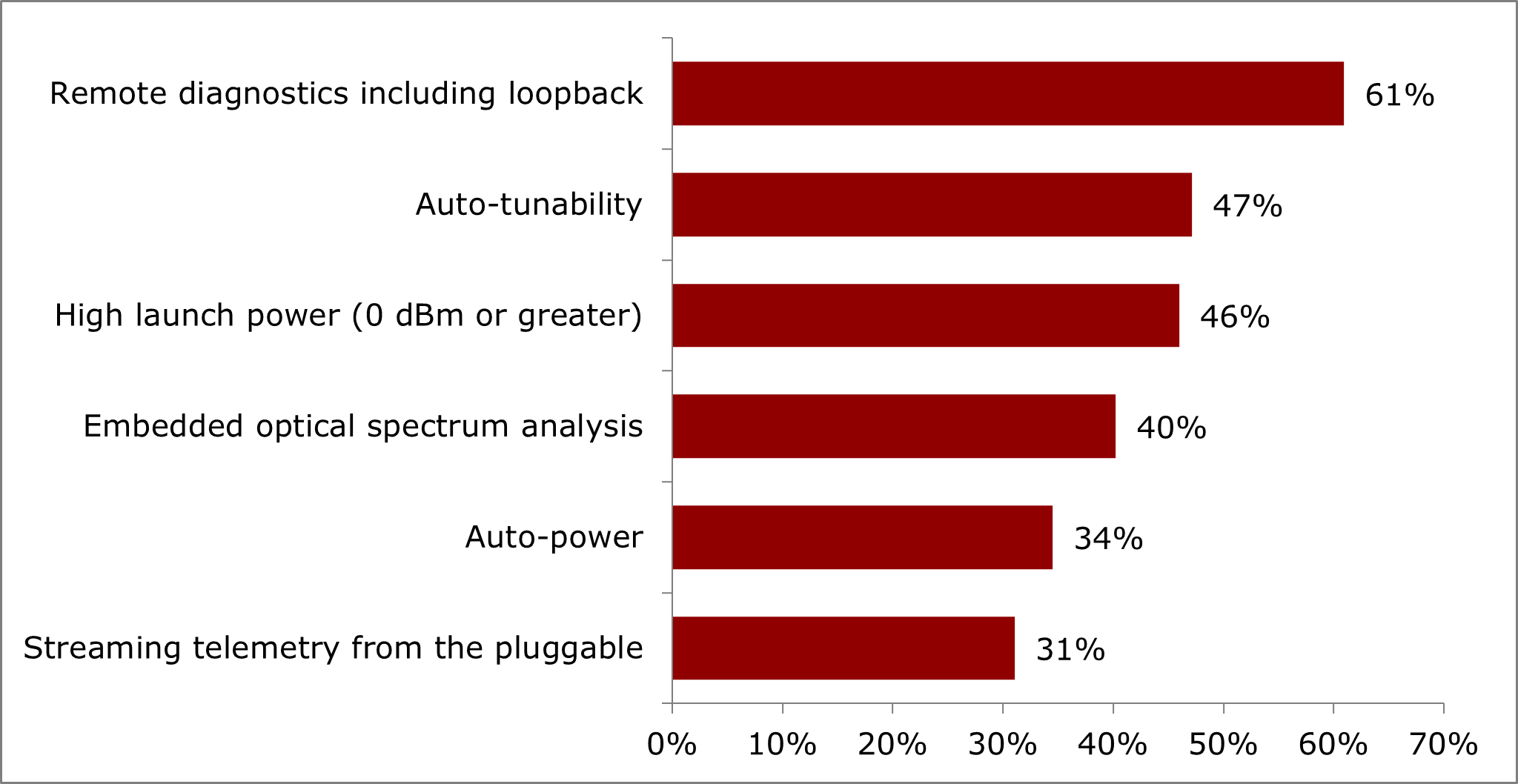

What advanced coherent DWDM pluggable features or capabilities do you find most beneficial to your network/operations?

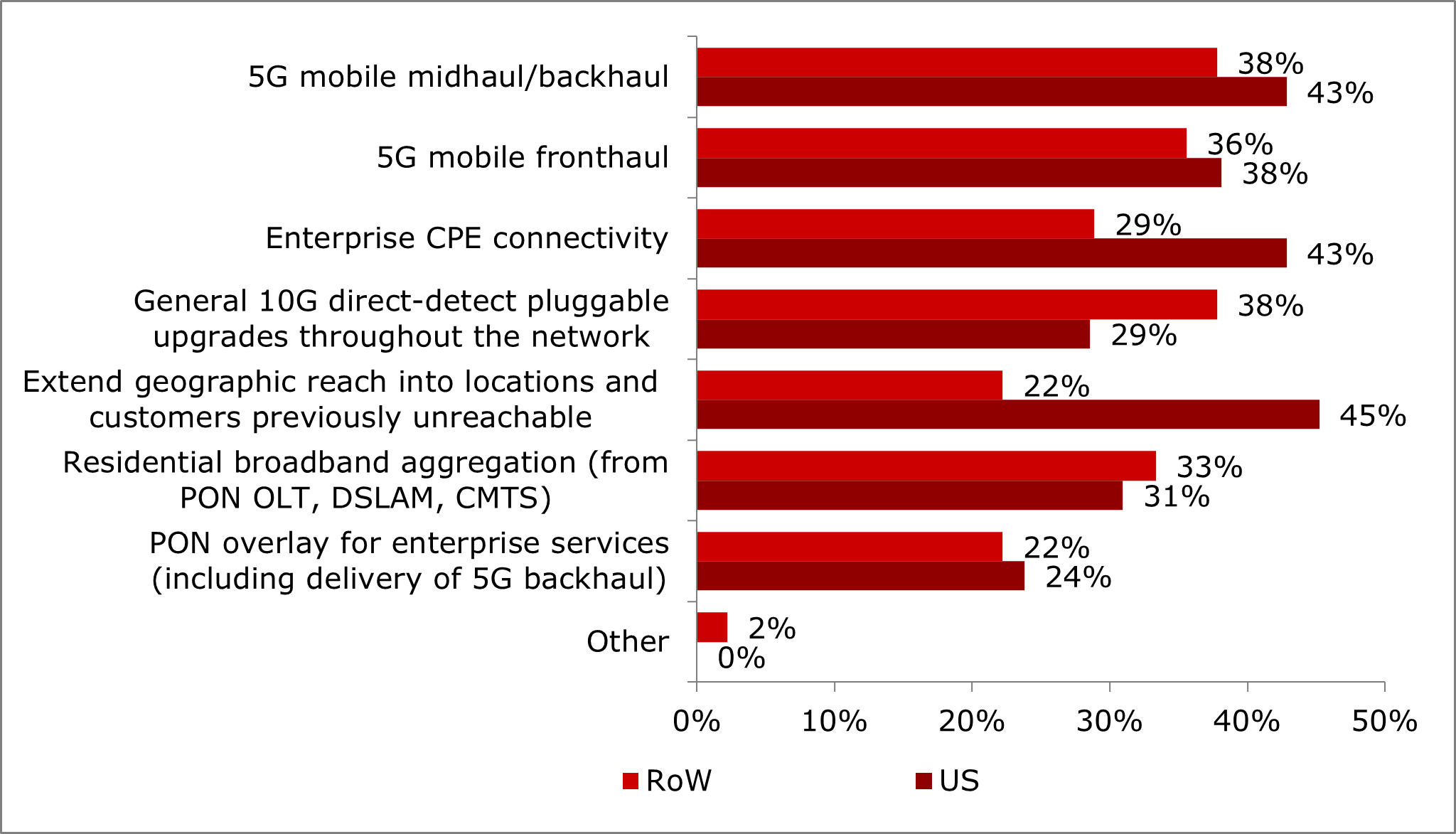

Coherent pluggable optics at 100G have use case priorities which vary significantly based on geographic region, particularly when separating U.S. respondents from their RoW counterparts. For the U.S., extending geographic reach is the top use case, followed by 5G backhaul/midhaul and enterprise connectivity. For RoW operators, however, extending geographic reach is not a priority use case.

When considering 100G coherent pluggables, what do you see as the most common use cases?

References:

https://www.lightreading.com/new-frontiers-for-coherent-optics/a/d-id/781813?

Coherent Optics: 100G, 400G and Beyond

Coherent Optics: 100G, 400G, & Beyond: A 2022 Heavy Reading Survey

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

Smartoptics Takes Leading Role in Sustainable Optical Networking

LightCounting: Optical components market to hit $20 billion by 2027+ Ethernet Switch ASIC Market Booms

|

The optical communications industry entered 2020 with very strong momentum. Demand for DWDM, Ethernet, and wireless fronthaul connectivity surged at the end of 2019, and major shifts to work-at-home and school-at-home in 2020 and 2021 due to the COVID-19 pandemic created even stronger demand for faster, more ubiquitous, higher reliability networks.

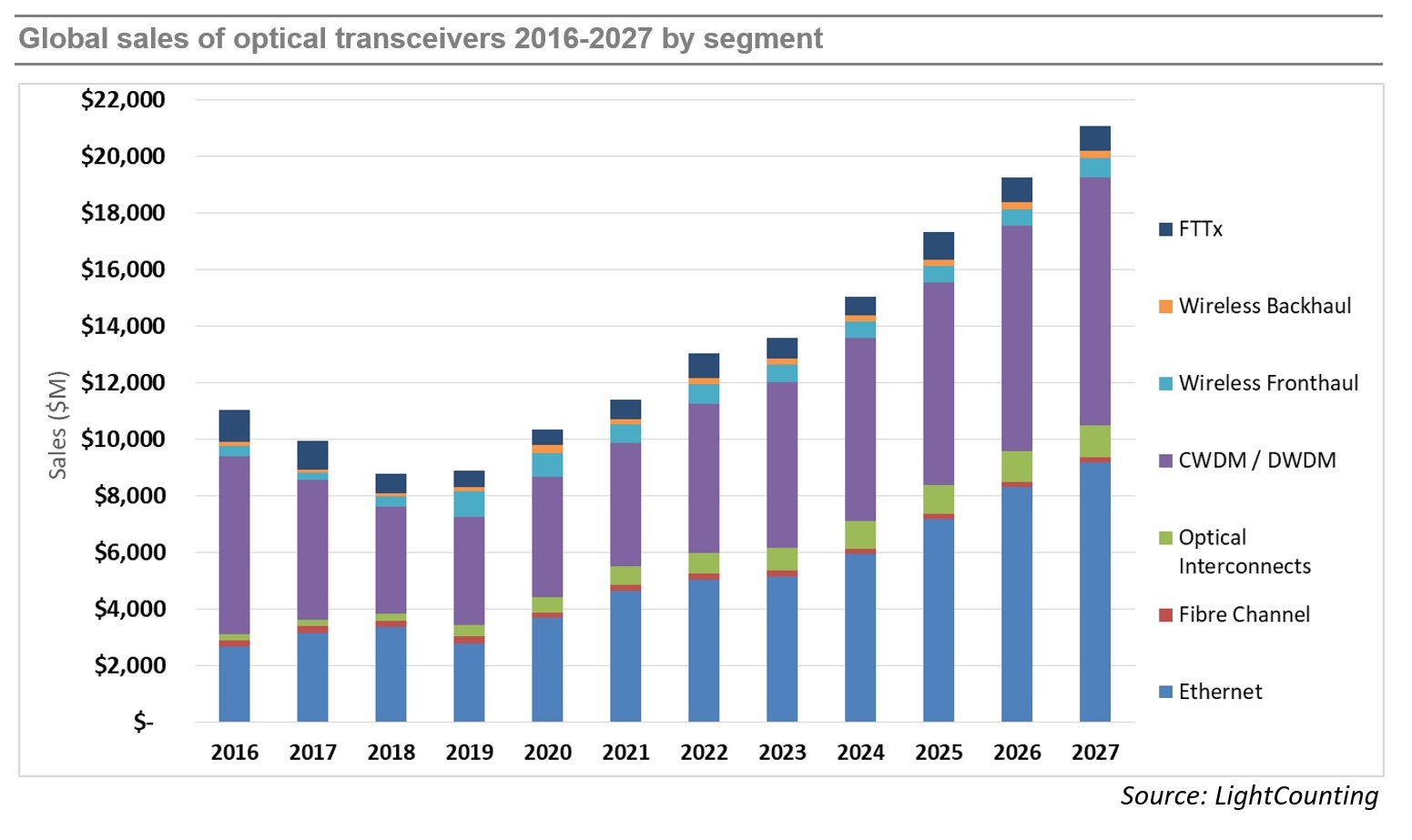

While supply chain disruptions continued, the industry was able to largely overcome them, and the market for optical components and modules saw strong growth in 2020 and 2021, as shown in the figure below. Light Counting believes the transceiver market is on track for another year of strong (14%) revenue growth in 2022, after increasing by 10% in 2021, and 17% in 2020. However, market growth is projected to slow to 4% in 2023, prior to recovering in 2024-2025.

Demand for optics is strong across all market segments, but continuing bottlenecks in the global supply chain negatively impacted sales of 400G DR4 and 100G DR1+ transceivers to Amazon in the first 9 month of 2022. Meta increased its deployments of optics sharply this year, but its latest forecast for 2023 has been reduced substantially. We suspect that Amazon and other cloud companies may moderate their investments in 2023, if the current economic slowdown continues to negatively impact their advertising, streaming, and retail businesses.

|

|

|

LightCounting’s latest forecast projects a 11% CAGR in 2022-2027, not very different from the 13% CAGR in the forecast published in October 2021. Strong sales of DWDM and Ethernet optics accounted for most of the market growth in 2021 and these segments are projected to lead the growth in 2022-2027. Sales of optical interconnects, mostly Active Optical Cables (AOCs), will also increase at double digit rates over the next 5 years. PON sales for FTTx networks will remain steady, as the China market ends its 10G cycle and North America and Europe ramp up 10G PON deployments, driven by government funding programs. 25G and 50G PON provide new growth later in the forecast period. Wireless fronthaul is one area of weakness, since 5G network deployments in China are reaching completion. This segment will return to growth in 2026-2027 with the onset of 6G deployments (which we don’t think will happen till many years later).

…………………………………………………………………………………………………………………………………………………………….

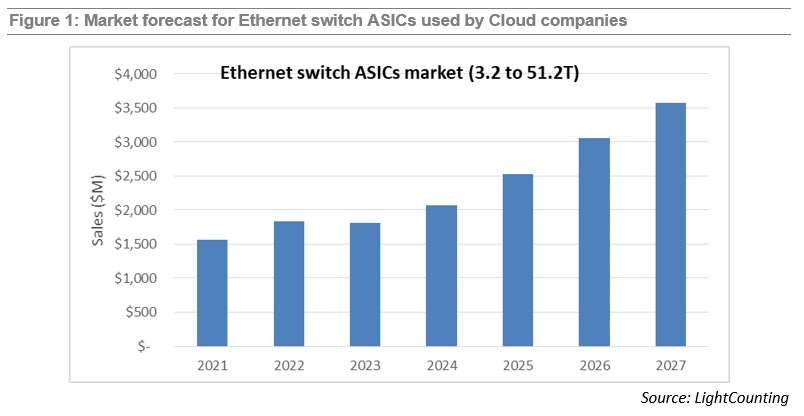

Demand for Ethernet switches from Cloud companies created a new market segment for very high bandwidth switches and switch ASICs. It also transformed the industry supply chain as Cloud companies started using internally designed Ethernet switches and opening these “white box” designs to a broader community. LightCounting’s report on Ethernet switch ASICs was first published in April 2022, and today the first update has been released. The report covers the most interesting segment of the switching ASIC market – high bandwidth (3.2T and above), low latency chips deployed in Cloud datacenters. The report offers brief profiles of the leading suppliers of merchant switch ASIC and system integrators, offering products to Cloud companies, and includes a forecast for sales of 3.2 to 51.2T switch ASICs. The updated report now includes 3.2T/6.4T chips in addition to the higher speed products. This change added close to $1 billion to the total market size compared to our April estimate. The forecast includes chips sold in the merchant market as well as chips used by Cisco in their own equipment (captive market). A lower forecast for 2023 compared to our April 2022 edition reflects reduced guidance by the leading Cloud companies for datacenter upgrades planned for next year. Despite a reduced forecast, the overall market is expected to roughly double in size from $1.8 billion in 2023 to $3.6 billion in 2027.

References:

|

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Cablecos use of 200-Gig coherent optical signals in their broadband access network progressed following a recent interop event at CableLabs that involved a five suppliers of coherent optical modules.

CableLabs confirmed that equipment and silicon from those players – Acacia (now part of Cisco), Ciena, Fujitsu Optical Components, Lumentum and Marvell – were found to interoperate with the organization’s Point-to-Point Coherent Optics (P2PCO) 2.0 specs [1.]. The number of participants might not be high, but what’s important is that the participants include DSP silicon from multiple manufacturers that represent the majority of the coherent optics industry.

Note 1. The P2PCO 2.0 specs doubled the operating capacity – from 100 Gbit/s per wavelength in the 1.0 specs, to 200 Gbit/s.

Demonstrating interoperability among so many different coherent DSP suppliers bodes incredibly well for network operators as it provides multi-vendor interoperability, which promotes scale and competition.

Image Courtesy of Cable Labs

Cable Labs conducted 100-Gig interops in 2018 and 2019. Those efforts tie into a broader initiative to use coherent optics technologies, typically used for long-haul, metro and submarine networks, to expand the capacity of fiber that’s already deployed on the hybrid fiber/coax (HFC) access network.

The CableLabs specs also describe a new technology called the Coherent Termination Device (CTD), which can be deployed in an outdoor aggregation node.

Matt Schmitt, a principal architect at CableLabs, said the scope of CableLabs’ interoperability efforts focus on the modules on the optical end – basically describing how a transceiver works at the physical layer.

And to help fit the cable network environment, the end of the network using the CTD is made to reside outdoors, rather than inside a facility.

“Almost every other application of coherent that you see, both ends of the link are in facilities,” such as a data center interconnect where many links are densely packed with racks and modules, Schmitt explained. The cable access application of coherent optics might involve one end that does sit at a facility, such as a hub site, with the other end involving the aforementioned field-deployed CTD.

“Those field boxes didn’t really exist when we started this,” he said.

The broader concept is to help cable operators improve the performance of their access network fibers situated between headends and hubs and fiber nodes for a range of use cases, and to do so without getting locked into one supplier.

CableLabs and its partners originally thought this 200-Gig interop would be completed sooner, but it was delayed a bit during the pandemic when travelling and in-person gatherings were limited or non-existent.

But Schmitt said the plus side of that intervening period meant that the interop ended up with wider supplier participation, particularly at the DSP (digital signal processor) level, than it might have otherwise.

Beyond raw capacity, the 200-Gig capability should help to support the new distributed access architecture (DAA), supported by multiple remote PHY or remote MAC/PHY devices, and the cable’s industry’s broader pursuit of delivering symmetrical 10Gbit/s performance to customers on the access network.

Schmitt said 200-Gig technology gets particularly interesting when operators look to support large, high-density areas that are being split into smaller service groups. It might also factor in as operators explore services beyond high-speed data over cable, such as mobile XHaul.

The use of CTDs with pluggable optics is also designed to support a relatively easy upgrade path. If an operator starts with 100-Gig, those modules can be swapped out for 200-Gig modules later.

This point-to-point P2P use case is just one aspect of coherent optics being explored by CableLabs. A separate-but-related coherent PON initiative still uses coherent signaling, but is focused on point-to-multipoint links.

For now, Schmitt said CableLabs doesn’t plan to hold another interop for P2PCO v2.0 products. “It really just worked so well. I’m not sure what more there will be to do in a follow-up interop,” he said.

CableLabs would be open to doing qualification testing for these new P2P coherent products if the market demands it. “Thus far, I haven’t been hearing of a big push for that,” Schmitt said. “I think people have been comfortable with what we’re getting from the interops and doing their own testing to see how it works.” As for next steps, this latest batch of handiwork will be showcased at the 10G Lab at CableLabs, Schmitt said.

Meanwhile, future commercial deployments will be determined by the availability of CPDs and interest form cable operators.

Among suppliers involved in the recent interop, Ciena confirmed that it currently has interoperable, CableLabs-compliant 200G coherent pluggables available as part of the supplier’s WaveLogic 5 Nano coherent pluggable portfolio.

Another factor for adoption will be costs compared to the 10-Gig DWDM tech that’s in use today. Schmitt acknowledges that the first endpoint is going to be greater with coherent technology, since it involves putting a switch or router in the field.

“Where it gets interesting is every time you need to add another device that’s sharing that same fiber run,” Schmitt said.

“With coherent, you have a higher upfront cost, but you’re going to have a much lower slope, because as you add more devices, all you have to do is add a pair of gray (standard) optics modules – very low cost … Where’s that crossover point in terms of number of endpoints? To me, is going to be one of the big deciders on when and how widespread the deployment of this technology gets.”

References:

A Jolt of Light: CableLabs Holds First 200G P2P Coherent Optics Interop

First Light for CableLabs® Point-to-Point Coherent Optics Specifications

Cignal AI: Datacom optical component revenue +27% to reach $4.7B in 2021

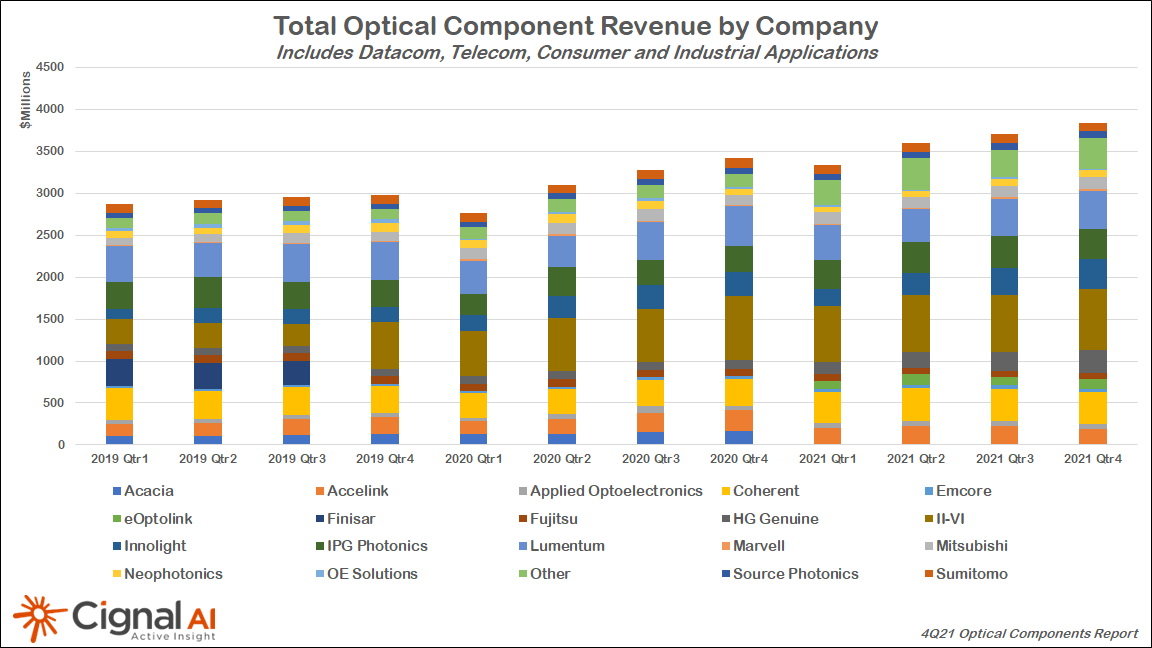

Cignal AI reports that total revenue for optical components, a category that includes optical transceivers, grew 15% in 2021. Components for datacom optical network applications led the way, growing 27% to account for $4.7 billion of the total $14.5 billion component sales registered for the year within the datacom, telecom, industrial, and consumer markets, the market research firm states in its latest Optical Components Report.

A transition by large cloud service providers and some enterprise network operators toward 400-Gbps transmission helped spur this growth. For example, 1.8 million QSFP-DD and OSFP datacom modules shipped during 2021, most of which were DR4 format. Meanwhile, more than 60,000 400G pluggable coherent modules shipped at the same time, with QSFP-DD ZR devices accounting for the majority.

“The transition to 400GbE is well underway, and pluggable coherent 400Gbps technology is revolutionizing the design of the optical networks that connect datacenters,” said Scott Wilkinson, Lead Optical Component Analyst at Cignal AI. “400Gbps speeds will drive spending and bandwidth growth both inside and outside the datacenter in 2022,” Scott added.

More Key Findings from the 4Q21 Optical Components Report:

- Supply chain difficulties limited Telecom optical components market growth the most in 2021. However, the segment is forecast to grow more than 8% in 2022.

- Consumer component revenue for 3D sensing applications was flat YoY as lower-cost components offset higher unit shipments.

- Industrial optical components used for welding and medical applications grew 18% in 2021, following a weak 2020. Following the acquisition of Coherent, II-VI is poised to control over 50% of this market.

- 1.8M QSFP-DD Datacom modules shipped during 2021, most of which were DR4 format. The report also tracks SR4, FR4, and LR4 Datacom transceivers.

- Over 60k 400Gbps pluggable coherent modules shipped last year, the majority of which were QSFP-DD ZR. The report captures the shipment details of all the emerging derivatives of this format, including ZR, ZR+, 0dB ZR+, and CFP2 based ZR+.

- Shipments of 200Gbps coherent CFP2 modules grew 17% to just over 200k units during 2021 as Chinese OEMs ramp this speed (which is less dependent on western technology) for longer distance metro and long haul applications.

References: