T-MobileUSA

T‑Mobile expands Home Internet to over 130 additional cities

T-Mobile US will increase its Home Internet service to more than 130 additional cities and towns across Michigan, Minnesota, New York, North Dakota, Ohio, Pennsylvania, South Dakota, West Virginia and Wisconsin. The move comes after it massively expanded its home broadband pilot to more than 20 million households in October.

The $50/month Home Internet pilot service will be deployed in underserved rural markets — through LTE-based coverage, with 5G service coming soon. The company says that only 63 percent of adults in rural America currently have access to high-speed internet.

“Home broadband has been broken for far too long, especially for those in rural areas, and it’s time that cable and telco ISPs have some competition,” said Dow Draper, T-Mobile EVP, Emerging Products. “We’ve already brought T-Mobile Home Internet access to millions of customers who have been underserved by the competition. But we’re just getting started. As we’ve seen in our first few months together with Sprint, our combined network will continue to unlock benefits for our customers, laying the groundwork to bring 5G to Home Internet soon.”

T-Mobile Home Internet is just $50/month all-in and features many of the same benefits that have made T-Mobile the fastest growing wireless provider for the past seven years:

- Self-installation. That means there’s no need for installers to come to your home.

- Taxes and fees included.

- No annual service contracts.

- No maddening “introductory” price offers. What you pay at sign-up is what you’ll pay as long as you have service.

- No hardware rental, sign-up fee or installation costs (because set-up is so easy!).

- No data caps.

- Customer support from the team that consistently ranks #1 in customer service satisfaction year after year.

Now that customers have had access to T-Mobile Home Internet since 2019, the reviews are in … and the feedback speaks for itself. Customers give T-Mobile Home Internet an average Net Promoter Score (NPS) of 42, compared to -75 (that’s a negative 75!) for their previous provider. Seventy-three percent report saving money with T-Mobile Home Internet, with 50% saving more than $30 per month (that’s $360 annually!).

The Home Internet pilot provides home broadband on the Un-carrier’s LTE network. With additional capacity unlocked by the merger with Sprint, T-Mobile is preparing to launch 5G Home Internet commercially nationwide, covering more than 50% of U.S. households within six years and providing a badly needed alternative to incumbent cable and telco ISPs.

Home broadband is one of the most uncompetitive and hated industries in America. Rural areas in particular lack options: more than three-quarters have no high-speed broadband service or only one option available. And when there’s no choice, customers suffer. It’s no wonder internet service providers have the second lowest customer satisfaction ratings out of 46 industries, beating cable and satellite TV companies by just one point according to the ACSI (American Customer Satisfaction Index)!

T-Mobile Home Internet service is available on a first-come, first-served basis, where coverage is eligible, based on equipment inventory and local network capacity, which is expanding all the time. For more information on T-Mobile Home Internet or to check availability for your home in these areas, visit t-mobile.com/isp.

Reference:

T-Mobile US earnings, revenue, and subscriber adds top estimates + Analysis of U.S. 5G leadership

T-Mobile US 3rd quarter 2020 results, reported today, were highlighted by crossing the 100 million wireless “customer” milestone (more clarity below) after reporting record-high postpaid net subscriber additions that were nearly as much as the rest of the U.S. telco industry combined. Controlled by Deutsche Telekom, T-Mobile reported third-quarter earnings of $1 per share, down a penny from $1.01 a share a year earlier. Including the merger with Sprint, pro-forma revenue rose 74% to $19.3 billion, the company said. The Sprint merger closed April 1st.

Since closing its merger with Sprint seven months ago, T-Mobile has been driving hard on integration including unifying employees and customers under one brand, rapidly improving the Sprint customer experience, and quickly rolling out 2.5 GHz spectrum to build the world’s best 5G network. Merger synergies are being realized faster than expected and the company expects to deliver more than $1.2 billion of synergies in 2020.

“Last quarter T-Mobile overtook AT&T to become #2 in U.S. wireless and today we announced our highest ever postpaid net adds. Now, with over 100 million wireless customers and America’s largest 5G network, there is no doubt that we’re the growth leader in wireless,” said Mike Sievert, T–Mobile CEO. “Customers are choosing T-Mobile in record numbers because we are the only ones that can deliver this combination of value and experience with a true 5G network that is available to customers in every single state! We’re consistently and profitably outpacing the competition – and we’re just getting started!”

T-Mo’s strong financial results included:

• Total service revenues increased year-over-year to $14.1 billion in Q3 2020, driven by the Sprint merger and continued customer growth.

• Total revenues increased year-over-year to $19.3 billion in Q3 2020, driven by the Sprint merger and continued customer growth.

• Net income increased year-over-year to $1.3 billion in Q3 2020, as revenue growth outpaced expense increases. Merger-related costs were $288 million pre-tax and $208 million, net of tax, in Q3 2020.

• EPS was relatively flat year-over-year at $1.00 in Q3 2020, as growth in net income was offset by a higher number of outstanding shares as a result of the Sprint merger.

• Adjusted EBITDA increased year-over-year to $7.1 billion in Q3 2020 primarily due to the Sprint merger and continued customer growth.

• Net cash provided by operating activities increased year-over-year to $2.8 billion in Q3 2020.

• Cash purchases of property and equipment including capitalized interest increased year-over-year to $3.2 billion in Q3 2020, as the company accelerated the build-out of its nationwide 5G network and ramped network integration activities related to the Sprint merger.

• Free Cash Flow decreased year-over-year to $352 million in Q3 2020.

Delivering Merger Synergies Faster Than Expected:

T-Mobile says it remains highly confident in its ability to deliver $43 billion of synergies and achieve the $6 billion of annualized savings from the Sprint merger from a combination of cost avoidance and expense reductions. In fact, the company is delivering faster than expected and targeting more than $1.2 billion of synergies in 2020. The company said in its earnings report that they:

• Expect more than $600 million of network synergies primarily from avoided new site builds and early site decommissioning.

• Expect approximately $500 million of sales, service and marketing synergies primarily from accelerated rationalization of retail stores, marketing consolidation and organizational redesign.

• Expect approximately $100 million of back office synergies primarily from accelerated organizational redesign.

The network team is quickly adding capacity to the T-Mobile network to facilitate more Sprint customer traffic. 15 percent of Sprint postpaid customer traffic has already been moved over to the T-Mobile network and customer network migrations have begun, as the company enabled cross-provisioning last month, thus separating the network migration from the billing system migration and enabling gross additions and upgrades from Sprint customers to be activated on the T-Mobile network.

The company also added 1.29 million devices other than phones to its network in the third quarter as school districts built out wireless hot spots to students during the coronavirus pandemic. The increased new wireless connections pushed T-Mobile’s total customer base to 100.4 million. T-Mo counts any wireless device with its own mobile identifier as a single customer.

Management also said that 15% of former Sprint traffic has been shifted over to the T-Mobile network. T-Mobile said its 5G network currently covers 270 million Americans. But that’s mostly on lower-frequency spectrum bands that meet the technical requirements of 5G but don’t deliver the full speed and capacity benefits the new technology promises. Sievert said Thursday that T-Mobile expects to have nationwide 5G coverage on the mid-band 2.5 GHz spectrum by the end of next year.

Extending 5G Network Leadership:

T-Mobile says they’re on a mission to build America’s best 5G network, offering all of the Un-carrier customers unrivalled coverage and capacity in every place that they live, work and play. The company has already been the first to launch a nationwide 5G network, first to launch standalone 5G (without a 5G core network implementation standard), and first to have 5G coverage in all 50 states and Puerto Rico.

- America’s largest 5G network covers 270 million people in 8,300 cities and towns across 1.4 million square miles. That’s more square miles of 5G coverage than Verizon and AT&T combined – 3.5x more than Verizon and 2x more than AT&T.

- T-Mobile continued to leverage its network to expand into new complementary 5G business opportunities like broadband and video to grow revenue per household. ◦ Expanded its Home Internet Pilot service to parts of 450 cities and towns, laying the groundwork for a nationwide 5G commercial launch of fixed wireless broadband.

- Launched its latest Un-carrier move with the introduction of next-gen streaming services TVision LIVE, VIBE and CHANNELS, and the TVision HUB, a new streaming device.

Image Credit: GoranJakus/Dreamstime …………………………………………………………………………………………………………………………………………………………………………………..

T-Mo marketing boss Matt Staneff said remote classes triggered a surge in demand for broadband connections, though the company only counted what it considered long-term accounts among the customer additions. School districts in California and New York were among the first to provide the cellular hot spots to students without enough internet bandwidth at home. “We have the capacity in the network to handle all this traffic,” Mr. Staneff said. “The education system was caught off guard and will never want to be that way again.”

Regarding the wireless telco’s 5G leadership in the U.S., analyst Craig Moffett wrote:

T-Mobile, can benefit from 5G simply by taking market share (from AT&T and Sprint). T-Mobile’s 5G network will be the first to offer significant mid-band coverage, and therefore to deliver meaningfully higher-than-4G speeds, and that advantage is likely to last for years into the future. That advantage will matter most in precisely the segment in which T-Mobile under-indexes most: business wireless.

That T-Mobile is poised to be first in 5G is an extraordinary turn of events. When AT&T made its ill-fated bid to buy TMobile in 2011, T-Mobile was a distant fourth place network. Their 3G GSM network was fast, but coverage was poor, and they compensated with ultra-low prices. T-Mobile made huge strides towards closing that gap in the 4G era, but their position in business wireless still lags. Their prices have remained the industry’s lowest, and their urban speeds are often now the industry’s fastest, but their coverage map is just now catching up. In 5G, T-Mobile won’t just catch Verizon on network quality; we expect they will pass them by. Worst-to-first stories are rare. You don’t have to believe that 5G is “the next big thing” to believe that T-Mobile itself is, well, “the next big thing.”

When T-Mobile’s 2.5 GHz spectrum is more or less fully deployed, they will have 2.5 GHz-based 5G available to 100M pops (potential 5G subscribers- NOT traditional Point of Presence) by the end of 2020. By the end of 2021, T-Mobile’s 5G service will be genuinely differentiated.

Spectrum licenses acquired from Sprint have helped T-Mobile engineers to expand their 5G footprint. The company said its existing 5G towers cover about 270 million Americans.

Ericsson: Multi-User MIMO with T-Mobile US; 5G with Telefónica; Open RAN Security WARNING

Author’s Note:

This post is actually three separate articles concerning “Ericsson in the news” today. Rather, than read all three parts, simply scroll down to the story that interests you. Let me (and others) know what you think by commenting in the box below the article.

1. Multi-User MIMO demo with T-Mobile US

T-Mobile US and Ericsson demonstrated a 16-layer multi-user multi-input multi-output (MU-MIMO) [1.] on one channel of 2.5 GHz spectrum. The peak cellular data rate was more than 5.6 Gbps.

During the test, engineers connected eight separate smartphones to the same 5G radio and resources using MU-MIMO and beamforming in a specific direction to achieve more than 700 Mbps data rate on each device.

Note 1. Multi-user MIMO (MU-MIMO) is a set of multiple-input and multiple-output (MIMO) technologies for wireless communication, in which a set of users or wireless terminals, each with one or more antennas, communicate with each other.

In contrast, single-user MIMO considers a single multi-antenna transmitter communicating with a single multi-antenna receiver. In a similar way that OFDMA adds multiple access (multi-user) capabilities to OFDM, MU-MIMO adds multiple access (multi-user) capabilities to MIMO. MU-MIMO has been investigated since the beginning of research into multi-antenna communication.

…………………………………………………………………………………….

Using MU-MIMO, T-Mobile US could potentially connect many more devices to the same cell infrastructure and still deliver very fast speeds to all of them. Using that set of technologies, wireless telcos might be able to deliver even better 5G performance to more people than was expected.

Using a commercially available massive MIMO radio with 64 antennas from Ericsson and OnePlus 8 5G smartphones T-Mobile sells today, 16 unique data streams were transmitted. Each stream was capable of transmitting/receiving at more than 350 Mbps. With two data streams for each device, that’s 700+ Mbps for each smartphone, all using the same radio resources at the same time.

With 100 MHz of total 5G spectrum used in the demonstration, T-Mobile US was able to achieve a 50+ bps/Hz in spectral efficiency. That is much higher than the single digit efficiency typically experienced today.

“This is what you get when you pair T-Mobile’s unmatched spectrum portfolio with the best damn team in wireless — innovation that changes the game for the entire industry,” said Neville Ray, President of Technology at T-Mobile. “We have a 5G network that’s second to none, and it’s getting better by the day thanks to our amazing engineers and partners. Just wait until you see what they do next for our customers!”

T-Mobile US expects to begin deploying this technology in 2021 as they continue the goal of building America’s best 5G network.

References:

https://www.t-mobile.com/news/network/t-mobile-achieves-mind-blowing-5g-speeds-with-mu-mimo

For more information about T-Mobile’s 5G vision, visit: www.t-mobile.com/5g. To see all the places you’ll get T-Mobile’s current 5G down to a neighborhood level, check out the map at www.t-mobile.com/coverage/5g-coverage-map.

https://www.telecompaper.com/news/t-mobile-us-achieves-5g-speeds-with-mu-mimo–1353491

…………………………………………………………………………………………………..

2. Ericsson partners with Telefónica on Spain 5G launch

Ericsson is providing new 3.5Ghz radio equipment and software upgrades to 5G-ready Ericsson radios in Telefónica’s network. With Ericsson Radio System products already deployed in parts of Telefónica Spain’s network, fast, flexible, and cost-efficient 5G activation is made easier.

Joaquín Mata, CTO, Telefónica Spain, says: “The launch of our 5G network constitutes a leap forward towards the hyper connectivity that will change the future of Spain. We are very pleased with the collaboration with Ericsson to build one of the best 5G networks in Europe.”

Arun Bansal, President of Ericsson Europe and Latin America, says: “With our leading technology, Telefónica will offer its customers 5G faster and support them to reach 75 percent coverage of the population by the end of the year. With our swift 5G roll-out, Spain is ready for the next digital revolution and Ericsson is proud to be powering it together with Telefónica.”

As the industry evolves towards RAN virtualization, with virtual RAN or Open RAN (O-RAN), it is important that a risk-based approach is taken to adequately address security.Virtualization throughout the network and a service-based architecture means that security needs to be handled in a new way.

5G will accelerate innovation and provide transformative use cases across multiple global sectors. However, it will also bring new security challenges for the mobile ecosystem, with broader attack surfaces, more devices and increased traffic loads. We must have networks that are trustworthy, resilient, and secure at every phase of the system lifecycle. These new security challenges are addressed by 3GPP’s SA3 security work group.Expanded threat surface

The introduction of new and additional touch points in O-RAN architecture, along with the decoupling of hardware and software, has the potential to expand the threat and attack surface of the network in numerous ways, including:

- New interfaces increase threat surface – for example, open fronthaul, A1, E2, etc.

- Near-Real-Time (RT) RIC and 3PP xApps introduces new threats that could be exploited

- Decoupling of hardware increases threat to Trust Chain

- Management interfaces may not be secured to industry best practices

- (not exclusive to O-RAN): adherence to Open Source best practices

These and other areas are explored in greater depth in Ericsson’s report, Security considerations of Open RAN. Many of these items are being studied in several O-RAN Alliance working groups, including the Security Task Group, a consensus-based standards group that will ensure that O-RAN implementations meet the levels of security expected by the industry.

Ericsson is committed to providing leadership and guidance in the O-RAN Alliance on these emerging areas of study. In the meantime, let’s take an in-depth look at just one of these new areas of risk:

Weakened Links in the Trust Chain

Virtualization and the use of cloud platforms give the possibility to utilize hardware resources better between different applications, but it will also introduce security risks as isolation between applications are only “logical” in software without physical isolation across hardware resources. Recently discovered vulnerabilities like Meltdown and Spectre reveal that there can be increased security risks when sharing hardware resources.

To establish a secure and trusted communication channel between two endpoints, one needs first to authenticate each side before a secure (confidentiality and integrity-protected) channel can be established. To authenticate each endpoint, a unique identifier and one or more credentials that shall be kept secret are needed. To protect the credentials in a computer environment, hardware security functionality such as Trusted Platform Module (TPM), Hardware Security Module (HSM), and secure enclaves, are used to establish a hardware root of trust.

In the case of virtualization and cloud environments, there are many layers that need to be considered to ensure the trust chain is maintained between applications and the underlying hardware. The authentication process is the base for establishing a secure communication channel, but it must trust the layers underneath to attest that the node, layer or data set has not been compromised. For example, a node could request a valid service, authenticate correctly to the system and be authorized to use that service yet still represent a malicious threat if it is running on compromised firmware.

As there are different layers between the hardware and its security functions and the application, one needs standardized interfaces and APIs to use the hardware security functions and allow those to attest to and validate the layers above. Together with standardized and interoperable APIs, there must also be a transparency to how the different layers use and provide the security functions in the chain, especially as different hardware vendors may have different security functions, capabilities or implementation variances.

Figure 1. O-RAN: Additional functions, interfaces and a modified architecture (Source: Ericsson)

Ericsson will continue its leadership role within the O-RAN Alliance and its Security Task Group to incorporate security best practices, ensuring that new deployments are ready to meet the level of security, resilience and performance expected by service providers and their customers.

The Open RAN Policy Coalition, a U.S. special interest (i.e. lobbying) group looking for U.S. government funding for Open RAN technology, today announced several new members (American Tower, Broadcom, GigaTera Communications, Inseego, Ligado Networks, Nvidia, RIFT, Texas Instruments and Xilinx). Ericsson is not a member, but arch rival Nokia is. Cloud giants AWS, Google and Facebook are members. Obviously, Chinese vendors aren’t welcome to join the Coalition. The complete Coalition membership list is here.

……………………………………………………………………………………………..

Coalition members believe that by standardizing or “opening” the protocols and interfaces between the various subcomponents (radios, hardware and software) in the RAN, we move to an environment where networks can be deployed with a more modular design without being dependent upon a single vendor. The Coalition will promote policies that:

- Support global development of open and interoperable wireless technologies;

- Signal government support for open and interoperable solutions;

- Use government procurement to support vendor diversity;

- Fund research and development;

- Remove barriers to 5G deployment; and

- Avoid heavy-handed or prescriptive solutions

…………………………………………………………………………………………

The FCC is scheduled to host an open RAN forum on September 14th. FCC Chairman Pai will host experts at the forefront of the development and deployment of open, interoperable, standards-based, virtualized radio access networks to discuss this innovative new approach to 5G network architecture.

Panelists include representatives from Nokia, Parallel Wireless, Mavenir, Altiostar, HP Enterprise, Dell, VM Ware, and other would be Open RAN hardware/software vendors. But Ericsson will not be among them.

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

T-Mobile USA claims they are the first wireless network operator in the world to launch a commercial nationwide standalone 5G network (5G SA). The “Un-carrier” is also expanding 5G coverage by 30 percent, now covering nearly 250 million people in more than 7,500 cities and towns across 1.3 million square miles.

“Since Sprint became part of T-Mobile, we’ve been rapidly combining networks for a supercharged Un-carrier while expanding our nationwide 5G footprint, and today we take a massive step into the future with standalone 5G architecture,” said Neville Ray, President of Technology at T-Mobile. “This is where it gets interesting, opening the door for massive innovation in this country — and while the other guys continue to play catch up, we’ll keep growing the world’s most advanced 5G network.”

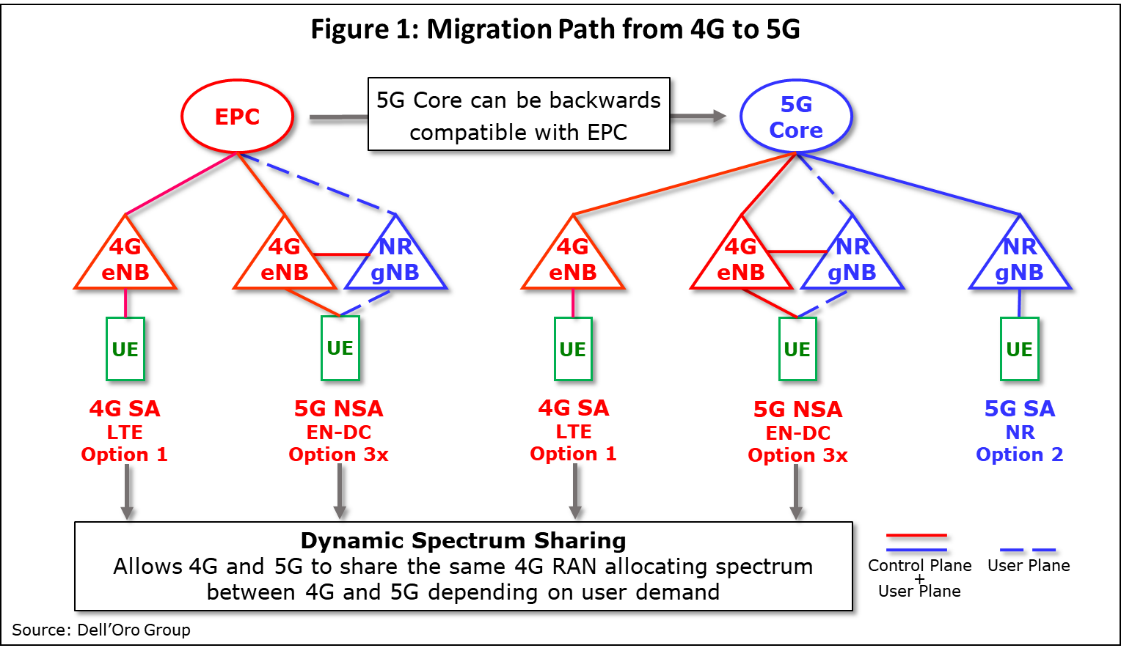

IEEE Techblog readers know that all previously deployed (pre-standard) “5G” networks focused on delivering new 5G radio (3GPP Rel 15 5G NR) in the data plane while leveraging existing LTE core networks, management and signaling in the control plane. With a new 5G Core network, T-Mobile engineers have already seen up to a 40% improvement in latency during testing. T-Mo claims:

“This is just the beginning of what can be done with Standalone 5G. When coupled with core network slicing in the future, 5G SA will lead to an environment where transformative applications are made possible — things like connected self-driving vehicles, supercharged IoT, real-time translation … and things we haven’t even dreamed of yet.”

In the near-term, 5G SA enables T-Mobile US to unleash its entire 600 MHz footprint for 5G. With non-standalone network architecture (NSA), 600 MHz 5G is combined with mid-band LTE to access the core network, but without SA the 5G signal only goes as far as mid-band LTE. With today’s launch, 600 MHz 5G can go beyond the mid-band signal, covering hundreds of square miles from a single tower and going deeper into buildings than before.

To make the world’s first nationwide commercial SA 5G network a reality, T-Mobile partnered closely with Cisco and Nokia to build its 5G core, and Ericsson and Nokia for state-of-the-art 5G radio infrastructure.

OnePlus, Qualcomm Technologies and Samsung have helped the Un-carrier ensure existing 5G endpoint devices can access 5G SA with a software update, based on compatibility. The 5G SA software update is required to activate the 5G SA functionality. For example, the Samsung Galaxy S20+ 5G requires a software download (available August 4, 2020) to enable 5G SA operation.

For more information about T-Mobile’s 5G vision, visit: www.t-mobile.com/5g. To see all the places you’ll get T-Mobile’s current 5G down to a neighborhood level, check out the map here: www.t-mobile.com/coverage/5g-coverage-map.

……………………………………………………………………………………………………………………………………

Comment and Analysis: Specs for 5G Core (there is no standard)

T-Mo’s launch of standalone 5G is noteworthy considering there are no standards for 5G Core from any SDO! ITU-T IMT 2020 non radio aspects SG’s aren’t even working on it!

Yeah, we know about 3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

Collectively, all three of the above referenced 3GPP Rel 16 5G Systems Architecture documents do not specify the detailed mechanisms, protocols and procedures to implement a 5G core network.

For example, there are many software choices for implementing a “cloud native” 5G Core: containers, virtualized network functions, kubernetes, micro-services. Each Network Function (NF) offers one or more services to other NFs via Application Programming Interfaces (APIs). And there is no standard for the APIs associated with a given NF!

The only 5G Core implementation spec we know of is from GSMA. It’s titled: “5G Implementation Guidelines: SA Option 2.” That document provides a checklist for operators that are planning to launch 5G networks in SA (Standalone) Option 2 configuration, technological, spectrum and regulatory considerations in the deployment. The current version of the document currently provides detailed guidelines for implementation of 5G using Option 2, reflecting the initial launch strategy being adopted by multiple operators. There is an implementation guideline for NSA Option 3 already available.

However, as described in “GSMA Operator Requirements for 5G Core Connectivity Options” there is a need for the industry ecosystem to support all of the 5G core connectivity options (namely Option 4, Option 5 and Option 7). As a result, further guidelines for all 5G deployment options will be provided in the future.

GSMA says “5G Stand Alone to Become Reality“:

“The deployment of fully virtualized networks using 5G Stand Alone Cores, thereby facilitating Edge Computing and Network Slicing, will enable enterprises and governments to reap the many benefits from high throughput, ultra-low latency and IoT to improve productivity and enhance services to their customers,” said Alex Sinclair, Chief Technology Officer, GSMA.

………………………………………………………………………………………………………………..

Other Voices on 5G Core Deployments:

1. From Rakuten CTO Tareq Amin via email to this author:

– Containerization/Cloud native 5G Core from Rakuten-NEC:

3GPP specification requires cloud native architecture as the general concept like distributed, stateless, and scalable. However, an explicit reference model is out of scope for 3GPP specification (TS 23.501). Therefore NEC 5GC cloud native architecture is based on 3GPP “openness” concept as well as ETSI NFV treats “container” and “cloud native,” which NEC is also actively investigating to apply its product.

2. Alex Quach, VP of Intel’s Data Platforms Group, said most operators around the world are still leveraging a 4G core network. “The way different service providers implement their 5G core is going to vary,” said Quach. “Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

4. Asked if SK Telecom has now completed its 5G Standalone core network, the South Korean carrier was vague in an email reply to FierceWireless. “To commercialize standalone 5G service in Korea, we are currently making diverse R&D efforts including conducting tests in both lab and commercial environment. Our latest achievements include the world’s first standalone (SA) 5G data session on our multi-vendor commercial 5G network.

……………………………………………………………………………………………………………………………

Other References:

https://www.gsma.com/futurenetworks/resources/5g-implementation-guidelines-sa-option-2-2/

3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios:

https://www.3gpp.org/ftp/

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

https://www.3gpp.org/ftp/

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

https://www.3gpp.org/ftp/

Ting Mobile Acquired by DISH; Tucows Enables Mobile Competition Globally

Dish Network has acquired the assets of MVNO Ting Mobile, including its customer relationships, from Tucows, for an undisclosed amount. Under the deal, most Ting Mobile customers across the US will become Dish customers from August. The customers will be able to access the new T-Mobile US network, continue using their own phones and keep their rates and customer experience, Dish said. Tucows remains the owner of the Ting Mobile tech stack.

The deal follows Dish’s recent entry on the mobile market through the acquisition of Sprint’s prepaid brand Boost Mobile. Started eight years ago, Ting also focuses on the prepaid market, targeting cost-conscious mobile users. Ting said it expects the deal to help Dish “disrupt the retail wireless market and become a major competitor in the US mobile industry.”

Here’s what the news means for Ting Mobile customers:

· No data migration, service interruption or billing changes

· The same great customer service with the same Ting Mobile team managing the service/running the business

· A renewed ability for Ting Mobile to innovate on price, staying true to its roots

John Swieringa, Group President, Retail Wireless and DISH COO:

“Today, we welcome Ting Mobile customers to DISH. Ting Mobile is a great brand that stands for better value in wireless, and we are eager to begin delivering our award-winning customer service to Ting subscribers. Our agreement with Tucows will accelerate our digital and operational capabilities in wireless. Elliot and his team have a strong track record as entrepreneurs and innovators, and we are excited to partner with them on our wireless venture.”

……………………………………………………………………………………………………………………………………………..

Tucows has separately launched Mobile Services Enabler (MSE) services, with Dish as its first customer. Tucows will going forward focus on growing its MSE business, delivering a wide range of functions such as billing, activation, provisioning, and funnel marketing to mobile providers. Tucows has more than 24 million domain names under management on its platform through a global reseller network of over 36,000 web hosts and ISPs.

References:

T-Mobile shutters Sprint’s 5G network; OpenSignal 5G User Experience report highlights

As expected following the April 1st close of T-Mobile’s acquisition, Sprint’s 5G network (which uses 2.5GHz mid-band spectrum) has been deactivated while the “new T-Mobile” works to re-deploy it across its own network.

The integration of the Sprint mid-band spectrum is a key part of T-Mobile’s 5G strategy, which aims to combine low-band 600MHz spectrum for broad, nationwide 5G coverage with faster but lower-range midband (Sprint’s 2.5GHz network) and short-range mmWave networks for a balance of coverage and speed.

T-Mobile has already deployed its new 2.5GHz spectrum in New York, the first market to benefit from the wireless network operator’s spectrum in low-, mid-, and millimeter wave bands. The operator’s 2.5GHz 5G is also live in “parts” of Chicago, Houston, Los Angeles, New York, and Philadelphia.

Most existing Sprint customers won’t be able to use their current devices going forward to access 5G. Newer devices that feature Qualcomm’s X55 modem, like the Galaxy S20 5G lineup, will still be able to access the 2.5GHz 5G when they relaunch as part of the new T-Mobile’s 5G network (along with the rest of T-Mobile’s low-band and mmWave 5G spectrum). T-Mobile is offering credits for affected customers to lease a new 5G device.

“We are working to quickly re-deploy, optimize and test the 2.5 GHz spectrum before lighting it up on the T-Mobile network. In the meantime, legacy Sprint customers with compatible devices can enjoy T-Mobile’s nationwide 5G network,” a T-Mobile spokesperson said.

According to data from a new Opensignal 5G User Experience report, customers using T-Mobile’s mid-band 5G are benefitting from average download speeds of around 330Mbps. The mobile analytics company ranks T-Mobile first for 5G availability; with customers receiving a 5G signal around twice as often as AT&T and 56 times more than Verizon.

T-Mobile’s press release about the Opensignal report said customers are seeing average download speeds of 330 Mbps on its mid-band 2.5 GHz network.

From that OpenSignal report:

T-Mobile wins the 5G Availability award, as its 5G users spend 22.5% of time connected to 5G:

The time connected to a 5G service is extremely important if users are to enjoy all of 5G’s benefits. In the U.S., T-Mobile won the 5G Availability award by a large margin with Sprint and AT&T trailing with scores of 14.1% and 10.3%, respectively. Verizon users saw their extremely fast 5G service 0.4% of the time because of the limited geographical reach of the mmWave wireless technology Verizon currently relies upon for 5G and the early stage of the 5G deployment.

Sprint’s 5G users’ experience is already changing as new T-Mobile combines its network capabilities:

When we previously looked at the 5G Download Speed of Sprint’s users some time ago we saw average 5G speeds of 114.2 Mbps reflecting the mid-band 5G wireless spectrum Sprint relied upon. But following the completion of T-Mobile’s acquisition of Sprint, the new T-Mobile is starting to provide Sprint 5G users with access to old T-Mobile’s 600MHz spectrum and so average 5G speeds are now 49.5 Mbps but 5G Availability has risen from 10.3% to 14.1% of time. T-Mobile is still in the process of merging its original network with Sprint and we expect the mobile network experience of Sprint users will continue to change for some time.

………………………………………………………………………………………………………………………………………………………………………….

“Building the fastest 5G network is easy if you only cover less than 50 square miles. Opensignal’s report shows that only T-Mobile is doing the hard work to deliver BOTH 5G coverage and speed. And we’re just getting started,” said Neville Ray, President of Technology at T-Mobile.

“With the addition of Sprint, the Un-carrier’s 5G is getting bigger, better and faster every day, moving quickly on our mission to build the world’s best 5G network, one unlike any other, to people all across the country!”

T-Mobile and Sprint were finally cleared to merge on April 1st, following discussions which began in 2013.

To appease regulators, T-Mobile agreed to sell Sprint’s prepaid business, Boost Mobile, and Virgin Mobile to Dish network for $1.4 billion. The deal also included selling Sprint’s entire 800 MHz portfolio of spectrum to Dish. Those deals formally completed yesterday.

Last month, T-Mobile asked California’s Public Utilities Commission (CPUC) to ease other conditions it agreed to in order for the merger to be granted – including job creation promises following the COVID-19 pandemic, average 5G coverage and speed commitments, and to remove a “burdensome” third independent test of its network.

……………………………………………………………………………………………………………………………………………………………………

References:

T-Mobile switches off Sprint’s 5G network following $26.5 billion merger

https://www.opensignal.com/reports/2020/06/usa/mobile-network-experience-5g

New T-Mobile no longer the “uncarrier”: layoffs, network outage, challenge integrating Sprint network

T-Mobile US Inc. is cutting jobs faster than initially planned after its April merger with rival Sprint Corp. created a company with about 80,000 employees. Before regulators signed off on T-Mobile’s $26 billion merger with Sprint, executives like former CEO John Legere said that the merger would create many new jobs from “day one.” With the ink barely dry on the deal, it’s abundantly clear that is NOT happening.

T-Mobile said in a securities filing late Wednesday that it expects to spend about $300 million more than initially projected on merger-related costs, primarily on severance expenses, to accelerate expected cost benefits from the deal. The company now expects merger costs before taxes to total $800 million to $900 million during the June-ended quarter. The “new T-Mo” didn’t detail the number of jobs being cut. T-Mobile ended 2019 with 53,000 workers. Sprint last reported 28,500 employees in early 2019.

T-Mobile Chief Executive Mike Sievert said Tuesday the company seeks to hire workers in 5,000 new positions like retail and engineering over the next 12 months. “As part of this process, some employees who hold similar positions are being asked to consider a career change inside the company, and others will be supported in their efforts to find a new position outside the company,” Mr. Sievert said.

The savings estimates T-Mobile provided investors suggest several thousand jobs are being eliminated, according to Jonathan Chaplin, a telecom analyst for New Street Research. Those cuts don’t include stores run by third-party dealers, some of which will switch to other brands, he added. “They will be cutting redundant positions, but adding other positions as they invest for growth,” Mr. Chaplin said.

T-Mobile last year told lawmakers that the then-proposed merger of the two wireless giants would yield more jobs at the combined company by 2024 than each business would employ on its own.

…………………………………………………………………………………………………………………………………………………

Back Story:

Last month, T-Mobile laid off an estimated 6,000 employees from its Metro prepaid division, layoffs that had everything to do with the merger, and nothing to do with the COVID-19 crisis. And on June 15th, hundreds of Sprint employees were unceremoniously fired as part of a six minute conference call during which nobody was allowed to ask questions:

“In a conference call on Monday lasting under six minutes, T-Mobile vice president James Kirby told hundreds of Sprint employees that their services were no longer needed. He declined to answer his employees’ questions, citing the “personal” nature of employee feedback, and ended the call.”

On June 19th, Tech Dirt’s Karl Bode wrote:

This was all ridiculously predictable. There’s 40 years of documented US telecom history showing that the elimination of a major competitor reduces competition and raises prices (oh hi, Comcast). Global markets (Canada, Ireland) have also made this clear. Such deals almost universally result in thousands of layoffs as redundant retail, support, and management positions are culled. It’s why similar deals of this type (AT&T’s 2011 acquisition of T-Mobile, T-Mobile’s 2014 acquisition of Sprint) were blocked. This isn’t a debate topic. It’s not a murky subject. Telecom consolidation routinely ends badly for employees and customers.

Economists made all of these points to the DOJ and FCC, but they were unceremoniously ignored. First by an FCC that couldn’t bother to even read its own staff analysis before rubber stamping the a merger it helped cook up behind closed doors, then by a DOJ whose “antitrust” boss personally escorted the deal to fruition while ignoring all criticism.

If you go back and look at some of ex-CEO John Legere’s blog posts from a few months ago (which I’m sure won’t be around much longer), the CEO repeatedly promised that the merger would be “job positive” from “day one”:

“So, let me be really clear on this increasingly important topic. This merger is all about creating new, high-quality, high-paying jobs, and the New T-Mobile will be jobs-positive from Day One and every day thereafter. That’s not just a promise. That’s not just a commitment. It’s a fact. To achieve what we’re setting out to do – become the supercharged Un-carrier that delivers new value, ignites competition and delivers nationwide real 5G for All – the New T-Mobile will provide an amazing and compelling set of services for consumers.”

Legere was so breathlessly offended by statements to the contrary, he tried to insist that union officials were lying — before reminding everybody he testified under oath about the deal’s looming job explosion:

“We also keep seeing the opposition try to use projected layoff numbers from an analyst’s projections that were based on a completely different deal at a completely different point in time to discredit this merger. It’s SO bad that the head of the Communications Workers Association (CWA) was bold enough to refer to those completely unrelated numbers in a CONGRESSIONAL HEARING. I guess if the real numbers don’t tell the story you want, you can just make up new ones? It’s actually offensive. At the hearings, I raised my right hand and swore under oath to tell the TRUTH… and the truth is that the New T-Mobile will CREATE JOBS.”

…………………………………………………………………………………………………………………………………………………

Network Outage:

T-Mobile network suffered a nationwide service failure on Monday. Federal regulators said they would investigate the incident, which led to intermittent voice and data coverage for about 12 hours. Company chief technology officer Neville Ray later said the problems stemmed from a supplier’s fiber optic circuit going down. But what happened to automated failure detection and recovery/restoral?

Cellphone carriers’ network backbones usually have several fallback routes should one path get severed. Mr. Ray said that “redundancy failed us and resulted in an overload situation that was then compounded by other factors.” The company said its Sprint customers weren’t affected and vowed to put new safeguards in place.

………………………………………………………………………………………………………………………………………………

Integrating Sprint’s 3G and 5G networks:

The “new T-Mo” also faces the challenge of integrating Sprint’s 3G CDMA network with its own 3G GSM network. Also the two former carriers were designing different 5G NSA networks, albeit both using 3GPP Release 15 “5G NR” for the data plane.

T-Mobile has had difficulty integrating Sprint’s customers and network assets and building out a faster 5G network throughout the country, The Wall Street Journal reported in May.

Despite pandemic-related challenges, T-Mobile has begun the process of integrating Sprint into the new stand-alone company and tapping into the trove of airwaves it acquired as part of the deal. Many of T-Mobile’s current executives remain in charge, though some Sprint leaders including technology chief John Saw hold key posts in the combined company.

………………………………………………………………………………………………………………………………………………..

Separately, AT&T has outlined plans to cut more than 3,400 jobs in the coming weeks, according to the Communications Workers of America, which represents a large share of the telecom and media giant’s 244,000 employees. Those cuts exclude hundreds of other positions potentially eliminated through store closures.

AT&T said it will make “targeted, but sizable reductions in our workforce across executives, managers and union-represented employees” as it overhauls its employee base. The carrier also is closing more stores to cater to online shoppers, a shift the company said it accelerated in response to the coronavirus crisis.

“Reducing our workforce is a difficult decision that we don’t take lightly,” AT&T said in a statement.

In light of the tens of thousands of AT&T layoffs the last few years, does anyone seriously believe that statement?

…………………………………………………………………………………………………………………………………………….

References:

https://www.wsj.com/articles/t-mobile-and-at-t-are-cutting-thousands-of-jobs-11592501203

https://www.wsj.com/articles/t-mobile-to-feel-coronavirus-pain-through-2020-11588799462

The New T-Mobile (with Sprint): Merging incompatible 3G networks and integrated 5G

At long last, T-Mobile closed its $23 billion acquisition of Sprint today (April 1, 2020) after a two-year effort to merge the two companies. The New T-Mobile also replaced long-time uncarrier CEO (cowboy) John Legere with his hand-picked successor Mike Sievert. T-Mobile now takes its place as an equal among the three major wireless carriers in the US.

The deal was the subject of protracted legal actions, opposition by 11 state attorney generals, lobbying before the FCC and the Justice Department, and other actions as consumer groups tried to find a way to block it.

The merger required Sprint to divest itself of Boost Mobile and the remains of Virgin Mobile, and it required a number of commitments by T-Mobile not to raise prices for three years, and to provide widespread wireless broadband. T-Mobile also had to help Dish Networks become a competitive wireless company as a way to quell fears that the merger would leave the U.S. with only three wireless telcos instead of four.

“During this extraordinary time, it has become abundantly clear how vital a strong and reliable network is to the world we live in. The New T-Mobile’s commitment to delivering a transformative broad and deep nationwide 5G network is more important and more needed than ever and what we are building is mission-critical for consumers,” said Mike Sievert, president and CEO of T-Mobile. “With this powerful network, the New T-Mobile will deliver real choice and value to wireless and home broadband customers and double down on all the things customers have always loved about the Un-carrier. T-Mobile has been changing wireless for good — and now we are going to do it on a whole new level!”

Sievert continued, “All of us at T-Mobile owe John an incredible thank you for everything he’s done to get this company to where we are today. He has changed what it means to be a CEO. Everything that T-Mobile has accomplished is the result of his vision for what a different kind of wireless provider could be. John IS what the Un-carrier is all about: advocating for customers at every turn, forcing us to think differently and always driving for more. He has always pushed the boundaries of what’s possible and pushed us to do the same. His leadership has made us what we are today, and we will take that into the future. Thank you, John, for everything you’ve done for wireless consumers and for our beloved employees!

I also want to thank Marcelo Claure and the entire Sprint leadership team for their hard work to get us to this huge day! We did it!… and I’m looking forward to welcoming Sprint employees into Team Magenta, and to working with you now as a member of our Board of Directors.”

This quantum leap forward can only be achieved by using T-Mobile and Sprint’s combined low-, mid- and high-spectrum bands — and only the New T-Mobile will have the resources to do it quickly.

- The network will have 14 times more capacity in the next six years than T-Mobile alone has today, enabling the New T-Mobile to leapfrog the competition in network capability and experience.

- Customers will have access to average 5G speeds up to eight times faster than current LTE in just a few years and 15 times faster over the next six years.

- Within six years, the New T-Mobile will provide 5G to 99% of the U.S. population and average 5G speeds in excess of 100 Mbps to 90% of the U.S. population.

- New T-Mobile’s business plan is built on covering 90% of rural Americans with average 5G speeds of 50 Mbps, up to two times faster than broadband on average.

“The network is at the core of everything we do as a business, and it’s critically important for keeping customers connected to each other, their communities and the world,” said Neville Ray, president of Technology at T-Mobile. “The supercharged 5G network that we’ll build as a combined company will be a huge step forward, transforming wireless, fueling innovation and delivering new experiences for customers all across the country that we can’t even imagine today.”

Impact on Users:

For users, the merger will initially be a non-event. Sprint is now a subsidiary of T-Mobile and will operate as a separate company. The transition will occur in stages, and while T-Mobile isn’t commenting on that, a highly placed source at T-Mobile said on background that customers of both companies will find that they have access to the other’s network in areas where they need better coverage.

However, many Sprint 3G devices (CDMA) can work on the T-Mobile’s 3G network (GSM), especially for voice calls or if 4G LTE mobile data access is not available. T-Mobile plans to use the model it used when it acquired MetroPCS, which was also an incompatible network. In that merger, T-Mobile replaced incompatible handsets as the old network was decommissioned.

…………………………………………………………………………………………………..

Pundits Weigh In:

Keith Pennachio, EVP and chief strategy officer at SQUAN, a network infrastructure company serving both T-Mobile and Sprint, said that he expects to see growth in network infrastructure. “We’ll see network consolidation, networks convergence for some sites and for moving traffic,” he said.

“I expect T-Mobile to take advantage of spectrum assets where T-Mobile didn’t have assets previously,” Pennachio said. “What you’ll start to see in markets where Sprint had a decent footprint, T-Mobile may opt to supplant some equipment to their own.” This will mean that in areas where T-Mobile didn’t have a great signal, the company will use Sprint’s sites and frequencies to improve things.

As the merger progresses, T-Mobile will update the programming on some cell sites so that Sprint customers with compatible phones will be able to use them. T-Mobile will also begin using Sprint’s 2.5 GHz mid-band spectrum to build out its network.

“I think they’re going to be very busy integrating the business, the networks and the employees,” said Brandon Parris of Morrison & Foerster, “and start in earnest their upgrades and their focus on 5G.” Parris led the team that advised Sprint and and its owner Softbank on the merger with T-Mobile.

“Whenever you have two huge industry giants it takes time,” Parris explained, “but they will go through the process of making sure the technology is integrated, and then adding 5G. You have to integrate everything from office space to compensation arrangements. It’s huge undertaking.”

………………………………………………………………………………………………

Deploying 5G:

According to a FAQ press release, “the new T–Mobile will build a transformative nationwide 5G network that will drive innovation and connect every American. With T–Mobile’s low-band, Sprint’s mid-band, and other spectrum, the highest capacity nationwide network in U.S. history will be built—400MHz+ on average nationwide.”

T-Mobile is starting its 5G buildout “almost immediately”

T-Mobile has long said that the primary driver for its merger with Sprint is its desire to combine its 600MHz spectrum with Sprint’s 2.5GHz spectrum for a 5G network. Indeed, in its press release Wednesday the New T-Mobile promised its forthcoming network would have 14 times more capacity in the next six years than T-Mobile alone has today. The operator added that it expects to provide average 5G speeds above 100Mbit/s to 90% of the US population within the next six years.

In comments to CNBC, incoming CEO Sievert said the operator is going to start on the construction of the network “almost immediately.” He said the company would use equipment from its existing suppliers Nokia and Ericsson to build “the world’s best 5G network.”

A key factor in in the integration of the two networks, will be the speed at which T-Mobile can begin rolling out its use of Sprint’s mid-band spectrum, which is critical to its 5G success.

While T-Mobile already has nationwide 5G with its 600 MHz low-band frequencies that feature much longer range than can exist in higher bands, the low bands have lower speeds. Mid-band spectrum is considered a perfect compromise between the speeds in the millimeter wave bands and the lower speeds in the low bands.

“With its lead in customer care and cost of service, T-Mobile is well positioned to bring that winning culture to its new family members, both the employees of Sprint as well as its customers,” said Ian Greenblatt, TMT head at J. D. Power. “The only 5G nationwide network is notable (despite being 600MHz only – it’s still faster than the fastest 4G-LTE) and will be even more capable with the addition of Sprint’s mid-band spectra.”

CTO Neville Ray told CNET that the operator would turn on its new 5G network first in Philadelphia, and that other cities would go live “rapidly” in the coming weeks.

Conclusions:

According to Pennachio, T-Mobile’s culture will play a critical role in the success of the merged companies. “The culture of T-Mobile is very different,” he said. “Now it creates this third competitor that’s strong from a spectrum but with a culture that’s more in line with technology companies.”

T-Mobile’s “in your face” culture, which has been compared with that at many Silicon Valley startups, could play a significant role in how the company impacts the wireless business.

………………………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-sprint-one-company

https://www.t-mobile.com/support/account/t-mobile-sprint-merger-faqs

https://www.lightreading.com/5g/the-eight-new-things-we-learned-about-new-t-mobile/d/d-id/758625?

U.S. District Judge approves T-Mobile- Sprint merger; New T-Mo will be #2 wireless carrier in U.S.

A federal judge has ruled in favor of T-Mobile USA’s merger with Sprint, despite evidence presented that showed the deal will likely erode competition, raise U.S. wireless data prices, and result in significant layoffs as redundant jobs are eliminated. U.S. District Judge Victor Marrero concluded the T-Mobile USA merger with Sprint, worth $26 billion when it was struck two years ago, wasn’t likely to substantially lessen competition, and rejected the main arguments by a group of states seeking to block the deal as anti-competitive. The judge praised T-Mobile in his ruling, calling it “a maverick that has spurred the two largest players in its industry to make numerous pro-consumer changes” and describing its business strategy as “undeniably successful.

Judge Marrero wrote:

“While Sprint has made valiant attempts to stay competitive in a rapidly developing and capital-intensive market, the overwhelming view both within Sprint and in the wider industry is that Sprint is falling farther and farther short of the targets it must hit to remain relevant as a significant competitor.”

“Finally, the FCC and DOJ have closely scrutinized this transaction and expended considerable energy and resources to arrange the entry of Dish as a fourth nationwide competitor, based on its successful history in other consumer industries and its vast holdings of spectrum, the most critical resource needed to compete in the RMWTS markets.”

“Dish’s statements at trial persuade the court that the new firm will take advantage of this opportunity, aggressively competing in the RMWTS markets to the benefit of price-conscious consumers and opening for consumer use a broad range of spectrum that had heretofore remained fallow.”

The two companies said they would move forward to finalize their long-delayed merger. The deal’s current terms offer Sprint shareholders new stock equal to 0.10256 of one T-Mobile share.

“Today was a huge victory for this merger… and now we are FINALLY able to focus on the last steps to get this merger done!” cheered T-Mobile CEO John Legere (pictured below) in a press release.

The states might decide to appeal the ruling and another U.S. district judge in Washington must approve the existing Justice Department arrangement. Letitia James, New York’s attorney general, said the states disagreed with the decision and would review their options. “There is no doubt that reducing the mobile market from four to three will be bad for consumers, bad for workers and bad for innovation,” Ms. James said.

The two companies also need clearance from California’s Public Utilities Commission and face a private antitrust suit challenging the merger. A judge in the Northern District of California ruled in January 2020 that the case could proceed if the carriers overcame the state-led challenge.

T-Mobile and Sprint hope to close the merger by April 1st. The two telcos have spent more than seven years pursuing a combination in some form. They abandoned previous attempts in 2013 and 2017 before their boards struck an agreement in early 2018 that would allow T-Mobile to take over its smaller rival, creating a company closer in size to Verizon and AT&T.

The new T-Mobile would be a formidable rival to Verizon and AT&T, the two largest wireless carriers in the country. In fact, the total number of “New T-Mobile” wireless subscribers will be more than AT&T currently has.

The “New T-Mobile” will be strengthened by a massive stockpile of wireless radio licenses held by Sprint. Those spectrum holdings allow the new company to serve more customers with high-speed internet service on the go, putting pressure on AT&T and Verizon to match them as carriers upgrade to faster 5G mobile networks.

The court victory also benefits T-Mobile parent Deutsche Telekom AG and Japan’s SoftBank Group Corp., Sprint’s majority owner. SoftBank Chairman Masayoshi Son, a billionaire investor who upended the telecom business in Japan, had been seeking a way to rescue an investment that proved less successful in the U.S.

Tuesday’s court verdict will test the idea that three big players will compete as effectively as four did. Dish enters the market with fewer customers than Sprint, making it a distant No. 4 in the consumer-cellular business.

Dish Chairman Charlie Ergen testified during the trial that his Englewood, Colo., company was better equipped to compete than Sprint. His new wireless service will ride over T-Mobile’s network at first, though customers will eventually use a new cellphone system Dish is required to build over seven years.

Quotes from opponents of the deal:

“We are profoundly disappointed that the judge approved a merger that will harm communities of color and low-income communities across California,” said Greenlining Institute Technology Equity Director Paul Goodman, in a statement.

“While the court may think it unlikely for a newly entrenched trio of enormous wireless carriers to collude rather than compete, the history of broken and abandoned merger promises from these companies – to say nothing of the mountains of evidence and expert analysis in this trial – say otherwise,” said Free Press Vice President of Policy and General Counsel Matt Wood, in a statement.

“The Rural Wireless Association disagrees with Judge Marrero’s decision to approve this deal, which has been consistently and drastically altered from what was originally proposed in early 2018, and now includes Dish, a company that has zero experience operating as a facilities-based mobile wireless carrier network as the savior for wireless competition,” the association said in a statement.

Quotes from supporters of the deal:

“I’m pleased with the district court’s decision. The T-Mobile-Sprint merger will help close the digital divide and secure United States leadership in 5G,” said FCC Chairman Ajit Pai in a statement.

“We appreciate Judge Marrero’s thorough evaluation of this merger. The ruling, in addition to the DOJ and FCC approvals, accelerates our ability to deploy the nation’s first virtualized, standalone 5G network and bring 5G to America,” said Dish Network’s Charlie Ergen in a statement. “We are eager to begin serving Boost customers while aggressively growing the business as a new competitor, bringing lower prices, greater choice and more innovation to consumers. We look forward to the Boost employees and dealers joining the Dish family.

Analyst Opinions:

“This is clearly a big win for T-Mobile, which will now how [sic] a superior spectrum position which it can use to launch 5G and handle even higher growth,” wrote the Wall Street research analysts at Lightshed in a post. “We also see this as a big win for Dish based on what we have learned about its MVNO terms. It’s not great news for Verizon, given that it removes Sprint and Dish’s spectrum as an alternative, created a new competitor in Dish and has empowered T-Mobile with the tools to deliver a superior network experience to consumers.”

“We view a deal as initially negative to AT&T/Verizon despite our view that consolidation should help to further rationalize the competitive/pricing environment long term considering T-Mobile is likely to be aggressive at least early on to help validate the premise of the deal which is it will result in more favorable pricing for consumers,” wrote the Wall Street analysts at Cowen in a note to investors.

“Dish will need to execute on a myriad of levels including building a cloud-native nationwide network followed by the operational challenges that come with competing against three very well entrenched wireless players,” the Cowen analysts added.

“The wireless industry is going to get tougher. Cable would have had a much easier time sucking subscribers out of Verizon and AT&T in a four-carrier market with a capacity constrained T-Mobile. Now they are going to have to fight T-Mobile for every one of those subs, and industry pricing is likely headed lower,” wrote the Wall Street analysts at New Street Research in a note to investors.

However, the New Street analysts pointed out that cable companies may also see some silver lining in the merger of Sprint and T-Mobile, if it is ultimately approved. “Cable will have one more company competing for its MVNO business. We have been surprised the companies haven’t announced new MVNO terms with Verizon or AT&T; negotiations were in full force in October / November last year. Perhaps they have been waiting to see what T-Mobile might offer them if the deal went through. Altice will be the most immediate winner; their MVNO with Sprint now moves to a much better network.”

…………………………………………………………………………………………

Addendum from Robin Hood Snacks:

|

Here’s the history of this complex courtship:

Sprint has been lagging rivals for a while… so the judge doesn’t think this deal will substantially hurt competition. Plus, regulators will make sure that Dish Network enters the game as a viable new service provider. Sprint will have to sell Dish 9M customers, but that’ll still be a distant competitor to the Big 3. |

|

THE TAKEAWAY

|

|

We have a three-opoly on our hands… Here’s the pecking order now: Verizon #1, New T-Mobile #2, and AT&T #3. And a three-opoly could affect your bill:

|

T-Mobile Earnings Beat + 5G Network Status + 600 MHz and Spectrum Position

T-Mobile US beat analysts’ estimates for quarterly revenue and profit on Thursday, as the wireless carrier added more mobile phone subscribers to its monthly plans, some of which come bundled with a Netflix Inc service.

The third-largest U.S. wireless carrier by subscribers has been awaiting a decision on its proposed merger with Sprint Corp. The two U.S. telcos delivered closing arguments in a federal court last month against a multi-state lawsuit that argues the merger will increase prices for the consumers.

T-Mobile’s fourth-quarter net income rose to $751 million from $640 million, a year earlier. Excluding items, the company earned 87 cents, beating analysts’ average estimate of 83 cents. Revenue rose to $11.88 billion from $11.45 billion, edging past analysts’ average estimate of $11.83 billion, according to IBES data from Refinitiv.

………………………………………………………………………………………………………………………………………………………………………………………

Highlights from the T-Mobile Investor Factbook website:

Strong Customer Growth:

• 1.9 million total net additions in Q4 2019 – 7.0 million in 2019 – 6th year in a row of more than 5 million total net additions

• 1.3 million branded postpaid net additions in Q4 2019, best in industry – 4.5 million in 2019, best in industry

• 1.0 million branded postpaid phone net additions in Q4 2019, best in industry – 3.1 million in 2019, best in industry

• 77,000 branded prepaid net additions in Q4 2019 – 339,000 in 2019

• Branded postpaid phone churn of 1.01% in Q4 2019, up 2 bps YoY – 0.89% in 2019, down 12 bps from 2018

First Nationwide 5G Network:

• Launched the first nationwide 5G network utilizing 600 MHz spectrum, forming the foundational 5G coverage layer for

New T-Mobile; network covers more than 200 million people and more than 5,000 cities and towns

• 4G LTE on 600 MHz now covers 248 million people and 1.5 million square miles

• Currently, more than 33 million 600 MHz compatible devices already on our network

Strong Standalone Outlook for 2020:

• Branded postpaid net additions of 2.6 to 3.6 million

• Net income is not available on a forward-looking basis(2)

• Adjusted EBITDA target of $13.7 to $14.0 billion, which includes leasing revenues of $450 to $550 million

• Cash purchases of property and equipment, including capitalized interest of approximately $400 million, are expected

to be $5.9 to $6.2 billion. Cash purchases of property and equipment, excluding capitalized interest, are expected to

be $5.5 to $5.8 billion

• In Q1 2020, pre-close merger-related costs are expected to be $200 to $300 million before taxes

• Net cash provided by operating activities, excluding payments for merger-related costs and any settlement of interest

rate swaps, is expected to be in the range of $7.9 to $8.5 billion

• Free Cash Flow, excluding payments for merger-related costs and any settlement of interest rate swaps, is expected

to be in the range of $5.4 to $5.8 billion

Total Customers:

• Total net customer additions were 1,863,000 in Q4 2019, compared to 1,747,000 in Q3 2019 and 2,402,000 in Q4 2018. This is the 27th consecutive quarter in which TMobile added more than one million total net customers.

• T-Mobile ended Q4 2019 with 86.0 million total customers, of which 67.9 million were total branded customers.

• For the full-year 2019, total net customer additions were 7,011,000 compared to 7,044,000 in 2018. This was the sixth consecutive year in which total net customer additions exceeded 5 million.

______________________________________________________________

5G NETWORK:

On December 2, 2019, T-Mobile launched America’s first nationwide 5G network, including prepaid 5G with Metro by T-Mobile, covering more than 200 million people and more than 5,000 cities and towns across over 1 million square miles with 5G. In addition, we introduced two new 600 MHz 5G capable superphones, the exclusive OnePlus 7T Pro 5G McLaren and the Samsung Galaxy Note10+ 5G and anticipate offering an industry-leading smartphone portfolio built to work on nationwide 5G in 2020. This 5G network is our foundational layer of 5G coverage on 600 MHz low-band spectrum.

Should we close our merger with Sprint, we will rapidly deploy 5G on Sprint’s 2.5 GHz spectrum, completing the “layer cake” of spectrum and providing consumers with an unmatched 5G experience. On June 28, 2019, T-Mobile introduced its 5G network using high-band millimeter wave (mmWave) spectrum in conjunction with the introduction of our first 5G handset, the Samsung Galaxy S10 5G. The 5G network on mmWave spectrum has been rolled out in parts of seven cities (New York City, Los Angeles, Dallas, Atlanta, Cleveland, Las Vegas and Miami).

600 MHz Spectrum:

- At the end of Q4 2019, T-Mobile owned a nationwide average of 31 MHz of 600 MHz low-band spectrum. In total, T-Mobile owns approximately 41 MHz of low-band spectrum (600 MHz and 700 MHz). The spectrum covers 100% of the U.S.

- As of the end of Q4 2019, T-Mobile had cleared 275 million POPs and expects to clear the remaining 600 MHz spectrum POPs in 2020.

- T-Mobile continues its deployment of LTE on 600 MHz spectrum using 5G-ready equipment. At the end of Q4 2019, we were live with 4G LTE in nearly 8,900 cities and towns in 49 states and Puerto Rico covering 1.5 million square miles and 248 million POPs.

- Combining 600 and 700 MHz spectrum, we have deployed 4G LTE in low-band spectrum to 316 million POPs.

Currently, more than 33 million devices on T-Mobile’s network are compatible with 600 MHz spectrum.

Spectrum Position:

- At the end of Q4 2019, T-Mobile owned an average of 111 MHz of spectrum nationwide, not including mmWave spectrum. The spectrum comprises an average of 31 MHz in the 600 MHz band, 10 MHz in the 700 MHz band, 29 MHz in the 1900 MHz PCS band, and 41 MHz in the AWS band. On June 3, 2019, the FCC announced the results of Auctions 101 (28 GHz spectrum) and 102 (24 GHz spectrum). In the combined auctions, T-Mobile spent $842 million to more than quadruple its nationwide average total mmWave spectrum holdings from 104 MHz to 471 MHz.

- We will evaluate future spectrum purchases in upcoming auctions and in the secondary market to further augment our current spectrum position. We are not aware of any such spectrum purchase options that come close to matching the efficiencies and synergies possible from merging with Sprint.

Network Coverage Growth:

- T-Mobile continues to expand its coverage breadth and covered 327 million people with 4G LTE at the end of Q4 2019.

- At the end of Q4 2019, T-Mobile had equipment deployed on approximately 66,000 macro cell sites and 25,000 small cell/ distributed antenna system sites.

Network Capacity Growth:

- Due to industry spectrum limitations (especially in mid-band), T-Mobile continues to make efforts to expand its capacity and increase the quality of its network through the re-farming of existing spectrum and implementation of new technologies including Voice over LTE (“VoLTE”), Carrier Aggregation, 4×4 multiple-input and multiple-output (“MIMO”), 256 Quadrature Amplitude Modulation (“QAM”) and License Assisted Access (“LAA”).

- VoLTE comprised 90% of total voice calls in Q4 2019, flat with 90% in Q3 2019 and up from 87% in Q4 2018. Carrier aggregation is live for T-Mobile customers in 969 markets, up from 956 markets in Q3 2019 and 923 in Q4 2018.

- 4×4 MIMO is currently available in 708 markets, up from 683 markets in Q3 2019 and 564 in Q4 2018.

- T-Mobile customers have 256 QAM available across the Un-carrier’s entire 4G LTE footprint.

Source: Opensignal USA Mobile Network Experience Report January 2020, based on data collection period from 9/16/2019 to 12/14/2019 - T-Mobile is the first carrier globally to have rolled out the combination of carrier aggregation, 4×4 MIMO and 256 QAM. This trifecta of standards has been rolled out to 701 markets, up from 674 markets in Q3 2019 and 549 markets in Q4 2018.

- LAA has been deployed to 30 cities including Atlanta, Austin, Chicago, Denver, Houston, Las Vegas, Los Angeles, Miami, New Orleans, New York, Philadelphia, Sacramento, San Diego, Seattle, and Washington, DC.

Network Speed:

- Based on data from Opensignal for Q4 2019, T-Mobile’s average download speed was 25.8 Mbps, AT&T at 27.5 Mbps, Verizon at 25.3 Mbps, and Sprint at 23.9 Mbps.

- Based on data from Opensignal for Q4 2019, T-Mobile’s average upload speed was 8.6 Mbps, compared to Verizon at 7.9 Mbps, AT&T at 6.0 Mbps, and Sprint at 2.7 Mbps.

…………………………………………………………………………………………………………………………………………………………………………

References:

https://investor.t-mobile.com/financial-performance/quarterly-results/default.aspx

https://www.youtube.com/watch?v=CHPuI289U-Q&feature=youtu.be