Uncategorized

du (UAE) deploys Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services

Du, the United Arab Emirates Integrated Telecommunications Company (EITC), announced that it has deployed Microchip’s TimeProvider 4100 Grandmaster clock for advanced 5G network services. Du said the deployment, as part of its investment in 5G technology, aims to provide its customers with best-in-class broadband services and network performance.

Microchip’s end-to-end timing solutions generate, distribute and apply precise time for multiple industries, including communications, aerospace and defense, IT infrastructure, financial services, power utilities and more. The company provides a broad range of clock and timing solutions ranging from MEMS oscillators to active hydrogen masers.

Image Credit: Microchip

New ETSI Reports: 1.] Use cases for THz communications & 2.] Frequency bands of interest in the sub-THz and THz range

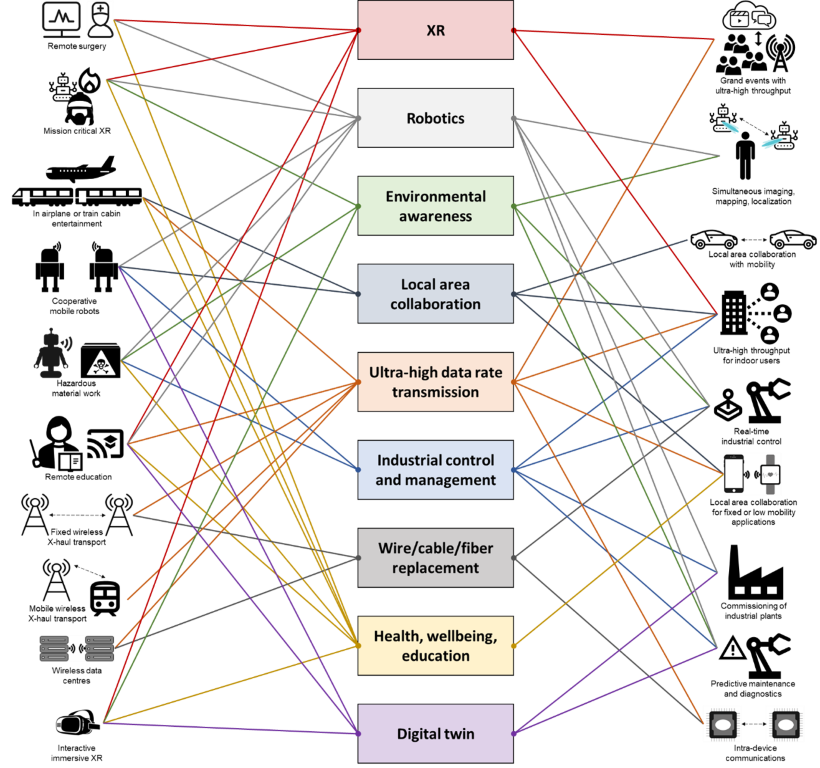

The European Telecommunications Standards Institute (ETSI) released a pair of reports from its relatively new Terahertz Industry Specification Group (ISG THz), created in December 2022. The reports envision how 6G technology might develop and what it will do. Importantly, the reports dive into more than a dozen 6G use cases – from remote surgery to real-time industrial control – as well as the terahertz spectrum bands where that might happen.

“The role of ETSI ISG THz is to develop an environment where various actors from the academia, research centres, industry can share, in a consensus-driven way, their pre-standardization efforts on THz technology resulting from various collaborative research projects and global initiatives, paving the way towards future standardization,” the organization wrote in a press release.

The first Report ETSI GR THz 001 identifies and describes use cases either enabled by or highly benefiting from the use of THz communications. Aspects addressed in the document include deployment scenarios, potential requirements, relevant operational environments and their associated propagation characteristics and/or measurements.

With the large amount of bandwidth available in THz bands, it is possible to achieve extremely high data rates and ease spectrum scarcity problems. Moreover, specific propagation properties of THz signals unlock new features such as accurate sensing and imaging capabilities. The above properties of THz communications open the way to enabling new use cases and could provide an answer to new societal challenges that need to be addressed by the future 6G communications systems. Some of these challenges relate to new functionalities that are not currently supported by cellular systems (e.g. accurate sensing, mapping, and localization), while others relate to new use cases that were not supported by previous communications systems.

The report defines the new use cases that the THz communications and sensing systems can support, along with summarizing the requirements of those use cases. For each identified use case, the report provides description of the deployment scenario, pre‑conditions required for the use case deployment, an example of service flows through a communication system supporting the use case, post-conditions enabled by the use case, identified potential requirements, and description of the physical environment, including propagation aspects, range, and mobility.

“The concept of remote surgery with support of THz communications comes with the promise of allowing people to be treated at anytime and anywhere, so that medical interventions could be done through the use of medical robots remotely controlled by a surgeon (away from the physical location where the actual surgery is performed),” according to the ETSI report.

Figure 1: Use case mapping to application areas

Here’s the full list of 6G use cases in the ETSI report:

-

remote surgery

-

in-airplane or train cabin entertainment

-

cooperative mobile robots

-

hazardous material work

-

remote education

-

fixed point to point wireless applications

-

mobile wireless X-haul transport

-

wireless data centres

-

interactive immersive XR

-

mission critical XR

-

real-time industrial control

-

simultaneous imaging, mapping, and localization

-

commissioning of industrial plants

-

grand events with ultra-high throughput

-

ultra-high throughput for indoor users

-

intra-device communications

-

local area collaboration for fixed or low mobility applications

-

local area collaboration for vehicular applications

-

predictive maintenance and diagnostics

The 75-page report also offers a lengthy look at the kinds of technologies that might be involved in operating 6G networks, including AI, advanced MIMO, Reflective Intelligent Surfaces (RIS) and edge computing.

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

The second Report ETSI GR THz 002 identifies frequency bands of interest in the sub-THz and THz range, describes the current regulatory situation and identifies the incumbent services to be considered for coexistence studies.

Figure 2: Frequency ranges within the THz band with different regulatory status

The frequency range 100 GHz – 10 THz is referred to as the ‘THz range’. The corresponding wavelengths are from 0,03 mm to 3 mm. Below this range, the mm-wave and microwave frequency ranges are found, already heavily utilized for communications and non-communications applications. Above 10 THz the near- and mid-infrared spectrum starts.

The interest for higher frequency bands increases with the increasing demand for higher bandwidths and lower latencies to serve critical applications. This is most pronounced in the research towards 6G technologies, which are expected to be ready for early deployments around 2030. The frequency ranges from 100 GHz and upwards is already utilized for non‑communications purposes, and therefore there is a need to understand the regulatory landscape and identify the most interesting frequency bands for THz communications.

“Between 100 GHz and 275 GHz, 8 bands with sufficient contiguous bandwidths are allocated to fixed and mobile services on a co-primary basis,” according to the report. “Above 275 GHz, interesting bands have been identified for THz communications purposes based on a combination of regulatory status and favourable propagation conditions.”

To be clear, most 5G vendors don’t expect 6G to run primarily in those terahertz spectrum bands. Companies like Ericsson and Nokia have said 6G will mainly run in the so-called “centimetric” spectrum bands that sit between 7GHz and 20GHz

Webinar:

Another way of discovering more about those two deliverables will be webinar scheduled for 11 April 2024, 15h CEST:

https://www.etsi.org/events/upcoming-events/2338-webinar-use-cases-and-spectrum-key-starting-points-for-terahertz-standards.

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 900 member organizations worldwide, drawn from 64 countries and five continents. The members comprise a diversified pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standards Organization (ESO). For more information, please visit https://www.etsi.org/

References:

https://www.etsi.org/deliver/etsi_gr/THz/001_099/001/01.01.01_60/gr_THz001v010101p.pdf

https://www.etsi.org/deliver/etsi_gr/THz/001_099/002/01.01.01_60/gr_THz002v010101p.pdf

https://www.lightreading.com/6g/etsi-s-new-6g-report-dives-into-thz-use-cases

mmWave Coalition on the need for very high frequency spectrum; DSA on dynamic spectrum sharing in response to NSF RFI

New ITU report in progress: Technical feasibility of IMT in bands above 100 GHz (92 GHz and 400 GHz)

ITU-R Report in Progress: Use of IMT (likely 5G and 6G) above 100 GHz (even >800 GHz)

Keysight and partners make UK’s first 100 Gbps “6G” Sub-THz connection

ETSI Integrated Sensing and Communications ISG targets 6G

ETSI NFV evolution, containers, kubernetes, and cloud-native virtualization initiatives

ETSI Experiential Networked Intelligence – Release 2 Explained

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

ETSI MEC Standard Explained – Part II

ITU Journal: NexGen Computer Communications & Networks

These solutions can include network optimization, effective data management, cognitive computing, block-chain solutions, and unconventional hardware and software design and implementation.

-

Network optimization:This can involve using techniques such as traffic engineering, load balancing, and caching to improve the performance of networks.

-

Effective data management:This can involve using techniques such as data compression, data encryption, and data analytics to improve the efficiency and security of data storage and transmission.

-

Cognitive computing:This can involve using techniques such as machine learning and artificial intelligence to improve the ability of networks to learn from data and make decisions autonomously.

-

Block-chain solutions:This can involve using techniques such as distributed ledgers and smart contracts to improve the security and transparency of networks.

-

Unconventional hardware and software design and implementation:This can involve using techniques such as open source software, software-defined networking, and network function virtualization to improve the flexibility and scalability of networks.

| Issue 1 – Editorial Volume 5 (2024), Issue 1 Enhancing user experience in home networks with machine learning-based classification Adaptive HELLO protocol for vehicular networks On the extraction of RF fingerprints from LSTM hidden-state values for robust open-set detection Unsupervised representation learning for BGP anomaly detection using graph auto-encoders A framework for automating environmental vulnerability analysis of network services Automated Wi-Fi intrusion detection tool on 802.11 networks Optimizing IoT security via TPM integration: An energy efficiency case study for node authentication |

5G Open Innovation Lab: update & progress report

The 5G Open Innovation (OI) Lab is a collaborative, development-focused ecosystem approach unlike traditional models, bringing together visionary startups, industry leaders, technical experts, and investors to break down silos that hamper innovation and build what’s next.

Intel was the 5G OI Lab’s first signed partner, followed by T-Mobile US. The list now includes 17 partners from AT&T, Comcast (who replaced T-Mobile US as founding partners), Accenture, Nokia, Microsoft, Dell Technologies, Palo Alto Networks, Spirent Communications and more.

Jim Brisimitzis – Founder & General Partner, 5G OI Lab:

“The opportunity for developers to impact the potential of edge and 5G is fundamentally bigger than connectivity. To realize this potential, we need a bold approach to experimenting, learning, and unleashing the transformational impact software is capable of. People like to refer to us as a startup accelerator, because on the surface it looks like that. But we’re really not.” He prefers the moniker “innovation broker.”

The lab team scouts for intriguing new technologies in enterprise, networking, applications, big data, AI, security and so on that present intriguing technology with market potential, and participating classes are selected by the lab’s partners (including CSPs), based on their priorities.

5G OI Lab now includes more than 118 multi-stage enterprise startups who have collectively raised more than $2 billion in venture capital. A few of the success stories:

- Private network software specialist Expeto, which worked with Dell, Rogers and Ericsson on a private 5G network that operates in a Canadian gold mine.

- Network observability start-up MantisNet partnered with Palo Alto Networks on a joint effort to work around quirks of how mobile networks are architected in order to identify mobile devices and implement security policies.

- Canadian start-up DarwinAI, recently acquired by Apple is moving ahead with a generative AI initiative later this year.

5G OI Lab has built 5G private networks that are used as testbeds for use cases that could serve particular industries well. The most recently announced is at the Tacoma Tideflats port area, and it supports five enterprise with use cases ranging from worker safety and worker communications such as push-to-talk capabilities to streaming surveillance video, to better supply chain visibility through faster data offloading via ship-to-shore connectivity; companies involved include Comcast, Dell Technologies, VMware by Broadcom, Intel, Expeto, Ericsson and others.

Brisimitzis comments: “What we have seen is that these internally run accelerators or labs—no offense to anyone—they end up being internal navel-gazing, because they are just about that company, and therefore the conversation is just about that company,” he explains. “Well, as large as Microsoft is, or Amazon, or AT&T, they’re part of a bigger ecosystem. And enterprises don’t buy from just one company, they buy from ecosystems.”

5G OI Lab endeavors to be part of an ecosystem that works together to bring new solutions from the lab to the field to the market.

Author’s Note:

The IEEE 5G/6G Innovation Testbed is a cloud-based, end-to-end 5G network emulator that enables testing and experimentation of 5G products and services. Secure, easily-accessible and “always on,” this platform brings 5G network testing and development to your fingertips and paves the way for speedier and smoother real world deployments.

References:

5G Open Innovation Lab: Relationships, resources and the road to innovation

Another 5G Open Innovation Lab: AT&T, Comcast, Nokia, Intel, Microsoft, Dell assist 118 startups in search of 5G Killer Apps

IBM: 5G use cases that are transforming the world (really ?)

NGMN issues ITU-R framework for IMT-2030 vs ITU-R WP5D Timeline for RIT/SRIT Standardization

The NGMN Alliance has issued the “ITU-R Framework for IMT-2030: Review and Future Direction.” In this essential publication, NGMN welcomes the recent ITU-R report on the ‘Framework and overall objectives of the future development of IMT for 2030 and beyond.’ This ITU-R report ( Recommendation ITU-R M. 2160) sets an important framework for future technology discussions towards 6G.

“Our publication underlines the importance of investment confidence for operators in order to deliver tangible value to customers while ensuring the commercial sustainability of current and future networks,” said Luke Ibbetson, Member of the NGMN Alliance Board and Head of Group R&D at Vodafone. “The capabilities identified for IMT-2030 should be able to be deployed as and when required, without compromising existing core connectivity services, and reflect a customer need that generates new value.”

There is close alignment between NGMN’s vision for 6G and the IMT-2030 framework. This close alignment covers vision, usage scenarios and essential capabilities, particularly related to practical and sustainable deployment and emphasizing harmonised global standards for mobile networks. NGMN goes on to provide recommendations and guidance on ITU-R aspects as it moves forward in the next stage of the IMT-2030 process, including:

- New features should be able to be deployed as and when required, without compromising existing core connectivity services, which reflect customer needs and generate new values.

- Evaluation should include interworking of IMT-2030 candidates with non-IMT systems.

- Reinforcement of the importance of global standards for mobile networks within industry consensus-based standards organisations (e.g., 3GPP).

- Consideration that advanced features introduced with the IMT-2020 network and/or a new radio interface might be candidates for IMT-2030.

- Any new radio interface must demonstrate significant benefits over and above IMT-2020 in key metrics such as spectral and/or energy efficiency, overall energy consumption reduction and/or cost advantages.

- Further work would be beneficial, as input to the process and next steps, to understand the commercial imperative for any extreme requirements of IMT-2030.

- IMT-2030 should continue to evolve based on IP communications, considering cloud native solutions, disaggregation, and service-based architecture, ensuring both forward and backward compatibility. Support for self-organisation to manage complexity and emerging capabilities.

“This publication provides a realistic evaluation of IMT-2030 technologies”, said Michael Irizarry, Member of the NGMN Alliance Board and Executive Vice President and Chief Technology Officer, Engineering and Information Technology, UScellular. “For a new IMT-2030 radio technology to become widely adopted for 6G, it must demonstrate significant benefits across key metrics such as energy efficiency, traffic capacity and cost reduction”.

“We at NGMN look forward to collaborative efforts with the ITU-R and subsequent phases of activity to shape the future of IMT-2030,” said Madam Yuhong Huang, Member of the NGMN Alliance Board and General Manager China Mobile Research Institute. She added, “We hope the industry will prioritize the development needs outlined by NGMN on behalf of its operator members and actively participate in 6G research, contributing novel technologies, unlocking innovative business opportunities, and enabling the sustainable development of the society for the benefit of our customers.”

Following the NGMN publications “6G Position Statement, an Operator View”, “6G Use Cases and Analysis”, “6G Drivers and Vision” and “6G Requirements and Design Considerations”, this latest publication “Analysis of ITU-R Framework for IMT-2030” marks the next step towards guidance for E2E requirements for 6G.

The publication can be downloaded here.

About NGMN Alliance:

The NGMN Alliance (NGMN) is a forum founded by world-leading Mobile Network Operators and open to all Partners in the mobile industry. Its goal is to ensure that next generation network infrastructure, service platforms and devices will meet the requirements of operators and ultimately will satisfy end user demand and expectations. The vision of NGMN is to provide impactful industry guidance to achieve innovative, sustainable and affordable mobile telecommunication services for the end user with a particular focus on Mastering the Route to Disaggregation / Operating Disaggregated Networks, Green Future Networks and 6G, whilst continuing to support 5G’s full implementation.

NGMN seeks to incorporate the views of all interested stakeholders in the telecommunications industry and is open to three categories of participants/NGMN Partners: Mobile Network Operators (Members), vendors, software companies and other industry players (Contributors), as well as research institutes (Advisors).

Collaboration is key to driving the industry’s most important subjects such as NGMN’s Strategic Focus Topics: Mastering the Route to Disaggregation, Green Future Networks and 6G. NGMN invites all parties across the entire value chain to join the Alliance in these important endeavors.

…………………………………………………………………………………………………………….

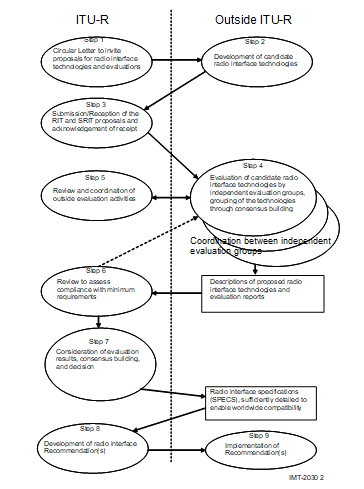

At its February 2024 meeting, ITU-R WP 5D produced a working document on the IMT-2030 process for standardization. The document describes the process and activities identified for the development of the IMT‑2030 terrestrial components radio interface Recommendations.

The time schedule for candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies is as follows:

Submission of proposals may begin at 54th meeting of Working Party (WP) 5D (currently planned to be 10-17 February 2027) and contribution to the meeting needs to be submitted by 1600 hours UTC, 12 calendar days prior to the start of the meeting.

The final deadline for submissions is 1600 hours Coordinated Universal Time (UTC), 12 calendar days prior to the start of the 59th meeting of WP 5D in February 2029. The evaluation of the proposed RITs and SRITs by the independent evaluation groups and the consensus-building process will be performed throughout this time period and thereafter.

…………………………………………………………………………………………………………………..

Editor’s Note: Don’t expect ITU-R M.[IMT-2030.SPECS] recommendation to be approved before sometime in 2031. The detailed specifications of each of IMT-2030 technology is scheduled for completion at ITU-R WP5D meeting #63 in June 2030. Draft revisions/spec updates are scheduled to be completed at 5D meeting #64 in October 2030.

Just as with 5G/IMT-2020, IMT-2030.SPECS will only cover the 6G RIT/SRIT (radio interfaces). 3GPP will do all the work on the 6G non-radio/systems aspects.

……………………………………………………………………………………………………………………

The seven steps in the IMT-2030 standardization process is shown in this Figure:

References:

NGMN publishes ITU-R Framework for IMT-2030: Review and Future Direction

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

Draft new ITU-R recommendation (not yet approved): M.[IMT.FRAMEWORK FOR 2030 AND BEYOND]

IEEE 5G/6G Innovation Testbed for developers, researchers and entrepreneurs

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

IMT-2030 Technical Performance Requirements (TPR) from ITU-R WP5D

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

IMT Vision – Framework and overall objectives of the future development of IMT for 2030 and beyond

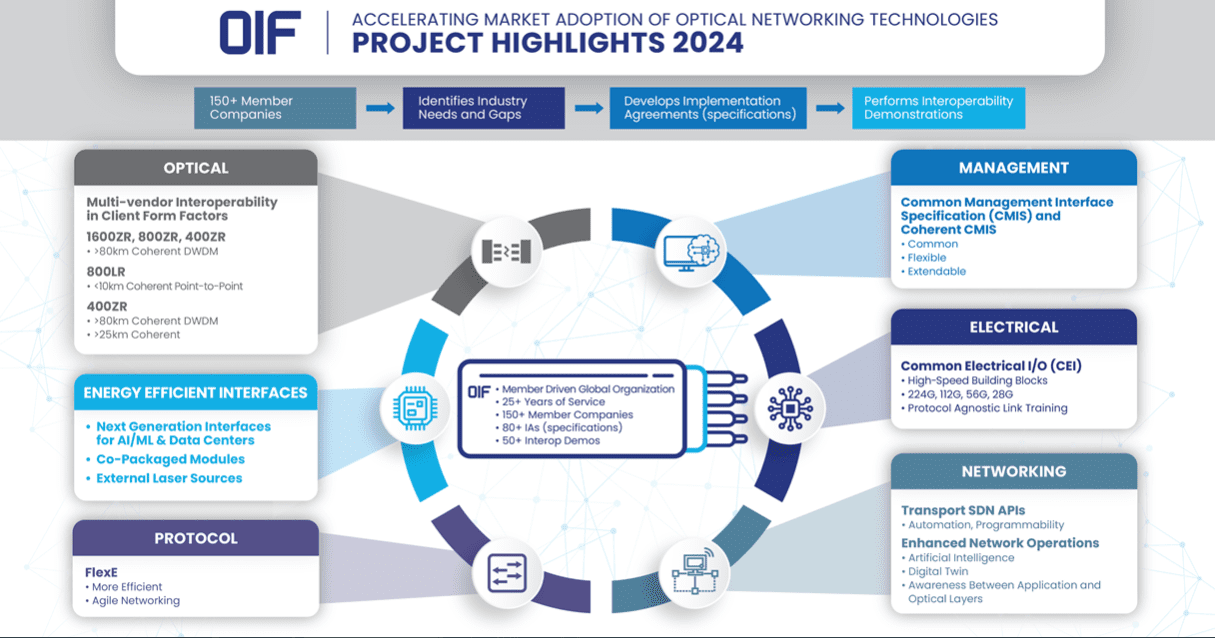

OIF Project Highlights: Interoperable 1600ZR+ & Retimed Tx Linear Rx Specs Energy Efficient Interfaces; Common Management Interface Specification (CMIS) Whitepaper

The Optical Internetworking Forum (OIF) concluded its Q1 2024 Technical and MA&E meeting in Jacksonville, Florida held January 16-18. The meeting resulted in the initiation of two new projects – the Interoperable 1600ZR+ and Retimed Tx Linear Rx Specs Energy Efficient Interfaces (EEI). Also, the reelection of the Physical and Link Layer (PLL) Working Group (WG) Chair and a white paper focused on advancing plug and play for Common Management Interface Specification (CMIS) modules. Andrew Schmitt, Cignal AI was a guest speaker.

“OIF’s quarterly membership meetings serve as a vital nexus for industry leaders to converge, collaborate and propel the field forward,” said Nathan Tracy, OIF President and TE Connectivity.

“These meetings are invaluable platforms for members to share insights, discuss and debate ongoing work and launch new projects. The synergy of minds and the shared commitment to innovation in these meetings not only ensures the timely execution of current initiatives but also lays the groundwork for solutions that have a tangible impact on the market now and in the years to come. It is through this collaborative spirit that OIF continues to be a driving force in advancing optical networking standards and technologies, fostering a community that thrives on the exchange of ideas and the collective pursuit of excellence.”

NEW PROJECTS:

Interoperable 1600ZR+:

The new OIF Interoperable 1600ZR+ project complements the 1600ZR project unveiled last September (2023). Responding to market demand for higher-performance (ZR+) modes, OIF is working towards integrating these modes into its application scope for 1600 Gb/s interfaces.

“OIF recognizes the importance of consolidated requirements in the ZR/ZR+ space to streamline development costs and enhance industry collaboration,” said Karl Gass, OIF PLL WG – Optical Vice Chair. “This project reinforces OIF’s role as the forum for coherent line interface discussions and demonstrates leadership by facilitating the evolution of next-generation technologies.”

Retimed Tx Linear Rx Specs EEI Project:

OIF has launched the Retimed Tx Linear Rx Specs EEI project, focusing on developing specifications for Retimed Tx Linear Rx (RTxLRx). The initial applications target Ethernet and Artificial Intelligence/Machine Learning (AI/ML), operating at 200G/lane over 500m single mode fiber (SMF) and 100G/lane over 30m multimode fiber (MMF), with potential for alternate applications. The project aims for full plug and play functionality in both electrical and optical domains, meeting the industry demand for power and latency savings. RTxLRx addresses constraints found in Linear Pluggable Optics (LPO) and provides flexibility, making it a candidate when LPO is not suitable.

“Embracing innovation, OIF maintains its pathfinder role in shaping new optical interface approaches,” said Jeff Hutchins, OIF Board Member and PLL WG – EEI Vice Chair and Ranovus. “Building upon the foundation laid by the ongoing work in the OIF PLL, our commitment extends to expanding the scope, diversity and standards of optical interfaces specified by OIF, ushering in a new era of connectivity and possibilities.”

White Paper: Path to CMIS Plug and Play:

In response to key challenges identified by members, OIF unveiled a white paper project on advancing plug and play for CMIS-managed modules. Feedback has emphasized difficulties in consistently managing modules from different vendors and the need for extensive host development with new module introductions. This white paper will provide practical recommendations to enhance plug and play. It focuses on creating guidelines that empower hosts to manage third-party modules effectively, with the goal of enabling seamless integration of new or unknown modules without requiring host software changes. The proposed guidelines will prioritize simplifying provisioning processes and improving module-to-host integration for enhanced efficiency in optical networking.

“This white paper will enhance the transformative power of CMIS, unveiling its capacity to revolutionize network management and interoperability,” said Ian Alderdice, OIF PLL Working Group – Management Co-Vice Chair and Ciena. “By providing valuable insights, it becomes a beacon guiding the evolution of optical networking standards, paving the way for a future where efficiency and seamless integration define the technological landscape.”

PLL WG Chair: OIF announced the reelection of David Stauffer, Kandou Bus, as PLL WG Chair.

Special Guest Speaker: Andrew Schmitt, Cignal AI:

The Q1 meeting featured guest speaker, Andrew Schmitt from Cignal AI, who shared valuable insights into the latest trends and developments in the optical networking industry. His presentation provided attendees with a comprehensive understanding of the current landscape and future possibilities within the field.

“OIF is an excellent forum for establishing standards on rapidly emerging technologies, and it is well-positioned to tackle the tough problems network operators and their suppliers face,” said Schmitt. “This meeting’s kick off of the 1600ZR+ process – a third generation follow up to the hugely successful 400ZR project – marks a major milestone for the industry. Further increasing the ease of deployment for 400ZR technology via CMIS is also a very valuable endeavor. I’m excited about these OIF initiatives and very pleased to offer Cignal AI’s current perspective on the market to such a capable and effective audience.”

………………………………………………………………………………………………………………..

OIF experts will provide valuable insights into the latest trends and developments in power consumption in optical AI networking and 224 Gbps Common Electrical I/O (CEI) at DesignCon 2024, taking place from January 30 to February 1, 2024, in Santa Clara, California.

About OIF:

OIF is where the optical networking industry’s interoperability work gets done. With more than 25 years of effecting forward change in the industry, OIF represents the dynamic ecosystem of 150+ industry leading network operators, system vendors, component vendors and test equipment vendors collaborating to develop interoperable electrical, optical and control solutions that directly impact the industry’s ecosystem and facilitate global connectivity in the open network world.

Editor’s Note:

This author participated in OIF meetings from its Sept 1998 inception till June 2003. Representing Ciena and NEC, he generated and presented contributions on the optical control plane (aka G.ASON and GMPLS) for SONET/SDH and the OTN.

Connect with OIF on LinkedIn, on X at @OIForum, at http://www.oiforum.com.

References:

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

Summit Communications selects Juniper Network’s PTX Series Routers for 400G Converged Optical Network in Bangladesh

Summit Communications, a leading end-to-end infrastructure service provider in Bangladesh has selected Juniper Network’s PTX Series Routers for 400G Converged Optical Routing solution upgrades to serve as the foundation of Summit’s core network. This will enable seamless network capacity expansion and efficient delivery of enhanced connectivity over hundreds of kilometers to various points of presence (PoPs) across the country.

Over the past decade, Bangladesh has undergone significant digitization and is now home to an emerging digital economy with over 66.94 million internet users. To accelerate this transformation further, the country’s Government has announced its vision of “Digital Bangladesh,” aimed at establishing a robust foundation for its digital economy. In support of this vision, Summit Communications has been instrumental in shaping the country’s networking landscape, notably constructing the largest fiber optic network infrastructure in the country.

With demand for mobile, internet and digital services continuing to soar, Summit Communications recognized the need to pioneer the adoption of innovative networking solutions to meet current and future connectivity demands. Building on a long-term relationship spanning over a decade, Summit partnered with Juniper for the next phase of their network transformation journey into 400G.

To enable a seamless transition to a Converged Optical Routing Architecture while improving its core network’s scalability, capacity and power efficiency, Summit Communications selected Juniper’s PTX10000 Series Packet Transport Routers. Equipped with 400G Coherent Optics, these routers will enable Summit’s network to achieve high-speed data transmission over long distances to its PoPs in Bangladesh while maintaining high reliability.

As Summit Communications progresses through its networking transformation journey with Juniper’s solutions, it will be in a strong position to meet its customers’ requirements, offering a superior end-user experience and top-tier performance in Bangladesh’s rapidly expanding digital economy.

Supporting Quotes:

“We have made tremendous progress over the years in delivering the high-quality networking infrastructure services to mobile operators and ISP customers in Bangladesh and are excited to strengthen our relationship with Juniper, particularly in integrating innovative 5G solutions. Their solutions will continue to play an integral role in our network, ensuring that we provide cutting-edge 5G connectivity and services for our customers guaranteeing fast, reliable, ultra-low latency services along with adaptation of network slicing and segment routing. Through our partnership, we look forward to supporting our country’s Digital Bangladesh vision.” – Arif Al Islam, Managing Director & Chief Executive Officer, Summit Communications Ltd.

“At Summit, one of our key goals is to lead the way in network innovation. Juniper’s 400G solutions will empower us to establish a more robust foundation, delivering the performance, scalability and operational efficiencies essential to our network. We are confident that a Juniper-powered network will enable us to continue providing best-in-class services that connect Bangladesh with the world, as well as contributing to the development of a digitally inclusive society in which everyone has access to cutting-edge services.” – Md. Farrukh Imtiaz, Chief Network Architect, Summit Communications Ltd.

“For years, Juniper has been a foundational presence in Bangladesh’s networking landscape through our partnership with Summit Communications, and we are honored to join them on the next phase of their network transformation journey. With our experience-first solutions, we remain committed to providing the technology needed to support their goals and meet the ever-evolving connectivity demands of businesses and consumers for years to come.” – Sajan Paul, Managing Director & Country Manager, India & SAARC, Juniper Networks

Additional Resources:

- Product & Solution Pages:

- Follow Juniper Networks online: Facebook | Twitter | LinkedIn

- Juniper Blogs and Community: J-Net

About Juniper Networks:

Juniper Networks is dedicated to dramatically simplifying network operations and driving superior experiences for end users. Our solutions deliver industry-leading insight, automation, security and AI to drive real business results. We believe that powering connections will bring us closer together while empowering us all to solve the world’s greatest challenges of well-being, sustainability and equality. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter, LinkedIn and Facebook.

Juniper Networks, the Juniper Networks logo, Juniper, Junos, and other trademarks listed here are registered trademarks of Juniper Networks, Inc. and/or its affiliates in the United States and other countries. Other names may be trademarks of their respective owners.

References:

Granite Telecommunications expands its service offerings with Juniper Networks

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Synopsys and Juniper Networks form new company to pursue “open” silicon photonics platform

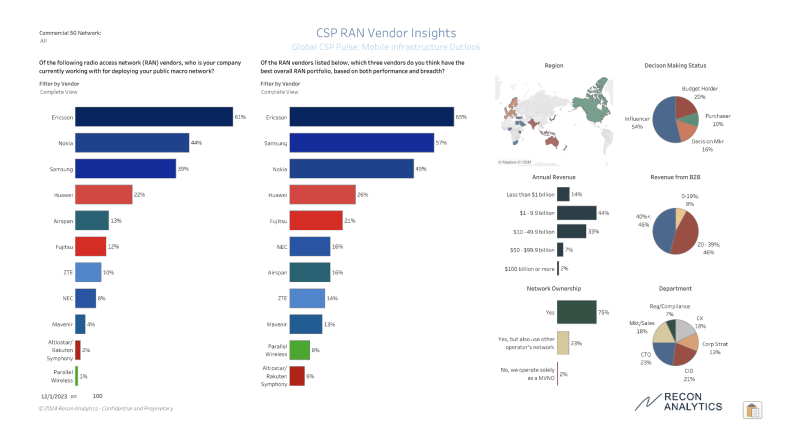

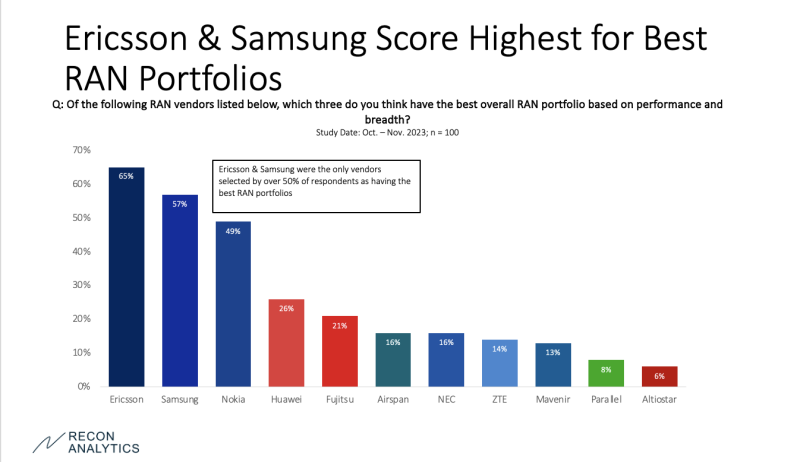

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

A Recon Analytics on-line survey results show that Ericsson, Nokia and Samsung are the top RAN vendors not including China. When the same global operators were asked which vendor had the best overall radio access network (RAN) portfolios, over 50% of respondents named Ericsson and Samsung as the top two. One would’ve expected Nokia to be #2, but the Finland based vendor ended 2023 on a negative trajectory when AT&T announced that it would work with Ericsson to deploy Open RAN equipment in its 5G network and exclude Nokia.

The survey was conducted in October and November, 2023 with 100 global network operators. Each respondent worked at a service provider that sells mobile services. Only one response per operator per country was allowed. Although a multinational operator like Orange France and Orange Belgium would count as two separate responses.

All respondents were required to have one of the following roles when it came to selecting network partners – influencer, budget holder, decision maker or purchaser.

Recon Analytics estimates there are only about 710 live commercial mobile networks in the world. The 100 network operators captured in its survey, represent the meaningful part of the world, according to Roger Entner, founder of Recon Analytics. However, the relatively low sample size results in a margin of error of 9.8%. Entner had earlier opined that “FWA was the 5G killer application.” That despite it is a wireles network configuration – not an application – and it is not one of the ITU-R use cases for 5G (aka IMT 2020).

Communication Service Provider RAN Vendor Insights:

When survey respondents were asked which vendors have the best overall RAN portfolio, they named Ericsson, Samsung and Nokia, in that order.

“Ericsson, with the overall highest level of positive responses for being a top three vendor, positions the company well for the future,” said Daryl Schoolar, analyst with Recon Analytics.

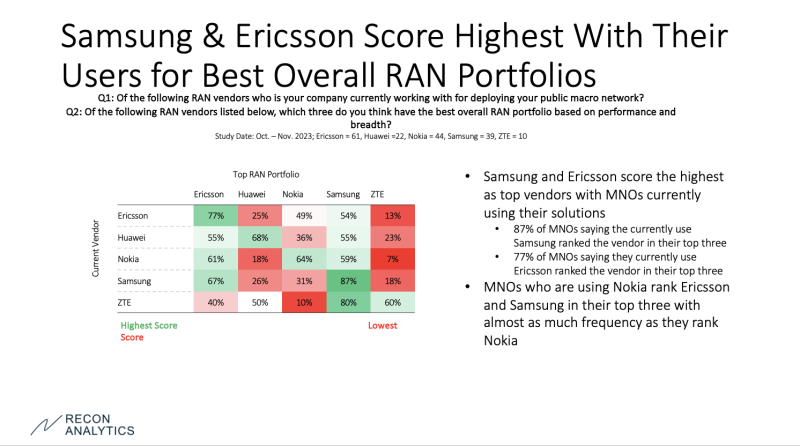

Of respondents who said they were currently using Ericsson equipment, 77% said Ericsson had one of the three best portfolios, followed by Samsung at 54%, and Nokia at 49%. 87% of respondents who say they are using Samsung gear list the Japan based vendor as having a top three portfolio.

“While Ericsson’s users don’t list it in their top three at the same frequency as Samsung, 77% is a strong showing and bodes well for its future,” said Schoolar. “Nokia has reason to be concerned as well. While its current users did select it in top three most often among the five vendors shown here, there was little separation between Nokia versus Ericsson and Samsung,” he added.

Meanwhile, Fujitsu and Mavenir (Open RAN only vendor) also scored well as vendors that operators are interested in for the future. Samsung’s top three status is 18 percentage points over its currently used status; Fujitsu’s top three status is 9 percentage points over currently used; and Mavenir’s top three status is 9 percentage points over currently used.

References:

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

LightCounting: Open RAN/vRAN market is pausing and regrouping

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT’s Q1-2024 Public safety LTE/5G report is a significant update from previous versions. The “Public Safety LTE & 5G Market: 2023 – 2030” report features a database of over 1,300 global public safety LTE/5G engagements – as of Q1’2024, in addition to detailed market analysis and forecasts for public safety broadband infrastructure, devices, applications and connectivity services.

Along with other unique content, the report covers a comprehensive review of public safety LTE/5G engagements across 86 countries, detailed case studies of 18 nationwide public safety broadband projects and additional case studies of 50 dedicated, hybrid, secure MVNO/MOCN and commercial operator-supplied systems, public safety spectrum allocation and usage, 3GPP standardization and commercial availability of critical communications-related features, analysis of public safety broadband application scenarios, practical examples of 5G era use cases, ongoing deployments of 3GPP standards-compliant MCX services and interworking functionality for LMR-broadband interoperability, recent advances in 5G NR sidelink-based device-to-device communications capabilities and other trends such as the emergence of portable 5G networks and 5G network slicing services (which require a 5G SA core network) for first responder agencies.

Report Summary:

With the commercial availability of 3GPP-specification compliant MCX (Mission-Critical PTT, Video & Data), HPUE (High-Power User Equipment), IOPS (Isolated Operation for Public Safety) and other critical communications features, LTE and 5G NR (New Radio) networks are increasingly gaining recognition as an all-inclusive public safety communications platform for the delivery of real-time video, high-resolution imagery, multimedia messaging, mobile office/field data applications, location services and mapping, situational awareness, unmanned asset control and other broadband capabilities, as well as MCPTT (Mission-Critical PTT) voice and narrowband data services provided by traditional LMR (Land Mobile Radio) systems. Through ongoing refinements of additional standards – specifically 5G MBS/5MBS (5G Multicast-Broadcast Services), 5G NR sidelink for off-network D2D (Device-to-Device) communications, NTN (Non-Terrestrial Network) integration, and support for lower 5G NR bandwidths – 3GPP networks are eventually expected to be in a position to fully replace legacy LMR systems by the late 2020s. National public safety communications authorities in multiple countries have already expressed a willingness to complete their planned narrowband to broadband transitions within the second half of the 2020 decade.

A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN-based public safety LTE and 5G-ready networks are operational or in the process of being rolled out throughout the globe. The high-profile FirstNet (First Responder Network) and South Korea’s Safe-Net (National Disaster Safety Communications Network) nationwide public safety broadband networks have been successfully implemented. Although Britain’s ESN (Emergency Services Network) project has been hampered by a series of delays, many other national-level programs have made considerable headway in moving from field trials to wider scale deployments – most notably, New Zealand’s NGCC (Next-Generation Critical Communications) public safety network, France’s RRF (Radio Network of the Future), Italy’s public safety LTE service, Spain’s SIRDEE mission-critical broadband network, Finland’s VIRVE 2.0 broadband service, Sweden’s Rakel G2 secure broadband system and Hungary’s EDR 2.0/3.0 broadband network. Nationwide initiatives in the pre-operational phase include but are not limited to Switzerland’s MSK (Secure Mobile Broadband Communications) system, Norway’s Nytt Nødnett, Germany’s planned hybrid broadband network for BOS (German Public Safety Organizations), Netherlands’ NOOVA (National Public Order & Security Architecture) program, Japan’s PS-LTE (Public Safety LTE) project, Australia’s PSMB (Public Safety Mobile Broadband) program and Canada’s national PSBN (Public Safety Broadband Network) initiative.

Other operational and planned deployments range from the Halton-Peel region PSBN in Canada’s Ontario province, New South Wales’ state-based PSMB solution, China’s city and district-wide Band 45 (1.4 GHz) LTE networks for police forces, Hong Kong’s 700 MHz mission-critical broadband network, Royal Thai Police’s Band 26 (800 MHz) LTE network, Qatar MOI (Ministry of Interior), ROP (Royal Oman Police), Abu Dhabi Police and Nedaa’s mission-critical LTE networks in the oil-rich GCC (Gulf Cooperation Council) region, Brazil’s state-wide LTE networks for both civil and military police agencies, Barbados’ Band 14 (700 MHz) LTE-based connectivity service platform, Zambia’s 400 MHz broadband trunking system and Mauritania’s public safety LTE network for urban security in Nouakchott to local and regional-level private LTE networks for first responders in markets as diverse as Laos, Indonesia, the Philippines, Pakistan, Lebanon, Egypt, Kenya, Ghana, Cote D’Ivoire, Cameroon, Mali, Madagascar, Mauritius, Canary Islands, Spain, Turkey, Serbia, Argentina, Colombia, Venezuela, Bolivia, Ecuador and Trinidad & Tobago, as well as multi-domain critical communications broadband networks such as MRC’s (Mobile Radio Center) LTE-based advanced MCA digital radio system in Japan, and secure MVNO platforms in Mexico, Belgium, Netherlands, Slovenia, Estonia and several other countries.

Even though critical public safety-related 5G NR capabilities defined in the 3GPP’s Release 17 and 18 specifications are yet to be commercialized, public safety agencies have already begun experimenting with 5G for applications that can benefit from the technology’s high-bandwidth and low-latency characteristics. For example, the Lishui Municipal Emergency Management Bureau is using private 5G slicing over China Mobile’s network, portable cell sites and rapidly deployable communications vehicles as part of a disaster management and visualization system.

In neighboring Taiwan, the Kaohsiung City Police Department relies on end-to-end network slicing over a standalone 5G network to support license plate recognition and other use cases requiring the real-time transmission of high-resolution images. The Hsinchu City Fire Department’s emergency response vehicle can be rapidly deployed to disaster zones to establish high-bandwidth, low-latency emergency communications using a satellite-backhauled private 5G network based on Open RAN standards. The Norwegian Air Ambulance is adopting a similar private 5G-based NOW (Network-on-Wheels) system for enhancing situational awareness during search and rescue operations.

In addition, first responder agencies in Germany, Japan and several other markets are beginning to utilize mid-band and mmWave (Millimeter Wave) spectrum available for local area licensing to deploy portable and small-scale 5G NPNs (Non-Public Networks) to support applications such as UHD (Ultra-High Definition) video surveillance, control of unmanned firefighting vehicles, reconnaissance robots and drones. In the near future, we also expect to see rollouts of localized 5G NR systems – including direct mode communications – for incident scene management and related use cases, potentially using up to 50 MHz of Band n79 spectrum in the 4.9 GHz frequency range (4,940-4,990 MHz), which has been designated for public safety use in multiple countries including but not limited to the United States, Canada, Australia, Malaysia and Qatar.

SNS Telecom & IT estimates that annual investments in public safety LTE/5G infrastructure and devices reached $4.3 Billion in 2023, driven by both new projects and the expansion of existing dedicated, hybrid government-commercial and secure MVNO/MOCN networks. Complemented by an expanding ecosystem of public safety-grade LTE/5G devices, the market will further grow at a CAGR of approximately 10% over the next three years, eventually accounting for more than $5.7 Billion by the end of 2026. Despite the positive outlook, some significant challenges continue to plague the market. The most noticeable pain point is the lack of a D2D communications capability.

The ProSe (Proximity Services) chipset ecosystem failed to materialize in the LTE era due to limited support from chipmakers and terminal OEMs. However, the 5G NR sidelink interface offers a clean slate opportunity to introduce direct mode D2D communications for public safety broadband users, as well as coverage expansion in both on-network and off-network scenarios using UE-to-network and UE-to-UE relays respectively. Recent demonstrations of 5G NR sidelink-enabled MCX services by the likes of Qualcomm have generated renewed confidence in 3GPP technology for direct mode communications.

Until recently, another barrier impeding the market was the non-availability of cost-optimized RAN equipment and terminals that support operation in spectrum reserved for PPDR (Public Protection & Disaster Relief) communications – most notably Band 68 (698-703 / 753-758 MHz), which has been allocated for PPDR broadband systems in several national markets across Europe, including France, Germany, Switzerland, Austria, Spain, Italy, Estonia, Bulgaria and Cyprus. Other countries such as Greece, Hungary, Romania, Sweden, Denmark, Netherlands and Belgium are also expected to make this assignment. Since the beginning of 2023, multiple suppliers – including Ericsson, Nokia, Teltronic and CROSSCALL – have introduced support for Band 68.

The “Public Safety LTE & 5G Market: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the public safety LTE and 5G market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational models, application scenarios, key trends, future roadmap, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2023 to 2030, covering public safety LTE/5G infrastructure, terminal equipment, applications, systems integration and management solutions, as well as subscriptions and service revenue.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a list and associated details of over 1,300 global public safety LTE/5G engagements – as of Q1’2024.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.snstelecom.com/public-safety-lte

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Daryl Schoolar: 5G mmWave still in the doldrums!

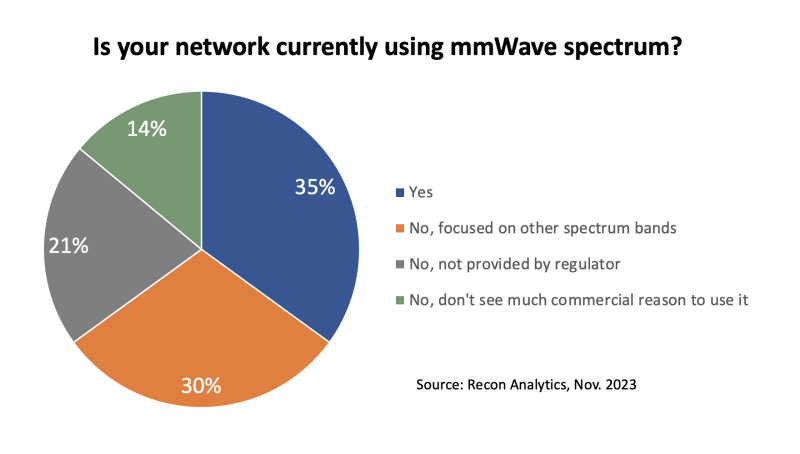

In November Recon Analytics completed a survey of 100 communication service providers (CSP) as part of its “Global Communication Service Provider Pulse” research practice. The survey included questions around the current state of their 5G networks, and their thoughts on 5G Advanced and 6G. Three of those questions are as follows:

- What has been the biggest benefit of deploying 5G?

- In the next phase of 5G’s development, also known as 5G-Advanced, several technological enhancements are under study or being developed. From the list below, which three possible 5G-Advanced technology areas do you think are the most important?

- What are the most important technology areas that you think 6G should focus on?

The most common answers to all three of those questions had to do with increasing network capacity and gaining access to new spectrum. And this is where having lots of water but nothing to drink comes into play. There are mobile operators today who already have large swaths of fallow spectrum in the form of mmWave.

mmWave [1.] provides mobile operators with thousands of megahertz of new capacity, but the majority of 5G operators (with the exception of Verizon) have not started to use it. The limited deployment reflects the coverage and in-building penetration challenges that come with mmWave. Our survey findings underscore this reality. Recon asked mobile operators who currently have a commercial 5G network if they were using mmWave spectrum, below are the responses we got back.

Note 1. 5G mmWave is a set of 5G frequencies that can provide ultra-fast speeds over short distances. It operates on wavelengths between 30 GHz and 300 GHz, which is higher than 4G LTE’s wavelengths of under 6 GHz.

Of the 100 operators we surveyed 66% have a commercial 5G network. Of that group, 35% say they have deployed 5G for mmWave. 44% of the respondents have mmWave spectrum but are either focused on building their network in other spectrum bands, or don’t currently see a commercial reason to use mmWave. The ongoing underutilization of 5G mmWave seems to be impacting the current outlook for future 6G spectrum as well.

When asking mobile network operators about what they thought were the most important areas 6G should focus on, the most common answer given was more capacity through new spectrum. Originally, industry discussions on new 6G spectrum bands were focused on terahertz, which would be even more challenging to work with than mmWave. In the last year there has been a shift. 6G spectrum discussions have moved to the possibility of using bands in the 7 GHz to 24 GHz range. While these bands still have their difficulties when it comes to coverage and in-door penetration, they are not as problematic as terahertz or in many cases mmWave. However, this change in thinking around 6G spectrum does not change the challenges mobile operators must deal with today when it comes to mmWave.

That is where companies like Pivotal Commware and ZTE can be of assistance. Pivotal Commware has pioneered 5G mmWave repeaters that allow a mobile network operator to improve signal range and coverage at a fraction of the cost of an additional mmWave radio. This helps to improve the economics of using mmWave for 5G. Verizon has publicly acknowledged that it is working with the vendor in the U.S. In Asia, ZTE has been working on a solution of its own to overcome line of sight issues with mmWave that it calls RIS 2.0. AIS (Thailand) has trialed RIS 2.0.

Mobile operators’ desire for more capacity is not going away, especially with the emergence of fixed wireless access. The challenge is finding new ways to meet those capacity needs. Operators can continue to milk lower bands and squeeze capacity improvements out of them, but that will only take them so far. mmWave and other higher spectrum bands are well suited to meet growing capacity requirements, but it will require the development of repeaters and reflective services to make those higher bands easier to use for 5G and eventually 6G. It doesn’t help operators to be surrounded by a spectrum they cannot effectively employ, like sailors at sea with no drinkable water in sight.

Daryl Schoolar is a director and analyst at Recon Analytics where he focuses on telecommunication service providers and companies that provide networking communication solutions to those service providers. Some of the topics he covers are digital transformation, 5G, 6G, cloud networking, and telecom service strategies.

UAE network operator “etisalat by e&” achieves 5G mmWave distance milestone

Saudi Arabia’s Stc Achieves 10 Gbps Speeds in 5G mmWave Trials

Verizon Point-To-Multipoint network architecture using mmWave Spectrum

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Nokia achieves extended range mmWave 5G speed record in Finland

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia