Worldwide telecom equipment market

Dell’Oro: Abysmal revenue results continue: Ethernet Campus Switch and Worldwide Telecom Equipment + Telco Convergence Moves to Counter Cable Broadband

Dell’Oro Group recently reported that:

1. 2Q 2024 worldwide Ethernet Campus Switch revenues contracted year-over-year for the third quarter in a row. Ethernet campus switch sales hit an all-time high in 2Q 2023 and a year later, vendors are suffering in comparison.

“We expect another year-over-year contraction in sales next quarter, in 3Q 2024,” said Siân Morgan, Research Director at Dell’Oro Group. “However, the outlook is improving, and the Ethernet Campus Switch market is expected to return to growth in 4Q 2024.”

“While the economy in China remains soft, Huawei grew year-over-year campus switch revenues across the rest of Asia Pacific and CALA. Over half of Huawei’s campus switch sales were generated outside China,” added Morgan.

Additional highlights from the 2Q 2024 Ethernet Switch–Campus Report:

- The contraction in Ethernet campus switch sales was broad-based across both modular and fixed form factors, all verticals and regions.

- Sales to North America fell the most of any macro-economic region.

- Cisco grew campus switch revenues on a quarter-over-quarter basis, for the first time in a year.

The Dell’Oro Group’s Ethernet Switch–Campus Quarterly Report offers a detailed view of Ethernet switches built and optimized for deployment outside the data center, to connect users and things to the Local Area Networks. The report contains in-depth market and vendor-level information on manufacturers’ revenue, ports shipped, and average selling prices for both Modular and Fixed, and Fixed Managed and Unmanaged Ethernet Switches (100 Mbps, 1/2.5/5/10/25/40/50/100/400 Gbps), Power-over-Ethernet, plus regional breakouts as well as split by customer size (Enterprise vs. SMB) and vertical segments. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………….

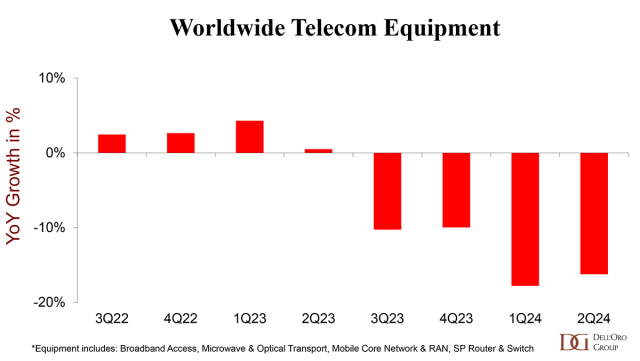

2. Preliminary findings indicate that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 16% year-over-year (Y/Y) in 2Q24, recording a fourth consecutive quarter of double-digit contractions. Helping to explain the abysmal results are excess inventory, weaker demand in China, challenging 5G comparisons, and elevated uncertainty.

Regional output deceleration was broad-based in the second quarter of 2024, reflecting slower revenue growth on a Y/Y basis in all regions, including North America, EMEA, Asia Pacific, and CALA (Caribbean and Latin America). Varied momentum in activity in the first half was particularly significant in China – the total telecom equipment market in China stumbled in the second quarter, declining 17% Y/Y.

The downward pressure was not confined to a specific technology, and initial readings show that all six telecom programs declined in the second quarter. In addition to the wireless programs (RAN and MCN), which are still impacted by slower 5G deployments, spending on Service Provider Routers fell by a third in 2Q24.

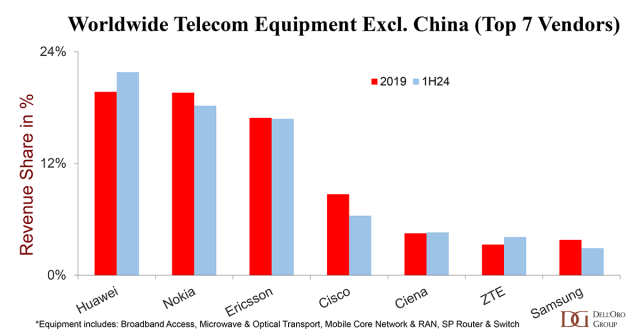

Supplier rankings were mostly unchanged. The top 7 suppliers in 1H24 accounted for 80% of the worldwide telecom equipment market and included Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung. Huawei and ZTE combined gained nearly 3 percentage points of share between 2023 and 1H24.

Supplier positions differ slightly when we exclude the Chinese market. Despite the ongoing efforts by the U.S. government to curb Huawei’s rise, Huawei is still well positioned in the broader telecom equipment market, excluding China, which is up roughly two percentage points relative to 2019 levels.

- Even with the second half of 2024 expected to account for 54% of full-year revenues, market conditions are expected to remain challenging in 2024.

- The Dell’Oro analyst team collectively forecasts global telecom equipment revenues to contract 8 to 10% in 2024, even worse than the 4% decline in 2023.

3. U.S. Telcos Betting on Convergence and Scale To End Cable’s Broadband Reign

U.S. telcos have been very active the past two weeks with deals and partnerships.

- Verizon announced a $20B deal to acquire Frontier Communications and push the combined entity to a fiber footprint of 25 million homes and a fixed wireless footprint of approximately 60 million homes.

- AT&T announced partnerships with four open access network providers to help it expand the reach of its fiber services outside its existing wireline footprint. AT&T will serve as an ISP in these markets, delivering both residential and enterprise services via these partnerships. AT&T is on track to pass a minimum of 30 million homes with fiber by 2025 in its own footprint, as well as an additional 1.5 million homes through its Gigapower joint venture with BlackRock.

- AT&T has also quietly increased the availability of its Internet Air FWA (Fixed Wireless Access) services to over 130 markets, as It potentially positions the service to move beyond just a means of capturing existing DSL subscribers.

These deals follow on the heels of T-Mobile’s proposed acquisition of Lumos Networks, which is slated to pass 3.5 million homes with fiber by the end of 2028. Under the terms of the deal, Lumos will transition to a wholesale model with T-Mobile as the anchor ISP. This is exactly the type of arrangement T-Mobile has established with some of its other infrastructure partners. However, with its partial ownership of Lumos, T-Mobile can presumably generate better returns and healthier margins from its broadband service offerings. The joint venture also is consistent with T-Mobile’s goal of expanding its market presence and footprint without expending a significant amount of capital. In fact, if you take the $1.4B that T-Mobile will ultimately invest in Lumos as it increases its homes passed from 320K to 3.5M by the end of 2028, T-Mobile’s cost per home passed ends up being somewhat less than $500.

That $500 per home passed figure could be even lower should Lumos continue to secure additional American Rescue Plan Act (ARPA) Capital Project Fund grants as well as a portion of the $3.6 B in aggregate BEAD (Broadband Equity, Access, and Development) funding across North Carolina, South Carolina, and Virginia.

The primary reason for T-Mobile’s push into both direct fiber network ownership and partnerships with open access fiber providers is that the operator has over 1 million customers on a waiting list for its fixed wireless service. These customers can’t be served because they are in markets where T-Mobile does not have enough 5G capacity to serve them. As T-Mobile expands the reach of its fiber offering, it can not only provide service to these customers but also existing FWA subscribers. Once an FWA subscriber switches to T-Mobile Fiber, that opens the spectrum for additional FWA subscribers.

US telcos are moving quickly to expand the reach of their fiber, fixed wireless, and ISP services to complement their nationwide mobile networks because they smell blood among the largest cable operators. Telcos are disrupting the broadband market faster and more efficiently right now—a disruption that could very well be amplified by Federal and State subsidies.

With the rollout of 5G networks having had little impact on the profitability of mobile services, fixed wireless has emerged as the most successful use case for mobile network operators (MNOs) can monetize their excess 5G capacity. FWA’s timing couldn’t have been better, with inflation having increased from 2021 on, pushing subscribers to seek out more affordable—but still high quality—broadband service offerings. FWA hit the market providing a powerful combination of affordability, speed, and availability.

The success of FWA combined with overall fiber network expansions has given telcos a potent tool for not only the convergence of mobile and fixed broadband services but also the emergence of these services being offered on an almost nationwide basis. It’s pretty simple math. If you can offer a product or service to a larger number of end customers, the higher the likelihood of continued net subscriber additions, all other things being equal.

Even in markets where there is overlap between fixed wireless and that MNO’s own (or marketed) fiber broadband services, there isn’t really a danger of cannibalization, because the two services will very likely address very different subscribers. As the telcos’ ARPU (average revenue per unit) results have shown, subscribers are willing to pay more for fiber-based connectivity. In 2Q24, for example, AT&T announced that its fiber broadband ARPU is $69 and that the mix shift of its subscribers to fiber has pushed overall broadband ARPU up to $66.17, representing a 6% increase from 2Q23.

Meanwhile, in the second quarter, T-Mobile reported an ARPA figure of $142.54, which was up from $138.94 in 2Q23. Partially fueling that increase was an increase in the number of customers per account, due largely to the adoption of FWA services. Remember, T-Mobile prices and treats its FWA offering as an additional line of service, making it very simple to add to an existing T-Mobile account.

With a starting price point of $50 and typical download speeds ranging from 33-182 Mbps and upload speeds of 6-23 Mbps, T-Mobile is clearly targeting the low-mid cable broadband tiers—and having a great deal of success in converting those subscribers.

Going forward, the 1-2 punch of FWA and fiber will allow the largest telcos to have substantially larger broadband footprints than their cable competitors. Combine that with growing ISP relationships with open access providers and these telcos can expand their footprint and potential customer base further. And by expanding further, we don’t just mean total number of homes passed, but also businesses, enterprises, MDUs (multi-dwelling units), and data centers. Fiber footprint is as much about total route miles as it is about total passings. And those total route miles are, once again, increasing in value, after a prolonged slump.

For cable operators to successfully respond, consolidation likely has to be back on the table. The name of the game in the US right now is how to expand the addressable market of subscribers or risk being limited to existing geographic serving areas. Beyond that, continuing to focus on the aggressive bundling of converged services, which certainly has paid dividends in the form of new mobile subscribers.

Beyond that, being able to get to market quickly in new serving areas will be critical. In this time of frenzied buildouts and expansions, the importance of the first mover advantage can not be overstated.

The push and pull of broadband and wireless subscribers isn’t expected to slow down anytime soon. Certainly, with inflation continuing to put pressure on household budgets, consumers are going to be focused on keeping their communications costs low and looking for value wherever they can find it. That means we are returning to an environment where subscribers take advantage of introductory pricing on services only to switch providers to extend that introductory pricing once the initial offer expires. That shifting and its expected downward pressure on residential ARPU will likely be countered by increasing ARPUs at some providers as they move existing DSL customers to fiber or, in the case of cable operators, move customers to multi-gigabit tiers.

The US broadband market is definitely in for a wild ride over the next few years as the competitive landscape changes across many markets. The net result is certain to be shifts in market share and ebbs and flows in net subscriber additions depending on consumer sentiment. One thing that will remain constant is that value and reliability will remain key components of any subscription decision. The providers that deliver on that consistently will ultimately be the winners.

References:

Ethernet Campus Switch Revenues Plunge by 30 Percent in 2Q 2024, According to Dell’Oro Group

US Telcos Betting on Convergence and Scale To End Cable’s Broadband Reign

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: Campus Ethernet Switch Revenues dropped 23% YoY in 1Q-2024

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Dell’Oro Group has completed its 1H2021 reports on “Telecommunications Infrastructure programs” including Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network (RAN), Service Provider Router & Switch markets. The data contained in these reports suggest that the positive trends that characterized the broader telecom equipment market extended into the second quarter, even if the pace of the growth slowed somewhat between the first and the second quarter.

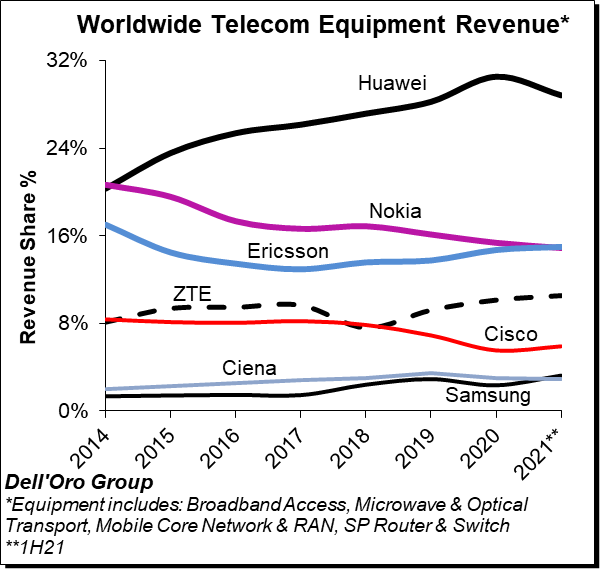

Preliminary estimates suggest the overall telecom equipment market advanced 10% year-over-year (Y/Y) during 1H21 and 5% Y/Y in the quarter, down from 16% Y/Y in the first quarter. The growth in the first half was primarily driven by strong demand for both wireless and wireline equipment, lighter comparisons, and the weaker US Dollar (USD). Helping to explain the Y/Y growth deceleration between 1Q and 2Q is slower growth in China.

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 1H21, with the top seven vendors comprising around ~81% of the total market.

Huawei is still the overall market leader by some margin, despite its sales and marketing challenges in many other parts of the world. Huawei’s market share slid below 30%, though that still almost double the share of its nearest rivals Ericsson and Nokia. Within the mix, Dell-Oro estimates Huawei and Nokia lost some ground between 2020 and 1H21 while Cisco, Ericson, Samsung, and ZTE recorded minor share gains over the same period.

Additional key takeaways from the 1H2021 reporting period include:

- Following the Y/Y decline in 1Q20, our analysis suggests the overall telecom equipment market recorded a fifth consecutive quarter of growth in the second quarter.

- The improved market sentiment in the first half was relatively broad-based, underpinned by single-digit growth in SP Routers and double-digit advancements in Broadband Access, Microwave Transport, Mobile Core Networks, and RAN.

- Aggregate 2Q21 revenues were in line with expectations, however, within the programs both Broadband Access and Microwave Transport were surprised on the upside while Optical Transport and SP Routers came in below expectations.

- From a regional perspective, China underperformed in the quarter, impacting the demand for both wireless and wireline-related infrastructure.

- Ongoing efforts by the US government to curb the rise of Huawei are starting to show in the numbers outside of China, not just for RAN but in other areas as well.

- Though Huawei is not able to procure custom ASICs for its telecom products, the supplier is assuring the analyst community its current inventory levels is not a concern over the near term for its infrastructure business.

- The majority of the vendors have through proactive measures been able to navigate the ongoing supply chain shortages and minimize the infrastructure impact. At the same time, the supply constraints appear more pronounced with higher volume residential and enterprise products including CPE and WLAN endpoints.

- Even with the unusual uncertainty surrounding the economy, the supply chains, and the pandemic, the Dell’Oro analyst team remains optimistic about the second half – the overall telecom equipment market is projected to advance 5% to 10% for the full-year 2021, unchanged from last quarter.

Two of the key telecom revenue drivers will be the RAN and Broadband Access markets, both of which have been growing at a strong pace this year so far: The RAN market is set to grow at between 10% and 15% this year, which means it could be worth as much as $40 billion, while the increasing number and size of investments in fibre broadband access networks around the world is driving growth in the Broadband Access market, which Dell’Oro reports was worth $3.6 billion during the second quarter alone.

Dell’Oro Group telecommunication infrastructure research programs consist of the following: Broadband Access, Microwave Transmission & Mobile Backhaul, Mobile Core Networks, Mobile Radio Access Network, Optical Transport, and Service Provider (SP) Router & Switch.

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Samsung Electronics said on Monday it had won a $6.64 billion order to provide wireless communication solutions to Verizon in the United States, a major win for the South Korean firm in the next-generation 5G network market. Samsung’s local unit Samsung Electronics America signed the agreement with Verizon Sourcing, a subsidiary of Verizon Communications, to offer network products for the wireless carrier through the end of 2025. This includes providing, establishing and maintaining the company’s 5G mobile telecom equipment.

…………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Nokia on the sidelines:

Nokia’s biggest customer is Verizon, JP Morgan research said in a July note to clients. Yet Nokia didn’t win any part of the new Verizon 5G order. That was predicted by Rosenblatt analyst Ryan Koontz, who said in July “Samsung will “leapfrog Nokia to secure one of the largest new supplier telecom contracts in many years.”

Nokia wrote in an email, “We do not comment on our customers’ vendor strategy. Nokia is proud to serve Verizon, and we are committed to continuing to help them build the best, most reliable and highest performing network. Nokia and Verizon have a longstanding strategic partnership in key technologies across their network with our end-to-end solutions portfolio.”

…………………………………………………………………………………………………………………………………………………………………………….

Samsung’s global prospects for its network business have improved following U.S. sanctions on its bigger rival Huawei , analysts said. The Trump administration last month unveiled plans to auction off spectrum previously dedicated to military purposes for commercial use starting in mid-2022, to ramp up fifth-generation network coverage in the United States. In July, the UK ordered Huawei equipment to be purged completely from its 5G network by the end of 2027, adding it needs to bring in new suppliers like Samsung Electronics and Japan’s NEC Corporation.

Verizon CEO Hans Vestberg told CNBC in July last year that Verizon does not use any Huawei equipment. Verizon had already been a Samsung customer before the order. Vestberg’s statement about no Huawei gear is not true, as Light Reading and other websites noted on Friday.

The FCC requested information about “the presence or use of Huawei or ZTE equipment and/or services in their networks, or in the networks of their affiliates or subsidiaries.”

The FCC’s goal is to determine how many US companies use equipment from Huawei or ZTE – the equipment has been deemed a threat to national security – and how much it might cost to replace that gear with equipment from “trusted” suppliers.

On Friday, the FCC published a list of companies that reported they have existing Huawei or ZTE equipment and services.

Three of the nation’s five biggest wireline phone providers (Verizon, CenturyLink and Windstream) have admitted to having equipment from Huawei or ZTE, according to Leichtman Research Group.

“Verizon’s networks do not include equipment from any untrusted vendors. In addition, the company is not seeking funds from the FCC to replace equipment,” a Verizon representative wrote in response to questions from Light Reading. “Verizon has a relatively small number of devices, called VoiceLink, which were made by Huawei and are used by some customers to make voice calls. There are no data services associated with these devices. Earlier this year, Verizon started replacing these units. That effort was temporarily halted by the pandemic and is now underway again. We expect to have all Voicelink devices fully retired by the end of the year.”

“Samsung winning the order from Verizon would help the company expand its telecom equipment business abroad, potentially giving leverage to negotiate with other countries,” Park Sung-soon, an analyst at Cape Investment and Securities told Reuters.

The order is for network equipment, a Samsung spokesman said. The company declined to comment on detailed terms the contract such as the portion of 5G-capable equipment included.

Verizon joined with Samsung long before 5G made its debut in smartphones last spring. In early 2018, the two firms teamed up for trial runs of 5G-powered home internet. Verizon officials have previously pledged not to use Huawei for its next-generation rollout. Samsung has supplied some network gear for prior generations including 4G LTE.

To Samsung, the deal represents a major 5G win. The contract, valued at 7.898 trillion South Korean won over five years, compares with the roughly 5 trillion won Samsung’s network business racked up in revenue in all of 2019.

Last year, 5G represented less than half of Samsung’s network business, of which U.S. carriers accounted for 10%, said S.K. Kim, a Seoul-based analyst with Daiwa Securities.

“With this latest long-term strategic contract, we will continue to push the boundaries of 5G innovation to enhance mobile experiences for Verizon’s customers,” Samsung said in a statement.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar — Telecom Equipment Vendor Market Shares:

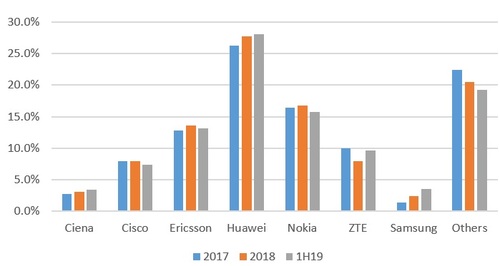

Samsung had a 3% market share of the global total telecom equipment market in 2019, behind No. 1 Huawei with 28%, Nokia’s 16%, Ericsson’s 14%, ZTE’s 10% and Cisco’s 7%, according to market research firm Dell’Oro Group.

Among 5G network sales, Samsung ranks No. 4 with about 13% of the total market, according to market research firm Dell’Oro Group. It trails the top three, which include China’s Huawei Technologies Co. and the European firms Ericsson AB and Nokia Corp.

Huawei said early this year that it had signed more than 90 5G contracts, and Ericsson last month touted its 100th 5G “commercial agreement.” Samsung hasn’t divulged how many 5G contracts it has signed. But it has high hopes, having invested more than $30 billion in the U.S. market alone.

………………………………………………………………………………………………………………………………………………………………………………………….

Separately, Samsung announced the Galaxy Book Flex 5G, an adaptable, 5G-powered addition to its premium laptop line. Galaxy Book Flex 5G is powered by the new 11th Gen Intel® Core™ processor with Intel® Iris® Xe graphics offering intelligent performance and powerful processing for impressive productivity and stunning entertainment, along with Wi-Fi 6 and 5G connectivity for an unparalleled laptop experience.

“Across the world, we’re being asked to adapt and change constantly, and it’s vital we have devices that move with us,” said Mincheol Lee, Corporate VP and Head of New Computing Biz Group at Samsung Electronics. “Thanks to our close collaboration with Intel, Galaxy Book Flex 5G provides users with a powerful performance, next-generation connectivity, effortless productivity and premium entertainment features, all in the form function of their choosing.”

……………………………………………………………………………………………………………………………………………………………………………………………..

References:

Dell’Oro: Worldwide Telecom Equipment market increases after 3 years of decline; VoLTE up 16% Y/Y

The worldwide telecom equipment market grew 6 percent year-over-year (Y/Y) in the past twelve months, according to a new Dell’Oro Group report. The majority of growth was driven by Mobile RAN and Optical Transport sales. Equipment manufacturer revenue in these two technology areas grew 10 percent and 8 percent, respectively.

The telecom equipment market shifted into a growth phase in 3Q 2018 after three years of decline. As a result, the market’s growth for the trailing four-quarter period ending 2Q 2019 was up significantly from a bottom reached in 2017. Most of the leading vendors gained revenue during this period with the highest percentage increases obtained by Samsung, ZTE, and Ciena.

Although Huawei was placed on the U.S. Entity List in late May, restricting its purchase of U.S. components without a license, the company seems to have avoided any negative impact on sales of telecom equipment. For the trailing four-quarter period (3Q18 through 2Q19), Huawei held the highest share of the telecom equipment market at 28 percent.

Nokia captured the second-highest share in the period due to its strong position in each of the seven technology segments included in the Telecom Equipment Market report. Nokia was a top vendor in each product category.

Global Telecom Equipment Market Share:

Dell’Oro’s market share rankings cover the entire telecom equipment industry and are inclusive of everything from Mobile Radio Access Network (RAN) to optical transport to routers to switches to packet cores and microwave transmission and mobile backhaul.

Huawei’s ability to grow its share through 2019 is noteworthy considering the Chinese tech giant is in the eye of the trade war between the U.S. and China, a battle that has global implications. Many (like this author) believe that the company is being used as a bargaining chip by the U.S. in that trade war. For example, President Trump banned some U.S. companies from doing business with Huawei on national security grounds, though it’s also viewed primarily as a negotiating tactic.

However, the ban may initially affect only Huawei’s smartphone business, which is #2 in the world. It relies on components from U.S. suppliers and the Android OS from Google. The company’s networking business — which includes cellular base stations, optical transport, Ethernet switches, routers and transponders– may be more insulated from the effects of the U.S. ban, given that sales cycles among global telecom service providers are much longer when compared with smartphone buyers.

Further, Huawei’s networking equipment has long been implicitly forbidden among major US telecom service providers, so the Chinese supplier has little to lose, except for sales of mobile base stations to rural U.S. carriers as per this IEEE Techblog post.

The Dell’Oro Group Advanced Research: Telecom Equipment Market Report is a compilation of the findings of seven research programs conducted by Dell’Oro Group. These research programs are:

Broadband Access and Home Networking, Carrier IP Telephony, Microwave Transmission & Mobile Backhaul, Mobile Radio Access Network, Optical Transport, Router & Carrier Ethernet Switch, and Wireless Packet Core. For more information, please contact us by email at [email protected].

…………………………………………………………………………………………..

VoLTE and Carrier Telephony:

In a separate report, Dell’Oro said that the worldwide Voice-over-LTE (VoLTE) infrastructure market revenues grew 16 percent Year-Over-Year (Y/Y) in 2Q 2019, as the Asia Pacific region took the leading role in licenses shipped, growing 62 percent Y/Y.

“It appears the tipping point of preparing 5G networks for voice with VoLTE is upon us as indicated by the growth rate we saw in 2Q 2019,” said Dave Bolan, senior analyst at Dell’Oro Group. “Licenses shipped to service providers in China and India accounted for most of the 62 percent growth in the Asia Pacific region. With 5G services expected to launch in October 2019, Chinese service providers are aggressively trying to migrate their 1.2 B LTE subscribers to VoLTE. Currently only about half are using VoLTE,” continued Bolan.

“In addition, the market in India is seeing a rapid shift to VoLTE services. For example, service provider Reliance Jio, had over 331 M VoLTE subscribers with a 54 percent Y/Y growth rate,” Bolan added.

Additional highlights from the 2Q 2019 Carrier IP Telephony report include:

- The top three ranking VoLTE vendors were Huawei, Nokia, and Ericsson

- Circuit switched core market revenues were down 21 percent Y/Y

- The IMS Core market revenues were up 13 percent Y/Y

- The Carrier IP Telephony market was up 5 percent Y/Y

The Dell’Oro Group Carrier IP Telephony Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for both wireline and wireless voice core markets. The segments include soft switches, media gateways, session border controllers, voice application servers, IMS CSCF and HSS, and legacy mobile switching centers. To purchase this report, please contact us at: [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Worldwide Telecom Equipment Market Grew 6 Percent in Past Twelve Months, According to Dell’Oro Group

Worldwide VoLTE Market Revenues Grew 16 Percent Y/Y in 2Q 2019, According to Dell’Oro Group