Telecom Italia (TIM) launches satellite Internet service; partners with Oracle for multi-cloud

Telecom Italia (TIM) is launching the new TIM SUPER SAT Internet service for new customers who live in areas of Italy not yet covered by fixed broadband and ultra-broadband networks. With this technology and the exclusive agreement signed recently with Eutelsat, customers will be able to browse at speeds up to 100M bit/s in download and 5M bit/s in upload.

The initiative confirms TIM’s commitment to overcome the digital divide, by providing Italian families with super-fast satellite Internet access in geographical areas not yet reached by TIM’s Fiber or Fixed Wireless Access (FWA) networks.

TIM Super Sat costs €49.90 (US$43) per month including a satellite kit complete with a satellite dish, a Wi-Fi modem and installation by a technician. It comes with a fair usage policy of 100GB per month at maximum speeds, after which speeds are reduced to 4Mbit/s (1Mbit/s upload).

The new TIM SUPER SAT offer also includes the sale of a satellite kit complete with a satellite dish, a Wi-Fi modem and installation by a specialized technician.

The service comes at something of a premium compared to terrestrial services: TIM currently offers 40Mbit/s 5G FWA services for €29.90 ($26) a month and FTTH with 1Gbit/s speeds also at €29.90 per month.

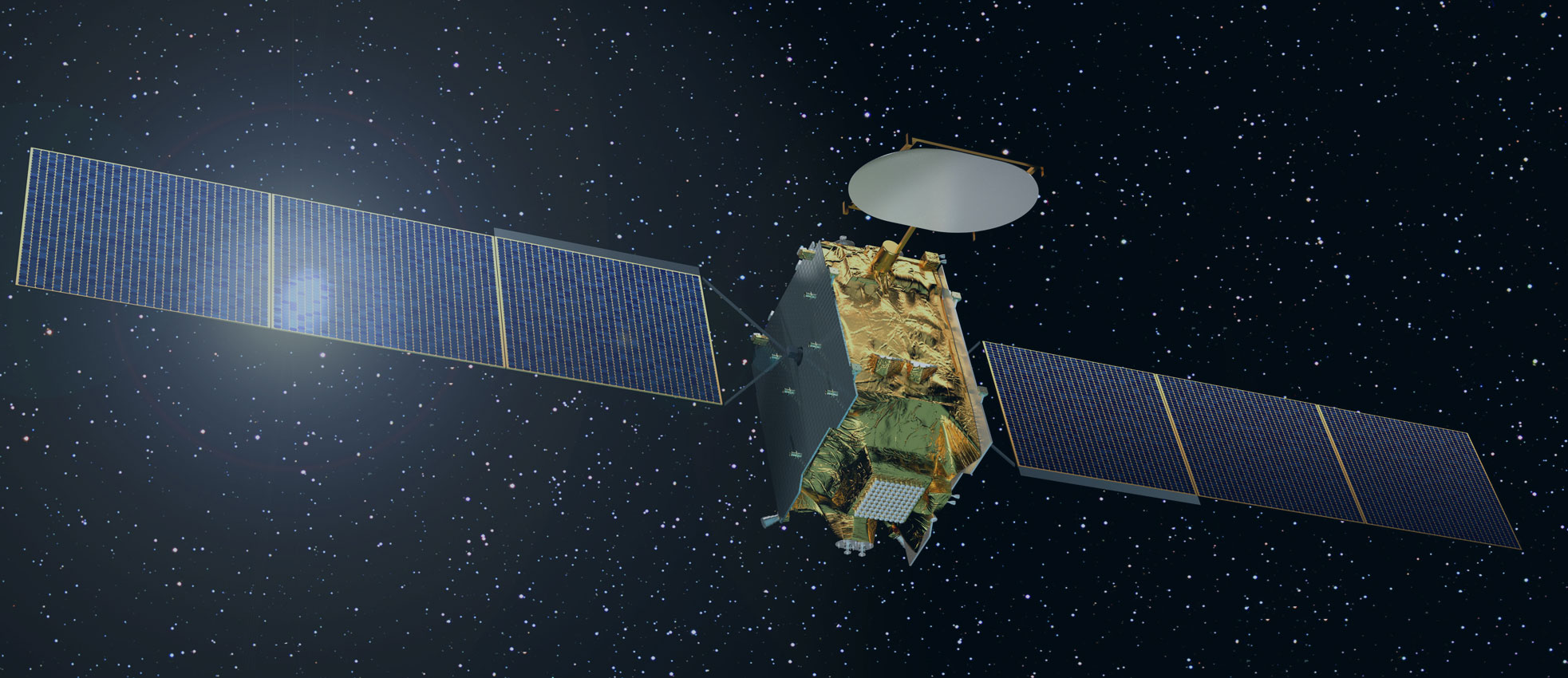

Although not mentioned in the October 8th press release, the new TIM Super Sat service is the result of an agreement signed by TIM and France-based satellite company Eutelsat in November 2020. TIM signed the strategic agreement with Eutelsat to provide connectivity to the most isolated and remote areas of the country. The satellite, due to enter into service in 2022, will also be built by Thales Alenia Space and will have Ka-band capacity of 500 Gbit/s.

Under its agreement with Eutelsat, TIM is purchasing the entire transmission capacity for Italy on the two new high-performance satellites that Eutelsat has either activated or will activate in the coming months: the Konnect and Konnect VHTS (very high throughput satellite).

In service since November 2020, Eutelsat Konnect has a total capacity of 75 Gbit/s and is capable of offering speeds of up to 100 Mbit/s in 15 European countries. Konnect VHTS is expected to allow speeds of up to 200 Mbit/s once it comes into operation.

For more information and to request the offer, interested customers can consult the usual channels and the dedicated page TIM SUPER SAT.

Italy Lags in European Broadband Internet:

In 2020, Italy ranked 24 out of 27 European Union member states in its take-up of ultrafast Internet of at least 100 Mbit/s, according to the Digital Economy and Society Index (DESI).

In its 2021 annual report, national statistics agency Istat noted that while Italy’s national recovery program has the “ambitious goal” of providing broadband coverage of at least 1 Gbit/s to the entire population by 2025, Italy is currently lagging far behind in the availability of ultra-broadband connections compared with other EU countries.

………………………………………………………………………………………………………………………………..

TIM and Oracle team up to offer multi-cloud services in Italy:

Oracle, TIM (Telecom Italia) and Noovle (TIM Group’s cloud company) [1.], today announced that they have signed a collaboration agreement as part of a plan to offer multi-cloud services [2.] for enterprises and public sector organizations in Italy.

Note 1. Launched in January 2021, Noovle SpA is TIM Group’s dedicated center of excellence for cloud and edge computing, with a focus on supplying bespoke multi-cloud services to TIM customers.

Note 2. Multi-cloud refers to using several instances of multiple clouds from different vendors. With multi-cloud, the use of different vendors means access to different features, underlying infrastructure, security, and other elements specific to the vendor’s offerings. Multi-cloud ties this all together, allowing enterprises and organizations to have access across vendors so data can be placed in an environment best suited to its capabilities.

………………………………………………………………………………………………………………………………….

Under the agreement, TIM Group plans to utilize advanced cloud infrastructure technologies to support its goal of advancing Italy’s digital modernization and establishing its position, through Noovle, as the market reference point for enterprise multi-cloud services in the country.

The three companies plan to bring their respective assets and expertise to develop and manage multi-cloud architecture services for Italian enterprises.

- Noovle brings an extensive data center network in Italy, which has been developed to the highest technological, security and environmental standards in line with TIM Group’s environmental, social and governance (ESG) goals.

- TIM provides an extensive sales network across the country, enabling the integration of cloud services with the Group’s ICT services portfolio: from IoT and 5G services to cybersecurity and advanced fixed and mobile connectivity services.

- Oracle brings its next-generation cloud infrastructure with its built-in security, superior performance, and availability, which is ideally suited for mission-critical and cloud native workloads in large enterprise and public sector environments.

A collaborative model, which includes connecting major cloud providers’ platforms in a multi-cloud environment, will support public and private organizations in addressing the challenges of digital transformation through advanced multi-cloud services, enabling operational efficiency, lower costs, and high security standards.

Oracle’s hybrid and multi-cloud strategy also aligns closely with TIM Group’s objectives in ensuring that all customer data is hosted in-country and customers have a cloud solution that meets their data sovereignty needs. TIM selected Oracle Cloud Infrastructure as part of its multi-cloud strategy to migrate the Group’s mission-critical data management workloads to the public cloud.

References:

https://www.gruppotim.it/en/press-archive/market/2021/CS-TIM-SUPER-SAT-ENG.html

https://www.lightreading.com/satellite/tim-launches-satellite-service-for-underserved/d/d-id/772683?

https://www.eutelsat.com/en/satellites.html

https://www.gruppotim.it/en/press-archive/market/2021/PR-TIM-Noovle-Oracle-ENG-08102021.html

Bharti Airtel, Ericsson conduct India’s first rural 5G trial; Ericsson – India Q & A

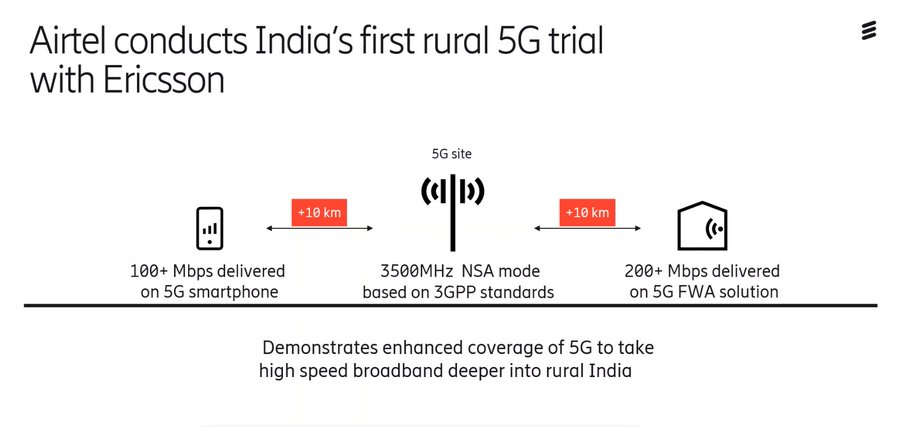

On October 5th Bharti Airtel said it has conducted India’s first rural 5G trial with Swedish telecoms equipment maker Ericsson. The demonstration took place in Bhaipur Bramanan village on the outskirts of Delhi/NCR using 5G trial spectrum allocated by India’s Department of Telecommunications (DoT).

“The trial showcases the massive potential offered by 5G towards bridging the digital divide by enabling access to high speed broadband through solutions such as enhanced mobile broadband (eMBB) and Fixed Wireless Access (FWA) services,” the companies said in a joint statement.

The trial demonstrated over 200Mbps throughput on 3GPP-compliant 5G Fixed Wireless Access (FWA) device located more than 10km from the site.

The trial also showcased that a commercially available 3GPP-based 5G smartphone could connect to the test network and record over 100Mbps speeds at a distance of more than 10km from the site.

The 5G site was powered by Ericsson’s 3GPP-compliant 5G radio. The trial was carried out by utilizing the allocated mid-band trial spectrum in 3500MHz band and existing FDD spectrum band.

“Having demonstrated India’s first 5G network and also the first 5G cloud gaming experience, Airtel is proud to have also conducted the nation’s first 5G trial in a rural geography. 5G will be a transformational technology when it comes to delivering broadband coverage to the last mile through use cases like FWA and contribute to a more inclusive digital economy,” said Randeep Singh Sekhon, Airtel CTO.

“The technology milestone of extended coverage achieved by Ericsson and Airtel as part of the ongoing 5G trial in India is even more significant since it demonstrates how 5G can ‘connect the unconnected’ in India, enable faster 5G rollout and truly help India realize its ‘Digital India’ vision,” added Nunzio Mirtillo, Head of Ericsson South east Asia, Oceania and India.

According to an Ericsson study, on average, a 10% increase in the Mobile Broadband adoption ratio causes a 0.8% increase in GDP.

Airtel has previously demonstrated cloud gaming in a 5G environment, as part of its 5G trials in Gurgaon’s Manesar. It had used the mid-band spectrum provided by the DoT for this purpose. The Sunil Mittal-led telco has also been rallying to ensure that any new 5G handset sold in India must support all existing bands in India for 5G, including the mmWave bands.

Earlier this year, Airtel successfully demonstrated 5G services over a live 4G-LTE network in Hyderabad, marking an industry first. It is also conducting 5G trials in multiple cities across India and validating technologies and use cases through the trial spectrum allotted by the DoT . Airtel has partnered with Ericsson and Nokia for these trials.

………………………………………………………………………………………………………………………

Q and A with Nunzio Mirtillo, head of Ericsson (Southeast Asia, Oceania and India):

How has been the market performing for Ericsson this year?

We have been doing well in India and increasing our market share constantly. Over the past three/four years, we have been increasing our market share in India and we have kept our market share when the merger with Vodafone and Idea happened. When it comes to Bharti, we have increased market share substantially in the last few years, both on core and on radio, showing two things – one, our willingness to stay and increase our presence in India, and two, that we are competitive. Because you can be willing to do something but then you also need to be competitive in terms of technology, in terms of TCO and we have been showing that. And on top of that we have been delivering quite a good quality of service to our customers because that is ultimately what counts the most.

Have your telco partners been spending on network expansion aggressively?

We know the situation of Vodafone Idea, and I believe they have a great chance to do well in India and I think they will. And now with the latest from the government, I hope they will have a nice restart. When it comes to Jio we are not a relevant partner with Jio when it comes to the radio business, although we work with Jio. I think they have been also doing their job and their investment in a nice way. But Bharti has accelerated quite a lot in the last few years, and you can see the result in their market evaluation and also in terms of subscriber acquisition, ARPU increase, and we have been part of that journey, partnering with them as well. Showing that India is a market where if you do invest, you provide network quality and you have the right strategy and the right focus, the market is there. And if you do well, you will get the payback for that.

How do you see this whole 5G story panning out in the Indian market?

The sooner the better for the country actually. As everyone says in Q1, the spectrum will be made available from the government to the operators. So, I really hope so. India has been a bit sleepy for a while but then in the last three, four years it really did catch up quite a lot on 4G. So now the country should not lose momentum.

Secondly, the government should make available at least between 80 to 100 megahertz of 3.5GHz or the mid-band to the existing operators and also make sure that they auction millimeter wave spectrum which is a 400 megahertz which will be very much needed going forward to match the tremendous demand of mobile broadband that will be there in the future. And also, you also need to take care of the transport network, so we also need enough spectrum on the E band for connecting the 5G networks.

That’s what we believe and that’s the basic and India cannot, in my view, go below basic because there’s the Digital Highway for the country, it’s not only kind of business as such. It’s really a vital infrastructure for the future of India. And they also need to make sure that they deliver that spectrum at a reasonable price because otherwise they will impact from the start the ones that are supposed to invest.

I think they will be reasonable, because I have seen a lot of good things in India in the last few years with the tremendous push shown on Digital India, Make in India, and it’s all good programs.

References:

Bloomberg: U.S. Billionaire’s Battle Over FCC’s 12 GHz Spectrum Policy

Charlie Ergen of Dish Network and Michael Dell of Dell Technologies have a plan to open up little-used wireless frequencies to millions of customers with a new 5G service. However, another billionaire strenuously objects. Elon Musk’s SpaceX filed an objection with the U.S. Federal Communications Commission (FCC), which governs airwaves distribution, saying the “scheme” would wreck his broadband-from-orbit service.

Dish Network responded with an FCC filing that accused SpaceX of “flimsy” and “far-fetched” criticism. RS Access LLC, a Dell company, cited what it calls SpaceX’s “long history of misleading information, rule-flaunting, and ad hominem attacks.”

The billionaires paths collide in a swath of spectrum known as the 12 gigahertz band [1.] Ergen and Dell have asked the FCC to allow higher-power traffic in 12 gigahertz airwaves they control in cities around the U.S. That’s 82 markets including New York and Chicago for Dish, and 60 markets including Austin, Texas and Omaha, Nebraska for Dell’s airwaves company, RS Access.

……………………………………………………………………………………………………………………………………………

Note 1. 12 GHz (more precisely 12.2-12.7 GHz Band ) is NOT one of the approved frequency bands in the revision to ITU Recommendation M.1036-6, which specifies ALL frequency bands for the TERRESTRIAL component of IMT (including IMT 2020). Despite that, the FCC is considering expanded terrestrial service rights in 500 megahertz of mid-band spectrum between 12.2-12.7 GHz (12 GHz band) without causing harmful interference to incumbent licensees.

………………………………………………………………………………………………………………………………………..

The 12 GHz spectrum band is currently restricted to one-way use. License holders include SpaceX, AT&T/DirecTV, Dish and other satellite providers, as well as companies that use the spectrum for downstream fixed wireless communications.

Some license holders, including Dish and fixed wireless provider RS Access, want the FCC to allow two-way use of the band. To support that view, RS Access submitted the RKF Engineering study that concluded that two-way use of the band would not interfere with incumbent users to the FCC.

Roberson and Associates found that 1 MHz of 12 GHz spectrum can carry 3.76 times as much data as 1 MHz of 28 GHz spectrum under peak throughput conditions.

Long-time 12 GHz 5G proponent RS Access refers to a report that identifies recent technology advances for making the 12 GHz band very desirable for 5G, including Massive MIMO, beamforming and 5G carrier aggregation.

………………………………………………………………………………………………………………………………………

This raucous battle of billionaires stands out on the ordinarily placid docket of the FCC, which is more often limited to detailed technical concerns such as antenna characteristics and signal power/ attenuation. It reflects the fortunes to be made as the U.S. moves toward 5G networks that will be used in many places, depending on the use case. A government auction earlier this year of 5G airwaves brought in $81 billion as the largest U.S. wireless providers snapped up frequencies; another airwaves sale that could net $25 billion is under way.

“It says they ain’t making spectrum no more!” said Tom Wheeler, a former FCC chairman. Spectrum describes the array of frequencies that companies use to offer telecommunications.

Space X also uses the 12 gigahertz frequencies. In FCC filings the company says the proposed higher-power signals could overwhelm the faint broadband signals that travel from its orbiting fleet of 1,500 or more satellites to customers’ rooftop receiving dishes.

Currently, services in the 12 gigahertz band are limited to low power under FCC rules designed to avoid interference with other users. Airwaves with higher power are typically worth more money, since their signals can travel farther and reach more customers. The increased potency can also increase the risk of overpowering other users’ signals.

Dish “has mastered the use of empty promises and attacks on competitors,” SpaceX told the FCC in a filing. Dell’s spectrum-holding RS Access told the FCC that SpaceX is offering a “false premise.” Dish then accused SpaceX of mounting an “attempt to obfuscate the issues.”

The fight has been brewing for at least five years. Dish and other holders of 12 gigahertz airwaves in 2016 asked the FCC to boost power for terrestrial users of the airwaves, citing skyrocketing demand for mobile data. At the time SpaceX’s first Starlink broadband satellite was three years from its 2019 launch. Dish and its partners at the time suggested satellite services should lose rights in the band.

Dell’s investment firm had made its purchase of 12 gigahertz airwaves via RS Access, which reached for influence inside the Beltway. It hired former House telecommunications counsel Justin Lilley, according to an October 2020 filing. Lilley’s roster of clients has included spectrum innovator Ligado Networks, wireless giant T-Mobile US and Facebook.

Lobbying expenses surged. Dell’s MSD Capital with no lobbying expenditures since its founding in 1998, spent $150,000 on lobbying in 2020, according to data compiled by Open Secrets, a non-profit that tracks money in Washington.

Dish, with a longtime presence in Washington, spent $1.8 million lobbying in 2020 and SpaceX spent $2.2 million, with each engaging more than three dozen lobbyists according to Open Secrets.

Dell called then-FCC Chairman Ajit Pai twice, in September and November of 2020. Ergen and Pai spoke in July of 2020. On Dec. 23, Musk called Pai — after two earlier calls between the two, according to FCC disclosure filings.

The FCC began its formal consideration with a 4-0 vote in January 2021, during the closing days of Ajit Pai’s tenure as FCC Chairman. The Republican left the agency following the presidential election, leaving the issue to the current FCC that is split 2-to-2 along partisan party lines.

Supporters formed a coalition that includes Dish, Dell, policy groups and two trade groups that include Dish as a member. RS Access presented a 62-page technical study that concluded coexistence between the 5G use and the satellite services can be achieved.

SpaceX, in a filing, said the airwaves are worth far less. Still it said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

“You don’t have to have them removed from the band at all,” V. Noah Campbell, chief executive officer of RS Access, said in an interview with Bloomberg. Campbell likened the proposal to a water main that’s been used at low capacity. “We just want the pipe open,” he said.

The spectrum in question could be worth as much as $54 billion if the FCC allows the change, according to a study submitted to the FCC by a Dell owned company. SpaceX, in a filing, said the airwaves are worth far less. The company said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

Dish Network has emphasized expanded demands for its 5G service, which is designed to connect not just mobile phones, but also IoT devices including baby monitors, vehicles, aerial drones, tractors, and factory gear. Dish has emphasized expanded demands for 5G service, which is designed to connect not just mobile phones, but also devices including baby monitors, vehicles, aerial drones, tractors, and factory gear.

“This band is really good for 5G,” Dish Executive Vice President Jeff Blum said in an interview with Bloomberg. “And it would be a missed opportunity if the commission left the status quo in place.”

References:

https://www.bloomberg.com/news/articles/2021-10-09/billionaires-musk-ergen-and-dell-brawling-over-spectrum-at-fcc (PREMIUM ARTICLE)

Battle Lines Thicken Over 5G Use of 12 GHz Spectrum, with SpaceX in the Crosshairs

https://www.fiercewireless.com/regulatory/massive-mimo-adaptive-beam-forming-spiff-up-12-ghz-band

Jio, Airtel, and Vodafone Idea Couldn’t Deliver True 4G Speeds in India

While 5G is coming (some day soon?) to India, and there are 4G networks present in almost all of the country, there is one thing that can’t be ignored. The private telecom operators who have built a strong business around providing 4G coverage throughout the country have failed to deliver ‘true 4G’ to Indians. Bharat Sanchar Nigam Limited (BSNL) is still a 2G/3G player, so that state-run telco is not included in this article.

According to the ‘Speed test Global Index’ report from Ookla [1.], India is currently at the 126th position in terms of providing the fastest mobile data speeds to users. Pakistan is ahead of India at 120th position.

Note 1. Here are the top 10 countries with the fastest mobile Internet speed in Mbps as of end of July 2021:

| 1 | – | United Arab Emirates | 195.52 |

| 2 | – | South Korea | 192.16 |

| 3 | +3 | Norway | 173.54 |

| 4 | -1 | Qatar | 169.17 |

| 5 | -1 | China | 163.45 |

| 6 | +1 | Saudi Arabia | 149.95 |

| 7 | +1 | Kuwait | 141.46 |

| 8 | -3 | Cyprus | 136.18 |

| 9 | – | Australia | 126.97 |

| 10 | – | Bulgaria | 126.21 |

| 11 | +1 | Switzerland | 115.83 |

| 12 | -1 | Luxembourg | 110.67 |

| 13 | +3 | Denmark | 103.35 |

| 14 | -1 | Netherlands | 100.48 |

| 15 | +2 | Oman | 97.81 |

| 16 | -1 | Sweden | 97.06 |

| 17 | -3 | United States | 96.31 |

| 18 | – | Singapore | 91.75 |

| 19 | – | Canada | 87.65 |

| 20 | +4 | Finland | 83.01 |

Mobile download speed jumped 59.5% over the last year globally to 55.07 Mbps

………………………………………………………………………………………………………………………………..

The average mobile Internet speed delivered to users in India was 17.96 Mbps. In comparison, the number one country on the list, United Arab Emirates (UAE), offers users 195.52 Mbps speeds while the U.S. average is 96.31 Mbps. There is a humongous difference between UAE and India.

So why does a telecom operator like Jio, which has so much profits in the books, can’t provide very high-speed networks to the users? This question also applies to companies like Vodafone Idea and Bharti Airtel.

The problem is getting higher mobile internet speeds would have costed the end-consumer a lot more money. Today, India offers mobile data at one of the cheapest/most affordable rates globally. From paying more than Rs 200 for each G Byte of mobile data in 2016, now Indians pay less than Rs 10 for the same amount.

This has allowed even the low-income Indian people to latch on to the same network services as the high-income ones. Since Jio arrived with ultra low prices, India’s mobile telcos could either reduce the price of data, or they could go out of business.

Because of affordable plans and services, which benefitted a lot to the customers, the overall profit margins and the average revenue per user (ARPU) started to drop. This resulted in the telcos being limited in their capacity to make investments in the networks to enhance performance.

In simple words, if the telcos don’t charge you more, they don’t earn more. If they don’t earn more, they can’t invest in their networks and really can’t provide you with the 4G experience customers in countries like the UAE do.

But there’s one more thing to factor in here. It is not just how the Indian market is that is responsible for this. But the telcos have also been fighting to get the larger subscriber market share. Companies like Jio can easily hike tariffs and support Vi and Airtel in doing the same. But Jio won’t go for the tariff hike to increase ARPU because it wants a larger subscriber market share. The other companies are also handicapped because of the same. However, it is not like Vi and Airtel don’t want a better subscriber market share; it’s just that the ball is in Jio’s court at the moment.

Further, the government had also put so much stress on the sector. There were so many forms of statuary dues, regulatory norms that involved so much money going out of the operators’ pockets. However, the recent relief package should be able to help with that.

India’s mobile operators are limited to provide a premium service to each of their customers because of their limited return on investments (ROI).

Note that providing better network services also includes purchasing more airwaves from the government, which involves thousands of crores. There are also other investments such as network towers, fiber conversion costs, and much more than a normal mobile consumer is aware of.

References:

https://telecomtalk.info/jio-airtel-vi-couldnt-deliver-true-4g/471560/

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

Telecom network infrastructure (NI) vendors had a 5.1% year-over-year (YoY) increase in revenue during the second quarter 2021, reflecting a significant pullback from a 10% gain in the previous quarter, according to MTN Consulting.

The market share leaders in the global telco NI market remain Huawei, Ericsson, Nokia, and ZTE, who are also the top providers of 5G infrastructure. After these top four, China Comservice took the fifth spot in 2Q21 due to services sales with domestic telcos. Cisco and Intel followed in the sixth and seventh spots, leveraging strength in the router market, and data centers and virtualization, respectively. CommScope, NEC, and Fiberhome round out the top 10.

- CommScope is a key provider in the connectivity market, both fixed and mobile, and for broadband CPE.

- NEC is becoming an important player in the emerging open RAN market.

- Fiberhome has a significant market share for network equipment in the Chinese telco market, across optical transport and mobile networks.

- Samsung, ranked 11 in 2Q21, is also a notable player in telco NI, as it is rising in the US due to success at Verizon, and has strong potential in Europe.

MTN Consulting’s telco network infrastructure market share study includes a wide range of vendor types and cuts across hardware, software, and services. That’s in contrast to other market research firms that only count telecom equipment vendors.

If one considers only hardware and software revenues from network equipment providers (NEPs), total revenues were $121.6 billion for the 2Q2021 annualized. The top ten providers for this market are Huawei, Nokia, Ericsson, ZTE, Intel, NEC, Cisco, Fiberhome, Samsung, and Fujitsu. The top four of these suppliers account for 64% of market revenues. This category (NEP hardware & software) most directly maps into what is sometimes reported as the “telecom equipment” market.

Vendors collectively received $110.4 billion in revenue during the first half of 2021, up 7.4% from the first half of 2020. Some of that growth can be attributed to a weak first half of 2020 when the initial spread of COVID-19 clobbered network infrastructure spending plans, Matt Walker, chief analyst at MTN Consulting, explained.

“Labor costs are a big part of telco opex (and rising), and automation is a key area of investment in 2021 for nearly all major telcos,” Walker wrote. “Numerous telcos are reporting that network operations are taking up a larger portion of the opex pie. This is important because vendors are increasingly selling into opex budgets within their telco customers, not just capex budgets. That’s especially true on the services and software sides.”

Total telco capex for the first half of 2021 jumped 9.8% year over year to $151.1 billion, he said, noting that the analyst firm added Airspan, Google Cloud, Amazon Web Services (AWS), and Microsoft Azure to its telco market coverage at the beginning of 2021. Telco capex grew 15% year over year in the second quarter of 2021 while telco opex climbed 14% during the same period.

The biggest YoY Telco NI sales jumps in 1H21 were easily recorded by Ericsson and Nokia, up $1.46 and $1.01B respectively. Cisco, Samsung, and Dell Technologies (VMWare) also saw sizable growth in the telco vertical, as did several vendors riding China’s 5G boom: China Comservice, ZTE, and Fiberhome. On the downside, Huawei’s $1.48B YoY decline in Telco NI sales in 1H2021 was far worse than any other supplier (due to being banned by the U.S. and other countries for political reasons).

Huawei market share decreased the most YoY, when comparing its annualized share in 2Q2021 with that of 2Q2020. As predicted, the company’s share of telco NI has now fallen below 20% (19.01% in 2Q2021, annualized).

For other NI vendors, most changes are due to one of three factors: M&A, telco spending cycles, and technology dislocations.

- Recent M&A deals of note include Capgemini-Altran, CommScope-ARRIS, ECI-Ribbon, Hengtong-Huawei Marine, Casa-Netcomm, and Amdocs-Openet.

- A number of vendors have been impacted by telcos’ 5G infrastructure push, including the recent shift towards core network spending.

- Several large countries are seeing growth in fiber access deployment spending.

- Telcos’ increased adoption of the cloud in a variety of forms cuts across a large number of the changes seen in the below charts. AWS, Azure and GCP have all seen dramatic growth in their telco vertical revenues in the last few quarters, as has Dell Technologies (VMWare) and Arista.

Regarding declines in NI market share, Samsung’s annualized share change reflects a dropoff in Korean 5G spend as it still awaits a pickup in the US, India and/or Europe.

Nokia’s share has stabilized, after falling due to a perception of falling behind in mobile RAN radio technology, as well as its backing away from China. Huawei’s share decline is due to political and supply chain obstacles.

Webscalers/Cloud Service Providers Penetrate Telco Market:

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers (aka webscalers) proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

The cloud sector has geared its offerings to businesses of all stripes and sizes. Serving telecom operators was not an initial focus for many reasons. Telcos have unique network requirements and stringent reliability criteria, and tend to make purchasing decisions slowly. Many telcos also viewed cloud providers with trepidation, as potential competitors on the enterprise side. Yet the telecom market is also one of the biggest around, viewed as a prize worth fighting for. Nearly $300 billion in annual capex and $1.2 trillion in opex (excluding depreciation) are figures that are hard to ignore. Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017. Last year, Microsoft bolstered its 5G and cloud-based telecoms offerings with the big-ticket acquisitions of Affirmed Networks and Metaswitch Networks.

This telco-webscale collaboration activity has picked up in the last 12-18 months. Webscale operators help telcos with service and application development, shifting of workloads, and developing, enabling and marketing cloud-based services. Collaborations can involve delivery of a portfolio of 5G edge computing solutions that leverage the telco’s 5G network and the webscale operator’s global cloud coverage, as well as its expertise in areas like Kubernetes, AI/ML, and data analytics. Managing costs is a central purpose of telcos’ willingness to partner with webscale providers. Increasingly, the webscale operators who deliver cloud services are competing alongside traditional telco-facing vendors like Amdocs, Citrix, CSG and Nokia.

For the four quarters ended 2Q2021, MTN Consulting estimates that AWS, Azure and GCP had aggregate revenues to the telco sector of $1.92 billion, up 78% from the 1Q2020 annualized period. These cloud providers will sometimes be valuable partners for telco-focused vendors, but in many cases they will be competitors, and are important to track.

Telco spending outlook for remainder of 2021:

Telco industry capex is likely to come in around $300B for 2021, only slightly up from $295B in 2019. Telco opex budgets are a bit more appealing for vendors. Opex (excluding depreciation & amortization) is roughly 4x capex, and the network operations-related (“netops”) piece of opex is growing for many telcos. For 2021, MTN Consulting projects netops opex of about $297B, from $282B in 2020, and telco outsourcing of netops tasks are widespread and growing. Cloud providers are taking advantage of some of this growth, but a large number of traditional Telco NI vendors sell into telco opex budgets.

…………………………………………………………………………………………………………………………….

In a related report, MTN says that telco revenues surged to 12.2% (for the first time in at least a decade on a YoY basis) coming in at $478.4 billion (B). But this unusually high growth is due to a weak base in 2Q20, when revenues totaled $426.5B, the lowest ever during the 1Q2011-2Q2021 period. Also, as witnessed in 1Q2021, the trend of currency appreciation against the US dollar in several key markets continued to play out in the latest quarter.

Annualized telco revenues also grew for the second straight quarter, posting $1.88 trillion with a YoY growth rate of 5.5% in 2Q21. At the network operator level, five of the top 20 best performing telcos by topline in 2Q21 posted double-digit growth on an annualized basis. These include Deutsche Telekom (30.6% YoY vs. annualized 2Q20), China Telecom (17.6%), China Mobile (17.3%), and China Unicom (14.1%). By the same criteria, the worst telco growth came from Softbank (-13.9%) during the same period. America Movil and Telefonica were only the two other operators among the top 20 to post a decline in revenues. While the big swings at Deutsche Telekom and Softbank are due to the former closing its acquisition of Sprint from Softbank in April 2020, growth witnessed by other operators was mostly an outcome of low base effect. Another factor for some operators is non-service revenues, as these have grown with 5G device sales in many markets.

The biggest capex spender in 2Q21 on a single quarter and annualized basis was China Mobile. This was despite the company’s YoY drops of 6.4% and 15.3% in the single quarter and annualized 2Q21 periods, respectively, enabled by CM’s network partnership with CBN. Nine out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 2Q21. Some of these include: Deutsche Telekom (52.1% YoY vs. annualized 2Q20), Vodafone (24.2%), Orange (17.6%), and BT (25.6%). On an annualized capital intensity basis, Rakuten beats all other telcos handily with a roughly 183% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Other capital intensity standouts include: Globe Telecom (49.9%), PLDT (43.1%), Oi (41%), Telecom Egypt (34.1%), CK Hutchison (32.7%), True Corp (31.3%), and Digi Communications (31.2%).

To improve operational efficiency, telcos are resorting to several initiatives specifically aimed at digitizing the sales and marketing function. Amid the pandemic last year, telcos were forced to operate with minimal human intervention, and automation efforts have only accelerated since then. As telco execs aim for more automated networks to sustain and grow profitability, automation will be a key selling point for vendor solutions.

Telco industry headcount continues to decline, falling to 4.838 million in 2Q21, down from 4.944 million a year ago. Telco spending on digital transformation, software-defined networks (SDN) and AI tools have facilitated a smaller workforce. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.5 million by 2025. However, we also expect telcos to invest heavily in their workforce: retraining existing employees on digital platforms, and hiring highly skilled software savvy employees. The average telco employee salary will rise as a result, an outlook consistent with 2Q21 results – annualized labor costs per employee increased to $61.5K in 2Q21 from $57.8K in 2Q20.

All four major geographical regions experienced double-digit growth in revenues from 2Q2020. But in capex terms, Europe was a standout as it managed to grow by 29.9% on a YoY basis in 2Q2021. The region also recorded not just an uptick but also the highest annualized capital intensity of 18.4% in 2Q2021, while all other regions witnessed a fall when compared to the same period last year. Europe’s capex growth story is courtesy of a late start to 5G spending due to delayed spectrum auctions, coupled with increased efforts in FTTH deployments and government-supported rural rollouts.

References:

https://www.mtnconsulting.biz/product/telecoms-biggest-vendors-2q21-edition/

https://www.mtnconsulting.biz/product/telecommunications-network-operators-2q21-market-review/

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

Distributed Access Architectures (DAA) Explained, Market Assessment and GCI Deployment

DAA Tutorial:

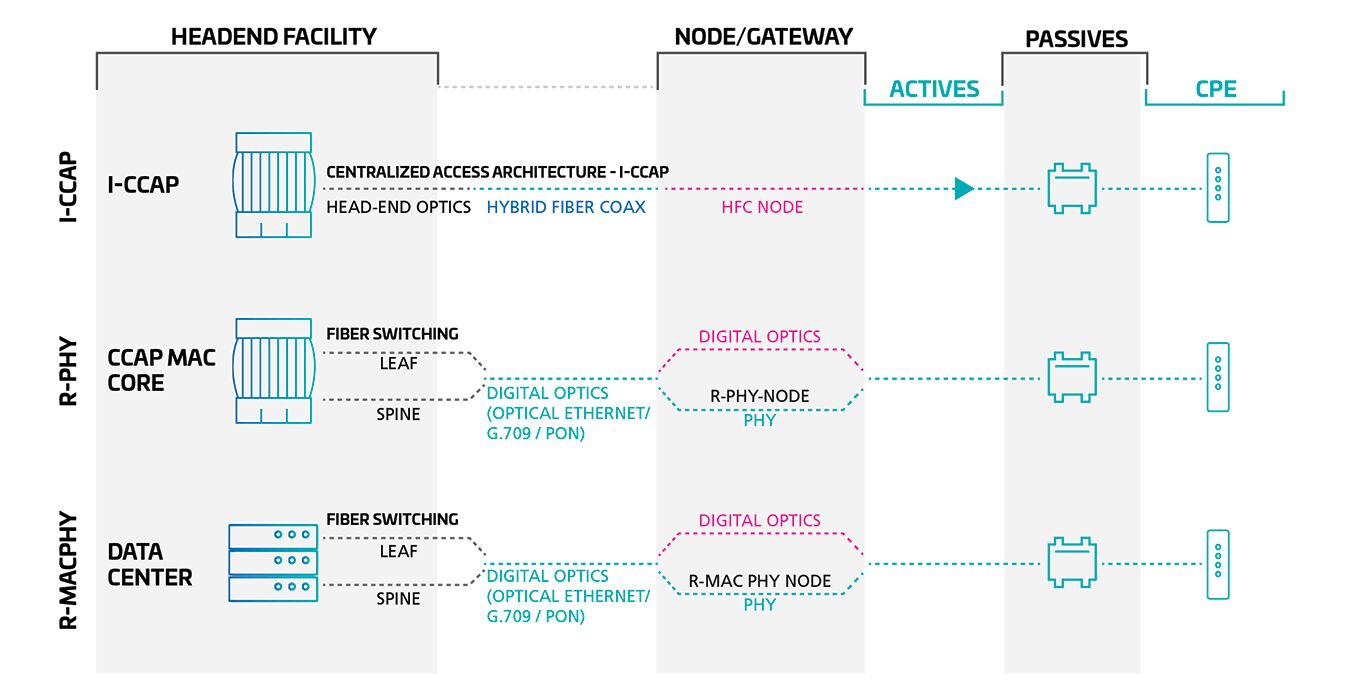

Distributed Access Architecture (DAA) – not to be confused with 1970’s Data Access Arrangement – is a method used to decentralize cable networks by relocating select functions that have typically resided in the headend or hub to intelligent fiber nodes, closer to the subscriber.

DAA enables the evolution of cable networks by decentralizing and virtualizing headend and network functions. DAA extends the digital portion of the headend or hub domain out to the fiber-optic node and places the digital-to-RF interface at the optical-coaxial boundary in the node. Replacing the analog optics from the headend converts the fiber link to a digital fiber Ethernet link, increasing the available bandwidth by improving fiber efficiencies (wavelengths and distance) and directional alignment with the NFV/SDN/FTTx systems of the future.

According to Viavi, DAA deployment hurdles include the assessment of jitter and timing for R-PHY deployments and the complete re-verification of all planned and existing services to be delivered over the new platform. Repurposing any legacy analog fiber for high-speed Ethernet also requires a thorough assessment of the fiber dispersion than can lead to10G Ethernet performance degradation.

Although the level of equipment changeover depends on the architecture selected, a common ingredient for any distributed access architecture deployment is the extensive retrofitting of digital nodes and the deeper digital fiber runs that connect to them. Although deployment strategies may differ substantially, the need for ongoing distributed architecture deployment to address consumer demand is no longer in question.

DAA replaces analog fiber with IP connections (digital fiber) and creates a software-defined network that supports:

- Node evolution with remote PHY and remote MAC/PHY

- Transition to digital optics, removing analog lasers

- Digital fiber closer to the subscriber’s home

- Migration to centralized data centers

- Flexible advertising, channel lineups and bandwidth management

There are three main approaches to DAA –Integrated CCAP (a centralized access architecture), Remote PHY and Remote MAC/PHY – both of which are distributed access architectures that are designed to move key functions out of the headend and closer to customers at the edge of a hybrid fiber – coaxial network. While the former focuses on moving the Physical layer further out, the latter also includes the media access control layer. These are shown in the following illustration:

Illustration Credit: CommScope

………………………………………………………………………………………………………………………………………………….

DAA Market Assessment:

The coronavirus pandemic shifted network operators’ priorities to upstream bandwidth, but now spending on remote PHY and remote MAC/PHY devices is increasing, tweeted Jeff Heynen of the Dell’Oro Group.

Heynen told Fierce Telecom that DAA spending on Remote PHY and Remote MAC-PHY devices in the first half of 2021 was up 62% compared to the first half of last year, jumping from $43 million to $69 million. He added spending for the full year is expected to reach $180 million, up 78% from 2020.

Remote PHY “still dominates the DAA overall spending, with Comcast, Cox, Vodafone, and others (unnamed) are responsible for most of the DAA deployments.” However, Remote MAC-PHY is forecast to gain more traction in 2022. “We’ll see more substantial increases in 2023 as operators upgrade their networks for DOCSIS 4.0,” Jeff added.

GCI Deploys CommScope’s DAA Solution:

Separately, Alaska’s #1 network operator GCI is deploying CommScope’s Remote MAC-PHY product as part of a network upgrade plan it is executing to deliver 2G and eventually 10G broadband to customers. The CommScope product GCI is using can be deployed as either a Remote PHY or Remote MAC-PHY device. [The CommScope RD2322 RxD is a Remote MAC/PHY Device (RMD)]

With the upcoming launch of the service in 19 Alaska communities, GCI will be among the nation’s leaders in 2G internet deployment.

The RD2322, which CommScope first announced in May, can be deployed as either a Remote PHY Device (RPD) or a RMD based on its software image. GCI deployed the RMD in its existing CommScope NC4000 fiber nodes by swapping the node lid, bringing a host of key advantages to the GCI network including a simplified, distributed access architecture (DAA), lower latency, greater headend efficiencies, and higher throughput.

“GCI is now among the first to deploy Remote MACPHY in its broadband network, and we credit our longstanding partnership with CommScope for our successful launch,” said Victor Esposito, vice president, Engineering, GCI. “The deployment of RMDs paves the way for GCI’s launch of 2 gig internet in the coming months and our journey to 10G in the next five years. RMD technology also allows us to move internet distribution from the centralized headend out into neighborhood nodes, enabling GCI to provide more reliable, better quality, and higher performance service to our customers. We look forward to working with CommScope to deploy RMDs throughout our network in Alaska.”

“CommScope deeply understands the imperative to transition networks to DAA,” said Ric Johnsen, senior vice president and segment leader, Broadband Networks, CommScope. “We designed the RD2322 platform to cater to the broad needs of our operator customers—whether they’re going directly to Remote MACPHY, like GCI, or are choosing to start with Remote PHY. The RMD leverages over 20 years of field-hardened software as well as seamless integration with legacy back-office infrastructure to make this high-profile transition simple and reliable.”

CommScope’s end-to-end solution for Remote MACPHY includes the RMD, fiber nodes, video delivery, fiber, cables, and connectors, as well as back-office software to orchestrate, onboard, manage, and scale deployments. The RMD provides an evolutionary path for operators to transition from I-CCAP and Remote PHY to Remote MACPHY—an architecture with a clear path to DOCSIS 4.0 Extended Spectrum DOCSIS. To find out more about CommScope’s solutions for Remote MACPHY, please visit the CommScope website.

References:

https://www.fiercetelecom.com/operators/gci-taps-commscope-for-daa-push-road-to-10-gbps

https://www.commscope.com/press-releases/2021/gci-deploys-commscope-remote-macphy-device-for-daa/

https://www.commscope.com/solutions/broadband-networks/distributed-access-architecture/

Ericsson, Singtel and global partners to power Singapore’s 5G enterprise ecosystem

Ericsson and Singtel have partnered to accelerate 5G adoption across multiple industries and leverage industry partnerships to develop and deploy advanced 5G solutions in Singapore. The partnership utilizes Ericsson’s networking expertise and Singtel’s 5G network, test facilities and capabilities, and also involves collaboration with global industry partners across various industries such as oil and gas, maritime, pharmaceutical, aerospace, financial services, retail and construction. The global partners are ABB, Axis Communications, Bosch, Bosch Rexroth, DHL Supply Chain, Hexagon, PTC and Rohde & Schwarz as well as Cradlepoint (part of Ericsson and provider of enterprise 5G wireless edge solutions).

Singtel recently announced a ramp up of its 5G roll out across Singapore and to accelerate the adoption of 5G by enterprises.

Bill Chang, Chief Executive Officer, Group Enterprise at Singtel said, “We are always looking for ways to stimulate conversations and drive even more innovation to encourage more 5G adoption by enterprises. Our partnership with Ericsson have been key to our 5G roll out and offers us a unique opportunity to come together to build an open platform for enterprises to ideate, co-create, test and eventually go-to-market. We have seen some encouraging outcomes from our early trials and key to that success is our common goal of transforming the future of business operations by harnessing the power of 5G. These trials are the springboard to more innovation and we welcome more enterprises to come on board with their ideas.”

“We have seen some encouraging outcomes from our early trials and key to that success is our common goal of transforming the future of business operations by harnessing the power of 5G. These trials are the springboard to more innovation and we welcome more enterprises to come on board with their ideas.””

The ABB single-arm YuMi® cobot used in a 5G setup. Photo Credit: ABB

With large scale applications of 5G as the end goal, Singtel and Ericsson are working with Hexagon on rolling out large scale autonomous shop floor measurement with 5G connection that can have potential benefits in the aerospace, oil and gas, construction, automotive, shipyard and wind energy industries. With a laser tracker device, non-contact, 3D precision measurements can be done easily, quickly and accurately on large pipes and aerospace parts, with the measured data then transmitted to the control center. The laser tracker device is connected to 5G for remote measurement and this allows for accurate measurements even in hard-to-reach areas and provides stability when measuring a freeform surface. With a more significant bandwidth, 5G technology also enables faster and more extensive measurements to be done.

Advances in technology are reshaping security capabilities and Axis Communications is leveraging 5G technology to innovate for a smarter and safer world. Trials have started using high performance Axis devices and cameras connected through Singtel’s MEC network. The trials demonstrate the ease and cost-effectiveness of deploying Axis devices with edge-based analytics for cities in areas that have previously been off-limits or too costly to do so, ultimately making cities safer and providing a better living environment. The new 5G network will also facilitate Axis Communications deployment of advanced analytics together with our devices in hard-to-reach places and enhancing security and protection in hitherto inaccessible areas.

Building a robust 5G ecosystem and shoring up capabilities

The partnership builds on the joint 5G initiatives rolled out by both companies in the past year. These include achieving Singapore’s fastest 5G speeds of 3.2 Gbps at Singtel’s unmanned pop-up retail store UNBOXED, using Ericsson’s high bandwidth, low latency 28 Ghz mmWave technology as well as Singtel’s GENIE, the world’s first portable 5G-in-a-box platform powered by Ericsson to enable enterprises to experience 5G’s capabilities and trial use cases in their own premises.

According to an Ericsson report – “5G for business: a 2030 market compass”, the total digitalisation revenue in Singapore is forecasted to reach US$17.41 billion by 2030, with 5G-enabled revenue estimated at US$6.48 billion. As a regional economic, business and technology hub, Singapore is an ideal launchpad for 5G-empowered industry 4.0 solutions including robotics, Augmented/Virtual/Mixed Reality, Artificial Intelligence and IoT which require fast speeds, high capacity and low latency connectivity.

Martin Wiktorin, Head of Ericsson Singapore, Brunei and Philippines, says: “As a global ICT leader with 97 live networks deployed worldwide, we are also pioneers for research in 5G for industries. Today, digitalization is a top priority for businesses, and 5G will enable a further shift towards digital transformation, accelerated by the current Covid-19 pandemic. With an extensive network of international partner engagements spanning a multitude of different ecosystems, this collaboration is built on the longstanding relationship we hold with Singtel and all global industry leaders. Together, we aim to further accelerate the 5G enterprise ecosystem and enhance Singapore’s leading edge as one of the world’s most competitive nations.”

On-going trials for industrial applications

A total of three trials are ongoing, with ABB, Axis Communications and Hexagon among the first companies to have started their trials. The trials span across advanced manufacturing, logistics, smart city development, analytics and industrial automation.

ABB has successfully tested the potential of 5G in the industrial manufacturing space, supporting the low latency operation of an ABB collaborative robot. The test was conducted in ABB’s workshop, where ABB’s single-arm YuMi® cobot was connected to Singtel’s 5G GENIE to access an on-site Multi-Access Edge Computing (MEC) platform.

Singtel’s 5G NSA and 5G SA network offerings:

Singtel had initially launched its 5G non-standalone (NSA) network in September of 2020, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum.

Singtel had announced their 5G SA network in the country this May. Singtel had partnered with Samsung to launch 5G SA. The 5G SA sites use 3.5 GHz spectrum.

Singtel said it plans to intensify its 5G SA deployment across the island state in the coming months as handset manufacturers progressively roll out 5G SA software updates for existing 5G handsets and launch more 5G SA-compatible models in Singapore later this year.

The Asian telco said it is using 28 GHz mmWave spectrum, in addition to the 3.5 GHz and 2.1 GHz bands, to boost its 5G deployment in Singapore.

References:

https://www.rcrwireless.com/20211008/5g/ericsson-singtel-boost-adoption-5g-industries

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Bandwidth growth, driven by the expansion of data centers and 5G network build-outs, is expected to drive the need for faster coherent Dense Wavelength Division Multiplexing (DWDM) pluggable optics. Consequently, Data Center Interconnect (DCI) and metro Optical Transport Network (OTN) platforms are transitioning from 100/200G to 400G pluggable coherent optical modules to support these hyper-connected architectures.

Microchip Technology (a fabless semiconductor company) and Cisco’s Acacia unit are working together to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The purpose of the collaboration is to establish an ecosystem to support 400G CFP2-DCO, QSFP-DD and OSFP modules for the 400ZR specification as well as the OpenZR+ and Open ROADM Multi-Source Agreement (MSA) applications.

The collaboration between Microchip and Acacia helps to enable the use of 400G coherent pluggable optics in OTN and Ethernet systems as follows:

- For converged packet/OTN optical platforms, Microchip’s DIGI-G5 and Acacia’s 400G CFP2-DCO module are designed to enable terabit-class OTN switching line cards, mux/transponders, and switch/transponders. The DIGI-G5 interoperates with Acacia’s 400G CFP2-DCO module using a Flexible OTN (FlexO) or NxOTU4 interface to efficiently support OTN traffic, including Open ROADM MSA interface modes and 200G/400G ITU-T standards currently being drafted.

- For compact modular optical systems, Microchip’s META-DX1 and Acacia’s 400ZR and OpenZR+ modules are designed to enable 400G flexible line rate muxponders/transponders with support for multiple client optics types including QSFP28, QSFP-DD, and OSFP modules, helping service providers to transition from 100 GbE to 400 GbE using the same hardware.

- For data center routing and switching platforms, Microchip’s META-DX1 and Acacia’s 400ZR and OpenZR+ modules are designed to enable dense 400 GbE or FlexE with per port MACsec encryption coherent line cards. This helps customers leverage IP routers/switches over DWDM (IPoDWDM) infrastructure in DCI deployments.

“DIGI-G5 and META-DX1 have enabled our optical transport, IP routing and Ethernet switching customers to implement a new class of multi-terabit OTN switching and high-density 100/400 GbE and FlexE line cards that deliver on stringent packet timing and integrated security capabilities for the build out of cloud and carrier 5G-ready optical networks,” said Babak Samimi, vice president for Microchip’s Communications business unit. “Our interoperability efforts with Acacia help to demonstrate that an ecosystem for volume deployment of these new line cards with pluggable 400G coherent optics exists.”

“With Acacia’s 400G coherent modules verified to interoperate with Microchip’s DIGI-G5 and META-DX1 devices, we see it as a robust solution designed to address network capacity growth and improved efficiency,” said Markus Weber, senior director DSP, product line management of Acacia, now part of Cisco. “The compact size and power efficiency of our 400G OpenZR+ CFP2-DCO modules were designed to help network operators deploy and scale capacity of high-bandwidth DWDM connectivity between data centers and in metro networks.”

Kevin So, associate director of product line management and marketing at Microchip, told Fierce Telecom that the pair have a history of collaboration that goes back to work on 100G. He said their latest effort is meant to proactively eliminate elements of risk operators face as they begin to upgrade to the latest 400G technology. While most solutions are based on industry standards, So cautioned that’s not always a guarantee that components from different companies will work well together.

“I’ve seen in our industry often standards are written, people think things are going to work and then you show up at a carrier lab and that’s when you discover problems. Standards still do not necessarily always ensure everything is interoperable ready to go, and it can be a barrier for ultimately our customers and service providers in deploying it,” Mr. So said.

The companies stated they successfully validated interoperability between their respective components for 400G, ZR and OpenZR+ configurations in converged packet and OTN optical platforms, compact modular optical systems and data center routing and switching platforms.

So said Microchip’s work with Acacia started in the pre-silicon stage, ensuring the interfaces and designs they were pursuing were compatible. Once the silicon in question became available, the pair “tested these components together as a system to make sure it’s robust enough.”

Tom Williams, director of marketing for Acacia told Fierce Telecom, “This interop testing demonstrates that leading vendors are working together to streamline the integration process. There wasn’t any expectation of issues, but it builds confidence to know that the vendors have already done this work directly.”

References:

https://www.fiercetelecom.com/telecom/cisco-s-acacia-microchip-team-400g-interoperability-testing

Additional Resources:

For more information about the Microchip products, contact a Microchip sales representative, authorized worldwide distributor, or visit the DIGI-G5 and META-DX1 pages.

For more information on Acacia’s 400G coherent pluggable optical solutions, visit acacia-inc.com/products/.

For additional information on standards:

- For OpenZR+ MSA visit openzrplus.org

- For Open ROADM MSA visit openroadm.org

- For 400ZR visit www.oiforum.com/technical-work/hot-topics/400zr-2/

Nokia and MediaTek use Carrier Aggregation to deliver 3.2 Gbps to end users

Nokia and MediaTek today announced that they have achieved a world’s first by successfully aggregating 5G Standalone (5G SA) spectrum using 3 Components Carrier (3CC) aggregation. This increases the sub-6Ghz 5G spectrum utilization by combining 210MHz of FDD and TDD spectrum more efficiently to reach 3.2Gbps peak downlink throughput. The move will enable communication service providers to deliver higher throughputs and better coverage to more customers.

- Successful validation test achieves first 3 Component Carriers sub-6GHz carrier aggregation combining FDD and TDD spectrum; Utilizes Nokia’s AirScale 5G Standalone Carrier Aggregation solution with commercial hardware and software

- The test combined 210MHz of spectrum from three component carriers to achieve 3.2Gbps downlink speeds

To achieve this performance, Nokia supplied its latest AirScale equipment including its AirScale 5G SA architecture powered by its energy-efficient ReefShark System-on-Chip (SoC) technology as well as its cloud-native 5G core. MediaTek provided its new M80 5G modem which combines mmWave and sub-6 GHz capabilities onto a single chip as well as the user equipment testing platform.

Carrier Aggregation (1st specified in LTE Advanced) combines frequency bands for higher rates and increased coverage, delivering superior network capacity by maximizing the spectral efficiency of 5G networks. Frequency division duplex (FDD) in 600MHz (n71) is a lower frequency band that provides a wide coverage area, improving cell edge performance. Time-division duplex (TDD) in 2600MHz (n41) has higher bandwidth and capacity. The combination of these spectrum bands supports a range of 5G deployment scenarios including indoor as well enhanced outdoor coverage. The high-band sub-6Ghz spectrum bands support high-capacity and extreme mobile broadband capabilities.

Telecoms.com’s Scott Bicheno wrote:

While claiming a ‘world first,’ the press release is a bit light on specifics. We’re told at least one of the carriers was in the 600 MHz band, using FDD technology, while at least one other was in the 2600 MHz band using TDD. A total of 210 MHz of spectrum were used but we’re not told the split. Our guess would be 10 MHz of the 600 band and 2×100 MHz of the 2600 band. The idea seems to be that this combo offers capacity when the higher frequency is available but can still fall back to a minimal level of coverage when it’s not.

JS Pan, General Manager, Wireless Communication System, and Partnerships at MediaTek, said: “This test demonstrates the importance of carrier aggregation in enabling mobile operators around the world to deliver best-in-class speed and capacity to their subscribers. The combination of Nokia’s AirScale portfolio and our technology boosts the possibilities of spectrum assets and 5G networks. We look forward to continuing to partner with Nokia to advance the 5G ecosystem.”

Mark Atkinson, SVP, Radio Access Networks PLM at Nokia, said: “Nokia continues to drive the 5G ecosystem by delivering new and important innovations. This validation test demonstrates how mobile operators can maximize their spectrum allocations and deliver enhanced coverage and capacity to subscribers. Nokia is committed to pushing the boundaries of 5G and delivering industry-leading performance. High-capacity Carrier Aggregation combinations can be achieved in both 5G Standalone (SA) and Non-Standalone (NSA) based on our scalable Airscale Baseband architecture.”

Mr. Bicheno commented:

It’s still not clear what the ‘world first’ claim refers to. Is it the aggregation of three carriers? Is it the combination of FDD and TDD in one transmission? Is it the total bandwidth achieved? It’s as if they’re trying to provoke journalists by failing to substantiate hyperbolic claims made in the headline. After all, that’s our job.

Yes, it is your job Scott and we are all grateful for that. Sadly, few other journalists (except a few like yours truly) hardly ever scrutinize a press release or news announcement.

Reference:

Nokia claims 3x carrier aggregation first with a bit of help from MediaTek

Summary of Facebook Connectivity Projects

Facebook Connectivity works with partners to develop these technologies and bring them to people across the world. Since 2013, Facebook Connectivity has accelerated access to a faster internet for more than 300M people around the world. Earlier this week, during an event called Inside the Lab, our engineers shared the latest developments on some of our connectivity technologies, which aim to improve internet capacity across the world by sea, land and air:

- Subsea cables connect continents and are the backbone of the global internet. Our first-ever transatlantic subsea cable system will connect Europe to the U.S. This new cable provides 200X more internet capacity than the transatlantic cables of the 2000s. This investment builds on other recent subsea expansions, including 2Africa PEARLS which will be the longest subsea cable system in the world connecting Africa, Europe and Asia.

- To slash the time and cost required to roll out fiber-optic internet to communities, Facebook developed a robot called Bombyx that moves along power lines, wrapping them with fiber cable. Since we first unveiled Bombyx, it has become lighter, faster and more agile, and we believe it could have a radical effect on the economics of fiber deployment around the world.

- Facebook also developed Terragraph, a wireless technology that delivers internet at fiber speed over the air. This technology has already brought high-speed internet to more than 6,500 homes in Anchorage, Alaska, and deployment has also started in Perth, Australia, one of the most isolated capital cities in the world.

Bombyx wraps fiber around existing telephone wires, clearing obstacles and flipping as it needs to along its route. (Source: Facebook)

Facebook wants to bring high-speed reliable internet to more than 300M people — but the work doesn’t stop there. Connecting the next billion will require many different approaches. And as people look for more immersive experiences in new virtual spaces like the metaverse, we need to increase access to a more reliable and affordable internet for everyone. The company believes this work is fundamental for creating greater equity where everyone can benefit from the economic, education and social benefits of a digitally connected world.

“High speed, reliable Internet access that connects us to people around the world is something that’s lacking for billions of people around the world,” Mike Schroepfer, Facebook’s chief technology officer, declared during the company’s “Inside the Lab” roundtable discussion. “Business as usual will not solve it. We need radical breakthroughs to provide radical improvements – 10x faster speeds, 10x lower costs.”

Facebook and its partners are in the process of building 150,000 kilometers of subsea cables, and working on new sea-based power stations that will provide those cables with power.

“This will have a major impact on underserved regions of the world, notably in Africa, where our work is set to triple the amount of Internet bandwidth reaching the continent,” Dan Rabinovitsj, Facebook’s VP of connectivity, explained. That activity partly ties into a new segment of subsea cables called 2Africa PEARLS that will connect three continents: Africa, Europe and Asia.

(Source: Facebook)

2Africa Pearls, a new segment of subsea cable that connects Africa, Europe and Asia, will bring the total length of the 2Africa cable system to more than 45,000 kilometers, making it the longest subsea cable system ever deployed, the company said.

Cynthia Perret, Facebook’s infrastructure program manager, noted every transatlantic cable Facebook connects will contain 24 fiber pairs. “Capacity alone isn’t enough,” she said, noting that Facebook is also working on ways to configure and adapt the amount of capacity provided to each landing point. Facebook is also utilizing a model called “Atlantis” to help forecast and optimize where subsea cable routes need to be built. An integrated adaptive bandwidth system will likewise allow Facebook to shift capacities based on traffic patterns and reduce congestion and improve reliably, Perret explained.

References: