VIAVI: 5G Service Now Reaches 1,662 Cities in 65 Countries

VIAVI today released new research demonstrating the accelerating pace at which 5G is growing, with coverage extending to an additional four countries and 301 cities worldwide since the beginning of this year. The new total — 1,662 cities across 65 countries — represents an increase of more than 20 percent during 2021 to date, according to the latest edition of the VIAVI report “The State of 5G,” now in its fifth year.

The top three countries that have the most cities with 5G coverage are China at 376, the United States at 284, and the Philippines with 95, overtaking South Korea which is now in fourth position with 85 cities. The APAC region remains in the lead with 641 cities, closely followed by EMEA at 623. The Americas region lags behind at 398 cities.

With the launch of commercial 5G services in four additional countries — Cyprus, Peru, Russia and Uzbekistan — well over a third of the world’s countries now have at least one live 5G network. However, the quality and speed of connectivity can vary significantly from region to region depending on available spectrum.

“Although we are seeing a significant jump in the number of networks being rolled out, not all 5G technologies are created equal,” said Sameh Yamany, Chief Technology Officer, VIAVI. “Networks operating in lower, mid and upper band frequencies perform very differently in terms of reach and throughput, increasing the importance of network assurance and optimization to consistently fulfill the promise of 5G.”

The latest edition of The State of 5G report is available here. The data was compiled from publicly available sources for information purposes only, as part of the VIAVI practice of tracking trends to enable cutting-edge technology development that allows communications service providers to command the 5G network.

This week during the Mobile World Congress in Barcelona, VIAVI is contributing to a demonstration of eMBB end-to-end testing with Rohde & Schwarz (Hall 3, Stand 3K30). VIAVI also will participate in a live panel discussion during the O-RAN ALLIANCE Industry Summit on June 29 to discuss the latest industry updates on the progress of O-RAN, and will showcase new virtual demos related to near-real-time RIC testing and deployment of an O-CU tester on edge infrastructure in the O-RAN Virtual Exhibition.

About VIAVI

VIAVI is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn, Twitter, YouTube and Facebook.

……………………………………………………………………………………………………………………………………………………………………………….

Only 19% of US business professionals claim to understand the benefits of 5G, according to a survey by Ciena, conducted in partnership with research firm Dynata. The survey found that there is an opportunity for telcos and the wider industry to better educate consumers on the full benefits that 5G can deliver, with:

- 41% of working professionals saying they only know a little bit about the benefits of 5G

- 32% of working professionals stating they have heard of 5G, but don’t understand what it is

- 8% of working professionals never having heard of 5G

Today, the main benefit that U.S. professionals associate with 5G is ‘faster access speeds’, which was cited by 61% of respondents. By contrast, only 6% of respondents considered ‘reduced latency (lag)’ to be a major benefit. Furthermore, only 18% of respondents said that they consider ‘more reliable connectivity’ to be a major benefit; and only 16% recognized ‘better wireless coverage’ as a major benefit. This illustrates a significant knowledge gap relating to 5G, both in terms of what it can deliver, and the terminology used to communicate the benefits.

Steve Alexander, Senior Vice President and Chief Technology Officer at Ciena, said: “5G is much more than just a faster wireless technology. 5G enables constant connectivity for people, machines and devices and is the infrastructure that the Internet of Things will rely on to create the cloud experience that we all need in our increasingly digital world. Yet, most professionals surveyed admit they don’t completely understand the broader benefits of 5G.”

“Fortunately, the data also highlighted the demand for 5G services, which could be leveraged – and indeed, driven – by providers effectively communicating the benefits and delivering the services users want, both humans and machines.”

Alexander at Ciena concluded: “People understand 5G will have an impact for closing the digital divide and providing a boost to major industries across the US. However, alongside delivering the scalable, intelligent, and adaptive infrastructures necessary to enable 5G, service providers and their trusted technology partners like Ciena must take steps to help close the knowledge gap.”

Notes To Editors

The survey was carried out by Dynata on behalf of Ciena, from April 13-23 2021 and included a representative sample of 1908 business professionals across the United States.

Fitch: 5G drives competitiveness, scale and consolidation or network sharing for APAC telcos

Tough competition and advantages of scale will drive consolidation in the APAC telecoms industry ahead of higher 5G investments, according to Fitch Ratings. The 5G technology will favor larger operators with strong balance sheets, which we expect to contribute to diverging credit quality over time among telcos.

Scale is increasingly important for telcos to drive cost efficiencies and manage cash flows amid a subdued growth environment. Data monetization remains a challenge in most markets, aggravated by price competition and the lack of differentiation among product offerings.

5G Drives Competitiveness: Competitive position and financial structure are key differentiating factors for APAC telcos, which will invest in 5G spectrum and capex to preserve their competitive capabilities in an increasingly commoditized sector. 5G technology will favor operators with scale and strong balance sheets, which may contribute to diverging credit quality over time across the peer group.

Spectrum assignments and renewals will take place over the next 18 months in India, Australia, Thailand, Korea, Malaysia and Hong Kong, underlining the emphasis on capital preservation through staggered investment, dividend reduction and asset sales. PT Telekomunikasi Indonesia Tbk (BBB/Stable) is the only company with high rating headroom, while Singapore Telecommunications Limited (A/Stable) has the least.

APAC region telecoms industry consolidation is highly likely. Fitch expects tight competition and significance of scale to raise the prospects of M&A in India, Indonesia, Malaysia and Singapore.

Thus, it will be difficult for smaller telcos to take on 5G infrastructure investments without an immediate ROI (return on investment) payback. Network-sharing – in the form of passive tower infrastructure or active radio equipment – has become important to drive scale efficiencies and the feasibility of 5G investments.

In their November 2020 APAC Telecoms report, Fitch said APAC telcos are likely to bolster cash generation ahead of their 5G investment upcycles, supporting stable competition in most markets. The outlook has worsened for three countries – Singapore, Thailand and Indonesia – down from four in the previous year.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.fitchratings.com/research/corporate-finance/asia-pacific-telecoms-peer-review-23-06-2021

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

Rakuten Mobile, NEC and Intel announced today that they have achieved a performance of 640 Gbps per server for the containerized User Plane Function (UPF) on the containerized 5G SA core network jointly developed by Rakuten Mobile and NEC running on the Rakuten Communications Platform (RCP).

In the absence of ITU-T standards or 3GPP implementation specs (beyond architecture and functional requirements) for 5G SA core network or the ultra hyped 5G functions that go with it (e.g. network slicing, automation, service chaining, etc), the Rakuten Mobile-NEC containerized 5G SA core network is a very important development.

We documented that in this IEEE Techblog post. Rakuten has said they plan to sell their RCS platform (which includes 5G SA core network spec and software) to 5G SA network providers. They say they already have at least 15 customers.

According to Dave Bolan of Dell’Oro Group, most 5G SA networks will be based on containers (rather then virtualized network functions/VNF).

Many analysts say that containerized UPF performance is needed to maximize the value of 5G deployment. This is because the control plane (C-plane) and user plane (U-plane), which were historically collocated, are completely decoupled in this disaggregated 5G architecture. Separating them enables an independently scalable UPF which is key to private networks, edge computing, hybrid cloud and to accelerate a variety of deployment scenarios. Rakuten Mobile has adopted 5G architecture from the launch of its network, including a CUPS (Control and User Plane Separated) packet core for its 4G LTE network.

TelecomTV says that control and data plane separation enables the 5G network operator to deploy multiple UPF instances closer to where the traffic originates, rather than at fixed locations in the network. The result is lower latency and a better user experience. It also means UPF instances can be turned on and off as capacity demand dictates, enabling operators to dynamically allocate network resources.

The 640 Gbps performance per server for the containerized UPF on the 5G SA core network was achieved in a laboratory environment in Tokyo. This represents a significant opportunity to drive high performance of the commercial network in the future.

NEC says it leveraged its industry-leading product development based on its advanced telecom and IT expertise to maximize CPU utilization and fast memory access. That software was facilitated by use of Intel’s latest high-performance infrastructure, including 3rd Gen Intel Xeon Scalable processors with built-in AI acceleration and Dual-port 100Gb Intel Ethernet Network Adapter E810-2CQDA2 with Dynamic Device Personalization (DDP).

Rakuten Mobile, Intel and NEC have collaborated on high-speed processing of containerized UPF, which plays a significant role in this initiative, and achieved a performance of 640 Gbps per server. High-speed processing in a containerized environment on Rakuten Mobile’s RCP enables instant and flexible deployment of UPF from edge to central locations based on traffic characteristics, leveraging RCP’s full automation features.

“Rakuten Mobile has successfully designed and built a fully containerized mobile network based on open standards,” commented Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “With NEC and Intel, we have demonstrated that extremely high-speed processing is possible on containers. We aim to continue to pursue performance improvements in the core to achieve higher throughput and reduce cost and energy consumption in the rollout of network technology in Japan and worldwide.”

“We’re proud that Rakuten Mobile, Intel and NEC were able to demonstrate industry-leading UPF performance,” commented NEC Executive Vice President Atsuo Kawamura. “NEC has been developing high-performance and highly reliable 5G systems by leveraging our vast experience that includes more than 25 years in mobile core networking. Our strong track record, technical capabilities and expertise in both network and computing domains, allowed us to bring high-quality 5G core to virtualization and cloud-native technology. NEC and Intel have a long-term relationship in the hardware business, including CPUs and NICs (Network Interface Cards), and have jointly enhanced the acceleration technology for virtualization, represented by the DPDK (Data Plane Development Kit). NEC performed significant optimization and improvements to pursue higher performance for the cloud-native UPF. In the future, we will continue to contribute to society through 5G in Japan and around the world leveraging the results of this project.”

“The fully virtualized Rakuten mobile network featuring NEC’s containerized 5G UPF software built on the latest Intel technology is another key proof point of how ecosystem collaboration and industry leading technology are both essential to fulfill the promise of 5G,” said Dan Rodriguez, corporate vice president and general manager of Intel’s Network Platforms Group. “The ongoing development and optimization work among the companies on the latest 3rd Gen Intel Xeon Scalable processors and Intel Ethernet 800 Series network adapters not only provides outstanding performance, but the added flexibility to run workloads from core to edge that are designed to offer the best experience for end users.”

Rakuten Mobile and NEC started jointly developing an open, fully containerized SA 5G core network in June 2020 to be utilized in Rakuten Mobile’s mobile network in Japan and made available within RCP.

In the RAN domain, NEC is also providing 5G radio units (5G RU) for Rakuten Mobile’s network in Japan, and recently, Rakuten Mobile and NEC announced the broadening of their collaboration to provide 5G and 4G radios and engineering services for Open RAN systems aligned with O-RAN specifications for global markets, and accelerate the global expansion of the RCP.

Through the joint development of the open and fully cloud native containerized SA 5G core network, Rakuten Mobile and NEC aim to drive innovation in global mobile technology and provide high-quality 5G network technology to customers in Japan and around the world.

Comment and Analysis:

In an email to this author earlier this year, Rakuten Mobile CTO Tareq Amin wrote: “NEC/Rakuten 5GC openness are realized by implementation of “Open Interface” defined in 3GPP specifications (TS 23.501, 502, 503 and related stage 3 specifications). 3GPP 5GC specification requires cloud native architecture as the general concept (service based architecture). It should be distributed, stateless, and scalable. However, an explicit reference model is out of scope for the 3GPP specifications.”

Dell’Oro Group’s Dave Bolan via an email this week: “All of 5G Core will be Cloud-Native, mostly Container-based. Except there are different cloud-native versions and container versions, not making it truly open. Anyone that wants to put their core on the public cloud will have to customize it for each cloud platform. Same may be true for the NFVI if it runs on – x86, AMD, ARM, or Nvidia – and couple that with the different UPF acceleration techniques, it gets complex very quickly.”

Alex Quach, VP of Intel’s Data Platforms Group, said most operators around the world are still leveraging a 4G core network. “The way different service providers implement their 5G core is going to vary,” said Quach. “Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

How could 5G SA possibly be open if there are no standards or implementation specs for 5G cloud native core network or true 5G functions like network slicing?

The result will be multiplicity of 5G SA carrier specific software running on different cloud service provider (CSP) compute servers. Note also that each CSP has their own set of APIs and different cloud configurations will be used for the 5G cloud native core network. The upshot is that changing a 5G SA software vendor or cloud service provider will be a huge problem for 5G network operators. Again, that’s because of the proprietary nature of 5G SA deployments in the absence of 5G core network standards/open implementation specs.

What’s worse is that this will have a huge negative impact on PORTABLE/GEOGRAPHICALLY MOBILE 5G endpoints, like smartphones, tablets, notebook computers, gaming consoles, etc. As each network provider’s 5G core network will be different, a unique, carrier specific 5G core download will be required for 5G endpoints for each 5G SA core network provider.

That will severely restrict portability/mobility to within a single carrier serving area and effectively prevent 5G SA roaming. For example, Samsung is providing 5G SA network downloads for its smartphones that operate on T-MobileUS 5G SA network. But those downloads won’t work on any other 5G SA network, so the truly mobile user will fall back to 4G-LTE whenever he or she is outside T-MobileUS’s carrier service area.

……………………………………………………………………………………………………………………………..

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T added 235,000 fiber connections in the first quarter, ending the period with nearly 5.2 million total fiber customers. AT&T says they have a total of around 15 million fiber and non-fiber customers, so fiber access is approximately 1/3 of total customers now.

The company recently announced it plans to build fiber to 3 million new customer locations this year and 4 million next year. AT&T plans to double the number of locations where it offers fiber Internet, from approximately 15 million to about 30 million, by 2025. To do that, AT&T is planning to increase its annual capital expenses from $21 billion to around $24 billion.

AT&T’s new focus on connectivity over content is a direct result of its spinning off Warner Media to Discovery, as we chronicled in this IEEE Techblog post. Thaddeus Arroyo, head of AT&T’s consumer business, made that crystal clear at a recent BoA investor event:

“We expect capital expenditures of about $24 billion a year after the Warner Media discovery transaction closes. That’s an incremental investment that’s going to go to fiber to 5G capacity and 5G C-band deployment.

We have another great opportunity, the one we continue to talk around fiber. So as part of this capital, we’re going to be investing in fiber expansion to meet the growing needs for bandwidth that require a much more robust fiber network regardless of the last mile serving technology. Fiber is the foundation that fuels our network. Expanding our fiber reach serves multiple services hanging off at each strand of fiber. It includes macro cell sites, small cell sites, wholesale services, enterprise, small business, and fiber that’s extended directly into our customers’ homes and into businesses.

We plan to reach 30 million customer locations passed with fiber by the end of 2025. That’s going to double our existing fiber footprint. And investing in fiber drives solid returns because it’s a superior product. Where we have fiber we win, we’re improving share in our fiber footprint, and the penetration rates are accelerating and growing, given our increased financial flexibility. We’re comfortable in our ability to invest and achieve our leverage targets that we outlined of getting to 2.6% at close and below 2.5% by the end of 2023.”

Mo Katibeh, the AT&T executive responsible for fiber and 5G build-outs, added on via a recent post on LinkedIn: “We are building MORE Fiber to MORE homes and businesses. And we’re talking A LOT of fiber – MILLIONS of new locations every year, planning to cover 30 MILLION customer locations by the end of 2025! And you know what comes with all that investment in America? JOBS. Our AT&T Network Build team is GROWING..”

Previously, Katibeh wrote on LinkedIn : “Contributing to a large portion of the $105B Capital spend between 2016 and 2020 – our team is building out AT&T #Fiber to MILLIONS of new customer locations in 2021, as well as augmenting America’s best mobility network with more capacity, more speed – and more #5G (you know I love 5G!).”

…………………………………………………………………………………………………………………………………………………………..

So with all that said, will AT&T’s fiber build-out keep pace with cable companies/MSOs DOCSIS networks?

Tom Rutledge, Charter’s CEO, made a brief comment about plant upgrades on the earnings call (note – Dave Watson made similar comments on the Comcast earnings call):

“We’re continuously increasing the capacity in our core and hubs and augmenting our network to improve speed and performance at a pace dictated by customers in the marketplace. We have a cost-effective approach to using DOCSIS 3.1, which we’ve already deployed, to expand our network capacity 1.2 gigahertz, which gives us the ability to offer multi-gigabit speeds in the downstream and at least 1 gigabit per second in the upstream.”

According to Leichtman Research Group, the top cable companies had 68 million broadband subscribers, and top wireline telecom companies had 33.2 million subscribers at the end of 2019.

“Based on the currently available information, cable stole wired broadband market share in Verizon and AT&T markets as well. Oy vey!” said Jim Patterson of Patterson Advisory Group in his May 2, 2021 newsletter. “Think about Comcast and AT&T as having roughly the same number of homes passed (AT&T probably closer to 57 million homes versus the nearly 60 million shown for Comcast),” he added. Patterson noted that top cable companies Comcast, Charter and Altice managed to capture 86% of broadband customer growth in the U.S. in the first quarter of this year.

“(AT&T) fiber connections simply aren’t growing fast enough to keep up,” wrote colleague Craig Moffett of MoffettNathanson in a recent note to clients. Here’s more:

To be sure, there are questions about the extent to which these deployments will overlap cable (or will instead be focused on unserved rural communities), and the extent to which labor and supply chain contraints might limit acheivability of announced targets. Still, taken together, these deployments suggest that, after a precipitous decline in new fiber construction in 2020, planned fiber deployments do, indeed, rise over the next two years; we expect that both 2021 and 2022 will represent new all-time peaks in total number of fiber homes passed. Typically, the competitive impact from overbuilds is felt with some lag, suggesting the impact on cable operators will peak in 2024/2025.

At the same time, we expect that federal stimulus to accelerate broadband market growth in 2021 and 2022, perhaps significantly, with new household formation, in particular, driving upside to 2021 and 2022 forecasts.

Longer term, however, Cable operators will have to contend with more fiber overbuilds, as TelCos increasingly see both more favorable economics for fiber deployment and increasingly acknowledge that their copper plant faces imminent obsolescence without it. The forecasts for fiber deployment in this note suggest that 2021 will be a record for fiber construction – assuming labor and materials capacity can accommodate the TelCos’ own forecasts – and 2022 will step up higher still. After that, deployments are expected to abate, at least to a degree.

“Cable can upgrade its plant quickly and at low cost to offer at least 4.6Gbit/s down and 1.5Gbit/s up, well beyond current fiber offerings. They can do this before the move to DOCSIS 4.0, which is still years off,” wrote the financial analysts at New Street Research in a recent note to investors. The result, according to the New Street analysts, is that fiber providers like AT&T won’t necessarily be able to dominate the fiber market with a 1 Gbit/s FTTH/FTTP connection and take market share from cable incumbents.

“Cable will face new fiber competition in more of its markets over the next few years; however, there is little to no prospect of fiber delivering a service in those markets that cable can’t easily match or beat,” New Street concluded.

…………………………………………………………………………………………………………………………………………………………….

“Looking back and being a little critical, we probably allowed the cable companies to execute and to take share in that market in a significant way,” AT&T CFO Pascal Desroches said at a recent Credit Suisse investor event.

AT&T executives have said that the company’s fiber investment ultimately will generate internal returns of around 15%. Desroches said that return on investment will be due to a variety of factors. Fiber “supports not only consumer needs, it supports needs for our enterprise businesses as well as needs for potentially our reseller business. So being able to look across and integrate the planning for fiber deployment such that it not only serves consumer needs, but it serves these other market adjacencies as well is something that we haven’t been very good at historically, That’s why we’re really bullish and we believe we’re going to be able to execute really well here,” AT&T’s CFO concluded.

References:

https://www.lightreading.com/opticalip/is-atandts-fiber-investment-good-idea/d/d-id/770468?

https://www.linkedin.com/feed/update/urn:li:activity:6813211481950318592/

FCC Grants Facebook permission to test converged WiFi/LTE indoor network in Menlo Park, CA

Following last month’s FCC filing to test a small 5G network, Facebook has filed another FCC Special Temporary Authority (STA) petition to test a “converged wireless system” that could potentially support concurrent communications across Wi-Fi and cellular networks in Menlo Park, CA (Facebook corporate headquarters).

In its FCC filing (granted June 23,2021), Facebook said “The experiment involves short-term testing of a LTE over-the-air setup for an indoor demonstration that is not likely to last more than six months, making an STA more appropriate than a conventional experimental license.”

Also, that it is researching a “proof of concept for a converged wireless system that will operate at the 2.4GHz Wi-Fi band and at Band 3 (1710MHz to 2495 MHz). The goal of the proof of concept is to create a demonstration and see if such a system may be viable. The system that will be tested will have a simple radio head that will be able to operate as a Wi-Fi Radio at 2.4 GHz and as a Band 3 cellular radio (LTE) concurrently. We will wirelessly connect dedicated client devices to demonstrate performance.”

The FCC approved Facebook’s request on June 23,2021. It will remain in effect until its scheduled expiration date of November 10, 2021. Facebook petition was filed under the “FCL Tech” name, which the company has been used for previous wireless tests in the 6GHz band.

Facebook will be using five units of unspecified AVX wireless network gear (E 102289 model). AVX is a Kyocera Group company. Their website states:

AVX Corporation is a leading international manufacturer and supplier of advanced electronic components and interconnect, sensor, control and antenna solutions with 33 manufacturing facilities in 16 countries around the world.

We offer a broad range of devices including capacitors, resistors, filters, couplers, sensors, controls, circuit protection devices, connectors and antennas. AVX components can be found in many electronic devices and systems worldwide.

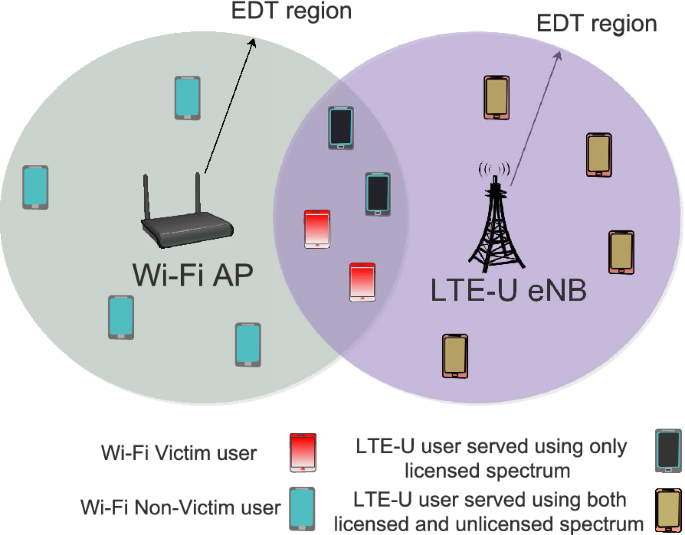

Since WiFi at 2.4 GHz is in unlicensed spectrum (and being used indoors), one would assume that Facebook would also like to operate LTE in unlicensed spectrum in their converged network.

LTE in unlicensed spectrum (LTE-Unlicensed, LTE-U) is a proposed extension of the 4G-LTE wireless standard intended to allow cellular network operators to offload some of their data traffic by accessing the unlicensed 5 GHz frequency band. LTE-Unlicensed is a proposal, originally developed by Qualcomm, for the use of the 4G LTE radio communications technology in unlicensed spectrum, such as the 5 GHz band used by IEEE 802.11a and 802.11ac compliant Wi-Fi equipment. It would serve as an alternative to carrier-owned Wi-Fi hotspots. Currently, there are a number of variants of LTE operation in the unlicensed band, namely LTE-U, License Assisted Access (LAA), and MulteFire.

License Assisted Access (LAA) is a feature of LTE that leverages the unlicensed 5 GHz band in combination with licensed spectrum to increase performance. It uses carrier aggregation in the downlink to combine LTE in unlicensed 5 GHz band with LTE in the licensed band to provide better data rates and a better user experience.

However, Facebook’s STA is only for the band between 1710-2495 MHz – not the 5 GHz band.

……………………………………………………………………………………………………………………………………………………

References:

https://apps.fcc.gov/oetcf/els/reports/GetApplicationInfo.cfm?id_file_num=0769-EX-ST-2021

https://apps.fcc.gov/oetcf/els/reports/STA_Print.cfm?mode=current&application_seq=107558

Linux Foundation creates standards for voice technology with many partners

The Linux Foundation is teaming up with Target, Microsoft, Veritone and other companies (see below) to create the Open Voice Network [1.], an initiative designed to “prioritize trust and standards” in voice-focused technology.

Note 1. The Open Voice Network is a central hub for creating and promoting common standards for voice assistants. The ultimate goal is a comprehensive set of guidelines and standards for everything about voice AI and voice assistants, including customer privacy and security.

The Linux Foundation is working with Target, Schwarz Gruppe, Wegmans Food Markets, Microsoft, Veritone, and Deutsche Telekom as the initial members. All of the members anticipate voice becoming the most common digital interface in the near future, and the Open Voice Network is how they plan to meet that moment. Each is committing money and other resources to create the standards, sharing them with others in the industry, and advocating on behalf of groups and companies that are using voice tech.

…………………………………………………………………………………………………………………………………………………….

“Voice is expected to be a primary interface to the digital world, connecting users to billions of sites, smart environments and AI bots. It is already increasingly being used beyond smart speakers to include applications in automobiles, smartphones and home electronics devices of all types. Key to enabling enterprise adoption of these capabilities and consumer comfort and familiarity is the implementation of open standards,” Linux Foundation senior vice president and general manager of projects Mike Dolan, said in a statement. “The potential impact of voice on industries including commerce, transportation, healthcare and entertainment is staggering, and we’re excited to bring it under the open governance model of the Linux Foundation to grow the community and pave a way forward.”

Jon Stine, executive director of the Open Voice Network, told ZDNet that the rapid growth of both the availability and adoption of voice assistance worldwide — and the future potential of voice as an interface and data source in an artificial intelligence-driven world — makes it important for certain standards to be communally developed.

Devices and applications are increasingly incorporating voice activation and navigation functions. Mike Dolan, senior vice president at the Linux Foundation, said the network was a “proactive response to combating deep fakes in AI-based voice technology.”

“Voice is expected to be a primary interface to the digital world, connecting users to billions of sites, smart environments and AI bots. It is already increasingly being used beyond smart speakers to include applications in automobiles, smartphones and home electronics devices of all types. Key to enabling enterprise adoption of these capabilities and consumer comfort and familiarity is the implementation of open standards,” Dolan said, adding that the organization was “excited to bring it under the open governance model of the Linux Foundation to grow the community and pave a way forward.”

The nonprofit said the open-source association would be dedicated to promoting open standards that support the adoption of AI-enabled voice assistance systems.

In addition to Target, Microsoft and Veritone, the Linux Foundation said it is working with Schwarz Gruppe, Wegmans Food Markets and Deutsche Telekom.

Ryan Steelberg, president and co-founder of Veritone, said self-regulation of synthetic voice content creation and used to protect the voice owner as well as establishing trust with the consumer is “foundational.”

“Having an open network through the Open Voice Network for education and global standards is the only way to keep pace with the rate of innovation and demand for influencer marketing,” Steelberg said. “Veritone’s MARVEL.ai, a Voice as a Service solution, is proud to partner with OVN on building the best practices to protect the voice brands we work with across sports, media and entertainment.”

Thousands of companies and organizations have created voice assistant systems independent of today’s general-purpose voice platforms as a way to streamline services and improve user experience.

Linux Foundation representatives said the Open Voice Network would support the platforms by “delivering standards and usage guidelines for voice assistant systems that are trustworthy, inclusive and open.” The organization will also provide guidance on voice-specific protection of user privacy and data security and ways to make voice assistants interoperable between platforms.

“To speak is human, and voice is rapidly becoming the primary interaction modality between users and their devices and services at home and work,” said Ali Dalloul, a general manager at Microsoft Azure.

“The more devices and services can interact openly and safely with one another, the more value we unlock for consumers and businesses across a wide spectrum of use cases, such as Conversational AI for customer service and commerce.”

The Linux Foundation compared the effort to the open standards that were introduced in the earliest days of the internet, noting that those initiatives helped create uniform ways for websites to connect and exchange information.

Voice assistants are now reliant on a variety of technologies, including Automatic Speech Recognition, Natural Language Processing, Advanced Dialog Management and machine learning.

Steelberg added that voice technologies and interfaces would be fully integrated into the majority of digital applications, devices, and workflows in five years. As this voice proliferation and adoption increases, he noted that it is imperative that organizations like the Open Voice Network and other participating voice tech providers and developers continue to stay diligent on consumer and data protection, as well as protecting the trademark, copyright and uses of peoples’ voices.

Voice technology began to emerge around 2011 with the introduction of Siri to iPhone users, according to Steelberg. Now, he said 1 in every 4 US adults owns some kind of smart speaker, and studies have shown that almost all smartphone users will be using some form of voice assistant within the next two years.

Stine added that data from January shows there are about 3 billion active conversational agents worldwide, and the number is expected to jump to 8.4 billion by 2024.

“The number of IoT devices such as smart thermostats, appliances, and speakers are giving voice assistants more utility in a connected user’s life,” Steelberg said.

“Smart speakers are the number one way we are seeing voice being used. However, it only starts there. Many industry experts even predict that nearly every application will integrate voice technology in some way in the next five years.”

Comment on Smart Speakers: After many years with Amazon Echo (since 2015) and Google (since 2020) smart speakers, I can STRONGLY state that their voice recognition skills have gotten much worse to the point that they can’t be used. I disabled the Alexa/Echo capability to control my AMAZON Fire TV and disconnected other Echo devices which were completely dysfunctional. I also disconnected the 2nd Google smart speaker because the results of voice inquiries/commands were totally wrong!

References:

Linux Foundation Launches Open Voice Network to Set Voice Tech Standards

5G Made in India: Bharti Airtel and Tata Group partner to implement 5G in India

On June 21st, Bharti Airtel and Tata Group announced a strategic partnership for implementing 5G network solutions for India. A 5G pilot should start in January 2022, unless it’s delayed by India’s Department of Telecommunications (DoT).

The announcement underscores a push for indigenous made 5G solutions in India. Despite tremendous hype, the world’s second-largest telecom market has not yet launched commercial 5G service.

Airtel’s partnership with Tata Group allows the telecom operator to take head-on, rival Reliance Jio’s so called “homegrown 5G solutions.” Mukesh Ambani-led Reliance Jio is accelerating the rollout of digital platforms and indigenously-developed next-generation 5G stack.

According to a statement, Tata Group has developed O-RAN (Open Radio Access Network) based radios and 5G NSA/SA (Non-Standalone=4G-LTE/Standalone) Core and has integrated a totally indigenous telecom stack, leveraging the Group capabilities and that of its partners.

“Tata Consultancy Services (TCS) brings its global system integration expertise and helps align the end-to-end solution to both 3GPP and O-RAN standards, as the network and equipment are increasingly embedded into software,” the Tata statement added.

Airtel will pilot and deploy this indigenous solution as part of its 5G rollout plans in India, with a pilot beginning in January 2022, as per the norms formulated by the government.

Gopal Vittal, Managing Director & CEO (India and South Asia) Bharti Airtel said, “We are delighted to join forces with the Tata Group to make India a global hub for 5G and allied technologies. With its world-class technology ecosystem and talent pool, India is well positioned to build cutting edge solutions and applications for the world. This will also provide a massive boost to India becoming an innovation and manufacturing destination.”

N Ganapathy Subramaniam from the Tata group/TCS said, “As a group, we are excited about the opportunity presented by 5G and adjacent possibilities. We are committed to building a world-class networking equipment and solutions business to address these opportunities in the networking space. We are pleased to have Airtel as our customer in this initiative.”

Airtel is a board member of the O-RAN Alliance and is committed to explore and implement O-RAN-based networks in India. Earlier this year, Airtel became the first telecom company in India to demonstrate 5G over its LIVE network in the city of Hyderabad. The company has started 5G trials in major cities using spectrum allocated by the Department of Telecom.

The Tata group’s telecom and media enterprises cater to the communication requirements of global business houses to SMEs, and from wholesale to home networks. TCS is a member of the O-RAN Alliance.

About Airtel:

Headquartered in India, Airtel is a global communications solutions provider with over 471 mn customers in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second-largest mobile operator in Africa. Airtel’s retail portfolio includes high-speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1 Gbps with convergence across linear and on-demand entertainment, streaming services spanning music and video, digital payments, and financial services. For enterprise customers, Airtel offers a gamut of solutions that includes secure connectivity, cloud and data centre services, cybersecurity, IoT, Ad Tech, and cloud-based communication. For more details visit www.airtel.com

About the Tata Group:

Founded by Jamsetji Tata in 1868, the Tata group is a global enterprise, headquartered in India, comprising 30 companies across ten verticals. The group operates in more than 100 countries across six continents, with a mission ‘To improve the quality of life of the communities we serve globally, through long-term stakeholder value creation based on Leadership with Trust’.

Tata Sons is the principal investment holding company and promoter of Tata companies. Sixty-six percent of the equity share capital of Tata Sons is held by philanthropic trusts, which support education, health, livelihood generation, and art and culture. In 2019-20, the revenue of Tata companies, taken together, was $106 billion (INR 7.5 trillion). These companies collectively employ over 750,000 people.

Each Tata company or enterprise operates independently under the guidance and supervision of its own board of directors. There are 29 publicly-listed Tata enterprises with a combined market capitalization of $123 billion (INR 9.3 trillion) as of March 31, 2020. Companies include Tata Consultancy Services, Tata Motors, Tata Steel, Tata Chemicals, Tata Consumer Products, Titan, Tata Capital, Tata Power, Tata Advanced Systems, Indian Hotels, and Tata Communications.

For more details visit www.tata.com.

For more information, please contact: Harsha Ramachandra [email protected]

…………………………………………………………………………………………………………………………………………

References:

https://www.tata.com/newsroom/business/tata-airtel-5g

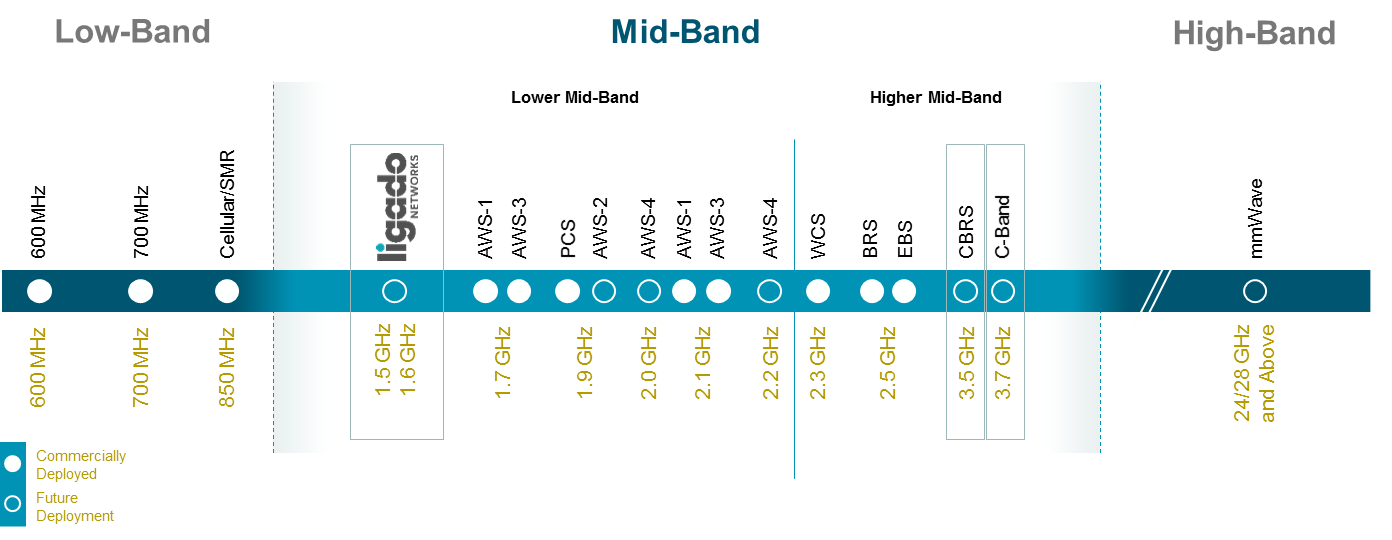

Oxymoron: 3GPP approves (?) Ligado’s L-Band Spectrum for 5G Private Networks

Overview:

Ligado Networks today announced it received approvals from Third Generation Partnership Project (3GPP) for new technical specifications that will enable its L-band spectrum [1.] to be deployed in 5G networks.

Note 1. L band is the IEEE designation for the range of frequencies in the radio spectrum from 1 to 2 gigahertz (GHz). The Global Positioning System carriers are in the L band, centered at 1176.45 MHz (L5), 1227.60 MHz (L2), 1381.05 MHz (L3), and 1575.42 MHz (L1) frequencies. L band waves are used for GPS units because they are able to penetrate clouds, fog, rain, storms, and vegetation.

Since World War II, radar systems engineers have used letter designations as a short notation for describing the frequency band of operation. This usage has continued throughout the years and is now an accepted practice of radar engineers.

………………………………………………………………………………………………………………………………….

Why is 3GPP “approval” of L-Band an oxymoron? Because 3GPP specifications have no legal standing and must be transposed by SDOs (like ETSI and ITU-R) before they become de jure standards. The best example of that were the 3GPP RIT/SRIT submissions to ITU-R WP5D which became the main part of ITU-R M.2150 (previously referred to as IMT 2020 Radio Access Network).

From the 3GPP website under the heading Official Publications:

The 3GPP Technical Specifications and Technical Reports have, in themselves, no legal standing. They only become “official” when transposed into corresponding publications of the Partner Organizations (or the national / regional standards body acting as publisher for the Partner). At this point, the specifications are referred to as UMTS within ETSI and FOMA within ARIB/TTC.

Some TRs (mainly those with numbers of the form xx.8xx) are not intended for publication, but are retained as internal working documents of 3GPP. Once a Release is frozen (see definition in 3GPP TR 21.900), its specifications are published by the Partners.

…………………………………………………………………………………………………………………………………………………

How Frequencies get standardized for International Mobile Telecommunications (IMT):

IMT frequencies for 3G, 4G, 5G are agreed upon once every four years at the ITU-R WRC. The last one was WRC 19 in Egypt in October 2019. After that, they are sent to ITU-R WP5D for detailed IMT terrestrial frequency arrangements, which are then included in a revision of ITU-R M.1036 – Frequency Arrangements for Terrestrial IMT. Once that M.1036 revision is approved, it is rubber stamped by ITU-R SG5 which meets once per year in November.

As of the close of last week’s WP5D meeting, there was no consensus on approving the WRC 19 specified mmW frequencies to be used with IMT 2150. Hence, the revision of M.1036 to include 5G frequencies has not been approved yet. One WP 5D meeting left to get that done this year prior to SG 5 meeting this November.

Ligado or the ITU-R 3GPP representative (currently ATIS) would have to submit their L-Band frequencies to WP 5D before their October 2021 meeting to get it approved as a frequency band to be used for M.2150 (the official one and only 5G RAN standard).

The closest M.1036 frequencies in the L band are 1.427-1.518 GHz and 1.710-2.200 GHz. Both bands use paired FDD arrangements to separate transmit and receive channels.

…….…………………………………………………………………………………………………………………………………………

Ligado wants to expand the L-Band vendor ecosystem and deploy new mid-band spectrum in 5G networks in the U.S. Ligado is currently developing a 5G Mobile Private Network Solution designed to bring the power of next-generation networks to the energy, manufacturing, health care, transportation, and other critical infrastructure sectors.

“This is a major milestone for us – in an already momentous year – and advances our vision to deploy this spectrum for a range of next-generation services,” said Ligado CEO Doug Smith. “The 3GPP green light gives us what we need to accelerate our commercial ecosystem activities and expand Ligado’s roster of partners to deploy this much-needed spectrum for U.S. businesses and consumers.”

3GPP approvals (?) of Band 24 (1.5 GHz and 1.6 GHz) may encourage vendors to build PRE-STANDARD 5G and LTE products compatible with Ligado’s mid-band spectrum. Ligado has already entered into commercial agreements with multiple 5G base station and chipset vendors. The company has also announced a collaboration with pioneering network operator Rakuten Mobile to showcase its 5G Mobile Private Network Solution, and the companies plan to deploy lab and field trials over the next 12 months.

The items that were approved at this week’s 3GPP plenary meeting include updates to Ligado’s existing LTE Band 24 (1.5 GHz and 1.6 GHz); a new 5G NR Band labeled n24; a new 5G NR Supplemental Uplink (SUL) Band labeled n99; and NR Carrier Aggregation (CA) and SUL band combinations for n24 and n99 with CBRS, C-Band and EBS/BRS spectrum. The approvals of SUL band n99 and band combinations will help facilitate the deployments of L-Band spectrum with other mid-band airwaves like the C-Band, CBRS, and EBS spectrum bands.

“Receiving these 3GPP approvals is a huge springboard to deploy the L-Band in U.S. 5G networks, and we’re excited to have continued support from several industry-leading vendors,” said Chief Technology Officer Maqbool Aliani. “Bringing this additional mid-band spectrum to the 5G market will help the U.S. roll out next-generation deployments more quickly, at lower costs, and with superior network performance.”

Ligado submitted these work items to 3GPP in June 2020 after winning unanimous, bipartisan approval from the Federal Communications Commission (FCC) to modify its existing spectrum license. In October 2020, the company announced it had successfully raised nearly $4 billion to develop and deploy the L-Band in 5G networks.

For years, it’s been rumored that Ligado wanted to sell its spectrum to the highest bidder, probably a wireless carrier desiring mid-band 5G spectrum. While that hasn’t happened, some still see it as a valuable resource for the Verizon or AT&T. If T-Mobile or Dish acquired the L-band, they would extend their advantage even further, according to New Street Research analyst Jonathan Chaplin in a September 2020 report.

“The final major step for Ligado will involve getting chipset and radio vendors to incorporate the L-Band into their designs, paving the way for a carrier to deploy the L-Band on towers and small cells and to sell devices that contain L-Band-supporting chipsets,” Chaplin wrote in a report for investors today. “This final leg of the process is likely to take some time, but could be accelerated by the support of a large industry player (one of the carriers), who can more easily encourage their vendors to integrate the spectrum into their equipment.”

Also, several analysts believe that the demand for private wireless networking equipment could eventually double the market for public wireless networks.

About Ligado Networks:

Building on 25 years of experience providing crucial satellite connectivity, Ligado’s mission is to modernize American businesses by delivering the 5G connectivity solutions needed to transform their operations and realize the efficiencies of a digital world. Our plans to deploy licensed mid-band spectrum in public and private 5G networks will help pave the way for future innovations and economic growth across America.

For further information:

Ligado Networks Media Contact:

Ashley Durmer, Chief Communications Officer and Head of Congressional Affairs

Tel: 703-390-2008

[email protected]

References:

https://www.fiercewireless.com/private-wireless/ligado-obtains-3gpp-approvals-for-l-band-5g

https://ieeexplore.ieee.org/document/29086

Busting a Myth: 3GPP Roadmap to true 5G (IMT 2020) vs AT&T “standards-based 5G” in Austin, TX

Samsung Looks to Europe to Expand Network Equipment Business; vRAN is the key

Samsung Electronics is focusing on Europe to retain its accelerating growth in the network equipment business. Even though Samsung Electronics is number one in memory chips and smartphones, it is behind Huawei, Ericsson, Nokia and ZTE in the 5G network equipment market.

Samsung Electronics had a 6 to 8% global telecom equipment market share as of the first quarter of 2021, according to Dell’Oro Group’s latest report. The company is just below Cisco (the world’s dominant router maker) and slightly ahead of Ciena (optical network market leader) to be ranked sixth over all in global telecom equipment revenues. Samsung is likely #5 in 5G RAN revenues, behind Huawei, Ericsson, Nokia and ZTE, but its 5G market share can not be determined at this time.

Since Samsung landed a $6.65 billion 5G infrastructure deal with Verizon and another huge deal with Japan’s NTT Docomo, its 5G network equipment business has been on an upward sales trajectory.

Samsung is taking extra steps and expanding its range of 5G trials in Europe. Currently, Samsung is conducting 5G trials with European telecom companies such as Deutsche Telekom in the Czech Republic, Play Communications in Poland, and other undisclosed European carriers.

Samsung recently won a big contract with Vodafone to supply the big European network operator with their cloud native virtualized RAN. That will be deployed in an Open RAN environment with other vendors (see below). Samsung says that it has been continuously leading in vRAN innovation, most recently showing the capability to support the multi-gigabit speeds of Massive MIMO radios on commercial off the shelf (COTS) servers.

“We are proud that this collaboration with Vodafone — one of the premier carriers in the world — will be the first scaled deployment of our pioneering 5G technologies in Europe, including vRAN and O-RAN,” said Paul Kyungwhoon Cheun, president and head of Networks Business at Samsung Electronics, in a statement. “This is a major step forward, as more operators are transitioning into new RAN technologies to prioritize user experience and efficiency.”

Vodafone’s initial focus will be on the 2,500 sites in the UK that it committed to open RAN in October 2020. According to Vodafone, it’s one of the largest deployments in the world and will be built jointly with Dell, NEC, Samsung and Wind River.

Asia, Oceana and India:

Samsung is also looking to expand in markets such as Southeast Asia, Australia and India. The South Korean giant said it has gained multiple new clients for its 5G equipment and systems which have increased by nearly 35% a year on average.

Samsung’s 5G vRAN kit debuted in July, adding a virtualized distributed unit (vDU) to its virtualized central unit (vCU) so the entire baseband is virtualized, along with a range of radio units. Samsung is Verizon’s 5G RAN vendor in parts of upstate New York and New England, a Verizon spokesperson confirmed. This is depicted in the illustration below:

Block Diagram of Samsung’s vRAN

………………………………………………………………………………………………………………………………………………….

Contrary to a recent Reuters article, there are no 5G stand alone/5G core networks in South Korea. Rather, South Korean telecom operators currently provide 5G services via non–standalone 5G networks, which depend on previous 4G-LTE networks which do NOT have a virtualized core (the 4G core network is called Evolved Packet Core).

The country’s three operators (SK Telecom, KT and LG Uplus) launched 5G service in April 2019. 5G NSA networks are available mostly in large Korean cities. Their 5G RANs are based on 3GPP Release 15 version of 5G-NR. In April 2021, the three operators agreed to share their 5G networks in 131 remote locations across the country, Yonhap news agency reported

Samsung’s network equipment business is relatively small for the conglomerate. It had revenue of 236.8 trillion South Korean Won ($212.50 billion) for 2020. The company does not announce separate numbers for the business and most analysts don’t have estimates for it.

Samsung said since the 5G network rollouts began in 2019 in various countries, it has seen the number of new clients for its 5G equipment and systems rise by 35% a year on average.

…………………………………………………………………………………………………..

Huawei, ZTE and other Chinese telecom gear vendors have faced backlash for various security and privacy issues. Since the U.S. has excluded Huawei from 5G rollouts, it has provided multiple opportunities to competitors to expand its market share. Many Central and Eastern European countries, including Romania, Poland, the Czech Republic and the Baltic states, have been broadly receptive to American arguments against Huawei.

Samsung is capitalizing on its virtualized RAN technology that allows telecom companies to freely use off-the-shelf network equipment in various combinations to connect users to networks. This is how the company plans to win 5G contracts that might otherwise have been awarded to Chinese telecom vendors, especially Huawei. For example, Verizon says they’ve already adopted Samsung’s vRAN technology for their 5G RAN.

Samsung’s goal is to become top-three in the 5G network equipment business, Woojune Kim, executive vice president of Samsung’s networks business told Reuters. However, Kim did not give a timeframe, citing the industry’s long incubation time period. “It took us about a decade to win the Verizon deal, since forming early relationships… It takes persistence,” he said.

Therefore, the period to achieve the #3 goal is still unknown. It might depend on Huawei’s revenue collapsing due to sanctions and Samsung moving ahead of ZTE to claim the #3 position behind Ericsson and Nokia.

Passive Optical Network (PON) technologies moving to 10G and 25G

A Variety of PON Technologies to Chose From:

Passive Optical Network (PON) technology is changing, moving from older GPON’s 2.5Gbit/s and 1.25Gbit/s data rates to XGS-PON’s maximum 10Gbit/s symmetric speeds and technologies such as NGPON2 and 25G PON (described at the end of this article).

“We didn’t see a lot of adoption of the XG, XGS-PON and 10G EPONs (Ethernet PONs) particularly because of cost within these networks, but what we have started seeing is the next generation or the NG-PON2 that uses time wave division multiplexing,” said Jason Morris, marketing manager at Corning Optical Communications during a webinar sponsored by Light Reading. Using up to eight wavelengths to create multiple transmission channels on a single strand of fiber “you can actually get up to 80G with this technology with channel bonding,” he added.

Rich Loveland, director of product management at Vecima Networks, pointed to explosive growth in fiber optic development, spurred by government broadband stimulus funding and connections to MDUs. In these broadband upgrade projects, “you don’t have to put PON in for it, but most are choosing it they are unserved anyway. It’s primarily a greenfield-type of operation.”

Among telcos, the choices are expanding beyond older GPON technology toward more advanced standards such as XGS-PON, which is “starting to come up quite a bit now over some of the NG-PON2 types of technologies,” Loveland said. “They are developing 25G. The ITU-T is defining 50G single-wavelength, and NG-PON2 seems to be adopted by one major operator right now.”

One year ago, AT&T deployed XGS-PON as per this IEEE Techblog post. It went live in 40 markets AT&T serves.

For most cable operators, it’s not realistic to replace all their coax access network with fiber, said Jorge Figueroa, manager of PON Solutions at Harmonic. Instead, he pointed to cloud-native platforms to provide a better migration path to PON fiber, with lower-cost, off-the-shelf programmable hardware that can manage DOCSIS or PON architectures simultaneously.

“Distributed Access Architecture allows us to go fiber-deeper, and by doing that we can provide Gigabit symmetric feeds by going maybe to DOCSIS 4.0,” he said. “The goal here is to squeeze the most out of that HFC, while at the same time giving us an easy transition to PON.”

Viavi has seen providers move from 1Gbit/s to 10Gbit/s services, with new builds favoring newer transmission schemes such as XGS-PON or 10G EPON options, said Douglas Clague, solutions marketing manager at Viavi.

A live Light Reading webinar poll indicates operators are exploring different PON upgrade options. With the ability to choose more than one option, about 29.9% said they were deploying next-generation PON technologies, while 18.2% said their companies were opting to go fiber-deep and an equal number were looking to deploy FTTP. About 15.6% were implementing DAA, while 13% were expecting to deploy DOCSIS 4.0 and 5.2% were moving to network virtualization.

In a IEEE Techblog post last week, Dell’Oro analyst Jeff Heynen said:

References:

https://www.lightreading.com/cable-tech/cable-players-are-taking-many-paths-to-pon-/d/d-id/770345?

Dell’Oro: Broadband Access equipment spending increased 18% YoY

https://www.cablelabs.com/tag/10g-25g-50g-pon

https://www.lightreading.com/opticalip/fttx/why-10gig-is-right-pon-play-today/a/d-id/768061?

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON