5G SA networks (real 5G) remain conspicuous by their absence

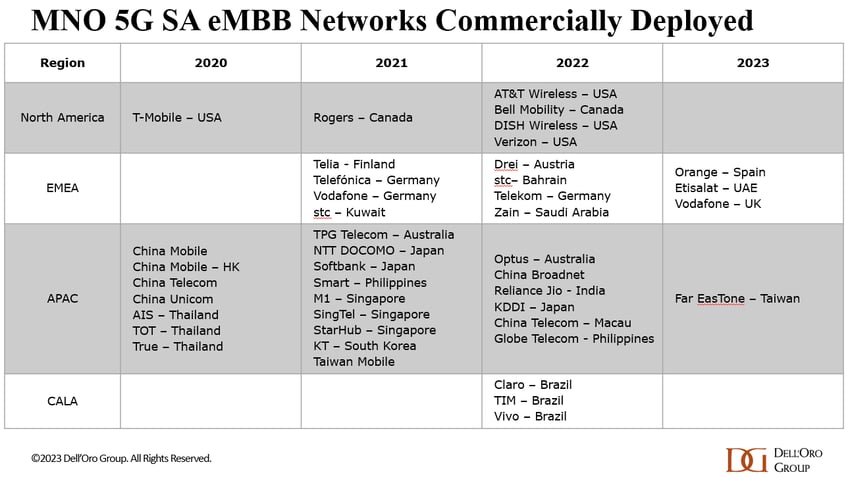

According to a May 2023 report from the Global mobile Suppliers Association (GSA), just 35 network operators in 24 countries and territories “are now understood to have launched or deployed public 5G SA networks.” That’s out of approximately 240 service providers which have now launched commercial 5G services, as per the recent Ericsson Mobility Report.

Dell’Oro’s Dave Bolan said, “Currently we count 43 live 5G SA networks for eMMB [enhanced mobile broadband]. For 2023, four [mobile network operators] have launched 5G SA networks,” he added. It should be noted that Dell’Oro doesn’t factor in fixed wireless access (FWA) or private 5G networks in its SA totals.

In Europe, Vodafone UK and Telefónica Spain join what remains a small set of network operators that have launched 5G SA, including Orange Spain and Vodafone Germany. Spain should provide an interesting study of what happens when two rival operators launch 5G SA service.

There are some glimmers of hope that 5G SA launches will accelerate soon. GSA (aka GSMA) has identified at least 1,063 announced devices with declared support for standalone 5G in sub-6GHz bands, 864 of which are commercially available. Furthermore, it said 116 operators in 53 countries and territories are now investing in 5G SA, including those that have actually deployed a public network. “This equates to 22.1% of the 524 operators known to be investing in 5G licenses, trials or deployments of any type,” the GSA said.

Separately, analysts say that 5G SA branding by network operators is quite confusing (we agree). Vodafone UK’s decision to use 5G Ultra for its 5G SA branding vs Telefonica using 5G+ are examples of that.

Gabriel Brown of Heavy Reading said, “customers don’t really know what it means, other than it denotes some form of technical advance.” He points out that 5G SA “requires a lot of investment and deep engineering expertise; this makes it a useful proxy for network quality. Operators need to take all the technical marketing opportunities they can get.”

“What happens when BT launches? Are they going to call it 5G+ or 5G Super Ultra or something like that? That’s going to make it even more confusing,” said Kester Mann, an analyst with CCS Insight. At the same time, he agrees that 5G standalone is a significant network upgrade and it makes sense that operators would want to gain a marketing edge over rivals that have yet to launch the service.

Notably, neither Vodafone nor Telefónica is charging extra for the more advanced 5G service, and both have focused on the improved speeds and reliability it will bring. They also emphasize eco-friendly aspects, such as lower energy consumption. However, Mann questioned Vodafone’s claim that customers with an eligible 5G Ultra device can expect up to 25% longer battery life. “Twenty-five percent faster than what?” he asked. “It’s a bit unclear.” However, such a claim would certainly be welcome news to consumers. “In a lot of our consumer research, battery life comes out as one of the common bugbears among people using mobile phones,” said Mann.

In the U.S., T-Mobile is the only network operator that’s deployed a 5G SA network. AT&T and Verizon have been talking about it for years, but the time frame for deployment has been pushed back several times.

Deloitte Global said it expects the number of mobile network operators investing in 5G SA networks via trials, planned deployments or rollouts to grow from more than 100 operators in 2022 to at least 200 by the end of this year.

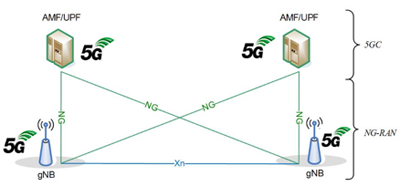

One reason why there are relatively few 5G SA networks deployed is there are no implementation standards. 3GPP 5G Architecture specs, rubber stamped by ETSI, provide several options to realize a 5G cloud-native core network which leads to different implementations. 3GPP decided NOT to liaise their 5G non-radio aspects specs (including 5G Architecture and 5G Security) to ITU-T.

Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

The latest 3GPP 5G Architecture spec is System architecture for the 5G System (5GS) (3GPP TS 23.501 version 17.9.0 Release 17), published by ETSI on July 5, 2023.

Source: 3GPP

Hence, the ITU JCA on IMT2020 and Beyond is dependent on other organizations for inputs to their roadmap. “The scope of JCA-IMT2020 is coordination of the ITU-T IMT-2020 standardization work with focus on non-radio aspects and beyond IMT2020 within ITU-T and coordination of the communication with standards development organizations, consortia and forums also working on IMT2020 and beyong IMT-2020 related standards.”

References:

https://www.silverliningsinfo.com/5g/5g-sa-springs-action

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

https://urgentcomm.com/2023/01/19/standalone-5g-progress-remains-a-disappointment/

https://www.3gpp.org/technologies/5g-system-overview

https://www.itu.int/en/ITU-T/jca/imt2020/Pages/ToR.aspx

Telstra partners with Starlink for home phone service and LEO satellite broadband services

Telstra, Australia’s #1 telco, will partner with SpaceX’s Starlink to provide phone and broadband services to rural Australia using Low Earth Orbit (LEO) satellites. Telstra said it planned to offer the new services before year’s end according to a blog post. It also promises higher download speeds compared to copper-based ADSL internet access.

Starlink, operated by Elon Musk’s SpaceX (private company). has built a fast-growing network of more than 3,500 satellites in Low-Earth Orbit that can provide connectivity in remote areas.

“Telstra will be able to provide home phone service and Starlink broadband services to Aussies as a bundle offer, as well as local tech support and the option of professional installation,” the telco said in the same blogpost. “This agreement also provides connectivity options for our business customers, with a higher bandwidth business option available in areas without fixed and mobile connectivity. The business offer will be available to purchase from Telstra both locally and in select countries overseas.”

Using LEO satellites will bring new capabilities to commercial satellite services in Australia, including faster communications. Signal distances travelled are shorter, as LEO satellites are vastly closer to earth compared to geostationary satellites at around 35,000 km above earth. It requires less power for an earthbound device to transmit to a satellite and there’s a reduced latency (delay) in transmission time.

Telstra said in its blog post:

One of the benefits of LEO satellites are that they are much closer than geostationary satellites to Earth with multiple satellites that are a part of a “constellation”, allowing them to send and receive signals much faster. As well as offering great data throughput, the proximity of these satellites reduces latency making them a great and more consistent option for services that need low latency, like voice and video calls.

The latency, download speeds and general experience in most circumstances will be far superior to copper-based ADSL and be better suited for most modern connectivity needs. Our team has been testing out in the field Starlink’s service and how we can best offer it to customers, including evolving our own modem specifically to support Starlink connectivity and Aussie households. We’re extremely excited to show you what this looks like later in the year.

Partnerships between telcos and LEO satellite providers will allow consumers to make satellite-connected calls using their regular smartphone from almost anywhere on the planet, whether there is a local cellular network or not. In Australia, mobile calls and even video calls will be possible on regular smartphones operating in remote and rural regions of Australia.

At Mobile World Congress held in Barcelona in March 2023, Telstra told ChannelNews it was working on adding LEO satellite audio and video calls to its network. Taiwanese chip designer MediaTek demonstrated the chips that phones would use for LEO satellite communications at the same conference.

UK phone maker Bullitt Group announced it was working with Motorola to bring satellite texting to regular phones in Australia this year, with video calling via LEO satellites to come within another two years. Their texting service has already rolled out in Europe and the US.

Telstra’s move is in line with emerging partnerships between telcos and satellite providers in the US, with T-Mobile forging a deal with Starlink and AT&T with AST SpaceMobile. T-Mobile and Starlink began testing their service in March.

Optus is yet to announce any service involving LEO satellite services locally, although it has been conducting tests. In November last year, Optus demonstrated satellite direct-to-mobile calls in partnership with LEO satellite provider Lynk.

Vodafone meanwhile has launched LEO satellite trials in Turkey with local operator partner SatCo.

It is a major coup for Telstra to be first among Australia-based Telcos to announce a specific service, however longer term, LEO satellites will allow Optus and Vodafone to be more formidable competition in rural and regional Australia, as LEO satellites will give them a reach that they don’t enjoy due to their lack of ground-based cellular infrastructure compared to Telstra.

Further, the Australian telco market will be opening up to increased international competition if offshore telcos want to join in. In March, ChannelNews reported that Amazon was gearing to take on the NBN with a fast satellite-based internet service.

Nevertheless LEO satellites are a fillip for Telstra in light of the Australian Competition and Consumer Commission’s (ACCC) decision late last year to veto a deal between Telstra and TPG Telecom to consolidate their presence in rural and fringe areas of the country through an infrastructure and service swap.

The coming of LEO satellite services also will be a test for the ACCC. To what extent does its jurisdiction cover LEO-satellite-based communications, particularly when it involves telecommunication services provided by foreign companies from space?

References:

We’re working with Starlink to connect more people in remote Australia

Telstra to partner with Elon Musk’s Starlink for satellite calls and broadband

Telefónica launches 5G SA in >700 towns and cities in Spain

Telefónica has followed Orange with the official launch of a 5G standalone (SA) network in more than 700 towns and cities throughout Spain. The service is branded Movistar 5G+ even though it is just 3GPP defined real 5G (with its own core network , rather than 5G NSA which uses LTE core network). The new Telefónica 5G SA network uses Ericsson and Nokia network equipment. Huawei has been excluded from it because the European Commission wants to ban Huawei in the EU for its alleged espionage work for the Chinese government.

Telefonica said its 5G NSA service in the 700 MHz band is currently available to around 85 percent of the Spanish population across 2,200 municipalities. The Spanish operator also uses the 3.5 GHz band for 5G and invested EUR 20 million to secure the maximum possible 1 GHz of spectrum in the 2.6 GHz band.

“Movistar customers will be able to enjoy 5G+ automatically and at no additional cost both in large cities and in small municipalities thanks to a highly capillarity deployment that will allow ultra-fast speeds and very low latency to be obtained in practically all of Spain,” the company explained in a statement.

The launch of 5G+, which offers greater coverage and browsing speeds of up to 1,600 megabits per second (Mbps), will take place within the scope of Movistar’s deployment in the 3,500 MHz band. In practice, 5G+ translates into better mobile experience in content downloads at the speed of fiber optics, streaming High quality and uninterrupted gaming. It also offers greater coverage in crowded spaces such as a sporting event or a music concert, according to Telefónica.

Movistar currently covers a total of 11 cities with 5G SA: Madrid, Barcelona, Malaga, Seville, Palma de Mallorca, Las Palmas de Gran Canaria, Ávila, Segovia, Castellón, El Ferrol and Vigo. The goal for the end of the year is to have “extensive 5G SA coverage in most cities with more than 250,000 inhabitants,” as well as in smaller towns, so that the capillarity of the service continues to be consolidated. However, in order to enjoy this service it is necessary to have a mobile that supports 5G SA. For the moment, Movistar has the new Xiaomi terminals to which new brands will be added.

Gabriel Brown, principal analyst at Heavy Reading, notes that Movistar operates the biggest network in Spain and has the largest number of live 3.5GHz sites, according to the independent AntenasMoviles website.

Said deployment is completed with the coverage in the 700 MHz band that Movistar has been offering since last year and currently reaches more than 2,200 municipalities, with advantages such as improved indoor coverage. The so-called low band is complemented in 5G with that of 3,500 MHz, ideal for services that require a user experience at a very high transmission speed, both for rural areas and large urban centers. In this way, Movistar already offers 5G coverage to more than 85% of the population, reports the company.–

Orange leads 5G SA coverage as it already reaches more than twenty cities that cover 30% of the population in Spain. In the case of Vodafone and MásMóvil, 5G SA is expected to be available before March 2024.

Heavy Reading’s Brown said, “It will be interesting to see if this gives it an edge in SA. Orange Spain, meanwhile, says it will launch network slicing before the end of the year.”

References:

https://euro.eseuro.com/business/572316.html

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

NTT DOCOMO is leveraging its expertise to support the Open RAN efforts of network operators worldwide. Earlier in 2023, DOCOMO adopted the OREX (Open RAN Ecosystem Experience) brand to strengthen the support scheme for international telecom operators in delivering the Open RAN system.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world,” explains Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN and OREX Evangelist. “OREX is committed to making 2023 the defining year for Open RAN. Our ultimate goal is to eliminate global communication gaps through the OREX initiative.”

NTT DOCOMO is the number one mobile operator in Japan. Having launched its first-generation service in 1979, since then the company has pioneered new technologies.

Today DOCOMO has three business segments: enterprise, smart life, and telecommunications. It has 87m subscribers, with 20m subscribers enjoying its 5G Open RAN services, with a total revenue of around US$44bn.

An expert in the mobile industry for more than 25 years, Abeta’s career at NTT DOCOMO started as a researcher for 4G in 1997.

“My career at NTT DOCOMO started as a researcher for 4G in 1997,” he explains. “Then, we brought our ideas to 3GPP and I participated in 3GPP standardisation from 2005.

“With 3GPP, I served as the Vice Chair of 3GPP RAN1 and the rapporteur of LTE and LTE-A. After the completion of the LTE standard specification, I led the development of eNB and gNB commercial products and network optimization in the commercial network as the General Manager of the Radio Access Network Development department.”

In 1997 the second-generation mobile system was introduced in Japan. Instead of GSM, Japan utilised the Personal Digital Cellular (PDC) system. “During this time, data services over the mobile network were initiated, but the data rate was incredibly low, starting at only 2.4kbps,” Abeta explains. “It’s hard to imagine today, but at that time, only small text messages could be transferred over the mobile network. Eventually, the data rate increased to 28.8kbps.

“In 1999, we launched the i-mode service, marking the beginning of internet services over the mobile network.”

In 2000, 3G was introduced, with DOCOMO playing a significant role in contributing to the 3GPP standard specification work. “We led technical discussions and managed the discussions as one of the officials, serving as the Chair. We were the first operator to deploy 3G networks nationwide and provided rich content via the 3G network. However, the data rate was still limited to 64Kbps or 384kbps. Later, HSPA technology was introduced, enabling much higher throughput.

“Moving forward, we proposed LTE together with our partners and launched 4G services in 2010,” Abeta describes. “Our 4G radio access network (RAN) was fully multi-vendor interoperable. We defined interfaces that were not initially defined by 3GPP, making us the first operator to deploy a multi-vendor interoperable RAN. The rise of smartphones in conjunction with our 4G services revolutionised the user experience, and its benefits are well-known.”

While DOCOMO’s communication services continued to thrive, the company also expanded its non-communication services, evolving into the smart-life service segment.

When it comes to the rollout of 5G, DOCOMO has contributed not only to 3GPP but also to the O-RAN alliance to realise multi-vendor interoperable Open RAN solutions. “In 2018, we established the 5G Open Partner Program, aiming to create new services and address social issues by collaborating with vertical players,” Abeta adds. “Currently, this program has attracted participation from 5,300 companies and organisations.”

In this exclusive interview, Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN Solutions and OREX Evangelist discussed its OREX brand, which offers a pre-integrated solution that simplifies integration, interoperability and lifecycle management.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world.”

NTT DOCOMO has been featured in the July issue of Mobile Magazine

Mobile Magazine is the ‘Digital Community’ for the global Telecoms industry. Mobile Magazine covers 5G, IoT, Technology, AI, Connectivity, Mobile Operators, Wireless networks and Media – connecting the world’s largest community of Telecoms executives. Mobile Magazine focuses on telecoms news, key telecoms interviews, telecoms videos, along with an ever-expanding range of focused telecoms white papers and webinars.

References:

https://mobile-magazine.com/magazines

SDFI: Denmark Achieves 94.5% Gigabit Broadband Internet Coverage

New data from the Broadband Mapping 2023 report by the Danish Agency for Data Supply and Efficiency (SDFI) reveals that 97.5% of homes and businesses in Denmark now have access to high-speed broadband internet access.

The latest report from the Styrelsen for Dataforsyning og Infrastruktur (SDFI) sheds light on Denmark’s regional broadband coverage rates. The Region North Jutland has almost reached a 100 percent coverage rate.

According to the report, the coverage rate in Northern Jutland stands at an impressive 98.9%. Central Jutland closely follows with 97.7% coverage, while Southern Denmark boasts a coverage rate of 98.3%t. Zealand, the country’s largest island, achieves a solid coverage rate of 98%.

Although the country has made progress in digital connectivity, according to SDFI, there are still regional disparities in coverage. The Capital Region of Hovedstaden lags behind the other regions with a coverage rate of 96.2% (compared to Northern Jutland with 98.9%). Further, 94.5% of all households in Denmark can access Gigabit speeds, an increase of 2.6 percentage points year-on-year.

The report highlights the ongoing efforts of telecommunications companies in deploying broadband across the country. According to SDFI, 97.5% of homes and businesses currently can access fast broadband with speeds of at least 100 Mbps download and 30 Mbps upload. Moreover, 94.5% of users have access to gigabit speeds, representing a 2.6 percent increase from last year.

The findings of the SDFI report demonstrate Denmark’s commitment to improving broadband infrastructure and connectivity nationwide. As the country continues to prioritize digital transformation, it will pave the way for a more connected and digitally empowered society.

References:

https://www.commsupdate.com/articles/2023/06/30/95-of-danish-households-covered-by-gigabit-speeds/

https://telecomtalk.info/denmark-achieves-945percent-gigabit-broadband-coverage-sdfi/727153/

https://digital-strategy.ec.europa.eu/en/node/9828/printable/pdf

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT‘s latest research report indicates that global spending on private LTE and 5G network infrastructure for vertical industries – which includes RAN (Radio Access Network), mobile core and transport network equipment – will account for more than $6.4 Billion by the end of 2026.

Private cellular networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

With the 3GPP-led standardization [1.] of features such as MCX (Mission-Critical PTT, Video & Data), URLLC (Ultra-Reliable, Low-Latency Communications), TSC (Time-Sensitive Communications), SNPNs (Standalone NPNs), PNI-NPNs (Public Network-Integrated NPNs) and network slicing, private networks based on LTE and 5G technologies have gained recognition as an all-inclusive connectivity platform for critical communications, Industry 4.0 and enterprise transformation-related applications. Traditionally, these sectors have been dominated by LMR (Land Mobile Radio), Wi-Fi, industrial Ethernet, fiber and other disparate networks.

Note 1. 3GPP specs become standards when they are “rubber stamped” by ETSI. Some are also contributed to ITU-R WP5D by ATIS, e.g. 3GPP NR became the essence of ITU-R M.2150 recommendation for 5G RANs.

The liberalization of spectrum is another factor that is accelerating the adoption of private LTE and 5G networks. National regulators across the globe have released or are in the process of granting access to shared and local area licensed spectrum.

Examples include, but are not limited to, the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Canada’s planned NCL (Non-Competitive Local) licensing framework, United Kingdom’s shared and local access licensing model, Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, France’s vertical spectrum and sub-letting arrangements, Netherlands’ geographically restricted mid-band spectrum assignments, Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band, Poland’s spectrum assignment for local government units and enterprises, Bahrain’s private 5G network licenses, Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong’s LWBS (Localized Wireless Broadband System) licenses, Australia’s apparatus licensing approach, India’s CNPN (Captive Non-Public Network) leasing framework and Brazil’s SLP (Private Limited Service) licenses. Even China – where mobile operators have been at the forefront of initial private 5G installations – has started allocating private 5G spectrum licenses directly to end user organizations.

Vast swaths of globally and regionally harmonized license-exempt spectrum are also available worldwide that can be used for the operation of unlicensed LTE and 5G NR-U equipment for private networks. In addition, dedicated national spectrum in sub-1 GHz and higher frequencies has been allocated for specific critical communications-related applications in many countries.

LTE and 5G-based private cellular networks come in many different shapes and sizes, including isolated end-to-end NPNs in industrial and enterprise settings, local RAN equipment for targeted cellular coverage, dedicated on-premise core network functions, virtual sliced private networks, secure MVNO (Mobile Virtual Network Operator) platforms for critical communications, and wide area networks for application scenarios such as PPDR (Public Protection & Disaster Relief) broadband, smart utility grids, railway communications and A2G (Air-to-Ground) connectivity.

However, it is important to note that equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players have slightly different perceptions as to what exactly constitutes a private cellular network. While there is near universal consensus that private LTE and 5G networks refer to purpose-built cellular communications systems intended for the exclusive use of vertical industries and enterprises, some industry participants extend this definition to also include other market segments – for example, 3GPP-based community and residential broadband networks deployed by non-traditional service providers. Another closely related segment is multi-operator or shared neutral host infrastructure, which may be employed to support NPN services in specific scenarios.

Key findings:

-

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 18% between 2023 and 2026, eventually accounting for more than $6.4 Billion by the end of 2026.

-

As much as 40% of these investments – nearly $2.8 Billion – will be directed towards the build-out of standalone private 5G networks that will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries.

-

This unprecedented level of growth in the coming years is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s.

-

Existing private cellular network deployments range from localized wireless systems in industrial and enterprise settings to sub-1 GHz private wireless broadband networks for utilities, FRMCS-ready networks for train-to-ground communications, and hybrid government-commercial public safety broadband networks, as well as rapidly deployable LTE/5G systems that deliver temporary or on-demand cellular connectivity.

-

As for the practical and quantifiable benefits of private LTE and 5G networks, end user organizations across manufacturing, mining, oil and gas, ports and other vertical industries have credited private cellular network installations with productivity and efficiency gains in the range of 30 to 70%, cost savings of more than 20%, and an uplift of up to 80% in worker safety and accident reduction.

-

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private LTE and 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Netherlands, Finland, Sweden, Norway, Poland, Bahrain, Japan, South Korea, Taiwan, China, Hong Kong, Australia, India and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

-

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a strong foothold in the private LTE and 5G network market. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to nationwide public safety broadband networks.

-

New classes of private network operators have also found success in the market. Notable examples include but are not limited to Celona, Betacom, Kajeet, BearCom, Ambra Solutions, iNET (Infrastructure Networks), Tampnet, Smart Mobile Labs, MUGLER, Telent, Logicalis, Citymesh, Netmore, RADTONICS, Combitech, Grape One (Japan), NS Solutions, OPTAGE, Wave-In Communication and the private 4G/5G business units of neutral host infrastructure providers such as Boingo Wireless, Crown Castle, Cellnex Telecom, BAI Communications/Boldyn Networks, Freshwave and Digita.

-

NTT, Kyndryl and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances and early commercial wins. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

-

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) recent acquisition of Italian mobile core technology provider Athonet.

-

The service provider segment is not immune to consolidation either. For example, in Australia, mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless specialist Aqura Technologies. More recently, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – another Australian pioneer in private LTE and 5G networks.

Summary of Private LTE/5G Engagements:

Some of the existing and planned private LTE and 5G engagements are in the following industry verticals:

-

Agriculture: Private cellular network installations in the agriculture industry range from custom-built 250 MHz LTE networks that provide wide area cellular coverage for agribusiness machinery, vehicles, sensors and field workers in Brazil to Japan’s standalone local 5G networks supporting 4K UHD (Ultra-High Definition) video transmission, mobile robotics, remote-controlled tractors and other advanced smart agriculture-related application capabilities.

-

Aviation: Private LTE and 5G networks have been deployed or are being trialed to support internal operations at some of the busiest international and domestic airports, including Hong Kong, Shanghai Pudong and Hongqiao, Tokyo Narita, London Heathrow, Paris-Charles de Gaulle, Orly and Le Bourget, Frankfurt, Cologne Bonn, Brussels, Amsterdam Schiphol, Vienna, Athens, Oslo, Helsinki, Bahrain, Chicago O’Hare, DFW (Dallas Fort Worth), Dallas Love Field and MSP (Minneapolis-St. Paul). Lufthansa Technik and JAL (Japan Airlines), among others, are leveraging private 5G connectivity for aircraft maintenance operations. In addition, national and cross-border A2G (Air-to-Ground) networks for inflight broadband and critical airborne communications are also beginning to gain significant traction.

-

Broadcasting: Within the broadcasting industry, FOX Sports, BBC (British Broadcasting Corporation), BT Group, RTÈ (Raidió Teilifís Éireann), Media Broadcast, WDR (Westdeutscher Rundfunk Köln), RTVE (Radiotelevisión Española), SVT (Sveriges Television), NRK (Norwegian Broadcasting Corporation), TV 2, TVBS, CMG (China Media Group) and several other media and broadcast players are utilizing private 5G networks – both temporary and fixed installations – to support live production and other use cases.

-

Construction: Mortenson, Ferrovial, BAM Nuttall (Royal BAM Group), Fira (Finland), Kumagai Gumi, Obayashi Corporation, Shimizu Corporation, Taisei Corporation, Takenaka Corporation, CSCEC (China State Construction Engineering Corporation), Hoban Construction, Hip Hing Engineering, Gammon Construction and Hyundai E&C (Engineering & Construction) are notable examples of companies that have employed the use of private LTE and 5G networks to enhance productivity and worker safety at construction sites.

-

Education: Higher education institutes are at the forefront of hosting on-premise 5G networks in campus environments. Tokyo Metropolitan University, McMaster University, Texas A&M University, Purdue University, Cal Poly (California Polytechnic State University), Northeastern University, UWM (University of Wisconsin-Milwaukee), RWTH Aachen University, TU Kaiserslautern (Technical University of Kaiserslautern) and CTU (Czech Technical University in Prague) are among the many universities that have deployed private 5G networks for experimental research or smart campus-related applications. Another prevalent theme in the education sector is the growing number of purpose-built LTE networks aimed at eliminating the digital divide for remote learning – particularly CBRS networks for school districts in the United States.

-

Forestry: There is considerable interest in private cellular networks to fulfill the communications needs of the forestry industry for both industrial and environmental purposes. For example, Swedish forestry company SCA (Svenska Cellulosa Aktiebolaget) is deploying local 5G networks to facilitate digitization and automation at its timber terminals and paper mills, while Tolko Industries and Resolute Forest Products are utilizing portable LTE systems to support their remote forestry operations in remote locations in Quebec and British Columbia, Canada, where cellular coverage has previously been scarce or non-existent.

-

Healthcare: Dedicated 5G campus networks have been installed or are being implemented to support smart healthcare applications in many hospitals, including Nagasaki University Hospital, West China Second University Hospital (Sichuan University), SMC (Samsung Medical Center), Ewha Womans University Mokdong Hospital, Bethlem Royal Hospital, Frankfurt University Hospital, Helios Park Hospital Leipzig, UKD (University Hospital of Düsseldorf), UKSH (University Hospital Schleswig-Holstein), UKB (University Hospital Bonn), Cleveland Clinic’s Mentor Hospital and Hospital das Clínicas (São Paulo). In addition, on-premise LTE networks are also operational at many hospitals and medical complexes across the globe.

-

Manufacturing: AGC, Airbus, Arçelik, ASN (Alcatel Submarine Networks), Atlas Copco, BASF, BMW, BorgWarner, British Sugar, Calpak, China Baowu Steel Group, COMAC (Commercial Aircraft Corporation of China), Del Conca, Delta Electronics, Dow, Ford, Foxconn, GM (General Motors), Gerdau, Glanbia, Haier, Holmen Iggesund, Inventec, John Deere, Logan Aluminum, Magna Steyr, Mercedes-Benz, Midea, Miele, Navantia, Renault, Ricoh, Saab, SANY Heavy Industry, Schneider Electric, SIBUR, Whirlpool, X Shore and Yara International and dozens of additional manufacturers – including LTE/5G equipment suppliers themselves – have already integrated private cellular connectivity into their production operations at their factories. Many others – including ArcelorMittal, Bayer, Bosch, Hyundai, KAI (Korea Aerospace Industries), Nestlé, Nissan, SEAT, Siemens, Stellantis, Toyota, Volkswagen and WEG – are treading cautiously in their planned transition from initial pilot installations to live 5G networks for Industry 4.0 applications.

-

Military: Led by the U.S. DOD’s (Department of Defense) “5G-to-Next G” initiative, several programs are underway to accelerate the adoption of private 5G networks at military bases and training facilities, defense-specific network slices and portable cellular systems for tactical communications. The U.S. military, Canadian Army, Bundeswehr (German Armed Forces), Italian Army, Norwegian Armed Forces, Finnish Defense Forces, Latvian Ministry of Defense, Qatar Armed Forces, ADF (Australian Defence Force), ROK (Republic of Korea) Armed Forces and Brazilian Army are among the many adopters of private cellular networks in the military sector.

-

Mining: Mining companies are increasingly deploying 3GPP-based private wireless networks at their surface and underground mining operations to support mine-wide communications between workers, real-time video monitoring, teleoperation of mining equipment, fleet management, self-driving trucks and other applications. Some noteworthy examples include Agnico Eagle, Albemarle, Anglo American, AngloGold Ashanti, Antofagasta Minerals, BHP, Boliden, Codelco, China Shenhua Energy, China National Coal, Eldorado Gold, Exxaro, Fortescue Metals, Freeport-McMoRan, Glencore, Gold Fields, Jiangxi Copper, Metalloinvest, Newcrest Mining, Newmont, Northern Star Resources, Nornickel (Norilsk Nickel), Nutrien, Polyus, Polymetal International, Rio Tinto, Roy Hill, Severstal, Shaanxi Coal, South32, Southern Copper (Grupo México), Teck Resources, Vale, Yankuang Energy and Zijin Mining.

-

Oil & Gas: Arrow Energy, BP, Centrica, Chevron, CNOOC (China National Offshore Oil Corporation), ConocoPhillips, Equinor, ExxonMobil, Gazprom Neft, Neste, PCK Raffinerie, Petrobras, PetroChina/CNPC (China National Petroleum Corporation), Phillips 66, PKN ORLEN, Repsol, Santos, Schlumberger, Shell, Sinopec (China Petroleum & Chemical Corporation), TotalEnergies and many others in the oil and gas industry are utilizing private cellular networks. Some companies are pursuing a multi-faceted approach to address their diverse connectivity requirements. For instance, Aramco (Saudi Arabian Oil Company) is adopting a 450 MHz LTE network for critical communications, LEO satellite-based NB-IoT coverage to enable connectivity for remote IoT assets, and private 5G networks for advanced Industry 4.0-related applications.

-

Ports & Maritime Transport: Many port and terminal operators are investing in private LTE and 5G networks to provide high-speed and low-latency wireless connectivity for applications such as AGVs (Automated Guided Vehicles), remote-controlled cranes, smart cargo handling and predictive maintenance. Prominent examples include but are not limited to APM Terminals (Maersk), CMPort (China Merchants Port Holdings), COSCO Shipping Ports, Hutchison Ports, PSA International, SSA Marine (Carrix) and Steveco. In the maritime transport segment, onboard private cellular networks – supported by satellite backhaul links – are widely being utilized to provide voice, data, messaging and IoT connectivity services for both passenger and cargo vessels while at sea.

-

Public Safety: A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN (Multi-Operator Core Network)-based public safety LTE networks are operational or in the process of being rolled out throughout the globe, ranging from national mission-critical broadband platforms such as FirstNet, South Korea’s Safe-Net, France’s RRF (Radio Network of the Future), Spain’s SIRDEE and Finland’s VIRVE 2.0 to the Royal Thai Police’s 800 MHz LTE network and Halton-Peel region PSBN (Public Safety Broadband Network) in Canada’s Ontario province. 5G NR-equipped PPDR (Public Protection & Disaster Relief) broadband systems are also starting to be adopted by first responder agencies. For example, Taiwan’s Hsinchu City Fire Department is using an emergency response vehicle – which features a satellite-backhauled private 5G network based on Open RAN standards – to establish high-bandwidth, low-latency emergency communications in disaster zones.

-

Railways: Although the GSM-R to FRMCS (Future Railway Mobile Communication System) transition is not expected until the late 2020s, a number of LTE and 5G-based networks for railway communications are being deployed, including Adif AV’s private 5G network for logistics terminals, SGP’s (Société du Grand Paris) private LTE network for the Grand Paris Express metro system, PTA’s (Public Transport Authority of Western Australia) radio systems replacement project, NCRTC’s (National Capital Regional Transport Corporation) private LTE network for the Delhi-Meerut RRTS (Regional Rapid Transit System) corridor, KRNA’s (Korea Rail Network Authority) LTE-R network and China State Railway Group’s 5G-R program. DB (Deutsche Bahn), SNCF (French National Railways), Network Rail and others are also progressing their 5G-based rail connectivity projects prior to operational deployment.

-

Utilities: Private cellular networks in the utilities industry range from wide area 3GPP networks – operating in 410 MHz, 450 MHz, 900 MHz and other sub-1 GHz spectrum bands – for smart grid communications to purpose-built LTE and 5G networks aimed at providing localized wireless connectivity in critical infrastructure facilities such as power plants, substations and offshore wind farms. Some examples of end user adopters include Ameren, CNNC (China National Nuclear Corporation), CPFL Energia, CSG (China Southern Power Grid), E.ON, Edesur Dominicana, EDF, Enel, ESB Networks, Bahrain EWA (Electricity and Water Authority), Evergy, Fortum, Hokkaido Electric Power, Iberdrola, Kansai Electric Power, KEPCO (Korea Electric Power Corporation), LCRA (Lower Colorado River Authority), Osaka Gas, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), SGCC (State Grid Corporation of China), Southern Company, Tampa Electric (Emera) and Xcel Energy.

-

Other Sectors: Private LTE and 5G networks have also been deployed in other vertical sectors, extending from sports, arts and culture to retail, hospitality and public services. From a horizontal perspective, enterprise RAN systems for indoor coverage enhancement are relatively common and end-to-end private networks are also starting to be implemented in office buildings and campuses. BlackRock, Imagin’Office (Icade), Mitsui Fudosan, NAVER, Rudin Management Company and WISTA Management are among the companies that have deployed on-premise private 5G networks in office environments.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

BT to offer HPE Aruba managed wireless LAN service

UK network operator BT announced a partnership with HPE’s Aruba division [1.] to offer customers a new managed wireless LAN service powered by HPE Aruba Networking delivering improved performance, flexibility and control of local area networks (LANs). It combines BT’s global reach and extensive experience in the design, deployment and management of in-building wired and wireless connectivity with the latest HPE Aruba Networking LAN solutions.

Note 1. On March 2, 2015, Hewlett-Packard announced it would acquire Aruba Networks for approximately $3 billion. It’s interesting that enterprise LANs are now moving from Ethernet to WiFi where Aruba has been a leader (see IDC chart below).

Many legacy LANs struggle to support hybrid workers’ expectations when accessing apps in offices, branches, warehouses, factories or campuses. This is exacerbated by increasing use of bandwidth-hungry video collaboration tools. Colleagues also expect consistent and reliable Wi-Fi connectivity around the building. The increasing number of connected devices, including internet of things (IoT), adds further complexity and cyber security risks.

BT’s new HPE Aruba Networking Managed LAN service will allow customers to securely modernise connectivity to support changing workstyles and keep apace of IoT demands.

As a first step, BT audits the LAN to identify what is already in place and what could be re-used and anything that should be replaced. HPE Aruba Networking provides interoperable technology that can avoid the need to replace the entire network. BT will work collaboratively with the customer to manage costs by providing a staged approach to modernisation with benefits realised at each stage.

BT then evaluates how to secure and protect connected devices. It simplifies visibility by giving customers a single dashboard hosted in the cloud. This centralises reporting, analytics, security, scalability and resilience in one platform to help customers deliver a consistent end-user experience. It can also identify redundant devices using unnecessary power and automate network and energy optimisation.

Andrew Small, director of voice and digital work, Business, BT Group, said: “It’s clear that legacy in-building networks can’t handle modern hybrid working and IoT devices, never mind what comes next. That’s why we’re expanding customer choice of managed LAN solutions by partnering with HPE Aruba Networking. This will offer the visibility, flexibility and security customers need to deliver productive, trusted wired and wireless connectivity.”

“Global customers that are building their connectivity strategies are focusing on modern enterprise networks that are secure, agile, responsive to business needs and simple to operate, while being powerful drivers of transformation,” said Phil Mottram, executive vice president and general manager, HPE Aruba Networking. “HPE Aruba Networking is at the forefront of reinventing how customers and partners can consume or deliver business-outcome focused networking, and by integrating our AI, security, automation, and Network as a Service capabilities, our global managed LAN service with BT is an example of how the network is helping customers achieve their business objectives.

Benefits from Aruba LAN managed by BT:

- Visibility across your network: Through cloud-native management console and single operating system that simplifies visibility and improves performance.

- Optimized existing assets: A solution that integrates and optimizes existing LAN infrastructure, so you are future-ready.

- Supported by BT’s experience in managing and transforming multi-vendor solutions to a more simplified and efficient network.

- Remove the skills gaps: With a trusted partnership that has the combined breadth and depth of our expertise to deliver standalone LAN, campus-wide LAN, and wider transformation solutions.

- Secure and automate: End-to-end managed service and deployment. Scale up or down as needed. Implement additional services, such as advanced security to gain greater insight into your network and apps.

- Innovate and grow: Through centralised reporting, analytics, security, scalability, and resilience all in one platform that helps you deliver a consistent end-user experience and build a robust and innovative LAN.

- Sustainable solution: BT’s Aruba LAN can identify redundant devices using unnecessary power. In addition, it uses automation to optimise network management and energy efficiency.

Market Assessment:

According to Dell’Oro group, enterprise WLAN revenues surged 48% year-on-year in the first quarter of the year, reaching $2.7 billion. Dell’Oro’s Wireless LAN research director Siân Morgan noted that the market hasn’t seen such consistent y-o-y revenue growth for 10 years. Dell’Oro expects revenues to reach $10 billion this year. Dell’Oro said the growth in Q1 appears to have been driven by backlogged orders being filled, and that this is actually masking a decline in new orders.

IDC published its own figures this month that put global enterprise Wireless LAN (WLAN) revenue at $2.8 billion in the first quarter, up 43.3 percent on last year. Similarly to Dell’Oro, IDC said growth was driven by the easing of component shortages and supply constraints, allowing suppliers to catch up with back orders.

In terms of vendors, IDC ranks HPE Aruba second by Q1 market share at 16 percent, noting that its revenue grew 39.5%. Cisco is still the clear leader, with a market share of 47.1% and impressive enterprise WLAN revenue growth of 62.7% (see chart).

References:

https://newsroom.bt.com/bt-and-hpe-partner-for-new-global-managed-lan-service/

https://www.globalservices.bt.com/en/solutions/products/aruba-lan

https://www.arubanetworks.com/products/wireless/access-points/indoor-access-points/

https://telecoms.com/522453/bt-taps-hpe-for-global-managed-lan-service/

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

MTN Consulting reports [1.] that the top three Telco Network Infrastructure (NI) equipment vendors continue to be Huawei, Ericsson, and Nokia. They account for 37.4% of the total market in annualized 1Q23, or 34.8% in 1Q23 alone. While the trio has captured >40% share of the market for most of 2016-22, Huawei’s share has fallen recently, and all three giants have been pressured by vendors in the cloud and IT services space (e.g. Amazon, Microsoft, Alphabet, Dell, VMWare…).

Note 1. This MTN Consulting study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-1Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

Focusing on the top three, Huawei has dropped in the last three periods (due to global sanctions), but remains dominant due to China.

Ericsson’s share decline was a function of lower RAN spending among its largest customers as the 5G rollout pace ebbs. The Swedish vendor hopes to offset this decline soon with new revenues from its blockbuster acquisition of network API platform vendor, Vonage. It expects the first revenues from the acquisition later this year and a ramp up further in the next two years.

Nokia, including (Alcatel-Lucent) ALU for pre-acquisition years, has also dipped as 5G RAN rollouts slowed. But it gained market share slightly in 1Q23 on account of 45% growth in its optical networks business along with some benefits from catch-up sales related to the supply chain challenges it witnessed in 2022.

China Comservice and ZTE have been trading the 4 and 5 spots off and on since early 2019. Notably, though, China Comservice is majority owned by Chinese telcos, and is not truly independent. Intel is in the 6th position due to data center, virtualization, edge compute and other telco projects, some done directly and some on an OEM basis.

CommScope remained at seventh position while NEC managed to surpass Cisco in the latest annualized 1Q23 period, as Cisco (9th position) witnessed a stark drop in its Telco NI revenues in 1Q23. Cisco’s decline is worrying, as its largest market (the U.S.) has a growing focus on 5G core, which Cisco has flagged in the past as key to the company growing telco revenues. Amdocs is ranked 10th due to its strength in network software.

Biggest Telco NI revenue changes on a YoY basis:

Three out of the top five vendors, in terms of YoY revenue growth, are the same for both single quarter and annualized 1Q23: Alphabet, Microsoft, and Lenovo. Two of these are cloud vendors (Alphabet and Microsoft) who are steadily improving their penetration of the telco vertical market with a range of solutions – digital transformation, service design, 5G core, workload offshift, etc. Lenovo is gaining traction with its disaggregated, virtual radio access network (vRAN), and multi-access edge computing (MEC) solutions. Clearfield is a small fiber company focused on the booming US market.

Other companies to show improvement in both periods include Tejas Networks which bagged a mega deal for a BSNL-MTNL 4G network; Rakuten Group (Symphony) benefiting from key deployments of its cloud-based Open RAN solutions; Harmonic which has benefited from strong cable access spending and a growing customer list; YOFC (a Chinese fiber company), and two large US-based engineering services-focused companies (DyCom and MasTec) benefiting from a fiber boom.

Declines in the 1Q23 annualized period include Cisco which continues to be worrisome on account of lower customer spending, though it noted improvement in supply chain constraints in the latest quarter. Extreme Networks, Casa, and Airspan all dipped, but noted that the supply chain challenges of previous quarters are improving. Cisco, the largest among the annualized decliners, remains optimistic about prospects as telcos move to 5G SA cores.

Supply chain issues improving:

For the past two years, vendors in the Telco NI market have been plagued with supply chain constraints. The situation is now easing though, if a review of vendor earnings from 1Q23 is anything to go by. Most significant vendors confirm the assessment of three months ago: shortages in specific component areas continue to be an issue but are improving with time, with normalcy likely in 2H23.

Nokia notes that “Going forward, growth rates are expected to slow in the coming quarters as Q1 benefited from some catch-up, as supply chains normalize”. Ericsson echoed this, saying that “…the big effect really comes from the ongoing inventory adjustments, and that comes because they build up large inventories when supply chain was tight and those inventory levels are now normalizing. We expect these adjustments to be completed during Q2, but some could slip into Q3 clearly”.

Juniper has a slightly more cautious view – “While supply has improved for the majority of our products, we continue to experience supply constraints for certain components, and supply chain costs remain elevated”.

Casa, Calix, and Ciena are also witnessing good improvements in supply chain and are expecting further improvements over the course of 2023. F5 Networks is benefiting from its strategy of redesigning the “hardest-to-get components” and “opening up new supply” sources.

Spending outlook:

Most large vendors appear to be cautiously optimistic about the spending outlook in Telco NI. While supply chain issues are expected to clear up by 2Q or 3Q 2023, MTN Consulting expects the market will start to flatten in the next few quarters. Per our latest official forecast, we expect telco capex – the main driver of Telco NI market – to reach $330B in 2023, and a small decline to $325B in 2024. However, it’s likely that both figures may be $5B or more too high. Ericsson, a key telco vendor, has signaled a cautious telco capex spend outlook in its latest earnings call: “In the second quarter, we expect operators to remain cautious with CapEx similar to Q1 and continue with the inventory adjustment that we have described”.

Lower expectations have been apparent on many 4Q22 earnings calls. DT, for instance, expects US capex will see a “strong decrease” in 2023, and thereafter stability. Verizon’s capex is set to fall nearly 20% YoY in 2023. Charter Communications cut its capex outlook for 2023 by about $500M, hitting both the low & high range. Orange expects a “strong decrease” (same wording) in total “ecapex” this year as its FTTH deployment peak has passed and it aims to increase its dividend. Canada’s BCE says that 2022 was the peak year in its accelerated capex program, and capex will begin to fall this year until capital intensity is back down to pre-COVID levels. Vodafone expects group capex in its current fiscal year to be flat to slightly down, as it pursues a “disciplined approach to capital allocation.” Telefonica says its declining capital intensity is proof that the investment peak is behind it. The MTN Group says capital intensity will decline from 18% to 15% over the next few years.

There are several factors to help explain lower expectations: some are company-specific, e.g. BCE is naturally reaching a latter phase in its buildout. There are also general factors, such as: rising interest rates; higher operating costs due to inflation, especially in energy; 5G’s failure to lift service revenues, leaving telcos highly dependent on volatile device revenues for any topline growth; and, cloud providers’ continually more aggressive pitches of new solutions to telcos. Cloud-based offerings can shift some capex to opex.

Amid all the cautious optimism, India as a market has emerged as a bright spot for the vendors. In 1Q23, Ericsson saw strong growth for its Networks business in India where it continues to rapidly roll out 5G. “It will make India a leading 5G nation and the leading nation for digitalization. And what we see is that the subscribers on 5G are using even more data than on 4G…” said Ericsson in its earnings call.

Ciena attributed its 60% YoY revenue growth in the Asia Pacific region to India, “which was up 88% year-over-year in Q2 to about $70 million, reflecting consistent strong demand from service providers in that market. India is going through a big cycle of 5G rollout and extension. And I think that’s going to happen over the next 1 to 3 years”.

Nokia also witnessed double-digit growth in both its Network Infrastructure and Mobile Networks divisions, reflecting the rapid 5G deployments in India: “…Q1 largely played out as we expected, with 5G deployments in India heavily influencing our Q1 top line.”

Telco Revenues Continue to Decline:

In 4Q22, global telco revenues plunged the most in more than a decade to post $429.6B, or -9.3% YoY – the fifth consecutive slump in a row. This impacted annual revenues and its growth rate for the year 2022 – they were $1,779.9B, down 5.9% YoY over the previous year. The sluggish top-line turned telcos cautious around spending on capex, the main driver for the Telco NI market, which declined for the second straight quarter to post $87.9B in 4Q22, down 5.1% YoY. This decline also knocked down annualized capex to $322.1B in 4Q22, from the peak of $330.0B in 2Q22.

On the brighter side, capex has held out better than revenues, pushing annualized capital intensity to a new all-time high of 18.1% in 4Q22. This was driven by a few countries who are in the midst of deploying 5G networks, notably India; while many more continue to scale up 5G to reach mass market coverage, and deploy fiber to support fixed broadband and to connect all the new radio infra (including small cells) needed for 5G.

Cloud vendors are also making critical inroads into the telco sector, aided by a growing number of stand-alone 5G core networks.

References:

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

LightCounting: Will Network Transformation resolve telecom’s paradox?

|

Christel Heydemann, the CEO of Orange, used her MWC ’23 keynote to highlight the paradox of the telecom market: telecom is a critical enabler of our digital future, yet a 2022 PwC report stated that nearly half (46%) of the global telecom CEOs surveyed thought their companies won’t survive another decade (the average figure for all industries surveyed was 39%). PwC cited the reason as telecoms’ poor record making money from technology.

Telecoms is a profitable business, yet competition and regulation are hampering its growth. Telecoms spends eye-watering amounts in investment – European CSPs alone are estimated to have spent $650 billion on technology in the last decade – yet the industry is one of the worse at getting a return on the investment.

|

|

|

Much of the spend has been on implementing the 5G wireless standard. 5G may be much vaunted by the CSPs but its impact is yet to be felt. That is because the wireless standard as envisaged is still to be implemented. What has been rolled out since 2019 is 5G non-standalone (NSA): a 4G networking/ 5G radio hybrid. It is 5G Standalone (5G SA) that delivers the tools other industries can benefit from: low latency wireless networking and clever network segmentation in the form of slicing.

Overall, some 40 CSPs had deployed 5G SA by the start of 2023, a small fraction of overall 5G deployments. Yet if 5G SA is what will grow revenues via the digitalization programs of different sectors, should there not be a greater urgency to deploy it?

The CSPs also must transform their businesses, their organizations, their staff development, address sustainability, and embrace a development that promises huge returns; artificial intelligence (AI).

Telecoms is built on the engineering disciplines of communications and computing and the CSPs have strong engineering teams. How can CSPs, that want to serve other industries in their digital transformation journeys, be so far behind when it comes to AI? Another paradox.

Network transformation’s impact on the future of the CSPsWhat will be the impact of network transformation and transformation in general on the future of the CSPs?

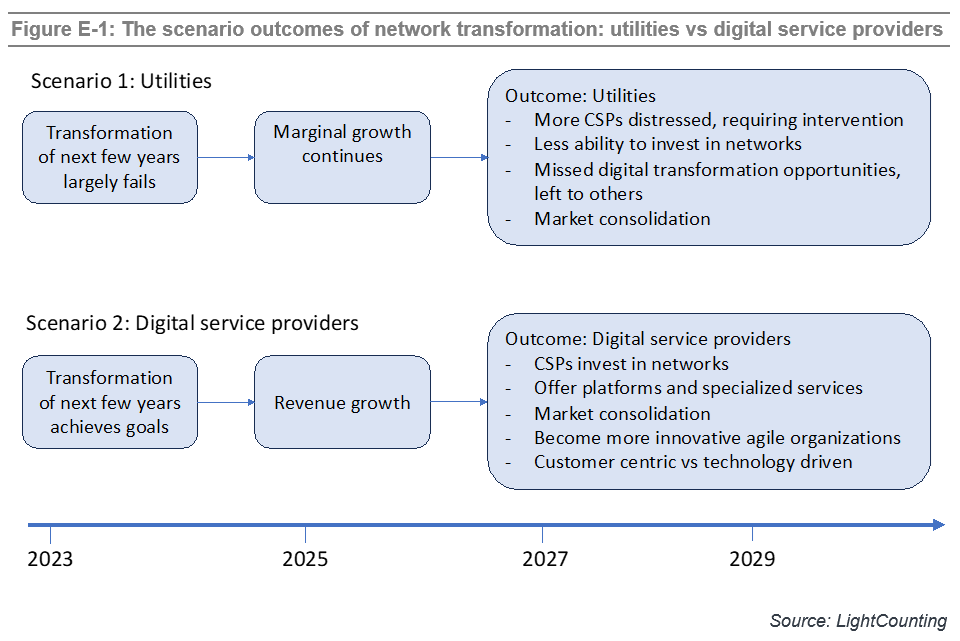

In the latest Network Transformation report, LightCounting defines two scenarios that bound the possible outcomes: Scenario 1 is where CSPs become utilities while Scenario 2 sees CSPs transform into Digital Service Providers.

In Scenario 1, dubbed Utilities, the transformation efforts fail to create the revenue growth needed nor enable the CSPs long-term aspirations to become digital service providers. The CSPs continue as businesses but are consigned to the infrastructure provider layer delivering connectivity services, limiting their ability to invest in their networks. They may still be ongoing businesses but will miss the digitalization opportunities thus bounding their business prospects.

Scenario 2, dubbed Digital Service Providers, is that network transformation achieves its goals. Successful network transformation will allow CSPs to play not only as infrastructure/ connectivity players but as platform providers and specialists addressing vertical markets.

LightCounting believes that some CSPs will be successful and become digital service providers. They will be able to acquire their less successful competitors, further improving scale of their business. Large scale will be very critical for the success of CSPs and their ability to compete with ICPs in offering new services.

Anti-monopoly regulators will have to find the right balance to limit the scale of CSPs, while letting them prosper. It is the huge success of ICPs which attracts attention of the regulators now. It is long overdue. Curbing the scale of ICP monopolies will also help CSPs to sustain their business, but they still need to transform themselves. The recent revelation that Amazon wants to bundle a phone service offering as part of Amazon Prime shows how vulnerable the CSPs are.

LightCounting defined this period as pivotal for the CSPs in last year’s network transformation report. One year on, this remains the case although what is at stake is clearer. We see more determination among CSPs to transform into digital service providers of the future. There is no viable alternative.

More information about the report is available at: Network Transformation

References:

|

Highlights of 2023 Mobile World Congress Shanghai, China

Mobile World Congress Shanghai (from June 28-30, 2023) showcased the impact of 5G networks on global businesses in Asia. This fourth anniversary of commercial 5G adoption offered a chance for network operators and vendors alike to reflect on the benefits of the latest network technology and what’s needed for broader 5G adoption.

According to Robert Clark of Light Reading, “Industry leaders returned after a four-year hiatus with little to say and even less to announce.” That’s nothing new. Shira Ovide, writing for the Washington Post in June 2023, called claims about 5G’s benefits for retail customers “mostly hot air.”

China Mobile talked up its prospects in two new 5G consumer services:

- Cloud phones, which could be tailored to meet the needs of different user segments – general-purpose use, gaming, streaming and so on. The apps, OS and processing of cloud phone voice and data are all running in the cloud, according to Li Bin, vice president of subsidiary China Mobile Internet Co.

- 5G new calling – an enhancement to VoNR that is meant to transform the voice call experience. It enables integration of other apps into a phone call, like real-time translation, or multi-party video or remote guidance.

Source: Grid Scheduler on Flickr (public domain)

……………………………………………………………………………………………………………………………………………

Meng Wanzhou Deputy Chairwoman, Rotating Chairwoman, CFO, daughter of Huawei founder Ren Zhengfei:

“5-point-5G is the next step forward for 5G. 5-point-5G will feature 10-gigabit downlink speeds, gigabit uplink speeds, the ability to support 100-billion connections, and native AI.” With much higher speeds, it’s believed 5-point-5G will offer greater levels of targeted support for industrial needs, in domains like IoT, sensing and advanced manufacturing.

A partnership between Huawei and Shaanxi Coal Industry Co. mines installed sensors that can deliver real-time data about dangerous gas levels and instability in mine tunnels, to alert control centers above ground as needed to ensure worker safety.

5G network technology in Tianjin, China, leverages Huawei’s 5GtoB solutions for remote operators. Higher network speeds allow for more efficient operations that yield meaningful results for port operator’s bottom lines, while consumers benefit by receiving goods faster.

In the manufacturing sector, companies are seeing a significant transformation in operations, as digitalization increases production capacity. A factory in Jingzhou, China, operated by Midea Group, became the world’s first fully 5G-connected electrical appliance factory. Powered by advanced mobile solutions from China Mobile and Huawei, production line capacity significantly increased — reducing inventory needs and delivering savings which can be passed on to consumers. As data volume requirements for operating modern businesses rise, 5G networks’ efficiency can be both more cost-efficient and require less energy.

Huawei made a bold claim that it would provide all the necessary components for running a 5.5G network by next year. However, no-one can define what 5.5G even is.

Yang Chaobin, the director and president of ICT Products & Solutions at Huawei, announced the company’s ambitious plans, stating that the launch would signify the beginning of the 5.5G era for the industry.

However, the term “5.5G” is currently not recognized by the 3rd Generation Partnership Project (3GPP), the organisation responsible for defining 5G and related standards.

The 3GPP is currently focused on evolving 5G through its work on Release 18, known as “5G-Advanced,” which includes significant enhancements like 10Gbps connections and the utilization of mmWave frequencies.

Huawei’s use of the term 5.5G seems to be an attempt to position Release 18 as the next iteration of 5G. Despite the lack of formal recognition, Huawei is confident in its ability to deliver advanced technologies, including AI-native capabilities, to enhance network performance and availability.

“With a clearly defined standardization schedule, the 5.5G Era is already poised for technological and commercial verification. In 2024, Huawei will launch a complete set of commercial 5.5G network equipment to be prepared for the commercial deployment of 5.5G,” Yang said. He claims that Huawei’s approach will enable the deployment of AI capabilities throughout the network.

Huawei’s involvement in 5G infrastructure has raised concerns among many governments due to security risks associated with the company. Several countries have even banned or restricted the use of Huawei’s 5G and 4G equipment. Consequently, it is unlikely that a significant number of global buyers will consider Huawei’s 5.5G offerings.

However, Huawei’s announcement could still garner positive attention domestically. Developing nations may also be attracted by Huawei’s competitively-priced communication equipment.

While Huawei’s claim to offer comprehensive solutions for a 5.5G network is ambitious, the term itself lacks formal recognition from standardization bodies. The company’s emphasis on AI capabilities and network enhancements may resonate with certain markets, but the geopolitical challenges it faces could limit its global reach.

References: