Cloud Computing

AWS, Google, Microsoft, Oracle win $9B DoD cloud computing contract (JWCC)

The U.S. Department of Defense (DoD) finally revealed the awards for its revamped cloud contract “Joint Warfighting Cloud Capability (JWCC),” with Amazon Web Services (AWS), Microsoft, Google and Oracle collectively getting $9 billion to improve the agency’s IT operations. The contracts run through 2028 the Pentagon said in a news release.

JWCC is a multiple-award contract vehicle that will provide the DoD the opportunity to acquire commercial cloud capabilities and services directly from the commercial Cloud Service Providers (CSPs) at the speed of mission, at all classification levels, from headquarters to the tactical edge.

This Indefinite-Delivery, Indefinite-Quantity (IDIQ) contract vehicle offers commercial pricing, or better, and streamlined provisioning of cloud services. With JWCC, warfighters will now have the opportunity to acquire the following capabilities under one contract:

- global accessibility

- available and resilient services

- centralized management and distributed control

- ease of use

- commercial parity

- elastic computing, storage, and network infrastructure

- advanced data analytics

- fortified security

- tactical edge devices

To get started using JWCC or to learn more, visit to contact the Defense Information Systems Agency (DISA) Hosting and Compute Center (HaCC) or to log-in to the JWCC Customer Portal. DISA has developed user-friendly cloud accelerators to make it easier for DOD customers to purchase, provision, and onboard into the cloud.

Photo of the U.S. Pentagon/DoD

The decision to award contracts to four companies was a shift for the Pentagon, three years after it had given a $10 billion cloud-computing contract to Microsoft. That contract, for the Joint Enterprise Defense Infrastructure, known as JEDI, became part of a legal battle over claims that President Donald J. Trump interfered in a process that favored Microsoft over its rival bidder, Amazon. In 2021, the Defense Department said it would not move forward with the Microsoft contract, as it “was developed at a time when the department’s needs were different and our cloud conversancy less mature.”

Instead, the Pentagon said, it would seek bids from multiple technology companies for the Joint Warfighting Cloud Capability. While market research indicated that Microsoft and Amazon would be best positioned to meet the needs, officials said they would also reach out to IBM, Oracle and Google.

“This is the biggest cloud Beltway deal in history and was a key deal to win for all the software vendors in this multiyear soap opera,” Dan Ives, a tech analyst with Wedbush Securities, said in an email. “It’s good to finally end this chapter and get a cloud deal finally done for the Pentagon after years of a roller coaster,” he added.

An AWS spokesperson said in an email, “We are honored to have been selected for the Joint Warfighting Cloud Capability contract and look forward to continuing our support for the Department of Defense. From the enterprise to the tactical edge, we are ready to deliver industry-leading cloud services to enable the DoD to achieve its critical mission.”

References:

Cloud Computing Giants Growth Slows; Recession Looms, Layoffs Begin

Among the megatrends driving the technology industry, cloud computing has been a major force. But for the first time in its brief history, the cloud has grown stormy as third-quarter cloud giant earnings details made very clear:

- Amazon Web Services (AWS) fell short of the mark on both earnings and revenue. Reports say parent Amazon.com (AMZN) has frozen hiring at its cloud computing unit and will be laying off 10,000 employees.

- Microsoft’s (MSFT) Azure cloud business at posted an unexpected slowdown in cloud computing growth. At Microsoft, “Intelligent Cloud” revenue rose 24% to $25.7 billion during the company’s fiscal first quarter, including Azure’s 35% growth to $14.4 billion. Excluding the impact of currency exchange rates, Azure revenue climbed 42%

- Alphabet’s (GOOGL) Google Cloud business came in ahead of forecasts, but Oppenheimer analyst Tim Horan said in a note to clients that it has “no line of sight to meaningful profits.”

Note: We don’t consider Facebook/Meta Platforms a cloud service provider, even though they build the IT infrastructure for their cloud resident data centers. They are first and foremost a social network provider that’s now desperately trying to create a market for the Metaverse, which really does not exist and may never be!

In late October, Synergy Research reported that Amazon, Microsoft and Google combined had a 66% share of the worldwide cloud services market in the 3rd quarter, up from 61% a year ago. Alibaba and IBM placed fourth and fifth, respectively according to Synergy. In aggregate, all cloud service providers excluding the big three have tripled their revenues since late 2017, yet their collective market share has plunged from 50% to 34% as their growth rates remain far below the market leaders.

In 2022, capital spending on internet data centers by the three big cloud computing companies will jump a healthy 25% to $74 billion, estimates Dell’Oro Group. In 2023, spending on warehouse-size data centers packed with computer servers and data storage gear is expected to slow. Dell’Oro puts growth at just 7%, which would take the market up to $79 billion.

Oppenheimer’s Horan wrote, “Cloud providers remain very bullish on long-term trends, but investors have been surprised at how economically sensitive the sector is. “Sales cycles in cloud services have elongated and customers are looking to cut cloud spending by becoming more efficient. Despite the deceleration, cloud is now a $160 billion-plus industry. But investors will be concerned given this is our first real cloud recession, which makes forecasts difficult.”

“This macro slowdown clearly will impact all aspects of tech spending over the next 12 to 18 months. Cloud spending is not immune to the dark macro backdrop as seen during earnings season over the past few weeks,” Wedbush analyst Daniel Ives told Investor’s Business Daily via an email. “That said, we estimate 45% of workloads have moved to the cloud globally and (the share is) poised to hit 70% by 2025 in a massive $1 trillion shift. Enterprises will aggressively push to the cloud and we do not believe this near-term period takes that broader thesis off course. The near-term environment is more of a speed bump rather than a brick wall on the cloud transformation underway. Microsoft, Amazon, Google, IBM (IBM) and Oracle (ORCL) will be clear beneficiaries of this cloud shift over the coming years and will power through this Category 5 (hurricane) economic storm.”

Bank of America expects a boost from next-generation cloud services that cater to “edge computing.” Amazon, Microsoft and Google are “treating the edge as an extension of their public cloud,” said a BofA report. The giant cloud computing companies have all partnered with telecom firms AT&T (T), Verizon (VZ) and T-Mobile US (TMUS). Their aim to embed their cloud services within 5G wireless networks. “Telcos are leveraging the hyperscale cloud to launch their own edge compute businesses,” BofA said.

At BMO Capital Markets, analyst Keith Bachman says investors need to reset their expectations as the coronavirus pandemic eases. The corporate switch to working from home spurred demand for cloud services. Online shopping boomed. And consumers turned to internet video and online gaming for entertainment.

“We think many organizations accelerated the journey to the cloud as Covid and hybrid work requirements exposed weaknesses in existing on-premise IT capabilities,” Bachman said in a note. “While spend remains healthy in the cloud category, growth has decelerated for the past few quarters. We believe economic forces are at work as well as a slower pace of cloud migrations post-Covid.”

Market research heavyweight Gartner updated its global cloud computing growth forecast Oct. 31. The new forecast was completed before third-quarter earnings were released by Amazon, Microsoft and Google. Gartner forecasted worldwide end-user spending on public cloud services will grow 20.7% in 2023 to $591.8 billion. That’s up from 18.8% growth in 2022.

In a press release, Gartner analyst Sid Nag cautioned: “Organizations can only spend what they have. Cloud spending could decrease if overall IT budgets shrink, given that cloud continues to be the largest chunk of IT spend and proportionate budget growth.

AWS, Microsoft Azure and Google’s cloud computing units are all growing at an above-industry-average rate. Still, AWS and Azure are slowing, perhaps a bit due to size as well as the economy.

- At Wolfe Research, MSFT stock analyst Alex Zukin said in his note: “The damage in Microsoft’s case came from another Azure miss in the quarter, but the bigger surprise was the guide of 37%. That is the largest sequential growth deceleration on record.”

- Google’s cloud computing revenue rose 38% to $6.28 billion. That’s up 2% from the previous quarter and topped estimates from GOOGL stock analysts by 4%. However, the company reported an operating loss of $644 million for the cloud business versus a $699 million loss a year earlier. Hoping to take market share from bigger AWS and Microsoft’s Azure, Google has priced cloud services aggressively, analysts say. It also stepped up hiring and spending on data centers. And it acquired cybersecurity firm Mandiant for $5.4 billion.

- “Amazon noted it has seen an uptick in AWS customers focused on controlling costs and is working to help customers cost-optimize,” Amazon stock analyst Youssef Squali at Truist Securities said in a report to clients. “The company is also seeing slower growth from certain industries (financial services, mortgage and crypto sectors),” he added.

- Oppenheimer’s Horan estimates that AWS will produce $13.9 billion in free cash flow in 2022. But he sees Google’s cloud unit having $10.6 billion in negative free cash flow.

Nonetheless, Deutsche Bank analyst Brad Zelnick remains upbeat on the cloud computing business. He wrote in a research note:

“We see a temporary slowdown in bringing new workloads to the cloud, though importantly not a change in organizations’ long-term cloud ambitions. The near-term forces of optimization can obscure what we believe remain very supportive underlying trends. We remain confident that we are in the early innings of a generational shift to cloud.”

References:

The First Real Cloud Computing Recession Is Here — What It Means For Tech Stocks

Synergy: Q3 Cloud Spending Up Over $11 Billion YoY; Google Cloud gained market share in 3Q-2022

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multi-cloud and hybrid cloud environments. DIsh is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/

CenturyLink offers Multi Cloud Connect L2 Service for Fiber-fed Buildings

CenturyLink has unveiled its Dynamic Connections, a Layer 2 (L2) based offering that provides access to many different cloud computing services. The third biggest U.S. wire-line carrier has partnered with Amazon Web Services and AWS GovCloud, saying it will add connections to Google Cloud and Microsoft Azure in coming weeks, then will add IBM, Oracle and other cloud computing services.

With growing day-to-day operations, organizations need a fast and easier way to connect their locations and data centers to cloud service providers. CenturyLink says they offer a complete portfolio of solutions for cloud connectivity. The company’s global access and extensive wavelength, Ethernet and IP VPN connectivity options are designed to meet today’s hybrid cloud requirements.

CenturyLink says they will provide high-performance connections to AWS, Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure, and other leading public and private clouds along with more than 2,200 third-party data centers.

Dynamic Connections is available to enterprise and government customers in fiber-fed buildings globally. CenturyLink has about 130,000 of those today, via an optical Ethernet port.

According to CenturyLink, the customer needs the right hardware and the right size port, but assuming that, they can turn up bandwidth from “as small as 10 Megabits/sec to up to 3 Gigabits/sec,” says Paul Savill, senior vice president of core network and technology solutions at CenturyLink.

“They would use log-in credentials to pull an inventory of all Ethernet ports they have at that enterprise in their locations across the world and they can then see that either in a map view or a list view,” Savill explains. “Then they can drill down to whatever location they want to connect- pick that Ethernet port and then pick the cloud service provider they want, at wherever location that is in the world, whatever data center it is running in, and then indicate the size of the bandwidth.”

Savill said that competing multi-cloud connect offerings –from AT&T’s NetBond, Verizon’s Secure Cloud Interconnect and Orange Business Services’ private and public cloud connections, etc. “can’t match our scale and flexibility.” [There is also Equinix Cloud Exchange Fabric].

As a L2 service, it doesn’t touch the Internet, which thereby provides greater security. In addition, CenturyLink is offering an open API for the service so that enterprise customers can build it into their own back-office systems and use those for provisioning instead of the portal.

Editor’s Note:

After CenturyLink acquired Savvis in 2011, the combined company attempted to promote its own cloud computing service using MPLS IP VPN for customer access to it. This new multi-cloud connect service is a huge improvement over that earlier solution. It will be interesting to see how it competes with AT&T Netbond, Verizon’s Secure Cloud Interconnect service, and Equinix Cloud Exchange Fabric.

References:

https://www.nasdaq.com/article/centurylink-introduces-cloud-connect-dynamic-connections-cm1035159

Google Expands Cloud Network Infrastructure via 3 New Undersea Cables & 5 New Regions

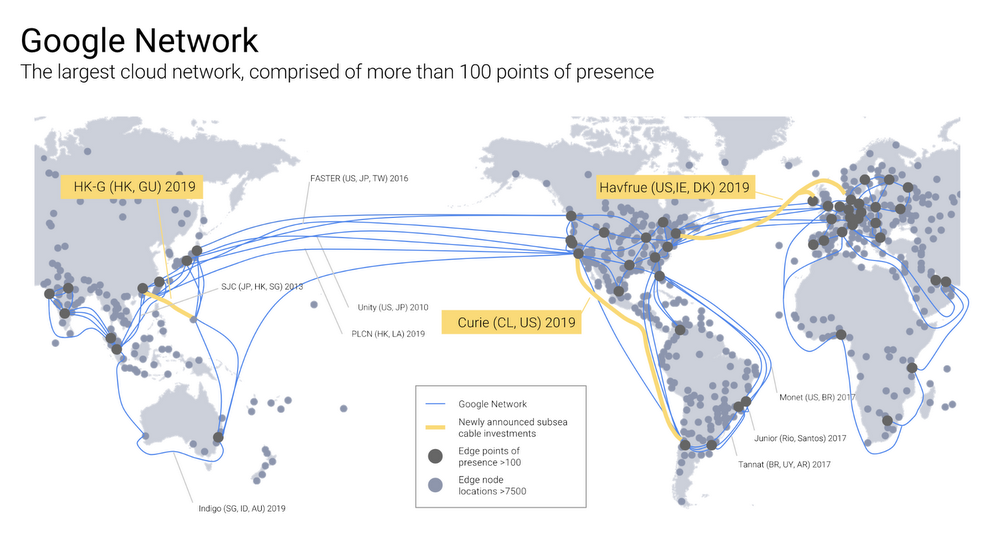

Google has plans to build three new undersea cables in 2019 to support its Google Cloud customers. The company plans to co-commission the Hong Kong-Guam (HK-G) cable system as part of a consortium. In a blog post by Ben Treynor Sloss, vice president of Google’s cloud platform, three undersea cables and five new regions were announced..

The HK-G will be an extension of the SEA-US cable system, and will have a design capacity of more than 48Tbps. It is being built by RTI-C and NEC. Google said that together with Indigo and other cable systems, HK-G will create multiple scalable, diverse paths to Australia. In addition, Google plans to commission Curie, a private cable connecting Chile to Los Angeles and Hvfrue, a consortium cable connecting the US to Denmark and Ireland as shown in the figure below.

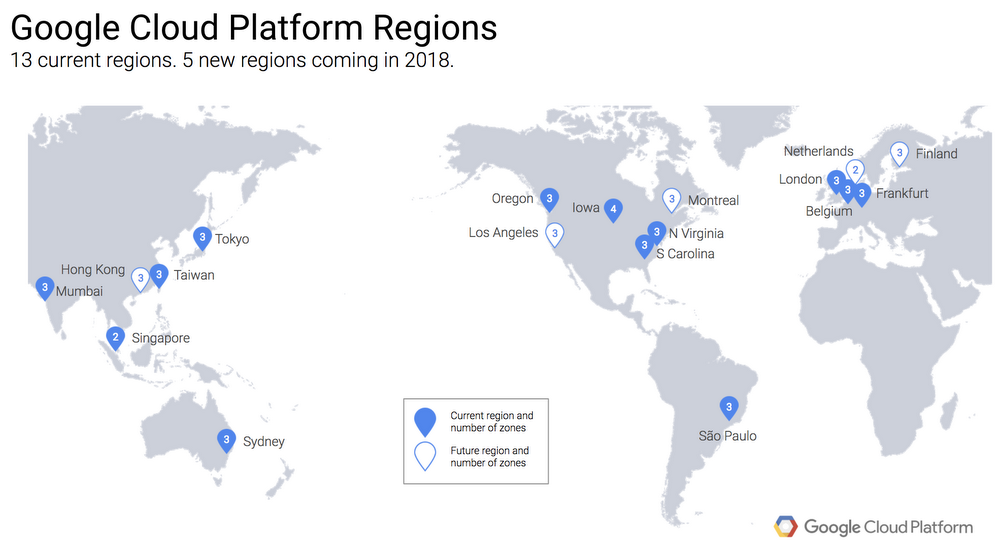

Late last year, Google also revealed plans to open a Google Cloud Platform region in Hong Kong in 2018 to join its recently launched Mumbai, Sydney, and Singapore regions, as well as Taiwan and Tokyo.

Of the five new Google Cloud regions, Netherlands and Montreal will be online in the first quarter of 2018. Three others in Los Angeles, Finland, and Hong Kong will come online later this year. The Hong Kong region will be designed for high availability, launching with three zones to protect against service disruptions. The HK-G cable will provide improved network capacity for the cloud region. Google promises they are not done yet and there will be additional announcements of other regions.

In an earlier announcement last week, Google revealed that it has implemented a compile-time patch for its Google Cloud Platform infrastructure to address the major CPU security flaw disclosed by Google’s Project Zero zero-day vulnerability unit at the beginning of this year.

Diane Greene, who heads up Google’s cloud unit, often marvels at how much her company invests in Google Cloud infrastructure. It’s with good reason. Over the past three years since Greene came on board, the company has spent a whopping $30 billion beefing up the infrastructure.

Google has direct investment in 11 cables, including those planned or under construction. The three cables highlighted in yellow are being announced in this blog post. (In addition to these 11 cables where Google has direct ownership, the company also leases capacity on numerous additional submarine cables.)

In the referenced Google blog post, Mr Treynor Sloss wrote:

At Google, we’ve spent $30 billion improving our infrastructure over three years, and we’re not done yet. From data centers to subsea cables, Google is committed to connecting the world and serving our Cloud customers, and today we’re excited to announce that we’re adding three new submarine cables, and five new regions.

We’ll open our Netherlands and Montreal regions in the first quarter of 2018, followed by Los Angeles, Finland, and Hong Kong – with more to come. Then, in 2019 we’ll commission three subsea cables: Curie, a private cable connecting Chile to Los Angeles; Havfrue, a consortium cable connecting the U.S. to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G), a consortium cable interconnecting major subsea communication hubs in Asia.

Together, these investments further improve our network—the world’s largest—which by some accounts delivers 25% of worldwide internet traffic……………….l.l….

Simply put, it wouldn’t be possible to deliver products like Machine Learning Engine, Spanner, BigQuery and other Google Cloud Platform and G Suite services at the quality of service users expect without the Google network. Our cable systems provide the speed, capacity and reliability Google is known for worldwide, and at Google Cloud, our customers are able to to make use of the same network infrastructure that powers Google’s own services.

While we haven’t hastened the speed of light, we have built a superior cloud network as a result of the well-provisioned direct paths between our cloud and end-users, as shown in the figure below.

According to Ben: “The Google network offers better reliability, speed and security performance as compared with the nondeterministic performance of the public internet, or other cloud networks. The Google network consists of fiber optic links and subsea cables between 100+ points of presence, 7500+ edge node locations, 90+ Cloud CDN locations, 47 dedicated interconnect locations and 15 GCP regions.”

……………………………………………………………………………………………………………………………………………………………………………………………

Reference: