Marvell

Marvell shrinking share of the RAN custom silicon market & acquisition of XConn Technologies for AI data center connectivity

Samsung and Nokia currently use Marvell’s OCTEON Fusion baseband processors and OCTEON Data Processing Units (DPUs) in their 5G Radio Access Network (RAN) equipment.

- OCTEON Fusion Processors: Samsung uses these baseband processors in its 5G base stations, particularly for massive MIMO (Multiple-Input Multiple-Output) deployments that require significant compute power for complex beamforming algorithms.

- OCTEON and OCTEON Fusion Families: Samsung has leveraged multiple generations of these processors for baseband and transport processing solutions.

- Customized OCTEON Silicon: Nokia uses customized Marvell OCTEON silicon across key applications, including multi-RAT (Radio Access Technology) RAN and transport.

- OCTEON Fusion Processors: These are used for baseband processing in Nokia’s 5G products.

- OCTEON TX2 and OCTEON 10 Families: These infrastructure processors are used for demanding tasks like packet processing, security, and edge inferencing within Nokia’s 5G infrastructure.

- OCTEON 10 Fusion: Nokia is working with the latest generation of this 5nm baseband platform, which supports use cases from radio units (RU) to distributed units (DU) for both traditional and Open RAN architectures.

……………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, the total global RAN market has been declining for years as network operators slash investment in network equipment and cut jobs. According to Omdia (owned by Informa):

- Global RAN equipment sales fell from $45 billion in 2022 to $40 billion in 2023 and just $35 billion in 2024. Nokia’s mobile networks business group suffered an operating loss of €64 million (US$75 million) on sales of €5.3 billion ($6.2 billion) for the first nine months of 2025.

- For its 2023 fiscal year (ending in January 2023), Marvell’s carrier division made almost $1.1 billion in revenues, more than 18% of total company sales. Two years later, annual revenues had slumped to just $338.2 million, less than 6% of turnover.

- Marvell’s carrier sales have also recently improved in fiscal 2026, rising 88% year-over-year for the first nine months, to $436.3 billion. However, that’s still half as much as Marvell made during the first nine months of fiscal 2024, and interest in the RAN has seemingly evaporated.

- Samsung’s share of the shrinking RAN market has declined. Amid contraction of the entire addressable market, revenues generated by Samsung Networks fell from 5.39 trillion South Korean won ($3.74 billion) in 2022 to just KRW2.82 trillion ($1.95 billion) in 2024. For the first nine months of 2025, Samsung reported network sales of KRW2.1 trillion ($1.46 billion). But it has also lost market share, which dipped from 6.1% in 2023 to 4.8% in 2024, according to Omdia.

- Ericsson has two development tracks – one for purpose-built RAN products based partly on its own custom RAN silicon and the other for an Intel-based virtual RAN. In contrast to Samsung, the purpose-built RAN silicon portfolio today accounts for nearly all of the company’s sales.

- Ericsson’s senior managers increasingly talk about virtualization as a means of developing one set of software for multiple hardware platforms. The hope is that software originally designed for use with Intel’s processors could be redeployed on CPUs from AMD or licensees from ARM Ltd. with minimal coding changes. Such optionality combined with the narrowing of the performance gap between CPUs and purpose built RAN silicon would make it hard for Ericsson to justify investment in its own custom silicon.

…………………………………………………………………………………………………………………………………………………………………………….

Today, Marvell announced it will acquire XConn Technologies for $540 million to boost AI/data center connectivity. In late 2025, the company announced the acquisition of Celestial AI for up to $5.5 billion to expand its optical interconnects for next-gen data centers, solidifying its position in infrastructure semiconductors.

Adding XConn’s PCIe and CXL switching technology (see illustrations below), fills gaps in Marvell’s silicon portfolio and enables the company to expand into higher-speed interconnects (like PCIe Gen 6).

XConn Technologies XC 50256 chip: 256 lanes with total 2,048GB/s switching capacity

…………………………………………………………………………………………………………………………………….

XC50256 CXL 2.0 Switch Chip

……………………………………………………………………………………………………………………………………………………………

As AI workloads scale, data center system design is evolving from single-rack deployments to larger, multi-rack configurations. These next-generation platforms increasingly require a high-bandwidth, ultra-low latency scale-up fabric such as UALink to efficiently connect large numbers of XPUs and enable more flexible resource sharing across the system.

UALink is a new open industry standard purpose-built for scale-up connectivity, enabling efficient, high-speed communication so multiple accelerators can operate together as a single, larger system. UALink builds on decades of PCIe ecosystem innovation and incorporates proven high-speed I/O techniques to meet the bandwidth, latency, and reach requirements of next-generation accelerated infrastructure.

Together, Marvell and XConn will bring together a significantly larger, integrated team to fully address the rapidly emerging opportunity in UALink switching as well as comprehensively support the growing list of customers and partners who want to work with Marvell in evolving their next generation AI platforms.

About Marvell:

To deliver the data infrastructure technology that connects the world, we’re building solutions on the most powerful foundation: our partnerships with our customers. Trusted by the world’s leading technology companies for over 30 years, we move, store, process and secure the world’s data with semiconductor solutions designed for our customers’ current needs and future ambitions. Through a process of deep collaboration and transparency, we’re ultimately changing the way tomorrow’s enterprise, cloud and carrier architectures transform—for the better.

About XConn Technologies:

XConn is the innovation leader in next-generation interconnect technology for high-performance computing and AI applications. The company is the industry’s first to deliver a hybrid switch supporting both CXL and PCIe on a single chip. Privately funded, XConn is setting the benchmark for data center interconnect with scalability, flexibility, and performance. For more information visit: https://www.xconn-tech.com

……………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/fragile-samsung-deal-with-marvell-shows-challenge-for-ran-chipmakers

RAN silicon rethink – from purpose built products & ASICs to general purpose processors or GPUs for vRAN & AI RAN

Dell’Oro: Analysis of the Nokia-NVIDIA-partnership on AI RAN

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Samsung and Marvell develop SoC for Massive MIMO and Advanced Radios

China gaining on U.S. in AI technology arms race- silicon, models and research

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

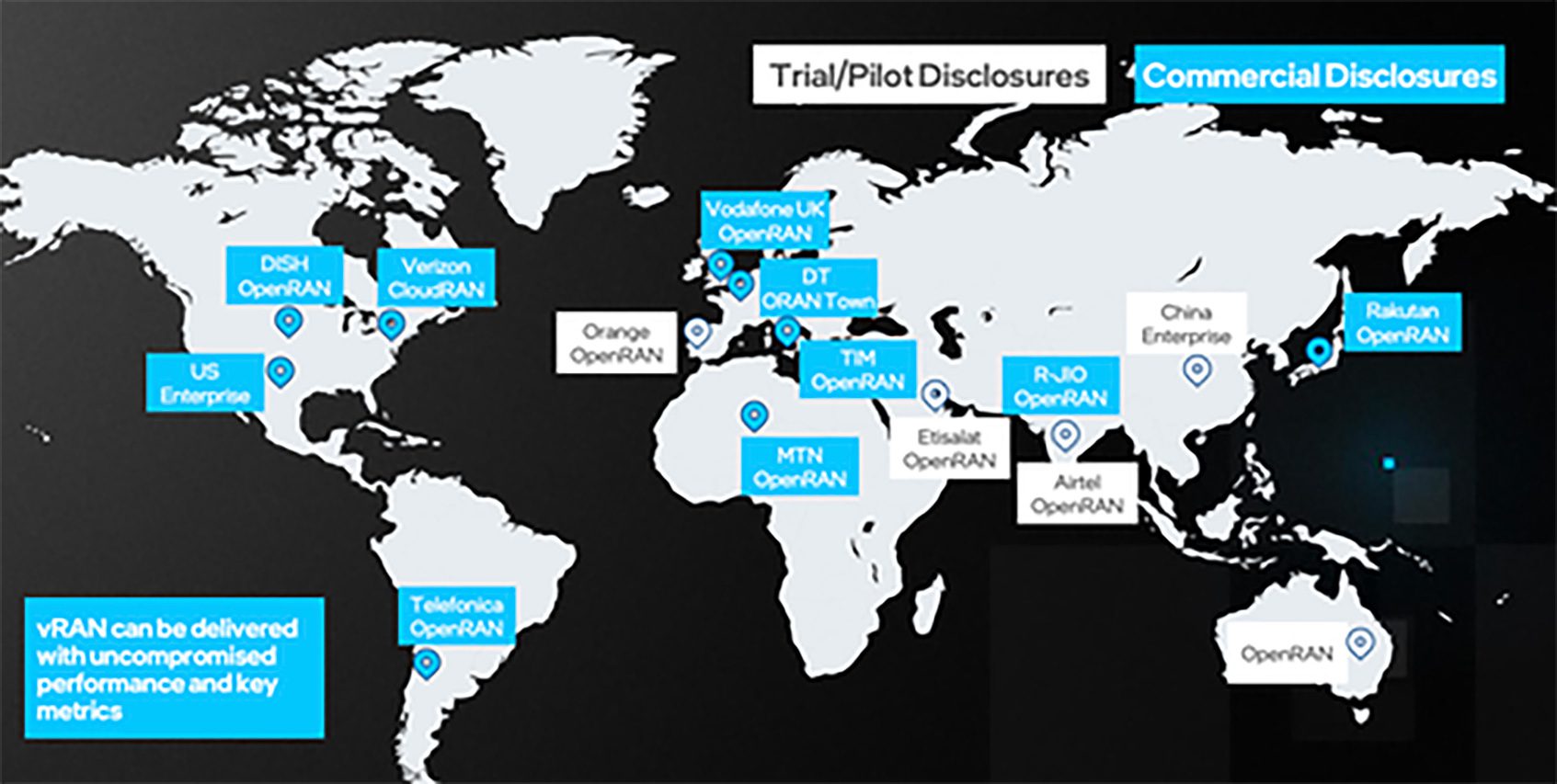

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

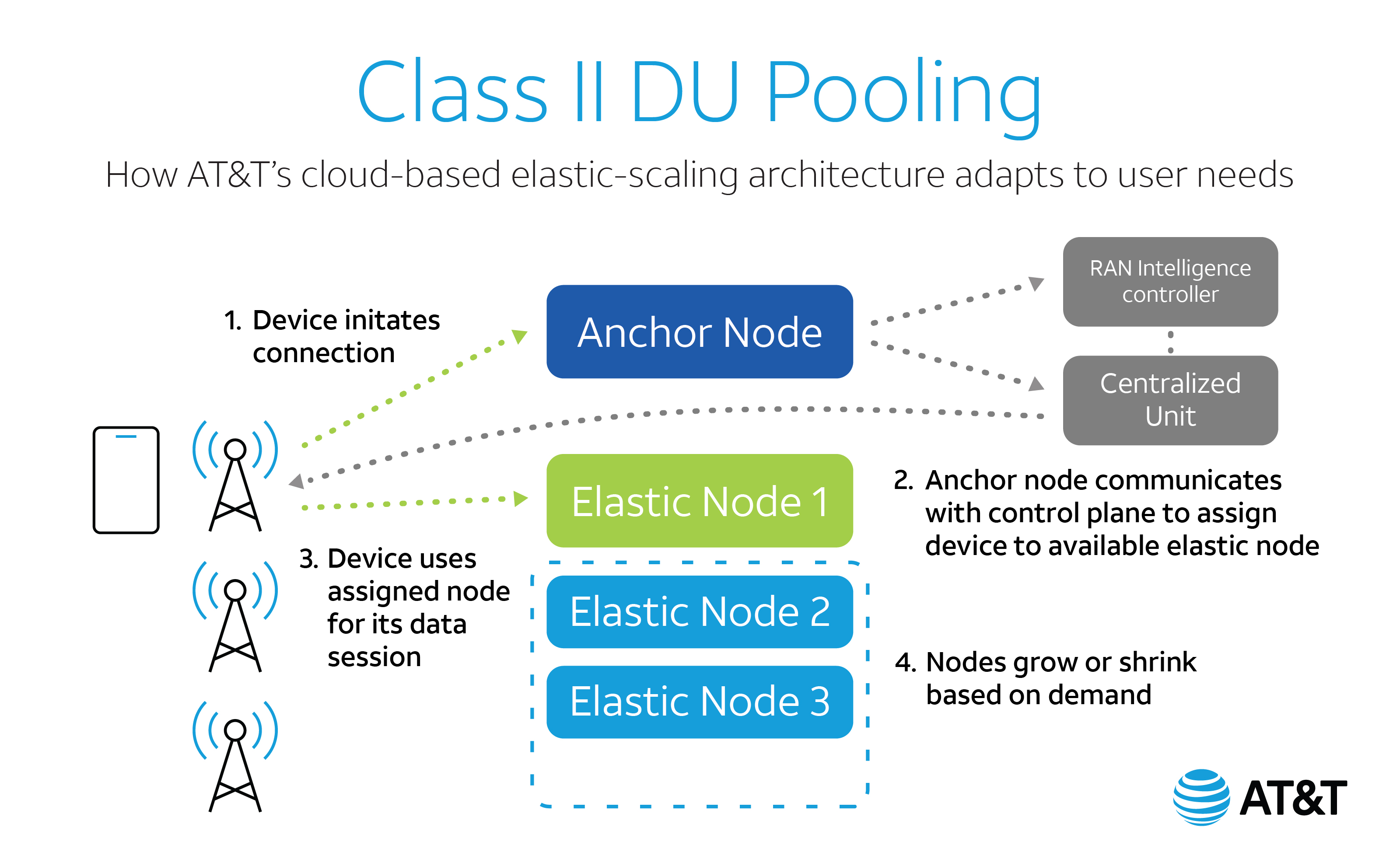

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

Samsung and Marvell develop SoC for Massive MIMO and Advanced Radios

Korean electronics giant Samsung Electronics said it has developed a new System-on-Chip (SoC) for its Massive MIMO and other advanced radios in partnership with U.S. chipmaker Marvell. It is expected to be available in Q2 2021 for use in equipment sold to Tier-One network operators.

The SoC is designed to help implement new technologies, which improve cellular radios by increasing their capacity and coverage, while decreasing power consumption and size. The new SoC is equipped to support both 4G and 5G networks simultaneously and aims to improve the capacity and coverage of cellular radios. It is claimed to save up to 70 percent in chipset power consumption compared to previous solutions.

“We are excited to extend our collaboration with Marvell to unveil a new SoC that will combine both companies’ strengths in innovation to advance 5G network solutions,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Samsung prioritizes the development of high-impact 5G solutions that offer a competitive edge to our operators. We look forward to introducing this latest solution to the market shortly.”

Samsung and Marvell have been working closely to deliver multiple generations of leading network solutions. Last year, the companies announced a collaboration to develop new 5G products, including innovative radio architectures to address the compute power required for Massive MIMO deployments.

“Our collaboration with Samsung spans multiple generations of radio network products and demonstrates Samsung’s strong technology leadership. The joint effort includes 4G and 5G basebands and radios,” said Raj Singh, Executive Vice President of Marvell’s Processors Business Group. “We are again honored to work with Samsung for the next generation Massive MIMO radios which significantly raise the bar in terms of capacity, performance and power efficiency.”

“Marvell and Samsung are leading the way in helping mobile operators deploy 5G with greater speed and efficiency,” said Daniel Newman, Founding Partner at Futurum Research. “This latest collaboration advances what’s possible through SoC technology, giving operators and enterprises a distinct 5G advantage through optimized performance and power savings in network deployments.”

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

……………………………………………………………………………………………………………………………………………….

On the network equipment side, Samsung Electronics recently won a 5G contract with Japanese telco NTT DOCOMO, as it seeks to challenge incumbents like Huawei, Ericsson, and Nokia in the telecom equipment business, according to media reports.

In India, Samsung Electronics is likely to apply for a production-linked incentive (PLI) scheme for telecom equipment manufacturing, benefiting from India’s program to locally make 4G and 5G gear and other equipment – for sales both in India and overseas, ET recently reported.

Samsung would then join other global manufacturers such as Cisco, Jabil, Flex and Foxconn, besides European telecom equipment vendors Nokia and Ericsson in applying for the PLI scheme that seeks to boost local production of telecom equipment and reduce imports.

References:

https://telecom.economictimes.indiatimes.com/news/samsung-marvell-develop-soc-for-5g-radios/81720284

Samsung Boosts the Performance of Massive MIMO

Samsung Collaborates With NTT DOCOMO on 5G

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Nokia has teamed up with semiconductor company Marvell Technology Group Ltd to develop customized 5G radio access system-on-chip leveraging its ReefShark technology. The alliance underscores Nokia’s commitment to deliver cost-effective and automated 5G network operations, especially at a time when it is aiming to walk the extra mile to revive its faltering 5G business.

As part of the agreement, Marvell Technology’s multi-core Radio Access Technology applications will be incorporated in Nokia’s AirScale RAN product line with its 5G-backed ReefShark portfolio. Equipped with customized ARM-architecture-based processor chips, this potential breakthrough innovation aims to deliver a best-in-class customer experience with reduced power consumption and enhanced performance and capacity.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Tommi Uitto, President of Mobile Networks at Nokia, said:

“This important announcement highlights our continued commitment to expanding the variety and utilization of ReefShark chipsets in our portfolio. This ensures that our 5G solutions are equipped to deliver best-in-class performance to our customers. As service providers continue to evolve their 5G plans and support growing traffic and new vertical services, the infrastructure and components must evolve rapidly. Adopting the latest advancements in silicon technology is a critical step to better serve our customers’ needs.”

“5G networks need to support billions of devices and machines, and this massive increase in volume and scale means that existing infrastructure and components must evolve rapidly, adopting technologies and techniques to enable to deploy 5G networks quickly, added Uitto.”

(Image credit: Nokia)

………………………………………………………………………………………………………………………….

Other Nokia Initiatives:

- Nokia also agreed to a partnership with Intel on programs to accelerate its 5G development. Intel’s new Atom chip is targeted at base stations. Nokia will ship Intel Atom-powered variants of its 5G AirScale radio access technology. The company will also use Intel’s second generation Xeon scalable processor in its AirFrame data center kit, allowing for common architecture from the cloud to the edge of 5G networks.

- Nokia said it needed several partnerships to enable it support and achieve its goals for 5G.

- Nokia will acquire optical networking technology provider Elenion. Nokia said that adding Elenion will broaden its addressable market and unlock some cost benefits.

- Nokia took a $561 million R&D loan which was signed with the European Investment Bank (EIB) in August 2018, but was only disbursed last month. The loan has an average maturity of about five years after disbursement according to Reuters. A Nokia representative said the company would use the loan to further accelerate its research and development of 5G technology

……………………………………………………………………………………………………………………………………………………………………………

Analysis by Zacks Equity Research:

Nokia has long struggled to undertake additional investments related to its 5G powered ReefShark SoCs. These SoCs are best known to leverage a single computer chip to operate an entire system. Unfortunately, its inability to develop ReefShark portfolio has hindered its cost-efficiency feature, compromising its profitability to rivals like Ericsson ERIC, which spends hefty amounts on R&D. Dearth of resources and geared up 5G spending cycle have also put Nokia at the risk of losing out on upcoming commercial launches.

The latest collaboration comes as a savior for the Finnish company to cater new vertical markets especially in the face of burgeoning network traffic and dynamic 5G plans. Dubbed as a key partnership, it is expected to reduce Nokia’s technical disparities and address the complex requirements of 5G NSA, SA, NR specifications for future 5G network deployments.

Nokia’s gross margin was negatively impacted by a high cost level associated with its first generation 5G products, product mix and profitability challenges in China. Despite a 4.2% rise in revenues in third-quarter 2019, the performance was marred by pricing pressure in early 5G deals and temporary capital expenditure constraints in North America related to the proposed merger of T-Mobile US and Sprint. This was followed by its decision to suspend dividend payments and slash guidance for 2020. The company has also decided to retrench about 180 employees in order to trim operating costs.

It remains to be seen whether Nokia will be able to script a turnaround amid a challenging macroeconomic environment and geopolitical uncertainties.

……………………………………………………………………………………………………………………………………………………………………………

About Marvell:

Marvell first revolutionized the digital storage industry by moving information at speeds never thought possible. Today, that same breakthrough innovation remains at the heart of the company’s storage, processing, networking, security and connectivity solutions. With leading intellectual property and deep system-level knowledge, Marvell’s infrastructure semiconductor solutions continue to transform the enterprise, cloud, automotive, industrial, and consumer markets. To learn more, visit: https://www.marvell.com/

About Nokia:

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.1 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,000 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

Marvell Communications

Phone: +1 408 222 8966

Email: [email protected]

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.zacks.com/stock/news/797965/can-nokia-revive-its-5g-business-with-marvell-partnership

https://www.techradar.com/news/nokia-secures-5g-chip-partnerships-with-intel-and-marvell