Verizon

A Tale of two Telcos: AT&T up (fiber & mid-band 5G); VZ down (net income falls; cost-cutting coming)

AT&T said on Thursday that it added 708,000 postpaid cellular end point connections, a metric investors use to measure the strength of a cellular carrier’s main profit center. For the third consecutive quarter, the tally easily topped forecasts of Wall Street analysts, who had been expecting 552,300 connections in the third quarter. AT&T executives said their core wireless business overshot their expectations during the third quarter, driving higher revenue and profits despite lingering worries about inflation.

“We’re in a much better place than the broader economy,” finance chief Pascal Desroches said in an interview. The company raised its targets for profit and core wireless revenue this year.

AT&T said that it has added more than 2.2 million wireless subscribers through three quarters, which it said it expected to top rivals.

Wireless-service revenue climbed 5.6%, an improvement the company attributed to rate increases, roaming fees and customer upgrades to premium plans. AT&T now expects full-year wireless service revenue to reach the high end of its previously forecast 4.5% to 5% growth range.

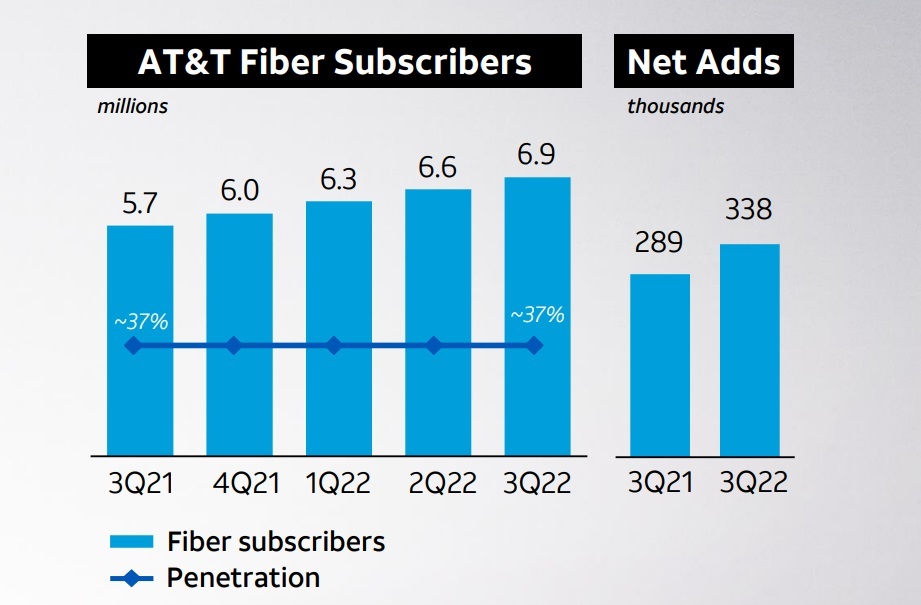

AT&T also added 338,000 customers to its fiber-optic network in the third quarter up from year ago additions of 289,000. That left AT&T with a fiber base of 6.93 million.. Chief Executive John Stankey said building new fiber optic lines remains a priority for the company.

Source: AT&T Q3 2022 earnings presentation

AT&T’s fiber strategy is driving average revenue per user (ARPU) upward. AT&T’s fiber ARPU for Q3 clocked in at $62.62, up from $58.17 in the year-ago period. Its general broadband ARPU in Q3 hit $58.63, up from $55.16 a year ago.

AT&T added another 500,000 fiber locations in Q3, extending its total to 18.5 million. Though the analysts at New Street Research thought that build cadence was a bit weak (they’ve been expecting AT&T to pass a fiber build rate exceeding 1 million per quarter this year), AT&T CEO John Stankey said on today’s earnings call that the company remains on track to achieve a target of 30 million-plus fiber locations by the end of 2025.

AT&T’s fiber penetration in Q3, at 37%, was unchanged even as the company continues to build out and light up more fiber locations. Stankey stressed that AT&T has been able to hit penetration rates of 30% “relatively quickly” with fiber, but acknowledged that the “next 20% takes a little bit longer.”

“I think the biggest change that’s occurred and penetration is how quickly we’re getting to the 20% level, versus historic numbers,” Stankey said. “But we’ve not made any assumption that once you hit that 30% level that the back end is going to go any faster.”

AT&T said it expects an adjusted full-year per-share profit of at least $2.50 from its continuing operations, a few cents higher than previously expected. And the company said its free cash flow, projected around $14 billion this year, should grow in 2023.

…………………………………………………………………………………………………………………………………

In sharp contrast, Verizon (the largest U.S. cellular carrier in terms of subscribers) reported a net gain of 8,000 phone connections under postpaid billing plans during the September quarter, a sign that recent rate increases had prompted many of its most reliable customers to leave the service.

Verizon’s overall net income, excluding profits from interests in non-controlling entities, fell nearly 24% to $4.9 billion in the September quarter. Higher overhead costs and interest expenses contributed to the weaker earnings, though the company’s adjusted profit still topped Wall Street analysts’ expectations, according to data from FactSet.

Verizon also said its consumer business lost 189,000 wireless retail postpaid connections. That was offset by Verizon’s business unit, which added 197,000 postpaid phone connections, giving the operator a total of 8,000 net new wireless connections.

Finance chief executive Matt Ellis said in an interview that the improving profitability in Verizon’s core wireless business showed that its strategy was pointing it in the right direction. Many subscribers were paying their bills on time and upgrading to more expensive plans over the past quarter despite signs of stress in the broader economy, he added.

“We can continue to bring customers in and step them up to grow revenue” with more full-featured plans, Ellis said. “If there’s opportunities to increase pricing, we obviously won’t be shy about doing that,” he added.

Verizon ended a four-year, $10 billion cost-cutting program last year, but has just started another one. The company revealed a new cost-cutting program on Friday that executives said will save $2 billion to $3 billion a year by 2025. The company didn’t detail how the initiative would trim expenses or how many, if any, jobs the move would affect.

“To further mitigate inflation impacts, we’ve started a new cost-savings program that we expect will provide a reduction in annual costs of $2-3 billion by 2025,” explained Verizon CFO Matt Ellis during the operator’s Q3 2022 conference call Friday. “This program will be focused on several areas in the business, including digitalization efforts to enhance the customer experience and streamlining internal operations with automation and process enhancements.”

Verizon’s headcount has declined from around 155,000 in 2017 to just 118,000 last year.

Verizon said it now covers 160 million people with its speedy C-band network, and expects to expand that number to 200 million in the first quarter of next year.

In contrast, AT&T said it is on track to cover 130 million people with its own midband 5G network by the end of this year, far ahead of the company’s initial projections.

During Verizon’s quarterly earnings call, CEO Hans Vestberg reiterated the company’s broad profit strategy: to gain new customers and to encourage existing customers to spend more money with the carrier. Specifically, he said Verizon is working to “step up” customers into more expensive service plans by offering goodies like streaming video subscriptions and faster 5G services.

Along those lines, Vestberg said 81% of Verizon’s customer base now subscribes to an unlimited data plan, and that 42% have selected one of its “premium” unlimited plans. He added that 60% of Verizon’s new customers selected a premium unlimited plan.

References:

https://www.wsj.com/articles/verizon-vz-q3-earnings-report-2022-11666355231

Verizon launches 5G Ultra Wideband Innovation Hub with the University of South Carolina; Spectrum Update

Verizon and the University of South Carolina are exploring how 5G Ultra Wideband (mmWave) can transform industries including manufacturing, healthcare and civil infrastructure, among others. To do this, Verizon and the university launched the Innovation Experience Hub, powered by Verizon 5G housed in the McNair Center in Columbia, SC where students, faculty, entrepreneurs, and corporate partners can collaborate to test and create new solutions powered by Verizon 5G Ultra Wideband, which is available in select areas.

Innovators at the hub will leverage 5G connectivity and solutions to help improve manufacturing processes with quality sensing and defect detection. In healthcare, they’ll test how 5G can enhance emergency response by enabling remote health monitoring and real-time analysis of patient vitals, as well as hospital connected asset management, to streamline asset retrieval and dispatch operations. When it comes to civil infrastructure, researchers will examine how 5G communications can enhance monitoring of roads and bridges with condition analytics and reporting, as well as drone-based visual inspection of roads, bridges and buildings, using AI-driven computer vision.

- Verizon brings 5G Ultra Wideband service to Innovation Hub at University of South Carolina housed in the McNair Center.

- With Verizon 5G Ultra Wideband, innovators can develop and test real-world 5G solutions for use cases such as manufacturing, healthcare and civil infrastructure.

- Initial projects will include manufacturing quality inspection and defect detection, healthcare connected asset management, and drone-based visual inspection of roads and bridges.

“Working with the University of South Carolina, we have a great opportunity to collaborate with dozens of partners to ideate and develop new 5G-powered solutions leveraging the latest technologies, including large-scale IoT, artificial intelligence, computer vision and augmented reality,” said Jennifer Artley, Verizon Business Senior Vice President of 5G Acceleration. “Verizon is the network America relies on. Giving researchers access to Verizon 5G Ultra Wideband, with its high bandwidth and low latency, can accelerate the innovation process, leading to new solutions that will transform how enterprises operate and grow.”

“Our relationship with Verizon exemplifies the benefits of partnerships between the University of South Carolina and the business community,” university president Michael Amiridis said. “This aligns with our focus on expanding research opportunities that solve problems and accelerate discoveries.”

This engagement is part of Verizon’s broader strategy to partner with enterprises, startups, universities, national labs and government/military organizations, to explore how 5G can disrupt and transform nearly every industry. Verizon operates several 5G Labs in the U.S. that specialize in developing use cases in industries ranging from healthcare to public safety to entertainment. In addition, Verizon is collaborating with various customers to establish 5G Innovation Hubs on-premises as part of an ongoing initiative to co-innovate and create new 5G applications.

Regarding Verizon’s wireless spectrum deployments, CEO Hans Vestberg told a Goldman Sachs Investor Conference last week:

“We have US 150 million POPs (Points of Presence) with the C-band and just reminder to all, we started in the first quarter deploying the C-band. That’s the pace we have right now and we have said that we’re going to pass plus or more than 175 million POPs by year end.

So this is going faster, but as you rightfully said, we’re using — we have 161 megahertz nationwide. We’re so far using 60 megahertz. We’re getting into 100 megahertz. We’ve talked a little bit about some market have 200 megahertz. So we have so much way to go here and improving the network. And what we see so far is of course, where we launch a C-band, we have a much higher step up ratio in those markets, which is a good indicator of that the C-band is really making difference.”

References:

https://www.verizon.com/about/news/verizon-launches-5g-innovation-hub-university-south-carolina

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Verizon is tripling the capacity of its fiber core network by upgrading older router equipment with new equipment, capable of utilizing the latest 400 Gbps per port optical technology. When the overhaul of the fiber core network (the superhighway Verizon uses to move customers’ data) is complete, Verizon will be able to manage 115 Tbps of data, the equivalent of almost 24 billion streaming songs, at any given moment. This upgrade will significantly increase the bandwidth needed to support wireless, home internet, enterprise, small business and FIOS customers.

In addition to providing the increased bandwidth needed for data growth over the next decade, the new equipment provided by Juniper Networks, Inc. offers many additional operational benefits:

- The equipment is half the size of the existing equipment, reducing space requirements in core facilities and driving down both power usage per GB and cost per GB to operate.

- The new equipment offers an advanced level of automation, allowing for automated interfaces with other network systems to make faster decisions and changes, improving reporting telemetry to advance analytics and real-time adjustments to address congestion or other performance improvements, and incorporating protocols like segment routing to make more intelligent routing decisions. These automations will make the Verizon network even more reliable, programmable and efficient.

- Additionally, because this new equipment is so dense with such large capacity, Verizon will be able to redesign its network architecture to spread the equipment out to additional facilities across geographies, building in an additional level of redundancy with the ability to reroute traffic onto a greater number of fiber routes when needed.

Verizon will replace its legacy 100 Gb/s packet network routers with Juniper’s latest PTX10000-series of modular routers. These use Juniper’s Express silicon that will eventually include the Express 5 platform Juniper introduced earlier this year. The Express 5 silicon can support up to 28.8 Tb/s of throughput, or the equivalent of 36, 800 Gb/s interfaces. This represents a 45% improvement in power efficiency over previous chipsets. The packet optical devices place data packets directly onto and receive them from an optical transport network. They are placed onto that network in what Juniper describes as an “optical transport envelope” that allows that data to bypass “much of the other external networking equipment needed to groom or otherwise process electrical or optical signals originating on the router.” This process reduces the chance of data corruption and allows for closer monitoring of that data.

“Our fiber network is the largely invisible foundation that is a key driving force behind providing the scalability and reliability our customers need and expect,” said Kyle Malady, Executive Vice President, President Global Networks & Technology at Verizon. “This new packet core will provide the reliability and capacity we need today, but more importantly will be able to scale to meet the forecasted future demands that will result from the incredible capabilities of our robust 5G network, the platform for 21st century innovation,” he added.

Kevin Smith, VP of planning at Verizon, said the PTX10000-series update will be replacing its legacy Juniper PTX3000 and PTX5000 routers that it deployed a decade ago. That legacy equipment tops out at 100 Gb/s throughput. “The kind of traffic that is on this network is all of our public and private traffic, global FiOS traffic, all of our wireless traffic, as well as our former XO [Communications] network. As we look ahead and we see both from an infrastructure as well as a customer perspective, a lot for 200-gig and 400-gig for both those places, and our current platform just can’t support that level of services,” Smith said. He added that Verizon expects a 10-times improvement in total throughput with the Express 5 silicon and new chassis footprint. Smith also said that the new equipment is upgradeable to support higher-performing optical protocols like 800 Gb/s and 1 Tb/s per-port optical technology. The current 400 Gb/s move can manage up to 115 Tb/s of data, which the carrier expects to meet network demands through 2032. Updating to 800 Gb/s or 1 Tb/s will increase support to 230 Tb/s of data.

Sally Bament, VP of cloud and service provider marketing at Juniper Networks, said those boxes will include the vendor’s four-slot, eight-slot, and 16-slot chassis housing Juniper’s line cards. Those boxes are more power-dense with a footprint half the size of the existing equipment. This results in each box requiring less power, which drives down power usage per gigabyte and the cost per gigabyte to operate.

Smith advised that the upgrades are just getting started and that it will take a couple of years to complete. This will involve overlaying the new equipment into the same locations as the current deployment as well as installing physically smaller options into more edge locations. That legacy equipment will continue to operate for some time after the new network is turned on as it will need to continue supporting the large number of network elements that will eventually be migrated to the new core.

References:

https://www.verizon.com/about/news/verizon-quadruples-capacity-fiber-network-core

Verizon’s 2Q-2022 weak subscriber growth results in lower forecasts

Highlights of Verizon’s 2Q-2022 Earnings Report:

Total Broadband:

- Total broadband net additions of 268,000, including 256,000 fixed wireless net additions. Total broadband net additions increased 39,000 from first-quarter 2022, and fixed wireless net additions increased 62,000 from first-quarter 2022.

- 36,000 Fios Internet net additions.

Total Wireless:

- Total wireless service revenue of $18.4 billion, a 9.1 percent increase year over year.

- Total retail postpaid churn of 1.03 percent, and retail postpaid phone churn of 0.81 percent.

- Postpaid phone net additions of 12,000.

………………………………………………………………………………………………………………………………………..

Verizon gained 12,000 postpaid wireless connections in the second quarter, a sign of relatively weak growth in its core customer base. Rival AT&T Inc. reported a net gain of 813,000 equivalent connections over the same span. Investors tend to track subscribers on postpaid mobile plans, which charge customers for monthly service after it is rendered, to measure wireless-company growth.

The weaker-than-expected customer additions prompted executives to raise rates for some midprice plans in June. The company also raised the monthly cost of some metered-data plans by $6 to $12 and boosted some consumer-plan fees. It added another monthly “economic adjustment charge” of up to $2.20 per line for business plans.

In the June quarter, Verizon’s net income decreased to $5.2 billion, down from $5.8 billion from the same period one year ago. On a per-share basis, its profit slipped to $1.24 from $1.40 a year earlier. Operating revenue was roughly flat from the previous year at $33.79 billion.

The company added 268,000 total broadband users in the second quarter, up 39,000 from the previous quarter. Verizon’s consumer segment struggled in the quarter, losing 215,000 postpaid phone subscribers due to an increase in churn and year-over-year decline in gross phone additions. Consumer operating income for the quarter fell 4.6% year over year to $7.2 billion.

Verizon’s business segment reported 430,000 wireless retail postpaid net additions, including 227,000 postpaid phone adds. Still, operating income for the segment was down 21.1% on an annual basis as wireless revenue declined.

Verizon said it expects wireless-service revenue growth of 8.5% to 9.5% in 2022, down from its earlier forecast of a 9% to 10% increase. The company also predicted its adjusted earnings would be flat to negative instead of growing this year.

In contrast, AT&T raised its wireless service revenue target, a sign it could be claiming some business from its rival. But its results also reflected some strain in consumers’ budgets. The company on Thursday lowered its free cash-flow target for 2022 due to costly smartphone promotions and customers taking slightly longer to pay their bills.

Verizon CFO Matt Ellis told analysts Friday that the company hadn’t seen “any noticeable change in the payment patterns from customers,” crediting the carrier’s “high-quality customer base.”

“We believe Verizon is currently between a rock and a hard place,” wrote CFRA Research analyst Keith Snyder. “On the one side you have AT&T, which is being extremely aggressive with promotions, and on the other, you have T-Mobile, who has a vastly superior 5G network currently.”

References:

https://www.verizon.com/about/news/verizon-reports-2q-and-first-half-2022-results

https://www.barrons.com/articles/verizon-earnings-guidance-51658490741

Verizon boost 5G Ultra Wideband capacity and availability with C-band spectrum

Highlights:

- Verizon has started deploying with 100 MHz of C-band spectrum in many markets across the US – a significant increase from the 60 MHz it has deployed in 5G markets to date.

- In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers.

- As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHZ across the nation.

Verizon said it started deploying nearly double the amount of C-band spectrum on its 5G network in order to boost capacity. A recent trial with 100 MHz carriers of the C band delivered peak download speeds of 1.4 Gbps near active cell sites and 500 Mbps further away from the towers.

Since it started the roll-out of the C band earlier this year, Verizon has been using blocks of 60 MHz. After recent successful trials of 100 MHz carriers, Verizon has started deploying the larger capacity in many markets across the US, the company announced. In addition to higher speeds and greater capacity for mobile customers, the extra spectrum is expected to support more 5G home broadband and business internet services for customers.

“This increase from using 60MHz to 100 MHz of C-band – which we will ultimately have available in many markets across the US – allows us to support more network traffic, deliver even better performance to our customers and add new products and services on top of the mobile and fixed wireless access solutions we provide today,” said Kyle Malady, EVP and President, Global Networks and Technology. “Reaching new levels of innovation and digital transformation in our society requires a fundamental transformation of the networks our world runs on. The continued evolution of our network is paving the way for this tremendous growth.”

In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers. This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear C-Band spectrum (which was originally scheduled to be cleared in December 2023). With the start of commercial deployment with 100 MHz of C-band, customers now have access to more spectrum than ever before. And there is still much runway ahead. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear the C-band spectrum. It was originally scheduled to be cleared only in December 2023. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

References:

https://www.telecompaper.com/news/verizon-boost-5g-capacity-with-extra-c-band-spectrum–1431401

https://www.verizon.com/about/news/verizon-provide-5g-ultra-wideband-service-more-cities-year

Verizon faces tough times as 5G fails to generate a decent ROI

In 2021, Verizon spent more than $50 billion at FCC auctions to acquire mid-band C-band spectrum licenses for 5G. Along with AT&T, it negotiated a high-profile battle with the U.S. airline industry and FAA to put those spectrum licenses into commercial operations at the beginning of this year.

Verizon launched a C-band 5G network covering 130 million people – almost half of the U.S. population- in the 1st quarter of 2022. By the end of the first quarter, around 40% of Verizon‘s customers owned 5G gadgets capable of accessing the network, and it’s already carrying almost a third of all of Verizon‘s data traffic where it is available.

According to results from network-monitoring company Ookla, Verizon‘s 5G download speeds doubled via to its C-band network launch. However, the effort has been costly. Verizon‘s quarterly capital expenses (capex) spiked during the first quarter thanks to the $1.5 billion it spent during the period on the network equipment necessary to put its C-band licenses into action. That figure doesn’t include the extra money Verizon spent on its massive marketing campaign, which included $1,000 handset subsidies and a $1,000 switcher credit, during the quarter to promote the new network.

What does Verizon have to show for all its mid-band 5G investments? So very much as Moody wrote in a report skeptical on 5G monetization.

In the 1st quarter of 2022, Verizon lost 36,000 postpaid phone customers. While that’s certainly an improvement over the operator’s quarterly performance from a year ago, and also better than some financial analyst expectations, it stands in stark contrast to the 691,000 new postpaid phone customers AT&T netted during the period. AT&T, for its part, has delayed slightly its own big mid-band 5G network buildout until next year.

Moreover, Verizon executives acknowledged that the company saw a slowdown in new customers signing up for Verizon service starting in February and accelerating into March, just as the operator’s C-band marketing campaign ramped up.

David Barden, a financial analyst with Bank of America Merrill Lynch, called out the situation during Verizon‘s quarterly conference call on Friday. “There was a time when Verizon had the best network and could charge the highest prices. And on these calls we would talk about margins and obtainable market share,” he said. “You guys are now [market] share donors. And we’re celebrating how many 5G phones we have and how much C-band we’re deploying, but it’s not obvious that that’s translating into something tangible that investors can celebrate in terms of financial reward. So can we talk a little about that?”

Verizon‘s management team, including CEO Hans Vestberg, argued that “our focus over time is to grow this business.”

“We’re going to compete well,” Vestberg said, adding that “we see more excitement in the market where we offer C-band.”

“This is going to pay off big time in 5-10 years,” he said of Verizon‘s broad 5G investments.

However, he also conceded that Verizon could suffer from inflationary pressures on its labor and energy costs. And, like AT&T CEO John Stankey, he said Verizon may consider raising service prices as a result.

Verizon has lowered their 2022 guidance to the low end of their previous range on every key metric, and they cut their forecast for service and other revenue growth to flat (from +1.0-1.5% previously). The company warned that it now expects its full-year 2022 financial results to come in at the low end of its previously announced guidance. Nonetheless, “we remain well positioned to achieve our long-term growth targets,” Vestberg said.

Analysts don’t seem to agree with Vestberg’s optimism:

“Verizon is growing neither its subscriber base nor its ARPU [average revenue per user]. At a time of rising inflationary pressures, pricing power is nowhere to be found,” wrote the colleague Craig Moffett at MoffettNathanson in a note to clients following the release of Verizon‘s first-quarter results. “And on the unit side, Verizon is already losing share. Unless something changes for 5G revenues that still seem rather intangible (IoT, MEC [multiaccess edge computing], or private networks), the growth runway for Verizon would appear rather weak.”

“There are areas for concern outside of the Wireless segment. Again like AT&T, their Wireline segment is a drag on growth that is only getting worse (their results in Business Wireline, in particular, were – like AT&T’s yesterday – shockingly weak). That puts even more of an onus on the Wireless unit to grow.”

“Things aren’t likely to get easier. Consolidated operating revenue (as reported) of $33.6B was 0.3% below consensus of $33.7B. With such anemic growth, the inflation backdrop is a troubling one. Costs will rise faster than revenues.”

Moffett sees “no easy answers” for Verizon. It could “bow to the pressure” and increase promotions, but he noted that this would further constrain average revenue per user growth for both Verizon and the broader industry. The company could stay disciplined with its pricing and promotional strategies, but doing so would risk further subscriber losses at a time when Verizon’s network advantage over rivals is in jeopardy. “In summary, the path forward remains a challenging one,” Craig concluded.

Financial analysts with New Street Research wrote: “We do remain concerned about Verizon‘s longer-term prospects in wireless, fueled by T-Mobile‘s lead over Verizon on deploying upper mid-band [spectrum] and big lead on total holdings in mid-band spectrum. Verizon management’s aspirations for strong service revenue growth driven by rising ARPU and growing subscribers also still seem way too optimistic in the face of rising competition from a challenger [T-Mobile] with a similar (if not soon-to-be better) network offering priced at a steep discount.”

The New Street analysts also acknowledged that there are widespread expectations that overall growth in the U.S. wireless industry will start to slow sometime this year and that Verizon could be the first 5G operator to suffer from that trend that may eventually affect all of the market’s players.

References:

https://www.lightreading.com/5g/is-verizons-big-5g-gamble-falling-apart/d/d-id/776998?

IBD – Controversy over 5G FWA: T-Mobile and Verizon are in; AT&T is out

Two of the three biggest U.S. telecom network providers, T-Mobile US and Verizon Communications, contend that selling 5G FWA (Fixed Wireless Access) broadband services to homes will prove to be a good business. However, AT&T has no plans to make a big push into that space. We wrote about this topic earlier this year, but it remains a conundrum as debate continues.

Whether these 5G FWA services will heat up broadband competition with cable TV companies — who dominate in high-speed internet services — is a controversial issue for telecom stocks. The fixed 5G wireless services also may compete with local phone companies in areas still served by copper line-based “DSL” services.

“Verizon and T-Mobile think the service can be a growth driver and will have attractive economics,” UBS analyst John Hodulik told Investor’s Business Daily (IBD). “FWA (fixed wireless access) is likely to do better where there are limited options for broadband and among subscribers used to lower speeds, so that means legacy DSL subscribers and slower speed cable. The big question is whether FWA has staying power over the next 5 to 10 years given necessary speed increases.”

AT&T has downplayed the potential of fixed 5G wireless. AT&T contends that as data usage surges over time, FWA will become increasingly uneconomic vs. fiber-optic landline alternatives.

“I think it stems from a genuinely different view of the engineering and capacity constraints,” MoffettNathanson analyst Craig Moffett told IBD. “The divergence in views about fixed wireless access between AT&T and Verizon or T-Mobile speaks to a genuine controversy in the telecom industry.” Craig added that telecom companies are scrambling to make money from huge investments in 5G radio spectrum.

Moffett said: “The renewed appetite for FWA may be a sign of a dawning realization that the gee-whizzy use cases of 5G may never materialize. That could be forcing operators to revisit every possible source of incremental revenue in a bid to earn at least some return on their huge investments in 5G spectrum.”

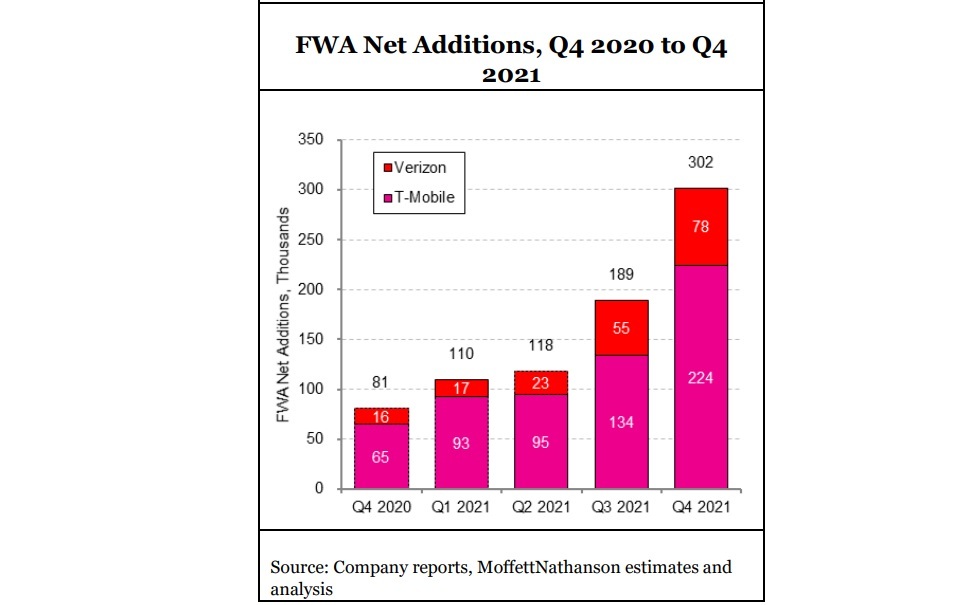

U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In a government auction that ended in early 2021, Verizon spent $45.45 billion on 5G “C-band” airwaves while T-Mobile invested $9.3 billion. AT&T spent $23.4 billion on the auction but it’s putting its 5G investments in areas other than FWA, like industrial 5G applications.

Meanwhile, there are cable TV firms looming with high-speed, coaxial cable. Comcast says it’s not worried about broadband competition from fixed 5G wireless services to homes.

“Time will tell, but it’s an inferior product,” Comcast Chief Executive Brian Roberts said at a recent Morgan Stanley conference. “And today, we can say we don’t feel much impact from (it). It’s lower speeds. And in the long run, I don’t know how viable the technology holds up.”

Cable companies offer hard landlines while 5G wireless services provide high-speed internet to homes mainly via indoor antennae that consumers self-install.

Eighty-seven percent of U.S. households subscribe to an internet service at home, compared with 83% in 2016, according to Leichtman Research Group. Also, cable TV firms comprise 70% of the broadband market, LRG said.

Verizon ended 2021 with 223,000 fixed wireless broadband customers, but most connected via 4G wireless networks. Meanwhile, T-Mobile had 646,000 fixed 5G broadband subscribers.

T-Mobile has told Wall Street analysts it expects to serve in a range of 7 million to 8 million fixed 5G wireless subscribers by 2025. Verizon has projected 3 million to 4 million subscribers over the same period.

T-Mobile charges $50 monthly for its home internet service. Verizon’s pricing starts at $50 or $70 monthly, depending on the data speeds provided. Verizon mobile phone customers with unlimited data plans get a discount.

T-Mobile’s 5G internet to home services provides data speeds up to 115 megabits per second, or Mbps. Verizon plans to provide speeds up to 300 Mbps.

T-Mobile uses mid-band radio spectrum to deliver fixed 5G broadband to homes. Verizon uses a mix of mid-band and high-band radio spectrum. In urban areas, Verizon may be able to deliver higher internet speeds with high-band spectrum, analysts say.

One area of debate remains whether fixed 5G broadband finds more success in suburban/urban markets or in rural areas.

“FWA is definitely a threat to cable companies,” Peter Rysavy, head of Rysavy Research, said in an email. “Particularly with (high frequency) mmWave, 5G can compete directly with cable. Mid-band spectrum is also effective but is best suited for lower density population areas. In these deployments, even T-Mobile limits the number of fixed wireless subscribers it can support in any geographical area.”

At UBS, Hodulik says that even if positioned as a low-end service, fixed 5G broadband still has a potential market of 20 million to 30 million homes.

AT&T, whose forerunner was regional Bell SBC Communications, has a sizable wireline local service area in 22 states. So it will face competition from fixed 5G broadband, just like cable TV firms. Verizon is based mainly in the northeast. T-Mobile doesn’t sell local phone services.

“AT&T has a huge wireline asset base that is only 25% upgraded to fiber,” Oppenheimer analyst Tim Horan told IBD. “So they are very exposed to competition from fixed wireless.”

At an analyst day on March 11, AT&T said it plans to upgrade 50% of its local markets, about 30 million customer locations, to high-speed fiber-optic broadband service by year-end 2025.

Meanwhile, AT&T CEO John Stankey commented on the controversy over FWA. AT&T sees FWA as playing a limited role for mobile small business and enterprise applications as well as in rural areas.

“We’re not opposed to fixed wireless, and I’m sure there’s going to be segments of the market where it’s going to be acceptable and folks are going to find it to be adequate right now,” Stankey said.

Fixed 5G broadband services to homes isn’t the only potential moneymaker for telecom network providers. Verizon, AT&T and T-Mobile aim to upgrade mobile phone users to unlimited data plans. They also plan to sell “private 5G” connections to businesses, Internet of Things (IoT) and 5G connections to industrial devices.

References:

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

AT&T and Verizon said today that they would limit some of their 5G wireless services for six months while federal regulators review the signals’ effect on aircraft sensors, an effort to defuse a conflict about C band interference that has roiled both industries.

The cellphone carriers detailed the proposed limits Wednesday in a letter to the Federal Communications Commission (FCC). The companies said they would lower the signals’ cell-tower power levels nationwide and impose stricter power caps near airports and helipads, according to a copy reviewed by The Wall Street Journal. This comes after, both companies agreed to push back their 5G C band rollouts by an additional month to January 5, 2022 after the FAA issued a Nov. 2 bulletin warning that action may be needed to address the potential interference caused by the 5G deployment.

“While we remain confident that 5G poses no risk to air safety, we are also sensitive to the Federal Aviation Administration‘s desire for additional analysis of this issue,” the companies said in the letter to FCC Chairwoman Jessica Rosenworcel.

“Wireless carriers, including AT&T and Verizon, paid over $80 billion for C-band spectrum—and have committed to pay another $15 billion to satellite users for early access to those licenses—and made those investments in reliance on a set of technical ground rules that were expressly found by the FCC to protect other spectrum users.”

AT&T and Verizon said they had committed for six months to take “additional steps to minimize energy coming from 5G base stations – both nationwide and to an even greater degree around public airports and heliports,” and said that should address altimeter concerns.

Wireless industry officials have held frequent talks with FCC and FAA experts to discuss the interference claims and potential fixes, according to people familiar with the matter. An FCC spokesman said the agreed-upon limits “represent one of the most comprehensive efforts in the world to safeguard aviation technologies” and the agency will work with the FAA “so that 5G networks deploy both safely and swiftly.” Wireless groups argue that there have been no C-Band aviation safety issues in other countries using the spectrum.

Earlier this month, the Federal Aviation Administration (FAA) warned it could restrict U.S. airspace in bad weather if the networks were turned on as planned in December. The FAA warning came in the thick of cellphone carriers’ network upgrade projects. A spokesman for the FAA called the proposal “an important and encouraging step, and we are committed to continued constructive dialogue with all of the stakeholders.” The FAA believes that aviation and 5G service in the band telecom companies have planned to use can safely coexist, he said.

AT&T and Verizon said they would temporarily lower cell-tower power levels for their 5G wireless services nationwide.

Photo Credit: GEORGE FREY/AGENCE FRANCE-PRESSE/GETTY IMAGES

Wireless industry executives don’t expect the temporary limits to seriously impair the bandwidth they provide customers because networks already direct signals away from planes and airport tarmacs, according to another person familiar with the matter.

Still, the voluntary limits are a rare step for wireless companies that place a high value on the spectrum licenses they hold. U.S. carriers spent $81 billion to buy licenses for the 5G airwaves in question, known as the C-band, and spent $15 billion more to prepare them for service this winter.

The carriers earlier this month delayed their rollout plans until early January after FAA leaders raised concerns about the planned 5G service. Air-safety officials worried the new transmissions could confuse some radar altimeters, which aircraft use to measure their distance from the ground.

At an industry event last week, FAA Administrator Steve Dickson said conducting flights in a safe manner and tapping spectrum for 5G services can both occur. He said the question was how to “tailor both what we’re doing in aviation so that it dovetails with the use of this particular spectrum.” Mr. Dickson said another focus is the use of the spectrum in other parts of the world and how it differs compared with the U.S. “That’s what the discussions are that we’re having with the telecoms right now.”

U.S. wireless companies send 5G signals over lower frequencies than the altimeters, but air-safety officials worried that some especially sensitive sensors could still pick up cell-tower transmissions. Regulators in Canada and France have also imposed some temporary 5G limits.

The carriers’ letter said the mitigation measures would provide more time for technical analysis “without waiver of our legal rights associated with our substantial investments in these licenses.”

C-band limits are most relevant to AT&T and Verizon, which paid premiums to grab licenses for the new signals ready for use in December 2021. The companies still plan to launch their service, subject to the new limits, in January 2022. The proposed limits would extend to July 6, 2022 “unless credible evidence exists that real world interference would occur if the mitigations were relaxed.”

Rival carrier T-Mobile US Inc. is less vulnerable to delay because it spent a smaller amount for licenses that are eligible for use in December 2023. It also controls a swath of licenses suitable for 5G that aren’t subject to air-safety claims.

It’s not yet clear whether the proposal will be accepted by the FAA, which has warned pilots of the possibility that “interference from 5G transmitters and other technology could cause certain safety equipment to malfunction, requiring them to take mitigating action that could affect flight operations.” After July 6th, both carriers say they’ll set everything back to normal “unless credible evidence exists that real-world interference would occur if the mitigations were relaxed.”

“Our use of this spectrum will dramatically expand the reach and capabilities of the nation’s next-generation 5G networks, advancing US leadership, and bringing enormous benefits to consumers and the US economy,” Verizon and AT&T claimed in their joint letter sent to the FCC.

The federal agencies and the companies they oversee are meanwhile stuck in what New Street Research analyst Blair Levin called “a deep state game of chicken” guided by each regulator’s particular interest, with no clear path towards resolution.

References:

https://www.wsj.com/articles/at-t-verizon-propose-5g-limits-to-break-air-safety-standoff-11637778722

Analysis: FCC’s C band auction impact on U.S. wireless telcos

Verizon partners with Amazon Project Kuiper to offer FWA in unconnected and underserved areas

Today at the 2021 Mobile World Congress (MWC) Los Angeles CA, Verizon and Amazon announced a strategic collaboration that will combine Verizon’s 5G wireless network with Amazon’s Project Kuiper constellation of low-Earth orbit (LEO) satellites. The first offering from the new partnership will backhaul Verizon’s cell sites through Amazon’s LEO satellites, enabling Verizon to offer fixed wireless access (FWA) in unconnected rural or underserved areas.

As part of the collaboration, Project Kuiper and Verizon have begun to develop technical specifications [1.] and define preliminary commercial models for a range of connectivity services for U.S. consumers and global enterprise customers operating in rural and remote locations around the world.

Note 1. There are no 3GPP specifications or ITU recommendations for the use of LEO satellites for 5G (IMT 2020/ITU-R M.2150) backhaul. Therefore, new carrier specifications are needed for 5G RANs to use LEO satellite networks for backhaul.

However, 3GPP is planning to include non-terrestrial networks (NTN) and to address satellite’s role in the 5G vision in their Release 17 package of specifications, to be released next year. You can read an overview of 3GPP NTN’s here.

ITU-R SG 4 is responsible for Satellite services. That includes Systems and networks for the fixed-satellite service, mobile-satellite service, broadcasting-satellite service and radiodetermination-satellite service. In particular,

ITU-R WP4B carries out studies on performance, availability, air interfaces and earth-station equipment of satellite systems in the FSS, BSS and MSS. This group has paid particular attention to the studies of Internet Protocol (IP)-related system aspects and performance and has developed new and revised Recommendations and Reports on IP over satellite to meet the growing need for satellite links to carry IP traffic. This group has close cooperation with the ITU Telecommunication Standardization Sector. Of particular interest are:

- Terms of Reference for Working Party 4B Correspondence Group on satellite radio interface technologies for the satellite component of IMT-2020.

- Working document towards a preliminary draft new Report ITU-R M.[XYZ.ABC] on Vision and requirements for satellite radio interface(s) of IMT-2020

…………………………………………………………………………………………………………………………………………………….

Amazon’s Project Kuiper is an initiative to increase global broadband access through a constellation of 3,236 satellites in low Earth orbit (LEO) around the planet. The system will serve individual households, as well as schools, hospitals, businesses and other organizations operating in places where internet access is limited or unavailable. Amazon has committed an initial $10 billion to the program, which will deliver fast, affordable broadband to customers and communities around the world.

The Verizon-Amazon partnership seeks to expand coverage and deliver new customer-focused connectivity solutions that combine Amazon’s advanced LEO satellite system and Verizon’s world-class wireless technology and infrastructure. To begin, Amazon and Verizon will focus on expanding Verizon data networks using cellular backhaul solutions from Project Kuiper. The integration will leverage antenna development already in progress from the Project Kuiper team, and both engineering teams are now working together to define technical requirements to help extend fixed wireless coverage to rural and remote communities across the United States.

Verizon Chairman and CEO Hans Vestberg said, “Project Kuiper offers flexibility and unique capabilities for a LEO satellite system, and we’re excited about the prospect of adding a complementary connectivity layer to our existing partnership with Amazon. We know the future will be built on our leading 5G network, designed for mobility, fixed wireless access and real-time cloud compute. More importantly, we believe that the power of this technology must be accessible for all. Today’s announcement will help us explore ways to bridge that divide and accelerate the benefits and innovation of wireless connectivity, helping benefit our customers on both a global and local scale.”

Amazon CEO Andy Jassy said, “There are billions of people without reliable broadband access, and no single company will close the digital divide on its own. Verizon is a leader in wireless technology and infrastructure, and we’re proud to be working together to explore bringing fast, reliable broadband to the customers and communities who need it most. We look forward to partnering with companies and organizations around the world who share this commitment.”

This partnership will also pave the way for Project Kuiper and Verizon to design and deploy new connectivity solutions across a range of domestic and global industries, from agriculture and energy to manufacturing and transportation. The Kuiper System is designed with the flexibility and capacity to support enterprises of all sizes. By pairing those capabilities with Verizon’s wireless, private networking and edge compute solutions, the two will be able to extend connectivity to businesses operating and deploying assets on a global scale.

Betsy Huber, President, The National Grange said: “The agriculture industry is going to see dramatic changes in how it operates and succeeds in the next several years. Smart farms, bringing technology to agriculture, and connecting the last mile of rural America will be at the forefront of helping our industry to provide food for billions around the globe. Ensuring connectivity in rural areas will be key to making these endeavors a success. We’re excited to see the leadership from both companies working together to help take our industry to the next level.”

Financial analysts at New Street Research said the opportunity could be worth billions of dollars to the two companies. Specifically, they argued that Verizon’s wireless network currently does not cover around 7 million Americans. “If 50% of these people become Kuiper/Verizon customers and assuming Verizon’s phone ARPU [average revenue per user] of ~$60, there could be $2.4 billion in annual revenue,” they wrote.

Amazon and Verizon have previously teamed up to serve customers across many industries, including integrating Verizon’s 5G Edge MEC platform with AWS Wavelength and forming the Voice Interoperability Initiative. This collaboration builds on the relationship between the two companies, and lays the groundwork for Amazon and Verizon to serve additional consumer and global enterprise customers around the world.

Executives from Verizon and Amazon hinted that backhaul is only the start of the companies’ new partnership. They noted that Verizon’s plan to use Amazon’s LEO satellites is just the latest in a long line of pairings between the companies stretching from edge computing to private wireless networks.

“We’ve worked with Verizon on many complex projects over the years,” Amazon SVP David Limp said during a keynote presentation at MWC LA. Limp said Amazon continues to design and build its LEO satellites at the company’s Redmond, Washington, offices.

Verizon’s Chief Strategy Officer Rima Qureshi suggested Amazon and Verizon would explore other offerings beyond cell-site backhaul in the future. She said the companies would pursue “joint solutions” for large enterprise customers in industries stretching from agriculture to energy to education. She also said Verizon and Amazon would look for opportunities both domestically and internationally.

Qureshi noted Verizon’s deal with Nokia to deploy a private 5G network for Southampton in the UK – the largest of the 21 Associated British Ports. She suggested an Amazon-powered satellite component to that offering could extend connectivity beyond the port and into the ocean.

A spokesman for Verizon told Bloomberg it’s a global partnership with Amazon and it’s open to exploring similar deals with other companies, but declined to comment on the finances of the deal.

5G wireless telco’s deals with LEO satellite companies:

This new alliance between Verizon and Project Kuiper comes six weeks after AT&T made a similar deal with LEO satellite operator OneWeb. Just like Verizon, AT&T said it would use that agreement LEO (OneWeb) satellites to extend its connectivity reach to hard-to-serve areas that fall outside of AT&T’s fiber footprint or are beyond the reach of AT&T’s cell towers. AT&T said it would use LEO technology to enhance connectivity when connecting to its enterprise, small and medium-sized business and government customers as well as hard-to-reach cell towers.

In January, KDDI in Japan said it would use Starlink – the LEO offering from Elon Musk’s SpaceX – to connect 1,200 of its remote cell towers with backhaul. KDDI said it would begin offering services under that new teaming as soon as next year.

However, Project Kuiper is way behind both Starlink and OneWeb in terms of satellite deployments. As noted by GeekWire, Starlink already counts 1,650 satellites in orbit (and around 100,000 users), while OneWeb’s constellation is now up to around 358 satellites. Amazon, meantime, has received FCC approvals for the operation of more than 3,000 LEO satellites but has yet to launch any of them. Amazon has committed $10 billion toward the construction of its Kuiper LEO satellite network.

References:

https://www.verizon.com/about/news/5g-leo-verizon-project-kuiper-team

https://www.bloomberg.com/news/articles/2021-10-26/amazon-signs-satellite-pact-with-verizon-in-challenge-to-musk

To learn more about partnering with Amazon and the Project Kuiper team, email [email protected]

……………………………………………………………………………………….

Related Articles:

https://news.kddi.com/kddi/corporate/english/newsrelease/2021/09/13/5400.html

WSJ: U.S. Wireless Carriers Are Winning 5G Customers for the Wrong Reason

AT&T and Verizon’s heavy promotions lead to booming growth, but value of next-gen networks to users still unclear, by Dan Gallagher

Even before the country’s two largest wireless carriers reported strong quarterly results this week, Morgan Stanley (MS) had a bit of cold water to splash on those carriers.

The investment bank published the results of its ninth annual broadband and wireless survey on Monday. Among the findings were that only 4% of respondents cited “innovative technology” such as 5G as an important factor in their choice of service. That number was unchanged from the previous year’s survey—despite an unremitting onslaught of marketing from wireless carriers and device makers for the next-gen wireless standard. [IEEE Techblog reported the results of the MS survey here]

That would appear inconsistent with the strong growth in wireless services reported by AT&T and Verizon VZ this week. On Wednesday, Verizon reported adding 429,000 postpaid wireless subscribers during the third quarter, which is up 52% from the number added in the same period last year. On Thursday morning, AT&T said it added 928,000 such users to its rolls in the same period—up 44% from the same period last year and the highest number of net new additions in more than a decade of what are considered the industry’s most valuable base of customers.

The two carriers have been selling 5G hard over the past couple of years. That picked up significantly last fall, when Apple Inc. launched its first iPhones compatible with the next-generation wireless technology. Those phones have been in hot demand. Analysts estimate total iPhone sales jumped 25% to a record of 237 million units in Apple’s fiscal year that ended last month, according to consensus estimates on Visible Alpha. The 5G-compatible iPhone 12 and 13 models are expected to account for more than 80% of that number.

But customers appear to be driven more by old-fashion promotions than cutting-edge technology. AT&T, Verizon and T-Mobile —which reports its results on Nov. 2—offered heavy discounts last year for iPhone 12 models paired with new 5G plans. That appears to have continued with the newest crop; wireless analyst Craig Moffett of MoffettNathanson notes that “promotions tied to premium unlimited plans have gotten richer” with the introduction of the iPhone 13 family this year. Indeed, the Morgan Stanley survey found price to be the most compelling driver in choice of a wireless plan, with 44% of respondents citing it as their top factor.