Year: 2020

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

Comcast added a record 633,000 residential and business broadband Internet customers in the Q3-2020, but lost another 273,000 video customers. Cable Communications total customer relationship net additions of 556,000, were the best quarterly result ever for the company.

Xfinity Mobile, Comcast’s mobile service via Verizon MVNO agreement, added 187,000 wireless subscriber in Q3-2020. That was down from additions of 204,000 lines in the year-ago quarter. There were 2.58 million mobile subs at the end of the quarter.

“We are nearly eight months into this pandemic – and despite many harsh realities, I couldn’t be more pleased and proud of how our team has worked together across the company to find safe and creative solutions to successfully operate in this environment. We are executing at the highest level; and perhaps, most importantly, accelerating innovation, which will drive long-term future growth. This third quarter, we delivered the best broadband results in our company’s history. Driven by our industry-leading platform and strategic focus on broadband, aggregation and streaming, we added a record 633,000 high-speed internet customers and 556,000 total net new customer relationships. At the same time, we’re growing our entertainment platforms with the addition of Flex, which has a significant positive impact on broadband churn and customer lifetime value. Our integrated strategy is also driving results in streaming with nearly 22 million sign-ups for Peacock to date, and we are exceeding our expectations on all engagement metrics in only a few months. And Sky continues to add customer relationships at higher prices while reducing churn to all-time lows in our core UK business. Going forward, and as we emerge from the pandemic, we believe we are extremely well positioned to provide seamless and integrated experiences for our customers and to deliver superior long-term growth and returns for our shareholders,” said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation.

Cable Communications revenue increased 2.9% to $15.0 billion in the third quarter of 2020, driven by increases in high-speed internet, business services, wireless and advertising revenue, partially offset by decreases in video, voice and other revenue. These results were negatively impacted by accrued customer regional sports network (RSN) fee adjustments related to canceled sporting events as a result of COVID-19. Excluding these adjustments5, Cable Communications revenue increased 3.9%. High-speed internet revenue increased 10.1%, due to an increase in the number of residential high-speed internet customers and an increase in average rates.

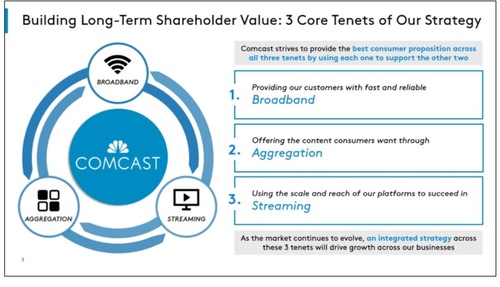

Comcast defined three “core tenets” that will drive its strategy focused on broadband Internet, content aggregation and scaling up its tech platforms for video streaming.

Source: Comcast

Xfinity Flex, Comcast’s free streaming video/smart home product for broadband-only customers, has helped the company retain its broadband base. Flex, which has about 1 million active users, has cut churn rates by 15% to 20% among new broadband customers that engage with the platform. Flex has also helped to offset Comcast’s pay-TV subscriber losses for the past two quarters.

“The goal of our common tech stack is to build once and deploy as many times in as many markets and in as many ways as possible on our network or through wholesale distribution,” Brian Roberts, Comcast’s chairman and CEO, said on the company’s earnings call. He noted that the approach generates “good margins” for the company.

Indeed, cable profit margins of 42.7% were up 290 bps YoY, continuing a steady uptrend and beating analyst consensus of 41.7% by 100 bps. Absent wireless, margins would have been 44.3%, the highest ever and fully 300 bps above the levels a year ago.

Meanwhile, Capital Expenditures (CAPEX) decreased 4.9% to $2.4 billion in the third quarter of 2020. Cable Communications’ capital expenditures decreased 2.5% to $1.8 billion. NBCUniversal’s capital expenditures decreased 29.3% to $357 million. Sky’s capital expenditures increased 127.3% to $237 million. For the nine months ended September 30, 2020, capital expenditures decreased 7.6% to $6.3 billion compared to 2019.

“We’re committed to accelerating the wireless business,” Dave Watson, CEO of Comcast Cable, said on today’s earnings call. Comcast may build out its own cellular infrastructure, at least on a targeted basis, which would effectively complement its MVNO arrangement with Verizon. Notably, Comcast was one of several cable operators that bid for and won CBRS spectrum, which it could use to offload mobile traffic in high-traffic areas. “We have the ability to evolve this [mobile] offering over time to where we choose to include our own wireless network with cellular infrastructure to generate even greater profitability in the most highly trafficked mobile areas,” Roberts said.

……………………………………………………………………………………………………………………………………………………………………………

Analyst Assessment:

Craig Moffett, principal of MoffettNathanson asks: Where are all the broadband subscribers coming from?

Verizon, AT&T, and now Comcast have all beaten expectations, and blown away historical growth rates. But it could also be asked of wireless, where, again, Verizon, AT&T, and now Comcast have all grown (Comcast a bit more slowly than expected, but it was solid growth nonetheless). It could even be asked of video, where, yes, Verizon, AT&T, and now Comcast have all lost fewer subscribers than expected. We, and the market, will be grappling with these questions for the next three months or longer. Let’s start by acknowledging the obvious: Comcast’s subscriber metrics in Q3 were absolutely stellar, whatever the explanation.

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2020-results

https://www.cmcsa.com/events/event-details/q3-2020-comcast-corporation-earnings-conference-call

Big Names Clash over 12 GHz for 5G despite it NOT being included in ITU M.1036 – Frequency Arrangements for IMT

Light Reading’s Mike Dano, says there is a contentious issue of whether 5G networks should be permitted to use the 12 GHz band. Apparently, the clash is between Charlie Ergan’s Dish Network and Dell (YES) vs AT&T and Elon Musk’s SpaceX (NO).

Interestingly, 12 GHz (more precisely 12.2-12.7 GHz Band ) is NOT one of the frequency bands in the revision to ITU Recommendation M.1036-6, which specifies ALL frequency bands for the TERRESTRIAL component of IMT (including IMT 2020).

–>Please refer to Editor’s Note below for more on the M.1036 revision which may contain a cop-out clause to permit use of any frequency for IMT 2020.SPECS. Mike Dano wrote:

According to at least one high-level source involved in the debates, the FCC might make some kind of ruling on the topic as soon as December. A senior FCC official confirmed that the agency is considering allowing 5G in 12GHz, but declined to comment on whether the item would be addressed during the FCC’s December meeting. Based on the increasingly contentious filings on the topic, it certainly appears that the fight over 12GHz is escalating.

In the U.S., the FCC exhaustively licensed the 12.2-12.7 GHz band in 2004-2005 timeframe through competitive bidding. The US terrestrial fixed licenses are co-primary with Direct Broadcast Satellite (DBS) and Non-Geostationary Orbit Fixed Satellite Service (NGSO FSS). In April 2016, a petition was filed seeking license modifications under section 316 to permit terrestrial mobile use in the band. Although the petition went through public notice/comment phases, no decisive action has been taken yet. Meanwhile, in August, 2017, FCC issued an inquiry into new opportunities in the mid-band spectrum between 3.7 GHz and 24 GHz. The combination of favorable propagation characteristics (as compared to bands above 24 GHz) and the opportunity for additional channel bandwidth (as compared to bands below 3.7 GHz), raises the potential of these bands to be used for next generation wireless services.

“The time has finally come for the commission to issue a Notice of Proposed Rulemaking (NPRM),” wrote RS Access this week in a filing to the FCC. Dell’s private money management firm backs RS Access, which owns 12GHz licenses and has been pushing for rules allowing 5G operations in the band. An NPRM by the FCC would signal a formal effort to decide on the matter, potentially sometime next year.

“Given the twin national imperatives of bringing spectrum to its highest and best use while unleashing spectrum for broadband connectivity, issuing a Notice of Proposed Rulemaking will allow debate to move from hollow rhetoric to the types of pragmatic solutions the country needs to accelerate 5G investment and innovation,” echoed Dish Network in its FCC filing.

AT&T and SpaceX are firmly against the idea of the FCC taking action. Instead, they argue that 5G operations in the 12 GHz band would affect their existing activities in 12GHz (AT&T’s DirecTV satellite TV service uses a portion of the band, as does SpaceX’s Starlink satellite Internet service).

“The parties urged the commission to deny the MVDDS Petition [a coalition including Dish and RS Access] for rulemaking outright or, at most, to issue a notice of inquiry rather than a Notice of Proposed Rulemaking given the current state of the record in this proceeding,” wrote AT&T and SpaceX – along with Amazon’s Kepler Communications, satellite companies Intelsat and SES, and bankrupt OneWeb – in their joint FCC filing. A note at the end stated: “See MVDDS 5G Coalition Petition for Rulemaking to Permit MVDDS Use of the 12.2-12.7 GHz Band for Two-Way Mobile Broadband Service, RM-11768 (filed Apr. 26, 2016) (“MVDDS Petition”).”

12 GHz proponents were hoping the FCC would discuss that issue at its November meeting. That’s unlikely as the main agenda item for that meeting will be to free up the 5.9GHz band for unlicensed operations as well as vehicle-to-vehicle communications using the C-V2X standard.

Dano concludes as follows:

The heavyweights involved in the 12 GHz proceeding are pulling out all the stops in the hopes they can get the FCC to act on one last contentious piece of spectrum policy before Biden begins his first term or President Trump begins his second. After all, Trump’s current FCC chairman, Pai, has not said whether he will stay on at the agency for Trump’s second term.

…………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note: IMT 2020 Frequency Free for All?

At the conclusion of its Oct 2020 meeting, ITU-R WP5D could NOT agree on revision of draft recommendation M.1036-6 which specifies frequency arrangements to be used with the terrestrial component of IMT, including IMT 2020.SPECS. So that document has yet to be sent to ITU-R SG5 for approval.

The 5D Frequency Aspects WG Oct 2020 report stated:

“The current version of the draft revision with these further proposed edits is contained in document 5D/TEMP/243(Rev.1) and Editor’s Notes have been included in the document to clarify the current situation.”

“Looking at the current situation with some of the critical and urgent deliverables of WG Spectrum Aspects & WRC-23 Preparations, it is clear that whilst progress has been made in some less controversial areas, there are a significant number of areas where very diverging and sometimes polarized views remain. It is the view of the WG Chair that the current situation with such polarized views and no room for compromise solutions is disappointing and that we cannot continue with this approach at the next meeting if we want to be successful in completing these critical outputs by the required deadlines. We must all put more efforts into finding efficient ways to advance the discussions and in particular to focus on middle ground and compromise solutions rather than repeating initial positions.”

Furthermore, the UNAPPROVED draft revision to M.1036-6 has several cop-outs. For example:

“That Recommendations ITU‑R M.1457, ITU‑R M.2012 and ITU‑R M.[IMT-2020.SPECS] contain external references to information on operating bands for IMT technologies which may go beyond the information in Recommendation ITU-R М.1036 and may cover broader frequency ranges as well as further uplink/downlink combinations” OR for ONLY IMT 2020.SPECS:

“That Recommendations ITU‑R M.[IMT-2020.SPECS] contains external references to information on operating bands for IMT technologies which may go beyond the information in Recommendation М.1036 and may cover broader frequency ranges as well as further uplink/downlink combinations.”

Note also, that the hotly debated 12 GHz frequency band the Dish and Dell are proposing for 5G is NOT contained in the draft revision to ITU-R M.1036-6. But the cop-out disclaimer above, would permit 12 GHz and any other frequency to be used for IMT 2020, which would obviously negate the purpose and intent of that ITU recommendation.

……………………………………………………………………………………………………………………………………………………..

References:

Global O-RAN Plugfests Across 5 Countries with 4G and 5G Lab and Field Test Platforms

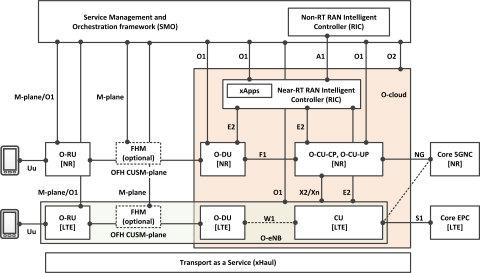

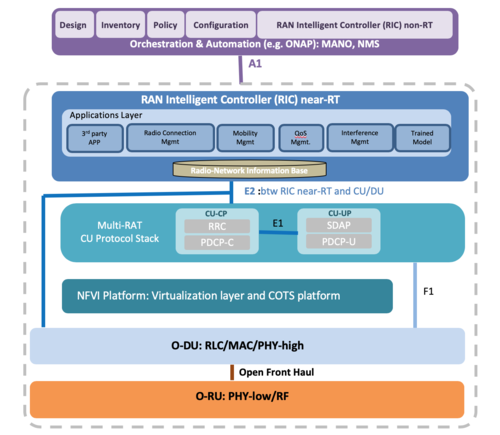

Plugfests in Europe and India have been demonstrating the interoperability of telecom equipment using the Open Radio Access Network (O-RAN) specifications. The plugfests were organized by the leading telecom communications service providers (CSPs) and the O-RAN Alliance with a series of on-site demonstrations in multiple countries. The plugfest involved a series of on-site demonstrations in multiple countries, conducted in September and October 2020. In a multi-vendor based O-RAN environment, ensuring interoperability will become the network operator’s principal concern.

O-RAN Plugfest 2020 Integration and Testing Configuration

Image Credits: O-RAN Alliance

………………………………………………………………………………………………………………………………………………………………………..

Test equipment provider Viavi was involved in the plugfests with its Test Suite for O-RAN Specifications to validate that all interfaces are working correctly, including the RF, signaling and interoperability, timing and synchronization. The VIAVI Test Suite for O-RAN Specifications offers comprehensive, integrated solutions to validate that all interfaces are working correctly – including RF, signaling and interoperability, timing and synchronization – and equipment is performing to specifications even under load and stress. In the lab, the TM500 and TeraVM families deliver UE, O-RAN subsystem and core network simulation to enable conformance, interoperability and performance testing of both complete base station and core network testing as well as wraparound testing of individual O-RAN subsystems and core network elements. In both the lab and the field, T-BERD/MTS-5800 validates critical synchronization parameters with necessary precision using its Timing Extension Module (TEM), delivering a highly stable reference signal for synchronizing test equipment and O-RAN components. CellAdvisor 5G characterizes and analyzes 4G and 5G RF signals. ONT-800 tests transport network performance up to 800G.

- The plugfest in Berlin, Germany, was hosted by Deutsche Telekom, with demonstrations of radio access equipment from Baicells, Benetel, Foxconn, QCT, Wind River, Wiwynn and other vendors. Viavi provided its TM500 including UE emulation for performance testing and O-DU emulation for O-RU subsystem testing; TeraVM for core emulation and traffic generation; MTS-5800 for transport and synchronization test; and CellAdvisor 5G for RF signal analysis.

- In a plugfest in Torino, Italy, hosted by TIM, VIAVI provided the MTS-5800 for timing and synchronization in demonstrations of radio access equipment from Commscope, WNC, Wiwynn and other vendors.

- Madrid, Spain plugfest was hosted by a major Spanish service provider, with demonstrations of O-RAN x-haul (fronthaul and midhaul) transport with equipment from multiple vendors. VIAVI provided the MTS-5800 for timing and synchronization, and ONT-800 for multi-port transport test.

- Bengaluru (Bangalore), India plugfest was hosted by Airtel, with demonstrations of multi-vendor integration of O-RAN compliant radio access software and equipment from Altiostar, NEC, VVDN and Xilinx. The VIAVI TM500-C-5G 5G NR UE emulator and TM500 O-RU emulator were used for in-depth verification of the O-DU’s compliance to the WG4 open fronthaul (C/U/S planes) specification. • Tokyo, Japan. This plugfest was hosted by Japanese service providers, with demonstrations of radio equipment from major O-DU/O-CU and O-RU vendors. VIAVI provided the TM500 for 5G NR UE emulation.

“As a champion of interoperability test methodologies, and the first company to introduce a comprehensive test suite for O-RAN specifications, VIAVI has worked closely with ecosystem partners and operators worldwide to help identify, isolate and resolve performance issues with disaggregated networks,” said Sameh Yamany, Chief Technology Officer, VIAVI. “The successful results of the global O-RAN ALLIANCE plugfest represent a significant step forward in the advancement of multi-vendor O-RAN environments, which are essential to scaling and sustaining 5G networks.”

………………………………………………………………………………………………………………………………………………………………………………………………………..

Viavi is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………

References:

NEC in contention to supply 5G radio units and 5G cloud native core network in UK

Following last Friday’s announcement that NEC and Analog Devices (ADI) have cooperated to design a 5G Network Massive MIMO Antenna Radio Unit for Rakuten Mobile, the Japanese IT icon is in contention to supply 5G base stations in the UK.

The UK has said it will no longer allow the use of Huawei equipment in its 5G networks due to unresolved security concerns, and required network providers to remove already-incorporated equipment by 2027. That’s largely due to the pressure the U.S. administration has put on allies to ban Huawei from their telecom networks based on the assertion that Huawei’s equipment could be used for cyberespionage, an allegation that the company denies.

With Huawei being banned from the UK’s 5G networks, Ericsson and Nokia, are the obvious choice to replace the world’s #1 telecom equipment company, other contenders are beginning to emerge. Those include South Korea’s Samsung as well as Japan’s Fujitsu and NEC. The latter probably has an edge due to their work with Rakuten Mobile on both 5G radio units and a cloud native 5G core network.

NEC’s 5G equipment utilizes highly accurate digital beamforming for efficient high-capacity transmission. The system also features seamless installation, achieved through circuit integration.

“Virtualization is a dependable and cost-efficient approach, and the world’s leading telecom providers are pursuing it as the next evolution of communications. ADI’s RF equipment allows us to provide the connectivity required to build an architecture that supports 5G full-spectrum systems,” said Nozomu Watanabe, Senior Vice President at NEC.

Working alongside Japanese companies will soon become even more appealing for the UK, with the government signing a historic post-Brexit trade deal with Japan last week. As part of the diplomatic trip to Japan, British International Trade Secretary Liz Truss spoke to NEC Chairman Nobuhiro Endo about 5G, leading to the tweet below suggesting NEC will help rollout 5G in the UK and look towards the creation of a 5G Open RAN Center of Excellence.

Japanese tech giant @NEC_jp_pr to support roll out of 5G in the UK.

The UK-Japan trade agreement signed today will bring two of the world’s most technologically advanced nations & democratic allies closer together. https://t.co/l78q7w24Ur

— Department for International Trade (@tradegovuk) October 23, 2020

With respect to Open RAN, last week NEC-Europe, together with Altiostar and Vodafone-Ziggo. teamed up to perform the first successful voice call over an open virtual RAN in the Netherlands. If ties with NEC and Japan continue to improve, Open RAN may begin to gain even more momentum in the UK as we enter 2021.

NTT recently acquired close to 5% ownership of NEC, which is example of an emerging trend of vertical integration in the OpenRAN world (for example Altiostar’s owners include Rakuten and Telefonica).

Commenting on the NEC announcement, Guillermo Pedraja, Head of Networks, 5G & IoT Consulting at NTT DATA UK said in a statement that “the UK government’s collaboration with NEC points to a thriving future for UK-Japanese cooperation, with the recent free trade agreement ensuring that businesses from both countries remain closely aligned as they lead the world in technology and innovation.”

He also saw in 5G an opportunity for the resurgence of Japanese technology companies in general. “Japanese firms are also positioning themselves as global centres of innovation in telecommunications technology. NTT’s decision early this year to take a 5% stake in NEC was an important moment that showcased Japanese telco giants’ willingness to combine forces to accelerate their capabilities in the 5G space,” Pedraja added.

……………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.nec.com/en/press/202010/global_20201023_01.html

https://twitter.com/UKinJapan/status/1319549412176265217

https://www.japantimes.co.jp/news/2020/10/26/business/corporate-business/japan-nec-5g-uk/

https://telecoms.com/507122/nec-gets-a-piece-of-the-uks-5g-bonanza/

https://www.totaltele.com/507641/NEC-steps-in-for-5G-as-UKJapan-sign-free-trade-agreement

U.S. Wireless Carrier’s Aggressive Promotions for iPhone 12 explained

- The launch of the iPhone 12 has sparked a battle for U.S. carriers to entice devices upgrades.

- AT&T, T-Mobile, and Verizon’s aggressive promotional pricing reflects the higher perceived lifetime value of attracting and retaining 5G wireless consumers.

The U.S. wireless carriers are betting that steep iPhone 12 promotions will more than pay off over time. Here’s why:

- U.S. wireless carriers are turning to promotions now in hopes that they will be able to secure new or retain customers throughout the 5G era. The most common time for wireless carriers to lose or gain subscribers is when customers switch smartphones, per The Wall Street Journal.

- The unusually aggressive device promotions also likely reflect the higher lifetime value of 5G customers. By 2025, 5G subscribers are expected to generate 2.5x more revenue per connection for carriers than the average cellular connection, according to Juniper Research forecasts cited by Light Reading.

- Wireless carriers are also likely attempting to meet US customers halfway, since so many people are cutting back on spending amid the economic slowdown. In Q2 2020, the average sale price of smartphones in the US sank to $503, representing a 10% year-over-year decline, according to Canalys.

Analyst colleague Craig Moffett generated this iPhone 12 Q & A in a blog post for his clients:

1. Why was Verizon featured so prominently in Apple’s iPhone launch?

Answer: Their millimeter wave broadband, sparsely available though it may be, is the only credible showcase for what 5G can do.

2. Why do Apple’s new iPhone’s sold outside of the U.S. not support millimeter wave signals?

Answer: Millimeter wave drains battery life incredibly quickly, and generates unwanted heat in the handset.

3. Why do Apple’s new phones in the U.S. default to turning off the very feature that is supposedly the reason to buy them?

Answer: To reduce heat and extend battery life.

4. What are the use cases that make 5G worth having?

Answer: We don’t know yet.

5. Why did AT&T decide to offer such a rich promotion – a free iPhone with almost any trade-in – for their existing subscribers?

Answer: Again, we don’t know.

6. Will 5G produce a high ROI for wireless carriers?

Answer: Most expect that 5G will mean higher capital intensity (capex), and therefore lower ROI.

………………………………………………………………………………………………………………………………………………

References:

C-Spire: Mobile 5G launch in Mississippi with 200Mbps peak speeds using a combo of 5G and LTE Advanced

C Spire today began rolling out its pre-standard 5G mobile service in Mississippi with plans to add more areas by the end of this year. Brookhaven in south Mississippi’s Lincoln County and Columbus in north Mississippi’s Lowndes County were strategically chosen as the initial 5G markets as part of C Spire efforts to make the technology available and provide the best network experience for customers.

The C Spire 5G launch is occurring in conjunction with the launch of the latest Apple iPhone 12 or iPhone 12 Pro required for 5G service. More 5G-enabled smartphones from other handset manufacturers, including Samsung, will be available for use in early 2021 along with expansion in other markets. The use of the Apple 5G iPhones implies this is a 5G-NR (3GPPP Rel 15) NSA implementation.

Specifically, parts of Hattiesburg, parts of Madison and Ridgeland in the greater Jackson metropolitan area and the Mississippi Gulf Coast, are expected to be 5G capable by the end of 2020 with more areas of the company’s footprint coming soon, according to Brian Caraway, General Manager of C Spire’s wireless division.

“We’re bringing consumers the benefits of new 5G wireless network technology where they need it the most with fast speeds, better service and an improved experience,” Caraway said. “Using a backbone of fiber optic infrastructure, we’re rolling out a better 5G network for now and for the future.”

5G implementation is part of over $200 million in recent network enhancements, including the deployment of additional Band 41 carriers with carrier aggregation, increased cell site antenna capacity using advanced features like 12-layer MIMO, 256 QAM modulation for better spectral efficiency, network-wide optimization for balanced data delivery and extensive coverage of 4G LTE Advanced announced previously this year.

During the transition to 5G across the network, Caraway said C Spire plans to continue to use improvements and enhancements offered from its current 4G LTE Advanced technology to ensure that customers have the best network experience uniquely designed for their needs and region.

“We’re deploying 5G at a variety of spectrums – so many customers will have a faster experience on a 5G network while others may still see the best performance on our 4G LTE deployments,” Caraway added. “5G is a new technology that will improve with time, but regardless of where you live, C Spire is dedicated to providing the best network experience for the most customers possible.” Indeed, C-Spire says that they are delivering peak speeds up to 200Mbps through a combination of the most advanced LTE and 5G technologies.

C Spire, a Mississippi-based telecommunications and technology services company, operates the nation’s largest privately-owned mobile services firm and sixth largest in the U.S. industry. The rollout is part of the firm’s broader efforts to bring consumers and businesses next-generation 5G benefits now and in the future. The company also installed new base stations and software at its 1,200-plus cell sites last year, resulting in a 20 percent average speed boost across its network.

References:

Analysis of AT&T’s Q3-2020 Earnings

AT&T today reported a drop in third-quarter revenues and profit, due mainly to the impact of the coronavirus pandemic on its entertainment business. Subscriber numbers showed some signs of recovery, with over 1 million postpaid net adds in the mobile market and broadband growth thanks to subsidised offers during the pandemic. AT&T said it now expects to generate free cash flow of at least USD 26 billion this year and pay out just over 50 percent of that in dividends.

Quarterly revenues fell to $42.3 billion from $44.6 billion in the year-ago quarter. WarnerMedia (-10%) was affected by the pandemic measures, while mobile service revenues (-0.3%) suffered from lower roaming. Legacy wireline services also continued to erode, and Latin America revenues were hurt by forex pressure. These declines were partly offset by higher mobile equipment sales (+6.4%) and higher advertising revenues as sports broadcasts resumed.

While operating costs were somewhat lower due to the slowdown in media production, operating profit still declined to $6.1 billion from USD 7.9 billion a year ago due to COVID-related incremental costs. In total, AT&T estimates the coronavirus crisis reduced EPS by 21 cents, including 2 cents in extra costs and 19 cents from lower revenue. The operator’s reported net earnings fell to $2.8 billion or 39 cents per share from $3.7 billion or 50 cents a share in Q3 2019.

After capital expenditure (capex) was reduced to $3.9 billion and operating cash flow increased to $12.1 billion, AT&T was left with free cash flow of $8.3 billion in Q3. The company reduced net debt by $2.9 billion compared to the end of June, leaving it with leverage of 2.66x adjusted EBITDA at the end of September. Over the full year, capex is still expected at around $20 billion.

AT&T mobile revenues were up 1% to $17.9 billion thanks to higher equipment sales, while EBITDA was slightly lower at $7.7 billion. Subscriber growth rebounded from the slower second quarter, with a total 5.5 million net additions. That included 1.1 million postpaid net adds, with 645,000 new phones, and postpaid ARPU was up slightly from Q2 to $49.94. The operator also added 245,000 new prepaid lines, while the remaining growth was new connected devices, which rose to nearly 76 million in total on the mobile network.

Mobility is AT&T’s largest and most important business, accounting for 42% of consolidated revenues. Analyst Craig Moffett wrote: “The subscriber results in Mobility were better than just “good.” They were a genuine positive. But can AT&T’s success be sustained in the face of a 5G investment cycle that favors T-Mobile today, and that will require big spending (to buy mid-band spectrum. e.g. C-band) tomorrow?”

AT&T managed to slow the decline of TV subscribers to losses of 627,000, half the number of the year-earlier period. That left the company with just under 17.8 million pay-TV subscribers at the end of the period (including 683,000 OTT customers), down 17.5 percent year-on-year. Pay-TV ARPU improved to $130.55 (excluding OTT).

For the first time in six quarters, AT&T’s IP broadband subscribers – FTTH and U-verse broadband subs, not including legacy DSL – posted growth. Broadband subscribers benefitted from relaxed terms to help people work and learn from home during the pandemic. AT&T added a net 158,000 subscribers, its first growth in six quarters, for a total base of 14.1 million at the end of September. The growth was entirely in AT&T Fiber, which grew by 357,000 subscribers to 4.7 million. Fiber connections finally grew fast enough to keep up with U-verse declines. Growth of 2.4% YoY in premium broadband ARPU only (AT&T doesn’t report DSL ARPU) was probably enough to offset the aforementioned 1.4% YoY decline in total subscribers; total broadband revenue growth very likely turned positive in the quarter.

Total Business Wireline revenue was $6.3B, down 2.5% YoY. That’s a deceleration in the rate of decline from last quarter’s 3.5% (although excluding IP sales in the second quarter a year ago, the decline last quarter would have been a gentler 1.7%, so Q3 may be better seen as a small acceleration in the rate of decline). Still, the result was better than the expectation of $6.25B by 1.4%.

HBO also showed growth, reaching over 38 million paying subscribers in the US for the linear channel HBO and SVOD service HBO Max combined. That beat AT&T’s year-end target of 36 million subscribers. The total includes 28.7 million subscribers for HBO Max, up from 26.6 million at the end of June.

With respect to AT&T’s competition in the telco space, Moffitt wrote: “AT&T’s positioning vis-à-vis the newly merged T-Mobile/Sprint demands attention. New T-Mobile will be competing on the basis of not only lower prices, but also a best in-class 5G network. T-Mobile has a much better mid-band spectrum position than either AT&T or Verizon. Both will need to spend money to keep up. Verizon is in a position to do so. AT&T is not. With the C-Band auction coming in December, AT&T doesn’t have much time to free up some balance sheet headroom.”

AT&T said in a slide presentation that the company is focused on market-based priorities:

• 5G wireless and fiber-based connectivity

• Expanding reach of software-based entertainment platforms

• Relentless commitment to customer experience

AT&T CFO John Stephens, speaking on the company’s Q3 earnings call, said AT&T is on track to grow its fiber base by 25% this year and add 1 million total new FTTP subscribers for all of 2020. That’s very impressive!

“My intent is to exit next year (2021) … gaining subscribers, gaining share and growing the broadband business,” said AT&T CEO John Stankey on the earnings call . “We still have a lot of fallow fiber that we can sell into. You saw that this quarter.” AT&T will look to expand its fiber footprint, but didn’t elaborate on how much more FTTP (AT&T Fiber) or how the associated capex it would spend to increase its fiber footprint.

“We think policy in the country, where it stands right now, is attractive for investment in infrastructure and attractive for investment in fiber. I don’t think we need policy to get better. We just need to ensure that the policy doesn’t whipsaw back to some place that is inconsistent with incenting infrastructure investment,” Stankey said.

………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/story/2020/q3_earnings_2020.html

https://investors.att.com/financial-reports/quarterly-earnings/2020

China Mobile has 114M “5G Package” subscribers vs 204M broadband wireline customers

China Mobile announced yesterday that it had approximately 946 million mobile customers as at 30 September 2020, which was down about 1 million from the previous quarter. There were 770 million 4G customers and 114 million 5G package customers. The latter number is a 44 million increase in the past three months. However, the growth in 5G subscribers is not quite what it seems. Like China Telecom, China Mobile uses the term “5G package customers,” which counts 4G customers on 5G plans. [The 3rd state owned China telco – China Unicom – does not yet give a breakout of 5G subs from its mobile subscriber base.] The 4G subscriber base, reflecting some migration to 5G package plans, shrank by 10 million during Q3-2020.

During the first three quarters of the year, China Mobile handset data traffic increased by 35.0% year-on-year to 65.3 billion GB with handset data DOU reaching 9.1GB. Total voice usage dropped by 7.1% year-on-year to 2,258.0 billion minutes, showing a further reduced rate of decline. Total SMS usage rose by 15.5% year-on-year to 713.0 billion messages and maintained favourable growth. Mobile ARPU continued to demonstrate a flattened rate of decline, dropping by 2.6% year-on-year to RMB48.9 for the first three quarters of the year.

As of 30 September 2020, China Mobile’s total number of broadband wireline customers was 204 million, with a net increase of 17.17 million for the first three quarters of the year. Wireline broadband ARPU amounted to RMB32.4.

Image Credit: China Mobile

China Mobile said it will “continue to put in an all-out effort to implement the “5G+” plan, further promote scale-based and value-oriented operations and foster the all-round development of CHBN markets, thereby maintaining growth in telecommunications services revenue for the full-year of 2020.” The Group acknowledged the increasing cost associated with 5G operations and maintenance, but did not elaborate on what those costs were:

Facing the challenges resulting from increasing costs incurred by 5G operations and maintenance and business transformation, the Group will allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas. In addition, it will take further measures to reduce costs and enhance efficiency, alongside efforts to maintain good profitability. The Group will maintain stable profit attributable to equity shareholders for the full-year of 2020, continuously creating value for investors.

Ericsson, which previously received a $593 million 5G contract with China Mobile for base stations wrote in an email to Light Reading: “”We have been riding on the investments in China and there are likely to be more than 500,000 base stations by the end of the year in China launched on 5G and of course we are quite pleased to participate in that rather fundamental and quite strong rollout.”

Market research firm Dell’Oro forecasts that China’s 5G rollout will drive an 8% increase in worldwide sales of radio access network products this year. Excluding China, it forecasts no growth in the RAN infrastructure market. Additional highlights from Dell’Oro’s 2Q2020 RAN report:

- 5G NR radio shipments accelerated 5x to 6x during 1H20, driven by robust growth in China.

- Millimeter Wave 5G NR deployments continued to advance rapidly, with revenues growing nearly four-fold.

- Initial estimates suggest that vendor rankings remained stable between 2019 and 1H20, while revenue shares changed somewhat as the Chinese suppliers reached new revenue share highs.

- Near-term RAN forecast has been adjusted upward, to reflect the faster-than-expected growth in China.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=237832

https://www.lightreading.com/5g/china-mobile-5g-subs-top-114m-in-q3/d/d-id/764778?

https://www.lightreading.com/5g/ericsson-rides-high-on-china-5g-boom/d/d-id/764770?

Huawei Executive: “China’s 5G user experience is fake, dumb and poor”-is it a con game?

RAN Market Growth Accelerated in 1H20, According to Dell’Oro Group

Microsoft and SpaceX Partner for Space-Cloud Initiative Challenging AWS

Microsoft Corp. is partnering with SpaceX to use the latter’s Starlink satellite internet service, as the software giant opens a new front in its cloud-computing battle with Amazon.com Inc. targeting space customers. Starlink is SpaceX’s ambitious plan to build an interconnected internet network with thousands of satellites. It’s designed to deliver high-speed internet service to anywhere on earth (just like satellite phones for voice communications).

Microsoft’s Azure Space , launched today (October 20, 2020), would help connect and deploy new services using swarms of low-orbit communications satellites to be built by SpaceX, and more traditional fleets of satellites circling the earth at higher altitudes. The Azure Space initiative is targeting commercial and government space businesses. It comes about three months after Amazon Web Services (AWS), disclosed its space-focused effort. Just a few weeks ago, Microsoft announced a new service called Azure Orbital to connect satellites directly to cloud resident data centers.

A new “Azure Modular Datacenter” is essentially a mobile unit about the size of a semi-trailer. Starlink’s global coverage helps make these Azure Modular Datacenters possible, as Microsoft says the product is designed “for customers who need cloud computing capabilities in hybrid or challenging environments, including remote areas.”

“The collaboration that we’re announcing today will allow us to work together to deliver new offerings for both the public and the private sector to deliver connectivity through Starlink for use on Azure,” SpaceX president and COO Gwynne Shotwell said in a video. “Where it makes sense, we will work with [Microsoft]: co-selling to our mutual customers, co-selling to new enterprise and future customers.”

To date, SpaceX has launched over 800 Starlink satellites – a fraction of the total needed for global coverage but enough to begin providing services in some regions, including in the northwest U.S. The company has an ongoing private beta test of the service, and is also working with organizations in rural regions of Washington state to deliver satellite internet service.

Some analysts have projected that the total revenue from space-related cloud services could total about $15 billion by the end of the decade, at least several times higher than current levels.

Competition in the cloud between Amazon AWS, the market leader, and No. 2 Microsoft Azure has been heating up in recent years. Amazon offers a service to connect its AWS cloud to satellites and is working on a competitor to Starlink called Kuiper – in addition to Bezos’ personal investment in his space rocket builder Blue Origin. The pandemic has intensified competition between AZURE and AWS as companies accelerate their shift to the cloud and make vendor choices that could last for years. At the same time, military and intelligence agencies are ramping up spending on a range of space projects.

Space is only the latest area where the two cloud giants are going head-to-head. In June, Amazon launched a dedicated business unit focused on securing space-related contracts. Amazon already has Maxar Technologies Inc. and Capella Space as customers, helping them manage data coming from satellites.

Microsoft’s goal is to create integrated, secure networks, linking various cloud, space and ground capabilities. The system, for instance, would accumulate and analyze huge volumes of data, supporting missions such as space-debris surveillance and missile warnings and helping to control the orbits of commercial satellites.

“The space community is growing rapidly, and innovation is lowering the barriers of access for public and private sector organizations. What used to solely be the bastion of governments, the innovation developed by private space companies has democratized access to space, and the use of space to create new scenarios and opportunities to meet the needs of both the public and private sector space has been powering the world for a long time,” wrote Microsoft Corp VP of Azure Global Tim Keane in a blog post. “We intend to make Azure the platform and ecosystem of choice for the mission needs of the space community,” Keane added.

In addition to working with SpaceX, formally known as Space Exploration Technologies Corp., Microsoft said it is in partnership with Luxembourg’s SES SA, which separately operates a network of larger satellites significantly farther from earth under the brand O3b. Microsoft executives declined to disclose the size of their anticipated investment, but the initiative targets some of the fastest-growing national-security endeavors in space, sometimes harnessing artificial intelligence.

SpaceX, which is in the process of deploying its Starlink project consisting of thousands of high-speed internet satellites intended to provide connectivity around the globe, makes a natural partner for Microsoft. A major reason is that Amazon founder Jeff Bezos is pursuing his own low-orbit satellite constellation. Jeff Bezos also owns Blue Origin, a rocket company competing with SpaceX.

Elon Musk has sparred with Bezos before. The SpaceX chief executive who also runs electric-vehicle maker Tesla Inc. this year called for a break up of Amazon after the retailer rejected a book about the coronavirus pandemic. Amazon later said it had taken the action in error.

Microsoft and Walmart Inc. struck a cloud-computing deal two years ago. And this year the software giant and FedEx Corp. struck a partnership. Months earlier, Amazon had temporarily blocked some of its vendors from using some FedEx services.

Amazon’s and Microsoft’s steps in space come as the U.S. Defense Department is moving rapidly to embrace such sprawling constellations of smaller spacecraft for communications, surveillance and other applications. Pentagon brass have said smaller, lighter and more maneuverable satellites are essential to protect U.S. assets from potential hostile actions in space.

Microsoft is “focused deeply on governments and defense,” said Tom Keane, a corporate vice president. The space effort, he said, provides an opportunity “to bring commercial technology and innovation to the military.”

Image Credit: Microsoft

SpaceX recently won a demonstration contract for a new generation of missile-warning satellites, which industry officials say could serve as the backbone for eventual Microsoft forays into that arena.

The U.S. national-security establishment also is shifting to greater cloud use. Microsoft last year beat out Amazon for a potential $10 billion cloud-computing contract for the Pentagon. Amazon has challenged the decision, which has since been affirmed by the Pentagon.

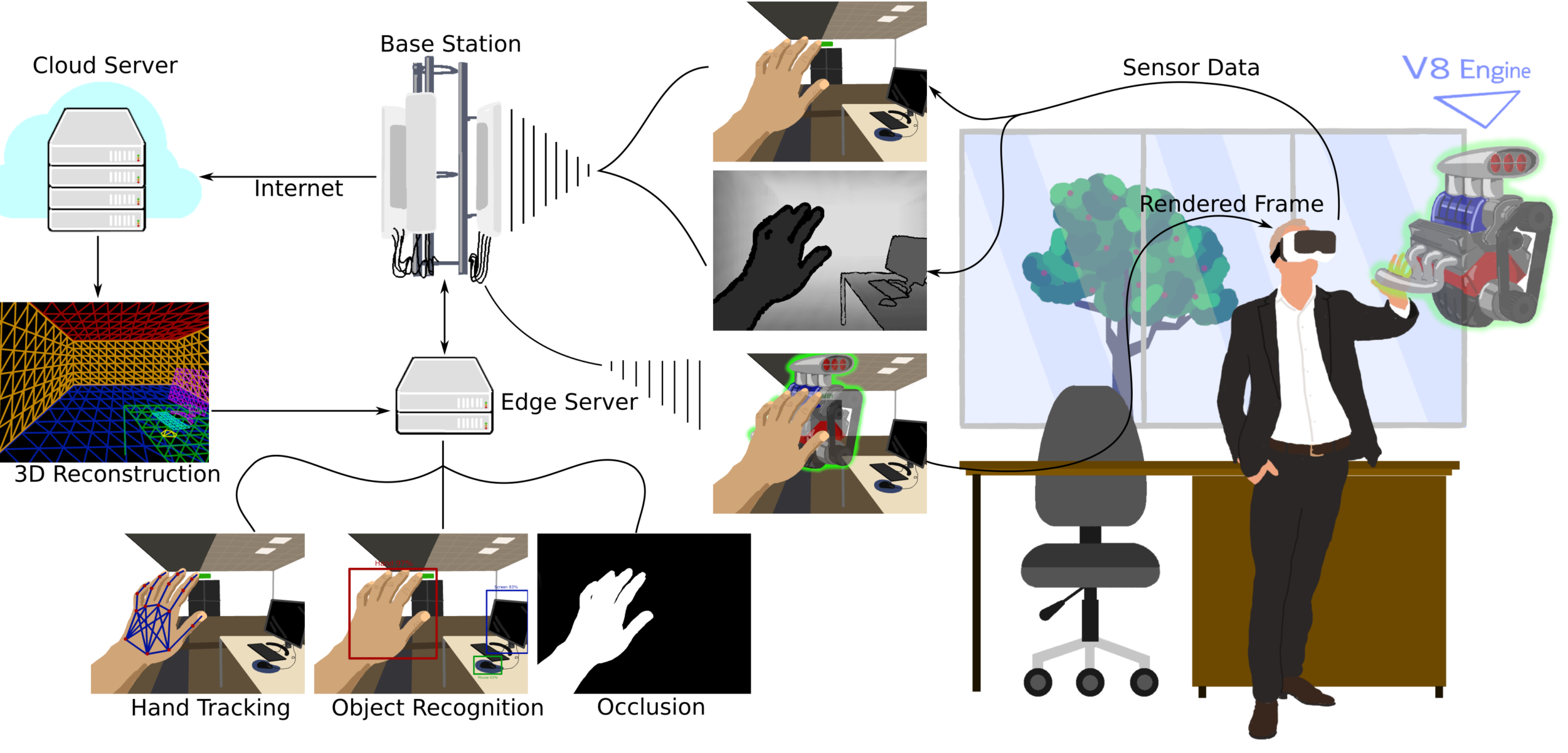

Connected Home IoT Technolgies and the EU TeamUp5G Project

by David Alejandro Urquiza Villalonga and Manuel José López Morales, researchers at Universidad Carlos III de Madrid

Introduction:

The concept of the “connected home” has gained a lot of attention in the last decade as a means to improve various aspects of life. Entertainment, security, energy and appliance control, and electronic health monitoring are just a few representative applications. Recently, the Internet of Things (IoT) has become increasingly important due to the COVID19 pandemic. With most employees working from home, remote access tools are booming because they connect people with their machines and assets. They enable people to remotely communicate with machines and perform virtual inspections, remote diagnostics as well as remote support.

Therefore, the development of a dynamic IoT environment that adapts to each individual’s needs is essential to provide an optimal productivity scenario. In this article, we describe an intelligent platform which interconnects several sensors and actuators using an IoT approach to collect and process big volumes of data. The IoT system, combined with a powerful artificial intelligence (AI) tool, learns the user’s behavior and offers improved new services according to their preferences [1] [2].

In this context, applications related to home security, remote health monitoring, climate control and lighting, entertainment, smart sleep, and intelligent shopping have been developed.

Challenges in IoT development and deployment:

There are several challenges to support massive IoT deployments providing connectivity for both cellular and non-cellular devices. New technologies with higher energy and spectral efficiency are required to enable smart device-to-device (D2D) communications with reduced connectivity costs [3]. The technical requirements to fulfill include:

• The interconnection of several sensors in an intelligent management platform according to a massive machine-type-communications (mMTC) approach. In this sense, new spectrum access techniques and energy-efficient technologies to support the operation of a large number of devices are required.

• Enhanced mobile broadband (eMBB) communication to support video streaming for entertainment, remote working, and online teaching.

• Scalability: this will become an issue mainly in relations to generic consumers as the number of devices in operation rises.

• Dense and durable off-grid power sources: it would make a difference if power could be broadcasted wirelessly to smartphones and sensors from a distance.

Popular current smart home devices:

Some of the most popular smart home devices include the intelligent wireless speaker “Google Home” with a connected voice management system that interacts with the Google Assistant helping with music, calendar, news, traffic, etc. On the other hand, Amazon has developed its own intelligent devices, namely “Amazon Echo” (with Alexa) and “Amazon Echo Plus,” which includes a smart home Zigbee hub for easy setup and control of compatible smart home devices.

Far-field speech recognition is included in the “Amazon Echo Spot,” which is designed with a smart alarm clock that can make video calls with a tiny 2.5-inch screen, or become a nursery camera. LifeSmart provides smart home solutions focusing on security, energy-saving, and bringing convenience to life with a complex network of automatic intercommunication devices that simplifies daily routines [4].

Renesas offers a wide variety of IoT solutions for security, comfiness, health, connectivity and others, for different sectors such as automotive, healthcare, industrial, and home appliances [5].

Supporting technologies for massive IoT deployment:

Nevertheless, many products offered by companies still provide IoT solutions that can be thought as of being in an infancy state. The underlying communication technologies have to increase their capabilities in order to overcome the challenging needs and provide an improvement to IoT solutions.

Therefore, new wireless communication technologies [including 5G (IMT 2020), WiFi 6 (IEEE 802.11ax), Bluetooth 5, etc.] will be combined with classical short range wireless technologies [such as ZigBee, NFC and others] and installed in homes and small business offices. Low Power Wide Area Network (LPWAN) technologies from cellular carriers are LTE-Cat M1 , narrow band IoT (NB-IoT) and LoRa/LoRaWAN.

Several studies reveal that higher frequencies are expected to be able to operate as complementary bands for the deployment of 5G networks with higher capacity. It is expected that millimeter wave (mmWave) ultra-dense small-cells supported by massive multiple-input multiple-output (mMIMO) will be able to offer the capabilities to interconnect multiple devices and to provide high-speed services even in indoor scenarios. These small-cells may be interconnected with each other and with the core network by means of a fiber optic connection or with a mmWave backhaul.

Editor’s Note: Some wireless communications professionals believe that a 5G fixed wireless network, using massive multiple-input multiple-output (mMIMO) systems at millimeter wave (mmWave) frequencies, will be able to offer high throughput and low latency to support many WiFi connected home devices. Verizon’s 5G Home Internet is an example of this.

On the other hand, network densification is a promising technology to overcome many issues in mmWave systems such as blockage and short-range coverage that can significantly increase the capacity of the network. Therefore, Ultra-dense networks (UDN) compound by small cells (SCs) is also considered to have an important role in IoT connectivity.

In addition, a fundamental feature needed to support massive IoT is scalability on the device and the infrastructure sides which can be provided by 5G cellular networks. 5G systems will be able to offer connectivity to an extremely large number of low-cost, low-power, low-complexity devices, based on an evolution of the current LTE narrow band IoT (NB-IoT) [3].

New radio access technologies will also be required. For example, cognitive radio (CR) to allocate bandwidth dynamically and to handle high interference levels. In addition, the big data processing capabilities for the AI learning and prediction process is supported only by 5G networks.

TeamUp5G Project:

TeamUp5G [6] is a European Training Network (ETN) in the frame of the Marie Skłodowska-Curie Innovative Training Networks (MSCA ITN) of the European Commission’s Horizon 2020 framework. TeamUp5G’s EU funding adds up to 3.72 million Euros between 2019 and 2022.

TeamUp5G is currently working on the use cases, technical challenges, and solutions to facilitate the technical feasibility of ultra-dense small cell networks.

The research objectives of TeamUp5G are focused on solving three problems: (1) Interference Management, waveforms, and mMIMO, (2) Dynamic Spectrum Management and Optimisation, and (3) Energy Consumption Reduction. Among others, it can provide the technical solutions to make massive IoT Smart Home connectivity feasible. Some of their research results include [7] and [8].

Where in Europe is TeamUp5G:

What Is the TeamUp5G Project:

Image Credit: TeamUp5G Project

In reference [7], the authors study a cognitive radio system with energy harvesting capabilities (CR-EH) to improve the spectral and energy efficiency according to the green communication paradigm. A novel optimal sensing policy to maximize detection performance of available spectrum and to protect primary users from interference is developed. The proposed scheme is based on the efficient use of harvested energy to implement spectrum sensing operations. Offline and online scheduling policies are derived with an optimal formulation based on convex optimization theory and Dynamic Programming (DP) algorithm, respectively. In addition, two heuristic solutions with low complexity are also proposed to dynamically manage the use of spectrum with high levels of energy efficiency which is essential for IoT deployment.

In reference [8], the authors demonstrated how scenarios with stringent conditions such as high mobility, high frequency selective, low SNR and short-packet communications can benefit from the use of non-coherent mMIMO. Non-coherent mMIMO avoids the need of channel state information (CSI) to extract the benefits of mMIMO. This avoids the waste of resources due to the overhead created by the orthogonal signals, which is more severe in scenarios with stringent conditions. These types of scenarios are very common in Home IoT, since low battery powered devices will be the most common, such as a variety of domestic sensors and actuators. Furthermore, in short-packet communications, the use of CSI is proportionally greater due to shorter useful data as also happens in Home IoT, in which many devices send short bursts of data from time to time, thus benefiting from the use of non-coherent communications.

Thus, it has been shown that new interference management techniques, energy harvesting, and non-coherent communications can overcome some of the technical challenges inherent in IoT networks for Smart Home applications.

Conclusions:

In this article, we have covered some aspects considered in IoT Smart Home 5G. We have first made an introduction with the basics of the use of IoT in homes, aided by 5G technology and AI. Secondly, we have presented some already existing solutions from companies such as Google, Amazon, LifeSmart, and Renesas, which work over legacy networks and thus do not extract all the potential benefits of 5G IoT Smart Home. We have continued stating the main technical challenges in IoT deployment. We have defined some technologies that will support the use of IoT at homes, including massive multiple-input multiple-output, millimeter waves, ultra dense networks, small cells, and cognitive radio. We have talked about the TeamUp5G project which partly focuses on the research of new solutions that can make the massive deployment of IoT Smart Home feasible.

From the perspective of the authors, the following decade will see an increase in the appearance of products based on the referenced technologies, which will bring the concept of IoT Smart Home based on 5G closer to reality.

References:

[1] K. E. Skouby y P. Lynggaard, «Smart home and smart city solutions enabled by 5G, IoT, AAI and CoT services», en 2014 International Conference on Contemporary Computing and Informatics (IC3I), nov. 2014, pp. 874-878, doi: 10.1109/IC3I.2014.7019822.

[2] H. Uddin et al., «IoT for 5G/B5G Applications in Smart Homes, Smart Cities, Wearables and Connected Cars», en 2019 IEEE 24th International Workshop on Computer Aided Modeling and Design of Communication Links and Networks (CAMAD), sep. 2019, pp. 1-5, doi: 10.1109/CAMAD.2019.8858455.

[3] S. Ahmadi, 5G NR: Architecture, Technology, Implementation, and Operation of 3GPP New Radio Standards. Academic Press, 2019.

[4] https://iot.ilifesmart.com/

[5] https://www.renesas.com/us/en/solutions.html

[6] https://teamup5g.webs.tsc.uc3m.es/

[7] D. A. Urquiza-Villalonga, J. Torres-Gómez, y M. J. Fernández-Getino-García, «Optimal Sensing Policy for Energy Harvesting Cognitive Radio Systems», IEEE Transactions on Wireless Communications, vol. 19, n.o 6, pp. 3826-3838, jun. 2020, doi: 10.1109/TWC.2020.2978818.

[8] M. J. Lopez-Morales, K. Chen-Hu and A. Garcia-Armada, “Differential Data-Aided Channel Estimation for Up-Link Massive SIMO-OFDM,” in IEEE Open Journal of the Communications Society, vol. 1, pp. 976-989, 2020, doi: 10.1109/OJCOMS.2020.3008634.