Month: December 2024

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Nvidia is proposing a new approach to telco networks dubbed “AI radio access network (AI-RAN).” The GPU king says: “Traditional CPU or ASIC-based RAN systems are designed only for RAN use and cannot process AI traffic today. AI-RAN enables a common GPU-based infrastructure that can run both wireless and AI workloads concurrently, turning networks from single-purpose to multi-purpose infrastructures and turning sites from cost-centers to revenue sources. With a strategic investment in the right kind of technology, telcos can leap forward to become the AI grid that facilitates the creation, distribution, and consumption of AI across industries, consumers, and enterprises. This moment in time presents a massive opportunity for telcos to build a fabric for AI training (creation) and AI inferencing (distribution) by repurposing their central and distributed infrastructures.”

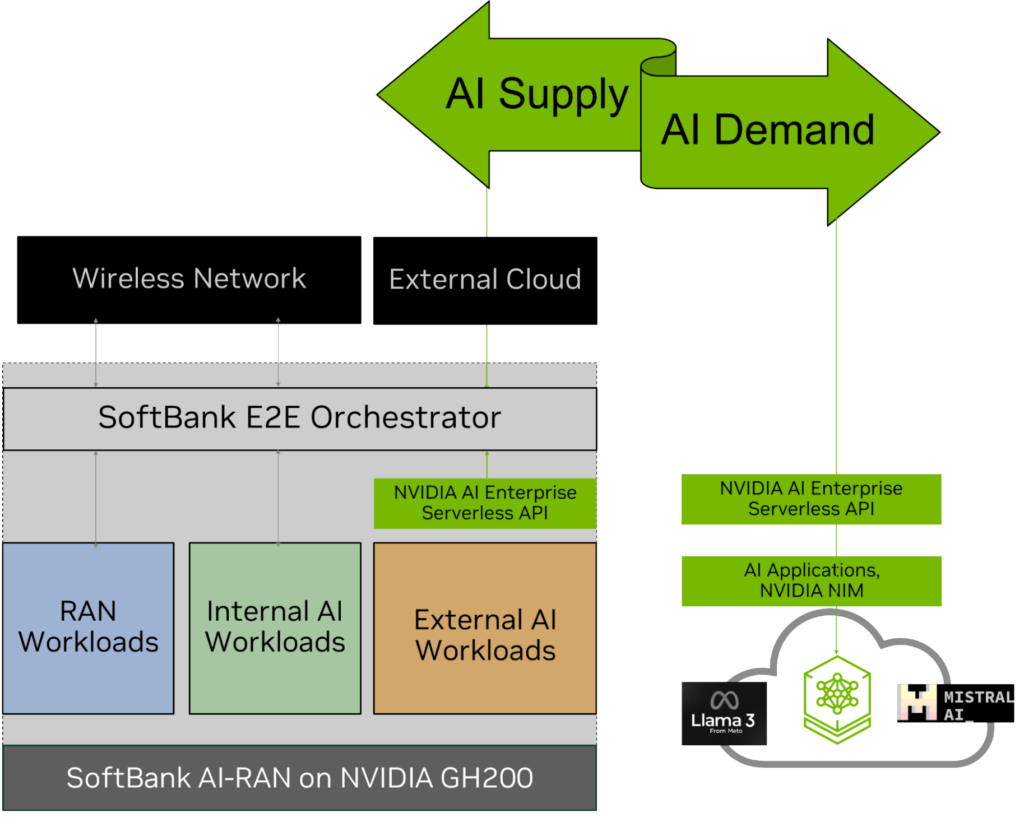

One of the first principles of AI-RAN technology is to be able to run RAN and AI workloads concurrently and without compromising carrier-grade performance. This multi-tenancy can be either in time or space: dividing the resources based on time of day or based on percentage of compute. This also implies the need for an orchestrator that can provision, de-provision, or shift workloads seamlessly based on available capacity.

![]()

Image Credit: Pitinan Piyavatin/Alamy Stock Photo

ARC-1, an appliance Nvidia showed off earlier this year, comes with a Grace Blackwell “superchip” that would replace either a traditional vendor’s application-specific integrated circuit (ASIC) or an Intel processor. Ericsson and Nokia are exploring the possibilities with Nvidia. Developing RAN software for use with Nvidia’s chips means acquiring competency in compute unified device architecture (CUDA), Nvidia’s instruction set. “They do have to reprofile into CUDA,” said Soma Velayutham, the general manager of Nvidia’s AI and telecom business, during a recent interview with Light Reading. “That is an effort.”

Proof of Concept:

SoftBank has turned the AI-RAN vision into reality, with its successful outdoor field trial in Fujisawa City, Kanagawa, Japan, where NVIDIA-accelerated hardware and NVIDIA Aerial software served as the technical foundation. That achievement marks multiple steps forward for AI-RAN commercialization and provides real proof points addressing industry requirements on technology feasibility, performance, and monetization:

- World’s first outdoor 5G AI-RAN field trial running on an NVIDIA-accelerated computing platform. This is an end-to-end solution based on a full-stack, virtual 5G RAN software integrated with 5G core.

- Carrier-grade virtual RAN performance achieved.

- AI and RAN multi-tenancy and orchestration achieved.

- Energy efficiency and economic benefits validated compared to existing benchmarks.

- A new solution to unlock AI marketplace integrated on an AI-RAN infrastructure.

- Real-world AI applications showcased, running on an AI-RAN network.

Above all, SoftBank aims to commercially release their own AI-RAN product for worldwide deployment in 2026. To help other mobile network operators get started on their AI-RAN journey now, SoftBank is also planning to offer a reference kit comprising the hardware and software elements required to trial AI-RAN in a fast and easy way.

SoftBank developed their AI-RAN solution by integrating hardware and software components from NVIDIA and ecosystem partners and hardening them to meet carrier-grade requirements. Together, the solution enables a full 5G vRAN stack that is 100% software-defined, running on NVIDIA GH200 (CPU+GPU), NVIDIA Bluefield-3 (NIC/DPU), and Spectrum-X for fronthaul and backhaul networking. It integrates with 20 radio units and a 5G core network and connects 100 mobile UEs.

The core software stack includes the following components:

- SoftBank-developed and optimized 5G RAN Layer 1 functions such as channel mapping, channel estimation, modulation, and forward-error-correction, using NVIDIA Aerial CUDA-Accelerated-RAN libraries

- Fujitsu software for Layer 2 functions

- Red Hat’s OpenShift Container Platform (OCP) as the container virtualization layer, enabling different types of applications to run on the same underlying GPU computing infrastructure

- A SoftBank-developed E2E AI and RAN orchestrator, to enable seamless provisioning of RAN and AI workloads based on demand and available capacity

AI marketplace solution integrated with SoftBank AI-RAN. Image Credit: Nvidia

The underlying hardware is the NVIDIA GH200 Grace Hopper Superchip, which can be used in various configurations from distributed to centralized RAN scenarios. This implementation uses multiple GH200 servers in a single rack, serving AI and RAN workloads concurrently, for an aggregated-RAN scenario. This is comparable to deploying multiple traditional RAN base stations.

In this pilot, each GH200 server was able to process 20 5G cells using 100-MHz bandwidth, when used in RAN-only mode. For each cell, 1.3 Gbps of peak downlink performance was achieved in ideal conditions, and 816Mbps was demonstrated with carrier-grade availability in the outdoor deployment.

……………………………………………………………………………………………………………………………………..

Could AMD GPU’s be an alternative to Nvidia AI-RAN?

AMD is certainly valued by NScale, a UK business with a GPU-as-a-service offer, as an AI alternative to Nvidia. “AMD’s approach is quite interesting,” said David Power, NScale’s chief technology officer. “They have a very open software ecosystem. They integrate very well with common frameworks.” So far, though, AMD has said nothing publicly about any AI-RAN strategy.

The other telco concern is about those promised revenues. Nvidia insists it was conservative when estimating that a telco could realize $5 in inferencing revenues for every $1 invested in AI-RAN. But the numbers met with a fair degree of skepticism in the wider market. Nvidia says the advantage of doing AI inferencing at the edge is that latency, the time a signal takes to travel around the network, would be much lower compared with inferencing in the cloud. But the same case was previously made for hosting other applications at the edge, and they have not taken off.

Even if AI changes that, it is unclear telcos would stand to benefit. Sales generated by the applications available on the mobile Internet have gone largely to hyperscalers and other software developers, leaving telcos with a dwindling stream of connectivity revenues. Expect AI-RAN to be a big topic for 2025 as operators carefully weigh their options. Many telcos are unconvinced there is a valid economic case for AI-RAN, especially since GPUs generate a lot of power (they are perceived as “energy hogs”).

References:

AI-RAN Goes Live and Unlocks a New AI Opportunity for Telcos

https://www.lightreading.com/ai-machine-learning/2025-preview-ai-ran-would-be-a-paradigm-shift

Nvidia bid to reshape 5G needs Ericsson and Nokia buy-in

Softbank goes radio gaga about Nvidia in nervy days for Ericsson

T-Mobile emerging as Nvidia’s big AI cheerleader

AI cloud start-up Vultr valued at $3.5B; Hyperscalers gorge on Nvidia GPUs while AI semiconductor market booms

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Nvidia enters Data Center Ethernet market with its Spectrum-X networking platform

FT: New benchmarks for Gen AI models; Neocloud groups leverage Nvidia chips to borrow >$11B

Will AI clusters be interconnected via Infiniband or Ethernet: NVIDIA doesn’t care, but Broadcom sure does!

Highlights of GSA report on Private Mobile Network Market – 3Q2024

According to GSA, the private mobile network market (PMNM) continued to grow in 3Q2024, as the number of unique customer references for deployments reached 1,603. The market is being driven by sectors like manufacturing, education, and mining, which use these networks for enhanced data, security and mobility needs.

On average, 71% of references included in the GSA database are non-public and unique to this database, submitted by members of the GSA Private Mobile Networks Special Interest Group (SIG). This number can be higher for certain industries, with more than 80% of sectors such as military and defense, maritime and power plants not visible in the public domain. The referenced SIG includes 16 companies: 450Alliance, 5G-ACIA, AI-Link, Airspan, Celona, Dell, Ericsson, GSMA, JMA Wireless, Keysight Technologies, Mavenir, Nokia, OnGo Alliance, OneLayer, PrivateLTEand5G.com and TCCA. GSA would like to thank its members 450Alliance, Airspan, Celona, Ericsson, Keysight Technologies, Mavenir, Nokia and OneLayer for sharing general information about their network deployments to enable this report and data set to be produced. New data has resulted in a significant uplift in this update.

Other PMNM highlights in the 3rd quarter 2024 include:

• There are 80 countries around the world with at least one private mobile network.

• Of the top 10 reporting countries, the United States reported growth of 24%, followed by the United Kingdom, up 11%, Sweden by 9% and Japan and Australia by 5% each. Finland and the Republic of Korea grew by 4% each

• Seaports and oil and gas were the fastest-growing industries, up 9%. Manufacturing, education and academic research and mining remain the top three sectors for customer references, although this does not represent the actual size and scale of deployments, which vary by user type.

• There are 80 countries around the world with at least one private mobile network.

• There is typically a strong, positive correlation between the number of private mobile network references and countries with dedicated spectrum. Private mobile networks are mainly in high- and upper-middle-income regions so far, with the United States, Germany, the United Kingdom, China and Japan having the most references. It is sometimes reported that China has a high number of networks, reaching up to 30,000, but GSA believes a large portion use the public network and therefore do not meet our definition.

Notes:

The definition of a private mobile network used in this report is a 3GPP-based 4G LTE or 5G network intended for the sole use of private entities, such as enterprises, industries and governments. They can use only physical elements, RAN or Core, or a combination of physical and virtual elements — for example hosted by a public land mobile network — but as a minimum, a dedicated network core must be implemented. The definition includes MulteFire or Future Railway Mobile Communication System. The network must use spectrum defined in 3GPP, be generally intended for business-critical or mission-critical operational needs, and where it is possible to identify commercial value, the database includes contracts worth more than €50,0000 and between €50,000 and €100,000 to filter out small demonstration network deployments. Private mobile networks are usually not offered to the general public, although GSA’s analysis does include the following: educational institutions that provide mobile broadband to student homes; private fixed wireless access networks deployed by communities for homes and businesses; city or town networks that use local licenses to provide wireless services in libraries or public places (possibly offering Wi-Fi with 3GPP wireless backhaul), which are not an extension of the public network.

Non-3GPP networks such as those using Wi-Fi, TETRA, P25, WiMAX, Sigfox, LoRa and proprietary technologies are excluded from the data set. Network implementations using solely network slices from public networks or placement of virtual networking functions on a router are also excluded. Where identifiable, extensions of the public network (such as one or two extra sites deployed at a location, as opposed to dedicated private networks) are excluded. These items may be described in the press as a type of private network.

References:

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector is a $1.5B opportunity

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Pente Networks, MosoLabs and Alliance Corp collaborate for Private Cellular Network in a Box

HPE Aruba Launches “Cloud Native” Private 5G Network with 4G/5G Small Cell Radios

IALA describes maritime use cases and applications for 5G Radio Interface Technologies (IMT 2020 RITs)

The International Organization for Marine Aids to Navigation (IALA) has been developing use cases and service requirements of Marine Aids to Navigation (Marine AtoN) including regulatory aspects for maritime safety, which may serve as input to support the development of IMT-2030 (6G RIT/SRIT) standardization. IALA has detailed some of use cases that IMT-2020 (5G RIT/SRIT) which have been applied in the maritime sector. They are requesting ITU-R WP5D to include those maritime use cases in the section 5.10 of the working document for the preliminary draft revision of Report ITU-R M.2527-0, titled “Applications of the Terrestrial Component of International Mobile Telecommunications for Specific Societal, Industrial, and Other Usages.”

IMT-2020 and beyond systems can be used to address such specific needs, such as:

− secure mechanism to associate an identity of a IMT-based device with a vessel identity;

− direct communication among vessels;

− communication between shore-based operations centers and vessels/unmanned aerial vehicles (UAVs)/unmanned underwater vehicles (UUVs);

− determining accurate position, heading and speed of IMT-based devices associated with a vessel identity, e.g. for maritime emergency requests or assisting IMT-based devices associated with other vessels with safety information;

− mechanisms of distributing a maritime emergency request received from a user endpoint (UE) to another UEs on a vessel.

− digitized workflows and processes, e.g. digital bunkering.

……………………………………………………………………………………………………………………..

Here are a few maritime use cases of IMT 2020:

1. Pilotage service and tug service

The use case on pilotage service is to provide shipboard users such as a pilot or a shipmaster and shore-based users such as pilot authorities, pilot organization or bridge personnel the exact information necessary to maneuver vessels over IMT systems through pilotage areas such as dangerous or congested waters and harbors or to anchor vessels in a harbor to safeguard traffic at sea and protect the environment.

A tug is a boat or ship that maneuvers vessels by pushing or towing them. Tugs move vessels that either should not move by themselves (e.g. vessels passing in a narrow canal, berthing and unberthing operations) or those that cannot move by themselves (e.g. barges, disabled ships, oil platforms). The use case of tug service is described for ship assistance (e.g. mooring), towage (in harbor/ocean), or escort operations to safeguard traffic at sea and protect the environment by IMT systems.

2. Autonomous surface ships

The autonomous surface ship is one of the main streams for the digital transformation of the maritime sector. The demand for the high performance of maritime communication technologies is expected to be skyrocketing once autonomous surface ships become pervasive at sea or in rivers. In general, most ships are designed for a life of 25 to 30 years, which means that multiple radio access technologies are highly likely to coexist in the maritime sector across two or three generational evolutions of IMT systems that have been evolved every ten years so far. IMT-2020 technologies provide the feature on the support of the multiple radio access technologies (RATs).

The size of autonomous ships is varied, and the length of such ships can be from a few meters to a few hundreds of meters. In case of an autonomous ship with the length of a few hundred meters, the communications environment on its deck or inside the ship may be similar with the one of smart factory, smart farm, or smart campus where local networks over IMT-2020 and beyond systems provide mobile services only within their territories. The IMT-2020 technologies related to non-public networks are applicable to provide the mobile communication services for cabin crews, passengers, or Internet of Things (IoT) devices integrated into navigation systems of the ship on board on its deck or inside the ship.

In addition, the direct communication between two ships is applicable over IMT-2020 technologies and it will help autonomous surface ships efficiently exchange the information related to their navigation and maritime safety and avoid any delay of the information delivery which may cause a risk on the conflict between autonomous surface ships. IMT-2020 and beyond systems are expected to continue to enhance the support of the direct communication among ships to provide much longer communication coverage which is sufficient to satisfy the requirement of the maritime sector.

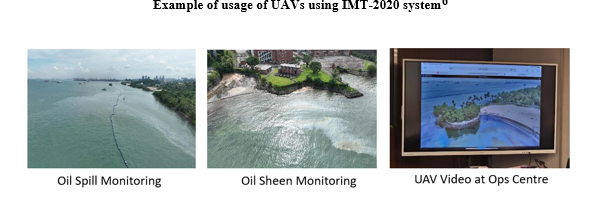

3. UAVs

As decarbonization efforts intensify in the maritime sector, novel ways are needed to reduce the carbon footprint of maritime operations in the port waters. UAVs is one such example that could achieve this. Take for example the management of the oil spill within port waters where multiple drone flights were conducted to capture high quality video footages for transmission back to the shore-based operations center via an IMT-2020 system.

Live high quality video footage was crucial to monitor and predict the movement of oil spills affected by waves, tides and wind, validate oil spill models, and allow better deployment of response assets.

Real-time video steaming service

Maritime incidents in the port waters are unavoidable, and speed is of the essence to resume normalcy for port and maritime operations. To ensure that emergency response teams are equipped to do so, standard operating procedures need to be periodically rehearsed and practiced to deal with such contingencies. During a ferry rescue exercise in Aug 2024, a simulation of collision between two domestic ferries, one electric and one diesel-powered, was carried out within port waters. The collision resulted in severe damage to the hull of the diesel-powered ferry, causing the vessel to take in water. An UUV was deployed from a vessel to conduct hull inspection of the diesel-powered ferry, and live high quality video footage was sent by IMT-2020 system to the shore-based operations centre for hull “damage” assessment to aid “rescue” operations.

Virtual marine Aids to Navigation (AtoN)

The term ‘marine Aids to Navigation (AtoN)’ means a device, system, or service which are external to a vessel, designed and operated to enhance safe and efficient navigation of all vessels or vessel traffic. Example of conventional types of such AtoN includes lighthouses, buoys, and day beacons. The maritime sector recently employed virtual marine AtoNs whose position information is broadcast to make ships identify them though they do not physically exist at sea. IMT-2020 technologies are applicable for the virtual marine AtoNs to enable their location information to be broadcast to ships on voyage around virtual marine AtoNs. In addition, more enhanced direct communication supporting the communication range sufficient for the maritime sector are expected to make IMT-2020 and beyond system attractive to the maritime sector because it may be useful to overcome the constraints of the maritime communication environment caused by the limited network infrastructure compared to the terrestrial communication environment.

Maritime services

The IMT-2020 technologies provide features that are useful for the communication among authorities, the emergency request, or the public warning. Mission critical services (e.g. mission critical push to talk, mission critical data service) over IMT-2020 system are applicable to the marine usage by enabling coast guard ships to efficiently exchange the information even in an isolated network at sea where coast guard ships are away from a shore and are unable to be connected to a core network on land.

IMT-2020 system also provides features for the public warning that are related to regulatory requirements. Additional enhancement of IMT-2020 technologies is expected to enhance the information related to marine regulatory requirements is integrated into features for the public warning.

Digitalization of bunkering processes and documentations such as electronic bunker delivery notes (eBDN), in alignment with IMO regulation 18 of MARPOL Annex VI, can be achieved IMT-2020[1] system within port waters. This will help to improve efficiency and productivity, increase transparency, enhance crew safety and facilitate interoperability between different systems.

Other use cases in ports

Automation and worker safety and retention are the key motivation for IMT applications at shipping ports. The world’s largest shipping ports operate 24 (hours) × 7 (days). In this dynamic environment, worker safety is a major concern. Another pain point for port operators is worker retention due to poor working conditions. For example, crane operators work in tight spaces, high above the ground, for an extended period. Remote control of crane operations, container trucks, and other heavy machinery in ports can alleviate these pain points. For instance, with real-time video streaming and analytics, a crane operator may be able to operate multiple lifts and cranes situated at an operations centre. As a result, remote operations can increase productivity, save labour costs, and improve worker safety.

Real-time video is critical for port security and remote control operations. Video surveillance is essential to maintaining port security. Real-time video surveillance with computer vision can be used to maintain security control and access. In addition to infrastructure security, real-time video is vital for handling heavy machineries, such as cranes and unmanned container trucks, in remote command and control operations. Private IMT-2020 networks promise superior coverage, low latency, and massive machine-type communications with fewer radios than existing RLAN-based meshing networks. While existing RLAN and meshing solutions are fine for fixed wireless applications, they are not reliable in dynamically changing mobile environments such as ports.

Drone inspection of port operations is another interesting IMT application found in shipping ports. In addition to drones, video-mounted cranes and containers tagged with sensors are used to track containers to help locate goods (within containers) in ports. Port operators are increasingly called upon to provide visibility of the supply chain to logistics and trucking companies and end customers in an increasingly connected world. As a result, port operators increasingly seek new technology solutions, such as private IMT-2020 and video analytics, to gain additional operational efficiency and compete against other port operators worldwide.

References:

International Organization for Marine Aids to Navigation LIAISON NOTE TO ITU-R WORKING PARTY 5D, 13 December 2024

3GPP TR 22.819: Feasibility Study on Maritime Communication Services over 3GPP system

3GPP TS 22.119: Maritime Communication Services over 3GPP system; Stage 1

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT says that private 5G in the global Defense Sector is a $1.5 Billion opportunity. The market research firm’s latest report indicates that cumulative spending on private 5G networks in the defense sector will reach $1.5 Billion between 2024 and 2027.

Private 5G and 4G LTE cellular networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – are rapidly gaining popularity across a diverse range of vertical industries. The defense industry is no exception to this trend, with private cellular network solutions in the sector extending from permanent 5G networks at military bases and training facilities to satellite-backhauled portable cellular systems for warfighters at the tactical edge.

Alongside their use of specialized, proprietary communication systems, armed forces around the world are increasingly turning to adapted COTS (Commercial-off-the-Shelf) network solutions – especially those built on 3GPP specs – to reduce costs, expedite deployment timelines and support increasingly complex application scenarios. The U.S. DOD (Department of Defense) has recently published its strategy for deploying Open RAN-compliant private 5G networks at military installations in the United States and overseas territories.

- Supported by over $650 Million in funding over the past three years, several U.S. Army, Navy, Marine Corps and Air Force bases already host on-premise 5G infrastructure for both experimental and operational use. 5G private networks have been deployed at over 14 U.S. military bases to date.

- The Spanish Army and Navy have awarded multiple contracts – collectively worth $15 Million – to mobile operator Telefónica to supply standalone private 5G networks for army brigades on the move, armored systems and helicopter maintenance parks, naval bases, ships and marine infantry units.

- The Norwegian Armed Forces are utilizing a combination of defense-specific network slices and tactical private 5G networks to support their future mobile communications needs while the South Korean military is leveraging private 5G installations for smart naval base operations, runway safety management and XR (Extended Reality)-based training, including small unit tactics and firearm disassembly/assembly-related education.

-

The Jordanian Armed Forces and Ministry of Interior are jointly investing over $10 Million to deploy a hybrid TETRA-LTE communications system to support both narrowband voice and broadband data applications.

-

As part of the Qatar MoD’s (Ministry of Defense) LTE-5G program, the Signals Corps of the Gulf country’s armed forces has deployed a nationwide wireless network for mission-critical communications.

-

The ADF (Australian Defence Force) relies on private LTE and 5G-ready networks to support wireless broadband communications for live and synthetic military training environments.

-

The South Korean military is leveraging private 5G installations for smart naval base operations, runway safety management and XR (Extended Reality)-based training, including small unit tactics and firearm disassembly/assembly-related education.

-

The Japanese Ministry of Defense plans to deploy local 5G networks across JSDF (Japan Self-Defense Forces) military installations to digitize rear-area operations, such as base security, and reduce the burden on personnel.

-

The Brazilian Army and state-level military police forces have installed private LTE infrastructure in strategic locations to facilitate high-availability and reliable broadband communications.

- Other examples range from the ZNV (Deployable Cellular Networks) program of the Bundeswehr (German Armed Forces) to the ADF’s (Australian Defence Force) private LTE and 5G-ready networks for live and synthetic military training environments.

SNS Telecom & IT’s “Private 5G/4G Cellular Networks for Defense: 2024 – 2030” report predicts that global spending on private 5G and 4G LTE network infrastructure in the defense sector will grow at a CAGR of 21% over the next three years, collectively accounting for nearly $1.5 Billion between 2024 and 2027.

……………………………………………………………………………………………………………………………………….

Military bases hosting fixed and transportable (rapidly deployable) private 5G network assets include but are not limited to Naval Air Station Whidbey Island (Washington), Naval Base Guam, Joint Base Pearl Harbor-Hickam (Hawaii), Fort Carson (Colorado), Marine Corps Base Camp Pendleton (California), Marine Corps Air Station Miramar (California), Nellis Air Force Base (Nevada), Fort Hood (Texas), Fort Bliss (Texas), Joint Base San Antonio (Texas), Marine Corps Logistics Base Albany (Georgia), Tyndall Air Force Base (Florida), Camp Grayling (Michigan) and Fort Bragg (North Carolina), explained SNS Telecom & IT 5G research director, Asad Khan said in an email to Fierce Network. “We definitely expect more rollouts, particularly Open RAN-compliant networks in line with the DOD’s recently published private 5G deployment strategy,” Khan added.

For more information, please visit: https://www.snstelecom.com/defense

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN (Virtualized RAN), small cells, mobile core, xHaul (Fronthaul, Midhaul & Backhaul) transport, network automation, mobile operator services, FWA (Fixed Wireless Access), neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX (Mission-Critical PTT, Video & Data), IIoT (Industrial IoT), V2X (Vehicle-to-Everything) communications and vertical applications.

References:

https://www.snstelecom.com/defense

FRMCS-Ready 5G/LTE Networks a $1.2 Billion Opportunity, Says SNS Telecom & IT

https://www.fierce-network.com/wireless/private-network-thats-lieutenant-network-you-soldier

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

For several years, many telecom analysts said it was inevitable that network operators would move telco workloads, especially their 5G SA core network software, into the giant data centers operated by Amazon Web Services (AWS), Google Cloud and Microsoft Azure. For example:

- In June 2021, AT&T made an agreement with Microsoft to run its 5G SA core network in the Azure public cloud platform. However, that 5G SA network is still not commercially available!

- In July 2023, India’s Tech Mahindra and Microsoft announced they’d collaborate to enable cloud-powered 5G SA core network for telecom operators worldwide. So far we don’t know of any takers?

- Dish Network outsourced its entire 5G infrastructure (including 5G SA core network) to run on the AWS public cloud platform which went live in February 2022. See Figure 1. below

- In May 2024, O2 Telefónica in Germany and Nokia announced the deployment of 5G standalone core software on Amazon Web Services (AWS).

Figure 1. DISH 5G Cloud Architecture

……………………………………………………………………………………………………………………..

However, the expected big move to telco public cloud did not happen in 2024! “No operators have core applications in the public cloud,” David Hennessy, the chief technology officer of the UK’s Three, told Light Reading earlier this year. 5G networks are spread across the geographies they serve. Hosting all functions in a single place just isn’t possible. Even the core, the domain allowing for the most centralization, is increasingly distributed across multiple facilities at the network “edge.” As a result, network operators are not using public cloud platforms for their 5G SA core or mission critical applications.

T-Mobile-US (the “un carrier”) has deployed its own 5G SA network. Cisco and Nokia are the primary vendors that built T-Mobile’s 5G SA core network. Some European network operators are resistant to use of the public cloud for telco-specific workloads. Those include the UK’s BT, which previously invested time and effort in building its own telco cloud with Canonical, a UK software company. Germany’s Deutsche Telekom has something similar called T-CaaS. Orange also has built a homegrown cloud based 5G SA network. Spain’s Telefónica is still not fully convinced by the other benefits of the public cloud providers. Automation is currently more advanced when both the core network software and infrastructure come from Ericsson than it is when Telefónica takes the core from Nokia and the infrastructure from AWS, according to Cayetano Carbajo, the operator’s director for core networks.

Carbajo is clearly disturbed by the lack of infrastructure standardization in a world of multiple different cloud offerings. Various telcos are working on this through an initiative called Sylva, overseen by the Linux Foundation. The fruit of it should be the ability for Telefónica to move network applications from one cloud to another without having to make big changes. Yet public cloud service providers are not even listed as sponsors on the Sylva website.

The alternative is to keep the 5G core on premises or in a private cloud. The latter might be used by other workloads, but – as the designation implies – it would not be shared with other companies. In general, 5G network operators have distributed their previously centralized workloads around a nationwide network, bringing resources into closer proximity with end-user devices. That results in lower latency as well as other service improvements.

For example, BT hosts its control plane functions at eight UK sites and its user plane software at 16 sites. Replicating this in the traditional public cloud, which relies on a smaller number of giant facilities, would be difficult if not impossible to do. As a result, IBM-owned Red Hat and Broadcom-owned VMware, the best-known cloud-computing players in this area, now propose to bring their software into a telco’s facilities. Microsoft calls it the “hybrid” cloud.

There was a bad omen for public cloud advocates in June when Microsoft revealed it was cutting telecom jobs and abandoning Affirmed Networks and Metaswitch, core network software developers it bought in high-profile deals several years ago. Clearly, Microsoft is retreating from the development of network applications.

References:

https://www.lightreading.com/cloud/2024-in-review-a-bad-year-for-public-cloud-in-telecom

Public cloud economics aren’t adding up for some telcos

The public cloud has failed to crack telecom

Telefónica still not fully sold on public cloud after AWS move

Telenor has a go at public cloud but needs AWS to help

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Building and Operating a Cloud Native 5G SA Core Network

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

https://aws.amazon.com/blogs/industries/telco-meets-aws-cloud-deploying-dishs-5g-network-in-aws-cloud/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.lightreading.com/cloud/the-public-cloud-has-failed-to-crack-telecom

Beyon partners with Ericsson to build energy-efficient wireless networks in Bahrain

Bahrain based Beyon announced it has renewed its sustainability Memorandum of Understanding (MoU) with Ericsson to expand their joint sustainability initiatives and circular economy practices for building energy-efficient networks in Bahrain.

The MoU renewal was signed by Beyon Chief Communications & Sustainability Officer Shaikh Bader bin Rashid Al Khalifa and Vice President and Head of Gulf Council Countries at Ericsson Middle East and Africa, Nicolas Blixell.

The companies also announced the successful outcomes of their sustainability collaboration, signed in early 2024, for accelerating the journey to a Net Zero future for both companies and managing Waste from Electronic and Electrical Equipment (WEEE).

Key achievements during the year include the initiation of ‘Ericsson Product Take-Back Programme’, which addresses the issue of e-waste and enables recycling of end-of-life electronic and electrical equipment in a responsible and sustainable way.

Software such as Cell Sleep Mode and Artificial Intelligence (AI)-powered MIMO Sleep Mode were also implemented on pilot sites, leading to a 22% average reduction in energy consumption where the features were activated.

Another 18% percent energy reduction was apparently achieved through the deployment of the single-antenna footprint Interleaved AIR 3218, compared to AIR 3227, to provide “5G Massive MIMO while addressing space constraints on rooftops and towers.”

“Our partnership with Ericsson demonstrates the substantial progress that can be made through focused sustainability initiatives,” said Shaikh Bader bin Rashid Al Khalifa, Beyon Chief Communications & Sustainability Officer. “The outcomes reflect our commitment to energy efficiency and our goal to reduce our environmental footprint through innovative technologies and circular economy practices. Ultimately these efforts fall in line with the Kingdom of Bahrain’s vision to achieve its sustainable development goals of 2030.”

Nicolas Blixell, Vice President and Head of Gulf Council Countries at Ericsson Middle East and Africa added: “The results of our collaboration with Beyon highlight the role of technologies in achieving sustainability goals. By leveraging our expertise and technologies, we have been able to deliver measurable energy savings and support Beyon in their journey towards Net Zero.”

Earlier this year, Three and Ericsson claimed to have improved energy efficiency by up to 70% at selected sites through AI, data analytics and a ‘Micro Sleep’ feature. The deployment of ‘next-generation AI-powered hardware and software solutions’ from Ericsson is part of a network modernisation initiative Three had been engaged in over the previous 18 months, we were told at the time.

Ericsson and Beyon share a longstanding relationship, through its telecom arm Batelco, with this sustainability collaboration marking another milestone in their efforts to enhance network efficiency and environmental performance across Beyon’s operations.

References:

Are cloud AI startups a serious threat to hyperscalers?

Introduction:

Cloud AI startups include Elon Musk’s xAI, OpenAI, Vultr, Prosimo, Alcion, Run:ai, among others. They all are now or planning to build their own AI compute servers and data center infrastructure. Are they a serious threat to legacy cloud service providers who are also building their own AI compute servers?

- xAI built a supercomputer it calls Colossus—with 100,000 of Nvidia’s Hopper AI chips—in Memphis, TN in 19 days vs the four months it normally takes. The xAI supercomputer is designed to drive cutting-edge AI research, from machine learning to neural networks with a plan to use Colossus to train large language models (like OpenAI’s GPT-series) and extend the framework into areas including autonomous machines, robotics and scientific simulations. It’s mission statement says: “xAI is a company working on building artificial intelligence to accelerate human scientific discovery. We are guided by our mission to advance our collective understanding of the universe.”

- Open AI lab’s policy chief Chris Lehane told the FT that his company will build digital infrastructure to train and run its systems. In an interview with the FT, Lehane said “chips, data and energy” will be the crucial factors in helping his company win the AI race and achieve its stated goal of developing advanced general intelligence (AGI), AI which can match or surpass the capability of the human brain. Lehane said the company would build clusters of data centers in the US mid west and south west, but did not going into further detail about the plan. DCD has contacted the company to ask for more information on its data center buildout.

Elon Musk’s xAI built a supercomputer in Memphis that it calls Colossus, with 100,000 Nvidia AI chips. Photo: Karen Pulfer Focht/Reuters

As noted in our companion post, Cloud AI startup Vultr raised $333 million in a financing round this week from Advanced Micro Devices (AMD) and hedge fund LuminArx Capital Management and is now valued at $3.5 billion

Threats from Cloud AI Startups include:

- Specialization in AI: Many cloud AI startups are highly specialized in AI and ML solutions, focusing on specific needs such as deep learning, natural language processing, or AI-driven analytics. They can offer cutting-edge solutions that cater to AI-first applications, which might be more agile and innovative compared to the generalist services offered by hyperscalers.

- Flexibility and Innovation: Startups can innovate rapidly and respond to the needs of niche markets. For example, they might create more specialized and fine-tuned AI models or offer unique tools that address specific customer needs. Their focus on AI might allow them to provide highly optimized services for machine learning, automation, or data science, potentially making them appealing to companies with AI-centric needs.

- Cost Efficiency: Startups often have lower operational overheads, allowing them to provide more flexible pricing or cost-effective solutions tailored to smaller businesses or startups. They may disrupt the cost structure of larger cloud providers by offering more competitive prices for AI workloads.

- Partnerships with Legacy Providers: Some AI startups focus on augmenting the services of hyperscalers, partnering with them to integrate advanced AI capabilities. However, in doing so, they still create competition by offering specialized services that could, over time, encroach on the more general cloud offerings of these providers.

Challenges to Overcome:

- Scale and Infrastructure: Hyperscalers have massive infrastructure investments that enable them to offer unparalleled performance, reliability, and global reach. AI startups will need to overcome significant challenges in terms of scaling infrastructure and ensuring that their services are available and reliable on a global scale.

- Ecosystem and Integration: As mentioned, many large enterprises rely on the vast ecosystem of services that hyperscalers provide. Startups will need to provide solutions that are highly compatible with existing tools, or offer a compelling reason for companies to shift their infrastructure to smaller providers.

- Market Penetration and Trust: Hyperscalers are trusted by major enterprises, and their brands are synonymous with stability and security. Startups need to gain this trust, which can take years, especially in industries where regulatory compliance and reliability are top priorities.

Conclusions:

Cloud AI startups will likely carve out a niche in the rapidly growing AI space, but they are not yet a direct existential threat to hyperscalers. While they could challenge hyperscalers’ dominance in specific AI-related areas (e.g., AI model development, hyper-specialized cloud services), the larger cloud providers have the infrastructure, resources, and customer relationships to maintain their market positions. Over time, however, AI startups could impact how traditional cloud services evolve, pushing hyperscalers to innovate and tailor their offerings more toward AI-centric solutions.

Cloud AI startups could pose some level of threat to hyperscalers (like Amazon Web Services, Microsoft Azure, and Google Cloud) and legacy cloud service providers, but the impact will take some time to be significant. These cloud AI startups might force hyperscalers to accelerate their own AI development but are unlikely to fully replace them in the short to medium term.

References:

ChatGPT search

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Ciena CEO sees huge increase in AI generated network traffic growth while others expect a slowdown

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

https://www.datacenterdynamics.com/en/news/openai-could-build-its-own-data-centers-in-the-us-report/

AI cloud start-up Vultr valued at $3.5B; Hyperscalers gorge on Nvidia GPUs while AI semiconductor market booms

Over the past two years, AI model builders OpenAI, Anthropic and Elon Musk’s xAI have raised nearly $40bn between them. Other sizeable investment rounds this week alone included $500mn for Perplexity, an AI-powered search engine, and $333mn for Vultr, part of a new band of companies running specialized cloud data centers to support AI.

Cloud AI startup Vultr raised $333 million in a financing round this week from Advanced Micro Devices (AMD) and hedge fund LuminArx Capital Management. That’s a sign of the super hot demand for AI infrastructure. West Palm Beach, Fla.-based Vultr said it is now valued at $3.5 billion and plans to use the financing to acquire more graphics processing units (GPUs) which process AI models. The funding is Vultr’s first injection of outside capital. That’s unusually high for a company that had not previously raised external equity capital. The average valuation for companies receiving first-time financing is $51mn, according to PitchBook.

Vultr said its AI cloud service, in which it leases GPU access to customers, will soon become the biggest part of its business. Earlier this month, Vultr announced plans to build its first “super-compute” cluster with thousands of AMD GPUs at its Chicago-area data center. Vultr said its cloud platform serves hundreds of thousands of businesses, including Activision Blizzard, the Microsoft-owned videogame company, and Indian telecommunications giant Bharti Airtel. Vultr’s customers also use its decade-old cloud platform for their core IT systems, said Chief Executive J.J. Kardwell. Like most cloud platform providers, Vultr isn’t using just one GPU supplier. It offers Nvidia and AMD GPUs to customers, and plans to keep doing so, Kardwell said. “There are different parts of the market that value each of them,” he added.

Vultr’s plan to expand its network of data centers, currently in 32 locations, is a bet that customers will seek greater proximity to their computing infrastructure as they move from training to “inference” — industry parlance for using models to perform calculations and make decisions.

Vultr runs a cloud computing platform on which customers can run applications and store data remotely © Vultr

……………………………………………………………………………………………………………………………………………………………………………………………..

The 10 biggest cloud companies — dubbed hyperscalers — are on track to allocate $326bn to capital expenditure in 2025, according to analysts at Morgan Stanley. While most depend heavily on chips made by Nvidia, large companies including Google, Amazon and Facebook are designing their own customized silicon to perform specialized tasks. Away from the tech mega-caps, emerging “neo-cloud” companies such as Vultr, CoreWeave, Lambda Labs and Nebius have raised billions of dollars of debt and equity in the past year in a bet on the expanding power and computing needs of AI models.

AI chip market leader Nvidia, which alongside other investors, provided more than $400 million to AI cloud provider CoreWeave [1.] in 2023. CoreWeave last year also secured $2.3 billion in debt financing by using its Nvidia GPUs as collateral.

Note 1. CoreWeave is a New Jersey-based company that got its start in cryptocurrency mining.

The race to train sophisticated AI models has inspired the commissioning of increasingly large “supercomputers” (aka AI Clusters) that link up hundreds of thousands of high-performance GPU chips. Elon Musk’s start-up xAI built its Colossus supercomputer in just three months and has pledged to increase it tenfold. Meanwhile, Amazon is building a GPU cluster alongside Anthropic, developer of the Claude AI models. The ecommerce group has invested $8bn in Anthropic.

Hyperscalers are big buyers of Nvidia GPUs:

Analysts at market research firm Omdia (an Informa company) estimate that Microsoft bought 485,000 of Nvidia’s “Hopper” chips this year. With demand outstripping supply of Nvidia’s most advanced graphics processing units for much of the past two years, Microsoft’s chip hoard has given it an edge in the race to build the next generation of AI systems.

This year, Big Tech companies have spent tens of billions of dollars on data centers running Nvidia’s latest GPU chips, which have become the hottest commodity in Silicon Valley since the debut of ChatGPT two years ago kick-started an unprecedented surge of investment in AI.

- Microsoft’s Azure cloud infrastructure was used to train OpenAI’s latest o1 model, as they race against a resurgent Google, start-ups such as Anthropic and Elon Musk’s xAI, and rivals in China for dominance of the next generation of computing. Omdia estimates

- ByteDance and Tencent each ordered about 230,000 of Nvidia’s chips this year, including the H20 model, a less powerful version of Hopper that was modified to meet U.S. export controls for Chinese customers.

- Meta bought 224,000 Hopper chips.

- Amazon and Google, which along with Meta are stepping up deployment of their own custom AI chips as an alternative to Nvidia’s, bought 196,000 and 169,000 Hopper chips, respectively, the analysts said. Omdia analyses companies’ publicly disclosed capital spending, server shipments and supply chain intelligence to calculate its estimates.

The top 10 buyers of data center infrastructure — which now include relative newcomers xAI and CoreWeave — make up 60% of global investment in computing power. Vlad Galabov, director of cloud and data center research at Omdia, said some 43% cent of spending on compute servers went to Nvidia in 2024. “Nvidia GPUs claimed a tremendously high share of the server capex,” he said.

What’s telling is that the biggest buyers of Nvidia GPUs are the hyperscalers who design their own compute servers and outsource the detailed implementation and manufacturing to Taiwan and China ODMs! U.S. compute server makers Dell and HPE are not even in the ball park!

What about #2 GPU maker AMD?

Dave McCarthy, a research vice president in cloud and edge services at research firm International Data Corp (IDC). “For AMD to be able to get good billing with an up-and-coming cloud provider like Vultr will help them get more visibility in the market.” AMD has also invested in cloud providers such as TensorWave, which also offers an AI cloud service. In August, AMD bought the data-center equipment designer ZT Systems for nearly $5 billion. Microsoft, Meta Platforms and Oracle have said they use AMD’s GPUs. A spokesperson for Amazon’s cloud unit said the company works closely with AMD and is “actively looking at offering AMD’s AI chips.”

Promising AI Chip Startups:

Nuvia: Founded by former Apple engineers, Nuvia is focused on creating high-performance processors tailored for AI workloads. Their chips are designed to deliver superior performance while maintaining energy efficiency, making them ideal for data centers and edge computing.

SambaNova Systems: This startup is revolutionizing AI with its DataScale platform, which integrates hardware and software to optimize AI workloads. Their unique architecture allows for faster training and inference, catering to enterprises looking to leverage AI for business intelligence.

Graphcore: Known for its Intelligence Processing Unit (IPU), Graphcore is making waves in the AI chip market. The IPU is designed specifically for machine learning tasks, providing significant speed and efficiency improvements over traditional GPUs.

Market for AI semiconductors:

- IDC estimates it will reach $193.3 billion by the end of 2027 from an estimated $117.5 billion this year. Nvidia commands about 95% of the market for AI chips, according to IDC.

- Bank of America analysts forecast the market for AI chips will be worth $276 billion by 2027.

References:

https://www.ft.com/content/946069f6-e03b-44ff-816a-5e2c778c67db

https://www.restack.io/p/ai-chips-answer-top-ai-chip-startups-2024-cat-ai

Market Outlook for Disaggregated Cell Site Gateways (DCSG)

A Disaggregated Cell Site Gateways (DCSG) is a white-box cell site gateway or router based on an open and disaggregated architecture for existing 2G/3G/4G and 5G networks. It permits network operators to choose different software applications from various vendors, essentially separating the hardware from the software functionality, providing greater flexibility and choice compared to traditional, vendor-locked cell site gateways, particularly important for the evolving demands of 5G networks.

After a two-year lull, the DCSG market regained momentum in 2023, driven by contracts across North America, Asia, and Africa. Market leaders like Ciena and IP Infusion now dominate Network Operating System (NOS) software, while Taiwanese ODMs Edgecore Networks Corporation and UfiSpace lead in white box hardware. The Edgecore CSR430 supports LTE and 5G mobile xHaul networks. It incorporates advanced features like precise timing synchronization, eCPRI fronthaul capabilities, and advanced telemetry to address the scalability demands of mobile operators rolling-out 5G.

DCSGs are growing in importance along with the worldwide expansion and densification of 5G networks, which require more capacity while offering more services. This means operators need to deploy ever more sites, gateways and radios, which, in turn, provides a real incentive for operators to deploy cost-effective white-box DCSG solutions.

According to global research firm Omdia, DCSGs are expected to grow rapidly to some 25% of new CSGs in 2024. Telecom Infra Project (TIP) says over 27,000 Disaggregated Cell Site Gateways have been deployed globally.

TÉRAL RESEARCH forecasts DCSG sales to exceed $500M by 2029, fueled by 5G deployment and open RAN growth. Despite challenges in breaking into established vendor markets, the push for vendor-neutral, cost-efficient solutions keeps disaggregation high on CSPs’ agendas.

References:

https://teralresearch.com/report/december-2024-disaggregated-cell-site-gateways-dcsg-337

https://www.ceragon.com/disaggregated-cell-site-gateways

https://www.adtran.com/en/innovation/telecom-infra-project/disaggregated-cell-site-gateways

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

New Zealand telco One NZ has commercially launched its Satellite TXT service to eligible phone customers [1.] enabling them to communicate via Starlin/SpaceX’s network of Low Earth orbit (LEO) satellites at no extra cost as long as they have a clear line of sight to the sky. The initial TXT service will take longer to send and receive TXT messages. In many cases, TXT messages will take 3 minutes. However, at times it may take 10 minutes or longer, especially during the first few months. As the service matures and more satellites are launched, we expect delivery times to improve. The type of eligible phone you are using, where you are in New Zealand and whether a satellite is currently overhead will all have an impact on whether your TXT is sent or received and how long it takes.

Note 1. There are only four handsets that can currently use of Satellite TXT: Samsung’s Galaxy Z Flip6, Z Fold6, and S24 Ultra, plus the OPPO Find X8 Pro. One NZ said the handset line-up will expand during the course of next year (2025).

“We have lift-off! I’m incredibly proud that One NZ is the first telecommunications company globally to launch a nationwide Starlink Direct to Mobile service, and One NZ customers are among the first in the world to begin using this groundbreaking technology,” exclaimed Joe Goddard, experience and commercial director at One NZ. He said coverage is available across the whole of New Zealand including the 40% of the landmass that isn’t covered by terrestrial networks – plus approximately 20 km out to sea. “Right from the start we’ve said we would keep customers updated with our progress to launch in 2024 and as the technology develops. Today is a significant milestone in that journey,” he added.

April 2023’s partnership with Starlink coincided with the beginning of a new era for One NZ, which up until that point had operated under the Vodafone brand. At the time, One NZ tempered expectations by making it clear the service wouldn’t launch until late 2024.

SpaceX in October finally received permission to begin testing Starlink’s direct-to-cell capabilities with One NZ. Later that same month, One NZ reported that its network engineers in Christchurch were successfully sending and receiving text messages over the network. “We continue to test the capabilities of One NZ Satellite TXT, and this is an initial service that will get better. For example, text messages will take longer to send but will get quicker over time,” said Goddard. He also went to some lengths to point out that Satellite TXT “is not a replacement for existing emergency tools, and instead adds another communications option.”

One NZ offered a few tips to help their customers use the service:

- To TXT via satellite, you need a clear line of sight to the sky. Unlike other satellite services, you don’t need to hold your phone up towards the sky.

- Keeping your TXT short will help. You can also prepare your TXT and press send as soon as you see the One NZ SpaceX banner appear on-screen.

- To check if your TXT has been delivered, check the time stamp next to your TXT. On a Samsung or OPPO, tap on the message.

- Remember to charge your phone or take a battery pack if you are out adventuring.

One NZ vs T-Mobile Direct to Cell Service:

New Zealand’s terrain – as varied and at times challenging as it is – can be covered by far fewer LEO satellites than the U.S. where T-Mobile has announced Direct to Cell service using Starlink LEO satellites. T-Mobile was granted FCC approval for the service in November, and is now signing up customers to test the US Starlink beta program “early next year.”

References:

https://one.nz/why-choose-us/spacex/

https://www.telecoms.com/satellite/one-nz-claims-direct-to-cell-bragging-rights-over-t-mobile-us

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?