Author: Alan Weissberger

ITU-R Reports in Progress: International Mobile Telecommunications (IMT) including IMT 2020

Working documents toward preliminary draft new ITU-R reports from WP5D:

M.[IMT.MULTIMEDIA] – Capabilities of the terrestrial component of IMT-2020 for multimedia communications

M.[IMT.INDUSTRY] – Addresses the usage, technical and operational aspects and capabilities of IMT for meeting specific needs of societal, industrial and enterprise usages.

M.[IMT.AAS] – Measurements and mathematical modelling of Advanced Antenna Systems (AAS) in IMT-2020 systems

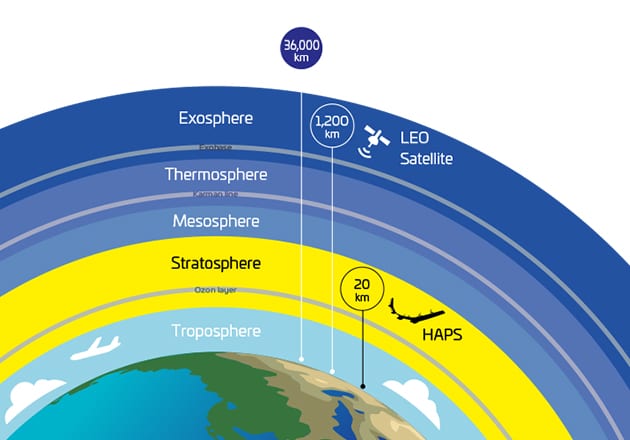

M.[HIBS-CHARACTERISTICS] – Related to WRC-23 agenda item 1.4 – Spectrum needs, usage and deployment scenarios, and technical and operational characteristics for the use of high-altitude platform stations as IMT base stations (HIBS) in the mobile service in certain frequency bands below 2.7 GHz

New draft Recommendations:

M.[FSS_ES_IMT_26GHz] – Guidelines to assist administrations to mitigate interference from FSS earth stations into IMT stations operating in the frequency bands 24.65-25.25 GHz and 27-27.5 GHz

References:

https://www.itu.int/md/R19-WP5D-C-1361/en

ITU-R Future Report: high altitude platform stations as IMT base stations (HIBS)

ITU-R Future Report: high altitude platform stations as IMT base stations (HIBS)

Virgin Media O2 deploys UK’s first 5G-connected hospital to transform healthcare

Virgin Media O2 (VMO2) and the NHS have collaborated to build the UK’s ‘first 5G connected hospital,’ which they say will transform healthcare. The Maudsley Smart Hospital and Maudsley Smart Pharmacy trials are funded by NHS digital with tech provided by VMO2 and Nokia, and are designed to explore the efficiency, safety and security benefits of using 5G-connected technologies in hospitals, across the usual catch-all 5G adjacent sectors of IoT, AR and AI.

Two wards at al Bethlem Royal Hospital in South London are now using dedicated, near-real-time connectivity to power e-Observations, where clinicians use handheld devices to update patient records, saving valuable time and improving accuracy. It seems to be implied interacting with the equipment over 5G will be more efficient than using the hospital’s WiFi network.

The 5G trials will also include an IoT innovation lab and platform, in partnership with Bruhati (South London and Maudsley has made Bruhati its partner for providing IoT technology to the Trust). This will look at smart, connected use cases – including remotely monitoring medicine fridges to ensure drugs are stored at the optimum temperature and thereby reducing expensive waste, tracking the air quality inside wards, and monitoring occupancy of desks and meeting rooms in the hospital.

An Augmented Reality (AR) tool called Remote Expert will allow maintenance workers in other hospitals to pop on a helmet and remotely help fix problems in some way, while an AI tool called Spatial Insights generates anonymised heat maps of crowd movement from CCTV footage, which will apparently help them to better plan layouts in the future. There is also talk of smart devices and monitoring to reduce medicine waste and track the air quality in wards, which sounds useful enough.

Mike Smith, Large Enterprise & Public Sector Director at Virgin Media O2 Business said: “The NHS has been a cornerstone of British society for nearly 75 years, and today, we’re proud to announce the switch-on of the UK’s first 5G-connected hospital – showing how next-generation technology can help create a smarter, modern healthcare service for everyone. Our aim is to map out the rollout of wireless and smart hospital connectivity across the NHS estate over the next three to five years. Trials like this are the embodiment of our mission to upgrade the UK, and a clear sign of the role we can play in helping to shape the NHS of the future.”

Stuart MacLellan, Acting Chief Information Officer at South London and Maudsley Foundation Trust said: “Exploring and using the latest technology supports our core strategic aim to deliver outstanding mental health care for people who use our services, their carers and families. We are proud to be partnering with Virgin Media O2 Business to create the UK’s first 5G-connected hospital, which enables us to use digital innovations to improve patient outcomes. This is a very exciting step forward.”

Kester Mann, technology analyst and Director, Consumer and Connectivity at CCS Insight, said: “This is a landmark moment for the UK telecoms and healthcare sectors. Dedicated 5G in hospitals can open the door to a range of new applications such as real-time tracking of patients’ conditions, remote support and round-the-clock monitoring of medicines and equipment. Its high throughput and low-latency characteristics can also improve the efficiency and security of existing operations, making healthcare services smarter, more accurate and more effective.”

…………………………………………………………………………………………………………………………

If the NHS trials can demonstrate how the implementation of AI heatmaps for planning layouts and AR headsets for maintenance workers can start taking chunks out of how long it takes to be treated for immediate and long term conditions, then everyone will surely be behind rolling it out elsewhere.

References:

VMO2 and Nokia help create UK’s ‘first 5G connected hospital’

Rakuten Mobile in joint venture with Tokyo Electric Power Company (TEPCO) to expand 4G/5G network

Japanese wireless network operator Rakuten Mobile has established a new joint venture company in its domestic market with Tokyo Electric Power Company (TEPCO) to deploy base stations at existing power grid sites as it looks to further expand its 4G and 5G coverage in a more efficient way.

The new company, called Rakuten Mobile Infrastructure Solution, began operating in Tokyo on July 1st. The entity has an initial nominal value of ¥300m (approximately $2.2m), with Rakuten Mobile owning a 51% stake in the venture and TEPCO holding the remaining 49% stake, the operator said in a statement (available in Japanese here).

Rakuten Mobile Infrastructure Solution is set to contribute to the telco’s vision for a stable communication environment by enhancing the efficiency of maintaining base stations through effective use of public assets. The new company will also look to develop installation specifications for Rakuten Mobile’s base station equipment and manage installation-related works.

The Japanese telecom industry upstart, which already covers 96% of the Japanese population with its 4G service, noted it is using “some power assets” to further build out its network.

Through the new company, Rakuten Mobile plans to expand its 4G and 5G networks, boost the density of base station deployments and “strengthen the development of communication infrastructure with the aim of providing stable services”. As it will use the existing power assets of TEPCO for the purpose (alongside the power company’s construction capabilities and know-how), the telco believes it can “improve the cost efficiency of base station maintenance”.

This is not the first engagement for the two companies: In March 2018, Rakuten Mobile secured an agreement to make use of TEPCO’s steel towers, power distribution poles, building roofs and other infrastructure, just a few months before it began building its greenfield cellular network, and in 2019 was part of a broader mobile operator initiative with TEPCO related to power grid infrastructure sharing.

References:

Google’s Equiano subsea cable lands in Namibia en route to Cape Town, South Africa

Google’s high-capacity Equiano subsea cable has landed at Swakopmund in Namibia en route to its end point at Melkbosstrand, north of Cape Town, South Africa.

The cable, which will link South Africa and Europe along Africa’s west coast, was landed in the seaside holiday town of Swakopmund late last week by landing partners Paratus Group and Telecom Namibia, which were contracted to build and operate the landing station.

Equiano is expected to be ready for commercial service in the fourth quarter of 2022 and will deliver up to 20 times the international capacity that was previously available in Namibia. Until now, Namibia has relied solely on the West Africa Cable System, or Wacs, for subsea Internet connectivity.

“This is a landmark event and a great day for Namibia’s digital transformation. We are very proud to be the Google landing partner, and infrastructure partner with Telecom Namibia, to deliver better connectivity to everyone in Namibia,” says Paratus Group CEO Barney Harmse in a statement.

“The Google Equiano cable shore landing is a major step in the development of our national telecommunications infrastructure,” said Telecom Namibia CEO Stanley Shanapinda. “The cable will ensure redundancy for Telecom Namibia and offers an alternative when other routes may be impaired.”

In South Africa, Openserve, the wholesale division of Telkom, will serve as the landing station partner for Equiano.

The company said in November 2021 that the 150Tbit/s (design capacity) Equiano system will come ashore at its landing station in Melkbosstrand, which already serves as the landing site for other submarine cables, including Sat-3, which follows a not dissimilar route to Europe as Equiano.

Openserve will offer terrestrial services connecting the Equiano cable to South African carrier-neutral data centres.

— © 2022 NewsCentral Media

References:

Future Market Insights: Lit Fiber Market to reach US$ 20B by 2032

The global lit fiber market is expected to witness an impressive growth rate of 16.7% over the forecasted years of 2022 to 2032, according to a new report by Future Market Insights, Inc. The lit fiber market size is anticipated to reach a valuation of around US$ 20 Billion by the end of year 2032 from the current valuation of US$ 4.28 Billion in 2022.

Lit fiber has been used in the IT and telecommunications sectors for a number of noteworthy applications since its beginnings. But in recent years, the sales of lit fiber have grown as a result of the discovery of various more unique applications.

Compared to conventional copper lines, lighted fiber is more durable and extremely resistant to the dangers and traffic found in the previous system. Over the years, the demand for lit fiber has strengthened as an active cable that is set up, controlled, and maintained exclusively by service providers.

Elevated level of data transfer via short- and long-distance communications is made possible by fiber optics that is observed to have strengthened the lit fiber market opportunities. For connectivity, industrial, IT and communications, and security applications, a number of international businesses have started providing illuminated fiber connectivity proliferating the market further.

Increased investment in research and development by key actors leads to the creation of new technologies, and advancements in fiber optic connectivity that is predicted to increase the competition among lit fiber market participants.

Key Takeaways from Market Study:

- The overall growth of the global lit fiber market is estimated to be around US$ 15.7 Billion during the coming decade by following the average CAGR of 16.7%.

- The global market for lit fiber is dominated by multi-modal fiber segment, which is estimated to grow at a rate of 16.3%, while the single-mode segment is projected to develop at the fastest pace of 17.2%.

- The higher selling segment, which accounts for over 60% of the sales revenue, is the lit fiber on-net connectivity items that is expected to grow at a CAGR of 17% during the projection period. And from the other front, the off-net lit fiber segment has grown in popularity recently and is expected to increase the sales of lit fiber over the years 2022 to 2032.

- With a market dominance the networking application segment have historically been the key driver of lit fiber industry expansion. However, due to the product’s growing popularity, a 31.7% growth rate in this segment is anticipated throughout the anticipated time frame.

- Of the world’s major geographical areas, North America accounts for more than 28% of the global lit fiber market. In contrast, the Asia Pacific lit fiber market has recently picked up steam and is expected to increase at an above average CAGR from 2022 to 2032.

Competitive Landscape:

The global lit fibre industry is highly fragmented and is anticipated to see an increased competition in the coming days as a result of the existence of several illuminated fibre market rivals. The major lit fibre companies are prioritising growing their customer base and serving underdeveloped areas at the same time as their major strategy to penetrate wider market.

Some of the well-known market players are among

- AT&T

- Attice USA

- Comcast

- Crown Castle Fiber

- Frontier

- GigabitNow

- Lumen

- Spectrum Enterprise

- Verizon

- Zayo among others

Recent Developments in the Global Lit Fiber Market:

- In line with the target of providing lit plus dark fibre connectivity at Coloblox’s ATL1 Atlanta data centre, FiberLight, LLC, which is a vendor of optical equipment, joined forces in August 2021.

References:

https://www.futuremarketinsights.com/reports/brochure/rep-gb-15116

Review of SideTrak Solo 17.3 inch portable monitor

This SideTrak Solo portable 17.3 inch monitor works great!

It was easy to set-up via Windows 10 laptop- plugged in HDMI cable for the audio/video and USB cable for power feeding from PC to monitor. Then changed Display settings to dual display from mirrored display in order to get 2 separate screens.

After set-up, you can drag a webpage from 1 screen to another which is very useful if you are doing research work or want to watch a video on 1 screen while working on the other screen.

The image clarity is better than on my new ACER laptop which was a pleasant surprise. You can adjust the volume UP or DOWN via the top & bottom buttons on the lower right side of the display. The stand is very stable so it’s easy to move the monitor.

Because it’s portable, you can take it along with your laptop to do work or watch videos away from home/on the road.

All in all, I’m very satisfied with this product!

References:

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

The worldwide public cloud services market, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service – System Infrastructure Software (SaaS – SIS), and Software as a Service – Applications, grew 29.0% year over year in 2021 with revenues totaling $408.6 billion, according to the International Data Corporation (IDC) Worldwide Semiannual Public Cloud Services Tracker.

Spending continued to consolidate in 2021 with the combined revenue of the top 5 public cloud service providers (Microsoft, Amazon Web Services, Salesforce Inc., Google, and SAP) capturing nearly 40% of the worldwide total and growing 36.6% year over year. With offerings in all four deployment categories, Microsoft captured the top position in the overall public cloud services market with 14.4% share in 2021, followed closely by Amazon Web Services with 13.7% share.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” said Rick Villars, group vice president, Worldwide Research at IDC. “For the next several years, leading cloud providers will play a critical role in helping enterprises navigate the current storms of disruption (inflation, supply chain, and geopolitical tensions), but IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services.”

While the overall public cloud services market grew 29.0% in 2021, revenue for foundational cloud services* that support digital-first strategies saw revenue growth of 38.5%. This highlights the increasing reliance of enterprises on a cloud innovation platform built around widely deployed compute services, data/AI services, and app framework services to drive innovation. IDC expects spending on foundational cloud services (especially IaaS and PaaS elements) to continue growing at a higher rate than the overall cloud market as enterprises leverage cloud to overcome the current disruptions and accelerate their shift toward digital business.

“The last few years have demonstrated that in challenging times, businesses increasingly rely on cloud services to modernize their operations and deliver more value to customers,” said Dave McCarthy, research vice president, Cloud and Edge Infrastructure Services. “This trend is expected to continue as public cloud providers offer more ways of extending cloud services to on-premises datacenters and edge locations. These expanded deployment options reduce many barriers to migration and will facilitate the next wave of cloud adoption.”

“In the digital-first world, enterprises that are serious about competing for the long term use the lens of business outcomes to evaluate strategic technology decisions, which fuels the fast-growing ecosystem seen in the public cloud market,” said Lara Greden, research director, Platform as a Service, IDC. “Cloud service providers showed relentless drive to enhance the productivity of developers and overall speed of application delivery, including emphasis on containers-first and serverless-first approaches.”

“SaaS applications remain the largest and most mature segment of public cloud, with 2021 revenues that have now reached $177 billion. The tailwinds of the pandemic continued to fuel expedited upgrades and replacements of older systems in 2021, though company goals haven’t changed. Companies seek applications that will help increase enterprise intelligence, improve operational efficiency, and drive better decision making. Ease of use, ease of implementation and integration, streamlined workflows, data and analytical accessibility, and time to value are the key criteria driving purchasing decisions, though verticalization has also steadily increased as a key priority,” said Eric Newmark, group vice president and general manager of IDC’s SaaS, Enterprise Software, and Worldwide Services division.

| Worldwide Public Cloud Services Revenue and Year-over-Year Growth, Calendar Year 2021 (revenues in US$ billions) | |||||

| Deployment Category | 2021 Revenue | Market Share | 2020 Revenue | Market Share | Year-over-Year Growth |

| IaaS | $91.3 | 22.4% | $67.3 | 21.3% | 35.6% |

| PaaS | $68.2 | 16.7% | $49.1 | 15.5% | 39.1% |

| SaaS – Applications | $177.8 | 43.5% | $143.9 | 45.4% | 23.5% |

| SaaS – System Infrastructure Software | $71.2 | 17.4% | $56.4 | 17.8% | 26.4% |

| Total | $408.6 | 100% | $316.7 | 100% | 29.0% |

| Source: IDC Worldwide Semiannual Public Cloud Services Tracker, 2H 2021 | |||||

While both the foundational cloud services market and the SaaS – Applications market are led by a small number of companies, there continues to be a healthy long tail of companies delivering cloud services around the globe. In the foundational cloud services market, these leading companies account for nearly three quarters of the market’s revenues with targeted use case-specific PaaS services or cross-cloud compute, data, or network governance services. The long tail is more pronounced in the SaaS– Applications market, where customers’ growing focus on specific outcomes ensures that over two thirds of the spending is captured outside the top 5.

Analysis:

We remain SUPER SKEPTICAL about IDC’s claim that Microsoft beat out cloud rival Amazon Web Services (AWS) in capturing the largest share of global public cloud services revenue last year. That conflicts with all our other resource checks!!!

IDC reported that Microsoft accumulated 14.4% of the market’s $408.6 billion in revenues last year, just a whisker ahead of the 13.7% that AWS snared. Microsoft has offerings in all four sections of the public cloud services market lumped by IDC into its report, including infrastructure as a service (IaaS), platform as a service (PaaS), system infrastructure SaaS, and application SaaS.

Salesforce, Google, and SAP rounded out the top five in IDC’s ranking, with those vendors capturing 40% of the total market. Overall market revenues increased 29% compared to the previous year.

SaaS applications brought in the most cloud services revenue with $177.8 billion, representing 23.5% growth from the year prior. IaaS accounted for $91.3 billion of revenue, followed by system infrastructure SaaS and PaaS.

Of the categories comprising IDC’s public cloud foundational services, PaaS saw the highest year-over-year growth at 39.1%, though it brought in the least 2021 revenue at $68.2 billion.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” IDC VP Rick Villars said in a statement.

In an increasingly digital world, enterprises that are truly thinking ahead use a business outcomes lens to make strategic decisions, and this is what fuels public cloud ecosystem growth, IDC PaaS Research Director Lara Greden explained.

Cloud service providers played their part in that growth this year with a “relentless drive” to improve developer productivity and speed of application delivery, “including emphasis on containers-first and serverless-first approaches,” she added.

Villars expects these cloud giants will continue to have a crucial role in helping enterprises solve persistent market challenges like supply chain disruption, inflation, and geopolitical tension.

“IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services,” Villars added.

……………………………………………………………………………………………………………………………………..

* Note: IDC defines Foundational Cloud Services as the Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service – System Infrastructure Software (SaaS – SIS) market segments where the top eight public cloud services providers (Amazon Web Services, Microsoft, Google, Alibaba Group, IBM, Tencent, Huawei, and Oracle) account for most of the revenue. These include the following key service portfolios:

- Compute Services: Virtualized x86 Compute, Bare Metal Compute, Block Storage, Accelerated Compute, Other Compute, and Software-Defined Compute Software.

- Data Services: Data Management Systems, Object Storage, File Storage, and Event Stream Processing Software.

- App Framework Services: Developer-centric software to develop and deploy applications in the cloud, including lifecycle management. These services include Integration Software, Deployment-Centric Application Platforms, and AI Lifecycle Software.

- Usage Multiplier Services: Services that encourage greater/more effective use of high value services by making it easier to adopt, connect, deploy, track, secure, and update those services. Includes load balancing and DNS as well as marketplaces and bundles of open-source software solutions.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49420022

IDC’s New Public Cloud Numbers: Microsoft Azure Edged Out AWS in 2021

IDC: Microsoft Azure now tied with AWS as top global cloud services provider

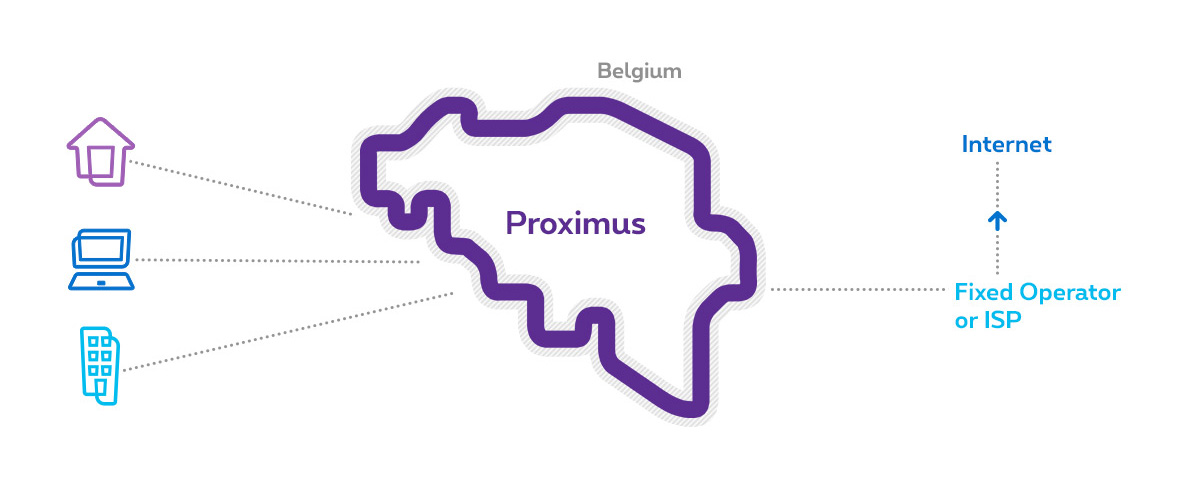

Proximus to extend fiber coverage to 95% of Belgian premises

Belgian network operator Proximus is teaming up with private equity partners in a bid to deliver gigabit fiber service to 95% of the country. The telco is planning to reach a final joint venture (JV) agreement with I4B by the end of 2022.

The company this week inked a memorandum of understanding (MOU) with I4B – The Belgian Infrastructure Fund – whose founding investors are the Federal Holding and Investment Company (SFPI-FPIM), AG Insurance and Synatom, will act as an anchor investor to the project. I4B’s mission is to finance the development of infrastructure with a positive impact on Belgium’s economic development, while taking into account societal and environmental requirements.

One of the joint ventures will focus on rollouts in the French-speaking Wallonia region of the country while the other will zero in on Dutch-speaking Flanders. Proximus will serve as a minority shareholder for each JV and the anchor tenant on the networks built in each region.

Proximus and I4B plan to spend around €4 billion (approximately $4.2 billion) between the two JVs. Petra De Sutter, Belgium’s deputy prime minister, said in a statement the partnership between Proximus and I4B will help ensure internet access in areas with “no or insufficient connectivity today.”

According to a report released by the FTTH Council Europe in May, Belgium topped the list as the fastest growing fiber market in the European Union (including the U.K.) by percentage. Its figures showed Belgium’s number of homes passed grew 109% between September 2020 and September 2021, outpacing Israel (107%) Greece (90%), Cyprus (83% and the U.K. (80%).

FFTH Council Europe forecast the number of homes passed by fiber in Belgium will skyrocket 568% by 2027 to reach a total of 3.9 million.

References:

https://www.fiercetelecom.com/telecom/proximus-inks-mou-push-fiber-17m-more-locations-belgium

https://www.proximus.com/news/2022/20220629-fiber-rollout.html

FTTH Council Europe: 197 million homes passed in 2026 in EU27+UK

PLDT to support 60 Terabit/s to US and Japan with US-Transpacific Jupiter Cable

Philippine telco PLDT will activate the US-Transpacific Jupiter cable system by July this year, and is expected to further enhance delivery of services and improve customer experience.

The addition of the Jupiter cable system to PLDT’s infrastructure greatly boosts the telco’s extensive fiber network, providing greater capacity in multiple Terabits per second to customers as well as cable diversity to ensure ability to re-route traffic in the event of undersea cable cuts.

“Investments on infrastructure like Jupiter allow PLDT to provide the vital connectivity that powers our digital economy, enabling us to help transform the country into a globally competitive and digitally-empowered nation,” PLDT and Smart FVP and Head of Enterprise Business Group Jojo G. Gendrano said.

“Specifically, this will fortify the Philippines’ position as the next strategic data center hub for global hyperscalers,” Gendrano added.

PLDT’s investment in the Jupiter cable system increases and reinforces the capacities and the resiliency of the telco leader’s existing undersea fiber links, to deliver massive amounts of data traffic going in and out of the country to the US.

Jupiter uses an “open cable model,” which allows consortium members to increase their capacities as needed by investing in technologies that boost data throughput. It terminates in Maruyama and Shima, Japan; Los Angeles (Hermosa Beach) and Pacific City, USA; and Daet, the Philippines, for a total cable length of about 14,600km. It consists of 5 fiber pairs in the main trunk connecting Maruyama and Shima, Japan and Los Angeles. The Jupiter cable system was intially designed with 400Gbps DWDM, for a total system capacity of 60Tbps, or 12Tbps per fiber pair. its main trunk has been ready for service as of May 2021.

Currently the largest among Philippine telcos, Jupiter is anticipated to increase PLDT’s international capacity of 20 Terabit/s to about 60 Terabit/s to US and Japan further establishing its lead, and ready to scale with the growing demands of digital services. These include the delivery of Cloud services, Fintech, and rich media content, which seamlessly complements PLDT’s existing fixed and mobile services.

The Jupiter Cable system is a joint project of global providers spanning 14,000 kilometers from the US to the Philippines bringing PLDT’s total number of international cabling systems to 17.

Jupiter is key to enhancing PLDT’s cable network resilience, increasing the PLDT Group’s submarine cable route diversity, and helps assure customers with sustained capacity availability in support of their growing demand for data and continuing digital transformation.

Currently, PLDT operates the country’s most extensive international submarine cable network and is set to expand further with the completion of two more major international cable systems namely Asia Direct Cable (ADC), and the APRICOT cable system set to be completed in the next two years.

References:

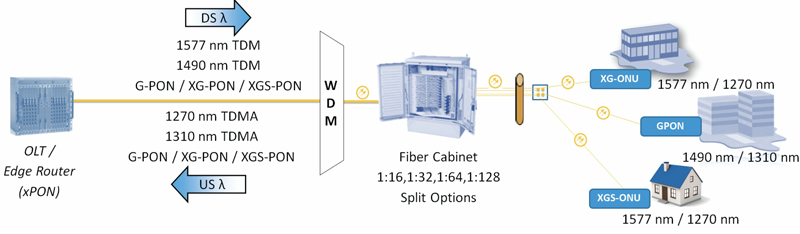

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022